Form DEF 14A WEB.COM GROUP, INC. For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant | ý |

Filed by a Party other than the Registrant | o |

Check the appropriate box:

o | Preliminary Proxy Statement | |||

o | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |||

ý | Definitive Proxy Statement | |||

o | Definitive Additional Materials | |||

o | Soliciting Material Pursuant to §240.14a-12 | |||

WEB.COM GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

(1) Title of each class of securities to which transaction applies: | ||||

(2) Aggregate number of securities to which transaction applies: | ||||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

(4) Proposed maximum aggregate value of transaction: | ||||

(5) Total fee paid: | ||||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

(1) Amount Previously Paid: | ||||

(2) Form, Schedule or Registration Statement No.: | ||||

(3) Filing Party: | ||||

(4) Date Filed: | ||||

WEB.COM GROUP, INC.

12808 Gran Bay Parkway West

Jacksonville, Florida 32258

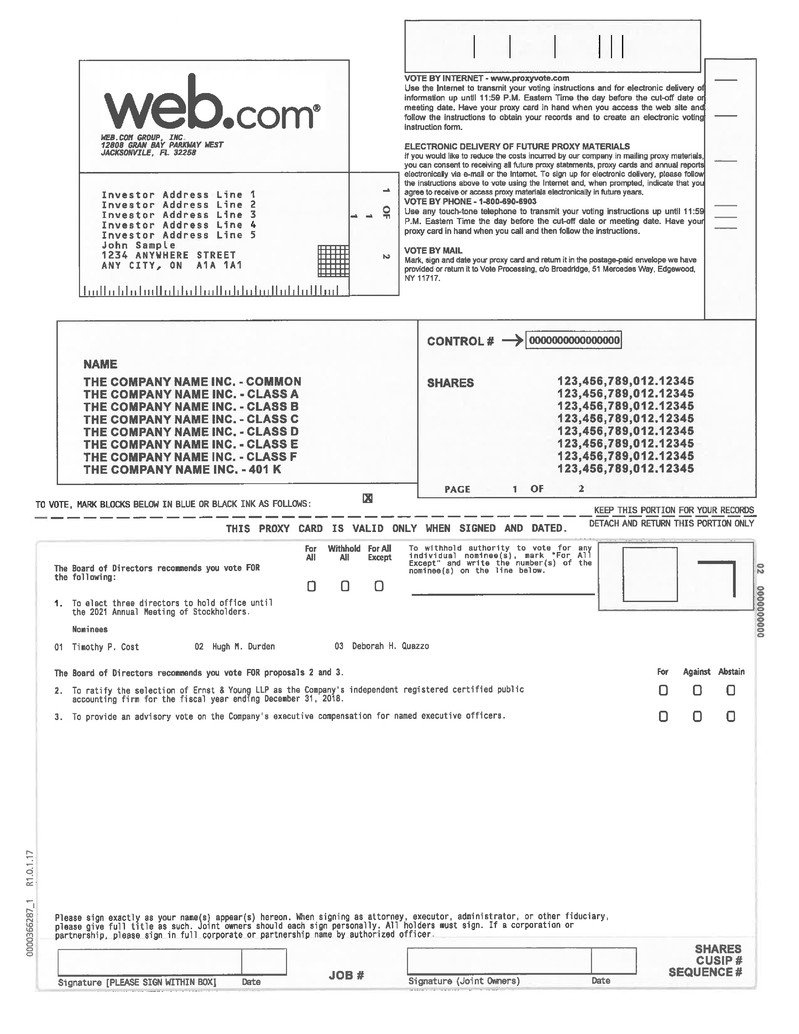

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 9, 2018

Dear Stockholder:

You are cordially invited to attend the 2018 Annual Meeting of Stockholders of WEB.COM GROUP, INC., a Delaware corporation (the “Company”). The meeting will be held on Wednesday, May 9, 2018 at 10:30 a.m. local time, at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

The purpose of the Annual Meeting is to:

1. | Elect three directors to hold office until the 2021 Annual Meeting of Stockholders. |

2. | Ratify the selection of Ernst & Young LLP as the independent registered certified public accounting firm for the fiscal year ending December 31, 2018. |

3. | Provide an advisory vote on the Company's executive compensation for named executive officers. |

Stockholders who owned Web.com Group, Inc. common stock at the close of business on the record date, March 14, 2018, are entitled to vote at the meeting, or any summary postponement or adjournment thereof.

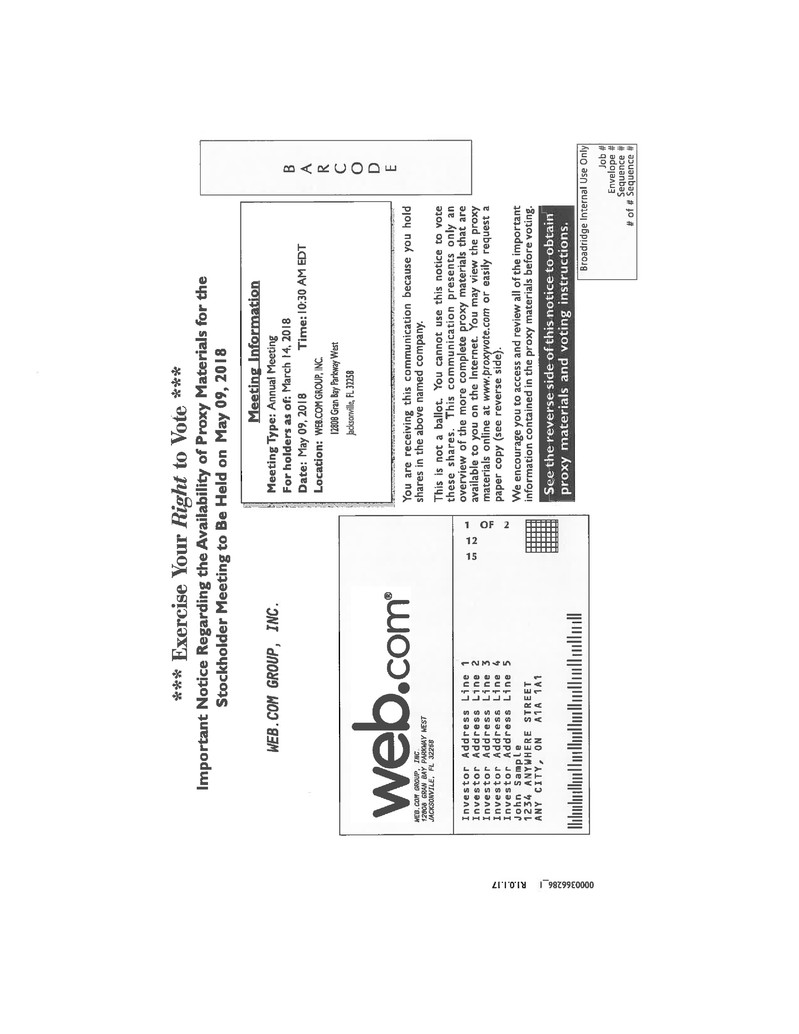

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on May 9, 2018:

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, including consolidated financial statements, are available to you at: www.proxyvote.com.

