Form DEF 14A HNI CORP For: May 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Under Rule 14a-12

|

|

HNI CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

||

|

☒

|

No fee required

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

HNI CORPORATION

600 EAST SECOND STREET

MUSCATINE, IOWA 52761

563-272-7400

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2018 Annual Meeting of Shareholders of HNI Corporation will be held at HNI Corporate Headquarters, 600 East Second Street, Muscatine, Iowa, on Tuesday, May 8, 2018, beginning at 10:30 a.m. (Central Daylight Time), for the purposes of:

| 1. |

Electing the three Directors named in the accompanying proxy statement;

|

| 2. |

Ratifying the Audit Committee's selection of KPMG LLP as the Corporation's independent registered public accountant for the fiscal year ending December 29, 2018;

|

| 3. |

Holding an advisory vote to approve named executive officer compensation; and

|

| 4. |

Transacting any other business properly brought before the meeting or any adjournment or postponement.

|

The holders of record of HNI Corporation common stock, par value $1.00 per share, as of the close of business on March 9, 2018, are entitled to vote at the meeting.

You are encouraged to attend the meeting.

By Order of the Board of Directors,

Steven M. Bradford

Senior Vice President, General Counsel and Secretary

March 23, 2018

YOUR VOTE IS VERY IMPORTANT. PLEASE MARK, SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PREPAID ENVELOPE OR VOTE USING THE TELEPHONE OR INTERNET VOTING PROCEDURES DESCRIBED ON THE PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOUR SHARES ARE HELD IN THE NAME OF A BANK, BROKER OR OTHER HOLDER OF RECORD, TELEPHONE OR INTERNET VOTING WILL BE AVAILABLE TO YOU ONLY IF OFFERED BY THEM. THEIR PROCEDURES SHOULD BE DESCRIBED ON THE VOTING FORM THEY SEND TO YOU.

| 1 | |

| 4 | |

| 4 | |

| 6 | |

| 7 | |

| 10 | |

| 12 | |

| 13 | |

| 13 | |

| 13 | |

| 13 | |

| 14 | |

| 14 | |

| 15 | |

| 16 | |

| 16 | |

| 28 | |

| 29 | |

| 30 | |

| 31 | |

| 32 | |

| 33 | |

| 33 | |

| 34 | |

| 38 | |

| 38 | |

| 40 | |

| 40 | |

| 40 | |

|

41

|

[This page intentionally left blank]

HNI Corporation

600 East Second Street

Muscatine, Iowa 52761

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 8, 2018

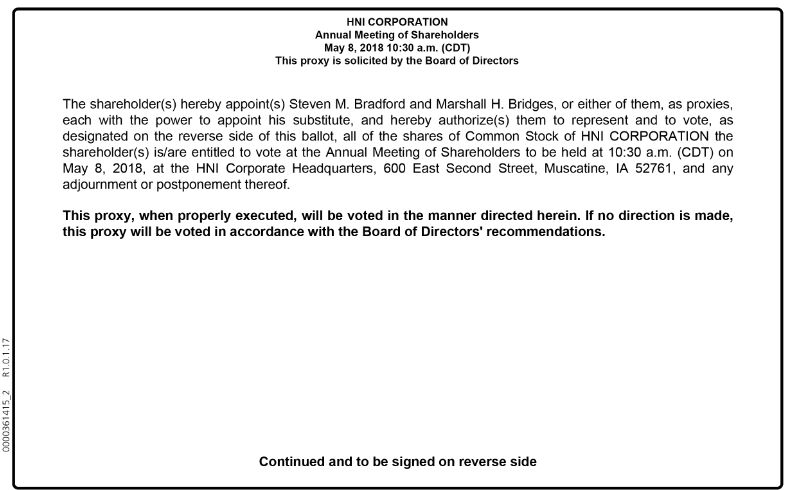

HNI Corporation (the "Corporation," "we," "our" or "us") is mailing this Proxy Statement, with the accompanying proxy card, to you on or about March 23, 2018, in connection with the solicitation of proxies by and on behalf of the Corporation's Board of Directors (the "Board" or "Directors") for the 2018 annual meeting of shareholders and any adjournment or postponement of the meeting (the "Meeting"). The Meeting will be held on Tuesday, May 8, 2018, beginning at 10:30 a.m., Central Daylight Time, at HNI Corporate Headquarters, 600 East Second Street, Muscatine, Iowa.

Who can attend and vote at the Meeting?

Shareholders of record as of the close of business on March 9, 2018 (the "Record Date") are entitled to attend and vote at the Meeting. Each share of the Corporation's common stock, par value $1.00 per share ("Common Stock"), is entitled to one vote on all matters to be voted on at the Meeting and can be voted only if the shareholder of record is present to vote or is represented by proxy. The proxy card provided with this Proxy Statement indicates the number of shares of Common Stock you own and are entitled to vote at the Meeting.

What constitutes a quorum at the Meeting?

The presence at the Meeting, in person or represented by proxy, of the holders of a majority of the outstanding shares of Common Stock ("Outstanding Shares") on the Record Date will constitute a quorum. On the Record Date, there were 43,442,707 Outstanding Shares. To determine whether a quorum exists, proxies received but marked "abstain" and so-called "broker non-votes" (described on the following page) will be counted as present.

What will I be voting on?

| • |

Election of each of the three nominees for Director named on page 5 of this Proxy Statement under "Proposal No. 1 – Election of Directors."

|

| • |

Ratification of the Audit Committee's selection of KPMG LLP as the Corporation's independent registered public accountant for the fiscal year ending December 29, 2018 ("Fiscal 2018"), as described on page 14 of this Proxy Statement under "Proposal No. 2 – Ratification of Audit Committee's Selection of KPMG LLP as the Corporation's Independent Registered Public Accountant for Fiscal 2018."

|

| • |

Adoption of an advisory resolution approving the compensation of the Corporation's named executive officers as described on page 38 of this Proxy Statement under "Proposal No. 3 – Advisory Vote to Approve Named Executive Officer Compensation."

|

How do I vote?

We urge you to vote by "proxy" (one of the individuals named on your proxy card will vote your shares as you have directed) even if you plan to attend the Meeting so we will know as soon as possible whether a quorum exists for us to hold the Meeting. Follow the instructions on your enclosed proxy card. Telephone and Internet voting is available to all registered and most beneficial holders.

Shareholders voting by proxy may use one of the following three options:

| • |

Fill out the enclosed proxy card, sign it and mail it in the enclosed, postage-paid envelope;

|

| • |

Vote by Internet (if available, instructions are on the proxy card); or

|

| • |

Vote by telephone (if available, instructions are on the proxy card).

|

If your shares of Common Stock are held for you as the beneficial owner through a broker, trustee or other nominee (such as a bank) in "street name," rather than held directly in your name, please refer to the information provided by your bank, broker or other holder of record to determine the options available to you.

The telephone and Internet voting facilities for shareholders will close at 11:59 p.m. Eastern Daylight Time on May 7, 2018. If you vote by mail, you should mail your signed proxy card sufficiently in advance for it to be received by May 7, 2018.

If you hold shares through the Corporation's retirement plan, your vote must be received by 11:59 p.m. Eastern Daylight Time on May 3, 2018.

If you sign, date and return the proxy card but do not specify how your shares are to be voted, then your proxy will vote your shares "FOR" all proposals, "FOR" election of each nominee for Director, and in your proxy's discretion as to any other business which may properly come before the Meeting.

How do I vote if my shares of Common Stock are held in "street name"?

