Form 8-K KNOLL INC For: May 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 22, 2018

Knoll, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-12907

Delaware | 13-3873847 | |

(State or other jurisdiction of | (IRS Employer | |

incorporation) | Identification No.) | |

1235 Water Street, East Greenville, Pennsylvania 18041

(Address of principal executive offices, including zip code)

(215) 679-7991

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

Knoll, Inc.’s President and Chief Executive Officer, Andrew B. Cogan, and Senior Vice President and Chief Financial Officer, Charles W. Rayfield, will meet with certain stockholders and investors during the second quarter of 2018. The materials used in connection with these meetings are attached as Exhibit 99.1 to this Current Report on Form 8-K. A copy also will be posted on Knoll’s website at www.knoll.com under the heading “Second Quarter 2018 Investor Presentation.”

The Company makes reference to non-GAAP financial measures in the attached investor presentation. A reconciliation of these non-GAAP financial measures to the applicable GAAP financial measures is contained in the attached investor presentation.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Exhibit 99.1 - Second Quarter 2018 Investor Presentation

The information in this report and the attached exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Knoll, Inc. | ||

Date: May 22, 2018 | By: | /s/ Michael A. Pollner |

Michael A. Pollner | ||

Senior Vice President, Chief Administrative Officer, General Counsel & Secretary | ||

EXHIBIT INDEX

Exhibit | Description | |

Knoll, Inc. Second Quarter 2018 Investor Presentation Andrew Cogan, President & CEO Andrew Cogan, President & CEO Bank Co-sponsored Incubator CharlesCharles Rayfield,Rayfield, SVPSVP && CFOCFO Richmond, Virginia © 2018 Knoll Inc. 1

Forward-Looking Statements/Non-GAAP Measures This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding Knoll, Inc.’s expected future financial position, results of operations, revenue and profit levels, cash flows, business strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include words such as "anticipate," "if," "believe," "plan," “goals," "estimate," "expect," "intend," "may," "could," "should," "will," and other similar expressions are forward-looking statements. This includes, without limitation, our statements and expectations regarding any current or future recovery in our industry, expectations with respect to Muuto integration and performance, and our expectations with respect to leverage. Such forward-looking statements are inherently uncertain, and readers must recognize that actual results may differ materially from the expectations of Knoll management. Knoll does not undertake a duty to update such forward-looking statements. Factors that may cause actual results to differ materially from those in the forward-looking statements include corporate spending and service-sector employment, price competition, acceptance of Knoll’s new products, the pricing and availability of raw materials and components, foreign exchange rates, transportation costs, demand for high quality, well designed furniture and coverings solutions, changes in the competitive marketplace, changes in trends in the market for furniture or coverings, the financial strength and stability of our suppliers, customers and dealers, access to capital, our success in designing and implementing our new enterprise resource planning system, our ability to successfully integrate acquired businesses, and other risks identified in Knoll’s Annual Report on Form 10-K, and other filings with the Securities and Exchange Commission, as well as other cautionary statements that are made from time-to-time in Knoll’s public communications. Many of these factors are outside of Knoll’s control. This presentation also includes certain non-GAAP financial measures. A “non-GAAP financial measure” is a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We present Non-GAAP measures because we consider them to be important supplemental measures of our performance and believe them to be useful to display ongoing results from operations distinct from items that are infrequent or not indicative of our operating performance. We have provided reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure in the presentation below. These non-GAAP measures are not indicators of our financial performance under GAAP and should not be considered as an alternative to the applicable GAAP measure. These non-GAAP measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Our presentation of these non-GAAP measures should not be construed as an inference that our future results will be unaffected by unusual or infrequent items. © 2018 Knoll Inc. 2

Knoll is: A constellation of design-driven brands and people, working together with our clients to create inspired modern interiors.

