Form DEF 14A NACCO INDUSTRIES INC For: May 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant | þ | ||

Filed by a Party other than the Registrant | |||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Under Rule 14a-12 | |

NACCO INDUSTRIES, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box): | ||

þ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | ||

(2) | Aggregate number of securities to which transaction applies: | ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) | Proposed maximum aggregate value of transaction: | ||

(5) | Total fee paid: | ||

o | Fee paid previously with preliminary materials: | ||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | ||

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

TABLE OF CONTENTS | PAGE |

NACCO INDUSTRIES, INC.

NACCO INDUSTRIES, INC.5875 LANDERBROOK DRIVE, SUITE 220

CLEVELAND, OHIO 44124-4069

NOTICE OF ANNUAL MEETING

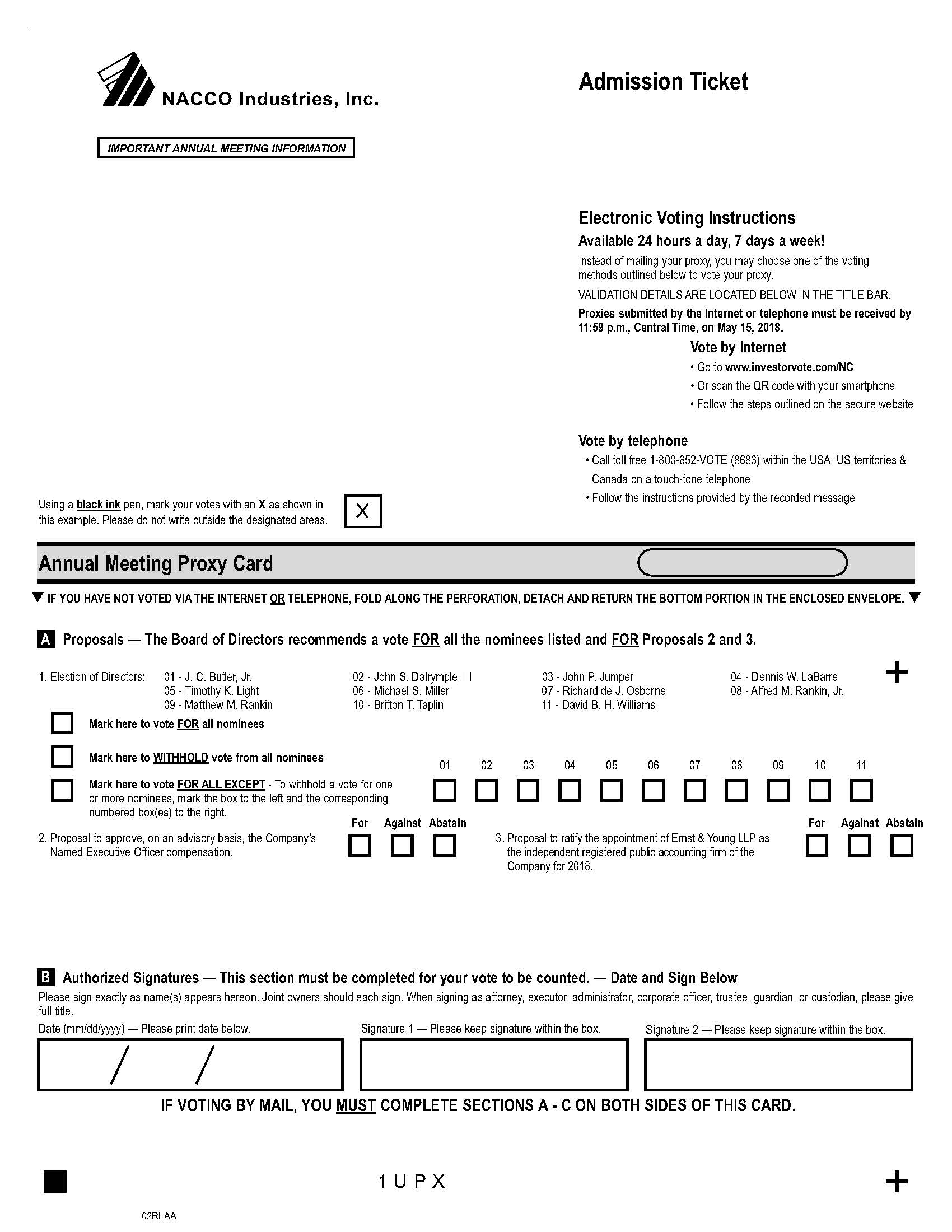

The Annual Meeting of stockholders (the "Annual Meeting") of NACCO Industries, Inc. (the "Company") will be held on Wednesday, May 16, 2018 at 11:00 a.m., at 5875 Landerbrook Drive, Cleveland, Ohio, for the following purposes:

1. | To elect eleven Directors, each for a term of one year and until their respective successors are duly elected and qualified; |

2. To approve, on an advisory basis, the Company's Named Executive Officer compensation;

3. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2018; and

4. To transact such other business as may properly come before the meeting.

The Board of Directors has fixed the close of business on March 19, 2018 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. The 2018 proxy statement and proxy card are being mailed to stockholders commencing on or about March 26, 2018.

John D. Neumann |

Secretary |

March 26, 2018

Your vote is very important. Whether or not you plan to attend the Annual Meeting in person, please promptly vote by telephone (1-800-652-8683) or over the Internet (www.investorvote.com/NC) or by completing and mailing the enclosed form of proxy. If you hold shares of both Class A Common Stock and Class B Common Stock, you only have to complete the single enclosed form of proxy or vote once via the Internet or telephone. A self-addressed envelope is enclosed and no postage is required if mailed in the United States. If you wish to attend the meeting and vote in person, you may do so.

The Company's Annual Report for the year ended December 31, 2017 is being mailed to stockholders with the 2018 Proxy Statement. The 2017 Annual Report contains financial and other information about the Company, but is not incorporated into the 2018 Proxy Statement and is not considered part of the proxy soliciting material. You should also note that other information contained on or accessible through our website other than this Proxy Statement is not incorporated by reference into this Proxy Statement and you should not consider that information to be part of this Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders To Be Held on May 16, 2018: The 2018 Proxy Statement and 2017 Annual Report are available, free of charge, at http://www.nacco.com by clicking on the "2018 Annual Meeting Materials" link.

NACCO INDUSTRIES, INC.

NACCO INDUSTRIES, INC.5875 LANDERBROOK DRIVE, SUITE 220

CLEVELAND, OHIO 44124-4069

PROXY STATEMENT — MARCH 26, 2018

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board") of NACCO Industries, Inc., a Delaware corporation (the "Company," "NACCO," "we," "our" or "us"), of proxies to be used at the annual meeting of our stockholders to be held on May 16, 2018 (the "Annual Meeting"). This Proxy Statement and the related form of proxy are being mailed to stockholders commencing on or about March 26, 2018.

If the enclosed form of proxy is executed, dated and returned or if you vote electronically, the shares represented by the proxy will be voted as directed on all matters properly coming before the Annual Meeting for a vote. Proxies that are properly signed without any indication of voting instructions will be voted as follows:

Proposal | Description | Board Vote Recommendation | Page Reference for More Detail |

1 | Election of eleven Director nominees named in this Proxy Statement | FOR | 46 |

2 | Approval, on an advisory basis, of the Company's Named Executive Officer compensation | FOR | 51 |

3 | The ratification of the appointment of Ernst & Young LLP ("EY") as our independent registered public accounting firm for 2018 | FOR | 53 |

N/A | Any other matters properly brought before the Board | As recommended by the Board or, if no recommendation is given, in the proxy holders' own discretion | N/A |

The proxies may be revoked at any time prior to their exercise by giving notice to us in writing or by executing and delivering a later-dated proxy. Attendance at the Annual Meeting will not automatically revoke a proxy, but a stockholder of record attending the Annual Meeting may request a ballot and vote in person, thereby revoking a previously granted proxy.

Stockholders of record at the close of business on March 19, 2018 will be entitled to notice of, and to vote at, the Annual Meeting. On that date, we had 5,362,773 outstanding shares of Class A Common Stock, par value $1.00 per share ("Class A Common"), entitled to vote at the Annual Meeting and 1,570,146 outstanding shares of Class B Common Stock, par value $1.00 per share ("Class B Common"), entitled to vote at the Annual Meeting. Each share of Class A Common is entitled to one vote for a nominee for each of the eleven directorships to be filled and one vote on each other matter properly brought before the Annual Meeting. Each share of Class B Common is entitled to ten votes for each such nominee and ten votes on each other matter properly brought before the Annual Meeting. Class A Common and Class B Common will vote as a single class on all matters anticipated to be brought before the Annual Meeting.