You will need to instruct your broker, trustee or other nominee how to vote your shares. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Meeting unless you obtain a legal proxy from the broker, trustee or other nominee holding your shares, giving you the right to vote the shares at the Meeting. Your broker, trustee or other nominee has enclosed with this Proxy Statement, or will provide upon request, voting instructions for you to use in directing the broker, trustee or other nominee how to vote your shares.

What discretion does my broker, trustee or other nominee have to vote my shares of Common Stock held in "street name"?

A broker, trustee or other nominee holding your shares of Common Stock in "street name" must vote those shares according to specific instructions it receives from you. New York Stock Exchange ("NYSE") rules determine the proposals on which brokers may not vote without specific instructions from you ("Non-Routine Proposals"). Your shares will not be voted on any Non-Routine Proposal if you do not provide voting instructions, giving rise to what is called a "broker non-vote." Shares represented by broker non-votes will be counted as present for purposes of determining a quorum.

It is important, if you hold shares in "street name," you provide specific voting instructions to your broker, trustee or other nominee or your shares will not be voted with respect to Proposal Nos. 1 and 3 because they are Non-Routine Proposals for which your broker, trustee or other nominee may not vote your shares in its discretion.

Can I change or revoke my vote or revoke my proxy?

Yes. You may change your vote at any time before the proxy is voted at the Meeting. For shareholders of record, if you voted your proxy card by mail, you may revoke your proxy at any time before it is voted by executing and delivering a timely and valid later-dated proxy, by voting by ballot at the Meeting or by giving written notice to HNI's Corporate Secretary. If you voted via the Internet or by telephone you may also change your vote with a timely and valid later-dated Internet or telephone vote, as the case may be, or by voting by ballot at the Meeting. Attendance at the Meeting will not revoke a proxy unless (a) you give proper written notice of revocation to the Secretary before the proxy is exercised or (b) you vote by ballot at the Meeting. Once voting is completed at the Meeting, you will not be able to revoke your proxy or change your vote.

If your shares are held in "street name," you must follow the specific voting directions provided to you by your broker, trustee or other nominee to change or revoke any instructions you have already provided.

How do I vote my shares in the Corporation's retirement plan?

If you participate in the Corporation's retirement plan, the proxy card you receive will also include Common Stock allocated to your account. Properly completed and signed proxy cards, including telephone and Internet voting, will serve to instruct the plan trustee on how to vote any shares allocated to your account and a portion of all shares as to which no instructions have been received (the "undirected shares") from plan participants. The proportion of the undirected shares to which your instructions will apply will be equal to the proportion of the shares to which the trustee receives instructions represented by your shares.

How is the Corporation soliciting proxies?

The Corporation bears the cost of preparing, assembling and mailing the proxy materials related to the solicitation of proxies by and on behalf of the Board. In addition to the use of the mail, certain of the Corporation's officers may, without additional compensation, solicit proxies in person, by telephone or through other means of communication. The Corporation will bear the cost of this solicitation.

How will my vote get counted?

Broadridge Financial Solutions ("Broadridge") will use an automated system to tabulate the votes and will serve as the Inspector of Election.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations identifying individual shareholders are handled in a manner to protect your voting privacy. Your vote will not be disclosed either within the Corporation or to third parties, except:

| • |

as necessary to meet applicable legal requirements;

|

| • |

to allow for the tabulation of votes and certification of the vote; and

|

| • |

to facilitate a successful proxy solicitation.

|

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Corporation's management.

How do I get to the Meeting location?

The Meeting will be held at HNI Corporate Headquarters, 600 East Second Street, Muscatine, Iowa. If driving to the Meeting from Quad City International Airport, from the main exit traffic light go straight onto I-74 to I-280, turn right (cloverleaf) onto I-280 West, drive approximately 11 miles crossing the Baker Bridge, take the second exit in Iowa (Exit 6 – Muscatine),

at the traffic light turn left (west) onto Highway 61 South, continue approximately 22 miles to Muscatine, continue on Hwy 61 bypass, turn left (south) at traffic light onto Park Avenue, veer right at stop sign at five-way stop onto Second Street, HNI Corporate Headquarters is approximately one mile on the left. If driving to the Meeting on I-80, take Exit 271 (Hwy 38 South), drive approximately 12 miles, proceed through major intersection of Hwy 38 and Hwy 61, continue on Park Avenue, veer right at stop sign at five-way stop onto Second Street, HNI Corporate Headquarters is approximately one mile on the left.

Where can I find proxy materials?

The Proxy Statement and annual report to security holders are available at http://investors.hnicorp.com/Docs.

The Corporation makes its annual reports, annual meeting notices and proxy statements available on the Internet. If you wish to receive these documents in the future over the Internet rather than receiving paper copies in the mail, please follow the instructions on your proxy card. These documents will be available on or about March 23, 2018 at http://investors.hnicorp.com/Docs. Once you give your consent, it will remain in effect until you notify the Corporation you wish to resume mail delivery of the annual reports and proxy statements. Even though you give your consent, you still have the right at any time to request copies of these documents at no charge by writing to the Corporate Secretary at HNI Corporation, 600 East Second Street, Muscatine, Iowa 52761, or calling the Corporation at 563-272-7123.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card you receive.

The Securities and Exchange Commission (the "SEC") has adopted rules permitting delivery of a single annual report and/or proxy statement to any household at which two or more shareholders reside, whom the Corporation believes to be members of the same family. If you wish to participate in this program and receive only one copy of future annual reports and/or proxy statements, please write to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. Your consent to receive only one copy of the annual report and/or proxy statement will remain in effect until Broadridge receives a written revocation notice from you, in which case the Corporation will begin sending individual copies within 30 days. The Corporation will continue to separately mail a proxy card for each registered shareholder account. The Corporation will promptly deliver separate copies of its annual report and/or proxy statement upon request. Shareholders may request copies by writing to the Corporate Secretary at HNI Corporation, 600 East Second Street, Muscatine, Iowa 52761, or calling the Corporation at 563-272-7123.

Did the Corporation utilize the SEC's "notice and access" proxy rules for delivery of the voting materials this year?

No. The Corporation delivered its voting materials in the same manner as it has in the past. However, many shareholders have previously consented to receive electronic delivery of the proxy statement and annual report to security holders and therefore did not receive hard copies of these materials. Next year, the Corporation intends to use the notice and access method of providing proxy materials to shareholders via the Internet. We believe this process will provide shareholders with a convenient and quick way to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials.

Where can I find the voting results of the Meeting?

The Corporation intends to announce preliminary voting results at the Meeting and will publish final results on a Current Report on Form 8-K, which will be filed with the SEC within four business days after the Meeting and available on the Corporation's website.

The Amended and Restated By-laws, as amended, of HNI Corporation (the "By-laws") currently provide for ten Directors and the Board currently consists of ten Directors. Nine of the ten Directors are independent Directors as further discussed on page 7 of this Proxy Statement under "Corporate Governance and Board Matters – Director Independence." Stan A. Askren, Chairman, President and Chief Executive Officer of the Corporation, is the only Director employed by the Corporation and is not independent under the NYSE listing standards or the Corporation's categorical independence standards (the "Categorical Standards").

The Board is divided into three classes. Generally, one class is elected each year for a term of three years. The terms of the three nominees, all of whom are current Directors, expire in 2018. If elected, the three Board-nominated candidates would serve a three-year term expiring at the Corporation's 2021 annual meeting of shareholders.

