Form 8-K Good Times Restaurants For: Jun 11

|

UNITED STATES

|

||

|

SECURITIES AND EXCHANGE COMMISSION

|

||

|

Washington, D.C. 20549

|

||

|

FORM 8-K

|

||

|

CURRENT REPORT

|

||

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

||

|

Date of Report (Date of earliest event reported)

|

||

|

June 11, 2018

|

||

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Nevada

|

000-18590

|

84-1133368

|

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

141 Union Boulevard, #400, Lakewood, CO 80228

|

||

|

(Address of principal executive offices including zip code)

|

||

|

Registrant’s telephone number, including area code: (303) 384-1400

|

||

|

Not applicable

|

||

|

(Former name or former address, if changed since last report.)

|

||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure.

|

Good Times Restaurants Inc. (the “Company”) is furnishing this Current Report on Form 8-K in connection with the disclosure of information in conjunction with investor meetings that will commence June 11, 2018. A copy of the presentation materials is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 7.01. The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing. This Report will not be deemed an admission as to the materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

| Item 9.01 |

Financial Statements and Exhibits.

|

| (d) |

Exhibits. The following exhibits are filed as part of this report:

|

|

Exhibit Number

|

Description

|

|

99.1

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

GOOD TIMES RESTAURANTS INC.

|

||

|

Date: June 11, 2018

|

|

|

|

Boyd E. Hoback

|

||

|

President and Chief Executive Officer

|

||

3

Exhibit 99.1

Nasdaq Capital Market: GTIMInvestor PresentationJune 2018

Forward-Looking Statements andNon-GAAP Financial Information 2 Forward-Looking StatementsThis presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation may be forward-looking statements. The words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intend,” “targets,” “projects,” “contemplates,” “believes,” “estimates”, “predicts,” “potential” or “continue” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from expectation are disclosed under the section “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”).All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or qualified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Any forward-looking statements made in this presentation is current only as of the date on which it is made. The Company does not undertake any obligation to publicly update any previously-made forward-looking statement, irrespective of any new information, changes in facts, circumstances, or developments, or otherwise, except as required by law.Non-GAAP Financial InformationThe non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, Restaurant Operating Profit and Cash on Cash Return on Investment) are not GAAP measures of financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not reflect tax payments, debt service requirements, capital expenditures, new restaurant openings and certain other cash costs that may recur in the future, including among other things, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using EBITDA and Adjusted EBITDA in a supplemental manner. EBITDA, Adjusted EBITDA, Restaurant Operating Profit and Cash on Cash Return on Investment are included in this presentation because they are key metrics used by management and our board of directors to assess our financial performance. EBITDA and Adjusted EBITDA are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Our measures of EBITDA, Adjusted EBITDA, Restaurant Operating Profit and Cash on Cash Return on Investment are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation.

3 Company and Concept Overview Two Differentiated and Complementary ConceptsExcellent Cash-on-Cash Return Model for Bad Daddy’s ExpansionMomentum Driven by Successful Execution Across Multiple GeographiesStable Cash Flow from Good Times That Can Be Reinvested in Bad Daddy’s GrowthExperienced Leadership TeamSophisticated Systems and Proven Operations Support Accelerated Growth 1 2 3 4 5 6 Founded in 2008Acquired by Good Times in 2015 as growth platformFull-service, upscale, chef-inspired restaurant conceptFounded by an award-winning entrepreneur founder of numerous successful conceptsOperates, licenses and franchises 29 restaurants in Colorado (12),North Carolina (12), Georgia (2), Oklahoma (1), South Carolina (1), and Tennessee (1) Founded in 1987Only QSR with steroid-free, hormone-free, vegetarian-fed, humanely-raised beef and chicken“Fresh, Handcrafted, All-Natural” positionOperates and franchises 36 restaurants located primarily in the front-range communities of ColoradoSuccessful refresh and update of brand started in 2013 coupled with remodels that are yielding strong financial results

