Form 8-K TerraForm Power, Inc. For: May 01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 1, 2018

____________________________________________________________

TerraForm Power, Inc.

(Exact name of registrant as specified in its charter)

______________________________________________________________

Delaware | 001-36542 | 46-4780940 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I. R. S. Employer Identification No.) |

7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814

(Address of principal executive offices, including zip code)

(240) 762-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Item 2.02 Results of Operations and Financial Condition.

On May 1, 2018, TerraForm Power, Inc. (“TerraForm Power”) issued a press release announcing the reporting of its financial results for the quarter ended March 31, 2018. The press release also reported certain financial and operating metrics of TerraForm Power as of or for the quarters ended March 31, 2018 and 2017. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

On May 1, 2018, TerraForm Power also posted presentation materials to the Investors section of its website at http://www.terraformpower.com, which were made available in connection with a previously announced May 2, 2018 investor conference call. A copy of the presentation is furnished herewith as Exhibit 99.2.

On May 1, 2018, TerraForm Power also posted a letter to shareholders to the Investors section of its website at http://www.terraformpower.com. A copy of the letter is furnished herewith as Exhibit 99.3.

In the attached press release, presentation, and letter, TerraForm Power discloses items not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), or non-GAAP financial measures (as defined in Regulation G promulgated by the U.S. Securities and Exchange Commission). A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is contained in the attached press release and presentation.

The information in this Current Report on Form 8-K (including the exhibits attached hereto) shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K (including the exhibits attached hereto) shall not be incorporated by reference into any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document.

Cautionary Note Regarding Forward-Looking Statements. Except for historical information contained in this Form 8-K and the press release, presentation, and letter attached as exhibits hereto, this Form 8-K and the press release, presentation, and letter contain forward-looking statements which involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release and presentation regarding these forward-looking statements.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TERRAFORM POWER, INC. | ||

Date: May 1, 2018 | By: | /s/ Matthew Berger |

Name: | Matthew Berger | |

Title: | Chief Financial Officer | |

Exhibit 99.1

TerraForm Power Reports First Quarter 2018 Results

BETHESDA, Md., May. 1, 2018 (GLOBENEWSWIRE) -- TerraForm Power, Inc. (Nasdaq: TERP) (“TerraForm Power”) today reported financial results for the three months ended March 31, 2018. For the first quarter of 2018, TerraForm Power’s results were significantly improved with CAFD of $23 million, compared with $19 million in the first quarter of 2017. Excluding the one-time impact of outages related to the Raleigh wind facility, CAFD was $29 million.

Recent Highlights

• | In advanced negotiations with an original equipment manufacturer to provide a full-wrap, long-term service contract covering all of our wind fleet that features a fixed price that is consistent with our business plan and attractive availability guarantees; contract execution expected in the coming weeks |

• | Received regulatory approval to launch an accretive tender offer to acquire 100% of Saeta Yield (“Saeta”), a European renewable power company with 1,000 Megawatts (“MW”) of recently constructed wind and solar assets |

• | Declared a Q2 2018 dividend of $0.19 per share, implying $0.76 per share on an annual basis |

Results

$ in millions, except per share amounts | 3 Months Ended 3/31/2018 | 3 Months Ended 3/31/2017 |

Generation (GWh) 1 | 1,834 | 1,982 |

Net Loss | $(76) | $(56) |

Earnings (Loss) per Share 2 | 0.56 | (0.37) |

Adj. EBITDA 3 | 96 | 103 |

CAFD 3 | 23 | 19 |

per Share 3,4 | 0.16 | 0.14 |

Results (excluding impact of outages related to Raleigh)

$ in millions, except per share amounts | 3 Months Ended 3/31/2018 | 3 Months Ended 3/31/2017 |

Adj. EBITDA 3,5 | $102 | $103 |

CAFD 3,5 | 29 | 19 |

per Share 3,4,5 | 0.20 | 0.14 |

1 Amount in 2017 is adjusted for sale of our UK and Residential portfolios.

2 Earnings per share for the three months ended March 31, 2018 includes the impact of a $145.0 million net loss allocated to non-controlling interests resulting from changes in tax rates effective January 1, 2018.

3 Non-GAAP measures. See “Calculation and Use of Non-GAAP Measures” and “Reconciliation of Non-GAAP Measures” sections. Amounts in 2017 adjusted for sale of our UK and Residential portfolios.

4 Diluted earnings (loss) per share is calculated based on the net income (loss) attributable to Class A common stockholders divided by the weighted average number of shares outstanding. CAFD per share calculated on shares outstanding of Class A common stock and Class B common stock on March 31. For the three months ended March 31, 2018, Class A common stock shares outstanding totaled 148.1 million (three months ended March 31, 2017: 92.2 million). For three months ended March 31, 2018, there were no Class B common stock shares outstanding (three months ended March 31, 2017: 48.2 million).

5 Excluding the impact of outages related to Raleigh.

“We have made significant progress in executing our business plan, which is resilient to macroeconomic factors and capital market volatility,” said John Stinebaugh, CEO of TerraForm Power. “After closing the Saeta acquisition this summer, our growth over the next five years will be driven primarily by executing our cost savings plan, accretion from the acquisition and organic growth initiatives, with limited need to issue equity.”

1

Growth Initiatives

Over the past few months, we have made significant progress executing an outsourcing agreement for all of our wind fleet. We are currently in advanced negotiations with an original equipment manufacturer to provide a full-wrap, long-term service agreement (“LTSA”). The scope of the LTSA would include comprehensive wind turbine operations and maintenance (O&M) as well as other balance of plant services for a term of 10 years, with flexibility to terminate early. The agreement would also lock in pricing and provide availability guarantees that are consistent with our business plan. We anticipate finalizing the agreement within the next few weeks. While we expect a modest amount of transition costs in order to implement the agreement, we should begin realizing cost savings in the second half of 2018. Combined with the $10 million in cost savings we expect to achieve on a run rate basis by the end of the second quarter, we are confident we will realize approximately $25 million in annual cost savings over the next two to three years.

In April, we received approval from Spain’s National Securities Market Commission (CNMV) of the prospectus for our tender offer to acquire Saeta, including approval of our €12.20 per share offer price as a fair price for a delisting tender offer. Saeta is a European renewable power company with 1,000 MW of wind and solar capacity that has an average remaining life in excess of 23 years. It has historically produced very stable cashflow, with an average contract and/or regulatory life of approximately 14 years. Commencing this week, we will launch a voluntary tender offer to acquire 100% of Saeta, which is supported by irrevocable commitments to purchase over 50% of Saeta’s shares. To the extent we acquire over 90% of Saeta’s shares in the voluntary offer, we will immediately proceed with a merger to acquire the remainder of Saeta. If we acquire less than 90% of Saeta’s shares, we will be able to delist Saeta’s shares by means of a purchase order at the approved price of €12.20 per share, which we anticipate launching shortly after the close of the voluntary offer. In either case, we are very confident we will acquire the vast majority of Saeta’s shares through tender offers by mid-summer.

Since February, it has become apparent to us that the volatility in the capital markets will likely continue for some period of time. As a result, we believe that it is prudent to consider increasing the equity to fund the Saeta transaction from $400 million up to $650 million, which is consistent with our initial underwriting and target returns. If we do so, we believe this would further strengthen our balance sheet and ensure that we have ample access to liquidity. The remainder of the ~$1.2 billion purchase price would be funded with ~$350 million in non-recourse debt raised from TerraForm Power’s unencumbered assets and ~$200 million of cash released from Saeta’s balance sheet. With the incremental equity, the Saeta acquisition would still be very accretive to TerraForm Power’s CAFD per share, and we expect our proforma corporate debt-to-cash flow ratio will decline to within our 4.0x to 5.0x goal, furthering our long-term plan to establish an investment grade rating. With a strong balance sheet and nearly $1 billion of available liquidity under committed facilities after the acquisition closes, we would be well-positioned to make opportunistic acquisitions in this period of market turbulence should they arise.

In addition to opportunistic acquisitions such as Saeta, we are looking for ways to take advantage of investment opportunities within our existing portfolio and to build our pipeline of organic growth opportunities. We are in late stage negotiations to acquire a 6 MW portfolio of operating distributed solar generation assets located in California and New Jersey pursuant to a right of first offer (“ROFO”) associated with a prior acquisition. Expected returns are at the high end of our target range with potential upside from executing our business plan. We have a ROFO on an additional 15 MW of operating distributed solar assets with the same seller, which we may be able to exercise in phases over the next 9-18 months.

We are also progressing a number of opportunities to establish relationships with developers in North America and Europe whereby we may provide capital to fund their pipeline of shovel-ready development projects and add-on acquisitions. We are in discussions with a renewable power developer in Europe in which we would commit capital to fund a strategy to consolidate small, regulated solar facilities in Spain. We are targeting returns on this program that would be accretive to our target return for Saeta.

Operations

In mid-January, the failure of a single faulty blade caused the collapse of a tower at our Raleigh wind facility in Dillon, Ontario. While the incident did not cause any injuries or impact the broader community, it reduced our CAFD for the quarter by approximately $6 million. In order to determine the root cause of the blade failure, we removed from service all 70 turbines at Raleigh and Bishop Hill that utilize the same blades. After a thorough investigation and rigorous inspections of the blades, all turbines were returned to service between mid-March and the end of April.

