Form DEFR14A Destination Maternity

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

DESTINATION MATERNITY

CORPORATION

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

| Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

| ||||

THE WORLD’S LARGEST MATERNITY APPAREL RETAILER

Executive Summary The Board has been refreshed (with only two continuing directors remaining from the six that were in place one year ago), including the addition of the Chairman from our largest stockholder (13%) The Board and Management have developed a revised go-forward strategy that is yielding results and has significant upside The Miller Group “plan” lacks substance and detail and the Group nominees lack the necessary experience and expertise to oversee the change already underway at the Company The Board has engaged extensively with the Miller Group, including making multiple settlement offers to avoid a costly and distracting proxy fight – the Miller Group is seeking total control and its true intentions are unclear The refreshed Board Nominees have the experience, a clear plan and are acting in the best interests of all stockholders

Table of Contents Overview of Destination Maternity 2017 – A Year of Transition Strategic Plan to Create Long-Term Value Highly Qualified, Experienced & Engaged Board The Miller Group is Not the Right Steward for Stockholders Conclusion

Overview of Destination Maternity

Who We Are The world’s largest designer and retailer of maternity apparel. Market Share Leader Strongest unaided brand awareness Large footprint with strong distribution partners* 487 stores in U.S. and Canada 637 leased & licensed locations 188 international locations Highly penetrated ecommerce platform showing explosive growth since relaunch in early 2017 primarily through branded websites. FY2017 ecommerce comparable sales up over 40%, including up 60% in 4Q 2017 Exclusive maternity provider for the following retailers: * Store counts as of 2-3-18

Our Key Brands Leveraging our brand awareness through specialty stores under our Motherhood Maternity and A Pea in the Pod nameplates A PEA IN THE POD AVENTURA MALL MOTHERHOOD ARDEN FAIR MALL

Our Industry

Our Mom2Be * There are more women age 24 in America than any other age. The average age for a woman having their first child in 2016 was 26.

59% make product recommendations and 41% share via social media. 30% check their phone 43x per day and use 4 or more devices during a day. 60% follow brands on social media to learn about new deals and coupons. 61% use online channels as part of their shopping experience. The Destination Maternity multi-channel shopper makes more purchases and spends more during her pregnancy than our store only shopper. 9 of 10 Millennial moms say product reviews are very influential on purchases of baby/children’s products. The Millennial Woman

We are solely focused on the maternity customer 75% of new moms will shop with us One-stop-shop for all maternity needs Unparalleled fit, knowledgeable client service, specialty store atmosphere When does the maternity customer shop with us… 80% of expectant moms shop in the first 6 months of pregnancy Week 16 is the peak shopping period Second trimester is the peak for both spend and visits One final trip prior to delivery week 38 to 40 Our Advantages in the Maternity Market

Significant Opportunity to Continue to Grow E-commerce Sales Penetration Over Time PINK BLUSH, ZULILY, ASOS AND AMAZON ARE ONLINE ONLY. All players have extended assortments compared to store. E-commerce

2017 – A Year of Transition

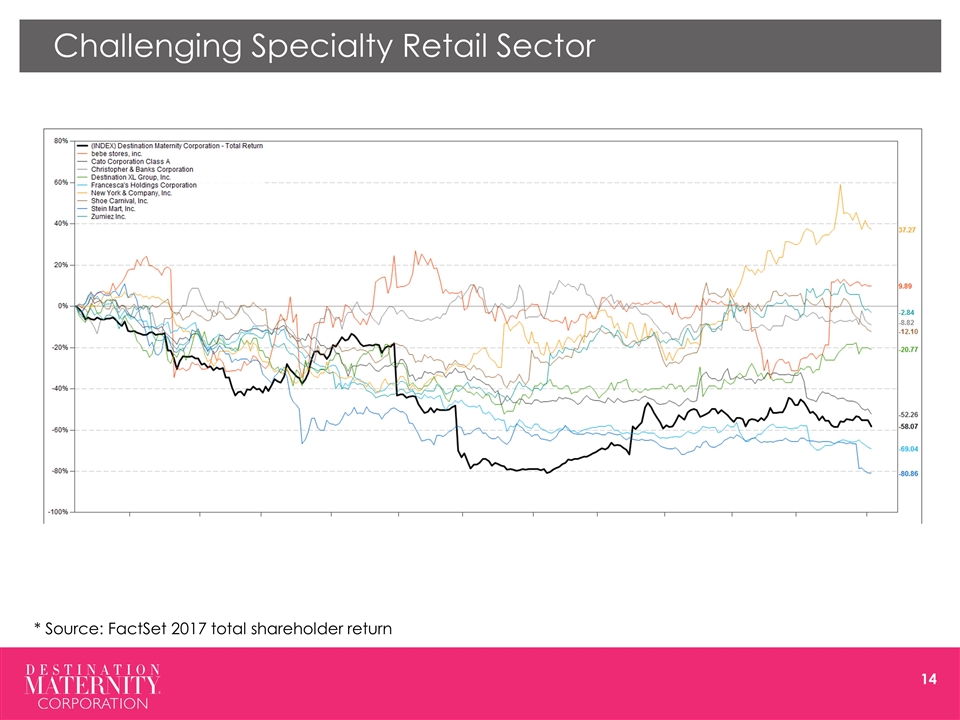

Challenging Specialty Retail Sector 27 retailers filed for bankruptcy between January 2017 – April 2018 More store closings were announced in 2017 than any other year on record.* In 2017 retailers announced plans to shutter more than 6,700 stores in the U.S.* * Fung Global Retail & Technology 10/25/17

Challenging Specialty Retail Sector * Source: FactSet 2017 total shareholder return

