Form 6-K SIERRA WIRELESS INC For: Apr 19

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the Month of April 2018

(Commission File. No. 000-30718).

SIERRA WIRELESS, INC.

(Translation of registrant’s name in English)

13811 Wireless Way

Richmond, British Columbia, Canada V6V 3A4

(Address of principal executive offices and zip code)

Registrant’s Telephone Number, including area code: 604-231-1100

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F | o | 40-F | ý | |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: | o | No: | ý | |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: | o | No: | ý | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Sierra Wireless, Inc. | ||

By: | /s/ David G. McLennan | |

David G. McLennan, Chief Financial Officer and Secretary | ||

Date: April 19, 2018 | ||

INCORPORATION BY REFERENCE

This Report on Form 6-K is incorporated by reference into the Registration Statement on Form S-8 of the registrant, which was filed with the Securities and Exchange Commission on March 31, 2016 (File No. : 333-210315).

NOTICE OF 2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS OF

SIERRA WIRELESS, INC.

TO BE HELD ON MAY 17, 2018

MANAGEMENT INFORMATION CIRCULAR

DATED April 10, 2018

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that the annual general meeting (the “Meeting”) of holders of common shares (“Shareholders”) of Sierra Wireless, Inc. (the “Corporation”) will be held at the Corporation’s head office at 13811 Wireless Way, Richmond, British Columbia, Canada, on Thursday, May 17, 2018 at 3:00 p.m., Pacific Time, for the following purposes:

1. | to receive the audited consolidated financial statements of the Corporation for the year ended December 31, 2017, and the auditors’ report thereon; |

2. | to appoint Ernst & Young LLP, Chartered Professional Accountants, as auditors of the Corporation for the ensuing year and to authorize the directors to fix the remuneration of the auditors; |

3. | to elect directors for the ensuing year; |

4. | to consider and, if deemed advisable, pass an ordinary resolution to approve certain amendments to the Corporation's 2011 Treasury Based Restricted Share Unit Plan and to approve all unallocated entitlements under the 2011 Treasury Based Restricted Share Unit Plan; |

5. | to consider and, if deemed advisable, approve an advisory resolution to accept the Corporation’s approach to executive compensation; and |

6. | to transact such other business as may properly come before the Meeting. |

The specific details of the foregoing matters to be put before the Meeting are set forth in the Management Information Circular accompanying this Notice of Meeting.

Only Shareholders of record at the close of business on April 10, 2018 are entitled to receive notice of the Meeting and to vote at the Meeting.

To ensure your representation at the Meeting, return the enclosed proxy, whether or not you plan to personally attend the Meeting. Sending your proxy will not prevent you from voting in person at the Meeting. All proxies completed by registered Shareholders must be returned to the Corporation:

• | by delivering the proxy to the Corporation’s transfer agent, Computershare Investor Services Inc. at its office at 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, for receipt not later than Tuesday, May 15, 2018, at 3:00 p.m. (Pacific Time); |

• | by fax to the Toronto office of Computershare Investor Services Inc., Attention: Proxy Tabulation at 416-263-9524 (outside of North America) or 1-866-249-7775 (within North America) not later than Tuesday, May 15, 2018 at 3:00 p.m. (Pacific Time); or |

• | by telephone or internet, as instructed in the enclosed form of proxy, not later than Tuesday, May 15, 2018 at 3:00 p.m. (Pacific Time). |

Non-registered Shareholders whose shares are registered in the name of an intermediary should carefully follow voting instructions provided by the intermediary. A more detailed description on returning proxies by non-registered Shareholders can be found on page 2 of the Management Information Circular accompanying this Notice of Meeting.

DATED at Richmond, British Columbia, this 10th day of April, 2018.

By Order of the Board of Directors

| |

David G. McLennan | |

Chief Financial Officer and Secretary | |

April 10, 2018

Dear Shareholder:

On behalf of the Board of Directors and Management of Sierra Wireless, Inc. (the “Corporation”), we cordially invite you to attend the annual general meeting of the holders of common shares of the Corporation to be held at our Richmond, British Columbia headquarters located at 13811 Wireless Way, Richmond, British Columbia on Thursday, May 17, 2018 at 3:00 p.m. Pacific Time.

This management information circular (the “Information Circular”) contains a description of business that will be conducted at the meeting, along with materials highlighting our activities and performance during the year.

Your participation in the affairs of the Corporation is important to us. Should you be unable to attend the meeting, there are instructions included within the Information Circular describing the process for providing your voting instructions to ensure that your voice is heard. The proxy voting instructions can be found on page 1 of this Information Circular.

We look forward to seeing you at the meeting.

Sincerely,

|  | |

Jason W. Cohenour | Kent P. Thexton | |

President and Chief Executive Officer | Chair of the Board | |

Table of Contents

GENERAL PROXY INFORMATION | |

Solicitation of Proxies | |

Appointment of Proxyholder | |

Notice to United States Shareholders | |

Registered Shareholders | |

Non-Registered Shareholders | |

Revocability of Proxies | |

Voting of Proxies and Discretionary Authority | |

Interest of Certain Persons in Matters to be Acted Upon | |

Interests of Informed Persons in Material Transactions | |

Voting Securities and Principal Holders Thereof | |

BUSINESS OF THE MEETING | |

1. Receipt of Financial Statements | |

2. Appointment of Auditors | |

3. Election of Directors | |

4. Amendment and Restatement of 2011 Treasury Based Restricted Share Unit Plan | |

5. Advisory Vote on Executive Compensation ("Say on Pay") | |

6. Other Matters | |

CORPORATE GOVERNANCE DISCLOSURE | |

Key Elements of Corporate Governance at Sierra Wireless | |

Statement of Corporate Governance Practices | |

Board of Directors | |

Role of the Board | |

Position Descriptions | |

Orientation and Continuing Education | |

Ethical Business Conduct | |

Compensation | |

Committees of the Board | |

Director Tenure | |

Diversity Policy | |

Corporate Social Responsibility | |

COMPENSATION DISCUSSION AND ANALYSIS | |

Responsibility for Executive Compensation Programs | |

Compensation Objectives | |

Research and Benchmarking | |

Elements of Executive Compensation | |

Retirement Benefits | |

Minimum Share Ownership Guidelines | |

Compensation Details | |

Share Performance | |

Incentive Plan Awards | |

Termination and Change of Control Benefits | |

DIRECTOR COMPENSATION | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | |

NORMAL COURSE ISSUER BID | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | |

DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE | |

ADDITIONAL INFORMATION | |

GENERAL | |

DIRECTORS’ APPROVAL OF THIS CIRCULAR | |

SCHEDULE A | |

APPENDIX A: Amendment and Restatement of 2011 Treasury Based Restricted Share Unit Plan | |

- 1 -

MANAGEMENT INFORMATION CIRCULAR

As at April 10, 2018

GENERAL PROXY INFORMATION

Solicitation of Proxies

This management information circular (the “Information Circular”) is provided in connection with the solicitation of proxies by management of the Corporation for use at the annual general meeting of its shareholders (the “Meeting”). While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the directors and regular employees of the Corporation. All costs of solicitation will be borne by the Corporation.

The Meeting will be held on Thursday, May 17, 2018 at 3:00 p.m. (Pacific Time) at 13811 Wireless Way, Richmond, British Columbia for the purposes set forth in the accompanying Notice of Meeting. The information contained herein is given as at April 10, 2018 except as otherwise indicated.

In this document, “you” and “your” refer to the shareholders of, and “Sierra Wireless”, the “Corporation”, “we”, “us” or “our” refer to Sierra Wireless, Inc.

