Form DEF 14A NEWPARK RESOURCES INC For: May 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) of THE SECURITIES EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant ☐

Check the appropriate box:

Preliminary Proxy Statement | |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

X | Definitive Proxy Statement |

Definitive Additional Materials | |

Soliciting Material Pursuant to §240.14a-12 | |

NEWPARK RESOURCES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

X | No fee required. |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) Title of each class of securities to which transaction applies: | |

(2) Aggregate number of securities to which transaction applies: | |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it is determined): | |

(4) Proposed maximum aggregate value of transaction: | |

(5) Total fee paid: | |

Fee paid previously with preliminary materials. | |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) Amount Previously Paid: | |

(2) Form, Schedule or Registration Statement No.: | |

(3) Filing Party: | |

(4) Date Filed: | |

NEWPARK RESOURCES, INC.

_________________________________________________

Notice of Annual Meeting

and

Proxy Statement

__________________________

2018 Annual Meeting of Stockholders

May 17, 2018

April 4, 2018

Dear Fellow Stockholder:

On behalf of the Board of Directors, you are cordially invited to attend our 2018 Annual Meeting of Stockholders of Newpark Resources, Inc. (the “Company”), which will be held on Thursday, May 17, 2018, at 10:00 a.m., Central Daylight Time, at the offices of the Company, 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381. In the following pages, you will find the Notice of Annual Meeting of Stockholders as well as a Proxy Statement describing the business to be conducted at the meeting.

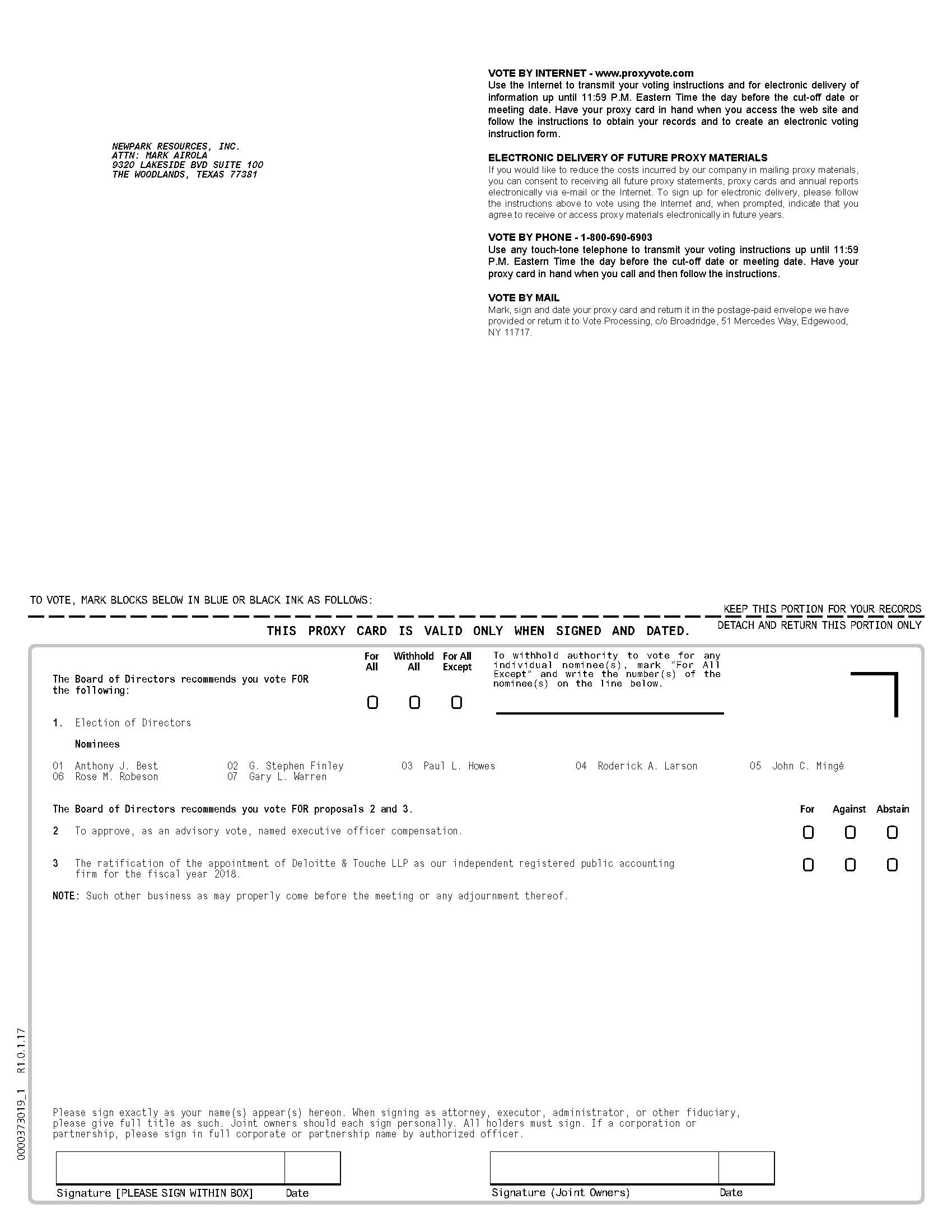

Whether or not you plan to attend the Annual Meeting, it is important that you study carefully the information provided in the accompanying Proxy Statement and vote. Please promptly vote your shares by telephone, by the Internet or, if the Proxy Statement was mailed to you, by marking, signing, dating and returning the proxy card in the prepaid envelope so that your shares can be voted in accordance with your wishes.

Thank you for your continued support. We look forward to seeing you at our 2018 Annual Meeting of Stockholders.

Sincerely,

PAUL L. HOWES

President and Chief Executive Officer

TABLE OF CONTENTS

NEWPARK RESOURCES, INC.

9320 Lakeside Blvd. Ste 100

The Woodlands, Texas 77381

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2018

To the Stockholders of Newpark Resources, Inc.:

The Annual Meeting of Stockholders of Newpark Resources, Inc., a Delaware corporation (the “Company”), will be held on Thursday, May 17, 2018, at 10:00 a.m., Central Daylight Time, at the offices of the Company, 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381, for the following purposes:

(1) | The election of seven directors to the Board of Directors; |

(2) | An advisory vote to approve named executive officer compensation; |

(3) | The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year 2018; and |

(4) | To consider and act upon such other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on March 26, 2018 will be entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement. A list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and for 10 days prior to the Annual Meeting at our executive offices, 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please promptly vote your shares by telephone, by the Internet or if this Proxy Statement was mailed to you, by marking, signing, dating and returning the enclosed proxy card as soon as possible in the enclosed postage prepaid envelope in order for your vote to be cast at the Annual Meeting. The giving of your proxy will not affect your right to vote in person should you later decide to attend the Annual Meeting. If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record for you to follow in order to vote your shares.

Dated: | April 4, 2018 | BY ORDER OF THE BOARD OF DIRECTORS |

| ||

Mark J. Airola | ||

Senior Vice President, General Counsel, | ||

Chief Administrative Officer and Corporate Secretary | ||

NEWPARK RESOURCES, INC.

9320 Lakeside Boulevard, Suite 100

The Woodlands, Texas 77381

PROXY STATEMENT

April 4, 2018

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Newpark Resources, Inc. for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the offices of the Company, 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381 on Thursday, May 17, 2018, at 10:00 a.m., Central Daylight Time, and any postponements or adjournments of the Annual Meeting.

Record Date and Outstanding Shares |

Notice Regarding the Availability of Proxy Materials |

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and related materials available over the Internet under the “notice and access” delivery model. The “notice and access” rule removes the requirement for public companies to automatically send their stockholders a printed set of proxy materials and allows them instead to deliver to their stockholders a “Notice Regarding the Availability of Proxy Materials” and to provide access to the documents over the Internet. A Notice Regarding the Availability of Proxy Materials was first mailed to all stockholders of record on or about April 4, 2018. The notice is not a form for voting, and presents an overview of the more complete proxy materials which contain important information and are available on the Internet and by mail. Stockholders are encouraged to access and review the proxy materials before voting.

This Proxy Statement, the form of proxy and voting instructions are being made available on or about April 4, 2018 at www.proxyvote.com. You may also request a printed copy of this Proxy Statement and the form of proxy by telephone at 1-800-690-6903, via the Internet at www.proxyvote.com or by email in accordance with the instructions given in the Notice Regarding the Availability of Proxy Materials. Our Annual Report to Stockholders, including financial statements, for the fiscal year ended December 31, 2017, is being made available at the same time and by the same method described above. The Annual Report to Stockholders is not to be considered as part of the proxy solicitation material or as having been incorporated by reference.

Any stockholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis by making such request via the Internet, email or by telephone. A request to receive proxy materials in printed form or electronically by email will remain in effect until the request is terminated by the stockholder.

Delivery of Documents to Stockholders Sharing an Address |

Street name stockholders in a single household who received only one copy of the Notice Regarding Availability of Proxy Materials may request to receive separate copies in the future by following the instructions provided on the voting instruction form sent to them by their bank, broker or other holder of record. Similarly, street name stockholders who are receiving multiple copies may request that only a single set of materials be sent to them in the future by checking the appropriate box on the voting instruction form. Otherwise, street name stockholders should contact their bank, broker, or other holder.

