Form 8-K/A Orion Group Holdings For: Aug 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 11, 2017

ORION GROUP HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

Delaware | 1-33891 | 26-0097459 | ||

(State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) | ||

12000 Aerospace Ave., Suite 300

Houston, Texas 77034

(Address of principal executive offices)

(713) 852-6500

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

TABLE OF CONTENTS

Item 8.01 Other Events

James Michael Pearson, a member of the Company's Board of Directors, entered into a Rule 10b5-1 Option Exercise and Sale Plan with a third party broker as of August 11, 2017 (including all requisite schedules). The agreement terminates on October 4, 2019 and although on August 17, 2017 it was filed on the requisite Form 8-K, the filing did not include all the schedules. Therefore, this Form 8-K/A amends and supplements the August 17, 2017 filing and includes as Exhibit 99.1* a complete copy of said plan, including all schedules.

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

Orion Group Holdings, Inc. | ||

By: /s/ Christopher J. DeAlmeida | ||

Dated: June 8, 2018 | Executive Vice President and Chief Financial Officer | |

2

Exhibit Index

Exhibit No. | Description | |

10b5-1 Option Exercise and Sales Plan | ||

3

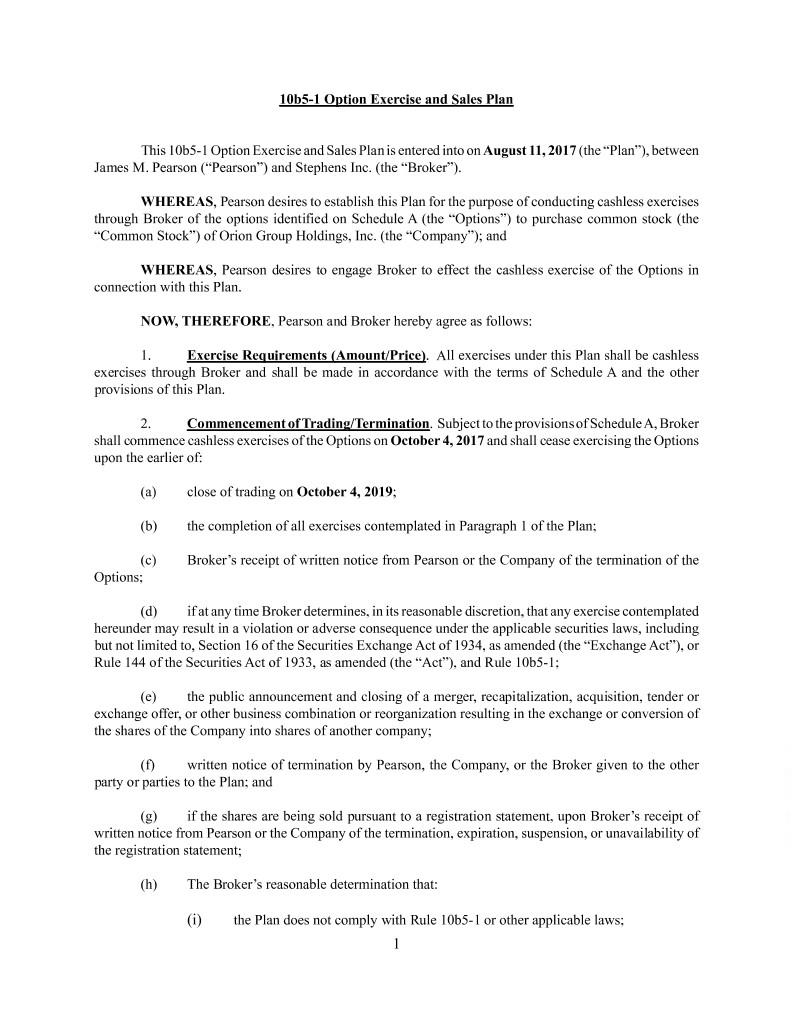

10b5-1 Option Exercise and Sales Plan This 10b5-1 Option Exercise and Sales Plan is entered into on August 11, 2017 (the “Plan”), between James M. Pearson (“Pearson”) and Stephens Inc. (the “Broker”). WHEREAS, Pearson desires to establish this Plan for the purpose of conducting cashless exercises through Broker of the options identified on Schedule A (the “Options”) to purchase common stock (the “Common Stock”) of Orion Group Holdings, Inc. (the “Company”); and WHEREAS, Pearson desires to engage Broker to effect the cashless exercise of the Options in connection with this Plan. NOW, THEREFORE, Pearson and Broker hereby agree as follows: 1. Exercise Requirements (Amount/Price). All exercises under this Plan shall be cashless exercises through Broker and shall be made in accordance with the terms of Schedule A and the other provisions of this Plan. 2. Commencement of Trading/Termination. Subject to the provisions of Schedule A, Broker shall commence cashless exercises of the Options on October 4, 2017 and shall cease exercising the Options upon the earlier of: (a) close of trading on October 4, 2019; (b) the completion of all exercises contemplated in Paragraph 1 of the Plan; (c) Broker’s receipt of written notice from Pearson or the Company of the termination of the Options; (d) if at any time Broker determines, in its reasonable discretion, that any exercise contemplated hereunder may result in a violation or adverse consequence under the applicable securities laws, including but not limited to, Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or Rule 144 of the Securities Act of 1933, as amended (the “Act”), and Rule 10b5-1; (e) the public announcement and closing of a merger, recapitalization, acquisition, tender or exchange offer, or other business combination or reorganization resulting in the exchange or conversion of the shares of the Company into shares of another company; (f) written notice of termination by Pearson, the Company, or the Broker given to the other party or parties to the Plan; and (g) if the shares are being sold pursuant to a registration statement, upon Broker’s receipt of written notice from Pearson or the Company of the termination, expiration, suspension, or unavailability of the registration statement; (h) The Broker’s reasonable determination that: (i) the Plan does not comply with Rule 10b5-1 or other applicable laws; 1