By Order of the Board of Directors | ||

Web.com Group, Inc. | ||

| ||

Matthew P. McClure | ||

Secretary | ||

Jacksonville, Florida

March 30, 2018

YOUR VOTE IS IMPORTANT

Even if you plan to attend the meeting in person, please date, sign and return your proxy card in the enclosed envelope, or vote via telephone, or the internet, prior to the meeting and as promptly as possible to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

WEB.COM GROUP, INC.

12808 Gran Bay Parkway West

Jacksonville, Florida 32258

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

May 9, 2018

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

Web.com Group, Inc. (sometimes referred to as the “Company” or “Web.com”), on behalf of its Board of Directors (the “Board”), is soliciting your proxy to vote on certain matters at the 2018 Annual Meeting of Stockholders (or any postponement or adjournment thereof). This Proxy Statement summarizes the information you need to review to vote. You are invited to attend this annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares, and instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or Internet.

The Company intends to mail this proxy statement and accompanying proxy card on or about March 30, 2018 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Stockholders who owned Web.com common stock at the close of business on the record date, March 14, 2018, are entitled to vote at the meeting. As of the record date, there were 49,517,966 shares of common stock outstanding and entitled to vote.

Stockholder of Record:

If on March 14, 2018, your shares were registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or Internet as instructed below to ensure your vote is counted.

Beneficial Owner:

If on March 14, 2018 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

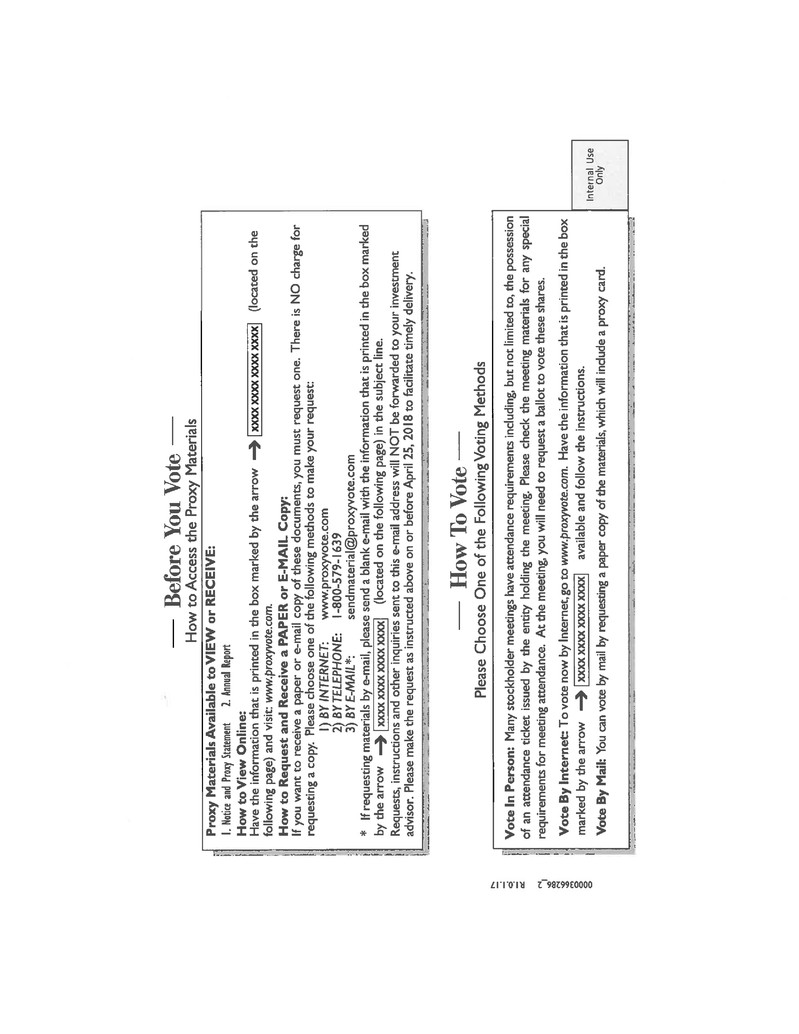

Notice and Access

You will find information regarding the matters to be voted on in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. We are sending our stockholders a notice regarding the availability of this proxy statement, our Annual Report on Form 10-K for year ended December 31, 2017, and other proxy materials via the Internet. This notice instructs you

1

how to access and review the proxy materials and how to submit your vote over the Internet, and you should follow the instructions set forth in the notice.

How do I attend the annual meeting?

The meeting will be held on Wednesday, May 9, 2018, at 10:30 a.m. local time at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. If you plan to attend the annual meeting and need directions, please contact our Investor Relations Department at 904-680-6600. Information on how to vote in person at the annual meeting is discussed below.

What am I voting on?

There are three proposals scheduled for a vote:

1.To elect three directors to hold office until the 2021 Annual Meeting of Stockholders.

2. To ratify the selection of Ernst & Young LLP as the Company's independent registered certified public accounting

firm for the fiscal year ending December 31, 2018.

3. To provide an advisory vote on the Company's executive compensation for named executive officers.

How do I vote?

•You may either vote “For” each nominee to the Board or you may “Withhold” your vote for each nominee.

•You may vote “For”, “Against”, or “Abstain” on the ratification of Ernst & Young as the Company’s independent

registered certified public accounting firm for 2018.

• | You may vote “For”, “Against”, or “Abstain” on the advisory vote on the compensation for named executive officers. |

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

• | If you wish to vote in person, you will receive a ballot when you arrive at the annual meeting. |

• | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

• | To vote over the telephone, dial toll-free 1-800-690-6903 and follow the recorded instructions. You will be asked to provide your holder account number and proxy access number from the enclosed proxy card. Your vote must be received by 11:59 p.m. Eastern time on May 8, 2018 to be counted. |

• | To vote on the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide your holder account number and proxy access number from the enclosed proxy card. Your vote must be received by 11:59 p.m. Eastern time on May 8, 2018 to be counted. |

2

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Web.com. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

You have one vote for each share of common stock you own as of the close of business on March 14, 2018.