COPIES OF THIS PROXY STATEMENT AND THE 2017 ANNUAL REPORT ON FORM 10-K, INCLUDING THE FINANCIAL STATEMENTS, FINANCIAL STATEMENT SCHEDULES AND EXHIBITS, ARE AVAILABLE PROMPTLY WITHOUT CHARGE BY CALLING (281) 362-6800, OR BY WRITING TO CORPORATE SECRETARY, NEWPARK RESOURCES, INC., 9320 LAKESIDE BOULEVARD, SUITE 100, THE WOODLANDS, TEXAS 77381. If you are receiving multiple copies of the Notice Regarding Availability of Proxy Materials, you also may request orally or in writing to receive a single copy by calling (281) 362-6800, or writing to Corporate Secretary, Newpark Resources, Inc., 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381. However, if you wish to receive a paper proxy and voting instruction form or other proxy materials for participation and voting in this year’s annual meeting, follow the instructions included in the Notice Regarding Availability of Proxy Materials sent to you.

Voting Information |

Revocation of Proxies |

Proposals | Recommendation of the Board | |

Proposal 1 - | Election of the seven directors nominated by the Board of Directors | FOR |

Proposal 2 - | Approval of the compensation of our named executive officers as disclosed in this proxy statement | FOR |

Proposal 3 - | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year 2018 | FOR |

The proxy confers discretionary authority to the persons named in the proxy authorizing those persons to vote, in their discretion, on any other matters properly presented at the Annual Meeting. Management is not currently aware of, nor does it intend to present at the Annual Meeting, any such other matters.

Your cooperation in promptly voting your shares via Internet, telephone or, if you received this Proxy Statement by mail, by returning the enclosed proxy, will reduce expenses.

Quorum |

Beneficial Ownership |

The following agenda items are considered non-routine, therefore, your bank, broker or other nominee will not be able to vote your shares on these items unless you have given explicit instructions to do so:

• | Election of directors; and |

• | The advisory vote to approve executive compensation. |

If you do not instruct your bank, broker or nominee how to vote your shares on the foregoing agenda items, then your shares will be considered “broker non-vote” with respect to those proposals.

The ratification of the appointment of Deloitte and Touche LLP is considered a routine agenda item and your bank, broker or other nominee is permitted to vote your shares even if such bank, broker or nominee does not receive voting instructions from you.

Proposal 1 - Election of Directors |

Voting Requirement to Approve Other Proposals |

The following summary describes the vote requirement to approve each of the proposals on the agenda, excluding the election of Directors, at the Annual Meeting assuming a quorum has been established for the transaction of business at the meeting.

• | Proposal 2 - Advisory vote to approve executive compensation. The approval of the advisory vote on the Company’s executive compensation requires the affirmative vote of a majority of the shares of common stock having voting power on such matter present, in person or by proxy, at the Annual Meeting. Abstentions will be considered as present at the Annual Meeting and included in the vote totals on this matter and will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the outcome of the advisory proposal. |

• | Proposal 3 - Ratification of the appointment of independent registered public accounting firm. Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year 2018 requires the affirmative vote of a majority of the shares of common stock having voting power on such matter present, in person or by proxy, at the Annual Meeting. Abstentions will be considered as present at the Annual Meeting and included in the vote totals on this matter and will have the same effect as a vote against the proposal. Brokers who have not received voting instructions from the beneficial owner have the discretionary authority to vote on the ratification of the appointment of Deloitte & Touche LLP. While we do not expect broker non-votes on this proposal, any broker non-votes will be included in the vote totals on this proposal and will have the same effect as a vote against this proposal. |

Solicitation of Proxies |

CORPORATE GOVERNANCE

General |

authorizes various types of transactions but is not involved in the details of the day-to-day operations of the business. Members of the Board of Directors keep informed of our business by participating in Board and committee meetings, by reviewing reports and other materials provided to them and through discussions with the Chief Executive Officer and other officers.

Board Leadership Structure |

The principal responsibilities of the non-executive Chairman of the Board are:

• | To manage the organization, functioning and affairs of the Board of Directors, in order to enable it to meets its obligations and responsibilities; |

• | To facilitate the functioning of the Board of Directors independently of management and maintain and enhance the governance quality of the Company and the Board; |

• | To interact regularly with the CEO and his staff on major strategy issues, handling of major business issues and opportunities, matters of corporate governance and performance issues, including providing feedback from other Board members and acting as a “sounding board” for the CEO; |

• | Together with the Chair of the Compensation Committee, to conduct a formal evaluation of the CEO’s performance at least annually; and |

• | To lead the Board of Directors in the execution of its responsibilities to the stockholders. |

Given the substantial overlap of the duties of a non-executive Chairman of the Board and a lead independent director, the Board of Directors determined there is no need at this time to designate a lead independent director. A complete description of the responsibilities of the non-executive Chairman of the Board is set forth in a charter adopted by the Board of Directors, a copy of which is available in the “Governance Documents” section under “Corporate Governance” on our website at www.newpark.com. A description of the powers and duties of the Chairman of the Board also is set forth in our Amended and Restated Bylaws.

Meeting Attendance |

Director Attendance at Annual Meeting |

Director Independence |

As disclosed in the biographical information under the section “Business Experience and Qualifications of Director Nominees,” Mr. Mingé currently serves as Chairman and President of BP America, Inc., which is a customer of our Fluids Systems business. In 2017, in the ordinary course of our business and based on a competitive bidding process, we provided products and services valued at approximately $0.50 million to BP America, Inc. Mr. Mingé was not involved in the decision to award the work to us. The Board of Directors determined that the relationship between our Company and BP America, Inc. did not disqualify Mr. Mingé from being considered as independent.

Board Role in Risk Management |

Director Nominations |

voted to waive the retirement age requirement for one year in recognition of the continuing challenges in the Company’s major markets and the desire to maintain Mr. Anderson’s strong leadership in that environment. Mr. Anderson will not stand for re-election at the 2018 Annual Meeting.

In the Fall of 2017, the Nominating and Corporate Governance Committee engaged in a search to identify and recruit candidates for the Board. Following a comprehensive search, Mr. John Mingé and Ms. Rose Robeson were both identified as candidates who had the skills deemed necessary for new members of the Board and who met the criteria contained in the charter for the Nominating and Corporate Governance Committee and the Corporate Governance Guidelines. Mr. Mingé was appointed to the Board effective as of December 1, 2017 and Ms. Robeson was appointed to the Board effective as of January 1, 2018. Both Mr. Mingé and Ms. Robeson have been placed in nomination for election by the stockholders at the 2018 Annual Meeting. The specific qualifications for Mr. Mingé and Ms. Robeson are detailed in the section entitled “Business Experience and Qualifications of Director Nominees.”

Stockholder Recommendations for Board Nominations |

The stockholder notice must set forth the following:

• | Name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; |

• | A representation that the stockholder is a holder of record of common stock entitled to vote at the meeting and intends to appear in person or by proxy to nominate the person or persons specified; |

• | A description of all arrangements or understandings between the stockholder and each nominee and any other person or persons under which the nomination(s) are made by the stockholder; |

• | For each person the stockholder proposes to nominate for election as a director, all information relating to such person that would be required to be disclosed in solicitations of proxies for the election of such nominees as directors pursuant to Schedule 14A promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

• | For each person nominated, a written consent to serve as a director, if elected; and |

• | A statement whether such nominee, if elected, intends to deliver an irrevocable resignation in accordance with our Corporate Governance Guidelines. |

In addition to complying with the foregoing procedures, any stockholder nominating a director must also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder.

The stockholder making the recommendation also should submit information demonstrating the number of shares he or she owns. Stockholders may send recommendations for director candidates for the 2019 Annual Meeting to the Nominating and Corporate Governance Committee by U.S. mail or overnight delivery at the following address: Chair, Nominating and Corporate Governance Committee, c/o Corporate Secretary, Newpark Resources, Inc., 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381.

Candidates recommended by the Nominating and Corporate Governance Committee must include a sufficient number of persons who, upon election, would be independent directors having the skills, experience and other characteristics necessary to provide qualified persons to fill all Board committee positions required to be filled by independent directors. In considering any candidates recommended by stockholders, the Nominating and

Corporate Governance Committee will take into account the same factors as apply to all other prospective nominees.

Board Orientation and Education |

Stockholder Communication with Board Members |

The Board of Directors has established a process for stockholders to send communications, other than sales-related communications, to one or more of its members. These communications should be sent by letter addressed to the member or members of the Board of Directors to whom the communication is directed, care of the Corporate Secretary, Newpark Resources, Inc., 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381. These communications, other than sales-related communications, will be forwarded to the Board member or members specified.

CORPORATE GOVERNANCE GUIDELINES

We are committed to adhering to sound principles of corporate governance and have adopted Corporate Governance Guidelines that the Board of Directors believes promote the effective functioning of the Board of Directors, its committees and our Company. The Corporate Governance Guidelines conform to the NYSE corporate governance listing standards and SEC rules and address, among other matters, director qualifications, independence and responsibilities, majority vote principles, Board committees, Board access to senior management, the independent accountants and other independent advisors, compensation of directors and assessments of committee performance. The Corporate Governance Guidelines are available in the “Governance Documents” section under “Corporate Governance” on our website at www.newpark.com and are also available, without charge, upon request to our Corporate Secretary at Newpark Resources, Inc., 9320 Lakeside Boulevard, Suite 100, The Woodlands, Texas 77381.

