Form 425 GENERAL ELECTRIC CO Filed by: WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): May 21, 2018 (May 20, 2018)

WESTINGHOUSE AIR BRAKE

TECHNOLOGIES CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or other Jurisdiction

of Incorporation)

| 033-90866 | 25-1615902 | |

| (Commission File No.) |

(I.R.S. Employer Identification No.) | |

| 1001 Air Brake Avenue Wilmerding, Pennsylvania |

15148 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(412) 825-1000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On May 21, 2018, Westinghouse Air Brake Technologies Corporation (“Wabtec”) published a press release announcing the transaction described in Item 8.01 below. A copy of the press release is attached as Exhibit 99.1 to this report and is incorporated into this Item 7.01 by reference.

Wabtec is holding a conference call at 8:30 AM ET on May 21, 2018 to discuss the transaction described in Item 8.01 below. A copy of the investor presentation to be used during the call and that may be used in connection with certain future investor presentations is attached as Exhibit 99.2 to this report and is incorporated into this Item 7.01 by reference.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| Item 8.01. | Other Events. |

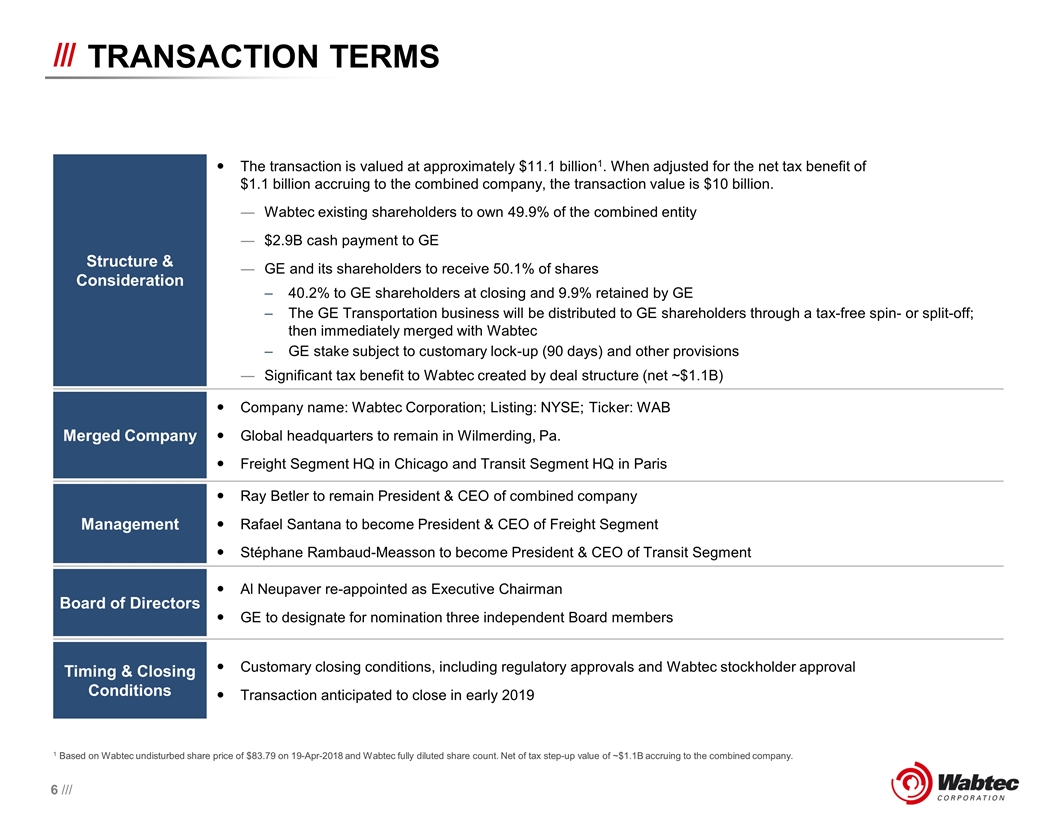

On May 21, 2018, Wabtec announced that it had entered into definitive agreements with General Electric Company (“GE”), Transportation Systems Holdings Inc., a newly formed wholly owned subsidiary of GE (“SpinCo”), and a newly formed wholly owned subsidiary of Wabtec (“Merger Sub”). Pursuant to (and subject to the terms and conditions of) the agreements, Wabtec and GE’s transportation business (“GE Transportation”) will be combined in a transaction in which GE will (i) sell a portion of the assets of GE Transportation to Wabtec, (ii) complete the spin-off or split-off of SpinCo (which will hold the remainder of GE Transportation) to GE shareholders, and (iii) immediately thereafter merge SpinCo with Merger Sub. As part of the transaction, GE will be paid a $2.9 billion up-front cash payment (subject to adjustment), and GE and its shareholders will receive approximately 50.1% of the fully diluted outstanding shares of Wabtec (with GE holding 9.9% of the fully diluted outstanding shares). Upon closing, Wabtec shareholders will own approximately 49.9% of the fully diluted outstanding shares of Wabtec. GE has the right to increase the portion of the merged company owned by GE shareholders (subject to a corresponding reduction in GE’s ownership). The transaction is expected to be tax free to the companies’ respective shareholders.

The transaction is expected to close in early 2019, subject to customary closing conditions, approval by Wabtec shareholders, and regulatory approvals.

Additional Information and Where to Find It

In connection with the proposed transaction between GE and Wabtec, SpinCo will file with the SEC a registration statement on Form S-4/S-1 containing a prospectus or a registration statement on Form 10 and Wabtec will file with the SEC a registration statement on Form S-4 that will include a combined proxy statement/prospectus. If the transaction is effected via an exchange offer, GE will also file with the SEC a Schedule TO with respect thereto. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other documents GE, Wabtec and/or SpinCo may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE DOCUMENTS WHEN THEY BECOME AVAILABLE, ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, AND OTHER DOCUMENTS FILED BY GE, WABTEC OR SPINCO WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, BECAUSE THESE

DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of these materials and other documents filed with the SEC by GE, Wabtec and/or SpinCo through the website maintained by the SEC at www.sec.gov. Investors and security holders will also be able to obtain free copies of the documents filed by GE, Wabtec and/or SpinCo with the SEC from the respective companies by directing a written request to GE and/or SpinCo at General Electric Company, 41 Farnsworth Street, Boston, Massachusetts 02210 or by calling 617-443-3400, or to Wabtec at Wabtec Corporation, 1001 Air Brake Avenue, Wilmerding, PA 15148 or by calling 412-825-1543.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any investor or security holder. GE, Wabtec, SpinCo, their respective directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from shareholders of Wabtec in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the relevant materials when filed with the SEC. Information regarding the directors and executive officers of GE is contained in GE’s proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on March 23, 2018, its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 23, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which was filed with the SEC on May 1, 2018 and certain of its Current Reports filed on Form 8-K. Information regarding the directors and executive officers of Wabtec is contained in Wabtec’s proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on April 5, 2018, its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 26, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 which was filed with the SEC on May 4, 2018 and certain of its Current Reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated above.

Caution Concerning Forward-Looking Statements

This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between GE and Wabtec. All statements, other than historical facts, including statements regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction, including future financial and operating results, the tax consequences of the proposed transaction, and the combined company’s plans, objectives, expectations and intentions; legal, economic and regulatory conditions; and any assumptions underlying any of the foregoing, are forward-looking statements.

-2-

Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Wabtec may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by GE or Wabtec, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of GE, Wabtec and SpinCo; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in achieving revenue and cost synergies of the combined company; (8) inability to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; and (14) other risk factors as detailed from time to time in GE’s and Wabtec’s reports filed with the SEC, including GE’s and Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this communication. Neither GE nor Wabtec undertakes any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) Exhibits. |

| Exhibit No. |

Description | |

| 99.1 | May 21, 2018 press release | |

| 99.2 | May 21, 2018 investor presentation | |

-3-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, Wabtec has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION | ||

