Form 425 FAIRMOUNT SANTROL HOLDIN Filed by: Unimin Corp

May 2018 Fairmount and Unimin to create Covia A Compelling Strategic Transaction Creating a Leader in Proppant and Industrial Materials Solutions Filed by Unimin Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Fairmount Santrol Holdings Inc. (Commission File No. 001-36670)

Disclaimer and Forward Looking Statements CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION This presentation contains statements which, to the extent they are not statements of historical or present fact, constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. All forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause actual results to differ materially from those anticipated or implied in forward looking statements are described in the registration statement on Form S-4 filed by Unimin Corporation (“Unimin”) under "Risk Factors," and in Fairmount Santrol’s Form 10-K under the heading “Cautionary Statement Regarding Forward-Looking Information”, as well as the information included in Fairmount Santrol’s Current Reports on Form 8-K and other factors that are set forth in management’s discussion and analysis of Fairmount Santrol’s most recently filed reports with the Securities and Exchange Commission (“SEC”). Additional important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: the proposed transaction (the “merger”) with Unimin not being timely completed, if completed at all; if the merger is completed, the impact of any undertakings required by the parties in order to obtain regulatory approvals; prior to the completion of the merger, Unimin’s and/or Fairmount Santrol’s respective businesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, business partners or governmental entities; the industry may be subject to future regulatory or legislative actions that could adversely affect Unimin’s and/or Fairmount Santrol’s respective businesses; and the parties being unable to successfully implement integration strategies. While Unimin and/or Fairmount Santrol may elect to update forward-looking statements at some point in the future, Unimin and Fairmount Santrol specifically disclaim any obligation to do so, even if estimates change and, therefore, you should not rely on these forward-looking statements as representing our views as of any date subsequent to today. Additional Information FAIRMOUNT SANTROL STOCKHOLDERS ARE ENCOURAGED TO READ THE PROXY STATEMENT, DATED APRIL 26, 2018, FOR THE SPECIAL MEETING OF FAIRMOUNT SANTROL STOCKHOLDERS SCHEDULED TO BE HELD ON MAY 25, 2018 AS FILED WITH THE SEC ON SCHEDULE 14A AND THE UNIMIN REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT IS PART OF THE REGISTRATION STATEMENT BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The final proxy statement/prospectus will be mailed to stockholders of Fairmount Santrol. Investors and security holders will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, or from Fairmount Santrol at its website, www.Fairmount Santrol.com. Participants in Solicitation Fairmount Santrol and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the merger. Information concerning Fairmount Santrol’s participants is set forth in the proxy statement, dated April 6, 2017, for Fairmount Santrol’s 2017 Annual Meeting of stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the merger is included in the registration statement and proxy statement/prospectus and other relevant materials filed with the SEC.

Disclaimer and Forward Looking Statements Note on Combined Company Data The combined company information included in this presentation has been prepared based on the arithmetic sum of the historical results of Fairmount Santrol and Unimin, and was not prepared in accordance with Regulation S-X of the SEC’s rules for pro forma financial information, and you should therefore not place undue reliance on this information. For a presentation of the combined company results for the year-ended December 31, 2017, on a pro forma basis, prepared in accordance with the pro forma requirements of Regulation S-X, see Unimin’s Form S-4 which has been filed with the SEC. Financial Forecasts The information contained herein includes certain financial forecasts, statements, estimates and projections (collectively, the “financial forecasts”) with respect to, among other matters, anticipated future performance of Fairmount Santrol and Unimin and anticipated industry trends. These financial forecasts are inherently based on various estimates and assumptions that are subject to the judgment of those preparing them. These financial forecasts are also subject to significant economic, competitive, industry and other uncertainties and contingencies, all of which are difficult or impossible to predict and many of which are beyond the control of Fairmount Santrol and Unimin. There can be no assurance that these financial forecasts will be realized or that actual results will not be significantly higher or lower than forecasted. The financial forecasts cover multiple years and become subject to greater uncertainty with each successive year. In addition, the financial forecasts also reflect assumptions that are subject to change and do not reflect revised prospects for Fairmount Santrol’s and Unimin’s businesses, changes in general business or economic conditions or any other transaction or event that has occurred or that may occur and that was not anticipated at the time the financial forecasts were prepared. The financial forecasts were not prepared with a view toward public disclosure or toward complying with U.S. GAAP, the published guidelines of the SEC regarding projections and the use of non-GAAP measures or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of prospective financial information. As a result, the inclusion of the financial forecasts in this document should not be relied on as necessarily predictive of actual future events or results. None of Unimin, Fairmount Santrol or their respective affiliates, advisors, officers, directors or other representatives can provide any assurance that actual results will not differ from the financial forecasts presented herein. None of Unimin, Fairmount Santrol or their respective affiliates, advisors, officers, directors or representatives has made or makes any representation regarding the combined company’s ultimate performance compared to the information contained in the financial forecasts or that forecast results will be achieved.

Section 1 Significant Value Delivered to Fairmount Shareholders Covia

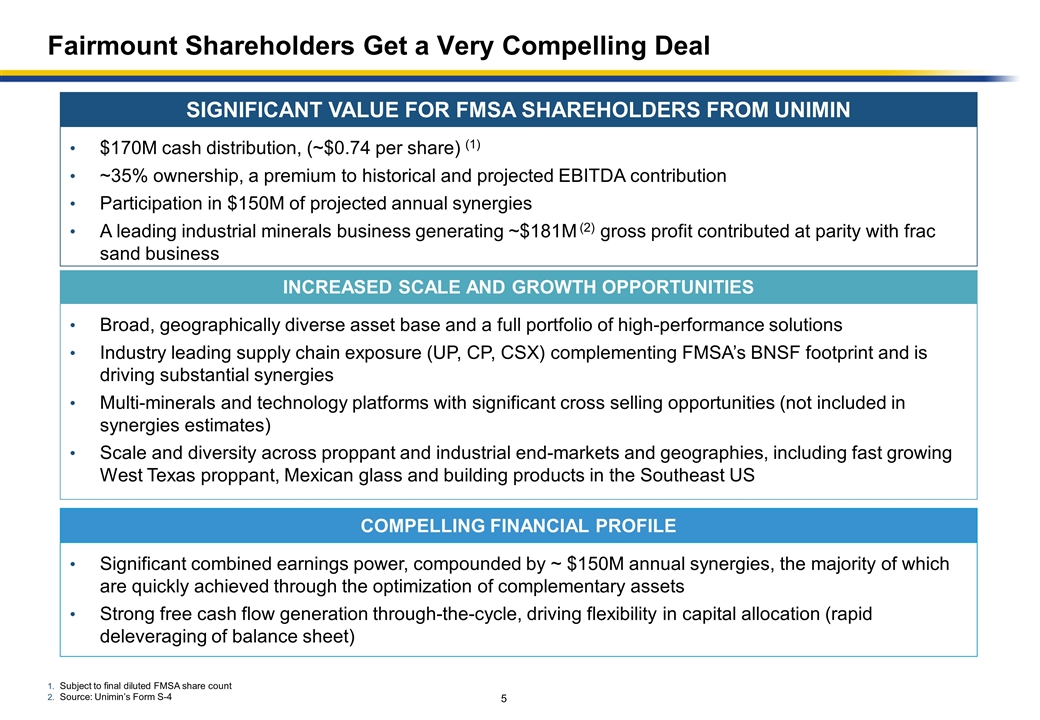

Fairmount Shareholders Get a Very Compelling Deal Subject to final diluted FMSA share count Source: Unimin’s Form S-4 INCREASED SCALE AND GROWTH OPPORTUNITIES SIGNIFICANT VALUE FOR FMSA SHAREHOLDERS FROM UNIMIN $170M cash distribution, (~$0.74 per share) (1) ~35% ownership, a premium to historical and projected EBITDA contribution Participation in $150M of projected annual synergies A leading industrial minerals business generating ~$181M (2) gross profit contributed at parity with frac sand business Broad, geographically diverse asset base and a full portfolio of high-performance solutions Industry leading supply chain exposure (UP, CP, CSX) complementing FMSA’s BNSF footprint and is driving substantial synergies Multi-minerals and technology platforms with significant cross selling opportunities (not included in synergies estimates) Scale and diversity across proppant and industrial end-markets and geographies, including fast growing West Texas proppant, Mexican glass and building products in the Southeast US COMPELLING FINANCIAL PROFILE Significant combined earnings power, compounded by ~ $150M annual synergies, the majority of which are quickly achieved through the optimization of complementary assets Strong free cash flow generation through-the-cycle, driving flexibility in capital allocation (rapid deleveraging of balance sheet)

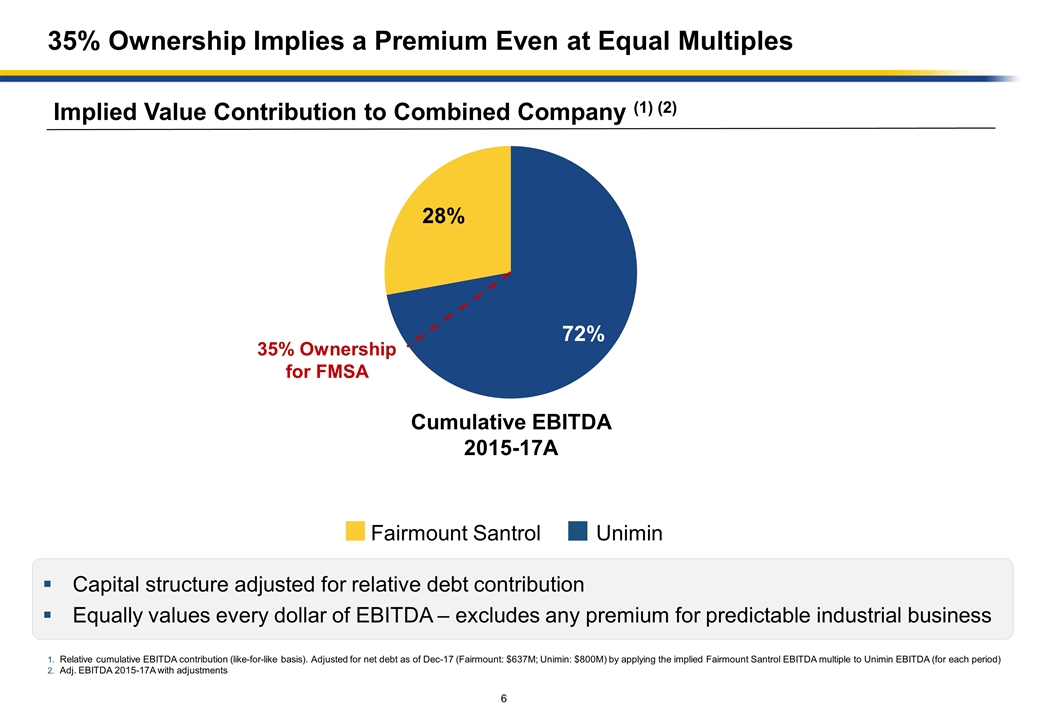

35% Ownership Implies a Premium Even at Equal Multiples Implied Value Contribution to Combined Company (1) (2) Relative cumulative EBITDA contribution (like-for-like basis). Adjusted for net debt as of Dec-17 (Fairmount: $637M; Unimin: $800M) by applying the implied Fairmount Santrol EBITDA multiple to Unimin EBITDA (for each period) Adj. EBITDA 2015-17A with adjustments Capital structure adjusted for relative debt contribution Equally values every dollar of EBITDA – excludes any premium for predictable industrial business Unimin Fairmount Santrol Cumulative EBITDA 2015-17A 35% Ownership for FMSA

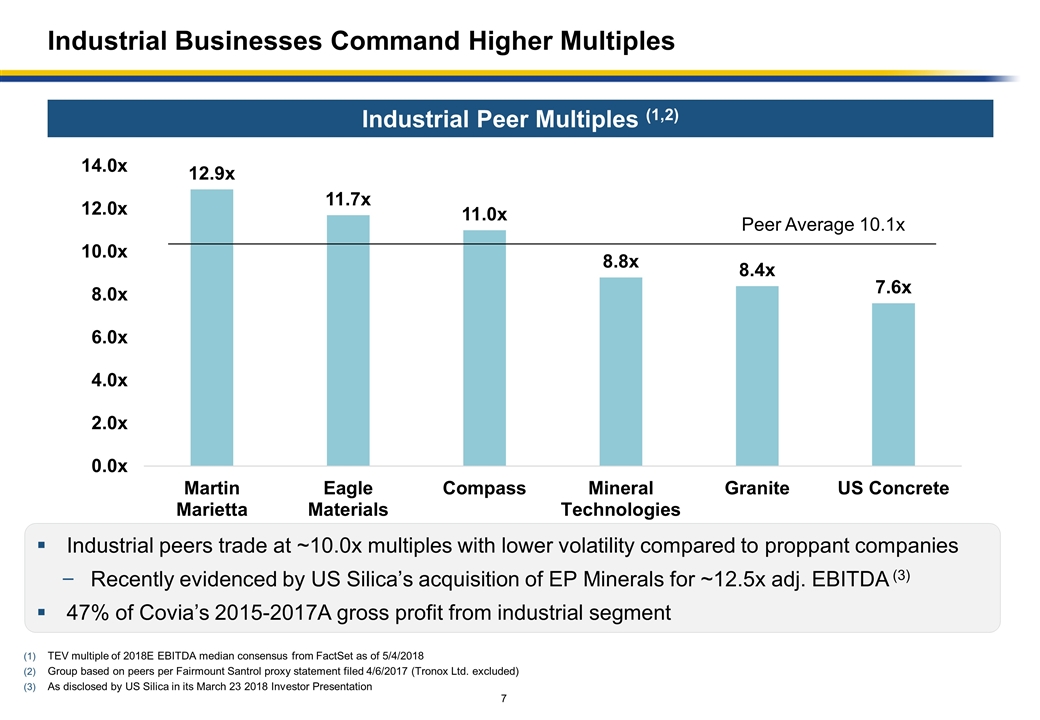

Industrial peers trade at ~10.0x multiples with lower volatility compared to proppant companies Recently evidenced by US Silica’s acquisition of EP Minerals for ~12.5x adj. EBITDA (3) 47% of Covia’s 2015-2017A gross profit from industrial segment Industrial Peer Multiples (1,2) TEV multiple of 2018E EBITDA median consensus from FactSet as of 5/4/2018 Group based on peers per Fairmount Santrol proxy statement filed 4/6/2017 (Tronox Ltd. excluded) As disclosed by US Silica in its March 23 2018 Investor Presentation Peer Average 10.1x Industrial Businesses Command Higher Multiples

