Form 8-K PROVIDENCE SERVICE CORP For: May 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 9, 2018

The Providence Service Corporation

(Exact name of registrant as specified in its charter)

Delaware | 001-34221 | 86-0845127 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

700 Canal Street, Third Floor Stamford, Connecticut | 06902 | |||

(Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (203) 307-2800

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ |

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2018, The Providence Service Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2018. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On May 9, 2018, the Company posted an investor presentation to the Investor Relations section of its website www.prscholdings.com, in connection with the earnings call for the quarter ended March 31, 2018. A copy of the investor presentation is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Number | Description |

99.1 99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

THE PROVIDENCE SERVICE CORPORATION | ||||

Date: May 9, 2018 | By: | /s/ William Severance | ||

Name: | William Severance | |||

Title: | Interim Chief Financial Officer | |||

Providence Service Corporation Reports First Quarter 2018 Results

Highlights for the First Quarter of 2018:

• | Revenue from continuing operations of $406.0 million, a 1.6% increase from the first quarter of 2017 |

• | Income from continuing operations, net of tax, of $5.7 million, or $0.29 per diluted common share, compared to $1.9 million, or $0.03 per diluted common share, in the first quarter of 2017 |

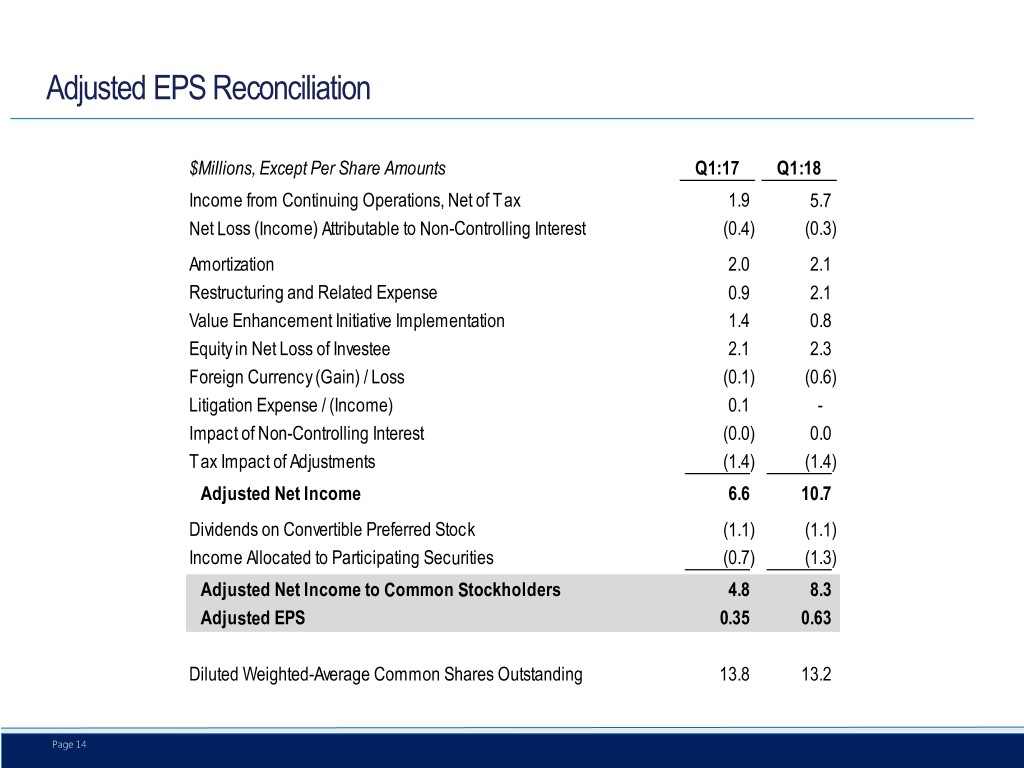

• | Adjusted Net Income of $10.7 million, a 61.5% increase from the first quarter of 2017; Adjusted EPS of $0.63, an 80.0% increase from the first quarter of 2017 |

• | Adjusted EBITDA of $19.3 million, a 24.0% increase from the first quarter of 2017 |

• | Adopted new revenue recognition standard resulting in unfavorable impact to revenue and earnings |

• | Repurchased 589 thousand shares from January 1, 2018 through May 7, 2018 |

• | Matrix completed the acquisition of HealthFair |

• | Announced organizational consolidation plan to strengthen operational effectiveness |

STAMFORD, CT – May 9, 2018 – The Providence Service Corporation (the “Company” or “Providence”) (Nasdaq: PRSC), today reported financial results for the three months ended March 31, 2018.

“The first quarter saw us continue with our positive earnings momentum and has given us a strong start to 2018,” stated Carter Pate, Interim Chief Executive Officer. He continued, “We produced another quarter of excellent financial results while also announcing an organizational consolidation plan to better focus our capital deployment and strategic resources on our core asset, LogistiCare. During the quarter, NET Services was focused on multiple new contract implementations and continued to progress its critical value enhancement initiatives aimed at decreasing transportation and call center costs while also improving the quality of its service offerings. Within WD Services, we successfully launched each of our Work and Health Program contracts and our underlying profitability was solid despite seeing a negative impact from adoption of the new revenue recognition standard. Lastly our Matrix Investment experienced strong year-over-year revenue growth while also beginning the process of integrating HealthFair. This great start to the year across all of our businesses gives us greater confidence in achieving our full year goals."

First Quarter 2018 Results

For the first quarter of 2018, the Company reported revenue from continuing operations of $406.0 million, an increase of 1.6% from $399.5 million in the first quarter of 2017. As previously disclosed, the Company adopted the new revenue recognition standard in the first quarter of 2018, resulting in a negative impact to revenue of $9.3 million versus the prior standard. In addition, WD Services benefited from favorable exchange rates, which provided a positive revenue impact of $6.4 million.

Income from continuing operations, net of tax, in the first quarter of 2018 was $5.7 million, or $0.29 per diluted common share, compared to $1.9 million, or $0.03 per diluted common share, in the first quarter of 2017. Income from continuing operations, net of tax, in the first quarters of 2018 and 2017 includes restructuring and related charges of $2.9 million and $2.4 million, respectively. Adjusted Net Income in the first quarter of 2018 was $10.7 million, or $0.63 per diluted common share, compared to $6.6 million, or $0.35 per diluted common share, in the first quarter of 2017.

Segment-level Adjusted EBITDA was $26.7 million in the first quarter of 2018, compared to $22.5 million in the first quarter of 2017. Adjusted EBITDA was $19.3 million in the first quarter of 2018, compared to $15.6 million in the first quarter of 2017.

In the first quarter 2018 the new revenue recognition standard resulted in a negative impact to operating income and Adjusted EBITDA of $3.5 million versus the prior standard. Income from continuing operations, net of tax, earnings per share, and Adjusted EPS were also negatively impacted by the adoption.

Share Repurchases

From January 1 2018, through May 7, 2018, the Company repurchased 589,000 shares of common stock for $37.4 million, or for an average price of $63.46 per share.

As previously announced, on April 3, 2018, the Company's Board of Directors amended the Company's ongoing stock repurchase program to add an additional $78 million of capacity and extend the expiration date of the program from December 31, 2018 to June 30, 2019. As of May 7, 2018, the Company has approximately $99.5 million of share repurchase availability under its share repurchase program.

Since beginning to repurchase shares in the fourth quarter of 2015 through May 7, 2018, the Company has repurchased 3.6 million shares of common stock, or approximately 22% of the Company’s common stock outstanding at the beginning of the fourth quarter of 2015, for $170.2 million, or for an average price of $47.18 per share.

Organizational Consolidation

As previously announced on April 11, 2018, we are currently in the process of an organizational consolidation to integrate substantially all activities and functions performed at the corporate holding company level into LogistiCare. We anticipate the organizational consolidation will result in a more streamlined company structure with greater operational and strategic alignment and better able to pursue both organic and inorganic growth initiatives. This strategic process is expected to take approximately 12 months to complete, over which time implementation costs will negatively impact earnings but once complete is expected to generate annual savings of at least $10 million. In furtherance of our efforts to create this more streamlined organizational structure and allow us to more effectively deploy capital and focus strategic resources towards the significant growth opportunities available to LogistiCare, we are also exploring strategic alternatives in regards to our WD Services segment, which may involve a sale transaction of the segment.

