Form 425 PARK NATIONAL CORP /OH/ Filed by: PARK NATIONAL CORP /OH/

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) | April 23, 2018 |

Park National Corporation |

(Exact name of registrant as specified in its charter) |

Ohio | 1-13006 | 31-1179518 |

(State or other jurisdiction | (Commission | (IRS Employer |

of incorporation) | File Number) | Identification No.) |

50 North Third Street, P.O. Box 3500, Newark, Ohio | 43058-3500 |

(Address of principal executive offices) | (Zip Code) |

(740) 349-8451 |

(Registrant’s telephone number, including area code) |

Not Applicable |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

ý | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 - Regulation FD Disclosure.

C. Daniel DeLawder, Chairman of the Board of Park National Corporation (“Park” or the “Company”), and David L.Trautman, Chief Executive Officer and President of Park, will make a presentation at the Company's Annual Meeting of Shareholders on April 23, 2018 which will be held at 2:00 p.m., Eastern Daylight Saving Time. The slides that will accompany the presentation are furnished in this Current Report on Form 8-K, pursuant to this Item 7.01, as Exhibit 99.1, and are incorporated herein by reference. The slides are also available in the “Investor Relations” section of Park's web site at www.parknationalcorp.com.

The text of the slide entitled “Safe Harbor Statement” is incorporated by reference into this Item 7.01.

Item 8.01 - Other Events.

On April 20, 2018, Park and its wholly-owned national bank subsidiary, The Park National Bank ("PNB"), received all required regulatory approvals from the Office of the Comptroller of the Currency ("OCC") for the merger (the "Merger") of NewDominion Bank, a North Carolina state-chartered bank ("NewDominion"), with and into PNB.

The Merger remains subject to the approval by the shareholders of NewDominion of the Agreement and Plan of Merger and Reorganization among Park, PNB and NewDominion, dated as of January 22, 2018, and the satisfaction of customary closing conditions. Park expects that the closing of the Merger will occur on or about July 1, 2018.

Important Information About the Merger

In connection with the proposed Merger, Park has filed with the Securities and Exchange Commission (the "SEC") a Registration Statement on Form S-4 that includes a Proxy Statement of NewDominion and a Prospectus of Park, as well as other relevant documents concerning the proposed Merger. The proposed Merger is being submitted to NewDominion's shareholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. SHAREHOLDERS OF NEWDOMINION ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT PARK, PNB, NEWDOMINION AND THE PROPOSED MERGER.

A free copy of the definitive Proxy Statement/Prospectus, as well as other filings containing information about Park and NewDominion, may be obtained at the SEC's Internet site (http://www.sec.gov). These documents may also be obtained, free of charge, from Park at the "Investor Information" section of Park's web site at www.parknationalcorp.com or from NewDominion at the "Investor Relations" section of NewDominion's website at www.newdominionbank.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Park National Corporation, 50 North Third St, P.O. Box 3500, Newark, OH 43058-3500, Attention: Investor Relations, Telephone: (740) 322-6844 or to NewDominion Bank, P.O. Box 37389, Charlotte, NC 28237, Attention: Investor Relations, Telephone: (704) 943-5725.

Item 9.01 - Financial Statements and Exhibits.

(a) | Not applicable |

(b) | Not applicable |

(c) | Not applicable |

(d) | Exhibits. The following exhibit is included with this Current Report on Form 8-K: |

Exhibit No. Description

99.1Slide presentation for the Park National Corporation Annual Meeting of Shareholders on April 23, 2018 (furnished pursuant to Item 7.01 hereof).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

PARK NATIONAL CORPORATION | ||

DATE: April 23, 2018 | /s/ Brady T. Burt | |

Brady T. Burt | ||

Chief Financial Officer, Secretary and Treasurer | ||

ANNUAL MEETING OF SHAREHOLDERS

April 23, 2018

1

File by Park National Corporation

Pursuant to Rule 425 under the Securities Act of 1933

Issuing Company: Park National Corporation

Registration Statement on Form S-4 File No. 333-2233559

Subject Company : NewDominion Bank

Safe Harbor Statement

2

Park cautions that any forward-looking statements contained in this presentation or otherwise made by management of Park are provided to

assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of

future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are

subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking

statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that

could cause actual results to differ materially include, without limitation: Park's ability to execute our business plan successfully and within the