Excluding outages related to Raleigh, our fleetwide performance was in-line with the same period in the prior year. In addition to the wind outsourcing agreement, we are making progress on our plan to enhance availability at our solar sites. We are in the process of evaluating each of our solar assets that have below average availability to determine the root cause of the underperformance. This will result in a performance improvement plant that should increase availability to our target of 97% and enhance the cash flow of

2

our solar fleet. Finally, the replacement of the battery energy storage system (BESS) at one of our wind farms in Maui is progressing on scope, schedule and budget.

Financial Results

Beginning this quarter, we will report CAFD using the definition that we disclosed last year, which we believe will provide a more meaningful measure for investors to evaluate our financial performance and our ability to pay dividends. As compared to preceding periods, CAFD has been revised to (i) exclude adjustments related to deposits into and withdrawals from restricted cash accounts, required by project financing arrangements, (ii) replace sustaining capital expenditures made during the quarter with the average long-term sustaining capital expenditures necessary to maintain the reliability and efficiency of our assets, and (iii) levelize debt service payments paid during the year rather than including the cash principal and interest payments made during a given quarter. For consistency purposes, we will also begin reclassifying into Adjusted EBITDA certain capital expenditures that we expect will be covered under our long-term service agreement and will be reported as O&M expense, prospectively. As a result of these changes, we expect less volatility in our quarterly CAFD than in previous years.

During the first quarter, our portfolio performed broadly in-line with expectations, excluding the impact of the outages related to Raleigh, delivering Adjusted EBITDA and CAFD of $102 million and $29 million, respectively. This represents a decrease in Adjusted EBITDA of $1 million but an increase of CAFD of $10 million compared to the same period last year. The decrease in Adjusted EBITDA was largely attributable to the transmission outage at Bishop Hill, which was partially offset by stronger resource at our utility scale solar facilities compared with the same period in the prior year. The increase in CAFD resulted from reduced interest expense that more than offset the decline in Adjusted EBITDA. Interest savings were driven by the attractive senior note, term loan B and corporate revolver refinancings completed in Q4 2017 as well as lower debt balances. For the first quarter, our total operating expenses on an annualized basis were $181 million, compared to total operating expenses of $191 million in 2017. The $10 million reduction reflects efficiencies from our organization structure and other cost savings initiatives. Deducting the nonrecurring lost revenue of $6 million related to Raleigh, Adjusted EBITDA was $96 million and CAFD was $23 million, representing a decline of $7 million, and an increase of $4 million for the quarter, respectively, compared to the same period in the prior year. We also recorded a non-cash asset impairment charge of $15 million due to the rejection of a Solar Renewable Energy Credit (“SREC”) contract with First Energy Solutions, which recently filed for bankruptcy.

Note that we have also enhanced our supplemental reporting package to better facilitate the assessment of our business by investors. Going forward, we will be providing an estimate of long-term average annual generation (LTA) by segment, which is defined as energy at the point of delivery, net of all recurring losses and constraints. Our LTA represents the level of production we expect to achieve by 2019 as we improve the performance of our fleet. In the short-term, we recognize that wind and irradiance conditions will vary from one period to the next. However, we expect our facilities will produce in-line with their long-term averages over time. We believe that comparing actual generation levels against LTA will enable investors to better assess the impact of an important factor that affects our business results.

Announcement of Quarterly Dividend

TerraForm Power today announced that, on April 30, 2018, its Board declared a quarterly dividend with respect to TerraForm Power’s Class A common stock of $0.19 per share. The dividend is payable on June 15, 2018, to shareholders of record as of June 1, 2018. This dividend represents TerraForm Power’s second dividend payment under Brookfield’s sponsorship.

About TerraForm Power

TerraForm Power owns and operates a best-in-class renewable power portfolio of solar and wind assets located primarily in the U.S., totaling more than 2,600 MW of installed capacity. TerraForm Power’s goal is to acquire operating solar and wind assets in North America and Western Europe. TerraForm Power is listed on the Nasdaq stock exchange (Nasdaq: TERP). It is sponsored by Brookfield Asset Management, a leading global alternative asset manager with more than $285 billion of assets under management.

For more information about TerraForm Power, please visit: www.terraformpower.com.

Contacts for Investors / Media:

Chad Reed

TerraForm Power

3

Quarterly Earnings Call Details

Investors, analysts and other interested parties can access TerraForm Power’s 2018 First Quarter Results as well as the Letter to Shareholders and Supplemental Information on TerraForm Power’s website at www.terraformpower.com.

The conference call can be accessed via webcast on May 2, 2018 at 9:00 a.m. Eastern Time at https://edge.media-server.com/m6/p/ty7ocvs7, or via teleconference at 1-844-464-3938 toll free in North America. For overseas calls please dial 1-765-507-2638, at approximately 8:50 a.m. Eastern Time. A replay of the webcast will be available for those unable to attend the live webcast.

Safe Harbor Disclosure

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Power expects or anticipates will occur in the future are forward-looking statements. They may include estimates of cash available for distribution (CAFD), dividend growth, cost savings initiatives, earnings, Adjusted EBITDA, revenues, income, loss, capital expenditures, liquidity, capital structure, future growth, and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Power’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Power believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, risks related to: risks related to the transition to Brookfield Asset Management Inc. sponsorship, including our ability to realize the expected benefits of the sponsorship; risks related to wind conditions at our wind assets or to weather conditions at our solar assets; risks related to the effectiveness of our internal controls over financial reporting; pending and future litigation; the willingness and ability of counterparties to fulfill their obligations under offtake agreements; price fluctuations, termination provisions and buyout provisions in offtake agreements; our ability to enter into contracts to sell power on acceptable prices and terms, including as our offtake agreements expire; our ability to compete against traditional and renewable energy companies; government regulation, including compliance with regulatory and permit requirements and changes in tax laws, market rules, rates, tariffs, environmental laws and policies affecting renewable energy; risks related to the proposed relocation of the Company’s headquarters; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; operating and financial restrictions placed on us and our subsidiaries related to agreements governing indebtedness; risks related to the expected timing and likelihood of completion of the tender offer for the shares of Saeta Yield, S.A., including the timing or receipt of any governmental approvals; risks related to our financing of the tender offer for the shares of Saeta Yield, S.A., including our ability to issue equity on terms that are accretive to our shareholders and our ability to implement our permanent funding plan; our ability to successfully identify, evaluate and consummate acquisitions; and our ability to integrate the projects we acquire from third parties, including Saeta Yield, S.A., or otherwise and realize the anticipated benefits from such acquisitions.

The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties, which are described in our Annual Report on Form 10-K and any subsequent Quarterly Report on Form 10-Q, as well as additional factors we may describe from time to time in other filings with the SEC. We operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and you should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

4

TERRAFORM POWER, INC AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Operating revenues, net | $ | 127,547 | $ | 151,135 | |||

Operating costs and expenses: | |||||||

Cost of operations | 37,323 | 34,338 | |||||

Cost of operations - affiliate | — | 5,598 | |||||

General and administrative expenses | 24,284 | 36,725 | |||||

General and administrative expenses - affiliate | 3,474 | 1,419 | |||||

Acquisition and related costs | 3,685 | — | |||||

Impairment of renewable energy facilities | 15,240 | — | |||||

Depreciation, accretion and amortization expense | 65,590 | 60,987 | |||||

Total operating costs and expenses | 149,596 | 139,067 | |||||

Operating (loss) income | (22,049 | ) | 12,068 | ||||

Other expenses: | |||||||

Interest expense, net | 53,554 | 68,312 | |||||

Loss on foreign currency exchange, net | 891 | 587 | |||||

Other expenses, net | 849 | 360 | |||||

Total other expenses, net | 55,294 | 69,259 | |||||

Loss before income tax benefit | (77,343 | ) | (57,191 | ) | |||

Income tax benefit | (976 | ) | (918 | ) | |||

Net loss | (76,367 | ) | (56,273 | ) | |||

Less: Net (loss) income attributable to redeemable non-controlling interests | (2,513 | ) | 835 | ||||

Less: Net loss attributable to non-controlling interests | (157,087 | ) | (25,339 | ) | |||

Net income (loss) attributable to Class A common stockholders | $ | 83,233 | $ | (31,769 | ) | ||

Weighted average number of shares: | |||||||

Class A common stock - Basic | 148,139 | 92,072 | |||||

Class A common stock - Diluted | 148,166 | 92,072 | |||||

Earnings (loss) per share: | |||||||

Class A common stock - Basic and diluted | $ | 0.56 | $ | (0.37 | ) | ||

Dividends declared per share: | |||||||

Class A common stock | $ | 0.19 | $ | — | |||

5

TERRAFORM POWER, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

March 31, 2018 | December 31, 2017 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 157,833 | $ | 128,087 | |||