Majority Vote Policy |

Stock Ownership Guidelines |

Stock Ownership Value Required at 5x Annual Cash Retainer | Stock Ownership Value at December 31, 2017(1) | ||||||

David C. Anderson | $ | 650,000 | $ | 1,469,233 | |||

Anthony J. Best | $ | 275,000 | $ | 722,082 | |||

G. Stephen Finley | $ | 275,000 | $ | 1,515,621 | |||

Roderick A. Larson | $ | 275,000 | $ | 722,082 | |||

John C. Mingé | $ | 275,000 | $ | — | (2) | ||

Rose M. Robeson | $ | 275,000 | $ | — | (3) | ||

Gary L. Warren | $ | 275,000 | $ | 1,829,676 | |||

(1) | Stock ownership value is calculated based on the number of shares owned by the director or members of his/her immediate family residing in the same household and time-based restricted stock held by the director, multiplied by the closing price of a share of our common stock on December 29, 2017, as reported by the NYSE, which was $8.60. |

(2) | Mr. Mingé was appointed to the Board effective as of December 1, 2017 and will have until December 2022 to meet the stock ownership guidelines. |

(3) | Ms. Robeson was appointed to the Board effective as of January 1, 2018 an will have until January 2023 to meet the stock ownership guidelines. |

Executive Sessions of Non-Management Directors |

Interested parties may direct their concerns to the Chairman of the Board or to any other non-management director or directors by following the procedures set forth in the section entitled “Stockholder Communication with Board Members.”

RELATED PERSON TRANSACTIONS AND PROCEDURE

The Board of Directors has adopted a Policy Regarding Covered Transactions with Related Persons which requires the approval or ratification by the Audit Committee of any Covered Transaction (as defined in the Policy Regarding Covered Transactions with Related Persons). A Covered Transaction includes, but is not limited to, any financial transaction, arrangement or relationship or any series of similar transactions, arrangements or relationships, including indebtedness and guarantees of indebtedness, in which (a) the aggregate amount involved will or may be expected to exceed $100,000 in any calendar year, (b) we are a participant and (c) any related person has or will have a direct or indirect interest (other than solely as a result of being a director or a less than 10% beneficial owner of another entity). The policy provides that any director, director nominee or executive officer must provide to the Chief Administrative Officer and Chair of the Audit Committee prior notification of all proposed terms of any Covered Transaction (other than related party transactions involving compensation matters and certain ordinary course transactions). The Audit Committee must review the relevant facts and circumstances of the Covered Transaction, including if the terms and conditions of the transaction are generally available to third parties under similar terms or

conditions, take into account the level of interest or relationship to the related person and the impact on a director’s independence, and either approve or disapprove the Covered Transaction. If the Audit Committee (or the Chairman of the Audit Committee pursuant to his/her delegated authority) is unable to provide advance approval of a Covered Transaction, the transaction will be considered at the next regularly scheduled meeting of the Audit Committee. At the next meeting, the Audit Committee will evaluate all options including, but not limited to, ratification, amendment or termination of the Covered Transaction. No director may participate in approval of a Covered Transaction for which he/she is a related party.

CODE OF ETHICS

The Board of Directors also has adopted a Code of Ethics for Senior Officers and Directors that applies to all of our directors, our principal executive officer, principal financial officer, principal accounting officer or controller, and other senior officers. The Code of Ethics for Senior Officers and Directors contains policies and procedures applicable to our directors and, as to our senior officers, supplements our Code of Business Ethics and Conduct which is applicable to all of our employees (together with the Code of Ethics for Senior Officers and Directors, the “Codes”). The purposes of the Codes, among other matters, are to deter wrongdoing and to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships. The Codes promote full, fair, accurate, timely and understandable disclosure in reports and other documents that we file with, or submit to, the SEC and in other public communications. The Codes also require compliance with applicable governmental laws, rules and regulations including, without limitation, insider trading laws. The Codes further require the prompt internal reporting of violations of the Codes to an appropriate person or persons and accountability for adherence to the Codes.

Any amendments to, or waivers of, the Codes with respect to our principal executive officer, principal financial officer or principal accounting officer or controller, or persons performing similar functions, will be disclosed in a Current Report on Form 8-K, which will be available on our website promptly following the date of the amendment or waiver.

Copies of our Code of Ethics for Senior Officers and Directors and our Code of Business Ethics and Conduct are available in the “Governance Documents” section under “Corporate Governance” on our website at www.newpark.com and are also available in print upon request from our Corporate Secretary.

BOARD COMMITTEES

Committees of the Board of Directors |

Newpark Resources, Inc.

9320 Lakeside Boulevard, Suite 100

The Woodlands, Texas 77381

Attn: Corporate Secretary

Audit Committee |

rules. The Audit Committee met eight (8) times during 2017 and did not take any action by unanimous written consent.

The Audit Committee is responsible for the selection, evaluation, compensation and, when necessary, replacement of the independent registered public accounting firm. The Audit Committee also has responsibility for providing independent review and oversight of the integrity of our financial statements, the financial reporting process, our systems of internal accounting and financial controls, the performance of our internal audit function and the independent auditors, the independent auditors’ qualifications and independence, our compliance with ethics policies and legal and regulatory requirements and to prepare the Audit Committee Report and disclosure required by the Audit Committee for inclusion in this proxy statement. The independent auditors report directly to the Audit Committee.

The specific responsibilities of the Audit Committee are set forth in the Committee’s charter, a copy of which is available in the “Board Committees & Charters” section under “Corporate Governance” on our website at www.newpark.com and is also available in print upon request from our Corporate Secretary.

Compensation Committee |

The Compensation Committee has responsibility for establishing, evaluating and administering our compensation arrangements, plans, policies and programs for our Chief Executive Officer and other executive officers and for administering our equity incentive plans. The Compensation Committee also has responsibility for making recommendations to the Board of Directors with respect to the adoption, approval and amendment of the cash-based incentive plans for executives and senior managers and all equity-based incentive compensation plans.

The Compensation Committee has the authority to retain compensation consultants to assist it in evaluating the compensation paid to our CEO and other executive officers. As noted in the “Compensation Discussion and Analysis” section of this proxy statement, for the 2017 fiscal year, the Compensation Committee retained Pearl Meyer & Partners, LLC (“Pearl Meyer”) to provide the Compensation Committee with advice and recommendations on the amount and form of executive and director compensation. Pearl Meyer did not advise management or provide any non-executive consulting services to the Company other than its work on behalf of the Compensation Committee, and it maintained no other economic relationship with the Company.

The specific responsibilities of the Compensation Committee are set forth in the Committee’s charter, a copy of which is available in the “Board Committees & Charters” section under “Corporate Governance” on our website at www.newpark.com and is also available in print upon request from our Corporate Secretary.

Nominating and Corporate Governance Committee |

The Nominating and Corporate Governance Committee assists and advises the Board of Directors with respect to the size, composition and functions of the Board of Directors, identifies potential candidates for the Board of Directors and recommends to the Board of Directors a slate of qualified nominees for election as directors at each annual meeting, oversees the annual evaluation of the Board of Directors as a whole and the committees of the Board of Directors, and develops and advises the Board of Directors with respect to corporate governance principles, policies and practices. The Nominating and Corporate Governance Committee also serves as the Qualified Legal Compliance Committee for purposes of Section 307 of the Sarbanes-Oxley Act and ensures compliance with the standards of the SEC for professional conduct for attorneys appearing and practicing before the SEC in the representation of our company.

The specific responsibilities of the Nominating and Corporate Governance Committee are set forth in the Committee’s charter, a copy of which is available in the “Board Committees & Charters” section under “Corporate Governance” on our website at www.newpark.com and is also available in print upon request from our Corporate Secretary.

EXECUTIVE OFFICERS

As of March 26, 2018, our executive officers, their ages and positions with us were as follows:

Name | Age | Title |

Paul L. Howes | 62 | President and Chief Executive Officer |

Gregg S. Piontek | 47 | Senior Vice President and Chief Financial Officer |

Mark J. Airola | 59 | Senior Vice President, General Counsel, Chief Administrative Officer, Chief Compliance Officer and Corporate Secretary |

Matthew S. Lanigan | 47 | Vice President and President of Mats & Integrated Services |

Bruce C. Smith | 66 | Chief Technology Marketing Officer |

Phillip T. Vollands | 49 | Vice President and President of Fluids Systems |

Douglas L. White | 49 | Corporate Controller and Chief Accounting Officer |

A description of the business experience of Mr. Howes during the past five years can be found in the “Election of Directors” section of this proxy under the heading “Business Experience and Qualifications of Director Nominees.”

Gregg S. Piontek joined us in April 2007 as our Vice President, Controller and Chief Accounting Officer. He was appointed as our Chief Financial Officer in October 2011 and given the title of Senior Vice President in February 2018. Before joining us, Mr. Piontek served in various financial roles for Stewart & Stevenson Services, Inc. and Stewart & Stevenson, LLC from June 2001 through March 2007, including Divisional Controller, Assistant Corporate Controller, and as Vice President and Chief Accounting Officer. Prior to that, Mr. Piontek served in various financial roles at General Electric, CNH Global N.V. and Deloitte & Touche LLP.