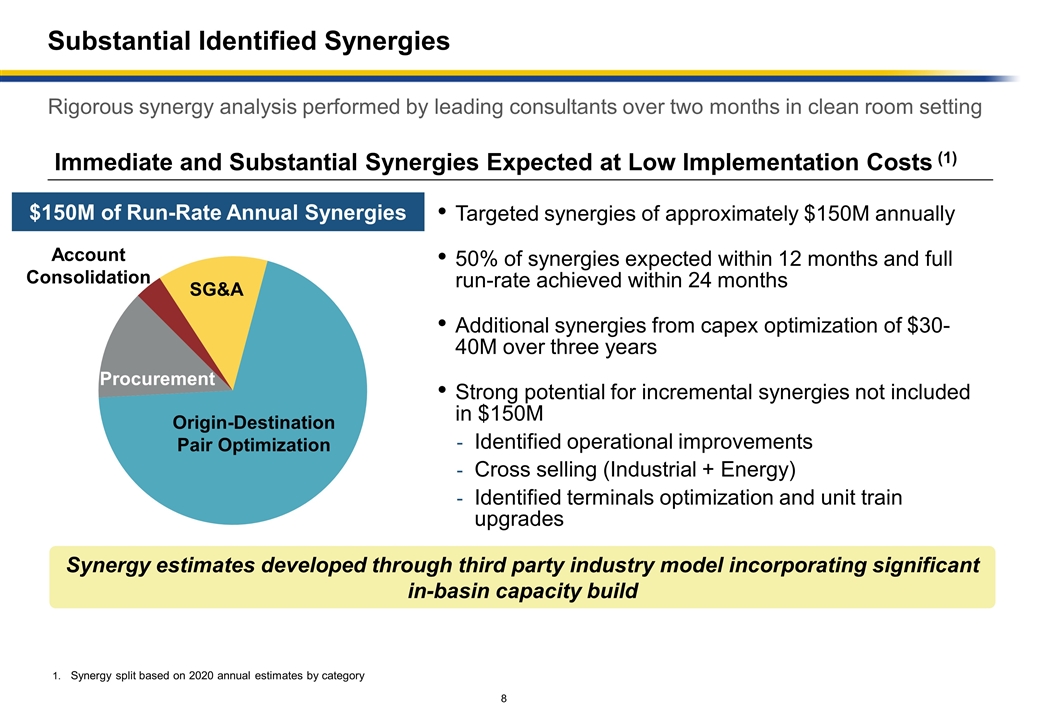

Substantial Identified Synergies Immediate and Substantial Synergies Expected at Low Implementation Costs (1) Origin-Destination Pair Optimization Account Consolidation Procurement SG&A Targeted synergies of approximately $150M annually 50% of synergies expected within 12 months and full run-rate achieved within 24 months Additional synergies from capex optimization of $30-40M over three years Strong potential for incremental synergies not included in $150M Identified operational improvements Cross selling (Industrial + Energy) Identified terminals optimization and unit train upgrades Synergy estimates developed through third party industry model incorporating significant in-basin capacity build Synergy split based on 2020 annual estimates by category Rigorous synergy analysis performed by leading consultants over two months in clean room setting $150M of Run-Rate Annual Synergies

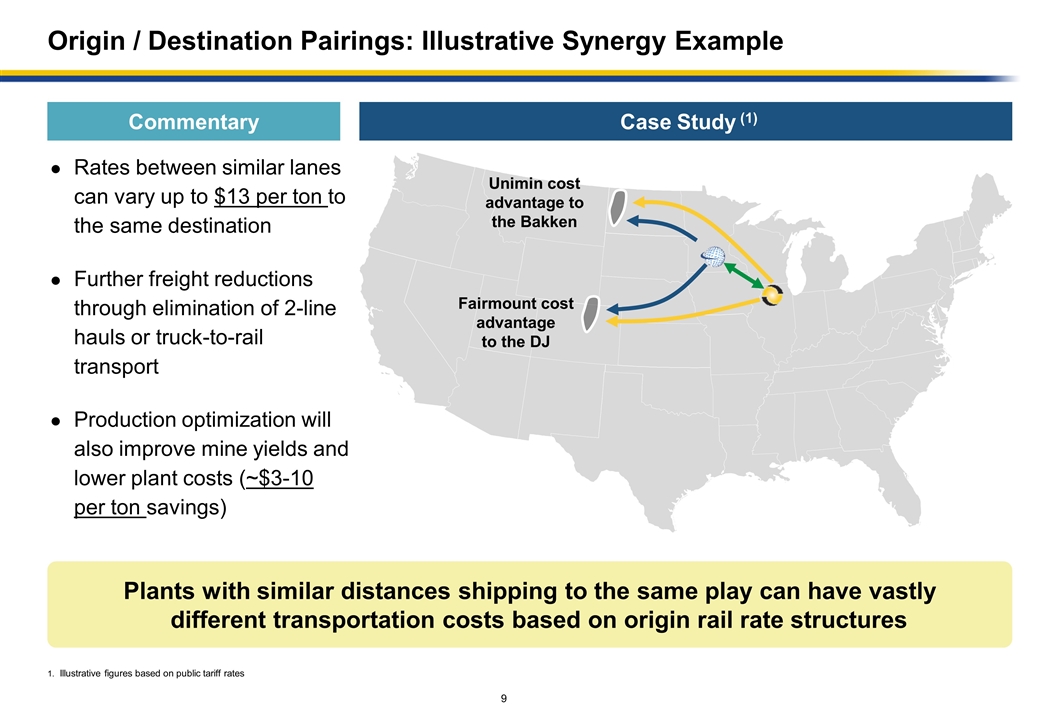

Rates between similar lanes can vary up to $13 per ton to the same destination Further freight reductions through elimination of 2-line hauls or truck-to-rail transport Production optimization will also improve mine yields and lower plant costs (~$3-10 per ton savings) Fairmount cost advantage to the DJ Unimin cost advantage to the Bakken Illustrative figures based on public tariff rates Plants with similar distances shipping to the same play can have vastly different transportation costs based on origin rail rate structures Commentary Case Study (1) Origin / Destination Pairings: Illustrative Synergy Example

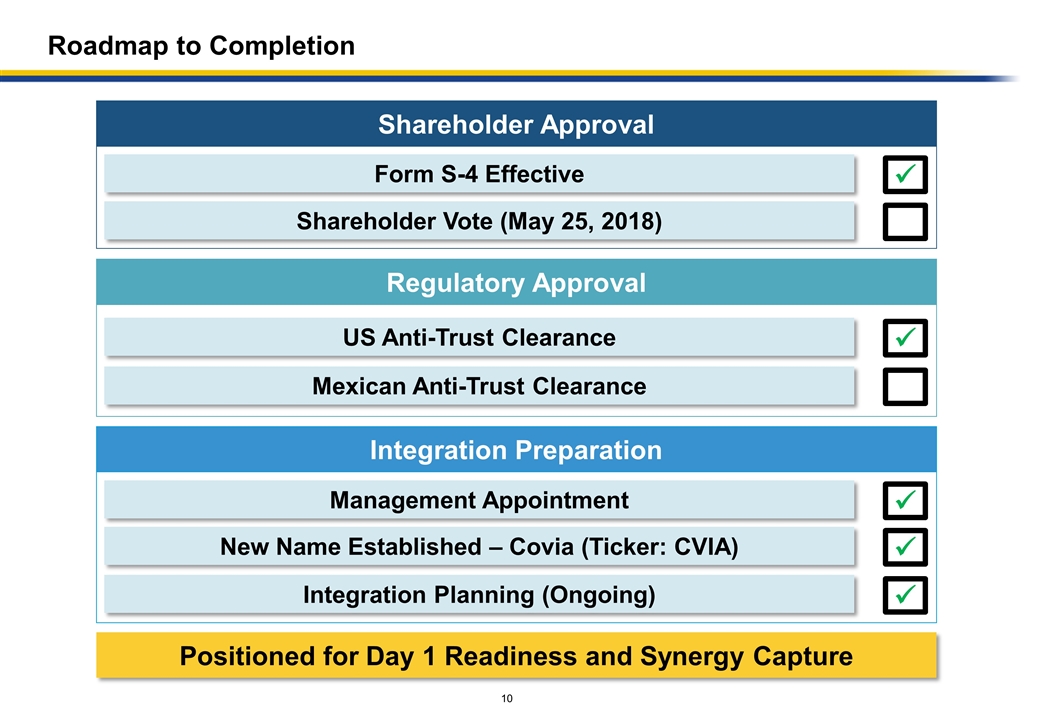

Roadmap to Completion Positioned for Day 1 Readiness and Synergy Capture Form S-4 Effective ü US Anti-Trust Clearance ü Management Appointment ü Integration Planning (Ongoing) ü Mexican Anti-Trust Clearance ü New Name Established – Covia (Ticker: CVIA) Shareholder Vote (May 25, 2018) Shareholder Approval Regulatory Approval Integration Preparation

Section 2 Key Investment Highlights Covia

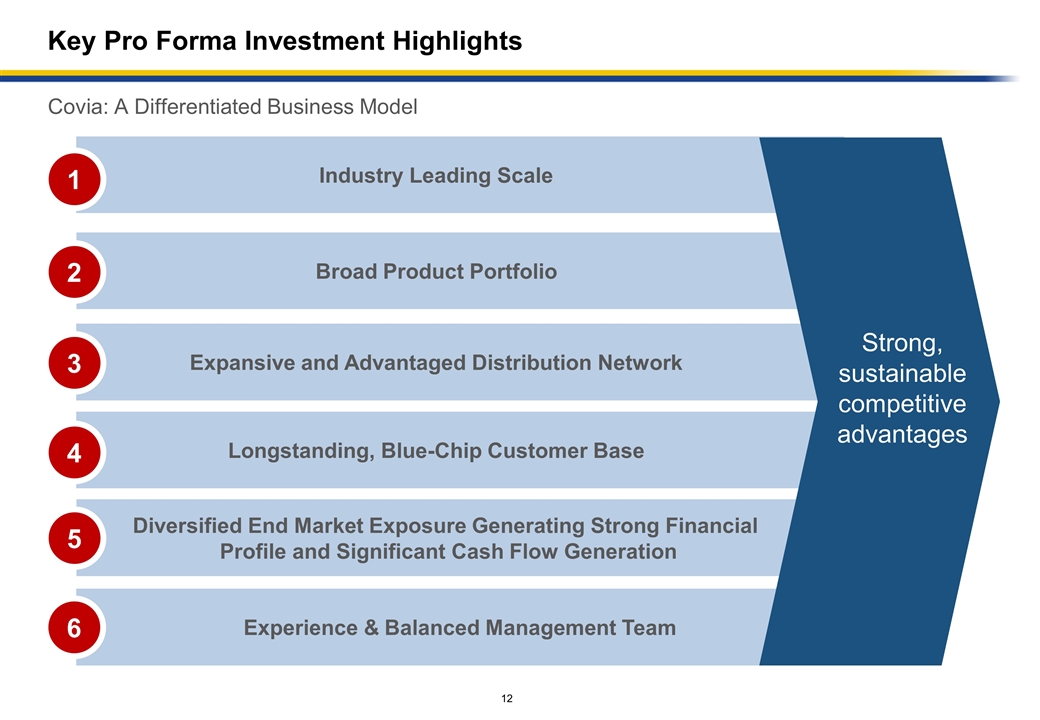

Industry Leading Scale Covia: A Differentiated Business Model Expansive and Advantaged Distribution Network Broad Product Portfolio Longstanding, Blue-Chip Customer Base Diversified End Market Exposure Generating Strong Financial Profile and Significant Cash Flow Generation 1 2 4 5 3 Key Pro Forma Investment Highlights Experience & Balanced Management Team 6 Strong, sustainable competitive advantages