Restricted cash | 51,987 | 54,006 | |||||

Accounts receivable, net | 70,346 | 89,680 | |||||

Prepaid expenses and other current assets | 43,473 | 65,393 | |||||

Due from affiliates | 4,856 | 4,370 | |||||

Total current assets | 328,495 | 341,536 | |||||

Renewable energy facilities, net, including consolidated variable interest entities of $3,238,105 and $3,273,848 in 2018 and 2017, respectively | 4,719,808 | 4,801,925 | |||||

Intangible assets, net, including consolidated variable interest entities of $810,724 and $823,629 in 2018 and 2017, respectively | 1,057,557 | 1,077,786 | |||||

Restricted cash | 43,577 | 42,694 | |||||

Other assets | 109,344 | 123,080 | |||||

Total assets | $ | 6,258,781 | $ | 6,387,021 | |||

Liabilities, Redeemable Non-controlling Interests and Stockholders' Equity | |||||||

Current liabilities: | |||||||

Current portion of long-term debt and financing lease obligations, including consolidated variable interest entities of $80,564 and $84,691 in 2018 and 2017, respectively | $ | 413,249 | $ | 403,488 | |||

Accounts payable, accrued expenses and other current liabilities, including consolidated variable interest entities of $40,109 and $34,199 in 2018 and 2017, respectively | 107,439 | 88,538 | |||||

Deferred revenue | 1,807 | 17,859 | |||||

Due to affiliates | 3,369 | 3,968 | |||||

Total current liabilities | 525,864 | 513,853 | |||||

Long-term debt and financing lease obligations, less current portion, including consolidated variable interest entities of $831,074 and $833,388 in 2018 and 2017, respectively | 3,181,122 | 3,195,312 | |||||

Deferred revenue, less current portion | 13,134 | 38,074 | |||||

Deferred income taxes | 16,839 | 18,636 | |||||

Asset retirement obligations, including consolidated variable interest entities of $98,812 and $97,467 in 2018 and 2017, respectively | 153,557 | 154,515 | |||||

Other long-term liabilities | 38,155 | 37,923 | |||||

Total liabilities | 3,928,671 | 3,958,313 | |||||

Redeemable non-controlling interests | 50,760 | 58,340 | |||||

Stockholders' equity: | |||||||

Class A common stock, $0.01 par value per share, 1,200,000,000 shares authorized, 148,586,447 shares issued and 148,086,027 shares outstanding in 2018 and 2017 | 1,486 | 1,486 | |||||

Additional paid-in capital | 1,841,692 | 1,866,206 | |||||

Accumulated deficit | (290,818 | ) | (398,629 | ) | |||

Accumulated other comprehensive income | 30,360 | 48,018 | |||||

Treasury stock, 500,420 shares in 2018 and 2017 | (6,712 | ) | (6,712 | ) | |||

Total TerraForm Power, Inc. stockholders' equity | 1,576,008 | 1,510,369 | |||||

Non-controlling interests | 703,342 | 859,999 | |||||

Total stockholders' equity | 2,279,350 | 2,370,368 | |||||

Total liabilities, redeemable non-controlling interests and stockholders' equity | $ | 6,258,781 | $ | 6,387,021 | |||

6

TERRAFORM POWER, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (76,367 | ) | $ | (56,273 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation, accretion and amortization expense | 65,590 | 60,987 | |||||

Amortization of favorable and unfavorable rate revenue contracts, net | 9,817 | 9,827 | |||||

Impairment of renewable energy facilities | 15,240 | — | |||||

Amortization of deferred financing costs and debt discounts | 2,684 | 4,639 | |||||

Unrealized loss (gain) on commodity contract derivatives, net | 2,148 | (2,231 | ) | ||||

Recognition of deferred revenue | (464 | ) | (3,987 | ) | |||

Stock-based compensation expense | — | 2,509 | |||||

Unrealized loss on foreign currency exchange, net | 779 | 748 | |||||

Deferred taxes | (882 | ) | 639 | ||||

Other, net | 2,907 | (22 | ) | ||||

Changes in assets and liabilities: | |||||||

Accounts receivable | (6,410 | ) | (10,982 | ) | |||

Prepaid expenses and other current assets | 15,390 | 7,024 | |||||

Accounts payable, accrued expenses and other current liabilities | 18,527 | 19,858 | |||||

Due to affiliates | (599 | ) | — | ||||

Deferred revenue | 368 | 186 | |||||

Other, net | 3,361 | 2,306 | |||||

Net cash provided by operating activities | 52,089 | 35,228 | |||||

Cash flows from investing activities: | |||||||

Capital expenditures | (2,720 | ) | (2,076 | ) | |||

Proceeds from reimbursable interconnection costs | 4,084 | — | |||||

Net cash provided by (used in) investing activities | 1,364 | (2,076 | ) | ||||

Cash flows from financing activities: | |||||||

Revolving credit facility draws | 52,000 | — | |||||

Revolving credit facility repayments | (42,000 | ) | (5,000 | ) | |||

Borrowings of non-recourse long-term debt | — | 79,835 | |||||

Principal payments on Term Loan and non-recourse long-term debt | (9,556 | ) | (11,870 | ) | |||

Debt financing fees | (2,134 | ) | (2,791 | ) | |||

Contributions from non-controlling interests in renewable energy facilities | 7,685 | 6,935 | |||||

Distributions to non-controlling interests in renewable energy facilities | (5,786 | ) | (9,692 | ) | |||

Due to/from affiliates, net | 3,214 | (4,841 | ) | ||||

SunEdison investment | — | 7,371 | |||||

Payment of dividend | (28,008 | ) | — | ||||

Net cash (used in) provided by financing activities | (24,585 | ) | 59,947 | ||||

Net increase in cash, cash equivalents and restricted cash | 28,868 | 93,099 | |||||

Net change in cash, cash equivalents and restricted cash classified within assets held for sale | — | 19,440 | |||||

Effect of exchange rate changes on cash, cash equivalents and restricted cash | (258 | ) | (471 | ) | |||

Cash, cash equivalents and restricted cash at beginning of period | 224,787 | 682,837 | |||||

Cash, cash equivalents and restricted cash at end of period | $ | 253,397 | $ | 794,905 | |||

7

Reconciliation of Non-GAAP Measures

Adjusted Revenue, Adjusted EBITDA and CAFD are supplemental non-GAAP measures that should not be viewed as alternatives to GAAP measures of performance, including revenue, net income (loss), operating income or net cash provided by operating activities. Our definitions and calculation of these non-GAAP measures may not necessarily be the same as those used by other companies. These non-GAAP measures have certain limitations, which are described below, and they should not be considered in isolation. We encourage you to review, and evaluate the basis for, each of the adjustments made to arrive at Adjusted Revenue, Adjusted EBITDA and CAFD.

Calculation of Non-GAAP Measures

We define Adjusted Revenue as operating revenues, net, adjusted for non-cash items including unrealized gain/loss on derivatives, amortization of favorable and unfavorable rate revenue contracts, net and other non-cash revenue items.

We define Adjusted EBITDA as net income (loss) plus depreciation, accretion and amortization, non-cash general and administrative costs, interest expense, income tax (benefit) expense, acquisition related expenses, and certain other non-cash charges, unusual or non-recurring items and other items that we believe are not representative of our core business or operating performance, as described further below.

We define “cash available for distribution” or “CAFD” as Adjusted EBITDA (i) minus cash distributions paid to non-controlling interests in our renewable energy facilities, if any, (ii) minus annualized scheduled interest and project level amortization payments in accordance with the related borrowing arrangements, (iii) minus average annual sustaining capital expenditures (based on the long-sustaining capital expenditure plans) which are recurring in nature and used to maintain the reliability and efficiency of our power generating assets over our long-term investment horizon, (iv) plus or minus operating items as necessary to present the cash flows we deem representative of our core business operations.

As compared to the preceding period, we revised our definition of CAFD to (i) exclude adjustments related to deposits into and withdrawals from restricted cash accounts, required by project financing arrangements, (ii) replace sustaining capital expenditures payment made in the year with the average annualized long-term sustaining capital expenditures to maintain reliability and efficiency of our assets, and (iii) annualized debt service payments. We revised our definition as we believe it provides a more meaningful measure for investors to evaluate our financial and operating performance and ability to pay dividends. For items presented on an annualized basis, we will present actual cash payments as a proxy for an annualized number until the period commencing January 1, 2018.

Furthermore, to provide investors with the most appropriate measures to assess the financial and operating performance of our existing fleet and the ability to pay dividends in the future, we have excluded results associated with our UK solar and Residential portfolios, which were sold in 2017, from Adjusted Revenue, Adjusted EBITDA and CAFD reported for all periods presented.

Use of Non-GAAP Measures

We disclose Adjusted Revenue because it presents the component of our operating revenue that relates to the energy production from our plants, and is, therefore, useful to investors and other stakeholders in evaluating the performance of our renewable energy assets and comparing that performance across periods in each case without regard to non-cash revenue items.