| By: | /s/ Patrick D. Dugan | |

| Patrick D. Dugan | ||

| Executive Vice President and Chief Financial Officer | ||

Date: May 21, 2018

-4-

Exhibit 99.1

|

|

News Release

WABTEC AND GE TRANSPORTATION TO MERGE,

CREATING GLOBAL LEADER FOR RAIL EQUIPMENT, SERVICES AND SOFTWARE

Strategic Combination Will Drive Shareholder Value Creation

by Accelerating Innovation in Transportation and Logistics

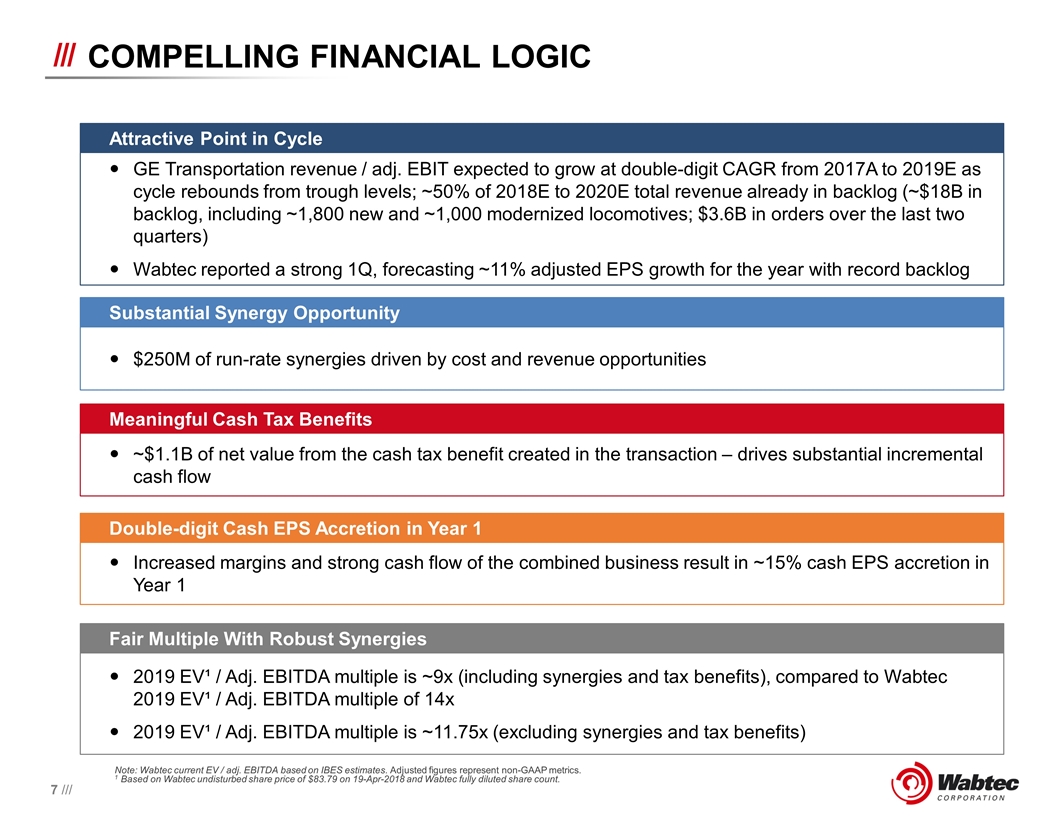

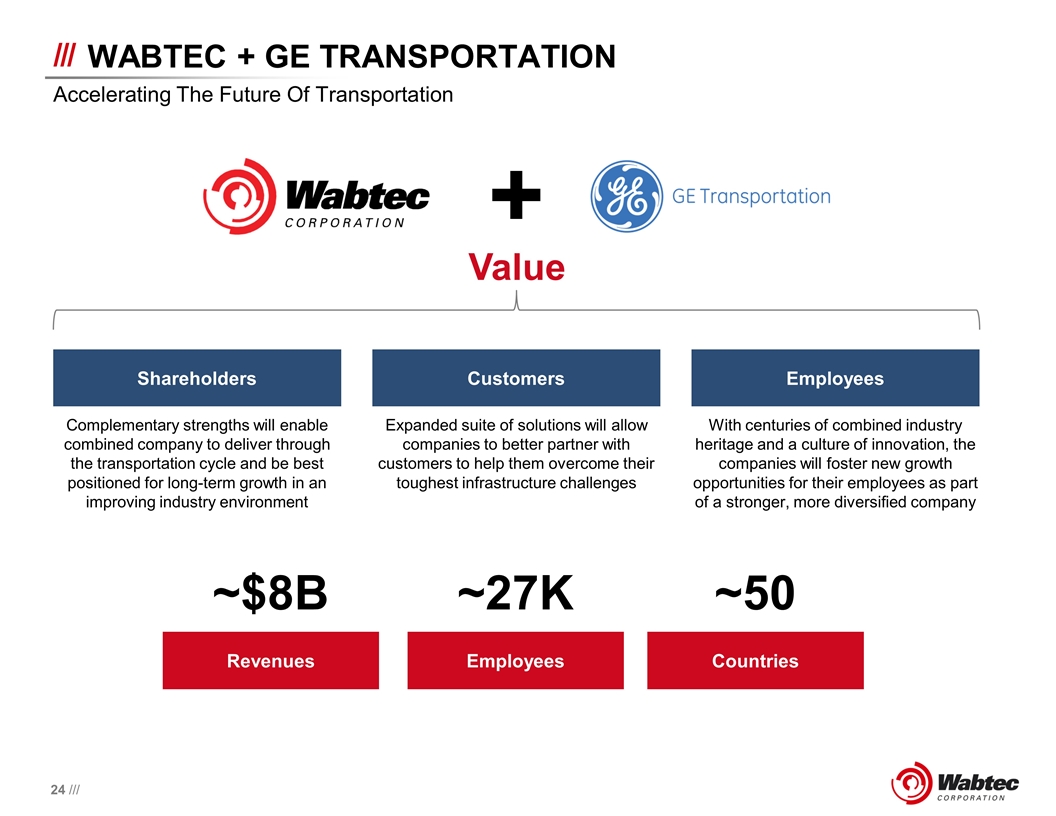

| • | Following the transaction, Wabtec will have approximately $8 billion in revenues, a more diversified business mix, higher margins, and approximately 15 percent cash EPS accretion in year one. |

| • | Both businesses are expected to benefit from the cyclical tailwinds they are experiencing as industry conditions improve. Complementary businesses and large global installed base will create additional opportunities for cross-selling, aftermarket services growth and new solutions in a rapidly evolving industry. |

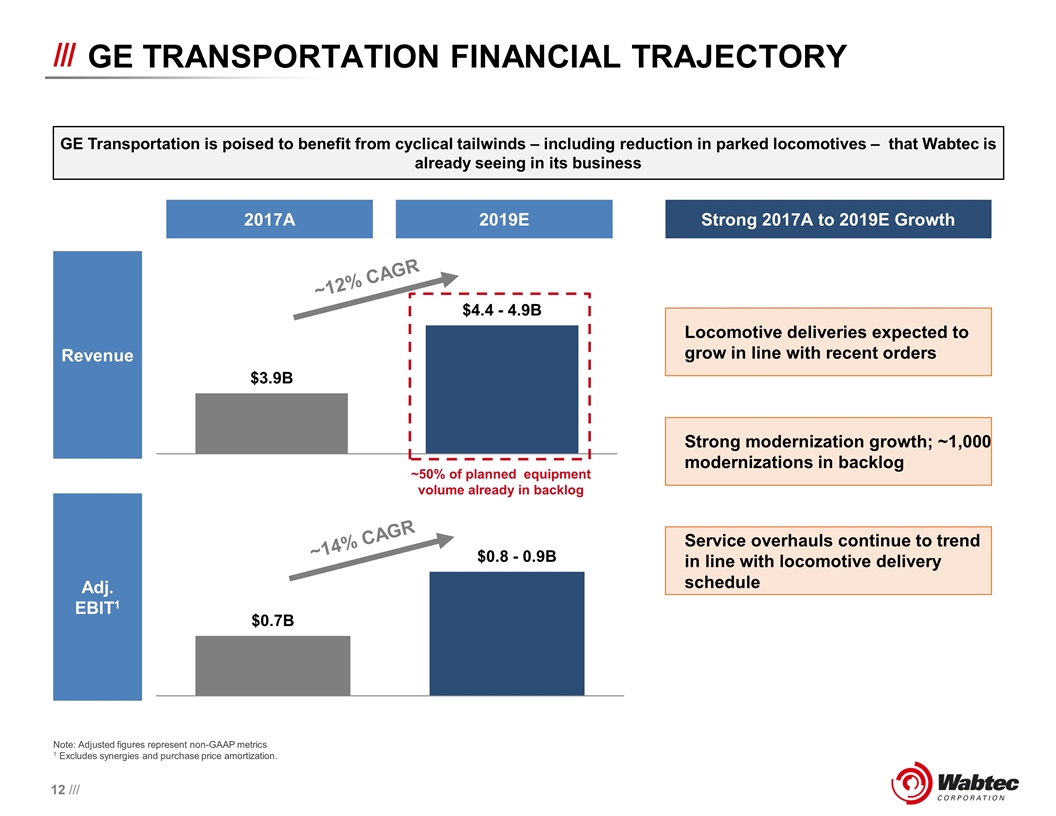

| • | GE Transportation is positioned for a substantial rebound, with estimated adjusted EBITDA growing from about $750 million in 2018 to between $900 million and $1 billion in 2019. |

| • | Substantial annual run-rate synergies of $250 million and a net present value of approximately $1.1 billion of net tax benefit will accrue to the combined company. |

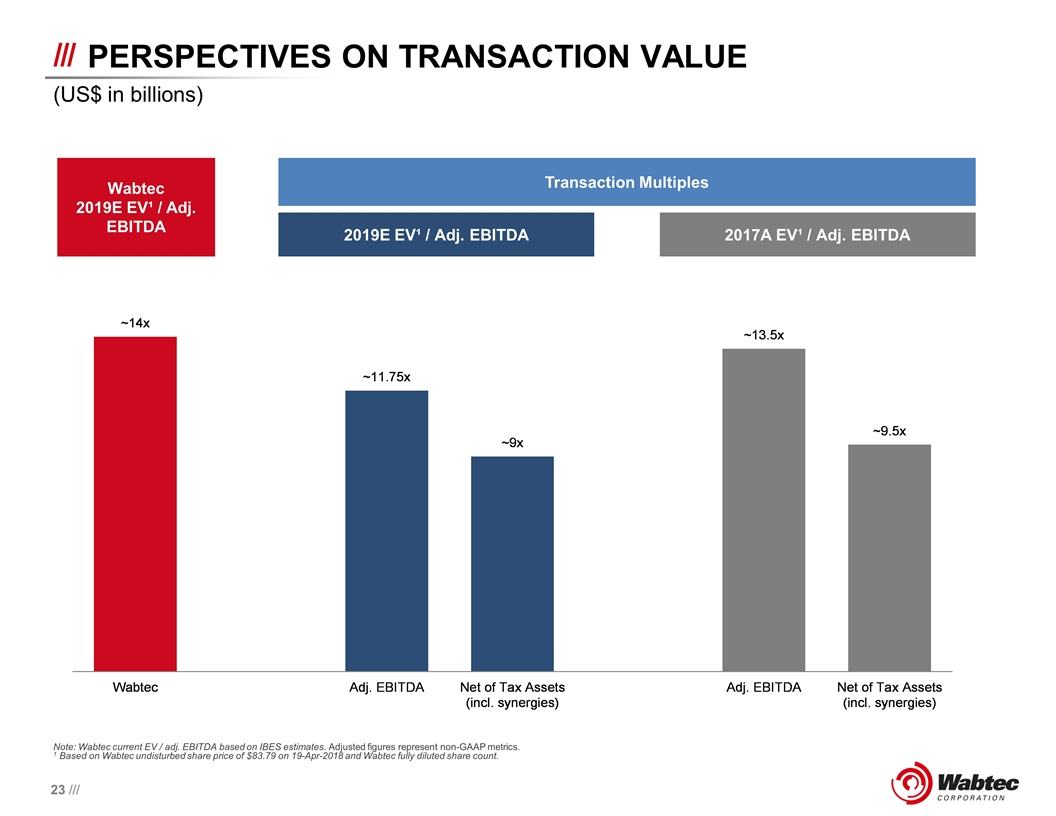

| • | The transaction is valued at approximately $11.1 billion.1 When adjusted for the net tax benefit of $1.1 billion accruing to the combined company, the transaction value is $10 billion. The 2019 EBITDA multiple range including synergies and tax benefits is approximately 9x, and the 2019 EBITDA multiple range excluding synergies and tax benefits is approximately 11.75x. |

| • | Strong free cash flow to enable rapid debt reduction, maintain Wabtec’s quarterly dividend and preserve investment grade credit rating. |

| • | Wabtec Chairman, Albert J. Neupaver, has been re-appointed executive chairman; Raymond T. Betler will remain president and CEO of the merged company; Rafael Santana, president and CEO of GE Transportation, will become president and CEO of Wabtec’s Freight Segment and Stéphane Rambaud-Measson, will become president and CEO of Wabtec’s Transit Segment. |

WILMERDING, Pa. and CHICAGO, May 21, 2018 – Wabtec Corporation (NYSE: WAB) has entered into a definitive agreement to combine with GE Transportation, a unit of General Electric Company (NYSE: GE). The combination will make Wabtec a Fortune 500, global transportation leader in rail equipment, software and services, with operations in more than 50 countries.

