Form DEF 14A FBL FINANCIAL GROUP INC For: May 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrant [X]

Filed by Party other than Registrant [ ]

Check the appropriate box:

[ ] Preliminary proxy statement

[ ] Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

[X] Definitive proxy statement

[ ] Definitive additional materials

[ ] Soliciting material pursuant to § 240.14a-12

FBL Financial Group, Inc. |

(Name of Registrant as specified in its charter) |

Name of person(s) filing proxy statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) | Title of each class of securities to which transaction applies: | |

2) | Aggregate number of securities to which transaction applies: | |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) | Proposed maximum aggregate value of transaction: | |

5) | Total fee paid: | |

[ ] Fee paid previously with preliminary materials.

[ ] | Check box if part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identifying the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) | Amount previously paid: | |

2) | Form, Schedule or Registration Statement No.: | |

3) | Filing party: | |

4) | Date filed: | |

FBL Financial Group, Inc.

5400 University Avenue

West Des Moines, IA 50266

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF FBL FINANCIAL GROUP, INC.

Date: Wednesday, May 16, 2018

Time: 8:00 a.m. Central Daylight Time

Place: FBL Financial Group, Inc. Corporate Headquarters

5400 University Avenue

West Des Moines, IA 50266

AGENDA:

1. | Elect a Board of Directors; |

2. | Advisory vote to approve named executive officer compensation; |

3. | Ratify the appointment of our Independent Registered Public Accounting Firm for 2018. |

At the meeting we will also report on FBL Financial Group’s 2017 business results and other matters of interest to shareholders. Only shareholders who owned stock at the close of business on March 15, 2018 can vote at this meeting or any adjournments that may take place.

On March 29, 2018, we made available to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2018 proxy statement and annual report, and vote, online. The 2018 proxy statement contains instructions on how you can (i) receive a paper copy of the proxy statement, proxy card and annual report, if you only received the Notice of Internet Availability of Proxy Materials by mail, or (ii) elect for subsequent years to receive your proxy statement, proxy card and annual report over the Internet, if you received them by mail this year.

Enclosed with this Notice of Annual Meeting is the 2018 proxy statement and proxy card, and the 2017 annual report on Form 10-K as filed with the Securities and Exchange Commission. The annual report on Form 10-K contains all information required to be included with an annual report to shareholders. In addition, you may view our online annual report on our website, www.fblfinancial.com. Whether or not you plan to attend the meeting, we urge you to vote your shares over the Internet or by telephone, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may date, sign and mail the proxy card in the envelope provided.

By Order of the Board of Directors

/s/ Dennis J. Presnall

Dennis J. Presnall

Secretary

March 29, 2018

1

TABLE OF CONTENTS | ||

Questions and Answers | ||

Corporate Governance | ||

Compensation of Non-Employee Directors | ||

Further Information Concerning the Board of Directors | ||

Proposal Number One - Election of Class A Directors | ||

Stock Ownership of Certain Beneficial Owners and Management | ||

Section 16(a) Beneficial Ownership Reporting Compliance | ||

Executive Officers | ||

Executive Compensation | ||

Compensation Discussion and Analysis | ||

Compensation Committee Report | ||

Summary Compensation Table | ||

2017 All Other Compensation | ||

2017 Grants of Plan-Based Awards | ||

Securities Authorized for Issuance Under Equity Compensation Plans | ||

Outstanding Equity Awards at Year End 2017 | ||

Option Exercises and Stock Vested in 2017 | ||

Pension Benefits | ||

2017 Non-Qualified Deferred Compensation | ||

Potential Payments Upon Termination or Change in Control | ||

Certain Relationships and Related Party Transactions | ||

Proposal Number Two - Advisory Vote on Named Executive Officer Compensation | ||

Report of the Audit Committee | ||

Proposal Number Three - Ratification of the Appointment of the Independent Registered Public Accounting Firm | ||

Notice of Electronic Availability of Proxy Statement and Annual Report

As required by rules adopted by the Securities and Exchange Commission (“SEC”), FBL Financial Group, Inc. (“FBL” or the “Company”) is making this proxy statement and proxy card, and its annual report on Form 10-K, available to shareholders electronically via the Internet. On March 29, 2018, we began mailing our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report, and vote, online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review online all of the important information contained in the proxy statement and annual report. The Notice also instructs you on how you may submit your proxy over the Internet.

If you received a Notice by mail and would like to receive a paper copy of our proxy materials, you must request one. There is no charge to you for requesting a paper copy. If you received a paper copy of our proxy materials and want to receive an electronic copy, you must request one. There is no charge to you for requesting an electronic copy.

Please make your request for a paper copy or electronic copy of proxy materials related to the May 16, 2018 shareholders meeting on or before May 2, 2018 to facilitate timely delivery.

You may make your request using one of the following methods:

• | By telephone: 1-800-579-1639 |

• | By e-mail: [email protected] (if requesting materials by e-mail, please send a blank e-mail with the 12 Digit Control Number [located on the Notice] in the subject line) |

• | By Internet: www.proxyvote.com |

2

QUESTIONS AND ANSWERS

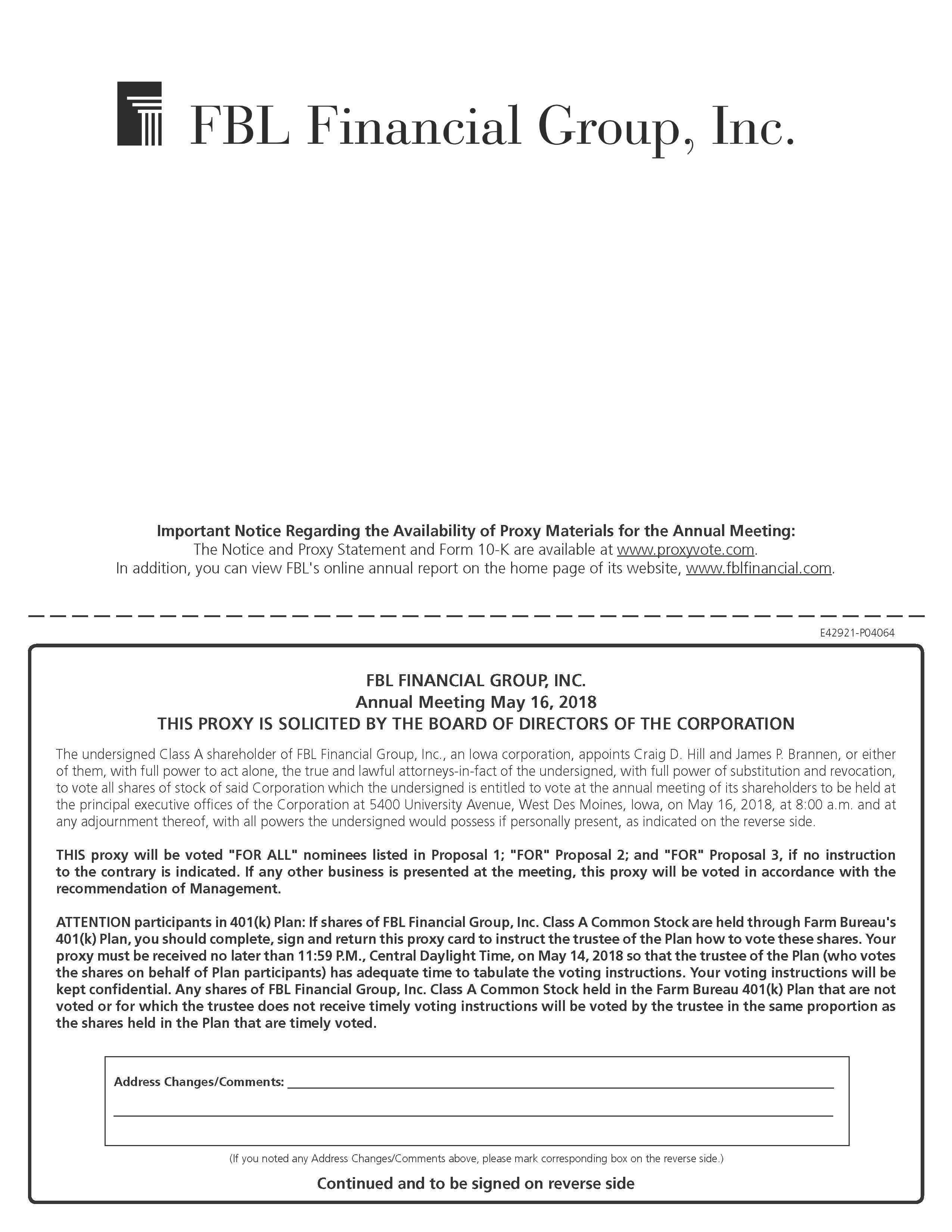

1 | Q: | On what may I vote? | |

A: | 1) the election of four Class A directors; | ||

2) the approval of a resolution regarding named executive officer compensation, on an advisory basis; | |||

