Form 10-K/A FAIRMOUNT SANTROL HOLDIN For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36670

FAIRMOUNT SANTROL HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 34-1831554 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

8834 Mayfield Road

Chesterland, Ohio 44026

(Address of Principal Executive Offices) (Zip Code)

(800) 255-7263

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(g) of the Securities Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Securities Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant computed by reference to the last sales price, $3.90 as reported on the New York Stock Exchange, of such common stock as of the closing of trading on June 30, 2017: $580,770,641

Number of shares of Common Stock outstanding, par value $0.01 per share, as of April 2, 2018: 224,954,671

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 Form 10-K”) originally filed on March 13, 2018 (the “Original Filing”) by Fairmount Santrol Holdings Inc., a Delaware corporation (the “Company”). The Company is filing this Amendment to present the information required by Part III of Form 10-K, as the Company will not file a definitive proxy statement within 120 days of the end of the Company’s fiscal year ended December 31, 2017.

This Amendment also provides additional information, concerning (i) how we assess the economic viability of our mineral reserves and (ii) average utilization rates over the past three years at each of our active facilities, as set forth herein under “Item 2 — Properties.”

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the date of the Original Filing.

ITEM 2. PROPERTIES

Our Reserves

We control one of the largest bases of silica sand reserves in the United States. From our reserves, we are able to produce a large selection of high-purity silica sand, lake sand, coated sand, silica gravel, and other specialty sands. According to the SEC Industry Guide 7, reserves are defined as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are categorized into proven (measured) reserves and probable (indicated) reserves. In accordance with SEC Industry Guide 7, our reserves are categorized as proven or probable.

We estimate that the company has approximately 893.4 million tons of proven recoverable mineral reserves as of December 31, 2017. Additional probable but not proven reserves are considered immaterial. Mineral reserve estimated quantities and characteristics at our properties are overseen by our internal geologists and engineers and validated by third party consulting company, GZA GeoEnvironmental, Inc.

The Company assesses the economic viability of our minerals reserves for each operation primarily by evaluating the following key criteria for mining feasibility: estimate of saleable quality reserves; percent recovery following processing; overburden stripping and other operational costs and annual production volumes. These factors are considered in preparation of a mine plan that ultimately estimates the tons of product to be sold per year and the estimated life of the mine. Historical mineral prices are considered in the context of market supply and demand dynamics to further assess the long term economic viability of the mineral reserve assets. The reserve estimates are updated annually based on sales, changes to reserve boundaries, new physical or chemical information on the reserve deposit or overburden, changes in the mine plan, changes in customer demand, current pricing forecasts and other business strategies.

2

Summary of Reserves

The following table provides information on each of our sand mining facilities. Included is the location and area of the facility; the type, amount, and ownership status of its reserves and whether or not they meet API standards, and the primary end markets that it serves:

| Active Mines |

Acres Owned/ Leased |

API | Proven Reserves In-Situ (Thousand Tons) |

Estimated Recovery Percentages |

Primary End Markets | |||||||||||||||||

| API White |

||||||||||||||||||||||

| Wedron, IL |

2,230 | O | API White | 223,296 | 80% | proppant, glass, foundry, specialty products | ||||||||||||||||

| 0 | L | |||||||||||||||||||||

| Maiden Rock, WI |

987 | O | API White | 24,061 | 70% | proppant, glass, foundry | ||||||||||||||||

| 576 | OM | |||||||||||||||||||||

| 377 | L | |||||||||||||||||||||

| Menomonie, WI |

2 | O | API White | 23,102 | 75% | proppant, glass, foundry, specialty products | ||||||||||||||||

| 366 | L | |||||||||||||||||||||

| Shakopee, MN |

93 | O | API White | 14,133 | 80% | proppant, glass, foundry, specialty products | ||||||||||||||||

| 115 | L | |||||||||||||||||||||

| Brewer, MO |

353 | O | API White | 31,460 | 80% | proppant, glass, foundry | ||||||||||||||||

| 0 | L | |||||||||||||||||||||

| API Brown |

||||||||||||||||||||||

| Voca, TX |

1,962 | O | API Brown | 187,013 | 50% | proppant, glass, foundry | ||||||||||||||||

| 0 | L | |||||||||||||||||||||

| Non-API |

||||||||||||||||||||||

| Chardon, OH |

591 | O | Non-API | 17,337 | 80% | glass, turf, landscaping, construction, | ||||||||||||||||

| 0 | L | filler/extender, foundry, industrial, proppant, filtration | ||||||||||||||||||||

| Beaver, OH |

91 | O | Non-API | 12,473 | 75% | turf, landscaping, industrial | ||||||||||||||||

| 216 | L | |||||||||||||||||||||

| Development Stage |

||||||||||||||||||||||

| Katemcy, TX |

848 | O | API Brown | 113,278 | 50% | potential to serve proppant, glass, foundry | ||||||||||||||||

| 0 | L | |||||||||||||||||||||

| Diamond Bluff, WI |

10 | O | API White | 44,539 | 70% | potential to serve proppant, glass, foundry | ||||||||||||||||

| 2,674 | L | |||||||||||||||||||||

| Kermit, TX |

0 | O | API Brown | 165,772 | 90% | potential to serve proppant, glass, foundry | ||||||||||||||||

| 3,250 | L | |||||||||||||||||||||

| Inactive |

||||||||||||||||||||||

| Bay City, WI |

40 | O | API White | 19,251 | 70% | proppant, glass, foundry | ||||||||||||||||

| 322 | OM | |||||||||||||||||||||

| 1,131 | L | |||||||||||||||||||||

| Harrietta, MI |

255 | O | Non-API | 11,087 | 75% | foundry, construction | ||||||||||||||||

| 86 | L | |||||||||||||||||||||

| Grand Haven, MI |

143 | O | Non-API | 6,555 | 85% | N/A | ||||||||||||||||

| 0 | L | |||||||||||||||||||||

| Total |

893,357 | |||||||||||||||||||||

Descriptions of Sand Facilities

As of December 31, 2017, we had seven active sand mining and processing operations facilities located in Illinois, Wisconsin, Minnesota, Missouri, Texas, and Ohio. We also have a processing facility located in Ontario, Canada that does not have any sand reserves but has an annual processing capacity of approximately 336,000 tons per year. We have inactive mines in Michigan, Minnesota, and Wisconsin and undeveloped mines in Texas and Wisconsin.

The mineral rights and access to mineral reserves for the majority of our facilities are secured through land that is owned. There are no underlying agreements and/or royalties associated with these properties. Where there are agreements and/or royalties associated related to our properties, we have provided more information in the facility descriptions below. We are required to pay production royalties on a per ton basis pursuant to our mineral reserve leases.

3

API White

Wedron, Illinois. Our Wedron, Illinois facility is located in Wedron, LaSalle County, Illinois and consists of owned real property. The facility, which is approximately 6 miles northeast of Ottawa, Illinois, is accessible via County Highway 21 off of State Highway 71 and State Highway 23. The site utilizes natural gas and electricity to process sand. Mining methods include mechanical removal of glacial overburden followed by drilling, blasting, and hydraulic mining. Hydraulically mined sand is pumped to the wash plant to be hydraulically sized and sent to the dry plant where it is dried and screened.

Our Wedron facility and its predecessors have operated since 1890. The washing and drying operations at our Wedron facility were upgraded in 2012, 2013, 2014, 2015 and 2016 in conjunction with significant capacity and reserve base increases. Significant railyard expansions in 2014 and 2015 facilitated greater flexibility and provided for unit train capabilities. Processed sand is shipped from the facility via truck or rail on the Burlington Northern Santa Fe (“BNSF”) and CSX Railroads via the Illinois Railnet. Our Wedron facility utilizes approximately 50,000 linear feet of rail. A portion of the sand is transferred by conveyor or trucked from our Wedron facility and is coated at our Technisand Wedron and/or Troy Grove, Illinois resin-coating facilities. The total net book value of the Wedron facility’s real property and fixed assets as of December 31, 2017 was $250.5 million.

