Form 8-K Global Medical REIT Inc. For: Mar 05

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 7, 2018 (March 5, 2018)

____________________

Global

Medical REIT Inc.

(Exact name of registrant as specified in its charter)

____________________

| Maryland | 001-37815 | 46-4757266 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

2 Bethesda Metro Center, Suite 440 Bethesda, MD 20814 |

||

| (Address of Principal Executive Offices) (Zip Code) |

||

| (202) 524-6851 | ||

| (Registrant’s Telephone Number, Including Area Code) | ||

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| 1 |

Item 1.01 Entry into a Material Definitive Agreement.

Belpre Medical Campus – Belpre, Ohio

Global Medical REIT Inc. (the “Company”) entered into a purchase contract, effective March 6, 2018 (the “Belpre Purchase Agreement”) with Minnite Family, LLC, a West Virginia limited liability company; Belpre I, LLC, a West Virginia limited liability company; Belpre II, LLC, a West Virginia limited liability company; Belpre III, LLC, a West Virginia limited liability company and Belpre IV, LLC, a West Virginia limited liability company (collectively, the “Belpre Seller”), to acquire an aggregate 155,600 square-foot portfolio of four medical office buildings (the “Belpre Portfolio”) and a right of first refusal to purchase a fifth, yet to be built, medical office building on the same campus. The aggregate purchase price of the Belpre Portfolio is $64,200,000. Up to $5,500,000 of the purchase price may be paid, at the Belpre Seller’s discretion, in the form of common units (“OP Units”) in the Company’s operating partnership subsidiary, Global Medical REIT L.P. (the “Operating Partnership”), at a per unit price of no lower than $9.00. The portion of the acquisition for which OP Units will be issued will be treated as a contribution to the Operating Partnership.

The Belpre Seller currently leases the entire Belpre Portfolio to Memorial Health System, pursuant to four triple-net leases (collectively, the “Belpre Portfolio Leases”) with a weighted average remaining lease term of approximately 13.3 years with each of the Belpre Portfolio Leases containing three, five-year tenant renewal options. The aggregate initial annual rent for the Belpre Portfolio is approximately $5.1 million. Upon the closing of the acquisition of the Belpre Portfolio, the Company expects to assume the Belpre Portfolio Leases.

The Company’s obligation to close the acquisition is subject to certain conditions. The Company has the right to terminate, without penalty, the Belpre Purchase Agreement on or before April 5, 2018, if, in its sole discretion, it is not satisfied with the results of its ongoing due diligence investigation. If the Company does not terminate the Belpre Purchase Agreement by April 5, 2018, the Company’s earnest money deposit in the amount of $1,000,000 (the “Initial Deposit”) becomes non-refundable except in the event of a Belpre Seller default or failure of a condition to closing. If the Company has not terminated the Belpre Purchase Agreement by April 5, 2018, it shall deposit an additional earnest money deposit in the amount of $1,000,000 (the “Additional Deposit”), which, along with the Initial Deposit, will become non-refundable in the event of a Company default. The Belpre Purchase Agreement is also subject to other customary terms and conditions as set forth in the Belpre Purchase Agreement. Although the Company believes completion of this acquisition is probable, there is no assurance that the Company will close this acquisition.

The above descriptions of the terms and conditions of the Belpre Purchase Agreement and the transactions contemplated thereby are only a summary and are not intended to be a complete description of the terms and conditions. All of the terms and conditions of the Belpre Purchase Agreement are set forth in the Belpre Purchase Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Amendment to Revolving Credit Facility

On March 6, 2018, the Company, the Operating Partnership, as borrower, and certain subsidiaries of the Operating Partnership (such subsidiaries, the “Subsidiary Guarantors”) entered into an amendment to the senior revolving credit facility (the “Credit Facility”) with BMO Harris Bank N.A., as Administrative Agent, which increased the commitment amount to $340 million (the “Credit Facility Amendment”). The Subsidiary Guarantors and the Company are guarantors of the obligations under the amended Credit Facility. The amount available to borrow from time to time under the amended Credit Facility is limited according to a quarterly borrowing base valuation of certain properties owned by the Subsidiary Guarantors.