Mark J. Airola joined us in October 2006 as our Vice President, General Counsel and Chief Administrative Officer and was appointed as our Corporate Secretary in December 2006 and Chief Compliance Officer in March 2007. He was named Senior Vice President in February 2011. Mr. Airola has practiced law for 33 years, primarily with large, publicly traded companies. From September 1995 through September 2006, Mr. Airola was employed by BJ Services Company, a provider of pressure pumping and other oilfield services to the petroleum industry, serving initially as Assistant General Counsel and subsequently, in 2003, also being named as Chief Compliance Officer (and as an executive officer). From February 1988 to September 1995, Mr. Airola held the position of Senior Litigation Counsel at Cooper Industries, Inc., a global manufacturer of electrical products and tools, and had initial responsibility for managing environmental regulatory matters and litigation and subsequently managing the company’s commercial litigation.

Bruce C. Smith joined us in April 1998 as our Vice President, International. In July 2017 he was appointed as our Chief Technology Marketing Officer. From October 2000 until July 2017, he served as President of Fluids Systems. He also held the title of Vice President of our Company beginning in 2006 and he was named as Executive Vice President of our Company in March 2011. Prior to joining us, Mr. Smith was the Managing Director of the U.K. operations of M-I Swaco, a competitor of our Fluids Systems segment, where he was responsible for two business units, including their drilling fluids unit.

Matthew S. Lanigan joined us in April 2016 as Vice President and President of Newpark Mats & Integrated Services LLC. From April 2014 to June 2015, Mr Lanigan served as a Managing Director of Custom Fleet Services in Australia for GE Capital Corporation, a financial services unit of General Electric. From September 2010 to March 2014, he served as Commercial Excellence Leader in the Asia Pacific for GE Capital. Previous to September 2010, Mr. Lanigan held various executive positions in marketing and sales for GE Capital Corporation.

Phillip T. Vollands joined us in October 2013 as President, North America Fluids Systems and became President, Western Hemisphere in August 2016. Since July 2017, he has served as Vice President of our Company and President, Fluids Systems. Prior to Newpark, he was Vice President, Tubular Running Services for Weatherford International from July 2010 to September 2013. Previously, from August 1997 to July 2010, he served in a variety of sales and operational roles of increasing responsibility for National Oilwell Varco including VP Power Generation Division and VP Global Strategic Accounts.

Douglas L. White joined us in April 2014 as our Corporate Controller. In May 2014, Mr. White was appointed as our Chief Accounting Officer. From February 2008 until January 2014, Mr. White served as Director of Financial Reporting for Cooper Industries where he was responsible for corporate accounting and external reporting. From July 2004 until February 2008, he served as Vice President and Corporate Controller of MMI Products, Inc. Prior to that, Mr. White held various audit positions with Ernst & Young LLP. Mr. White is a Certified Public Accountant.

OWNERSHIP OF COMMON STOCK

Certain Beneficial Owners |

The following table sets forth information, as of the date indicated in the applicable Schedule 13G with respect to each stockholder identified as beneficially owning greater than 5% of our common stock, the number of outstanding shares of our common stock and the percentage beneficially owned. Except as otherwise indicated below, each person named in the table has sole voting and investment power with respect to all shares of common stock beneficially owned by that person. Percentage ownership is based on 89,316,490 shares of common stock outstanding as of March 26, 2018.

Shares of Common Stock Beneficially Owned | |||

Name and Address of Beneficial Owner | Number | Percent | |

BlackRock, Inc.(1) 55 East 52nd Street New York, New York 10055 | 11,920,557 | 13.3% | |

The Vanguard Group(2) 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 7,991,672 | 8.9% | |

Dimensional Fund Advisors LP(3) 6300 Bee Cave Road, Building One Austin, Texas 78746 | 7,446,784 | 8.3% | |

FMR LLC(4) 245 Summer Street Boston, Massachusetts 02210 | 5,066,276 | 5.7% | |

Daruma Capital Management, LLC(5) 626 King Avenue Bronx, New York 10464 | 4,373,697 | 4.9% | |

(1) | Based solely on Amendment No. 9 to Schedule 13G filed with the SEC on January 19, 2018 by BlackRock, Inc. According to the Schedule 13G/A, BlackRock, Inc. has sole voting power with respect to 11,679,836 shares and sole dispositive power with respect to 11,920,557 shares. According to the Schedule 13G/A, all shares are beneficially owned by BlackRock, Inc., a parent holding company, and on behalf of its wholly owned subsidiaries: (i) BlackRock (Netherlands) B.V.; (ii) BlackRock Advisors, LLC; (iii) BlackRock Asset Management Canada Limited; (iv) BlackRock Asset Management Ireland Limited; (v) BlackRock Asset Management Schweiz AG; (vi) BlackRock Financial Management, Inc.; (vii) BlackRock Fund Advisors; (viii) BlackRock Institutional Trust Company, National Association; (ix) BlackRock Investment Management (Australia) Limited; (x) BlackRock Investment Management (UK) Limited; and (xi) BlackRock Investment Management, LLC. BlackRock Fund Advisors beneficially owns 5% or greater of the outstanding shares reported on the Schedule 13G/A. |

(2) | Based solely on Amendment No. 5 to Schedule 13G filed with the SEC on February 9, 2018 by The Vanguard Group. According to the Schedule 13G/A, The Vanguard Group has sole voting power with respect to 96,424 shares, shared voting power with respect to 20,441 shares, sole dispositive power with respect to 7,884,766 shares, and shared dispositive power with respect to 106,906 shares. According to the Schedule 13G/A, Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc, is the beneficial owner of 86,465 shares or 0.10% of the common stock outstanding of the Company as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 30,400 shares or 0.03% of the Common Stock outstanding of the Company as a result of its serving as investment manager of Australian investment offerings. |

(3) | Based solely on Amendment No. 9 to Schedule 13G filed with the SEC on February 9, 2018, by Dimensional Fund Advisors LP. According to Schedule 13G/A, Dimensional Fund Advisors LP has sole voting power over 7,025,789 shares and sole dispositive power over 7,446,784 shares. According to the Schedule 13G/A, Dimensional Fund Advisors LP is an investment adviser registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (collectively, the “Funds”). In certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds. In its role as investment adviser, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) may possess voting and/or investment power over the securities that are owned by the Funds, and may be deemed to be the beneficial owner of the shares held by the Funds. However, all securities of the Company reported in the Schedule 13G/A are owned by the Funds. Dimensional disclaims beneficial ownership of the securities. |

(4) | Based solely on Amendment No. 2 to Schedule 13G filed with the SEC on February 13, 2018. According to the Schedule 13G/A, FMR LLC has sole voting power with respect to 117,000 shares and sole dispositive power with respect to 5,066,276 shares. According to the Schedule 13G/A, shares are beneficially owned by FIAM LLC and FMR Co., Inc. FMR Co., Inc. beneficially owns 5% or greater of the outstanding shares reported on the Schedule 13G/A. Abigail P. Johnson is a Director, Chairman and Chief Executive Officer of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

(5) | Based solely on Schedule 13G filed with the SEC on February 14, 2018. According to the Schedule 13G, Daruma Capital Management, LLC and Mariko O. Gordon has shared voting power with respect to 1,900,381 shares and shared dispositive power with respect to 4,373,697 shares. According to the Schedule 13G, the 4,373,697 shares beneficially owned by Daruma Capital Management, LLC and Mariko O. Gordon are held in the accounts of private investment vehicles and managed accounts advised by Daruma Capital Management, LLC. |

Ownership of Directors and Executive Officers |

Shares Beneficially Owned | ||||

Name | Number | Percent (1) | ||

Paul L. Howes | 1,704,932 | (2) | 1.9% | |

Mark J. Airola | 718,934 | (3) | * | |

Bruce C. Smith | 677,872 | (4) | * | |

Gregg S. Piontek | 416,065 | (5) | * | |

Matthew S. Lanigan | 50,000 | (6) | * | |

Gary L. Warren | 212,753 | * | ||

G. Stephen Finley | 176,235 | * | ||

David C. Anderson | 170,841 | * | ||

Anthony J. Best | 83,963 | * | ||

Roderick A. Larson | 83,963 | * | ||

John C. Mingé | — | * | ||

Rose M. Robeson | — | * | ||

All current directors and executive officers as a group (14 persons) | 4,430,612 | (7) | 4.8% | |

*Indicates ownership of less than 1%.

