Form DFAN14A Destination Maternity Filed by: Miller Nathan G

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

Filed by the Registrant

|

Filed by a Party other than the Registrant

|

Check the appropriate box:

|

|

Preliminary Proxy Statement

|

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

Definitive Proxy Statement

|

|

|

Definitive Additional Materials

|

|

|

Soliciting material Pursuant to §240.14a-12

|

|

Destination Maternity Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

Nathan G. Miller

Peter O’Malley

Holly N. Alden

Christopher B. Morgan

Marla A. Ryan

Anne-Charlotte Windal

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

No fee required.

|

|

|

|

||

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

Fee paid previously with preliminary materials.

|

|

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

||

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

On May 16, 2018, the following materials were posted to www.destfacts.com:

Executive Summary:Our Plan to Effect Change At Destination Maternity May 15, 2018

2 DISCLAIMERThe information contained in this presentation (the “Information”) is based on publicly available information about Destination Maternity Corporation (the “Company”), which has not been independently verified by Nathan G. Miller or Peter O’Malley (the “Investors”). The Investors recognize that there may be confidential or otherwise non-public information in the possession of the Company or others that could lead the Company or others to disagree with the Investors’ conclusions. This presentation and the Information are neither a recommendation nor solicitation to buy or sell any securities. The Information is made available exclusively by the Investors and not by or on behalf of the Company or its affiliates or subsidiaries or any other person. While the Investors have invested in common stock of the Company and Mr. Miller has nominated directors for election to serve on the board of directors of the Company (the “Board”), the Investors are not affiliates of the Company and neither the Investors nor their representatives are authorized to disseminate any information for or on behalf of the Company, and they do not purport to do so. It is possible that there will be developments in the future that cause the Investors to change their position regarding the Company. The Investors hereby disclaim any and all liability as to the accuracy, completeness, or timeliness of the Information and for any omissions of material facts, including with respect to the Company, Mr. Miller’s proposed slate of directors, or any other matter. The Investors disclaim any obligation to correct, update or revise the Information or to otherwise provide any additional materials. Additionally, the Investors have not sought or obtained consent from any third party to use any information that has been obtained or derived from a third party. Thus, stockholders and others should conduct their own independent investigation and analysis of the Company, the Mr. Miller’s proposed slate of directors, and the Information. Except where otherwise indicated, the Information speaks as of the date hereof. The analysis of the Company’s performance and the potential areas for improvement on the pages that follow are based on public information and extensive due diligence. This presentation contains statements reflecting the Investors’ opinions and beliefs with respect to the Company and its business, based on the Investors’ research, analysis, and experience. All such statements are based upon the Investors’ opinions and beliefs, whether or not those statements are expressly so qualified.

3 CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS The analyses provided herein may include certain forward-looking statements, estimates, and projections prepared with respect to, among other things, general economic and market conditions, changes in management, changes in Board composition, actions of the Company and its subsidiaries or competitors, the ability to implement business strategies and plans and pursue business opportunities in the retail industry. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe the Investors’ objectives, plans, or goals are forward-looking. Such forward-looking statements, estimates, and projections reflect various assumptions by the Investors concerning anticipated results that are inherently subject to significant uncertainties and contingencies and have been included solely for illustrative purposes, including those risks and uncertainties detailed in the continuous disclosure and other filings of the Company with the Securities and Exchange Commission (“SEC”) at www.sec.gov. No representations, express or implied, are made as to the accuracy or completeness of such forward-looking statements, estimates, or projections or with respect to any other materials herein. Actual results may vary materially from the estimates and projected results contained herein.

Summary Cost Reduction Margin Improvement Revenue Growth Stabilizing & reversing SG&A expense growthReducing unnecessary recurring costsRenegotiating contracts & leases Focus on profitable salesReduction in discounting (increasing sales price)Negotiations with vendors for price concessions Expansion into other categoriesGrowth of marketing partnershipsImprovements to in-store conversions 4 This is an executive summary of the nominees’ business, strategic initiatives, continuity and transition plans.