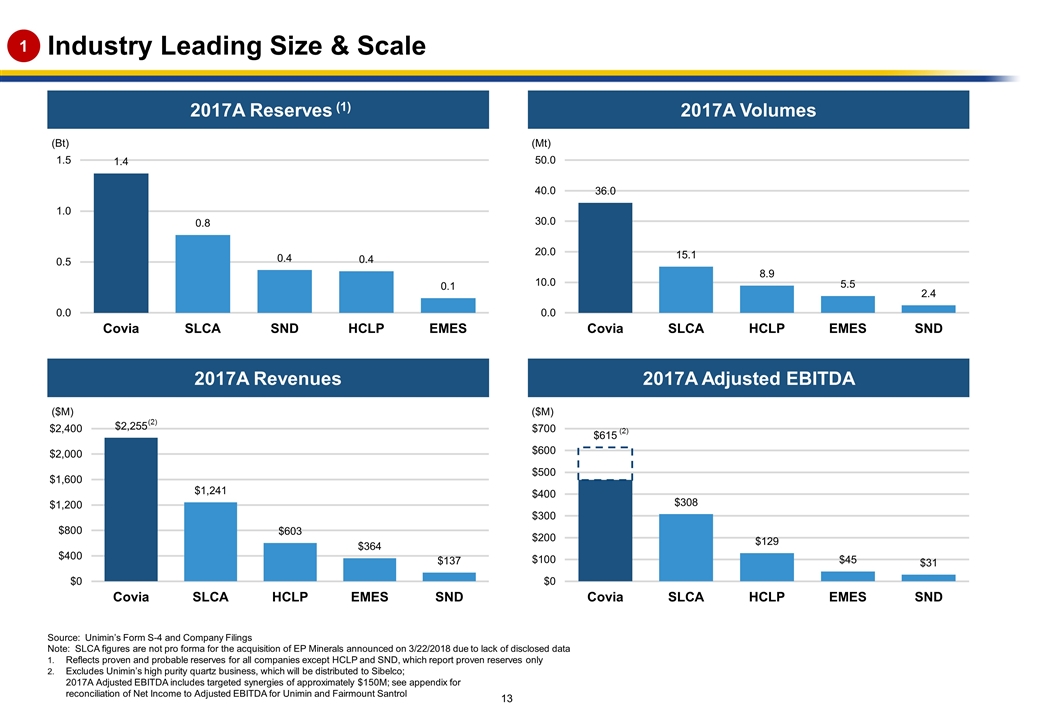

2017A Reserves (1) Source: Unimin’s Form S-4 and Company Filings Note: SLCA figures are not pro forma for the acquisition of EP Minerals announced on 3/22/2018 due to lack of disclosed data Reflects proven and probable reserves for all companies except HCLP and SND, which report proven reserves only Excludes Unimin’s high purity quartz business, which will be distributed to Sibelco; 2017A Adjusted EBITDA includes targeted synergies of approximately $150M; see appendix for reconciliation of Net Income to Adjusted EBITDA for Unimin and Fairmount Santrol 2017A Volumes 2017A Adjusted EBITDA (2) Industry Leading Size & Scale 1 2017A Revenues (2)

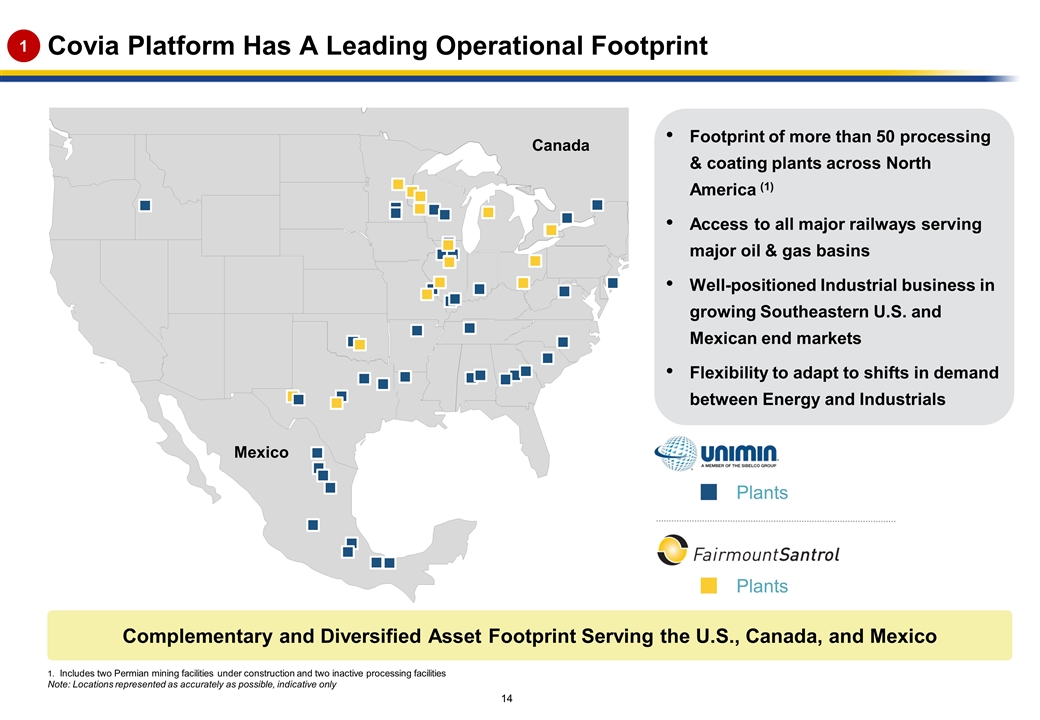

Covia Platform Has A Leading Operational Footprint Includes two Permian mining facilities under construction and two inactive processing facilities Note: Locations represented as accurately as possible, indicative only Footprint of more than 50 processing & coating plants across North America (1) Access to all major railways serving major oil & gas basins Well-positioned Industrial business in growing Southeastern U.S. and Mexican end markets Flexibility to adapt to shifts in demand between Energy and Industrials Mexico Canada 1 Plants Plants Complementary and Diversified Asset Footprint Serving the U.S., Canada, and Mexico

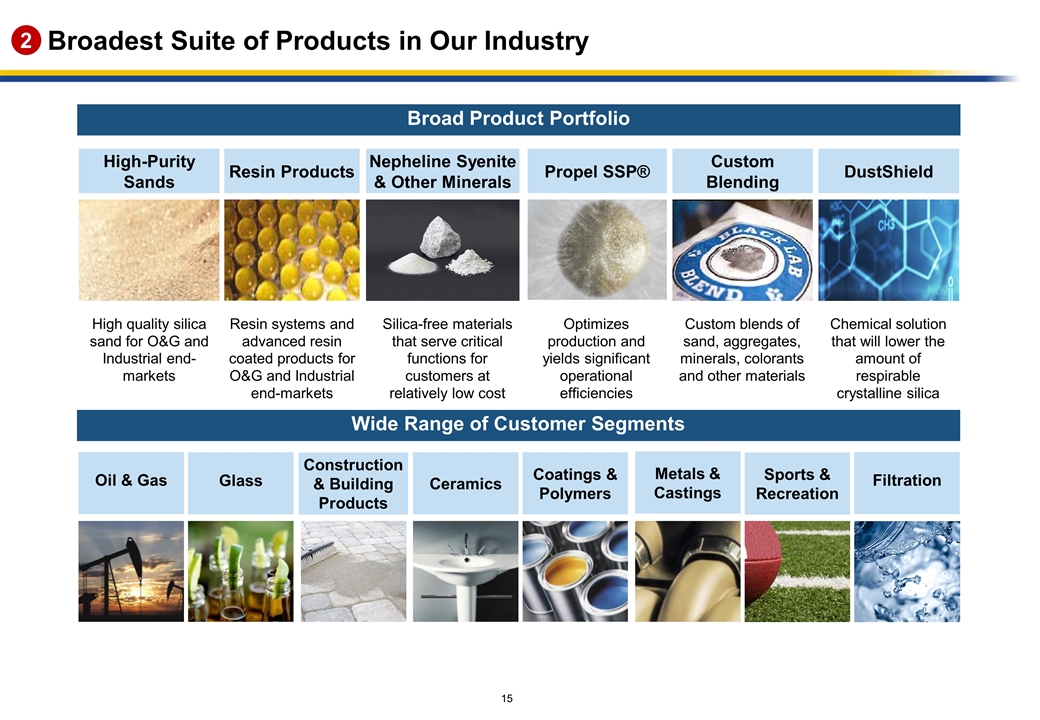

Broad Product Portfolio Wide Range of Customer Segments Glass Construction & Building Products Ceramics Coatings & Polymers Metals & Castings Filtration Oil & Gas High-Purity Sands High quality silica sand for O&G and Industrial end-markets Custom Blending Custom blends of sand, aggregates, minerals, colorants and other materials DustShield Chemical solution that will lower the amount of respirable crystalline silica Propel SSP® Optimizes production and yields significant operational efficiencies Resin Products Resin systems and advanced resin coated products for O&G and Industrial end-markets Silica-free materials that serve critical functions for customers at relatively low cost Nepheline Syenite & Other Minerals Sports & Recreation 2 Broadest Suite of Products in Our Industry

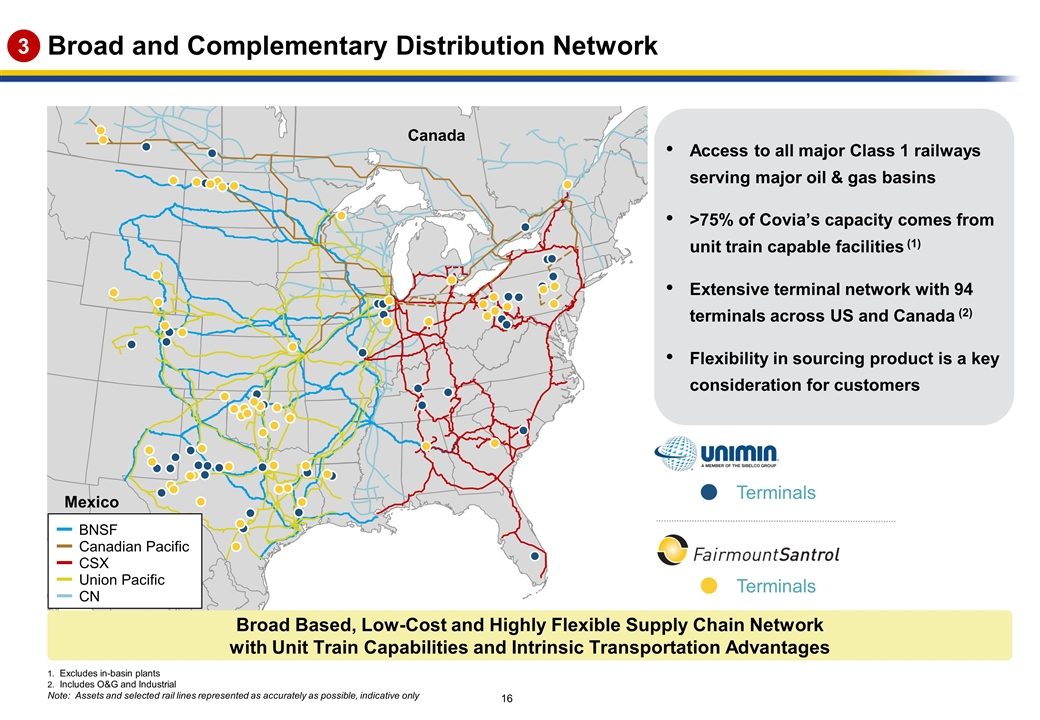

Broad and Complementary Distribution Network 3 Terminals Terminals Mexico Canada Canadian Pacific BNSF CSX CN Excludes in-basin plants Includes O&G and Industrial Note: Assets and selected rail lines represented as accurately as possible, indicative only Broad Based, Low-Cost and Highly Flexible Supply Chain Network with Unit Train Capabilities and Intrinsic Transportation Advantages Access to all major Class 1 railways serving major oil & gas basins >75% of Covia’s capacity comes from unit train capable facilities (1) Extensive terminal network with 94 terminals across US and Canada (2) Flexibility in sourcing product is a key consideration for customers Union Pacific

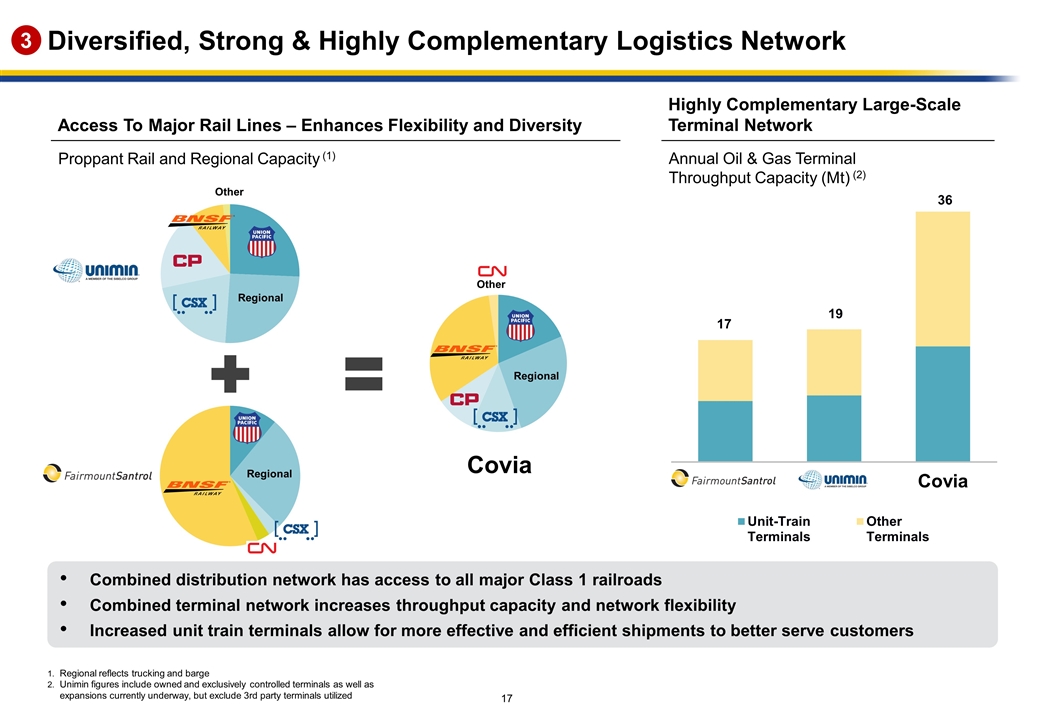

Regional reflects trucking and barge Unimin figures include owned and exclusively controlled terminals as well as expansions currently underway, but exclude 3rd party terminals utilized Combined distribution network has access to all major Class 1 railroads Combined terminal network increases throughput capacity and network flexibility Increased unit train terminals allow for more effective and efficient shipments to better serve customers Annual Oil & Gas Terminal Throughput Capacity (Mt) (2) Highly Complementary Large-Scale Terminal Network Proppant Rail and Regional Capacity (1) Access To Major Rail Lines – Enhances Flexibility and Diversity Regional Regional Regional 3 Diversified, Strong & Highly Complementary Logistics Network Covia Covia

