Form 8-K GENERAL CABLE CORP /DE/ For: May 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K |

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2018

General Cable Corporation

(Exact name of registrant as specified in its charter)

Delaware (State of incorporation) | 001-12983 (Commission File Number) | 06-1398235 (IRS Employer Identification No.) |

4 Tesseneer Drive Highland Heights, Kentucky 41076-9753 (Address of principal executive offices, including zip code) | ||

(859) 572-8000 (Registrant’s telephone number, including area code) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2018, General Cable Corporation issued a press release announcing its financial results for the first quarter of 2018. A copy of the press release is furnished as Exhibit 99.1 to this current report and is incorporated herein by reference.

General Cable makes reference to non-GAAP financial measures in the press release. Reconciliations of non-GAAP financial measures contained in the press release to the comparable GAAP financial measures are contained in the press release or in General Cable’s First Quarter 2018 Investor Presentation available on General Cable’s website. Attached as Exhibit 99.2 and incorporated herein by reference are certain slides which are included in General Cable’s First Quarter 2018 Investor Presentation and which contain such reconciliation information.

The information furnished on this Form 8-K, including the exhibits attached, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, regardless of any general incorporation language in such filing.

Item 9.01 | Financial Statements and Exhibits. |

(d) | Exhibits |

Exhibit No. | Description | |

99.1 | Press Release dated May 7, 2018 | |

99.2 | Certain slides contained in General Cable’s First Quarter 2018 Investor Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

GENERAL CABLE CORPORATION | ||

May 7, 2018 | By: | /s/ EMERSON C. MOSER |

Emerson C. Moser | ||

Senior Vice President, General Counsel and Corporate Secretary | ||

EXHIBIT INDEX

Exhibit 99.1

GENERAL CABLE REPORTS FIRST QUARTER 2018 RESULTS

HIGHLAND HEIGHTS, KENTUCKY, May 7, 2018 - General Cable Corporation (NYSE: BGC) reported today results for the first quarter ended March 30, 2018. For the quarter, reported loss per share was $0.08 and reported operating income was $34 million. Adjusted earnings per share and adjusted operating income were $0.20 and $38 million, respectively, for the quarter. See page two of this press release for the reconciliation of reported to adjusted results and related disclosures.

Michael T. McDonnell, President and Chief Executive Officer, said, “Our first quarter reflects continued performance improvement in Latin America, stronger subsea and land turnkey project activity in Europe, and demand stability in our North America businesses, particularly electric utility, construction and automotive. Although commodity pricing and business dynamics related to our review of strategic alternatives and pending transaction with Prysmian S.p.A. affected results, our 2018 outlook is positive, as seasonal demand trends, turnkey project activity and restructuring savings are expected to drive sequential and year over year improvement in the second quarter.” McDonnell continued, “Regarding the pending merger with Prysmian, we are also pleased that the regulatory approval process is advancing, and we continue to expect the merger to be completed by the third quarter of 2018, subject to receiving the remaining regulatory approvals and satisfying other customary conditions.”

Summary

• | Reported operating income of $34 million was up $10 million year over year primarily due the wind down of restructuring costs coupled with stronger subsea and land turnkey project activity in 2018 |

• | Adjusted operating income of $38 million decreased $7 million year over year as continued performance improvement in Latin America and stronger subsea and land turnkey project activity in Europe were more than offset by subsiding metal benefits and unfavorable product mix in North America |

◦ | Impact of rising metal prices was a benefit of $2 million and $7 million for the first quarter of 2018 and 2017, respectively |

• | Operating cash flow was a use of $86 million for the first quarter of 2018 driven by investments in working capital and rising metal prices |

• | Maintained significant liquidity with $255 million of availability on the Company’s $700 million asset-based revolving credit facility and $54 million of cash and cash equivalents |

First Quarter Segment Demand

North America - Unit volume as measured in metal pounds sold was up 4% versus prior year driven by stronger demand for construction, automotive and aluminum rod products.

Europe - Unit volume as measured in metal pounds sold was up 7% versus prior year driven by stronger demand for electric utility products including subsea and land turnkey project activity.

Latin America - Unit volume as measured in metal pounds sold was down 10% versus prior year driven by uneven spending on electric infrastructure and construction projects throughout the region as well as the impact of the Company’s go-to-market initiatives focused on margin improvement. Aerial transmission cables in Brazil as measured in metal pounds sold was down 8% year over year.

Net Debt

At the end of the first quarter 2018 and the end of the fourth quarter 2017, total debt was $1,169 million and $1,086 million, respectively, and cash and cash equivalents were $54 million and $85 million, respectively. The increase in net debt was driven by seasonal investments in working capital and rising metal prices.

Non-GAAP Financial Measures

Adjusted operating income (defined as operating income before extraordinary, nonrecurring or unusual charges and other certain items), adjusted earnings per share (defined as diluted earnings per share before extraordinary, nonrecurring or unusual charges and other certain items) and net debt (defined as long-term debt plus current portion of long-term debt less cash and cash equivalents) are “non-GAAP financial measures” as defined under the rules of the Securities and Exchange Commission (“SEC”). Metal-adjusted revenues and return on metal-adjusted sales on a segment basis, both of which are non-GAAP financial measures, are also provided herein. See “Segment Information.”