What if I return a proxy card but do not make specific choices?

If you return a signed proxy card without marking any voting selections, your proxy will follow the Board’s recommendations and vote your shares as follows:

“For” the nominees for director.

“For” the ratification of Ernst & Young as the Company’s independent registered certified public accounting firm for

2018.

“For” the approval of the executive compensation for named executive officers.

If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his judgment.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, the Company’s directors and employees also may solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. The Company also may reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

3

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your

shares, you may revoke your proxy in any one of three ways:

•You may submit another properly completed proxy card with a later date.

•You may send a written notice that you are revoking your proxy to the Company’s secretary at 12808 Gran Bay

Parkway West, Jacksonville, Florida 32258.

•You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke

your proxy.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by February 8, 2019, to the Secretary of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. All proposals must comply with Rule 14a-8 under the Securities and Exchange Act of 1934, as amended.

A stockholder nomination for director or a proposal that will not be included in next year’s proxy materials, but that a stockholder intends to present in person at next year’s annual meeting, must comply with the notice, information and consent provisions contained in the Company’s Bylaws. In part, the Bylaws provide that to timely submit a proposal or nominate a director you must do so by submitting the proposal or nomination in writing, to the Company’s Secretary at the Company’s principal executive offices no later than the close of business on February 8, 2019, (90 days prior to the first anniversary of the 2018 Annual Meeting Date) nor earlier than the close of business on January 9 2019 (120 days prior to the first anniversary of the 2018 Annual Meeting Date). In the event that the Company sets an annual meeting date for 2019 that is not within 30 days before or after the anniversary of the 2018 Annual Meeting date, notice by the stockholder must be received no earlier than the close of business on the 120th day prior to the 2019 Annual Meeting and not later than the close of business on the later of the 90th day prior to the 2019 Annual Meeting or the 10th day following the day on which public announcement of the date of the 2019 Annual Meeting is first made. The Company’s Bylaws contain additional requirements to properly submit a proposal or nominate a director. If you plan to submit a proposal or nominate a director, please review the Company’s Bylaws carefully. You may obtain a copy of the Company’s Bylaws by mailing a request in writing to the Secretary of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count, for the proposal to elect directors, “For” and “Withhold”; and, with respect to all other proposals, “For”, and “Against” votes, abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for each proposal and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker

4

non-votes. Generally, “non-discretionary” matters include director elections and other matters like those involving a contest or a matter that may substantially affect the rights or privileges of stockholders, such as mergers or stockholder proposals.

How many votes are needed to approve each proposal?

•For the election of directors, the three nominees receiving the most “For” votes from the holders of shares present

in person or presented by proxy will be elected. Only votes “For” affect the outcome of this proposal.

•For the vote on the approval of Ernst & Young as the Company’s auditors for 2018, the proposal must receive a vote

“For” vote from the majority of shares present in person or represented by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes have no effect and will

not be counted towards the vote total.

For the advisory vote regarding executive compensation for the named executive officers to be approved, the proposal

needs to receive “For” votes from the holders of a majority of the shares present in person or represented by proxy.

If you “Abstain” from voting, the abstention will have the same effect as an “Against” vote. Broker non-votes will

have no effect. This vote is advisory in nature and is not binding on the Company.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if a majority of the shares outstanding on the record date are represented by stockholders present at the meeting or by proxy. On March 14, 2018, the record date, there were 49,517,966 shares outstanding and entitled to vote. Thus, 24,758,984 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a Form 8-K to be filed on or before May 15, 2018.

How can I access the Proxy Statement and Annual Report?

You can view the 2018 Proxy Statement and the 2017 Annual Report at http://ir.web.com/annuals.cfm or request a copy by mail, without charge, upon written request to: Secretary, Web.com Group, Inc., 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please either notify your broker or direct your written request to the Secretary, Web.com Group, Inc., 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. You may also make

5

these requests by calling the Secretary at (904) 680-6600. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017, IS AVAILABLE WITHOUT CHARGE AT http://ir.web.com/ OR BY MAIL UPON WRITTEN REQUEST TO: SECRETARY, WEB.COM GROUP, INC., 12808 GRAN BAY PARKWAY WEST, JACKSONVILLE, FLORIDA 32258.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Web.com’s Board is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class shall serve for the remainder of the full term of that class, and until the director’s successor is elected and qualified or until the director’s death, resignation or removal. This includes vacancies created by an increase in the number of directors.

As of December 31, 2017, the Board had eight members. There are three directors in the class whose term of office expires in 2018. Mr. Hugh M. Durden, Mr. Timothy Cost and Ms. Deborah H. Quazzo were last elected to the Board by the Company’s stockholders at its Annual Meeting of Stockholders on May 7, 2015. If elected at this annual meeting, the three directors will serve until the 2021 annual meeting of stockholders, or until that time and until their successors are elected and have qualified, or until such director’s death, resignation or removal.

It is the Company’s policy to encourage directors and nominees for director to attend the annual meeting, and all directors participated in the Company’s 2017 annual meeting.

Set forth below are brief biographies of Messrs. Cost and Durden and Ms. Quazzo, the nominees for election at the annual meeting, and of each additional director whose term will continue after the 2018 annual meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2021 ANNUAL MEETING

Timothy P. Cost, age 58, has served as a member of the Board since December 5, 2014, and he is also a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Cost is currently the President of Jacksonville University and has held that position since February 1, 2013. He was Executive Vice President of PepsiCo, a food and beverage company, from 2010 to 2012. He has 32 years of senior executive experience at many of the world’s top companies, including Bristol-Myers Squibb, Kodak, ARAMARK, Wyeth/Pfizer, Centocor/Johnson & Johnson, and Pharmacia. Mr. Cost holds an undergraduate degree from Jacksonville University and an MBA in Finance and Economics from the William E. Simon School of Business at the University of Rochester.

Based on his specific experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee determined that Mr. Cost is well qualified to serve as a director of the Company; specifically, when evaluating Mr. Cost’s qualifications, the Board and the Nominating and Corporate Governance Committee considered his 30 years plus of experience on mergers and acquisitions, strategy, marketing and communications, crisis/issues management, and capital markets and concluded that this experience and expertise will provide a valuable perspective to the Company. In addition, his current status as an “independent director” under the NASDAQ rules played an important role in such determination.