The sand reserve mined from the open-pit mine at the Wedron facility is the St. Peter Sandstone formation. The Wedron facility produces high purity, round grain silica sand that meets the API requirements for proppant application. The Wedron facility production capacity, including the expansion project completed in April 2016, is approximately 9.0 million tons per year. The average utilization rate over the past three years was 82%. The surface deposit at the Wedron facility is a high purity, round grain sand with a minimum silica content of 99%, which meets API requirements for proppant application. The controlling attributes are iron and grain size. Iron is concentrated near the surface, where orange iron staining is evident and also increases where the bottom contact becomes concentrated in iron pyrite. Maximum average full face iron content is 0.020%. The deposit tends to exhibit a coarser grain size distribution in the top half of the deposit.

Maiden Rock, Wisconsin. Our Maiden Rock, Wisconsin facility is located in Maiden Rock, Pierce County, Wisconsin and consists of owned and leased real property. The mineral reserves at the Maiden Rock facility are secured under mineral leases that, with the exercise of renewal options, expire between 2021 and 2046. The facility is within the Village and Town of Maiden Rock along State Highway 35. The Maiden Rock facility utilizes natural gas and electricity to process sand. This is an underground mine and mining methods include drilling and blasting. The reserves are located at a depth of 230 feet. The sand is removed from the face of the tunnels with a front end loader and deposited into a container where it is combined with water to form a slurry. The slurry is pumped to the surface wash plant to be hydraulically sized and sent to the dry plant where it is dried and screened.

The Maiden Rock facility and its predecessors have operated since the 1920s. We acquired a 50% equity interest in the facility from Wisconsin Industrial Sand in 1997, and acquired the remaining equity interest in 1999. The washing and drying operations at the Maiden Rock facility were upgraded in 2012 in conjunction with a significant capacity increase. Processed sand is shipped from the Maiden Rock facility via truck or rail on the BNSF Railroad.

The Maiden Rock facility utilizes a new rail loadout facility and approximately 5,000 linear feet of rail constructed in 2012. This plant is unit train capable, utilizing the new unit train railyard at the Bay City facility. The total net book value of the Maiden Rock facility’s real property and fixed assets as of December 31, 2017 was $45.1 million.

The sand reserve mined from the underground mine at the Maiden Rock facility is the Jordan Sandstone formation. The Maiden Rock facility produces high purity, round grain silica that meets API requirements for proppant application. The mining capacity is approximately 1.3 million tons per year, and the average utilization rate over the past three years was 51%.

The underground deposit at this facility is a high purity, round grain sand with a minimum silica content of 99%, which meets API requirements for proppant application. The controlling attributes are turbidity, acid solubility, and grain size. The deposit tends to exhibit a coarser grain size distribution near the top of the deposit. Grain size distribution is maintained through control of mine horizon. Turbidity and acid solubility are controlled though the use of hydrosizers during wet processing.

Menomonie, Wisconsin. Our Menomonie, Wisconsin facility is located in Menomonie, Dunn County, Wisconsin and consists of owned and leased real property. The mineral reserves at our Menomonie facility are secured under mineral subleases that expire in 2044. We constructed the Menomonie facility in 2007 approximately two miles east of Menomonie and it is accessible via US Highway 12 / State Highway 16. The Menomonie facility utilizes natural gas and electricity to process sand. Mining methods include the mechanical removal of glacial overburden followed by drilling, blasting and mechanical mining. Mined sand is processed and shipped by truck or rail. A remote transload facility adjacent to the Union Pacific (UP) Railroad is located approximately one mile north of the site. The total net book value of the Menomonie facility’s real property and fixed assets as of December 31, 2017 was $8.8 million.

The sand reserve mined from the open-pit at the Menomonie facility is the Wonewoc Sandstone formation. The Menomonie facility produces high purity, round grain silica sand that meets the API requirements for proppant application. The mining capacity is approximately 750,000 tons per year, and the average utilization rate over the past three years was 47%. The surface deposit at the Menomonie facility is a high purity, round grain sand with a minimum silica content of 99% which meets API requirements for proppant application. The controlling attributes are turbidity, iron, and grain size. Maximum average full face iron content is 0.080%. The deposit tends to exhibit a coarser grain size distribution in top half of deposit. Turbidity is controlled though the use of attrition scrubbers during wet processing. Iron is controlled during processing through the use of magnetic separators.

4

Bay City, Wisconsin. Our Bay City, Wisconsin facility is located in Isabelle and Hartland Township, Pierce County, Wisconsin and consists of owned and leased real property. The mineral reserves at the Bay City facility are secured under mineral leases that, with the exercise of renewal terms, expire between 2045 and 2106. The Bay City facility was opened in 1919 and operated continuously until 1989. We acquired the mine through the acquisition of Wisconsin Specialty Sand and constructed the associated Hager City processing (drying) plant in 2007. This underground mine is approximately 1.5 miles northeast of Bay City on State Highway 35. The reserves are located at a depth of 230 feet. The mine utilizes electricity to process sand. Mining methods include drilling and blasting. As a result of the challenging conditions in the global oil and gas markets, these operations were idled in 2015. Although the processing facility was idled, the railyard remains active and provides unit train capabilities for the Maiden Rock facility.

Mined sand is shipped approximately five miles to the Hager City plant for further processing and eventual shipment via truck or rail on the BNSF Railroad. The Hager City plant, constructed by Wisconsin Industrial Sand Company, LLC in 2007, was expanded in 2013 and 2014 with the addition of a new rail yard containing approximately 19,000 linear feet of rail for assembling unit trains. The total net book value of the Bay City facility’s real property and fixed assets as of December 31, 2017 was $41.4 million.

The sand reserve mined from the underground mine at the Bay City facility is the Jordan Sandstone formation. The Bay City facility produces high purity, round grain silica that meets API requirements for proppant application. The mining capacity is approximately 780,000 tons per year, and the average utilization rate over the past three years was 13%. The underground deposit at the Bay City facility is a high purity, round grain sand with a minimum silica content of 99% which meets API requirements for proppant application. The controlling attributes are turbidity, acid solubility, and grain size. The deposit tends to exhibit a coarser grain size distribution near the top of the deposit. Grain size distributions are maintained through control of mine horizon. Turbidity and acid solubility are controlled though the use of hydrosizers during wet processing.

Shakopee, Minnesota. Our Shakopee, Minnesota facility is located in Shakopee, Scott County, Minnesota and consists of owned and leased real property. The mineral reserves at our mine are secured by fee ownership and a lease agreement that, with the exercise of renewal options, expires in 2030. The facility is approximately four miles south of Shakopee, Minnesota and is accessible via US Highway 169. The Shakopee facility utilizes natural gas and electricity to process sand. Mining methods include the mechanical removal of glacial overburden followed by drilling, blasting and mechanical mining. As a result of the challenging conditions in the global oil and gas markets, these operations were idled in 2015 and re-opened in 2017.

Mining occurred at the Shakopee facility for a short time in the 1980s by others until the property was reclaimed. The mine was permitted by Great Plains Sand in 2012 and acquired by us in 2013, at which time we changed the name to Shakopee Sand LLC. We upgraded the washing and drying operations at the facility following the acquisition. Processed sand is shipped from the Shakopee facility via truck or by rail on the UP. The total net book value of the Shakopee facility’s real property and fixed assets as of December 31, 2017 was $12.0 million.