Except as set forth above, there were no additional changes to the Credit Facility. The above description of the terms and conditions of the Credit Facility Amendment is only a summary and is not intended to be a complete description of the terms and conditions. All of the terms and conditions of the Credit Facility Amendment are set forth in the Credit Facility Amendment, which will be filed as Exhibit to our Quarterly Report on Form 10-Q for the period ended March 31, 2018, and the original Credit Agreement, previously filed as an exhibit to the Current Report on Form 8-K on March 6, 2017.

| 2 |

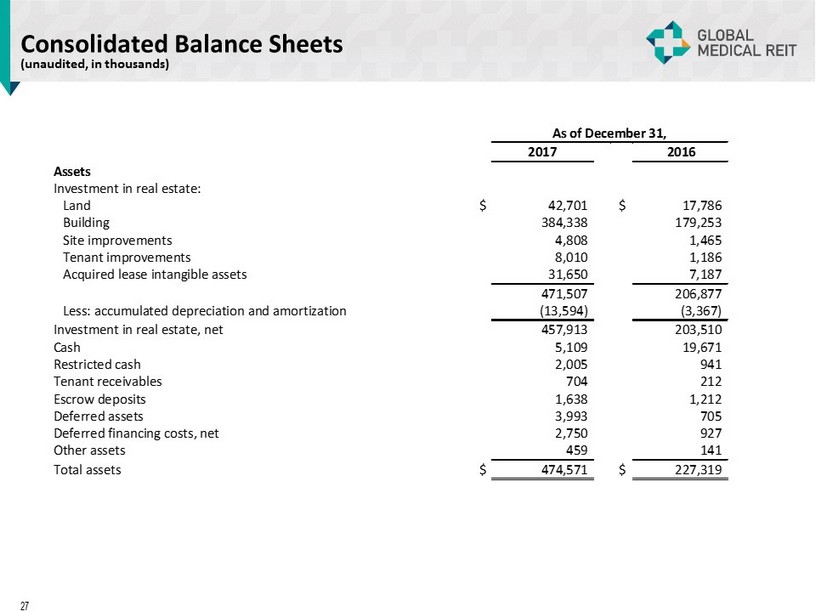

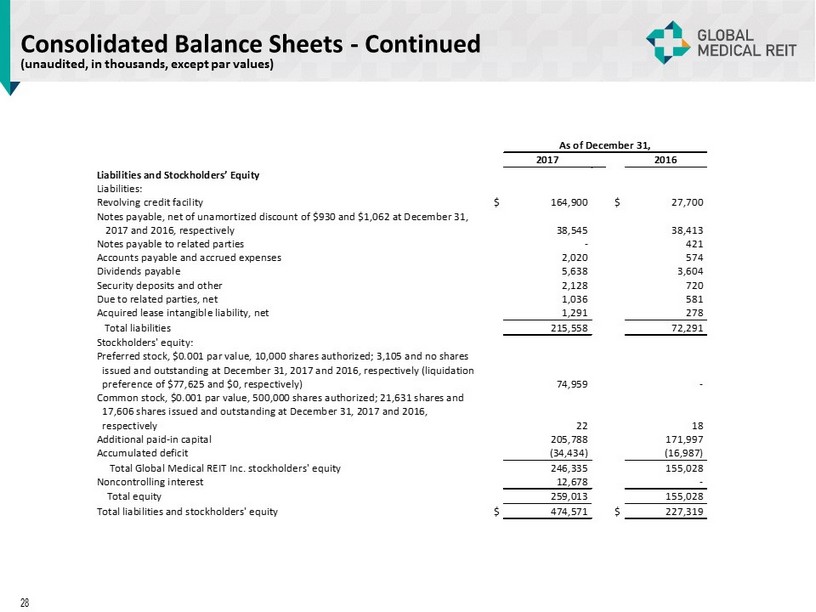

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2018, the Company issued a press release announcing the Company’s financial position as of December 31, 2017, and operating results for the three months and year ended December 31, 2017 and other related information. A copy of the press release has been furnished as Exhibit 99.4 to this Current Report on Form 8-K, and is incorporated herein by reference.