At the Annual Meeting, in accordance with Delaware law and our Amended and Restated Bylaws ("Bylaws"), the inspectors of election appointed by the Board for the Annual Meeting will determine the presence of a quorum and tabulate the results of stockholder voting. As provided by Delaware law and our Bylaws, the holders of a majority of the outstanding voting power of all classes of our stock, issued and outstanding, and entitled to vote at the Annual Meeting and present in person or by proxy at the Annual Meeting, will constitute a quorum for the Annual Meeting. The inspectors of election intend to (1) treat properly executed proxies marked "abstain" as "present" for purposes of determining whether a quorum has been achieved at the Annual Meeting and (2) treat proxies held in "street name" by brokers that are voted on at least one, but not all, of the proposals to come before the Annual Meeting (the "broker non-votes") as "present" for purposes of determining whether a quorum has been achieved at the Annual Meeting.

Proposal 1 is to elect eleven Directors, each for a term of one year and until their respective successors are duly elected and qualified. Our Bylaws provide that our Directors are elected by a plurality vote. Shares for which authority is

1

withheld to vote for Director nominees and broker non-votes will have no effect on the election of Directors except to the extent the failure to vote for a Director nominee results in another nominee receiving a larger number of votes. In accordance with Delaware law and our Bylaws, the eleven Director nominees receiving the greatest number of votes will be elected Directors.

Proposal 2 is an advisory vote on the Company's Named Executive Officer compensation. We will consider the affirmative vote of the holders of a majority of the votes cast as approval of Proposal 2. Although Proposal 2 is non-binding, the advisory vote allows our stockholders to express their opinions regarding our executive compensation. Abstentions and broker non-votes will not be treated as votes cast, so they will not affect the outcome of Proposal 2.

In accordance with our Bylaws, the affirmative vote of the holders of a majority of the votes cast is required to approve all other proposals that are brought before the Annual Meeting, including Proposal 3. As a result, abstentions will not be treated as votes cast so will not affect the outcome of Proposal 3. Because the ratification of the appointment of the independent auditor is considered a "routine" matter under NYSE rules, there will be no broker non-votes with respect to Proposal 3. Abstentions and broker non-votes with respect to any other proposal will not be counted for purposes of determining whether a proposal has received the required approval by our stockholders.

We are not aware of any business that may properly be brought before the Annual Meeting other than those matters described in this Proxy Statement. If any matters other than those shown on the proxy card are properly brought before the Annual Meeting, the proxy card gives discretionary authority to the persons named on the proxy card to vote the shares represented by such proxy card.

In accordance with Delaware law and our Bylaws, we may, by a vote of the stockholders, in person or by proxy, adjourn the Annual Meeting to a later date(s), without changing the record date. If we were to determine that an adjournment was desirable, the appointed proxies would use the discretionary authority granted pursuant to the proxy cards to vote in favor of such an adjournment.

2

PART I - CORPORATE GOVERNANCE INFORMATION | ||||

About NACCO | ||||

NACCO is the public holding company for The North American Coal Corporation ("NACoal"). NACoal operates surface mines that supply coal primarily to power generation companies under long-term contracts, and provides other value-added services to natural resource companies. In addition, its North American Mining business maintains and operates draglines and other equipment under contracts with sellers of aggregates. NACoal's service-based business model aligns its operating goals with customers' objectives.

Code of Conduct | ||||

We have adopted a Code of Corporate Conduct that applies to all of our Directors and employees and is designed to provide guidance on how to act legally and ethically while performing work for NACCO and NACoal. We have also adopted Corporate Governance Guidelines that provide a framework for the conduct of our Board. The Code of Corporate Conduct, the Corporate Governance Guidelines and our Independence Standards for Directors, as well as the charters of the committees of our Board, are available free of charge on our website at http://www.nacco.com, under the heading "Corporate Governance."

All of our Directors and employees annually complete certifications with respect to their compliance with our Code of Corporate Conduct.

Leadership Development and Succession Planning | ||||

Developing leaders who will successfully lead our Company into the future is one of our Board's most crucial functions. Annually, our Board formally reviews and discusses management development and succession plans for the Chief Executive Officer ("CEO") of the Company and each of his direct reports. With the assistance of the CEO, the Board also assesses the leadership potential of other individual senior executives throughout the Company. Succession planning and leadership development are top priorities of the Board and senior management.

Hedging and Speculative Trading Policies and Limited Trading Windows | ||||

The Company prohibits officers and Directors from purchasing financial instruments, including pre-paid variable forward contracts, equity swaps, collars and exchange funds, or otherwise engaging in transactions that are designed or have the effect of hedging or offsetting any change in the market value of equity securities granted to the officer or Director by the Company as part of his or her compensation or held, directly or indirectly, by the officer or Director. However, the Company does not prohibit its employees who are not officers from engaging in such transactions.

As noted elsewhere in this Proxy Statement, restricted shares of Class A Common that are issued to Directors and certain senior management employees of the Company for compensatory purposes are generally subject to transfer restrictions for a period of ten years from the last day of the applicable performance period and, during that time period, the restricted shares may not be transferred (subject to certain exceptions), hedged or pledged. The Company does not have a policy preventing employees, including executive officers and senior managers, or Directors from pledging shares of non-restricted Class A Common or Class B Common.

3

Board Composition | ||||

Our Board currently consists of eleven Directors. Directors are elected at each annual meeting to serve for one-year terms and until their respective successors are duly elected and qualified, subject to their earlier death, resignation or removal. If a nominee is unavailable for election at the time of the Annual Meeting, an event that the Board has no reason to believe will occur, proxy holders will vote for another nominee proposed by the Board or, as an alternative, the Board may reduce the number of Directors to be elected at the Annual Meeting. Biographical information and qualifications of our Directors are included under "Proposal 1 - Election of Directors" beginning on page 46.

Board Leadership Structure and Risk Management | ||||

The Company's roles of Chairman and Chief Executive Officer are separated, enabling J.C. Butler, Jr., our President and CEO, to focus on managing the Company and the NACoal business and Alfred M. Rankin, Jr., our non-executive Chairman, to devote his time and attention to matters of Board oversight and governance. The Board believes that Mr. Rankin, the Company's former President and CEO, possesses unique in-depth knowledge of the issues, opportunities and challenges facing the Company. Because of this knowledge and insight, the Board believes that Mr. Rankin is in a strong position to identify effective strategic opportunities and priorities and to lead the discussion for the execution of the Company's strategies and achievement of its objectives. As Chairman, Mr. Rankin is able to:

• | focus our Board on the most significant strategic goals and risks of the Company; |

• | utilize the individual qualifications, skills and experience of the other members of the Board to maximize their contributions to our Board; |

• | ensure that each other Board member has sufficient knowledge and understanding of our business to enable such other member to make informed judgments; |

• | facilitate the flow of information between our Board and our management; and |

• | provide the perspective of a long-term stockholder. |

This Board leadership structure also enhances the effectiveness of the NACoal Board of Directors, which has a parallel structure to the Company's Board and provides oversight at the strategic and operational level. Each Director who serves on our Board is also a member of the NACoal Board of Directors. Our Chairman also serves as the Chairman of the NACoal Board of Directors, which provides a common and consistent presence that enables the NACoal Board of Directors to function effectively and efficiently. We do not assign a lead independent Director, but the Chairman of our Compensation Committee presides at the regularly scheduled meetings of non-management Directors.

The Board oversees our risk management. The full Board regularly reviews information provided by management to oversee our risk identification, risk management and risk mitigation strategies. Our Board committees assist the full Board's oversight of our material risks by focusing on risks related to the particular area of concentration of the relevant committee. For example, our Compensation Committee oversees risks related to our compensation policies, our Audit Review Committee oversees financial reporting and control risks and our Nominating and Corporate Governance Committee oversees risks associated with the independence of the Board and potential conflicts of interest. Each committee reports on their discussions of the applicable risks to the full Board during Board meetings. The full Board incorporates the insight provided by these reports into its overall risk management analysis.

