Form 6-K Concordia International For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: May 2018

Commission File Number: 001- 37413

Concordia International Corp.

(Translation of registrant’s name into English)

277 Lakeshore Road East, Suite 302

Oakville, Ontario

L6J 1H9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

On May 15, 2018, Concordia International Corp. (“Concordia”) released its first quarter 2018 results. In conjunction with this announcement Concordia is filing the following exhibits:

Exhibit 99.1 | Press release of Concordia International Corp., dated May 15, 2018 |

Exhibit 99.2 | Management’s Discussion and Analysis of Financial Condition and Results of Operations for the three months ended March 31, 2018. |

Exhibit 99.3 | Unaudited Condensed Interim Consolidated Financial Statements as at and for the three months ended March 31, 2018. |

This report on Form 6-K shall be deemed to be incorporated by reference into Concordia’s Registration Statements on Form S-8 (File No. 333-209498) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Concordia International Corp. | |||

By: | /s/ David Price | ||

Name: | David Price | ||

Title: | Chief Financial Officer | ||

Date: May 15, 2018

EXHIBIT INDEX

Exhibit No. | Description |

Exhibit 99.1 |

Exhibit 99.2 |

Exhibit 99.3 |

Concordia International Corp. Announces First Quarter 2018 Results

• | First quarter 2018 revenue of $152 million |

• | First quarter 2018 GAAP net loss of $56 million |

• | First quarter 2018 adjusted EBITDA1 of $72 million |

• | Generated cash flow from operations of $51 million in the first quarter of 2018 and concluded the quarter with a cash balance of $344 million |

• | On May 2, 2018, announced the execution of a support agreement with debtholders holding in aggregate more than 72 per cent of its affected secured debt and more than 64 per cent of its affected unsecured debt in connection with a proposed recapitalization transaction that would raise $586.5 million, and reduce the Company’s outstanding debt by approximately $2.4 billion and reduce its annual interest costs by approximately $172 million |

OAKVILLE, ON – May 15, 2018 – Concordia International Corp. (“Concordia” or the “Company”) (NASDAQ: CXRX) (TSX: CXR), an international specialty pharmaceutical company focused on becoming a leader in European specialty, off-patent medicines, today announced its financial and operational results for the first quarter of 2018. All financial references are in U.S. dollars (USD) unless otherwise noted.

“Concordia’s first quarter results were consistent with management’s expectations,” said Graeme Duncan, interim Chief Executive Officer of Concordia. “The Company has also recently made significant progress

1

towards the realignment of its capital structure. Looking forward, we are optimistic Concordia can complete its proposed recapitalization transaction by July 31, 2018 and emerge as a stronger business.”

Consolidated First Quarter 2018 Financial and Operational Results

• | Reported first quarter revenue of $152.3 million, compared to $160.6 million for the first quarter of 2017, and $150.2 million for the fourth quarter of 2017. |

• | GAAP net loss for the first quarter of $55.7 million. |

• | Reported first quarter adjusted EBITDA1 of $72.0 million, compared to $84.2 million for the first quarter of 2017, and $70.8 million for the fourth quarter of 2017. |

• | On a constant currency basis, first quarter 2018 revenue and adjusted EBITDA were 2.2% and 2.0% lower than their respective amounts in the fourth quarter of 2017. |

• | Generated cash flows from operating activities of $50.6 million in the first quarter of 2018, compared to $86.2 million in the first quarter of 2017. |

• | As of March 31, 2018, the Company’s liquidity consisted of $343.8 million of cash and cash equivalents. |

• | On May 2, 2018, Concordia announced the execution of a support agreement with debtholders holding in aggregate more than 72 per cent of its affected secured debt and more than 64 per cent of its affected unsecured debt in connection with a proposed recapitalization transaction that would raise $586.5 million and reduce the Company’s outstanding debt by approximately $2.4 billion and reduce its annual interest costs by approximately $172 million. |

• | In connection with the proposed recapitalization transaction, on May 2, 2018, the Ontario Superior Court of Justice (“the Court”) issued an interim order authorizing the holding of meetings of affected debtholders and shareholders to vote on Concordia’s CBCA plan of arrangement pursuant to which the proposed recapitalization transaction is to be implemented. |

2

• | Completion of the proposed recapitalization transaction will be subject to, among other things, approval of the CBCA plan of arrangement by the requisite majorities of the secured debtholders and the unsecured debtholders at the meetings to be held on June 19, 2018, such other approvals as may be required by the Court or the TSX, other applicable regulatory approvals, approval of the CBCA plan of arrangement by the Court and the satisfaction or waiver of applicable conditions precedent. |

First Quarter 2018 Segment Results

Concordia International segment’s revenue for the first quarter of 2018 was $113.0 million compared to $113.7 million in the fourth quarter of the 2017.

Revenue for the first quarter of 2018 decreased by $5.8 million or 5%, compared to the corresponding period in 2017.

This decrease is attributable to volume and price declines on key products, including Liothyronine Sodium, Trazodone, and Prednisolone. These revenue decreases were partially offset by an increase in revenue from Nitrofurantoin. The sterling strengthening against the U.S. dollar resulted in $14.7 million of additional translated revenue in the first quarter of 2018 compared to the corresponding period in 2017.

Concordia North America segment’s first quarter 2018 revenue of $39.3 million was moderately higher than fourth quarter 2017 revenue of $36.5 million.

Revenue for the first quarter of 2018 decreased by $2.5 million or 6%, compared to the corresponding period in 2017. The decrease was primarily attributable to competitive pressures on products, including Donnatal® and Kapvay®. These decreases were partially offset by an increase in revenue from Plaquenil® authorized generic.

3

Pipeline Update

In the first quarter of 2018, Concordia launched one new product into markets that have a current IMS estimated market value in excess of $20 million.

Concordia also has 28 products that have already been approved or are awaiting approval by the regulators. These products, if launched, are expected to compete in markets that have a current IMS estimated market value in excess of $250 million.

In addition, the Company currently has 17 products under development that are anticipated to launch in the next three to five years. These products, if launched, are expected to compete in markets that have a current IMS estimated market value in excess of $1.4 billion.

The Company believes that these products include several first-to-market or early-to-market opportunities for difficult-to-make products.

Additionally, Concordia has 14 products identified for potential development that if launched, are expected to compete in markets that have a current IMS estimated market value in excess of $350 million.

Therefore, in total, Concordia’s current pipeline is now comprised of approximately 60 products that could compete in markets that have a current IMS estimated market value in excess of $2 billion.

With its recently announced leadership transition, the Company will continue to evaluate the composition of its pipeline of medicines.

4

Leadership Transition

Concordia announced on May 2, 2018, that Graeme Duncan has been appointed interim Chief Executive Officer of the Company. Mr. Duncan succeeded Concordia’s previous CEO, Allan Oberman, who left the Company to pursue other opportunities.

The Company also announced on May 2, 2018, that its Chief Corporate Development Officer, Sarwar Islam, left the Company to pursue other opportunities. Guy Clark, previously Chief Strategy Officer at AMCo Pharmaceuticals from 2013 to 2015, joined Concordia, effective May 3, 2018, as the Company’s Chief Corporate Development Officer.

Consolidated Financial Results

Three months ended | ||||

(in $000's, except per share data) | Mar 31, 2018 | Mar 31, 2017 | ||

Revenue | 152,264 | 160,557 | ||

Gross profit | 101,106 | 115,415 | ||

Gross profit % | 66 | % | 72 | % |

Total operating expenses | 112,345 | 97,049 | ||

Operating income (loss) | (11,239 | ) | 18,366 | |

Income tax expense (recovery) | 4,704 | 4,489 | ||

Net loss | (55,694 | ) | (78,824 | ) |

Loss per share | ||||

Basic | (1.09 | ) | (1.54 | ) |

Diluted | (1.09 | ) | (1.54 | ) |

EBITDA (1) | 94,503 | 56,932 | ||

Adjusted EBITDA (1) | 72,024 | 84,242 | ||

Consolidated Results of Operations

Revenue for the first quarter of 2018 decreased by $8.3 million, or 5%, compared to the corresponding period in 2017. This decrease was due to lower sales from both segments, partially offset by higher foreign exchange

5

rates impacting translated revenues from the Concordia International segment for the first quarter of 2018 compared to the corresponding period in 2017. Revenues were lower primarily due to lower volumes resulting from competition on a number of the Company's products in both segments.