The information included in this Current Report on Form 8-K, including the press release furnished as Exhibit 99.4 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information disclosed above in Item 1.01 – Amendment to Revolving Credit Facility is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Entry into Material Contract with Named Executive Officer and Compensatory Arrangements of Certain Officers.

Equity Incentive Awards

On March 5, 2018, the Board of Directors (the “Board”) of the Company approved the recommendations of the Compensation Committee of the Board with respect to the granting of 2018 Long-Term Performance-Based Incentive LTIP Awards (the “Long-Term Performance Awards”) and Long-Term Time-Based Incentive LTIP Awards (the “Long-Term Time-Based Awards” and, together with the Long-Term Performance Awards, the “Awards”) to the executive officers of the Company and other employees of the external manager of the Company (the “Manager”) who perform services for the Company. The Awards were granted pursuant to the Company’s 2016 Equity Incentive Plan.

The Awards granted are described below.

Name |

Title |

2018 Long-Term Performance Award Target |

Number of Target Long-Term Performance Award Units |

2018 Long-Term Time-Based Award |

Number of Long-Term Time-Based Award Units |

| Jeffrey Busch | Chief Executive Officer, Chairman of the Board & President |

$129,600 | 19,840 | $86,400 | 13,111 |

| Alfonzo Leon | Chief Investment Officer | $120,000 | 18,370 | $80,000 | 12,140 |

| Robert Kiernan | Chief Financial Officer | $93,600 | 14,330 | $62,400 | 9,469 |

| Jamie Barber | General Counsel and Secretary | $79,200 | 12,124 | $52,800 | 8,012 |

| Allen Webb | SVP, SEC Reporting and Technical Accounting |

$71,136 | 10,890 | $47,424 | 7,196 |

| 3 |

The number of target LTIP Units comprising each Long-Term Performance-Based Award is based on the fair value of the Long-Term Performance-Based Awards as determined by an independent valuation consultant, in each case rounded to the next whole LTIP unit to eliminate fractional units.

Long-Term Performance-Based Awards

The Long-Term Performance-Based Awards will be subject to the terms and conditions of LTIP Long-Term Performance-Based Award Agreements (“LTIP Long-Term Performance-Based Award Agreements”) between the Company and each grantee in the form attached hereto as Exhibit 99.1 (for grantees who have an employment agreement with the Manager) or Exhibit 99.2 (for grantees who do not have an employment agreement with the Manager), which are incorporated herein by reference. Terms not otherwise defined herein have the meanings assigned to them in the LTIP Long-Term Performance-Based Award Agreements.

The number of Earned LTIP Units that each grantee is entitled to receive under the LTIP Long-Term Performance-Based Award Agreements will be determined following the conclusion of a three-year performance period (the “Long-Term Performance Period”) based on the Company’s Total Shareholder Return (“TSR”) on both an absolute basis (“Absolute TSR Component”) (representing 75% of the target Long-Term Performance-Based Award) and relative to the companies comprising the SNL U.S. Healthcare REIT Index (“Relative TSR Component”) (representing 25% of the target Long-Term Performance-Based Award) during the Long-Term Performance Period. Grantees will not be entitled to receive any LTIP Units except to the extent they are earned upon the end of the Long-Term Performance Period in accordance with the terms and conditions of the LTIP Long-Term Performance-Based Award Agreements. Long-Term Performance-Based Award LTIP Units that are not earned will be forfeited and cancelled and unvested Earned LTIP Units will be subject to forfeiture prior to vesting as set forth below.