(1) | The percentage ownership is based on 89,316,490 shares of common stock outstanding as of March 26, 2018. For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares that such person or group of persons has the right to acquire within 60 days of March 26, 2018 (or May 25, 2018). |

(2) | Includes 1,117,113 shares issuable upon exercise of options. |

(3) | Includes 379,979 shares issuable upon the exercise of options. |

(4) | Includes 408,002 shares issuable upon the exercise of options. |

(5) | Includes 268,102 shares issuable upon the exercise of options. |

(6) | Includes, as of May 25, 2018, 25,000 shares which remain subject to restricted stock awards. |

(7) | Includes (i) 2,234,856 shares issuable upon the exercise of options and (ii) as of May 25, 2018, 25,000 shares which remain subject to restricted stock awards. |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction |

Named Executive Officer | Position Title |

Paul L. Howes | President and Chief Executive Officer |

Gregg S. Piontek | SVP and Chief Financial Officer |

Mark J. Airola | SVP, General Counsel, Chief Administrative Officer and Corporate Secretary |

Matthew S. Lanigan | VP and President of Mats & Integrated Services |

Bruce C. Smith | Chief Technology Marketing Officer |

We have provided an Executive Summary for 2017 followed by a more detailed analysis and specific information concerning compensation. The detailed discussion of our compensation addresses the following areas:

• | Our executive compensation philosophy and how that philosophy is reflected in the key components of our executive compensation program, including an analysis of “realized pay” compared to the compensation reflected in the Summary Compensation Table; |

• | The results of the “Say on Pay” vote from the 2017 Annual Meeting of Stockholders and how the Compensation Committee responded to the vote of (and other feedback from) our stockholders; |

• | How we implement our executive compensation programs and the roles of our Compensation Committee, members of management, and the Compensation Committee’s independent consultants in establishing executive compensation; |

• | The key elements of our executive compensation program and how our compensation was determined for 2017 for our CEO and our other NEOs; and |

• | The employment agreements with our NEOs and other significant policies and matters related to executive compensation. |

EXECUTIVE SUMMARY

Our performance. The markets for our products and services improved in 2017, recovering from the significant contraction that occurred in the oil and gas industry beginning in the fourth quarter of 2014 and continuing until early 2016. The reduction in activity was much more pronounced in North America where activity levels (measured by rig counts) declined on average from 2,241 to 639 during that time frame. Rig counts improved consistently throughout 2017, however, the number of rigs drilling in North America remains approximately 50% of the 2014 average. In spite of the slow recovery in this key market, we achieved a significant improvement in financial performance in 2017. We believe our NEOs were instrumental in achieving those results. Below is a summary of significant accomplishments during 2017:

• | We remained focused on safety. Our Total Recordable Incident Rate (TRIR) for 2017 was 0.50, significantly lower than the industry average. We achieved this result despite increasing headcount by approximately 33% during the year both through hiring and an acquisition. |

• | We provided returns to our stockholders that outperformed many of our peers. On a three-year (2015-2017) annualized total stockholder return basis, we performed in the 84th percentile of our peer group. For 2017, we provided a positive return to stockholders when only two companies in the Oilfield Services Index (OSX) posted positive returns. |

• | We took advantage of our position coming out of the 2015/16 downturn. The steps our management took in 2016 and 2017 (including reducing costs, amending our credit facility and reducing debt) secured our balance sheet, protected the core business and preserved stockholder value. As a result we were well-prepared for the market recovery that began in 2016, which enabled us to accomplish the following in 2017: |

◦ | Ranked #2 in market share for U.S. drilling fluids1, eclipsing two of our much larger integrated competitors; |

◦ | Ranked #3 in market share globally for drilling fluids1; |

◦ | Entering into an agreement with Baker Hughes, a GE Company, to provide drilling fluids and related services as part of an integrated service offering in support of the Greater Enfield project in offshore Western Australia; |

◦ | Being selected by Cairn Oil & Gas to provide drilling and completion fluids, along with associated services, in support of Cairn’s onshore drilling in India; and |

◦ | Expanding our footprint in our Mats & Integrated Services segment with our acquisition of Well Service Group, Inc. and Utility Access Solutions Inc. These acquisitions are expected to allow us to expand the scope of our service offerings in oil and gas markets and also to expand our business as a service provider in the utility transmission and distribution sector. |

Our efforts to improve governance and risk management. We continue to improve compensation governance and help ensure alignment with stockholder interests, as reflected by the following:

What we Do | What we Don’t Do |

Stock Ownership Guidelines - Our Board has substantial stock ownership guidelines for officers and Directors. | No Excise Tax Gross-Ups - Our NEO severance agreements do not include excise tax gross-up benefits. |

Pay for Performance - A significant portion of our NEO compensation is performance-based. | No Re-Pricing - We do not allow re-pricing of stock options without stockholder approval. |

Mandatory Deferral Mechanism - Short-term bonuses have a mandatory deferred payout above a certain level of performance. | No Hedging - Board members and executive officers are prohibited from engaging in hedging transactions that could eliminate or limit the risks and rewards of owning our stock. |

Independent Compensation Consultant - The Compensation Committee benefits from its use of an independent compensation consulting firm, which provides no other services to the Company. | No “single-trigger” change in control cash payments - Receipt of the benefits by our NEOs and employees is conditioned on a change in control of our Company and termination of employment. |

Compensation-related Highlights for 2017. Following are some of the key compensation-related decisions for 2017, all of which are discussed in greater detail in the remainder of this Compensation Discussion and Analysis:

• | We received 97% support from our stockholders in our annual advisory vote on our executive compensation program (“Say on Pay”). We discuss the responses to results from the stockholder vote in the section below entitled “Consideration of Advisory Say on Pay Voting Results.” |

• | The NEO base salaries were restored in 2017 to their 2016 pre-reduction levels. |

• | The Compensation Committee approved bonuses for our NEOs under our annual incentive plan at a level above over-achievement in recognition of our very strong 2017 performance. The bonuses earned by our NEOs for 2017 are consistent with our pay for performance philosophy. |

• | In response to feedback from our stockholders, the Compensation Committee took steps to reduce stockholder dilution by changing a portion of the long-term incentives for our NEO’s from equity awards to performance-based cash awards. In June 2017, our Compensation Committee approved a Long Term Incentive Cash Plan (the “Cash Plan”) to allow a portion of our long-term incentives to be cash-based awards, rather than equity-based awards. The Compensation Committee also established for 2017 that 25% of the total target award for long-term incentives to our NEOs will be granted in the form of time-based cash awards and 25% in the form of performance-based cash awards (the performance metric being set as total stockholder return (“TSR”) relative to a |

1 Source: Kimberlite International Oilfield Research, June 2017

specified peer group over a three-year performance period). For the balance of the long-term incentive awards, our Compensation Committee approved equity awards at each NEO’s target level with 50% of the total value provided in the form of time-based restricted stock units.

The Compensation Committee concluded that this mix of time-based awards and performance-based awards provides an appropriate balance of market competitiveness, long-term performance incentive, and alignment of long-term compensation for the NEOs with the interests of our stockholders.

• | Our NEOs achieved total direct compensation at 93% of target opportunity. Total direct compensation is defined as the sum of base salary, annual incentive, and grant date value of equity incentive compensation. |

Executive Compensation Philosophy and Objectives |

We design the executive compensation program to attract, motivate and retain the executive talent that we need in order to implement our business strategy and to improve our long-term profitability and stockholder value. To this end, our executive compensation program is characterized by the following principal objectives:

• | Competitiveness: providing compensation programs and pay opportunities that are competitive with market practice; |

• | Pay-for-performance: tying a majority of pay opportunities to achievement of short-term and long-term performance criteria; |

• | Stockholder alignment: structuring pay programs to closely align executive rewards with stockholder interests; and |

• | Compensation governance and risk assessment: consistently reviewing (and addressing, as appropriate) potential areas for compensation-related risk and provide for appropriate mechanisms and controls. |

Competitiveness. The Compensation Committee believes that the total compensation of our NEOs should be competitive with the market in which we compete for talent in order to enhance our ability to attract and retain the right caliber of executives. The Compensation Committee considers the oil and gas industry to be the market in which we compete for executive talent and we use a combination of peer group and broader industry data in order to assess the competitiveness of our compensation programs. The Compensation Committee generally targets NEO compensation at the market median, with opportunities to earn above or below the market median in return for performance. However, target levels of individual pay are not based on a strict adherence to the market median but may vary from median levels based on a variety of considerations, including internal equity, individual performance, time in position and availability of comparable market data.

Some of the challenges that we face in recruiting and retaining talented executive and senior managers, when compared with other companies in the oilfield services industry (peers and competitors), include:

• | Our NEOs successfully navigated an extremely challenging downturn in the oil and gas industry which has in turn made our executives targets for companies looking to fill open positions. The competition for talent is not limited to our direct peers or competitors, but spans the entire upstream and midstream oil and gas marketplace and includes companies both smaller and significantly larger than us. Attracting and then retaining high performing individuals is critical to our success, and under the ongoing market conditions, we need to be creative in our approach to salaries, incentive targets and retention tools, which sometimes means compensating our executives at a level in excess of the market median. |

• | Our Company is smaller, both in market capital and revenue, than our larger competitors; and, those competitors have the ability to offer more compensation (base pay, incentives and benefits) than we can offer. We offer competitive compensation but do not have the scale to engage in numerous, competitive bidding exercises with our larger competitors. In addition, although we offer competitive benefits, we do not offer all of the benefits of our larger competitors, nor can we assure our employees that we can sustain those benefits during an extended downturn. For example, in 2009 and again in 2016, we reduced salaries and suspended the employer matching contributions to our 401(k) defined contribution retirement plan. |

• | We are more vulnerable to slow-downs in North American drilling activity levels than our larger competitors. While each of our larger competitors has significant exposure to the North American market, they also have more revenues from international markets and offer a wider scope of products |

and services, some of which are not as dependent on drilling rig activity as our Fluids Systems business or, to a lesser extent, our Mats & Integrated Services business. As part of our strategic plan, we are:

◦ | Expanding our business that originates outside of North America; |

◦ | Extending the fluids product line to include completion and stimulation chemicals, with future plans for additional chemicals; and |

◦ | Diversifying our Mats & Integrated Services business to the electrical transmission and distribution markets and pipeline construction/inspection/repair. |

However, we remain at a disadvantage when compared to many of our competitors and this requires that we be creative in the compensation plans we adopt for our key personnel.