Gross profit for the first quarter of 2018 decreased by $14.3 million or 12%, compared to the corresponding period in 2017 primarily due to the revenue decreases described above. The decrease in gross profit percentage of 6% for the first quarter of 2018 compared to the corresponding period in 2017, is primarily due to a change in the mix of product sales within both segments.

Operating expenses for the first quarter of 2018 increased by $15.3 million, or 16%, compared to the corresponding period in 2017. Operating expenses were higher for the first quarter of 2018 primarily due to $10.3 million higher restructuring costs arising from the Company's initiative to realign its capital structure and $8.9 million higher amortization charges on intangible assets, partially offset by $1.7 million lower share-based compensation expense and $1.6 million lower general and administrative costs.

General and administrative expenses reflect costs related to salaries and benefits, professional and consulting fees, public company costs, travel, facility leases and other administrative expenditures. General and administrative expenses of $12.2 million for the first quarter of 2018 decreased by 11%, compared to the corresponding period in 2017. This decrease is a result of the Company's objective to reduce operating costs across the business.

Selling and marketing expenses reflect costs incurred by the Company for the marketing, promotion and sale of the Company’s broad portfolio of products across the Company's segments. Selling and marketing costs of $9.8 million for the first quarter of 2018 increased by $0.05 million compared to the corresponding period in 2017 primarily as a result of unfavorable foreign exchange rate movements impacting translation.

6

Research and development expenses reflect costs for clinical trial activities, product development, professional and consulting fees and services associated with the activities of the medical, clinical and scientific affairs, quality assurance costs, regulatory compliance and drug safety costs (pharmacovigilance) of the Company. Research and development costs for the first quarter of 2018 of $7.1 million decreased by $0.9 million, or 11%, compared to the corresponding period in 2017. This decrease is primarily due to a refund for regulatory fees.

The current income tax expense recorded for the first quarter of 2018 decreased by $1.3 million compared to the corresponding period in 2017. Income taxes were lower primarily due to lower taxable income compared to the corresponding period in 2017, partially offset by the impact of foreign exchange translation of the income tax expense from the Concordia International segment.

The net loss for the first quarter of 2018 was $55.7 million. Significant components comprising the net loss for the first quarter of 2018 are interest and accretion expenses of $80.1 million and amortization of intangible assets of $65.6 million offset by gross profit of $101.1 million.

Adjusted EBITDA of $72.0 million for the first quarter of 2018 decreased by $12.2 million, or 15%, compared to the corresponding period in 2017. The decline is primarily due to lower sales and gross margins from both segments, partially offset by higher foreign exchange rates impacting translated results during the first quarter of 2018.

As of March 31, 2018, the Company had cash and cash equivalents of $344 million and 51,283,574 common shares issued and outstanding.

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent an exemption from registration under the Securities Act of 1933.

Conference Call Notification

The Company will hold a conference call on Tuesday, May 15, 2018, at 8:30 a.m. ET hosted by senior management. A question-and-answer session will follow the corporate update.

7

CONFERENCE CALL DETAILS | |

DATE: | Tuesday, May 15, 2018 |

TIME: | 8:30 a.m. ET |

DIAL-IN NUMBER: | (647) 427-7450 or (888) 231-8191 |

TAPED REPLAY: | (416) 849-0833 or (855) 859-2056 |

REFERENCE NUMBER: | 6279535 |

This call is being webcast and can be accessed by going to:

https://event.on24.com/wcc/r/1662068/13765CA15C10901698E03BCE3F0B1174

An archived replay of the webcast will be available by clicking the link above.

About Concordia

Concordia is an international specialty pharmaceutical company with a diversified portfolio of more than 200 patented and off-patent products, and sales in more than 90 countries. Going forward, the Company is focused on becoming a leader in European specialty, off-patent medicines.

Concordia operates out of facilities in Oakville, Ontario and, through its subsidiaries, operates out of facilities in Bridgetown, Barbados; London, England and Mumbai, India.

Non-IFRS Measures

This press release makes reference to certain measures that are not recognized measures under International Financial Reporting Standards (“IFRS”). These non-IFRS measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. When used, these measures are defined in such terms as to allow the reconciliation to the closest IFRS measure. These measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute to the Company’s financial information reported under IFRS. Management uses non-IFRS measures such as

8

EBITDA, adjusted EBITDA, and adjusted gross profit to provide investors with supplemental information of the Company’s operating performance and thus highlight trends in the Company’s core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets, to assess its ability to meet future debt service requirements, in making capital expenditures, and to consider the business’s working capital requirements. Readers are cautioned that the non-IFRS measures contained herein may not be appropriate for any other purpose.

Adjusted Gross Profit

As used herein, adjusted gross profit is defined as gross profit adjusted for non-cash fair value increases to the cost of acquired inventory from a business combination. Under IFRS, acquired inventory is required to be written-up to fair value at the date of acquisition. As this inventory is sold the fair value adjustment represents a non-cash cost of sale amount that has been excluded in adjusted gross profit in order to normalize gross profit for this non-cash component.

Three months ended | ||||

(in $000’s) | Mar 31, 2018 | Mar 31, 2017 | ||

Gross profit per financial statements | 101,106 | 115,415 | ||

Add back: Fair value adjustment to acquired inventory | — | 311 | ||

Adjusted Gross profit | 101,106 | 115,726 | ||

EBITDA

EBITDA is defined as net loss from continuing operations adjusted for net interest and accretion expense, income tax expense, depreciation and amortization. Management uses EBITDA to assess the Company’s operating performance.

Adjusted EBITDA

9

Adjusted EBITDA is defined as EBITDA adjusted for certain charges including costs associated with acquisitions, restructuring initiatives, and other costs (which includes onerous contract costs and direct costs associated with contractual terminations), management retention costs, non-operating gains / losses, integration costs, legal settlements (net of insurance recoveries) and related legal costs, non-cash items such as unrealized gains / losses on derivative instruments, share based compensation, fair value changes including purchase consideration and derivative financial instruments, asset impairments, fair value increases to inventory arising from purchased inventory from a business combination, gains / losses from the sale of assets and unrealized gains / losses related to foreign exchange. Management uses Adjusted EBITDA, among other non-IFRS financial measures, as the key metric in assessing business performance when comparing actual results to budgets and forecasts. Management believes Adjusted EBITDA is an important measure of operating performance and cash flow, and provides useful information to investors because it highlights trends in the underlying business that may not otherwise be apparent when relying solely on IFRS measures.

The table below sets forth the reconciliation of net loss from continuing operations to EBITDA and to adjusted EBITDA for the three month periods ended March 31, 2018 and March 31, 2017.

Three months ended | ||||

(in $000’s) | Mar 31, 2018 | Mar 31, 2017 | ||

Net loss | (55,694 | ) | (78,824 | ) |

Interest and accretion expense | 80,122 | 92,541 | ||

Interest income | (706 | ) | (18,479 | ) |

Income taxes | 4,704 | 4,489 | ||

Depreciation | 470 | 488 | ||

Amortization of intangible assets | 65,607 | 56,717 | ||

EBITDA | 94,503 | 56,932 | ||

Fair value adjustment to acquired inventory | — | 311 | ||

Acquisition related, restructuring and other | 15,494 | 5,216 | ||

Share-based compensation | 1,267 | 2,952 | ||

Fair value (gain) loss on purchase consideration and derivatives | 425 | 27,506 | ||

Foreign exchange (gain) loss | 1,341 | 990 | ||

Unrealized foreign exchange (gain) loss | (41,006 | ) | (9,665 | ) |

Adjusted EBITDA | 72,024 | 84,242 | ||

10

Notice Regarding Trademarks

This press release includes trademarks that are protected under applicable intellectual property laws and are the property of Concordia or its affiliates or its licensors. Solely for convenience, the trademarks of Concordia, its affiliates and/or its licensors referred to in this press release may appear with or without the ® or TM symbol, but such references or the absence thereof are not intended to indicate, in any way, that the Company or its affiliates or licensors will not assert, to the fullest extent under applicable law, their respective rights to these trademarks. Any other trademarks used in this press release are the property of their respective owners.