Appointment of Proxyholder

The individuals named in the accompanying form of proxy are the Chief Executive Officer (or “CEO”) and Chief Financial Officer (or “CFO”) of the Corporation. A shareholder has the right to appoint as a proxyholder a person or company (who need not be a shareholder of the Corporation) other than the persons designated in the previous sentence to attend and act on the shareholder’s behalf at the Meeting. To exercise this right, the shareholder may either insert the name of such other person or company in the blank space provided in the form of proxy or complete and submit another form of proxy.

A person or company whose name appears on the books and records of the Corporation is a registered shareholder. A non-registered shareholder is a beneficial owner of common shares of the Corporation (“Common Shares”) whose Common Shares are registered in the name of an intermediary (such as a bank, trust company, securities dealer or broker, or a clearing agency in which an intermediary participates).

Notice to United States Shareholders

The solicitation of proxies by the Corporation is not subject to the requirements of Section 14(a) of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under the U.S. Exchange Act. Accordingly, this Information Circular has been prepared in accordance with the applicable disclosure requirements in Canada. Residents of the United States should be aware that such requirements are different than those of the United States applicable to proxy statements under the U.S. Exchange Act.

Registered Shareholders

A registered shareholder may vote Common Shares owned by it at the Meeting either in person or by proxy. A registered shareholder who wishes to vote in person at the Meeting need not complete or return the form of proxy included with this Information Circular, as those registered shareholders choosing to attend the Meeting may have their votes taken and counted at the Meeting. However, to ensure your representation at the Meeting we encourage you to return the enclosed proxy, whether or not you plan to personally attend. Sending your proxy will not prevent you from voting in person at the Meeting.

- 2 -

A registered shareholder who chooses to vote by proxy can do so using several methods in addition to mailing the enclosed form of proxy. All proxies completed by registered shareholders must be returned to the Corporation:

• | by delivering the proxy to the Corporation’s transfer agent, Computershare Investor Services Inc. ("Computershare") at its office at 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, for receipt not later than Tuesday, May 15, 2018, at 3:00 p.m. (Pacific Time); |

• | by fax to the Toronto office of Computershare, Attention: Proxy Tabulation at 416-263-9524 (outside North America) or 1-866-249-7775 (within North America) not later than Tuesday, May 15, 2018, at 3:00 p.m. (Pacific Time); or |

• | by telephone or internet, as instructed in the enclosed form of proxy, not later than Tuesday, May 15, 2018, at 3:00 p.m. (Pacific Time). |

Please review the enclosed form of proxy carefully for additional information and resources for assistance. To be effective, a proxy form must be received by Computershare no later than 3:00 p.m. (Pacific Time) two days (excluding Saturdays, Sundays, and statutory holidays) preceding the Meeting or any adjournment of the Meeting.

The Common Shares represented by such shareholder’s proxy will be voted or withheld from voting in accordance with the instructions indicated by the shareholder on the form of proxy or alternative method of voting on any ballot that may be called for.

Non-Registered Shareholders

We have distributed copies of this Information Circular and accompanying Notice of Meeting to intermediaries for distribution to non-registered shareholders at the Corporation's expense. Unless a non-registered shareholder has waived its rights to receive these materials, an intermediary is required to deliver them to the non-registered shareholder and to seek instructions on how to vote the Common Shares beneficially owned by the non-registered shareholder. In many cases, intermediaries will have used a service company to forward these Meeting materials to non-registered shareholders.

Non-registered shareholders who receive these Meeting materials will typically be given the ability to provide voting instructions in one of two ways.

Usually a non-registered shareholder will be given a voting instruction form, which must be completed and signed by the non-registered shareholder in accordance with the instructions provided by the intermediary. In this case, a non-registered shareholder cannot use the mechanisms described above for registered shareholders and must follow the instructions provided by their intermediary (which in some cases may allow the completion of the voting instruction form by telephone or the Internet).

Occasionally, however, a non-registered shareholder may be given a proxy that has already been signed by the intermediary. This form of proxy is restricted to the number of Common Shares beneficially owned by the non-registered shareholder but is otherwise not completed. This form of proxy does not need to be signed by the non-registered shareholder. In this case, the non-registered shareholder can complete the proxy and vote by mail or facsimile only, as described above for registered shareholders.

These procedures are designed to enable non-registered shareholders to direct the voting of their Common Shares. Any non-registered shareholder receiving either a form of proxy or a voting instruction form who wishes to attend and vote at the Meeting in person (or have another person attend and vote on their behalf), should strike out the names of the persons identified in the form of proxy as the proxy holder and insert the non-registered shareholder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, should follow the corresponding instructions provided by the intermediary. In either case, the non-registered shareholder should carefully follow the instructions provided by the intermediary.

- 3 -

Revocability of Proxies

A shareholder may revoke a proxy by delivering an instrument in writing executed by the shareholder or the shareholder’s attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney for the corporation, either to the registered office of the Corporation at Suite 2600, Three Bentall Centre, 595 Burrard Street, P.O. Box 49314, Vancouver, British Columbia, V7X 1L3, at any time up to 3:00 p.m. (Pacific Time) two days (excluding Saturdays, Sundays, and statutory holidays) preceding the Meeting, or if adjourned, any reconvening thereof, or to the Chair of the Meeting on the day of the Meeting before any vote in respect of which the proxy is to be used shall have been taken or in any other manner provided by law.

A revocation does not affect any matter on which a vote has been taken prior to the revocation. A shareholder of the Corporation may also revoke a proxy by signing a form of proxy bearing a later date and returning such proxy and delivering it to Computershare as aforesaid at any time up to 3:00 p.m. (Pacific Time) two days (excluding Saturdays, Sundays, and statutory holidays) preceding the Meeting or any adjournment thereof.

A person duly appointed under a form of proxy will be entitled to vote the Common Shares represented thereby only if the form of proxy is properly completed and delivered in accordance with the requirements set out above and such proxy has not been revoked.

Voting of Proxies and Discretionary Authority

Unless specifically directed in the form of proxy to withhold the Common Shares represented by the form of proxy from a ballot or show of hands, the proxies named in the accompanying form of proxy shall vote the Common Shares represented by the form of proxy on each ballot or show of hands. Where a choice with respect to any matter to be acted upon has been specified in the form of proxy, the Common Shares will be voted in accordance with the specifications so made.

In the absence of any instructions on the proxy or if such instructions are unclear, Common Shares represented by the form of proxy will be voted IN FAVOUR of each matter identified on the form of proxy, in each case as more particularly described elsewhere in this Information Circular.

The enclosed form of proxy when properly completed and delivered and not revoked confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other matter of business is properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of proxy to vote in accordance with their best judgment on such matter of business. At the time of the printing of this Information Circular, management knows of no such amendment, variation or other matter which may be presented at the Meeting.

Interest of Certain Persons in Matters to be Acted Upon

Other than as disclosed in this Information Circular, no director or executive officer of the Corporation, past, present or nominated, or any associate or affiliate of such persons, or any person on behalf of whom this solicitation is made, has any interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting other than the election of directors, except to the extent that such persons may be directly involved in the normal business of the Meeting or the general affairs of the Corporation.

