Form DEF 14A Internap Corp For: Jun 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Internap Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

Internap Corporation

12120 Sunset Hills Road, Suite 330

Reston, VA 20190

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

To our Shareholders,

We invite you to attend Internap Corporation’s 2018 Annual Meeting of Shareholders at the Sheraton Reston Hotel, 11810 Sunrise Valley Drive, Reston, VA 20191, on Thursday, June 7, 2018, at 9:00 a.m. local time. At the meeting, shareholders will be asked: to vote upon the following proposals:

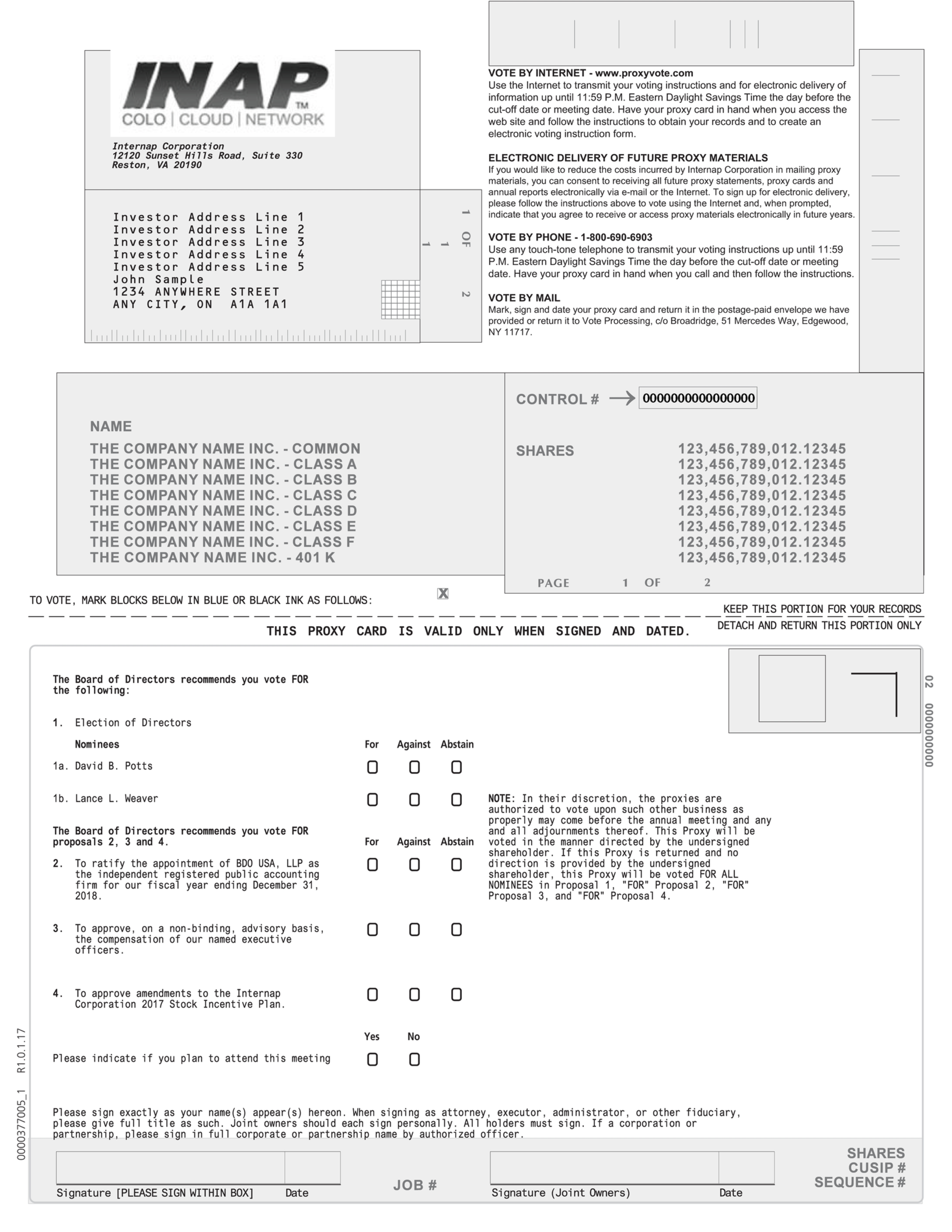

| 1. | To elect David B. Potts and Lance L. Weaver as directors of the Company, each to hold office until the 2021 Annual Meeting of Shareholders and until his successor is duly elected and qualified; |

| 2. | To ratify the appointment of BDO USA, LLP as the independent registered public accounting firm for our fiscal year ending December 31, 2018; |

| 3. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| 4. | To approve amendments to the Internap Corporation 2017 Stock Incentive Plan to increase the number of shares of common stock available for issuance by 1,000,000 shares and to approve certain other changes; and |

| 5. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

You can vote at the annual meeting and any adjournment if you were a shareholder of record on April 9, 2018. Distribution of this proxy statement and enclosed proxy card or the Notice of Internet Availability of Proxy Materials to shareholders will begin on or about April 19, 2018.

|

|

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

/s/ Peter D. Aquino

|

|

|

Peter D. Aquino

|

|

|

President and Chief Executive Officer

|

Reston, Virginia

April 12, 2018

Your Vote is Important to Us. Even if You Plan to Attend the Annual Meeting in Person,

PLEASE SIGN, DATE, AND RETURN THE ENCLOSED PROXY PROMPTLY OR

VOTE BY TELEPHONE OR THE INTERNET.

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Shareholders to be Held on June 7, 2018.

Our proxy statement for the 2018 Annual Meeting of Shareholders and the Annual

Report to Shareholders for the fiscal year ended December 31, 2017 are available at

www.proxyvote.com.

Internap Corporation 2018 Proxy Statement Summary

This summary does not contain all of the information you should consider. You should read the complete proxy statement before voting.

Date and Time: June 7, 2018 at 9:00 a.m. local time.

Place: Sheraton Reston Hotel, 11810 Sunrise Valley Drive, Reston, VA 20191.

Record Date: April 9, 2018.

Proposal 1: Election of Two Director Nominees for Three-Year Terms Expiring in 2021

The Board recommends a vote “FOR” all of the director nominees

Director Nominees

| 1. | David B. Potts: Executive Vice President and Chief Financial Officer of ARRIS International, Inc. |

| 2. | Lance L. Weaver: Former President, Money Cards for Virgin Money Holdings in the U.K. |

Proposal 2: Ratification of the Audit & Finance Committee’s Appointment of BDO USA, LLP as the

Independent Registered Public Accounting Firm for our Fiscal Year Ending December 31, 2018

The Board recommends a vote “FOR” Proposal 2

Summary of Proposal

| • | BDO USA, LLP reappointed by our Audit & Finance Committee on February 13, 2018. |

| • | Information about the audit fees paid in fiscal years 2017 and 2016 are on page 42. |

Proposal 3: Advisory Resolution Approving Compensation of our Named Executive Officers

The Board recommends a vote “FOR” Proposal 3

Summary of Proposal

| • | We follow a “pay for performance” philosophy and maintain best practices in pay and corporate governance, summarized on pages 21 – 24 of this proxy statement. |

| • | Bonuses were generally earned under our 2017 Short-Term Incentive Plan and Long-Term Incentive Plan due to meeting applicable financial performance targets for 2017. |

| • | Restricted stock granted to executive officers in 2017, with one-half performance-based restricted stock and one-half time-based restricted stock. |

| • | Summary Compensation Table is on page 36. |

Proposal 4: Approval of Amendments to the Internap Corporation 2017 Stock Incentive Plan

The Board recommends a vote “FOR” Proposal 4

Summary of Proposal

| • | Increase the number of shares authorized under the 2017 Stock Incentive Plan by 1,000,000. |

| • | Provide the ability to vest, at the sole discretion of the Board, stock awards of a retiring director prior to the minimum vesting period because a more significant portion of director compensation is now paid in shares of restricted stock. |

| • | Provide that stock awards in employment agreements may vest prior to the minimum vesting period due to contractual acceleration without affecting the 5% exception. |

| • | Summary of proposal 4 is on pages 44 – 50 and the Amendment is contained in Annex A to this proxy statement. |

Internap Corporation

12120 Sunset Hills Road, Suite 330

Reston, VA 20190

2018 ANNUAL MEETING OF SHAREHOLDERS

June 7, 2018

PROXY STATEMENT

These proxy materials are being furnished to you in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the annual meeting. Unless the context indicates otherwise, references to “the Company” means Internap Corporation and its subsidiaries and “INAP,” “we”, “our” or “us” refer to the Company, including the Company’s management, Board or committees of the Board, as the case may be.