Directors' Meetings and Committees | ||||

Our Board held eleven meetings in 2017. During their tenure in 2017, all of our current Directors attended more than ninety percent (90%) of the meetings held by our Board and by the committees on which they served. We hold a regularly scheduled meeting of our Board in conjunction with our annual meeting of stockholders. Directors are expected to attend the annual meeting of stockholders absent an appropriate excuse. All of our Directors, as of the date of our 2017 annual meeting of stockholders, attended our 2017 annual meeting of stockholders.

In accordance with NYSE rules, our non-management Directors are scheduled to meet in executive session, without management, once a year. The Chairman of the Compensation Committee typically presides at such meetings. Additional

4

meetings of the non-management Directors may be scheduled when the non-management Directors believe such meetings are desirable. The determination of which Director should preside at any such additional meetings will be made based on the subject matter to be discussed at each such meeting. A meeting of the non-management Directors was held on February 14, 2018. Only independent Directors attended the meeting.

Our Board has established the following standing committees: an Audit Review Committee, a Compensation Committee, a Nominating and Corporate Governance ("NCG") Committee and an Executive Committee. The current members of each committee and the number of meetings held in 2017 are shown below:

Director | Audit Review | Compensation | NCG | Executive |

J.C. Butler, Jr. | X | |||

John S. Dalrymple, III | X | |||

John P. Jumper | X | X | Chair | X |

Dennis W. LaBarre | X | X | X | X |

Timothy K. Light | X | X | ||

Michael S. Miller | X | Chair | X | |

Richard de J. Osborne | Chair | X | X | X |

Alfred M. Rankin, Jr. | Chair | |||

Matthew M. Rankin | ||||

Britton T. Taplin | X | |||

David B.H. Williams | X | |||

2017 Meetings | 6 | 6 | 3 | 0 |

Audit Review Committee. Mr. Jumper is the only member of the Audit Review Committee who currently serves on more than three public company audit committees. The Audit Review Committee has responsibilities in its charter with respect to:

• | the quality and integrity of our financial statements; |

• | our compliance with legal and regulatory requirements; |

• | the adequacy of our internal controls; |

• | our policies to monitor and control our major financial risk exposures; |

• | the qualifications, independence, selection, compensation and retention of our independent registered public accounting firm; |

• | the performance of our internal audit department and independent registered public accounting firm; |

• | assisting our Board and us in interpreting and applying our Corporate Compliance Program and other issues related to corporate and employee ethics; and |

• | preparing the Annual Report of the Audit Review Committee to be included in our Proxy Statement. |

Our Board has determined that:

• | Messrs. Osborne and Miller qualify as audit committee financial experts as defined in rules issued by the U.S. Securities and Exchange Commission ("SEC"); |

• | each member of the Audit Review Committee is independent, as defined by the SEC and described in the listing standards of the NYSE; |

• | each member of the Audit Review Committee is financially literate as described in the NYSE listing standards; and |

• | Mr. Jumper's simultaneous service on the audit committees of more than three public companies does not impair his ability to effectively serve on the Company's Audit Review Committee. |

5

Compensation Committee. The Compensation Committee has responsibilities in its charter with respect to the administration of our policies for compensating our employees, including our executive officers and senior managers, and Directors. Among other things, these responsibilities include:

• | the review and approval of corporate goals and objectives relevant to compensation; |

• | the evaluation of the performance of the CEO, other executive officers and senior managers in light of these goals and objectives; |

• | the determination and approval of CEO, other executive officer and senior manager compensation levels; |

• | the consideration of whether the risks arising from our employee compensation policies are reasonably likely to have a material adverse effect on us; |

• | the making of recommendations to our Board, where appropriate or required, and the taking of other actions with respect to all other compensation matters, including equity-based plans and other incentive plans; |

• | the periodic review of Board compensation; and |

• | the review and approval of the Compensation Discussion and Analysis and the preparation of the annual Compensation Committee Report to be included in our Proxy Statement. |

The Compensation Committee may, in its discretion, delegate duties and responsibilities to one or more subcommittees or, in appropriate cases, to our executive officers and senior managers. The Compensation Committee retains and receives assistance in the performance of its responsibilities from an internationally recognized compensation consulting firm, discussed under "Compensation Consultants" on page 12. The Board has determined that each member of the Compensation Committee is independent, as defined in the SEC rules and described in the NYSE listing standards.

Nominating and Corporate Governance Committee. Among other things, the NCG Committee's responsibilities contained in its charter include:

• | the review and making of recommendations to our Board of the criteria for membership on our Board; |

• | the review and making of recommendations to our Board of the optimal number and qualifications of Directors believed to be desirable; |

• | the establishment and monitoring of a system to receive suggestions for nominees to directorships of the Company; |

• | the identification and making of recommendations to our Board of specific candidates for membership on our Board; and |

• | oversight of an annual review of our Board. |

The NCG Committee will consider Director candidates recommended by our stockholders. See "Procedures for Submission and Consideration of Director Candidates" on page 48. The NCG Committee is also responsible for reviewing and recommending changes to our Certificate of Incorporation, Bylaws, Code of Conduct and Corporate Governance Guidelines, as appropriate; overseeing evaluations of the Board's effectiveness; and annually reporting to the Board the NCG Committee's assessment of our Board's performance. The Board has determined that each member of the NCG Committee is independent, as described in the NYSE listing standards. The NCG Committee may consult with members of the Taplin and Rankin families, including Alfred M. Rankin, Jr. and J.C. Butler, Jr., regarding the composition of our Board.

Executive Committee. The Executive Committee may exercise all of the powers of our Board over the management and control of our business during the intervals between meetings of our Board.

Directors' Independence | ||||

Our Board has determined that, based primarily on the ownership of Class A Common and Class B Common by the members of the Taplin and Rankin families and their voting history, we have the characteristics of, and may be, a "controlled company," as defined in Section 303A of the NYSE listing standards. However, the Board has elected not to make use at the

6

present time of any of the exceptions to the NYSE listing standards that are available to controlled companies. Accordingly, at least a majority of the members of our Board is independent, as described in the NYSE listing standards, and our Compensation Committee, Audit Review Committee and NCG Committee are composed entirely of independent Directors. In making a determination as to the independence of our Directors, our Board considered Section 303A of the NYSE listing standards and broadly considered the materiality of each Director's relationship with us. Based on this criteria, our Board has determined that the following current Directors are independent:

John S. Dalrymple, III | Michael S. Miller |

John P. Jumper | Richard de J. Osborne |

Dennis W. LaBarre | Matthew M. Rankin |

Timothy K. Light | Britton T. Taplin |

The Board has also determined that James A. Ratner and David F. Taplin, who resigned as Directors on September 29, 2017 in connection with the Company's spin-off of Hamilton Beach Brands Holding Company ("HBBHC") to our stockholders, were independent as described in the NYSE listing standards.

Compensation Committee Interlocks and Insider Participation | ||||

None of our executive officers serves or has served on the board of directors or compensation committee of another company at any time during which an executive officer of such other company served as a member of our Compensation Committee.

Review and Approval of Related-Person Transactions | ||||

J.C. Butler, Jr., our current President and CEO, and David B.H. Williams, one of our Directors, are the sons-in-law of Alfred M. Rankin, Jr., our current non-executive Chairman who was our President and CEO until September 30, 2017. In 2017, Mr. Rankin received $5,654,763 in total compensation from us (as shown on the Summary Compensation Table on page 36), Mr. Butler received $3,620,722 in total compensation from us (as shown on the Summary Compensation Table on page 36) and Mr. Williams received $184,953 in total compensation from us (as shown on the Director Compensation Table on page 49).

The Audit Review Committee reviews all relationships and transactions in which the Company and our Directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest in such transactions. Our legal department is primarily responsible for the processes and controls to obtain information from the Directors and executive officers with respect to related-person transactions in order to enable the Audit Review Committee to determine whether we or a related person has a direct or indirect material interest in the transaction. In the course of its review, the Audit Review Committee considers:

• | the nature of the related person's interest in the transaction; |

• | the material terms of the transaction, including, without limitation, the amount and type of transaction; |

• | the importance of the transaction to the related person and to us; |

• | whether the transaction would impair the judgment of a Director or executive officer to act in our best interest; and |

• | any other matters the Audit Review Committee deems appropriate. |

Based on this review, the Audit Review Committee will determine whether to approve or ratify any transaction that is directly or indirectly material to us or a related person. Any member of the Audit Review Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote with respect to the approval or ratification of the transaction. However, such Director may be counted in determining the presence of a quorum at a meeting of the Audit Review Committee that considers the transaction.