How We Win 4 Business Differentiated Service “Radical Hospitality”A commitment to high-touch serviceEfficient but personalized Dedicated to offering incredible food and unparalleled service in QSR environment High-quality, Segment-Leading Food Quality “Artfully Created Food”Chef-driven recipes, yet fast prep speedsHigh quality, fresh ingredientsRegional / seasonal ingredients and menu offerings The QSR industry’s only all-natural, handcrafted brand positioningAntibiotic- and hormone-free protein platformWhere possible uses regional / seasonal ingredients Brands with Personality and Attitude A “Bad Ass Bar”Local craft beers in bar menu at every locationEdgy, retro attitude in a suburb-friendly spacePersonality permeates brand – in the décor, menu names, service style Quirky irreverent advertisingEmphasizes the quality and natural brand positioning Financial Great Momentum Multi-geography concept successful in diverse regionsHigh customer receptivity, six restaurants opened in FY2017 and nine restaurants projected FY2018 History of continued SSS growthDriving sales without reliance on discountingBrand well positioned for franchising and opportunistic expansion Industry Leading Unit Economics Combination of higher average check, smaller box, and low cost to build leads to strong unit economicsIndustry leading cash-on-cash returns Flexible real estate model that can work in a variety of sitesHigh cash-on-cash returns

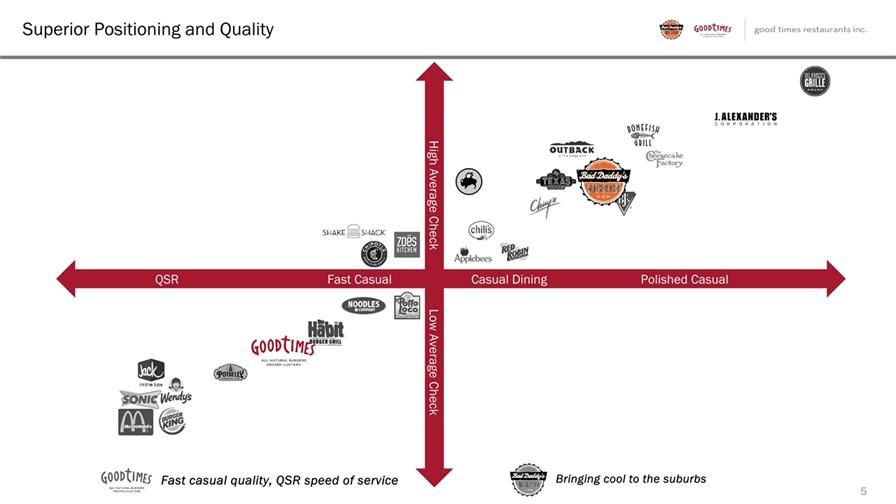

Superior Positioning and Quality 5 Bringing cool to the suburbs Fast casual quality, QSR speed of service QSR Fast Casual Casual Dining Polished Casual High Average Check Low Average Check