Under the agreement, which has been approved by the Boards of Directors of Wabtec and GE, GE will receive $2.9 billion in cash at closing and GE and its shareholders will receive a 50.1% ownership interest in the combined company, with Wabtec shareholders retaining 49.9% of the combined company. The transaction is expected to be tax free to the companies’ respective shareholders.

| 1 | Based on Wabtec share price of $83.79 on 19-Apr-2018, the last unaffected trading day prior to media speculation regarding a potential transaction, and Wabtec fully diluted share count. |

|

|

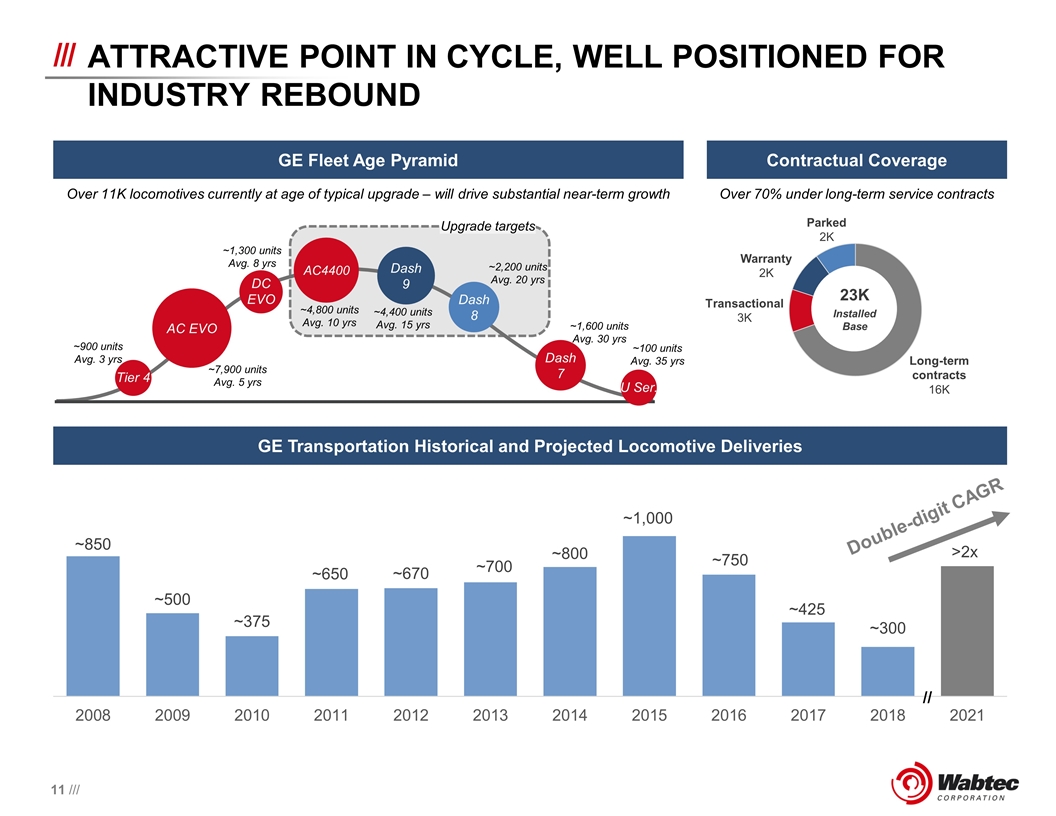

News Release

Both companies are expected to benefit from the cyclical tailwinds they are experiencing as industry conditions improve. GE Transportation revenues and EBIT are expected to grow at double digit CAGRs from 2017A to 2019E as the cycle rebounds from trough levels. The GE Transportation business is positioned for a significant rebound, with estimated adjusted EBITDA growing from about $750 million in 2018 to between $900 million and $1 billion in 2019. The backlog of approximately $18 billion includes about 1,800 new locomotives and approximately 1,000 to be modernized. GE Transportation has received $3.6 billion in orders in the last two quarters. Wabtec reported a strong Q1, also forecasting robust growth for the year with record backlog.

The combination will bring together two global leaders in rail equipment, services and software, combining GE Transportation, a global digital industrial leader and supplier to the rail, mining, marine, stationary power and drilling industries, with Wabtec’s broad range of freight, transit and electronics solutions. Wabtec and GE shareholders will have ownership in a combined company with significantly expanded margins, a highly attractive growth profile based on an improved business mix, expanded global reach, and faster innovation in key growth areas.

KEY STRATEGIC BENEFITS

The combination is expected to:

| • | Drive increased value for shareholders: With approximately $8 billion in combined revenues and a large global installed base, the combined company will have a leading position in key freight rail and transit geographies worldwide, and will be well-positioned to serve customers as industry demand continues to improve. Investors are expected to benefit through ownership of a stronger, more diverse business better positioned to perform through the cycle, with expected annual double-digit EPS growth and total run-rate synergies of about $250 million estimated to be achieved by 2022. Furthermore, the transaction will facilitate a tax step-up with an NPV of approximately $1.1 billion of net tax benefit accruing to the combined company. |

| • | Create a leading equipment, aftermarket services, and digital solutions provider across the transportation ecosystem: From factory to final destination – and every point in-between – the combined company will have the capabilities to accelerate lifecycle solutions for the transportation industry and unlock significant productivity for customers by improving interoperability, efficiency, and competitiveness. |

| • | Capitalize on digital/electronic technologies to develop autonomous capabilities: Bringing together GE Transportation’s digital solutions with Wabtec’s electronic systems is expected to drive the advancement and implementation of technology solutions to improve safety, efficiency and productivity for the transportation industry. This combination will create a compelling offering to meet the industry’s rapidly growing demand for rail performance, with the potential to unlock billions in annual savings across freight rail for customers and operators. |

|

|

News Release

| • | Generate growth opportunities through the extensive installed base and attractive global footprint: The combined company will be a leading global freight and transit rail provider with more than 23,000 locomotives in its global installed base and content on virtually all locomotives and freight cars in North America, creating significant opportunities for aftermarket parts and services in key regions around the world. |

Effective immediately, Wabtec Chairman Albert J. Neupaver has been re-appointed executive chairman of the company, while Raymond T. Betler remains Wabtec’s president and CEO. Following the completion of the transaction, Stéphane Rambaud-Measson will become president and CEO of Wabtec’s Transit Segment; and Rafael Santana, president and CEO of GE Transportation, will become president and CEO of Wabtec’s Freight Segment.

Betler said: “Wabtec and GE Transportation are global industry leaders and we believe that together we have a unique opportunity to drive tremendous growth in 2019 and beyond as the industry continues to improve. By bringing together our highly complementary strengths we are confident that this transformational combination will create value for both Wabtec and GE shareholders, innovative solutions for our customers, and new outlets for long-term career growth for our employees. Our two companies have more than 250 years of rail industry heritage, and our shared focus on safety, reliability, quality, and customer relationships will enable a smooth integration.”

Santana said: “The combination of our two strong brands and remarkable people is an excellent fit that will create an organization well-positioned to accelerate the future of transportation. Together, we can expand our global reach, strengthen our market capabilities and lead digital innovation across the transportation industry. We are seeing growth in rail traffic and recent promising orders for new and modernized locomotives from North American Class I, Shortlines and international railroads, and are confident in the compelling long-term opportunities and synergies before us.”

GOVERNANCE AND HEADQUARTERS

Following the completion of the transaction, Wabtec’s corporate headquarters will remain in Wilmerding, Pa. Wabtec’s Freight Segment will be headquartered in Chicago, and Wabtec’s Transit Segment headquarters will remain in Paris.

GE will designate for nomination three independent Board members.

TRANSACTION DETAILS

GE will receive a $2.9 billion up-front cash payment, and GE and its shareholders will receive a 50.1% ownership interest in the combined company. Based on Wabtec’s stock price on April 19, 2018, the last unaffected trading day prior to media speculation regarding a potential transaction, the value of the transaction is approximately $11.1 billion. When adjusted for the net tax step-up value of $1.1 billion accruing to the combined company, the transaction value is $10 billion. The transaction is expected to be tax free to the companies’ respective shareholders.

|

|

News Release

Wabtec and GE Transportation will be combined in a transaction in which GE will (i) sell a portion of the assets of GE Transportation to Wabtec; (ii) complete the spin-off or split-off of a portion of GE Transportation to GE shareholders; and (iii) immediately thereafter merge GE Transportation with a wholly owned subsidiary of Wabtec. Upon closing, Wabtec shareholders will own approximately 49.9%, and it is planned that GE shareholders will own approximately 40.2%, and GE will own 9.9% of the merged company on a fully diluted basis. GE has the right to increase the portion of the merged company owned by GE shareholders (subject to a corresponding reduction in GE’s ownership).

Wabtec has obtained full commitments for a $2.9 billion bridge facility and expects to put in place permanent debt financing prior to closing. The Company is committed to maintaining a strong investment grade credit rating profile and will use its strong cash flow to prioritize debt reduction.

The transaction is expected to close in early 2019, subject to customary closing conditions, approval by Wabtec shareholders, and regulatory approvals.

CONFERENCE CALL AND INVESTOR INFORMATION

Wabtec and GE Transportation will host a conference call today at 8:30 am Eastern to discuss the transaction. An audio webcast of the investor call can be accessed at https://engage.vevent.com/rt/kekstandcompanyao~1688628. A replay will also be available at the same link after the event. You can also access the link by going to www.wabtec.com and clicking on the “Webcasts” tab in the “Investor” section. To view a copy of the presentation that will be discussed during the call, click on the “Press Releases” tab under “About Us” and click on the press release titled “Wabtec and GE Transportation to Merge.” The presentation will be included at the end of the press release on the website.