The sand reserve mined from the open-pit mine at the Shakopee facility is the Jordan Sandstone formation. The deposit produces high purity, round grain silica sand which meets API requirements for proppant application. The mining capacity is approximately 718,000 tons per year, and the average utilization rate over the past three years was 21%. This surface deposit at the Shakopee facility is a high purity, round grain sand with a minimum silica content of 99% which meets API requirements for proppant application. The controlling attributes are turbidity and grain size. The deposit tends to exhibit a coarser grain size distribution in the top half of deposit. Turbidity is controlled through the use of hydrosizers and attrition scrubbers during wet processing. Fine and coarse areas are blended to meet the grain size average.

Brewer, Missouri. Our Brewer, Missouri mine is located in Brewer, Perry County, Missouri and consists of owned real property. The facility, approximately one-half mile northwest of Brewer, Missouri, is accessible via State Highway M. We acquired the inactive mine in 2013. The operation was reactivated and began production in December 2014 but was idled in 2015 due to the challenging conditions in the global oil and gas markets. In January 2017, the decision was made to return Brewer to full production due to an increase in demand for proppants. The mine resumed production in the first quarter of 2017. Mining methods include the mechanical removal of overburden followed by drilling, blasting and mechanical mining. The total net book value of the facility’s real property and fixed assets as of December 31, 2017 was $22.2 million.

The sand reserve mined from the open-pit mine at the Brewer facility is the St. Peter Sandstone formation. The deposit produces high purity, round grain silica that meets API requirements for proppant application. The mining capacity is approximately 1.3 million tons per year, and the average utilization rate over the past three years was 31%. The surface deposit at the Brewer facility is a high purity, round grain sand with a minimum silica content of 99% which meets API requirements for proppant application. The controlling attributes are turbidity and grain size. The deposit tends to exhibit a coarser grain size distribution in top half of deposit. Turbidity is controlled through the use of hydrosizers and attrition scrubbers during wet processing.

5

API Brown

Voca, Texas. Our Voca, Texas facility is located in Voca, Mason and McCulloch Counties, Texas and consists of owned real property. The facility, which is approximately 1.5 miles southeast of Voca, is accessible via County Highway 1851, south of State Highway 71. Sand mining and processing operations were developed at the facility during 2008, with the construction of existing plants completed in 2012. We acquired the operations in 2013. The Voca facility utilizes propane and electricity to process sand. Mining methods include the mechanical removal of thin overburden followed by drilling, blasting, and mechanical mining. The total net book value of the Voca facility’s real property and fixed assets as of December 31, 2017 was $92.4 million.

The sand reserve mined at our Voca property is the Hickory Sandstone Member of the Riley formation. The Voca facility produces high purity, round grain silica which meets API requirements for proppant application. The mining capacity is approximately 1.2 million tons per year, and the average utilization rate over the past three years was 59%. The surface deposit at the Voca facility is a high purity, round grain sand with a minimum silica content of 98% which meets API requirements for proppant application. The controlling attributes are turbidity and grain size. Turbidity is controlled through the use of hydrosizers and attrition scrubbers during wet processing. Grain size is controlled through the use of hydrosizers and wet screening.

Non-API

Chardon, Ohio. Our Chardon, Ohio facility is located in Geauga County, Ohio and consists of owned real property. The facility, which is approximately two miles south of Chardon, is accessible via State Route 44. The site utilizes natural gas and electricity to process sand. Mining methods include the mechanical removal of glacial overburden followed by drilling, blasting and mechanical mining.

The mine was opened in 1938 and acquired by Best Sand in 1978. We acquired the mine as a result of the merger of Wedron Silica and Best Sand in 1986. Upgrades were made to the wash plant in 2009, the fluid bed dryer in 2012 and the rotary dryer circuit in 2012. The reserve base was increased by 950,000 tons in 2014 and 1.2 million tons in 2015. The total net book value of the Chardon facility’s real property and fixed assets as of December 31, 2017 was $10.5 million.

The sand reserve mined from the open-pit mine at the Chardon facility is the Sharon Conglomerate formation. This plant produces high purity, sub-angular grain silica sand and gravel used for industrial and recreational markets. The mining capacity is approximately 1.1 million tons per year, and the average utilization rate over the past three years was 61%. The surface deposit at the Chardon facility is a high purity, sub-round grain silica sand/gravel. The deposit has a minimum silica content of 99% ideal for glass and foundry applications. The contributing attributes are iron and grain size distribution. The mine’s iron averages 0.084%.

Beaver, Ohio. Our Beaver, Ohio facility, acquired in 1994 from Schrader Sand and Gravel, is located in Jackson Township, Pike County, Ohio and consists of owned and leased real property. The mineral reserves at this facility are secured under mineral leases that, with the exercise of renewal options, expire in 2024. The facility, which is approximately six miles northeast of Beaver, Ohio, is accessible via County Road 521. The facility utilizes electricity to process sand. Mining methods include the mechanical removal of glacial overburden followed by drilling, blasting and mechanical mining. The total net book value of the Beaver facility’s real property and fixed assets as of December 31, 2017 was $1.3 million.

The sand reserve mined from the open-pit mine at the Beaver facility is the Sharon Conglomerate formation. The Beaver facility produces high purity, sub-angular grain silica sand and gravel. The mining capacity is approximately 426,000 tons per year, and the average utilization rate over the past three years was 10%. The surface deposit at the Beaver facility is a high purity, sub-angular grain silica sand/gravel. The deposit has a minimum silica content of 99% and is ideal for turf/landscaping and industrial applications. The controlling attribute is cleanliness. Cleanliness is controlled through wet processing.

Harrietta, Michigan. Our Harrietta, Michigan facility is located in Slagle Township, Wexford County, Michigan and consists of owned and leased real property. The facility, which is approximately three miles northeast of Harrietta, Michigan, is accessible via West 28th Road and State Highway 37. The facility utilizes recycled oil and electricity to process sand. Mining methods include mechanical removal of overburden and excavation of sand.

We acquired Wexford Sand from Sargent Sand in 1998. A new screen plant was installed in 2008. The processed sand is shipped from the Harrietta facility by bulk via truck or rail on the Great Lakes Central Railroad. The total net book value of the Harrietta facility’s real property and fixed assets as of December 31, 2017 was $1.2 million.

The sand reserve mined from the open-pit mine at the Harrietta facility is a glacial outwash sand deposit for proppant applications. Glacial outwash is glacial sediments deposited by melting glacial ice at the terminus of a glacier. The mining capacity is approximately 625,000 tons per year, and the average utilization rate over the past three years was 7%. This surface deposit at the Harrietta is sub-round grain sand with minimum silica content of 96% ideal for foundry applications. The controlling attributes are Acid Demand Value (ADV) and grain size distribution.

As a result of challenging conditions in end markets, this facility was closed in 2015. However, it is in the process of being re-opened and producing sand, and is scheduled for the second quarter of 2018.

6

Grand Haven, Michigan. Our Grand Haven, Michigan facility is located in Grand Haven, Ottawa County, Michigan. The mine and facility consists of owned real property that is subject to a reverter to the prior property owner in 2021. The mine and facility have been closed since 2014. The facility, which is approximately two miles south of Grand Haven, Michigan, is accessible via Lakeshore drive and US Highway 31.

The sand reserve historically mined from the open-pit mine at the facility is a dune sand deposit. This surface dune deposit is a high purity, sub-round grain sand with minimum silica (SiO2) content of 96% ideal for foundry metal casting applications. The controlling attributes are grain size and chemistry, (ADV). The mine’s ADV ranges from 30-50. ADV is controlled through floatation during wet processing. The grain size distribution averages greater than 50% plus 50 mesh. There is no net book value assigned to the Grand Haven mine or facility.