The Compensation Committee continues to monitor the competitiveness of our programs and to make adjustments to individual pay levels as appropriate in order to provide total direct compensation opportunities at our targeted level of the market (i.e., market median).

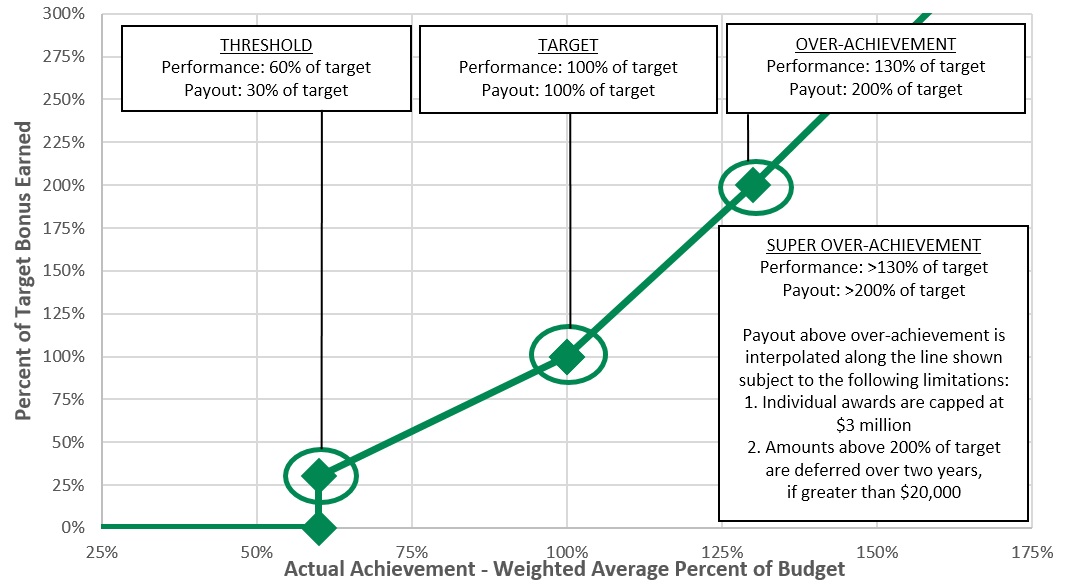

Pay-for-Performance. In establishing targeted compensation levels, the Compensation Committee places a significant portion of each NEOs compensation at risk through the use of variable compensation, the majority of which is performance-based. Variable pay includes performance-based non-equity (cash) incentives for achievement of specified performance objectives on an annual basis, long-term performance-based incentives based on relative stockholder returns, and equity incentive compensation where value depends upon our stock price.

The table below summarizes the principal components of our pay-for-performance approach to our executive officer compensation. A more detailed description of each component of our NEOs’ pay can be found in the “Direct Compensation” section of this proxy under the heading “Elements of Executive Compensation.”

Components of NEO Total Direct Compensation | ||

Component | Category | Pay-for-Performance Component |

Base Salary | Fixed Pay | Annual Merit Review Adjustments, if any, consider each individual’s experience, performance and contributions over time. Provides a competitive salary relative to our peer groups. |

Annual Cash Incentive | Performance-Based (Variable) | Annual Performance Awards are based on achieving corporate and business unit financial goals on an annual basis, and can include individual objectives or discretionary items. |

Long-Term Incentives | Performance-Based (Variable) | Multi-Year Performance Long-term incentive awards with multi-year vesting periods. Realized value contingent upon long-term growth in stockholder value – particularly in the case of equity awards. Performance-based cash awards provide the opportunity to earn from zero to 150% of target at the end of the three-year performance period. |

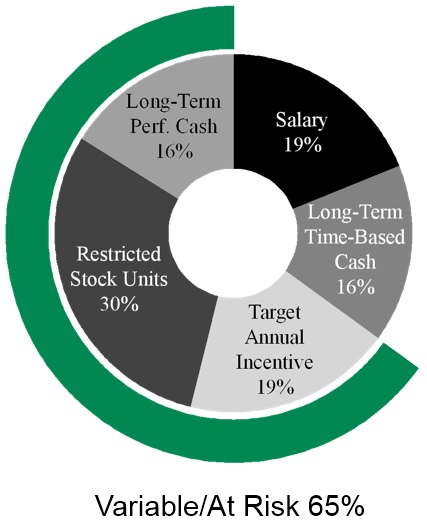

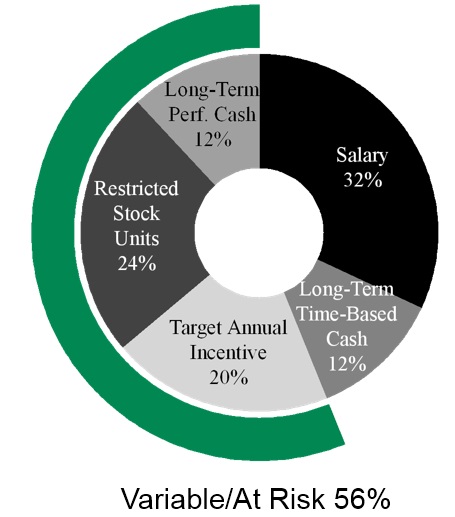

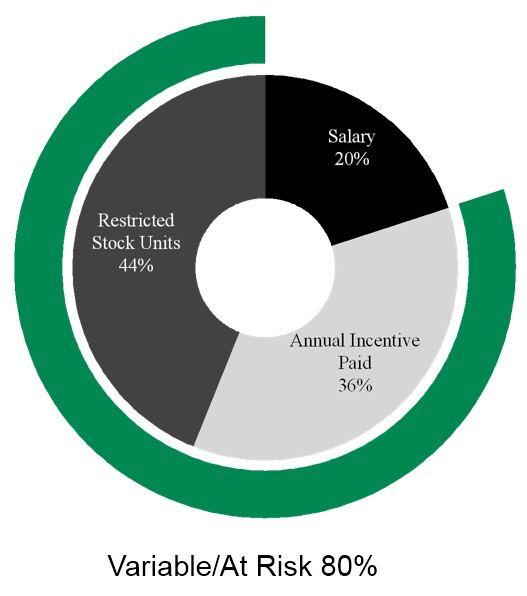

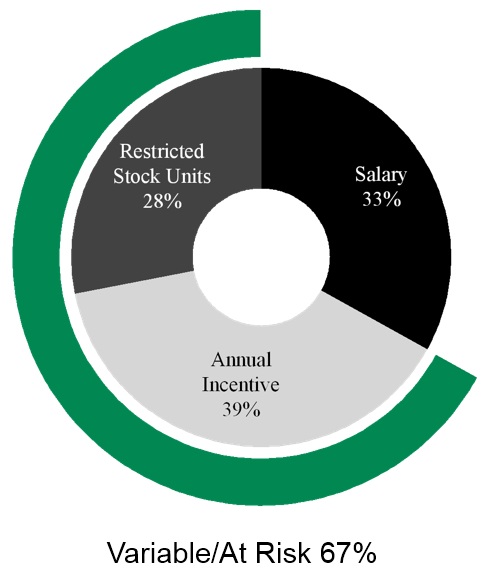

The Compensation Committee typically sets 60% to 90% of the NEOs’ target compensation as contingent, performance-based pay (both short-term and long-term performance). In 2017, the Compensation Committee considered alternatives to the structure of the historical long-term incentive awards in the context of a relatively low stock price resulting from the declines in the oil and gas markets and recognition of the potential dilutive impact on stockholders. The result was a change in the composition of long-term incentives awarded to our NEOs. Granting of both time-based cash awards and performance-based cash awards under the Cash Plan provides for both long-term retention and performance elements in the compensation of our NEOs’ total compensation. Notwithstanding these changes, a significant portion of the NEOs’ compensation is variable and contingent on performance. We require that outstanding individual and corporate performance be achieved for an executive’s compensation to significantly exceed the median compensation levels (based on benchmarks discussed in greater detail below). During 2017, approximately 80% of actual compensation for our CEO and 67% of actual compensation for our other NEOs was delivered in the form of variable pay.