2017 Was a Year of Transition Invested significant time, effort and resources into the proposed merger with French children's clothing retailer, Orchestra-Prémaman, that was ultimately not completed. Upon the termination of the merger agreement, the stock price dropped 42% in a single day In connection with the 2017 annual meeting Orchestra was critical of the Company and the Board Since then the Board has demonstrated a true commitment to positive change, openness to appointing highly-qualified directors, willingness to revise its strategic plan, a commitment to finding a new permanent CEO, and a willingness to seek stockholder input into the revised go-forward strategy and vision for the future Orchestra believes that the refreshed Board and Management team have developed an aggressive go forward strategy and are moving in the right direction to drive positive change to benefit all stockholders

2017 Was a Year of Transition Company took decisive action under the Board's leadership to position Destination for profitable, long-term growth, including: Agreeing to part ways with the Company’s CEO in September 2017 after the terminated Orchestra merger and the Board replaced its long-time chairman with an independent Board member, Barry Erdos, who has decades of retail experience Working with the management team and external consultants to immediately implement a expense reduction initiative that is expected to yield in excess of $10 million in run-rate savings Immediately green-lighting management's proposed omnichannel initiatives including ship-from store and pick up from store Approving a refinancing of the Company’s debt significantly improving liquidity and access to capital to support go-forward initiatives Developing, with management, a revised go-forward strategy focused on growth and profitability

2017 Was a Year of Transition Initiated a CEO Transition to bring a fresh look at Destination Maternity Retained Kirk Palmer Associates to lead the search for a new permanent Chief Executive Officer Melissa Payner-Gregor, an independent director of the Company, is currently serving as Interim Chief Executive Officer Established an "Office of the CEO" comprised of Melissa Payner-Gregor, Ronald J. Masciantonio, the Company's Executive Vice President & Chief Administrative Officer, David Stern, the Company's Executive Vice President & Chief Financial Officer, and Shelley Liebsch, the Company's Senior Vice President of Merchandising and Design The Board also formed a three member Business Initiatives Committee, including Pierre Mestre, to advise and consult with the Company’s management and report to the full Board of Directors on matters respecting the Company’s business initiatives

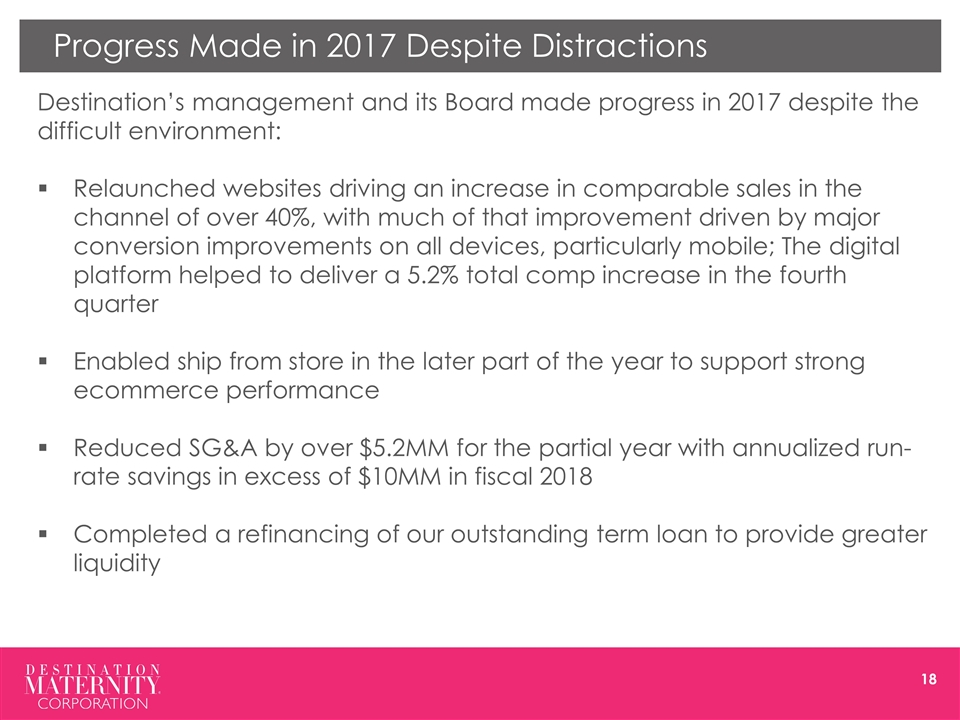

Progress Made in 2017 Despite Distractions Destination’s management and its Board made progress in 2017 despite the difficult environment: Relaunched websites driving an increase in comparable sales in the channel of over 40%, with much of that improvement driven by major conversion improvements on all devices, particularly mobile; The digital platform helped to deliver a 5.2% total comp increase in the fourth quarter Enabled ship from store in the later part of the year to support strong ecommerce performance Reduced SG&A by over $5.2MM for the partial year with annualized run-rate savings in excess of $10MM in fiscal 2018 Completed a refinancing of our outstanding term loan to provide greater liquidity