We disclose Adjusted EBITDA because we believe it is useful to investors and other stakeholders as a measure of financial and operating performance and debt service capabilities. We believe Adjusted EBITDA provides an additional tool to investors and securities analysts to compare our performance across periods and among us and our peer companies without regard to interest expense, taxes and depreciation and amortization. Adjusted EBITDA has certain limitations, including that it: (i) does not reflect cash expenditures or future requirements for capital expenditures or contractual liabilities or future working capital needs, (ii) does not reflect the significant interest expenses that we expect to incur or any income tax payments that we may incur, and (iii) does not reflect depreciation and amortization and, although these charges are non-cash, the assets to which they relate may need to be replaced in the future, and (iv) does not take into account any cash expenditures required to replace those assets. Adjusted EBITDA also includes adjustments for non-cash impairment charges, gains and losses on derivatives and foreign currency swaps, acquisition related costs and items we believe are infrequent, unusual or non-recurring, including adjustments for general and administrative expenses we have incurred as a result of the SunEdison bankruptcy.

We disclose CAFD because we believe cash available for distribution is useful to investors in evaluating our operating performance and because securities analysts and other stakeholders analyze CAFD as a measure of our financial and operating performance and our ability to pay dividends. CAFD is not a measure of liquidity or profitability, nor is it indicative of the funds needed by us to operate

8

our business. CAFD has certain limitations, such as the fact that CAFD includes all of the adjustments and exclusions made to Adjusted EBITDA described above.

The adjustments made to Adjusted EBITDA and CAFD for infrequent, unusual or non-recurring items and items that we do not believe are representative of our core business involve the application of management judgment, and the presentation of Adjusted EBITDA and CAFD should not be construed to infer that our future results will be unaffected by infrequent, non-operating, unusual or non-recurring items.

In addition, these measures are used by our management for internal planning purposes, including for certain aspects of our consolidated operating budget, as well as evaluating the attractiveness of investments and acquisitions. We believe these Non-GAAP measures are useful as a planning tool because it allows our management to compare performance across periods on a consistent basis in order to more easily view and evaluate operating and performance trends and as a means of forecasting operating and financial performance and comparing actual performance to forecasted expectations. For these reasons, we also believe these Non-GAAP measures are also useful for communicating with investors and other stakeholders.

The following tables present a reconciliation of Operating Revenues to Adjusted Revenue and net loss to Adjusted EBITDA to CAFD and has been adjusted to exclude asset sales in the UK and Residential portfolios:

9

Three Months Ended March 31 | ||||||

(in thousands) | 2018 | 2017 | ||||

Adjustments to reconcile operating revenues, net to adjusted revenue | ||||||

Operating revenues, net | $127,547 | $151,135 | ||||

Unrealized (gain) loss on commodity contract derivatives, net (a) | 2,148 | (2,231) | ||||

Amortization of favorable and unfavorable rate revenue contracts, net (b) | 9,817 | 9,827 | ||||

Other non-cash items (c) | (416) | (3,433) | ||||

Adjustment for Asset Sales | — | (6,596) | ||||

Adjusted revenue | $139,096 | $148,702 | ||||

Direct operating costs (d) | (43,383) | (45,738) | ||||

Settled FX gain (loss) | (112) | 161 | ||||

Adjusted EBITDA | $95,601 | $103,125 | ||||

Non-operating general and administrative expenses (e) | (18,065) | (25,374) | ||||

Stock-based compensation expense | — | (2,509 | ) | |||

Acquisition and related costs | (3,685 | ) | — | |||

Depreciation, accretion and amortization expense (f) | (75,406 | ) | (70,814 | ) | ||

Impairment charges | (15,240 | ) | — | |||

Interest expense, net | (53,554 | ) | (68,312 | ) | ||

Income tax benefit | 976 | 918 | ||||

Adjustment for asset sales | — | 3,147 | ||||

Other non-cash or non-operating items (g) | (6,994) | 3,546 | ||||

Net loss | ($76,367) | ($56,273) | ||||

(in thousands) | Three Months Ended March 31 | |||||

Reconciliation of adjusted EBITDA to CAFD | 2018 | 2017 | ||||

Adjusted EBITDA | $95,601 | $103,125 | ||||

Fixed management fee | (2,500 | ) | — | |||

Variable management fee | (787 | ) | — | |||

Adjusted interest expense (h) | (49,508 | ) | (60,011 | ) | ||

Levelized principal payments (i) | (24,350 | ) | (24,810 | ) | ||

Cash distributions to non-controlling interests (j) | (4,737 | ) | (9,602 | ) | ||

Sustaining capital expenditures (k) | (1,850 | ) | (244 | ) | ||

Adjustment for asset sales | — | (134 | ) | |||

Other (l) | 10,722 | 10,940 | ||||

Cash available for distribution (CAFD) (m) | $22,591 | $19,264 | ||||

a) | Represents unrealized loss (gain) on commodity contracts associated with energy derivative contracts that are accounted for at fair value with the changes recorded in operating revenues, net. The amounts added back represent changes in the value of the energy derivative related to future operating periods, and are expected to have little or no net economic impact since the change in value is expected to be largely offset by changes in value of the underlying energy sale in the spot or day-ahead market. |

b) | Represents net amortization of purchase accounting intangibles arising from past business combinations related to favorable and unfavorable rate revenue contracts. |

c) | Primarily represents recognized deferred revenue related to the upfront sale of investment tax credits. |

d) | In the three months ended March 31, 2017, reclassifies $2.3 million wind sustaining capital expenditure into direct operating costs, which will be covered under a new Full Service Agreement. |

e) | Pursuant to the management services agreement, SunEdison agreed to provide or arrange for other service providers to provide management and administrative services to us. In the three months ended March 31, 2017, we accrued $0.4 million of costs incurred for management and administrative services that were provided by SunEdison under the Management |

10

Services Agreement that were not reimbursed by TerraForm Power and were treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA. In addition, non-operating items and other items incurred directly by TerraForm Power that we do not consider indicative of our core business operations are treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA. These items include extraordinary costs and expenses related primarily to restructuring, legal, advisory and contractor fees associated with the bankruptcy of SunEdison and certain of its affiliates (the “SunEdison bankruptcy”) and investment banking, legal, third party diligence and advisory fees associated with the Brookfield transaction, dispositions and financings. The Company’s normal general and administrative expenses, paid by Terraform Power, are the amounts shown below and were not added back in the reconciliation of net income (loss) to Adjusted EBITDA ($ in millions):

Q1 2018 | Q1 2017 |

$7 M | $9 M |

f) | Include reductions (increases) within operating revenues due to net amortization of favorable and unfavorable rate revenue contracts as detailed in the reconciliation of Adjusted Revenue. |

g) | Represents other non-cash items as detailed in the reconciliation of Adjusted Revenue and associated footnote and certain other items that we believe are not representative of our core business or future operating performance, including but not limited to: loss (gain) on foreign exchange (“FX”), unrealized loss on commodity contracts, loss on investments and receivables with affiliate, loss on disposal of renewable energy facilities, and wind sustaining capital expenditure previously reclassified. |

h) | Represents project-level and other interest expense and interest income attributed to normal operations. The reconciliation from Interest expense, net as shown on the Unaudited Condensed Consolidated Statement of Operations to adjusted interest expense applicable to CAFD is as follows: |

$ in millions | Q1 2018 | Q1 2017 | |

Interest expense, net | ($54) | ($68) | |

Amortization of deferred financing costs and debt discounts | 3 | 5 | |

Adjustment for asset sales | — | 4 | |

Other | 1 | (1) | |

Adjusted interest expense | ($50) | ($60) | |

i) | Represents levelized project-level and other principal debt payments to the extent paid from operating cash. |

j) | Represents cash distributions paid to non-controlling interests in our renewable energy facilities. The reconciliation from Distributions to non-controlling interests as shown on the Unaudited Condensed Consolidated Statement of Cash Flows to Cash distributions to non-controlling interests, net for the three months ended March 31, 2018 and 2017 is as follows: |

$ in millions | Q1 2018 | Q1 2017 | |

Distributions to non-controlling interests | ($6) | ($10) | |

Adjustment for non-operating cash distributions | 1 | — | |

Cash distributions to non-controlling interests, net | ($5) | ($10) | |

k) | Represents long-term average sustaining capex starting in 2018 to maintain reliability and efficiency of the assets. |

l) | Represents other cash flows as determined by management to be representative of normal operations including, but not limited to, wind plant “pay as you go” contributions received from tax equity partners, interconnection upgrade reimbursements, major maintenance reserve releases or (additions), and releases or (postings) of collateral held by counterparties of energy market hedges for certain wind plants. |

m) | CAFD in 2017 was recast as follows to present the levelized principal payments and adjusted interest expense in order to reduce volatility in reported CAFD. In the twelve months ended December 31, 2017, CAFD remained $88 million as reported previously. |

11

$ in millions | Q1 2017 | Q2 2017 | Q3 2017 | Q4 2017 | 2017 |

Cash available for distribution (CAFD) before debt service reported | $104 | $120 | $106 | $91 | $421 |

Levelized principal payments | (25) | (25) | (25) | (24) | (99) |

Adjusted interest expense | (60) | (61) | (63) | (50) | (234) |

Cash available for distribution (CAFD), recast | $19 | $34 | $18 | $17 | $88 |

12

TERRAFORM POWER

Q1 2018 Supplemental

Three Months Ended March 31, 2018

Information

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements

involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words

such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,”

“potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance,

events, or developments that the Company expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected

cash available for distribution, earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangements and other financial

performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or

descriptions of assumptions underlying any of the above. Forward-looking statements provide the Company’s current expectations or predictions of future

conditions, events, or results and speak only as of the date they are made. Although the Company believes its expectations and assumptions are reasonable, it

can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are listed below and further disclosed under

the section entitled Item 1A. Risk Factors: risks related to the transition to Brookfield Asset Management Inc. sponsorship, including our ability to realize the

expected benefits of the sponsorship; risks related to wind conditions at our wind assets or to weather conditions at our solar assets; risks related to the

effectiveness of our internal controls over financial reporting; pending and future litigation; the willingness and ability of counterparties to fulfill their obligations

under offtake agreements; price fluctuations, termination provisions and buyout provisions in offtake agreements; our ability to enter into contracts to sell power on

acceptable prices and terms, including as our offtake agreements expire; our ability to compete against traditional and renewable energy companies; government

regulation, including compliance with regulatory and permit requirements and changes in tax laws, market rules, rates, tariffs, environmental laws and policies

affecting renewable energy; risks related to the expected relocation of the Company’s headquarters; the condition of the debt and equity capital markets and our

ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness

going forward; operating and financial restrictions placed on us and our subsidiaries related to agreements governing indebtedness; risks related to the expected

timing and likelihood of completion of the tender offer for the shares of Saeta Yield, S.A., including the timing or receipt of any governmental approvals; risks

related to our financing of the tender offer for the shares of Saeta Yield, S.A., including our ability to issue equity on terms that are accretive to our shareholders

and our ability to implement our permanent funding plan; our ability to successfully identify, evaluate and consummate acquisitions; and our ability to integrate the

projects we acquire from third parties, including Saeta Yield, S.A., or otherwise and our ability to realize the anticipated benefits from such acquisitions.

The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or

expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results

to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and

uncertainties, which are described in our Annual Report on Form 10-K and any subsequent Quarterly Report on Form 10-Q, as well as additional factors we may

describe from time to time in other filings with the SEC. We operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from

time to time, and you should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a

complete set of all potential risks or uncertainties.

3

Q1 2018 HIGHLIGHTS

Activities Highlights

• Announced offer to acquire 100% of Saeta Yield, a leading, publicly-listed European owner and

operator of wind and solar assets, located primarily in Spain. Received Spanish regulatory approval

for the acquisition and for our offer price of €12.20 per share; launching tender offer in early May;

expecting to close the transaction in June or July

• We are in advanced negotiations with an original equipment manufacturer to provide a full-wrap long-

term service contract covering all our wind fleet, which features a fixed price that is consistent with our

business plan and attractive availability guarantees

• In late stage negotiations to acquire a fully contracted 6 MW DG solar portfolio; includes a ROFO on

an additional 15 MW with the same seller, which we may be able to exercise in phases over the next

9-18 months

• In January one of the towers at our Raleigh, Ontario facility collapsed due to a single faulty blade. In

order to determine the root cause of the blade failure, we removed from service all 70 turbines across

the fleet that utilize the same blades. After a thorough investigation to determine the root cause of the

blade failure and rigorous inspections of the blades, the turbines have been returned to normal service

• In early February 2018, we upsized our corporate revolving credit facility to $600 million, TERP now

has over $1 billion of liquidity under committed facilities

• Paid quarterly dividend of $0.19 per share, or $0.76 per share on an annualized basis – a 6% increase

over previous guidance

4

2018 2017

2,022 2,022

1,834 1,982

$ 139 $ 149

96 103

(76) (56)

23 19

$ 0.56 $ (0.37)

$ 0.16 $ 0.14

1,897 1,982

$ 102 $ 103

$ 29 $ 19

Adjusted for sale of our UK solar and Residential portfolios.

Total generation (GWh) (1)(5)

(5)

Adjusted EBITDA(3)(5)

CAFD(3)(5)

(4)

(1)

(2)

(3)

Earnings per share for the three months ended March 31, 2018 includes the impact of a $145.0 million net loss

allocated to non-controlling interests resulting from changes in tax rates effective January 1, 2018.

Loss per share calculated on weighted average basic and diluted Class A shares outstanding. CAFD per share

calculated on shares outstanding of Class A common stock and Class B common stock on March 31. For three

months ended March 31, 2018, Class A common stock shares outstanding totaled 148.1 million (three months

ended March 31, 2017: 92.2 million). For three months ended March 31, 2018, there is no Class B common stock

shares outstanding (three months ended March 31, 2017: 48.2 million).

Excluding impact of Raleigh outages in 2018.

Non-GAAP measures. See “Calculation and Use of Non-GAAP Measures” and “Reconciliation of Non-GAAP

Measures” sections. Amounts in 2017 adjusted for sale of our UK and Residential portfolios.

Three months ended

(MILLIONS, EXCEPT AS NOTED)

Total generation (GWh)(1)

Mar 31

LTA generation (GWh)

Adjusted EBITDA(3)

Adjusted Revenue(3)

CAFD(3)

Excluding impact of Raleigh outages

Earnings (loss) per share(2)

CAFD per share(3)(4)

Net loss

• Our portfolio performed broadly in-line with expectations,

excluding the impact of the Raleigh outages, delivering

Adjusted EBITDA and CAFD of $102 million and $29

million

• Adjusted EBITDA $1 million down mainly due to

congestion in Texas Wind, partially offset by stronger

resource in Utility Solar

• CAFD $10 million higher due to lower debt service

driven by refinancing executed in Q4 2017, and lower

distributions to non-controlling interests, partially

offset by lower Adjusted EBITDA

• Including the nonrecurring lost revenue related to the

Raleigh outages, Adjusted EBITDA and CAFD were $96

million and $23 million

• Excluding the impact of the Raleigh outages, total

generation in Q1 2018 of 1,897 GWh, ~4% lower than Q1

2017, primarily due to curtailment in our Wind segment.

We experienced fleet availability of 95%

• Net loss of ($76) million was $20 million greater than Q1

2017 primarily due to lower Adjusted EBITDA and asset

impairment in DG Solar of $15 million due to FirstEnergy

Solutions bankruptcy

• Robust liquidity with over $1 billion of corporate liquidity

available to fund growth

Q1 2018 HIGHLIGHTS (continued)

Key Performance Metrics

Key Balance Sheet Metrics

Performance Highlights

1,834 GWh

Generation

~$1,037 million

Corporate Liquidity

$23 million

CAFD

Mar 31 Dec 31

2018 2017

1,037 855

3,637 3,643

5,966 6,071

(1)

(IN $ MILLIONS)

Corporate liquidity

Total long-term debt

Total capitalization(1)

Total capitalization is comprised of total stockholders ’ equity, redeemable non-controlling interests ,

and Total long-term debt.

5

Our Business

TerraForm Power’s goal is to own and operate high-quality solar and wind

generation assets in North America and Western Europe

Performance Targets and Key Measures

• Our objective is to deliver an attractive total return in the low teens per annum to

our shareholders

• Expect to generate return from a dividend backed by stable cashflow from our

assets and 5-8% annual dividend per share increase that we believe is

sustainable over the long term

• We target a dividend payout of 80-85% of CAFD

• Over the next five years, expect growth to be driven primarily by cost

savings, accretion from Saeta acquisition, and organic investments

• Opportunistic, value-oriented acquisitions expected to provide upside to our

business plan

• Growth in CAFD per share is a key performance metric as it is a proxy for our

ability to increase distributions

6

20+ years

15%

15-20 years

28%

10-15 years

39%

<10 years

18%

Our Operations

Owner and operator of a 2,606 MW diversified portfolio of high-quality solar and

wind assets, primarily in the US, underpinned by long-term contracts

Solar Wind Total

US 894 MW 1,453 MW 2,347 MW

International 181 MW 78 MW 259 MW

Total 1,075 MW 1,531 MW 2,606 MW

Solar

67%

Wind

33%

2.6 GW

Fleet

Large Scale Portfolio with Cash

Flow Diversified by Technology1

Long-Term Offtake Contract1

1. Weighted on 2017 project CAFD.

Average

~14 Years

Remaining

7

Generation and Revenue

• Long term average annual generation (LTA) is energy at the point of delivery net of all recurring losses and

constraints. Our LTA represents the level of production that we expect to achieve starting in 2019 as we improve the

performance of our fleet

• We compare actual generation levels against the long-term average to highlight the impact of an important factor that

affects the variability of our business results. In the short-term, we recognize that wind and irradiance conditions will

vary from one period to the next; however, we expect our facilities will produce electricity in-line with their long-term

averages over time

(GWh) (MILLIONS)

Actual Generation LTA Generation Operating Revenue, Net Adjusted Revenue(1)

Q1 2018 Q1 2017 Q1 Q1 2018 Q1 2017 Q1 2018 Q1 2017

Wind

Central Wind 669 778 779 32$ 40$ 40$ 49$

Texas Wind 430 479 454 6$ 13$ 6$ 10$

Hawaii Wind 41 39 66 8$ 7$ 8$ 7$

Northeast Wind 325 330 324 22$ 25$ 24$ 25$

1,465 1,626 1,623 68$ 85$ 78$ 91$

Solar

NA Utility Solar 204 189 219 23$ 21$ 24$ 22$

International Utility Solar 62 64 66 8$ 8$ 7$ 9$

DG 103 103 114 29$ 30$ 30$ 27$

369 356 399 60 59 61 58

Total adjusted for Asset Sales 1,834 1,982 2,022 128$ 144$ 139$ 149$

Asset Sold 50 - 7 - 7

Total 1,834 2,032 2,022 128$ 151$ 139$ 156$

(1) Non-GAAP measures. See "Calculation and Use of Non-GAAP Measures" and "Reconciliation of Non-GAAP Measures” sections. Adjusted for unrealized (gain) loss on commodity

contract derivatives, amortization of favorable and unfavorable rate revenue contracts, other non-cash items, and sale of our UK solar and Residential portfolios.