7

Communications With Directors | ||||

Our stockholders and other interested parties may communicate with our Board as a group, with the non-management Directors as a group, or with any individual Director by sending written communications to NACCO Industries, Inc., 5875 Landerbrook Drive, Suite 220, Cleveland, Ohio 44124-4069, Attention: Secretary. Complaints regarding accounting, internal accounting controls or auditing matters will be forwarded directly to the Chairman of the Audit Review Committee. All other communications will be provided to the individual Director(s) or group of Directors to whom they are addressed. Copies of all communications will be provided to all other Directors. However, any communications that are considered improper for submission will not be provided to the Directors. Examples of communications that would be considered improper include, without limitation, customer complaints, solicitations, communications that do not relate, directly or indirectly, to our business, or communications that relate to improper or irrelevant topics.

Audit Matters | ||||

Pre-Approval Policies and Procedures

Under our pre-approval policies and procedures, only audit, audit-related services and limited tax services will be performed by EY, our principal independent registered public accounting firm. All such services must be pre-approved by our Audit Review Committee. For 2017, the Audit Review Committee authorized us to engage EY for specific audit, audit-related and tax services up to specified fee levels. The Audit Review Committee has delegated to the Chairman of the Audit Review Committee the authority to approve services other than audit, review or attest services, which approvals are reported to the Audit Review Committee at its next meeting. We provide a summary of authorities and commitments periodically at meetings of the Audit Review Committee. The Audit Review Committee has determined that the provision of non-audit services to us by EY may be generally incompatible with maintaining its independence. As a result, we have adopted a policy to limit the services provided by our independent registered public accounting firm that are not audit or audit-related services.

Fee Information

Fees for professional services provided by our auditors included the following (in millions):

2017 | 2016 | |

Audit Fees (1) | $2.5 | $2.9 |

Audit-Related Fees (2) | $0.5 | $0.1 |

Tax Fees (3) | $0 | $0 |

All Other Fees (4) | $0 | $0 |

Total | $3.0 | $3.0 |

(1) "Audit Fees" principally include services rendered by EY for the audit of our annual financial statements and internal controls; the reviews of the interim financial statements included in our Forms 10-Q and services provided in connection with statutory audits and regulatory filings with the SEC.

(2) "Audit-Related Fees" include assurance and related services rendered by EY for accounting advisory matters and audits of certain employee benefit plans.

(3) "Tax fees" are for tax compliance related services and were de minimis in 2017 and 2016.

(4) No other services were performed by EY for us during the last two fiscal years.

Report of the Audit Review Committee

The Audit Review Committee oversees our financial reporting process on behalf of the Board of Directors. The Audit Review Committee is comprised solely of independent Directors as defined by the SEC and described in the listing standards of the NYSE. The Audit Review Committee's responsibilities are listed on page 5 and the Audit Review Committee's charter is available at www.nacco.com. In fulfilling its oversight responsibilities, the Audit Review Committee reviewed and discussed the audited financial statements contained in our Annual Report with Company management.

8

The Audit Review Committee reviewed with EY, our independent auditor, which is responsible for expressing an opinion on the conformity of our annual financial statements with U.S. generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Review Committee by the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB"), including PCAOB Auditing Standard No. 1301, Communications With Audit Committees, the rules of the SEC, and other applicable regulations. In addition, the Audit Review Committee has discussed with EY the firm's independence from Company management and the Company, including the matters in the letter from EY required by PCAOB Rule 3526, Communication with Audit Committees Concerning Independence, and considered the compatibility of non-audit services with EY's independence. The Audit Review Committee also reviewed and discussed together with management and EY the Company's audited financial statements for the year ended December 31, 2017, and the results of management's assessment of the effectiveness of the Company's internal control over financial reporting and EY's audit of internal control over financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Review Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements and management's assessment of the effectiveness of the Company's internal control over financial reporting be included in our Annual Report on Form 10-K for the year ended December 31, 2017, filed by the Company with the SEC.

RICHARD DE J. OSBORNE, Chairman

JOHN P. JUMPER TIMOTHY K. LIGHT

DENNIS W. LABARRE MICHAEL S. MILLER

9

PART II - EXECUTIVE COMPENSATION INFORMATION | ||||

HBBHC Spin-Off

On September 29, 2017, the Company spun-off HBBHC, a former wholly owned subsidiary of the Company and the parent company of Hamilton Beach Brands, Inc. ("HBB") and The Kitchen Collection, LLC ("KC"), to our stockholders. The spin-off resulted in changes to our Named Executive Officer group (as defined below), as well as our compensation programs. For the portion of 2017 prior to the spin-off, Alfred M. Rankin, Jr. was employed by the Company. For periods after the spin-off:

• | Mr. Rankin retired from the Company. However, Mr. Rankin entered into a consulting agreement with the Company after the spin-off. This Proxy Statement includes compensation earned by Mr. Rankin (i) during the first nine months of 2017 prior to the spin-off when he was the President and CEO of NACCO, and (ii) during the last three months of 2017 when he was an independent consultant and Chairman of the Board of Directors for NACCO. |

• | J.C. Butler, Jr. became the Company's President and CEO on October 1, 2017. This Proxy Statement describes the compensation earned by Mr. Butler during the entire 2017 calendar year, both before and after the spin-off. |

• | Messrs. Trepp and Tidey remained executive officers of HBB, which is no longer a subsidiary of the Company. This Proxy Statement generally includes only compensation that was earned by Messrs. Trepp and Tidey during the first nine months of 2017 while HBB was a wholly owned subsidiary of NACCO. |

SEC rules require that HBBHC also disclose in its 2018 proxy statement compensation earned by Messrs. Rankin, Trepp and Tidey during the first nine months of 2017 prior to the spin-off date. As a result, the disclosure of pre-spin compensation contained in this Proxy Statement as to Messrs. Rankin, Trepp and Tidey is duplicative of the pre-spin compensation shown in HBBHC's 2018 proxy statement. NACCO and HBBHC did not both pay Messrs. Rankin, Trepp and Tidey for services provided prior to the spin-off, and Messrs. Rankin, Trepp and Tidey were not compensated twice for the same duties. As a result, the information contained in this Proxy Statement and HBBHC's 2018 proxy statement should be read carefully to avoid double-counting of such amounts.

The material elements of our 2017 compensation objectives and policies as they relate to the Named Executive Officers (the "NEOs") listed in the Summary Compensation Table on page 36 are described below. This discussion and analysis should be read in conjunction with all accompanying tables, footnotes and text in the Proxy Statement.

Summary of our Executive Compensation Program | ||||

Our executive compensation program strongly ties the compensation of our NEOs to our short-term and long-term business objectives and to stockholder interests. Key elements of compensation include base salary, annual incentive compensation, long-term incentive compensation and defined contribution retirement benefits.

At our 2017 annual meeting of stockholders, NACCO again received strong support for our compensation program with almost 98% of the votes cast approving our advisory vote on Named Executive Officer compensation. The Compensation Committee believes that this overwhelming support reinforces the philosophy and objectives of our executive compensation program. |

We pay for performance. We align our executive compensation with corporate performance on both a short-term and a long-term basis. In 2017, over 69% of Mr. Butler's target compensation was incentive-based and "at risk" and, as a group, over 65% of all other NEOs' target compensation was incentive-based and "at risk." (See table on page 14.) In addition, the long-term awards for Messrs. Rankin (through September 30, 2017) and Butler and Elizabeth I. Loveman are paid in the form of restricted shares of Class A Common which, as described in more detail on pages 25 and 26, are generally subject to transfer restrictions for a period of ten years. The value of these restricted stock awards continues to be at risk based on future Company performance and continues to align the interests of these NEOs with those of our stockholders.