expected timeframe; general economic and financial market conditions, specifically in the real estate markets and the credit markets, either

nationally or in the states in which Park and our subsidiaries do business, may experience a slowing or reversal of the recent economic

expansion in addition to continuing residual effects of recessionary conditions and an uneven spread of positive impacts of recovery on the

economy and our counterparties, resulting in adverse impacts on the demand for loan, deposit and other financial services, delinquencies,

defaults and counterparties' ability to meet credit and other obligations; changes in interest rates and prices may adversely impact prepayment

penalty income, mortgage banking income, the value of securities, loans, deposits and other financial instruments and the interest rate

sensitivity of our consolidated balance sheet as well as reduce interest margins and impact loan demand; changes in consumer spending,

borrowing and saving habits, whether due to the newly-enacted tax legislation, changing business and economic conditions, legislative and

regulatory initiatives, or other factors; changes in unemployment; changes in customers', suppliers', and other counterparties‘ performance and

creditworthiness; asset/liability repricing risks and liquidity risks; our liquidity requirements could be adversely affected by changes to regulations

governing bank and bank holding company capital and liquidity standards as well as by changes in our assets and liabilities; competitive factors

among financial services organizations could increase significantly, including product and pricing pressures, changes to third-party relationships

and our ability to attract, develop and retain qualified bank professionals; clients could pursue alternatives to bank deposits, causing us to lose a

relatively inexpensive source of funding; uncertainty regarding the nature, timing and effect of changes in banking regulations or other regulatory

or legislative requirements affecting the respective businesses of Park and our subsidiaries, including major reform of the regulatory oversight

structure of the financial services industry and changes in laws and regulations concerning taxes, pensions, bankruptcy, consumer protection,

rent regulation and housing, financial accounting and reporting, environmental protection, insurance, bank products and services, bank capital

and liquidity standards, fiduciary standards, securities and other aspects of the financial services industry, specifically the reforms provided for in

the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and the Basel III regulatory capital reforms, as

well as regulations already adopted and which may be adopted in the future by the relevant regulatory agencies, including the Consumer

Financial Protection Bureau, the OCC, the FDIC, and the Federal Reserve Board, to implement the Dodd-Frank Act's provisions, and the Basel

III regulatory capital reforms; the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting

Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, and the accuracy of our

assumptions and estimates used to prepare our financial statements; changes in law and policy accompanying the current presidential

administration, including the recently enacted Tax Cuts and Jobs Act, and uncertainty or speculation pending the enactment of such changes;

uncertainties in Park's preliminary review of, and additional analysis of, the impact of the Tax Cuts and Jobs Act;

3

Safe Harbor Statement (cont.)

the effect of healthcare laws in the United States and potential changes for such laws which may increase our healthcare and other costs and

negatively impact our operations and financial results; significant changes in the tax laws, which may adversely affect the fair values of net

deferred tax assets and obligations of state and political subdivisions held in Park's investment securities portfolio; the effect of trade, monetary,

fiscal and other governmental policies of the U.S. federal government, including money supply and interest rate policies of the Federal Reserve

Board; disruption in the liquidity and other functioning of U.S. financial markets; the impact on financial markets and the economy of any

changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels

of U.S., European and Asian government debt and concerns regarding the creditworthiness of certain sovereign governments, supranationals

and financial institutions in Europe and Asia; the uncertainty surrounding the actions to be taken to implement the referendum by United

Kingdom voters to exit the European Union; our litigation and regulatory compliance exposure, including any adverse developments in legal

proceedings or other claims and unfavorable resolution of regulatory and other governmental examinations or other inquiries; the adequacy of

our risk management program; the impact of our ability to anticipate and respond to technological changes on our ability to respond to customer

needs and meet competitive demands; the ability to secure confidential information and deliver products and services through the use of

computer systems and telecommunications networks; a failure in or breach of our operational or security systems or infrastructure, or those of

our third-party vendors and other service providers, resulting in failures or disruptions in customer account management, general ledger,

deposit, loan, or other systems, including as a result of cyber attacks; operational issues stemming from and/or capital spending necessitated

by, the potential need to adapt to industry changes in information technology systems on which Park and our subsidiaries are highly dependent;

fraud, scams and schemes of third parties; the impact of widespread natural and other disasters, pandemics, dislocations, civil unrest, terrorist

activities or international hostilities on the economy and financial markets generally or on us or our counterparties specifically; demand for loans

in the respective market areas served by Park and our subsidiaries; the ability to obtain required governmental and shareholder approvals with

respect to, and the ability to complete, the proposed merger transaction involving Park, PNB and NewDominion Bank (the “NewDominion