These Company-defined non-GAAP financial measures exclude from reported results those items that management believes are not indicative of our ongoing performance and are being provided herein because management believes they are useful in analyzing the operating performance of the business and are consistent with how management reviews our operating results and the underlying business trends. Use of these non-GAAP measures may be inconsistent with similar measures presented by other companies and should only be used in conjunction with the Company’s results reported according to GAAP. Historical segment adjusted operating results are disclosed in the First Quarter 2018 Investor Presentation available on the Company’s website.

A reconciliation of GAAP operating income (loss) and diluted earnings (loss) per share to adjusted operating income and earnings per share follows:

First Quarter of 2018 versus First Quarter of 2017 | |||||||||

First Quarter | |||||||||

2018 | 2017 | ||||||||

In millions, except per share amounts | Operating Income | EPS | Operating Income * | EPS | |||||

Reported | $ 34.3 | $ (0.08) | $ 24.2 | $ 0.24 | |||||

Adjustments to reconcile operating Income/EPS | |||||||||

Non-cash convertible debt interest expense (1) | - | 0.01 | - | 0.01 | |||||

Mark to market (gain) loss on derivative instruments (2) | - | 0.24 | - | (0.10 | ) | ||||

Restructuring and divestiture costs (3) | 2.8 | 0.03 | 14.1 | 0.09 | |||||

Legal and investigative costs (4) | 0.5 | 0.01 | 0.3 | - | |||||

(Gain) loss on sale of assets (5) | - | - | 3.5 | 0.02 | |||||

Asia Pacific and Africa (income)/loss (6) | 0.6 | (0.01 | ) | 2.8 | 0.01 | ||||

Total adjustments | 3.9 | 0.28 | 20.7 | 0.03 | |||||

Adjusted | $ 38.2 | $ 0.20 | $ 44.9 | $ 0.27 | |||||

NOTE: The tables above reflect EPS adjustments based on the Company's full year effective tax rate for 2018 and 2017 of 40%

* Historical results have been recast to reflect the Company’s adoption of ASU 2017-07, “Compensation - Retirement Benefits (Topic 715)”

(1) | The Company's adjustment for the non-cash convertible debt interest expense reflects the accretion of the equity component of the 2029 convertible notes, which is reflected in the income statement as interest expense. |

(2) | Mark to market (gains) and losses on derivative instruments represents the current period changes in the fair value of commodity instruments designated as economic hedges. The Company adjusts for the changes in fair values of these commodity instruments as the earnings associated with the underlying contracts have not been recorded in the same period. |

(3) | Restructuring and divestiture costs represent costs associated with the Company's announced restructuring and divestiture programs as well as costs associated with the review of strategic alternatives that resulted in the previously announced definitive merger agreement with Prysmian. Examples consist of, but are not limited to, employee separation costs, asset write-downs, accelerated depreciation, working capital write-downs, equipment relocation, contract terminations, consulting fees and legal costs. The Company adjusts for these charges as management believes these costs will not continue at the conclusion of both the restructuring and divestiture programs and closing of the merger. |

(4) | Legal and investigative costs represent costs incurred for external legal counsel and forensic accounting firms in connection with the restatement of our financial statements and the Foreign Corrupt Practices Act investigation. The Company adjusts for these charges as management believes these costs will not continue at the conclusion of these investigations which are considered to be outside the normal course of business. |

(5) | Gains and losses on the sale of assets are the result of divesting certain General Cable businesses. The Company adjusts for these gains and losses as management believes the gains and losses are one-time in nature and will not occur as part of the ongoing operations. |

(6) | The adjustment excludes the impact of operations in the Africa and Asia Pacific segment which are not considered "core operations" under the Company's strategic roadmap. The Company has divested or closed these operations which are not expected to continue as part of the ongoing business. For accounting purposes, the continuing operations in Africa and Asia Pacific do not meet the requirement to be presented as discontinued operations. |

2

About General Cable

General Cable (NYSE: BGC), with headquarters in Highland Heights, Kentucky, is a global leader in the development, design, manufacture, marketing and distribution of aluminum, copper and fiber optic wire and cable products for the energy, communications, automotive, industrial, construction and specialty segments. General Cable is one of the largest wire and cable manufacturing companies in the world, operating manufacturing facilities in its core geographical markets, and has sales representation and distribution worldwide. For more information about General Cable visit our website at www.generalcable.com.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this press release including, without limitation, statements regarding future financial results and performance, plans and objectives, capital expenditures, understanding of competition, projected sources of cash flow, potential legal liability, proposed legislation and regulatory action, and our management’s beliefs, expectations or opinions, are forward-looking statements, and as such, we desire to take advantage of the “safe harbor” which is afforded to such statements under the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. You can generally identify forward-looking statements as statements containing the words “believe,” “expect,” “may,” “anticipate,” “intend,” “estimate,” “project,” “plan,” “assume,” “seek to” or other similar expressions, or the negative of these expressions, although not all forward-looking statements contain these identifying words.