Selected Industrial Customers Longstanding, Blue-Chip Customer Base Selected Energy Customers 4 A leading asset footprint and national logistics network allows Covia to serve blue-chip customers across end markets Broad and loyal customer base comprised of S&P 500 and industry-leading companies Long-standing relationships with very high renewal rates driven by: Commitment to quality and reliability as critical supplier to customer operations Close integration with customer operations >2,000 (1) Total Customers >75% of Tons Sold to Contracted Customers Reflects preliminary estimate of Covia’s consolidated total customers. Unimin currently serves more than 1,400 Industrial customers and approximately 1,500 total customers. Fairmount Santrol currently has over 75 Energy customers and over 830 customers across all end markets

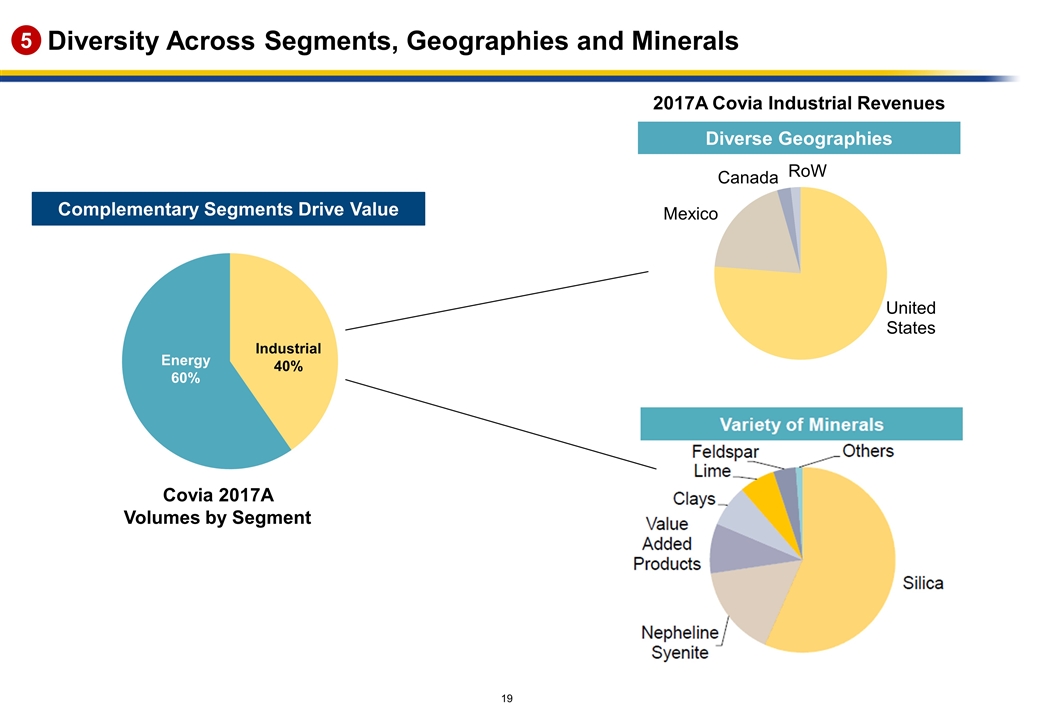

Industrial 40% Energy 60% Diversity Across Segments, Geographies and Minerals 5 2017A Covia Industrial Revenues Diverse Geographies Complementary Segments Drive Value Covia 2017A Volumes by Segment

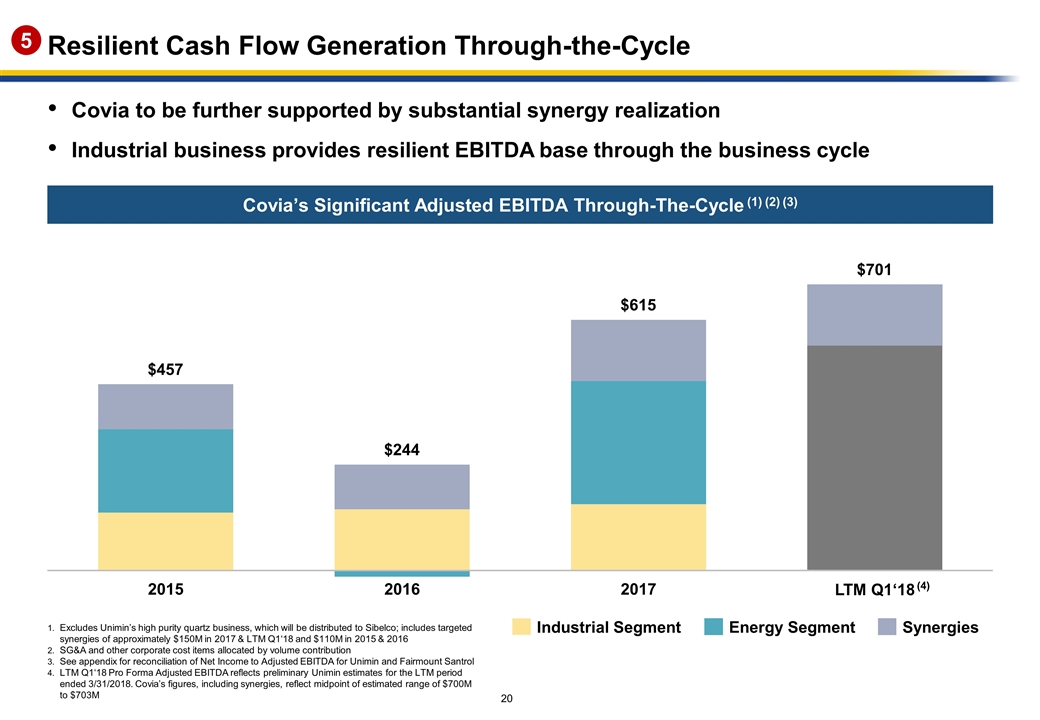

Resilient Cash Flow Generation Through-the-Cycle Covia’s Significant Adjusted EBITDA Through-The-Cycle (1) (2) (3) Energy Segment Industrial Segment Synergies Excludes Unimin’s high purity quartz business, which will be distributed to Sibelco; includes targeted synergies of approximately $150M in 2017 & LTM Q1‘18 and $110M in 2015 & 2016 SG&A and other corporate cost items allocated by volume contribution See appendix for reconciliation of Net Income to Adjusted EBITDA for Unimin and Fairmount Santrol LTM Q1‘18 Pro Forma Adjusted EBITDA reflects preliminary Unimin estimates for the LTM period ended 3/31/2018. Covia’s figures, including synergies, reflect midpoint of estimated range of $700M to $703M Covia to be further supported by substantial synergy realization Industrial business provides resilient EBITDA base through the business cycle (4) 5

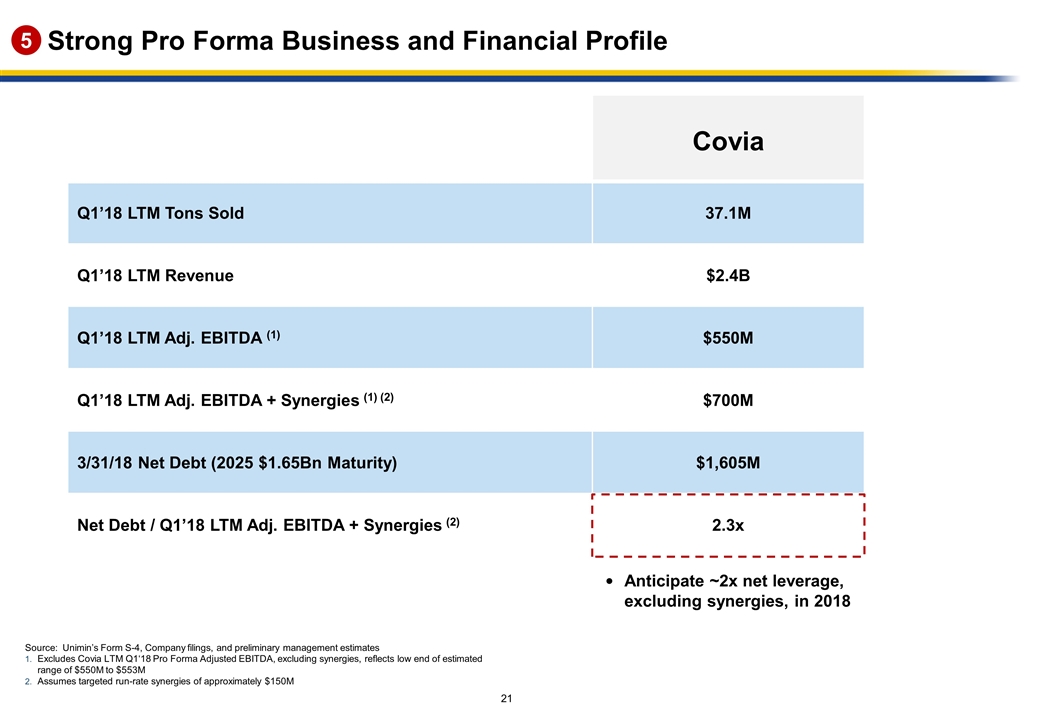

Q1’18 LTM Tons Sold 37.1M Q1’18 LTM Revenue $2.4B Q1’18 LTM Adj. EBITDA (1) $550M Q1’18 LTM Adj. EBITDA + Synergies (1) (2) $700M 3/31/18 Net Debt (2025 $1.65Bn Maturity) $1,605M Net Debt / Q1’18 LTM Adj. EBITDA + Synergies (2) 2.3x Source: Unimin’s Form S-4, Company filings, and preliminary management estimates Excludes Covia LTM Q1‘18 Pro Forma Adjusted EBITDA, excluding synergies, reflects low end of estimated range of $550M to $553M Assumes targeted run-rate synergies of approximately $150M Anticipate ~2x net leverage, excluding synergies, in 2018 Strong Pro Forma Business and Financial Profile Covia 5

Fairmount Santrol Financial Update and Outlook Sequential proppant volumes -5%, driven by seasonal impacts on production, process engineering changes, and to a lesser extent, rail delays Raw sand pricing up ~$4/ton sequentially Adjusted EBITDA increased over $7 million or 11% sequentially I&R volumes -3% year-over-year on customer plant shutdown and unseasonably cold weather impacting sports and recreational volumes First-quarter 2018 results ~20% increase in sequential proppant volumes driven by higher effective utilization of plants and new capacity from Wexford and Kermit (combined 200k tons) Kermit will begin production in May and ramp to full capacity by Q4 ’18 Coated proppant volumes to be up low-teens sequentially Proppant cost per ton decreases ~$1/ton, with relatively flat pricing I&R year-over-year volumes to be up low single digits, with profitability increasing by similar amount SG&A estimated at $25M for the quarter, with $3M in stock compensation – does not include merger transaction expenses Second-quarter 2018 Outlook Full-Year 2018 Outlook Total capex estimated to be $150-$160M – Kermit ($50-55M), Seiling, OK ($50M) 5