Hugh M. Durden, age 74, has served as a member of the Company’s Board of Directors since January 2006, and he is also Chairman of the Compensation Committee and a member of the Audit Committee. Since 2005, Mr. Durden has been the Chairman of the Board of Trustees of the Alfred I. DuPont Testamentary Trust, and a director of the Nemours Foundation from 1997 until 2015. Mr. Durden was a director of the St. Joe Company, a NYSE listed real estate development company, from 2000 until 2012, and Chairman of the St. Joe Board of Directors from 2009 until 2012. From January 1994 until December 2000, Mr. Durden served as President of Wachovia Corporate Services, and Executive Vice President of Wachovia Corporation, a banking corporation. Mr. Durden holds a B.A. degree from Princeton University and an MBA from the Freeman School of Business at Tulane University.

Based on his specific experience, qualifications, attributes and skills, it is the belief of the Board and the Nominating and Corporate Governance Committee that Mr. Durden is well qualified to serve as a director of the Company. Specifically, when evaluating Mr. Durden’s qualifications, the Board and the Nominating and Corporate Governance Committee considered his over

7

30 years of experience in corporate finance and his MBA in finance, and considered his skills and experience as very important attributes in providing valued advice and helping to guide the Company with its financial strategy. In addition, his current status as an “independent director” under the NASDAQ rules plays an important role in such evaluation.

Deborah H. Quazzo, age 57, has served as a member of the Board since January 6, 2011, and she is also a member of the Audit Committee and the Nominating and Corporate Governance Committee. Ms. Quazzo has been the Managing Partner of GSV Acceleration, LLC, a venture capital fund investing in education and talent technology companies, since June 2016. Ms. Quazzo is also the Managing Partner of GSV Advisors, LLC, a merchant bank providing advisory and investment services to the education and business services sectors, and has held that position since April 2009. She was co-founder and President of ThinkEquity Partners, an investment bank from 2001 until 2007, when it was acquired by London-based Panmure Gordon, and served on the Board of Directors of Panmure Gordon from March 2007 to October 2008. Prior to 2001, she was Managing Director of the Investment Banking Division of Merrill Lynch & Co., and previously held positions with JP Morgan. She is also an active Board member for Degreed, The Educational Testing Service (ETS), Lightneer, Remind, and Ascend Learning (a portfolio company of Blackstone and CCCP). She holds a B.A. from Princeton University and a M.B.A. from Harvard Business School.

Based on her specific experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee believe that Ms. Quazzo is well qualified to serve as a director of the Company. Specifically, when evaluating Ms. Quazzo’s qualifications, the Board and the Nominating and Corporate Governance Committee considered her financial and entrepreneurial experience and considered her skills and experience in creating and growing businesses as a valuable asset to the Company. In addition, her current status as an “independent director” under the NASDAQ rules played an important role in such evaluation.

THE BOARD OF DIRECTORS RECOMMMENDS A VOTE IN FAVOR OF EACH NAMED NOMINEE

8

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2019 ANNUAL MEETING

Philip J. Facchina, age 56, has served as a member of the Board since November 2010. He is Chairman of the Nominating and Corporate Governance Committee and he is a member of the Audit Committee and Compensation Committee. Mr. Facchina is a Partner of SurgCenter Development, is Advisor to the CEO of Johanna Foods, Inc., where he chairs the Audit Committee, is a Member of the Board of Vion Corporation, Senior Advisor to the Professional Fighters League, and he is also a member of the Board of CargoSense, Inc. From April 2008 to December 2017, Mr. Facchina served as a Partner, Co-Portfolio Manager and the Chief Operating Officer of Ramsey Asset Management, LLC, an investment management firm. From August 1998 to March 2008, he served as Senior Managing Director and Group Head of Technology, Media and Telecom and Healthcare Investment Banking Groups as well as Head of Financial Sponsors at Friedman, Billings, Ramsey and FBR Capital Markets, an investment banking firm. Mr. Facchina holds an MBA degree from the Wharton School of Business at the University of Pennsylvania and a B.S. degree in Accounting from the University of Maryland.

Based on his specific experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee believe that Mr. Facchina is well qualified to serve as a director of the Company. Specifically, when evaluating Mr. Facchina's qualifications, the Board and the Nominating and Corporate Governance Committee determined that his over 30 years of business experience in investment banking, investment management and as a senior corporate executive, the Board and the Nominating and Corporate Governance Committee determined that this experience combined with his acumen and skills are valuable assets helping guide the Company with its financial strategy. In addition, his current status as an “independent director” under the NASDAQ rules played an important role in such determination. Mr. Facchina also qualifies as an “audit committee financial expert” under SEC guidelines.

John Giuliani, age 56, has served as a member of the Board since February 6, 2015, and he is also a member of the Compensation Committee. Mr. Giuliani is currently Chief Executive Officer of Conversant, a subsidiary of Alliance Data Systems, Inc., a NYSE-listed provider of marketing, loyalty, and credit solutions company since December 2012. He was Chief Operating Officer of ValueClick (now Conversant), from May 2012 to December 2012. From December 2005 to August 2011, he was Chairman and Chief Executive Officer of Dotomi, Inc., an internet Media and Advertising Company until its sale to ValueClick in August 2011. Mr. Giuliani has served on the boards of Q Interactive, Claria, and Bluestem Brands. He holds an MBA degree from Kellogg School of Management.

Based on his specific experience, qualifications, attributes and skills, the Board and the Nominating Corporate Governance Committee believe that Mr. Giuliani is qualified to serve as a director of the Company. Specifically, when evaluating Mr. Giuliani's qualifications, the Board and the Nominating and Corporate Governance Committee determined that his experience as having served in internet advertising companies, his 20+ years in the market servicing/advertising sectors, and in his previous role of director/advisor for early stage companies, bring technology and marketing knowledge to the Company that will help guide it in its business arena. In addition, his current status as an “independent director” under the NASDAQ rules played an important role in such determination.

Robert S. McCoy, Jr., age 79, has served as a member of the Board since March 2006, and a member of the Audit Committee, and a member of the Nominating and Corporate Governance Committee. From November 2003 until its sale in 2016, Mr. McCoy served as a Director of Krispy Kreme Doughnuts, Inc., a NYSE-listed food company. Mr. McCoy was a Director of MedCath Corporation from October 2003 until its dissolution in September 2012. Mr. McCoy retired in September 2003 as Vice Chairman and Chief Financial Officer of Wachovia Corporation, a diversified financial services company, after spending two years co-managing the integration of Wachovia and First Union Corporation subsequent to their 2001 merger, where he had served as a senior executive officer since 1991. He was also the President and Chief Financial Officer of South Carolina National Corporation from 1984 to 1991. Mr. McCoy holds a BBA from Western Michigan University with an Accounting Major. He was also a certified public accountant, and was a partner in the firm of PricewaterhouseCoopers from 1974 through 1984.