The Board has adopted guidelines for identifying and evaluating candidates for Director. Under those guidelines, the Corporation's Public Policy and Corporate Governance Committee (the "Governance Committee") takes into account a number of factors when identifying potential nominees, including: possession of desired skills, experience and abilities identified by the Governance Committee; ability to communicate ideas and contribute to Board deliberations; independence from management; diversity; judgment, integrity and reputation; existing commitments to other businesses; potential conflicts of interest with other pursuits; and legal constraints. Although the Corporation has no specific policy on diversity, the guidelines broadly define diversity to include factors such as age, race, gender, education, ethnicity, career experience and personality; understanding of and experiences in manufacturing, distribution, technology, finance and marketing; and international experience and culture. The Governance Committee reviews these factors and others considered useful by the Governance Committee in the context of an assessment of the perceived needs of the Board from time to time. The Governance Committee may use a variety of means to identify potential nominees, including recommendations from the Chairman, Directors or others associated with the Corporation. The Governance Committee may also retain third-party search firms to identify potential nominees based on the Corporation's established criteria for director candidates discussed above. The Governance Committee screens potential candidates and recommends suitable candidates to the Board for nomination.

The Corporation does not have minimum qualifications for Directors; however, Directors should possess the highest personal and professional integrity and ethics and be willing and able to devote the required time to the Corporation. The Board believes it should be comprised of Directors with varied and complementary backgrounds, which together build the overall strength of the Board.

Shareholders wishing to recommend a candidate for nomination by the Corporation as Director for inclusion in the Corporation's proxy statement for the 2019 annual meeting of shareholders should write to the Corporation's Corporate Secretary before November 23, 2018, and include the information required by Section 2.16(a)(2) of the By-laws. The Governance Committee will consider candidates for Director recommended by shareholders by applying the criteria for candidates described above and considering the additional information required by the By-laws.

Nominees for Election

The Board is nominating for election Stan A. Askren, Mary A. Bell and Ronald V. Waters, III, each for a term of three years (collectively, the "Nominees"). The Nominees elected as Directors at the Meeting will hold office for the indicated term or until their respective successors are elected and qualified, subject to their prior death, resignation or removal.

Ms. Bell and Messrs. Askren and Waters were most recently elected as Directors at the Corporation's 2015 annual meeting of shareholders. Below is biographical information as well as the particular experience, qualifications, attributes and/or skills of each Nominee which led the Board to conclude the Nominee should serve as a Director. In addition, each Nominee must possess the highest personal and professional integrity and ethics and a willingness and ability to devote the required time to the Corporation. The Board has determined each Nominee possesses these qualities.

Stan A. Askren, age 57, has been a Director of the Corporation since 2003. Mr. Askren has also been the Chairman and Chief Executive Officer since 2004 and the President of the Corporation since 2003. He is a director of Armstrong World Industries, Inc., a global leader in the design and manufacture of ceiling systems and a director of Allison Transmission Holdings, Inc., the world’s largest manufacturer of fully automatic transmissions for medium and heavy duty commercial vehicles. Mr. Askren brings to the Board extensive experience and knowledge of the Corporation’s business, operations and culture. Mr. Askren was vice president of marketing and an executive vice president of the Corporation’s hearth products operating segment. He worked in the Corporation’s office furniture operating segment as a group vice president of The HON Company and president of Allsteel Inc. Mr. Askren has served as the vice president of human resources and an executive vice president of the Corporation. Mr. Askren also brings to the Board finance and corporate governance experience through his service on the audit and compensation committees of other public companies.

Mary A. Bell, age 57, has been a Director of the Corporation since 2006. Ms. Bell has been a director of Husco International Inc. since November 2015. Prior to her retirement in July 2015, Ms. Bell was a Vice President of Caterpillar, the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. From 2004 to 2007, she was the Vice President of Caterpillar’s Logistics Division and served as Chairman and President of Cat Logistics Services, Inc., formerly a wholly owned subsidiary of Caterpillar. Ms. Bell brings to the Board considerable logistics, manufacturing and dealer channel expertise and general management experience derived primarily from her service in various roles at Caterpillar.

Ronald V. Waters, III, age 66, has been a Director of the Corporation since 2002. Mr. Waters has been an independent business consultant since May 2010. Previously, from 2009 to May 2010, he was a Director and the President and Chief Executive Officer of LoJack Corporation, and from 2007 to 2008, he was a Director and the President and Chief Operating Officer of LoJack. He is a director of Fortune Brands Home & Security, Inc., an industry-leading home and security products company, and Paylocity Corporation, a leading software provider of cloud-based payroll and human capital management software. From October 2012 to January 2015, Mr. Waters was a director of Chiquita Brands International, Inc. Mr. Waters brings to the Board chief executive officer experience through his former role as Chief Executive Officer of LoJack and significant finance expertise derived primarily from his service on the audit committee of two other public companies and previous roles as Chief Operating Officer at two public companies, Chief Financial Officer at Wm. Wrigley Jr. Company, Controller at The Gillette Company and partner of a large public accounting firm. He has extensive outside audit experience, and although Mr. Waters does not currently serve on the Corporation’s Audit Committee, he qualifies as an “audit committee financial expert.” Mr. Waters also brings to the Board international, law and information technology expertise derived primarily from his service in various roles at several large public companies.

The Corporation believes all Nominees listed above will be available to serve if elected. However, if any one of them becomes unavailable, the persons named as proxies in the accompanying proxy card have discretionary authority to vote for a substitute chosen by the Board. Any vacancies not filled at the Meeting may be filled by the Board.

Required Vote

Election of the Nominees as Directors requires the affirmative vote of the holders of a majority of the Outstanding Shares voted at the Meeting. Abstentions and broker non-votes will not be counted for purposes of determining whether this Proposal has received sufficient votes for approval.

Recommendation of the Board

|

THE BOARD RECOMMENDS A VOTE "FOR" THE ELECTION OF THE NOMINEES AS DIRECTORS.

|

Below is biographical information about each incumbent Director as well as their particular experience, qualifications, attributes and/or skills which led the Board to conclude the Director should serve as a Director. In addition, each Director must possess the highest personal and professional integrity and ethics and a willingness and ability to devote the required time to the Corporation. The Board has determined each Director possesses these qualities.

Mses. Jones and Smith and Mr. Porcellato comprise a class of Directors whose terms will expire at the Corporation's 2019 annual meeting of shareholders.

Mary K.W. Jones, age 49, has been a Director of the Corporation since February 2016. Since January 2013, Ms. Jones has been Senior Vice President and General Counsel of Deere & Company ("Deere"), a world-leading provider of advanced products and services for agriculture, construction, forestry and turf care. From 2010 through 2012, she served as Deere’s Vice President, Global Human Resources. Ms. Jones brings to the Board significant risk management, corporate governance and general legal expertise, derived largely from her role leading the Deere compliance and legal functions. In addition, she brings to the Board significant expertise in the areas of talent strategy, executive succession planning and compensation, derived from her former role as Deere’s Vice President, Global Human Resources.

Larry B. Porcellato, age 59, has been a Director of the Corporation since 2004 and has served as the Lead Director since May 2017. From 2009 to July 2014, Mr. Porcellato was the Chief Executive Officer of The Homax Group, Inc., a leading specialty application consumer products supplier to the home care and repair markets. Previously, from February 2007 to December 2008, he was an independent business consultant and, from 2002 to January 2007, he was the Chief Executive Officer of ICI Paints North America. Mr. Porcellato is a director of OMNOVA Solutions, Inc., an innovator of emulsion polymers, specialty chemicals and decorative and functional surfaces, and a director of privately held PSAV Holding LLC, an international, full-service technology in-house audiovisual provider. Mr. Porcellato brings to the Board chief executive officer experience in the building products industry through his former leadership of Homax and his former role as Chief Executive Officer of ICI Paints and financial expertise derived primarily from his past service on the audit committee of another public company and previous finance and division leadership roles at other public companies. He also brings to the Board international and marketing expertise derived primarily from his service in various international and marketing roles at Rubbermaid Incorporated and Braun Canada Inc. and corporate governance experience through his service on the compensation and governance committees of another public company.