Information About the Proxy Materials and Our 2018 Annual Meeting of Shareholders

| Q: | Why am I receiving these materials? |

| A: | Our Board is providing these proxy materials to you on the Internet or has delivered printed versions of these materials to you by mail in connection with its solicitation of proxies for use at the 2018 Annual Meeting of Shareholders, which will take place on June 7, 2018 at the Sheraton Reston Hotel, 11810 Sunrise Valley Drive, Reston, VA 20191, at 9:00 a.m. local time. You are invited to attend the annual meeting and are requested to vote upon the proposals described in this proxy statement. |

| Q: | What information is contained in these materials? |

| A: | The information included in this proxy statement relates to the proposals to be voted upon at the annual meeting, the voting process, the compensation of our directors and named executive officers and certain other important information. Our Annual Report to Shareholders for the year ended December 31, 2017, which includes our audited consolidated financial statements for the years ended December 31, 2017, 2016 and 2015, is included in these proxy materials. If you received printed versions of these materials by mail, these materials also include the proxy card for the annual meeting. |

| Q: | Why did I receive a Notice of Internet Availability in the mail instead of printed proxy materials as in previous years? |

| A: | For 2018, we are using the Notice and Access process of providing proxy materials. In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy materials and the proxy card to all of our shareholders, we have elected to furnish such materials to certain of our shareholders by providing access to these documents over the Internet. On or about April 19, 2018, we sent a Notice of Internet Availability to such shareholders. |

These shareholders have the ability to access the proxy materials on a website referred to in the Notice of Internet Availability or request to receive a printed set of the proxy materials by calling the toll-free number found on the Notice of Internet Availability. We encourage you to take advantage of the availability of the proxy materials on the Internet in order to help reduce the cost to print and distribute the proxy materials.

| Q: | How can I get electronic access to the proxy materials? |

| A: | The Notice of Internet Availability provides you with instructions regarding how to view the proxy materials, vote your shares, request printed versions of the proxy materials and select the method of receiving proxy materials. Copies of the proxy materials are also available for viewing at www.proxyvote.com. |

| Q: | What proposals will be voted upon at the annual meeting? |

| A: | There are four proposals scheduled to be voted upon at the annual meeting: |

| • | election of David B. Potts and Lance L. Weaver as directors of the Company, each to hold office until the 2021 Annual Meeting of Shareholders and until his successor is duly elected and qualified; |

1

| • | ratify the appointment of BDO USA, LLP as the independent registered public accounting firm for our fiscal year ending December 31, 2018; |

| • | approve, on a non-binding, advisory basis, the compensation of our named executive officers; and |

| • | approve amendments to the Internap Corporation 2017 Stock Incentive Plan, including increasing the number of shares of common stock available for issuance by 1,000,000, and making certain other changes. |

In addition, we will consider and vote upon such other business as may properly come before the annual meeting. We are not currently aware of any other matters to be considered and voted upon at the meeting.

| Q: | How does Internap Corporation’s Board of Directors recommend that I vote? |

| A: | Your Board of Directors recommends that you vote your shares “FOR” each of the named director nominees; “FOR” ratification of the appointment of BDO USA, LLP as the independent registered public accounting firm for our fiscal year ending December 31, 2018; “FOR” the advisory resolution approving compensation of our named executive officers; and “FOR” the amendments to the Internap Corporation 2017 Stock Incentive Plan. |

| Q: | Who may vote? |

| A: | You may vote at the annual meeting or by proxy if you were a shareholder of record at the close of business on April 9, 2018. Each shareholder is entitled to one vote per share on each matter presented. As of April 9, 2018, there were approximately 21,179,529 shares of our common stock outstanding. |

| Q: | How do I vote before the annual meeting? |

| A: | We offer the convenience of voting by mail-in proxy, telephone or the Internet. See the enclosed proxy, or Notice of Internet Availability for voting instructions. If you properly sign and return the proxy in the form we have provided, or properly vote by telephone or the Internet, your shares will be voted at the annual meeting and at any adjournment of that meeting. |

| Q: | What if I return my proxy but do not provide voting instructions? |

| A: | If you specify a choice, your proxy will be voted as specified. If you return a signed proxy but do not specify a choice, your shares will be voted “FOR” each of the named director nominees; “FOR” ratification of the appointment of BDO USA, LLP as the independent registered public accounting firm for our fiscal year ending December 31, 2018; “FOR” the advisory resolution approving compensation of our named executive officers; and “FOR” the amendments to the Internap Corporation 2017 Stock Incentive Plan. |

In all cases, your proxy will be voted in the discretion of the individuals named as proxies on the proxy card with respect to any other matters that may come before the annual meeting.

| Q: | Can I change my mind after I vote? |

| A: | You may revoke your proxy and change your vote at any time before the polls close at the annual meeting by voting again via the Internet or by telephone, by completing, signing, dating, and returning a new proxy card form with a later date, or by attending the annual meeting and voting in person. Only your latest dated proxy we receive at or prior to the annual meeting will be counted. However, your attendance at the annual meeting will not automatically revoke your proxy unless you vote again at the annual meeting before the polls close and specifically request that your prior proxy be revoked by delivering to our Corporate Secretary a written notice of revocation prior to the annual meeting. |

| Q: | How can I vote my shares in person at the annual meeting? |

| A: | Shares held directly in your name as the shareholder of record may be voted in person at the annual meeting. If you choose to vote in person, please bring the enclosed proxy card and proof of identification. Even if you plan to attend the annual meeting in person, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the annual meeting. Shares held in “street name” through a brokerage account or by a bank or other nominee may be voted in person by you if you obtain a signed proxy from the record holder giving you the right to vote the shares. |

2

| Q: | What is the quorum requirement for the annual meeting? |

| A: | The presence in person or by proxy of the holders of a majority of the shares entitled to vote at the annual meeting is necessary to constitute a quorum. If a registered shareholder indicates on his or her proxy card that the shareholder wishes to abstain from voting, or a beneficial owner instructs its bank, broker or other nominee that the shareholder wishes to abstain from voting, these shares are considered present and entitled to vote at the annual meeting. These shares will count toward determining whether or not a quorum is present. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | The voting requirements to approve the proposals are as follows: |

| • | Election of Directors: Directors must be elected by a plurality of votes cast. This means that the individuals with the largest number of votes “For” are elected as directors up to the maximum number of directors to be chosen at the annual meeting. |

| • | Ratification of the appointment of BDO USA, LLP: Requires an affirmative vote of the majority of shares voting on the proposal. |

| • | Advisory resolution approving compensation of our named executive officers: Requires an affirmative vote of the majority of shares voting on the proposal. |

| • | Amendments to the Internap Corporation 2017 Stock Incentive Plan: Requires an affirmative vote of the majority of shares voting on the proposal. |

| Q: | What are broker non-votes and what effect do they have on the proposals? |

| A: | Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because (a) the broker has not received voting instructions from the beneficial owner and (b) the broker lacks discretionary voting power to vote those shares. |