(ii) Pearson or Broker has not complied with the Plan, Rule 10b5-1, or other applicable securities laws; or (iii) Pearson has made misstatements herein or in any client representation letter to Broker. 3. Modification. This Plan may be modified by mutual agreement of the parties provided that such modification is in writing, is made in good faith, and is not part of a plan or scheme by Pearson to evade prohibitions of Rule 10b5 of the Exchange Act or other applicable laws or regulations, and such modification is pre-cleared or acknowledged by the Company’s designated legal counsel. 4. Market Disruption or other Disruption. Pearson understands that Broker may not be able to effect an exercise due to a market disruption, a legal, regulatory, or contractual restriction applicable to the Broker or to the relevant market, or a failure of the Company to comply with its share delivery and other obligations contained in the Company Acknowledgement attached hereto. If any exercise cannot be executed as required by Paragraph 1 above due to a market disruption, a legal, regulatory, or contractual restriction applicable to the Broker or any other cause, Broker shall (unless Broker determines to terminate this Plan as provided in Paragraph 2 above) effect such exercise as promptly as practical after the cessation or termination of such market disruption, applicable restriction, or other event provided that, the exercise complies with the exercise requirements as provided in Paragraph 1 above. In the event of a stock split or reverse stock split, the dollar amount at which shares are sold and number of Option shares will be automatically adjusted to the extent provided in the award notice relating to the Options. 5. Pearson Representation and Warranties. Pearson represents and warrants that: (a) Pearson is not aware at the time of his or her execution hereof of material, nonpublic information with respect to the Company or any securities of the Company (including the Common Stock) and is entering into this Plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1 of the Exchange Act. (b) Pearson is currently able to sell shares of Common Stock in accordance with the Company’s insider trading policies and Pearson has obtained the written approval of the Company to enter into this Plan. (c) Pearson is currently authorized to exercise the Options with respect to the number of shares of Common Stock specified on Schedule A, and Pearson will provide prompt written notice to Broker in the event such authorization is terminated. (d) Pearson shall have no authority to exercise, and shall not attempt to exercise, any influence or control over how, when, or whether to effect the cashless exercise of the Options hereunder. (e) Pearson shall not communicate any material, nonpublic information with respect to the Company or any securities of the Company (including the Common Stock and the Options) to any employees or representatives of Broker involved in the administration of this Plan or the execution of any trades hereunder. 2