Based on his specific experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee believe that Mr. McCoy is well qualified to serve as a director of the Company. Specifically, when

9

evaluating Mr. McCoy’s qualifications, the Board and the Nominating and Corporate Governance Committee considered his experience as a member of the Boards of Krispy Kreme Doughnuts, Inc. and MedCath Corporation; his risk-management and financial experience as Chief Financial Officer of Wachovia Corporation and his accounting experience as a partner at PricewaterhouseCoopers, the Board and the Nominating and Corporate Governance Committee determined that his experience during a 42-year career, and his roles involving integration, finance, and preparation of financial statements are invaluable assets that are useful to the Company in dealing with the Board’s oversight responsibilities of the Company’s public company reporting requirements, particularly in the financial arena. In addition, his current status as an “independent director” under the NASDAQ rules played an important role in such determination. Mr. McCoy also qualifies as an “audit committee financial expert” under SEC guidelines.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2020 ANNUAL MEETING

David L. Brown, age 64, has served as the Company’s Chief Executive Officer since August 2000, Chairman of the Board since October 2000, and a member of the Board since August 1999. Mr. Brown is also President and has served in this position since October 2009, and previously from August 1999 until March 2000, and from August 2000 until September 2007. Mr. Brown was a managing partner of Atlantic Partners Group, a private equity firm, from March 2000 until August 2000. Prior to joining us, Mr. Brown founded Atlantic Teleservices, a technology services company in 1997, and served as its Chief Executive Officer from 1997 until its acquisition by the Company in August 1999. Mr. Brown holds a B.A. from Harvard University.

Based on his specific experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee have determined that Mr. Brown is well qualified to serve as a director of the Company. Specifically, after evaluating Mr. Brown’s qualifications, the Board and the Nominating and Corporate Governance Committee believes Mr. Brown’s extensive experience with the Company which is a consequence of his long tenure as Chief Executive Officer and Chairman of the Board, brings necessary historic knowledge, technological expertise and continuity to the Board. The Board and Nominating and Corporate Governance Committee also believes that, as a result of his long tenure with the Company in his executive position, in particular his experience in guiding the Company through numerous and often transformational acquisitions during his tenure as Chief Executive Officer, Mr. Brown brings to the Board substantial leadership skills, financial and acquisition expertise.

Timothy I. Maudlin, age 67, has served as a member of the Company’s Board of Directors since February 2002 and was appointed Lead Director in January 2007. He is Chairman of the Audit Committee, and a member of the Compensation Committee. Since December 2015, he has been a member of the Board and Chair of the Audit Committee of Alteryx, Inc. (AYX), a NYSE-listed service data analytics company. From May 2008 until its sale in July 2013, Mr. Maudlin was the Chair of the Audit committee, the Lead Director since May 2010, and the Chair of the Nominating and Governance committee since March 2012 of Exact Target, Inc., which was a NYSE-listed cross-channel, interactive marketing company. Mr. Maudlin was a Director and Chair of the Audit Committee of MediaMind Technologies, Inc., which was a NASDAQ listed advertising management solutions company from August 2008 until its sale in 2011. Mr. Maudlin was a member of the Board, Lead Director, Chair of the Audit Committee and the Compensation Committee of Monetate, Inc., a privately-held multi-channel personalization company through July 2017; a member of the Board, Chair of the Audit Committee and a member of the Compensation Committee of eVestment Alliance, a privately-held intelligence company serving the institutional investing community through October 2017. Mr. Maudlin is also a member of the Board, Chair of the Audit Committee and a member of the Compensation Committee of Drillinginfo, a privately-held intelligence company serving the oil and gas industry; a member of the Board and Chair of the Audit Committee of PluralSight, LLC, a privately-held professional technology learning company; a member of the Board, Lead Independent Director and Chair of the Audit Committee of Frontline Education, LLC, a privately-held company serving the education community through September 2017. Mr. Maudlin is also a member of the Board and Chair of the Audit Committee of Ministry Brands, LLC, a software company serving faith-based organizations. He is a certified public accountant and holds a B.A. from St. Olaf College and a M.M. from Kellogg School of Management at Northwestern University with Majors in Accounting, Finance and Management.

10

Based on his specific experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee have determined that Mr. Maudlin is well qualified to serve as a director of the Company. Specifically, when evaluating Mr. Maudlin’s combination of extensive financial experience, qualifications, attributes and skills, the Board and the Nominating and Corporate Governance Committee considered his experience as a board member over the last 15 years of a number of public and private companies and his 20 plus years as the managing partner of a venture capital firm as qualifications that play a significant role in the Board’s oversight and in guiding the Company on its business strategy, public company reporting requirements, and financial responsibilities. In addition, his current status as an “independent director” under the NASDAQ rules played an important role in such determination. Mr. Maudlin also qualifies as an “audit committee financial expert” under SEC guidelines.

INDEPENDENCE OF THE BOARD OF DIRECTORS

As required under NASDAQ listing standards, a majority of the members of a listed company’s Board must qualify as “independent,” as affirmatively determined by the Board. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of NASDAQ, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board affirmatively has determined that the following directors are independent directors within the meaning of the applicable NASDAQ listing standards: Messrs. Cost, Durden, Facchina, Giuliani, Maudlin and McCoy, and Ms. Quazzo. In making this determination, the Board found that none of the independent directors or nominees for director has a material or other disqualifying relationship with the Company. Mr. Brown, the Chief Executive Officer and President of the Company, is not an independent director.

MEETINGS OF THE BOARD OF DIRECTORS

The Board met seven times during the last fiscal year. Each incumbent Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which each director served, held during the period for which each person was a director or committee member, respectively.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Board maintains governance practices followed by the Company as documented in the Corporate Governance Principles to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and to make decisions that are independent of the Company’s management. The principles are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Principles set forth the practices the Board will follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer’s performance, evaluation and succession planning, and board committees and compensation. The Corporate Governance Principles, as well as the charters for each committee of the Board, are periodically reviewed by the Board, and may be viewed at ir.web.com.corporate-governance.cfm.