If you do not vote your proxy and your shares are held in street name, your brokerage firm may either vote your shares on routine matters or leave your shares unvoted. On non-routine matters, if the brokerage firm has not received voting instructions from you, the brokerage firm cannot vote your shares on that proposal, which is considered a “broker non-vote.” Broker non-votes will be counted for purposes of establishing a quorum to conduct business at the annual meeting. We believe that the proposal for the ratification of the appointment of our independent registered public accounting firm will be considered routine. We believe that all of the other proposals in this proxy statement will be considered non-routine. Accordingly, brokers that do not receive instructions will likely be entitled to vote on the ratification of the appointment of our independent registered public accounting firm at the annual meeting, but may not vote on the election of directors or on any other proposal in this proxy statement. Therefore, we encourage you to vote before the annual meeting so that your shares will be represented and voted at the meeting even if you cannot attend in person.

| Q: | What does it mean if I receive more than one proxy or voting instruction card? |

| A: | It means that your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

| Q: | Where can I find the voting results of the annual meeting? |

| A: | We will announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K within four business days after the date of the meeting. |

3

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board currently consists of nine members. Our Board is divided into three classes, with each class to be as nearly equal in number as possible. Each class serves a term of office of three years, with the term of one class expiring at the annual meeting in each successive year. In 2017, our Board increased the size of the Board to nine, as part of an orderly succession planning process.

The Board prides itself on its ability to recruit and retain directors who have the highest personal and professional integrity, have demonstrated exceptional ability and judgment and effectively serve our shareholders’ long-term interests. We seek to achieve an appropriate level of diversity in the membership of our Board and to assemble a broad range of skills, expertise, knowledge and contacts to benefit our business. The Nominations and Governance Committee, which is comprised of all independent members of the Board, and the full Board annually assess the current make-up of the Board, considering diversity across many dimensions, including gender, race, age, industry experience, functional areas (e.g., technology and finance), geographic scope, public and private company experience, academic background and director experience in the context of an assessment of the current and expected needs of the Board. The Nominations and Governance Committee reviews director candidates based on the Board’s needs as identified through this assessment and other factors, including their relative skills and characteristics, their exemplification of the highest standards of personal and professional integrity, their independence under listing standards of The Nasdaq Global Market (“Nasdaq”), their potential contribution to the composition and culture of the Board and their ability and willingness to actively participate in the Board and committee meetings and to otherwise devote sufficient time to their Board duties. In particular, the Nominations and Governance Committee and the Board believe that sound governance of our company in an increasingly complex marketplace requires a wide range of viewpoints, backgrounds, skills and experiences. Although the Board does not have a formal policy regarding Board diversity, the Board believes that having such diversity among its members enhances the Board’s ability to make fully informed, comprehensive decisions.

Among other things, the Board believes it is important to have individuals on the Board with one or a combination of the following skills and experiences:

| • | Information Technology Infrastructure Services Experience. We provide information technology infrastructure services. Given the nature of our business, we believe it is important for members of the Board collectively to have experience in the industry in which we operate to provide insights into areas that are critical to our success. |

| • | Leadership Experience. The Board believes that directors with significant leadership experience, including chief executive officer, chief financial officer, chief operating officer and chief technology officer experience, provide it with special insights, including organization development and leadership practices, and individuals with this experience help the company identify and develop its own leadership talent. They demonstrate a practical understanding of organizations, process, strategy, risk management and the methods to drive change and growth. These individuals also provide the Company with a valuable network of contacts and relationships. |

| • | Finance Experience. The Company uses financial metrics in managing its overall operations and the operations of its business units. The Company and its shareholders value accurate and insightful financial tracking and reporting. The Board seeks directors that understand finance and financial reporting processes, including directors who qualify as audit committee financial experts. Experience as members of audit committees of other boards of directors also gives directors insight into best audit committee practices. |

| • | Public and Private Company Experience. The Company has been listed on Nasdaq for over 20 years. Although the Company’s business units operate as part of a public company, management expects them to drive growth in their business units using the entrepreneurial spirit of private company leadership. The Board believes it is important to have directors who are familiar with the regulatory requirements and environment for publicly traded companies, and to have directors who have experience applying an entrepreneurial focus to building a company or a business unit. |

We believe that our Board collectively possesses these types of experience.

As recommended by the Nominations and Governance Committee, our Board has nominated David B. Potts and Lance L. Weaver as Class I directors for terms expiring at the 2021 Annual Meeting of Shareholders. Each proposed

4

nominee is willing to serve as a director if elected. However, if a nominee is unable to serve or is otherwise unavailable for election, which is not contemplated, our incumbent Board may or may not select a substitute nominee. If a substitute nominee is selected, your shares will be voted for the substitute nominee (unless you give other instructions). If a substitute nominee is not selected, your shares will be voted for the remaining nominee. Proxies will not be voted for more than two nominees.

On February 20, 2018, Daniel C. Stanzione, the non-executive Chairman of the Board of the Company, informed the Board that he would be retiring from the Board following the 2018 Annual Meeting of Shareholders of the Company. Dr. Stanzione has served as a director since 2004 and the non-executive Chairman since 2009. Dr. Stanzione reached our mandatory retirement age last year, but agreed to accept nomination for re-election to the Board and continue as Chairman in order to facilitate the transition of a new Chief Executive Officer. Since the transition is complete, Dr. Stanzione elected to retire from the Board.

In addition, on February 20, 2018, Charles B. Coe and Patricia L. Higgins, directors of the Company, informed the Board that they do not intend to stand for re-election at the 2018 Annual Meeting of Shareholders. Mr. Coe has served as a director since 2003 and served as Chair of the Compensation Committee. Ms. Higgins has served as a director since 2004 and served as Chair of the Nominations and Governance Committee. Mr. Coe and Ms. Higgins played important roles in onboarding the new management team and transitioning their leadership roles in their respective Board committees. Mr. Coe’s decision and Ms. Higgins’ decision were not as a result of any disagreement with the Company. The Board determined to reduce the size of the Board of Directors after the annual meeting to six members.

Biographical information for each nominee and each current director is presented below.

Nominees for Terms Expiring in 2021 (Class I)

David B. Potts, 60, has served as a director since 2017. He serves as Executive Vice President and Chief Financial Officer of ARRIS International, Inc. (Nasdaq: ARRS) since 2004 and previously was responsible for the ARRIS’ finance and IT functions from the acquisition of ARRIS Interactive L.L.C. in 2001 until 2016. Prior to joining ARRIS, Mr. Potts was the Chief Financial Officer of ARRIS Interactive L.L.C. from 1995 to 2001. From 1984 through 1995, Mr. Potts held various executive management positions with Nortel Networks, including Vice President and Chief Financial Officer of Bell Northern Research and Vice President of Mergers and Acquisitions in Toronto. Prior to Nortel Networks, Mr. Potts was with Touche Ross in Toronto. Mr. Potts holds a Bachelor of Commerce degree from Lakehead University in Canada and is a member of the Institute of Chartered Accountants in Canada. Mr. Potts background and skills qualify him to chair our Audit & Finance Committee after the Annual Meeting of Shareholders and to serve as an audit committee financial expert.

David Potts’ significant experience in IT functions, finance responsibilities and leadership at ARRIS International, Inc. as well as his varied management experience qualifies him to serve as a director of INAP.