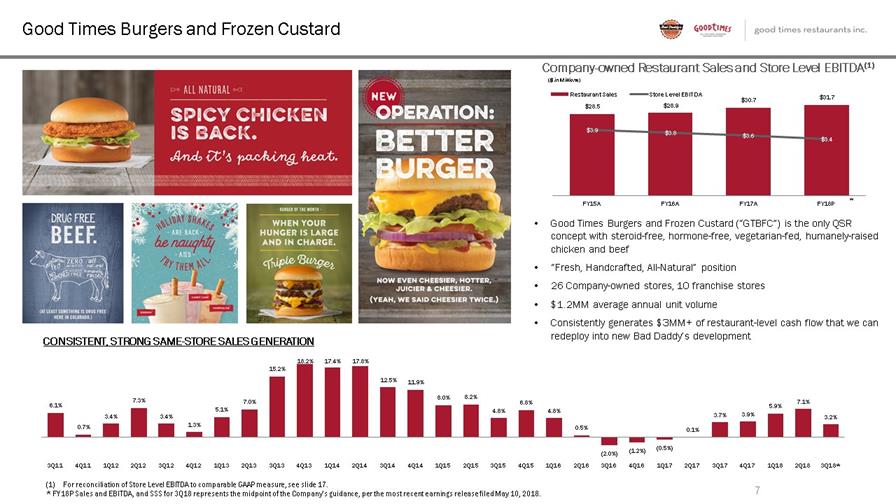

Good Times Burgers and Frozen Custard 7 Good Times Burgers and Frozen Custard (“GTBFC”) is the only QSR concept with steroid-free, hormone-free, vegetarian-fed, humanely-raised chicken and beef“Fresh, Handcrafted, All-Natural” position26 Company-owned stores, 10 franchise stores$1.2MM average annual unit volumeConsistently generates $3MM+ of restaurant-level cash flow that we can redeploy into new Bad Daddy’s development Company-owned Restaurant Sales and Store Level EBITDA(1) ($ in Millions) For reconciliation of Store Level EBITDA to comparable GAAP measure, see slide 17.* FY18P Sales and EBITDA, and SSS for 3Q18 represents the midpoint of the Company’s guidance, per the most recent earnings release filed May 10, 2018. * CONSISTENT, STRONG SAME-STORE SALES GENERATION

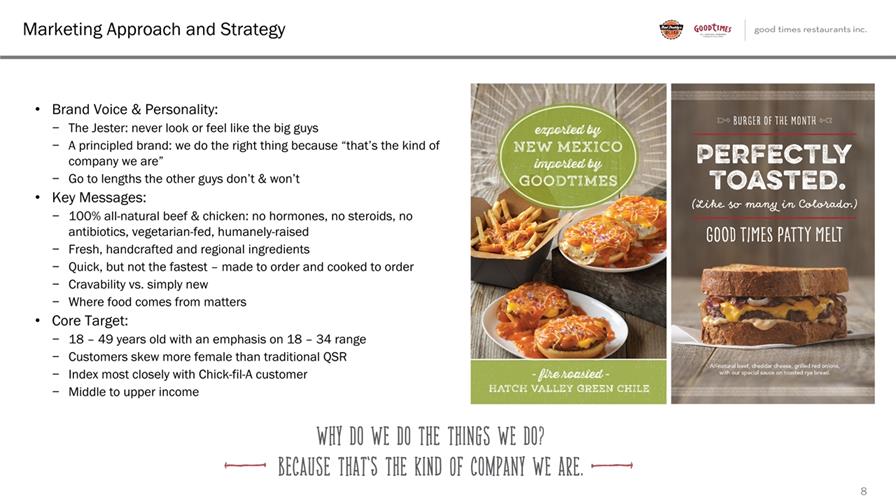

Marketing Approach and Strategy 8 Brand Voice & Personality:The Jester: never look or feel like the big guysA principled brand: we do the right thing because “that’s the kind of company we are”Go to lengths the other guys don’t & won’tKey Messages:100% all-natural beef & chicken: no hormones, no steroids, no antibiotics, vegetarian-fed, humanely-raisedFresh, handcrafted and regional ingredientsQuick, but not the fastest – made to order and cooked to orderCravability vs. simply newWhere food comes from mattersCore Target:18 – 49 years old with an emphasis on 18 – 34 rangeCustomers skew more female than traditional QSRIndex most closely with Chick-fil-A customerMiddle to upper income

10 THIS PAGE INTENTIONALLY BLANK

Bad Daddy’s Burger Bar – Future Growth Platform 11 Bad Daddy’s Burger Bar (“BDBB”) is a 29-unit full service concept with a high-energy, chef-driven, burger- and bar-focused positioning founded in Charlotte, NC in 2008Fully-committed to full service model; strong volume in a comparatively small box enables us to generate high energy, high sales per square foot, and spend a little more on elevated service27 Company-owned stores, 1 franchise store, 1 licensed store as of June 10, 2018~$17 per person average check (including alcohol)59% Dinner / 41% Lunch, 84% Food / 16% AlcoholImplied guidance of ~10MM restaurant-level cash flow represents an ~60% CAGR between 2015 and 2018, and expect continued growth rate at ~30% - 40% for each of the following two years. Company-owned Restaurant Sales and Store Level EBITDA (1) ($ in Millions) (1) For reconciliation of Store Level EBITDA to comparable GAAP measure, see slide 17.*FY2018P represents the midpoint of the Company’s guidance, per the most recent earnings release filed May 10, 2018. * FY15 – FY18P CAGR: 36.4% System-wide Units