Development

Katemcy, Texas. Our Katemcy, Texas reserves are located in Katemcy, Mason County, Texas and consist of owned real property. The mine property was purchased in September 2013 and is accessed via County Road 1222 and State Highway 87. The mine has not yet been developed and the property is currently used as agricultural land. This deposit is capable of producing high purity, round grain silica sand that meets API requirements for proppant application. Plans to develop the mine property are under review. The sand reserve at this proposed open-pit mine is the Hickory Sandstone Member of the Riley formation. The total net book value of Katemcy as of December 31, 2017 is included in the net book value of the Voca facility.

The surface reserve is a high purity, round grain sand with a minimum silica content of 98% which meets API requirements for proppant application. The controlling attributes will be turbidity and grain size.

Diamond Bluff, Wisconsin. Our Diamond Bluff, Wisconsin reserves are located in Diamond Bluff and Oak Grove Townships, Pierce County, Wisconsin and consist of owned and leased real property. The mineral reserves are secured under mineral leases that expire between 2063 and 2064. The mine access property was purchased in 2014 and is undeveloped. The mine was permitted by the Diamond Bluff Township in 2012 and by the Oak Grove Township in 2014. The facility, which is located approximately one mile northwest of the unincorporated community of Diamond Bluff, is accessible off of 1005th Street via State Highway 35. The proposed underground mine site will be at a depth of 230 feet and will utilize electricity to process sand through drilling, blasting, mechanical, and hydraulic mining methods. Mined sand will be shipped approximately eight miles to the Hager City plant for further processing and eventual shipment via truck or rail on the BNSF Railroad. The total net book value of the facility’s real property and fixed assets as of December 31, 2017 is included in the net book value of the Bay City facility.

The sand reserve at this proposed underground mine is the Jordan Sandstone formation. This deposit is capable of producing high purity, round grain silica sand which meets API requirements for proppant application. This underground reserve is a high purity, round grain sand with a minimum silica content of 99% which meets API requirements for proppant application. The controlling attributes are turbidity, acid solubility, and grain size. The deposit tends to exhibit a coarser grain size distribution near the top of the deposit.

Kermit, Texas. Our Kermit, Texas reserves are located eight miles east of Kermit, Winkler County, Texas and consists of approximately 3,250 acres of leased property. The location is accessible via Highway 115 with access to the Delaware and Midland basins. The facility (currently under construction) will mine sand through the excavation method and will use natural gas and electricity to process sand. The sand will be transported by slurry to the processing plant where it will be washed, screened, and dried. The finished product will be shipped via truck. At December 31, 2017, this property is a greenfield site with construction expected to be completed and the facility expected to be in operation in the second quarter of 2018. The net book value of the location’s real property and fixed assets is $79.2 million as of December 31, 2017. The mining capacity will be approximately 3.0 million tons.

The sand reserves are an active dune deposit that is capable of producing high purity and round grain silica sand that meets API requirements for proppant application.

Coating, Resin Manufacturing, Specialty Blending, and Research and Development Facilities

We have six strategically located coating facilities in North America near our mining operations. These facilities are on a combination of leased as well as owned land and buildings. As of March 2018, two of the domestic facilities were inactive or closed. We also have three international coating facilities located in Mexico, Denmark, and China.

We have four specialty blending facilities, located in Ohio, Illinois, and Texas. These operations make custom blends of aggregates for use in industrial and commercial flooring, polymer cements, grouts and performance mortars. An additional specialty facility, Mineral Visions, located in Illinois, produces specialty colored quartz. We have a manufacturing facility in Michigan, Alpha Resins, which produces resins primarily for our own use. These properties are all on owned land and buildings. We have research and development facilities also located in Texas and Illinois. These facilities are leased.

7

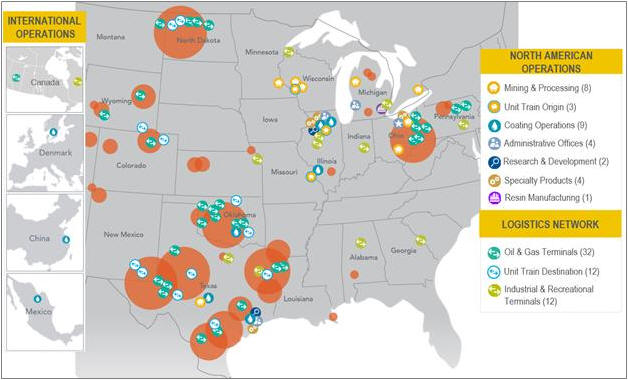

The following map reflects the location of our mining and processing, resin manufacturing, coating, specialty blending and R&D facilities and our administrative offices:

The following table reflects the segment(s) served by significant locations:

| Segment | ||||||

| Location |

Proppant Solutions |

I&R | Corporate | |||

| Chesterland, OH |

— | — | X | |||

| Ottawa, IL |

— | — | X | |||

| Sugar Land, TX |

— | — | X | |||

| Benton Harbor, MI |

— | — | X | |||

| Wedron, IL |

X | X | — | |||

| Menomonie, WI |

X | X | — | |||

| Voca, TX |

X | — | — | |||

| Brewer, MO |

X | — | — | |||

| Shakopee, MN |

X | — | — | |||

| Maiden Rock, WI |

X | — | — | |||

| Hager City, WI |

X | — | — | |||

| Harrietta, MI |

X | X | — | |||

| Chardon, OH |

— | X | — | |||

| Beaver, OH |

— | X | — | |||

| Troy Grove, IL |

X | X | — | |||

| Roff, OK |

X | — | — | |||

| Cutler, IL |

X | — | — | |||

| Fresno, TX |

— | X | — | |||

| Detroit, MI |

X | X | — | |||

| Ontario, Canada |

X | X | — | |||

| Mexico |

X | — | — | |||

| Denmark |

X | — | — | |||

| China |

X | — | — | |||

8

Product Delivery

We have established an oil and gas logistics network that we believe is highly responsive to our customers’ needs. Our terminal network includes 44 active oil and gas terminals and 12 industrial and recreational terminals. These terminals are a combination of facilities that we own or lease, as well as properties that are owned and operated by third parties. They generally consist of rail and transload operations, plus in some cases additional storage and handling facilities.

Item 10. Directors, Executive Officers and Corporate Governance

OUR EXECUTIVE OFFICERS

Executive officers are elected by and serve at the discretion of the Board of Directors (the “Board”) of Fairmount Santrol Holdings Inc. (the “Company”). The names of our current executive officers, their ages as of March 8, 2018 and their positions with the Company are set forth below, followed by certain other information about them. There are no family relationships between any of our executive officers.

| Name |

Age | Position | ||||

| Jenniffer D. Deckard |

52 | President and Chief Executive Officer | ||||

| Michael F. Biehl |

62 | Executive Vice President, Chief Financial Officer | ||||

| Gerald L. Clancey |

48 | Executive Vice President, Chief Commercial Officer | ||||

| Brian J. Richardson |

45 | Executive Vice President, Chief People Officer | ||||

| George W. Magaud |

54 | Executive Vice President, Chief Strategy & Innovation Officer | ||||

| Robert B. Larson |

46 | Executive Vice President, Engineering and Supply Chain Operations | ||||

| Daniel N. Gerber |

65 | Executive Vice President, Operations | ||||

| David J. Crandall |

51 | Executive Vice President, General Counsel and Secretary | ||||

Executive Officers of the Registrant

Jenniffer D. Deckard, age 52, has served as President, Chief Executive Officer and Director of Fairmount Santrol since 2013. Previously, Ms. Deckard served as President from January 2011 until May 2013, and Vice President of Finance and Chief Financial Officer and other previous roles in accounting and finance from 1994 until 2011. Ms. Deckard joined the Board of RPM International Inc. (NYSE: RPM) in 2015 and serves as a member of RPM’s Governance and Nominating Committee. In her local community, Ms. Deckard serves on the boards of The Cleveland Foundation and the EDWINS Foundation. She also serves on the Case Western Reserve University’s Weatherhead School of Management’s Visiting Committee and the Board of Directors for the Fairmount Santrol Foundation. Ms. Deckard received a B.S. from the University of Tulsa and an M.B.A. from Case Western Reserve University.