Lance L. Weaver, 63, has served as a director since 2017. He is an accomplished consumer financial services executive with nearly 40 years of experience across the consumer lending, mortgage and credit card asset classes. He has served as an advisor to financial services companies including VISA, Citigroup, Total System Services and Apollo Capital, and was President, Money Cards for Virgin Money Holdings in the U.K. from 2013 to 2015. Before holding these positions, he was President of EMEA Card Services for Bank of America, with approximately $30 billion in assets across Europe, Canada and China. He had previously served on the senior management team of MBNA Corporation for 15 years, where he helped build MBNA into the largest independent credit card lender in the world when it was acquired by Bank of America in 2006. His prior experience includes executive leadership roles with Citigroup, Wells Fargo and Maryland National Bank. Mr. Weaver currently serves as lead director of PRA Group, Inc. (Nasdaq: PRAA). Mr. Weaver is a past member of the Georgetown University board of directors and board of trustees, and a past board chair of MasterCard. Mr. Weaver earned a Bachelor of Arts degree in marketing from Georgetown University.

Lance Weaver’s leadership roles at a variety of financial services companies and knowledge of IT risk and processes, as well as his service at PRA Group, Inc. qualifies him to serve as a director of INAP.

Your Board of Directors unanimously recommends that you vote FOR each of the above-listed nominees.

Continuing Directors Terms Expiring in 2020 (Class III)

Debora J. Wilson, 60, has served as a director since 2010. Ms. Wilson brings more than 30 years of experience managing key operational functions including sales, marketing, product development technology, human resources

5

and finance/accounting. Ms. Wilson gained valuable executive management, business and leadership skills during her service as Chief Executive Officer of a technology-driven company. Ms. Wilson also brings knowledge of corporate governance matters based on her experience as a director of several public and private company boards of directors. Ms. Wilson served as a President and Chief Executive Officer of The Weather Channel from 2004 to 2009 and in other positions including Senior Vice President, Executive Vice President and Chief Operating Officer of The Weather Channel from 1994 to 2004. Before joining The Weather Channel, Ms. Wilson spent 15 years in the telecommunications industry at Bell Atlantic (now Verizon). Ms. Wilson is a member of the board of directors, chair of the compensation committee and member of the audit committee of Markel Corporation (NYSE: MKL) and a member of the board of directors and chair of the compensation committee of ARRIS International, Inc. (Nasdaq: ARRS). Ms. Wilson holds a B.S. in Business Administration from George Mason University in Virginia.

Peter J. Rogers, Jr., 63, has served as a director since 2016. Mr. Rogers brings more than 30 years of experience managing key operational functions including finance, marketing, business development, investor relations and mergers and acquisitions. Most recently, he serves as President and Chief Executive Officer of Dovetail Systems of Bethesda, Maryland, a hospitality software company, where he is also a member of its board of directors. In addition, he is a board member of two other privately held hospitality software companies; StayNTouch of Bethesda, MD and B4Checkin of Halifax, Nova Scotia, Canada. He serves as board chairman for B4Checkin. He is also an advisor to Purple Cloud Technologies of Atlanta, Georgia, a startup hotel software company. He is also a principal of The Stroudwater Group, a management consulting company located in Washington, D.C. and a member of the New Dominion Angels Investor Group of Northern Virginia. Mr. Rogers started his career in 1979 with General Foods Corporation (now Kraft Foods Corporation, Nasdaq: MDLZ), White Plains, NY, as a Senior Financial Analyst. He spent seven years as a Financial Analyst and Consumer Products Marketing Manager with the Van Leer Corporation, a Dutch company, in its U.S. subsidiary, Keyes Fibre Co. of Stamford, CT. In 1987, Mr. Rogers joined MICROS Systems, Inc., Columbia, MD, as Director of Marketing. Mr. Rogers spent 27 years with MICROS (Nasdaq: MCRS) as it grew from a small company ($18 million revenue and $3 million market capitalization) to a global leader in information systems for the hospitality and retail industries ($1.4 billion revenue and $5.3 billion market capitalization). He served as Director of Marketing, Director of Business Development and a Product Director from 1987 to 1996. Mr. Rogers was Executive Vice President for Business Development and Investor Relations for MICROS from 1996 to 2014. Mr. Rogers left MICROS shortly after it was acquired by Oracle Corporation in 2014. Mr. Rogers also served in the role of setting product and service pricing, initiating its stock repurchase program at the board level, developing and managing its strategic partner relationships, creating its strategic plan and participating in its merger and acquisition efforts. He created its electronic payments business, one of the first integrated credit card payment systems in the hospitality industry. He managed its integrated credit card business for 24 years, extending its platform globally. Mr. Rogers has extensive board experience. He served as a board member for Johns Hopkins Howard County (MD) General Hospital (Chair, Vice Chairman, and board member), Johns Hopkins Medicine and Executive Boards, the Howard County (Maryland) Economic Development Authority (Chair, Vice Chair, Treasurer and board member), and The Hotchkiss School of Lakeville, CT. He also served as President of the Hotchkiss School Annual Fund. He currently serves on the Advisory Board for Penn State University’s School of Hospitality Management. Mr. Rogers is a graduate of the University of Pennsylvania (BA Economics – Honors) and New York University’s Stern Graduate School of Business (M.B.A. Corporate Finance). He holds a professional certificate in Investor Relations from the University of Michigan Ross School of Business and a Corporate Board Fellowship designation from the National Association of Corporate Directors.

Continuing Directors Terms Expiring in 2019 (Class II)

Gary M. Pfeiffer, 68, has served as a director since 2007. Mr. Pfeiffer’s extensive experience includes public company officer, finance and accounting experience, corporate leadership experience, international operations experience, public sector experience as well as service on the boards of directors of other public companies, including service as non-executive chairman of the board of directors and chairman of audit, compensation and executive committees. This experience includes services as Chief Financial Officer and in other senior finance roles and in senior roles involving executive management during his more than 32 years with E. I du Pont de Nemours and Company (DuPont), a large, complex, technology based, multinational science-based products and services company. During his career with DuPont (NYSE: DD), Mr. Pfeiffer held a variety of financial and business leadership positions in the United States, Brazil and Japan. From 1997 to 2006, Mr. Pfeiffer served as Senior Vice President and Chief Financial Officer of DuPont, Mr. Pfeiffer also served as Secretary of Finance for the State of Delaware from January 2009 through June 2009. Mr. Pfeiffer is a member of the board of directors of Quest Diagnostics, Inc. (NYSE: DGX). Mr. Pfeiffer previously served as a director of The Talbots, Inc. from 2004 to May 2012, having last

6

served as its non-executive Chairman of the board of directors and as a director of TerraVia Holdings, Inc., formerly Solazyme, Inc. Mr. Pfeiffer holds a B.A. and an M.B.A. from the College of William and Mary in Virginia. Mr. Pfeiffer’s background and skills qualify him to serve as our audit committee financial expert.

Peter D. Aquino, 57, has been our President, Chief Executive Officer and Director since September 2016. He is a veteran of the technology, media and telecommunications (TMT) industries, with a track record of successfully guiding major expansion efforts, turnarounds and strategic partnerships and transactions at both public and private companies. Prior to assuming his role at the Company, Mr. Aquino served as Chairman and Chief Executive Officer, and later as Executive Chairman, of Primus Telecommunications Group, Inc. (“PTGi”) from 2010 until 2013. Under his leadership, PTGi grew into an integrated telecommunications company serving consumer and business customers with voice, data, high-capacity fiber and data center services globally. Prior to this, he was the President and Chief Executive Officer of RCN Corporation from 2004 until 2010 where he built the company into an all-digital HDTV cable multiple system operator and created an advanced fiber-based commercial network through organic and acquisition strategies. He is also the founder of Broad Valley Capital, LLC, where he provided consulting services and capital to improve companies’ business operations, productivity and asset value. He began his career at Bell Atlantic (now Verizon) in 1983. Mr. Aquino recently served on the board of directors of Lumos Networks (Nasdaq: LMOS) and FairPoint Communications, Inc. (Nasdaq: FRP), prior to both being sold in 2017. Mr. Aquino holds a Bachelor’s Degree from Montclair State University and an M.B.A. from George Washington University in Washington, D.C.