Segment Results

For analysis purposes, the Company provides revenue, expenses, operating income (loss), income (loss) from continuing operations, net of taxes, and Adjusted EBITDA on a segment basis. Segment results include revenue and expenses incurred by each segment, as well as an allocation of certain direct expenses incurred by Corporate and Other on behalf of the segment. No direct cash expenses were incurred by Corporate on behalf of the Matrix Investment segment. The activities reflected in Corporate and Other include executive, accounting, finance, internal audit, tax, legal, public reporting, certain strategic and corporate development functions and the results of the Company’s captive insurance company.

NET Services

NET Services revenue was $336.7 million for the first quarter of 2018, an increase of 3.9% from $324.0 million in the first quarter of 2017. Operating income was $19.6 million, or 5.8% of revenue, in the first quarter of 2018, compared to $11.8 million, or 3.6% of revenue, in the first quarter of 2017. Included in NET Services operating income in the first quarters of 2018 and 2017 were $0.8 million and $1.3 million, respectively, of restructuring and related charges. NET Services Adjusted EBITDA was $23.9 million, or 7.1% of revenue, in the first quarter of 2018, compared to $16.3 million, or 5.0% of revenue, in the first quarter of 2017. First quarter 2018 revenue includes a negative impact of $3.9 million from the adoption of the new revenue recognition standard, as the accounting for one contract changed from a gross basis to net basis. This change had no impact to NET Services operating income or Adjusted EBITDA.

The year-over-year increase in NET Services revenue was primarily due to the impact of numerous new contracts, including new managed care organization ("MCO") contracts in Indiana and New York and new state contracts in Texas. Increased membership and rates across various existing contracts also positively impacted revenue in the first quarter of 2018. These increases to revenue were partially offset by the ending of state contracts in New York and Connecticut and certain of our MCO contracts in Florida as well as reduced membership under our renewed state contract in Virginia. NET Services Adjusted EBITDA margins in the first quarter of 2018 benefited from the favorable resolution of contractual adjustments and retrospective rate adjustments as well as lower transportation costs on a per trip basis due to our value enhancement activities, partially offset by higher utilization across certain contracts and the ending of our state contract in New York.

WD Services

WD Services revenue was $69.4 million for the first quarter of 2018, a decrease of 8.1% from $75.5 million in the first quarter of 2017. Operating loss was $2.0 million in the first quarter of 2018 compared to income of $2.2 million in the first quarter of 2017. Included within WD Services operating income (loss) in the first quarters of 2018 and 2017 were restructuring and related costs of $1.6 million and $1.1 million, respectively. WD Services Adjusted EBITDA was $2.8 million, or 4.1% of revenue, in the first quarter of 2018 compared to Adjusted EBITDA of $6.3 million, or 8.3% of revenue, in the first quarter of 2017. First quarter 2018 revenue reflects a $5.4 million negative impact on revenue and a $3.5 million negative impact on operating income and Adjusted EBITDA as a result of the adoption of the new revenue recognition standard. WD Services benefited from favorable exchange rates in the first quarter of 2018, which provided a positive revenue impact of $6.4 million, although only a small impact on Adjusted EBITDA. Excluding the impact of currency exchange rates, revenue declined 16.7% in the first quarter of 2018 versus the first quarter of 2017.

The year-over-year decrease in WD Services revenue in the first quarter of 2018, on a constant currency basis and excluding the negative impact of the adoption of the new revenue recognition standard, was primarily due to the anticipated decline in Work Program revenues, partially offset by the launch of the Work and Health Program and growth in health services revenue in the UK. Excluding the negative impact of the adoption of the new revenue recognition standard, WD Services first quarter 2018 Adjusted EBITDA as a percentage of revenue was in line with the first quarter of 2017. The first quarter of 2017 included a favorable Adjusted EBITDA impact of $5.2 million related to the finalization of a contractual adjustment, whereas the first quarter of 2018 included a favorable impact of only $1.1 million related to contractual adjustments. This net reduction in income was offset by payroll savings generated by our Ingeus Futures restructuring programs.

Corporate and Other

Corporate and Other incurred a $7.9 million operating loss in the first quarter of 2018 compared to an operating loss of $7.2 million in the first quarter of 2017. Included within Corporate and Other operating loss in the first quarter of 2018 were restructuring and related costs of $0.4 million related to the consolidation of the holding company structure into LogistiCare. Corporate and Other Adjusted EBITDA was negative $7.4 million in the first quarter of 2018 compared to negative $7.0 million in the first quarter of 2017.

This increase in Corporate and Other's Adjusted EBITDA loss was primarily due to an increase in cash settled stock-based compensation expense of $1.1 million, as a result of a more significant increase in the Company’s stock price in the first quarter of 2018 as compared to the first quarter of 2017.

Matrix Investment (Equity Investment)

For the three months ended March 31, 2018, Providence recorded a loss in equity earnings of $2.3 million related to its Matrix Investment compared to a loss of $0.7 million for the first quarter of 2017.

As Providence’s interest in Matrix is accounted for as an equity method investment, the following numbers are not included within the Company’s consolidated results of operations. For the first quarter of 2018, Matrix’s revenue was $67.4 million, an increase of 20.7% from $55.9 million in the first quarter of 2017. Matrix’s operating loss was $0.8 million, for the first quarter of 2018, compared to income of $1.0 million, for the first quarter of 2017. Included within Matrix’s operating loss in the first quarter of 2018 were $3.1 million of management fees paid to Matrix shareholders and transaction costs of $2.2 million related to the acquisition of HealthFair. Included within Matrix's operating income in the first quarter of 2017 was $2.2 million of expense related to transaction bonuses paid to the Matrix management team, $0.8 million of other transaction related expenses, and $0.5 million of management fees paid to Matrix shareholders.

Matrix net loss was $8.5 million for the first quarter of 2018, compared to $1.9 million for the first quarter of 2017. Matrix's net loss in the first quarter of 2018 includes $6.0 million of interest expense related to the acceleration of deferred financing fees triggered by the refinancing of Matrix's debt in relation to the HealthFair acquisition. Matrix’s Adjusted EBITDA was $13.5 million, or 20.0% of revenue, for the first quarter of 2018, compared to $12.5 million, or 22.4% of revenue, in the first quarter of 2017.

The positive year-over-year revenue growth for the first quarter of 2018 was related to the acquisition of HealthFair, which contributed approximately 50% of the increase in revenue as well as increased in-home visit volumes within Matrix’s legacy operations, partially offset by lower pricing. The year-over-year decline in Adjusted EBITDA as a percentage of revenue was primarily due to the timing of new contract startup costs at HealthFair and lower pricing.

As of March 31, 2018, Matrix had cash of $19.6 million and $330.0 million of term loan debt outstanding under its credit facility, which was entered into in February 2018 in conjunction with the HealthFair acquisition. At the end of the quarter, Providence's ownership interest in Matrix was 43.6%.

Investor Presentation and Conference Call

Providence will hold a conference call to discuss its financial results on Thursday, May 10, 2018 at 8:00 a.m. ET. An investor presentation has been prepared to accompany the conference call and can be found on the Company’s website (investor.prscholdings.com.). To access the call, please dial:

US toll-free: 1 (844) 244 3865

International: 1 (518) 444 0681

Passcode: 6043738

Replay (available until May 17, 2018):

US toll-free: 1 (855) 859 2056

International: 1 (404) 537 3406

Passcode: 6043738

You may also access the conference call via webcast at investor.prscholdings.com, where the call also will be archived.

About Providence

The Providence Service Corporation owns subsidiaries and investments primarily engaged in the provision of healthcare services in the United States and workforce development services internationally. For more information, please visit prscholdings.com.

Non-GAAP Financial Measures and Adjustments

In addition to the financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release includes EBITDA, Adjusted EBITDA and Segment-level Adjusted EBITDA for the Company and its operating segments, and Adjusted Net Income and Adjusted EPS for the Company, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before certain items, including (as applicable): (1) restructuring and related charges, including costs related to our corporate reorganization, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) gain or loss on sale of equity investments, (6) management fees and (7) certain transaction and related costs. Segment-level Adjusted EBITDA is calculated as Adjusted EBITDA for the company excluding the Adjusted EBITDA associated with corporate and holding company costs reported as our Corporate and Other Segment. Adjusted Net Income is defined as income (loss) from continuing operations, net of tax, before certain items, including (1) restructuring and related charges, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) intangible amortization expense, (6) gain or loss on sale of equity investments, (7) the non-recurring impact of the Tax Cuts and Jobs Act, (8) excess tax charges associated with long term incentive plans, (9) the impact of adjustments on noncontrolling interests, (10) transaction and related costs and (11) the income tax impact of such adjustments. Adjusted EPS is calculated as Adjusted Net Income less (as applicable): (1) dividends on convertible preferred stock, (2) accretion of convertible preferred stock discount, and (3) income allocated to participating stockholders, divided by the diluted weighted-average number of common shares outstanding. We utilize these non-GAAP performance measures, which exclude certain expenses and amounts, because we believe the timing of such expenses is unpredictable and not driven by our core operating results, and therefore render comparisons with prior periods as well as with other companies in our industry less meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net earnings in equity investees are excluded from these measures, as we do not have the ability to manage these ventures, allocate resources within the ventures, or directly control their operations or performance.

Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be

different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non-GAAP financial information is not meant to be considered in isolation from or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,” “anticipate,” “should” and “likely” and similar expressions identify forward-looking statements. In addition, statements that are not historical should also be considered forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Such forward-looking statements are based on current expectations that involve a number of known and unknown risks, uncertainties and other factors which may cause actual events to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, our continuing relationship with government entities and our ability to procure business from them, our ability to manage growing and changing operations, the implementation of healthcare reform law, government budget changes and legislation related to the services that we provide, our ability to renew or replace existing contracts that have expired or are scheduled to expire with significant clients, and other risks detailed in Providence’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Providence is under no obligation to (and expressly disclaims any such obligation to) update any of the information in this press release if any forward-looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise.

Investor Relations Contact

Laurence Orton – Interim CAO & SVP Finance

(203) 307-2800

--financial tables to follow--

Providence Service Corporation

Page 6

The Providence Service Corporation | ||||||||

Unaudited Condensed Consolidated Statements of Income | ||||||||

(in thousands except share and per share data) | ||||||||

Three months ended March 31, | ||||||||

2018 | 2017 | |||||||

Service revenue, net | $ | 406,046 | $ | 399,494 | ||||

Operating expenses: | ||||||||

Service expense | 371,235 | 369,410 | ||||||

General and administrative expense | 18,413 | 17,027 | ||||||

Depreciation and amortization | 6,798 | 6,269 | ||||||

Total operating expenses | 396,446 | 392,706 | ||||||

Operating income (loss) | 9,600 | 6,788 | ||||||

Other expenses: | ||||||||

Interest expense, net | 326 | 352 | ||||||

Equity in net (gain) loss of investees | 2,321 | 2,060 | ||||||

Loss (gain) on foreign currency transactions | (623 | ) | (62 | ) | ||||

Income (loss) from continuing operations before income taxes | 7,576 | 4,438 | ||||||

Provision (benefit) for income taxes | 1,842 | 2,523 | ||||||

Income (loss) from continuing operations, net of tax | 5,734 | 1,915 | ||||||

Discontinued operations, net of tax | (8 | ) | (5,866 | ) | ||||

Net income (loss) | 5,726 | (3,951 | ) | |||||

Net loss (income) attributable to noncontrolling interests | (296 | ) | (374 | ) | ||||

Net income (loss) attributable to Providence | $ | 5,430 | $ | (4,325 | ) | |||

Net income (loss) available to common | ||||||||

stockholders | $ | 3,762 | $ | (5,473 | ) | |||

Basic earnings (loss) per common share: | ||||||||

Continuing operations | $ | 0.29 | $ | 0.03 | ||||

Discontinued operations | — | (0.43 | ) | |||||

Basic earnings (loss) per common share | $ | 0.29 | $ | (0.40 | ) | |||

Diluted earnings (loss) per common share: | ||||||||

Continuing operations | $ | 0.29 | $ | 0.03 | ||||

Discontinued operations | — | (0.43 | ) | |||||

Diluted earnings (loss) per common share | $ | 0.29 | $ | (0.40 | ) | |||

Weighted-average number of common | ||||||||

shares outstanding: | ||||||||

Basic | 13,105,965 | 13,704,272 | ||||||

Diluted | 13,199,440 | 13,768,524 | ||||||

--more--

Providence Service Corporation

Page 7

The Providence Service Corporation | ||||||||

Condensed Consolidated Balance Sheets | ||||||||

(in thousands) | ||||||||

March 31, 2018 | December 31, 2017 | |||||||

(Unaudited) | ||||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 86,229 | $ | 95,310 | ||||

Accounts receivable, net of allowance | 173,176 | 158,926 | ||||||

Other current assets (1) | 58,785 | 42,093 | ||||||

Total current assets | 318,190 | 296,329 | ||||||

Property and equipment, net | 50,447 | 50,377 | ||||||

Goodwill and intangible assets, net | 165,502 | 165,607 | ||||||

Equity investments | 166,276 | 169,912 | ||||||

Other long-term assets (2) | 19,828 | 21,865 | ||||||

Total assets | $ | 720,243 | $ | 704,090 | ||||

Liabilities, redeemable convertible preferred stock and stockholders' equity | ||||||||

Current liabilities: | ||||||||

Current portion of long-term obligations | $ | 1,712 | $ | 2,400 | ||||

Other current liabilities (3) | 258,084 | 224,530 | ||||||

Total current liabilities | 259,796 | 226,930 | ||||||

Long-term obligations, less current portion | 644 | 584 | ||||||

Other long-term liabilities (4) | 61,203 | 63,013 | ||||||

Total liabilities | 321,643 | 290,527 | ||||||

Mezzanine and stockholder's equity | ||||||||

Convertible preferred stock, net | 77,546 | 77,546 | ||||||

Stockholders' equity | 321,054 | 336,017 | ||||||

Total liabilities, redeemable convertible preferred stock and stockholders' equity | $ | 720,243 | $ | 704,090 | ||||

(1) Comprised of other receivables, restricted cash and prepaid expenses and other.

(2) Comprised of restricted cash, less current portion, deferred tax assets and other assets.

(3) Comprised of accounts payable, accrued expenses, accrued transportation costs, deferred revenue and reinsurance and related liability reserves.

(4) Includes deferred tax liabilities and other long-term liabilities.

--more--

Providence Service Corporation

Page 8

The Providence Service Corporation | ||||||||

Unaudited Condensed Consolidated Statements of Cash Flows | ||||||||

(in thousands) (1) | ||||||||

Three months ended March 31, | ||||||||

2018 | 2017 | |||||||

Operating activities | ||||||||

Net income | $ | 5,726 | $ | (3,951 | ) | |||

Depreciation and amortization | 6,798 | 6,269 | ||||||

Stock-based compensation | 933 | 1,466 | ||||||

Equity in net (gain) loss of investees | 2,321 | 2,060 | ||||||

Other non-cash credits | (876 | ) | (2,483 | ) | ||||

Changes in working capital | 10,716 | 32,837 | ||||||

Net cash provided by operating activities | 25,618 | 36,198 | ||||||

Investing activities | ||||||||

Purchase of property and equipment | (4,987 | ) | (5,738 | ) | ||||

Equity investments/loan to joint venture | — | (566 | ) | |||||

Other investing activities | — | (3 | ) | |||||

Net cash provided by investing activities | (4,987 | ) | (6,307 | ) | ||||

Financing activities | ||||||||

Preferred stock dividends | (1,089 | ) | (1,090 | ) | ||||

Repurchase of common stock, for treasury | (37,167 | ) | (18,753 | ) | ||||

Other financing activities | 7,997 | (571 | ) | |||||

Net cash used in financing activities | (30,259 | ) | (20,414 | ) | ||||

Effect of exchange rate changes on cash | 115 | 548 | ||||||

Net change in cash and cash equivalents | (9,513 | ) | 10,025 | |||||

Cash, cash equivalents and restricted cash at beginning of period | 101,606 | 86,392 | ||||||

Cash, cash equivalents and restricted cash at end of period (2) | $ | 92,093 | $ | 96,417 | ||||

(1) Includes both continuing and discontinued operations.