Strategic Plan to Create Long-Term Value

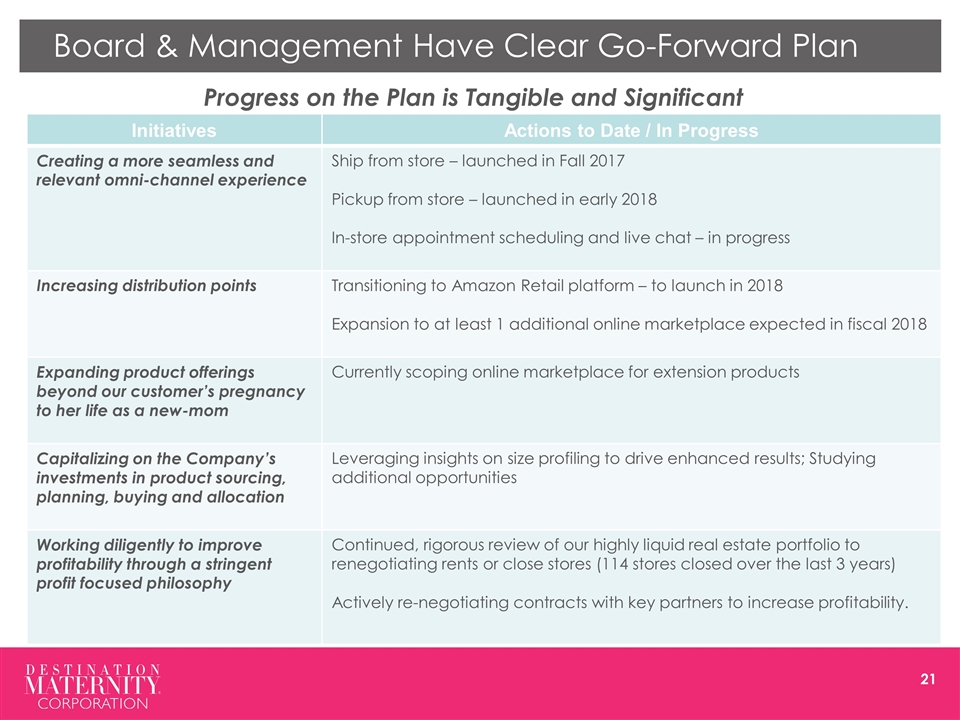

Board & Management Have Clear Go-Forward Plan The Board and management have worked closely on a significant revision to Destination’s go-forward strategy, highlighted by the following: Creating a more seamless and relevant omni-channel experience to lift performance in all channels leveraging our strengths in each channel to benefit all channels Increasing distribution points to increase market share as well as profit to gain leverage on SG&A Expanding product offerings beyond our customer’s pregnancy to her life as a new-mom Protecting and expand the marketing partnerships revenue Capitalizing on the Company’s investments in product sourcing, planning, buying and allocation Improving profitability through a stringent profit focused philosophy, including a continued, rigorous review of our real estate portfolio as well as opportunistically cutting or investing in our operations where ROI appropriate

Board & Management Have Clear Go-Forward Plan Progress on the Plan is Tangible and Significant Initiatives Actions to Date / In Progress Creating a more seamless and relevant omni-channel experience Ship from store – launched in Fall 2017 Pickup from store – launched in early 2018 In-store appointment scheduling and live chat – in progress Increasing distribution points Transitioning to Amazon Retail platform – to launch in 2018 Expansion to at least 1 additional online marketplace expected in fiscal 2018 Expanding product offerings beyond our customer’s pregnancy to her life as a new-mom Currently scoping online marketplace for extension products Capitalizing on the Company’s investments in product sourcing, planning, buying and allocation Leveraging insights on size profiling to drive enhanced results; Studying additional opportunities Working diligently to improve profitability through a stringent profit focused philosophy Continued, rigorous review of our highly liquid real estate portfolio to renegotiating rents or close stores (114 stores closed over the last 3 years) Actively re-negotiating contracts with key partners to increase profitability.

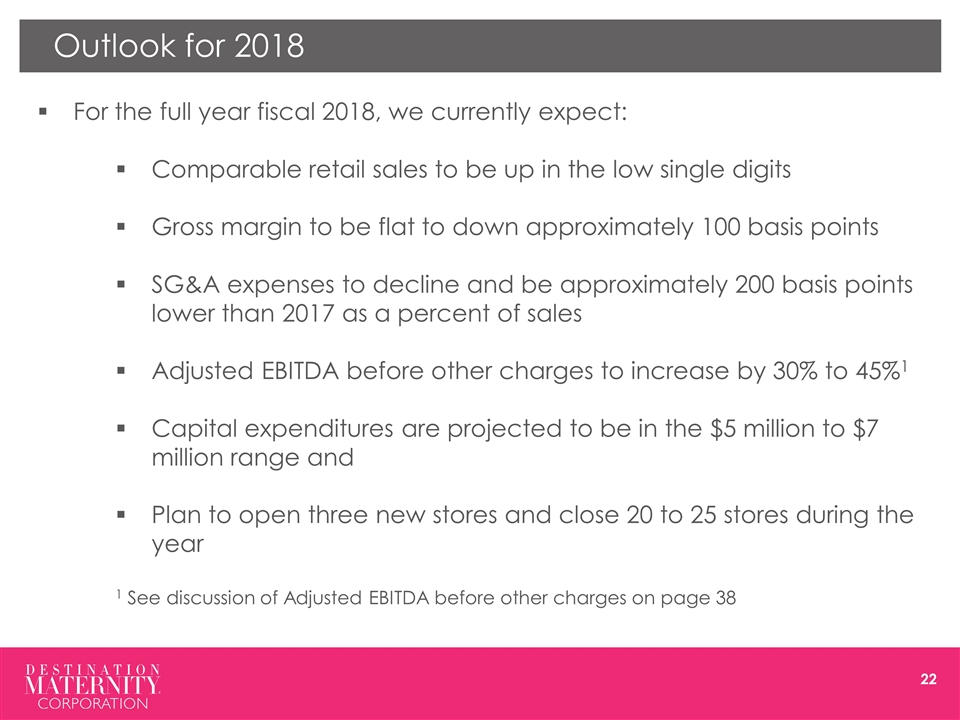

Outlook for 2018 For the full year fiscal 2018, we currently expect: Comparable retail sales to be up in the low single digits Gross margin to be flat to down approximately 100 basis points SG&A expenses to decline and be approximately 200 basis points lower than 2017 as a percent of sales Adjusted EBITDA before other charges to increase by 30% to 45%1 Capital expenditures are projected to be in the $5 million to $7 million range and Plan to open three new stores and close 20 to 25 stores during the year 1 See discussion of Adjusted EBITDA before other charges on page 38