10

Other key features of our executive compensation program include:

What We Do | What We Do Not Do |

Equity compensation awards for Directors and NACCO employees generally must be held for ten years - Stock awards cannot be pledged, hedged or transferred during this time | We do not provide our NEOs with employment or severance agreements or individual change in control agreements |

We provide limited change in control protections for all employees that (i) accelerate the time of payment of previously vested incentive benefits and non-qualified retirement benefits and (ii) provide for pro-rata target incentive payments for the year of any change in control | We do not provide any tax gross-ups except for certain relocation expenses (none were paid to the NEOs) and in two non-qualified retirement plans that were frozen in 2007 |

We provide a modest level of perquisites, the majority of which are paid in cash, that are determined based on market reasonableness | We do not provide our NEOs any minimum or guaranteed bonuses |

We use an independent compensation consultant who does not perform any other work for the Company | We do not take into account our long-term awards when determining our retirement benefits |

We set our target compensation at the 50th percentile of our chosen benchmark and deliver compensation above or below this level based on performance | We do not have any active defined benefit plans for non-union employees and only gave our NEOs credit for time worked under our frozen pension plans |

Compensation Discussion and Analysis | ||||

Executive Compensation Governance

The Compensation Committee of our Board of Directors and the Compensation Committee of the NACoal Board of Directors, which, together with the Compensation Committees of the HBB and KC Boards of Directors prior to the spin-off (collectively, the "Compensation Committee") unless the context requires otherwise, establish and oversee the administration of our policies for compensating our employees, including our NEOs. Each Compensation Committee consists solely of independent Directors. The Compensation Committee's responsibilities are listed on page 6.

Named Executive Officers for 2017

The NEOs for 2017 are listed below:

Name and Title | Employer |

J.C. Butler, Jr. (1) - President and CEO of NACCO and NACoal | NACCO |

Elizabeth I. Loveman - Vice President, Controller and Principal Financial Officer of NACCO | NACCO |

Alfred M. Rankin, Jr. (1) - Chairman of NACCO and NACoal | NACCO |

Carroll L. Dewing - Vice President - Operations of NACoal | NACoal |

John D. Neumann - Vice President, General Counsel and Secretary of NACCO and NACoal | NACoal |

Harry B. Tipton, III - Vice President - Engineering of NACoal | NACoal |

Gregory H. Trepp (2) - President and CEO of HBB and CEO of KC | HBB |

R. Scott Tidey (2) - Senior Vice President North American Sales & Marketing of HBB | HBB |

(1) | Mr. Butler became President and CEO of NACCO on October 1, 2017. Mr. Rankin retired as President and CEO of NACCO, effective September 30, 2017, after which he served as NACCO's non-executive Chairman of the Board. |

(2) | Although HBBHC and its subsidiaries (including HBB and KC) were spun-off from the Company in September 2017, SEC rules require that Messrs. Trepp and Tidey be included as NEOs in this Proxy Statement. |

11

Compensation Consultants

The Compensation Committee receives assistance and advice from the Korn Ferry Hay Group (the "Hay Group"), an internationally recognized compensation consulting firm. The Hay Group is engaged by and reports to the Compensation Committee and also provides advice and discusses compensation issues directly with management.

The Hay Group makes recommendations regarding substantially all aspects of compensation for our Directors and senior management employees, including the NEOs. For 2017, the Hay Group was engaged to make recommendations regarding:

• | Director compensation levels; |

• | 2017 salary midpoints, incentive compensation targets (calculated as a percentage of salary midpoint) and target total compensation for senior management positions; |

• | 2017 salary midpoints and/or range movement for all other employee positions; and |

• | mid-year Hay point levels, salary midpoints and incentive targets for all new senior management positions and/or changes to current senior management positions. |

All Hay point recommendations are determined by the Hay Group through the consistent application of the Hay point methodology, which is a proprietary method that takes into account the know-how, problem solving and accountability requirements of the position.

Representatives of the Hay Group attended two of the Compensation Committee meetings in 2017 and, during one of those meetings, consulted with the Compensation Committee in executive session without management present. The Hay Group did not provide any other services to us or the Compensation Committee in 2017. The Compensation Committee considered and assessed all relevant factors, including the six factors set forth in Rule 10c-1(b)(4)(i)-(vi) under the Securities Exchange Act of 1934 (the "Exchange Act"), that could give rise to a potential conflict of interest with respect to the Hay Group. Based on this review, the Compensation Committee assessed the independence of the Hay Group and is not aware of any conflict of interest that has been raised by the work performed by the Hay Group.

Hay Group's All Industrials Survey - Salary Midpoint

As a starting point for setting target total compensation, the Compensation Committee directed the Hay Group to use its proprietary survey of a broad group of domestic industrial organizations ranging in size from approximately $150 million to approximately $5 billion in annual revenues (the "All Industrials survey"). For 2017, participants in the All Industrials survey included 359 parent organizations and 460 independent operating units that satisfied the Hay Group's quality assurance controls and represented almost all segments of industry, including consumer products and mining.

The Compensation Committee chose this survey as its benchmark for the following reasons:

• | it provides relevant information regarding the compensation paid to employees, including senior management employees, with similar skill sets used in our industries and represents the talent pool from which we recruit; |

• | the use of a broad-based survey reduces volatility and lessens the impact of cyclical upswings or downturns in any one industry that could otherwise skew the survey results in any particular year; |

• | due to our holding group structure, this survey provides internal consistency in compensation among all of our subsidiaries, regardless of industry; and |

• | it provides a competitive framework for recruiting employees from outside our industries. |

Using its proprietary Hay point methodology, the Hay Group compares positions of similar scope and complexity with the data contained in the All Industrials survey. The Compensation Committee directs the Hay Group to derive a median salary level for each Hay point level targeted at the 50th percentile of the All Industrials survey (the "salary midpoint"). The Compensation Committee sets target compensation levels at (or slightly below) the salary midpoint determined by the Hay Group because it believes that the use of salary midpoints (i) helps to ensure our compensation program provides sufficient compensation to attract and retain talented executives and (ii) maintains internal pay equity, without overcompensating our employees.

12

Because salary midpoints are based on each Hay point level, all of the employees at a particular Hay point level generally have the same salary midpoint. The salary midpoints provided by the Hay Group are then used to calculate the total target compensation of all senior management employees, including the NEOs. Prior to the spin-off, the Compensation Committee applied special rules when setting Mr. Rankin's salary midpoint and total target compensation - refer to note (3) on page 14.

Compensation Policy and Methodology - Total Target Compensation

The guiding principle of our compensation program is the maintenance of a strong link between an employee's compensation, individual performance and the performance of the Company or the subsidiary for which the employee performs services. The primary objectives of our compensation program are to:

• | attract, retain and motivate talented management; |

• | reward management with competitive compensation for achievement of specific corporate and individual goals; |

• | make management long-term stakeholders in the Company; |

• | ensure that management's interests are closely aligned with those of our stockholders; and |

• | maintain consistency in compensation among all of the Company's subsidiaries. |

The Compensation Committee establishes a comprehensively defined "target total compensation" amount for each senior management employee following rigorous evaluation standards that help to ensure internal equity. In this process, the Compensation Committee reviews "tally sheets" for the NEOs and other senior management employees that list each employee's title, Hay points and the following information for the current year, as well as that being proposed for the subsequent year:

• | Salary midpoint, as determined by the Hay Group from the All Industrials survey; |

• | Cash in lieu of perquisites (if applicable); |

• | Short-term incentive target dollar amount (determined by multiplying the salary midpoint by a specified percentage of that midpoint, as determined by the Compensation Committee, with advice from the Hay Group, for each salary grade); |

• | Long-term incentive target dollar amount (determined in the same manner as the short-term incentive target); |

• | Target total compensation, which is the sum of the foregoing amounts; and |

• | Base salary (a defined amount derived from the salary midpoint). |

In November 2016, the Compensation Committee reviewed the tally sheets for each of our NEOs to decide whether it should make changes to the 2017 compensation program. The Compensation Committee determined that the overall program continued to be consistent with our compensation objectives and did not make any material changes for 2017.

The design of our compensation program provides employees with the opportunity to earn superior compensation for outstanding results. Base salaries are set at levels appropriate to allow our incentive plans to serve as significant motivating factors. Because our program provides significantly reduced compensation for results that do not meet or exceed the established performance targets for the year, it encourages NEOs to earn incentive pay greater than 100% of target over time by delivering outstanding managerial performance.

The Compensation Committee views the various components of compensation as related but distinct. While the Compensation Committee determines the salary midpoint based on the information provided from the All Industrials survey, it generally sets base salary levels between 80% and 120% of salary midpoint (up to 130% for Mr. Rankin before the Company's spin-off of HBBHC). The Compensation Committee also obtains the total target incentive compensation amounts from the All Industrials survey but determines the mix of short-term and long-term incentives in its discretion, based on its decision regarding how best to motivate our employees.