3) the ratification of the appointment of our Independent Registered Public Accounting Firm for 2018. | |||

2 | Q: | How does the Board recommend I vote on the proposals? | |

A: | The Board recommends voting as follows: ● FOR each of the nominees for Class A director named in this proxy statement, ● FOR the advisory vote to approve named executive officer compensation, ● FOR ratification of the appointment of the Independent Registered Accounting Firm. | ||

3 | Q: | Why are there only four Class A director nominees? | |

A: | We use the controlled company exemption under New York Stock Exchange (“NYSE”) corporate governance rules. This permits a company with a majority shareholder not to have a majority of its directors be independent and to vary the makeup of certain director committees. This year the Class B common shareholders will elect six Class B directors, and the Class A common and Series B preferred shareholders will elect four Class A directors. The four Class A director nominees include our Chief Executive Officer and three independent nominees. | ||

4 | Q: | Who is entitled to vote? | |

A: | Shareholders as of the close of business on March 15, 2018 (the record date) are entitled to vote at the annual meeting. | ||

5 | Q: | How do I vote? | |

A: | Depending on the form of proxy or voting instructions you receive, you may follow directions to cast your vote by telephone or over the Internet. Or, if you receive a printed proxy card, you may sign and date it and return it in the pre-paid envelope. If you return your signed proxy card but do not indicate how you wish to vote, your shares will be voted in accordance with the Board’s recommendations. Regardless of the method of voting you use, you have the right to revoke your proxy at any time before the meeting by: 1) notifying FBL’s corporate secretary, 2) voting in person or 3) returning a later dated proxy. | ||

6 | Q: | Who will count the votes? | |

A: | We have retained Broadridge Investor Communication Solutions, Inc. (“Broadridge”) to distribute our proxy materials, receive the proxies and tabulate the results. Broadridge’s report will be reviewed by an employee of our legal department who will be appointed as the inspector of election. | ||

7 | Q: | Is my vote confidential? | |

A: | Proxy cards, ballots and voting tabulations that identify individual shareholders are mailed or returned directly to Broadridge. An image of them may be forwarded to us after the meeting. We would not release information identifying individual shareholders unless legally required to do so. We do not receive any identifying information regarding how employees vote Class A common shares held in their 401(k) accounts. | ||

8 | Q: | What shares are included in the proxies? | |

A: | Your proxy represents all of your shares, including those in our direct stock purchase plan administered by our transfer agent, American Stock Transfer & Trust Company. Shares held in custody by Principal Financial Group for the 401(k) plan for employees are represented by a separate voting instruction. If you do not vote by telephone or Internet or return your proxy cards, your shares will not be voted. If employees do not vote by Internet or return their voting instruction card, their shares in the 401(k) plan will be voted in proportion to the votes instructed by other employees. | ||

9 | Q: | What does it mean if I get more than one Notice? | |

A: | If your shares are registered differently and are in more than one account, you may receive more than one Notice. Respond to each Notice to ensure that all your shares are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, American Stock Transfer & Trust Company, at (866) 892-5627. Employees will receive a separate voter instruction card for shares in the 401(k) plan, in addition to a Notice for any shares owned directly. | ||

3

10 | Q: | How many shares can vote? | |

A: | As of the record date, March 15, 2018, 24,879,776 shares of Class A common stock, 11,413 shares of Class B common stock and 5,000,000 shares of Series B preferred stock were issued and outstanding. Every shareholder of common stock is entitled to one vote for each share held. Each share of Series B preferred stock is entitled to two votes. In summary, there were a total of 34,891,189 eligible votes as of the record date. The Class A common shareholders and the Series B preferred shareholders vote together to elect the Class A directors; the Class B common shareholders elect the Class B directors. The Class A common shareholders and the Series B preferred shareholders vote together as one class, and the Class B common shareholders vote as one class, on all other matters. | ||

11 | Q: | What is a “quorum”? | |

A: | A “quorum” means that holders of shares representing a majority of the outstanding votes are present at the meeting in person or represented by proxy. There must be a quorum for the meeting to be held. Directors must receive a plurality of votes cast to be elected. Proposal Two and Proposal Three must receive more than 50% of the votes cast in each voting group to be adopted. If you submit a properly executed proxy, even if you abstain from voting, then you will be considered part of the quorum. However, abstentions and broker non-votes are not counted in the tally of votes FOR or AGAINST a proposal. A WITHHELD vote is the same as an abstention. | ||

12 | Q: | Who can attend the annual meeting? | |

A: | Your directors and management look forward to personally greeting any shareholders who are able to attend. However, only persons who were shareholders at the close of business on March 15, 2018 can vote. | ||

13 | Q: | How will voting on any other business be conducted? | |

A: | Although we do not know of any business to be conducted at the 2018 annual meeting other than the proposals described in this proxy statement, if any other business is presented at the annual meeting, giving your proxy authorizes Craig Hill, FBL’s Chairman, and Jim Brannen, FBL’s Chief Executive Officer, to vote on such matters at their discretion. | ||

14 | Q: | Who are the largest shareholders? | |

A: | See “Stock Ownership of Certain Beneficial Owners and Management” for information concerning security ownership by each person who is known to the Company to be the beneficial owner of more than 5% of any class of the Company’s voting securities as of February 28, 2018. | ||

15 | Q: | How are the Class B directors elected? | |

A: | Only Farm Bureau organizations affiliated with the American Farm Bureau Federation and in whose geographic territory the Company’s insurance subsidiaries use the Farm Bureau name and logo may own Class B common stock. Farm Bureau organizations or their affiliates in fourteen Midwestern and Western states own Class B shares. By agreement, only presidents of the fourteen state Farm Bureau organizations, and one officer of a state Farm Bureau organization, are eligible for nomination as the six Class B directors. The Class B nominating committee is made up of the presidents of the fourteen state Farm Bureau organizations, who meet annually to determine the nominees. Their determinations are made based on the voting power of the organizations they represent. All of the Class B common shareholders have agreed they will vote to elect the named nominees as Class B directors. It is expected that the President and an additional officer of the Iowa Farm Bureau Federation will both be Class B directors, as long as that organization remains the largest shareholder. | ||

16 | Q: | When are shareholder proposals for the next annual meeting due? | |

A: | All shareholder proposals to be considered for inclusion in next year’s proxy statement must be submitted in writing to Secretary, FBL Financial Group, Inc., 5400 University Avenue, West Des Moines, Iowa 50266 by November 29, 2018. You must have held the lesser of $2,000 market value or 1% of the Company’s securities entitled to vote on the proposal, for at least one year before submitting a proposal, and you must continue to hold those securities through the date of the meeting. | ||

4

FBL’s advance notice bylaw provisions require that any shareholder proposal to be presented from the floor of the annual meeting must be submitted to the Corporate Secretary at the above address not less than 120 days before the first anniversary of the prior year’s annual meeting, which would be no later than January 16, 2019. That notice needs to include as to each matter the shareholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought, the reasons for conducting such business and any material interest in such business of the shareholder and the beneficial owner, if any, on whose behalf the proposal is made; (ii) the name and address of, and class and number of shares owned beneficially and of record by, the shareholder and beneficial owner; and (iii) in the event that such business includes a proposal to amend either the articles of incorporation or the bylaws, the language of the proposed amendment. The shareholder must also comply with all applicable requirements of the Securities Exchange Act of 1934 and the rules and regulations thereunder. | |||

17 | Q: | Can a shareholder nominate someone as a director of the Company? | |

A: | As a shareholder of record, you may recommend any person as a nominee for Class A director. Recommendations are made by writing to the Secretary of the Company not less than 120 days prior to the first anniversary of the prior year’s annual meeting. Your notice needs to set forth your name and address, the name, address, age and principal occupation or employment of the person to be nominated, a representation that you are a record holder of Class A common stock, and intend to appear in person or proxy at the meeting to nominate the person specified, the number and class of shares you own and the number and class of shares, if any, owned by the nominee. You also need to describe any arrangements between you and the nominee and other information as required by the Securities Exchange Act of 1934 and the rules and regulations thereunder, including the nominee’s written consent to being named in a proxy statement and to serve as a director if elected. Nominations for Class B directors are governed by an agreement between all the holders of Class B common stock. | ||

CORPORATE GOVERNANCE

Company Business

The Company is a holding company which markets individual life insurance and annuity products through distribution channels of our subsidiary Farm Bureau Life Insurance Company (“Farm Bureau Life”), principally under the consumer brand name Farm Bureau Financial Services. The Farm Bureau Life distribution channel markets to Farm Bureau members and other individuals and businesses in the Midwestern and Western sections of the United States. In addition, in the state of Colorado, we offer life insurance and annuity products through a subsidiary of Farm Bureau Life, Greenfields Life Insurance Company.