(f) Pearson shall complete, execute, and deliver to Broker, any Notice of Intent to Exercise forms as may be required by Broker or the Company in connection with any exercise of the Options effected hereunder. (g) Pearson shall cause the Company to execute and deliver to Broker the Company Acknowledgement attached hereto as Exhibit A. 6. Compliance with the Securities Laws. (a) It is the intent of the parties that this Plan comply with the requirements of Rule 10b5-1(c) (1)(i)(B) under the Exchange Act and this Plan shall be interpreted to comply with the requirements of Rule 10b5-1(c) under the Exchange Act. (b) Pearson agrees to make all filings, if any, required under Sections 13(d) and 16 of the Exchange Act. (c) Pearson agrees to complete, execute and deliver to Broker Forms 144 for the sales to be effected under this Plan at such times and in such numbers as Broker shall request, and, Broker agrees to file such Forms 144 on behalf of Pearson as required by applicable law. 7. Governing Law. This Plan shall be governed by and construed in accordance with the laws of the State of Arkansas. 8. Notices. Notices of any trades under this Plan shall be delivered in accordance with Schedule B. 9. Exercise Notice to the Company. Pearson hereby exercises (i) the Option granted to Pearson by the Company on 12/4/2007, expiring 12/3/2017, and elects to purchase for $14.25 per share that number of shares of Common Stock that are exercised with respect to such Option pursuant to the parameters of Schedule A hereto; and (ii) the Option granted to Pearson by the Company on 10/7/2008, expiring 10/06/2018, and elects to purchase for $6.00 per share that number of shares of Common Stock that are exercised with respect to such Option pursuant to the parameters of Schedule A hereto; and (iii) the Option granted to Pearson by the Company on 11/19/2009, expiring 11/18/2019, and elects to purchase for $19.11 per share that number of shares of Common Stock that are exercised with respect to such Option pursuant to the parameters of Schedule A hereto; and (iv) the Option granted to Pearson by the Company on 11/18/2010, expiring 11/17/2020 and elects to purchase for $13.69 per share that number of shares of Common Stock that are exercised with respect to such Option pursuant to the parameters of Schedule A hereto; and (v) the Option granted to Pearson by the Company on 1/19/2012, expiring 1/18/2022 and elects to purchase for $6.52 per share that number of shares of Common Stock that are exercised with respect to such Option pursuant to the parameters of Schedule A hereto. ***SIGNATURE PAGE FOLLOWS*** 3

IN WITNESS WHEREOF, the undersigned have signed this Plan as of the date first written above. 4