(2) Includes restricted cash of $5,864 at 31 March 2018 and $13,535 at 31 March 2017

--more--

Providence Service Corporation

Page 9

The Providence Service Corporation

Reconciliation of Non-GAAP Financial Measures

Segment Information and Adjusted EBITDA

(in thousands)

(Unaudited)

Three months ended March 31, 2018 | ||||||||||||||||||||||||

NET Services | WD Services | Total Segment-Level | Matrix Investment | Corporate and Other | Total Continuing Operations | |||||||||||||||||||

Service revenue, net | $ | 336,696 | $ | 69,350 | $ | 406,046 | $ | — | $ | — | $ | 406,046 | ||||||||||||

Operating expenses: | ||||||||||||||||||||||||

Service expense | 310,701 | 60,534 | 371,235 | — | — | 371,235 | ||||||||||||||||||

General and administrative expense | 2,937 | 7,613 | 10,550 | — | 7,863 | 18,413 | ||||||||||||||||||

Depreciation and amortization | 3,494 | 3,218 | 6,712 | — | 86 | 6,798 | ||||||||||||||||||

Total operating expenses | 317,132 | 71,365 | 388,497 | — | 7,949 | 396,446 | ||||||||||||||||||

Operating income (loss) | 19,564 | (2,015 | ) | 17,549 | — | (7,949 | ) | 9,600 | ||||||||||||||||

Other expenses: | ||||||||||||||||||||||||

Interest expense, net | 18 | 369 | 387 | — | (61 | ) | 326 | |||||||||||||||||

Equity in net (gain) loss of investees | — | (23 | ) | (23 | ) | 2,344 | — | 2,321 | ||||||||||||||||

Loss (gain) on foreign currency | ||||||||||||||||||||||||

transactions | — | (623 | ) | (623 | ) | — | — | (623 | ) | |||||||||||||||

Income (loss) from continuing | ||||||||||||||||||||||||

operations, before income tax | 19,546 | (1,738 | ) | 17,808 | (2,344 | ) | (7,888 | ) | 7,576 | |||||||||||||||

Provision (benefit) for income taxes | 5,020 | (138 | ) | 4,882 | (518 | ) | (2,522 | ) | 1,842 | |||||||||||||||

Income (loss) from continuing operations, net of taxes | 14,526 | (1,600 | ) | 12,926 | (1,826 | ) | (5,366 | ) | 5,734 | |||||||||||||||

Interest expense, net | 18 | 369 | 387 | — | (61 | ) | 326 | |||||||||||||||||

Provision (benefit) for income taxes | 5,020 | (138 | ) | 4,882 | (518 | ) | (2,522 | ) | 1,842 | |||||||||||||||

Depreciation and amortization | 3,494 | 3,218 | 6,712 | — | 86 | 6,798 | ||||||||||||||||||

EBITDA | 23,058 | 1,849 | 24,907 | (2,344 | ) | (7,863 | ) | 14,700 | ||||||||||||||||

Restructuring and related charges (1) | 823 | 1,617 | 2,440 | — | 448 | 2,888 | ||||||||||||||||||

Equity in net (gain) loss of investees | — | (23 | ) | (23 | ) | 2,344 | — | 2,321 | ||||||||||||||||

Loss (gain) on foreign currency transactions | — | (623 | ) | (623 | ) | — | — | (623 | ) | |||||||||||||||

Adjusted EBITDA | $ | 23,881 | $ | 2,820 | $ | 26,701 | $ | — | $ | (7,415 | ) | $ | 19,286 | |||||||||||

(1) Restructuring and related charges include redundancy program costs of $1,360 and property related costs of $257 for WD Services, value enhancement initiative implementation costs of $823 for NET Services and organizational consolidation costs of $448 within Corporate and Other.

--more—

Providence Service Corporation

Page 10

The Providence Service Corporation

Reconciliation of Non-GAAP Financial Measures

Segment Information and Adjusted EBITDA

(in thousands) (Unaudited)

Three months ended March 31, 2017 | ||||||||||||||||||||||||

NET Services | WD Services | Total Segment-Level | Matrix Investment | Corporate and Other | Total Continuing Operations | |||||||||||||||||||

Service revenue, net | $ | 324,034 | $ | 75,460 | $ | 399,494 | $ | — | $ | — | $ | 399,494 | ||||||||||||

Operating expenses: | ||||||||||||||||||||||||

Service expense | 306,192 | 63,203 | 369,395 | — | 15 | 369,410 | ||||||||||||||||||

General and administrative expense | 2,891 | 7,044 | 9,935 | — | 7,092 | 17,027 | ||||||||||||||||||

Depreciation and amortization | 3,151 | 3,040 | 6,191 | — | 78 | 6,269 | ||||||||||||||||||

Total operating expenses | 312,234 | 73,287 | 385,521 | — | 7,185 | 392,706 | ||||||||||||||||||

Operating income (loss) | 11,800 | 2,173 | 13,973 | — | (7,185 | ) | 6,788 | |||||||||||||||||

Other expenses: | ||||||||||||||||||||||||

Interest expense, net | 11 | 267 | 278 | — | 74 | 352 | ||||||||||||||||||

Equity in net (gain) loss of investees | — | 1,400 | 1,400 | 660 | — | 2,060 | ||||||||||||||||||

Loss (gain) on foreign currency | ||||||||||||||||||||||||

transactions | — | (62 | ) | (62 | ) | — | — | (62 | ) | |||||||||||||||

Income (loss) from continuing | ||||||||||||||||||||||||

operations, before income tax | 11,789 | 568 | 12,357 | (660 | ) | (7,259 | ) | 4,438 | ||||||||||||||||

Provision (benefit) for income taxes | 4,621 | 805 | 5,426 | (249 | ) | (2,654 | ) | 2,523 | ||||||||||||||||

Income (loss) from continuing operations, net of taxes | 7,168 | (237 | ) | 6,931 | (411 | ) | (4,605 | ) | 1,915 | |||||||||||||||

Interest expense, net | 11 | 267 | 278 | — | 74 | 352 | ||||||||||||||||||

Provision (benefit) for income taxes | 4,621 | 805 | 5,426 | (249 | ) | (2,654 | ) | 2,523 | ||||||||||||||||

Depreciation and amortization | 3,151 | 3,040 | 6,191 | — | 78 | 6,269 | ||||||||||||||||||

EBITDA | 14,951 | 3,875 | 18,826 | (660 | ) | (7,107 | ) | 11,059 | ||||||||||||||||

Restructuring and related charges (1) | 1,299 | 1,056 | 2,355 | — | — | 2,355 | ||||||||||||||||||

Equity in net (gain) loss of investees | — | 1,400 | 1,400 | 660 | — | 2,060 | ||||||||||||||||||

Loss (gain) on foreign currency transactions | — | (62 | ) | (62 | ) | — | — | (62 | ) | |||||||||||||||

Litigation expense (2) | — | — | — | — | 143 | 143 | ||||||||||||||||||

Adjusted EBITDA | $ | 16,250 | $ | 6,269 | $ | 22,519 | $ | — | $ | (6,964 | ) | $ | 15,555 | |||||||||||

(1) Restructuring and related charges include redundancy program costs of $553, other severance costs of $182 and value enhancement implementation costs of $321 within WD Services and $199 of former CEO departure costs and value enhancement implementation initiative costs of $1,100 for NET Services.

(2) Litigation expense related to defense cost for a putative stockholder class action derivative complaint, which is more fully described in the Company's Form 10-K.

--more--

Providence Service Corporation

Page 11

The Providence Service Corporation

Summary Financial Information of Equity Investments (1)

(in thousands)

(Unaudited)

Three months ended March 31, 2018 | |||||||||||||||

Matrix Investment | Mission Providence | Other | Total | ||||||||||||

Revenue | $ | 67,429 | $ | — | $ | 864 | $ | 68,293 | |||||||

Operating expense (2) | 59,166 | — | 805 | 59,971 | |||||||||||

Depreciation and amortization | 9,052 | — | 8 | 9,060 | |||||||||||

Operating income (loss) | (789 | ) | — | 51 | (738 | ) | |||||||||

Other expense (income) | — | — | (12 | ) | (12 | ) | |||||||||

Interest expense (6) | 10,343 | — | — | 10,343 | |||||||||||

Provision (benefit) for income taxes | (2,614 | ) | — | 16 | (2,598 | ) | |||||||||

Net income (loss) | (8,518 | ) | — | 47 | (8,471 | ) | |||||||||

Interest | 43.6 | % | 75.0 | % | 50.0 | % | N/A | ||||||||

Net income (loss) - Equity Investment | (3,716 | ) | — | 23 | (3,693 | ) | |||||||||

Management fee and other (3) | 1,372 | — | — | 1,372 | |||||||||||

Equity in net gain (loss) of investee | $ | (2,344 | ) | $ | — | $ | 23 | $ | (2,321 | ) | |||||