We also manage all aspects of two Farm Bureau affiliated property-casualty insurance companies, Farm Bureau Property & Casualty Insurance Company (“Farm Bureau Property & Casualty”) and Western Agricultural Insurance Company (“Western Ag”), which operate predominately in eight states in the Midwest and West.

Board Organization

The Company utilizes the “controlled company” exemption under the NYSE corporate governance standards because the Company has a majority shareholder, the Iowa Farm Bureau Federation. Under the controlled company exemption, a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company is not required to have a majority of the Board of Directors consist of independent directors, and the corporate governance and compensation committees are not required to consist only of independent directors. The Company’s Audit Committee continues to consist of three independent directors.

The Board makes its own determinations from time to time of what form of Board leadership works best for the Company. However, as long as the Company has a single shareholder owning a significant voting block, it is expected that a representative of that shareholder will be Chairman of the Board, and that the Board will not choose to have the same individual serve as Chairman and Chief Executive Officer of the Company. So long as the Chairman of the Board is affiliated with the majority shareholder, the Board, by action of the independent directors, expects to appoint a Lead Director who will conduct any separate meetings of non-management and independent directors and have such other duties and responsibilities as are set by the Board from time to time. The majority shareholder and the Board have determined that this leadership structure gives appropriate deference to the economic interests of the majority shareholder and the other Farm Bureau-affiliated shareholders, while encouraging valuable input and oversight from the independent directors.

Under this arrangement, Craig Hill, President of the Iowa Farm Bureau Federation, is the Chairman of the Board of FBL. The independent directors have elected Paul Larson as the Lead Director. He was also elected Vice Chairman of the Board and appointed to the Executive Committee. In addition to chairing an executive session of the independent directors in the course of each formal Board meeting, the Lead Director is also the primary recipient of communications from shareholders and other interested parties.

5

Except as otherwise specified in the Company's bylaws, assignments to, and chairs of, the committees are recommended by the Class A Nominating and Corporate Governance Committee and selected by the Board. All committees report on their activities to the Board. See “Further Information Concerning the Board of Directors” for more information regarding the membership and workings of the various committees.

Corporate Governance

The Company is committed to strong corporate governance, as demonstrated by the following practices and structure: (i) Audit Committee comprised only of independent directors, (ii) designation of an independent Lead Director, (iii) annual election of the full Board of Directors, (iv) adoption of director and executive officer stock ownership guidelines, (v) limitation on the number of public company boards on which Class A directors may serve, (vi) periodic director education programs, (vii) annual Board evaluations, (viii) adoption of Board member criteria, and (ix) requirement for Class A directors to offer their resignation upon a significant change in primary occupational responsibilities.

The Board of Directors has adopted governance guidelines for the Company and the Board to ensure effective corporate governance. The governance principles are summarized below, and the full text of the governance guidelines is posted on the Company's website at www.fblfinancial.com.

Objective of the Board of Directors

The business of FBL is managed under the direction of the Board. The Board represents the interests of the shareholders; as such, it oversees the strategic direction and conduct of the Company's business activities so as to enhance the long-term value of the Company. One of the Board's principal roles is to select and oversee a well-qualified and responsible Chief Executive Officer and management team to run the Company on a daily basis.

Board and Board Committee Responsibilities Include:

• | Nominate Board candidates for election by the shareholders; |

• | Oversee management, including the selection, monitoring, evaluation and compensation of the Chief Executive Officer and other senior executives; |

• | Oversee compliance with laws, regulations and ethical behaviors; |

• | Understand the major risks in the Company’s business and available risk management techniques and confirm that control procedures are adequate; |

• | Promote integrity and candor in the audit of the Company’s financial statements and operations, and in all financial reporting and disclosures; |

• | Review and approve management’s strategic and business plans; |

• | Review and approve major transactions, financial plans, objectives and actions, including significant capital allocations and expenditures; |

• | Monitor management’s performance of its plans and objectives and advise management on significant decisions; and |

• | Assess its own effectiveness. |

Board Operation

The Board normally has four regularly scheduled meetings each year and special meetings as needed. Committee meetings are normally held in conjunction with Board meetings, plus additional meetings as needed. The Chairman, the Lead Director, the Board and the committee chairs are responsible for conducting meetings and informal consultations in a fashion that encourages communication, meaningful participation and timely resolution of issues. Directors receive the agenda and materials in advance of meetings and may ask for additional information from, or meet with, senior management at any time. Strategic planning sessions are held periodically at regular Board meetings. Board education sessions are held at least annually. In 2017, all directors attended educational training sessions.

Board’s Role in Risk Oversight

The Board of Directors is responsible for risk oversight. The Audit Committee monitors financial reporting risks and enterprise risk management (ERM). The Management Development and Compensation Committee reviews the potential of risks being related to or created by compensation and incentive systems. It concluded in March 2018 that the Company's compensation policies and practices for all employees, including executive officers, do not create risks that are reasonably likely to have a material adverse effect on the Company.

The Company’s management team monitors all other risks on an ongoing basis. An employee-staffed Enterprise Risk Management Committee is responsible for identifying risks that impact any and all of our businesses, establishing a reporting system to appropriately address risks and communicating results regularly to the management team, Audit Committee and

6

Board of Directors. The Enterprise Risk Management Committee monitors quarterly surveys of the identified risks for possible elevations or changes in risk status with relation to established risk tolerances. A “dashboard” report is provided quarterly to the management team and the Audit Committee for their assessments of these risks.

Board Advisers

The Board and its committees (consistent with their respective charters) may retain their own advisers and consultants as they consider necessary to carry out their responsibilities.

Board Evaluation

The Class A Nominating and Corporate Governance Committee coordinates an annual evaluation process by the directors of the Board's performance and procedures, including evaluation of committee performance. The Board and each of the standing committees have conducted annual evaluations of their performance and procedures, including the adequacy of their charters, as established in the bylaws and charter documents.

Board Compensation

The Management Development and Compensation Committee, in accordance with the policies and principles set forth in its charter, reviews and makes recommendations to the full Board with respect to the compensation of directors. As part of such review, the Management Development and Compensation Committee periodically reviews director compensation, including additional compensation for committee members, in comparison to companies that are similarly situated to ensure that such compensation is reasonable, competitive and customary. In addition, the Board will review all consulting contracts with, or other arrangements that provide other indirect forms of compensation to, any director or former director.

Director Share Ownership Guidelines

To more closely align the interests of directors and the Company's shareholders, the Board has determined that directors are required to own FBL stock worth three times their annual retainer within five years of becoming a director. The annual retainer is $30,000 for Class A directors and $12,500 for Class B directors, resulting in a share value ownership requirement equivalent to $90,000 for Class A directors and $37,500 for Class B directors. "Ownership" includes shares owned outright, in retirement plans, in the Directors Compensation Plan when funded by restricted stock units, and other grants of restricted stock units. For Class B directors, "ownership" also includes any Class A common stock owned by the Class B director's employer, an affiliate of such employer, the Farm Bureau entity of which the director is president, or the affiliate of such an entity. Our directors may choose to receive some or all director fees in cash-settled restricted stock units under the Directors Compensation Plan, which are recognized as the ownership of equivalent shares for purposes of the share ownership guidelines. As of February 28, 2018, all of our directors have met or are on track to meet the ownership requirements.

Corporate Conduct

We have adopted a Code of Business Ethics and Conduct that applies to all employees, officers and directors of the Company and meets the requirements of a "code of business conduct and ethics" under the listing standards of the NYSE. We have also adopted a Code of Ethics for Senior Financial Officers that meets the requirements of a “code of ethics” as defined by Item 406 of Regulation S-K. Both the Code of Business Ethics and Conduct and the Code of Ethics for Senior Financial Officers (together, the "Codes") are posted on our website at www.fblfinancial.com under the heading Corporate Governance - Governance Documents. Any amendments to the Codes are promptly incorporated into the website posting. We intend to disclose any waivers of the Codes for executive officers or directors on our website. The Company has also adopted a Corporate Compliance Manual, which memorializes compliance practices.

Communications with the Board of Directors

The Board has established a process for shareholders and other interested parties to communicate with members of the Board, including the Lead Director. If you have any concern, question or complaint regarding our compliance with any policy or law, or would otherwise like to contact the Board, you can mail materials c/o Secretary, FBL Financial Group, Inc., 5400 University Avenue, West Des Moines, IA 50266, or e-mail [email protected].