Knoll’s reputation for iconic design, leadership, quality and innovation in both the workplace and residential markets is recognized globally 1938 80 2018 © 2018 Knoll Inc. 4

Four strategic imperatives drive our strategy › Target underpenetrated and emerging ancillary categories and markets for growth › Expand our reach into residential and decorator channels around the world › Maximize office segment profitability and growth › Leverage technology to expand our market visibility and improve our efficiency © 2018 Knoll Inc. 5

Knoll brands span commercial and residential applications with high design opportunities, and are heavily influenced by architect and designer specifiers Luxury HOLLY HUNT Edelman KnollStudio • Favorable demographics • High margin opportunities DatesWeiserKnollTextiles Spinneybeck • Fragmented competitors Affordable luxury FilzFelt Muuto • Changing work style Knoll Office • Resimercial aesthetic - Residential product • Global capability KnollExtra - Hybrid product - Commercial product Accessible Commercial Residential $73B Global Commercial Market $266B Global Residential Market • $8B luxury • $9B luxury • $11B affordable luxury • $17B affordable luxury ~$18.5B North American Market Sources: Based on Knoll, Inc. and BIFMA estimates © 2018 Knoll Inc. 6

We have a singular line-up of brands and offerings from high-performance workplace to “resimericial” ancillary… Knoll Office DatesWeiser KnollStudio Muuto Ancillary Offering © 2018 Knoll Inc. 7

…and from uber-luxury living spaces to affordable luxury for the home HOLLY HUNT | Vladimir Kagan KnollStudio LA Home Design Shop Muuto © 2018 Knoll Inc. 8

Through both organic product development and M&A we continue to shift the mix of our sales and profits outside Office and NA Q1 2018 Net Sales Q1 2018 Adjusted Q1 2018 Net Sales by Geography EBITDA 14% 39% 59% 61% 41% 86% Office Lifestyle N. America Rest of World Office Lifestyle Note: Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Operating Profit by segment to Adjusted EBITDA by segment, see page 30. © 2018 Knoll Inc. 9

As Office clients rethink their priorities, we see a major inflection point in workplace design, creating new challenges and opportunities for Knoll Primary Primary Activity Client Space Allocation Activity Individual Group Formal Casual Corporate / commercial aesthetic Residential aesthetic Dedicated Shared One Size Fits All Competition for Talent Fixed Mobile / Adjustable $1M+ projects Small to mid size projects © 2018 Knoll Inc. 10

Solving ancillary is critical for maintaining our position as a market leader and fueling growth Estimated share of wallet1 Estimated Market share2 2015 Knoll Dealers 2016 Industry ~$18.3B3 Workstations Ancillary Workstations Ancillary (Primary Spaces) (Activity) (Primary Spaces) (Activity) workplace ±90% ±10% workplace ±7% ±1% 1 ±50% combined share of wallet based on major project 2 ±4% combined market share, Knoll Estimate review and reported Dealer value 3 Preliminary BIFMA 2016 estimate © 2018 Knoll Inc. 11