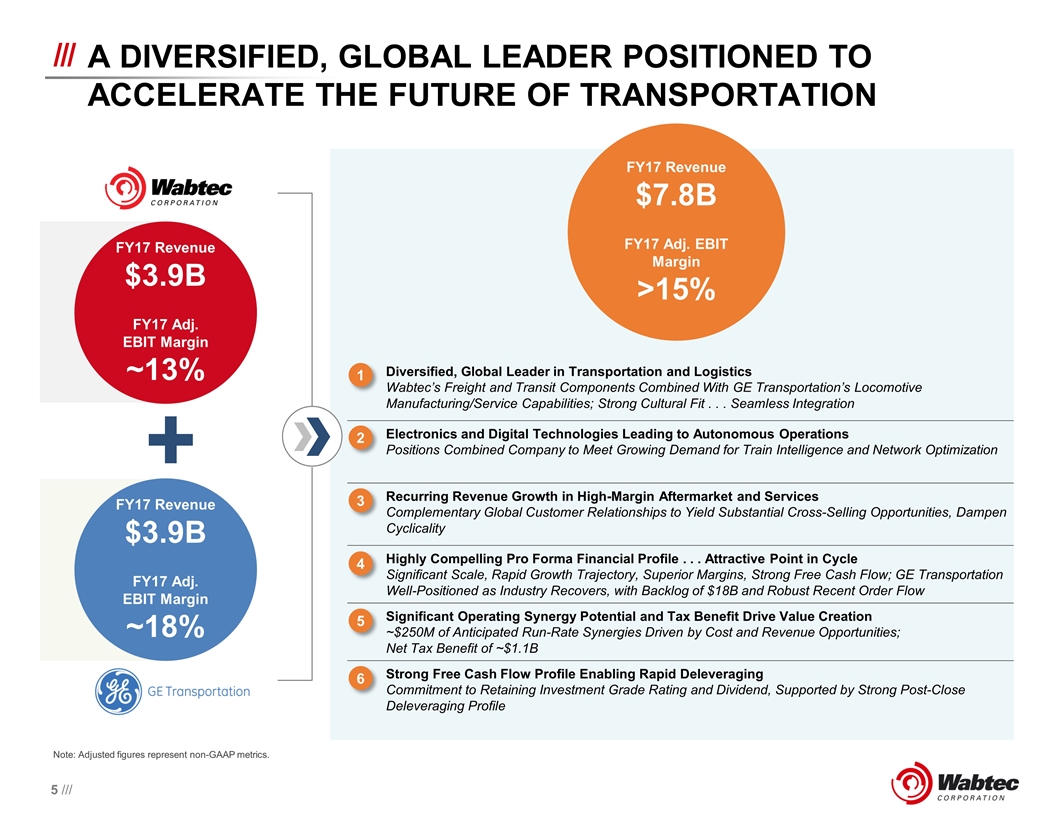

ABOUT WABTEC

Wabtec Corporation is a leading global provider of equipment, systems and value-added services for transit and freight rail. Through its subsidiaries, the company manufactures a range of products for locomotives, freight cars and passenger transit vehicles. The company also builds new switcher and commuter locomotives, and provides aftermarket services. The company has roughly 18,000 employees and facilities located throughout the world. For the fiscal year ending December 31, 2017, Wabtec generated approximately $3.9 billion in revenue and $504 million in adjusted EBIT (approximately 13% margin).

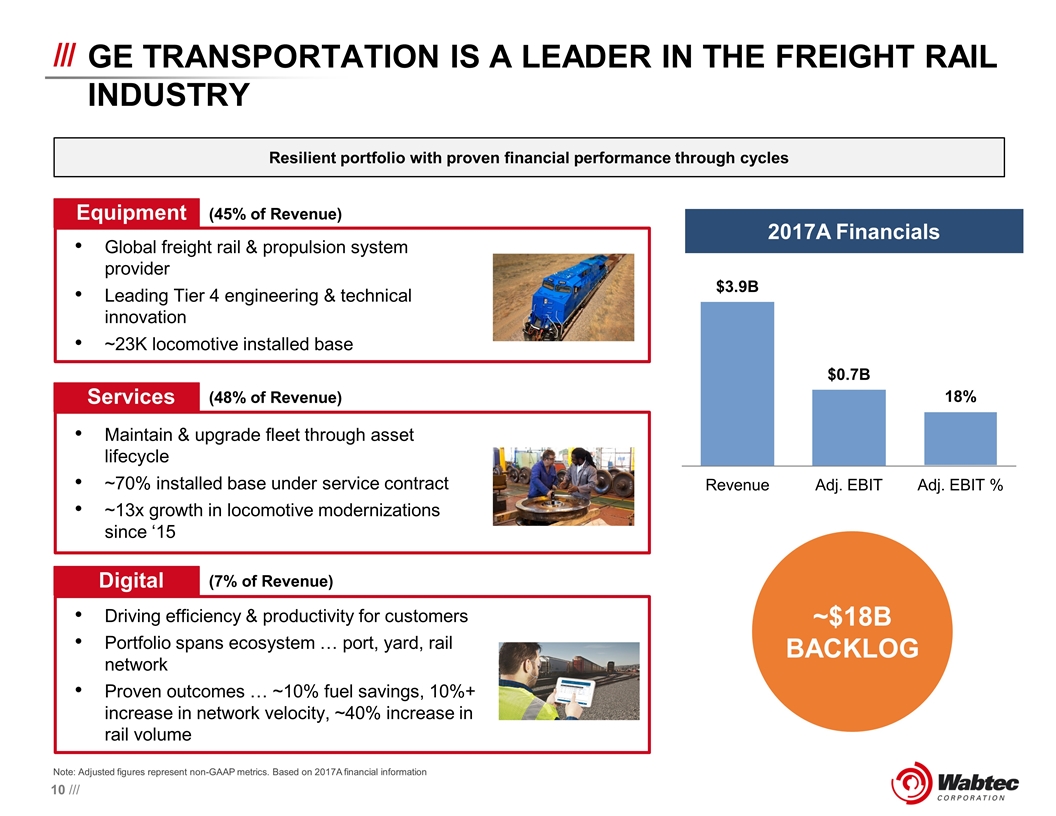

ABOUT GE TRANSPORTATION

GE Transportation helps move the world and improve the world, as a global technology leader and supplier of equipment, services and digital solutions to the rail, mining, marine, stationary power and drilling industries. GE Transportation’s innovations help customers deliver goods and services with greater speed and savings using advanced manufacturing techniques and connected machines. The company employs approximately 9,000 employees worldwide. GE Transportation has a backlog of roughly $18 billion, including approximately 1,800 new locomotives and roughly 1,000 locomotive modernized units. For the fiscal year ending December 31, 2017, GE Transportation generated approximately $3.9 billion in revenue and $701 million in adjusted EBIT (approximately 18% margin).

ADVISORS

Goldman, Sachs & Co., LLC and Jones Day are acting as financial advisors and legal counsel, respectively, to Wabtec in the transaction.

|

|

News Release

Morgan Stanley & Co. LLC and Dyal Co. LLC are acting as financial advisors, and Davis Polk & Wardwell LLP as legal advisors, to GE in the transaction.

# # #

CONTACTS

Investors

Tim Wesley, Wabtec

412-825-1543 or [email protected]

Matt Cribbins, GE

617-443-3400 or [email protected]

Media

Deia Campanelli, GE

773-297-0482 or [email protected]

Rich Stimel, Wabtec

412-825-1423 or [email protected]

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction between GE and Wabtec, Transportation Systems Holdings Inc., a wholly owned subsidiary of GE created for the transaction (“SpinCo”), will file with the SEC a registration statement on Form S-4/S-1 containing a prospectus or a registration statement on Form 10 and Wabtec will file with the SEC a registration statement on Form S-4 that will include a combined proxy statement/prospectus. If the transaction is effected via an exchange offer, GE will also file with the SEC a Schedule TO with respect thereto. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other documents GE, Wabtec and/or SpinCo may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE DOCUMENTS WHEN THEY BECOME AVAILABLE, ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, AND OTHER DOCUMENTS FILED BY GE, WABTEC OR SPINCO WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of these materials and other documents filed with the SEC by GE, Wabtec and/or SpinCo through the website maintained by the SEC at www.sec.gov. Investors and security holders will also be able to obtain free copies of the documents filed by GE, Wabtec and/or SpinCo with the SEC from the respective companies by directing a written request to GE and/or SpinCo at General Electric Company, 41 Farnsworth Street, Boston, Massachusetts 02210 or by calling 617-443-3400. Investors and security holders can also contact Wabtec at Wabtec Corporation, 1001 Air Brake Avenue, Wilmerding, PA 15148 or by calling 412-825-1543.

NO OFFER OR SOLICITATION

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

PARTICIPANTS IN THE SOLICITATION

This communication is not a solicitation of a proxy from any investor or security holder. GE, Wabtec, SpinCo, their respective directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from shareholders of Wabtec in connection with the proposed transaction. Information regarding the persons who may, under the rules

|

|

News Release

of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the relevant materials when filed with the SEC. Information regarding the directors and executive officers of GE is contained in GE’s proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on March 23, 2018, its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 23, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which was filed with the SEC on May 1, 2018 and certain of its Current Reports filed on Form 8-K. Information regarding the directors and executive officers of Wabtec is contained in Wabtec’s proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on April 5, 2018, its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 26, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 which was filed with the SEC on May 4, 2018 and certain of its Current Reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated above.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between GE and Wabtec. All statements, other than historical facts, including statements regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction, including future financial and operating results, the tax consequences of the proposed transaction, and the combined company’s plans, objectives, expectations and intentions; legal, economic and regulatory conditions; and any assumptions underlying any of the foregoing, are forward-looking statements.

Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Wabtec may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by GE or Wabtec, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of GE, Wabtec and SpinCo; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in achieving revenue and cost synergies of the combined company; (8) inability to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; and (14) other risk factors as detailed from time to time in GE’s and Wabtec’s reports filed with the SEC, including GE’s and Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this communication. Neither GE nor Wabtec undertakes any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Wabtec and GE Transportation to Merge Accelerating the Future of Transportation May 21, 2018 Exhibit 99.2

ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction between GE and Wabtec, Transportation Systems Holdings Inc., a wholly owned subsidiary of GE created for the transaction (“SpinCo”), will file with the SEC a registration statement on Form S-4/S-1 containing a prospectus or a registration statement on Form 10 and Wabtec will file with the SEC a registration statement on Form S-4 that will include a combined proxy statement/prospectus. If the transaction is effected via an exchange offer, GE will also file with the SEC a Schedule TO with respect thereto. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other documents GE, Wabtec and/or SpinCo may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE DOCUMENTS WHEN THEY BECOME AVAILABLE, ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, AND OTHER DOCUMENTS FILED BY GE, WABTEC OR SPINCO WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of these materials and other documents filed with the SEC by GE, Wabtec and/or SpinCo through the website maintained by the SEC at www.sec.gov. Investors and security holders will also be able to obtain free copies of the documents filed by GE, Wabtec and/or SpinCo with the SEC from the respective companies by directing a written request to GE and/or SpinCo at General Electric Company, 41 Farnsworth Street, Boston, Massachusetts 02210 or by calling 617-443-3400. Investors and security holders can also contact Wabtec at Wabtec Corporation, 1001 Air Brake Avenue, Wilmerding, PA 15148 or by calling 412-825-1543. NO OFFER OR SOLICITATION This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Important Information

PARTICIPANTS IN THE SOLICITATION This communication is not a solicitation of a proxy from any investor or security holder. GE, Wabtec, SpinCo, their respective directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from shareholders of Wabtec in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the relevant materials when filed with the SEC. Information regarding the directors and executive officers of GE is contained in GE’s proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on March 23, 2018, its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 23, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which was filed with the SEC on May 1, 2018 and certain of its Current Reports filed on Form 8-K. Information regarding the directors and executive officers of Wabtec is contained in Wabtec’s proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on April 5, 2018, its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 26, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 which was filed with the SEC on May 4, 2018 and certain of its Current Reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated above. Important Information

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between GE and Wabtec. All statements, other than historical facts, including statements regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction, including future financial and operating results, the tax consequences of the proposed transaction, and the combined company’s plans, objectives, expectations and intentions; legal, economic and regulatory conditions; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Wabtec may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by GE or Wabtec, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of GE, Wabtec and SpinCo; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in achieving revenue and cost synergies of the combined company; (8) inability to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; and (14) other risk factors as detailed from time to time in GE’s and Wabtec’s reports filed with the SEC, including GE’s and Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Neither GE nor Wabtec undertakes any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Forward-looking statements

Today’s Presenters Timothy Wesley VP of Investor Relations Albert Neupaver Executive Chairman Raymond Betler President and Chief Executive Officer Patrick Dugan Chief Financial Officer Rafael Santana President and Chief Executive Officer

Diversified, Global Leader in Transportation and Logistics Wabtec’s Freight and Transit Components Combined With GE Transportation’s Locomotive Manufacturing/Service Capabilities; Strong Cultural Fit . . . Seamless Integration Electronics and Digital Technologies Leading to Autonomous Operations Positions Combined Company to Meet Growing Demand for Train Intelligence and Network Optimization Recurring Revenue Growth in High-Margin Aftermarket and Services Complementary Global Customer Relationships to Yield Substantial Cross-Selling Opportunities, Dampen Cyclicality Highly Compelling Pro Forma Financial Profile . . . Attractive Point in Cycle Significant Scale, Rapid Growth Trajectory, Superior Margins, Strong Free Cash Flow; GE Transportation Well-Positioned as Industry Recovers, with Backlog of $18B and Robust Recent Order Flow Significant Operating Synergy Potential and Tax Benefit Drive Value Creation ~$250M of Anticipated Run-Rate Synergies Driven by Cost and Revenue Opportunities; Net Tax Benefit of ~$1.1B Strong Free Cash Flow Profile Enabling Rapid Deleveraging Commitment to Retaining Investment Grade Rating and Dividend, Supported by Strong Post-Close Deleveraging Profile A Diversified, Global Leader Positioned to accelerate the future of Transportation FY17 Revenue $3.9B FY17 Adj. EBIT Margin ~13% FY17 Revenue $3.9B FY17 Adj. EBIT Margin ~18% FY17 Revenue $7.8B FY17 Adj. EBIT Margin >15% 1 2 3 4 5 6 Note: Adjusted figures represent non-GAAP metrics.

Structure & Consideration The transaction is valued at approximately $11.1 billion1. When adjusted for the net tax benefit of $1.1 billion accruing to the combined company, the transaction value is $10 billion. Wabtec existing shareholders to own 49.9% of the combined entity $2.9B cash payment to GE GE and its shareholders to receive 50.1% of shares 40.2% to GE shareholders at closing and 9.9% retained by GE The GE Transportation business will be distributed to GE shareholders through a tax-free spin- or split-off; then immediately merged with Wabtec GE stake subject to customary lock-up (90 days) and other provisions Significant tax benefit to Wabtec created by deal structure (net ~$1.1B) Merged Company Company name: Wabtec Corporation; Listing: NYSE; Ticker: WAB Global headquarters to remain in Wilmerding, Pa. Freight Segment HQ in Chicago and Transit Segment HQ in Paris Management Ray Betler to remain President & CEO of combined company Rafael Santana to become President & CEO of Freight Segment Stéphane Rambaud-Measson to become President & CEO of Transit Segment Board of Directors Al Neupaver re-appointed as Executive Chairman GE to designate for nomination three independent Board members Timing & Closing Conditions Customary closing conditions, including regulatory approvals and Wabtec stockholder approval Transaction anticipated to close in early 2019 Transaction Terms 1 Based on Wabtec undisturbed share price of $83.79 on 19-Apr-2018 and Wabtec fully diluted share count. Net of tax step-up value of ~$1.1B accruing to the combined company.

Compelling financial logic GE Transportation revenue / adj. EBIT expected to grow at double-digit CAGR from 2017A to 2019E as cycle rebounds from trough levels; ~50% of 2018E to 2020E total revenue already in backlog (~$18B in backlog, including ~1,800 new and ~1,000 modernized locomotives; $3.6B in orders over the last two quarters) Wabtec reported a strong 1Q, forecasting ~11% adjusted EPS growth for the year with record backlog Attractive Point in Cycle $250M of run-rate synergies driven by cost and revenue opportunities Substantial Synergy Opportunity ~$1.1B of net value from the cash tax benefit created in the transaction – drives substantial incremental cash flow Meaningful Cash Tax Benefits Increased margins and strong cash flow of the combined business result in ~15% cash EPS accretion in Year 1 Double-digit Cash EPS Accretion in Year 1 2019 EV¹ / Adj. EBITDA multiple is ~9x (including synergies and tax benefits), compared to Wabtec 2019 EV¹ / Adj. EBITDA multiple of 14x 2019 EV¹ / Adj. EBITDA multiple is ~11.75x (excluding synergies and tax benefits) Fair Multiple With Robust Synergies Note: Wabtec current EV / adj. EBITDA based on IBES estimates. Adjusted figures represent non-GAAP metrics. 1 Based on Wabtec undisturbed share price of $83.79 on 19-Apr-2018 and Wabtec fully diluted share count.

Business Overview

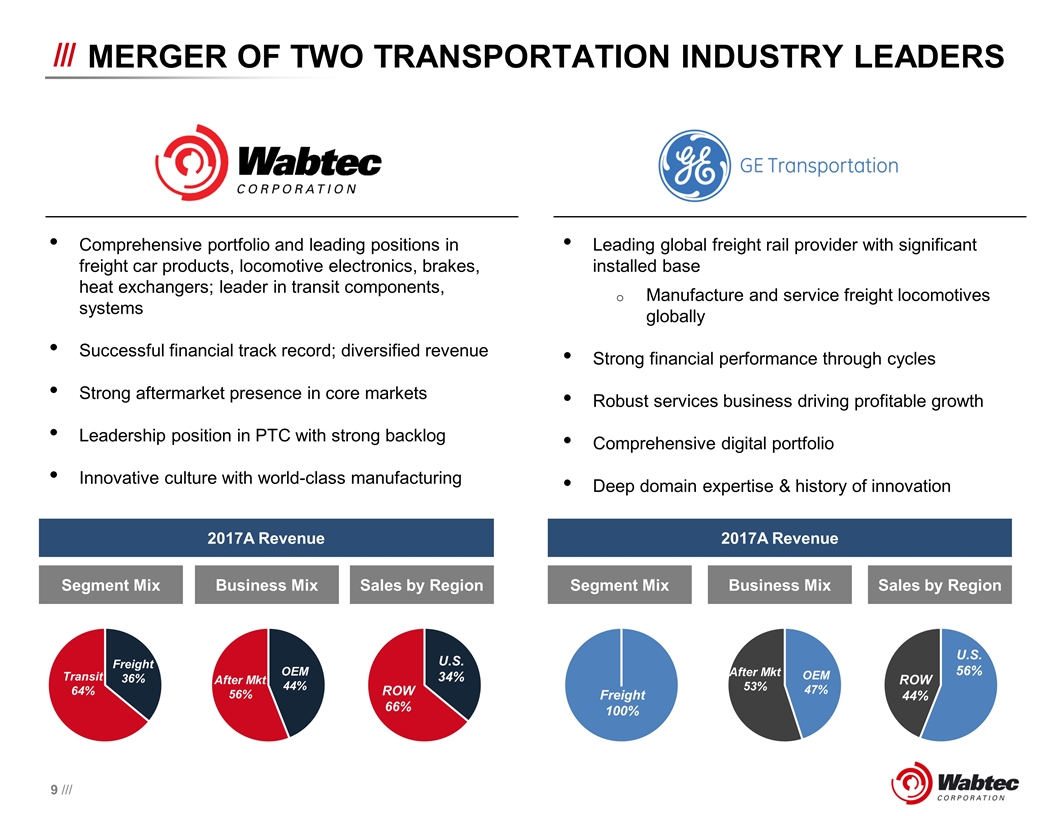

Merger of two transportation industry leaders Comprehensive portfolio and leading positions in freight car products, locomotive electronics, brakes, heat exchangers; leader in transit components, systems Successful financial track record; diversified revenue Strong aftermarket presence in core markets Leadership position in PTC with strong backlog Innovative culture with world-class manufacturing Leading global freight rail provider with significant installed base Manufacture and service freight locomotives globally Strong financial performance through cycles Robust services business driving profitable growth Comprehensive digital portfolio Deep domain expertise & history of innovation Segment Mix Business Mix Sales by Region Segment Mix Business Mix Sales by Region Transit 64% Freight 36% ROW 66% U.S. 34% After Mkt 56% OEM 44% After Mkt 53% OEM 47% ROW 44% U.S. 56% Freight 100% 2017A Revenue 2017A Revenue

Driving efficiency & productivity for customers Portfolio spans ecosystem … port, yard, rail network Proven outcomes … ~10% fuel savings, 10%+ increase in network velocity, ~40% increase in rail volume Maintain & upgrade fleet through asset lifecycle ~70% installed base under service contract ~13x growth in locomotive modernizations since ‘15 GE Transportation is a leader in the freight rail industry Global freight rail & propulsion system provider Leading Tier 4 engineering & technical innovation ~23K locomotive installed base Equipment Services Digital ~$18B BACKLOG Resilient portfolio with proven financial performance through cycles 2017A Financials Note: Adjusted figures represent non-GAAP metrics. Based on 2017A financial information (45% of Revenue) (48% of Revenue) (7% of Revenue)