BOARD AND COMMITTEE MEMBERSHIP AND MEETINGS

Our shareholders elect the Board to oversee management of our Company. The Board delegates authority to the Chief Executive Officer and other executive officers to pursue the Company’s mission and oversees the Chief Executive Officer’s and executive officers’ conduct of our business. In addition to its general oversight function, the Board reviews and assesses the Company’s strategic and business planning and the executive officers’ approach to addressing significant risks and has additional responsibilities including the following:

| • | reviewing and approving the Company’s key objectives and strategic business plans and monitoring implementation of those plans and the Company’s success in meeting identified objectives; |

| • | reviewing the Company’s financial objectives and major corporate plans, business strategies and actions; |

| • | approving the Company’s annual corporate budget and major capital expenditures and purchase commitments; |

| • | selecting, evaluating and compensating the Chief Executive Officer and overseeing Chief Executive Officer succession planning; |

| • | providing advice and oversight regarding the selection, evaluation, development and compensation of executive officers; |

| • | reviewing significant risks confronting our Company and alternatives for their mitigation; and |

| • | assessing whether adequate policies and procedures are in place to safeguard the integrity of our business operations and financial reporting and to promote compliance with applicable laws and regulations, and monitoring management’s administration of those policies and procedures. |

During 2017, our Board held 12 meetings. In 2017, each director attended the 2017 Annual Meeting of Shareholders in person and all directors attended at least 75% of the meetings of the Board and the committees on which they served. We have three standing committees of the Board: the Audit & Finance Committee (formerly the Audit Committee), the Compensation Committee and the Nominations and Governance Committee. Members of each committee are appointed by the Board and the authority, duties and responsibilities of each committee are governed by written charters approved by the Board. These charters can be found in the “Corporate Governance” section on the Investor Relations page of our website at www.INAP.com. In addition to regular meetings of the Board and committees, we have regular scheduled executive sessions for non-management directors.

7

The current membership for each of the standing committees is as follows:

|

Audit & Finance Committee

|

Compensation Committee

|

Nominations and

Governance Committee |

|

Gary M. Pfeiffer (Chair)

|

Charles B. Coe (Chair)

|

Patricia L. Higgins (Chair)

|

|

David B. Potts

|

Patricia L. Higgins

|

Charles B. Coe

|

|

Peter J. Rogers, Jr.

|

Lance L. Weaver

|

David B. Potts

|

|

Daniel C. Stanzione

|

Debora J. Wilson

|

Gary M. Pfeiffer

|

|

|

|

Peter J. Rogers, Jr.

|

|

|

|

Daniel C. Stanzione

|

|

|

|

Lance L. Weaver

|

|

|

|

Debora J. Wilson

|

Following the 2018 annual meeting of shareholders, and provided that the directors listed in proposal 1 are elected to the Board, the membership for each of the standing committees will be as follows:

|

Audit & Finance Committee

|

Compensation Committee

|

Nominations and

Governance Committee |

|

David B. Potts (Chair)

|

Debora J. Wilson (Chair)

|

Gary M. Pfeiffer (Chair)

|

|

Gary M. Pfeiffer

|

Gary M. Pfeiffer

|

David B. Potts

|

|

Peter J. Rogers, Jr.

|

Lance L. Weaver

|

Peter J. Rogers, Jr.

|

|

|

|

Lance L. Weaver

|

|

|

|

Debora J. Wilson

|

Audit & Finance Committee

The Board has determined that all members of the Audit & Finance Committee (the “Audit & Finance Committee”) are independent as defined by Nasdaq rules, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules of the SEC, as applicable to audit committee members. The Board has determined that Mr. Pfeiffer, the committee Chairman, and Mr. Potts are each an “audit committee financial expert” under rules of the SEC. The Audit & Finance Committee met nine times in 2017. The Audit & Finance Committee:

| • | appoints, retains, compensates, oversees, evaluates and, if appropriate, terminates our independent registered public accounting firm; |

| • | annually reviews the performance, effectiveness, objectivity and independence of our independent registered public accounting firm; |

| • | establishes procedures for the receipt, retention and treatment of complaints regarding accounting and auditing matters; |

| • | reviews with our independent registered public accounting firm the scope and results of its audit; |

| • | approves all audit services and pre-approves all permissible non-audit services to be performed by our independent registered public accounting firm; |

| • | assesses and provides oversight to management relating to identification and evaluation of major risks inherent in our business and the control processes with respect to such risks; |

| • | oversees the financial reporting process and discusses with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| • | reviews and monitors our accounting principles, policies and financial and accounting processes and controls; |

| • | oversees our internal audit function and reviews and approves the annual internal audit plan; and |

| • | oversees our financial strategy, capital structure and liquidity position. |

8

Compensation Committee

The Board has determined that all members of the Compensation Committee are independent as defined by Nasdaq rules, the Exchange Act and rules of the SEC, as applicable to compensation committee members. The Compensation Committee met six times during 2017. The Compensation Committee:

| • | assists the Board in discharging its responsibilities relating to executive compensation and fulfilling its responsibilities relating to our compensation and benefit programs and policies; |

| • | oversees the overall compensation structure, policies and programs, and assesses whether the compensation structure establishes appropriate incentives for executive officers and employees; |

| • | administers and makes recommendations with respect to our incentive compensation plans, including equity-based incentive plans; |

| • | reviews and approves the compensation of our executive officers, including bonuses and equity compensation; |

| • | reviews and approves corporate goals relevant to executive officers, evaluates the performance of such executive officers in light of these goals and approves the compensation of the executive officers based on the evaluation (other than for the Chief Executive Officer, whose compensation is recommended by the Compensation Committee for approval by the Board); |

| • | reviews and discusses with management our Compensation Discussion and Analysis and related disclosures required by the rules of the SEC and recommends to the Board whether such disclosures should be included in our proxy statement; |

| • | reviews and recommends employment agreements and severance arrangements for executive officers, including change in control provisions; |

| • | reviews the compensation of directors for service on the Board and committees and makes recommendations to the Board regarding such compensation; and |

| • | engages, determines compensation for and oversees the work of any consultants and advisors retained by the Compensation Committee, at the expense of the company, and oversees compliance with applicable requirements relating to the independence of such consultants or advisors. |

See the “Compensation Discussion and Analysis” section below for more information regarding the Compensation Committee’s processes and procedures.