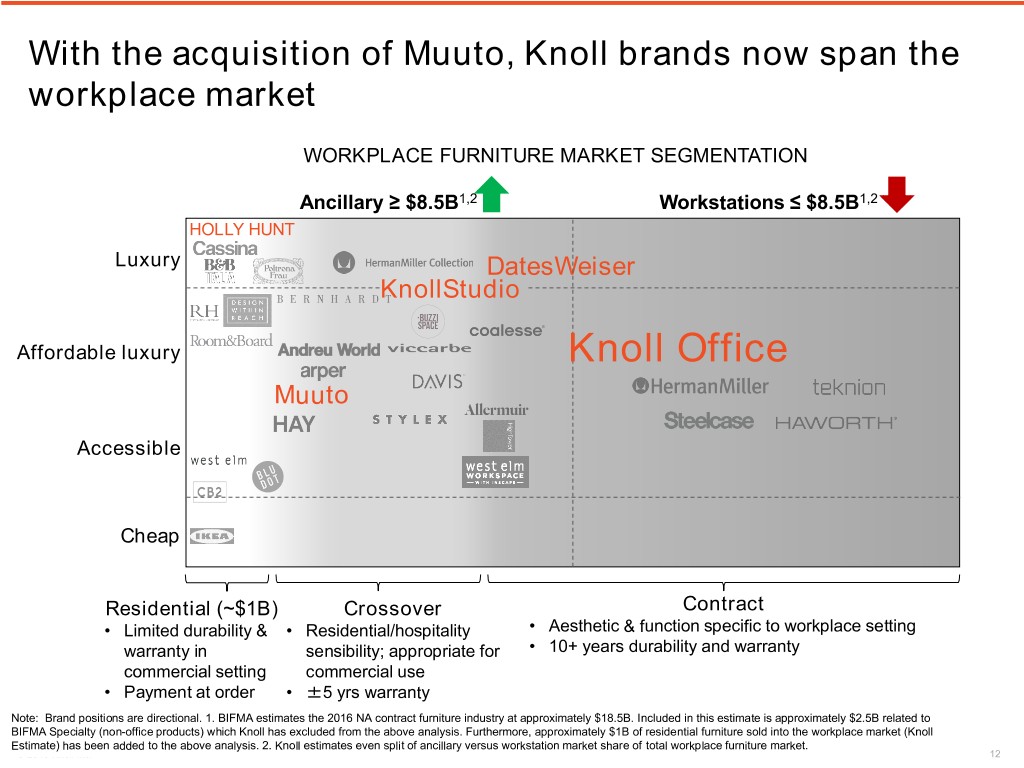

With the acquisition of Muuto, Knoll brands now span the workplace market WORKPLACE FURNITURE MARKET SEGMENTATION Ancillary ≥ $8.5B1,2 Workstations ≤ $8.5B1,2 HOLLY HUNT Luxury DatesWeiser KnollStudio Affordable luxury Knoll Office Muuto Accessible Cheap Residential (~$1B) Crossover Contract • Limited durability & • Residential/hospitality • Aesthetic & function specific to workplace setting warranty in sensibility; appropriate for • 10+ years durability and warranty commercial setting commercial use • Payment at order • ±5 yrs warranty Note: Brand positions are directional. 1. BIFMA estimates the 2016 NA contract furniture industry at approximately $18.5B. Included in this estimate is approximately $2.5B related to BIFMA Specialty (non-office products) which Knoll has excluded from the above analysis. Furthermore, approximately $1B of residential furniture sold into the workplace market (Knoll Estimate) has been added to the above analysis. 2. Knoll estimates even split of ancillary versus workstation market share of total workplace furniture market. © 2018 Knoll Inc. 12

Muuto Expansion Strategy We plan to more than double the size of Muuto over the next 3-5 years 1• North America: Massive upside to ~$15M sales today by leveraging Knoll client base, architect and designer relationships, and contract and residential distributors • Proven market acceptance in NA Muuto with key co-working and residential 2017A: retailers $71M Sales $19M Adjusted EBITDA 2• Europe: Introduce Muuto to Knoll residential distribution and corporate clients 1 3• Product: Scale product scope 2 3 Sales & EBITDA growth >2X Note: Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Net Earnings to Adjusted EBITDA, see page 30. © 2018 Knoll Inc. 13

In 2017 and Q1 2018 sales of newer workplace platforms eclipsed those of legacy systems and storage © 2018 Knoll Inc. 14

Industry indicators are mixed Corporate Profits declined in Q4 CEO Confidence remains positive Architectural Billings down slightly % Change from Prior Year Quarter CEO Confidence Index ABI Billing Index 25.00% 80 60 20.00% 15.00% 70 55 10.00% 60 5.00% 50 0.00% 50 2014 2015 2016 2017 (5.00)% 45 (10.00)% 40 (15.00)% 30 40 (20.00)% 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Source: Bureau of Economic Analysis as of Q4 2017 Source: Chief Executive Magazine Source: American Institute of Architects Net absorption remains flat Annual Net Absorption (sf) 60 55 50 45 Millions 40 35 30 25 2014 2015 2016 2017 TTM Q1-18 Source: JLL © 2018 Knoll Inc. 15