Attractive point in cycle, well positioned for industry rebound GE Fleet Age Pyramid Contractual Coverage AC EVO AC4400 Dash 9 Dash 8 Dash 7 ~900 units Avg. 3 yrs ~7,900 units Avg. 5 yrs ~1,300 units Avg. 8 yrs ~4,800 units Avg. 10 yrs ~4,400 units Avg. 15 yrs ~2,200 units Avg. 20 yrs ~1,600 units Avg. 30 yrs ~100 units Avg. 35 yrs Upgrade targets Tier 4 DC EVO U Ser. 23K Parked 2K Warranty 2K Transactional 3K Long-term contracts 16K GE Transportation Historical and Projected Locomotive Deliveries Double-digit CAGR Over 11K locomotives currently at age of typical upgrade – will drive substantial near-term growth Over 70% under long-term service contracts Installed Base

Note: Adjusted figures represent non-GAAP metrics 1 Excludes synergies and purchase price amortization. GE Transportation Financial Trajectory GE Transportation is poised to benefit from cyclical tailwinds – including reduction in parked locomotives – that Wabtec is already seeing in its business 2019E Revenue Adj. EBIT1 2017A Locomotive deliveries expected to grow in line with recent orders ~12% CAGR ~14% CAGR Strong modernization growth; ~1,000 modernizations in backlog Service overhauls continue to trend in line with locomotive delivery schedule ~50% of planned equipment volume already in backlog Strong 2017A to 2019E Growth

GE Transportation competitive strengths Note: Adjusted figures represent non-GAAP metrics Leading global freight rail provider with a 23K locomotive installed base across both developed and emerging markets Growing services business with $13B backlog drives recurring revenues and mitigates cycles Comprehensive digital portfolio driving train performance and network optimization Leading engineering and technical intellectual property Strong horizontal / efficient supply chain Proven leadership team & results-driven culture Ability to maintain solid 18%+ adj. EBIT margins through the cycle

Strategic Rationale

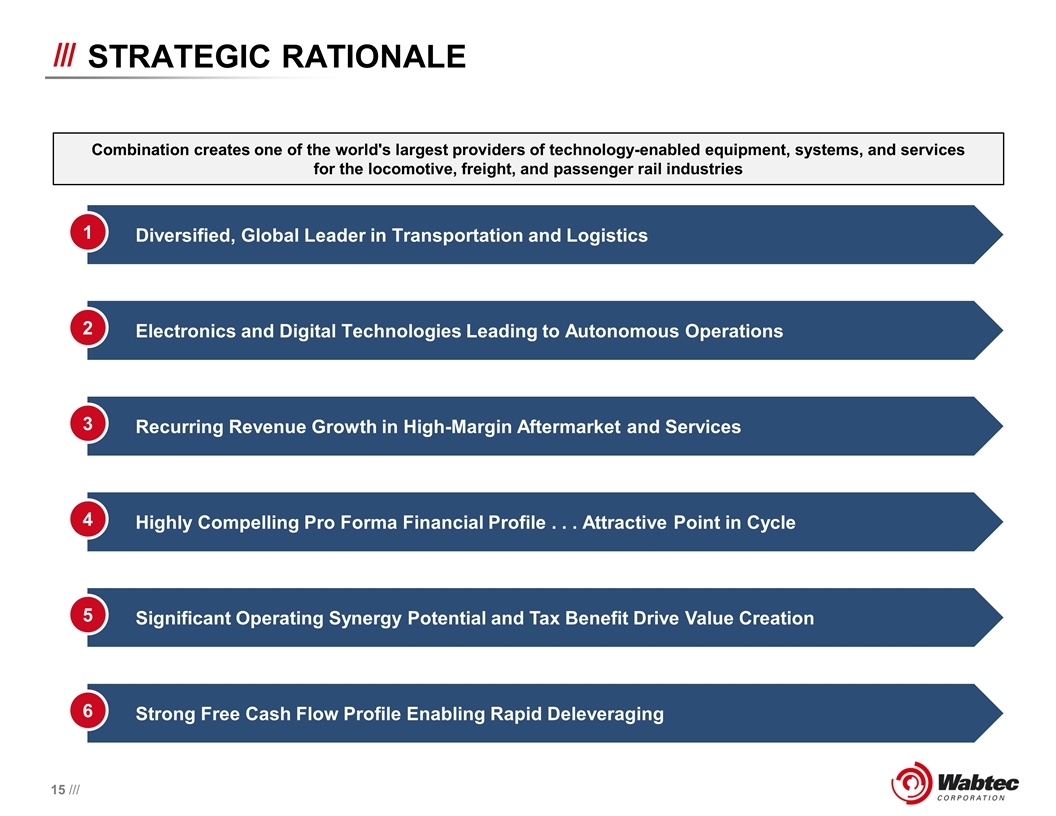

Strategic Rationale Diversified, Global Leader in Transportation and Logistics 1 Electronics and Digital Technologies Leading to Autonomous Operations Recurring Revenue Growth in High-Margin Aftermarket and Services Highly Compelling Pro Forma Financial Profile . . . Attractive Point in Cycle 2 3 4 Significant Operating Synergy Potential and Tax Benefit Drive Value Creation 5 Strong Free Cash Flow Profile Enabling Rapid Deleveraging 6 Combination creates one of the world's largest providers of technology-enabled equipment, systems, and services for the locomotive, freight, and passenger rail industries

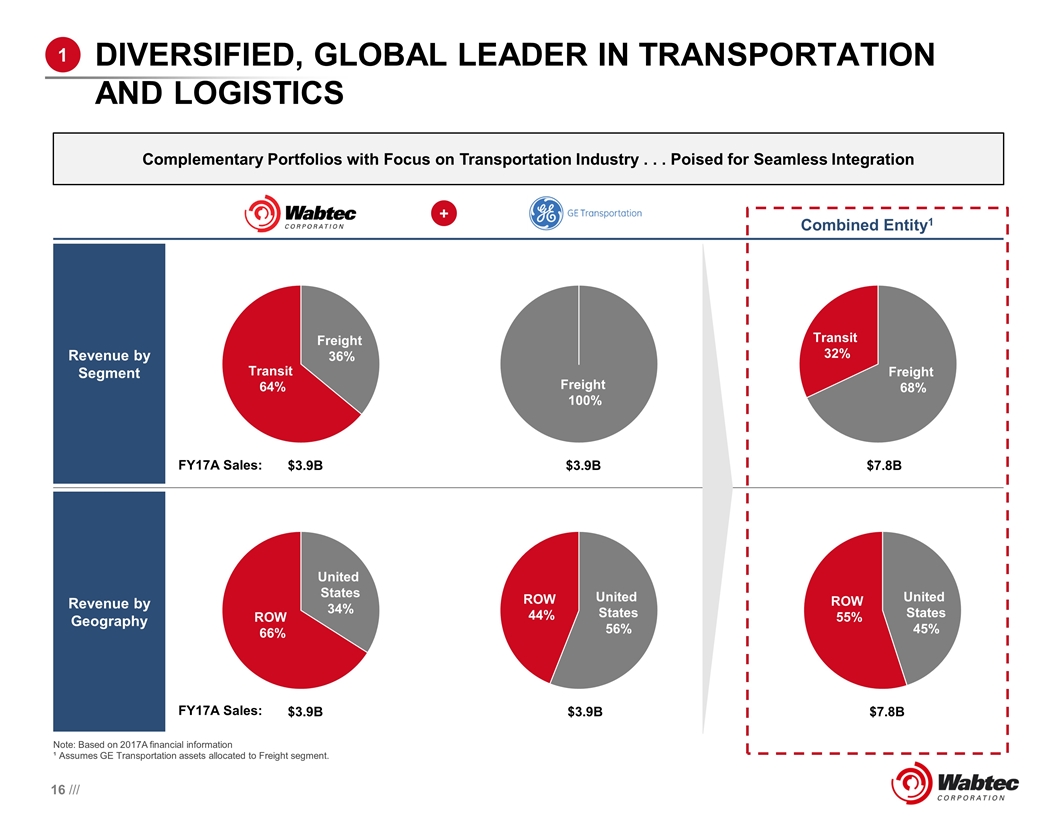

Diversified, global leader in transportation and logistics Combined Entity1 Revenue by Segment Revenue by Geography + FY17A Sales: FY17A Sales: 1 Complementary Portfolios with Focus on Transportation Industry . . . Poised for Seamless Integration Note: Based on 2017A financial information ¹ Assumes GE Transportation assets allocated to Freight segment.