Actual results may differ materially from those discussed in forward-looking statements as a result of factors, risks and uncertainties over many of which we have no control. These factors, risks and uncertainties include, but are not limited to, the following: (1) general economic conditions, particularly those in the construction, energy and information technology sectors; (2) the volatility in the price of raw materials, particularly copper and aluminum; (3) the announced review of strategic alternatives, including a potential sale of the Company, and the decision to engage or not to engage in any strategic alternative, could cause disruptions in the business; (4) our ability to maintain or negotiate and consummate new business or strategic relationships or transactions; (5) impairment charges with respect to our long-lived assets; (6) our ability to execute our plan to exit all of our Asia Pacific and African operations; (7) our ability to achieve all of our anticipated cost savings associated with our previously announced global restructuring plan; (8) our ability to invest in product development, to improve the design and performance of our products; (9) economic, political and other risks of maintaining facilities and selling products in foreign countries; (10) domestic and local country price competition; (11) our ability to successfully integrate and identify acquisitions; (12) the impact of technology; (13) our ability to maintain relationships with our distributors and retailers; (14) the changes in tax rates and exposure to new tax laws; (15) our ability to adapt to current and changing industry standards; (16) our ability to execute large customer contracts; (17) our ability to maintain relationships with key suppliers; (18) the impact of fluctuations in foreign currency rates; (19) compliance with foreign and U.S. laws and regulations, including the Foreign Corrupt Practices Act; (20) our ability to negotiate extensions of labor agreements; (21) our ability to continue our uncommitted accounts payable confirming arrangements; (22) our exposure to counterparty risk in our hedging arrangements; (23) our ability to achieve target returns on investments in our defined benefit plans; (24) possible future environmental liabilities and asbestos litigation; (25) our ability to attract and retain key employees; (26) our ability to make payments on our indebtedness; (27) our ability to comply with covenants in our existing or future financing agreements; (28) lowering of one or more of our debt ratings; (29) our ability to maintain adequate liquidity; (30) our ability to maintain effective disclosure controls and procedures and internal control over financial reporting; (31) the trading price of our common stock; and (32) other material factors.

See Item 1A of the Company’s 2017 Annual Report on Form 10‑K as filed with the SEC on February 28, 2018 and subsequent SEC filings for a more detailed discussion on some of these risks.

Forward-looking statements reflect the views and assumptions of management as of the date of this press release with respect to future events. The Company does not undertake, and hereby disclaims, any obligation, unless required to do so by applicable securities laws, to update any forward-looking statements as a result of new information, future events or other factors. The inclusion of any statement in this press release does not constitute an admission by the Company or any other person that the events or circumstances described in such statement are material.

Contact:

Investor Relations

(859) 572-8684

3

GENERAL CABLE CORPORATION AND SUBSIDIARIES | ||||||||

Consolidated Statements of Operations | ||||||||

(in millions, except per share data) | ||||||||

(unaudited) | ||||||||

Three Fiscal Months Ended | ||||||||

March 30, | March 31, | |||||||

2018 | 2017 | |||||||

Net sales | $ | 1,020.5 | $ | 918.2 | ||||

Cost of sales | 914.8 | 799.2 | ||||||

Gross profit | 105.7 | 119.0 | ||||||

Selling, general and administrative expenses | 71.4 | 94.8 | ||||||

Operating income (loss) | 34.3 | 24.2 | ||||||

Other income (expense) | (15.6 | ) | 14.6 | |||||

Interest income (expense): | ||||||||

Interest expense | (19.2 | ) | (20.7 | ) | ||||

Interest income | 0.9 | 0.6 | ||||||

(18.3 | ) | (20.1 | ) | |||||

Income (loss) before income taxes | 0.4 | 18.7 | ||||||

Income tax (provision) benefit | (4.6 | ) | (6.3 | ) | ||||

Net income (loss) including noncontrolling interest | (4.2 | ) | 12.4 | |||||

Less: net income (loss) attributable to noncontrolling interest | 0.1 | — | ||||||

Net income (loss) attributable to Company common shareholders | $ | (4.3 | ) | $ | 12.4 | |||

Earnings (loss) per share - Net income (loss) attributable to Company common shareholders per common share | ||||||||

Earnings (loss) per common share - basic | $ | (0.08 | ) | $ | 0.25 | |||

Weighted average common shares - basic | 50.9 | 49.8 | ||||||

Earnings (loss) per common share - assuming dilution | $ | (0.08 | ) | $ | 0.24 | |||