Cost Reduction Stabilizing & reversing SG&A expense growthTargeted $7.5M in SG&A / Corporate OverheadReducing unnecessary recurring costsReducing reliance on third parties and vendors targeting $5MRe-negotiating contracts & leasesBulk renegotiation of leases could reduce lease costs $2M Potential RisksCritical Employee Departures Internal volatilityStaff disruption Risk MitigationProper incentives & management Focus non-employee costsDeep network/bench of candidates 5

Margin Improvement Focus on profitable salesTeam will be incentivized towards profitable sales, not simply revenue growthReduction in discounting (increasing effective sales price)Reducing the pace or depth of discounting will improve marginsNegotiations with vendors for price concessionsWorking with manufacturers to reduce delivery timeline and reduce costs per item Potential RisksLower sales volumeVendor holdoutTiming Risk MitigationPlans to improve conversion rates+50 vendors gives us leverageContracts are long-term but allow flexibility 6

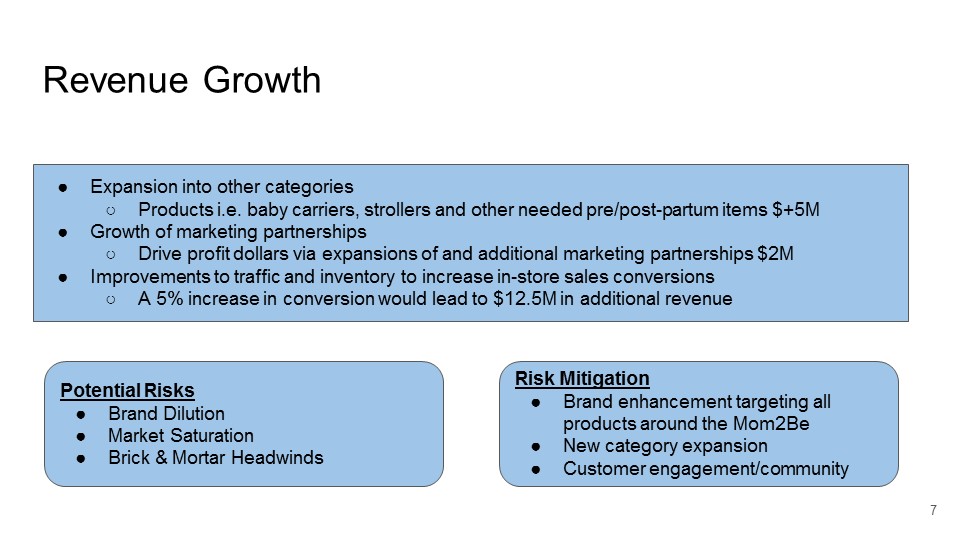

Revenue Growth Expansion into other categoriesProducts i.e. baby carriers, strollers and other needed pre/post-partum items $+5MGrowth of marketing partnershipsDrive profit dollars via expansions of and additional marketing partnerships $2MImprovements to traffic and inventory to increase in-store sales conversionsA 5% increase in conversion would lead to $12.5M in additional revenue Potential RisksBrand DilutionMarket SaturationBrick & Mortar Headwinds Risk MitigationBrand enhancement targeting all products around the Mom2BeNew category expansionCustomer engagement/community 7

Implementation A detailed and methodical series of plans to clarify, identify and implement the short-to-mid term cost reduction and revenue improvement initiatives.With these materials in-hand we believe that we can make a beneficial impact from day 1. 10 Week Plans100 Day plansFinancial metrics & Key Performance IndicatorsManagement development plansManagement continuity planStaff assessment and training plansFeedback mechanismsCommunication plansInternal (staff, management, stores and DC)External (stakeholders, shareholders and vendors)Marketing & Advertising plansWeb-sales & testing plans 8

Turnaround Plan Transition - First 30 Days Detail & Plan - 30 to 90 Days Build & Grow - Post 90 Days CommunicateEmployeesShareholdersConfirmationQ1 ResultsCost ReductionHire a Permanent CEO Phase Improve Cash FlowNegotiate w/ vendorsDetail out plans180 Days360 DaysSupport CEO Transition ImplementRevenue strategyCost Reduction & ReorganizationIdentify and Recruit Key Talent 9

Transition CommunicateTo ensure a smooth transition, we would seek to nominate an interim CEO. Recruiting efforts for a qualified permanent CEO would be a critical priority. We would also look to maintain and incentivize the 10-20 key employees at the Named Executive Officer, SVP, VP and Director levels. Immediately following the outcome of the vote we would seek to communicate with and assuage the concerns of the corporate, distribution center and store staff. We are deeply committed to making this company succeed and grow. ConfirmDepending on the results of Q1 and the specifics on the ground we will confirm our cost reduction and revenue growth plans with the key leaders and managers and develop 30/60/90 day roll-out plans. 10