Investment Rationale › Improving macro environment with decreasing headwind from legacy products helping drive sales › Lean opportunities to drive Office margins higher › Strong track record of successful acquisitions; Muuto expected to be immediately accretive to both margins and EPS › Significant benefit from lower tax rates for both clients and Knoll › Driven and motivated management team aligned with shareholder objectives © 2018 Knoll Inc. 16

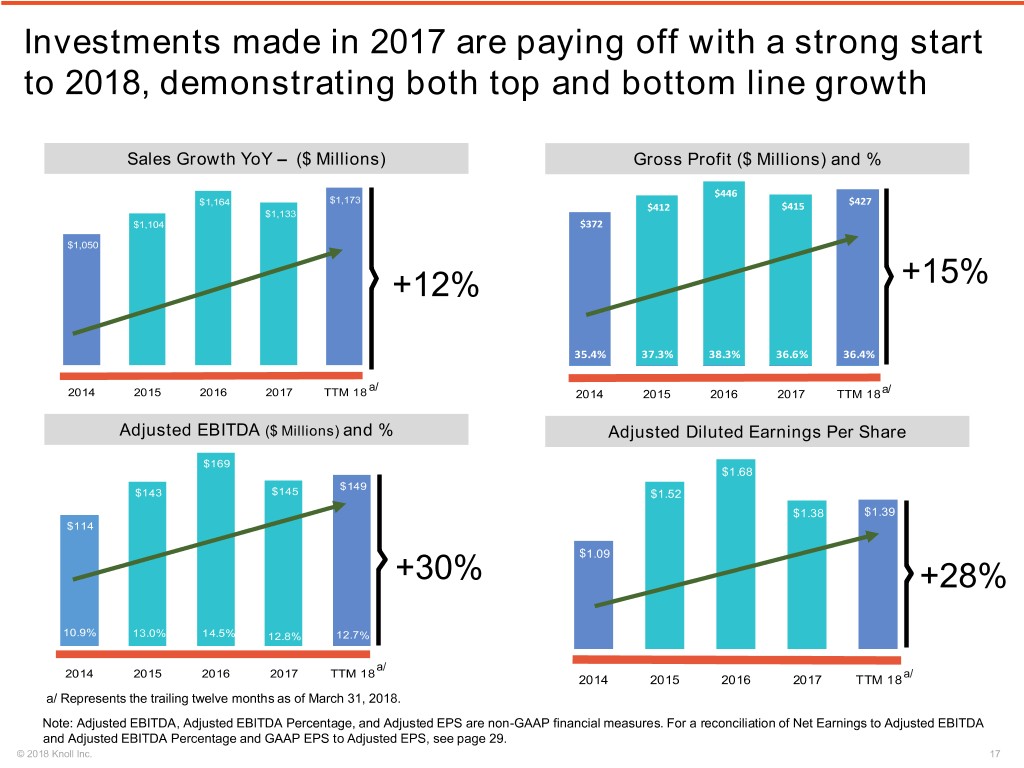

Investments made in 2017 are paying off with a strong start to 2018, demonstrating both top and bottom line growth Sales Growth YoY – ($ Millions) Gross Profit ($ Millions) and % $446 $1,164 $1,173 $427 $412 $415 $1,133 $1,104 $372 $1,050 +12% +15% 35.4% 37.3% 38.3% 36.6% 36.4% a/ 2014 2015 2016 2017 TTM 18 2014 2015 2016 2017 TTM 18a/ Adjusted EBITDA ($ Millions) and % Adjusted Diluted Earnings Per Share $169 $1.68 $149 $143 $145 $1.52 $1.38 $1.39 $114 $1.09 +30% +28% 10.9% 13.0% 14.5% 12.8% 12.7% a/ 2014 2015 2016 2017 TTM 18 a/ 2014 2015 2016 2017 TTM 18 a/ Represents the trailing twelve months as of March 31, 2018. Note: Adjusted EBITDA, Adjusted EBITDA Percentage, and Adjusted EPS are non-GAAP financial measures. For a reconciliation of Net Earnings to Adjusted EBITDA and Adjusted EBITDA Percentage and GAAP EPS to Adjusted EPS, see page 29. © 2018 Knoll Inc. 17