- 4 -

Interests of Informed Persons in Material Transactions

Other than as disclosed in this Information Circular, no informed person of the Corporation (as that term is defined in National Instrument 51-102 — Continuous Disclosure Obligations), proposed nominee for election as a director, or any associate or affiliate of the foregoing, had any material interest, direct or indirect, in any transaction since the commencement of the Corporation's most recently completed financial year or has any material interest, direct or indirect, in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

Voting Securities and Principal Holders Thereof

The Corporation is authorized to issue an unlimited number of Common Shares of which, as of the date of this Information Circular, 35,980,133 Common Shares are issued and outstanding as fully paid and non-assessable shares. The holders of Common Shares are entitled to one vote for each Common Share held. The Corporation is also authorized to issue an unlimited number of preference shares, issuable in series, of which none are issued and outstanding.

Any shareholder of record at the close of business on April 10, 2018 (the “Record Date”) who either personally attends the Meeting or who has completed and delivered a form of proxy in the manner and subject to the provisions described above shall be entitled to vote or have his Common Shares voted at the Meeting.

To the knowledge of the directors and executive officers of the Corporation, as at the date hereof, no person or company beneficially owns or controls or directs, directly or indirectly, 10% or more of the voting rights attached to the outstanding Common Shares.

- 5 -

BUSINESS OF THE MEETING

1. | Receipt of Financial Statements |

The audited consolidated financial statements of the Corporation for the year ended December 31, 2017, including the auditors’ report thereon, are available on SEDAR at sedar.com or on the Corporation’s website at sierrawireless.com/company/investor-information/annual-reports-and-regulatory-filings/. Copies of such financial statements will also be available at the Meeting. No vote will be taken on the financial statements at the Meeting.

2. | Appointment of Auditors |

At the meeting, the Shareholders will be asked to vote on the re-appointment of Ernst & Young LLP ("EY"), Chartered Professional Accountants, as auditors of the Corporation for the ensuing year and to authorize the Board to fix their remuneration. The term of the auditor shall end at the close of the next annual meeting of the shareholders. EY was first appointed auditor of the Company on May 19, 2016.

The persons named as proxyholders in the enclosed form of proxy, if not expressly directed to the contrary, intend to vote FOR the appointment of Ernst & Young LLP, Chartered Professional Accountants, as auditors of the Corporation to hold office until the next annual meeting of shareholders or until a successor is appointed and to authorize the directors to determine the remuneration to be paid to the auditors. A simple majority of the votes cast at the Meeting, whether in person or by proxy, will constitute approval of the resolution to appoint EY as auditors of the Corporation to hold office until the next annual meeting of shareholders or until a successor is appointed and to authorize the directors to determine the remuneration to be paid to the auditors.

Audit Fees

For the fiscal years ended December 31, 2017 and 2016 the Corporation paid Auditors fees as follows:

(in United States dollars) | 2017 | 2016 | ||||||

Audit fees | $ | 1,127,400 | $ | 827,654 | ||||

Tax fees | 6,200 | — | ||||||

Audit-related fees | — | — | ||||||

Audit fees for 2017 and 2016 include fees related to the audit of our year-end financial statements, audit of our internal control over financial reporting, review of our interim financial statements, statutory audits, consents and services that are normally provided by our auditors in connection with statutory and regulatory filings or engagements for such year. Tax fees for 2017 were for tax compliance matters.

- 6 -

3. | Election of Directors |

The restated articles of incorporation of the Corporation provide that our Board of Directors (the “Board”) shall consist of a minimum of one director and a maximum of nine directors. The term of office of each of the present directors expires at the Meeting. The Board presently consists of seven directors and it is intended that seven directors be elected for the ensuing year.

Each director elected will hold office until the next annual meeting of shareholders of the Corporation or until his or her successor is duly elected or appointed, unless his or her office is earlier vacated in accordance with the By-laws of the Corporation or with the provisions of the Canada Business Corporations Act (“CBCA”).

Majority Voting Policy

The Board has adopted a majority voting policy pursuant to which, in an uncontested election of directors, each director nominee who does not receive a greater number of Common Shares voted in favour of his or her election than Common Shares “withheld” from voting must tender his or her resignation to the Chair of the Board, to take effect on acceptance by the Board. The Governance and Nominating Committee will consider such tendered resignation and make a recommendation to the Board as to the action to be taken with respect to such tendered resignation. The Board will take formal action on the Governance and Nominating Committee’s recommendation no later than 90 days following the date of the shareholders’ meeting and will announce its decision by press release. If the Board declines to accept the resignation, it will include in the press release the reason or reasons for its decision. The director will not participate in the Governance and Nominating Committee or Board deliberations on the resignation.

Advance Notice Provisions

The Corporation’s By-Law No. 1 provides for advance notice of nominations of directors (“Advance Notice Provisions”) in circumstances where nominations of persons for election to the Board are made by shareholders other than pursuant to a requisition of a meeting or a shareholder proposal, in each case made pursuant to the provisions of the CBCA. The Advance Notice Provisions fix deadlines by which a shareholder must notify the Corporation of nominations of persons for election to the Board as follows: such notice must be provided to the Corporate Secretary of the Corporation (i) in the case of an annual meeting (including an annual and special meeting) of shareholders, not less than 30 days prior to the date of the meeting; provided, however, that in the event that the meeting is to be held on a date that is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of the meeting was made, notice by the nominating shareholder may be given not later than the close of business on the tenth day following the Notice Date; and (ii) in the case of a special meeting (which is not also an annual or annual and special meeting) of shareholders called for the purpose of electing directors (whether or not called for other purposes), not later than the close of business on the fifteenth day following the day on which the first public announcement of the date of the meeting was made. The Advance Notice Provisions also stipulate that certain information about any proposed nominee and the nominating shareholder be included in such a notice in order for it to be valid. The purpose of the Advance Notice Provisions is to ensure that all shareholders, including those participating in a meeting by proxy rather than in person, receive adequate prior notice of director nominations, as well as sufficient information concerning the nominees, and can thereby exercise their voting rights in an informed manner. In addition, the Advance Notice Provisions should assist in facilitating an orderly and efficient meeting process. A copy of the Corporation’s By-Law No. 1 is available on SEDAR at www.sedar.com.

The persons named as proxyholders in the enclosed form of proxy, if not expressly directed to the contrary, intend to vote FOR the nominees listed in the table below under the heading "Director Nominees". Management does not contemplate that any of the nominees will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another nominee in their discretion. All of the nominees presented for election as directors are currently directors of the Corporation. All persons nominated were recommended to the Board by the

- 7 -

Governance and Nominating Committee. The persons nominated and named below are, in the opinion of the Board, well qualified to act as directors and all have confirmed their willingness to serve.

Director Nominees

The following pages set out detailed information on director nominees including:

•place of residence;

•year first elected or appointed as a director;

•age, principal occupation at present and within the preceding five years and whether independent;

•other principal directorships;

•committee memberships and meeting attendance in 2017;

•achievement indicator of minimum share ownership guidelines; and

• | securities held including the number of Common Shares beneficially owned by each director nominee or over which each exercises control or direction, directly or indirectly. |

◦ | the Common Shares and Restricted Share Units ("RSUs") values at December 31, 2017 were calculated using the closing share price of the Common Shares on the TSX of Cdn$25.70 translated at the spot foreign exchange rate of Cdn$1.00 = US$0.7954 for Canadian resident director nominees and on the NASDAQ of US$20.45 for non-Canadian resident director nominees. |

◦ | the Common Shares and RSUs values at December 31, 2016 were calculated using the closing share price of the Common Shares on the TSX of Cdn$21.02 translated at the spot foreign exchange rate of Cdn$1.00 = US$0.7439 for Canadian resident director nominees and on the NASDAQ of US$15.70 for non-Canadian resident director nominees. |

- 8 -

GREGORY D. AASEN

West Vancouver, British Columbia, Canada

Independent Director since: 1997

Age: 62

Mr. Aasen is a Corporate Director. Prior to his retirement in June 2007, Mr. Aasen was the chief strategy officer at PMC-Sierra, a company which Mr. Aasen was instrumental in founding in 1992. At PMC-Sierra, Mr. Aasen also served as vice president and general manager of the Communications Products division, chief operating officer, and chief technology officer. With extensive experience in the semiconductor industry, Mr. Aasen began his career at Mitel. In 1986, he joined MPR Teltech and later established the Pacific Microelectronic Centre (PMC) which provided the genesis for PMC-Sierra which was spun out of MPR Teltech in 1992. Mr. Aasen received a bachelor’s degree in Electrical Engineering from the University of British Columbia in 1979.