Net Debt (4) | 310,384 | ||||||||||||||

Three months ended March 31, 2017 | |||||||||||||||

Matrix Investment | Mission Providence | Other | Total | ||||||||||||

Revenue | $ | 55,855 | $ | 9,388 | $ | 425 | $ | 65,668 | |||||||

Operating expense (2) | 46,814 | 10,190 | 445 | 57,449 | |||||||||||

Depreciation and amortization | 8,033 | 1,003 | 2 | 9,038 | |||||||||||

Operating income (loss) | 1,008 | (1,805 | ) | (22 | ) | (819 | ) | ||||||||

Other expense (income) | — | 2 | (11 | ) | (9 | ) | |||||||||

Interest expense | 3,607 | 53 | — | 3,660 | |||||||||||

Provision (benefit) for income taxes | (742 | ) | 1 | (3 | ) | (744 | ) | ||||||||

Net income (loss) | (1,857 | ) | (1,861 | ) | (8 | ) | (3,726 | ) | |||||||

Interest | 46.8 | % | 75.0 | % | 50.0 | % | N/A | ||||||||

Net income (loss) - Equity Investment | (869 | ) | (1,396 | ) | (4 | ) | (2,269 | ) | |||||||

Management fee and other (5) | 209 | — | — | 209 | |||||||||||

Equity in net gain (loss) of investee | $ | (660 | ) | $ | (1,396 | ) | $ | (4 | ) | $ | (2,060 | ) | |||

(1) The results of equity method investments are excluded from the calculation of Providence's Adjusted EBITDA and Adjusted Net Income.

(2) Excludes depreciation and amortization.

(3) Includes amounts relating to management fees due from Matrix to Providence of $1,432 less Providence share-based compensation expense of $60.

(4) Represents cash of $19,616 and debt of $330,000 on Matrix's standalone balance sheet as of March 31, 2018.

(5) Includes amounts relating to management fees due from Matrix to Providence of $236 less Providence share-based compensation expense of $27.

(6) Includes $6.0 million of expense related to the acceleration of deferred financing fees upon debt refinancing

--more--

Providence Service Corporation

Page 12

The Providence Service Corporation

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA: Matrix Medical Network (1)(2)(5)

(in thousands) (Unaudited)

Three months ended March 31, | |||||||

2018 | 2017 | ||||||

Revenue | $ | 67,429 | $ | 55,855 | |||

Operating expense (3) | 59,166 | 46,814 | |||||

Depreciation and amortization | 9,052 | 8,033 | |||||

Operating income (loss) | (789 | ) | 1,008 | ||||

Interest expense | 10,343 | 3,607 | |||||

Provision (benefit) for income taxes | (2,614 | ) | (742 | ) | |||

Net income | (8,518 | ) | (1,857 | ) | |||

Depreciation and amortization | 9,052 | 8,033 | |||||

Interest expense | 10,343 | 3,607 | |||||

Provision (benefit) for income taxes | (2,614 | ) | (742 | ) | |||

EBITDA | 8,263 | 9,041 | |||||

Matrix management transaction bonuses | — | 2,163 | |||||

Management fees (4) | 3,057 | 503 | |||||

Acquisition costs | 2,169 | — | |||||

Transaction costs | 6 | 831 | |||||

Adjusted EBITDA | $ | 13,495 | $ | 12,538 | |||

(1) Matrix's Adjusted EBITDA is not included within Providence's Adjusted EBITDA in any period presented.

(2) Providence accounts for its proportionate share of Matrix's results using the equity method.

(3) Excludes depreciation and amortization.

(4) Management fees in Q1 2018 include fees earned in association with the acquisition of HealthFair.

(5) 2018 includes the results of HealthFair since the date of acquisition

--more--

Providence Service Corporation

Page 13

The Providence Service Corporation

Reconciliation of Non-GAAP Financial Measures

Adjusted Net Income and Adjusted Net Income per Common Share:

(in thousands, except share and per share data)

(Unaudited)

Three months ended March 31, | |||||||||

2018 | 2017 | ||||||||

Income from continuing operations, net of tax | $ | 5,734 | $ | 1,915 | |||||

Net loss (income) attributable to noncontrolling interests | (296 | ) | (374 | ) | |||||

Restructuring and related charges (1) | 2,888 | 2,355 | |||||||

Equity in net (gain) loss of investees | 2,321 | 2,060 | |||||||

Loss (gain) on foreign currency transactions | (623 | ) | (62 | ) | |||||

Intangible amortization expense | 2,070 | 1,963 | |||||||

Litigation (income) expense, net (2) | — | 143 | |||||||

Impact of adjustments on noncontrolling interests | 2 | (18 | ) | ||||||

Tax effected impact of adjustments | (1,417 | ) | (1,370 | ) | |||||

Adjusted Net Income | 10,679 | 6,612 | |||||||

Dividends on convertible preferred stock | (1,089 | ) | (1,090 | ) | |||||

Income allocated to participating securities | (1,278 | ) | (708 | ) | |||||

Adjusted Net Income available to common stockholders | $ | 8,312 | $ | 4,814 | |||||

Adjusted EPS | $ | 0.63 | $ | 0.35 | |||||

Diluted weighted-average number of common shares outstanding | 13,199,440 | 13,768,524 | |||||||

(1) Restructuring and related charges are comprised of employee separation costs, severance and other costs related to the former CEO of Providence, NET Services chief executive officer search fees, as well as third-party consulting and implementation costs related to WD Services' Ingeus Futures initiative and NET Services' LogistiCare Member Experience initiative and costs related to the consolidation of the holding company activities into LogistiCare. See the above Segment Information and Adjusted EBITDA tables for a detailed breakdown of the restructuring and related charges for each time period presented.

(2) Income or expense related to defense cost and final settlement for a putative stockholder class action derivative complaint, which is more fully described in the Company's Form 10-K.

--more--

Providence Service Corporation

Page 14

The Providence Service Corporation

Segment-Level Impact of ASC 606 Adoption

(in thousand)

(Unaudited)

The following table summarizes the impact that the adoption of ASC 606, Revenue from Contracts with Customers, had on the Company's Q1 2018 results;

Three Months Ended March 31, 2018 | Three Months Ended March 31, 2017 (1) | |||||||||||||||||

Segment | Caption | Historical US GAAP | ASC 606 Adjustment | As Reported | As Reported | |||||||||||||

NET Services (2) | Revenue | $ | 340,633 | $ | (3,937 | ) | $ | 336,696 | $ | 324,034 | ||||||||

Adjusted EBITDA | 23,881 | — | 23,881 | 16,250 | ||||||||||||||

WD Services (3) | Revenue | 74,715 | (5,365 | ) | 69,350 | 75,460 | ||||||||||||

Adjusted EBITDA | 6,272 | (3,452 | ) | 2,820 | 6,269 | |||||||||||||

Corporate and Other | Revenue | — | — | — | — | |||||||||||||

Adjusted EBITDA | (7,415 | ) | — | (7,415 | ) | (6,964 | ) | |||||||||||

Total Continuing Operations | Revenue | $ | 415,348 | $ | (9,302 | ) | $ | 406,046 | $ | 399,494 | ||||||||

Adjusted EBITDA | 22,738 | (3,452 | ) | 19,286 | 15,555 | |||||||||||||

5.5 | % | 4.7 | % | 3.9 | % | |||||||||||||

(1) The company adopted ASC 606 using the modified retrospective method resulting in an opening retained earnings adjustment of $5.7 million, primarily related to the acceleration of revenue for the UK Work Program. Prior periods are not adjusted for the new revenue standard.

(2) NET Services Q1 2018 revenue was impacted by a change to recognize revenue for one contract on a net basis. There is no margin impact for this adjustment

(3) WD Services Q1 2018 revenue was primarily impacted by the acceleration of revenue under the UK Work Programme, including the amount of revenue captured in the opening balance sheet adjustment, as well as the deferral of revenue for

the Youth Services program which will be recognized as the courses are delivered in the summer and fall of 2018. Adjustment is also made for direct costs associated with the revenue adjustments.