As required under applicable NASDAQ listing standards, during the fiscal year ended December 31, 2017, the Company’s independent directors met five times in regularly scheduled executive sessions at which only independent directors were present. Mr. Maudlin, Lead Director and chair of the Audit Committee, presided over the executive sessions. Persons interested in communicating with the independent directors with their concerns or issues may address correspondence to a particular director or to the independent directors generally, in care of Web.com Group, Inc., at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. If no particular director is named, letters will be forwarded, depending on the subject matter, to the respective chair of the Audit, Compensation, or Nominating and Corporate Governance Committees.

11

Mr. Brown serves as Chair of the Board, Chief Executive Officer and President. The Board believes that having a combined Chief Executive Officer and Chair of the Board role, helps to ensure that the Board and management act with a common purpose and if these offices were separated, it could have the potential to give rise to a divided leadership, which could interfere with good decision-making and weaken the Company’s ability to develop and implement strategy. Instead, the Board believes that combining these two positions provides a single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, the Board believes that this combination serves to act as a bridge between management and the Board, facilitating the regular flow of information, and knowledge of the Company.

The Board appointed Mr. Maudlin as Lead Director to help reinforce the independence of the Board as a whole. Mr. Maudlin’s responsibilities as Lead Director include: presiding at all executive sessions of the Board and giving the Chair and CEO feedback on matters discussed; reviewing and providing input with respect to possible agenda items to be presented at the meeting; serving as principal liaison between the Chair and the other independent directors of the Board; providing feedback to the Chair and acting as a sounding board with respect to strategies, accountability, relationships and other issues; overseeing that the Board discharges its responsibilities, and ensuring that the Board evaluates the performance of management objectively. Mr. Maudlin, in his position as Lead Director, plays a significant role not only in the Board’s leadership but in maintaining the independence of the Board.

The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s credit, liquidity and operations, as well as the risks associated with each.

One of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, the Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The Audit Committee oversees management of financial risks, as well as oversight of the enterprise risk management of the Company. The Compensation Committee oversees whether any of our compensation plans and programs has the potential to encourage excessive risk-taking. The Nominating and Corporate Governance Committee monitors the effectiveness of the Company’s Corporate Governance Principles, including whether they are successful in preventing illegal or improper liability - creating conduct. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about the risks overseen by these committees.

The following table provides the current membership and the meeting information for the fiscal year ended December 31, 2017 for each of the Board committees:

Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||

Timothy P. Cost | x | x | |||||

Hugh M. Durden | x | x* | |||||

Philip J. Facchina | x | x | x* | ||||

John Giuliani | x | ||||||

Timothy I. Maudlin | x* | x | |||||

Robert S. McCoy, Jr. | x | x | |||||

Deborah H. Quazzo | x | x | |||||

Total meetings during 2017: | 6 | 4 | 1 | ||||

* Committee Chair.

12

The Board has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company. Below is a description of each committee of the Board.

AUDIT COMMITTEE

The Audit Committee of the Board oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent registered public accounting firm; determines and approves the engagement of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on the Company’s audit engagement team as required by law; confers with management and the independent registered public accounting firm regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review the Company’s annual audited financial statements and quarterly financial statements with management and the independent auditor, including reviewing the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operation” set forth in the Company’s quarterly reports on Form 10-Q and annual report on Form 10-K. During 2017 the Audit Committee met four times in executive session with the Company’s independent auditor.

The Audit Committee reviews with management and the Company’s auditors, as appropriate, the Company’s guidelines and policies with respect to risk assessment, risk management, and financial risk exposure, and the steps that management takes to monitor and control these exposures. The Audit Committee Charter gives specific authority to the Audit Committee for this assessment of risk, and for oversight of the enterprise risk management of the Company.

The Audit Committee charter can be found on the Company’s website at http://ir.web.com/corporate-governance.cfm. The Board annually reviews the NASDAQ listing standards definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent (as required by Rule 5605 of the NASDAQ Listing Rules). The Board has determined that Mr. Facchina, Mr. Maudlin and Mr. McCoy qualify as “audit committee financial experts,” under applicable SEC rules.

13

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following report of the Audit Committee shall not constitute “soliciting material,” shall not be deemed “filed” with the SEC and is not to be incorporated by reference into any of the Company’s other filings under the Securities Act or the Exchange Act, except to the extent the Company specifically incorporates this report by reference therein.

Primary Responsibilities and 2017 Actions

The Audit Committee represents and assists the Board in fulfilling its oversight responsibility relating to the integrity of the Company’s financial statements and the financial reporting process, the systems of internal accounting and financial controls, and the annual independent audit of the Company’s financial statements. The Audit Committee oversees the quality and integrity of our financial reporting processes and the Company’s systems of internal accounting controls and reviews with management and the external auditors, as appropriate, the guidelines and policies with respect to risk assessment, risk management, and financial risk exposures, and the steps that management takes to monitor and control these exposures. Management is responsible for preparing the financial statements and for establishing and maintaining adequate internal controls over financial reporting, and establishing and implementing guidelines and policies with respect to risk assessment, risk management and financial risk exposures. The external auditors are responsible for performing an independent audit of those financial statements and an independent audit of the effectiveness of the Company’s internal controls over financial reporting.

In 2017, the Audit Committee held six meetings. Meeting agendas are established by the Audit Committee’s Chair. During 2017, among other things, the Audit Committee:

• | Met with the senior members of the Company’s financial management team at each regularly scheduled meeting. |

• | Held separate private sessions, during its regularly scheduled meetings, with each of the Company’s Chief Legal Officer, internal audit, and Ernst & Young LLP, the Company’s independent auditors, at which candid discussions regarding financial management, legal, accounting, auditing and internal control issues took place. |

• | Continued its long-standing practice of having independent legal counsel, who regularly attends committee meetings. |

• | Received periodic updates on management’s process to assess the adequacy of the Company’s system of internal control over financial reporting, the framework used to make the assessment, and management’s conclusions on the effectiveness of the Company’s internal controls over financial reporting. |

• | Discussed with the independent auditors the Company’s internal control assessment process, management’s assessment with respect thereto and the independent auditors’ evaluation of the Company’s system of internal control over financial reporting. |

• | Reviewed and discussed with management and the independent auditors the Company’s earnings releases and quarterly and annual reports on Form 10-Q and Form 10-K, prior to filing with the SEC. |

• | Reviewed with senior members of the Company’s financial management team, internal auditors, and the independent auditors, the overall audit scope and plans, the results of internal and external audit examinations, evaluations by management and the independent auditors of the Company’s internal controls over financial reporting and the quality of the Company’s financial reporting. |

• | Reviewed with management, the internal auditors, and the independent auditors, significant risks and exposures identified by management, the overall adequacy and effectiveness of the Company’s legal, regulatory and ethical compliance programs. |

In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the responsibility for establishing and maintaining adequate internal controls over financial reporting and for preparing the financial

14

statements and other reports, and of the independent auditors, who are engaged to audit and report on the consolidated financial statements of the Company and subsidiaries and the effectiveness of the Company’s internal control over financial reporting.