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | None | |||||||||

Human Resources Committee | 10/10 | 100% | ||||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 20,477 | 15,737 | 36,214 | $ | 740,279 | 14,686 | Meets | |||||

2016 | 20,138 | 8,814 | 28,952 | $ | 452,716 | 14,686 | ||||||

Change | 339 | 6,923 | 7,262 | $ | 287,563 | — | ||||||

- 9 -

ROBIN A. ABRAMS

Los Altos, California, U.S.A.

Independent Director since: 2010

Age: 66

Ms. Abrams is a Corporate Director. Prior to her retirement, Ms. Abrams gained extensive experience in governance and management of large, publicly traded entities including as the CEO of Zilog, Palm Computing, Inc. and VeriFone. Ms. Abrams has held internationally focused executive positions at Apple and Unisys and has held CEO positions at the following start-up companies: Firefly Mobile, a mobile products company for the youth market and BlueKite, a leading provider of bandwidth optimization software for wireless operators. Ms. Abrams earned her B.A. and J.D. degrees from the University of Nebraska, and she serves on the board of directors of several companies as well as on the board of trustees for the Anita Borg Institute for Women and Technology.

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | HCL Technologies - Bombay Stock Exchange (“BSE”) and National Stock Exchange of India (“NSE”) (Audit and Compensation Committees) Lattice Semiconductor - NASDAQ ( Nominating and Governance Committee) FactSet Research Systems Inc. - NASDAQ (Audit, Nominating and Governance Committees) | |||||||||

Audit Committee | 8/8 | 100% | ||||||||||

Governance and Nominating Committee | 4/4 | 100% | ||||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 14,709 | 9,522 | 24,231 | $ | 495,524 | 17,627 | Meets | |||||

2016 | 12,414 | 4,218 | 16,632 | $ | 261,122 | 21,886 | ||||||

Change | 2,295 | 5,304 | 7,599 | $ | 234,402 | (4,259 | ) | |||||

- 10 -

PAUL G. CATAFORD

Calgary, Alberta, Canada

Independent Director since: 1998

Age: 54

Mr. Cataford currently serves as the President and Chief Executive Officer of Zephyr Sleep Technologies, a developer and manufacturer of sleep-related medical devices, an office he has held since April 2010. Previously, he was the President and Chief Executive Officer of University Technologies Inc. (2004 to 2009) and prior to that was Executive Managing Director of BMO Nesbitt Burns Equity Partners Inc. (Private Equity); and Managing Director and President of BCE Capital Inc. (Venture Capital). In addition, Mr. Cataford has served on public and private boards for over 20 years. Mr. Cataford currently serves on the boards of: AGJunction Inc. (TSX - AJX, Audit Committee Chair); Trakopolis IoT Corp. (TSXV - TRAK); and Defence Construction Canada (a Crown Corporation). Mr. Cataford has extensive knowledge and experience in: technology investing; building and scaling technology companies; corporate governance; public/private finance; and financial reporting. Mr. Cataford completed a Mechanical Engineering Degree at Queen's University (1987) and a Masters of Business Administration specializing in finance and international business, at the Schulich School of Business (York University - 1991). Mr. Cataford has received the Institute of Corporate Directors certified designation (ICD.D) after attending the ICD-Rotman Directors Education Program (University of Toronto - 2002).

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | None | |||||||||

Audit Committee | 8/8 | 100% | ||||||||||

Human Resources Committee | 10/10 | 100% | ||||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 8,330 | 11,141 | 19,471 | $ | 398,022 | 8,782 | Meets | |||||

2016 | 7,830 | 4,218 | 12,048 | $ | 188,392 | 12,582 | ||||||

Change | 500 | 6,923 | 7,423 | $ | 209,630 | (3,800 | ) | |||||

- 11 -

JASON W. COHENOUR

Blaine, Washington, U.S.A.

Director since: 2005

Age: 56

Mr. Cohenour is President and Chief Executive Officer of Sierra Wireless and has overall Management responsibility for the Corporation. He joined Sierra Wireless in 1996 as Vice President of Sales, was promoted to Senior Vice President, Worldwide Sales in 2000 and served as Chief Operating Officer from August 2004 to October 2005 leading global sales, marketing and operations activities. Mr. Cohenour was appointed President and CEO of the Corporation in October 2005 and also joined the Board of Directors at that time. He has been active in the development of the wireless data industry since 1988 and was previously Regional Vice President with Ram Mobile Data. He began his wireless career in 1988 with Motorola's Mobile Data Division, where he helped establish Motorola as a leading provider of wireless data solutions. As President and CEO of Sierra Wireless, Mr. Cohenour has been instrumental in building a world-class wireless communications technology company, recognized by global customers as a ‘trusted partner’. Under his leadership, the business has grown from $105 million in revenue in 2005 to over $690 million in 2017 and in the same period the Company has transformed into a global leader in wireless solutions for the Internet of Things.

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | None | |||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 325,528 | 75,826 | 401,354 | $ | 8,207,689 | 199,309 | Meets | |||||

2016 | 350,939 | 69,857 | 420,796 | $ | 6,606,497 | 169,306 | ||||||

Change | (25,411 | ) | 5,969 | (19,442 | ) | $ | 1,601,192 | 30,003 | ||||

- 12 -

CHARLES E. LEVINE

Glen Ellen, California, U.S.A

Independent Director since: 2003

Age: 64

Mr. Levine is a Corporate Director. He is a retired executive who has a track record of developing brands into large businesses, most notably when he was President and Chief Operating Officer of Sprint PCS where he oversaw revenue growth to over $10 billion in four and a half years and at AT&T, where he turned around the Consumer Products and Small Business Market. He has held senior management positions at CAD Forms Technology and Octel Communications (now part of Alcatel Lucent). Mr. Levine was named Marketer of the Year in 1999 by MC Magazine and CEO of the Year in 2001 by Frost & Sullivan for his notable achievements at Sprint. He holds an MBA (Marketing) from the J.L. Kellogg Graduate School of Management-Northwestern University, and a bachelor’s degree in Economics from Trinity College. Mr. Levine also serves on the Boards of several not-for-profit organizations.