Chef-driven menu with big portions and in-your-face flavors 12 Simple, high-quality ingredients executed at a high levelHouse-made sauces and dressings“Create Your Own” burgers and saladsMonthly chef specialsFeatured proteins include beef, chicken, turkey, buffalo and tunaBar sales averaging ~16.2% of mix for LTM (ranged from 11 – 25%)17 – 20 local micro-brews on tapFresh-squeezed cocktails, “Bad Ass Margarita” Burgers Starters / Sides Non-Burgers / Salads Drinks / Desserts

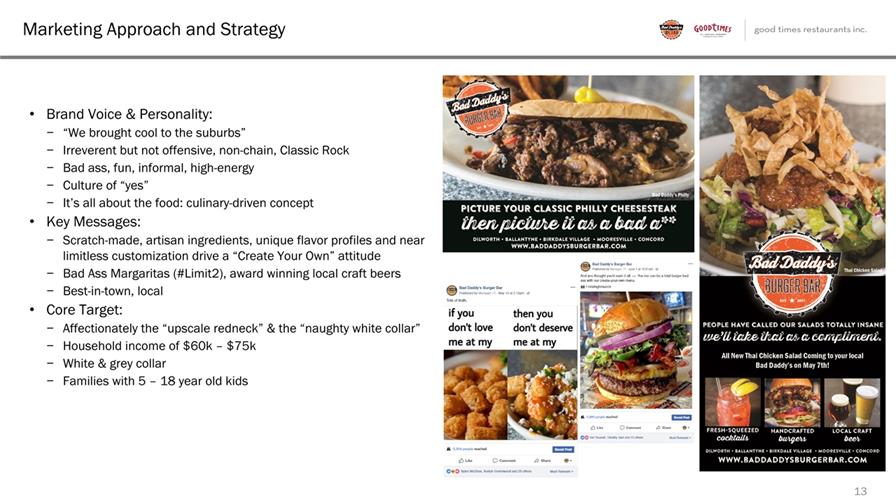

Marketing Approach and Strategy 13 Brand Voice & Personality:“We brought cool to the suburbs”Irreverent but not offensive, non-chain, Classic RockBad ass, fun, informal, high-energyCulture of “yes”It’s all about the food: culinary-driven conceptKey Messages:Scratch-made, artisan ingredients, unique flavor profiles and near limitless customization drive a “Create Your Own” attitudeBad Ass Margaritas (#Limit2), award winning local craft beersBest-in-town, local Core Target:Affectionately the “upscale redneck” & the “naughty white collar”Household income of $60k – $75kWhite & grey collarFamilies with 5 – 18 year old kids

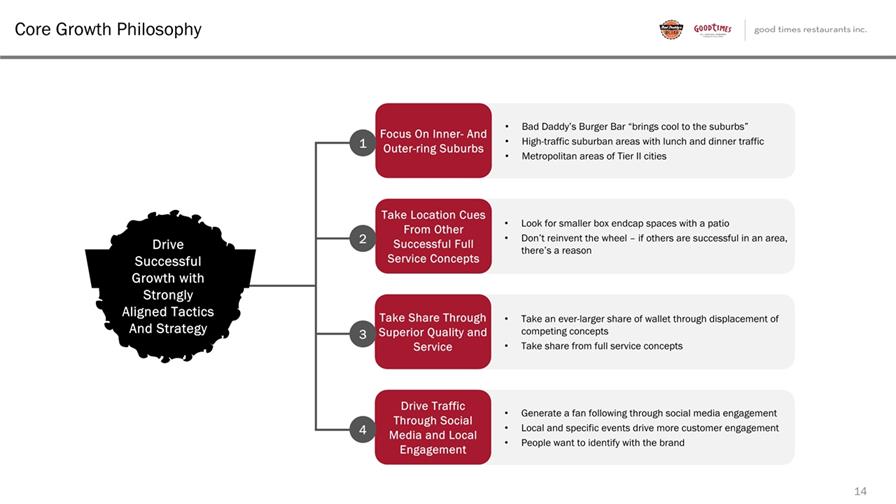

Bad Daddy’s Burger Bar “brings cool to the suburbs”High-traffic suburban areas with lunch and dinner trafficMetropolitan areas of Tier II cities Take an ever-larger share of wallet through displacement of competing conceptsTake share from full service concepts Look for smaller box endcap spaces with a patio Don’t reinvent the wheel – if others are successful in an area, there’s a reason Generate a fan following through social media engagementLocal and specific events drive more customer engagementPeople want to identify with the brand Focus On Inner- And Outer-ring Suburbs Take Location Cues From Other Successful Full Service Concepts Take Share Through Superior Quality and Service Drive Traffic Through Social Media and Local Engagement Core Growth Philosophy 14 1 2 3 Drive Successful Growth with Strongly Aligned Tactics And Strategy 4