Weighted average common shares - assuming dilution | 50.9 | 51.6 | ||||||

GENERAL CABLE CORPORATION AND SUBSIDIARIES | ||||||||

Consolidated Statements of Operations | ||||||||

Segment Information | ||||||||

(in millions) | ||||||||

(unaudited) | ||||||||

Three Fiscal Months Ended | ||||||||

March 30, | March 31, | |||||||

2018 | 2017 | |||||||

Revenues (as reported) | ||||||||

North America | $ | 586.1 | $ | 543.0 | ||||

Europe | 264.6 | 181.0 | ||||||

Latin America | 168.2 | 157.9 | ||||||

Africa / Asia Pacific | 1.6 | 36.3 | ||||||

Total | $ | 1,020.5 | $ | 918.2 | ||||

Revenues (metal adjusted) (1) | ||||||||

North America | $ | 586.1 | $ | 587.0 | ||||

Europe | 264.6 | 193.0 | ||||||

Latin America | 168.2 | 176.0 | ||||||

Africa / Asia Pacific | 1.6 | 39.2 | ||||||

Total | $ | 1,020.5 | $ | 995.2 | ||||

Metal Pounds Sold | ||||||||

North America | 147.9 | 141.7 | ||||||

Europe | 39.2 | 36.8 | ||||||

Latin America | 50.4 | 56.3 | ||||||

Africa / Asia Pacific | — | 9.0 | ||||||

Total | 237.5 | 243.8 | ||||||

Operating Income (loss) | ||||||||

North America | $ | 20.7 | $ | 25.4 | ||||

Europe | 7.6 | (3.1 | ) | |||||

Latin America | 6.6 | 4.7 | ||||||

Africa / Asia Pacific | (0.6 | ) | (2.8 | ) | ||||

Total | $ | 34.3 | $ | 24.2 | ||||

Adjusted Operating Income (loss) (2) | ||||||||

North America | $ | 24.0 | $ | 41.4 | ||||

Europe | 7.6 | (1.4 | ) | |||||

Latin America | 6.6 | 4.9 | ||||||

Total | $ | 38.2 | $ | 44.9 | ||||

Return on Metal Adjusted Sales (3) | ||||||||

North America | 4.1 | % | 7.1 | % | ||||

Europe | 2.9 | % | (0.7 | )% | ||||

Latin America | 3.9 | % | 2.8 | % | ||||

Total | 3.7 | % | 4.7 | % | ||||

Capital Expenditures | ||||||||

North America | $ | 5.4 | $ | 21.1 | ||||

Europe | 3.8 | 11.9 | ||||||

Latin America | 3.8 | 2.0 | ||||||

Africa / Asia Pacific | — | 0.2 | ||||||

Total | $ | 13.0 | $ | 35.2 | ||||

Depreciation & Amortization | ||||||||

North America | $ | 7.7 | $ | 9.2 | ||||

Europe | 6.1 | 5.5 | ||||||

Latin America | 3.3 | 4.2 | ||||||

Africa / Asia Pacific | — | 0.6 | ||||||

Total | $ | 17.1 | $ | 19.5 | ||||

Revenues by Major Product Lines | ||||||||

Electric Utility | $ | 354.1 | $ | 323.2 | ||||

Electrical Infrastructure | 266.2 | 237.5 | ||||||

Construction | 225.8 | 198.9 | ||||||

Communications | 127.9 | 116.8 | ||||||

Rod Mill Products | 46.5 | 41.8 | ||||||

Total | $ | 1,020.5 | $ | 918.2 | ||||

(1) Metal-adjusted revenues, a non-GAAP financial measure, is provided in order to eliminate an estimate of metal price volatility from the comparison of revenues from one period to another. | ||||||||

(2) Adjusted operating income (loss) is a non-GAAP financial measure. The Company is providing adjusted operating income (loss) on a segment basis because management believes it is useful in analyzing the operating performance of the business and is consistent with how management reviews the underlying business trends. A reconciliation of segment reported operating income (loss) to segment adjusted operating income (loss) is provided in the appendix of the First Quarter 2018 Investor Presentation, located on the Company's website. | ||||||||

(3) Return on Metal Adjusted Sales is calculated on Adjusted Operating Income (Loss). | ||||||||

GENERAL CABLE CORPORATION AND SUBSIDIARIES | ||||||||

Consolidated Balance Sheets | ||||||||

(in millions, except share data) | ||||||||

Assets | March 30, 2018 | December 31, 2017 | ||||||

(unaudited) | ||||||||

Current Assets: | ||||||||

Cash and cash equivalents | $ | 53.5 | $ | 84.7 | ||||

Receivables, net of allowances of $19.3 million at March 30, 2018 | ||||||||

and $19.2 million at December 31, 2017 | 811.9 | 714.2 | ||||||

Inventories | 728.7 | 736.1 | ||||||

Prepaid expenses and other | 61.5 | 60.0 | ||||||

Total current assets | 1,655.6 | 1,595.0 | ||||||

Property, plant and equipment, net | 526.1 | 530.3 | ||||||

Deferred income taxes | 7.2 | 7.9 | ||||||

Goodwill | 11.0 | 11.0 | ||||||

Intangible assets, net | 22.1 | 23.3 | ||||||

Unconsolidated affiliated companies | 0.2 | 0.2 | ||||||

Other non-current assets | 58.1 | 67.6 | ||||||

Total assets | $ | 2,280.3 | $ | 2,235.3 | ||||

Liabilities and Total Equity | ||||||||

Current Liabilities: | ||||||||

Accounts payable | $ | 444.9 | $ | 437.5 | ||||

Accrued liabilities | 254.5 | 308.8 | ||||||

Current portion of long-term debt | 33.9 | 46.9 | ||||||

Total current liabilities | 733.3 | 793.2 | ||||||

Long-term debt | 1,135.5 | 1,038.8 | ||||||

Deferred income taxes | 114.4 | 108.6 | ||||||

Other liabilities | 163.8 | 162.9 | ||||||

Total liabilities | 2,147.0 | 2,103.5 | ||||||

Total Equity: | ||||||||

Common stock, $0.01 par value, issued and outstanding shares: | ||||||||

March 30, 2018 - 50,728,522 (net of 7,910,174 treasury shares) | ||||||||

December 31, 2017 - 50,583,870 (net of 8,054,826 treasury shares) | 0.6 | 0.6 | ||||||