Highly Qualified, Experienced & Engaged Board

Refreshed and Engaged Board of Directors The Board has actively considered its composition including pursuing the addition of new members to expand the skills and experience on the Board to accelerate Destination Maternity’s path to profitable growth Half of Destination’s nominees have joined the Board in the last four months (with only 2 nominees remaining from the 6 directors in office only 1 year ago): Recruited Peter Longo, formerly of Macy’s, to join our Board The Board added Pierre Mestre, the Chairman and founder of Orchestra-Prémaman, our largest stockholder Made numerous overtures to the Miller Group to offer multiple seats on the Board (all overtures rejected) These additions and actions show our Board’s receptiveness to new opinions into the boardroom for the benefit of all stockholders Destination’s Board understands the importance of maintaining fresh perspectives and new viewpoints, and will continue to regularly evaluate its composition

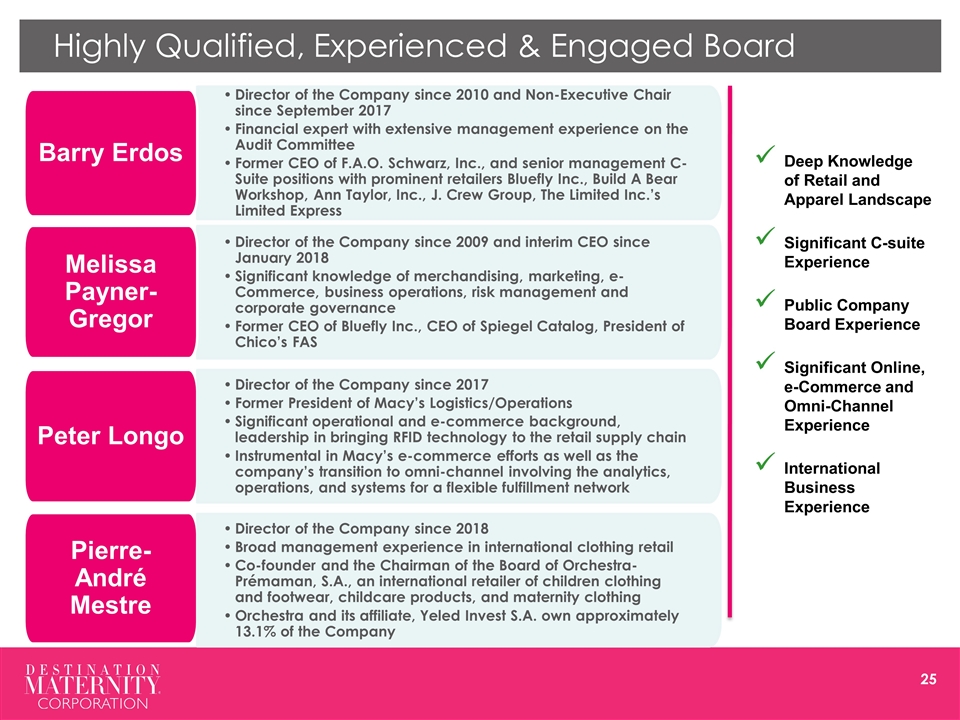

Director of the Company since 2009 and interim CEO since January 2018 Significant knowledge of merchandising, marketing, e-Commerce, business operations, risk management and corporate governance Former CEO of Bluefly Inc., CEO of Spiegel Catalog, President of Chico’s FAS Highly Qualified, Experienced & Engaged Board Director of the Company since 2010 and Non-Executive Chair since September 2017 Financial expert with extensive management experience on the Audit Committee Former CEO of F.A.O. Schwarz, Inc., and senior management C-Suite positions with prominent retailers Bluefly Inc., Build A Bear Workshop, Ann Taylor, Inc., J. Crew Group, The Limited Inc.’s Limited Express Barry Erdos Peter Longo Pierre-André Mestre Melissa Payner-Gregor Deep Knowledge of Retail and Apparel Landscape Significant C-suite Experience Public Company Board Experience Significant Online, e-Commerce and Omni-Channel Experience International Business Experience Director of the Company since 2017 Former President of Macy’s Logistics/Operations Significant operational and e-commerce background, leadership in bringing RFID technology to the retail supply chain Instrumental in Macy’s e-commerce efforts as well as the company’s transition to omni-channel involving the analytics, operations, and systems for a flexible fulfillment network Director of the Company since 2018 Broad management experience in international clothing retail Co-founder and the Chairman of the Board of Orchestra-Prémaman, S.A., an international retailer of children clothing and footwear, childcare products, and maternity clothing Orchestra and its affiliate, Yeled Invest S.A. own approximately 13.1% of the Company