Committee Member Independence and Financial Expert

From January 1, 2017 to December 31, 2017, the Audit Committee was comprised of Messrs. Maudlin (Chair), Durden, McCoy, and Facchina and Ms. Quazzo, all of whom satisfied the independence criteria of the NASDAQ listing standards for serving on an audit committee. SEC regulations require the Company to disclose whether its Board has determined that a director qualifying as a “financial expert” serves on the Company’s Audit Committee. Beginning in 2005 and continuing annually, the Board made a qualitative assessment of Mr. Maudlin’s level of knowledge and experience based on a number of factors, including, but not limited to, his formal education and previous experience as an audit manager with Arthur Andersen and as a chief financial officer, his understanding of internal controls and procedures for financial reporting, and an understanding of audit committee functions and responsibilities, and the Board has determined that Mr. Maudlin qualifies as a “financial expert” within the meaning of such regulations.

Beginning in 2015 and continuing annually, the Board made a qualitative assessment of Mr. McCoy’s experience and knowledge based on, including but not limited to, his previous positions as Vice Chairman and Chief Financial Officer of Wachovia Corporation and South Carolina Bank, serving as chair of the Audit Committee of two companies, having been a certified public accountant, and having been a partner with PricewaterhouseCoopers, his understanding of internal controls and financial reporting, and made a determination that Mr. McCoy qualifies as a “financial expert” within the SEC regulations.

In March 2016, the Board made a qualitative assessment of Mr. Facchina's experience and knowledge based on, including but not limited to, his over 30 years of business experience in investment banking, investment management and as a senior corporate executive as well as his formal education and previous experience as an audit manager with Arthur Young and Company and made a determination that Mr. Facchina qualifies as a "financial expert" within the SEC regulations.

Recommendation Regarding 2017 Audited Financial Statements

The Audit Committee has reviewed and discussed the Company’s audited financial statements for the calendar year ended December 31, 2017, with management. In addition, the Audit Committee has met and has discussed with management and with Ernst & Young LLP, the Company’s independent registered public accounting firm for 2017, with respect to matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has discussed with Ernst & Young, LLP, without management present, the results of their examinations, the overall quality of the company’s financial reporting as well as the results of their review of the Company’s internal controls over financial reporting. The Audit Committee also has received written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence, and has discussed the firm’s independence.

Based on the reviews and discussions referred to above, and the reports of Ernst & Young LLP, the Audit Committee has recommended to the Board, and the Board has approved, that the Company’s audited financial statements for the fiscal year ended December 31, 2017, be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2017, for filing with the SEC.

AUDIT COMMITTEE | |

Timothy I. Maudlin, Chair | |

Hugh M. Durden | |

Philip J. Facchina | |

Robert S. McCoy, Jr. | |

Deborah H. Quazzo | |

15

COMPENSATION COMMITTEE

The Compensation Committee of the Board reviews and approves the overall compensation policies, plans and programs for the Company. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s executive officers and other senior management; determines and approves the compensation and other terms of employment of the Company’s Chief Executive Officer; reviews and approves the compensation and other terms of employment of the other executive officers; reviews and, in consultation with the Nominating and Corporate Governance Committee, recommends to the full Board compensation for independent directors; and administers the Company’s stock equity programs, stock bonus plans, deferred compensation plans and other similar programs. However, the Compensation Committee may, at its discretion and in accordance with the philosophy of making information available to the Board, present executive compensation matters to the entire Board for its review and approval. In the Compensation Discussion and Analysis section of this proxy statement, the material elements of the compensation program and an analysis of the factors underlying the Compensation Committee’s compensation policies are more fully discussed. Based on this, the Compensation Committee has recommended to the Board of Directors that this analysis be included in the proxy statement and in the Company’s annual report on form 10-K for the year ended December 31, 2017. Furthermore, all members of the Company’s Compensation Committee are independent (for purposes of the NASDAQ Listing Rules).

The Compensation Committee charter can be found on the Company’s corporate website at http://ir.web.com/corporate-governance.cfm.

During 2017, the Compensation Committee met four times in executive session. In addition, various members of Management and other employees as well as outside advisors and consultants are invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation Committee meetings. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the sole authority to approve the consultant’s reasonable fees and other retention terms.

In connection with setting board and executive compensation for 2017, the Compensation Committee engaged Compensation & Leadership Solutions, LLC (“CLS”), a compensation consulting firm to evaluate the Company’s existing compensation posture, strategy and practices in connection with the Company’s long-term strategic goals and to assist in refining the Company’s compensation program. As part of its engagement, and pursuant to the SEC and NASDAQ Listing Rules, the Compensation Committee reviewed the independence of CLS in light of the factors enumerated in the NASDAQ Listing Rules, and based on this review and, the Compensation Committee determined that CLS is independent of management and the Compensation Committee. CLS, as part of its engagement work, developed a comparative peer group of companies and performed analyses of compensation levels for that group and that review is and the specific duties of CLS in 2017 are more fully described in the Compensation Discussion and Analysis section of this proxy statement. No additional services were performed by CLS.

The Compensation Committee generally acts on all equity awards to be granted under the Company’s equity incentive plan at its regularly scheduled meetings, although from time to time, grants may be made outside of these regularly scheduled meetings to accommodate special business needs.

Historically, the Compensation Committee has made most significant adjustments to executive compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the first quarter of the year. However, the Compensation Committee also considers matters related to individual compensation as necessary throughout the year. The Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. For all executives and directors, as part of its deliberations, the Compensation Committee may review and consider materials such as financial reports and projections, operational data, tax and accounting

16

information, summary descriptions of the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, Company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels, and recommendations of management, the Chief Executive Officer and the Compensation Committee’s compensation consultant.

The specific determinations made by the Committee with respect to executive compensation for fiscal year 2017 are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

From January 1 to December 31, 2017, the Compensation Committee consisted of Messrs. Durden (Chair), Cost, Facchina, Giuliani, and Maudlin. No member of the Compensation Committee is an officer or employee of the Company, and none of the Company’s executive officers serve as a member of a compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Compensation Committee. Therefore, there is no relationship that requires disclosure as a Compensation Committee interlock. Each of the Company’s directors holds Web.com’s securities as set forth under the heading “Security Ownership of Certain Beneficial Owners and Management.”