###

Q1 2018 Update May 10, 2018

Forward-looking Statements and Non-GAAP Financial Information Forward-looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,” “anticipate,” “should” and “likely” and similar expressions identify forward-looking statements. In addition, statements that are not historical should also be considered forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Such forward-looking statements are based on current expectations that involve a number of known and unknown risks, uncertainties and other factors which may cause actual events to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, our continuing relationship with government entities and our ability to procure business from them, our ability to manage growing and changing operations, the implementation of healthcare reform law, government budget changes and legislation related to the services that we provide, our ability to renew or replace existing contracts that have expired or are scheduled to expire with significant clients, and other risks detailed in Providence’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Providence is under no obligation to (and expressly disclaims any such obligation to) update any of the information in this press release if any forward-looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise. Non-GAAP Financial Information In addition to the financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release includes EBITDA, Adjusted EBITDA and Segment-level Adjusted EBITDA for the Company and its operating segments, and Adjusted Net Income and Adjusted EPS for the Company, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before certain items, including (as applicable): (1) restructuring and related charges including costs related to the corporate reorganization, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) gain or loss on sale of equity investments, (6) management fees and (7) transaction and related costs. Segment-level Adjusted EBITDA is calculated as Adjusted EBITDA for the company excluding the Adjusted EBITDA associated with corporate and holding company costs reported as our Corporate and Other Segment. Adjusted Net Income is defined as income (loss) from continuing operations, net of tax, before certain items, including (1) restructuring and related charges, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) intangible amortization expense, (6) gain or loss on sale of equity investments, (7) the impact of the Tax Cuts and Jobs Act, (8) excess tax charges associated with long term incentive plans, (9) the impact of adjustments on non-controlling interests, (10) certain transaction and related costs and (11) the income tax impact of such adjustments. Adjusted EPS is calculated as Adjusted Net Income less (as applicable): (1) dividends on convertible preferred stock, (2) accretion of convertible preferred stock discount, and (3) income allocated to participating stockholders, divided by the diluted weighted-average number of common shares outstanding. We utilize these non- GAAP performance measures, which exclude certain expenses and amounts, because we believe the timing of such expenses is unpredictable and not driven by our core operating results, and therefore render comparisons with prior periods as well as with other companies in our industry less meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net earnings in equity investees are excluded from these measures, as we do not have the ability to manage these ventures, allocate resources within the ventures, or directly control their operations or performance. Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non- GAAP financial information is not meant to be considered in isolation from or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business. Page 2

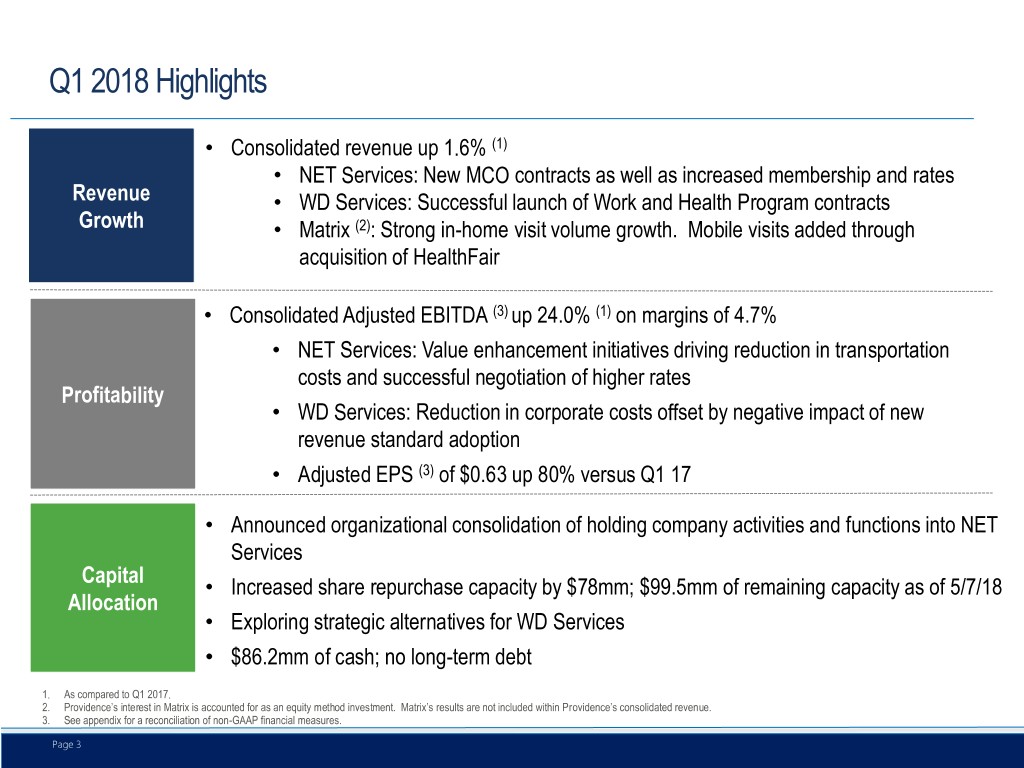

Q1 2018 Highlights • Consolidated revenue up 1.6% (1) • NET Services: New MCO contracts as well as increased membership and rates Revenue • WD Services: Successful launch of Work and Health Program contracts Growth • Matrix (2): Strong in-home visit volume growth. Mobile visits added through acquisition of HealthFair • Consolidated Adjusted EBITDA (3) up 24.0% (1) on margins of 4.7% • NET Services: Value enhancement initiatives driving reduction in transportation costs and successful negotiation of higher rates Profitability • WD Services: Reduction in corporate costs offset by negative impact of new revenue standard adoption • Adjusted EPS (3) of $0.63 up 80% versus Q1 17 • Announced organizational consolidation of holding company activities and functions into NET Services Capital • Increased share repurchase capacity by $78mm; $99.5mm of remaining capacity as of 5/7/18 Allocation • Exploring strategic alternatives for WD Services • $86.2mm of cash; no long-term debt 1. As compared to Q1 2017. 2. Providence’s interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue. 3. See appendix for a reconciliation of non-GAAP financial measures. Page 3

NET Services • Revenue growth driven by new MCO contracts in New York and Indiana and new state contracts in Texas as well as higher membership and rates across multiple regions Q1 2018 • Value Enhancement initiatives continuing to reduce transportation costs Highlights • Successful launch of multiple new contracts, including in Illinois, Indiana, and Oregon • Continued talent investment in key areas such as IT, Sales, and Strategy % FYE FYE LTM $Millions Q1:17 Q1:18 Growth 2016 2017 Q1:18 Key Financial Revenue 324.0 336.7 3.9% 1,233.7 1,318.2 1,330.9 Metrics Adjusted EBITDA (1) 16.2 23.9 92.4 85.3 93.0 (1) % Margin 5.0% 7.1% 7.5% 6.5% 7.0% Capex 3.7 2.6 10.8 15.3 14.2 • Continued implementation of Value Enhancement initiatives, including development of next generation reservation software, incorporation of route optimization technology, and nationwide deployment of real-time GPS capabilities 2018 Focus • Reinvest portion of Value Enhancement savings to drive organic growth and build further competitive advantages • Organic growth initiatives within NEMT and new adjacent markets and services 1. See appendix for a reconciliation of non-GAAP financial measures. Page 4

WD Services • Successful launch of all Work & Health Program contracts • Additional UK Health contract wins adds to revenue diversification Q1 2018 • New revenue recognition standard adoption negatively impacting both revenue and Adj. Highlights EBITDA • Negative $5.4mm and negative $3.5mm impact to revenue and Adj. EBITDA, respectively, in Q1 2018 % FYE FYE LTM $Millions Q1:17 Q1:18 Growth 2016 2017 Q1:18 Key Financial Revenue 75.5 69.4 -8.1% 344.4 305.7 299.6 Metrics (1) Adjusted EBITDA (2) 6.3 2.8 5.5 16.3 12.9 (2) % Margin 8.3% 4.1% 1.6% 5.3% 4.3% Capex 2.0 2.4 19.8 4.5 4.9 • Evaluation of strategic alternatives for WD Services segment • Constructively work with UK Ministry of Justice on the Probation System Review to 2018 Focus achieve further improvements to the future funding of the Offender Rehabilitation Program • Ramp up of new contracts (Work & Health and UK Health contracts) • Further business development within UK Skills, Health, and Youth Services markets 1. Adjusted EBITDA in historical periods excludes Mission Providence as this JV was accounted for as an equity method investment. 2. See appendix for a reconciliation of non-GAAP financial measures. Page 5