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | None | |||||||||

Audit Committee | 8/8 | 100% | ||||||||||

Human Resources Committee | 10/10 | 100% | ||||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 39,862 | 9,522 | 49,384 | $ | 1,009,903 | 17,627 | Meets | |||||

2016 | 44,428 | 4,218 | 48,646 | $ | 763,742 | 23,838 | ||||||

Change | (4,566 | ) | 5,304 | 738 | $ | 246,161 | (6,211 | ) | ||||

- 13 -

THOMAS SIEBER

Zurich, Switzerland

Independent Director since: 2014

Age: 56

Mr. Sieber is a Corporate Director and also currently serves as the Chairman of the Board of the Swiss utility company Axpo Holding AG, a position he has held since March 2016. Mr. Sieber has extensive experience as a technology industry executive with demonstrated expertise in building pan-European enterprise sales channels. Mr. Sieber was the CEO of Salt Mobile SA (formerly Orange Switzerland) from 2009 to 2012, where he led a successful turnaround of the business and drove the sale process of the company to a new owner. He then served as Chairman until the end of 2015. Before joining Orange, Mr. Sieber was Executive Vice President of Sales for Fujitsu Siemens Computers. Mr. Sieber started his career at Hewlett-Packard, advancing to General Manager for Small and Medium Enterprise, EMEA, by the time he left the company in 2001. He studied Business Administration at the University of St.Gallen (HSG) in Switzerland, graduating in 1987. Mr. Sieber also currently serves on the board of directors of the Swiss software company Garaio AG and the Indian IT services company, HCL Technologies.

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | HCL Technologies - Bombay Stock Exchange (“BSE”) and National Stock Exchange of India (“NSE”) | |||||||||

Audit Committee | 8/8 | 100% | ||||||||||

Governance and Nominating Committee | 4/4 | 100% | ||||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 32,238 | 9,522 | 41,760 | $ | 853,992 | 10,904 | Meets | |||||

2016 | 29,943 | 4,218 | 34,161 | $ | 536,328 | 10,904 | ||||||

Change | 2,295 | 5,304 | 7,599 | $ | 317,664 | — | ||||||

- 14 -

KENT P. THEXTON

Toronto, Ontario, Canada

Independent Director since: 2005

Age: 55

Mr. Thexton has served as the non-executive Chair of the Board of Sierra Wireless since February 2016. Since May 2016, he has served as Managing Partner of ScaleUP Ventures Inc., a venture capital fund that targets early stage investments in high growth technology companies in large, growing markets that have begun to show traction. From January 2014 to April 2016, Mr. Thexton was Managing Director of OMERS Ventures, the venture capital investment arm of the OMERS Pension Plan. During his career, Mr. Thexton has spent almost 25 years in both founder and operational management positions at growth companies globally including serving as Chief Data and Marketing Officer and board member at European telecom firm O2 Group plc, which sold to Telefonica S.A. in 2005 for $35 billion. Mr. Thexton has been an active and successful angel investor for a number of years and also founded venture-backed i-wireless, which grew to become a leading US MVNO with over one million subscribers.

Board and Committee Memberships | Meeting Attendance | Public Board Memberships | ||||||||||

Board of Directors | 10/10 | 100% | None | |||||||||

Governance and Nominating Committee | 4/4 | 100% | ||||||||||

Securities held as at fiscal year end | ||||||||||||

Common Shares | RSUs | Total Common Shares and RSUs | Total Value of Common Shares and RSUs (US$) | Options | Minimum Share Ownership Guidelines | |||||||

2017 | 17,405 | 11,709 | 29,114 | $ | 595,142 | 9,691 | Meets | |||||

2016 | 15,837 | 8,814 | 24,651 | $ | 385,462 | 14,686 | ||||||

Change | 1,568 | 2,895 | 4,463 | $ | 209,680 | (4,995 | ) | |||||

- 15 -

None of the nominees for election as a director is, as at the date of this Information Circular, or has been, within ten years before the date of this Information Circular, a director or executive officer of any company, including the Corporation, that:

(a) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation which, in each case, was in effect for a period of more than 30 consecutive days (each, an “order”) that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or |

(b) while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

In addition, none of the nominees for election as a director has, within the ten years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

No proposed director has been subject to (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director.

Further Information on Proposed Nominees

For further information relating to the proposed nominees, refer to the section entitled "Directors and Executive Officers" in our Annual Information Form ("AIF") dated March 7, 2018. The information included in this Information Circular is current as of the date of this Information Circular. The AIF is available on our website at sierrawireless.com/company/investor-information/annual-reports-and-regulatory-filings/ or on SEDAR at sedar.com.

- 16 -

Director Attendance and Meetings Held During the Year Ended December 31, 2017

Board members are expected to attend all board meetings and meetings of the committees on which they serve. The following table sets out the attendance, in person and by telephone, of the Board members at Board meetings and Board standing committee meetings held during the year ended December 31, 2017. In 2017, five Board meetings were held in person and five meetings were held by telephone conference.

Board and committee meetings held during the year ended December 31, 2017 | Board Meetings Attended | Committee Meetings Attended | Percentage of Meetings Attended |

Gregory D. Aasen | 10 of 10 | 10 of 10 | 100% |

Robin A. Abrams | 10 of 10 | 12 of 12 | 100% |

Paul G. Cataford | 10 of 10 | 18 of 18 | 100% |

Jason W. Cohenour | 10 of 10 | N/A (1) | 100% |

Charles E. Levine | 10 of 10 | 18 of 18 | 100% |

Thomas Sieber | 10 of 10 | 12 of 12 | 100% |

Kent P. Thexton | 10 of 10 | 4 of 4 | 100% |

(1) | Mr. Cohenour is not independent and is not a member of any Board committee. He attends certain committee meetings in his capacity as President and Chief Executive Officer at the invitation of the respective committee chair. |

Committee Memberships and Independence Status of Director Board Nominees

The following table sets out the Board committee memberships and independence status of each director board nominee as of the date of this Information Circular.

Board Committee Composition | ||||

Directors | Independent | Audit | Governance and Nominating | Human Resources |

Gregory D. Aasen | ü | — | — | Chair |

Robin A. Abrams | ü | ü | Chair | — |

Paul G. Cataford | ü | Chair | — | ü |

Jason W. Cohenour | û | — | — | — |

Charles E. Levine | ü | ü | — | ü |

Thomas Sieber | ü | ü | ü | — |

Kent P. Thexton | ü | — | ü | — |

The Board determined that each director nominee is independent of management except Jason Cohenour who is the President and Chief Executive Officer of the Corporation. All members of the Board committees are independent. For detailed information about how the Board determines director independence, see the section entitled Independence on page 22.

Director Attendance at the 2017 Annual Meeting of Shareholders

The Corporation encourages each member of the Board to attend its annual meeting of shareholders. At our last meeting held May 19, 2017, all of the director nominees attended the meeting.

- 17 -

2017 AGM Voting Results for Directors

The 2017 voting results for directors standing for re-election at the Meeting were announced by the Corporation by press release on May 19, 2017 and are set out below.

Directors | Votes For | % of Votes | Votes Withheld | % of Votes |

Jason W. Cohenour | 9,593,018 | 98.55 | 141,333 | 1.45 |

Gregory D. Aasen | 9,337,496 | 95.93 | 396,555 | 4.07 |

Robin A. Abrams | 9,616,064 | 98.78 | 118,287 | 1.22 |

Paul G. Cataford | 9,582,958 | 98.44 | 151,393 | 1.56 |

Charles E. Levine | 9,584,032 | 98.46 | 150,319 | 1.54 |

Thomas Sieber | 9,641,694 | 99.05 | 92,658 | 0.95 |

Kent P. Thexton | 9,639,239 | 99.02 | 95,112 | 0.98 |

4. | Amendment and Restatement of 2011 Treasury Based Restricted Share Unit Plan and Re-Approval of all Unallocated Entitlements Thereunder |

Background

The Corporation implemented the 2011 Treasury Based Restricted Share Unit Plan (the “Treasury RSU Plan”) to further the growth and profitability of the Corporation by increasing long-term incentives and encouraging Common Share ownership on the part of employees, independent contractors and outside directors of the Corporation and its subsidiaries.