7

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Cash compensation payable to our non-employee directors is shown in the table below.

Non-employee directors annual fee | $ | 45,000 | |

Class A Director retainer | 30,000 | ||

Class B Director retainer | 12,500 | ||

Board meeting fees | 1,500 | ||

Board telephonic meeting fees | 1,000 | ||

Committee meeting fees | |||

Audit | 1,000 | ||

Management Development and Compensation | 1,000 | ||

Class A Nominating and Corporate Governance | 1,000 | ||

Executive | 1,000 | ||

Class B Nominating By telephone | 500 250 | ||

Other Retainers | |||

Lead Director | 10,000 | ||

Audit chair | 10,000 | ||

Management Development and Compensation chair | 10,000 | ||

Class A Nominating and Corporate Governance chair | 5,000 | ||

Non-employee directors who serve on the boards of both the Company and its wholly owned subsidiary, Farm Bureau Life, receive the higher of the two retainers paid to directors, not both. Directors may elect to receive their fees in cash or in cash-settled deferred stock equivalent units pursuant to the Director Compensation Plan. All directors are reimbursed for travel expenses incurred in attending Board and committee meetings.

2017 Director Compensation Table | ||||||||||||

Fees Earned/Paid in Cash(f) | Stock Awards | All Other Compensation(g) | Total | |||||||||

Name(a) | ($) | ($) | ($) | ($) | ||||||||

Roger K. Brooks | 105,000 | — | — | 105,000 | ||||||||

Jerry L. Chicoine | 49,250 | — | — | 49,250 | ||||||||

Richard W. Felts(b) | 57,000 | — | 21,557 | 78,557 | ||||||||

Joe D. Heinrich(c) | 55,000 | — | — | 55,000 | ||||||||

Craig D. Hill(d) | — | 72,278 | — | 72,278 | ||||||||

James A. Holte(e) | 55,000 | — | 24,300 | 79,300 | ||||||||

Paul A. Juffer | 83,000 | — | — | 83,000 | ||||||||

Paul E. Larson | 109,250 | — | — | 109,250 | ||||||||

Kevin D. Paap | 1,500 | — | 43,800 | 45,300 | ||||||||

Kevin G. Rogers | 57,500 | — | 18,100 | 75,600 | ||||||||

Scott E. VanderWal | 56,000 | — | 21,300 | 77,300 | ||||||||

(a) | Excludes Mr. Brannen, who as Chief Executive Officer of the Company was not separately compensated for his service as a director. See “Executive Compensation” and “Summary Compensation Table” for further information regarding Mr. Brannen’s compensation. |

(b) | Mr. Felts is an officer of the Kansas Farm Bureau. Of the indicated compensation amount, a portion of that payable to Mr. Felts is paid to the Kansas Farm Bureau, and he is separately compensated by that organization for his services, including service as a director of the Company. |

(c) | Mr. Heinrich is an officer of the Iowa Farm Bureau Federation. Of the indicated compensation amount, a portion of that payable to Mr. Heinrich is paid to the Iowa Farm Bureau Federation, and he is separately compensated by that organization for his services, including service as a director of the Company. |

(d) | As a corporate officer, Mr. Hill is also considered an employee of the Company. As such, he received stock awards consisting of service-based cash-settled restricted stock units which vest and are paid over a five-year period. |

(e) | Mr. Holte is an officer of the Wisconsin Farm Bureau Federation. Of the indicated compensation amount, a portion of that payable to Mr. Holte is paid to the Wisconsin Farm Bureau Federation, and he is separately compensated by that organization for his services, including service as a director of the Company. |

(f) | Various directors have elected to defer various amounts of earned fees to the Director Compensation Plan, a nonqualified deferred compensation vehicle which accumulates cash-settled restricted stock units based on the market price of the Company’s Class A common stock on the date of fee payments. The Director Compensation Plan also accumulates dividend equivalents on the restricted stock units at the same rate as dividend payments on the Company’s Class A common stock. |

8

(g) | Includes Farm Bureau Life director retainer, Farm Bureau Life board and committee meeting fees, group life premiums for Farm Bureau Life directors, Class B Nominating Committee fees and guest travel. |

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

The Board of Directors met five times during 2017. All of the directors attended at least 75% of the Board meetings and committee meetings of which they were members. The Company has adopted a formal policy that attendance of directors at the annual shareholder meeting is expected. With the exception of one Class A director who was retiring from the Board and not seeking re-election, all directors then in office attended the last annual meeting in May 2017.

The committees of the Board of Directors and the number of meetings held by each committee in 2017 were:

Number of Meetings Held During 2017 | |

Committee Name | |

Executive Committee | 6 |

Audit Committee | 10 |

Management Development and Compensation Committee | 5 |

Class A Nominating and Corporate Governance Committee | 4 |

Class B Nominating Committee | 1 |

The Executive Committee is composed of Mr. Hill (Chair), Mr. Brannen, Mr. Felts, Mr. Larson and Dennis J. Presnall, Secretary of the Company, who is Executive Secretary of the Iowa Farm Bureau Federation. The Executive Committee may exercise all powers of the Board of Directors during intervals between meetings of the Board, with certain exceptions.

The Audit Committee consists of Mr. Larson (Chair), Mr. Brooks and Mr. Juffer. The Audit Committee must include only Class A directors who are independent of management and free from any relationships that would interfere with the exercise of independent judgment. The Board of Directors has determined that the above members of the Audit Committee meet such standards, and further that all are “financially literate” and have “accounting or related financial management expertise,” as required by the NYSE Listed Company Manual. Further, the Board of Directors has determined that all members are “audit committee financial experts,” as that term is defined in SEC regulations.

The Audit Committee hires FBL's Independent Registered Public Accounting Firm and reviews the professional services to be provided by the firm and its independence from our management. The Audit Committee also reviews the scope of the audit by the Independent Registered Public Accounting Firm and its fees, our annual and quarterly financial statements and related filings with the SEC, the system of internal accounting controls and other matters involving the accounting, auditing and financial reporting practices and procedures of the Company as it may find appropriate or as may be brought to its attention, oversees risk analysis and meets quarterly with members of the internal audit staff. The Audit Committee is required to review with the Independent Registered Public Accounting Firm and management any material transaction or series of similar transactions to which FBL was, within the past year, or is currently expected to be, a party, and with respect to which a director, executive officer, or holder of more than five percent of any class of voting stock of the Company is a party. Additionally, if the Audit Committee determines that any transaction or proposed transaction between FBL and Farm Bureau Property & Casualty or Western Ag may be unfair to FBL, the Board is required to submit the matter to a coordinating committee for resolution. A copy of the current Audit Committee Charter is available on our website, www.fblfinancial.com.

The Management Development and Compensation Committee consists of Mr. Brooks (Chair), Mr. Felts, Mr. Juffer and Mr. VanderWal. A Stock Subcommittee consisting only of the two independent directors has been formed to manage equity-based security grants and performance terms under Section 16 of the Securities Exchange Act and Section 162(m) of the Internal Revenue Code, respectively. The Committee's responsibilities are to assure that the executive officers of the Company and its wholly-owned affiliates are compensated effectively in a manner consistent with the shareholders' interests and consistent with the compensation strategy of the Company, internal equity considerations, competitive practice and the requirements of the appropriate regulatory bodies, to oversee hiring, promotion and development of executive talent within the Company, including management succession planning and review, and to administer any benefit plans related to or based on the Company's equity securities. The committee has full responsibility for determining the compensation of the Chief Executive Officer, in conjunction with the Board's review of the Chief Executive Officer's performance. A copy of the current Management Development and Compensation Committee Charter is available on our website, www.fblfinancial.com.

The Class A Nominating and Corporate Governance Committee is composed of Mr. Juffer (Chair), Mr. Heinrich, Mr. Holte and Mr. Paap. The responsibilities of the Class A Nominating and Corporate Governance Committee include assisting the Board in (i) identifying qualified individuals to become Class A directors, consistent with criteria approved by the Board, (ii) determining the composition of the Board of Directors and its committees, (iii) monitoring a process to assess Board effectiveness and (iv) developing and implementing the Company's corporate governance guidelines. The Class A Nominating

9

and Corporate Governance Committee also takes the lead in preparing and conducting annual assessments of Board and committee performance, and makes recommendations to the Board for improvements in the Board's operations. It also periodically reviews other matters involving the Company's corporate governance, including director education and the size of the Board, and recommends appropriate changes to the Board. A copy of the current Class A Nominating and Corporate Governance Committee Charter and the corporate governance guidelines are available on our website, www.fblfinancial.com.