Notice regarding future-oriented financial information:

To the extent any forward-looking statements or forward-looking information in this press release or in statements made during the earnings conference call constitute future-oriented financial information or financial outlooks within the meaning of applicable securities laws, such information is being provided to demonstrate the potential financial performance of the Company and readers are cautioned that this information may not be appropriate for any other purpose and that they should not place undue reliance on such future-oriented financial information and financial outlooks.

Future-oriented financial information and financial outlooks (collectively, “FOFI”), as with forward-looking statements and forward-looking information generally, are, without limitation, based on the assumptions and subject to the risks set out below under “Notice Regarding Forward-Looking Statements”, a number of which are beyond the Company’s control. In addition, the following is summary of the significant assumptions underlying the FOFI contained in the Company’s earnings disclosure:

• prescription trends;

• pricing for the Company’s products;

• future market demand trends;

11

• mix of sales to government and non-government customers;

• gross profits for each product;

• foreign currency rates, including translation between the U.S. dollar and the pound sterling;

• inventory levels;

• operating cost estimates;

• ability to develop and market future product launches;

• anticipated timing of future product launches;

• cost to develop future products;

• anticipated timing to exit markets;

• operating cost synergies realized; and

• annual cost of current tax by jurisdiction

The FOFI do not purport to present the Company’s financial condition in accordance with IFRS, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. It is expected that there will be differences between actual and forecasted results, and the differences may be material, including due to the occurrence of unforeseen events occurring subsequent to the preparation of the FOFI. The inclusion of the FOFI in the earnings disclosure should not be regarded as an indication that Concordia considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

Risks and other factors related to FOFI include those risks and other factors referenced in this press release as well as in Concordia’s filings with the Canadian Securities Administrators and the Securities and Exchange Commission, including (a) the factors described under the heading “Forward-looking Statements” in Concordia’s Management’s Discussion and Analysis dated May 15, 2018 for the period ended March 31, 2018 and (b) the factors described under the heading “Risk Factors” in Concordia’s

12

Annual Report on Form 20-F dated March 8, 2018, both of which are available on SEDAR, online at www.sedar.com and on EDGAR, online at www.sec.gov.

Notice Regarding Forward-Looking Statements:

This press release and statements made during the earnings conference call may include forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws, regarding Concordia and its business, which may include, but are not limited to: statements with respect to Concordia's long-term growth strategy (including the components of the DELIVER strategy), the completion of the proposed recapitalization transaction including obtaining any necessary approvals, satisfying any conditions and the expected timing thereof, the terms of any proposed recapitalization transaction (including the terms and/or size of the private placement offering), Concordia emerging from its proposed recapitalization transaction as a stronger business, Concordia’s focus on realigning its capital structure, changes to Concordia’s organizational structure, Concordia’s global teams being focussed on leveraging the Company’s diverse portfolio of medicines, global sales platform, and product pipeline in order to support the Company’s long-term growth, the Company's ability to operate in the ordinary course, discussions with Concordia's lenders and their advisors with respect the proposed recapitalization transaction, a proposed recapitalization transaction, reducing the Company's existing debt and interest expense (including the amounts thereof), positioning the Company for long-term growth, the Company's available liquidity to operate its business and meet its financial commitments (including commitments to employees, customers, suppliers and business partners), the benefits of the CBCA process, proceedings under the CBCA including with respect to CBCA proceedings compared to proceedings under bankruptcy and insolvency statutes, the ability of the CBCA process to protect the Company's business, preserve Concordia's cash and/or give Concordia additional time to reach a consensual transaction, Concordia's intention to make scheduled interest and amortization payments, Concordia's management continuing to lead day-to-day operations, achieving the best possible recapitalization transaction, reaching a consensual transaction with holders of the Company's debt, maximizing Concordia's potential, implementing a plan of arrangement, addressing certain payments as part of a proposed recapitalization transaction, protection for the Company and its subsidiaries against

13

defaults and any related steps or actions under CBCA proceedings, the focus on becoming a leader in European specialty, off-patent medicines, Concordia's objectives and priorities, the outlook for 2018, the implementation of Concordia's long term growth strategy (and the timing thereof), the stabilization of Concordia's business, the execution, timing and impact of Concordia's business stabilization objectives, Concordia's liquidity, the improvement of working capital and liquidity based on near term initiatives and efficiencies launched by the Company, Concordia's financial performance (including the performance of its operating segments), the ability of Concordia to execute and deliver on business plans and growth strategies, the ability to drive long-term stakeholder value, the implementation of actions to manage competitive challenges, the Company taking actions to rebuild value for stakeholders (and the ability of Concordia to rebuild value for its stakeholders), optimism about Concordia's future, the growth of Concordia and the rate of revenue growth, the sources of revenue growth, the stability of Concordia's business (including, without limitation, with respect to its business in certain jurisdictions), the diversification of the Company's geographic and therapeutic platform, product lines and/or sales channels, Concordia's ability to expand globally, Concordia’s pipeline of products, Concordia’s intention to continue to evaluate additional opportunities above and beyond its current pipeline to further increase the Company’s pipeline and portfolio, the intention to launch products, the number of potential product launches, the development and/or approval of new products, the timing of product launches, success of product launches, the size and/or estimated value of the markets in which Concordia has launched or intends to launch products, Concordia's ability to launch first-to-market, early-to-market or difficult-to-make products, potential product launches including first-to-market or early-to-market opportunities for difficult-to-make products, Concordia's network of partners, Concordia's revenue by geography, expected debt levels and leverage, free cash flows, Concordia's debt structure, expected sources of funds (including expected levels of cash on hand), future growth of the Company (including, without limitation, the Company's expansion globally), the ability to pay certain obligations of Concordia, the ability to use the Company's expected cash flow and cash on hand to pay certain future obligations, the Company's cash on hand and cash flows being sufficient to meet the Company's liquidity needs, concentration of Concordia's business, cash on hand after satisfying obligations during 2018, the performance of Concordia's products and segments, the revenue-generating capabilities and/or potential of Concordia's assets, Concordia's financial strength, the continued and/or expected profitability of Concordia's products and/or services, the sales and/or demand for Concordia's

14

products, the deployment of cash towards value creating initiatives (including to fund future acquisitions and the launch of pipeline products, and settle other obligations as they become due), the expansion into new indications and new markets for Concordia's existing and/or future products, Concordia's ability to evaluate growth opportunities on a global scale (and the availability of such opportunities), the ability to expand existing sales of Concordia's products in certain markets, market opportunities for Concordia's products, Concordia's ability to provide patients with safe and efficacious medicines, the safety and efficacy of Concordia's products, the ability to obtain necessary approvals, enrollment of patients into clinical trials, the outcomes and success of clinical trials, Concordia’s intention to reduce operating costs across the business and other factors. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as "plans", "is expected", "expects", "scheduled", "intends", "contemplates", "anticipates", "believes", "proposes" or variations (including negative and grammatical variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Such statements are based on the current expectations of Concordia's management, and are based on assumptions and subject to risks and uncertainties. Although Concordia's management believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this press release may not occur by certain specified dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties affecting Concordia, including risks associated with the proposed recapitalization transaction including the inability to complete a proposed recapitalization transaction or complete a proposed recapitalization transaction in a timely or efficient manner or on the terms set forth in Concordia’s public filings, the inability of the Company to obtain the necessary approvals and satisfy conditions to complete the proposed recapitalization transaction, the inability to reduce the Company's debt and/or interest payments, the inability to position the Company for long-term growth, the inability of the Company to emerge as a stronger business post-recapitalization, the inability to execute the DELIVER strategy, risks associated with Concordia’s organizational structure, including the ability to retain qualified staff and executives, the inability of Concordia’s current organizational structure to support Concordia’s business, the inability of the Company’s global teams to leverage the Company’s diverse portfolio of medicines, global sales platform, and product pipeline in order to support the Company’s long-term growth, the Company's available liquidity being insufficient to operate its business and meet its