13

The following table sets forth target total compensation for the NEOs, as recommended by the Hay Group and approved by the Compensation Committee for 2017 before the HBBHC spin-off:

Named Executive Officer | (A) Salary Midpoint ($) | (%) | (B) (1) Cash in Lieu of Perquisites ($)(1) | (%) | (C) Short-Term Plan Target ($) | (%) | (D) Long-Term Plan Target ($) | (%) | (A)+(B)+(C)+(D) Target Total Compensation ($) |

J.C. Butler, Jr. (2) | $672,700 | 29% | $35,000 | 1% | $470,890 | 20% | $1,160,408 | 50% | $2,338,998 |

Elizabeth I. Loveman (2) | $244,400 | 56% | $8,000 | 2% | $85,540 | 20% | $98,371 | 23% | $436,311 |

Alfred M. Rankin, Jr. (2)(3) | $669,900 | 20% | $28,000 | 1% | $669,900 | 20% | $1,925,963 | 58% | $3,293,763 |

Carroll L. Dewing | $315,800 | 50% | $16,000 | 3% | $142,100 | 22% | $157,900 | 25% | $631,800 |

John D. Neumann | $298,300 | 50% | $16,000 | 3% | $134,235 | 22% | $149,150 | 25% | $597,685 |

Harry B. Tipton, III | $275,900 | 52% | $16,000 | 3% | $110,360 | 21% | $124,155 | 24% | $526,415 |

Gregory H. Trepp (4) | $672,700 | 31% | $34,992 | 2% | $470,890 | 22% | $1,009,050 | 46% | $2,187,632 |

R. Scott Tidey (4) | $399,700 | 44% | $19,992 | 2% | $199,850 | 22% | $279,790 | 31% | $899,332 |

(1) | In addition to providing limited perquisites to a limited number of employees in unique circumstances, senior management employees are paid a fixed dollar amount of cash in lieu of perquisites. The dollar amounts provided to the NEOs in 2017 were approved by the Compensation Committee in November 2016 based on a triennial analysis performed by the Hay Group in 2014. Based on this analysis, the Compensation Committee set a defined perquisite allowance for each senior management employee, based on Hay point levels. The Hay Group performed the triennial analysis in August 2017, at which time the Compensation Committee decided not to change the amounts. These amounts are paid in cash ratably throughout the year. This approach satisfies our objective of providing competitive total compensation to our NEOs while recognizing that perquisites are largely just another form of compensation. |

(2) | The amounts shown include a 15% increase from the Hay-recommended long-term plan target awards that the Compensation Committee applies each year to account for the immediately taxable nature of the NACCO Long-Term Equity Plan awards. See "NACCO Long-Term Equity Plan" beginning on page 28. |

(3) | Mr. Rankin served as the Chairman, President and CEO of the Company until September 30, 2017. He currently is non-executive Chairman of the Company. Additionally, in 2017, Mr. Rankin also served as the Chairman, President and CEO of Hyster-Yale Materials Handling, Inc. ("Hyster-Yale"). Hyster-Yale is a former subsidiary of the Company that was spun-off to our stockholders in 2012. The Compensation Committee directed the Hay Group to use the 50th percentile of the All Industrials survey to develop an appropriate salary midpoint for the position of a stand-alone Chairman, President and CEO of NACCO and its subsidiaries. The Compensation Committee then reduced this amount to reflect the fact that Mr. Rankin continued to provide services to both NACCO and Hyster-Yale in 2017. After considering several alternative reduction methods, in order to provide for compensation reflective of the value of Mr. Rankin's services to us, the Compensation Committee applied a 30% reduction factor to the Hay-recommended 2017 salary midpoint. As a result, the Compensation Committee set Mr. Rankin's 2017 target total compensation as follows: |

2017 Mr. Rankin Target Compensation | (A) Salary Midpoint | (B) Cash in Lieu of Perquisites | (C) Short-Term Plan Target (100%) | (D) Long-Term Plan Target (287.5%) | (A)+(B)+(C)+(D) Target Total Compensation |

Hay-Recommended Amounts | $957,000 | $40,000 | $957,000 | $2,751,375 | $4,705,375 |

Adjusted Amounts Determined by Compensation Committee (30% reduction - as reflected in above-table) | $669,900 | $28,000 | $669,900 | $1,925,963 | $3,293,763 |

(4) | Target total compensation for Messrs. Trepp and Tidey is the amount approved by the Compensation Committee in November 2016, and not a pro-rated amount to reflect the spin-off of HBBHC. |

Target total compensation is supplemented by health and welfare benefits and retirement benefits, which consist of both (i) qualified defined contribution plans and (ii) nonqualified defined contribution plans (the "Excess Plans"). Certain NEOs and other employees are also entitled to various frozen retirement benefits. In addition, the Compensation Committee may award discretionary cash and equity bonuses to employees, including the NEOs, although it rarely does so and did not do so for the NEOs in 2017.

14

Impact of HBBHC Spin-Off on 2017 Compensation

As a result of the HBBHC spin-off, the following changes were made to the compensation of Messrs. Rankin and Butler:

•Job Duties/Payrolls: Mr. Rankin retired from NACCO, effective September 30, 2017. Mr. Butler was appointed President and CEO of NACCO, effective October 1, 2017.

•Base Salary and Perquisite Allowances: Mr. Butler's base salary was increased to $630,000 following the spin-off to account for his new role as President and CEO of NACCO.

•Short-Term Incentive Compensation: Mr. Rankin's 2017 short-term award was based on pre-spin service and prorated to reflect his retirement. Payout of 75% of Mr. Butler's and Ms. Loveman's 2017 short-term awards (for the first three quarters of 2017 prior to the spin-off) was calculated taking into account the performance of NACoal and HBB, and payout of the remaining 25% was calculated taking into account the performance of NACoal only.

•Long-Term Incentive Compensation: Mr. Rankin's 2017 long-term award was based on pre-spin service and prorated to reflect his retirement. Payout of 75% of Mr. Butler's and Ms. Loveman's 2017 long-term awards (for the first three quarters of 2017 prior to the spin-off) was calculated taking into account the performance of NACoal and HBB, and payout of the remaining 25% was calculated taking into account the performance of NACoal only.

•Non-Executive Director and Consulting Fees: Following the spin-off, Mr. Rankin serves as the non-executive Chairman of the Board of NACCO and, in that Director role, he receives an annual retainer of $250,000 ($150,000 of which is paid in restricted shares of Class A Common). Mr. Rankin also entered into a consulting agreement with the Company to provide support to the President and CEO of NACCO following the spin-off. In this consulting role, Mr. Rankin receives a monthly consulting fee of $41,666.67.

Base Salaries

The Compensation Committee sets annual base salaries intended to be competitive in the marketplace to recruit and retain talented senior management employees. Base salaries provide employees with a set amount of money during the year with the expectation that they will perform their responsibilities to the best of their abilities and in accordance with our best interests. For 2017, the Compensation Committee determined the base salary for each NEO by taking into account his or her individual performance for 2016 and the relationship of his or her 2016 base salary to the new 2017 salary midpoint for his or her Hay point level. In general, base salaries are set between 80% and 120% of an employee's salary midpoint (up to 130% for Mr. Rankin). The Compensation Committee also took into account other relevant information, including:

• | general inflation, salary trends and economic forecasts provided by the Hay Group; |

• | general budget considerations and business forecasts provided by management; and |

• | any extraordinary personal or corporate events that occurred during the prior year. |

Employees with lower base salaries compared to their salary midpoint and/or superior performance have the potential for larger salary increases. Employees with higher base salaries compared to their salary midpoint and/or who have performed less effectively during the performance period have the potential for smaller or no salary increases.