Michael F. Biehl, age 62, has served as Executive Vice President and Chief Financial Officer since 2016. Prior to joining Fairmount Santrol, Mr. Biehl served as Executive Vice President and Chief Financial Officer for publicly traded Chart Industries, Inc. for almost 15 years. Prior to that, he held management positions at the former Oglebay Norton Company and Ernst & Young LLP. Mr. Biehl received a B.B.A from Ohio University and M.B.A. from Northwestern University’s Kellogg School of Management. He continues to be a licensed C.P.A. in Ohio and is a member of both the OSCPA and AICPA. Locally, Mr. Biehl is actively involved at St. Joseph Academy and currently serves as Chairman of its Board of Directors.

Gerald L. Clancey, age 48, has served as Executive Vice President, Chief Commercial Officer since 2015. In this role, he has responsibility for Domestic and International Sales into the Proppant and Industrial & Recreational (I&R) channels as well as leadership for Supply Chain and Logistics. Previously, Mr. Clancey served as Executive Vice President of Supply Chain and I&R since 2011, Vice President of Sales for I&R from 2002 to 2011 and General Sales Manager for the company’s TechniSand resin-coated foundry division from 1998 to 2002. He was previously President of the Foundry Educational Foundation and served several terms on its Board of Directors. Mr. Clancey received a B.S. from Kent State University and M.B.A. from the University of Notre Dame.

Brian J. Richardson, age 45, has served as Executive Vice President, Chief People Officer since 2015. In this capacity he provides leadership for our Human Resources, Information Technology, Risk Management, Sustainable Development and Internal Communications functions. Prior to joining the company, Mr. Richardson was Sr. Vice President of Human Resources for the Global Finishes Group of The Sherwin-Williams Company. Mr. Richardson serves on the National Board of Directors of the Alzheimer’s Association, where he is a member of the Executive Committee and Chair of the Strategic Planning Committee. Locally, he serves on the Board of Directors for the United Way of Greater Cleveland, where he is a member of the Executive Committee and Chair of the Human Resources Committee. Mr. Richardson received a B.A. Finance from Baldwin-Wallace College and M.B.A. from The Ohio State University.

George W. Magaud, age 54, has served as Executive Vice President, Chief Strategy & Innovation Officer since 2015. In this role, he leads the company’s Strategic Development efforts as well as the Marketing and R&D organizations. Prior to this, he served as Executive Vice President, Strategic Development since joining the company in 2014. Previously, Mr. Magaud worked for Lafarge where he held positions in Strategy and Business Development, Marketing and Product Development, as well as Operations in Europe and in the United States. Mr. Magaud received his undergraduate degree from Yale University and a business degree from Institut d’Etudes Politiques de Paris.

9

Robert B. Larson, age 46, has served as Executive Vice President, Engineering and Supply Chain Operations since April 2016. Previously, Mr. Larson served as Senior Vice President of Engineering, Process & Technology since 2015 and Vice President of Engineering from 2011 to 2015. He served as both a Manager and then Director of Engineering from 2003 until 2011. Mr. Larson currently serves as the Chairman of the Engineering and Technology committee for The Industrial Minerals Association of North America. He holds a B.S. in Electrical Engineering from the University of Illinois and M.B.A. from the University of Michigan’s Ross School of Business.

Daniel N. Gerber, age 65, has served as Executive Vice President, Operations since 2016. Previously, Mr. Gerber served as Senior Vice President and Vice President of Operations from 2010 until 2016 and Director of Operations and Manager of Illinois Operations within the Industrial Sand Division, from 2004 until 2010. Prior to joining the company, Mr. Gerber was Vice President of Operations for Better Materials Corporation as well as the US Silica Corporation. He currently serves as the Vice Chairman of National Industrial Sand Association. Mr. Gerber received a B.S. in Mining Engineering from the University of Wisconsin-Platteville.

David J. Crandall, age 51, has served as Executive Vice President, General Counsel and Secretary since January 2017. Previously, Mr. Crandall served as Sr. Vice President, General Counsel and Secretary from January 2016 to December 2016 and Vice President, General Counsel and Secretary from January 2011 to December 2015. Prior to joining Fairmount Santrol, he was a Partner at Calfee, Halter & Griswold, L.L.P, where he practiced general corporate and merger and acquisition law. He graduated Phi Beta Kappa, Magna Cum Laude with a B.S. in Economics from Allegheny College and graduated Cum Laude from the Syracuse University College of Law.

OUR DIRECTORS

The authorized number of Directors of the Company presently is fixed at ten, with the Board divided into three Classes, each with three-year terms. Currently, two Classes, Class I and Class II, have three Directors each. The names of our Directors, their ages as of March 8, 2018 and their positions with the Company are set forth below, followed by certain other information about them:

| Name |

Age | Position | ||||

| Michael G. Fisch |

55 | Director | ||||

| Charles D. Fowler |

72 | Director | ||||

| Matthew F. LeBaron |

47 | Chairman of the Board | ||||

| Lawrence N. Schultz |

70 | Director | ||||

| Jenniffer D. Deckard |

52 | President, Chief Executive Officer and Director | ||||

| Michael C. Kearney |

69 | Director | ||||

| William P. Kelly |

68 | Director | ||||

| William E. Conway |

90 | Director | ||||

| Stephen J. Hadden |

63 | Director | ||||

| Michael E. Sand |

36 | Director | ||||

Set forth below is a brief biographical description of each of our Directors. The primary individual experience, qualifications, attributes and skills of each of our Directors that led to the Nominating and Governance Committee’s and Board’s conclusion that such Director should serve as a member of the Board are also described in the following paragraphs.

Michael G. Fisch is the President and CEO of American Securities LLC, which he co-founded in 1994. He is also a managing member, director and/or officer of numerous American Securities’ affiliates. Mr. Fisch is a Board member of Human Rights Watch where he is a Vice Chairman, Treasurer and Chairman of the Investment Committee and the Human Capital & Organizational Diversity Committee; and member of the President’s Leadership Council of Dartmouth College. Mr. Fisch holds a B.A. degree from Dartmouth College and an M.B.A. from Stanford University’s Graduate School of Business, where he has been a Distinguished Guest Lecturer since 2006. Mr. Fisch’s knowledge of general management, business operating best practices, and capital allocations makes him particularly well qualified to serve on our Board. In addition, he has proven that he is an effective leader.

Charles D. Fowler has served as a Director since 1984 and is Chairman of the Executive Committee of the Board. Mr. Fowler and the Wedron Silica management team partnered with William E. Conway in 1984 to acquire Wedron Silica and ultimately merge it with Mr. Conway’s company, Best Sand, to create Fairmount Minerals (now Fairmount Santrol). Mr. Fowler served as President and Chief Executive Officer from 1996 until his retirement in 2013. He served as the past Chairman of the Board and continues to serve on the Board of Case Western Reserve University and is on the boards of directors of Flying Horse Farms, DDC Clinic and the Greater Cleveland Water Alliance. He received a B.S. from Purdue University and completed the Executive M.B.A. program at Case Western Reserve University. Due to his experience as our former President and Chief Executive Officer, Mr. Fowler is particularly well qualified to serve on our Board. In addition, in such roles, he has proven that he is an effective leader. As one of the founders of the Company, Mr. Fowler brings to the Board an extensive understanding of the Company’s business. Mr. Fowler’s past and future service enables him to develop comprehensive knowledge of the various segments of our business and the critical internal and external challenges we face.