The Treasury RSU Plan is an important component of the Corporation's overall compensation program and allows the Corporation to attract, hire and retain skilled employees in a highly competitive environment. The granting of Treasury RSU units enables our employees to participate in the long-term growth and performance of the company in alignment with shareholder value creation. Our employee base is expected to grow over time as the Corporation expands both organically and through acquisition. The continued availability of the Treasury RSU Plan will allow us to incent and retain our valued employees as they execute on the longer term vision for the Company.

A summary of the Treasury RSU Plan is included in Schedule A hereto.

At the Meeting, Shareholders will be asked to approve a resolution to amend and restate the Treasury RSU Plan in the form attached to this Information Circular as Appendix A and to approve all unallocated entitlements under the Treasury RSU Plan, in compliance with TSX rules. Among other things, the proposed Amendments provide that the maximum number of Common Shares issuable pursuant to outstanding awards under the Treasury RSU Plan from time to time will not exceed 3.7% of the number of issued and outstanding Common Shares from time to tome. As of April 10, 2018, this Amendment will result in 1,331,265 common shares being subject to issuance under the Treasury RSU Plan.

- 18 -

Approval by Shareholders

Shareholder approval of the Treasury RSU Plan is not required by law but is required by applicable stock exchange rules. The text of the resolution of the shareholders of the Corporation to approve the Treasury RSU Plan and all unallocated entitlements is set forth below:

“BE IT RESOLVED, as an ordinary resolution of the shareholders of Sierra Wireless, Inc. (the “Corporation”), that:

1. | The amendments to the 2011 Treasury Based Restricted Share Unit Plan ("Treasury RSU Plan") shown in Appendix A attached to the Corporation’s 2018 Management Information Circular ("Information Circular") be and hereby are approved; |

2. | The unallocated entitlements under the Treasury RSU Plan are hereby approved and the Corporation will have the ability to issue Restricted Share Units which may be settled in Common Shares from treasury until May 17, 2021; and |

3. | Any director or officer of the Corporation is hereby authorized and instructed to make any such changes to the Treasury RSU Plan amendments set forth in Appendix A to the Information Circular as such director or officer deems necessary in their discretion to satisfy the intent of the foregoing resolutions. |

The persons named in the enclosed form of proxy, if named as proxy, intend to vote FOR the above resolution unless a shareholder has specified in such shareholder’s proxy that such shareholder’s shares are to be voted against such resolution.

In the event that the foregoing resolutions are not passed by the requisite number of votes cast at the Meeting, the Company will not have the ability to settle future RSUs granted under the Treasury RSU Plan in Common Shares issued from treasury, and the Company will only be permitted to grant further unallocated awards under the RSU Plan to be settled in cash. Previously allocated RSUs under the Treasury RSU Plan will continue unaffected by the approval or disapproval of the resolution to approve the unallocated entitlements to be settled in Common Shares issued from treasury under the Treasury RSU Plan. Any RSUs that have been terminated, cancelled or that have expired will be available for re-granting, but will not be able to be settled in Common Shares issued from treasury.

The foregoing resolution must be approved by a simple majority of 50% plus one vote of the votes cast by shareholders.

- 19 -

5. | Advisory Vote on Executive Compensation ("Say on Pay") |

The underlying principle for executive pay throughout the Corporation is “pay-for-performance”. We believe that this philosophy achieves the goal of attracting and retaining excellent employees and executive officers, while rewarding the demonstrated behaviors that reinforce the Corporation’s values and help to deliver on its corporate objectives. A detailed discussion of our executive compensation program is provided in the “Compensation Discussion and Analysis” section of this Information Circular on page 34.

After monitoring recent developments and emerging trends in the practice of holding advisory votes on executive compensation (commonly referred to as “Say on Pay”), the Board has determined to provide shareholders with a “Say on Pay” advisory vote at the Meeting. This non-binding advisory vote on executive compensation will provide you as a shareholder with the opportunity to vote “For” or “Against” our approach to executive compensation through the following resolution:

“Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in the Information Circular delivered in advance of the 2018 Annual General Meeting of shareholders of the Corporation.”

As this is an advisory vote, the results will not be binding upon the Board. However, the Board will consider the outcome of the vote as part of its ongoing review of executive compensation. The Board believes that it is essential for the shareholders to be well informed of the Corporation’s approach to executive compensation and considers this advisory vote to be an important part of the ongoing process of engagement between the shareholders and the Board.

The Board unanimously recommends that the shareholders vote FOR the advisory vote on executive compensation and unless instructed otherwise, the persons named in the enclosed form of proxy will vote FOR the advisory vote on executive compensation.

6. | Other Matters |

The Corporation knows of no other matters to be submitted to the shareholders at the Meeting. If any other matters properly come before the Meeting, it is the intention of the persons designated in the enclosed form of proxy to vote the Common Shares they represent in accordance with their judgment on such matters.

- 20 -

CORPORATE GOVERNANCE DISCLOSURE

Key Elements of Corporate Governance at Sierra Wireless

Key Elements | Highlights | Page |

Code of Business Conduct and supporting policies | The Board promotes a strong culture of integrity and ethical behavior for directors, management and employees, and we require all directors to certify compliance with our Code of Business Conduct each year | 25 |

Board independence | The majority (86%) of our directors are independent and all board committees comprise independent directors. Our Board Chair, Kent Thexton, is an independent director | 22 |

Director attendance and engagement | All members of the Board are fully engaged in their duties as directors which is demonstrated by 100% director attendance at Board and committee meetings in 2017 | 16 |

Board tenure | We use the annual board assessment to inform the GNC's decision to propose director nominees and we have a mandatory board retirement policy requiring directors to retire in the year that they reach age 70 | 32 |

Majority Voting Policy | Director nominees not receiving majority approval from shareholders of their nomination must tender their resignations | 6 |

Annual Board and director assessment process | We have a formal annual process for assessment of the Board, its committees and individual directors | 28 |

Director Compensation | Our Board compensation is designed to enable recruitment of experienced and talented directors whose interests are aligned with those of our shareholders. Directors receive annual equity awards consisting of 100% restricted share units and do not receive stock options as of April 1, 2017 | 54 |

Director equity ownership | Directors are expected to hold a minimum number of common shares that is no less than an amount equal to 3 times the annual board retainer and all directors are in compliance with the guidelines | 43 |

Board orientation and continuing education | We provide new directors with an intensive orientation to the Company and directors undertake annual development activities sponsored by the Company and other providers of professional development | 25 |

Say-on-pay | We hold an annual advisory vote on executive compensation | 19 |

Board Skills Matrix | The Governance and Nominating Committee maintains a Board skills matrix which is updated annually | 29 |

Board diversity | The Board has a diverse mix of skills, background and experience and has adopted a Diversity Policy including, but not limited to, diversity characteristics such as gender, age, ethnicity, and geography | 33 |

In camera meetings | At every regularly scheduled Board and committee meeting, independent directors meet without management present to provide a forum for open and frank discussion | 22 |

- 21 -

Statement of Corporate Governance Practices

We are committed to corporate governance practices that enhance the interest of our shareholders, employees, customers, suppliers and other stakeholders. Our corporate governance practices provide a solid basis on which we oversee and conduct the operations of our business. Some of these practices include:

(a) separating the role of the President and Chief Executive Officer from that of the Chair of the Board;

(b) conducting in-camera sessions at each meeting of the Board and each Board committee meeting, where Board and committee members meet separately without management present;

(c) having both the external auditor and the Company’s senior risk management executive report to the Audit Committee; and

(d) conducting in-camera sessions at each quarterly Audit Committee meeting where committee members meet separately with the external auditor and the senior risk management executive without management present.