Nominations and Governance Committee

The Board of Directors has determined that all members of the Nominations and Governance Committee are independent as defined by Nasdaq rules, as applicable to nominating committee members. The Nominations and Governance Committee met four times during 2017. The Nominations and Governance Committee:

| • | assists the Board in fulfilling its responsibilities on matters and issues related to our corporate governance practices; |

| • | in conjunction with the Board, establishes qualification standards for membership on the Board and its committees; |

| • | leads the search for individuals qualified to become members of the Board, reviews the qualifications of candidates for election to the Board and assesses the contributions and independence of incumbent directors eligible to stand for re-election to the Board; |

| • | selects and recommends to the Board the nominees for election or re-election by the shareholders at the annual meeting, and selects and recommends to the Board individuals to fill vacancies and newly created directorships on the Board; |

| • | develops and recommends to the Board corporate governance guidelines, reviews the guidelines on an annual basis and recommends any changes to the guidelines as necessary; |

| • | establishes and recommends to the Board guidelines, in accordance with applicable rules and regulations, to be applied when assessing the independence of directors; |

9

| • | reviews and approves related person transactions, as defined in applicable SEC rules, and establishes policies and procedures for the review, approval and ratification of related person transactions; |

| • | annually reviews and makes recommendations to the Board concerning the structure, composition and functioning of the Board and its committees and recommends to the Board directors to serve as committee members and chairpersons; |

| • | reviews directorships in other public companies held by or offered to directors; |

| • | assists the Board in developing and evaluating candidates for executive positions, including the Chief Executive Officer, and overseeing development of executive succession plans; |

| • | develops and recommends to the Board for its approval an annual self-evaluation process for the Board and its committees and oversees the evaluation process; and |

| • | reviews and reports on all matters generally relating to corporate governance. |

Compensation Committee Interlocks and Insider Participation

The directors who served on our Compensation Committee in 2017 are Charles B. Coe, Patricia L. Higgins, Lance L. Weaver and Debora J. Wilson. No member of the Compensation Committee is a current or former executive officer or employee of our Company. None of our executive officers served and currently none of them serves on the board of directors or compensation committee of any other entity with executive officers who have served on our Board or Compensation Committee.

Our Board has adopted Corporate Governance Guidelines that outline the general duties and functions of the Board and management and set forth general principles regarding Board composition, independence, Board meetings and responsibilities, Board committees, annual performance evaluations for the Board and our Chief Executive Officer and management succession and development. The Corporate Governance Guidelines are attached to the charter of the Nominations and Governance Committee, which can be found in the “Corporate Governance” section on the Investor Relations page of our website at www.INAP.com.

Our Corporate Governance Guidelines assist our Board in fulfilling its responsibilities to shareholders and provide a framework for the Board’s oversight responsibilities regarding our business. Our Corporate Governance Guidelines are dynamic and have been developed and revised to reflect changing laws, regulations and good corporate governance practices. The guidelines also provide guidance and transparency to management, employees and shareholders regarding the Board’s philosophy, high ethical standards, expectations for conducting business and decision-making processes.

The following is a summary of certain of our policies and guidelines relating to corporate governance. You may access complete current copies of our Code of Conduct, Corporate Governance Guidelines, Audit & Finance Committee Charter, Compensation Committee Charter, and Nominations and Governance Committee Charter in the “Corporate Governance” section on the Investor Relations page of our website at www.INAP.com. Each of these is also available in print to any shareholder upon request to our Corporate Secretary.

Identification and Evaluation of Director Candidates

The Board prides itself on its ability to recruit and retain directors who have a diversity of experience, who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who are effective (in conjunction with the other members of the Board) in collectively serving the long-term interests of our shareholders. The Nominations and Governance Committee of the Board acts as the Board’s nominating committee. All members of the Nominations and Governance Committee are independent as defined by Nasdaq rules. The Nominations and Governance Committee seeks individuals qualified to become directors and recommends candidates for all director openings to the full Board. For a discussion of the Board’s membership criteria and how the company seeks to achieve diversity in Board membership and to attract directors with a broad range of skills, expertise, knowledge and contacts to benefit our business, see “Proposal 1 — Election of Directors.” The Nominations and Governance Committee considers director candidates in anticipation of upcoming director elections and other potential or expected Board vacancies.

10

The Nominations and Governance Committee considers director candidates suggested by directors, executive officers and shareholders and evaluates all nominees for director in the same manner. Shareholders may recommend individual nominees for consideration by the Nominations and Governance Committee by communicating with the committee as discussed below under “Shareholder Communications with the Board of Directors.” From time to time, the Nominations and Governance Committee may retain a third-party search firm to identify director candidates and has sole authority to select the search firm and approve the terms and fees of any director search engagement.

Shareholder Nominations

Shareholders who wish to recommend nominees for consideration by the Nominations and Governance Committee must submit their nominations in writing to our Corporate Secretary. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether such individual can read and comprehend basic financial statements and other board memberships, if any, held by the recommended individual. The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board of Directors and to serve if elected by the shareholders. The Nominations and Governance Committee may consider such shareholder recommendations when it evaluates and recommends nominees to the full Board for submission to the shareholders at each annual meeting. Shareholder nominations made in accordance with these procedures and requirements must be addressed to the attention of Richard P. Diegnan, Corporate Secretary, Internap Corporation, 12120 Sunset Hills Road, Suite 330, Reston, VA 20190.

In addition, shareholders may nominate directors for election without consideration by the Nominations and Governance Committee. Any shareholder may nominate an individual by complying with the eligibility, advance notice and other provisions set forth in our bylaws. A written notice of nomination must be received by our Corporate Secretary at our executive offices in Reston, Virginia, not less than 90 nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting, except in certain circumstances. For purposes of our annual meeting to be held in 2019, such notice must be received not later than March 9, 2019 and not earlier than February 7, 2019. You should address any shareholder nomination to the attention of Richard P. Diegnan, Corporate Secretary, Internap Corporation, 12120 Sunset Hills Road, Suite 330, Reston, VA 20190 and include the information and comply with the requirements set forth in our bylaws. Our bylaws provide that any notice of nomination for director must describe various matters regarding the nominee and the shareholder including, among other things, the name, address, class and number of our shares that are owned beneficially and of record, any relevant agreements, arrangements or understandings between the shareholder and any affiliates or associates, and any arrangements having the effect of mitigating a decrease in our share price or affecting the voting power of the shareholder, including derivative positions.

Our bylaws contain specific eligibility requirements that each nominee for director must satisfy. Each nominee must:

| • | complete and return a written questionnaire with respect to the background and qualifications of such nominee and the background of any other person or entity on whose behalf the nomination is being made; and |

| • | provide a written representation and agreement that the nominee would comply with applicable law and our policies and guidelines if elected as a director and that the nominee is not and will not become a party to: (a) any voting commitment that has not been disclosed to us or that could limit the nominee’s ability to comply with applicable fiduciary duties; and (b) any agreement, arrangement or understanding with any person or entity other than us regarding indirect compensation, reimbursement or indemnification in connection with service as a director. |

Board Leadership Structure

Our Board does not have a formal policy with respect to whether the Chief Executive Officer should also serve as Chairman of the Board. Our Board makes the decision regarding leadership structure based on its evaluation of the experience, skills and personal interaction between persons in leadership roles as well as the needs of our company at any point in time. When making this decision, the Board considers factors such as:

| • | the person filling each role and his or her experience at the Company and/or in the information technology infrastructure services industry; |

| • | the composition, independence and effectiveness of the entire Board; |

11

| • | other corporate governance structures in place; |

| • | the compensation practices used to motivate our executive leadership team; |

| • | our leadership succession plan; and |

| • | the competitive and economic environment facing the Company. |

The Board periodically reviews its leadership structure to ensure that it remains the optimal structure for our Company and our shareholders.

Since 2002, we have had different individuals serving as our Chairman of the Board of Directors and Chief Executive Officer. Currently, Daniel C. Stanzione is our Chairman and Peter D. Aquino is our Chief Executive Officer. Gary M. Pfeiffer has agreed to serve as the Chairman after the 2018 Annual Meeting of Shareholders. As Chairman, Dr. Stanzione leads the Board in its role to provide general oversight of board governance for the Company and to provide guidance and support for the Chief Executive Officer. Further, the Chairman sets the agenda for, and presides over meetings of the Board. As Chief Executive Officer, Mr. Aquino is responsible for developing and executing the strategic plan, as well as for overseeing the day-to-day operations and performance of the Company.