Additional paid-in capital | 704.7 | 706.6 | ||||||

Treasury stock | (149.9 | ) | (151.9 | ) | ||||

Retained earnings (deficit) | (197.7 | ) | (195.3 | ) | ||||

Accumulated other comprehensive loss | (227.1 | ) | (230.8 | ) | ||||

Total Company shareholders' equity | 130.6 | 129.2 | ||||||

Noncontrolling interest | 2.7 | 2.6 | ||||||

Total equity | 133.3 | 131.8 | ||||||

Total liabilities and equity | $ | 2,280.3 | $ | 2,235.3 | ||||

GENERAL CABLE CORPORATION AND SUBSIDIARIES | ||||||||

Consolidated Statements of Cash Flows | ||||||||

(in millions) | ||||||||

(unaudited) | ||||||||

Twelve Fiscal Months Ended | ||||||||

March 30, 2018 | March 31, 2017 | |||||||

Cash flows of operating activities: | ||||||||

Net income (loss) including noncontrolling interest | $ | (4.2 | ) | $ | 12.4 | |||

Adjustments to reconcile net income (loss) to net cash flows of operating activities: | ||||||||

Depreciation and amortization | 17.1 | 19.5 | ||||||

Foreign currency exchange (gain) loss | 2.1 | (2.0 | ) | |||||

Non-cash interest charges | 1.0 | 1.0 | ||||||

Deferred income taxes | 3.4 | (2.3 | ) | |||||

(Gain) loss on disposal of subsidiaries | — | 3.5 | ||||||

(Gain) loss on disposal of property | — | 2.9 | ||||||

Changes in operating assets and liabilities, net of effect of divestitures: | ||||||||

(Increase) decrease in receivables | (24.6 | ) | (1.9 | ) | ||||

(Increase) decrease in inventories | (36.5 | ) | (42.8 | ) | ||||

(Increase) decrease in other assets | (6.9 | ) | (2.5 | ) | ||||

Increase (decrease) in accounts payable | 8.2 | 19.1 | ||||||

Increase (decrease) in accrued and other liabilities | (45.1 | ) | (95.4 | ) | ||||

Net cash flows of operating activities | (85.5 | ) | (88.5 | ) | ||||

Cash flows of investing activities: | ||||||||

Capital expenditures | (13.0 | ) | (35.2 | ) | ||||

Proceeds from properties sold | — | 0.3 | ||||||

Disposal of subsidiaries, net of cash disposed of | — | 5.3 | ||||||

Net cash flows of investing activities | (13.0 | ) | (29.6 | ) | ||||

Cash flows of financing activities: | ||||||||

Dividends paid to shareholders | (9.2 | ) | (9.4 | ) | ||||

Proceeds from debt | 538.8 | 731.7 | ||||||

Repayments of debt | (459.5 | ) | (622.4 | ) | ||||

Net cash flows of financing activities | 70.1 | 99.9 | ||||||

Effect of exchange rate changes on cash, cash equivalents and restricted cash | (1.9 | ) | 0.8 | |||||

Increase (decrease) in cash, cash equivalents and restricted cash | (30.3 | ) | (17.4 | ) | ||||

Cash, cash equivalents and restricted cash — beginning of year | 96.2 | 103.6 | ||||||

Cash, cash equivalents and restricted cash — end of year | $ | 65.9 | $ | 86.2 | ||||

Consolidated Adjusted Exhibit 99.2 Operating Income 1st Quarter 2018 2017 Operating Operating In millions, except per share amounts Income EPS Income* EPS Reported $ 34.3 $(0.08) $ 24.2 $ 0.24 Adjustments to Reconcile Operating Income/EPS (1) Non-cash convertible debt interest expense - 0.01 - 0.01 (2) Mark to market (gain) loss on derivative instruments - 0.24 - (0.10) (3) Restructuring and divestiture costs 2.8 0.03 14.1 0.09 (4) Legal and investigative costs 0.5 0.01 0.3 - (5) (Gain) loss on sale of assets - - 3.5 0.02 (6) Asia-Pacific and Africa (income) loss 0.6 (0.01) 2.8 0.01 Total Adjustments 3.9 0.28 20.7 0.03 Adjusted $ 38.2 $ 0.20 $ 44.9 $ 0.27 * - Historical results have been recast to reflect the Company’s adoption of ASU 2017-07, “Compensation – Retirement Benefits (Topic 715)” Note 1: The table above reflects EPS adjustments based on the Company's full year effective tax rate for 2018 and 2017 of 40% Note 2: See footnote definitions on slide 6 1