15

financial commitments (including commitments to employees, customers, suppliers and business partners), risks associated with proceedings under the CBCA, Concordia's management no longer leading day-to-day operations, the inability to achieve the best possible recapitalization transaction, the inability to reach a consensual transaction with holders of the Company's debt, the inability to maximize Concordia's potential, Concordia's failure to make scheduled interest and amortization payments (which could result in a loss of the protections afforded by the CBCA process (including the stay of proceedings thereunder), the inability to negotiate with Concordia's lenders, the CBCA process not providing the protection sought by Concordia, third parties not complying with the CBCA order and taking steps against Concordia and its subsidiaries, the inability of the CBCA process to preserve Concordia's cash, the inability to implement a plan of arrangement under the CBCA process, the risks associated with issuing and allocating new equity including the significant dilution of the Company's outstanding common shares, the value of existing equity following the completion of a recapitalization being limited or having no value, the inability to address certain payments as part of a proposed recapitalization, the inability of CBCA proceedings to protect the Company and its subsidiaries against defaults and any related steps or actions, Concordia defaulting on its obligations (including under its debt agreements) which could result in Concordia having to file for bankruptcy or insolvency, Concordia being put into an insolvency or bankruptcy proceeding, including due to the failure to achieve a consensual transaction in the CBCA process, the Company's inability to become a leader in European specialty, off-patent medicines, Concordia's inability to stabilize its business, Concordia's inability to implement its long term strategic plan or being delayed in implementing such plan, the inability of Concordia to accelerate growth by maximizing its existing assets and future market opportunities, the inability of Concordia to expand its product portfolio (including, without limitation, the inability of Concordia to launch products due to regulatory impediments or competitive market changes), the inability of Concordia to add additional products to its pipeline of products, the inability of Concordia to optimize its operating platform, changes in laws, including tax laws, that could result in Concordia's operating platform being adversely affected, Concordia's inability to strengthen its financial foundation, cash on hand and cash flows from operations being insufficient to meet Concordia's liquidity needs, the inability to implement Concordia's objectives and priorities, which could result in financial strain on the Company and continued pressure on the Company's business, Concordia's securities, risks associated with developing new product indications, increased indebtedness and leverage, the inability to generate cash flows, revenues

16

and/or stable margins, the inability to grow organically, the inability to repay debt and/or satisfy future obligations, risks associated with Concordia's outstanding debt, risks associated with the geographic markets in which Concordia operates and/or distributes its products, risks associated with fluctuations in exchange rates (including, without limitation, fluctuations in currencies), risks associated with the use of Concordia's products to treat certain diseases, the pharmaceutical industry and the regulation thereof, the failure to comply with applicable laws, risks relating to distribution arrangements, possible failure to realize the anticipated benefits of acquisitions and/or product launches (including the product launches described herein), risks associated with the integration of assets and businesses into Concordia's business, product launches (including, without limitation, unsuccessful product launches), the inability to develop and/or obtain approvals for new products, the inability to launch products or the delay in launching products, regulatory delays in product approvals, the inability to launch first-to-market, early-to-market or difficult-to-make products, the inability to capture a share of any market in which Concordia has launched or intends to launch its products, the fact that historical and projected financial information may not be representative of Concordia's future results, the failure to obtain regulatory approvals (including, without limitation, with respect to Photofrin® as a new treatment for certain forms of cancer or with respect to the product launches described herein), the FDA permitting unapproved products to remain on the market and compete with Concordia's products (including, without limitation, Donnatal®), economic factors, market conditions, acquisition opportunities, risks associated with the acquisition and/or launch of pharmaceutical products (including, without limitation, the product launches described herein), risks regarding clinical trials and/or patient enrollment into clinical trials, the equity and debt markets generally, risks associated with growth and competition (including, without limitation, with respect to Concordia's niche, hard-to-make products and Concordia's key products in its International and North America segments (including the competitive pressures on some of the products described herein)), general economic and stock market conditions, risks associated with the United Kingdom's exit from the European Union (including, without limitation, risks associated with regulatory changes in the pharmaceutical industry, changes in cross-border tariff and cost structures and the loss of access to the European Union global trade markets), risks associated with regulatory investigations (including the current investigations being undertaken by competition authorities with respect to the Company's operations), risks related to the introduction of new legislation, or amendments to existing legislation, in the jurisdictions in which Concordia carries on business (including,

17

without limitation, the U.K. Health Service Medical Supplies (Costs) Act), risks related to patent infringement actions, the loss of intellectual property rights, risks associated with class action litigation, risks associated with Concordia's inability to defend itself in certain legal actions or being found to have violated certain laws (including, without limitation, the regulatory investigations and class actions which Concordia is currently subject to), which may require Concordia to make certain payments in respect of such legal matters or which may result in certain fines being levied against Concordia, Concordia’s inability to reduce operating costs across the business and risks and uncertainties detailed from time to time in Concordia's filings with the Securities and Exchange Commission and the Canadian Securities Administrators and many other factors beyond the control of Concordia. Although Concordia has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement or forward-looking information can be guaranteed. Except as required by applicable securities laws, forward-looking statements and forward-looking information speak only as of the date on which they are made and Concordia undertakes no obligation to publicly update or revise any forward-looking statement or forward-looking information, whether as a result of new information, future events, or otherwise.

1 Management uses non-IFRS measures such as EBITDA, Adjusted EBITDA, adjusted net income, adjusted gross profit, and Adjusted EPS to provide a supplemental measure of operating performance. Please refer to the “Non-IFRS Measures” section of this press release for further information.

For more information please contact:

Adam Peeler

Concordia International Corp.

905-842-5150 x 240

18

FIRST QUARTER ENDED MARCH 31, 2018

MANAGEMENT’S

DISCUSSION AND ANALYSIS

May 15, 2018

Table of Contents | |||

1 | Management's Discussion and Analysis | ||

2 | Business Overview and Segments | ||

3 | Recent Events | ||

4 | Results of Operations | ||

5 | Segment Performance | ||

6 | Corporate and Other Costs | ||

7 | Selected Quarterly Financial Information | ||

8 | Balance Sheet Analysis | ||

9 | Liquidity and Capital Realignment | ||

10 | Lending Arrangements and Debt | ||

11 | Contractual Obligations | ||

12 | Related Party Transactions | ||

13 | Non-IFRS Financial Measures | ||

14 | Critical Accounting Estimates | ||

15 | Contingencies | ||

16 | Outstanding Share Data | ||

17 | Control Environment | ||

18 | Forward-looking Statements | ||

1 Management Discussion and Analysis

The following Management’s Discussion and Analysis ("MD&A") summarizes Concordia International Corp.’s ("Concordia" or the "Company", or "we" or "us" or "our") consolidated operating results and cash flows for the three month period ended March 31, 2018 with a comparative prior period, and the Company’s balance sheet as at March 31, 2018 with a comparative period to December 31, 2017. The MD&A was prepared as of May 15, 2018 and should be read in conjunction with the unaudited condensed interim consolidated financial statements and the notes thereto as at and for the three month period ended March 31, 2018 and the consolidated financial statements and Management's Discussion and Analysis for the year ended December 31, 2017. Financial information in this MD&A is based on financial statements that have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and amounts are stated in thousands of United States Dollars ("USD"), which is the reporting currency of the Company, unless otherwise noted. The significant exchange rates used in the translation to the reporting currency are:

US$ per Great British pound (£) | ||

As at, and for the periods ended | Spot | Average |

January 1, 2016 to March 31, 2016 | 1.4395 | 1.4321 |

April 1, 2016 to June 30, 2016 | 1.3395 | 1.4354 |

July 1, 2016 to September 30, 2016 | 1.3008 | 1.3136 |

October 1, 2016 to December 31, 2016 | 1.2305 | 1.2438 |

January 1, 2017 to March 31, 2017 | 1.2489 | 1.2387 |

April 1, 2017 to June 30, 2017 | 1.3004 | 1.2781 |

July 1, 2017 to September 30, 2017 | 1.3402 | 1.3088 |

October 1, 2017 to December 31, 2017 | 1.3494 | 1.3276 |

January 1, 2018 to March 31, 2018 | 1.4037 | 1.3910 |

Certain prior period financial information has been presented to conform to the current period presentation.