Abbie J. Smith, age 64, has been a Director of the Corporation since 2000 and served as the Lead Director from May 2014 to May 2017. Ms. Smith is the Boris and Irene Stern Distinguished Service Professor of Accounting, and since 1999 has been a Chaired Professor, of The University of Chicago Booth School of Business, a national leader in higher education and research. She is a director of DFA Investment Dimensions Group Inc., Dimensional Investment Group Inc. and Ryder System, Inc., a commercial transportation, logistics and supply chain management solutions company. Ms. Smith is also a trustee of The UBS Funds (Chicago), UBS Relations Trust and UBS SMA Relationship Trust. Ms. Smith brings to the Board considerable financial and corporate governance expertise based primarily on her extensive research and teaching at the University of Chicago and her service on mutual fund complex and other public company audit, performance, finance and nominating committees. Ms. Smith currently serves on the Corporation’s Audit Committee, and qualifies as an “audit committee financial expert.”

Messrs. Calado, Hartnett and Stern and Ms. Francis comprise a class of Directors whose terms will expire at the Corporation's 2020 annual shareholders meeting.

Miguel M. Calado, age 62, has been a Director of the Corporation since 2004. Mr. Calado has been Chairman and President of the WY Group and an employee of WY Group (USA) Inc. since April 2017. From 2014 to April 2017, Mr. Calado was Vice President, Corporate Development and President of the iMax Diagnostic Imaging Business Unit of Hovione SA, an international fine chemicals company. From 2006 to 2014, he was the Vice President and Chief Financial Officer of Hovione. He has been President of GAMCAL, LLC, an investment company since 2006. Mr. Calado brings to the Board extensive international, general management, manufacturing and financial expertise derived primarily from his previous service as Chief Financial Officer of an international manufacturing company and prior service in various roles at several large, packaged and consumer goods public companies. These roles and companies include Executive Vice President and President, International for Dean Foods Company and several international finance roles for PepsiCo, Inc., including Senior Vice President, Finance and Chief Financial Officer, PepsiCo Foods International. Although Mr. Calado does not serve on the Corporation’s Audit Committee, he qualifies as an “audit committee financial expert.”

Cheryl A. Francis, age 64, has been a Director of the Corporation since 1999. Ms. Francis has been an independent business and financial advisor since 2000 and the Co-Chairman of the Corporate Leadership Center, a not-for-profit organization focused on developing tomorrow’s business leaders, since 2008. Previously, from 2002 to 2008, she was the Vice Chairman of the Corporate Leadership Center. Ms. Francis is a director of Aon plc, a leading global professional services firm providing a broad range of risk, retirement and health solutions, and Morningstar, Inc., a leading provider of independent investment research in North America, Europe, Australia and Asia. Ms. Francis brings to the Board significant financial expertise based primarily on her prior role as Chief Financial Officer of R.R. Donnelley & Sons Company and service on the audit and finance committees of other public companies. She also brings to the Board corporate governance experience through her service on the compensation and governance committees of other public companies, and executive leadership development experience based on Corporate Leadership Center work with CEOs, leading academic institutions and corporate executives. She currently serves as the Chairperson on the Corporation’s Audit Committee and qualifies as an “audit committee financial expert.”

John R. Hartnett, age 57, has been a Director of the Corporation since August 2016. Mr. Hartnett is an Executive Vice President at Illinois Tool Works Inc. ("ITW"), a Fortune 200 global multi-industrial manufacturing leader with seven industry-leading business segments. Mr. Hartnett has been with ITW for 36 years and currently heads its Welding segment. Mr. Hartnett brings to the Board extensive engineering, marketing, manufacturing, distribution and management experience from his numerous business roles at ITW including his most recent role as head of ITW’s Construction Products segment.

Brian E. Stern, age 70, has been a Director of the Corporation since 1998. Mr. Stern has been a director of Starboard Capital Partners, LLC, since July 2007. He is a director and investor in Blackrock Microsystems LLC (Utah). Previously, from 2004 to June 2007, Mr. Stern was the Senior Vice President, Xerox, Fuji Xerox Operations of Xerox Corporation, a developer, marketer, manufacturer, financier and servicer of document processing products and services. Mr. Stern brings to the Board significant knowledge of the office products and office supplies industry and expertise in product development, sales and marketing. He also has substantial experience in international operations, manufacturing, channels of distribution and general management.

Director Independence

In addition to complying with NYSE listing standards and applicable SEC rules pertaining to director independence, the Corporation adopted the Categorical Standards, which are attached as Exhibit A to the Governance Guidelines and available on the Corporation's website at www.hnicorp.com, under "Investors - Corporate Governance - Governance Guidelines."

Under the Governance Guidelines, at least three-fourths of the Directors must meet the NYSE listing standards pertaining to director independence and the Categorical Standards. The Board has determined each Director, including each nominee for Director, other than Mr. Askren, has no material relationship with the Corporation (either directly or as a partner, shareholder or officer of an organization having a relationship with the Corporation) and is independent under the NYSE listing standards and the Categorical Standards, including any heightened independence standards applicable to a Director's service on the Corporation's Audit Committee, Human Resources and Compensation Committee or Governance Committee.

Mr. Askren, the Corporation's Chairman, President and Chief Executive Officer, does not meet these independence standards because he is employed by the Corporation.

Processes and Procedures for the Consideration and Determination of Executive Compensation by Compensation Committee

The Compensation Committee is responsible for developing and implementing the Corporation's compensation policies and programs for the Chairman and CEO and other senior executives as further discussed throughout the Compensation Discussion and Analysis (the "CD&A") which begins on page 16 of this Proxy Statement.

Board Leadership Structure

The Corporation's current board leadership structure consists of a combined Chairman and CEO position and nine independent Directors, one of whom has been designated Lead Director.

While certain of the conventional functions for the Chairman have been shared by all Directors, the Chairman position has traditionally been held by the Corporation's CEO. The Board believes the combined role of Chairman and CEO promotes unified leadership and direction for the Corporation, which allows for a single, clear focus for management to execute the Corporation's strategy and business plans. The Board believes this leadership structure has contributed to the long-term growth and financial success of the Corporation.

The Corporation has strong governance structures and processes in place to ensure the independence of the Board, eliminate conflicts of interest and prevent dominance of the Board by management. All Directors, with the exception of the Chairman, are independent as defined under NYSE listing standards, applicable SEC rules and the Categorical Standards, and all committees of the Board are comprised entirely of independent Directors. In addition, the Board and the Governance Committee have assembled a Board comprised of strong and sophisticated Directors who are currently or have recently been leaders of major companies or institutions, are independent thinkers and have a wide range of expertise and skills.