Transaction”) on the proposed terms within the expected timeframe; the risk that the businesses of PNB and NewDominion Bank will not be

integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost

savings from the NewDominion Transaction may not be fully realized within the expected timeframe; revenues following the NewDominion

Transaction may be lower than expected; customer and employee relationships and business operations may be disrupted by the NewDominion

Transaction; and other risk factors relating to the banking industry as detailed from time to time in Park's reports filed with the SEC including

those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2017. Park

does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any

forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the

occurrence of unanticipated events, except to the extent required by law.

Park National Corporation Profile

(as of March 31, 2018)

• 10 Community Bank Divisions

• 2 Specialty Finance Companies

• One non-bank workout subsidiary

• 29 Ohio counties

• 108 bank offices

• 6 specialty finance offices

• 1,750 FTEs

4

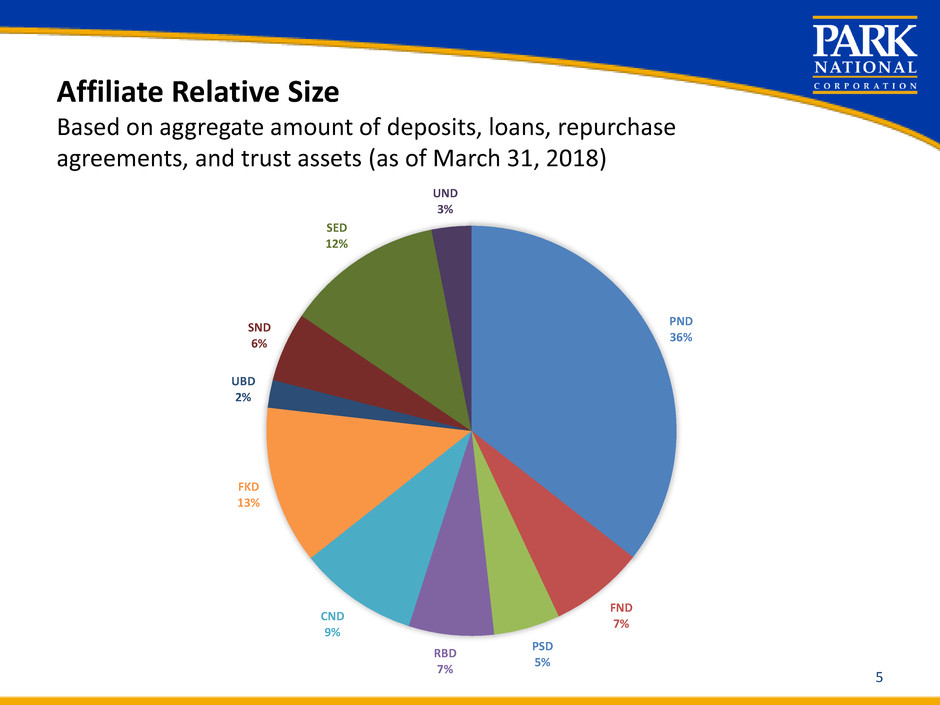

Affiliate Relative Size

Based on aggregate amount of deposits, loans, repurchase

agreements, and trust assets (as of March 31, 2018)