The following table sets forth the annual base salary rate determined for each NEO for 2017:

Named Executive Officer | 2017 Salary Midpoint ($) | 2017 Base Salary and as a Percentage of Salary Midpoint ($) (%) | Change Compared to 2016 Base Salary (%) | |

J.C. Butler, Jr. (1) | $672,700 | $630,000 | 94% | 14.1% |

Elizabeth I. Loveman | $244,400 | $219,816 | 90% | 6.0% |

Alfred M. Rankin, Jr. (2) | $669,900 | $604,836 | 90% | 5.0% |

Carroll L. Dewing | $315,800 | $285,243 | 90% | 6.5% |

John D. Neumann | $298,300 | $296,780 | 99% | 4.5% |

Harry B. Tipton, III | $275,900 | $289,292 | 105% | 2.0% |

Gregory H. Trepp (3) | $672,700 | $700,000 | 104% | 18.7% |

R. Scott Tidey (3) | $399,700 | $399,700 | 100% | 15.3% |

15

(1) | Mr. Butler's salary midpoint was established before the spin-off. His annual base salary was increased from $566,064 to $630,000 following the spin-off. |

(2) | The Compensation Committee reduced Mr. Rankin's salary midpoint by 30% from the Hay-recommended amount for a stand-alone CEO of NACCO in 2017. |

(3) | The salary amounts included in the Summary Compensation Table on page 36 for Messrs. Trepp and Tidey are the amounts they earned before the spin-off date while HBB was a subsidiary of the Company. |

Incentive Compensation

Applicable Incentive Compensation Plans. One of the principles of our compensation program is that senior management employees, including the NEOs, are compensated based on the performance of the Company or the business unit for which the employee performed services. Due to our holding company structure, this means that the incentive compensation of the senior management employees who are employed by NACCO is based on the aggregate performance of our subsidiaries. For 2017, the NACCO employees were compensated based solely on the performance of NACoal (all four quarters) and HBB (first three quarters). The performance of KC was deemed immaterial and not included in the 2017 performance measures for NACCO employees. The table below identifies the incentive compensation plans in which the NEOs participated during 2017:

Named Executive Officer | Incentive Compensation Plans |

J.C. Butler, Jr., Elizabeth I. Loveman and Alfred M. Rankin, Jr. | NACCO Short-Term Plan NACCO Long-Term Equity Plan |

Carroll L. Dewing, John D. Neumann and Harry B. Tipton, III | NACoal Short-Term Plan NACoal Long-Term Plan |

Gregory H. Trepp and R. Scott Tidey | HBB Short-Term Plan HBB Long-Term Plan |

Overview. Our incentive compensation plans are designed to align the compensation interests of the senior management employees with our short-term and long-term interests. A significant portion of the NEOs' compensation is linked directly to the attainment of specific corporate financial and operating targets. The Compensation Committee believes that a material percentage of the NEOs' compensation should be contingent on the performance of the Company and/or the subsidiary for which they are responsible. As illustrated on the target total compensation table on page 14, over 69% of Mr. Butler's 2017 target compensation was variable or "at risk" and tied to Company performance and, as a group, over 65% of all other NEOs' target compensation was tied to Company performance. Each of the NEO's incentive compensation payouts for 2017 exceeded the sum of his or her fixed payments (base salary plus perquisite allowance) for the year.

The performance criteria and target performance levels for the incentive plans are established within the Compensation Committee's discretion, and are based upon management's recommendations as to the performance objectives of the Company or the particular business for the year. Two types of performance targets are used in the incentive compensation plans:

• | Targets Based on Annual Operating Plans. Certain performance targets are based on forecasts contained in the Company's or each subsidiary's 2017 annual operating plan ("AOP"). With respect to these targets, there is an expectation that these performance targets will be met during the year. If they are not, the participants will not receive all or a portion of the award that is based on these performance criteria. In 2017, the Compensation Committee set most of the financial performance targets under our short-term incentive plans against the 2017 AOPs so that our employees would receive an incentive payout if they achieved AOP results in the short-term. However, the entry level and maximum payment limits under these plans were set so that employees would not be over-compensated simply for meeting AOP results. |

• | Targets Based on Long-Term Goals. Other performance targets are not based on the 2017 AOPs. Rather, they are based on long-term goals established by the Compensation Committee. Because these targets are not based on the AOPs, it is possible in any given year that the level of expected performance may be above or below the specified performance target for that year. The performance targets under the HBB Long-Term Plan and the Special Project Award targets under the NACoal Long-Term Plan are examples of targets that are based on long-term corporate objectives. They are not based on targets established by management and contained in our five-year long-range business plan (although there is a correlation between them). These targets represent performance that the Compensation Committee believes we should deliver over the long-term, not the performance that is expected in the current year or the near term. |

16

Design of Incentive Program: Use of ROTCE to Establish Maximum Payment Pools. Historically, Internal Revenue Code Section 162(m) provided generally that we could not deduct compensation of more than $1 million that was paid to certain executive officers for federal income tax purposes unless that compensation was "qualified performance-based compensation." Among other requirements, the performance-based exception to Internal Revenue Code Section 162(m) required that deductible compensation be paid under a plan that has been approved by our stockholders. We previously obtained stockholder approval of the following incentive plans that provide benefits to the NEOs (the "162(m) Plans"):

• | The NACCO Annual Incentive Compensation Plan (the "NACCO Short-Term Plan"); |

• | The NACCO Executive Long-Term Incentive Compensation Plan (the "NACCO Long-Term Equity Plan"); |

• | The NACoal Annual Incentive Compensation Plan (the "NACoal Short-Term Plan"); |

• | The NACoal Long-Term Incentive Compensation Plan (the "NACoal Long-Term Plan"); |

• | The HBB Annual Incentive Compensation Plan (the "HBB Short-Term Plan"); and |

• | The HBB Long-Term Incentive Compensation Plan (the "HBB Long-Term Plan"). |

The exemption from Internal Revenue Code Section 162(m)'s deduction limit for qualified performance-based compensation has been repealed, effective for taxable years beginning after December 31, 2017, subject to transition relief available for certain arrangements in place as of November 2, 2017.

For each 162(m) Plan, we historically established a payment pool based on actual results against a pre-established return on total capital employed ("ROTCE") performance target that was designed to potentially meet the requirements for qualified performance-based compensation under Internal Revenue Code Section 162(m). The Compensation Committee has believed that use of ROTCE performance measures align the executives' interests with those of our stockholders.

For 2017, a minimum ROTCE target had to be met in order for any payment to be permitted, and any payment pool to be created, under a particular 162(m) Plan. A maximum ROTCE target established the maximum limit, and a maximum payment pool, for awards that can be paid to each covered employee under Internal Revenue Code Section 162(m) under a particular 162(m) Plan for the 2017 performance period. ROTCE is calculated as follows:

Earnings Before Interest After-Tax after adjustments

divided by

Total Capital Employed after adjustments

Earnings Before Interest After-Tax is equal to the sum of interest expense, net of interest income, less 38% for taxes (23% for taxes incurred in a legal entity that is eligible to claim percentage depletion or the applicable foreign tax rate for non-U.S. entities), plus consolidated net income from continuing operations. Total Capital Employed is equal to (i) the sum of the average debt and average stockholders' equity less (ii) average consolidated cash. For purposes of the NACCO Short-Term Plan and the NACCO Long-Term Equity Plan, average debt, stockholders' equity and consolidated cash are calculated by taking the sum of the balance at the beginning of the year and the balance at the end of each of the next twelve months divided by thirteen. ROTCE is calculated from the Company or subsidiary financial statements using average debt, average stockholders' equity and average cash based on the sum of the balance at the beginning of the year and the balance at the end of each quarter divided by five, which is then adjusted for any non-recurring or special items.

17

The same ROTCE target was used under the NACCO Short-Term Plan and NACCO Long-Term Equity Plan for 2017. For this purpose, ROTCE was calculated as follows:

2017 Net income | $ | 28,463 | |

Plus: 2017 Interest expense, net | 3,672 | ||

Less: Income taxes on 2017 interest expense | (1,395 | ) | |

Earnings Before Interest After-Tax | $ | 30,740 | |

2017 Average stockholders' equity (12/31/2016 and each of 2017's quarter ends) | $ | 220,458 | |

2017 Average debt (12/31/2016 and each of 2017's quarter ends) | 76,225 | ||

Less: 2017 Average cash (12/31/2016 and each of 2017's quarter ends) | (74,116 | ) | |

Total Capital Employed | $ | 222,567 | |

ROTCE (Before Adjustments) | 13.8 | % | |

Plus: Adjustments to Earnings Before Interest After-Tax | $ | 171,226 | |

Plus: Adjustments to Total Capital Employed | $ | 7,580 | |

NACCO Adjusted Consolidated ROTCE | 87.8 | % | |

Adjustments to the ROTCE calculation are for non-recurring or special items that were established by the Compensation Committee at the time the ROTCE targets were set. For 2017, the ROTCE adjustments related to (i) the effect of the HBBHC spin-off; and (ii) the after-tax impact of the following costs or expenses only if they were in excess of the amounts included in the 2017 AOPs:

• | any tangible or intangible asset impairment; |

• | certain litigation and retirement plan settlement costs; |

• | environmental expenses, asset retirement obligations, and black lung liability; and |

• | costs relating to valuation allowances against deferred tax assets. |

The Compensation Committee determined that these items were incurred in connection with improving our operations and, as a result, these items should not adversely affect incentive payments, as the actions or events were beneficial to us or were generally not within the employees' control. Similar ROTCE calculations (and adjustments) were made under the subsidiary 162(m) Plans in 2017.