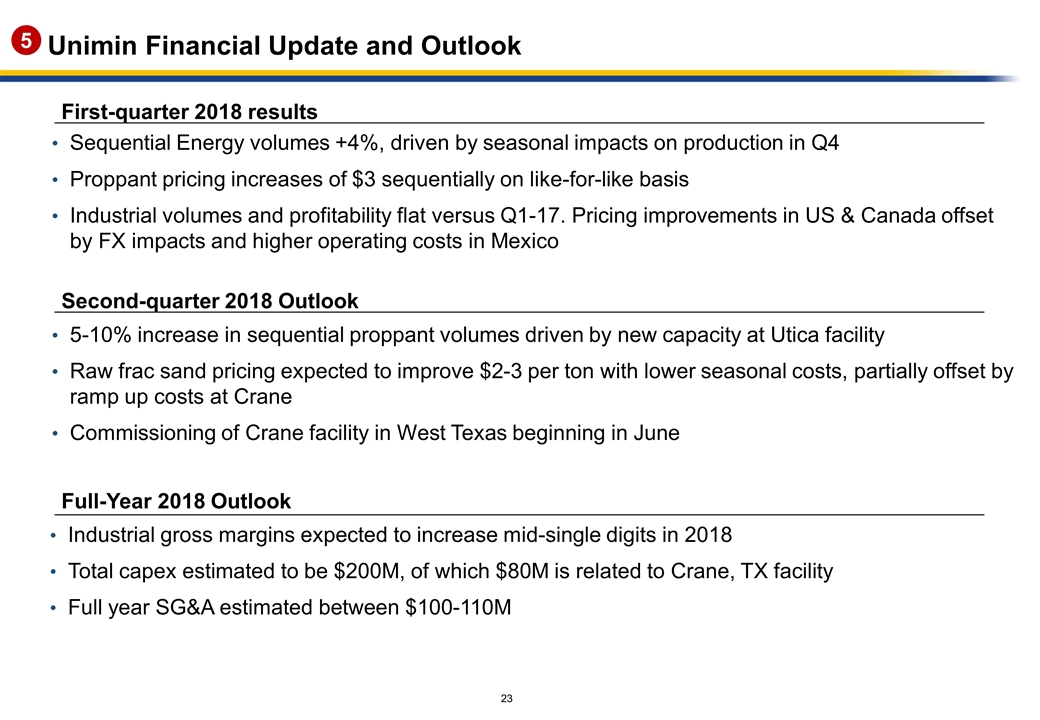

Unimin Financial Update and Outlook Sequential Energy volumes +4%, driven by seasonal impacts on production in Q4 Proppant pricing increases of $3 sequentially on like-for-like basis Industrial volumes and profitability flat versus Q1-17. Pricing improvements in US & Canada offset by FX impacts and higher operating costs in Mexico First-quarter 2018 results 5-10% increase in sequential proppant volumes driven by new capacity at Utica facility Raw frac sand pricing expected to improve $2-3 per ton with lower seasonal costs, partially offset by ramp up costs at Crane Commissioning of Crane facility in West Texas beginning in June Second-quarter 2018 Outlook Full-Year 2018 Outlook Industrial gross margins expected to increase mid-single digits in 2018 Total capex estimated to be $200M, of which $80M is related to Crane, TX facility Full year SG&A estimated between $100-110M 5

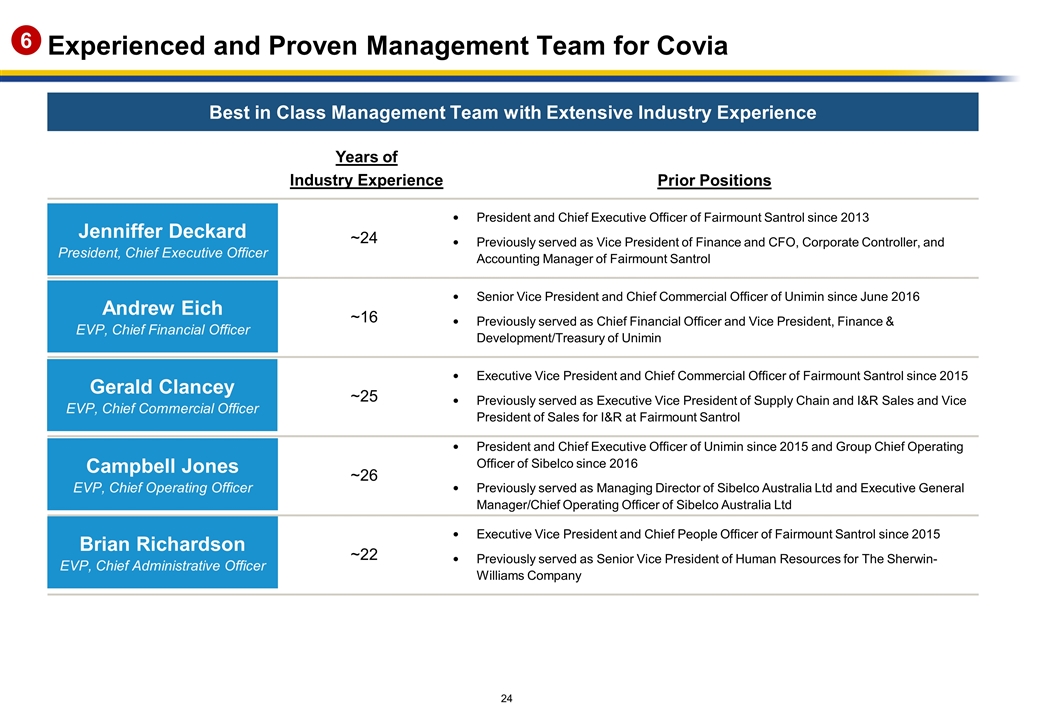

Experienced and Proven Management Team for Covia Best in Class Management Team with Extensive Industry Experience Years of Industry Experience Prior Positions ~24 President and Chief Executive Officer of Fairmount Santrol since 2013 Previously served as Vice President of Finance and CFO, Corporate Controller, and Accounting Manager of Fairmount Santrol ~16 Senior Vice President and Chief Commercial Officer of Unimin since June 2016 Previously served as Chief Financial Officer and Vice President, Finance & Development/Treasury of Unimin ~25 Executive Vice President and Chief Commercial Officer of Fairmount Santrol since 2015 Previously served as Executive Vice President of Supply Chain and I&R Sales and Vice President of Sales for I&R at Fairmount Santrol ~26 President and Chief Executive Officer of Unimin since 2015 and Group Chief Operating Officer of Sibelco since 2016 Previously served as Managing Director of Sibelco Australia Ltd and Executive General Manager/Chief Operating Officer of Sibelco Australia Ltd ~22 Executive Vice President and Chief People Officer of Fairmount Santrol since 2015 Previously served as Senior Vice President of Human Resources for The Sherwin-Williams Company Jenniffer Deckard President, Chief Executive Officer Andrew Eich EVP, Chief Financial Officer Brian Richardson EVP, Chief Administrative Officer Gerald Clancey EVP, Chief Commercial Officer Campbell Jones EVP, Chief Operating Officer 6

Section 3 Industry Update Covia

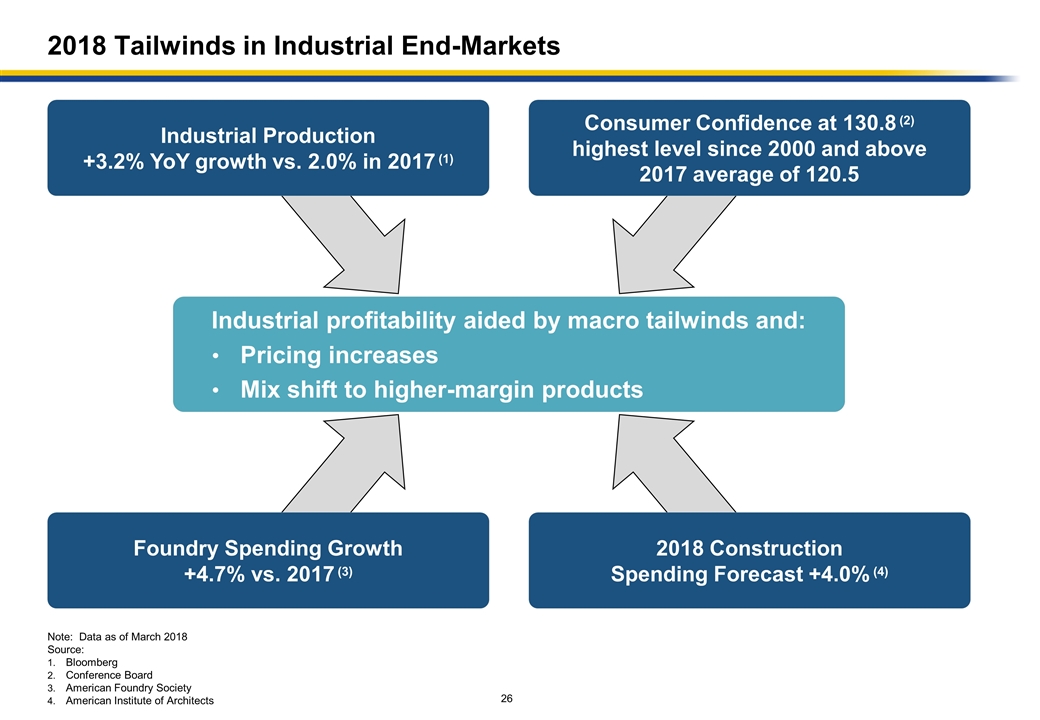

2018 Tailwinds in Industrial End-Markets Industrial Production +3.2% YoY growth vs. 2.0% in 2017 (1) Consumer Confidence at 130.8 (2) highest level since 2000 and above 2017 average of 120.5 2018 Construction Spending Forecast +4.0% (4) Foundry Spending Growth +4.7% vs. 2017 (3) Industrial profitability aided by macro tailwinds and: Pricing increases Mix shift to higher-margin products Note: Data as of March 2018 Source: Bloomberg Conference Board American Foundry Society American Institute of Architects

GDP+ Growth? Industrial Market Overview – Demand Company Products Demand Drivers Applications GDP Consumer Trends Auto Silica Nepheline Syenite Container Float Feldspar Clay & Kaolin DustShield Fiberglass Display Glass Housing Construction Consumer Trends Silica Nepheline Syenite Sanitaryware Tile Feldspar Clay & Kaolin Clay Bricks Ceramics Construction Infrastructure Spending Silica Nepheline Syenite Clay & Kaolin Mortars Grouts Lime Custom Blending DustShield Carpet and Roofing Construction GDP Heavy Industry Auto Silica Olivine Lime Resin Systems Foundry Castings Nepheline Syenite Clay & Kaolin Coated Products Customer Blending Metals & Castings GDP Reformulations Food-Grade Materials Silica Nepheline Syenite Clay & Kaolin Paints Adhesives Antiblocking Lime Coated Products Custom Blending Packaging Electrical Coatings & Polymers GDP Recycling Silica Nepheline Syenite Turf Landscape Infill Lime DustShield Filtration Engineered Fields Growth Silica Colored Play Sand Turf Landscape Infill Custom Blending DustShield Bunker Sand Sports & Recreation ü ü ü ü

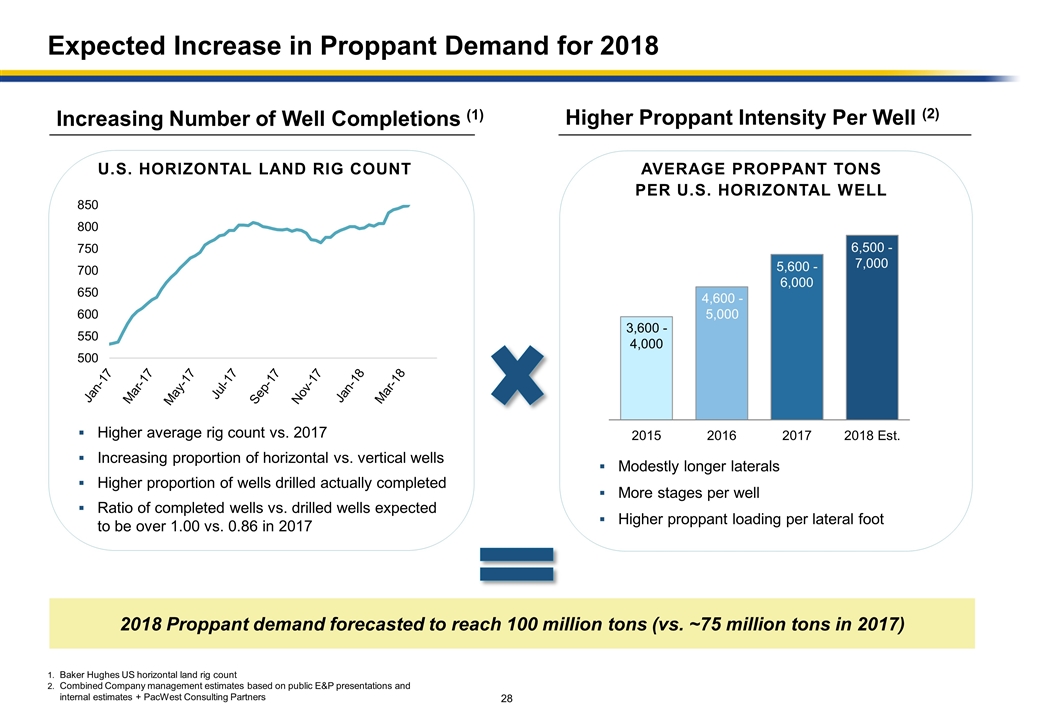

Expected Increase in Proppant Demand for 2018 2018 Proppant demand forecasted to reach 100 million tons (vs. ~75 million tons in 2017) U.S. Horizontal Land Rig Count Higher average rig count vs. 2017 Increasing proportion of horizontal vs. vertical wells Higher proportion of wells drilled actually completed Ratio of completed wells vs. drilled wells expected to be over 1.00 vs. 0.86 in 2017 Average Proppant Tons per U.S. Horizontal Well 4,600 - 5,000 5,600 - 6,000 3,600 - 4,000 6,500 - 7,000 Modestly longer laterals More stages per well Higher proppant loading per lateral foot Increasing Number of Well Completions (1) Higher Proppant Intensity Per Well (2) Baker Hughes US horizontal land rig count Combined Company management estimates based on public E&P presentations and internal estimates + PacWest Consulting Partners