The Class B Nominating Committee reviews nominations for election to the Board as Class B directors pursuant to a shareholders agreement among the Class B shareholders, and nominates candidates to fill Class B director vacancies. The Committee members are the presidents of the fourteen state Farm Bureau organizations in the trade area of Farm Bureau Life, including those who are current Class B directors. Mr. Hill chairs the committee.

In addition to the Board committees, we have established several operational committees consisting of employees, the activities of which are reported to the Board. Mr. Brannen sits on some of these committees in his capacity as Chief Executive Officer. The Board may establish other committees in its discretion.

PROPOSAL NUMBER ONE ─ ELECTION OF CLASS A DIRECTORS

There are four nominees for election as Class A directors, to be elected by the vote of the Class A common shareholders and Series B preferred shareholders, voting together as a single class. One nominee is the Chief Executive Officer of the Company and three nominees are independent of management. Each of the nominees have previously been elected by the shareholders. The Board of Directors, based on information received in questionnaires and in personal interviews, has determined that all nominees are qualified to serve, and the three independent nominees ─ Mr. Brooks, Mr. Juffer and Mr. Larson ─ possess the degree of independence from management and from the Company mandated by the SEC and NYSE.

Process of Nominations

The Class A Nominating and Corporate Governance Committee identifies potential Board candidates from its own network of business and industry contacts, and from recommendations from other directors, Class B shareholders and management. The committee will also consider nominations made by Class A shareholders, as explained in the answer to question 17 under "Questions and Answers." The Board has established criteria for the committee to use in assessing nominees in the areas of competency, skills/experience and personal representations.

Competency includes: integrity, accountability, independent thought process, high performance standards and business credibility, freedom from conflict, adequate time to fulfill duties and attributes to fit into any existing needs of the Board.

Skills/experience include: financial literacy, executive experience, leadership skills, technical skills in identified areas of need, fortitude to make and stand behind tough decisions and achievement in business, career, education and community; agribusiness or public company experience is a plus.

Personal representations include: express strong values and integrity of character, make informed judgments, maturity and confidence of judgment, courage of convictions, loyalty, committed to representing long-term interests of the shareholders, strong support of “duties of care”, diligence of a reasonably prudent person, will act in good faith, rationally and fair, practical wisdom, commitment to develop knowledge to advance the interests of the Company and the industry, commitment to prepare for and attend meetings and willingness to resign upon significant changes in abilities or value of contribution due to altered employment status, residency, geographic location or health.

The committee will review the preceding criteria along with the candidates’ qualifications to determine if they possess several of the following characteristics: business and financial acumen, knowledge of the insurance and financial services industries, knowledge of agriculture and agricultural businesses and prior experience as a director. Additionally, the Board believes that it is desirable that the Board members represent diverse viewpoints and have unique thinking due to diverse experiences. The Board is not limited by a formal policy with respect to diversity; the committee considers several types of diversity, including diversity of education, professional experience, skills, geography, gender, age and life experience. The committee also reviews the candidate’s independence from the Company and its management, based on responses to written questions, background checks and personal interviews.

Independence Determinations

In making its independence determinations, the Board specifically reviewed information that Director Paul E. Larson is also a director of Wellmark, Inc. and Wellmark of South Dakota, Inc., which provide Blue Cross-Blue Shield health insurance policies sold by agents of the Company's insurance affiliates in Iowa and South Dakota. The Company's managed affiliate, Farm Bureau Property & Casualty, received approximately $14.2 million of commission income for such sales in 2017, approximately 89% of which was in turn paid out as commissions and royalties. The financial results of this managed affiliate are not consolidated with the Company, and it has its own separate board of directors, not including Mr. Larson. Mr. Larson is not an officer or shareholder of Wellmark. The amounts involved are less than 2% of revenues of the affected

10

companies. Mr. Larson is also a director of GuideOne Mutual Insurance Company and GuideOne Specialty Mutual Insurance Company, which are each property/casualty insurers that are not in competition with the Company. Based on these facts, the Board determined that these relationships do not affect the independence of Mr. Larson.

There were no other relationships involving the independent directors and the Company that required an assessment of independence by the Board. All directors are elected annually, and serve a one-year term until the next annual meeting. If any director is unable to stand for election, the Board expects to designate a substitute. In that case, proxies voting for the original director candidate will be cast for the substituted candidate.

Nominees for Class A Director

Director Qualifications

The following paragraphs provide information as of the date of this proxy statement about each nominee. The information presented includes information each director has given us about his age, all positions he holds, his principal occupation and business experience for the past five years and the names of other publicly-held companies of which he currently serves as a director or has served as a director during the past five years. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he should serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to FBL and our Board. Finally, we value their significant experience on other public company, private company and community boards of directors and board committees.

Attributes of Class A Nominees

In nominating the Class A Directors, the Class A Nominating and Corporate Governance Committee determined that the last sentence of each nominee’s biographical paragraph which follows captures the essence of the specific experiences, qualifications, attributes or skills that qualify the person to serve as a director. Ages are as of December 31, 2017.

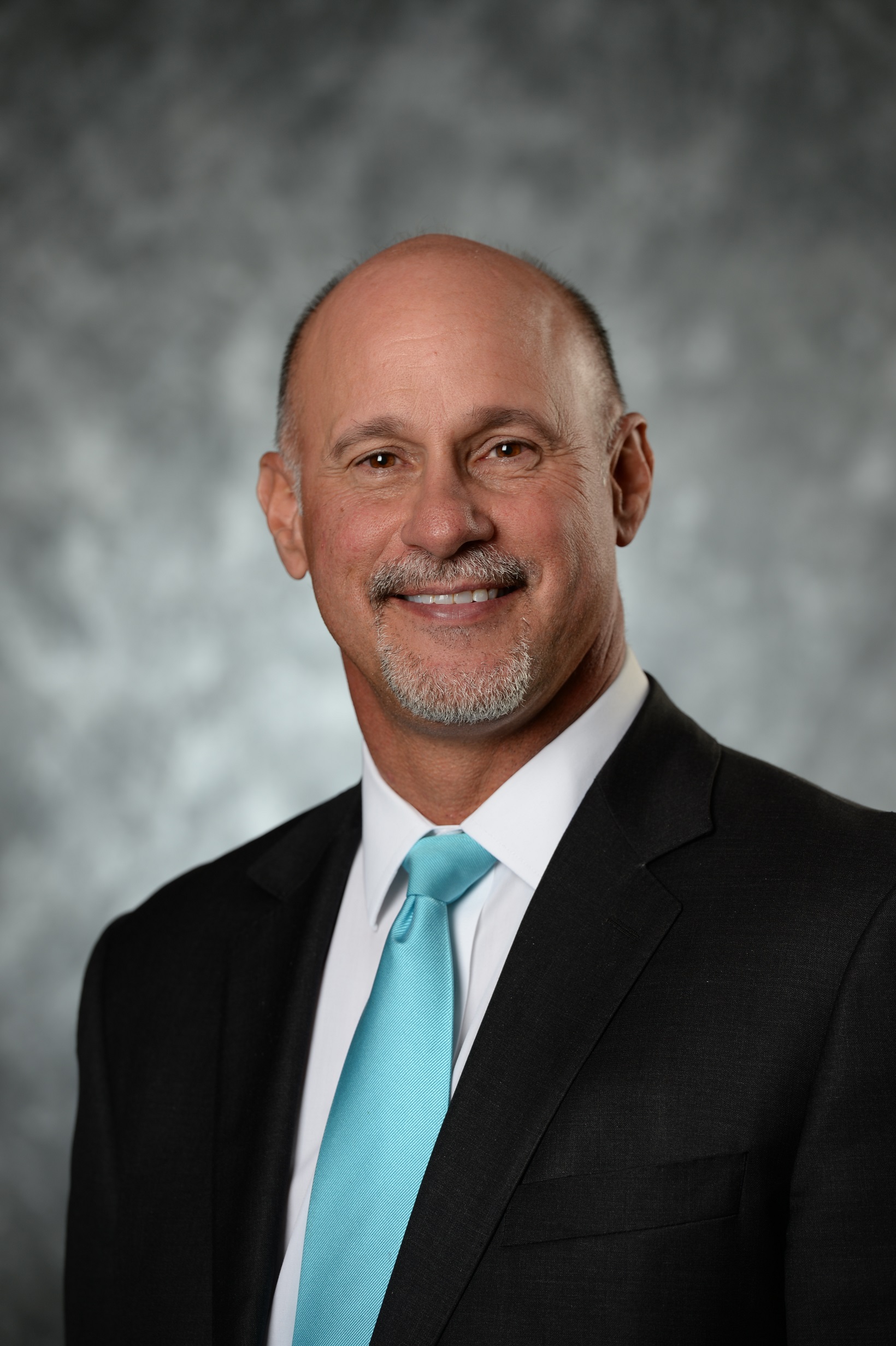

| James P. Brannen, Chief Executive Officer and Class A director Member: Executive Committee Class A Director since 2013 Age: 55 |