PND

36%

FND

7%

PSD

5%

RBD

7%

CND

9%

FKD

13%

UBD

2%

SND

6%

SED

12%

UND

3%

5

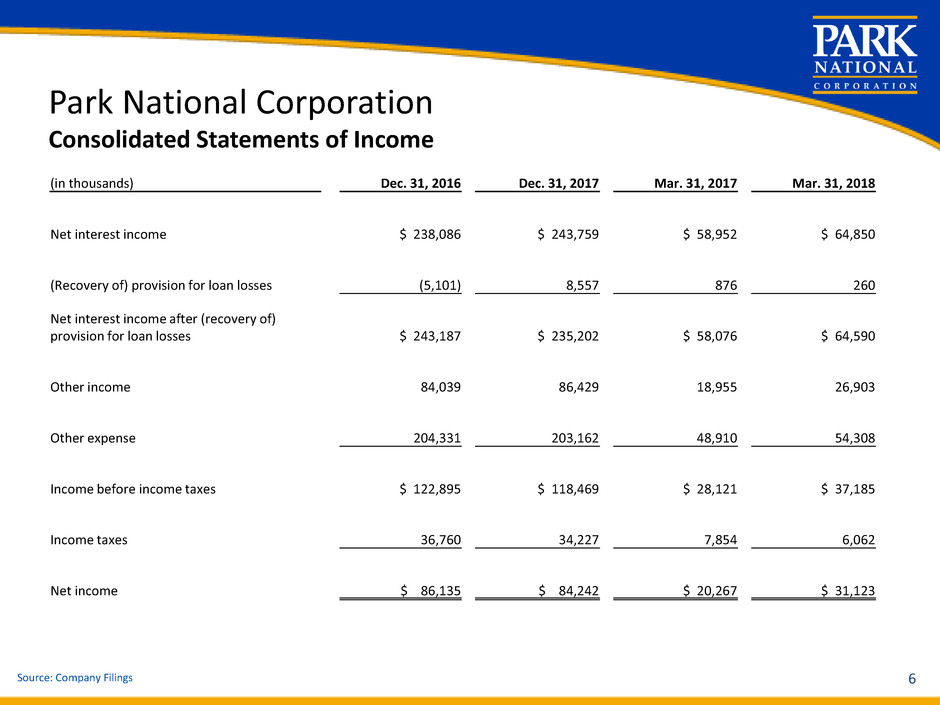

Park National Corporation

Consolidated Statements of Income

Source: Company Filings 6

(in thousands) Dec. 31, 2016 Dec. 31, 2017 Mar. 31, 2017 Mar. 31, 2018

Net interest income $ 238,086 $ 243,759 $ 58,952 $ 64,850

(Recovery of) provision for loan losses (5,101) 8,557 876 260

Net interest income after (recovery of)

provision for loan losses $ 243,187 $ 235,202 $ 58,076 $ 64,590

Other income 84,039 86,429 18,955 26,903

Other expense 204,331 203,162 48,910 54,308

Income before income taxes $ 122,895 $ 118,469 $ 28,121 $ 37,185

Income taxes 36,760 34,227 7,854 6,062

Net income $ 86,135 $ 84,242 $ 20,267 $ 31,123

Park National Corporation

Consolidated Balance Sheets

Source: Company Filings 7

(in millions) Dec. 31, 2016 Dec. 31, 2017 Mar. 31, 2018

Cash & cash equivalents $ 146 $ 169 $ 277

Investment securities 1,580 1,513 1,464

Loans 5,272 5,372 5,292

Allowance for loan losses (51) (50) (49)

Other assets 521 534 535

Total assets $ 7,468 $ 7,538 $ 7,519

Noninterest bearing deposits 1,523 1,634 1,618

Interest bearing deposits 3,999 4,183 4,466

Total deposits 5,522 5,817 6,084

Total borrowings 1,134 906 624

Other liabilities 70 59 58

Total shareholders’ equity 742 756 753

Total liabilities & shareholders’ equity $ 7,468 $ 7,538 $ 7,519

The Park National Bank

Consolidated Statements of Income

Source: Company Filings 8

(in thousands) Dec. 31, 2016 Dec. 31, 2017 Mar. 31, 2017 Mar. 31, 2018

Net interest income $ 227,576 $ 235,243 $ 57,480 $ 61,441

Provision for (recovery of) loan losses 2,611 9,898 720 (67)

Net interest income after provision for

(recovery of) loan losses $ 224,965 $ 225,345 $ 56,760 $ 61,508

Other income 79,959 82,742 19,114 19,915

Other expense 182,718 185,891 45,206 49,001

Income before income taxes $ 122,206 $ 122,196 $ 30,668 $ 32,422

Income taxes 37,755 34,881 9,182 5,677

Net income $ 84,451 $ 87,315 $ 21,486 $ 26,745

The Park National Bank

Consolidated Balance Sheets

Source: Company Filings 9

(in millions) Dec. 31, 2016 Dec. 31, 2017 Mar. 31, 2018

Cash & cash equivalents $ 146 $ 168 $ 270

Investment securities 1,573 1,508 1,453

Loans 5,235 5,339 5,274

Allowance for loan losses (49) (48) (47)