Detail & Plan Improve Cash Flow via short term plansFollowing confirmation we will execute our plan to renegotiate contracts (leases and vendors) to reduce costs. We will also implement our plans for new category product sales and add-ons to improve profits (hard goods and additional soft goods). Detailing medium and long term plansWhile implementing the “quick wins,” we will also clarify and detail the 180 day (FY18) plan and the 360 (FY19) plans. 11

Build & Grow BuildIn building the organization of the future we will rightsize teams to be flexible and nimble with an omni-brand, omni-channel and customer focused mindset. After stabilizing the company we would look to onboard key talent that would help drive our growth strategy. GrowWe believe this is a company with unmatched growth potential, there are a myriad of a different products and services that families need when they’re becoming new parents. We would like to see the stores become a true “destination” for the Mom2Be for all of their apparel, education, infant and wellness needs.Sponsor in-store experiences to draw future parents to store via pre and postpartum programming from birthing classes to La Leche events. 12

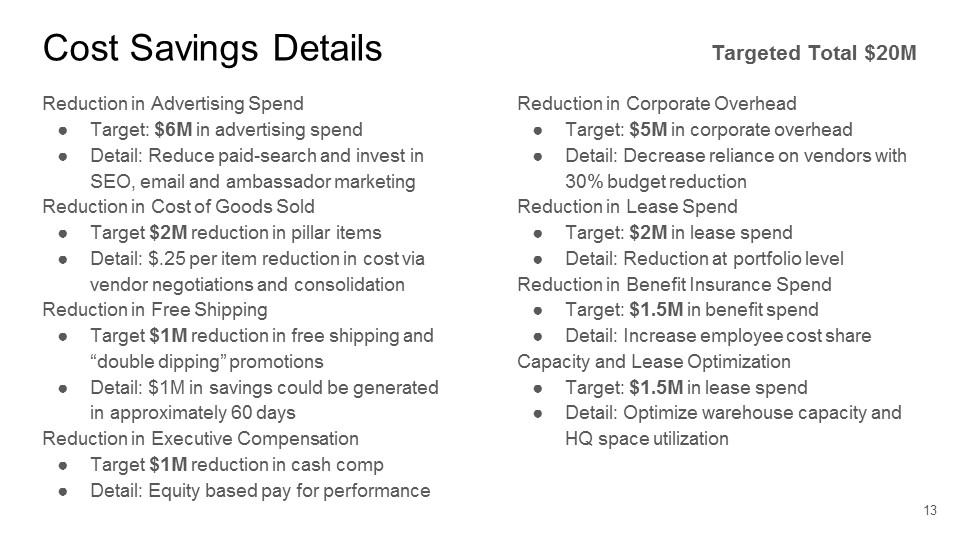

Cost Savings Details Targeted Total $20M Reduction in Advertising SpendTarget: $6M in advertising spendDetail: Reduce paid-search and invest in SEO, email and ambassador marketingReduction in Cost of Goods SoldTarget $2M reduction in pillar itemsDetail: $.25 per item reduction in cost via vendor negotiations and consolidationReduction in Free ShippingTarget $1M reduction in free shipping and “double dipping” promotionsDetail: $1M in savings could be generated in approximately 60 daysReduction in Executive CompensationTarget $1M reduction in cash compDetail: Equity based pay for performance Reduction in Corporate OverheadTarget: $5M in corporate overheadDetail: Decrease reliance on vendors with 30% budget reductionReduction in Lease SpendTarget: $2M in lease spendDetail: Reduction at portfolio level Reduction in Benefit Insurance SpendTarget: $1.5M in benefit spendDetail: Increase employee cost share Capacity and Lease OptimizationTarget: $1.5M in lease spend Detail: Optimize warehouse capacity and HQ space utilization 13