8

Selected Income Statement and Balance Sheet Information

The following tables present selected income statement and balance sheet information by operating

segment:

Income Statement Balance Sheet

2018 2017

(12) 6

(7) 5

(57) (67)

$ (76) $ (56)

49 47

54 65

(7) (9)

$ 96 $ 103

23 21

35 33

(35) (35)

$ 23 $ 19

Three months ended

Mar 31

(MILLIONS, UNLESS NOTED)

Net loss

Solar

Wind

Corporate

Total

Adjusted EBITDA

Solar

Wind

Corporate

Total

Total

CAFD

Solar

Wind

Corporate

2,814 2,897

3,342 3,401

103 89

$ 6,259 $ 6,387

1,101 1,145

882 884

1,946 1,929

$ 3,929 $ 3,958

1,713 1,752

2,460 2,517-

(1,843) (1,840)

$ 2,330 $ 2,429

Solar

Wind

Corporate

Total

Total

Total Equity and NCI

Solar

Wind

Corporate

Total

Total Liabilities

Solar

Wind

Corporate

As of

(MILLIONS) Mar 31, 2018 Dec 31, 2017

Total Assets

9

Operating Segments

10

Solar

The following table presents selected key performance metrics for our Solar segment:

Overview

• 1,075 MW of net capacity

• 515 Sites in diverse geographies

• Average remaining PPA life of 17 years

• Average offtaker credit rating of Aa3

• Diverse mix of high quality modules

Contracted cash flows

• Utility scale – generation contracted by

investment grade counterparties (such

as state utilities)

• Distributed generation – mostly behind

the meter generation contracted by

investment grade public offtakers

(municipalities, universities, schools,

hospitals), and commercial and

industrial offtakers

2018 2017

1,075 1,075

399 399

93% 93%

369 356

$ 61 $ 58

$ 166 $ 162

(1) Adjusted for sale of our UK solar and Residential portfolios.

(MILLIONS, UNLESS NOTED)

Average Adj. Revenue per MWh(1)

Adjusted Revenue (1)

Generation (GWh) (1)

LTA Generation (GWh)

Availability (%)

Capacity (MW)

Three months ended

Mar 31

11

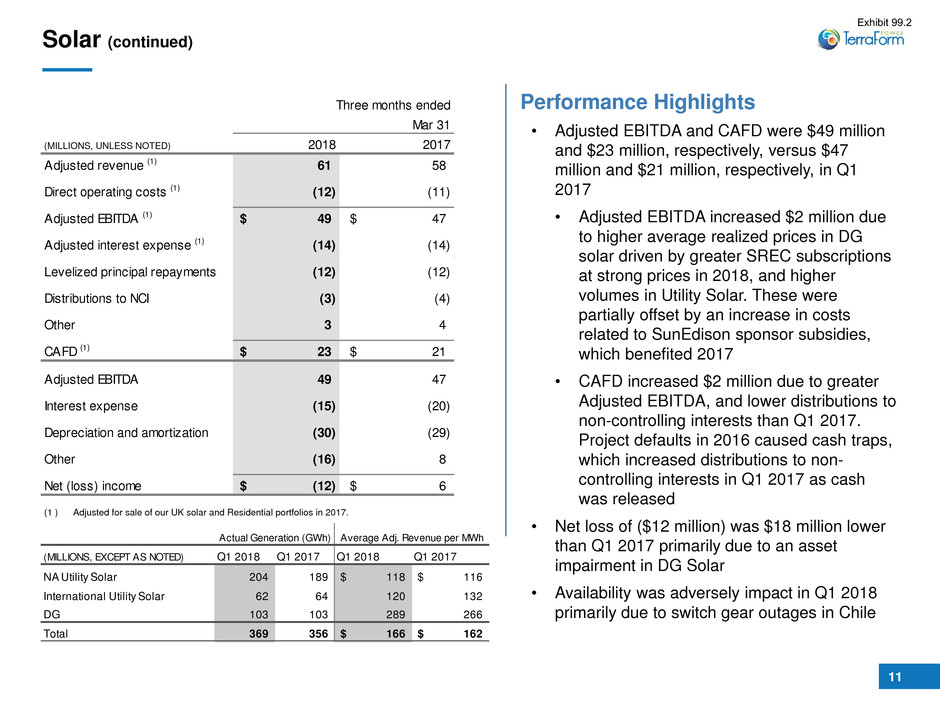

Solar (continued)

• Adjusted EBITDA and CAFD were $49 million

and $23 million, respectively, versus $47

million and $21 million, respectively, in Q1

2017

• Adjusted EBITDA increased $2 million due

to higher average realized prices in DG

solar driven by greater SREC subscriptions

at strong prices in 2018, and higher

volumes in Utility Solar. These were

partially offset by an increase in costs

related to SunEdison sponsor subsidies,

which benefited 2017

• CAFD increased $2 million due to greater

Adjusted EBITDA, and lower distributions to

non-controlling interests than Q1 2017.

Project defaults in 2016 caused cash traps,

which increased distributions to non-

controlling interests in Q1 2017 as cash

was released

• Net loss of ($12 million) was $18 million lower

than Q1 2017 primarily due to an asset

impairment in DG Solar

• Availability was adversely impact in Q1 2018

primarily due to switch gear outages in Chile

Performance Highlights

2018 2017

61 58

(12) (11)

$ 49 $ 47

(14) (14)

(12) (12)

(3) (4)

3 4

$ 23 $ 21

49 47

(15) (20)

(30) (29)

(16) 8

$ (12) $ 6

(1 ) Adjusted for sale of our UK solar and Residential portfolios in 2017.

Depreciation and amortization

Other

Net (loss) income

(MILLIONS, UNLESS NOTED)

Adjusted revenue (1)

Direct operating costs (1)

Adjusted EBITDA (1)

Adjusted interest expense (1)

Levelized principal repayments

Distributions to NCI

Other

CAFD (1)

Adjusted EBITDA

Interest expense

Mar 31

Three months ended

Actual Generation (GWh) Average Adj. Revenue per MWh

(MILLIONS, EXCEPT AS NOTED) Q1 2018 Q1 2017 Q1 2018 Q1 2017

NA Utility Solar 204 189 118$ 116$

International Utility Solar 62 64 120 132

DG 103 103 289 266

Total 369 356 166$ 162$

12

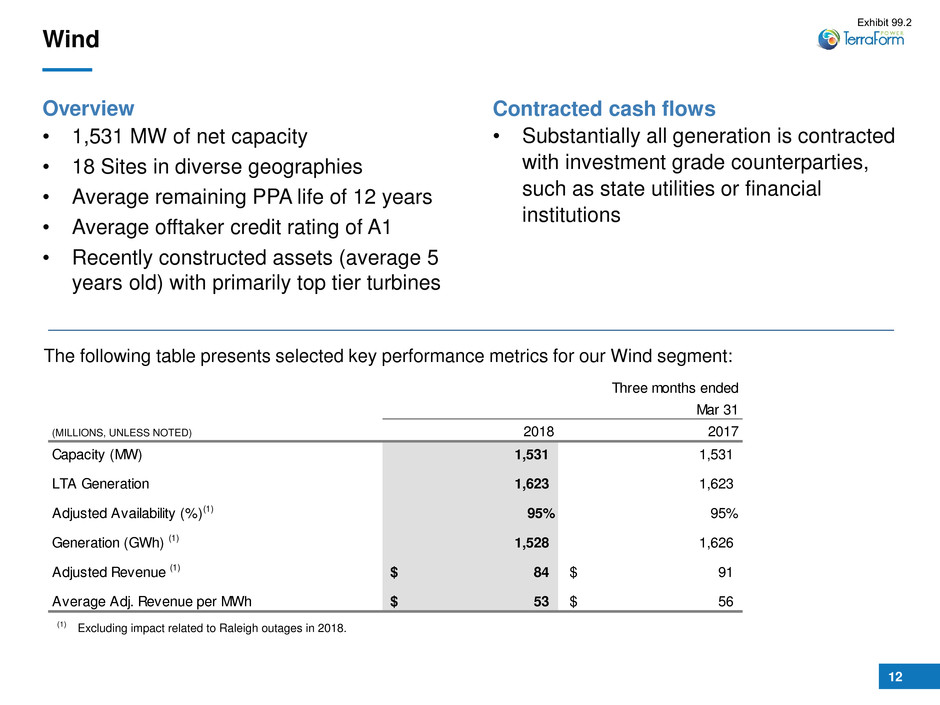

Wind

Overview

• 1,531 MW of net capacity

• 18 Sites in diverse geographies

• Average remaining PPA life of 12 years

• Average offtaker credit rating of A1

• Recently constructed assets (average 5

years old) with primarily top tier turbines

Contracted cash flows

• Substantially all generation is contracted

with investment grade counterparties,

such as state utilities or financial

institutions

The following table presents selected key performance metrics for our Wind segment:

2018 2017

1,531 1,531

1,623 1,623

95% 95%

1,528 1,626

$ 84 $ 91

$ 53 $ 56

Capacity (MW)

(1) Excluding impact related to Raleigh outages in 2018.