Other assets 485 501 506

Total assets $ 7,390 $ 7,468 $ 7,456

Noninterest bearing deposits 1,635 1,717 1,714

Interest bearing deposits 3,995 4,180 4,463

Total deposits 5,630 5,897 6,177

Total borrowings 1,115 917 634

Other liabilities 58 48 49

Total shareholders’ equity 587 606 596

Total liabilities & shareholders’ equity $ 7,390 $ 7,468 $ 7,456

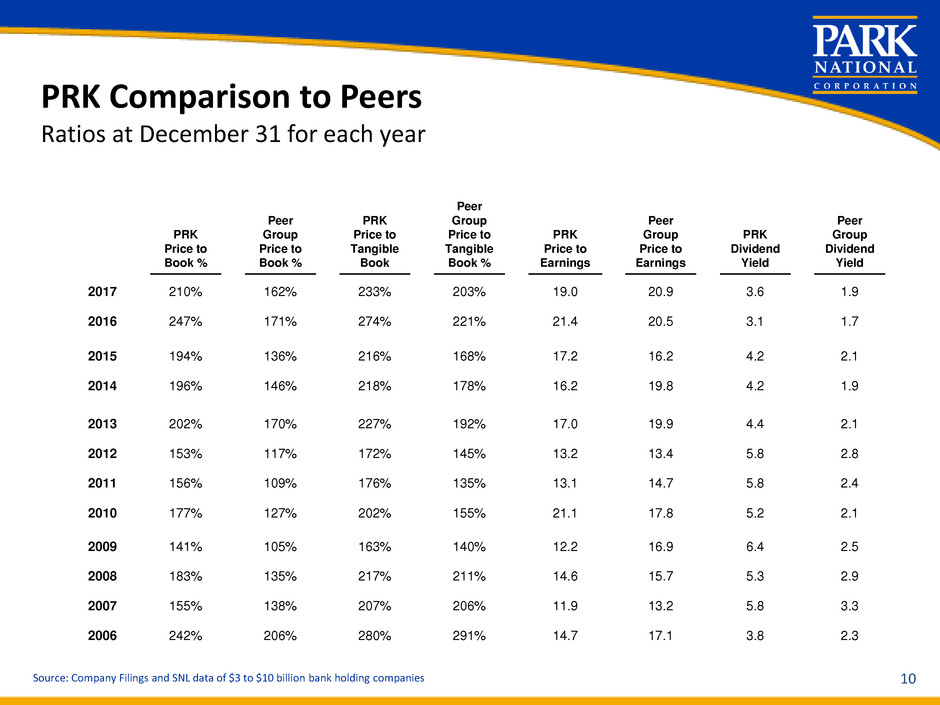

PRK Comparison to Peers

Ratios at December 31 for each year

Source: Company Filings and SNL data of $3 to $10 billion bank holding companies 10

PRK

Price to

Book %

Peer

Group

Price to

Book %

PRK

Price to

Tangible

Book

Peer

Group

Price to

Tangible

Book %

PRK

Price to

Earnings

Peer

Group

Price to

Earnings

PRK

Dividend

Yield

Peer

Group

Dividend

Yield

2017 210% 162% 233% 203% 19.0 20.9 3.6 1.9

2016 247% 171% 274% 221% 21.4 20.5 3.1 1.7

2015 194% 136% 216% 168% 17.2 16.2 4.2 2.1

2014 196% 146% 218% 178% 16.2 19.8 4.2 1.9

2013 202% 170% 227% 192% 17.0 19.9 4.4 2.1

2012 153% 117% 172% 145% 13.2 13.4 5.8 2.8

2011 156% 109% 176% 135% 13.1 14.7 5.8 2.4

2010 177% 127% 202% 155% 21.1 17.8 5.2 2.1

2009 141% 105% 163% 140% 12.2 16.9 6.4 2.5

2008 183% 135% 217% 211% 14.6 15.7 5.3 2.9

2007 155% 138% 207% 206% 11.9 13.2 5.8 3.3

2006 242% 206% 280% 291% 14.7 17.1 3.8 2.3

Dividends

11

On April 20, 2018, the Park Board of Directors declared a quarterly cash

dividend of $0.96 per common share, an increase of $0.02 per common

share.

Additionally, the Park Board of Directors declared a $0.25 per common

share special cash dividend.