TARGET TOTAL DIRECT COMPENSATION - 2017 | ||

CEO | Other NEOs | |

|  | |

ACTUAL TOTAL DIRECT COMPENSATION - 2017 | ||

CEO | Other NEOs | |

|  | |

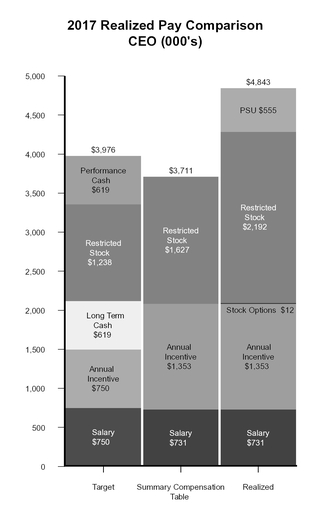

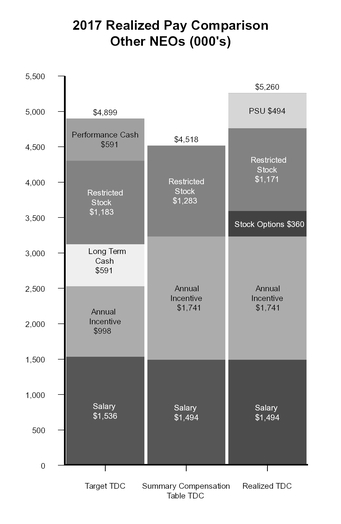

Summary of Realized Pay for 2017. As previously discussed, in order to reduce dilution and preserve shares under our 2015 Employee Equity Incentive Plan (the “2015 Plan”), we introduced time-based cash and performance-based cash awards in 2017. The time-based cash awards vest over three years and provide an element of retention in the NEOs total compensation. The performance-based cash awards replaced our performance-based restricted stock units, but do not provide equivalent potential compensation value to the NEO. We believe it is important to keep in mind that, unlike short-term performance-based cash incentive compensation (which rewards executives for performance relative to pre-determined goals in the previous year), we maintain the view that long-term incentive compensation, whether in the form of equity or cash, is an incentive for future performance. We grant these awards not to recognize past performance, but to align the long-term interests of our executives with those of our stockholders and to provide an incentive which rewards executives over time for helping to drive future growth in stockholder value.

We have summarized below the realized compensation for our NEOs during 2017 in contrast to the compensation numbers presented in the Summary Compensation Table. In the first table below, we have included a description of how the NEOs total direct compensation for 2017 is calculated using data from the Summary Compensation Table, as compared with our realized compensation calculation. The tables below represent supplemental information and are not intended to be a substitute for the information provided in the Summary Compensation Table, which has been prepared in accordance with the SEC’s disclosure rules. Each measure includes 2017 actual cash compensation (2017 salary plus annual incentive earned and paid for 2017 performance), but differs in how we include the long-term incentives:

Measure of Total Direct Compensation | Components Included | ||||

Base Salary | Annual Incentive | Stock Options | Restricted Stock | Performance Units | |

Summary Compensation Table total direct compensation | Actual 2017 Salary | Actual Amount Earned for 2017 Performance(1) | N/A | Grant date value of awards made during 2017 | N/A |

Realized total direct compensation | Same | Same | Value realized from option exercises during 2017 | Value realized from stock vesting during 2017 | Value realized from units vesting during 2017 |

(1) | The portion of the payout attributable to performance at the super over-achievement level is deferred, paid over the subsequent two years, and is not reflected in the Summary Compensation Table. |

As shown in the table above, because of meaningful grants of long-term equity incentives in prior years and the performance of our stock in 2017, the actual aggregate compensation realized by our NEOs was 123% of their total compensation as reflected in the Summary Compensation Table for 2017. These results reflect our variable compensation and pay-for-performance philosophy.

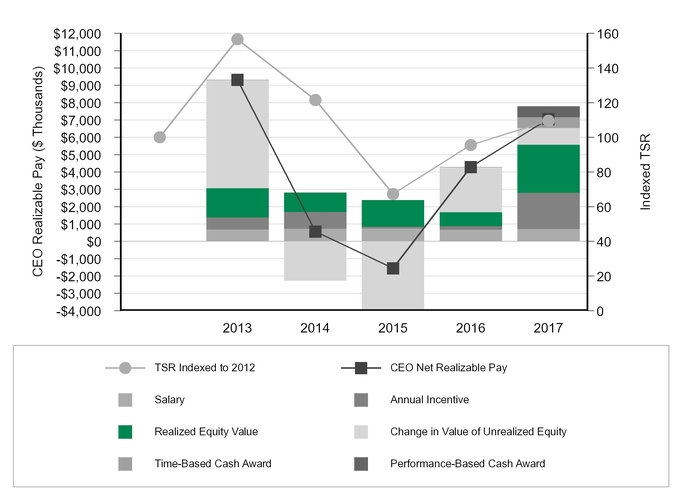

Alignment of Pay and Performance |

• | Annual Cash Compensation: salary and annual cash incentive earned for each fiscal year; |

• | Long-term incentive cash compensation: time-based cash awards granted for each fiscal year and the value of performance-based cash awards at probable payout; and |

• | Net Realizable Equity Value, which is the sum of: |

◦ | Realized equity value (Value realized upon exercise of options + Value realized upon vesting of restricted stock); |

◦ | Change in Value of Unrealized Equity (Change in year-end “in the money” value of exercisable options + Change in year-end value of unvested restricted shares); and |

◦ | Long-term Performance Unit Plan Payout for the performance period ending in 2017. |

Vesting of 2014 Performance Stock Units. As part of the annual long term incentives issued to our NEOs, performance-based restricted stock units were granted in May 2014. The Compensation Committee established the performance criteria based upon TSR compared to the 2014 peer group, with a three-year performance period (June 2014 - May 2017). At the completion of the performance period, our Compensation Committee compared our TSR during the performance period against the designated peer group. Our performance for the three-year period was at the 94th percentile of the peer group. At this level of performance, the NEOs were entitled to a payout of restricted stock at 150% of the target shares awarded.

CEO Realizable Pay: Well Aligned with Annual Performance |

As shown, the changes in CEO realizable pay opportunities by year have been well aligned with the returns experienced by our stockholders, in large part because of the significant portion of CEO pay that is variable.

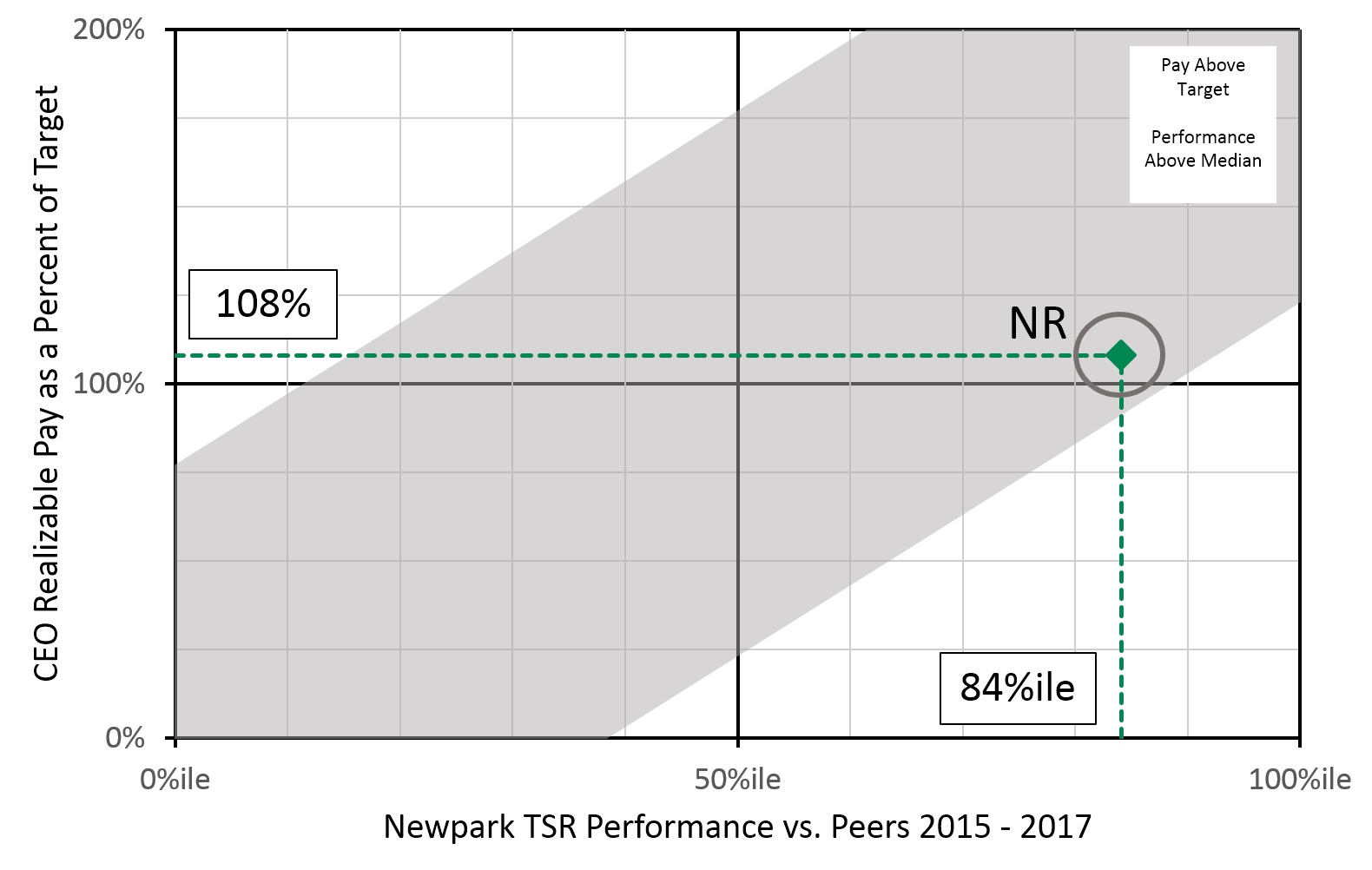

CEO Realizable Pay: Aligned With Performance Against Peers |

Relative Alignment: Realizable Pay as a Percent of Target vs. Performance against Peers. In order to demonstrate the alignment of CEO pay relative to peers, we compared (i) CEO realizable pay as a percent of target total direct compensation for the three-year period from 2015 to 2017 to (ii) our performance relative to our peer group over the same period.