Mr. Brannen was named Chief Executive Officer in August 2012. Prior to his appointment as Chief Executive Officer, he served as Chief Financial Officer, Chief Administrative Officer and Treasurer since 2007. Mr. Brannen joined FBL in 1991 and held various positions in the tax and accounting areas prior to being named Vice President - Finance in 2000. Prior to joining FBL, Mr. Brannen managed corporate tax matters for insurance companies at Ernst &Young. Since October of 2015, Mr. Brannen has served on the board of directors of public company Great Western Bancorp, Inc. and its bank subsidiary, Great Western Bank. He is a graduate of the University of Iowa with a major in accounting. He is a member of the American Institute of Certified Public Accountants and the Iowa Society of Certified Public Accountants. Mr. Brannen serves in several civic and industry organizations, including the board of directors of the Greater Des Moines Partnership and the Iowa Business Council, and the Board of Governors of the Property Casualty Insurers Association of America. We believe Mr. Brannen’s qualifications to sit on our Board of Directors include his position as Chief Executive Officer and his intimate knowledge of the Company and the insurance industry gained through many years of employment.

11

| Roger K. Brooks, Class A director Member: Audit and Management Development and Compensation Committees Class A Director since 2009 Age: 80 |

Mr. Brooks is the retired Chief Executive Officer and Chairman of AmerUs Group. He retired from AmerUs in 2005, after nearly 50 years of service. Mr. Brooks has served on numerous community boards and is a member of the Iowa Insurance Hall of Fame and Iowa Business Hall of Fame. He was previously a Fellow of the Society of Actuaries. Mr. Brooks graduated magna cum laude with a bachelor’s degree in mathematics from the University of Iowa. He also participated in Stanford University’s Executive Program. We believe Mr. Brooks’ qualifications to sit on our Board of Directors include his demonstrated insurance industry expertise and experience through his 50 year tenure at AmerUs Group, retiring as its Chief Executive Officer and Chairman.

| Paul A. Juffer, Class A director Member: Audit, Class A Nominating and Corporate Governance and Management Development and Compensation Committees Class A Director since 2017 Age: 57 |

Mr. Juffer is the Managing Partner of LWBJ Financial, LLC ("LWBJ"), where he has practiced as a certified public accountant since 1997. LWBJ and its wholly owned subsidiaries, LWBJ, LLP and LWBJ Capital Advisors, LLC, provide public accounting, business consulting, mergers and acquisitions advisory and other transaction-related services to clients. Through LWBJ, Mr. Juffer has served as Chief Financial Officer for several emerging technology companies, including most recently for Harrisvaccines, Inc. from 2013 to 2015. Prior to his time at LWBJ, he was Chief Financial Officer for a technology company and worked as an auditor at KPMG. Mr. Juffer holds Series 7, Series 24, Series 63 and Series 79 licenses and is a member of the American Institute of Certified Public Accountants and the Iowa Society of Certified Public Accountants. He has a bachelor's degree in accounting from the University of Iowa. We believe Mr. Juffer’s qualifications to sit on our Board of Directors include his background in accounting, financial management and technology.

| Paul E. Larson, Class A director, Lead Director and Vice Chairman of the Board Member: Audit and Executive Committees Class A Director since 2004 Age: 65 |

Mr. Larson retired in 1999 as President of Equitable Life of Iowa and its subsidiary, USG Annuity and Life, after 22 years with the companies. Mr. Larson holds both a law degree and a certified public accountant designation. He was named Outstanding CPA in Business and Industry by the Iowa Society of CPAs in 1999, and inducted into the American Institute of CPA's Business and Industry Hall of Fame in 2000. Since 2017, he has served on the board of directors of Greenfields Life Insurance Company, a subsidiary of Farm Bureau Life. He is also a member of the board of directors of non-public companies Wellmark, Inc., Wellmark of South Dakota, Inc., GuideOne Mutual Insurance Company and GuideOne Specialty Mutual Insurance Company. We believe Mr. Larson’s qualifications to sit on our Board of Directors include his accounting and financial management background, and 20 years of experience with a public life insurance company.

YOUR BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THESE NOMINEES FOR CLASS A DIRECTOR.

12

Nominees for Class B Director, to be elected by the Class B Common Shareholders

Attributes of Class B Director Nominees

In nominating the Class B Directors, the Class B Nominating Committee determined that the last sentence of each nominee’s biographical paragraph which follows, in capsule form, captures the essence of the specific experiences, qualifications, attributes or skills that qualify the person to serve as a director. Ages are as of December 31, 2017.

| Craig D. Hill, Class B director, Chairman of the Board and chair of the Executive Committee Member: Executive and Class B Nominating Committees Class B Director 2002 to 2004, and since 2007 Age: 62 |

Mr. Hill was elected President of the Iowa Farm Bureau Federation and its subsidiary, Farm Bureau Management Corporation, in December 2011 and has served on its board of directors since 1989. He was its Vice President from 2001 to 2011. He served on the board of Farm Bureau Life from 1989 to 2007, and again from December 2011 when he also became its President. He has been on the board of Farm Bureau Property & Casualty since 1989, and also serves on the board of Western Ag. Mr. Hill is also a director of the American Farm Bureau Federation and FB BanCorp. Mr. Hill farms 1,000 acres of row crops and has a swine operation in Warren County, Iowa. We believe Mr. Hill’s qualifications to sit on our Board of Directors include his point of view as President of our majority shareholder, his experience as a director of our primary operating and managed companies and his knowledge of the rural marketplace.

| Richard W. Felts, Class B director Member: Executive, Management Development and Compensation and Class B Nominating Committees Class B Director since 2015 Age: 69 |

Mr. Felts is President of the Kansas Farm Bureau. He is also a director of Farm Bureau Life, the chairman of Farm Bureau Property & Casualty and the chairman of Western Ag. He farms near Liberty, Kansas and is a partner in Felts Farms, a diversified grain and livestock operation. Mr. Felts earned a bachelor's degree in agriculture and animal science from Kansas State University. We believe Mr. Felts’ qualifications to sit on our Board of Directors include his experience as a director of our primary operating and managed companies and his knowledge of agriculture and the rural marketplace for our insurance products.

| Joe D. Heinrich, Class B director Member: Class A Nominating and Corporate Governance Committee Class B Director since 2013 Age: 56 |

Mr. Heinrich was elected Vice President of the Iowa Farm Bureau Federation in 2011 and to its board of directors in 2004. He is a director of Farm Bureau Property & Casualty and Western Ag. Mr. Heinrich and his family farm with his nephew. Together, they have a diversified operation including corn, soybeans, oats and hay, plus a beef cow-calf herd and a dairy operation. We believe Mr. Heinrich’s qualifications to sit on our Board of Directors include his experience as a director of our primary operating subsidiary and managed companies, and his point of view as Vice President of our majority shareholder.

13

| James A. Holte, Class B director Member: Class A Nominating and Corporate Governance and Class B Nominating Committees Class B Director since 2016 Age: 64 |

Mr. Holte was first elected as President of the Wisconsin Farm Bureau Federation in 2012 and has served on its board of directors since 1995. He is also a director of Farm Bureau Life and the American Farm Bureau Federation and is President and a director of Rural Mutual Insurance Company. Mr. Holte farms near Elk Mound, Wisconsin, raising beef cattle and growing corn, soybeans and alfalfa. We believe Mr. Holte’s qualifications to sit on our Board of Directors include his experience as a director of our primary operating subsidiary and his knowledge of agriculture and the rural marketplace.

| Kevin D. Paap, Class B director Member: Class A Nominating and Corporate Governance and Class B Nominating Committees Class B Director since 2017 Age: 57 |

Mr. Paap has served as President of the Minnesota Farm Bureau Federation since 2005 and has served on its board of directors since 1997. Mr. Paap serves on the board of directors of Farm Bureau Life, Farm Bureau Property & Casualty and Western Ag. He also serves on the board of trustees of the Minnesota FFA Foundation and on the board of directors for the Center for Rural Policy and Development. Mr. Paap owns and operates a farm in Blue Earth County, Minnesota, growing corn and soybeans. We believe Mr. Paap’s qualifications to sit on our Board of Directors include his experience as a director of our primary operating subsidiary and managed companies, and his knowledge of the rural marketplace.

| Scott E. VanderWal, Class B director Member: Management Development and Compensation and Class B Nominating Committees Class B Director since 2011 Age: 54 |

Mr. VanderWal has been president of the South Dakota Farm Bureau Federation since 2004, and a member of its board of directors since 1997. He has also served as the Vice President of the American Farm Bureau Federation since 2016, and as a member of its board of directors since 2006. Mr. VanderWal is also a member of the boards of directors of Farm Bureau Property & Casualty (since 2004), Farm Bureau Life (since 2004), Western Ag (since 2006) and FB BanCorp (since 2004), and serves on the executive committee and as treasurer for the U.S. Farmers & Ranchers Alliance (since 2016). He also serves as chair of the Farm Bureau Property & Casualty audit and budget committee. Mr. VanderWal received a bachelor's degree in General Agriculture, with a Plant Science minor, from South Dakota State University in 1985. His family farm operation near Volga, South Dakota includes corn, soybeans, custom cattle feeding and custom harvesting. Mr. VanderWal does the overall financial management, accounting, crop management and planning for the farm operation. We believe Mr. VanderWal’s qualifications to sit on our Board of Directors include his experience as a director of our primary operating subsidiary and managed companies, and his knowledge of the rural marketplace.