Three months ended

Mar 31

(MILLIONS, UNLESS NOTED)

Adjusted Revenue (1)

Average Adj. Revenue per MWh

LTA Generation

Adjusted Availability (%)(1)

Generation (GWh) (1)

13

Wind (continued)

Performance Highlights

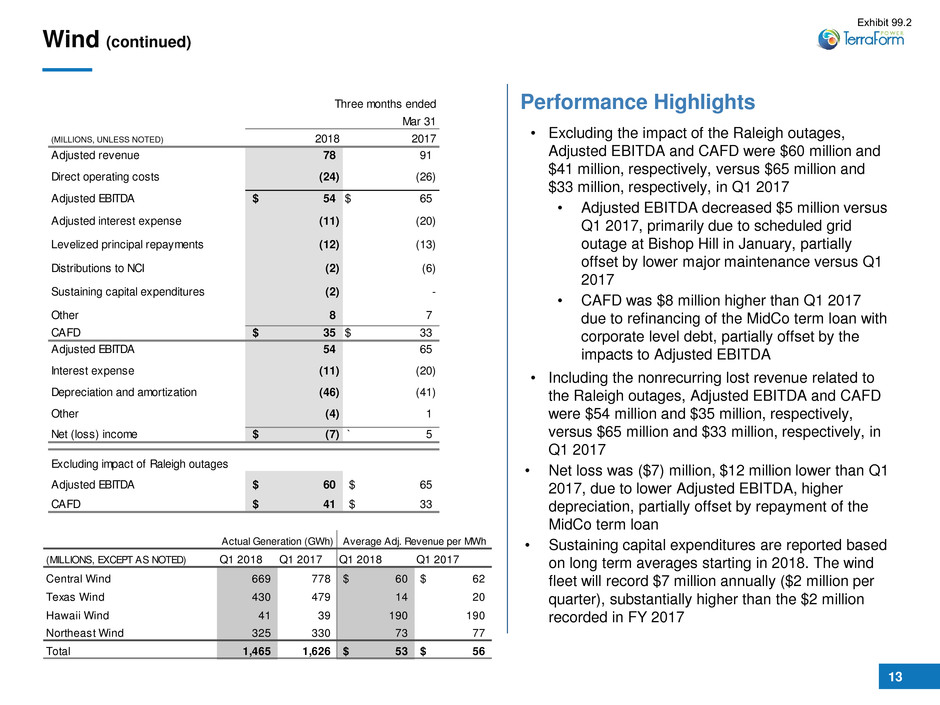

• Excluding the impact of the Raleigh outages,

Adjusted EBITDA and CAFD were $60 million and

$41 million, respectively, versus $65 million and

$33 million, respectively, in Q1 2017

• Adjusted EBITDA decreased $5 million versus

Q1 2017, primarily due to scheduled grid

outage at Bishop Hill in January, partially

offset by lower major maintenance versus Q1

2017

• CAFD was $8 million higher than Q1 2017

due to refinancing of the MidCo term loan with

corporate level debt, partially offset by the

impacts to Adjusted EBITDA

• Including the nonrecurring lost revenue related to

the Raleigh outages, Adjusted EBITDA and CAFD

were $54 million and $35 million, respectively,

versus $65 million and $33 million, respectively, in

Q1 2017

• Net loss was ($7) million, $12 million lower than Q1

2017, due to lower Adjusted EBITDA, higher

depreciation, partially offset by repayment of the

MidCo term loan

• Sustaining capital expenditures are reported based

on long term averages starting in 2018. The wind

fleet will record $7 million annually ($2 million per

quarter), substantially higher than the $2 million

recorded in FY 2017

Actual Generation (GWh) Average Adj. Revenue per MWh

(MILLIONS, EXCEPT AS NOTED) Q1 2018 Q1 2017 Q1 2018 Q1 2017

Central Wind 669 778 60$ 62$

Texas Wind 430 479 14 20

Hawaii Wind 41 39 190 190

Northeast Wind 325 330 73 77

Total 1,465 1,626 53$ 56$

2018 2017

78 91

(24) (26)

$ 54 $ 65

(11) (20)

(12) (13)

(2) (6)

Sustaining capital expenditures (2) -

8 7

$ 35 $ 33

54 65

(11) (20)

(46) (41)

(4) 1

$ (7) ` 5

$ 60 $ 65

$ 41 $ 33

Adjusted EBITDA

CAFD

Excluding impact of Raleigh outages

Other

Net (loss) income

CAFD

Adjusted EBITDA

Interest expense

Depreciation and amortization

Adjusted EBITDA

Adjusted interest expense

Levelized principal repayments

Distributions to NCI

Other

(MILLIONS, UNLESS NOTED)

Adjusted revenue

Direct operating costs

Three months ended

Mar 31

14

Corporate

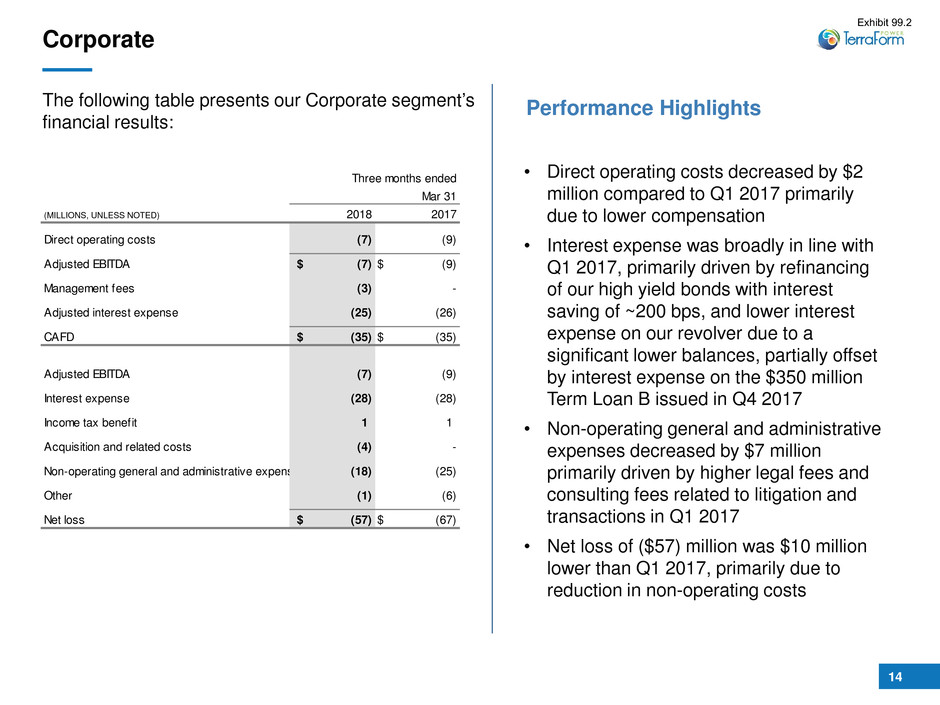

The following table presents our Corporate segment’s

financial results:

Performance Highlights

• Direct operating costs decreased by $2

million compared to Q1 2017 primarily

due to lower compensation

• Interest expense was broadly in line with

Q1 2017, primarily driven by refinancing

of our high yield bonds with interest

saving of ~200 bps, and lower interest

expense on our revolver due to a

significant lower balances, partially offset

by interest expense on the $350 million

Term Loan B issued in Q4 2017

• Non-operating general and administrative

expenses decreased by $7 million

primarily driven by higher legal fees and

consulting fees related to litigation and

transactions in Q1 2017

• Net loss of ($57) million was $10 million

lower than Q1 2017, primarily due to

reduction in non-operating costs

2018 2017

(7) (9)

$ (7) $ (9)

(3) -

(25) (26)-

$ (35) $ (35)

(7) (9)

(28) (28)-

1 1- -

(4) -- -

(18) (25)- -

(1) (6)

$ (57) $ (67)

Three months ended

Mar 31

(MILLIONS, UNLESS NOTED)

Direct operating costs

Adjusted EBITDA

Management fees

Income tax benefit

Acquisition and related costs

Other

Net loss

Adjusted interest expense

CAFD

Adjusted EBITDA

Interest expense

Non-operating general and administrative expens

15

Progress Versus Cost Savings Objectives

• On an annualized basis,

Q1 operating costs plus

base management fee of

$181 million, compared to

operating costs of $191

million on a same store

basis in 2017, illustrating

cost savings of $10 million

• Q1 Corporate operating

costs include $0.9 million

of audit fees, which were

concentrated in Q1 and

not reflective of the normal

quarterly run rate

Three months ended March 31

2018

(MILLIONS, UNLESS NOTED) Solar Wind Corp Total

Operating costs ($12) ($24) ($7) ($43)

Base management fee - - (2) (2)

Total operating costs ($12) ($24) ($9) ($45)

Annualized

2018

Solar Wind Corp Total

Operating costs ($48) ($97) ($25) ($171)

Base management fee - - (10) (10)

Total operating costs ($48) ($97) ($35) ($181)

Tw elve months ended December 31

2017

Solar Wind Corp Total

Operating costs (1) ($52) ($106) ($31) ($189)

Base management fee - - (2) (2)

Total operating costs ($52) ($106) ($33) ($191)

2018 vs 2017 total operating costs ($10)

(1) Operating costs in 2017 include $5.8 million of costs previously reported as

sustaining capex related to our w ind assets. These costs w ill largely be covered by

our recently signed FSA contracts and so are being reported for all periods as

operating costs.