We believe that separating the roles of Chairman and Chief Executive Officer represents an appropriate allocation of roles and responsibilities at this time given, among other things, the benefits of Dr. Stanzione’s experience, independence and tenure as a director of the Company, which dates back to 2004. Mr. Aquino is well-positioned as the leader to develop and execute the Company’s corporate strategy and to focus on operations and growth initiatives.

The Company believes this separation of responsibility is appropriate to provide independent Board oversight of and direction for the Company’s executive leadership team, led by Mr. Aquino. Further, the Company believes that having an independent Chairman provides for more effective monitoring and objective evaluation of the Chief Executive Officer’s performance, which enables more direct accountability for the Chief Executive Officer’s performance.

Our Corporate Governance Guidelines provide that if our Chairman is not independent, the Board may designate a Lead Director who will be independent. The Board, however, has not determined it necessary to designate a Lead Director as the Company feels our current structure, as described above, functions well and provides the necessary separation of roles.

Independence

The Board annually assesses the independence of all directors. No director qualifies as “independent” unless the Board affirmatively determines that the director is independent under the listing standards of Nasdaq. Our Corporate Governance Guidelines require that a majority of our directors be independent. Our Board believes that the independence of directors and committee members is important to assure that the Board and its committees operate in the best interests of the shareholders and to avoid any appearance of conflict of interest.

Under Nasdaq standards, our Board has determined that the following eight directors are independent: Charles B. Coe, Patricia L. Higgins, Gary M. Pfeiffer, David B. Potts, Peter J. Rogers, Jr., Daniel C. Stanzione, Debora J. Wilson and Lance L. Weaver. Mr. Aquino is not independent because he currently serves as our President and Chief Executive Officer. For five years, we have had not more than one active or former management employee serving as a director. In that regard, Mr. Aquino has served as a director since his appointment as Chief Executive Officer in September 2016.

Risk Oversight by Our Board of Directors

While risk management is primarily the responsibility of our management team, our Board is responsible for the overall supervision of our risk management activities. The Board implements its risk oversight function both at the full Board level and through delegation to various committees. These committees meet regularly and report back to the full Board. The Audit & Finance Committee has primary oversight responsibility not only for financial reporting with respect to our major financial exposures and the steps management has taken to monitor and control such exposures, but also for the effectiveness of management’s enterprise risk management process that monitors and manages key business risks facing our Company. The Audit & Finance Committee also oversees our procedures for the receipt, retention and treatment of complaints relating to accounting and auditing matters and oversees management of our legal and regulatory compliance systems. Most recently, the Audit & Finance Committee amended its charter to expand its role to include oversight of the Company’s financial strategies, capital structure,

12

liquidity position, banking relationships and tax policies. The Compensation Committee oversees risks relating to our compensation plans and programs. The Nominations and Governance Committee regularly reviews our governance structure, practices and policies to improve governance of our Company and our engagement efforts with our shareholders with a goal to promote the long-term interests of our shareholders.

Management provides updates throughout the year to the respective committees regarding the management of the risks they oversee and each of these committees reports on risk to the full Board at regular meetings of the Board. The Board periodically reviews the allocation of risk responsibility among the Board’s committees and implements any changes that it deems appropriate. In addition to the reports from the committees, the Board receives presentations throughout the year from various department and business unit leaders that include discussion of significant risks as appropriate. At each regularly-scheduled Board meeting, the Chairman and Chief Executive Officer address, in a director-only session, matters of particular importance or concern, including any significant areas of risk that require Board attention. Additionally, through dedicated sessions focusing entirely on corporate strategy, the full Board reviews in detail the company’s short- and long-term strategies, including consideration of significant risks facing us and how the risks could impact our business.

Our Vice President of Internal Audit coordinates the day-to-day risk management process for our Company and reports directly to the Chief Financial Officer and to the Audit & Finance Committee. The Vice President of Internal Audit updates the Audit & Finance Committee at least quarterly in regular and executive sessions and annually updates the full Board regarding the company’s risk analyses and assessments and risk mitigation strategies and activities. The Vice President of Internal Audit also updates the Compensation Committee annually regarding the risk of our compensation plans and programs.

We believe that our approach to risk oversight, as described above, optimizes our ability to assess inter-relationships among the various risks, make informed cost-benefit decisions and approach emerging risks in a proactive manner. We also believe that our risk structure complements the current leadership structure of our Board, as it allows our independent directors, through the three fully-independent standing Board committees, to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

We conducted a risk assessment of our 2017 compensation plans and programs to identify potential risks associated with the design of the plans and programs and assess the controls in place to mitigate risks, if any, to an acceptable level. Based on this assessment, management has concluded that our compensation plans and programs do not contain risks that are reasonably likely to cause a material adverse effect on us. We evaluated each plan and program independently and as part of our overall compensation framework. In general, our compensation plans and programs:

| • | are well documented, appropriately communicated, consistently applied and reviewed annually by the Compensation Committee; |

| • | are based on both individual performance and company performance metrics that are tied to the strategic goals and objectives of the company; |

| • | balance short- and long-term rewards, with compensation capped at levels consistent with industry standards; |

| • | do not encourage excessive risk taking, do not focus on short-term gains rather than long-term value creation, do not reward circumvention of controls or do not contain unrealistic goals and/or targets; and |

| • | are compared to industry standards and peer companies on an on-going basis by both the internal compensation department as well as the Compensation Committee’s independent compensation consultant and amended periodically to maintain consistency with common practices. |

Based on these factors, the absence of any identified incentives for risk-taking above the level associated with our business model, the involvement of our independent Compensation Committee and our overall culture and control environment, we have concluded our compensation plans do not promote excessive risk taking.

Stock Ownership Guidelines for Directors and Executive Officers

The Board believes that directors and management should have a significant financial stake in our Company to align their interests with those of our shareholders. In that regard, the Board adopted stock ownership guidelines that require directors and executive officers to own specified amounts of our stock granted to them in connection with their service to the company. The stock ownership guidelines are further described below in “Non-Employee Director

13

Compensation — Stock Ownership Guidelines for Non-Employee Directors” and “Compensation Discussion and Analysis — Stock Ownership Guidelines for Named Executive Officers.”

Code of Conduct and Ethics Hotline

We have a Code of Conduct that covers our directors, officers (including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer) and employees and satisfies the requirements for a “code of ethics” within the meaning of SEC rules. A copy of the code is posted in the “Corporate Governance” section on the Investor Relations page of our website at www.INAP.com. The code is available in print to any person without charge, upon request sent to Richard P. Diegnan, our Corporate Secretary at Internap Corporation, 12120 Sunset Hills Road, Suite 330, Reston, VA 20190. We will disclose, in accordance with all applicable laws and regulations, amendments to, or waivers from, our Code of Conduct.

Any suggestions, concerns or reports of misconduct at our company or complaints or concerns regarding our financial statements and accounting, auditing, internal control and reporting practices can be reported by submitting a report on https://INAP.alertline.com/gcs/welcome (anonymously, if desired) or by calling our third-party provider, Global Compliance, Inc. at (800) 323-6182.

Attendance

Attendance at Board and committee meetings is central to the proper functioning of our Board and is a priority. Directors are expected to make every effort to attend all meetings of the Board, meetings of committees on which they serve and the Annual Meeting of Shareholders.

Board and Company Culture

Our Corporate Governance Guidelines are coupled with a robust, open and effective Board environment that promotes respect, trust and candor, fosters a culture of open dissent and permits each director to express opinions and contribute to the Board process. Directors are expected to have unrestricted access to management and any Company information they believe is necessary and appropriate to perform their roles as directors. The participation of Board members and the open exchange of opinions are further encouraged at the Board committee level through the periodic rotation of Board members among its standing committees. This open and candid operating environment is shared by management and the Board and is essential to fully realize the benefits of our Corporate Governance Guidelines, committee charters and other policies governing our company.