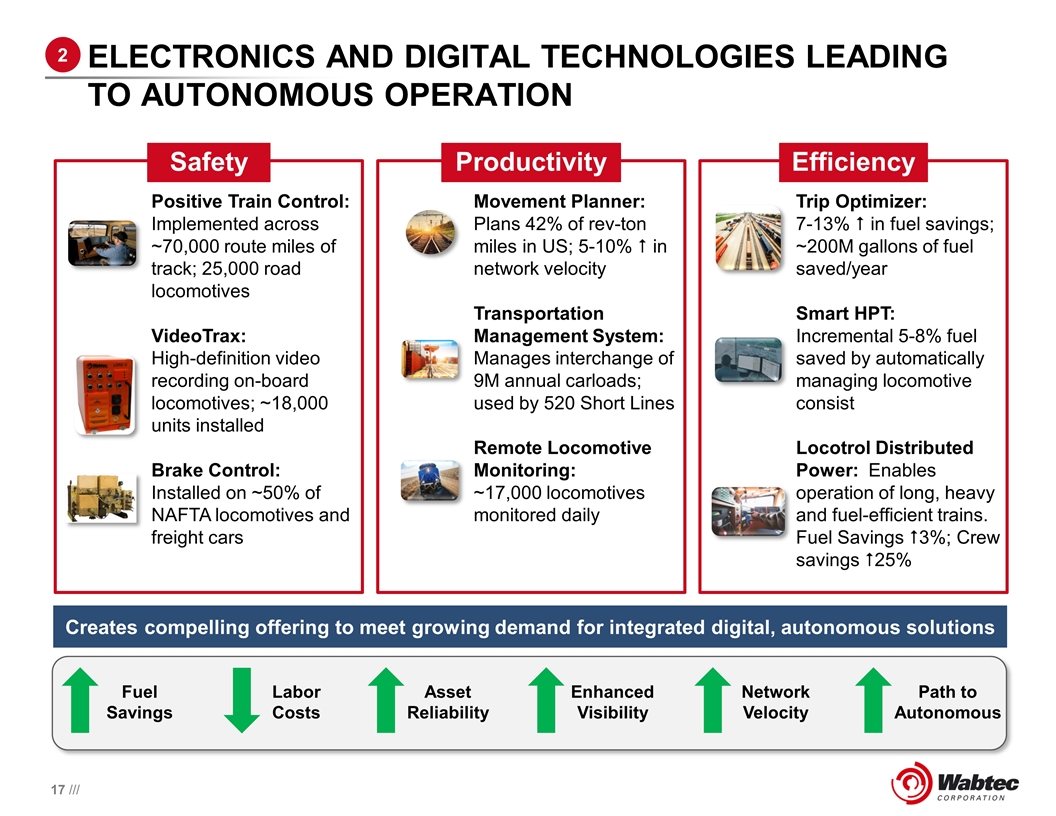

Trip Optimizer: 7-13% # in fuel savings; ~200M gallons of fuel saved/year Smart HPT: Incremental 5-8% fuel saved by automatically managing locomotive consist Locotrol Distributed Power: Enables operation of long, heavy and fuel-efficient trains. Fuel Savings #3%; Crew savings #25% Movement Planner: Plans 42% of rev-ton miles in US; 5-10% # in network velocity Transportation Management System: Manages interchange of 9M annual carloads; used by 520 Short Lines Remote Locomotive Monitoring: ~17,000 locomotives monitored daily electronics and digital technologies leading to autonomous operation Positive Train Control: Implemented across ~70,000 route miles of track; 25,000 road locomotives VideoTrax: High-definition video recording on-board locomotives; ~18,000 units installed Brake Control: Installed on ~50% of NAFTA locomotives and freight cars Safety 2 Creates compelling offering to meet growing demand for integrated digital, autonomous solutions Fuel Savings Labor Costs Asset Reliability Enhanced Visibility Network Velocity Path to Autonomous Productivity Efficiency

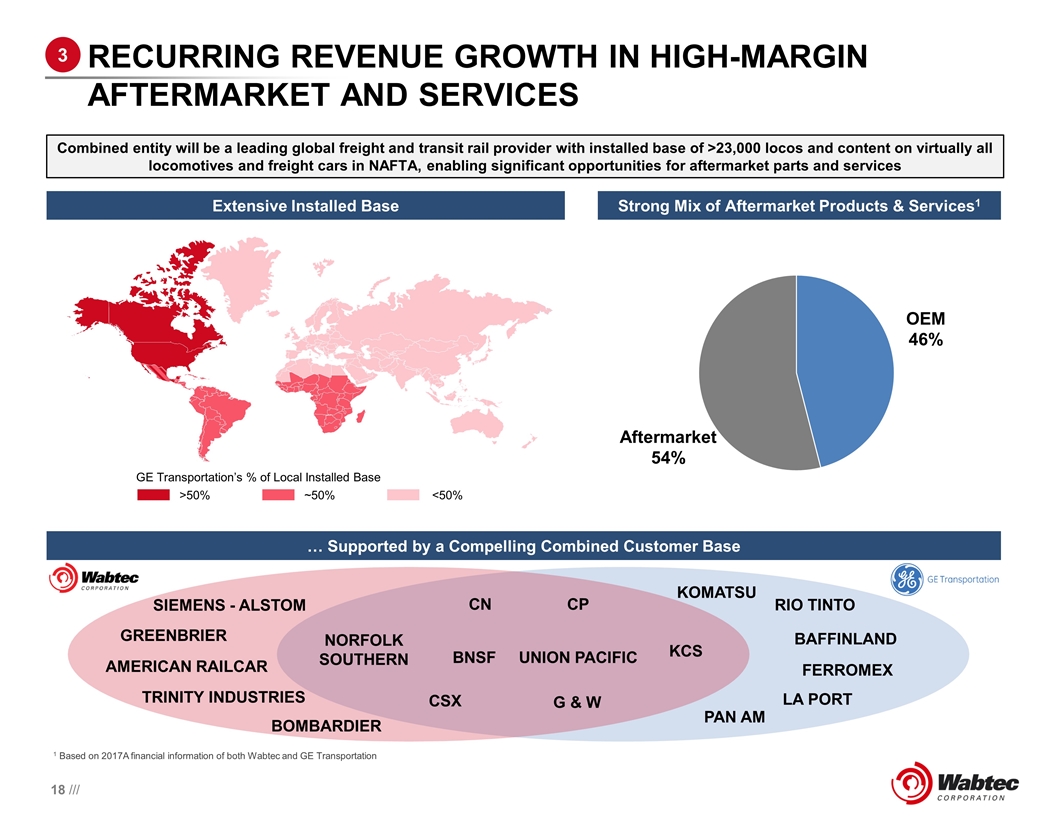

Recurring Revenue Growth in High-Margin Aftermarket and Services Combined entity will be a leading global freight and transit rail provider with installed base of >23,000 locos and content on virtually all locomotives and freight cars in NAFTA, enabling significant opportunities for aftermarket parts and services 1 Based on 2017A financial information of both Wabtec and GE Transportation Strong Mix of Aftermarket Products & Services1 Extensive Installed Base >50% ~50% <50% GE Transportation’s % of Local Installed Base 3 … Supported by a Compelling Combined Customer Base BOMBARDIER GREENBRIER AMERICAN RAILCAR TRINITY INDUSTRIES SIEMENS - ALSTOM KOMATSU RIO TINTO FERROMEX LA PORT BAFFINLAND PAN AM CSX UNION PACIFIC G & W NORFOLK SOUTHERN CN CP BNSF KCS

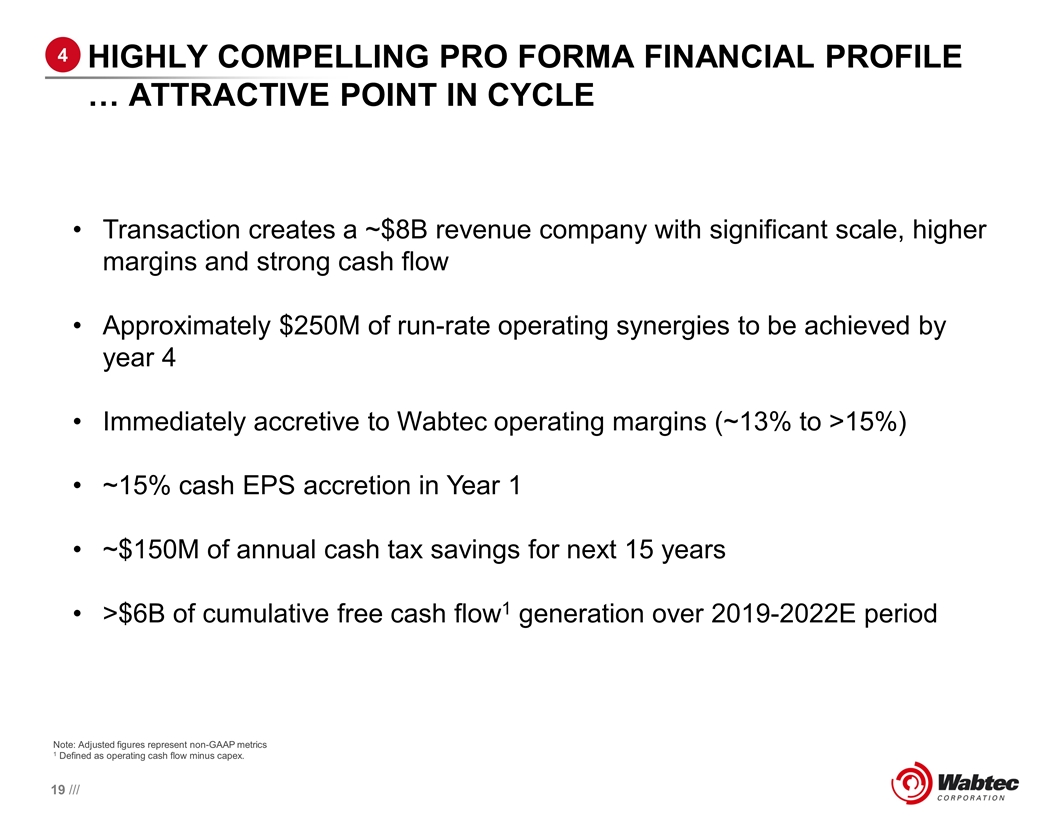

Note: Adjusted figures represent non-GAAP metrics 1 Defined as operating cash flow minus capex. Highly compelling PRO FORMA FINANCIAL PROFILE … Attractive point in cycle 4 Transaction creates a ~$8B revenue company with significant scale, higher margins and strong cash flow Approximately $250M of run-rate operating synergies to be achieved by year 4 Immediately accretive to Wabtec operating margins (~13% to >15%) ~15% cash EPS accretion in Year 1 ~$150M of annual cash tax savings for next 15 years >$6B of cumulative free cash flow1 generation over 2019-2022E period