At least annually, the Governance and Nominating Committee assesses emerging governance best practices and where appropriate, governance practices are enhanced.

This section discusses our governance approach, policies and practices. It also describes the role and functioning of the Board and the three standing Board committees. Our AIF includes the mandates of the Board and the three standing committees of the Board all of which are incorporated by reference herein. The AIF is available on our website at sierrawireless.com/company/investor-information/annual-reports-and-regulatory-filings/ or on SEDAR at sedar.com.

The Corporation is a Canadian reporting issuer with its Common Shares listed on the TSX and the NASDAQ Global Market. In Canada, we are subject to securities regulations that impose on us a requirement to disclose certain corporate governance practices that we have adopted. Canadian regulations also provide guidance on various corporate governance practices that corporations like ours should adopt. The Corporation also monitors corporate governance developments in Canada and adopts best practices where such practices are aligned with our values and our goal of continuous improvement. Pursuant to an exemption granted by NASDAQ, we are permitted to follow our home country governance regulations with respect to quorum requirements, rather than those set forth by NASDAQ.

Our corporate governance disclosure obligations are set out in National Instrument 58-101 — Disclosure of Corporate Governance Practices, and National Policy 58-201 — Corporate Governance Guidelines and Multilateral Instrument 52-110 — Audit Committees. These instruments set out a series of guidelines and requirements for effective corporate governance (collectively, the “Guidelines”). The Guidelines address matters such as the constitution and independence of corporate boards, the functions to be performed by boards and their committees and the effectiveness and education of board members.

Board of Directors

The Board oversees our business and the conduct of business by senior management and acts in accordance with the CBCA, the Restated Articles of Incorporation and By-laws of the Corporation, all other applicable statutory and legal requirements, our policies, the written mandate of the Board and Board committees and our Code of Business Conduct.

The Board presently consists of seven directors. Board size and composition are reviewed annually based on changes in legal requirements, best practices, the skills and experiences required to enhance the Board’s effectiveness and the number of directors needed to discharge the duties of the Board and its committees effectively. The Governance and Nominating Committee has determined that at this time seven directors is the desired Board size for effective decision making. Current information about each of the seven nominee directors can be found on pages 8 to 14 of this Information Circular.

- 22 -

Independence

Acting on the recommendation of the Governance and Nominating Committee, the Board determines whether or not each director is independent. Based on information provided by each director, the Board considers all of the relationships each director has with the Corporation in light of the independence standards described in section 1.4 of National Instrument 52-110 — Audit Committees. A director is considered independent only where the Board affirmatively determines that the director has no material relationship with the Corporation. The Board has determined that, of our seven current directors, six directors, or 86%, are independent directors under the standards described in section 1.4 of National Instrument 52-110 — Audit Committees. Jason W. Cohenour is the Corporation’s President and Chief Executive Officer and is not considered to be independent under these rules. Each of the Audit, Human Resources and Governance and Nominating Committees consist entirely of independent directors.

Independent Chair

We believe that the separation of the position of President and Chief Executive Officer from that of the Chair of the Board enhances the Board’s independence. For this reason, our Board is led by a non-executive, independent director, Kent P. Thexton. Mr. Thexton was appointed Chair of the Board on February 4, 2016, replacing Charles E. Levine who was the Chair of the Board from 2007 to 2016. During his tenure as Chair of the Board, Mr. Levine was always an independent director. The Chair of the Board is responsible for the overall leadership and management of the Board. According to the position description, the key responsibilities of the Chair of the Board include:

• | providing leadership to enhance Board effectiveness; |

• | managing the activities of the Board and ensuring coordination among committees of the Board; |

• | ensuring that the respective roles of the Board and management are well delineated; |

• | acting as a liaison between the Board and management; |

• | ensuring that the Board has the information it needs to be effective; |

• | ensuring that the Board monitors the achievement of the aims, strategy and policies of the Corporation; |

• | representing the Corporation on particular matters identified by the Board or management with stakeholders; and |

• | leading by example and setting a high standard of integrity. |

Refer to the tables under “Business of the Meeting — Election of Directors - Director Nominees” for information related to director attendance at meetings of the Board and the three standing committees.

In Camera Sessions

It is the practice of the Board for the independent directors to meet without management at each Board and committee meeting. In 2017, there was an in camera session as part of every regularly scheduled Board meeting as well as every standing committee meeting. During these sessions, the independent directors discuss, among other things, business execution and implementation by management. The Chair of the Board communicates with management regarding the discussions of the independent directors where appropriate.

Interlocking Directorships

The following directors of the Corporation currently serve together on interlocking Boards:

Robin A. Abrams and Thomas Sieber serve together on the Board of HCL Technologies.

- 23 -

Role of the Board

Board Mandate

The roles and responsibilities of the Board are set out in the Board Mandate, the full text of which is included in our AIF and incorporated herein by reference. The AIF is posted on our website at sierrawireless.com/company/investor-information/annual-reports-and-regulatory-filings/ and can also be found on SEDAR at sedar.com.

The Governance and Nominating Committee is responsible for reviewing and assessing the adequacy of the Board Mandate on an annual basis.

Strategic Planning

Management is responsible for developing the strategic plan, which it presents to the Board each year for approval. During 2017, the Board held two meetings to specifically discuss the strategic plan and other strategic issues such as corporate opportunities and the main risks facing our business. Performance against the strategic plan and other strategic issues are discussed at each Board meeting.

Risk Management

The Board is responsible for overseeing risk and the risk management process including:

• | ensuring that our principal risks are identified and that appropriate measures are in place to manage those risks; |

• | monitoring our risk management process; and |

• | seeking assurance that our internal control and management information systems are effective. |

The Board has delegated specific risk management responsibilities to the Audit Committee. The Senior Director, Corporate Reporting and Risk Management reports directly to the Chair of the Audit Committee. During 2017, the Audit Committee received regular reports from the Senior Director, Corporate Reporting and Risk Management at which time risk management activities were discussed including observations and assessments of the Corporation’s systems of governance, risk management and compliance. In addition, during 2017, the Audit Committee held four meetings during which extensive portions of the agenda were devoted to risk management and related topics. The Audit Committee provides updates on risk management to the full Board as warranted and, in any case, no less frequently than annually.

We use an enterprise risk management process to effectively identify, assess, prioritize and manage risk, and to provide comprehensive reporting to the Audit Committee and the Board. Our enterprise risk management framework is a broadly focused systematic approach to assessing, analyzing, evaluating, reporting and monitoring significant risks facing the Corporation.

Our enterprise risk management process includes a risk management committee which is chaired by the Senior Director of Corporate Reporting and Risk Management and is comprised of members of the senior management team. The risk management committee oversees key processes related to the identification, prioritization and mitigation of key risks where applicable.

Internal Controls

The Board and Audit Committee are responsible for monitoring the integrity of our internal controls and management information systems. The Audit Committee is responsible for overseeing the process for ensuring that the Corporation has effective internal controls, including controls over accounting and financial reporting systems.

Management is responsible for establishing and maintaining an adequate system of internal control over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes. During 2017, management evaluated the effectiveness of our internal controls over financial reporting and concluded the internal controls over financial reporting were effective as at December 31, 2017.

- 24 -

During 2017, the Senior Director of Corporate Reporting and Risk Management provided reports, on two occasions, to the Audit Committee on management’s internal control compliance activities.