The number of LTIP Units earned under the Absolute TSR Component of the Long-Term Performance-Based Awards will be determined as soon as reasonably practicable following the earlier of (a) the calendar day immediately preceding the third anniversary of March 5, 2018, or (b) the date upon which a Change of Control occurs (the “Long-Term Valuation Date”), by multiplying the total target number of Long-Term Performance-Based Award LTIP Units by 75% and then multiplying such product by the applicable Percentage of Absolute TSR Component Earned based on the Company’s Total Shareholder Return as shown below:

| Total Shareholder Return | Percentage of Absolute TSR Component Earned |

| 21% | 50% |

| 27% | 100% |

| 33% | 200% |

The Absolute TSR Component will be forfeited in its entirety if the Total Shareholder Return is less than 21%. If the Total Shareholder Return is between 21% and 27%, or between 27% and 33%, the percentage of the Absolute TSR Component earned will be determined using linear interpolation as between those tiers, respectively.

| 4 |

The number of Long-Term Performance-Based Award LTIP Units earned under the Relative TSR Component will be determined as soon as reasonably practicable following the Long-Term Valuation Date by multiplying the number of Award LTIP Units by 25% and then multiplying such product by the applicable Percentage of Relative TSR Component Earned based on the Company’s Relative Performance as shown below:

| Relative Performance | Percentage of Relative TSR Component Earned |

TSR equal to the 35th percentile of Peer Companies |

50% |

TSR equal to the 55th percentile of Peer Companies |

100% |

TSR equal to or greater than the 75th percentile of Peer Companies |

200% |

The Relative TSR Component will be forfeited in its entirety if the Relative Performance is below the 35th percentile of Peer Companies. If the Relative Performance is between the 35th percentile and 55th percentile of Peer Companies, or between the 55th percentile and 75th percentile of Peer Companies, the percentage of the Relative TSR Component earned will be determined using linear interpolation as between those tiers, respectively.

As soon as practicable following the Long-Term Valuation Date, the Compensation Committee will determine the number of LTIP Units earned by each grantee under both the Absolute TSR Component and the Relative TSR Component. Any Award LTIP Units that are not earned as set forth above will be forfeited, and the grantee will have no right in or to any such unearned and unissued LTIP Units after it is determined that they were not earned.

Units that have been earned based on performance as provided above are subject to forfeiture restrictions that vest in the following amounts and on the following vesting dates subject to the continuous service of the grantee through and on the applicable vesting date:

(i) 50% of the Earned LTIP Units become vested, and cease to be subject to forfeiture, as of the Long-Term Valuation Date; and

(ii) 50% of the Earned LTIP Units become vested, and cease to be subject to forfeiture, on the first anniversary of the Long-Term Valuation Date.

Long-Term Time-Based Awards

The Long-Term Time-Based Awards will be subject to the terms and conditions of LTIP Unit Award Agreements (“LTIP Unit Award Agreements,” and, together with the LTIP Long-Term Performance-Based Award Agreements, the “Award Agreements”) between the Company and each grantee in the form filed as exhibit herewith as Exhibit 99.3, which is incorporated herein by reference. Long-Term Time-Based Awards become vested, and cease to be subject to forfeiture, in equal one-third increments on each of the first, second and third anniversaries of the date of grant (March 5, 2018).

Distributions

Pursuant to the LTIP Long-Term Performance-Based Award Agreements, distributions equal to the dividends declared and paid by the Company will accrue during the applicable period on the maximum number of LTIP Units that the grantee could earn (if applicable) and are paid with respect to all of the Earned LTIP Units at the conclusion of the applicable period, in cash or by the issuance of additional LTIP Units at the discretion of the Compensation Committee.