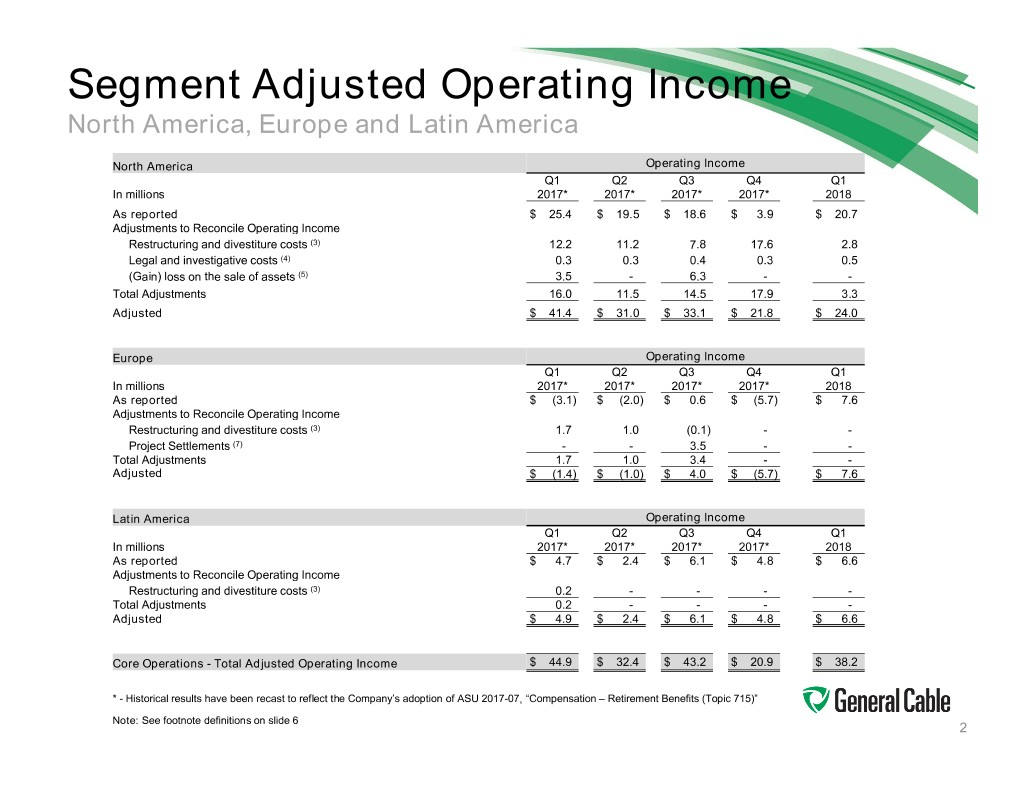

Segment Adjusted Operating Income North America, Europe and Latin America North America Operating Income Q1 Q2 Q3 Q4 Q1 In millions 2017* 2017* 2017* 2017* 2018 As reported $ 25.4 $ 19.5 $ 18.6 $ 3.9 $ 20.7 Adjustments to Reconcile Operating Income Restructuring and divestiture costs (3) 12.2 11.2 7.8 17.6 2.8 Legal and investigative costs (4) 0.3 0.3 0.4 0.3 0.5 (Gain) loss on the sale of assets (5) 3.5 - 6.3 - - Total Adjustments 16.0 11.5 14.5 17.9 3.3 Adjusted $ 41.4 $ 31.0 $ 33.1 $ 21.8 $ 24.0 Europe Operating Income Q1 Q2 Q3 Q4 Q1 In millions 2017* 2017* 2017* 2017* 2018 As reported $ (3.1) $ (2.0) $ 0.6 $ (5.7) $ 7.6 Adjustments to Reconcile Operating Income Restructuring and divestiture costs (3) 1.7 1.0 (0.1) - - Project Settlements (7) - - 3.5 - - Total Adjustments 1.7 1.0 3.4 - - Adjusted $ (1.4) $ (1.0) $ 4.0 $ (5.7) $ 7.6 Latin America Operating Income Q1 Q2 Q3 Q4 Q1 In millions 2017* 2017* 2017* 2017* 2018 As reported $ 4.7 $ 2.4 $ 6.1 $ 4.8 $ 6.6 Adjustments to Reconcile Operating Income Restructuring and divestiture costs (3) 0.2 - - - - Total Adjustments 0.2 - - - - Adjusted $ 4.9 $ 2.4 $ 6.1 $ 4.8 $ 6.6 Core Operations - Total Adjusted Operating Income $ 44.9 $ 32.4 $ 43.2 $ 20.9 $ 38.2 * - Historical results have been recast to reflect the Company’s adoption of ASU 2017-07, “Compensation – Retirement Benefits (Topic 715)” Note: See footnote definitions on slide 6 2