Some of the statements contained in this MD&A constitute forward-looking information within the meaning of applicable Canadian securities legislation and forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements"), which are based upon the current internal expectations, estimates, projections, assumptions and beliefs of the Company's management ("Management"). Refer to the "Forward-Looking Statements" section of this MD&A for a discussion of certain risks, uncertainties, and assumptions relating to forward-looking statements. Additional information relating to the Company, including the Company’s Annual Report on Form 20-F, is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. The results of operations, business prospects and financial condition of Concordia will be affected by, among other things, the "Risk Factors" set out in Concordia’s Annual Report on Form 20-F dated March 8, 2018 and other documents filed with the Canadian Securities Administrators and the United States Securities and Exchange Commission, available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Certain measures used in this MD&A do not have any standardized meaning under IFRS. When used, these measures are defined in such terms as to allow the reconciliation to the closest IFRS measure. See "Results of Operations", "Segment Performance", "Selected Quarterly Financial Information", and "Non-IFRS Financial Measures".

Concordia Management's Discussion and Analysis | Page 2 |

2 Business Overview and Segments

Concordia is an international specialty pharmaceutical company, owning or licensing, through its subsidiaries, a diversified portfolio of branded and generic prescription products. The Company has two reporting segments, which consist of Concordia International and Concordia North America, in addition to its Corporate cost centre.

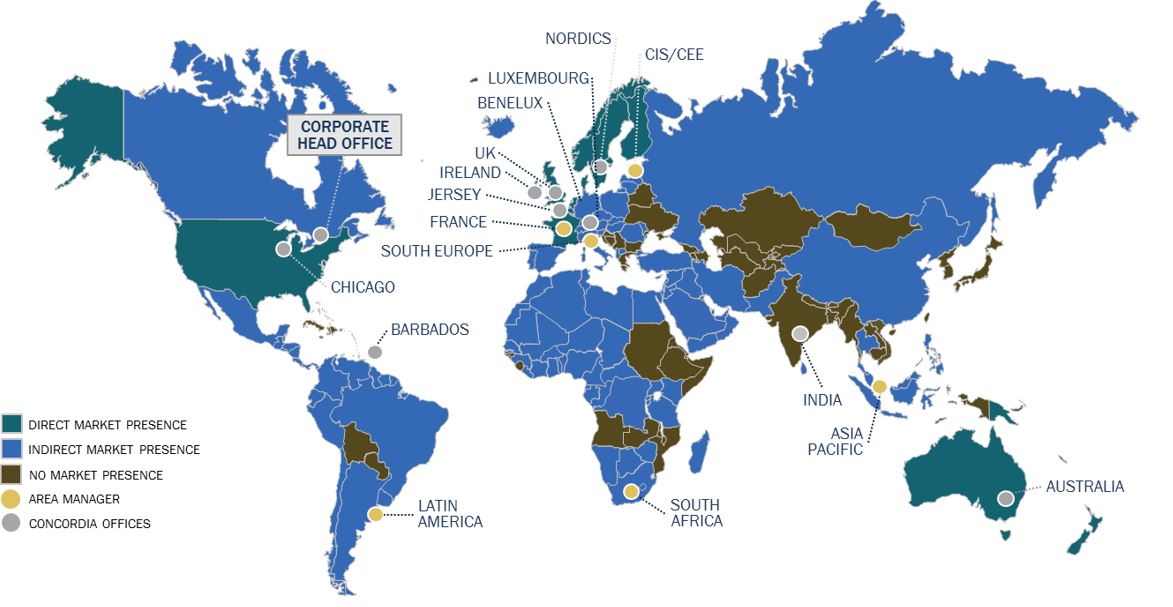

* In above, “CIS” means the Commonwealth of Independent States and “CEE” means Central and Eastern Europe.

The registered and head office of the Company is located at 277 Lakeshore Rd. East, Suite 302, Oakville, Ontario, L6J 1H9. The Company’s records office is located at 333 Bay St., Suite 2400, Toronto, Ontario, M56 2T6. The Company’s common shares are listed on the Toronto Stock Exchange under the symbol "CXR" and on the NASDAQ under the symbol "CXRX".

Concordia International

The Concordia International segment consists of a diversified portfolio of branded and generic products that are sold to wholesalers, hospitals and pharmacies in over 90 countries. The Concordia International segment specializes in the acquisition, licensing and development of off-patent prescription medicines, which may be niche, hard to make products. The segment’s over 200 products are manufactured and sold through an out-sourced manufacturing network and marketed internationally through a combination of direct sales and local distribution relationships. The Concordia International segment operates primarily outside of the North American marketplace.

Concordia North America

The Concordia North America segment has a diversified product portfolio that focuses primarily on the United States pharmaceutical market. These products include, but are not limited to, Donnatal® for the treatment of irritable bowel syndrome; Zonegran® for the treatment of partial seizures in adults with epilepsy; Nilandron® for the treatment of metastatic prostate cancer; Lanoxin® for the treatment of mild to moderate heart failure and atrial fibrillation; Plaquenil® for the treatment of lupus and rheumatoid arthritis; and Photofrin® for the treatment of certain types of cancer. Concordia North America’s product portfolio consists of branded products and authorized generic contracts. The segment’s products are manufactured through an out-sourced production network and sold primarily through a third party distribution network in the United States.

Corporate

The Corporate cost centre represents certain centralized costs including costs associated with the Company's head office and senior management located in Canada and costs associated with being a public reporting entity.

Concordia Management's Discussion and Analysis | Page 3 |

3 Recent Events

Canada Business Corporations Act (the "CBCA") Proceedings

On October 20, 2017, the Company announced that it and one of its wholly-owned subsidiaries commenced a court proceeding under the CBCA.

On May 2, 2018, the Company announced a proposed transaction to realign its capital structure (the “Recapitalization Transaction”).

The proposed Recapitalization Transaction would raise new equity capital of $586.5 million, and to reduce the Company’s total outstanding debt by approximately $2.4 billion.

In connection with the proposed Recapitalization Transaction, the Company entered into a support agreement (the “Support Agreement”) with certain holders of the Company’s existing secured debt (the “Secured Debt”) and certain holders of the Company’s existing unsecured debt (the “Unsecured Debt”) that are subject to confidentiality agreements with Concordia and which hold in the aggregate approximately $1.6 billion in principal amount, or approximately 72%, of the Company’s Secured Debt and approximately $1.0 billion in principal amount, or approximately 64% of the Company’s Unsecured Debt (the “Initial Consenting Debtholders”). The Initial Consenting Debtholders are comprised of an ad hoc committee of holders of Secured Debt and an ad hoc committee of holders of Unsecured Debt. Pursuant to the Support Agreement, the Initial Consenting Debtholders have, among other things, agreed to support the Recapitalization Transaction and vote in favour of the plan of arrangement (the “CBCA Plan”) in Concordia’s previously announced proceedings (the "CBCA Proceedings") under the CBCA pursuant to which the Recapitalization Transaction is expected to be implemented.

In addition, on May 2, 2018 Concordia obtained an interim order (the “Interim Order”) issued by the Ontario Superior Court of Justice (the "Court") in the CBCA Proceedings authorizing, among other things, the holding of the following meetings (the “Meetings”) scheduled for June 19, 2018: (i) a meeting of holders of the Secured Debt (the “Secured Debtholders”); (ii) a meeting of holders of the Unsecured Debt (the “Unsecured Debtholders”); and (iii) a meeting (the "Shareholders' Meeting") of holders of the Company’s common shares (the “Shareholders”), in each case to consider and vote upon, among other things, the CBCA Plan to implement the Recapitalization Transaction.