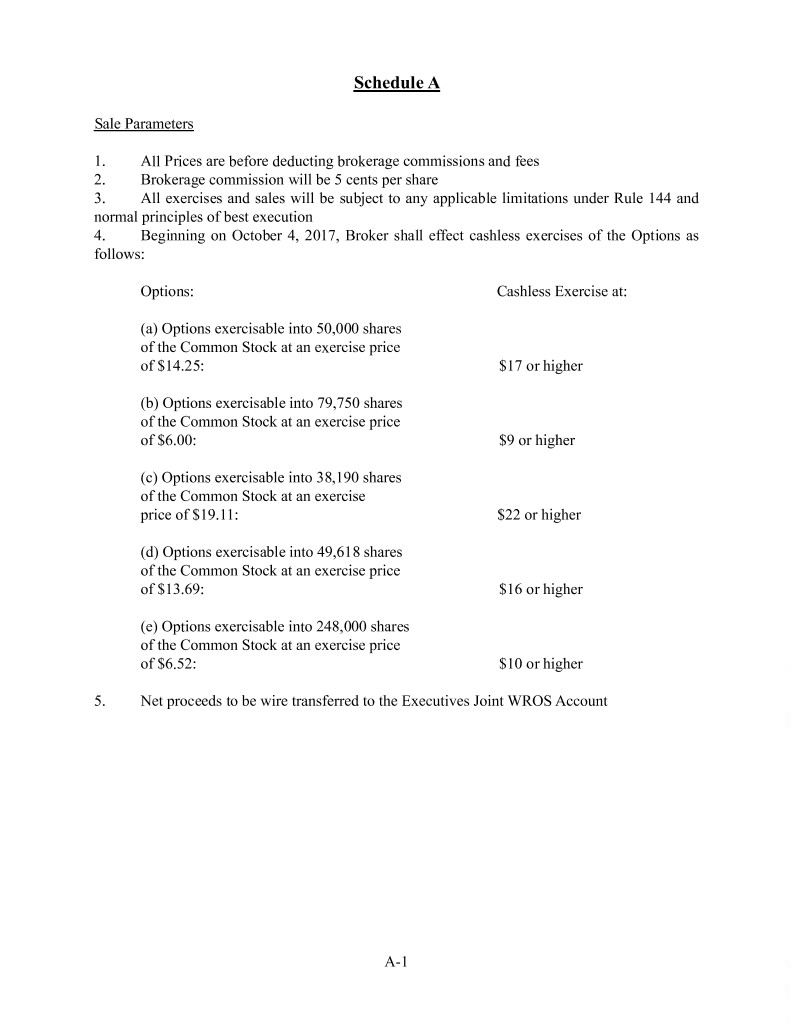

Schedule A Sale Parameters 1. All Prices are before deducting brokerage commissions and fees 2. Brokerage commission will be 5 cents per share 3. All exercises and sales will be subject to any applicable limitations under Rule 144 and normal principles of best execution 4. Beginning on October 4, 2017, Broker shall effect cashless exercises of the Options as follows: Options: Cashless Exercise at: (a) Options exercisable into 50,000 shares of the Common Stock at an exercise price of $14.25: $17 or higher (b) Options exercisable into 79,750 shares of the Common Stock at an exercise price of $6.00: $9 or higher (c) Options exercisable into 38,190 shares of the Common Stock at an exercise price of $19.11: $22 or higher (d) Options exercisable into 49,618 shares of the Common Stock at an exercise price of $13.69: $16 or higher (e) Options exercisable into 248,000 shares of the Common Stock at an exercise price of $6.52: $10 or higher 5. Net proceeds to be wire transferred to the Executives Joint WROS Account A-1

Schedule B Confirmations of all trades under the Plan or other notices shall be sent by email to the following persons: Pearson: James M. Pearson Company’s Compliance Officer: Peter R. Buchler Broker: David Phillips B-1