Matthew F. LeBaron has served as Chairman of the Board since 2010. Mr. LeBaron is a co-founder of LeBaronBrown Industries, a private investment holding company focused on investing in industrial businesses. He was previously a Managing Director at American Securities, which he joined in 1999. Mr. LeBaron serves on the board of United Distribution Group, an American Securities portfolio company, and has previously served on the boards of numerous other private and public companies. Previously, Mr. LeBaron was a

10

private equity investor at Bain Capital, Inc. and a consultant at The Boston Consulting Group. He received a B.A. from Amherst College and an M.B.A. from the Harvard Business School. As an investor with over two decades of experience, Mr. LeBaron brings to our Board the knowledge of corporate finance, corporate governance, corporate transactions, organizational development and strategic planning. Due to this experience, he is particularly well qualified to serve on our Board.

Lawrence N. Schultz has been a member of the Board of Directors since 2010, and presently serves on the Board of Directors of the Wilderness Condominium Association and Wilderness Country Club, Inc, serving as Secretary and a member of the Executive Committee, Finance Committee and Strategic Planning Committee of both. He served as an officer of Central National Bank of Cleveland, now a part of KeyBank N.A., while attending the M.B.A. and J.D. programs at Cleveland State University. He joined Calfee, Halter & Griswold LLP in 1978 after receiving his J.D. degree from Cleveland State University, and served on Calfee’s executive and management committees. He served as principal outside counsel and Secretary to Agilysys, Inc. (NASDAQ: AGYS), its Board and its Board Committees from 1999 until his retirement in 2010 and presently serves on the advisory boards of L.D. Kichler Company and Austin Powder Holding Co., Inc. Mr. Schultz received his B.A. degree from Ohio Northern University in 1970. At the time of his retirement, he served on the boards and executive committees of University Circle Inc. and The Deaconess Foundation, including as Chair of their Audit Committees, and as Chair of the Board of The Gordon Square Arts District. Mr. Schultz’s board service, legal expertise and business management experience, as well as his demonstrated successful performance as a director, qualify him to serve on our Board.

Jenniffer D. Deckard. See Ms. Deckard’s biography in “Executive Officers of the Registrant” above. Due to Ms. Deckard’s experience as our President and Chief Executive Officer, she is particularly qualified to serve on our Board. In addition, in her role as our Chief Executive Officer, she has proven that she is an effective leader. Ms. Deckard’s financial expertise and over 23 years with the Company provides our Board with intimate working knowledge of our day-to-day business, plans, strategies and initiatives.

Michael C. Kearney is the Chairman of the Board of Supervisory Directors, President and Chief Executive Officer of Frank’s International N.V. (“Frank’s International”) since September 2017. He has previously served as the Chair of its Audit Committee and a member of its Compensation Committee, and assumed the role of Chairman of the Board in January 2016. Frank’s International, a Dutch company, specializes in supplying engineered tubular services for the oil and gas industry on a global basis. Mr. Kearney formerly served as President and Chief Executive Officer of DeepFlex Inc. (“DeepFlex”) from September 2009 until June 2013, and served as DeepFlex’s Chief Financial Officer from January 2008 until September 2009. From 2004 to 2007, Mr. Kearney served as Executive Vice President and Chief Financial Officer of Tesco Corporation, a publicly held oil service company. From 1998 until 2004, Mr. Kearney served as the Chief Financial Officer and Vice President – Administration of Hydril Company, a manufacturer of products for petroleum drilling and production. Mr. Kearney has a Master of Science degree in Accountancy from the University of Houston and a Bachelor of Business Administration degree in Finance from Texas A&M University. Mr. Kearney brings to the Board extensive international business and operations experience in multiple industries, offering breadth of knowledge that benefits the Company’s diverse business units. Mr. Kearney is particularly well-qualified to serve as a Director on our Board because he brings senior management and corporate financial experience.

William P. Kelly served as Chairman and Chief Executive Officer of Unifrax Corporation from 1996 to 2006. From 2010 to 2015, he served on the Executive Council of American Securities. He is a member of The Operating Council for Kirtland Capital Partners. He is a Board member for privately held Unifrax Corporation and Smart Source Computer Rentals. He received a B.S. degree in Ceramics Engineering from Alfred University and an M.B.A. from Duquesne University. He also attended the Tuck Executive Program at Dartmouth College. We believe that, due to his experience as a chairman, chief executive officer of Unifrax as well as Board membership of Unifrax and several other private companies, he is particularly well qualified to serve on our Board. In these roles, he has proven to be an effective leader.

William E. Conway has served as Chairman of the Board (emeritus) since 2010. After he and other investors acquired Best Sand in 1978, Mr. Conway invested in Wedron Silica in 1984, along with Charles D. Fowler and the Wedron Silica management team. Best Sand and Wedron Silica then merged to form Fairmount Minerals, now known as Fairmount Santrol, in 1986. Mr. Conway served as Chairman of the Board and Chief Executive Officer of Best Sand from 1978 until 1984 and Fairmount Minerals from 1984 to 1996. From 1996 until 2010, he served as Chairman of the Board. Prior to entering the industrial minerals business in 1978, Mr. Conway held management positions with Pickands Mather & Co., Diamond Shamrock Corporation and Midland-Ross Corporation. Mr. Conway serves on the boards of directors of the Cleveland Clinic Foundation, University School and Cleveland Botanical Garden. Mr. Conway received a B.S. from Yale University and completed the Executive Program at the University of California, Berkeley. Due to his experience as our former Chairman of the Board and Chief Executive Officer, Mr. Conway is particularly well qualified to serve on our Board. In addition, in such roles, he has proven that he is an effective leader. As one of the founders of the Company, Mr. Conway brings to the Board an extensive understanding of the Company’s business. Mr. Conway’s past and future service enables him to develop comprehensive knowledge of the various segments of our business and the critical internal and external challenges we face.

11

Stephen J. Hadden has over 40 years of experience in the oil and gas industry, having served in various management roles for Texaco Inc., now Chevron Corporation, and more recently as Executive Vice President of Worldwide Exploration and Production for Devon Energy Corporation from 2004 until 2009. Mr. Hadden is currently a director of Ulterra Drilling Technologies, a leading PDC bit supplier in the U.S., and serves as a Senior Executive Advisor for Tennenbaum Capital Partners, LLC, a leading alternative investment management firm. Previously, Mr. Hadden was a director of LINN Energy from 2013 until 2017 and with Berry Petroleum Company from 2011 until its merger with LINN Energy. Mr. Hadden also served with the following entities: The Advisory Board of the Society of Petroleum Engineers, the Upstream Committee of the American Petroleum Institute, and the Western States Petroleum Association. He has a Bachelor of Science degree in Chemical Engineering from The Pennsylvania State University. Due to his significant experience in the oil and gas industry, including service on industry advisory boards, and his experience serving on public company boards and committees, Mr. Hadden is particularly well qualified to serve on our Board.

Michael E. Sand joined American Securities in 2005 and currently serves as a Principal at the firm. Previously, Mr. Sand worked at Goldman Sachs, where he focused on mergers and acquisitions and strategic advisory assignments. He is a member of the Board of Directors of MW Industries, Ulterra Drilling Technologies, Blue Bird Corporation (NASDAQ: BLBD) and GTL. He was previously a director of Delphi Midstream Partners. He received a B.S. from the University of Pennsylvania and a M.B.A. from Columbia University. Mr. Sand’s knowledge of corporate finance, funds management, corporate transactions and strategic planning makes him particularly well qualified to serve on our Board.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s officers and Directors and persons who own 10% or more of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Commission. Officers, Directors and 10% or greater stockholders are required by SEC regulations to furnish the Company with copies of all Forms 3, 4 and 5 they file.

Based solely on the Company’s review of the copies of such forms it has received, the Company believes that all of its officers and Directors complied with all filing requirements applicable to them with respect to transactions during the fiscal year ended December 31, 2017.