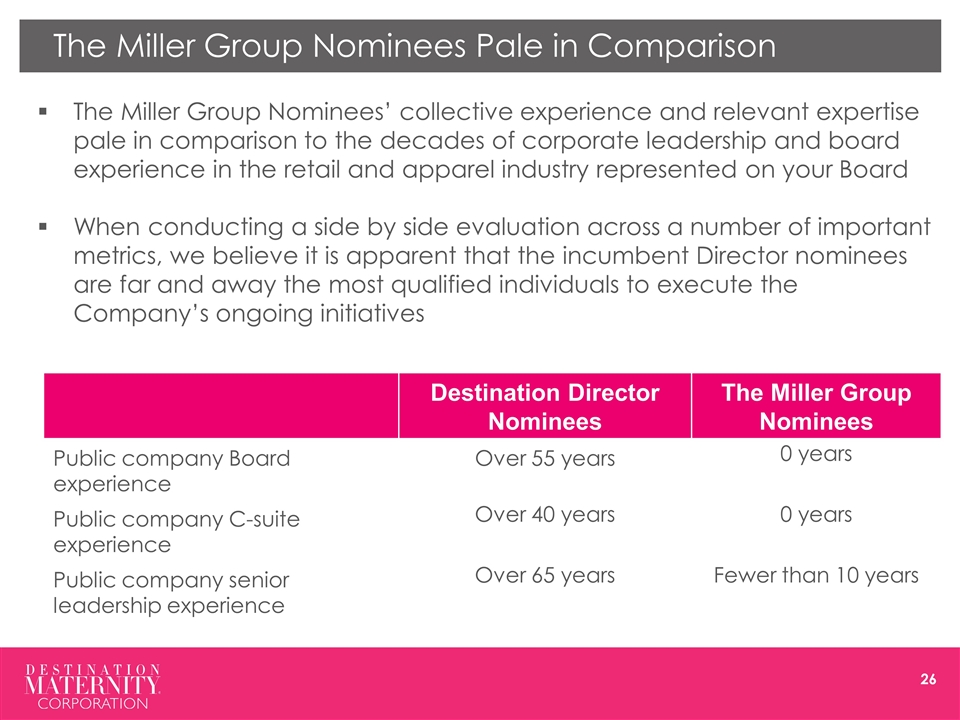

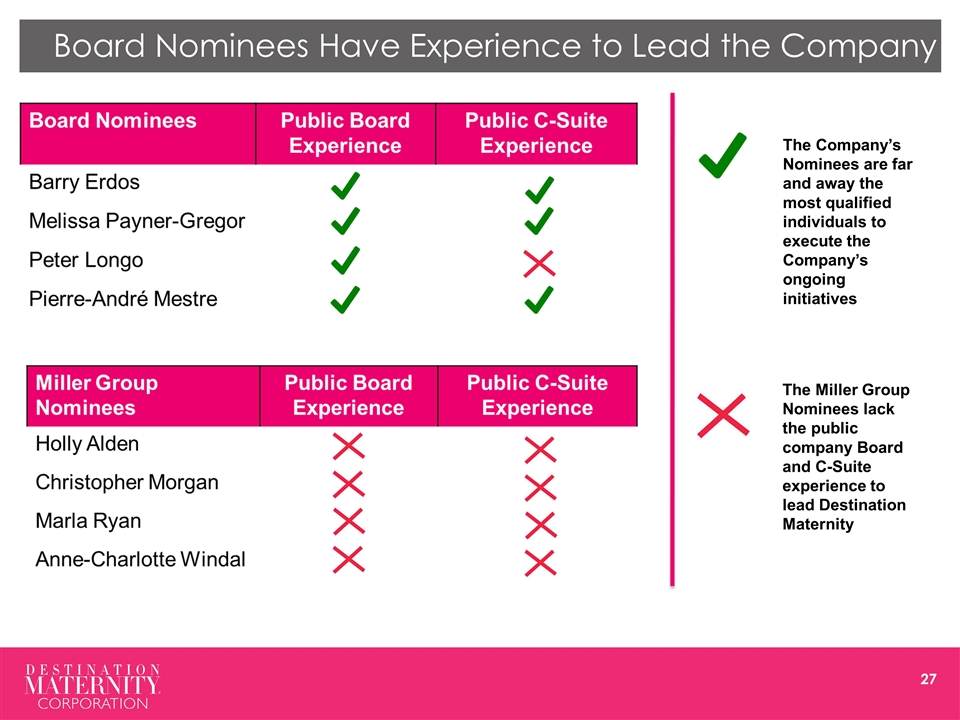

The Miller Group Nominees Pale in Comparison The Miller Group Nominees’ collective experience and relevant expertise pale in comparison to the decades of corporate leadership and board experience in the retail and apparel industry represented on your Board When conducting a side by side evaluation across a number of important metrics, we believe it is apparent that the incumbent Director nominees are far and away the most qualified individuals to execute the Company’s ongoing initiatives Destination Director Nominees The Miller Group Nominees Public company Board experience Over 55 years 0 years Public company C-suite experience Over 40 years 0 years Public company senior leadership experience Over 65 years Fewer than 10 years

Board Nominees Have Experience to Lead the Company The Miller Group Nominees lack the public company Board and C-Suite experience to lead Destination Maternity The Company’s Nominees are far and away the most qualified individuals to execute the Company’s ongoing initiatives