Matrix Investment • Revenue growth in excess of 20% supported by organic in-home visit volume growth and introduction of mobile visits from HealthFair acquisition Q1 2018 • Closed HealthFair acquisition and began integration process Highlights • Completed integration of LP Health • Contract start-up costs at HealthFair negatively impacted margins in the quarter % FYE FYE LTM $Millions Q1:17 Q1:18 Growth 2016 2017 Q1:18 Revenue 55.9 67.4 20.7% 207.7 227.9 239.4 Key Financial (2) Adjusted EBITDA 12.5 13.5 51.7 51.7 52.6 (1) Metrics (2) % Margin 22.4% 20.0% 24.9% 22.7% 22.0% Capex 1.8 2.3 12.5 11.0 11.6 Net Debt 310.4 • Integration of HealthFair acquisition and capture of associated revenue and cost synergies • Conversion of 2017 new customer wins at Matrix and HealthFair into strong organic growth 2018 Focus • Continued new sales momentum supported by introduction of additional ancillary services and tests, combined in-home and mobile offerings, and quality visits 1. Represents 100% of Matrix’s results of operations. Providence’s equity interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated results of operations in any period presented. Results reflect HealthFair from its acquisition date of February 16, 2018, and no periods are presented on a pro- forma basis. See appendix for additional detail. 2. See appendix for a reconciliation of non-GAAP financial measures. Page 6

Segment Results $Millions Q1:17 Q1:18 2016 2017 LTM Q1:18 Revenue % Growth NET Services 324.0 336.7 3.9% 1,233.7 1,318.2 1,330.9 WD Services 75.5 69.4 -8.1% 344.4 305.7 299.6 (1) Total Revenue 399.5 406.0 1.6% 1,578.2 1,623.9 1,630.4 (2) Matrix 55.9 67.4 20.7% 207.7 227.9 239.4 Adj. EBITDA (3) NET Services 16.2 23.9 92.4 85.3 93.0 WD Services 6.3 2.8 5.5 16.3 12.9 Total Segment-Level 22.5 26.7 97.8 101.7 105.8 Corporate and Other (7.0) (7.4) (25.6) (29.2) (29.7) Total Adj. EBITDA 15.6 19.3 72.2 72.4 76.2 Matrix (2) 12.5 13.5 51.7 51.7 52.6 Adj. EBITDA Margins (3) NET Services 5.0% 7.1% 7.5% 6.5% 7.0% WD Services 8.3% 4.1% 1.6% 5.3% 4.3% Segment-Level 5.6% 6.6% 6.2% 6.3% 6.5% Total 3.9% 4.8% 4.6% 4.5% 4.7% Matrix (2) 22.4% 20.0% 24.9% 22.7% 22.0% Memo: Revenue Recognition Std Impact Revenue: NET Services (3.9) Revenue: WD Services (5.4) Total Revenue Impact (9.3) Adj. EBITDA: NET Services - Adj. EBITDA: WD Services (3.5) Total Adj. EBITDA Impact (3.5) 1. Total Revenue includes revenue from Corporate and Other. 2. Represents 100% of Matrix’s total revenue and Adj. EBITDA. Providence’s equity interest is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue or Adjusted EBITDA in any period presented. Results reflect HealthFair from its acquisition date of February 16, 2018, and no periods are presented on a pro-forma basis. 3. See appendix for a reconciliation of non-GAAP financial measures. Page 7

Cashflow Summary FYE FYE LTM $Millions Q1:17 Q1:18 2016 2017 Q1:18 Cash Earnings (1),(2) 3.4 14.9 57.0 42.8 54.3 Working Capital (1),(3) 32.8 10.7 6.8 12.3 (9.8) Cash Earnings (After Working Capital) 36.2 25.6 63.7 55.0 44.5 Capex (Continuing Operations) 5.7 5.0 32.0 19.9 19.2 1. Includes continuing and discontinued operations. 2. Cash earnings represents cash provided by operating activities prior to changes in operating assets and liabilities. 3. Working capital represents changes in operating assets and liabilities and excludes net taxes associated with sale of Human Services of $22.0mm for FYE 2016. Page 8

Balance Sheet / Capital Structure Summary $Millions 12/31/15 12/31/16 12/31/17 3/31/18 Cash (1) 84.8 72.3 95.3 86.2 Long-term Debt (1) 305.0 - - - Net Debt 220.2 (72.3) (95.3) (86.2) Matrix Carrying Value (2) - 157.2 169.7 166.0 Shares Outstanding (mm) (3) 17.3 15.9 15.4 15.0 Share Repurchase Activity • Since 12/31/17 have repurchased 589k shares for $37.4mm (4) • 22% of common shares repurchased since beginning of Q4 2015 (5) • $99.5mm of capacity remaining (4) under current share repurchase program 1. Includes Cash and Long-term Debt related to discontinued operations. 2. Represents the carrying value of Providence’s retained equity interest in Matrix. As of 3/31/18, Providence equity ownership in Matrix was 43.6%. 3. Shares outstanding equals common shares outstanding plus total preferred shares on an as-converted basis. As of 5/7/18 shares outstanding equaled 15.0mm. 4. As of 5/7/2018. 5. Represents repurchase of common shares through 5/7/18 as a percentage of common shares outstanding at the beginning of Q4 2015 Page 9

Appendix

Adjusted EBITDA Reconciliation (Segment-Level) NET Services WD Services Segment-Level FYE FYE LTM FYE FYE LTM FYE FYE LTM $Millions Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Revenue 324.0 336.7 1,233.7 1,318.2 1,330.9 75.5 69.4 344.4 305.7 299.6 399.5 406.0 1,578.1 1,623.9 1,630.4 Income from Cont Ops after Income Taxes 7.2 14.5 47.4 41.7 49.0 (0.2) (1.6) (46.2) 10.0 8.7 6.9 12.9 1.2 51.7 57.7 Interest Expense, Net 0.0 0.0 (0.0) 0.1 0.1 0.3 0.4 0.8 1.3 1.4 0.3 0.4 0.8 1.4 1.5 Provision (Benefit) For Income Taxes 4.6 5.0 29.7 24.0 24.4 0.8 (0.1) (1.2) 1.2 0.3 5.4 4.9 28.5 25.2 24.7 Depreciation and Amortization 3.2 3.5 12.4 13.3 13.6 3.0 3.2 13.8 12.9 13.0 6.2 6.7 26.2 26.1 26.6 EBITDA 15.0 23.1 89.5 79.0 87.1 3.9 1.8 (32.8) 25.4 23.4 18.8 24.9 56.7 104.5 110.5 Asset Impairment - - - - - - - 19.6 - - - - 19.6 - - Restructuring and Related Expense 0.2 - 0.9 0.2 0.0 0.7 1.6 9.0 2.8 3.6 0.9 1.6 9.8 3.0 3.7 Value Enhancement Initiative Implementation 1.1 0.8 2.0 6.1 5.8 0.3 - 2.6 0.8 0.5 1.4 0.8 4.6 6.9 6.3 Equity in Net Loss (Gain) of Investee - - - - - 1.4 (0.0) 8.5 1.4 (0.0) 1.4 (0.0) 8.5 1.4 (0.0) (Gain) on Sale of Mission Providence - - - - - - - - (12.4) (12.4) - - - (12.4) (12.4) Ingeus Acquisition Related Cost / Income - - - - - - - - (2.0) (2.0) - - - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - - - - - - - - Foreign Currency (Gain) / Loss - - - - - (0.1) (0.6) (1.4) 0.3 (0.2) (0.1) (0.6) (1.4) 0.3 (0.2) Litigation Expense - - - - - - - - - - - - - - - Adjusted EBITDA 16.2 23.9 92.4 85.3 93.0 6.3 2.8 5.5 16.3 12.9 22.5 26.7 97.8 101.7 105.8 % Margin 5.0% 7.1% 7.5% 6.5% 7.0% 8.3% 4.1% 1.6% 5.3% 4.3% 5.6% 6.6% 6.2% 6.3% 6.5% Page 11