INFORMATION CONCERNING THE BOARD OF DIRECTORS

Our Board has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The Executive Committee exercises the power and authority of the Board in the period between Board meetings. The functions of each of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee are governed by charters that have been adopted by our Board. Our Board also has adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities, and a Corporate Code of Business Conduct and Ethics that applies to our Directors, officers, and employees (the “Code of Ethics”).

The charters of the Audit Committee, Compensation Committee and Nominating and Governance Committee, the Corporate Governance Guidelines and the Code of Ethics are available on our website at www.fairmountsantrol.com and in print to any stockholder who requests a copy. Requests for copies should be directed to Secretary, Fairmount Santrol Holdings Inc., 8834 Mayfield Road, Chesterland, Ohio 44026. We intend to disclose any amendments to the Code of Ethics, and any waiver of the Code of Ethics granted to any Director or executive officer, on our website. As of the date of this Proxy Statement, there have been no such waivers.

Audit Committee

The Audit Committee is designed to assist the Board in fulfilling its oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, and the performance of our internal audit function and independent auditor, and producing the Audit Committee Report. The specific functions and responsibilities of our Audit Committee are set forth in the Audit Committee Charter which is available on the Company’s website.

Our Board has determined that each member of the Audit Committee is financially literate and satisfies the current independence standards of the NYSE listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board has also determined that each of Messrs. Schultz, Kearney and Kelly qualifies as an “audit committee financial expert” as that term is defined in Item 407(d) of Regulation S-K of the Exchange Act. Each of Messrs. Schultz, Kearney and Kelly also satisfies the NYSE accounting and financial management expertise requirements.

12

| Item 11. | Executive Compensation |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

In this Compensation Discussion and Analysis, or CD&A, we describe our executive compensation framework, including our philosophy, objectives and design, our compensation setting process, our executive compensation program components, and the decisions made in 2017 with respect to the compensation of each of our named executive officers. The following disclosure also gives context for the data we present in the compensation tables below and the narratives that accompany the compensation tables.

The following individuals are our named executive officers for 2017, as that term is defined by the SEC.

| Name | Title | |

| Jenniffer D. Deckard | President and Chief Executive Officer | |

| Michael F. Biehl | Executive Vice President and Chief Financial Officer | |

| Gerald L. Clancey | Executive Vice President and Chief Commercial Officer | |

| George W. Magaud | Executive Vice President and Chief Strategy and Innovation Officer | |

| Brian J. Richardson | Executive Vice President and Chief People Officer |

Compensation Framework

Our executive compensation program is focused on promoting overall performance and maximizing long-term stockholder value. We expect our executive team to possess and demonstrate strong leadership and management capabilities in line with our mission and core principles. To reward and retain our leaders, including our named executive officers, we have designed a total compensation approach that rewards both short-term and long-term success, based on value creation and sustainable corporate growth for our stockholders. Overall, our executive compensation program is structured to align the financial interests of our executive officers and our stockholders by encouraging and rewarding our executive officers for performance that achieves or exceeds significant financial and operational performance goals and by holding them accountable for results. The Compensation Committee and management regularly review those programs to make sure they are meeting the business challenges to achieving our growth and value creation goals.

Philosophy

We are focused on our mission to exceed all expectations while fulfilling our economic, social, and environmental responsibilities. We rely on these core principles to unite us in our vision of sustainability: ethics, safety, leadership, total quality, environmental stewardship, empowerment, personal excellence, celebration/fun, continuous improvement, health and wellness, teamwork/shared ownership and social responsibility.

We need a highly talented team of executives who believe in our mission and principles. In structuring our executive compensation packages, our Board and our Compensation Committee consider how each component of compensation promotes retention, motivates executive performance and furthers our mission. We believe that to attract and retain high quality senior executives, we must provide them with a competitive level of compensation that rewards their outstanding contributions and commitment. We also believe that performance- and equity-based compensation play a significant role in aligning the interests of management with the long-term interests of our stockholders.

To ensure our executive compensation is an effective tool to attract, motivate and retain executive talent, our Board defined the Company’s philosophy with respect to our named executive officers’ pay position to be relative to executives with similar positions at companies within our compensation peer group. The Compensation Committee and management determined an appropriate pay philosophy for the Company:

| • | Salaries should approximate the 50th percentile; |

| • | Annual bonus opportunities, at target, should fall within the 50th to 75th percentile range; and |

| • | Target long-term incentive awards, such as stock option, RSUs and PRSUs, should fall within the 50th to 75th percentile range. |

Our Compensation Committee reaffirmed this philosophy in connection with its annual executive compensation program review in 2017. We target the general industry’s 50th and 75th percentile range based on findings that show target pay in the oil & gas industry appears to be greater than that for a general industrial company similar to our size. Accordingly, our pay philosophy positions us near the oil and gas industry’s median.

Currently, the target compensation levels for our named executive officers, except our CEO, approximates market median. Almost all of our named executive officers receive salaries within 11% of market median. Target bonus multiples are generally in the market’s top quartile, positioning our target cash compensation in the market’s second quartile (between the 50th and 75th percentiles). Target long-term equity incentive values approximate the second quartile, positioning target direct pay at approximately the 60th percentile of the market. Currently, the target compensation for our CEO is below the targeted pay position. As a result, the Compensation Committee may consider approaches to bring the compensation of our CEO in line with our philosophy in a responsible and reasonable timeframe and manner.

Objectives

Our compensation programs for our named executive officers are built to support the following objectives:

| • | attract, retain and motivate highly qualified executives to deliver the highest level of results; |

13

| • | reward high levels of achievement based performance on indicators that promote value creation and sustainable corporate growth with commensurate levels of compensation; |

| • | build stock ownership and align the interests of our executives with those of our stockholders through equity-based incentives; and |

| • | encourage our executives to fulfill our mission, model our core principles and live by our company motto of “Do good. Do well.” |

Design

Our executive compensation program has three main components: (1) base salary; (2) annual cash incentive compensation; and (3) long-term incentive awards. Each component is designed to be consistent with the Company’s compensation philosophy.

To align pay with the interests of our stockholders, we strive to create competitive compensation packages that cultivate long-term value creation without taking unnecessary risks. We believe that a combination of both short-term and long-term compensation creates an optimal pay-for-performance environment. We motivate and reward our executive officers for successfully executing our mission and for achieving annual strategic targets. The compensation program for our executives has been designed to emphasize variable pay over fixed pay and to reward long-term achievement.

We support our objectives through an executive compensation program that includes a mix of fixed and at-risk compensation, which is intended to motivate our executives to exceed our goals and reward them in a manner that is commensurate with their levels of achievement. Our short-term incentive plan is designed around clear, concise, effective and measurable performance indicators that we believe are directly linked to value creation and sustainable corporate growth. In addition, our executive compensation program includes a significant equity-based component. We believe that equity compensation offers the best vehicle to focus our executive officers on our mission and the achievement of our long-term strategic and financial objectives, and to align our executive officers with the long-term interests of our stockholders.

Role of the Compensation Committee

The Compensation Committee is responsible for overseeing all aspects of our executive compensation programs, including executive salaries, payouts under our annual bonus plan, the size and structure of equity awards, and any executive perquisites. The Compensation Committee is solely responsible for annually reviewing and determining the compensation of our CEO, and reviews and approves compensation of other executive officers.

The Compensation Committee Charter requires the Compensation Committee to oversee the Company’s compensation programs and, in consultation with the CEO, develop and recommend to the Board an appropriate compensation and benefits philosophy and strategy for the Company. The Compensation Committee Charter is available on our website at www.fairmountsantrol.com.

Role of Management in Determining Compensation

In setting compensation for 2017, our CEO and members of our human resources group, worked closely with the Compensation Consultant and the Compensation Committee. These members of management often attended meetings of the Compensation Committee to provide an analysis of market compensation data. In addition, our General Counsel typically attends meetings of the Compensation Committee to present information, record minutes and answer applicable questions. Our CEO made recommendations to the Compensation Committee regarding compensation and annual bonus goals for our executive officers (other than themselves) because of their daily involvement with our executive team. No executive officer participated directly in the final deliberations or determinations regarding his or her own compensation package.