Strong organic growth in Q1 2018 driven by favorable mix in newer workplace models, as well as the addition of Muuto #REF! Q1-18 Q1-17 B / (W) Actual Actual vs. Prior Year Orders $ 296.0 $ 267.8 $ 28.2 10.5% Net Sales $ 296.6 $ 256.8 $ 39.7 15.5% Gross Profit 107.7 95.7 12.0 12.6% Gross Margin % 36.3% 37.3% (100) bps Adjusted Operating Expenses 83.7 75.1 (8.6) (11.5)% Adjusted Operating Profit 24.0 20.6 3.4 16.6% Adjusted Operating Profit % 8.1% 8.0% 10 bps Adjusted EBITDA $ 36.8 $ 32.3 $ 4.5 14.1% Adjusted EBITDA % 12.4% 12.6% (20) bps Adjusted Diluted EPS $0.35 $0.31 $ 0.04 12.9% Note: Adjusted Operating Expenses, Adjusted Operating Profit and Adjusted Operating Profit Percentage, Adjusted EBITDA and Adjusted EBITDA Percentage, and Adjusted EPS are non-GAAP financial measures. For a reconciliation of GAAP Operating Expenses to Adjusted Operating Expenses, see page 27, GAAP Operating Profit and GAAP Operating Profit Percentage to Adjusted Operating Profit and Adjusted Operating Profit Percentage, see page 26, Net Earnings to Adjusted EBITDA and Adjusted EBITDA Percentage, see page 28 and EPS to Adjusted Diluted EPS, see page 27. © 2018 Knoll Inc. 18

Knoll, Inc. Q1 2018 Results by Segment vs. Prior Year ($ in millions) Net Sales (millions) Adjusted EBITDA (millions) + NA Office - new + Muuto - acquisition platform sales + Volume + Muuto – acquisition + Europe + Europe – large - Inflation + Price + DatesWeiser – Ford projects Foundation Phase 1 - OpEx Investment - Inflation - Net Price + Holly Hunt – Kagan & - OpEx Investment Outdoor Line +14.1% +15.5% $37 $297 $32 $257 +14.0% +14.9% $24 $182 +15.4% $21 $158 +16.3% $16 $14 $115 $99 12.6% 12.4% 9.0% 9.1% 21.2% 20.7% Q1-17 Q1-18 Q1-17 Q1-18 Q1-17 Q1-18 Q1-17 Q1-18 Q1-17 Q1-18 Q1-17 Q1-18 KNOLL OFFICE LIFESTYLE KNOLL OFFICE LIFESTYLE (20) bps 10 bps (50) bps * Excluding unallocated corporate adjusted EBITDA of ($2.9M) in Q1 2017 and ($3.5M) in Q1 2018 Note: Adjusted EBITDA is a non-GAAP financial measures. For a reconciliation of GAAP Operating Profit to Adjusted EBITDA by segment, see page 30. © 2018 Knoll Inc. 19

Inflation continues to be a gross margin headwind, partially offset by continuous improvement activities and volume Knoll, Inc. Gross Margin Baseline › Continuous improvement activities were steady during 2017 and continued through Q1 2018 › Pricing pressure intensified in the 4th quarter of 2017 was partially alleviated by price increases in Q1 2018 › Muuto added additional volume in Q1 2018, contributing to overall margin increases over prior quarter © 2018 Knoll Inc. 20

“Less is More” Bringing Lean to Knoll We are implementing a culture of continuous improvement Lean across Knoll › Driving out waste and inefficiency › Engaging our manufacturing associates › Process and productivity improvement Recycled Content Lean Initiatives Waste and Landfill Safety Incident Rate © 2018 Knoll Inc. 21