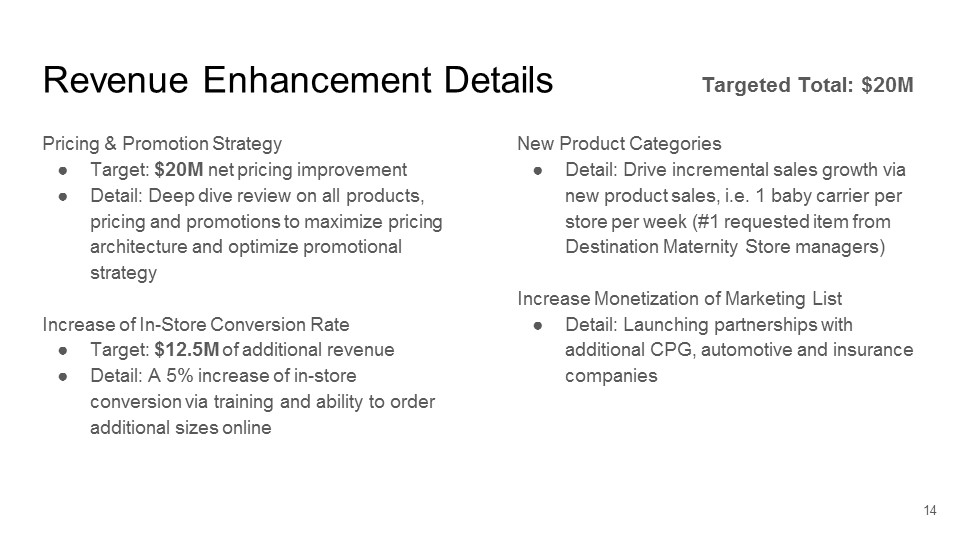

Revenue Enhancement Details Targeted Total: $20M New Product CategoriesDetail: Drive incremental sales growth via new product sales, i.e. 1 baby carrier per store per week (#1 requested item from Destination Maternity Store managers)Increase Monetization of Marketing ListDetail: Launching partnerships with additional CPG, automotive and insurance companies Pricing & Promotion StrategyTarget: $20M net pricing improvement Detail: Deep dive review on all products, pricing and promotions to maximize pricing architecture and optimize promotional strategy Increase of In-Store Conversion RateTarget: $12.5M of additional revenueDetail: A 5% increase of in-store conversion via training and ability to order additional sizes online 14

Investors propose three women as board members at Destination Maternity

Updated: MAY 15, 2018 — 6:11 PM EDT

by Erin Arvedlund, Inquirer Staff Writer

Destination Maternity faces plenty of drama next Wednesday at its annual shareholder meeting — including vocal activist shareholders, two slates of directors up for election, and a stock price that everyone is hoping will crack $3 a share after years of dismal performance.

Kenosis Capital, an investment fund headed by Peter O’Malley, and Nathan Miller of NGM Capital are two investors asking other Destination shareholders to vote in a clean slate of four new directors at the beleaguered maternity and baby clothing retailer. Together, the dissident investors hold roughly 9 percent of Destination Maternity, or about 14.6 million shares.

Last fall, Destination Maternity had done battle with French shareholder and competitor Orchestra, and after a bitter proxy battle, gave it a seat on the board. Roughly six months later, Destination Maternity’s stock hasn’t budged much from where it was, and investors Miller and O’Malley are putting forth four new directors, including three women: Holly N. Alden, cofounder of Skullcandy with her husband, Rick Alden; Anne-Charlotte Windal, a former Wall Street retail analyst with Bernstein Research, and Marla A. Ryan, a 25-year retail executive most recently with Land’s End.

Company management is asking shareholders to vote against the new slate and keep the incumbent board. That includes Pierre-André Mestre, recently appointed director, who is chairman of the largest stockholder, French retailer Orchestra; Peter Longo, Barry Erdos, and Melissa Payner-Gregor, the interim CEO.

The vote will take place next Wednesday at the company’s Moorestown headquarters at 9:15 a.m., according to public filings.

Two additional outside consultants also disagree: ISS recommended that shareholders vote in a split board at Destination Maternity (including two management board member candidates and two outside board candidates) while Glass-Lewis recommended voting with management’s slate.

Amid the drama, Destination Maternity has the opportunity to pick up business from the now-defunct Babies R Us, and take its place as the dominant retailer to expectant mothers and new parents, said Trip Miller, managing partner at Gullane Capital in Memphis. Miller, no relation to Nathan Miller, said his fund Gullane Capital owns roughly 3 percent of Destination Maternity stock, or just over 467,000 shares.