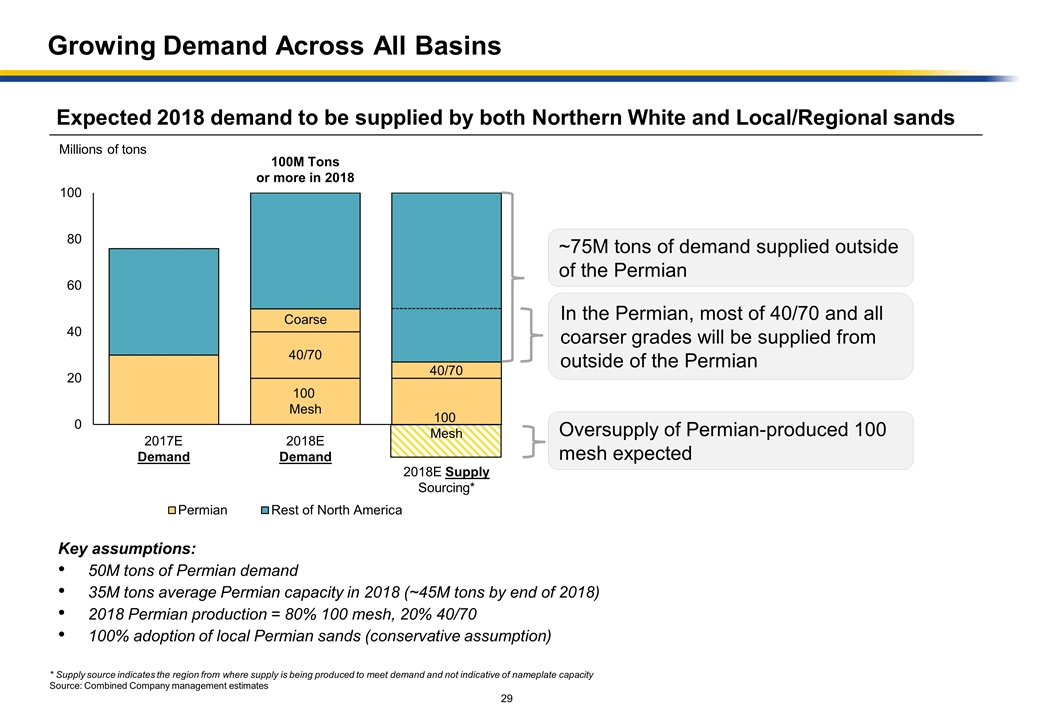

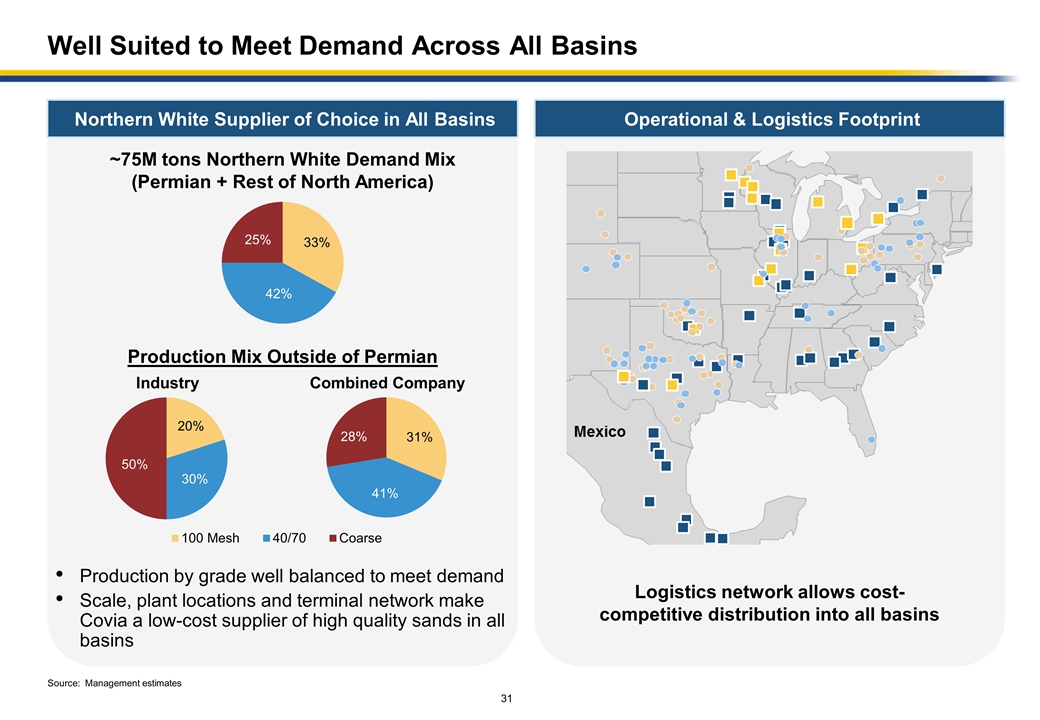

Growing Demand Across All Basins Expected 2018 demand to be supplied by both Northern White and Local/Regional sands Millions of tons 100M Tons or more in 2018 Coarse 40/70 100 Mesh 40/70 ~75M tons of demand supplied outside of the Permian Key assumptions: 50M tons of Permian demand 35M tons average Permian capacity in 2018 (~45M tons by end of 2018) 2018 Permian production = 80% 100 mesh, 20% 40/70 100% adoption of local Permian sands (conservative assumption) * Supply source indicates the region from where supply is being produced to meet demand and not indicative of nameplate capacity Source: Combined Company management estimates 2017E Demand 2018E Demand 2018E Supply Sourcing* 100 Mesh In the Permian, most of 40/70 and all coarser grades will be supplied from outside of the Permian Oversupply of Permian-produced 100 mesh expected

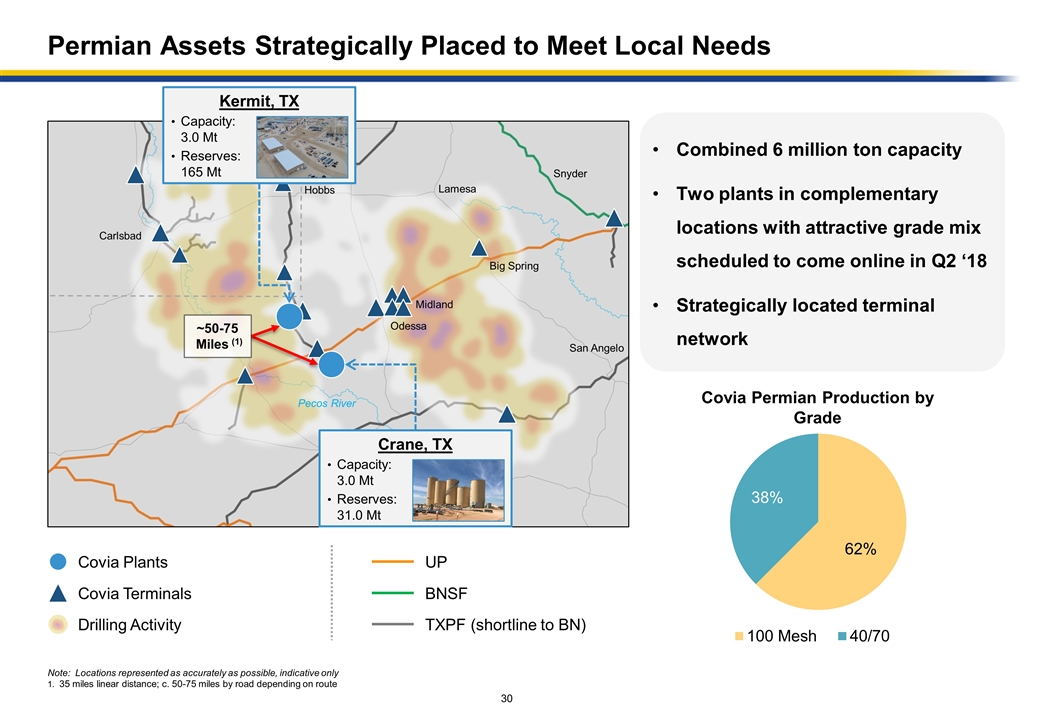

Permian Assets Strategically Placed to Meet Local Needs Combined 6 million ton capacity Two plants in complementary locations with attractive grade mix scheduled to come online in Q2 ‘18 Strategically located terminal network Carlsbad Hobbs Lamesa Snyder Big Spring Midland Odessa San Angelo Pecos River ~50-75 Miles (1) Note: Locations represented as accurately as possible, indicative only 35 miles linear distance; c. 50-75 miles by road depending on route Covia Permian Production by Grade 62% 38% UP BNSF TXPF (shortline to BN) Covia Terminals Drilling Activity Covia Plants Kermit, TX Capacity: 3.0 Mt Reserves: 165 Mt Crane, TX Capacity: 3.0 Mt Reserves: 31.0 Mt

Well Suited to Meet Demand Across All Basins Operational & Logistics Footprint Source: Management estimates Northern White Supplier of Choice in All Basins ~75M tons Northern White Demand Mix (Permian + Rest of North America) Combined Company Industry Production by grade well balanced to meet demand Scale, plant locations and terminal network make Covia a low-cost supplier of high quality sands in all basins Production Mix Outside of Permian Logistics network allows cost-competitive distribution into all basins

A Compelling Strategic Combination Creating a Leader in Proppants and Industrial Materials Solutions Procurement Transaction creates significant value for FMSA shareholders: $170 million cash consideration Approximately 35% ownership of stronger, more diverse company Strong case for multiple uplift $150M in annual synergies, with upside from cross-selling Highly complimentary combination of products, plants, logistical assets, geographies and end-markets served Covia will be extremely well-positioned to meet proppant and industrial demand cost-effectively Strong financial profile with ability to generate strong earnings in all parts of the industry cycle Diversity in products and markets contributes to stability of earnings

Appendix Covia

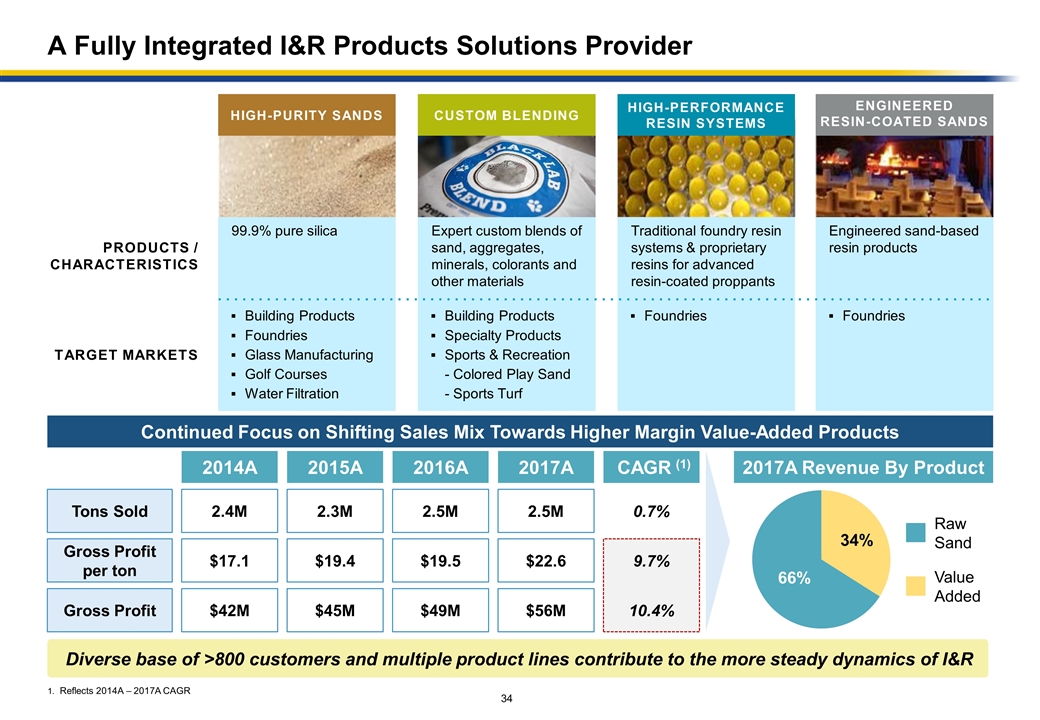

A Fully Integrated I&R Products Solutions Provider Diverse base of >800 customers and multiple product lines contribute to the more steady dynamics of I&R Products / Characteristics Target Markets 99.9% pure silica Engineered sand-based resin products Expert custom blends of sand, aggregates, minerals, colorants and other materials Traditional foundry resin systems & proprietary resins for advanced resin-coated proppants Building Products Foundries Glass Manufacturing Golf Courses Water Filtration Foundries Building Products Specialty Products Sports & Recreation - Colored Play Sand - Sports Turf Foundries HIGH-PURITY SANDS ENGINEERED RESIN-COATED SANDS Custom Blending High-performance Resin Systems Continued Focus on Shifting Sales Mix Towards Higher Margin Value-Added Products Tons Sold Gross Profit per ton Gross Profit 2014A 2.4M $17.1 $42M 2015A 2.3M $19.4 $45M 2016A 2.5M $19.5 $49M 2017A 2.5M $22.6 $56M CAGR (1) 0.7% 9.7% 2017A Revenue By Product 34% 66% Raw Sand Value Added Reflects 2014A – 2017A CAGR 10.4%

Energy Products to Address All Well Environments Raw sand Tier 1, API NWS 99.8% pure silica Northern White Silica Sands Tier 2, API Regional sand (Voca) Texas Gold® Frac Sand Permian Regional sand (Kermit) Permian Sand Increases: Reservoir Recovery – Both IP & EUR (by optimizing well geometry) & Operational Efficiencies Propel SSP® Transport Technology Flowback Protection Strength Increased Highest Highest Increased Curable Resin-coated sand Precured (Tempered) Value Add Well Productivity 2017A Proppant Revenue: $835M Raw Proppant Value-Added Proppant 2017A Proppant Volumes: 10.3Mt Raw Proppant Value-Added Proppant Value-Added Products Enhance Margin Contribution 8% 92% 22% 78%