Knoll, Inc. and Competitor Margin Trends Adjusted Gross Margin % 40.0% 37.5% 35.0% While gross margins across the industry have been pressured by market headwinds in commodities 32.5% pricing, foreign currency impacts and net price realization, continuous improvement activities and 30.0% price increases have largely offset these pressures 27.5% 25.0% Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Knoll MLHR SCS Kimball HNI Adjusted Operating Margin % 13.0% 12.0% 11.0% 10.0% Despite the gross margin pressures, Knoll 9.0% continues to manage operating margins above its 8.0% peers 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Knoll MLHR SCS Kimball HNI Note: Competitor gross margin and adjusted operating margin data was derived from publicly filed information. The calculation of adjusted gross margin percentage and adjusted operating margin percentage may be done differently by each of these companies and may not be directly comparable. For a reconciliation of Knoll GAAP Operating Margins to Adjusted Operating Margins, see page 26. © 2018 Knoll Inc. 22

Historical trends demonstrate our ability to reduce overall leverage Bank Net Leverage Ratio(1) Bank Debt ($ in millions)(2) $533 3.21 3.12 2.41 $290 2.23 $276 $239 $232 1.67 $197 1.37 1.37 $179 2013 Q1-2014 2014 2015 2016 2017 Q1-2018 2013 Q1-2014 2014 2015 2016 2017 Q1-2018 (1) For details on the calculation of the Bank Net Leverage Ratio, see (2) Includes bank debt, outstanding letters of credit, and guarantee obligations. page 28. The Q1-2018 bank net leverage ratio incorporates TTM EBITDA for Muuto. › $750M facility, with ability to expand up to $650M with accordion and unsecured debt › $400M revolver › $250M US-based Term Loan A › €82M Euro-based Term Loan A › Executed a $300M, 1 year forward swap contract on LIBOR based debt › Fixed LIBOR rate of 2.63% beginning Jan 1, 2019 › Hedged amount amortizes by $50M each calendar year © 2018 Knoll Inc. 23

And we continue to return cash to shareholders through dividends and buybacks $41.2 $33.1 $34.7 $30.3 $31.7 $32.1 $29.2 $24.4 $22.7 $29.5 Dividends Shares Repurchases ($ millions) ($ $10.9 $9.0 $8.7 $5.5 $2.6 2014 2015 2016 2017 TTM 2018 © 2018 Knoll Inc. 24

Thank You 25 © 2018 Knoll Inc. 25

Reconciliation of Non-GAAP Results Q1 2017 Q1 2018 Operating Profit ($mm) $ 20.6 $ 22.5 Add back (deduct): Asset impairment charge - - Pension settlement - - Acquisition charges - 1.0 Restructuring charges - 0.5 Adjusted Operating Profit ($mm) $ 20.6 $ 24.0 Operating Profit % 8.0% 7.6% Adjusted Operating Profit % 8.0% 8.1% Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Operating Profit ($mm) $ 20.0 $ 22.3 $ 28.3 $ 28.7 $ 21.8 $ 31.8 $ 33.5 $ 35.2 $ 35.8 $ 23.0 $ 22.2 $ 30.1 $ 12.6 $ 22.5 Add back: Intangible asset impairment charge - - - - 10.7 - - - - - - - 16.3 - Pension settlement and OPEB curtailment 6.5 - - - - - - - - - - - 2.2 - Restructuring charges 0.7 - - - 0.5 - - - - - 2.2 - - 0.5 Seating product discontinuation - - - - 0.9 - - - - - - - - - Acquisition expenses - - - - - - - - - - - - 0.5 1.0 Remeasurement of FilzFelt Earn-out liability 0.5 - - - - - - - - - - - - - Adjusted Operating Profit $ 27.7 $ 22.3 $ 28.3 $ 28.7 $ 33.9 $ 31.8 $ 33.5 $ 35.2 $ 35.8 $ 23.0 $ 24.4 $ 30.1 $ 31.6 $ 24.0 Net Sales ($mm) $ 286.5 $ 266.5 $ 268.6 $ 263.6 $ 305.7 $ 284.6 $ 294.7 $ 292.1 $ 292.9 $ 256.8 $ 268.7 $ 291.3 $ 316.1 $ 296.6 GAAP Operating Profit % 7.0% 8.4% 10.5% 10.9% 7.1% 11.2% 11.4% 12.1% 12.2% 9.0% 8.3% 10.3% 4.0% 7.6% Adjusted Operating Profit % 9.7% 8.4% 10.5% 10.9% 11.1% 11.2% 11.4% 12.1% 12.2% 9.0% 9.1% 10.3% 10.0% 8.1% © 2018 Knoll Inc. 26