Management Succession Planning

The Board is responsible for ensuring that adequate succession planning measures are in place for the CEO. During 2017, the Board met and performed a succession assessment of the CEO. The Board also reviewed the CEO’s assessment of the succession plans for the Corporation’s senior executives. The assessment included an analysis of potential CEO successors identified within the organization. The assessment also included a review of developmental plans where training or experience will be sought for identified succession candidates to enable their successful advancement. More broadly, developing internal talent is a strategic priority for the organization. In order to support our growth initiatives, we recognize the need for a strong bench of internal candidates for every key leadership position. As such, development plans are put in place for high potential and succession candidates.

Position Descriptions

The Board has adopted and approved written position descriptions for the Chair of the Board and the chair of each standing committee of the Board as follows:

•Position Description — Chair, Governance and Nominating Committee;

•Position Description — Chair, Audit Committee; and

•Position Description — Chair, Human Resources Committee.

Each committee chair position description sets out the qualifications to be met to be appointed chair of the particular committee and the responsibilities and specific duties of the chair.

The full text of the position descriptions for the Chair of the Board and for the chair of each of the three standing committees are posted on our website at sierrawireless.com/company/investor-information/board-of-directors-and-governance/.

Chief Executive Officer

The CEO is appointed by the Board and is responsible for managing the affairs of the Corporation. His key responsibilities include setting the vision for the Corporation, focusing on creating value for shareholders and developing and implementing a strategic plan that is consistent with the corporate vision.

The Board has developed and approved, a position description for the CEO of the Corporation, setting out the duties, roles and responsibilities of the CEO, including the following:

• | developing, implementing and assessing the effectiveness of corporate strategy and business plans; |

• | providing executive leadership to the Corporation and achieving the results targeted in the corporate strategy and business plans; |

• | representing the Corporation in communications with stakeholders including shareholders, customers, suppliers, partners, employees, governments, regulators, industry, community and others; |

• | recruiting, retaining, assessing the performance of and developing a high caliber executive team, key employees and their successors; |

• | establishing and maintaining corporate policies and culture, leading by example and setting a high standard of integrity in all aspects of the business; and |

• | promoting programs that deliver shareholder value in excess of that of our peers. |

- 25 -

Orientation and Continuing Education

The Governance and Nominating Committee provides leadership for the Board’s director orientation and education programs for new members of the Board. In this regard, the Governance and Nominating Committee ensures that each new director fully understands the role of the Board, the Board committees, his or her responsibilities and liabilities associated with being a director of the Corporation and a member of a committee and the nature and operation of the Corporation's business. This is accomplished by an orientation program that includes meetings with the Chair of the Board, committee chairs, management and, where necessary, with industry subject matter experts to better understand the nature and operation of our business, our products and our corporate governance standards. New directors are provided with key information about the Corporation along with other information designed to help directors familiarize themselves with our business, our organization, our policies and our operations.

The Governance and Nominating Committee is also responsible for arranging continuing education for directors to ensure that the directors acquire and maintain skills and knowledge relevant to the performance of their duties as directors. Each Board member is expected to ensure that his or her knowledge and understanding of our business remains current. In 2017 management made regular business update presentations to the Board. In addition to the ongoing reporting on the business, these presentations included information on industry and market developments, competitive positioning and product & service developments. Strategy sessions were also conducted and information provided at these meetings included broad market & industry overviews, market positioning, ecosystem trends, technology landscape and longer term product & service strategy. In addition, Directors hold meetings from time to time in locations where we have operations and as part of those meetings they are able to review our activities first-hand. In addition to these scheduled events, our Directors are invited to tour the Corporation’s facilities and meet with executive and operational management at their convenience. Directors are encouraged to attend professional development courses and seminars in order to enhance their skills as directors, at the Corporation’s expense. In 2017, one or more of the directors attended courses and seminars covering the following topics: cyber security; risk management and strategy; board governance practices; global markets and governance; semiconductor market forces; revenue recognition; capital allocation and shareholder activism.

Ethical Business Conduct

A strong culture of ethical business conduct is essential to governance. We are committed to conducting business ethically, honestly and in full compliance with all applicable laws and regulations, including anti-bribery and corruption laws and regulations.

Code of Business Conduct

The Board has a written Code of Business Conduct (the “Code”) which sets out the standards of business practice and principles of behaviour with which we expect every director, officer, employee and contractor of the Corporation and its subsidiaries to comply. The Code describes our commitment to conducting business in accordance with the highest standards of business conduct and ethics and is designed to work in conjunction with our other key policies including the Corporation's:

•Procedures for Reporting Concerns to the Audit Committee;

•Insider Trading Policy;

•Disclosure Policy;

•Privacy Policy;

•Information Security Policy;

•Anti-Bribery and Corruption Policy;

•Anti-Hedging Policy for Directors and Officers;

•Harassment and Discrimination Prevention Policy; and

•Confidentiality and Conflict of Interest Agreements executed by each employee.

- 26 -

Each director, officer, employee and contractor of the Corporation executes our Conflict of Interest Agreement and Confidentiality Agreement and acknowledges in writing that they have read, understood and agree to comply with our Code of Business Conduct at the time of first hire or engagement. In addition, each year, all employees and directors are required to confirm that they are following the Code. The compliance process is enhanced by regular employee training and awareness sessions held at our main business locations.

The Code includes our expectations of conduct in the following areas:

•complying with the law and conducting business with integrity;

•avoiding conflicts of interest;

•use of corporate property including electronic devices;

•confidentiality; and

•accuracy of records and report.

The full text of the Code is filed on SEDAR at sedar.com and is posted on our website at sierrawireless.com/company/investor-information/board-of-directors-and-governance/.

Code Compliance and Monitoring

The Code is reviewed annually by the Governance and Nominating Committee. Updates, if any, are submitted to the Board for approval. The most recent update to the Code was approved by the Board in May 2017. The Board has delegated oversight of compliance with the Code to the Audit Committee.

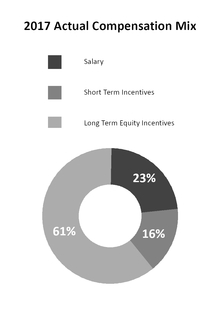

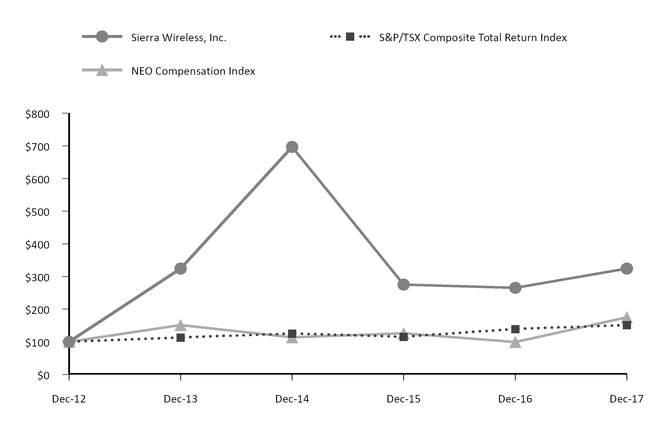

In accordance with the Code and the CBCA, each director and officer is required to disclose to the Corporation, in writing, the nature and extent of any interest he or she has in each material contract or material transaction made or proposed with the Corporation. Our Code requires that each director and officer make this disclosure in an appropriate and timely manner, as required by law. In accordance with the CBCA, the director who is required to make such a disclosure may not vote on any resolution to approve the contract or transaction, except in certain, limited circumstances.