“We bought the stock starting at $2.38 a share starting last year,” said Miller of Gullane.

“We think it can double in five to 10 years, and it’s a business than can make between $20 million and $30 million” in EBIDTA, or earnings before interest, depreciation, taxes, and amortization, annually. “With the right team in place, it could be a $10 stock or more, but not with current management in place,” he added. His firm will vote with the activists for a completely new board of directors.

“We would not be happy with a split board,” said Gullane’s Miller.

“We’d like to see a clear direction. The people who got the company into this mess shouldn’t be the ones getting us out. Like Wynn Resorts, our largest holding, Destination needs a larger female representation on the board.”

Destination Maternity shares have dropped from more than $30 a share in 2013 to just under $3 a share currently.

Dissident shareholders O’Malley and Nathan Miller declined to comment, but on May 3 they issued a news release outlining their plans: “Our nominees will seek to implement our strategic plan. We believe our turnaround plan, which seeks to improve margins by rationalizing inventory and cutting wasteful spending,” can increase cash flow by approximately $40 million, net income by approximately $30 million, and incremental earning per share by up to $2.

“We believe that Destination Maternity has tremendous potential — as evidenced by our collective ownership of almost 9 percent of the company’s stock. With our nominees on the board of directors, we believe we can end and reverse the company’s decline with our turnaround plan and meaningfully improve the value of the company’s shares,” the statement said.

In its latest news release, the company urged shareholders to vote its slate, citing “product extensions into baby soft and hard goods, capitalizing on the immediate opportunity in the market created by the Toys R Us / Babies R Us bankruptcy.”

“There has been a lot of change already. We’re in a good place right now,” said one Destination Maternity executive who requested anonymity, adding “we’re always open to offers that would maximize shareholder value, but we have a strategy that’s a winner. No one’s interested in a bargain sale.”

Among the candidates for new board members, Holly Alden, the cofounder of SkullCandy, currently runs the Alden Charitable Foundation, which supports the Holly House, a transitional home for families fleeing polygamy, and the Encircle house in Provo, Utah, supporting LGBT youth.

Marla Ryan worked as senior vice president of retail at Land’s End, and before that spent years in retail, including the Gap, Brooks Brothers, J. Crew, and American Eagle, according to Bloomberg.

Currently, the maternity clothing and retailer’s board is made up entirely of men — apart from the interim CEO.

ISS agreed with shareholders Ketosis and NGM partly, saying they had “made a persuasive case that additional change at the board level is warranted.”

However, ISS recommended shareholders should vote for Marla Ryan and Anne-Charlotte Windal, rather than all four of the dissident shareholders’ slate.

Cost Savings Details Targeted Total $20M Reduction in Advertising SpendTarget: $6M in advertising spendDetail: Reduce paid-search and invest in SEO, email and ambassador marketingReduction in Cost of Goods SoldTarget $2M reduction in pillar itemsDetail: $.25 per item reduction in cost via vendor negotiations and consolidationReduction in Free ShippingTarget $1M reduction in free shipping and “double dipping” promotionsDetail: $1M in savings could be generated in approximately 60 daysReduction in Executive CompensationTarget $1M reduction in cash compDetail: Equity based pay for performance Reduction in Corporate OverheadTarget: $5M in corporate overheadDetail: Decrease reliance on vendors with 30% budget reductionReduction in Lease SpendTarget: $2M in lease spendDetail: Reduction at portfolio level Reduction in Benefit Insurance SpendTarget: $1.5M in benefit spendDetail: Increase employee cost share Capacity and Lease OptimizationTarget: $1.5M in lease spend Detail: Optimize warehouse capacity and HQ space utilization 13

R

evenue Enhancement Details Targeted Total: $20M New Product CategoriesDetail: Drive incremental sales growth via new product sales, i.e. 1 baby carrier per store per week (#1 requested item from Destination Maternity Store managers)Increase Monetization of Marketing ListDetail: Launching partnerships with additional CPG, automotive and insurance companies Pricing & Promotion StrategyTarget: $20M net pricing improvement Detail: Deep dive review on all products, pricing and promotions to maximize pricing architecture and optimize promotional strategy Increase of In-Store Conversion RateTarget: $12.5M of additional revenueDetail: A 5% increase of in-store conversion via training and ability to order additional sizes online 14