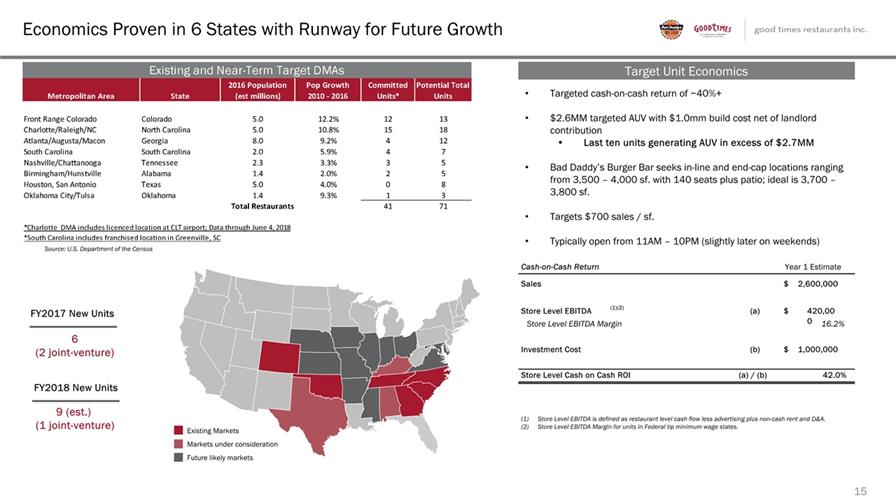

Economics Proven in 6 States with Runway for Future Growth 15 Existing Markets Future likely markets Markets under consideration 9 (est.) (1 joint-venture) FY2018 New Units Source: U.S. Department of the Census FY2017 New Units 6(2 joint-venture) Target Unit Economics Targeted cash-on-cash return of ~40%+$2.6MM targeted AUV with $1.0mm build cost net of landlord contributionLast ten units generating AUV in excess of $2.7MMBad Daddy’s Burger Bar seeks in-line and end-cap locations ranging from 3,500 – 4,000 sf. with 140 seats plus patio; ideal is 3,700 – 3,800 sf.Targets $700 sales / sf.Typically open from 11AM – 10PM (slightly later on weekends) Store Level EBITDA is defined as restaurant level cash flow less advertising plus non-cash rent and D&A.Store Level EBITDA Margin for units in Federal tip minimum wage states. Cash-on-Cash Return Year 1 Estimate Sales 2,600,000 $ Store Level EBITDA (1)(2) (a) 420,000 $ Store Level EBITDA Margin 16.2% Investment Cost (b) 1,000,000 $ Store Level Cash on Cash ROI (a) / (b) 42.0%