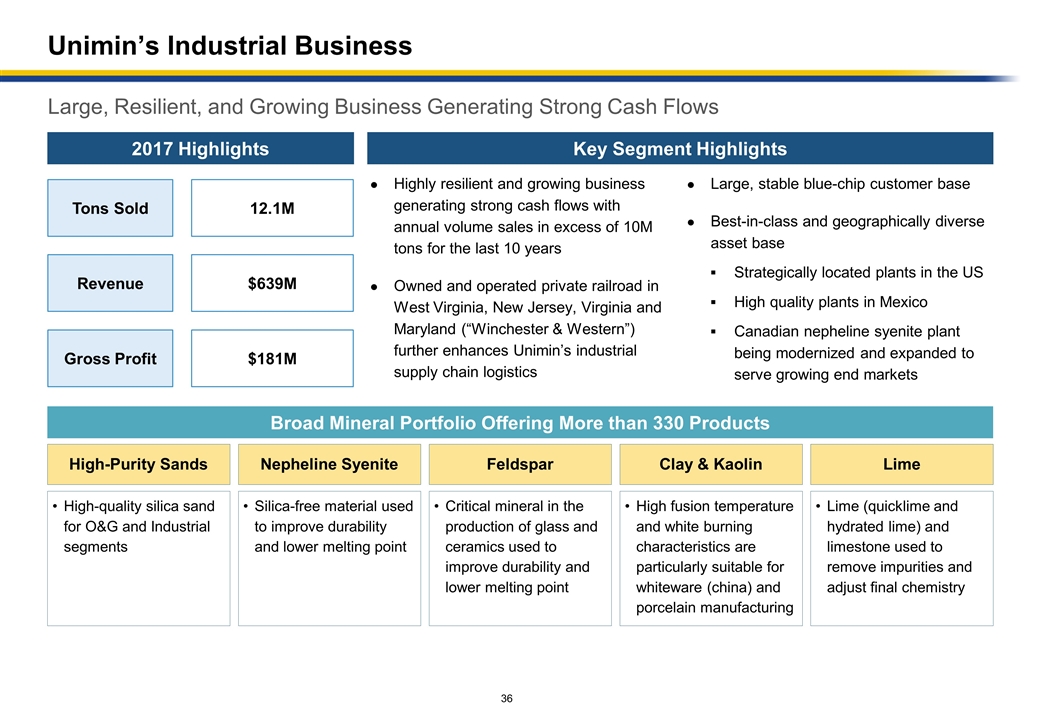

Unimin’s Industrial Business Large, Resilient, and Growing Business Generating Strong Cash Flows Highly resilient and growing business generating strong cash flows with annual volume sales in excess of 10M tons for the last 10 years Owned and operated private railroad in West Virginia, New Jersey, Virginia and Maryland (“Winchester & Western”) further enhances Unimin’s industrial supply chain logistics Key Segment Highlights 2017 Highlights Silica-free material used to improve durability and lower melting point Nepheline Syenite Broad Mineral Portfolio Offering More than 330 Products Clay & Kaolin High fusion temperature and white burning characteristics are particularly suitable for whiteware (china) and porcelain manufacturing Large, stable blue-chip customer base Best-in-class and geographically diverse asset base Strategically located plants in the US High quality plants in Mexico Canadian nepheline syenite plant being modernized and expanded to serve growing end markets Gross Profit $181M Tons Sold 12.1M $639M Revenue High-Purity Sands High-quality silica sand for O&G and Industrial segments Feldspar Critical mineral in the production of glass and ceramics used to improve durability and lower melting point Lime Lime (quicklime and hydrated lime) and limestone used to remove impurities and adjust final chemistry

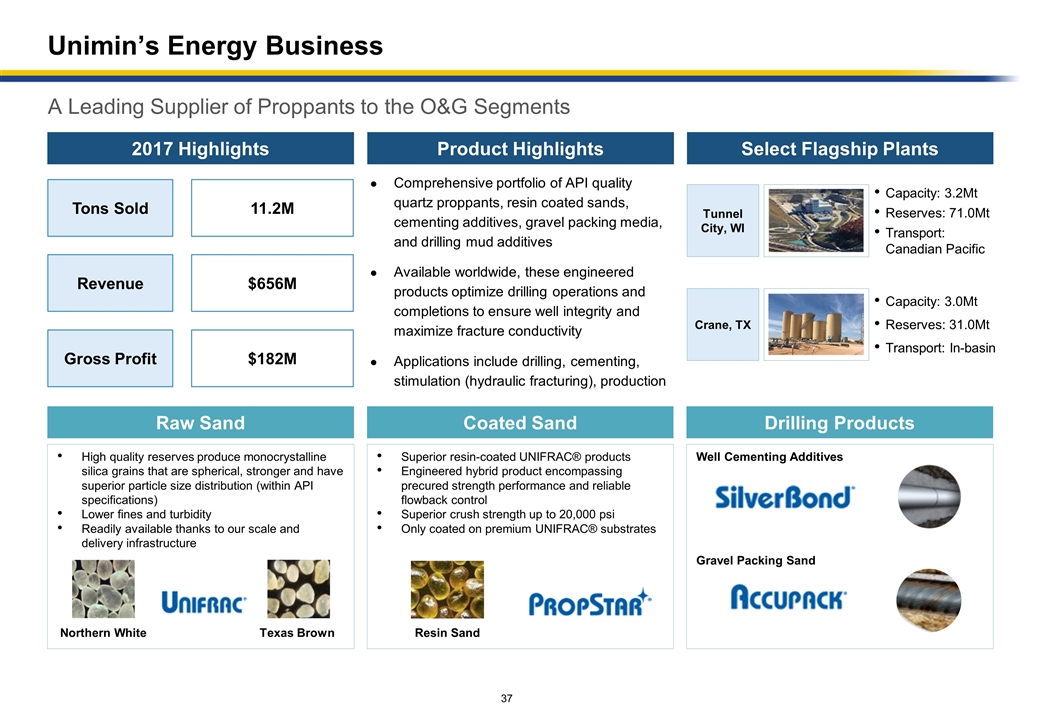

Unimin’s Energy Business A Leading Supplier of Proppants to the O&G Segments Well Cementing Additives Gravel Packing Sand Product Highlights High quality reserves produce monocrystalline silica grains that are spherical, stronger and have superior particle size distribution (within API specifications) Lower fines and turbidity Readily available thanks to our scale and delivery infrastructure Select Flagship Plants Superior resin-coated UNIFRAC® products Engineered hybrid product encompassing precured strength performance and reliable flowback control Superior crush strength up to 20,000 psi Only coated on premium UNIFRAC® substrates Comprehensive portfolio of API quality quartz proppants, resin coated sands, cementing additives, gravel packing media, and drilling mud additives Available worldwide, these engineered products optimize drilling operations and completions to ensure well integrity and maximize fracture conductivity Applications include drilling, cementing, stimulation (hydraulic fracturing), production Crane, TX Capacity: 3.0Mt Reserves: 31.0Mt Transport: In-basin Tunnel City, WI Capacity: 3.2Mt Reserves: 71.0Mt Transport: Canadian Pacific 2017 Highlights Raw Sand Coated Sand Drilling Products Gross Profit $182M Tons Sold 11.2M $656M Revenue Resin Sand Northern White Texas Brown

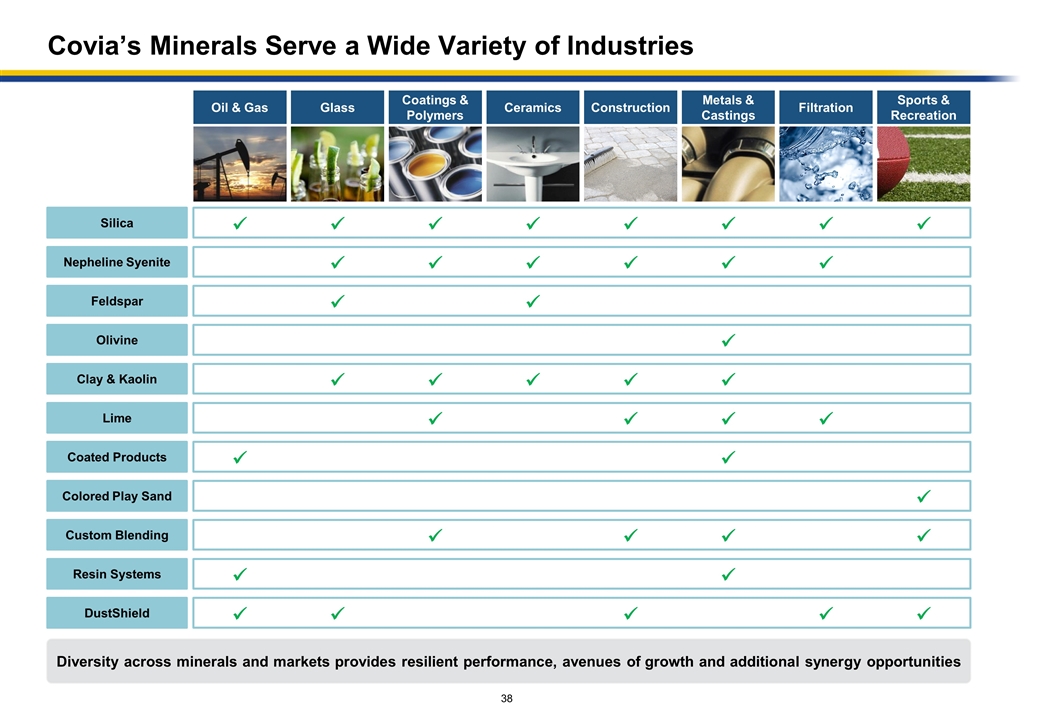

Covia’s Minerals Serve a Wide Variety of Industries Silica Nepheline Syenite Feldspar Olivine Clay & Kaolin Ceramics ü Lime Coated Products DustShield Glass ü Filtration ü Colored Play Sand Custom Blending Coatings & Polymers ü Sports & Recreation ü Resin Systems Metals & Castings ü Oil & Gas ü ü Construction ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü Diversity across minerals and markets provides resilient performance, avenues of growth and additional synergy opportunities

Covia Financials

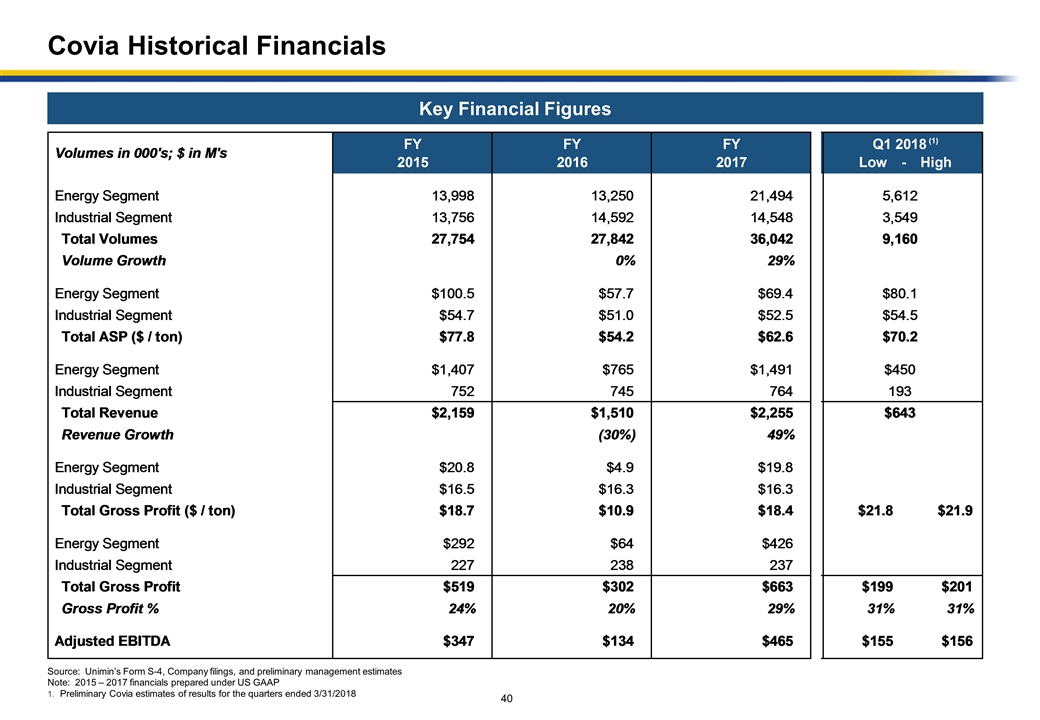

Covia Historical Financials Key Financial Figures Source: Unimin’s Form S-4, Company filings, and preliminary management estimates Note: 2015 – 2017 financials prepared under US GAAP Preliminary Covia estimates of results for the quarters ended 3/31/2018