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee of the Board is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company, reviewing and evaluating incumbent directors, recommending to the Board for selection candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, annually assessing the performance of the Board, Board committees and each member of the Board and developing a set of corporate governance principles for the Company. The Nominating and Corporate Governance Committee charter can be found on the Company’s corporate website at http://ir.web.com/corporate-governance.cfm. All members of the Nominating and Corporate Governance Committee are independent.

The Nominating and Corporate Governance Committee reviews candidates for director in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee may consider skills, age, and such other factors as it deems appropriate given the current needs of the board and the Company, to maintain a balance of knowledge, experience and capability. The Nominating and Corporate Governance Committee also considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, having demonstrated excellence in his or her field, having demonstrated the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. The Nominating and Corporate Governance Committee does not have a formal policy on diversity. Candidates for board membership are evaluated using the criteria identified above. During 2017 the Nominating and Corporate Governance Committee met one time in executive session.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and

17

then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates, and has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of the Company’s voting stock.

The Nominating and Corporate Governance Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board, and the Nominating and Corporate Governance Committee recommends to the Board of Directors that the nominees for election at the annual meeting be presented to the stockholders for approval.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORSCTORS

The Company’s Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Secretary of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. All communications will be compiled by the Secretary of the Company and submitted to the Board or the individual directors on a periodic basis. These communications will be reviewed by one or more employees of the Company designated by the Board, who will determine whether they should be presented to the Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications (such as advertisements, solicitations and communications not requiring Board consideration). The screening procedures have been approved by a majority of the independent directors of the Board. All communications directed to the Audit Committee in accordance with the Company’s Whistleblower Policy that relates to questionable accounting or auditing matters involving the Company will be promptly and directly forwarded to the Audit Committee.

CODE OF CONDUCT

The Company has adopted the Web.com Group, Inc. Code of Conduct that applies to all officers, directors and employees. The Code of Conduct is available on the Company’s website at http://ir.web.com/corporate-governance.cfm. If the Company makes any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

18

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

CERTIFIED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Ernst & Young LLP (“Ernst & Young”) as the Company’s independent registered certified public accounting firm for the fiscal year ending December 31, 2018 and has further directed that management submit the selection of Ernst & Young for ratification by the Company's stockholders at the annual meeting. Ernst & Young has audited the Company’s financial statements since 2003. Representatives of Ernst & Young are expected to be present at the annual meeting at which they will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Ernst & Young as the Company’s independent registered certified public accounting firm. However, the Audit Committee of the Board is submitting the selection of Ernst & Young to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether to retain Ernst & Young as the Company’s independent registered certified public accounting firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Ernst & Young as the Company’s independent registered certified public accounting firm. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

INDEPENDENT AUDITORS

Ernst & Young audited the accounts of the Company and its consolidated entities and performed other services for the year ended December 31, 2017.

PRINCIPAL ACCOUNTANT FEES AND SERVICE

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2017 and 2016, by Ernst & Young, the Company’s principal accountant (all fees described below were approved by the Audit Committee):

Fiscal Year Ended December 31, | ||||||||||

2017 | 2016(5) | |||||||||

(in thousands $) | ||||||||||

Audit Fees (1) | 1,775 | 1, 695 | ||||||||

Audit-Related Fees (2) | 64 | 231 | ||||||||

Tax Fees (3) | 25 | 30 | ||||||||

All Other Fees (4) | 5 | 3 | ||||||||

(1) Includes integrated audit fees, quarterly review fees, and fees for services related to SEC filings, including comfort letters and

consents and work performed related to the acquisition of Yodle, Inc.

(2) | Includes IT assurance fees, accounting consultations and merger and acquisition and diligence fees. |

(3) Includes fees for tax consulting services.

(4) Subscription to EY Online, a research tool of Ernst & Young.

19

(5) Amounts in this column have been revised from last year’s proxy statement to reflect final billings, which amounts were not known

at the time of last year’s filing.

PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee pre-approves all audit and non-audit services rendered by the Company’s independent registered certified public accounting firm, Ernst & Young. While the Audit Committee Charter permits the Audit Committee to delegate pre-approval authority to one or more Committee members, as well as to the pre-approval of defined categories of services, the Audit Committee has not yet done so. To date, all pre-approvals have been given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service.

The Audit Committee has determined that the rendering of the services other than audit services by Ernst & Young is compatible with maintaining the principal accountant’s independence. In 2017, the Audit Committee approved all the services performed by Ernst & Young.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT AUDITORS FOR YEAR ENDED DECEMBER 31, 2018

20

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

At the 2017 Annual Meeting of Stockholders, the stockholders indicated their preference that the Company solicit a non-binding advisory vote on the compensation of the named executive officers, commonly referred to as a “say-on-pay vote,” every year. The Board has adopted a policy that is consistent with that preference.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers, which is a reflection of the philosophy, policies and practices of the Company and the Compensation Committee described in this proxy statement. The compensation of the Company’s named executive officers subject to this vote is disclosed in the “Compensation Discussion and Analysis,” the compensation tables, and the related narrative disclosure contained in this proxy statement. As discussed in those disclosures, the Compensation Committee, which is responsible for designing and administering our executive compensation program, continuously refines the Company’s executive compensation structure and processes, consistent with evolving corporate governance practices and the views of our stockholders. The Compensation Committee designs our executive compensation programs to focus executive decision-making on our overall business strategy, reinforce a pay for performance culture, to remain responsible in the face of economic adversity, and to allow the Company to attract and retain executives with the skills critical to the Company’s long-term success. We believe that our compensation philosophy provides a very real linkage between Company results, stockholder value and executive compensation. We encourage you to carefully review the “Compensation Discussion and Analysis” for additional details on our executive compensation, including our compensation philosophy and objectives, as well as the processes the Compensation Committee used to determine the structure and amounts of the compensation of our NEOs in 2017.

The Board is asking our stockholders to indicate your support for the compensation of the Company’s named executive officers as described in this proxy statement by casting a non-binding advisory vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant

to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables

and narrative discussion is hereby APPROVED.”

Because the vote is advisory, it is not binding on the Board of Directors or the Company. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Advisory approval of this proposal requires the vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting.

Unless the Board decides to modify its policy regarding the frequency of soliciting advisory votes on the compensation of the Company’s NEOs, the next scheduled say-on-pay vote will be at the 2023 Annual Meeting of Stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A NON-BINDING ADVISORY VOTE “FOR” THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

21

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 14, 2018 by: (i) each director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its common stock.