14

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows how many shares of Class A common stock were beneficially owned, as of February 28, 2018, by each director, nominee for director and named executive officer, individually, and the directors and executive officers (as designated by the Board of Directors) as a group. The percentage of FBL Class A common shares beneficially owned by any director or executive officer does not exceed 1%, and by all directors and executive officers as a group does not exceed 1%.

Name | Shares Beneficially Owned | ||

James P. Brannen | 27,865 | (a)(b) | |

Roger K. Brooks | 2,849 | ||

Richard W. Felts | — | ||

Charles T. Happel | 787 | (a) | |

Joe D. Heinrich | — | ||

Craig D. Hill | 1,000 | ||

James A. Holte | — | ||

Paul A. Juffer | — | ||

Paul E. Larson | 12,715 | (c) | |

Kevin D. Paap | 3,299 | ||

Daniel D. Pitcher | 9,260 | (a) | |

Donald J. Seibel | 21,493 | (a)(b)(d) | |

D. Scott Stice | — | ||

Scott E. VanderWal | 2,000 | ||

All directors and executive officers as a group (18 persons, including those listed above) | 87,365 | ||

(a) | Includes share units held in the 401(k) Savings Plan equivalent to the following shares: Mr. Brannen, 13,510; Mr. Happel, 787; Mr. Pitcher, 9,260; and Mr. Seibel, 1,688. |

(b) | Includes share equivalent units held in the Executive Salary and Bonus Deferred Compensation Plan and the Employer Match Deferred Compensation Plan for the following named executive officers: Mr. Brannen, 14,355; and Mr. Seibel, 7,528. |

(c) | Includes deferred units in the Director Compensation Plan equivalent to the following shares: Mr. Larson, 6,362. |

(d) | Includes 12,277 shares for which Mr. Seibel shares voting and investment power with his spouse. |

Set forth below is information as of February 28, 2018 concerning security ownership by each person who is known to the Company to be the beneficial owner of more than 5% of any class of the Company’s voting securities.

Name and Address | Class A Common Stock | Class B Common Stock | Series B Preferred Stock | |||||||||

Shares Beneficially Owned | % of Class | Shares Beneficially Owned | % of Class | Shares Beneficially Owned | % of Class | |||||||

Iowa Farm Bureau Federation (a) 5400 University Ave. West Des Moines, IA 50266 | 14,760,303 | 59.3 | % | 7,619 | 66.8 | % | 5,000,000 | 100.0 | % | |||

Dimensional Fund Advisors LP (b) Building One 6300 Bee Cave Rd. Austin, TX 78746 | 2,095,095 | 8.4 | % | — | — | — | — | |||||

Farm Bureau Mutual Holding Company (a)(c) 5400 University Ave. West Des Moines, IA 50266 | 199,016 | 0.8 | % | 2,390 | 20.9 | % | — | — | ||||

(a) | The Class B common stock is convertible into an equal number of shares of Class A common stock at the election of the holder. Shares listed under “Class A common stock - shares beneficially owned” do not include shares deemed to be owned as a result of the shareholder’s ownership of Class B common stock. |

(b) | Information is as of December 31, 2017 based on a Schedule 13G/A filed with the U.S. Securities and Exchange Commission. Dimensional Fund Advisors LP (“Dimensional”) has sole voting power with respect to 2,033,648 shares of Class A common stock and sole dispositive power with respect to 2,095,095 shares of Class A common stock. Dimensional has indicated that it has beneficial ownership with respect to the shares as a result of acting as an investment adviser to four investment companies and acting as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts. Dimensional disclaims beneficial ownership. |

(c) | Ownership is through indirect subsidiaries Farm Bureau Property & Casualty and Western Ag. |

15

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires certain officers and directors of a public company, and persons who own more than ten percent of a registered class of a public company’s equity securities, to file reports of beneficial ownership and changes in beneficial ownership with the SEC. Based solely on our review of the copies of such reports received by us, or upon written representations received from certain reporting persons, we believe that during 2017 our Section 16 officers, directors and ten-percent shareholders complied with all Section 16(a) filing requirements applicable to them.

EXECUTIVE OFFICERS

Our executive and other officers provide services to the Company and to certain affiliates. Services performed for affiliates are charged to the affiliates on the basis of a time allocation and the affiliates are required to reimburse the Company for the cost of services. As explained in the section “Certain Relationships and Related Party Transactions - Transactions with Farm Bureau Property & Casualty and Affiliates,” we receive management fees for managing certain affiliates whose financial statements are not consolidated with ours.

The executive officers of the Company, as named by the Board of Directors, are as follows:

Name | Age | Position | ||

James P. Brannen | 55 | Chief Executive Officer | ||

Donald J. Seibel | 54 | Chief Financial Officer and Treasurer | ||

Casey C. Decker | 43 | Chief Information Officer | ||

Lori K. Geadelmann | 52 | General Counsel | ||

Nicholas C. Gerhart | 42 | Chief Administrative Officer | ||

Charles T. Happel | 56 | Chief Investment Officer | ||

Daniel D. Pitcher | 56 | Chief Operating Officer - Property Casualty Companies | ||

D. Scott Stice | 49 | Chief Marketing Officer | ||

Raymond W. Wasilewski | 59 | Chief Operating Officer - Life Companies | ||

The following describes the business experience, principal occupation and employment during the last five years of the executive officers:

Biographical information for Mr. Brannen is found above under “Proposal Number One - Election of Class A Directors.”

Donald J. Seibel was named Chief Financial Officer and Treasurer in August 2012. He had previously been Vice President - Finance and a member of the executive management team since 2007. Mr. Seibel joined FBL in 1996 and became GAAP Accounting Vice President in 1998 and Vice President - Accounting in 2002. Prior to joining FBL, Mr. Seibel worked in public accounting at Ernst & Young. Mr. Seibel holds a bachelor’s degree in accounting from Iowa State University, is a certified public accountant and chartered global management accountant, a member of the American Institute of Certified Public Accountants and the Iowa Society of Certified Public Accountants, and holds the Fellow Life Office Management Institute (FLMI) certification. Mr. Seibel is also active in civic and industry organizations, currently serving on the board of directors of Greater Des Moines Habitat for Humanity and Variety - The Children’s Charity.

Casey C. Decker was named Chief Information Officer in June 2016. He joined FBL in 2004 and progressed through various information technology roles, leading to Business Technology Vice President from February 2012 to July 2014. Beginning in July 2014 until his appointment as Chief Information Officer, Mr. Decker served as Agency Support Vice President, leading the team that provides strategies and solutions to support agents in growing successful and sustainable businesses. Prior to joining FBL, he was the Director of Technology for a not-for-profit organization in Chicago with responsibilities for creating and leading programs that improved information systems capabilities for various social service agencies and public schools. Mr. Decker holds a bachelor’s degree from Drake University and a master’s degree in Management Information Systems from DePaul University. He serves on the boards of directors of the Food Bank of Iowa, Junior Achievement of Central Iowa and the Global Insurance Accelerator, and as a member of the Education Cabinet for United Way of Central Iowa.

Lori K. Geadelmann was named General Counsel in March 2018. She joined FBL in 1993 and prior to being named as General Counsel, most recently served as Vice President - Assistant General Counsel and Corporate Compliance Officer. Ms. Geadelmann received a B.A., with distinction, from Iowa State University and a J.D. degree, with honors, from Drake University Law School. She serves on the life and health guaranty association boards in Iowa, Colorado and Montana, chairing

16

the Iowa and Colorado boards of directors. She also serves as Vice President of the Iowa Insurance Institute and chairs the Life and Financial Services Committee for the Federation of Iowa Insurers. Ms. Geadelmann is a Chartered Life Underwriter (CLU) and member of the Polk County Bar Association, Iowa State Bar Association, Association of Corporate Counsel and Society of Corporate Compliance and Ethics.