In February 2005, the Board adopted Lead Director Guidelines. The Lead Director's duties and responsibilities include:

| • |

presiding at all meetings of the independent Directors;

|

| • |

communicating to the Chairman and CEO the substance of the discussions and consensus reached at the meetings of independent Directors;

|

| • |

encouraging the independent Directors and the Chairman and CEO to communicate with each other at any time and to act as principal liaison between the independent Directors and the Chairman and CEO on sensitive matters;

|

| • |

providing input to the Chairman and CEO on preparation of agendas for Board and committee meetings;

|

| • |

presiding at Board meetings when the Chairman and CEO is not in attendance;

|

| • |

acting as spokesperson for the Corporation in the event the Chairman and CEO is unable to act due to conflict of interest or incapacity; and

|

| • |

receiving and responding to communications from interested parties to the independent Directors.

|

Larry Porcellato has been the Lead Director since May 2017.

The Board regularly meets in executive session without the presence of management and the independent Directors meet at least quarterly without the presence of management or the CEO. The Lead Director presides at these meetings and provides the Board's guidance and feedback to the Chairman and CEO and the Corporation's management team. Further, the Board has regular and complete access to the Corporation's management team. At each Board and committee meeting, Directors receive valuable information and insight from management on matters impacting the Corporation.

Given the strong leadership of the Chairman and CEO, the counterbalancing role of the Lead Director and a Board comprised of strong and independent Directors, the Board believes it is in the best long-term interests of the Corporation and its shareholders to maintain a combined role of Chairman and CEO.

Board's Role in Risk Oversight

The Board administers its risk oversight role primarily through its committee structure and the committees' regular reports to the Board at each quarterly Board meeting. The Audit Committee meets frequently during the year (nine times in 2017) and discusses with management, the Corporation's Vice President, Internal Audit, and the Corporation's independent registered public accountant:

| • |

current business trends affecting the Corporation;

|

| • |

major risks facing the Corporation;

|

| • |

steps management has taken to monitor and control the risks; and

|

| • |

adequacy of internal controls that could significantly affect the Corporation's financial statements.

|

At least annually, the Board discusses with management the appropriate level of risk relative to corporate strategy and business objectives and reviews with management the Corporation's existing risk management processes, including information security and data protection procedures, and their effectiveness. The Audit Committee also reviews the Corporation's enterprise risk management process for identification of, and response to, major risks. The Audit Committee provides the Board with a report concerning its risk oversight activities at each quarterly Board meeting. Each key risk identified for the Corporation is referred to the Board or assigned a committee of the Board for oversight and each committee regularly reports to the Board regarding these risks.

Compensation Risk Assessment

A senior management team, under the oversight of the Compensation Committee, annually conducts a risk assessment of the Corporation's compensation policies and practices to ensure they do not encourage excessive risk taking by members which could result in a material adverse effect on the Corporation.

Based on this most recent compensation risk assessment, both management and the Compensation Committee believe the risks arising from the Corporation's compensation policies and practices, as managed, are not reasonably likely to have a material adverse effect on the Corporation.

Board Meetings

The Board held four regular meetings and no special meetings during 2017. No member of the Board attended fewer than 75% of the meetings of the Board or any committee on which he or she served.

In accordance with the NYSE listing standards regarding corporate governance and the Governance Guidelines, the Corporation's non-management Directors meet in executive sessions without management present at each regular Board meeting. Mr. Porcellato, Lead Director, presides at these executive sessions. The Corporation's non-management Directors met in executive sessions at all four regular Board meetings during 2017.

Director Attendance at Annual Meetings of Shareholders

All Directors are encouraged to attend annual meetings of shareholders when possible. Last year all Directors attended the 2017 annual meeting of shareholders.

Shareholder Communications with the Board

Shareholders and interested parties may communicate with the Lead Director, the Chairperson of the Governance Committee, the Senior Vice President, General Counsel and Secretary, or with the Corporation's non-management Directors as a group, by sending an email to "[email protected]" or by writing to Lead Director, Chairperson of the Governance Committee, Senior Vice President, General Counsel and Secretary or Non-Management Directors at HNI Corporation, 600 East Second Street, Muscatine, Iowa 52761, Attention: Corporate Secretary. All communications received will be opened by the office of the Corporate Secretary for the sole purpose of determining whether the contents are a message to the Directors. Any communications not in the nature of advertising or promotions of a product or service will be promptly forwarded to the appropriate party.

Board Committees

The Board has three standing committees, the Audit Committee, the Compensation Committee and the Governance Committee. The Governance Committee fulfills the role of a nominating committee. Each committee operates under a written charter, which has been approved by the Board. The Board reviews each committee charter at least annually. Current copies of the committees' charters can be found on the Corporation's website at www.hnicorp.com, under "Investors - Corporate Governance - Committee Charters." Shareholders may request a copy of the charters by writing to the Corporate Secretary at HNI Corporation, 600 East Second Street, Muscatine, Iowa 52761. During 2017, each current Director attended all of the meetings of the committees on which the Director served.

Audit Committee. The Audit Committee is comprised of Cheryl A. Francis, Chairperson, Larry B. Porcellato and Abbie J. Smith. The Board has determined all members of the Audit Committee are financially literate under NYSE listing standards. The Board has also determined Mses. Francis and Smith are "audit committee financial experts," as defined by Item 407(d)(5) of Regulation S-K. In accordance with the Audit Committee Charter, none of the Audit Committee members serve simultaneously on audit committees of more than three public companies. The Audit Committee met nine times during 2017. The Audit Committee is responsible for, among other things:

| • |

overseeing of the integrity of the Corporation's financial statements;

|

| • |

selecting the independent registered public accounting firm to audit the Corporation's financial statements and ensuring the firm's independence;

|

| • |

discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results;

|

| • |

developing procedures to enable submission of anonymous concerns about accounting or auditing matters;

|

| • |

considering the adequacy of our internal accounting controls and audit procedures;

|

| • |

reviewing related party transactions;

|

| • |

reviewing our legal compliance risk exposures and program for promoting and monitoring compliance with applicable legal and regulatory requirements;

|

| • |

pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm; and

|

| • |

overseeing our internal audit function.

|

Human Resources and Compensation Committee. The Compensation Committee is comprised of Ronald V. Waters, III, Chairperson, Mary A. Bell and John R. Hartnett. Each member qualifies as an "outside director" for purposes of Section 162(m) ("Section 162(m)") of the Internal Revenue Code of 1986, as amended (the "Code") and a "non-employee director" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act"). The Compensation Committee met four times during 2017. The Compensation Committee is responsible for, among other things:

| • |

reviewing and recommending executive compensation plans and determining whether they encourage excessive risk taking;

|

| • |

monitoring executive succession planning for certain key executives;

|

| • |

reviewing and adopting member benefit programs;

|

| • |

recommending to the Board persons designated as executive officers; and

|

| • |

overseeing annual performance evaluation of the Chairman and CEO by the Board.

|

Public Policy and Corporate Governance Committee. The Governance Committee is comprised of Brian E. Stern, Chairperson, Miguel M. Calado and Mary K.W. Jones. The Governance Committee met four times during 2017. The Governance Committee serves as the nominating committee and identifies individuals qualified to serve as Directors of the Corporation consistent with criteria approved by the Board. Additionally, the Governance Committee is responsible for, among other things:

| • |

recommending Director nominees to the Board for the next annual meeting of shareholders;

|

| • |

considering and making recommendations regarding non-employee Director compensation;

|

| • |

developing and recommending to the Board corporate governance principles applicable to the Corporation;

|

| • |

overseeing the evaluation process for our Board and committees; and

|

| • |

reviewing the Corporation's finance policy and capital structure.

|

The Governance Committee is responsible for annually reviewing the compensation paid to Directors for service on the Board and for recommending changes in compensation to the Board, if appropriate. The Board is responsible for approving Director compensation based on recommendations of the Governance Committee. Neither the Governance Committee nor the Board delegates its authority with respect to setting Director compensation to any other person or group. However, the Corporation's management may, at the request of the Governance Committee, assist the Governance Committee in its review of Director compensation, which may include recommending changes to compensation. Although it has not done so recently, the Governance Committee has authority to retain and terminate a consultant to assist in the evaluation of the compensation and benefits for Directors and to approve the consultant's fees and other retention terms.