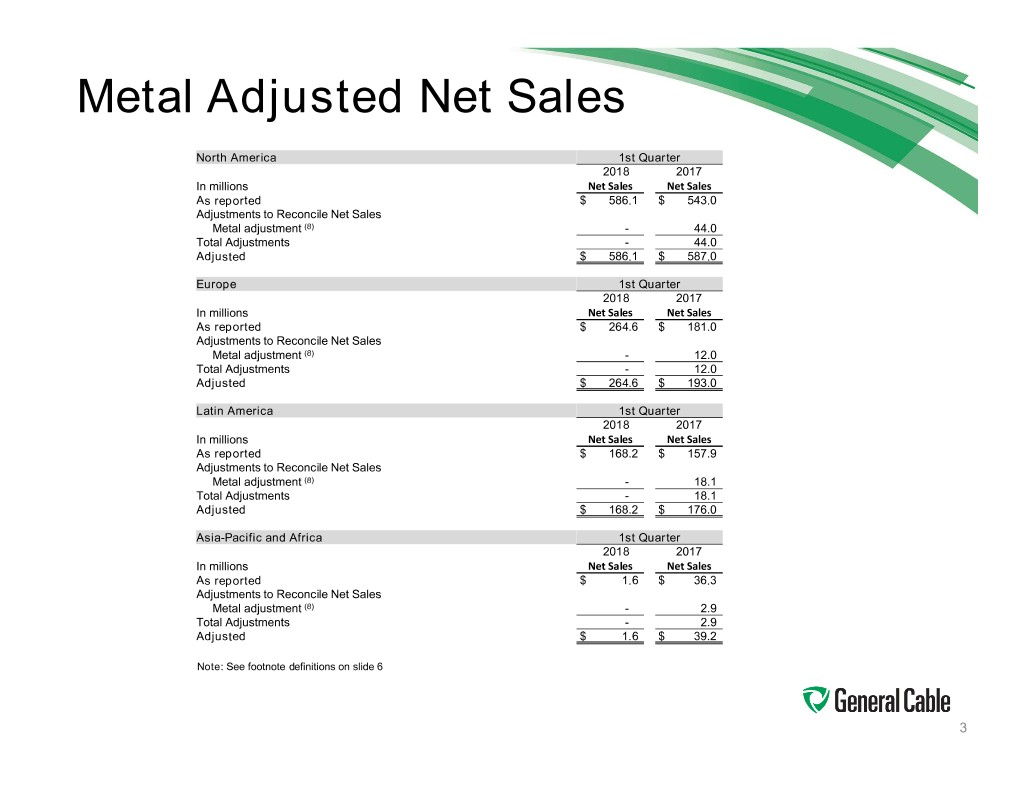

Metal Adjusted Net Sales North America 1st Quarter 2018 2017 In millions Net Sales Net Sales As reported $ 586.1 $ 543.0 Adjustments to Reconcile Net Sales Metal adjustment (8) - 44.0 Total Adjustments - 44.0 Adjusted $ 586.1 $ 587.0 Europe 1st Quarter 2018 2017 In millions Net Sales Net Sales As reported $ 264.6 $ 181.0 Adjustments to Reconcile Net Sales Metal adjustment (8) - 12.0 Total Adjustments - 12.0 Adjusted $ 264.6 $ 193.0 Latin America 1st Quarter 2018 2017 In millions Net Sales Net Sales As reported $ 168.2 $ 157.9 Adjustments to Reconcile Net Sales Metal adjustment (8) - 18.1 Total Adjustments - 18.1 Adjusted $ 168.2 $ 176.0 Asia-Pacific and Africa 1st Quarter 2018 2017 In millions Net Sales Net Sales As reported $ 1.6 $ 36.3 Adjustments to Reconcile Net Sales Metal adjustment (8) - 2.9 Total Adjustments - 2.9 Adjusted $ 1.6 $ 39.2 Note: See footnote definitions on slide 6 3