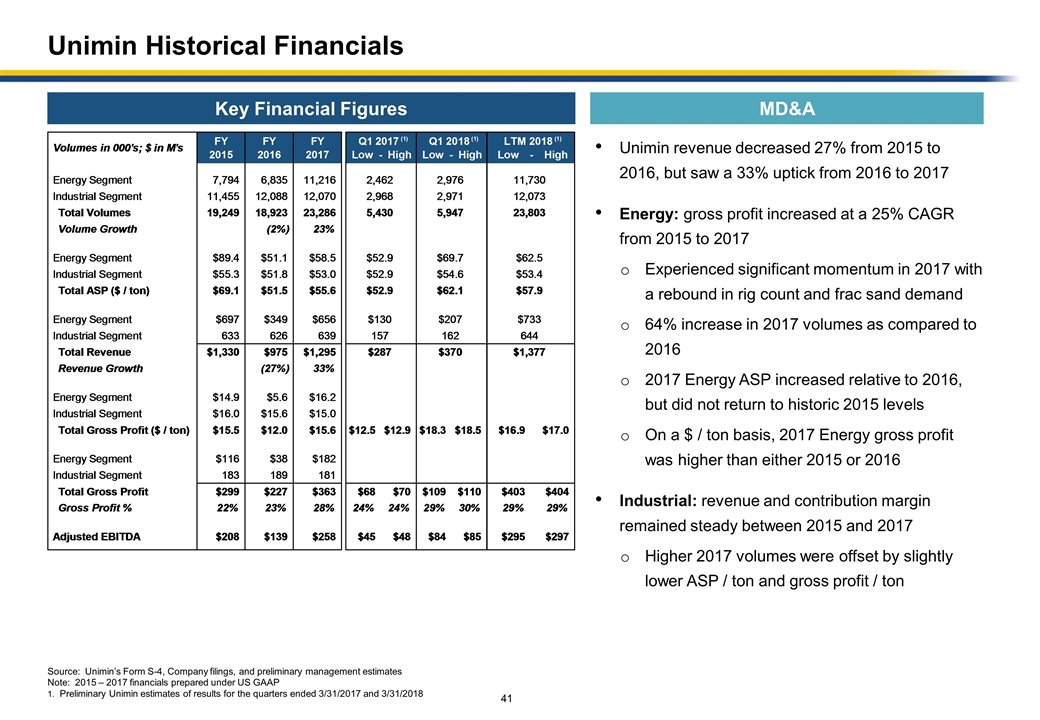

Unimin Historical Financials Unimin revenue decreased 27% from 2015 to 2016, but saw a 33% uptick from 2016 to 2017 Energy: gross profit increased at a 25% CAGR from 2015 to 2017 Experienced significant momentum in 2017 with a rebound in rig count and frac sand demand 64% increase in 2017 volumes as compared to 2016 2017 Energy ASP increased relative to 2016, but did not return to historic 2015 levels On a $ / ton basis, 2017 Energy gross profit was higher than either 2015 or 2016 Industrial: revenue and contribution margin remained steady between 2015 and 2017 Higher 2017 volumes were offset by slightly lower ASP / ton and gross profit / ton MD&A Key Financial Figures Source: Unimin’s Form S-4, Company filings, and preliminary management estimates Note: 2015 – 2017 financials prepared under US GAAP Preliminary Unimin estimates of results for the quarters ended 3/31/2017 and 3/31/2018

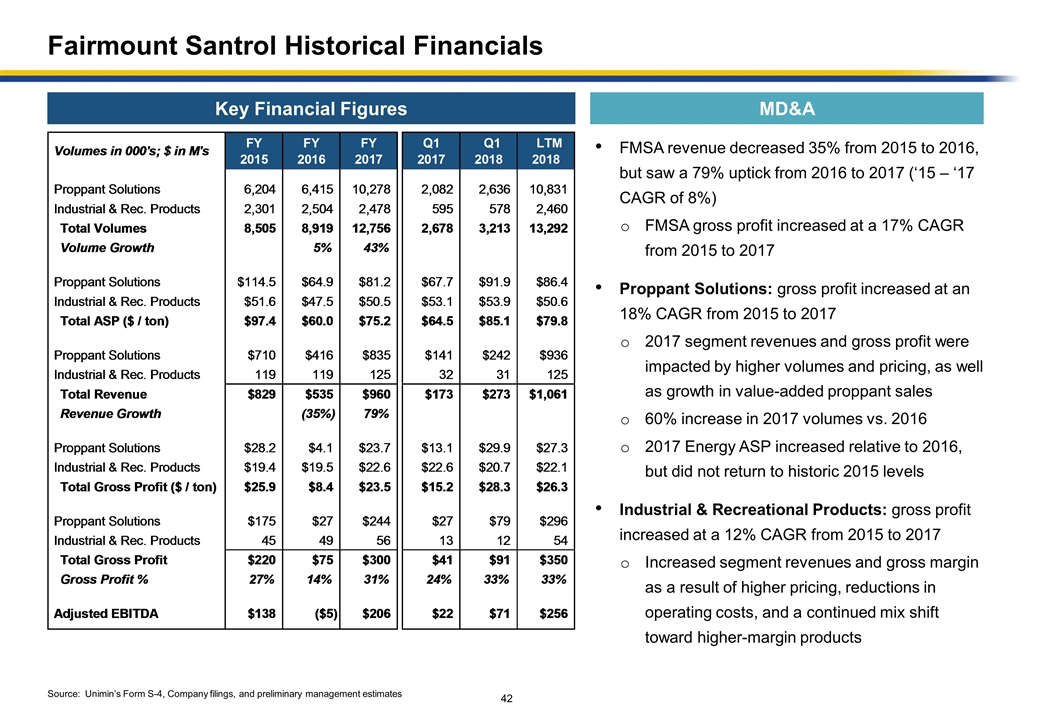

Fairmount Santrol Historical Financials FMSA revenue decreased 35% from 2015 to 2016, but saw a 79% uptick from 2016 to 2017 (‘15 – ‘17 CAGR of 8%) FMSA gross profit increased at a 17% CAGR from 2015 to 2017 Proppant Solutions: gross profit increased at an 18% CAGR from 2015 to 2017 2017 segment revenues and gross profit were impacted by higher volumes and pricing, as well as growth in value-added proppant sales 60% increase in 2017 volumes vs. 2016 2017 Energy ASP increased relative to 2016, but did not return to historic 2015 levels Industrial & Recreational Products: gross profit increased at a 12% CAGR from 2015 to 2017 Increased segment revenues and gross margin as a result of higher pricing, reductions in operating costs, and a continued mix shift toward higher-margin products MD&A Key Financial Figures Source: Unimin’s Form S-4, Company filings, and preliminary management estimates

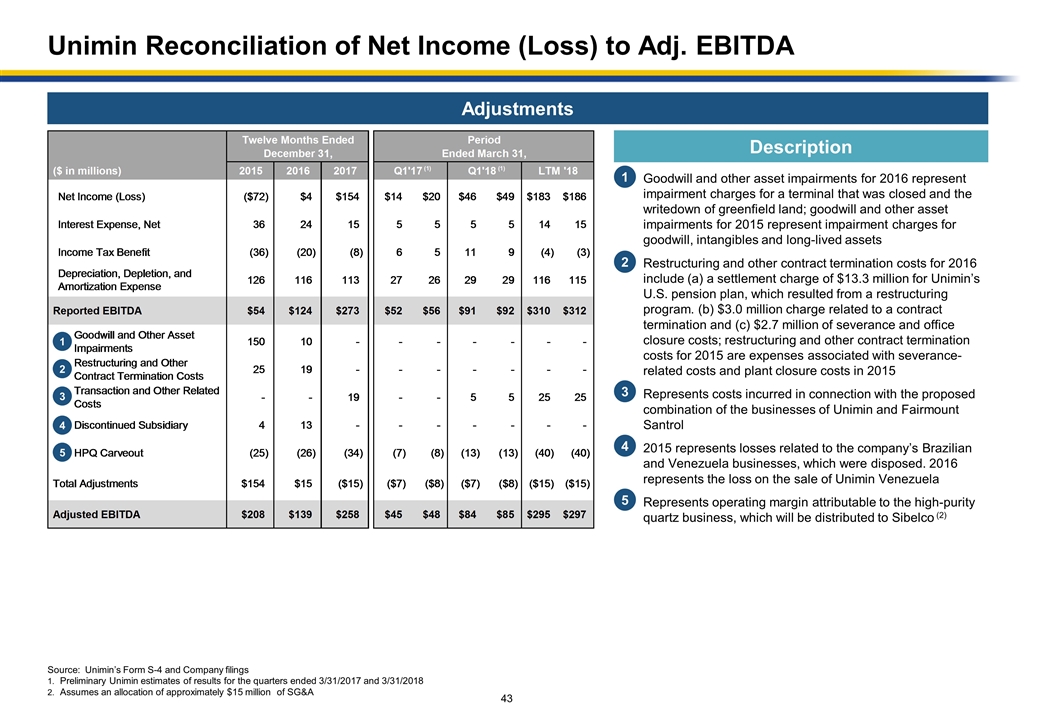

Unimin Reconciliation of Net Income (Loss) to Adj. EBITDA Adjustments Description Goodwill and other asset impairments for 2016 represent impairment charges for a terminal that was closed and the writedown of greenfield land; goodwill and other asset impairments for 2015 represent impairment charges for goodwill, intangibles and long-lived assets Restructuring and other contract termination costs for 2016 include (a) a settlement charge of $13.3 million for Unimin’s U.S. pension plan, which resulted from a restructuring program. (b) $3.0 million charge related to a contract termination and (c) $2.7 million of severance and office closure costs; restructuring and other contract termination costs for 2015 are expenses associated with severance-related costs and plant closure costs in 2015 Represents costs incurred in connection with the proposed combination of the businesses of Unimin and Fairmount Santrol 2015 represents losses related to the company’s Brazilian and Venezuela businesses, which were disposed. 2016 represents the loss on the sale of Unimin Venezuela Represents operating margin attributable to the high-purity quartz business, which will be distributed to Sibelco (2) 1 2 3 4 5 1 2 3 4 5 Source: Unimin’s Form S-4 and Company filings Preliminary Unimin estimates of results for the quarters ended 3/31/2017 and 3/31/2018 Assumes an allocation of approximately $15 million of SG&A

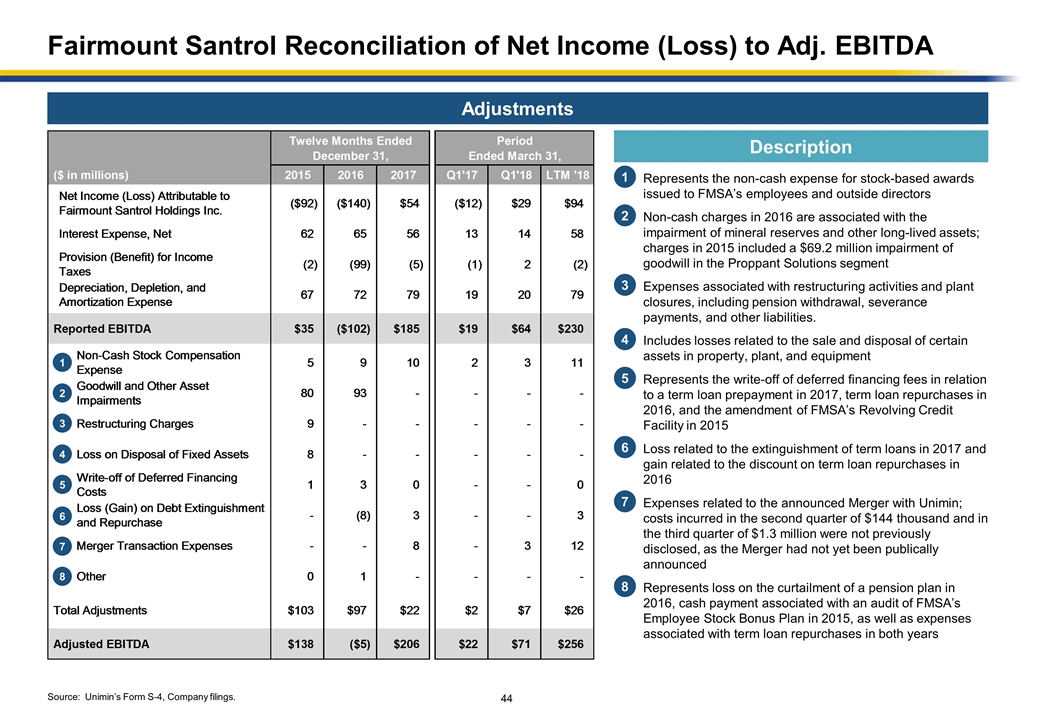

Fairmount Santrol Reconciliation of Net Income (Loss) to Adj. EBITDA Description Represents the non-cash expense for stock-based awards issued to FMSA’s employees and outside directors Non-cash charges in 2016 are associated with the impairment of mineral reserves and other long-lived assets; charges in 2015 included a $69.2 million impairment of goodwill in the Proppant Solutions segment Expenses associated with restructuring activities and plant closures, including pension withdrawal, severance payments, and other liabilities. Includes losses related to the sale and disposal of certain assets in property, plant, and equipment Represents the write-off of deferred financing fees in relation to a term loan prepayment in 2017, term loan repurchases in 2016, and the amendment of FMSA’s Revolving Credit Facility in 2015 Loss related to the extinguishment of term loans in 2017 and gain related to the discount on term loan repurchases in 2016 Expenses related to the announced Merger with Unimin; costs incurred in the second quarter of $144 thousand and in the third quarter of $1.3 million were not previously disclosed, as the Merger had not yet been publically announced Represents loss on the curtailment of a pension plan in 2016, cash payment associated with an audit of FMSA’s Employee Stock Bonus Plan in 2015, as well as expenses associated with term loan repurchases in both years Adjustments 1 2 3 4 5 6 7 8 6 7 8 1 2 3 4 5 Source: Unimin’s Form S-4, Company filings.