Each independent Director receives an annual retainer of $170,000, of which $65,000 is paid in cash in equal installments of $16,250 at each quarterly Board meeting (prior to the May 9, 2017 Board meeting, the annual cash retainer was $65,280) and

$105,000 is paid in the form of Common Stock issued under the 2017 Equity Plan following the May Board meeting (prior to the May 9, 2017 Board meeting, the Common Stock retainer was $97,920). In 2017, each independent Director received:

| • |

a cash installment payment of $16,320 at the February Board meeting and $16,250 at each of the May, August and November Board meetings; and

|

| • |

a $105,000 Common Stock grant at the May Board meeting.

|

The Lead Director receives an additional annual retainer of $19,000. Prior to the May 9, 2017 Board Meeting, each Audit Committee member received an additional annual retainer of $6,000. The Chairperson of the Audit Committee receives an additional annual retainer of $15,000. The Chairpersons of the Compensation Committee and Governance Committee each receive an additional annual retainer of $10,000. As with the cash portion of the annual retainer for Board service, retainers for committee Chairperson or Lead Director service are paid in equal installments at each quarterly Board meeting.

Directors are reimbursed for travel and related expenses incurred to attend meetings. For purposes of determining Director compensation, an independent Director is anyone who is not a member of the Corporation. Directors who are members of the Corporation do not receive additional compensation for service on the Board.

The Corporation's policy with regard to Common Stock ownership by independent Directors is for each Director to own Common Stock with a market value of five times or more the cash portion of the annual retainer. To promote Common Stock ownership, Directors are required to receive one-half of the cash portion of their annual retainer in the form of shares of Common Stock to be issued under the 2017 Equity Plan or, to the extent the Director participates in the HNI Corporation Directors Deferred Compensation Plan (the "Directors Deferred Plan"), in the form of nonvoting share units to be credited to the Director's account under the Directors Deferred Plan. This requirement does not, however, apply to any Director owning Common Stock with a market value of five times or more the cash portion of the annual retainer. As of the end of 2017, all of the Corporation's independent Directors were in compliance with the Corporation's policy with regard to stock ownership.

Under the 2017 Equity Plan, Directors may elect to receive all or a portion of their cash retainers in the form of shares of Common Stock. Under the Directors Deferred Plan, each Director has the opportunity to defer up to 100% of his or her retainers. Amounts can be deferred to a cash account earning interest at a rate set each year at 1% above the prime interest rate or to the Corporation's notional stock account in the form of nonvoting share units that fluctuate in value based on the price increase or decrease of Common Stock and earn dividends distributed to all shareholders. The dividends are automatically reinvested for each participant to acquire additional nonvoting shares units. For any cash compensation deferred to the Corporation's notional stock account, the number of nonvoting share units is determined by dividing the amount of the compensation by the fair market value of a share of Common Stock on the date the compensation would have otherwise been paid. Each Director participating in the Directors Deferred Plan elects, on an annual basis, the date or dates of distribution (i.e., a Director can elect a lump-sum distribution or distribution via annual installments not to exceed 15) of any amounts he or she has deferred. In addition, each independent Director is eligible to receive awards of stock options to purchase Common Stock, restricted stock or Common Stock grants, or any combination thereof, under the 2017 Equity Plan in the amounts as the Board may authorize.

In May 2017, each of the Directors was granted 2,325 shares of Common Stock under the 2017 Equity Plan. The Corporation does not have a non-equity incentive plan for independent Directors. As of the Record Date, the Corporation has never issued stock options or restricted stock to the independent Directors and all shares of Common Stock issued to Directors in lieu of cash retainer amounts were fully vested upon issuance.

Director Compensation for 2017

|

Name

|

Fees Earned or

Paid in Cash

($) (1)

|

Stock Awards

($) (2)

|

Change in Pension

Value and Nonqualified

Deferred Compensation Earnings

($) (3)

|

All Other

Compensation ($)

(4)

|

Total

($)

|

|

Mary A. Bell

|

65,070

|

105,000

|

—

|

1,988

|

172,058

|

|

Miguel M. Calado

|

65,070

|

105,000

|

—

|

1,988

|

172,058

|

|

Cheryl A. Francis

|

81,570

|

105,000

|

—

|

1,988

|

188,558

|

|

John R. Hartnett

|

66,570

|

105,000

|

—

|

1,988

|

173,558

|

|

Mary K.W. Jones

|

65,070

|

105,000

|

—

|

1,988

|

172,058

|

|

Larry B. Porcellato

|

80,820

|

105,000

|

300

|

1,988

|

188,108

|

|

Abbie J. Smith

|

69,820

|

105,000

|

—

|

1,988

|

176,808

|

|

Brian E. Stern

|

75,070

|

105,000

|

—

|

1,988

|

182,058

|

|

Ronald V. Waters, III

|

75,070

|

105,000

|

2,531

|

1,988

|

184,589

|

Notes

| (1) |

For 2017, the independent Directors listed in the table above each earned the following fees: Ms. Bell - $65,070 annual retainer; Mr. Calado - $65,070 annual retainer; Ms. Francis - $65,070 annual retainer plus $1,500 retainer for service on the Audit Committee, $15,000 retainer for service as Chairperson of the Audit Committee; Mr. Hartnett - $65,070 annual retainer plus $1,500 retainer for service on the Audit Committee; Ms. Jones - $65,070 annual retainer; Mr. Porcellato – $65,070 annual retainer plus $1,500 retainer for service on the Audit Committee plus $14,250 retainer for service as Lead Director; Ms. Smith – $65,070 annual retainer plus $4,750 retainer for service as Lead Director; Mr. Stern – $65,070 annual retainer plus $10,000 retainer for service as Chairperson of the Governance Committee; and Mr. Waters - $65,070 annual retainer plus $10,000 retainer for service as Chairperson of the Compensation Committee. Mses. Bell, Jones and Smith received 100% of cash retainer, and Mr. Hartnett received 75% of cash retainer, in the form of Common Stock under the 2007 Equity Plan for the first quarter of 2017 and under the 2017 Equity Plan for the remainder of the year, which equated to the following: Ms. Bell - 1,639 shares; Ms. Jones - 1,639; Ms. Smith - 1,740; and Mr. Hartnett - 1,253.

|

| (2) |

Represents the portion of the annual retainer paid in the form of shares – a $105,000 Common Stock grant authorized by the Board on May 9, 2017 under the 2017 Equity Plan. Each independent Director serving on the Board as of May 9, 2017 was issued 2,325 shares of Common Stock at a price of $45.16 (the closing price of a share of Common Stock on the date of grant, May 9, 2017) for a total grant date fair value of $104,997, as computed in accordance with FASB Accounting Standards Codification Topic 718. The difference between the $105,000 Common Stock grant authorized by the Board and the actual value of Common Stock issued ($104,997) was approximately $3. As the Corporation only issues fractional shares under the Directors Deferred Plan, and not under the 2017 Equity Plan, the Corporation paid each independent Director serving on the Board as of May 9, 2017, $3, either in the form of cash in lieu of a fractional share for those Directors who did not elect to defer their Common Stock grant under the Directors Deferred Plan or in the form of a fractional share for those Directors who did elect to defer their Common Stock grant under the Directors Deferred Plan. Ms. Jones deferred 100% of her Common Stock grants under the Directors Deferred Plan. There are no unexercised option awards or unvested stock awards outstanding as of the end of 2017 for any of the Directors.