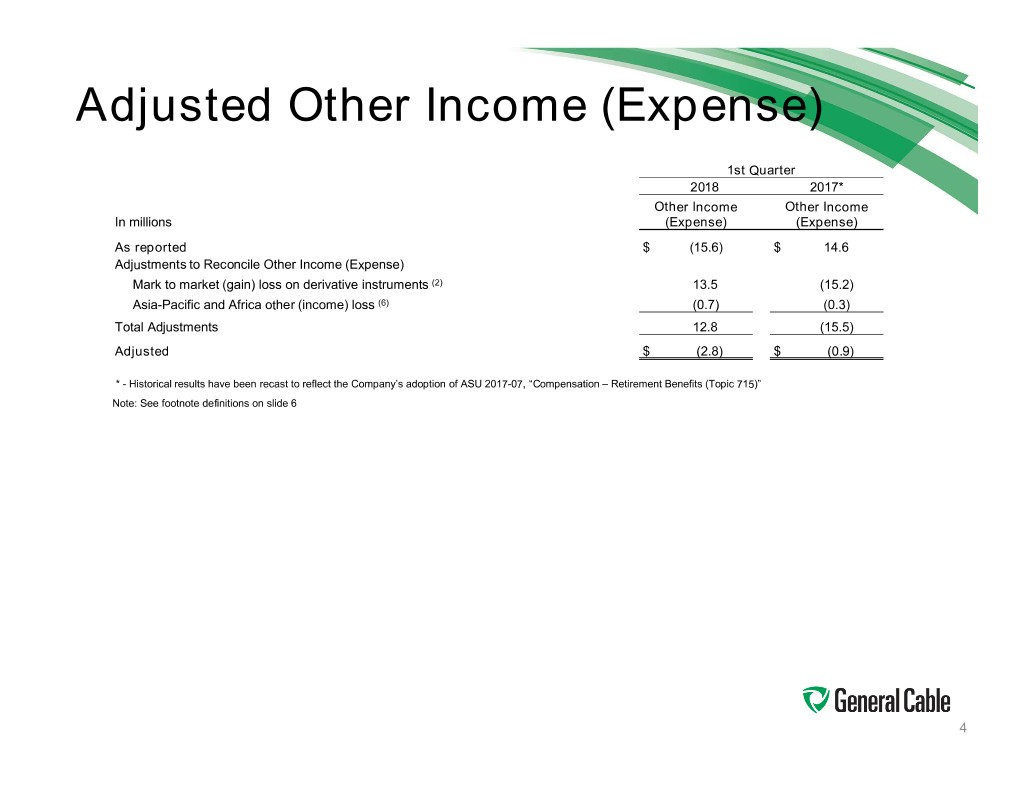

Adjusted Other Income (Expense) 1st Quarter 2018 2017* Other Income Other Income In millions (Expense) (Expense) As reported $ (15.6) $ 14.6 Adjustments to Reconcile Other Income (Expense) Mark to market (gain) loss on derivative instruments (2) 13.5 (15.2) Asia-Pacific and Africa other (income) loss (6) (0.7) (0.3) Total Adjustments 12.8 (15.5) Adjusted $ (2.8) $ (0.9) * - Historical results have been recast to reflect the Company’s adoption of ASU 2017-07, “Compensation – Retirement Benefits (Topic 715)” Note: See footnote definitions on slide 6 4

Adjusted EBITDA 12 Months 12 Months Ended Ended In millions Q1 2018 2017* Net income (loss) attributable to Company common shareholders $ (73.3) $ (56.6) Net income (loss) attributable to noncontrolling interest 2.0 1.9 Equity in net (earnings) losses of affiliated companies - - Income tax provision (benefit) 14.1 15.8 Interest expense, net 74.9 76.7 Other (income) expense 3.6 (26.6) Operating income (loss) $ 21.3 $ 11.2 Adjustments to Reconcile Operating Income (3) Restructuring and divestiture costs 40.3 51.6 (4) Legal and investigative costs 1.5 1.3 (5) (Gain) loss on sale of assets 6.3 9.8 (7) Project settlments 3.5 3.5 (6) Asia-Pacific and Africa (income) loss 61.8 64.0 Total Adjustments 113.4 130.2 Adjusted operating income 134.7 141.4 Depreciation and amortization (9) 71.0 72.8 Adjusted EBITDA $ 205.7 $ 214.2 * - Historical results have been recast to reflect the Company’s adoption of ASU 2017-07, “Compensation – Retirement Benefits (Topic 715)” Note: See footnote definitions on slide 6 5

Footnotes (1) - The Company's adjustment for the non-cash convertible debt interest expense reflects the accretion of the equity component of the 2029 convertible notes, which is reflected in the income statement as interest expense. (2) - Mark to market (gains) and losses on derivative instruments represents the current period changes in the fair value of commodity instruments designated as economic hedges. The Company adjusts for the changes in fair values of these commodity instruments as the earnings associate d with the underlying contracts have not been recorded in the same period. (3) - Restructuring and divestiture costs represent costs associated with the Company's announced restructuring and divestiture programs as well as costs associated with the review of strategic alternatives that resulted in the previously announced definitive merger agreement wi th Prysmian. Examples consist of, but are not limited to, employee separation costs, asset write -downs, accelerated depreciation, working capital write-downs, equipment relocation, contract terminations, consulting fees and legal costs. The Company adjusts for these charges as management believes these costs will not continue at the conclusion of both the restructuring and divestiture programs and closing of the merger. (4) - Legal and investigative costs represent costs incurred for external legal counsel and forensic accounting firms in connection with the restatement of our financial statements and the Foreign Corrupt Practices Act investigation. The Company adjusts for these charges as managemen t believes these costs will not continue at the conclusion of these investigations which are considered to be outside the normal course of business. (5) - Gains and losses on the sale of assets are the result of divesting certain General Cable businesses. The Company adjusts for these gains and losses as management believes the gains and losses are one -time in nature and will not occur as part of the ongoing operations. (6) - The adjustment excludes the impact of operations in the Africa and Asia Pacific segment which are not considered "core operations" under the Company's strategic roadmap. The Company has divested or closed these operations which are not expected to continue as part of the ong oing business. For accounting purposes, the continuing operations in Africa and Asia Pacific do not meet the requirement to be presented as discontinued op erations. (7) - Project settlements represents losses associated with claim settlements related to the Company's German submarine power cable business. The Company adjusts for these losses as management believes they are one -time in nature and will not occur as part of the ongoing operations. (8) - The metal adjustment to net sales is the Company's estimate of metal price volatility to revenues from one period to another. (9) - Excludes depreciation and amortization in Asia Pacific and Africa for the twelve months ended December 31, 2017 and the twelve months ended March 30, 2018 of $1.1 million and $0.5 million, respectively. 6