For 2017, final ROTCE results under the 162(m) Plans resulted in the following maximum payment pools being available under the 162(m) Plans:

162(m) Plan | 2017 Consolidated ROTCE Target for 100% Payout (1) | 2017 Adjusted ROTCE Result | 2017 Maximum Permitted Payment (% of Target Award) |

NACCO Short-Term Plan | 3.5% | 87.8% | 150.0% |

NACCO Long-Term Equity Plan (2) | 3.5% | 87.8% | 350.0% |

NACoal Short-Term Plan | 4.0% | 20.7% | 150.0% |

NACoal Long-Term Plan (3) | 4.0% | 20.7% | 350.0% |

HBB Short-Term Plan | 8.0% | 32.3% | 150.0% |

HBB Long-Term Plan | 8.0% | 32.3% | 150.0% |

(1) | The 2017 ROTCE targets that were used in the 162(m) Plans are based on NACCO's consolidated ROTCE for the NACCO incentive plans, NACoal's consolidated ROTCE for the NACoal incentive plans and HBB's consolidated ROTCE for the HBB incentive plans. The NACCO and HBB 2017 ROTCE targets were unchanged from those in effect in 2016. The NACoal ROTCE target for the NACoal Short-Term Plan was reduced from 5% in 2015 to 4% in 2016 to reflect reduced forecasted ROTCE results for 2016 and 2017 as a result of the wind down of the Centennial Natural Resources, LLC ("Centennial") operations and lower projected revenue results for Mississippi Lignite Mining Company ("MLMC"). |

18

(2) | The general rule is that the cash-denominated awards under the NACCO Long-Term Equity Plan for 2017 may not exceed 350% of the target award levels. However, since the awards payable under the NACCO Long-Term Equity Plan are based on the sum of the payout percentages under the NACoal Long-Term Plan and the HBB Long-Term Plan, if the awards under both such plans achieve the maximum payout results due to extraordinary company results, then the maximum payment permitted under the NACCO Long-Term Equity Plan for 2017 is the amount specified in the plan document, which is the greater of $12 million or the fair market value of 500,000 Class A Common shares. |

(3) | As discussed in more detail on page 27, the NACoal Long-Term Plan consists of a "Standard Award" and "Special Project Award." The maximum payout for the Standard Award is 150%. The maximum payout for the Special Project Award is 200%. |

The Compensation Committee then exercises "negative discretion" under the 162(m) Plans by considering the results of underlying financial and operating performance measures for each applicable subsidiary to determine the final incentive compensation payment for each participant. These underlying financial and operating performance measures are listed in the incentive compensation tables beginning on page 20 and reflect the achievement of specified business goals for 2017 (for those targets that are based on the AOPs) or for future years (for those targets that are based on long-term goals). See "Deductibility of Executive Compensation" on page 34 for additional information about our philosophy on structuring our incentive compensation plans for tax purposes.

Incentive Compensation Tables. When reviewing the incentive compensation tables beginning on page 20, the following factors should be considered:

• | The applicable incentive compensation plan, performance objectives and targets and payout percentages are different for each NEO, depending on his or her employer. The Compensation Committee considered the factors described under "Incentive Compensation - Overview" beginning on page 16 to set the underlying performance criteria and target performance levels for the 2017 incentive compensation awards. The particular performance criteria for 2017 were chosen because they were believed to have a positive correlation with long-term stockholder returns. |

• | In calculating the final performance results, adjustments were made for various items incurred in connection with improving our operations, consistent with the adjustments listed for the ROTCE calculation above. |

• | Achievement percentages are based on the formulas contained in underlying performance guidelines adopted annually by the Compensation Committee for each incentive plan. The formulas do not provide for straight-line interpolation from the performance target to the maximum payment target. |

• | Target awards for each executive are equal to a specified percentage of the executive's 2017 salary midpoint, based on the number of Hay points assigned to the position and the appropriate level of incentive compensation targets recommended by the Hay Group and adopted by the Compensation Committee at that level. The Compensation Committee then increases the target awards under the NACCO Long-Term Equity Plan by 15% to account for the immediately taxable nature of the award. |

• | The plans have a one-year performance period. However, the Compensation Committee suspended the KC long-term plan for 2017 and did not take KC performance results into account when determining the incentive compensation benefits of the NACCO employees for 2017. |

• | Final awards are determined after year-end by comparing actual performance to the pre-established performance targets that were set by the Compensation Committee. |

• | The Compensation Committee, in its discretion, may decrease or eliminate awards. The Compensation Committee, in its discretion, may also increase awards and may approve the payment of awards where business unit performance would otherwise not meet the minimum criteria set for payment of awards, although it rarely does so and, in the case of the NEOs, was prohibited from doing so under the 162(m) Plans. |

• | Short-term plan awards are paid annually in cash. Except for earlier payments in the case of death, disability and other limited circumstances, HBB and NACoal Long-Term Plan awards are paid in cash after a three-year holding period. NACCO Long-Term Equity Plan awards are paid annually as a combination of cash and restricted shares of Class A Common. The restricted shares are generally subject to a holding period of ten years. |

19

• | All awards are fully vested when granted, with the exception of any Special Project Awards issued under the NACoal Long-Term Plan which are not vested until after the end of the three-year holding period when the Compensation Committee approves payment. |

• | Due to the nature of the NACoal and HBB Long-Term Plans, the awards and payments under the plans are also required to be described in the Nonqualified Deferred Compensation Table on page 42. |

Short-Term Incentive Compensation

Depending on the NEO's position, the short-term plans were designed to provide target short-term incentive compensation between 35% and 100% of their 2017 salary midpoint. The following table shows the short-term target awards and payouts approved by the Compensation Committee for each NEO for 2017:

Named Executive Officer and Short-Term Plan (1) | (A) 2017 Salary Midpoint ($) | (B) Short-Term Plan Target as a % of Salary Midpoint (%) | (C) = (A)x(B) Short-Term Plan Target ($) | (D) Short-Term Plan Payout as % of Target (%) (1) | (E) = (C) x (D) Short-Term Plan Payout ($) |

J.C. Butler, Jr. (NACCO Short-Term Plan) | $672,700 | 70% | $470,890 | 118.9% | $559,712 |

Elizabeth I. Loveman (NACCO Short-Term Plan) | $244,400 | 35% | $85,540 | 114.4% | $97,914 |

Alfred M. Rankin, Jr. (NACCO Short-Term Plan) (2) | $669,900 | 100% | $669,900 | 112.3% | $562,643 |

Carroll L. Dewing (NACoal Short-Term Plan) (3) | $315,800 | 45% | $142,100 | 120.8% | $178,626 |

John D. Neumann (NACoal Short-Term Plan) (3) | $298,300 | 45% | $134,235 | 120.8% | $169,519 |

Harry B. Tipton, III (NACoal Short-Term Plan) (3) | $275,900 | 40% | $110,360 | 120.8% | $125,594 |

Gregory H. Trepp (HBB Short-Term Plan) (4) | $672,700 | 70% | $470,890 | 103.7% | $488,313 |

R. Scott Tidey (HBB Short-Term Plan) (4) | $399,700 | 50% | $199,850 | 103.7% | $207,244 |

(1) | Refer to the tables that follow for detailed calculations of the 2017 payout percentages for each short-term plan. |

(2) | Mr. Rankin's actual short-term plan payout amount, included in the Summary Compensation Table on page 36, was pro-rated based on his period of service in 2017 prior to retirement on September 30, 2017. |