The foregoing summaries of the Award Agreements are qualified in their entirety by reference to the forms of agreement filed herewith as Exhibits 99.1, 99.2 and 99.3.

| 5 |

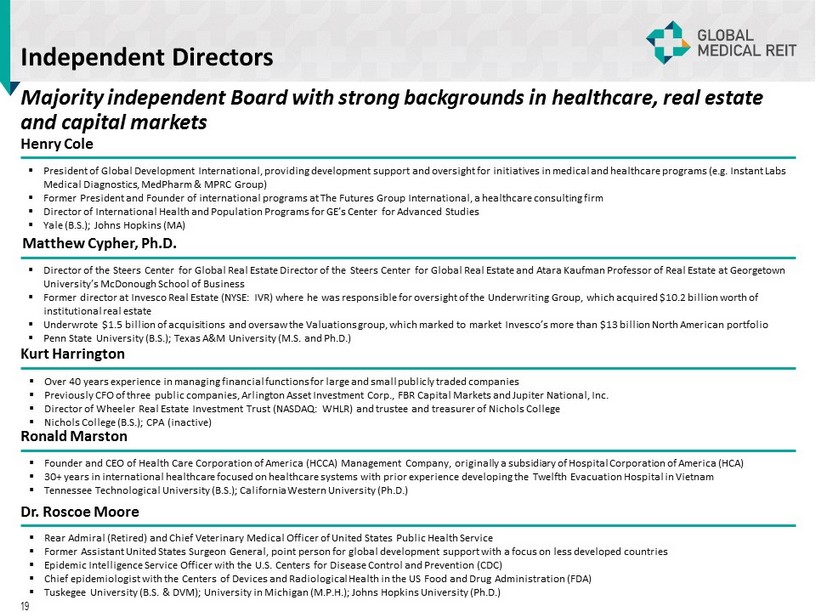

Director Compensation

On March 5, 2018, the Board also approved the following annual compensation amounts for its independent directors for the year beginning with the 2018 annual meeting of the Company’s stockholders:

|

Independent Director Compensation

| |

| Annual Cash Retainer | $30,000, payable quarterly in arrears |

| Annual Equity Award | $30,000, granted on the date of the annual meeting upon election of the grantee as a director and payable as a number of LTIP Units based on the average closing price of the Company’s common stock as reported on the NYSE during the 10 trading days preceding the date of the annual meeting and subject to forfeiture restrictions that will lapse on the first anniversary of the grant date subject to continued service as a director through such vesting date. |

|

Independent Committee Member Compensation

| |

| Annual Cash Retainer |

Audit Committee: $6,000 Compensation Committee: $5,000 Nominating & Corporate Governance Committee: $3,500 Investment Committee: $5,500

All payable quarterly in arrears |

| Annual Cash Retainer for Chair |

Audit Committee Chair: $12,000 Compensation Committee Chair: $10,000 Nominating & Corporate Governance Committee Chair: $7,000 Investment Committee Chair: $11,000

All payable quarterly in arrears |

|

Lead Independent Director Compensation

| |

| Annual Cash Retainer | $15,000, payable quarterly in arrears |

Retention Awards

On March 5, 2018, the Board approved retention awards consisting of 19,727 LTIP Units, representing a grant date value of $130,000, to Robert Kiernan, the Company’s Chief Financial Officer, and 16,692 LTIP Units, representing a grant date value of $110,000, to Jamie Barber, the Company’s General Counsel and Secretary. 50% of the LTIP Units will vest on March 5, 2020 and 50% will vest on March 5, 2021. The LTIP Units were granted pursuant to the Company’s 2016 Equity Incentive Plan and will be subject to the terms and conditions of the LTIP Unit Award Agreements between the Company and each grantee in the form filed as exhibit herewith as Exhibit 99.3, which is incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

On March 7, 2018, the Company updated a presentation concerning the Company on its website, www.globalmedicalreit.com, on the “Investors” page. A copy of the investor presentation is furnished as Exhibit 99.5 to this Current Report on Form 8-K and is incorporated herein solely for purposes of this Item 7.01 disclosure.