The Miller Group is Not the Right Steward for Stockholders

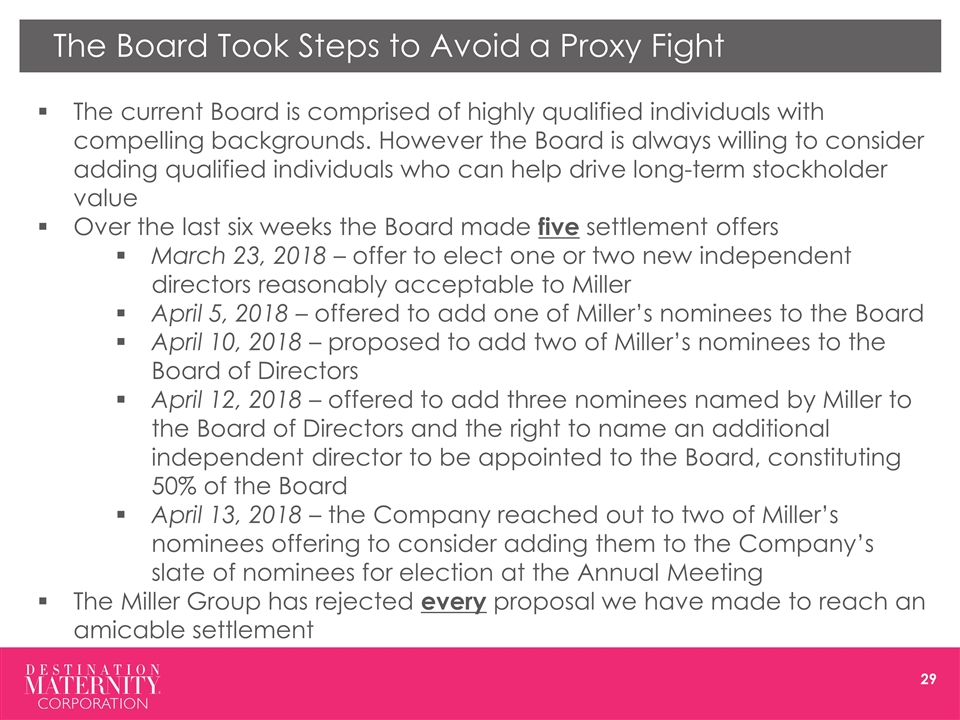

The Board Took Steps to Avoid a Proxy Fight The current Board is comprised of highly qualified individuals with compelling backgrounds. However the Board is always willing to consider adding qualified individuals who can help drive long-term stockholder value Over the last six weeks the Board made five settlement offers March 23, 2018 – offer to elect one or two new independent directors reasonably acceptable to Miller April 5, 2018 – offered to add one of Miller’s nominees to the Board April 10, 2018 – proposed to add two of Miller’s nominees to the Board of Directors April 12, 2018 – offered to add three nominees named by Miller to the Board of Directors and the right to name an additional independent director to be appointed to the Board, constituting 50% of the Board April 13, 2018 – the Company reached out to two of Miller’s nominees offering to consider adding them to the Company’s slate of nominees for election at the Annual Meeting The Miller Group has rejected every proposal we have made to reach an amicable settlement

The Miller Group is Not the Right Steward for Stockholders The Board’s good faith efforts to reach a settlement were met with continued disproportionate demands by the Miller Group The Miller Group, owns less than 9% of the Company’s stock, is seeking disproportionate influence and is seeking to take control of Destination The Miller Group has offered no “roadmap,” no “turnaround plan,” and no detailed plan of any kind to drive profitable growth, and has not offered any strategic or constructive ideas to increase stockholder value – either publicly or during our face-to-face meetings The dissident nominees have no experience on the board or in the C-suite of a public company, and offer no relevant experience, skills or perspectives that are not already well-represented in the Boardroom The Miller Group’s lack of a strategic plan for the business risks derailing the significant progress the incumbent Board and management have made towards profitable growth

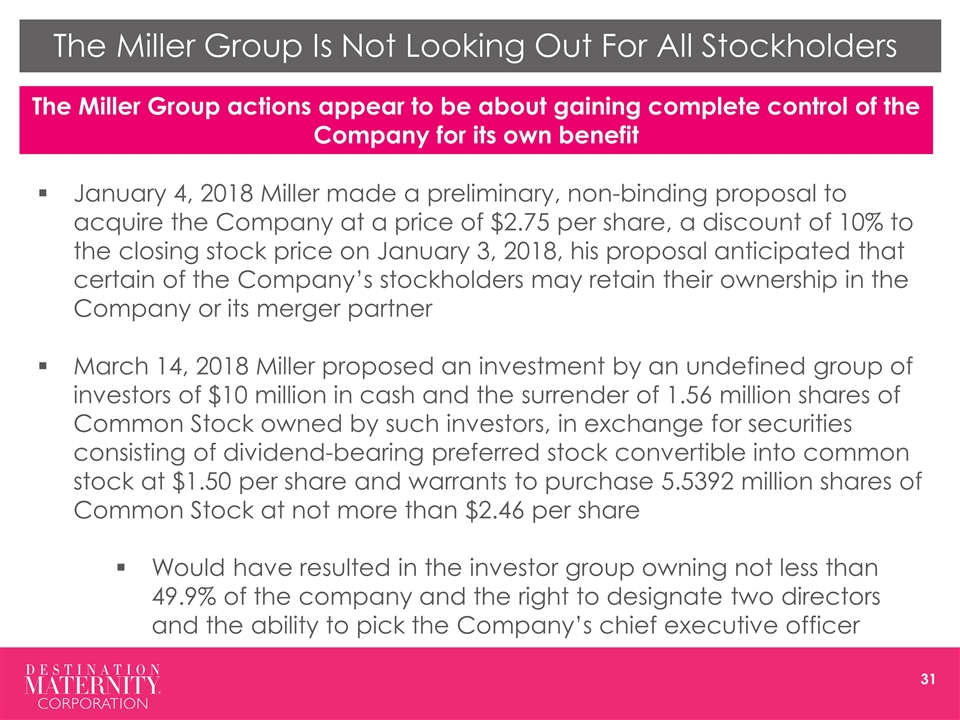

The Miller Group Is Not Looking Out For All Stockholders January 4, 2018 Miller made a preliminary, non-binding proposal to acquire the Company at a price of $2.75 per share, a discount of 10% to the closing stock price on January 3, 2018, his proposal anticipated that certain of the Company’s stockholders may retain their ownership in the Company or its merger partner March 14, 2018 Miller proposed an investment by an undefined group of investors of $10 million in cash and the surrender of 1.56 million shares of Common Stock owned by such investors, in exchange for securities consisting of dividend-bearing preferred stock convertible into common stock at $1.50 per share and warrants to purchase 5.5392 million shares of Common Stock at not more than $2.46 per share Would have resulted in the investor group owning not less than 49.9% of the company and the right to designate two directors and the ability to pick the Company’s chief executive officer The Miller Group actions appear to be about gaining complete control of the Company for its own benefit