Target Total Direct Compensation (3 year cumulative) | Realizable Total Direct Compensation | |

Base salary | Actual salary paid in each year | Actual salary paid in each year |

Annual Incentive | Target annual incentive opportunity | Actual cash incentive earned for each year |

Stock Options | Grant date value of target annual award | In-the-money value of options granted during period - valued at 12/31/2017 |

Restricted Stock | Grant date value of target annual award | Value of all shares granted during period – at 12/31/2017 |

Performance Units | Grant date value of target annual award | Value of shares granted during period based on a probable payout – at 12/31/2017 |

Time-based Cash | Grant date value of target annual award | Value of the award granted during period - at 12/31/2017 |

Performance-Based Cash | Grant date value of target annual award | Value of the award based on probable payout at 12/31/2017 |

The results of this review for pay opportunities granted to our CEO for the fiscal years 2015-2017 are presented in the chart below.

As shown, CEO realizable pay for the period 2015 – 2017 was reasonably well-aligned with TSR performance relative to our peers. Mr. Howes’ realizable pay as a percentage of target over this period fell within the alignment fairway. Two of the three years in this time frame (2015 and 2016) were particularly challenging for our industry, while 2017 reflected a modest improvement. The Company consistently outperformed its peers during that cycle,

As shown, CEO realizable pay for the period 2015 – 2017 was reasonably well-aligned with TSR performance relative to our peers. Mr. Howes’ realizable pay as a percentage of target over this period fell within the alignment fairway. Two of the three years in this time frame (2015 and 2016) were particularly challenging for our industry, while 2017 reflected a modest improvement. The Company consistently outperformed its peers during that cycle, which we believe is reflective of the performance of our CEO. Our CEO’s realizable pay was slightly above target reflecting our relative performance in spite of the general decline in stock prices for oil and gas related companies.

Stockholder Alignment. We believe that the interests of our stockholders and executives should be aligned by ensuring that a portion of our executives’ compensation is directly determined by:

• | Adjusted EBITDA (or other relevant financial metrics) through annual incentive opportunities; and |

• | Appreciation in our stock price through long-term (equity) incentive awards. |

With realizable value tied to increased stockholder value, long-term (equity) incentives provide our executives with an opportunity to share in the value they create, which is consistent with our pay-for-performance philosophy. As noted in the table above, for 2017 (as in prior years) a very strong degree of alignment exists between realizable pay for our CEO and the stockholder value represented by our performance versus the peer group. During 2017, the Compensation Committee awarded fifty percent (50%) of our NEOs’ long-term compensation as equity incentives in the form of time-based restricted stock units. The remainder of our NEOs’ long-term compensation was awarded in the form of time-based (25%) and performance-based (25%) cash awards. The grant date value of equity incentive awards can vary from year to year based upon considerations such as competitive market data, prior grants made to individuals, share availability and stockholder dilution. Time-based awards, including our long-term cash awards, typically vest over a three-year period.

As discussed above for 2017 the Compensation Committee allocated 25% of the long-term incentive valuation for the NEOs to performance-based cash awards. The achievement criteria for the performance-based cash awards is based on the Company’s TSR over a three-year performance period compared to the results of a specified peer group.

In support of our goal of stockholder alignment, the executive compensation program also includes stock ownership guidelines for executives and Directors. The current guideline levels of ownership are shown below:

Executive & Director Stock Ownership Guidelines | |

Title | Ownership Target |

Chief Executive Officer | 5x salary |

Chief Legal Officer and Chief Financial Officer | 3x salary |

Division Presidents | 3x salary |

Other Designated Officers/Executives | 1x salary |

Non-employee Directors | 5x retainer |

Unvested time-based restricted shares or units are counted toward the satisfaction of these guidelines. However, unexercised stock options and unearned performance-based restricted stock units do not count toward satisfaction of these guidelines. Non-employee directors and executive officers have five years from the date of first election or appointment, as applicable, to reach the required level of stock ownership. In the event of an increase in the annual cash retainer or an increase in the ownership requirement, the executives and non-employee directors have five years from the effective date of the increase to acquire any additional shares needed to meet the stock ownership guidelines. Our officers and Directors were in compliance with these ownership guidelines as of December 31, 2017.

Compensation governance and risk assessment. A risk assessment of the executive compensation program is undertaken as part of the annual procedures for the Compensation Committee. That process includes assessing:

• | Each aspect of the various components of direct compensation (salary, annual cash incentives, and long-term incentives); and |

• | Metrics used for any performance-based plans. |

The risks are assessed for each component and metric, along with consideration being given to alternative compensation approaches. To the extent that risks are identified, the Compensation Committee also considers whether the risks have or can be mitigated through various features of the compensation plans. Further discussion of the risk assessment is contained in the “Executive Compensation” section in this proxy under the heading “Risk Assessment of Compensation Programs.”

Consideration of Advisory Say on Pay Voting Results |

• | Monitors the performance of the Company and its senior executives; |

• | Makes business determinations concerning what performance goals the Compensation Committee believes are appropriate; |

• | Determines what financial incentives are appropriate to incentivize the achievement of these goals; and |

• | Designs and modifies the Company’s executive compensation programs as it deems appropriate and consistent with these determinations. |

In making its determinations, the Compensation Committee is guided by its obligations to the Company’s stockholders and its business judgment concerning what is in the best interest of the stockholders.

In 2017, the Company’s stockholders voted 97% (excluding broker non-votes) in favor of our executive compensation practices as disclosed in the Company’s proxy statement. In advance of the vote at the annual meeting, and otherwise throughout 2017, we have engaged in discussions with and received input from our stockholders regarding executive compensation. Taking into consideration all of the input that we received, and the previous positive results of voting on our executive compensation practices, in 2017 the Compensation Committee introduced cash awards under the Cash Plan to our executive compensation in order to reduce stockholder dilution and preserve available shares under our 2015 Plan. The mix of time-based restricted stock units, time-based cash awards and performance-based cash awards provides the NEOs with variable, incentive compensation which aligns with stockholder interests while also providing a retention component.

The Process of Managing our Executive Compensation Programs |

The Compensation Committee operates under a written charter adopted by the Board of Directors on June 11, 2003, and last revised on November 14, 2017. The Compensation Committee charter is available in the “Board Committees & Charters” section under “Corporate Governance” on our website at www.newpark.com and is also available in print upon request from our Corporate Secretary. In addition to the more specific responsibilities set forth in its charter, the Compensation Committee:

• | Discharges the Board of Directors’ responsibilities with respect to all forms of compensation of our executive officers (although decisions regarding the compensation of the CEO require the participation of all of the independent directors of the Board); |

• | Administers our equity incentive plans; and |

• | Produces an annual compensation committee report for our proxy statement. |

As part of its authority and responsibilities, our Compensation Committee establishes our overall compensation philosophy and reviews and approves compensation for our NEOs. As further explained below, our Compensation Committee approves the specific compensation of our CEO (with the participation of all independent directors of the Board of Directors) and each of our other NEOs. The Compensation Committee reviews the Compensation Committee charter annually to determine if there are any additional compensation or benefits issues it may need to address and to verify that the Compensation Committee has met all its assigned responsibilities for the year. The Compensation Committee also undertakes a “self-evaluation” of its performance on an annual basis. This self-evaluation allows the committee members to assess areas for improvement in the compensation program and processes. The Compensation Committee establishes a calendar annually for specific compensation actions to address throughout the year.

Engagement of an Independent Advisor. The Compensation Committee has the authority to retain special counsel and other experts, including compensation consultants. Since 2012, the Compensation Committee has

retained the services of Pearl Meyer to act solely as the consultant for the Compensation Committee. The Compensation Committee regularly reviews the services provided by its outside consultants and believes that Pearl Meyer is independent and has no conflict of interest in providing executive compensation consulting services. In making this determination, the Compensation Committee noted that during fiscal 2017:

• | Pearl Meyer did not provide any services to the Company or management other than services requested by or with the approval of the Compensation Committee, and its services were limited to executive compensation consulting. Specifically, Pearl Meyer does not provide, directly or indirectly through affiliates, any non-executive compensation services, including pension consulting or human resource outsourcing; |

• | Fees we paid to Pearl Meyer for 2017 were less than 1% of Pearl Meyer’s total revenue for the year; |

• | Pearl Meyer maintains a conflicts policy, which was provided to the Compensation Committee with specific policies and procedures designed to ensure independence; |

• | None of the Pearl Meyer consultants working on Company matters had any business or personal relationship with Committee members; |

• | None of the Pearl Meyer consultants (or any consultants at Pearl Meyer) working on Company matters had any business or personal relationship with any executive officer of the Company; and |

• | None of the Pearl Meyer consultants working on Company matters directly owned Company stock. |

The Compensation Committee continues to monitor the independence of its compensation consultant on a periodic basis.