12

64.06

64.70

61.17

62.82

61.19

58.74

68.95

68.00

64.98

64.03

62.21

50

55

60

65

70

75

12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 3/31/2018

Pe

rc

en

t

(%

)

Efficiency Ratio

PRK Peer Group

PRK vs. Peers

Source: BHC Performance Report; Peers include all bank holding companies nationwide with total assets between $3.0 and $10.0 billion.

March 31, 2018 data not available for Peer Group.

Park National Corporation

Nonperforming Assets

Source: BHC Performance Report and Company Filings; March 31, 2018 data unavailable for Peer Group (N/A)

Peers include all bank holding companies nationwide with total assets between $3.0 and $10.0 billion 13

(in thousands)

Dec. 31,

2016

Dec. 31,

2017

Mar. 31,

2018

Total nonperforming loans1 $ 89,908 $ 73,848 $ 67,523

Other real estate owned 13,926 14,190 9,055

Total nonperforming assets2 $ 103,834 $ 88,038 $ 76,578

Percentage of nonperforming loans to loans (PRK) 1.71% 1.37% 1.28%

Percentage of nonperforming assets to total assets (PRK) 1.39% 1.17% 1.02%

Peer Group Information

Percentage of nonperforming loans to loans 0.64% 0.55% N/A

Percentage of nonperforming assets to total assets 0.57% 0.48% N/A

Note: Total Legacy Vision Bank nonperforming assets at December 31, 2016, December 31, 2017, and March 31, 2018 were $29.2 million, $27.2 million, and $7.3

million, respectively.

1 Includes nonaccrual loans and loans past due 90 days or more and still accruing.

2 Excludes other nonperforming assets at PNB of $3.9 million and $4.8 million as of March 31, 2018 and December 31, 2017, respectively.

14

3.00

3.50

4.00

4.50

5.00

5.50

12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 3/31/2018

14.0

16.0

18.0

20.0

22.0

24.0

26.0

28.0

(A

ss

et

s

in

m

ill

io

ns

)

(R

ev

en

ue

in

m

ill

io

ns

)

Trust Assets (market value) (left Y axis) Fiduciary Revenue (right Y axis)

The Park National Bank

Fiduciary Income and Asset Trends

Source: Company Filings

Fiduciary income for 2018 is calculated as the annualized fiduciary income of $6.4 million for the three months ended March 31, 2018.

The Park National Bank

Indirect Loan Trends

Source: Company Filings

15

$0

$200

$400

$600

$800

$1,000

$1,200

12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 3/31/2018

(L

oa

ns

in

m

ill

io

ns

)

Indirect Loan Totals

16

The Park National Bank Mortgage Totals

Source: Company Filings

Dec. 31, 2013 Dec. 31, 2014 Dec. 31, 2015 Dec. 31, 2016 Dec. 31, 2017 Mar. 31, 2018

Portfolio Loans $1,177 $1,221 $1,248 $1,219 $1,165 $1,151

Serviced Loans $1,326 $1,264 $1,273 $1,328 $1,370 $1,369

Total Mortgage Loans $2,503 $2,485 $2,521 $2,547 $2,535 $2,520

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

D

ep

os

it

s

(in

m

ill

io

ns

)

17

The Park National Bank Deposit Totals

Source: Company Filings

Dec. 31, 2015 Dec. 31, 2016 Dec. 31, 2017 Mar. 31, 2017 Mar. 31, 2018

Noninterest Bearing $1,508 $1,635 $1,717 $1,655 $1,714

Interest Bearing $3,939 $3,995 $4,180 $4,368 $4,463

Total Deposits $5,447 $5,630 $5,897 $6,023 $6,177

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

D

ep

os

it

s

(in

m

ill

io

ns

)

The Park National Bank

The bank of choice

Headquarter Counties – Deposits (in thousands)

Source: SNL, June 30, 2017 18

Bank Division

Year Joined

Park

Hdqtr. Co.