Nicholas C. Gerhart joined FBL and was named Chief Administrative Officer in January 2017. In this role, he has responsibility for enterprise strategic planning, government relations, human resources and health services, among other administrative functions. Mr. Gerhart served as the Insurance Commissioner of the State of Iowa from February 2013 until December 2016. Prior to serving as Insurance Commissioner, he worked at Sammons Financial Group, an insurance holding company, and American Equity Investment Life Insurance Company. Mr. Gerhart earned his law degree and health law certificate from St. Louis University School of Law and a Masters of Health Administration from St. Louis University School of Public Health. He also earned a B.A. from the University of Northern Iowa. Mr. Gerhart is an active community leader and currently serves on the board of directors of The Homestead and the board of trustees of ChildServe.

Charles T. Happel, CFA, is Chief Investment Officer. He joined the Company in 1984 as a Farm Bureau Financial Services agent, moving to the corporate office in 1986. Over the next fifteen years, he held various positions in investments, including securities analyst and portfolio manager. Mr. Happel became Securities Vice President in 2001, developing and executing strategy for property-casualty and equity mutual fund portfolios. He assumed the position of Vice President - Investments in August 2008, and was named Chief Investment Officer in September 2009. Mr. Happel is a graduate of the University of Northern Iowa and earned an MBA from Drake University. He is a Chartered Financial Analyst (CFA) Charterholder and holds a number of industry designations, including CFP, FLMI, ChFC, CLU and CPCU. Mr. Happel is a member of the CFA Institute and the CFA Society of Iowa.

Daniel D. Pitcher is Chief Operating Officer – Property Casualty Companies. Prior to his current position, he served as Vice President, Property-Casualty Companies from 2007 to 2011. Mr. Pitcher joined FBL in 1998 and held various information system roles including as Information Systems Vice President in 2002. Prior to joining FBL, Mr. Pitcher spent 15 years with Nationwide/Allied Insurance in various life and property casualty information systems roles. Mr. Pitcher holds a bachelor’s degree in business administration from Drake University and the FLMI certification. He is a member of the board of directors of United Way of Central Iowa.

D. Scott Stice was named Chief Marketing Officer in June 2013. He has overall responsibility for sales, marketing and distribution for the Company’s brand, Farm Bureau Financial Services, and its multiline exclusive agency force. Prior to joining FBL, Mr. Stice was Senior Vice President and head of field strategy and execution at Farmers Insurance from 2011 to 2013, and Senior Vice President Eastern Operations from 2008 to 2011. Mr. Stice began his insurance career with Farmers Insurance as an exclusive agent in 1990, and held various agency, marketing and field operations positions. Mr. Stice earned a bachelor’s degree in business management and administration from the University of the Redlands, and an MBA from Pepperdine University. He serves on the board of directors of the Greater Des Moines American Heart Association.

Raymond W. Wasilewski was named Chief Operating Officer – Life Companies in July 2014. Previously he had served as Chief Administrative Officer since May 2013, with responsibility for Information Technology, Human Resources and Agency Services. He joined the management team in 2011 as Vice President, Information Technology. He has been with FBL Financial Group since 1997. Mr. Wasilewski holds a bachelor’s degree in vocational education from Southern Illinois University and a master’s degree in computer information systems from Nova Southeastern University. Before joining FBL Financial Group, he was a consultant, a commercial software designer, a computer science and electronics instructor at Alaska Junior College and served in the U.S. Navy for 17 years in the cryptography field.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides information regarding compensation during 2017 for the following executive officers of FBL:

James P. Brannen, Chief Executive Officer

Donald J. Seibel, Chief Financial Officer and Treasurer

Charles T. Happel, Chief Investment Officer

Daniel D. Pitcher, Chief Operating Officer - Property Casualty Companies

D. Scott Stice, Chief Marketing Officer

These executive officers are referred to in this Compensation Discussion and Analysis and in the subsequent tables as our named executive officers, or “NEOs.”

17

Overview

Reimbursement of Compensation Expenses by Managed Affiliates

We sell individual life insurance and annuity products through an exclusive distribution channel in the Midwestern and Western sections of the United States. Several subsidiaries support various functional areas of our life insurance companies and other affiliates by providing investment advisory and marketing and distribution services.

In addition, we manage all aspects of two Farm Bureau-affiliated property-casualty companies, Farm Bureau Property & Casualty and Western Ag (together, the “PC Companies”). The financial results of the PC Companies are not included in our consolidated financial results. We earn a management fee from the PC Companies for our management services. Additionally, we are reimbursed for compensation and other expenses incurred by us in providing services to the PC Companies. While nearly all employees are employed by and compensated by the Company, the compensation expenses of our executive officers and employees are allocated between us and our subsidiaries on the one hand, and the PC Companies on the other hand, based on time and responsibility estimates and studies. For the NEOs, the PC Companies reimbursed us for the following percentage of their 2017 total compensation expense: Mr. Brannen, 40%; Mr. Seibel, 35%; Mr. Happel, 0%; Mr. Pitcher, 100%; and Mr. Stice, 50%. Although none of Mr. Happel’s compensation expense was directly reimbursed to us, the PC Companies pay fees to our subsidiary for investment advice and related services, as further described under “Certain Relationships and Related Party Transactions - Transactions with Farm Bureau Property & Casualty and Affiliates.”

Enterprise wide, the PC Companies reimbursed us for approximately 71.5% of our 2017 total salary and payroll tax expenses, 48.0% of our 2017 annual cash incentives and 33.5% of our 2017 long-term incentives and deferred compensation. As a result, the PC Companies are paying their proportionate share of our total salaries, cash incentives and long-term incentives, as well as all other forms of compensation and benefits. These allocations and reimbursements should be considered in any analysis of FBL’s compensation costs, executive compensation costs and costs and uses of short-term and long-term incentive plans.

We value good relationships with the state and local Farm Bureau entities which sponsor and allow us and the PC Companies to do business in their geographic areas. We believe attention to the property-casualty business allows us to do a more effective job of cross-selling life insurance products to property-casualty customers, and our cross-sales are consistently significantly above industry averages. We further emphasize this relationship by including property-casualty-related components in both our annual cash incentive and our long-term incentive programs.

Executive Compensation Philosophy and Goals

The Management Development and Compensation Committee (referred to as the “Committee” in this Compensation Discussion and Analysis) periodically reviews the executive compensation program in light of trends in practice, regulatory guidance, internal developments and other considerations as appropriate. The programs reflect the key compensation principles at FBL as stated below.

We expect that the FBL compensation program will help us attract and retain highly qualified and motivated employees at all levels, encourage and reward achievement of our annual and long-term goals and operating plans and align officers’ and employees’ interests with shareholders, all in an effort to increase shareholder value. With respect to our executive officers, we intend that our executive compensation program will effectively and appropriately compensate them and will guide their activities in response to targeted incentives we provide, both over the short and long terms. We measure the appropriateness of the compensation package by comparing it to payments made by other companies in the insurance and financial services industries. Our target is to have overall executive compensation at approximately the blended average of the median of survey data and compensation for peer group companies for comparable positions and performance.

We used a variety of compensation elements to reach these goals in 2017. These include base salary, annual cash performance-based incentives, long-term incentive awards measured by our stock price and by the financial performance of Farm Bureau Property & Casualty, retirement benefits, general employee benefits, executive benefits and limited perquisites. These elements are reviewed periodically and adjusted as appropriate.

We strive to develop simple and effective programs that reflect the value of our Company. Transparency and integrity in the design, administration and communication of our program are key objectives.

Management Development and Compensation Committee and Supporting Resources

The Committee is in charge of all aspects of executive compensation. See “Further Information Concerning the Board of Directors” for additional information regarding the Committee. Our Chief Executive Officer and Chief Financial Officer typically attend meetings of the Committee.

The Committee has retained FW Cook as its compensation consultant, and has determined there are no relationships between the consultant and the Company or its affiliates that compromise the consultant’s independence. The consultant is

18

exclusively accountable to the Committee. On occasion, certain executive officers may provide information regarding the compensation and benefit programs and business context to the consultant and review drafts of the consultant’s reports, where not concerning executive officer compensation, for accuracy with respect to Company information. The Company from time to time has also utilized the services of the Hay Group in reviewing its employment and compensation arrangements, including executive compensation.