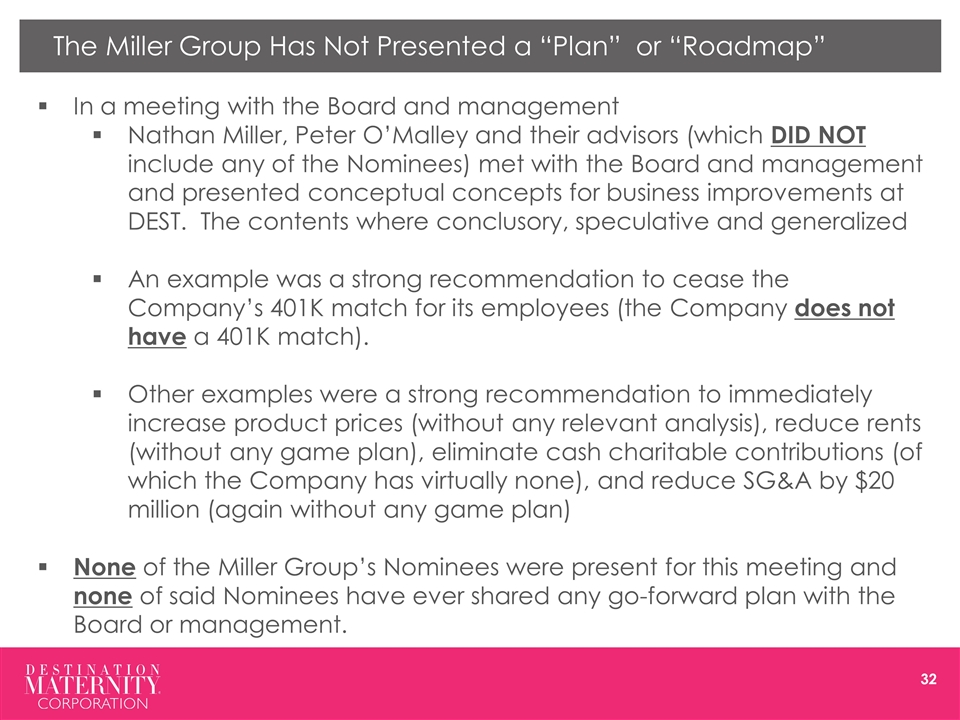

The Miller Group Has Not Presented a “Plan” or “Roadmap” In a meeting with the Board and management Nathan Miller, Peter O’Malley and their advisors (which DID NOT include any of the Nominees) met with the Board and management and presented conceptual concepts for business improvements at DEST. The contents where conclusory, speculative and generalized An example was a strong recommendation to cease the Company’s 401K match for its employees (the Company does not have a 401K match). Other examples were a strong recommendation to immediately increase product prices (without any relevant analysis), reduce rents (without any game plan), eliminate cash charitable contributions (of which the Company has virtually none), and reduce SG&A by $20 million (again without any game plan) None of the Miller Group’s Nominees were present for this meeting and none of said Nominees have ever shared any go-forward plan with the Board or management.