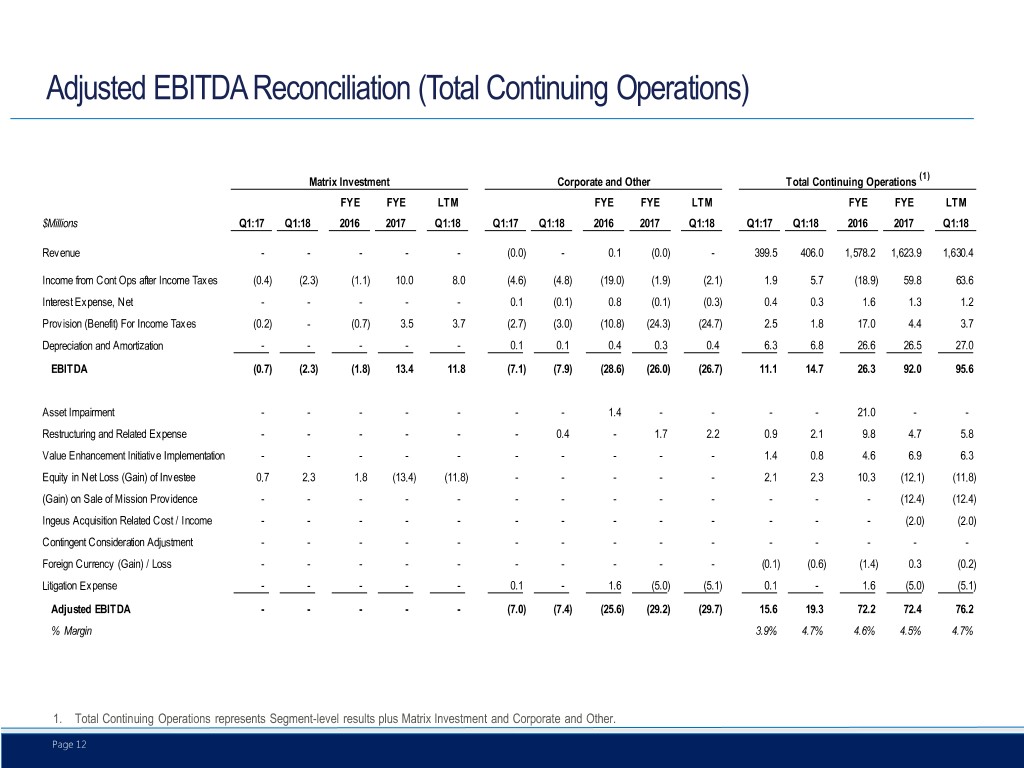

Adjusted EBITDA Reconciliation (Total Continuing Operations) (1) Matrix Investment Corporate and Other Total Continuing Operations FYE FYE LTM FYE FYE LTM FYE FYE LTM $Millions Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Q1:17 Q1:18 2016 2017 Q1:18 Revenue - - - - - (0.0) - 0.1 (0.0) - 399.5 406.0 1,578.2 1,623.9 1,630.4 Income from Cont Ops after Income Taxes (0.4) (2.3) (1.1) 10.0 8.0 (4.6) (4.8) (19.0) (1.9) (2.1) 1.9 5.7 (18.9) 59.8 63.6 Interest Expense, Net - - - - - 0.1 (0.1) 0.8 (0.1) (0.3) 0.4 0.3 1.6 1.3 1.2 Provision (Benefit) For Income Taxes (0.2) - (0.7) 3.5 3.7 (2.7) (3.0) (10.8) (24.3) (24.7) 2.5 1.8 17.0 4.4 3.7 Depreciation and Amortization - - - - - 0.1 0.1 0.4 0.3 0.4 6.3 6.8 26.6 26.5 27.0 EBITDA (0.7) (2.3) (1.8) 13.4 11.8 (7.1) (7.9) (28.6) (26.0) (26.7) 11.1 14.7 26.3 92.0 95.6 Asset Impairment - - - - - - - 1.4 - - - - 21.0 - - Restructuring and Related Expense - - - - - - 0.4 - 1.7 2.2 0.9 2.1 9.8 4.7 5.8 Value Enhancement Initiative Implementation - - - - - - - - - - 1.4 0.8 4.6 6.9 6.3 Equity in Net Loss (Gain) of Investee 0.7 2.3 1.8 (13.4) (11.8) - - - - - 2.1 2.3 10.3 (12.1) (11.8) (Gain) on Sale of Mission Providence - - - - - - - - - - - - - (12.4) (12.4) Ingeus Acquisition Related Cost / Income - - - - - - - - - - - - - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - - - - - - - - Foreign Currency (Gain) / Loss - - - - - - - - - - (0.1) (0.6) (1.4) 0.3 (0.2) Litigation Expense - - - - - 0.1 - 1.6 (5.0) (5.1) 0.1 - 1.6 (5.0) (5.1) Adjusted EBITDA - - - - - (7.0) (7.4) (25.6) (29.2) (29.7) 15.6 19.3 72.2 72.4 76.2 % Margin 3.9% 4.7% 4.6% 4.5% 4.7% 1. Total Continuing Operations represents Segment-level results plus Matrix Investment and Corporate and Other. Page 12

Adjusted EBITDA Reconciliation (Matrix) (1) Matrix FYE 2016 Q4:2016 FYE FYE HA HA (3) (3) (2) (3) (2) (3) $Millions Q1:17 Q1:18 2016 2017 Services Matrix Total Services Matrix Total Revenue 55.9 67.4 207.7 227.9 166.1 41.6 207.7 10.7 41.6 52.3 Net Income (Loss) (1.9) (8.5) 110.1 26.7 114.3 (4.2) 110.1 109.0 (4.2) 104.8 Interest Expense, Net 3.6 10.3 12.9 14.8 9.9 2.9 12.9 0.6 2.9 3.6 Provision (Benefit) For Income Taxes (0.7) (2.6) 60.4 (29.6) 63.3 (2.8) 60.4 59.9 (2.8) 57.1 Depreciation and Amortization 8.0 9.1 27.5 33.5 21.1 6.4 27.5 - 6.4 6.4 EBITDA 9.0 8.3 210.9 45.4 208.6 2.3 210.9 169.5 2.3 171.8 Gain on Disposition - - (167.9) - (167.9) - (167.9) (167.9) - (167.9) Management Fee 0.5 3.1 - 2.3 - - - - - - Transaction Costs 3.0 2.1 6.4 3.9 0.0 6.3 6.4 (0.8) 6.4 5.6 Write-off of Deferred Financing Costs - - 2.3 - 2.3 - 2.3 2.3 - 2.3 Adjusted EBITDA 12.5 13.5 51.7 51.7 43.1 8.6 51.7 3.1 8.6 11.7 % Margin 22.4% 20.0% 24.9% 22.7% Reconciliation of Income / Loss from Equity Investment to Matrix Net Income (4) Equity in Net Gain (Loss) of Investee (0.7) (2.3) (1.9) (0.7) (0.7) Management Fee and Other (0.2) (1.4) (1.0) (0.2) (0.2) Net Gain (Loss) - Equity Investment (0.9) (3.7) (2.9) (0.9) (0.9) Divided by: Providence % Equity Investment in Matrix (5) 46.6% 43.6% 46.6% 46.8% 46.8% Matrix Net Income Standalone (1.9) (8.5) (6.3) (1.8) (1.8) 1. Represents 100% of Matrix’s results including the results of HealthFair since its acquisition of February 16, 2018. Providence’s retained equity interest is now accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue or Adjusted EBITDA in any period presented. 2. Represents Matrix's results of operation through the Matrix Transaction on October 19, 2016. These results are included within Discontinued Operations on the Company's consolidated financial statements. 3. Represents Matrix's results of operation from October 20, 2016 to December 31, 2017, as applicable. Providence accounts for its proportionate share of Matrix's results during this time period using the equity method. 4. A reconciliation has been provided to bridge from the income from Equity in net gain (loss) of investee to Matrix’s standalone Net Income for periods following the Matrix JV transaction. 5. For FYE 2017, % Equity Interest represents Providence’s equity interest in Matrix as of December 31, 2017. It should be noted that Providence’s equity interest in Matrix decreased from 46.8% to 46.6% primarily due to a rollover of management bonuses into equity during Q3:2017. In addition, Providence’s equity interest in Matrix decreased to 43.6% following the rollover of certain HealthFair equity interests related to the acquisition during Q1:2018. Page 13

Adjusted EPS Reconciliation $Millions, Except Per Share Amounts Q1:17 Q1:18 Income from Continuing Operations, Net of Tax 1.9 5.7 Net Loss (Income) Attributable to Non-Controlling Interest (0.4) (0.3) Amortization 2.0 2.1 Restructuring and Related Expense 0.9 2.1 Value Enhancement Initiative Implementation 1.4 0.8 Equity in Net Loss of Investee 2.1 2.3 Foreign Currency (Gain) / Loss (0.1) (0.6) Litigation Expense / (Income) 0.1 - Impact of Non-Controlling Interest (0.0) 0.0 Tax Impact of Adjustments (1.4) (1.4) Adjusted Net Income 6.6 10.7 Dividends on Convertible Preferred Stock (1.1) (1.1) Income Allocated to Participating Securities (0.7) (1.3) Adjusted Net Income to Common Stockholders 4.8 8.3 Adjusted EPS 0.35 0.63 Diluted Weighted-Average Common Shares Outstanding 13.8 13.2 Page 14