Comparative Framework

The Compensation Committee utilizes a peer group for pay and performance benchmarking to evaluate whether executive officer pay levels are aligned with Company performance on a relative basis. The Compensation Committee has identified (i) a compensation peer group for executive officer pay benchmarking, which we refer to as our compensation peer group, and (ii) a performance peer group for payment of long-term incentive performance-based awards, which we refer to as our performance peer group. The Compensation Committee primarily identifies public companies that are of comparable size or scale (based on revenue, market capitalization, total assets, enterprise value and number of employees) and operating in the oil and gas field services or basic materials industries. The identity of the companies included in both of our peer groups is adjusted from time to time to reflect the impact of mergers, acquisitions, or other significant events to ensure the reference companies continue to meet the established criteria for comparison.

Compensation Peer Group

The Compensation Committee utilizes a peer group of companies to ensure that our executive compensation program is competitive in the market. The Compensation Committee retained Pay Governance LLC (the “compensation consultant”), an independent compensation consulting firm, to conduct a compensation benchmark study. The compensation consultant annually reviews peer group proxy data to identify the compensation paid to executives holding equivalent positions or having similar responsibilities at a group of basic materials and oil & gas field services companies with comparable sales that are considered to be our peers. The compensation consultant also compiles compensation data derived from broad-based surveys of industrial companies of similar size to us. The peer group is also used to benchmark general pay program design characteristics.

In August 2016, the Compensation Committee, with input from its compensation consultant and management, assessed our peer group. The Compensation Committee considered the changes in our capital structure and revenues resulting from the turbulent economic environment during 2015 and 2016 to identify a peer group that was indicative of our expected revenue size in the foreseeable future at the time of 2017 pay decisions.

14

This analysis resulted in a peer group with annual revenue ranging from $200 million to $1.7 billion, with median annual revenue of about $900 million (which equates to approximately 0.35x to 3.0x our 2016 revenue). The 18 companies in the peer group used for 2017 pay decisions comprised:

| Basic Energy Services, Inc. | Headwaters Incorporated | Pioneer Energy Services | ||

| CARBO Ceramics Inc. | Helix Energy Solutions Group, Inc. | RPC, Inc. | ||

| Compass Minerals International, Inc. | Key Energy Services, Inc. | TETRA Technologies, Inc. | ||

| Dril-Quip, Inc. | Minerals Technologies Inc. | U.S. Concrete, Inc. | ||

| Eagle Materials Inc. | Newpark Resources, Inc. | U.S. Silica Holdings, Inc. | ||

| Forum Energy Technologies, Inc. | Oil States International, Inc. | Summit Materials, Inc. |

For the 2017 peer group, the following companies were eliminated for the following reasons:

| • | Martin Marietta Materials, Granite Construction and Tronox were all too large, each with revenue that exceeded $2.0 billion, the upper boundary of our size-based peer screen; |

| • | C&J Energy Services was entering Chapter 11 in 2017; and |

| • | Seventy Seven Energy was acquired. |

For the 2017 peer group, the following companies were added because they fit the business criteria and had revenues less than $2.0 billion:

| • | Summit Materials, Inc. and Pioneer Energy Services. |

15

Performance Peer Group

In 2017, the Compensation Committee with input from management and our Compensation Consultant approved a broader performance peer group against which to measure our 2017-2019 LTIP performance cycle. Our performance peer group is comprised of certain peer companies included in our compensation peer group plus additional companies that are primarily engaged in the oil and gas field services or basic materials industries. Based on input from our Compensation Consultant and management, the Compensation Committee reviewed and selected additional peer group companies for inclusion in our performance peer group that are comparable to us. We believe a larger performance peer group eliminates some of the outliers in terms of extreme positive or negative performance. For the 2017-2019 performance cycle, the companies in the performance peer group consisted of:

| Archrock Partners, L.P. | Forum Energy Technologies, Inc.* | Profire Energy, Inc. | ||

| Archrock, Inc. | Gulf Island Fabrication, Inc. | Rowan Companies plc | ||

| Atwood Oceanics, Inc. | Helix Energy Solutions Group, Inc.* | RPC, Inc.* | ||

| Basic Energy Services, Inc.* | Helmerich & Payne, Inc. | SAExploration Holdings, Inc. | ||

| CARBO Ceramics Inc.* | Hi-Crush Partners LP | Steel Excel Inc. | ||

| Compass Minerals International, Inc.* | Independence Contract Drilling, Inc. | Summit Materials, Inc. | ||

| CSI Compressco LP | Key Energy Services, Inc.* | Superior Drilling Products, Inc. | ||

| Dawson Geophysical Company | Martin Marietta Materials, Inc.* | Superior Energy Services, Inc. | ||

| Diamond Offshore Drilling, Inc. | Natural Gas Services Group, Inc. | Tesco Corporation | ||

| Dril-Quip, Inc. | Oceaneering International, Inc. | TETRA Technologies, Inc. | ||

| Eco-Stim Energy Solutions, Inc. | Oil States International, Inc. | U.S. Silica Holdings, Inc. | ||

| Enservco Corporation | Parker Drilling Company | Unit Corporation | ||

| Exterran Corporation | Patterson-UTI Energy, Inc. | USA Compression Partners, LP | ||

| Forbes Energy Services Ltd. | Pioneer Energy Services Corp. | Vulcan Materials Company |

| * | Also included in our compensation peer group. |

Elements of Compensation

Our named executive officer compensation program for fiscal 2017 included three main elements:

| • | Base salary; |

| • | Annual performance-based cash incentives; and |

| • | Long-term equity-based compensation in the form of non-qualified stock options and service-and performance-based RSUs. |

Pay Mix

We use these particular elements of compensation because we believe that they provide a balanced mix of fixed compensation and at-risk compensation that produces short-term and long-term performance incentives and rewards. With this balanced portfolio, we provide the executive with a base salary while motivating the executive to focus on the business metrics that will produce a high level of performance and provide the executive with additional compensation through short- and long-term incentives.

16

Total Direct Compensation

The target compensation of our named executive officers is based on principles of our executive compensation program with rewards for performance. We have three elements of total direct compensation: base salary, annual incentives and long-term incentives, which are described below. We also provide standard health and retirement plans and limited perquisites.

| Compensation Component | Key Characteristics | Purpose | ||

| Base Salary | Fixed compensation, reviewed and adjusted annually, if and when appropriate | Compensate named executive officers fairly for the responsibility level of the position held | ||

| Annual Bonus | Variable, performance-based compensation | Motivate and reward named executive officers for achieving annual business objectives over which they have some degree of influence and control | ||

| Equity Compensation: Stock Options, RSUs and PRSUs |

Variable, performance- and service-based compensation, awarded under the Long Term Incentive Plan | Retain executives through the vesting period, reward executives for achieving performance objectives, facilitate shared ownership among the executives, and align interests of our executives with those of our stockholders | ||

| Health and Retirement Plans | Fixed compensation | Intended to attract and retain qualified executive officers and to provide benefits that promote employee health and support employees in attaining financial security; generally, the benefits provided to our named executive officers are the same as for our other employees | ||

| Perquisites and other Personal Benefits | Fixed compensation | Intended to be relatively modest in nature and to provide a business-related benefit to the Company, and to assist in attracting and retaining executive officers | ||

Base Salary

We pay annual base salaries to provide a fixed base of cash compensation to our named executive officers for their services to us during the year. The Compensation Committee believes base salaries are a necessary element of compensation in order to attract and retain highly qualified executive officers. Base salary is further influenced by internal pay equity and market benchmarks and trends.