|

| (3) |

Includes above-market interest earned on cash compensation deferred under the Directors Deferred Plan. Interest on deferred cash compensation is earned at one percent over the prime rate. Above-market earnings represent the difference between the interest earned under the Directors Deferred Plan and 120% of the applicable federal long-term rate. Above-market interest earned by Mr. Porcellato is for cash compensation deferred prior to January 1, 2007, and interest earned by Mr. Waters is for cash compensation deferred prior to January 1, 2010.

|

| (4) |

Includes dividends earned on Common Stock grants during 2017.

|

The Corporation has adopted a written policy for reviewing and approving transactions between the company and its related persons, including directors, director nominees, executive officers, five percent shareholders and their immediate family members or affiliates. The policy applies to:

| • |

All financial transactions, arrangements or relationships involving more than $100,000;

|

| • |

Transactions in which the Corporation, or one of its affiliates, is a participant; and

|

| • |

Transactions in which a related person could have a direct or indirect interest.

|

The policy does not apply to certain compensation payments approved by the appropriate Board committee, transactions available to all other shareholders or employees on the same terms, transactions with an entity where the related person's interest is only as a director or a less than ten percent owner, or transactions in which the rate charged by a related person is determined by competitive bid.

The Corporation's Office of the General Counsel (the "General Counsel") performs the initial review of all transactions subject to the policy. Quarterly, the General Counsel reports to the Audit Committee each known transaction to be considered by the Audit Committee pursuant to the policy, including the proposed aggregate value of each transaction and any other relevant information.

After review, the Audit Committee approves, ratifies or disallows each transaction in accordance with the guidelines set forth above.

If the General Counsel learns of an ongoing or completed transaction, arrangement or relationship not submitted for prior review and approval, the General Counsel will submit it to the Audit Committee for ratification, amendment, rescission or termination.

For 2017, the Corporation had no material related party transactions required to be disclosed in accordance with SEC regulations.

The Corporation maintains the Ethics Code as part of its corporate compliance program. The Ethics Code applies to all Directors and members (i.e., employees), including the Corporation's chief executive officer, chief financial officer, principal accounting officer or controller or persons performing similar functions. The Ethics Code is available for download on the Corporation's website at www.hnicorp.com, under "Investors - Corporate Governance - Member Code of Integrity." The Corporation intends to disclose amendments to or waivers of the Ethics Code granted to the individual executive officers listed above and the Directors on the Corporation's website within four business days of the amendment or waiver. Shareholders may request a copy of the Ethics Code by writing to the Corporate Secretary at HNI Corporation, 600 East Second Street, Muscatine, Iowa 52761.

The Corporation's insider trading policy prohibits hedging transactions. Specifically, the Corporation prohibits members, directors, or their designees, from hedging their ownership of the Corporation's Common Stock (including prepaid variable forwards, equity swaps, collars and exchange funds), engaging in short sales or purchasing put or call options, pledging their shares of the Corporation's Common Stock, holding them in a margin account or engaging in short-term transactions with shares of the Corporation's Common Stock.

The Governance Guidelines are available for download on the Corporation's website at www.hnicorp.com, under "Investors - Corporate Governance - Governance Guidelines." Shareholders may request a copy of the Governance Guidelines by writing to the Corporate Secretary at HNI Corporation, 600 East Second Street, Muscatine, Iowa 52761.

KPMG LLP AS THE CORPORATION'S

INDEPENDENT REGISTERED PUBLIC ACCOUNTANT FOR FISCAL 2018

The Audit Committee is directly responsible for the appointment, retention, oversight, and compensation, including approval of audit fees, of the external audit firm retained to audit our financial statements. Further, in conjunction with the mandated rotation of the audit firm's lead engagement partner, the Audit Committee and its chair are directly involved in the selection of the audit firm's lead engagement partner.

KPMG has been retained as our independent registered public accounting firm since 2015. In order to ensure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the audit firm. Based on its most recent evaluation of KPMG, the members of the Committee believe the continued retention of KPMG is in the best interest of the Corporation and its shareholders. The Board proposes shareholders ratify the appointment of KPMG as the Corporation’s independent public accountant for Fiscal 2018 at the Meeting. Although shareholder ratification is not required by the By-laws or otherwise, the Corporation is submitting the selection of KPMG to its shareholders to permit shareholders to participate in this important decision. If the shareholders fail to ratify the Audit Committee's selection of KPMG, the Audit Committee will reconsider the selection.

Representatives of KPMG will be present at the Meeting, have an opportunity to make a statement if they so desire and be available to respond to appropriate questions.

Recommendation of the Board

|

THE BOARD RECOMMENDS A VOTE "FOR" RATIFICATION OF THE AUDIT COMMITTEE'S

SELECTION OF KPMG LLP AS THE CORPORATION'S INDEPENDENT REGISTERED

PUBLIC ACCOUNTANT FOR FISCAL 2018.

|

The Audit Committee is comprised entirely of independent directors who meet the independence requirements of the NYSE Listed Company Manual and the SEC. The Audit Committee operates under a written charter adopted by the Board of Directors, which you may access in the corporate governance section of our website at http://www.hnicorp.com/investors/corporate-governance.

The Audit Committee has responsibility for selecting and evaluating the independent audit firm, which reports directly to the Audit Committee, overseeing the performance of the Corporation’s internal audit function, and assisting the Board of Directors in its oversight of enterprise risk management including privacy and data security.

Management has primary responsibility for the Corporation’s consolidated financial statements and the overall reporting process, for maintaining adequate internal control over financial reporting and, with the assistance of the Corporation’s internal auditors, for assessing the effectiveness of the Corporation’s internal control over financial reporting. KPMG LLP (“KPMG”), the Corporation’s independent registered public accounting firm since 2015, is responsible for performing an independent audit of the Corporation’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”), expressing an opinion as to the conformity of the consolidated financial statements with generally accepted accounting principles in the United States, and auditing management’s assessment of the effectiveness of internal control over financial reporting. The Audit Committee’s responsibility is to monitor and oversee these processes and work with KPMG’s lead partner, who was appointed in 2015.

The Audit Committee also oversees management’s processes to identify and quantify material risks facing the Corporation, including risks disclosed in the Corporation’s Annual Report on Form 10-K. The Audit Committee meets regularly with the internal auditors and KPMG, with and without management present, to discuss the results of their examinations, the evaluation of the Corporation’s internal control over financial reporting and the overall quality of the Corporation’s accounting.

Management represented to the Audit Committee the Corporation's consolidated financial statements for fiscal year ended December 30, 2017 were prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the consolidated financial statements with management and KPMG. Management has also represented it has assessed

the effectiveness of the Corporation’s internal control over financial reporting, and has determined that, as of December 30, 2017, the Corporation maintained effective internal control over financial reporting. The Audit Committee has reviewed and discussed with management and KPMG this assessment. The Audit Committee has also discussed with KPMG its evaluation of the accounting principles, practices and judgments applied by management, and any items required to be communicated to it by KPMG in accordance with regulations promulgated by the SEC and the PCAOB including the matters required to be discussed by PCAOB Auditing Standard No. 1301.