16

We operate with sufficient liquidity to enable us to fund expected growth initiatives, capital expenditures, and distributions,

and to provide protection against any sudden adverse changes in economic circumstances or short-term fluctuations in

generation.

Principal sources of liquidity are cash flows from operations, our credit facilities, up-financings of subsidiary borrowings

and proceeds from the issuance of securities.

Corporate liquidity and available capital were $1,037 million and $1,210 million, respectively, as of March 31, 2018:

Liquidity

$ 73 $ 47

12 21

Cash available to corporate 85 68

Authorized credit facilities 600 450

Draws on credit facilities (70) (60)

Commitments under revolver (78) (103)

Undrawn Sponsor Line 500 500

952 787

$ 1,037 $ 855

73 60

95 97

5 3

$ 1,210 $ 1,015

Other project-level unrestricted cash

Project-level restricted cash

Project-level credit commitments, unissued

Available capital

(MILLIONS)

Unrestricted corporate cash

Project-level distributable cash

Credit facilities

Available portion of credit facilities

Mar 31

2018

Dec 31

2017

Corporate liquidity

17

Maturity Profile

We finance our assets primarily with project level debt that generally has long-term maturities that amortize

over the contract life, few restrictive covenants and no recourse to either TerraForm Power or other projects.

We have long-dated, staggered debt maturities. We have no meaningful maturities over next four years.

The following table summarizes our scheduled principal repayments, overall maturity profile and average

interest rates associated with our borrowings over the next five years:

Notes 7.6 $ - $ - $ - $ - $ - $ 1,500 $ 1,500 5.1%

Term Loan 4.6 3 4 4 4 336 - 350 4.6%

Revolver (1) 3.5 70 - - - - - 70 4.9%

Total corporate 6.9 73 4 4 4 336 1,500 1,920 5.0%

Utility scale 15.1 34 37 41 44 46 677 879 5.7%

Distributed generation 8.5 9 20 10 10 6 43 98 6.8%

Solar 14.4 44 57 51 53 53 720 977 5.9%

Wind 8.9 46 50 50 51 208 334 740 5.5%

Total non-recourse 12.0 90 107 101 104 261 1,054 1,717 5.7%

Total borrrowings 9.4 $ 163 $ 111 $ 105 $ 108 $ 597 $ 2,554 $ 3,637 5.3%

4% 3% 3% 3% 16% 70%

Revolver is classified as current in 2018 because the majority has been paid off in Q2 2018. The remaining balance and future borrowings are eligible to be rolled over for the duration of facilities’ term

Principal Repayments

Corporate borrowings

Non-recourse debt

2021 2022 Thereafter Total

Weighted

Average

Interest

Rate(MILLIONS)

Weighted

Average

Life

Remainder

of 2018 2019 2020

(1)

18

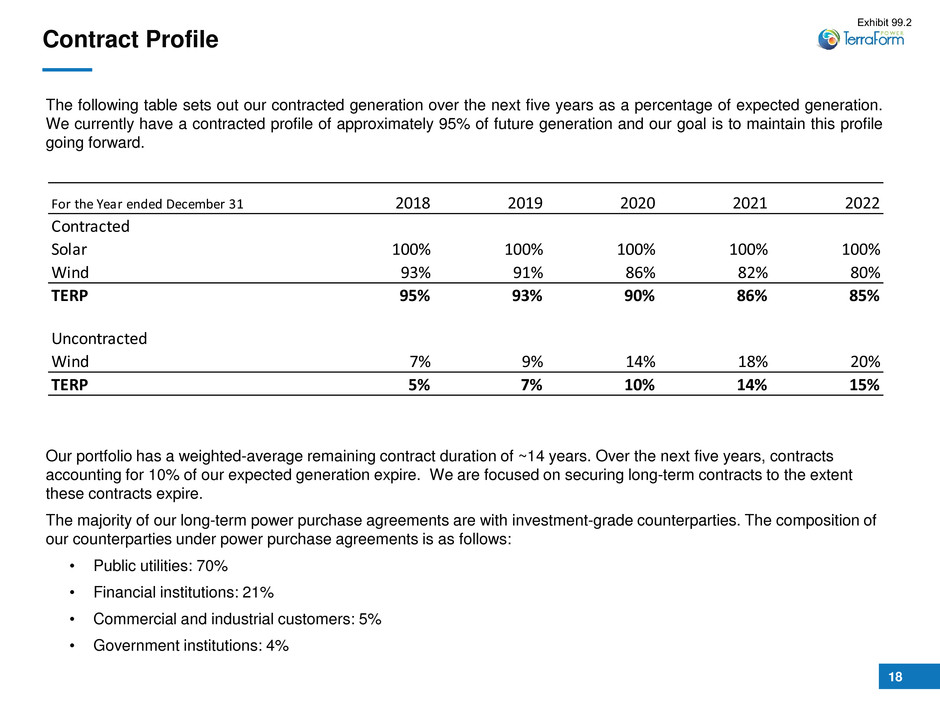

Our portfolio has a weighted-average remaining contract duration of ~14 years. Over the next five years, contracts

accounting for 10% of our expected generation expire. We are focused on securing long-term contracts to the extent

these contracts expire.

The majority of our long-term power purchase agreements are with investment-grade counterparties. The composition of

our counterparties under power purchase agreements is as follows:

• Public utilities: 70%

• Financial institutions: 21%

• Commercial and industrial customers: 5%

• Government institutions: 4%

The following table sets out our contracted generation over the next five years as a percentage of expected generation.

We currently have a contracted profile of approximately 95% of future generation and our goal is to maintain this profile

going forward.

Contract Profile

For the Year ended December 31 2018 2019 2020 2021 2022

Contracted

Solar 100% 100% 100% 100% 100%

Wind 93% 91% 86% 82% 80%

TERP 95% 93% 90% 86% 85%

Uncontracted

Wind 7% 9% 14% 18% 20%

TERP 5% 7% 10% 14% 15%

19

Appendix 1 - Reconciliation of Non-GAAP Measures

20

Reconciliation of Non-GAAP Measures

for the Three Months Ended March 31

(MILLIONS, EXCEPT AS NOTED) Solar Wind Corp Total Solar Wind Corp Total

Revenue $60 $68 $0 $128 $66 $85 $0 $151

Unrealized (gain) loss on commodity contract derivatives, net (a) - 2 - 2 - (2) - (2)

Amortization of favorable and unfavorable rate revenue contracts, net (b) 1 8 - 9 2 8 - 10

Other non-cash items (c) - - - - (3) - - (3)

Adjustment for asset sales - - - - (7) - - (7)

Adjusted revenues $61 $78 $0 $139 $58 $91 $0 $149

Direct operating costs (d) (12) (24) (7) (43) (11) (26) (9) (46)

Adjusted EBITDA $49 $54 ($7) $96 $47 $65 ($9) $103

Non-operating general and administrative expenses (e) - - (18) (18) - - (25) (25)

Stock-based compensation expense - - - - - - (3) (3)

Acquisition and related costs - - (4) (4) - - - -

Depreciation, accretion and amortization expense (f) (30) (46) - (76) (29) (41) (1) (71)

Impairment charges (15) - - (15) - - - -

Interest expense, net (15) (11) (28) (54) (20) (20) (28) (68)

Income tax benefit - - 1 1 - - 1 1

Adjustment for asset sales - - - - 3 - - 3

Other non-cash or non-operating items (g) (1) (4) (1) (6) 5 1 (2) 4

Net (loss) income ($12) ($7) ($57) ($76) $6 $5 ($67) ($56)

(MILLIONS, EXCEPT AS NOTED) Solar Wind Corp Total Solar Wind Corp Total

Adjusted EBITDA $49 $54 ($7) $96 $47 $65 ($9) $103

Fixed management fee - - (2) (2) - - - -

Variable management fee - - (1) (1) - - - -

Adjusted interest expense (h) (14) (11) (25) (50) (14) (20) (26) (60)

Levelized principal payments (i) (12) (12) - (24) (12) (13) - (25)

Cash distributions to non-controlling interests (j) (3) (2) - (5) (4) (6) - (10)

Sustaining capital expenditures (k) - (2) - (2) - - - -

Other (l) 3 8 - 11 4 7 - 11