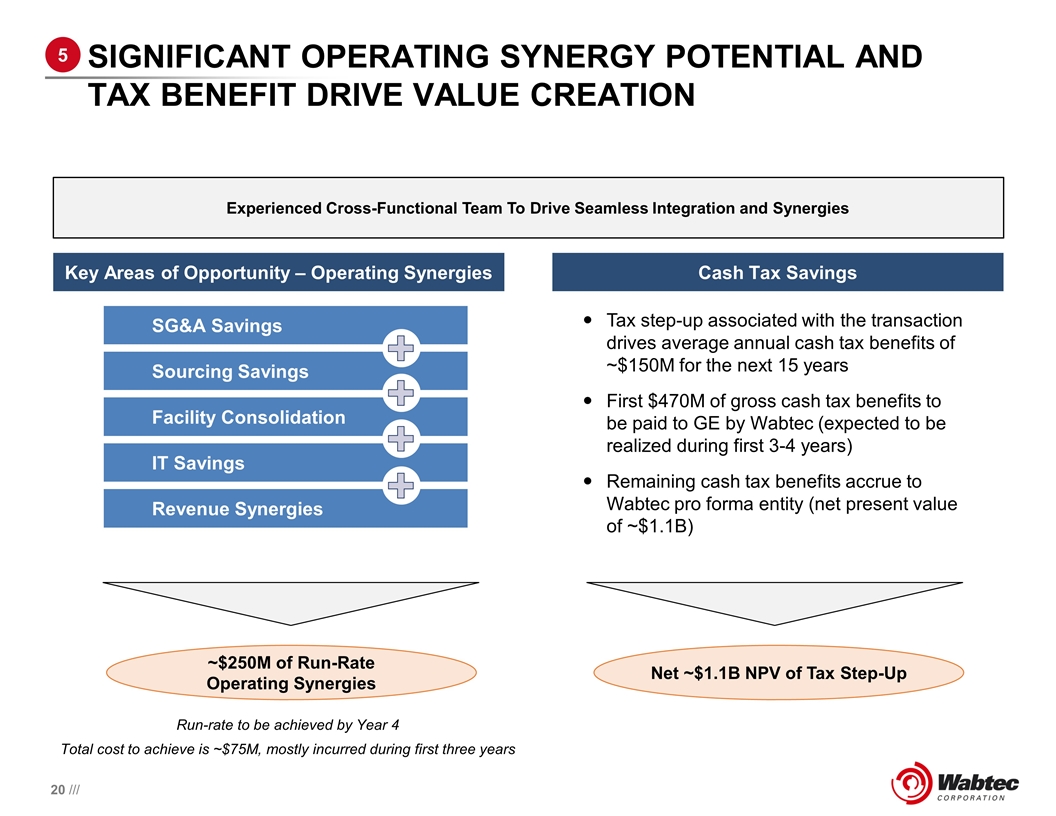

Significant Operating Synergy Potential and Tax benefit Drive Value Creation Experienced Cross-Functional Team To Drive Seamless Integration and Synergies 5 Key Areas of Opportunity – Operating Synergies Run-rate to be achieved by Year 4 Total cost to achieve is ~$75M, mostly incurred during first three years Tax step-up associated with the transaction drives average annual cash tax benefits of ~$150M for the next 15 years First $470M of gross cash tax benefits to be paid to GE by Wabtec (expected to be realized during first 3-4 years) Remaining cash tax benefits accrue to Wabtec pro forma entity (net present value of ~$1.1B) ~$250M of Run-Rate Operating Synergies SG&A Savings Sourcing Savings Facility Consolidation IT Savings Revenue Synergies Cash Tax Savings Net ~$1.1B NPV of Tax Step-Up

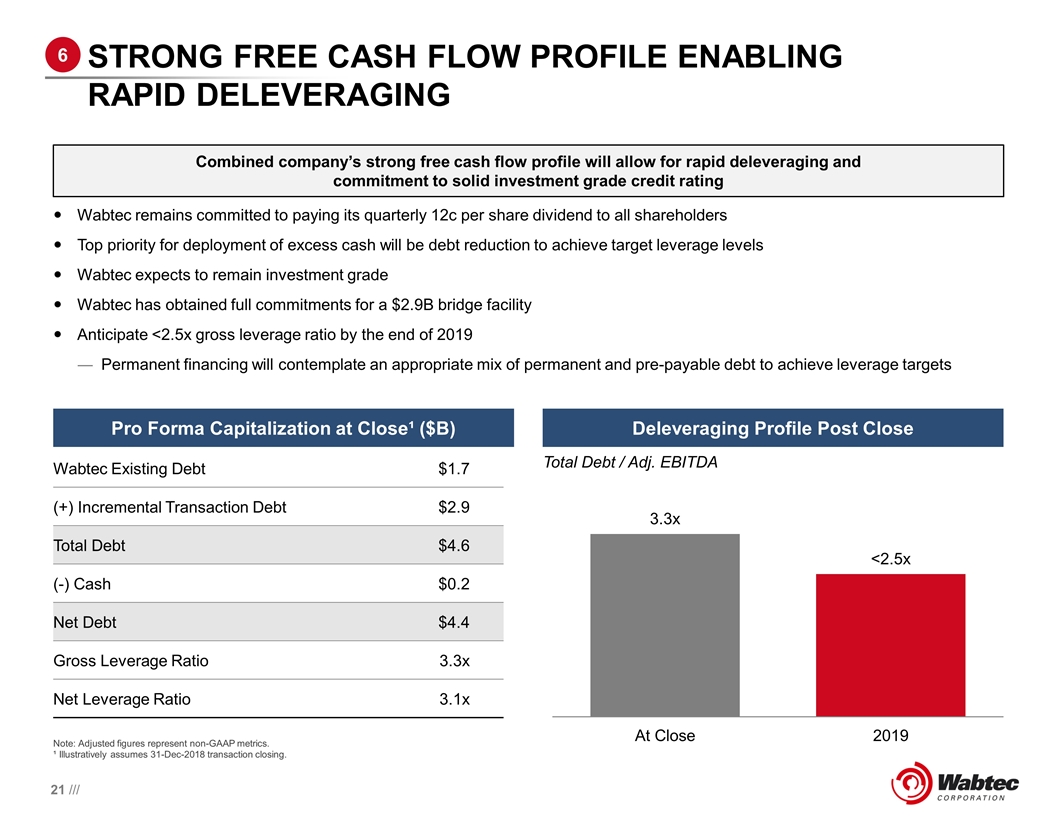

Strong Free Cash Flow Profile Enabling Rapid Deleveraging Wabtec remains committed to paying its quarterly 12c per share dividend to all shareholders Top priority for deployment of excess cash will be debt reduction to achieve target leverage levels Wabtec expects to remain investment grade Wabtec has obtained full commitments for a $2.9B bridge facility Anticipate <2.5x gross leverage ratio by the end of 2019 Permanent financing will contemplate an appropriate mix of permanent and pre-payable debt to achieve leverage targets Deleveraging Profile Post Close Wabtec Existing Debt $1.7 (+) Incremental Transaction Debt $2.9 Total Debt $4.6 (-) Cash $0.2 Net Debt $4.4 Gross Leverage Ratio 3.3x Net Leverage Ratio 3.1x Pro Forma Capitalization at Close¹ ($B) Combined company’s strong free cash flow profile will allow for rapid deleveraging and commitment to solid investment grade credit rating 6 Total Debt / Adj. EBITDA Note: Adjusted figures represent non-GAAP metrics. ¹ Illustratively assumes 31-Dec-2018 transaction closing.

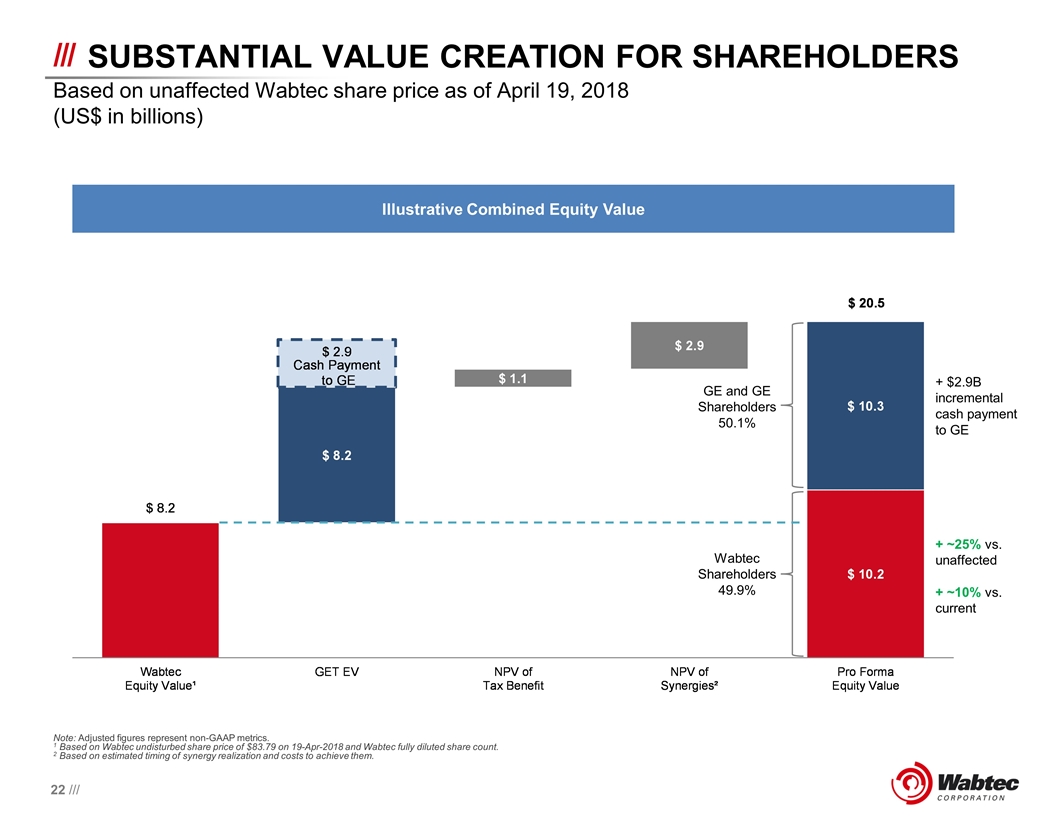

Substantial value creation for shareholders Based on unaffected Wabtec share price as of April 19, 2018 (US$ in billions) Note: Adjusted figures represent non-GAAP metrics. 1 Based on Wabtec undisturbed share price of $83.79 on 19-Apr-2018 and Wabtec fully diluted share count. 2 Based on estimated timing of synergy realization and costs to achieve them. Illustrative Combined Equity Value GE and GE Shareholders 50.1% Wabtec Shareholders 49.9% + $2.9B incremental cash payment to GE + ~25% vs. unaffected + ~10% vs. current

Perspectives on Transaction Value (US$ in billions) Note: Wabtec current EV / adj. EBITDA based on IBES estimates. Adjusted figures represent non-GAAP metrics. 1 Based on Wabtec undisturbed share price of $83.79 on 19-Apr-2018 and Wabtec fully diluted share count. Transaction Multiples 2019E EV¹ / Adj. EBITDA Wabtec 2019E EV¹ / Adj. EBITDA 2017A EV¹ / Adj. EBITDA

WABTEC + GE TRANSPORTATION Accelerating The Future Of Transportation + Shareholders Customers Employees Complementary strengths will enable combined company to deliver through the transportation cycle and be best positioned for long-term growth in an improving industry environment Expanded suite of solutions will allow companies to better partner with customers to help them overcome their toughest infrastructure challenges With centuries of combined industry heritage and a culture of innovation, the companies will foster new growth opportunities for their employees as part of a stronger, more diversified company Revenues Countries Employees ~$8B ~27K ~50 Value

Q&A