The Audit Committee received and reviewed the written disclosures and the letter from KPMG required by the PCAOB regarding KPMG's communications with the Audit Committee concerning independence and discussed with KPMG its independence. The Audit Committee also concluded the provision of non-audit services by KPMG is compatible with maintaining their independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board the consolidated financial statements referred to above be included in the Corporation's Annual Report on Form 10-K for the year ended December 30, 2017.

AUDIT COMMITTEE

Cheryl A. Francis, Chairperson

Larry B. Porcellato

Abbie J. Smith

The following table sets forth the aggregate fees billed to the Corporation for the audit and other services provided by KPMG for fiscal 2017 and fiscal 2016:

|

Fee Category

|

Fiscal 2017

|

Fiscal 2016

|

||||||

|

Audit Fees (1)

|

$

|

1,800,000

|

$

|

1,469,000

|

||||

|

Audit-Related Fees (2)

|

5,000

|

51,829

|

||||||

|

Tax Fees (3)

|

50,118

|

196,137

|

||||||

|

All Other Fees (4)

|

41,925

|

—

|

||||||

|

Total

|

$

|

1,897,043

|

$

|

1,716,966

|

||||

| (1) |

Audit Fees represent fees for professional services provided in connection with the audit of the annual financial statements, review of quarterly financial statements and audit services provided in connection with other statutory and regulatory filings or engagements.

|

| (2) |

Audit-Related Fees represent accounting consultations.

|

| (3) |

Tax Fees represent fees billed for tax compliance, tax advice and tax planning.

|

| (4) |

All Other Fees represent fees for services other than the services reported in Audit Fees, Audit-

|

Related Fees, and Tax Fees.

Pre-Approval of Fees

The Audit Committee may delegate to one or more members of the Audit Committee the authority to pre-approve audit related and other services not prohibited by law to be performed by the Corporation's independent registered public accountant and associated fees. The delegated member or members must report any such pre-approvals to the Audit Committee at its next scheduled meeting. All of the KPMG fees incurred in fiscal 2017 and fiscal 2016 were approved by the Audit Committee.

Our CD&A describes the key features of our executive compensation program and the Compensation Committee's approach in deciding 2017 compensation for our Named Executive Officers:

|

Name

|

Position

|

|

Stan A. Askren

|

Chairman, President and Chief Executive Officer, HNI Corporation

|

|

Marshall H. Bridges

|

Chief Financial Officer; Senior Vice President, HNI Corporation

|

|

Kurt A. Tjaden

|

President HNI International; Senior Vice President, HNI Corporation

(Former Chief Financial Officer)

|

|

Jeffrey D. Lorenger

|

President, Office Furniture, HNI Corporation

|

|

Vincent P. Berger

|

President, Hearth & Home Technologies; Executive Vice President, HNI Corporation

|

|

Jerald K. Dittmer

|

Senior Vice President, Strategic Development

|

The CD&A is divided into four parts:

| 1. |

Executive Compensation Overview

|

| 2. |

Executive Compensation Objectives and Governance

|

| 3. |

Executive Compensation Elements

|

| 4. |

Additional Compensation Programs and Policies

|

1. Executive Compensation Overview

Primary Compensation Elements

The primary elements of our compensation program are base salary, and annual and long-term performance-based incentive opportunities. These primary elements were chosen to attract the best talent and drive long-term shareholder value creation.

|

Element

|

Description

|

Purpose

|

|

|

Base Salary

(see page 19)

|

Annual cash compensation.

|

Compensation for expected day-to-day responsibilities. Pay adjustments are based on capabilities, responsibilities and market factors.

|

|

|

Annual Incentive Opportunity

(see page 20)

|

Targeted variable compensation equal to a percentage of base salary paid once a year and based 80% on financial performance and 20% on individual objectives.

|

Focus executives on annual performance goals, typically financially driven.

|

|

|

Long-term Incentive Opportunity

(see page 22)

|

Variable performance compensation typically in the form of stock options and cash earned at the end of a three-year period based on economic profit goals.

|

Align executives' decisions with long-term shareholder value creation. Promote executive retention.

|

Other Key Compensation Practices

The Compensation Committee regularly reviews developments in executive compensation and governance and adjusts our practices and policies.

|

HNI Compensation Practices

|

||

|

What We Do

|

||

|

Pay for performance

|

P

|

A large majority of executive compensation is based on achievement of long-term value creation.

|

|

Stock ownership guidelines

|

P

|

Stock ownership guidelines require the CEO to hold shares valued at 5x base salary and other Named Executive Officers at 3x base salary.

|

|

Double trigger change in control

|

P

|

Both a change in control and involuntary termination are required for the change in control agreement to take effect.

|

|

Clawback policy

|

P

|

Performance-based compensation, under certain circumstances, will be canceled or reclaimed if an executive engages in fraud or financial misconduct.

|

|

Anti-hedging policy

|

P

|

Officers and directors are prohibited from engaging in hedging or pledging transactions with respect to HNI stock.

|

|

Independent compensation consultant

|

P

|

The Compensation Committee engages an independent compensation consultant who works only for the Committee, and not for management.

|

|

Annual shareholder Say on Pay

|

P

|

The Corporation holds an annual advisory vote regarding Named Executive Officer compensation.

|

|

Annual compensation risk assessment

|

P

|

The Compensation Committee reviews a risk assessment of the Named Executive Officer compensation program every year.

|

|

What We Don't Do

|

||

|

No repricing of underwater options

|

r

|

Underwater options are not repriced or replaced.

|

|

No perquisites

|

r

|

Perquisites are not provided to executives or directors.

|

|

No employment contracts

|

r

|

Neither the CEO nor any other Named Executive Officers have an employment contract.

|

|

No dividends on unearned performance awards

|

r

|

Dividends are not paid on restricted stock units.

|

|

No supplemental executive benefits

|

r

|

Executive officers are not offered additional benefits beyond those generally available to all members.

|

2. Executive Compensation Objectives and Governance

Philosophy and Objective

The Corporation's Board believes in aligning the compensation of the Corporation's leadership with creating long-term value for shareholders and other important stakeholders, including members and customers. Governance of the executive compensation program, including hands-on involvement of the Compensation Committee, is guided by this principle.

Pay for Performance

The executive compensation program for 2017 highlights the Corporation's pay for performance philosophy, with a large majority of each senior executive's compensation tied to the achievement of long-term value creation, awarded through performance-based annual and long-term awards and stock options. Shareholders have continued to voice their support for the Corporation's pay for performance compensation program— over 97% of votes cast in last year's Say on Pay vote approved the compensation of the Named Executive Officers.

The Corporation believes economic profit is the best indicator of long-term shareholder value creation and uses economic profit to measure financial performance goal achievement under the annual and long-term incentive plans. Economic profit is defined as after-tax operating profit less a charge for invested capital. Economic profit promotes the simultaneous optimization of growth, earnings and capital efficiency.

Pay Mix

For 2017, the target compensation mix for the CEO and other Named Executive Officers is shown below. Approximately 81% of CEO compensation and 71% of all other Named Executive Officers' compensation is considered variable based on achieving financial and strategic objectives.

Compensation Committee and Independent Directors

The Compensation Committee is responsible for the oversight of the Corporation's executive compensation programs. The Compensation Committee reviews and recommends to the Board for approval by the independent Directors all elements of the CEO's compensation. For the other Named Executive Officers, the Compensation Committee considers recommendations from the CEO and approves all elements of compensation except equity grants, which the Compensation Committee recommends for approval by the independent Directors.