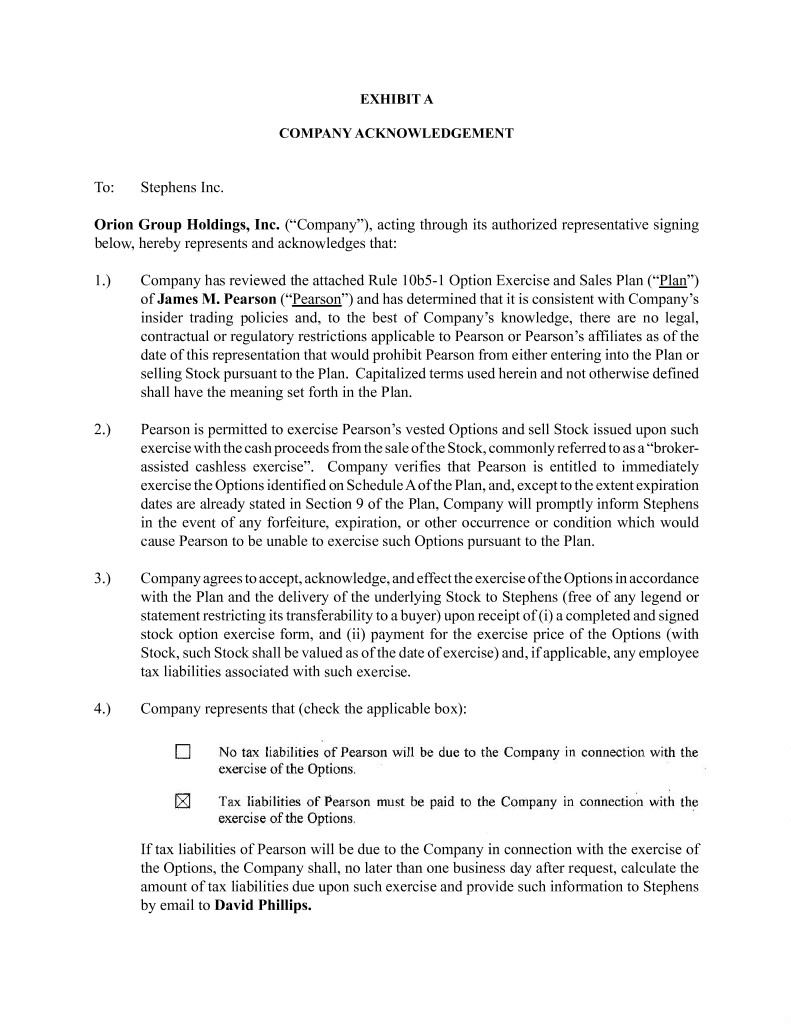

EXHIBIT A COMPANY ACKNOWLEDGEMENT To: Stephens Inc. Orion Group Holdings, Inc. (“Company”), acting through its authorized representative signing below, hereby represents and acknowledges that: 1.) Company has reviewed the attached Rule 10b5-1 Option Exercise and Sales Plan (“Plan”) of James M. Pearson (“Pearson”) and has determined that it is consistent with Company’s insider trading policies and, to the best of Company’s knowledge, there are no legal, contractual or regulatory restrictions applicable to Pearson or Pearson’s affiliates as of the date of this representation that would prohibit Pearson from either entering into the Plan or selling Stock pursuant to the Plan. Capitalized terms used herein and not otherwise defined shall have the meaning set forth in the Plan. 2.) Pearson is permitted to exercise Pearson’s vested Options and sell Stock issued upon such exercise with the cash proceeds from the sale of the Stock, commonly referred to as a “broker- assisted cashless exercise”. Company verifies that Pearson is entitled to immediately exercise the Options identified on Schedule A of the Plan, and, except to the extent expiration dates are already stated in Section 9 of the Plan, Company will promptly inform Stephens in the event of any forfeiture, expiration, or other occurrence or condition which would cause Pearson to be unable to exercise such Options pursuant to the Plan. 3.) Company agrees to accept, acknowledge, and effect the exercise of the Options in accordance with the Plan and the delivery of the underlying Stock to Stephens (free of any legend or statement restricting its transferability to a buyer) upon receipt of (i) a completed and signed stock option exercise form, and (ii) payment for the exercise price of the Options (with Stock, such Stock shall be valued as of the date of exercise) and, if applicable, any employee tax liabilities associated with such exercise. 4.) Company represents that (check the applicable box): If tax liabilities of Pearson will be due to the Company in connection with the exercise of the Options, the Company shall, no later than one business day after request, calculate the amount of tax liabilities due upon such exercise and provide such information to Stephens by email to David Phillips.

5.) Upon receipt by Company of a completed exercise notice and payment (as described in Section 3.) above) from Stephens of the amounts due in connection with such exercise, Company will deliver, within two business days after the option exercise, book entry shares to Stephens’ DTC account (DTC #0419) via DTCC’s Direct Withdrawal At Custodian (DWAC) functionality. Any questions may be directed to Pam Mills, Stephens Inc. Retail Control Supervisor, 501-377-2207. The shares so delivered will not be encumbered or restricted in any manner, and will be fully paid and non-assessable. 6.) During the Sale Periods set forth in the Plan, Company agrees to provide notice as soon as practicable to Stephens (i) in the event that the Plan becomes inconsistent with Company’s insider trading policies, (ii) if the Company becomes aware of legal, contractual or regulatory restrictions applicable to Pearson or Pearson’s affiliates that would prohibit any sale pursuant to the Plan (such notice merely stating that there is a restriction applicable to Pearson without specifying the reasons for such restriction), or (iii) except to the extent expiration dates are already stated in Section 9 of the Plan, upon the occurrence of any forfeiture, expiration, or other event or condition which would cause Pearson to be unable to exercise any Options in accordance with the Plan. In any event, Company shall not communicate any material nonpublic information about Company or its securities to Stephens with respect to the Plan. The foregoing notice shall be provided by email to David Phillips and shall indicate the anticipated duration of the restriction but shall not include any other information about the nature of the restriction or its applicability to Pearson. Any such notice is provided under the express condition that Stephens shall (i) maintain such information in confidence, (ii) share it only with those persons who reasonably need to know the information in the execution and administration of the Plan, and (iii) use any information concerning or contained in such notice (including existence of the notice) for no purpose other than the execution and administration of the Plan; provided, however, nothing in this paragraph shall prohibit Stephens or its attorney from responding to any inquiry from the Securities and Exchange Commission, or other legal or regulatory authority regarding such notice or its underlying facts and circumstances. 7.) The Company’s obligations set forth herein constitute its legal, valid and binding obligations enforceable against it in accordance with their terms.