Certain Key Recapitalization Transaction Terms

The Recapitalization Transaction contemplates the following key terms and conditions:

Secured Debt

• | The Company’s Secured Debt in the aggregate principal amount of approximately $2.2 billion, plus accrued and unpaid interest, will be exchanged for (i) cash in an amount equal to any outstanding accrued and unpaid interest (at contractual non-default rates) in respect of the Secured Debt, (ii) cash in the amount of $500 million (the “Secured Creditor Cash Pool”), (iii) any Additional Cash Amount (as defined below) and (iv) new secured debt (the “New Secured Debt”) comprised of new senior secured term loans (“New Senior Secured Term Loans”) and new senior secured notes (“New Senior Secured Notes”). The Company expects the aggregate principal amount of the New Secured Debt to be issued to Secured Debtholders pursuant to the Recapitalization Transaction to be approximately $1.4 billion; |

• | Each Secured Debtholder will receive its pro rata share of the New Secured Debt, in the form of either New Senior Secured Term Loans or New Senior Secured Notes depending on the type of Secured Debt held by such Secured Debtholder, subject to (i) holders of the Company’s existing secured term loans as of the record date of May 9, 2018 (the “Record Date”) having the right to elect to receive their New Secured Debt in the form of New Senior Secured Notes, provided that any such elections may be subject to certain re-allocations pursuant to the terms of the Recapitalization Transaction, and (ii) Secured Debtholders receiving New Senior Secured Term Loans having the right to elect to receive their New Senior Secured Term Loans denominated in USD or Euros, provided that any such elections may be subject to certain re-allocations pursuant to the terms of the Recapitalization Transaction; |

• | Secured Debtholders as of the Record Date who vote in favour of the CBCA Plan on or prior to the early consent date of June 6, 2018 (the “Early Consent Date”), as it may be extended by Concordia (the “Early Consenting Secured Debtholders”) will be entitled to receive on implementation of the Recapitalization Transaction pursuant to the CBCA Plan early consent consideration in the form of cash equal to 5% of the principal amount of Secured Debt owing to such Early Consenting Secured Debtholder as of the Record Date and voted in favour of the CBCA Plan (the “Secured Debtholder Early Consent Cash Consideration”) as additional consideration in exchange for their Secured Debt; |

• | If the aggregate amount of Secured Debtholder Early Consent Cash Consideration that becomes payable pursuant to the Recapitalization Transaction is less than $100 million, then an amount equal to the difference between $100 million and the amount of Secured Debtholder Early Consent Cash Consideration that becomes payable (the “Additional Cash Amount”) will be paid on a pro rata basis to each Secured Debtholder as additional consideration in exchange for their Secured Debt; and |

• | The final principal amount of New Secured Debt to be issued pursuant to the Recapitalization Transaction shall be in such amount that results in the aggregate consideration payable to Secured Debtholders pursuant to the Recapitalization Transaction by way of the Secured Creditor Cash Pool, the New Secured Debt and the Secured Debtholder Early Consent Cash Consideration (but not including the payment of accrued and unpaid interest or the Additional Cash Amount) being equal to 93.3835% of the principal amount of Secured Debt owing to such Secured Debtholders if such Secured Debtholders are Early Consenting Secured Debtholders, |

Concordia Management's Discussion and Analysis | Page 4 |

and approximately 88.3835% of the principal amount of Secured Debt owing to such Secured Debtholders if such Secured Debtholders are not Early Consenting Secured Debtholders.

Unsecured Debt

• | The Company’s Unsecured Debt in the aggregate principal amount of approximately $1.6 billion, plus accrued and unpaid interest, will be exchanged for (i) new common shares of Concordia representing approximately 8% of the outstanding common shares of Concordia immediately following the implementation of the Recapitalization Transaction (the “Unsecured Debt Exchange Shares”) and (ii) any Reallocated Unsecured Shares (as defined below); |

• | Unsecured Debtholders as of the Record Date who vote in favour of the CBCA Plan on or prior to the Early Consent Date, as it may be extended by Concordia (the “Early Consenting Unsecured Debtholders”) will be entitled to receive on implementation of the Recapitalization Transaction pursuant to the CBCA Plan early consent consideration in the form of new common shares of Concordia equal to their pro rata share (calculated based on the principal amount of Unsecured Debt held by such Early Consenting Unsecured Debtholders as at the Record Date and voted in favour of the CBCA Plan, divided by the aggregate principal amount of Unsecured Debt outstanding as at the Record Date) of a pool of common shares (the “Unsecured Early Consent Share Pool”) representing approximately 4% of the outstanding common shares of Concordia immediately following implementation of the Recapitalization Transaction pursuant to the CBCA Plan (the “Unsecured Debtholder Early Consent Shares”) as additional consideration in exchange for their Unsecured Debt; and |

• | If less than 100% of Unsecured Debt is voted in favour of the CBCA Plan by Early Consenting Unsecured Debtholders, any shares remaining in the Unsecured Early Consent Share Pool not issued as Unsecured Debtholder Early Consent Shares (the “Reallocated Unsecured Shares”) will be issued to all holders of Unsecured Debt on a pro rata basis as additional consideration for their Unsecured Debt. |

Private Placement

• | Approximately $586.5 million (the “Total Offering Size”) in cash will be invested to acquire new common shares of Concordia representing in the aggregate approximately 88% of the outstanding common shares of Concordia immediately following the implementation of the Recapitalization Transaction (the “Private Placement Shares”) by certain parties who executed a subscription agreement with the Company (the “Subscription Agreement”) concurrently with the execution of the Support Agreement (the “Private Placement Parties”) pursuant to a private placement (the “Private Placement”); |

• | The proceeds of the Private Placement will be used towards paying the Secured Creditor Cash Pool and the Secured Debtholder Early Consent Cash Consideration to be paid as part of the consideration for the exchange of the Secured Debt; |

• | Each of the Private Placement Parties will be entitled to receive its pro rata share (based on its subscription commitment) of cash consideration in the aggregate amount of $44 million (subject to any corresponding adjustments to the extent the Total Offering Size is reduced pursuant to the terms of the Subscription Agreement) (the “Private Placement Consideration”), which is payable on the terms set out in the Subscription Agreement, including on completion of the Recapitalization Transaction and certain earlier events; and |

• | Pursuant to the Subscription Agreement, the Private Placement Parties and the Company expect to agree on certain governance terms and registration rights. The governance terms will be described in more detail in the Company’s management information circular to be mailed to Secured Debtholders, Unsecured Debtholders and Shareholders in connection with the various Meetings to be held to approve the CBCA Plan. |

Existing Shares and Equity Claims

• | Upon completion of the Recapitalization Transaction, existing Shareholders will retain their existing common shares of Concordia, subject to a share consolidation of one common share in exchange for 300 existing common shares to be implemented as part of the Recapitalization Transaction and the dilution resulting from the issuance of common shares pursuant to the Recapitalization Transaction, such that the existing Shareholders will own approximately 0.35% of the outstanding common shares of Concordia immediately following implementation of the Recapitalization Transaction; and |

• | All other equity interests in Concordia, including all options, warrants, rights or similar instruments, will be cancelled on implementation of the Recapitalization Transaction pursuant to the CBCA Plan, and all equity claims, other than existing equity class action claims against Concordia (the “Existing Equity Class Action Claims”), will be released pursuant to the CBCA Plan, provided that any recovery in respect of any Existing Equity Class Action Claims will be limited to recovery as against any applicable insurance policies maintained by the Company. |

Share Dilution

• | The existing common shares retained by the Shareholders upon implementation of the Recapitalization Transaction and the common shares to be issued under the CBCA Plan, including the Unsecured Debt Exchange Shares, the Reallocated Unsecured Shares, the Unsecured Debtholder Early Consent Shares and the Private Placement Shares, shall be subject to dilution following the completion of the Recapitalization Transaction pursuant to the issuance of any new common shares under the management equity incentive plan to be adopted pursuant to the Recapitalization Transaction. |

Concordia Management's Discussion and Analysis | Page 5 |

Subject to the satisfaction or waiver of applicable conditions, the Recapitalization Transaction is expected to be completed by July 31, 2018.