Reconciliation of Non-GAAP Results Three Months Ended March 31, 2018 2017 ($ in millions) Knoll Inc. Operating Expenses $ 85.2 $ 75.1 Less: Acquisition expenses 1.0 - Restructuring charges 0.5 - Adjusted Operating Expenses 83.7 75.1 Three Months Ended March 31, 2018 2017 Knoll Inc. Diluted Earnings per Share $ 0.31 $ 0.31 Add back: Loss on debt extinguishment 0.03 Acquisition expenses 0.02 Restructuring charges 0.01 Less: Tax effect on non-GAAP adjustments 0.02 Adjusted Diluted Earnings per Share $ 0.35 $ 0.31 © 2018 Knoll Inc. 27

Reconciliation of Non-GAAP Results Three Months Ended March 31, 2018 2017 ($ in millions) Net Earnings ($mm) $ 15.3 $ 15.4 Add back: Income tax (benefit) expense $ 5.50 5.7 5.8 Interest expense 5.5 1.7 Depreciation and amortization 8.2 6.0 EBITDA $ 34.7 $ 28.9 Add back: Stock compensation 2.5 3.5 Other non-cash items (1.9) (0.1) Acquisition expenses 1.0 Restructuring charges 0.5 Adjusted EBITDA $ 36.8 $ 32.3 Net Sales ($mm) $ 296.6 $ 256.8 Adjusted EBITDA % 12.4% 12.6% 12/31/13 3/31/14 12/31/14 12/31/15 12/31/16 12/31/17 3/31/18 (1) (1) (1) (1) (1) (1) (2) Debt Levels $ 178.8 $ 289.8 $ 275.5 $ 238.7 $ 231.8 $ 197.4 $ 517.8 LTM Net Earnings ($mm) $ 23.2 $ 25.0 $ 46.6 $ 66.0 $ 82.1 $ 80.2 $ 92.3 a/ LTM Adjustments Interest 5.3 5.5 6.7 6.1 4.7 6.8 11.0 Taxes 15.7 16.0 29.2 37.5 45.4 (1.6) 1.3 Depreciation and Amortization 16.3 16.9 20.0 21.3 23.0 26.7 29.4 Non-cash Items and Other (3) 19.7 27.0 11.9 12.5 13.4 32.4 31.8 LTM Adjusted EBITDA $ 80.2 $ 90.4 $ 114.4 $ 143.4 $ 168.7 $ 144.5 $ 165.8 Bank Net Leverage Calculation (4) 2.23 3.21 2.41 1.67 1.37 1.37 3.12 (1) - Outstanding debt includes outstanding letters of credit and guarantee obligations. Per the terms of the credit facility filed with the Securities and Exchange Commission on May 21, 2014, excess cash over $15.0M reduces the outstanding debt. (2) - Outstanding debt includes outstanding letters of credit and guarantee obligations. Per the terms of the credit facility filed with the Securities and Exchange Commission on January 23, 2018, cash up to $15.0M reduces the outstanding debt. (3) - Non-cash and Other items include, but are not limited to, intangible asset impairment charges, pension settlements and other postretirement benefit curtailment, stock-based compensation expenses, unrealized gains and losses on foreign exchange, restructuring charges, and acquisition expenses. (4) - Bank net leverage is calculated by dividing debt by LTM Adjusted EBITDA, as calculated in accordance with our credit facility. a/ Represents the trailing twelve months as of March 31, 2018 and includes twelve months of Muuto net earnings © 2018 Knoll Inc. 28