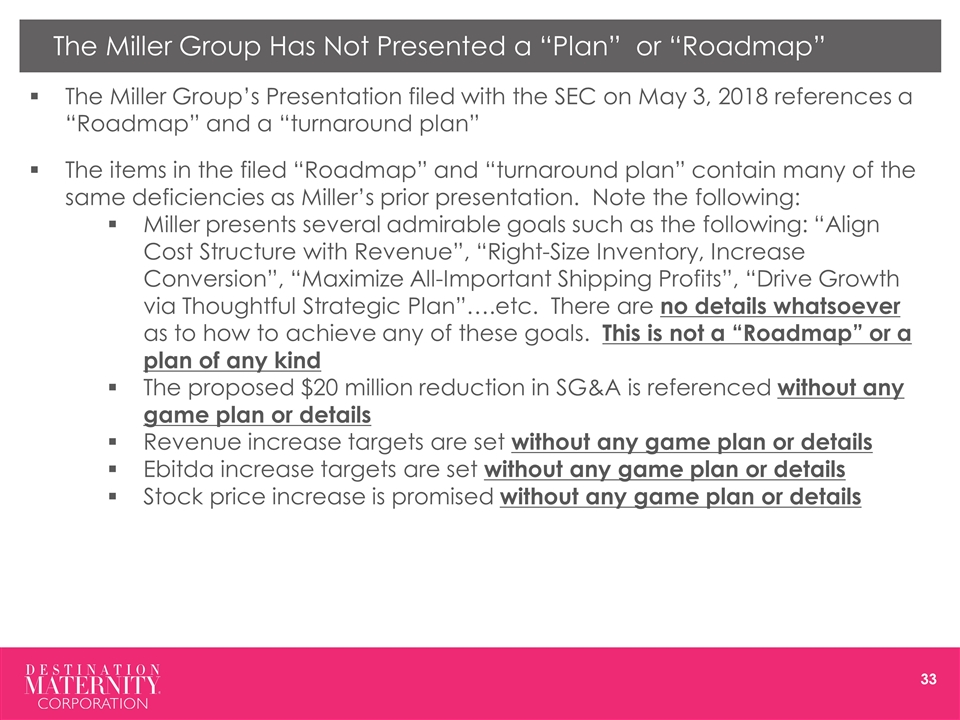

The Miller Group Has Not Presented a “Plan” or “Roadmap” The Miller Group’s Presentation filed with the SEC on May 3, 2018 references a “Roadmap” and a “turnaround plan” The items in the filed “Roadmap” and “turnaround plan” contain many of the same deficiencies as Miller’s prior presentation. Note the following: Miller presents several admirable goals such as the following: “Align Cost Structure with Revenue”, “Right-Size Inventory, Increase Conversion”, “Maximize All-Important Shipping Profits”, “Drive Growth via Thoughtful Strategic Plan”….etc. There are no details whatsoever as to how to achieve any of these goals. This is not a “Roadmap” or a plan of any kind The proposed $20 million reduction in SG&A is referenced without any game plan or details Revenue increase targets are set without any game plan or details Ebitda increase targets are set without any game plan or details Stock price increase is promised without any game plan or details

Conclusion

Conclusion The Board has been refreshed, including the addition of the chairman of our largest stockholder The Board and Management have a clear go-forward strategy that is yielding results The Miller Group lacks a plan and necessary experience and expertise to oversee the change already underway at the Company The Miller Group rejected five settlement offers and appears to be only interested in taking control of the Company at the expense of all other stockholders The refreshed Board Nominees have the experience, a clear plan and are acting in the best interests of all stockholders Turning over control to the Miller Group could disrupt continued successful execution of the plan and damage stockholder value Vote for the Company Nominees with the experience and the clear plan in place that are acting in the interests of all shareholders

Thank You

Forward Looking Statements Some of the information in this presentation (as well as information included in oral statements or other written statements made or to be made by us), contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements involve a number of risks and uncertainties. A number of factors could cause our actual results, performance, achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, but are not limited to: the continuation of economic recovery of the retail industry in general and of apparel purchases in particular, our ability to successfully manage our various business initiatives, the success of our international expansion, our ability to successfully manage, retain and expand our leased department and licensed relationships and marketing partnerships, future sales trends in our existing store base and through the Internet, unusual weather patterns, changes in consumer spending patterns, raw material price increases, overall economic conditions and other factors affecting consumer confidence, demographics and other macroeconomic factors that may impact the level of spending for maternity apparel, expense savings initiatives, our ability to anticipate and respond to fashion trends and consumer preferences, unanticipated fluctuations in our operating results, the impact of competition and fluctuations in the price, availability and quality of raw materials and contracted products, availability of suitable store locations, continued availability of capital and financing, our ability to hire and develop senior management and sales associates, our ability to develop and source merchandise, our ability to receive production from foreign sources on a timely basis, potential stock repurchases, potential debt prepayments, the continuation of the regular quarterly cash dividend, the trading liquidity of our common stock, changes in market interest rates, war or acts of terrorism and other factors set forth in the Company's periodic filings with the Securities and Exchange Commission, or in materials incorporated therein by reference (including those referenced in our Annual Report on Form 10-K under the caption “Risk Factors.”) In addition, these forward-looking statements necessarily depend upon assumptions, estimates and dates that may be incorrect or imprecise and involve known and unknown risks, uncertainties and other factors. Accordingly, any forward-looking statements included in this presentation do not purport to be predictions of future events or circumstances and may not be realized. Forward-looking statements can be identified by, among other things, the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “pro forma,” “anticipates,” “intends,” “continues,” “could,” “estimates,” “plans,” “potential,” “predicts,” “goal,” “objective,” or the negative of any of these terms, or comparable terminology, or by discussions of our outlook, plans, goals, strategy or intentions. Forward-looking statements speak only as of the date made. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission, we assume no obligation to update any of these forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements.

Non-GAAP Financial Measures This presentation contains our current expectation for an increase in fiscal year 2018 Adjusted EBITDA before other charges. The Company’s management believes that this non-GAAP financial measure provides useful information about the Company’s results of operations to both investors and management. This non-GAAP financial measure is provided because management believes it is an important measure of financial performance used in the retail industry to measure operating results, to determine the value of companies within the industry and to define standards for borrowing from institutional lenders. The Company uses this non-GAAP financial measure as a measure of the performance of the Company. In addition, certain of the Company’s cash and equity incentive compensation plans are based on the Company’s level of achievement of Adjusted EBITDA before other charges. This non-GAAP financial measure reflects a measure of the Company’s operating results before consideration of certain charges and consequently, this measure should not be construed as an alternative to net income (loss) or operating income (loss) as an indicator of the Company’s operating performance, as determined in accordance with generally accepted accounting principles. The Company may calculate this non-GAAP financial measure differently than other companies. A reconciliation of the Company's expectation for Adjusted EBITDA before other charges to the most directly comparable GAAP measure has not been presented as it is not practicable without unreasonable efforts.

Important Additional Information Destination Maternity, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from Destination Maternity stockholders in connection with the matters to be considered at Destination Maternity’s 2018 Annual Meeting to be held on May 23, 2018. On April 23, 2018, Destination Maternity filed a definitive proxy statement (the “Proxy Statement”) and form of White proxy card with the SEC in connection with any such solicitation of proxies from Destination Maternity stockholders. INVESTORS AND STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD WITH RESPECT TO THE 2018 ANNUAL MEETING, AND OTHER DOCUMENTS FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the Proxy Statement and other materials to be filed with the SEC in connection with Destination Maternity’s 2018 Annual Meeting. Stockholders may obtain the Proxy Statement, any amendments or supplements to the Proxy Statement and other documents filed by Destination Maternity with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Investor Relations section of our corporate website at http://investor.destinationmaternity.com.