In connection with the Recapitalization Transaction, it is anticipated that Concordia will continue from the Business Corporations Act (Ontario) to the CBCA.

Alternative Implementation Process

The Recapitalization Transaction is being implemented pursuant to the CBCA Plan. The Company is also soliciting votes to advance the Recapitalization Transaction pursuant to insolvency proceedings under Chapter 11 of the United States Bankruptcy Code (a “Chapter 11 Process”), contemporaneously with soliciting votes in respect of the CBCA Plan. Concordia currently intends to complete and implement the CBCA Plan pursuant to the CBCA Proceedings. Contemporaneous solicitation of votes in respect of a Chapter 11 Process ensures that the Company has the future ability to also complete the Recapitalization Transaction under such an alternative implementation process if the Company elects to do so in the future, subject to certain conditions and consent requirements as provided for in the Support Agreement. In addition, in accordance with the terms of the Interim Order, a vote cast in favour of the CBCA Plan at the Meetings may also be counted in favour of implementing a plan of arrangement on substantially similar terms in any insolvency proceedings under the Companies’ Creditors Arrangement Act (Canada) that may be commenced by the Company, to the extent such proceedings are consented to by the majority private placement parties and the majority initial consenting debtholders.

Management and Board of Director Changes

On May 2, 2018, the Company announced that it appointed Graeme Duncan as its interim Chief Executive Officer, and also announced the departure of Allan Oberman, the Company's former Chief Executive Officer and Board Member. The Company paid approximately $7.7 million in severance to the former Chief Executive Officer.

On May 2, 2018, the Company also announced that it appointed Guy Clark as the Company's Chief Corporate Development Officer, and also announced the departure of Sarwar Islam, the Company's former Chief Corporate Development Officer.

Relocation of Corporate Head Office

During the second quarter of 2018, the Company's corporate head office is expected to be relocated to 5770 Hurontario Street, Suite 310, Mississauga, Ontario, L5R 3G5. At the Shareholders' Meeting, Shareholders will be asked to approve a resolution to move the corporate head office to Mississauga, Ontario.

Notification of the termination of the Currency Swaps and termination of Revolving Commitments

On October 20, 2017, the counterparty to the Company's August 17, 2016 cross currency swap agreement ("August Swap Agreement") and November 3, 2016 cross currency swap agreement ("November Swap Agreement", and together with the August Swap Agreement, the "Currency Swaps") notified the Company that it would be terminating the Currency Swaps effective October 23, 2017 due to commencement of the CBCA Proceedings. As part of the Recapitalization Transaction, the Company has agreed to the amount of the Currency Swaps liability ($114,431), which amount will be addressed in the same manner as the Secured Debt under the Recapitalization Transaction. In addition, on October 27, 2017, the Company terminated the revolving commitments under the Company's credit agreement dated October 21, 2015, as amended ("Credit Agreement"). No amounts had been drawn or were outstanding in respect of the revolving commitments at such time.

Rating Agency Changes

On May 7, 2018, Standard & Poors Global Ratings ("S&P") lowered its issue-level ratings on Concordia’s Secured Debt to "CC" from "CCC-". S&P noted that its “SD” corporate credit rating and "D" rating on Concordia’s Unsecured Debt remained unchanged. In addition, on May 8, 2018, Moody’s Investors Service ("Moody’s") placed the Company’s “Ca” Corporate Family Rating and Ca-PD/LD Probability of Default Rating under review for upgrade. Moody’s also affirmed its "Caa2" senior secured ratings and "C" senior unsecured ratings. The SGL-4 Speculative Grade Liquidity Rating was also affirmed. To the extent that the Company intends to complete any future transactions following the Recapitalization Transaction, the Company’s ability to complete any such transactions may be effected by credit rating agency decisions.

Business Impact in Relation to Brexit

On June 23, 2016, the United Kingdom held a referendum and voted to withdraw from the European Union ("Brexit"). On March 29, 2017, the United Kingdom delivered notice to the European Council in accordance with Article 50 of the Treaty on European Union of the United Kingdom’s intention to withdraw from the European Union. The Company understands that the timeframe for the negotiated withdrawal of the United Kingdom from the European Union is approximately two (2) years from the date of the withdrawal notification. However, as no member state has formally withdrawn from the European Union in the past, there is no precedent for the operation of Article 50 and, as a result, the timing and outcome of Brexit continues to be uncertain at this time. The Concordia International segment has significant operations within the United Kingdom and other parts of the European Union, and therefore continues to monitor developments related to Brexit, including the impact resulting from currency market movements.

Concordia Management's Discussion and Analysis | Page 6 |

Business Impact in Relation to the UK Health Service Medical Supplies (Costs) Act 2017 (the "Act")

The Act received Royal Assent on April 27, 2017. The Act introduces provisions in connection with controlling the cost of health service medicines and other medical supplies. The Act also introduces provisions in connection with the provision of pricing and other information by manufacturers, distributors and suppliers of those medicines and medical supplies. The Company continues to monitor the implementation of the Act and its impact on its business. Refer to the "Risk Factors" section of the Company's Annual Report on Form 20-F dated March 8, 2018.

Concordia Management's Discussion and Analysis | Page 7 |

4 Results of Operations

Three months ended | ||||

(in $000's, except per share data) | Mar 31, 2018 | Mar 31, 2017 | ||

Revenue | 152,264 | 160,557 | ||

Gross profit | 101,106 | 115,415 | ||

Gross profit % | 66 | % | 72 | % |

Total operating expenses | 112,345 | 97,049 | ||

Operating income (loss) | (11,239 | ) | 18,366 | |

Income tax expense (recovery) | 4,704 | 4,489 | ||

Net loss | (55,694 | ) | (78,824 | ) |

Loss per share | ||||

Basic | (1.09 | ) | (1.54 | ) |

Diluted | (1.09 | ) | (1.54 | ) |

EBITDA (1) | 94,503 | 56,932 | ||

Adjusted EBITDA (1) | 72,024 | 84,242 | ||

Adjusted EPS (1) | (0.19 | ) | 0.22 | |

Notes:

(1) | Represents a non-IFRS measure. For the relevant definitions and reconciliation to reported results, see "Non-IFRS Financial Measures" section of this MD&A. Management believes non-IFRS measures, including Adjusted EBITDA, provide supplementary information to IFRS measures used in assessing the performance of the business. |

Revenue

Revenue for the first quarter of 2018 decreased by $8,293, or 5%, compared to the corresponding period in 2017. This decrease was due to lower sales from both segments, partially offset by higher foreign exchange rates impacting translated revenues from the Concordia International segment for the first quarter of 2018 compared to the corresponding period in 2017. Revenues were lower primarily due to lower volumes resulting from competition on a number of the Company's products in both segments. The Concordia International segment revenue for the first quarter of 2018 decreased by $5,779, or 5%, due to $20,463 lower revenue primarily as a result of volume and price declines on key products, including Liothyronine Sodium, Trazodone and Predisolone, partially offset by $14,684 higher revenue as a result of favourable foreign exchange rates positively impacting translated results. The Concordia North America segment revenue for the first quarter of 2018 decreased by 6% when compared to the corresponding period in 2017, mainly as a result of lower volumes on key products, including Donnatal® and Kapvay®. Refer to the "Segment Performance" section of this MD&A for a further discussion on segmental and product specific performance.

Gross Profit and Gross Profit %

Gross profit for the first quarter of 2018 decreased by $14,309, or 12%, compared to the corresponding period in 2017 primarily due to the revenue decreases described above. The decrease in gross profit percentage of 6% for the first quarter of 2018 compared to the corresponding period in 2017, is primarily due to a change in the mix of product sales within both segments. Refer to the "Segment Performance" section of this MD&A for a further discussion on segmental and product specific performance.

