Form DEFA14A SCHLUMBERGER LIMITED/NV

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

SCHLUMBERGER N.V.

(SCHLUMBERGER LIMITED)

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Schlumberger Limited

5599 San Felipe St., 17th Floor

Houston, Texas 77056

March 15, 2018

DEAR STOCKHOLDER:

By now you should have received a copy of Schlumberger’s 2018 Proxy Statement, along with the proxy card or notice of Internet availability of proxy materials.

We are writing to you today to ask for your support by voting in accordance with the recommendations of our Board of Directors on all proposals. In particular, we are asking for you to vote FOR our say-on-pay proposal (Item 2).

The proxy advisory firm Glass, Lewis & Co. (“Glass Lewis”) recently issued its proxy report in which it recommended a vote “FOR” our say-on-pay proposal. Another proxy advisory firm, Institutional Shareholder Services (“ISS”), recently issued its own proxy report in which it recommended a vote “against” our say-on-pay proposal.

In opposing our say-on-pay proposal, ISS focuses on our Compensation Committee’s decision to make a one-time grant of restricted stock awards (“RSUs”) to four of our named executive officers (“NEOs”) for retention purposes. The ISS report suggests that the sole purpose of the RSU grants was to compensate our executives for past performance-based equity awards that did not vest. It also suggests that the RSUs grants insulated our executives from the pay-for-performance process. ISS also did not acknowledge the Committee’s rationale for the RSU grant which was key executive retention at the beginning of the industry recovery.

Despite the historic downturn that began in late 2014, our management team has strengthened our market-leading services and product lines through strategic acquisitions, organic-growth and research and development; improved our operational agility and competitiveness for the long-term; and increased our total addressable market throughout the world by 50%. We take pride in the fact that our executives are very highly sought after, and we expect to continue to take all appropriate steps to retain our talented executive team, which our Committee believes is the best in the industry.

For the following reasons, all of which are set out in our Proxy Statement, we disagree with the recommendation of ISS:

| • | Pay-for-performance is the cornerstone of our executive compensation program, as evidenced by the fact that 100% of our annual long-term incentive (“LTI”) awards to our NEOs are performance-based. Our commitment is evidenced by our NEOs’ forfeiture of all LTI awards in 2017 and 2018 as a result of missed performance goals and by the fact that 73% of our CEO’s stock options (and 75% of our other NEOs, on average) remain “underwater.” |

| • | The performance share units (the “PSUs”) that did not vest in 2017 and 2018 were based on an absolute performance metric, namely return on capital employed (“ROCE”). However, we performed solidly versus the competition during the downturn. For example, we generated higher relative ROCE than all other major oilfield service companies in 2015 and 2016. We also recorded positive ROCE throughout the downturn, even though two of our three top competitors recorded negative ROCE during this period. |

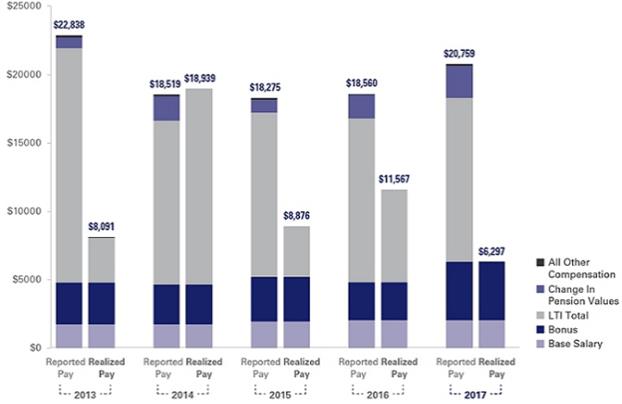

| • | The chart below shows the actual compensation delivered to our CEO from 2013 to 2017, and demonstrates that his realized pay was significantly lower than his reported pay for all but one year during this period. We believe that this chart underscores our commitment to paying for performance. |

CEO: Reported Pay vs. Realized Pay

| • | Almost all of our NEOs’ pay is at risk. Eighty-eight percent of our CEO’s 2017 total direct compensation was at risk, while, 87% of our other NEOs’ 2017 total direct compensation was at risk. |

| • | Our Compensation Committee awarded the one-time RSUs solely to address retention concerns as our industry recovers from the worst downturn in 30 years. As this industry recovery continues, competition for our executives has increased, and they continue to be a prime recruitment target of many of our competitors and customers. Since 2014, more than 20 of our former executives have become CEOs and other C-suite executives at competitors and some of our customers. Our Committee awarded the RSUs to keep together the senior management team that successfully navigated the downturn and positioned us best for the long-term. The Committee’s goal was to provide an incentive for our executives to remain with the Company, not to make them whole for the performance-based awards that did not vest. |

| • | In setting the size of the RSU awards, our Compensation Committee did not intend to replace the value of past LTI awards that were unearned. This is borne out by the fact that the RSU awards constituted approximately 35% of an executive’s annual LTI grant target value. |

Our Proxy Statement, this supplemental proxy material, and our 2017 Annual Report, are available at http://investorcenter.slb.com/phoenix.zhtml?c=97513&p=irol-reportsannual.

Your vote is important. Our Board of Directors recommends that you vote FOR Item 2, the advisory vote on executive compensation.

We appreciate your time and consideration on these matters and ask for your support of the Board’s recommendation.

| By order of the Board of Directors |

|

| Alexander C. Juden |

| Secretary |