Shareholder Communications with the Board of Directors

Shareholders and interested parties may communicate with our Board by sending correspondence to the Board, a specific Board committee or a director c/o Corporate Secretary, Internap Corporation, 12120 Sunset Hills Road, Suite 330, Reston, VA 20190 or by sending electronic mail to [email protected].

The Corporate Secretary reviews all communications to determine whether the contents include a message to a director and will provide a summary and copies of all correspondence (other than solicitations for services, products or publications) to the applicable directors at each regularly scheduled meeting. The Corporate Secretary will alert individual directors to items which warrant a prompt response from the individual director prior to the next regularly scheduled meeting. Our Corporate Secretary will route items warranting prompt response, but not addressed to a specific director, to the applicable committee chairperson.

NON-EMPLOYEE DIRECTOR COMPENSATION

In 2017, our Compensation Committee reviewed the amount and mix of our non-employee director compensation program. The Compensation Committee, in consultation with our independent compensation consultant, elected not to increase the amount of non-employee director compensation. However, to better align the interests of our directors and our shareholders and to promote a responsible mix of cash compensation to equity compensation, the Compensation Committee:

| • | reduced the cash retainer paid to each of the directors by $20,000 and increased the annual stock grant by $20,000; |

14

| • | paid the committee chairperson annual retainer and committee member retainer in an equivalent value of restricted shares rather than payable in cash; and |

| • | reduced the Board chairman annual cash retainer from $100,000 to $40,000, to be paid in equivalent value of restricted shares. |

The Compensation Committee has not increased the amounts for director retainers, committee chairperson retainers or committee retainers since 2015. It is our view that the current non-employee director compensation program, in terms of total value, is generally aligned with other similar companies in terms of market cap, complexity, industry and business stage. In addition, our 2017 Stock Incentive Plan specifically limits the amount of non-employee director compensation we can award to $500,000 per year.

In 2017, our non-employee director compensation program was as follows:

|

|

Cash

($) |

Restricted Stock

Award |

||

|

Newly appointed or elected director

|

|

—

|

|

Number of restricted shares equal to $110,000

|

|

Annual director retainer

|

$

|

40,000

|

|

Number of restricted shares equal to $130,000

|

|

Audit & Finance Committee chairperson annual retainer

|

|

—

|

|

Number of restricted shares equal to $15,000

|

|

Audit & Finance Committee member annual retainer

|

|

—

|

|

Number of restricted shares equal to $7,500

|

|

Compensation Committee chairperson annual retainer

|

|

—

|

|

Number of restricted shares equal to $10,000

|

|

Compensation Committee member annual retainer

|

|

—

|

|

Number of restricted shares equal to $5,000

|

|

Nominations and Governance Committee chairperson annual retainer

|

|

—

|

|

Number of restricted shares equal to $7,500

|

|

|

|

|

|

|

|

Chairman annual retainer

|

|

—

|

|

Number of restricted shares equal to $40,000

|

The number of shares of restricted common stock to be awarded is determined by dividing the amount of the cash retainer to be received by the closing price of a share of common stock as of the date on which the retainer would otherwise have been paid. Restricted stock vests on the one-year anniversary of date of issuance.

The following table lists the compensation paid to our non-employee directors during 2017:

|

Name(1)

|

Fees Earned or

Paid in Cash |

Stock

Awards(2) |

Total

|

||||||

|

Charles B. Coe

|

$

|

40,000

|

|

$

|

140,970

|

|

$

|

180,970

|

|

|

Patricia L. Higgins

|

|

40,000

|

|

|

142,231

|

|

|

182,231

|

|

|

Gary M. Pfeiffer

|

|

40,000

|

|

|

145,970

|

|

|

185,970

|

|

|

David B. Potts

|

|

20,000

|

|

|

123,757

|

|

|

143,757

|

|

|

Peter J. Rogers, Jr.

|

|

40,000

|

|

|

134,730

|

|

|

174,730

|

|

|

Daniel C. Stanzione

|

|

40,000

|

|

|

178,495

|

|

|

218,495

|

|

|

Lance L. Weaver

|

|

10,000

|

|

|

114,992

|

|

|

124,992

|

|

|

Debora J. Wilson

|

|

40,000

|

|

|

137,230

|

|

|

177,230

|

|

| (1) | In addition to serving as a director, Mr. Aquino has served as our Chief Executive Officer and President since September 2016 and his compensation is reflected in the Summary Compensation Table. Mr. Aquino does not receive any compensation for serving as a director. |

| (2) | Represents the full grant date fair value of restricted stock granted in 2017, calculated in accordance with FASB ASC Topic 718. We value restricted stock using the closing price of our common stock reported on Nasdaq on the applicable grant date. For additional valuation assumptions, see Note 12 to our Consolidated Financial Statements for the fiscal years ended December 31, 2017 and December 31, 2016, and Note 13 to our Consolidated Financial Statements for the fiscal year ended December 31, 2015. The values in this column may not correspond to the actual value that the non-employee directors will realize at the time that the restricted stock vests. In 2017, the shares of restricted stock were granted at fair market value per share on the date of grant for all non-employee directors. |

15

The following table lists the number of outstanding restricted stock awards and stock options held by our non-employee directors as of December 31, 2017. The reported numbers reflect only grants made by the Company and do not include any other stock that a director may have acquired on the open market. The awards reported below have been adjusted for the 1-for-4 reverse stock split completed on November 20, 2017:

|

Name

|

Stock

Awards #(a) |

Options #(b)

|

||||

|

Charles B. Coe

|

|

34,939

|

|

|

18,639

|

|

|

Patricia L. Higgins

|

|

36,207

|

|

|

18,139

|

|

|

Gary M. Pfeiffer

|

|

35,271

|

|

|

9,639

|

|

|

David B. Potts

|

|

7,155

|

|

|

—

|

|

|

Peter J. Rogers, Jr.

|

|

25,264

|

|

|

—

|

|

|

Daniel C. Stanzione

|

|

37,430

|

|

|

18,139

|

|

|

Lance L. Weaver

|

|

7,351

|

|

|

—

|

|

|

Debora J. Wilson

|

|

32,541

|

|

|

4,072

|

|

| (a) | Includes awards of restricted stock net of any shares withheld at the election of a director to satisfy minimum statutory tax obligations upon vesting plus shares acquired upon exercise of vested stock options. Some of the reported grants remain subject to time-based vesting. |

| (b) | All outstanding options are fully vested. |

In 2018, our non-employee director compensation program will be revised as follows:

| • | reduce the cash retainer paid to each of the directors by $10,000 and increased the annual stock grant by $10,000; and |

| • | the number of shares of restricted common stock to be awarded will be determined by dividing the amount of the cash retainer to be received by the 90-day rolling average closing price of a share of common stock as of the date on which the retainer would otherwise have been paid. Restricted stock vests on the one-year anniversary of date of issuance. |

Stock Ownership Guidelines for Non-Employee Directors

The Board has implemented stock ownership guidelines that require each non-employee director to beneficially own a number of shares of Company common stock equal to five times the annual director retainer as identified above. All non-employee directors meet the required guidelines other than Mr. Rogers, who was appointed to our Board in 2016, and Mr. Potts and Mr. Weaver, who were appointed to our Board in 2017. We believe that these guidelines further align the interests of directors and shareholders. Please see “Compensation Discussion and Analysis — Stock Ownership Guidelines for Named Executive Officers” for additional information regarding the guidelines.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND OFFICERS AND DIRECTORS

Five Percent Shareholders