Operating Expenses

Operating expenses for the first quarter of 2018 increased by $15,296, or 16%, compared to the corresponding period in 2017. Operating expenses were higher during the first quarter of 2018 primarily due to $10,278 higher restructuring costs arising from the Company's initiative to realign its capital structure and $8,890 higher amortization charges on intangible assets, partially offset by $1,685 lower share based compensation expense and $1,570 lower general and administrative costs. For a further detailed description of operating expenses, refer to the "Corporate and Other Costs" section of this MD&A. For a further detailed description of certain segment operating expenses, refer to "Segment Performance" section of this MD&A.

Operating income (loss) for the first quarter of 2018 decreased by $29,605 compared to the corresponding period in 2017 due to the decrease in gross profit and higher operating expenses as described above.

Concordia Management's Discussion and Analysis | Page 8 |

The current income tax expense recorded for the first quarter of 2018 decreased by $1,296 compared to the corresponding period in 2017. Income taxes were lower primarily due to lower taxable income compared to the corresponding period in 2017, partially offset by the impact of foreign exchange translation of the income tax expense from the Concordia International segment. The deferred income tax expense recorded for the first quarter of 2018 increased by $1,511 and is mainly the result of movements in the foreign exchange rates, partially offset by the reversal of certain temporary differences.

The net loss for the first quarter of 2018 was $55,694 and EPS loss was $1.09 per share. Significant components comprising the net loss for the first quarter of 2018 are interest and accretion expenses of $80,122 and amortization of intangible assets of $65,607 offset by gross profit of $101,106. Refer to the "Corporate and Other Costs" section of this MD&A for further information related to expenses impacting net loss.

EBITDA and Adjusted EBITDA

EBITDA is higher than the net loss as it excludes: interest and accretion expense; interest income; income taxes; depreciation; and amortization of intangible assets. Refer to the "Non-IFRS Financial Measures" section of this MD&A for a full reconciliation. EBITDA for the first quarter of 2018 increased by $37,571 compared to the corresponding period in 2017. The increase in EBITDA was primarily due to $27,314 lower fair value loss on derivative financial instruments and $31,341 higher unrealized foreign exchange gain, partially offset by $14,309 lower gross profit and $10,278 higher acquisition related, restructuring and other costs.

Adjusted EBITDA also includes adjustments for: impairments; fair value adjustments to acquired inventory; acquisition related, restructuring and other costs; share-based compensation; fair value (gain) loss including purchase consideration and derivative financial instruments; foreign exchange (gain) loss; unrealized foreign exchange (gain) loss; and legal settlements and related legal costs (refer to the "Non-IFRS Financial Measures" section of this MD&A for a full reconciliation and description of these expenses). Adjusted EBITDA for the first quarter of 2018 decreased by $12,218, or 15%, compared to the corresponding period in 2017. The decline is primarily due to lower sales and gross margins from both segments, partially offset by higher foreign exchange rates impacting translated results during the first quarter of 2018. Adjusted EBITDA by segment for the three month period ended March 31, 2018 was $51,748 from Concordia International and $24,273 from Concordia North America. Refer to the "Segment Performance" section of this MD&A for a further discussion on segment performance. In addition, during the first quarter of 2018 the Company incurred $3,997 of Corporate costs related to the Corporate Head Office. Corporate expenses decreased by $1,641 compared to the corresponding period in 2017, primarily due to lower general and administrative expenses, including professional fees incurred during the first quarter of 2018.

Concordia Management's Discussion and Analysis | Page 9 |

5 Segment Performance

Concordia International

Three months ended | ||||

(in $000's) | Mar 31, 2018 | Mar 31, 2017 | ||

Revenue | 112,950 | 118,729 | ||

Cost of sales | 41,673 | 37,501 | ||

Gross profit | 71,277 | 81,228 | ||

Gross profit % | 63 | % | 68 | % |

Adjusted Gross Profit (1) | 71,277 | 81,539 | ||

Adjusted Gross Profit %(1) | 63 | % | 69 | % |

General and Administrative, Selling and Marketing and Research and Development Expenses | 19,529 | 18,298 | ||

Adjusted EBITDA(1) | 51,748 | 63,241 | ||

Notes:

(1) | Represents a non-IFRS measure. For the relevant definitions see "Non-IFRS Financial Measures" section of this MD&A. |

Revenue for the first quarter of 2018 decreased by $5,779 or 5%, compared to the corresponding period in 2017. A $20,463 decrease in revenue was partially offset by a $14,684 increase in revenue as a result of the Great British Pound ("GBP") strengthening against the USD, given a significant portion of the segment revenues are earned in GBP. Declines to revenue attributable to key products during the quarter, excluding the impact of foreign currency translation, were: (i) a $9,488 decrease from Liothyronine Sodium; (ii) a $2,384 decrease from Trazodone; (iii) a $2,064 decrease from Prednisolone; (vi) a $1,643 decrease from Biperiden Hydrochloride; and (v) a $1,244 decrease from Prochlorperazine. These lower product volumes and revenues are primarily due to ongoing competitive market pressures resulting in market share erosion. These revenue decreases were partially offset by $2,751 increased revenue from Nitrofurantoin. The remaining decrease was primarily due to general competitive market pressures across the segment's product portfolio.

Cost of sales for the first quarter of 2018 increased by $4,172 or 11%, compared to the corresponding period in 2017. The increase in cost of sales during the first quarter of 2018 is primarily due to the impact of foreign exchange, partially offset by volume declines from products described above.

Gross profit for the first quarter of 2018 decreased by $9,951 primarily due to the factors described above.

Gross profit as a percentage of revenue for the first quarter of 2018 decreased by 5% compared to the corresponding period in 2017. The decrease was primarily due to a shift in product mix, with certain higher margin products experiencing additional market competition, when compared to the first quarter of 2017.

General and administrative, selling and marketing and research and development costs increased by $1,231 primarily due to the impact of foreign exchange. Excluding the $2,249 unfavorable impact of foreign exchange, these costs decreased by $1,018 as a result of lower general and administrative expenses.

Concordia Management's Discussion and Analysis | Page 10 |

Concordia North America

Three months ended | ||||

(in $000's) | Mar 31, 2018 | Mar 31, 2017 | ||

Revenue | 39,314 | 41,828 | ||

Cost of sales | 9,485 | 7,641 | ||

Gross profit | 29,829 | 34,187 | ||

Gross profit % | 76 | % | 82 | % |

General and Administrative, Selling and Marketing and Research and Development Expenses | 5,556 | 7,548 | ||

Adjusted EBITDA(1) | 24,273 | 26,639 | ||

Notes:

(1) | Represents a non-IFRS measure. For the relevant definitions, see "Non-IFRS Financial Measures" section of this MD&A. |

Revenue for the first quarter of 2018 decreased by $2,514 or 6%, compared to the corresponding period in 2017. The decrease was primarily due to: (i) a $3,533 decrease from Donnatal®, as a result of additional competitive pressures that have resulted in a loss of market share; and (ii) a $2,456 decrease from Kapvay®. In the first quarter of 2018, Donnatal® continued to face pressure from a non-FDA approved product being distributed by a competitor and an additional competitive product launched in the second quarter of 2017. These decreases were partially offset by a $1,516 increase in revenue from Plaquenil® authorized generic. The remaining decrease was primarily due to general competitive market pressures across the segment's product portfolio.

Cost of sales for the first quarter of 2018 increased by $1,844, or 24%, compared to the corresponding period in 2017. The increase in cost of sales when compared with the decrease in revenue is due to a shift in product mix to lower margin products.

Gross profit for the first quarter of 2018 decreased by $4,358, or 13%, primarily due to lower revenue as described above.

Gross profit as a percentage of revenue for the first quarter of 2018 decreased by 6%, compared to the corresponding period in 2017. The decrease was primarily due to a shift in product mix.

General and administrative, selling and marketing and research and development costs decreased by $1,992 primarily due to lower bad debt expenses and a refund of regulatory fees, partially offset by higher selling and marketing costs associated with the co-promotion agreement for sales of Donnatal®.

Concordia Management's Discussion and Analysis | Page 11 |

6 Corporate and Other Costs

The following table details expenses from the Company's Corporate cost centre and other operating expenses from the business segments:

Three months ended | ||||

(in $000's) | Mar 31, 2018 | Mar 31, 2017 | ||