Reconciliation of Non-GAAP Results Years Ended December 31, 2014 2015 2016 2017 TTM 2018 Net Earnings ($mm) $ 46.6 $ 66.0 $ 82.1 $ 80.2 $ 80.1 Add back: Income tax (benefit) expense 29.2 37.5 45.4 (1.6) (1.6) Interest expense 7.4 6.9 5.4 7.5 11.4 Depreciation and amortization 19.3 20.5 22.4 26.1 28.3 EBITDA $ 102.5 $ 130.9 $ 155.3 $ 112.2 $ 118.2 Add back: (1) Non-cash items and other 11.9 12.5 13.4 32.3 30.9 Adjusted EBITDA $ 114.4 $ 143.4 $ 168.7 $ 144.5 $ 149.1 Net Sales ($mm) $ 1,050.3 $ 1,104.4 $ 1,164.3 $ 1,132.9 $ 1,172.6 Adjusted EBITDA % 10.9% 13.0% 14.5% 12.8% 12.7% (1) - Non-cash and Other items include, but are not limited to, asset impairment charge, pension settlement and other postretirement benefit curtailment, stock-based compensation expenses, unrealized gains or losses on foreign exchange, restructuring charges, and acquisition expenses Years Ended December 31, 2014 2015 2016 2017 TTM 2018 Earnings per Share - Diluted $ 0.97 $ 1.36 $ 1.68 $ 1.63 $ 1.63 Add back: Intangible asset impairment charge - 0.22 - 0.33 0.33 Pension settlement and OPEB curtailment 0.14 - - 0.04 0.04 Acquisition expenses - - - 0.01 0.03 Seating product discontinuation charge - 0.02 - - - Restructuring charges 0.03 0.02 - 0.04 0.04 Loss on debt extinguishment - - - - 0.03 Less: Tax effect on non-GAAP adjustments 0.05 0.09 - 0.13 0.17 Tax Reform impact - - - 0.54 0.54 Adjusted Earnings per Share - Diluted $ 1.09 $ 1.52 $ 1.68 $ 1.38 $ 1.39 © 2018 Knoll Inc. 29

Reconciliation of Non-GAAP Results Q1 2017 Q1 2018 Knoll, Inc Office Lifestyle Corporate Knoll, Inc. Office Lifestyle Corporate Knoll, Inc. Operating Profit ($mm) $ 8.8 $ 18.4 $ (6.6) $ 20.6 $ 8.9 $ 20.2 $ (6.6) $ 22.5 Add back (deduct): Asset impairment charge - - - - - - - - Pension settlement - - - - - - - - Acquisition charges - - - - - - 1.0 1.0 Restructuring charges - - - - 0.5 - - 0.5 Adjusted Operating Profit ($mm) $ 8.8 $ 18.4 $ (6.6) $ 20.6 $ 9.4 $ 20.2 $ (5.6) $ 24.0 Add Back: Depreciation and amortization 4.1 1.7 0.2 6.0 5.0 3.0 0.2 8.2 Stock compensation 0.6 0.5 2.4 3.5 0.4 0.7 1.4 2.5 Other non-cash items 0.8 0.3 1.1 2.2 1.7 (0.1) 0.5 2.1 Adjusted EBITDA ($mm) $ 14.3 $ 20.9 $ (2.9) $ 32.3 $ 16.5 $ 23.8 $ (3.5) $ 36.8 Net Sales ($mm) $ 158.0 $ 98.8 N/A $ 256.8 $ 181.6 $ 115.0 N/A $ 296.6 Adjusted EBITDA % 9.0% 21.2% N/A 12.6% 9.1% 20.7% N/A 12.4% 2017 Muuto Net Earnings ($mm) $ 8.9 Add back: Income tax (benefit) expense 4.3 Interest expense 0.6 Depreciation and amortization 0.6 EBITDA $ 14.5 Add back: - Acquisition costs 4.6 Other non-cash items 0.3 Adjusted EBITDA $ 19.4 Net Sales ($mm) $ 71.3 Adjusted EBITDA % 27.2% Note: Per the 8-K/A, filed with the Securities and Exchange Commission on April 12, 2018, 2017 Muuto net earnings were reported as 58.9M DKK and Muuto net sales were reported as 470.1M DKK. These figures were converted to USD using an exchange rate of 0.1516 © 2018 Knoll Inc. 30

© 2018 Knoll Inc. 31