Financial Review

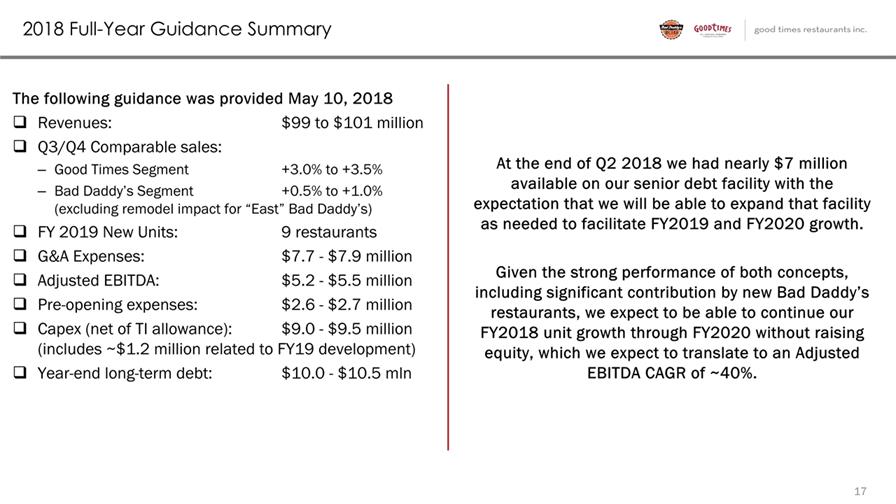

2018 Full-Year Guidance Summary The following guidance was provided May 10, 2018Revenues: $99 to $101 millionQ3/Q4 Comparable sales:Good Times Segment +3.0% to +3.5%Bad Daddy’s Segment +0.5% to +1.0% (excluding remodel impact for “East” Bad Daddy’s)FY 2019 New Units: 9 restaurantsG&A Expenses: $7.7 - $7.9 millionAdjusted EBITDA: $5.2 - $5.5 millionPre-opening expenses: $2.6 - $2.7 millionCapex (net of TI allowance): $9.0 - $9.5 million(includes ~$1.2 million related to FY19 development)Year-end long-term debt: $10.0 - $10.5 mln 17 At the end of Q2 2018 we had nearly $7 million available on our senior debt facility with the expectation that we will be able to expand that facility as needed to facilitate FY2019 and FY2020 growth.Given the strong performance of both concepts, including significant contribution by new Bad Daddy’s restaurants, we expect to be able to continue our FY2018 unit growth through FY2020 without raising equity, which we expect to translate to an Adjusted EBITDA CAGR of ~40%.

Good Times Burgers and Frozen Custard Summary Financials 18 Systemwide Units Total Net Revenue Store Level EBITDA ($ in Millions) ($ in Millions) (1) FY18P represents the midpoint of the Company’s guidance, per the most recent earnings release filed May 10, 2018. (1) (1) (1) ($ in Thousands) Reconciliation of Store Level EBITDA to Segment Income from Operations (1)

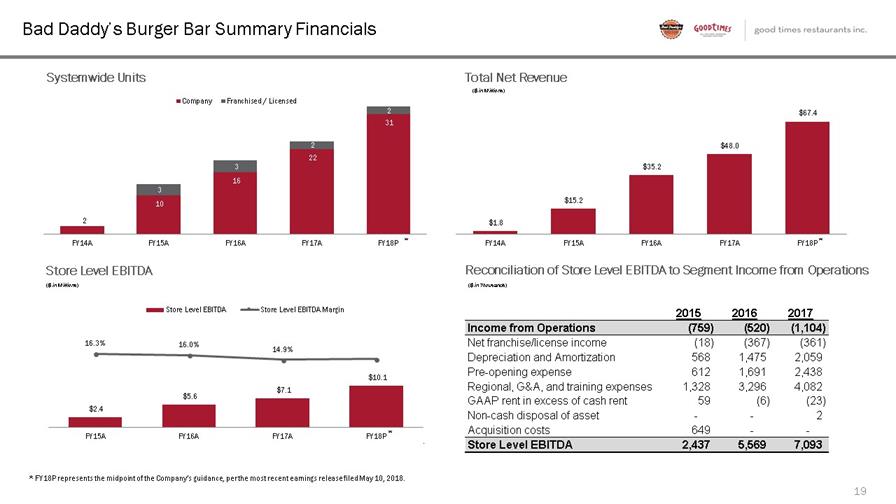

Bad Daddy’s Burger Bar Summary Financials 19 Systemwide Units Store Level EBITDA ($ in Millions) ($ in Millions) Total Net Revenue * FY18P represents the midpoint of the Company’s guidance, per the most recent earnings release filed May 10, 2018. * ($ in Thousands) Reconciliation of Store Level EBITDA to Segment Income from Operations * *

Good Times Restaurants Inc. Consolidated Summary Financials 20 Total Systemwide Restaurants Total Net Revenue Adjusted EBITDA Reconciliation of Adjusted EBITDA to Reported Net Loss ($ in Millions) ($ in Millions) FY13 – FY18P CAGR: 34.1% (1) (1) (1) FY18P represents the midpoint of the Company’s guidance, per the most recent earnings release filed May 10, 2018. ($ in Thousands) (1)