Deposits

Total County

Deposits

% of 2017

Market Share

% of 2016

Market Share

2017

Headquarter

County

Market Share

Rank

2016

Headquarter

County

Market Share

Rank

Park National 1908 $1,613,780 $2,611,419 61.80% 62.04% 1 1

Fairfield National 1985 374,477 2,096,636 17.86% 18.68% 1 1

Richland Bank 1987 567,846 1,840,054 30.86% 29.17% 1 1

Century National 1990 471,279 1,409,758 33.43% 33.92% 1 1

First-Knox National 1997 543,554 876,117 62.04% 61.62% 1 1

Second National 2000 285,655 1,168,809 24.44% 24.73% 2 2

Security National 2001 492,712 1,529,161 32.22% 32.39% 1 1

Seven largest OH divisions $4,349,303 $11,531,954 37.72% 37.74%

Other OH divisions – headquarter counties 626,405 5,387,683 11.63% 11.48%

Total OH divisions – headquarter counties $4,975,708 $16,919,637 29.41% 29.39%

Remaining Ohio bank deposits $1,061,440

Total Ohio bank deposits $6,037,148

Net Promoter Score

Comparison of Results

35

77 78.61 79.86

0

10

20

30

40

50

60

70

80

90

Financial Industry Average 2015 PRK Average 2016 PRK Average 2017 PRK Average

World Class

Companies

19

Financial Industry Includes direct banks, credit unions, community banks, regional banks and national banks.

Source: 2017 Satmetrix, Net Promoter Industry Benchmarks

PRK data as of 12/31/2015, 12/31/2016, and 12/31/2017

All PNB banking divisions surveyed quarterly through four segments – 1Q Onilne Banking, 2Q Checking Statements, 3Q Lobbies

and Drive-Thrus, 4Q Mortgage Customers.

Priority Series of Accounts

Four great accounts, one is perfect for you!

Advantage Account

Premium perks

⎼ Earns interest

⎼ ATM fee refunds ($20/month)

⎼ Free checks

⎼ Overdraft Guard

Simplicity Account

Uncomplicated banking

⎼ Free introductory checks

⎼ Paperless statement

Access Account

Popular for a reason

⎼ ATM fee refunds ($10/month)

⎼ Free checks

⎼ Mailed or paperless statement

Connect Account

All the basics

⎼ Checkless checking

⎼ Paperless statement

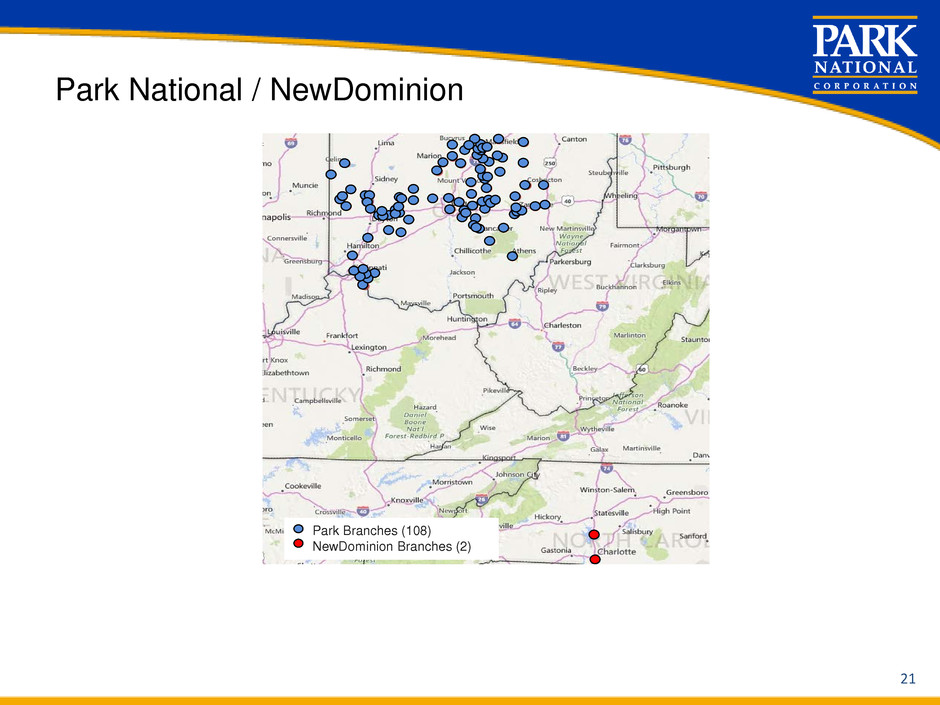

Park National / NewDominion

21

Park Branches (108)

NewDominion Branches (2)

22

ANNUAL MEETING OF SHAREHOLDERS

April 23, 2018

23