Such investor presentation shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The information in this Item 7.01, as well as Exhibit 99.5, shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing.

| 6 |

| Item 8.01 | Other Events. |

On March 7, 2018, the Company announced the declaration of:

| · | a cash dividend for the first quarter of 2018 of $0.20 per share of common stock to stockholders of record as of March 22, 2018, to be paid on April 10, 2018; and |

| · | a cash dividend of $0.46875 per share to holders of its Series A Cumulative Redeemable Preferred Stock, $0.001 par value per share (the “Series A Preferred Stock”), of record as of April 15, 2018, to be paid on April 30, 2018. This dividend represents the Company’s quarterly dividend on its Series A Preferred Stock for the period from January 31, 2018 through April 29, 2018. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

*Filed herewith

| 7 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Global Medical REIT Inc. | ||

| By: | /s/ Jamie A. Barber | |

| Jamie A. Barber | ||

| Secretary and General Counsel | ||

Dated: March 7, 2018

| 8 |

Exhibit 10.1

CONTRIBUTION AND SALE AGREEMENT

Between

Minnite Family, LLC, a West Virginia limited liability company;

Belpre I, LLC, a West Virginia limited liability company;

Belpre II, LLC, a West Virginia limited liability company;

Belpre III, LLC, a West Virginia limited liability company; and

Belpre IV, LLC, a West Virginia limited liability company

(collectively, “Seller”)

and

GMR Belpre, LLC, a Delaware limited liability company

(“Buyer”)

Property:

807 Farson St., Belpre, Ohio 45714 (Belpre I)

805 Farson St., Belpre, Ohio 45714 (Belpre II)

803 Farson St., Belpre, Ohio 45714 (Belpre III)

799 Farson St., Belpre, Ohio 45714 (Belpre IV)

March 6, 2018

TABLE OF CONTENTS

| Page | |||

| 1. | Sale and Purchase | 2 | |

| 2. | Purchase Price | 2 | |

| 2.1 | Deposit | 3 | |

| 2.2 | Payment at Closing | 3 | |

| 2.3 | Independent Consideration | 4 | |

| 2.4 | Allocation | 4 | |

| 2.5 | Tax Consequences to Seller | 4 | |

| 3. | Property Information; Confidentiality | 4 | |

| 3.1 | Entry | 5 | |

| 3.2 | Inspection Period | 6 | |

| 3.3 | Title and Survey Matters | 6 | |

| 3.4 | Memoranda of Leases | 7 | |

| 4. | Representations and Warranties of Seller | 7 | |

| 4.1 | Authority | 7 | |

| 4.2 | No Conflict | 8 | |

| 4.3 | OFAC Compliance | 8 | |

| 4.4 | No Governmental Authority Required | 8 | |

| 4.5 | Credit of the Property | 9 | |

| 4.6 | Governmental Commitments | 9 | |

| 4.7 | Leases | 9 | |

| 4.8 | No Condemnation | 9 | |

| 4.9 | Contracts | 9 | |

| 4.10 | Tenant Improvement Allowances | 10 | |

| 4.11 | Correction of Conditions | 10 | |

| 4.12 | Compliance | 10 | |

| 4.13 | Zoning | 10 | |

| 4.14 | Property Permits | 10 | |

| 4.15 | Structural Defects | 10 | |

| 4.16 | Utilities | 10 | |

| 4.17 | Hazardous Materials | 11 | |

| 4.18 | Litigation | 11 | |

| 4.19 | FIRPTA | 11 | |

| 4.20 | Liens | 11 | |

| 4.21 | Insurance | 12 | |

| 4.22 | Operation | 12 | |

| 4.23 | Change of Facts | 12 | |

| 4.24 | On-Site Employees | 12 | |

| 4.25 | Information | 12 | |

| 4.26 | Seller’s Knowledge | 12 | |

| i |

| 4.27 | No Other Options | 12 | |

| 4.28 | Survivability of Representations and Warranties | 13 | |

| 4.29 | Limitations Regarding Representations and Warranties | 13 | |

| 4.30 | Additional Representations and Warranties by OP Unit Holder | 13 | |

| 5. | Representations of Buyer | 16 | |

| 5.1 | Authority | 16 | |

| 5.2 | No Conflict | 16 | |

| 5.3 | OFAC Compliance | 16 | |

| 6. | Conditions Precedent | 16 | |

| 6.1 | Conditions Precedent to Buyer’s Obligations | 16 | |

| 6.2 | Conditions Precedent to Seller’s Obligations | 17 | |

| 6.3 | Termination of Agreement with Respect to a Removed Parcel; Election and Termination Options | 18 | |

| 7. | Failure of Conditions | 19 | |

| 7.1 | Failure of a Buyer Closing Condition | 19 | |

| 7.2 | Failure of a Seller Closing Condition | 19 | |

| 8. | Pre-Closing Matters | 19 | |

| 8.1 | Termination for Default | 19 | |

| 8.2 | Leasing Matters | 19 | |

| 8.3 | Adjustments of Leasing Expenses | 20 | |

| 8.4 | Operation of Property | 20 | |

| 8.5 | Contracts | 20 | |

| 8.6 | No Contracting for Sale of Property | 20 | |

| 8.7 | No Liens on Property | 20 | |

| 8.8 | Survival | 20 | |

| 9. | Closing; Deliveries | 20 | |

| 9.1 | Time of Closing | 20 | |

| 9.2 | Seller Deliveries | 21 | |

| 9.3 | Buyer Deliveries | 23 | |

| 10. | Apportionments; Taxes; Expenses | 23 | |

| 10.1 | Apportionments | 23 | |

| 10.2 | Closing Costs | 25 | |

| 11. | Damage or Destruction; Condemnation; Insurance | 26 | |

| 12. | Remedies | 26 | |

| 12.1 | Buyer Default | 26 | |

| 12.2 | Seller Default | 26 | |

| 13. | Possession | 27 | |

| 14. | Notices | 27 | |

| ii |

| 15. | Brokers | 28 | |

| 16. | Escrow Agent | 28 | |

| 16.1 | Obligations | 28 | |

| 16.2 | Reliance | 28 | |

| 16.3 | Indemnification | 28 | |

| 16.4 | Disputes | 29 | |

| 16.5 | Counsel | 29 | |

| 16.6 | Interest | 29 | |

| 17. | Indemnification | 29 | |

| 17.1 | Seller’s Indemnification | 29 | |

| 17.2 | Buyer’s Indemnification | 29 | |

| 17.3 | Definition of Exist | 30 | |

| 18. | Miscellaneous | 30 | |

| 18.1 | Assignability | 30 | |

| 18.2 | Governing Law; Bind and Inure | 30 | |

| 18.3 | Recording | 30 | |

| 18.4 | Time of the Essence | 30 | |

| 18.5 | Further Assurances | 30 | |

| 18.6 | Exclusivity | 30 | |

| 18.7 | Non-Solicitation | 31 | |

| 18.8 | Headings | 31 | |

| 18.9 | Counterparts | 31 | |

| 18.10 | Exhibits | 31 | |

| 18.11 | Use of Proceeds to Clear Title | 31 | |

| 18.12 | Submission not an Offer or Option | 31 | |

| 18.13 | Entire Agreement; Amendments | 32 | |

| 18.14 | Attorneys’ Fees | 32 | |

| 18.15 | Waiver of Jury Trial | 32 | |

| 18.16 | No Waiver | 32 | |

| 18.17 | Rules of Construction | 32 | |

| 18.18 | Confidentiality | 32 | |

| 18.19 | Section 1031 Exchange | 33 | |

| 19. | Additional Provisions Concerning the OP Units | 33 | |

| 19.1 | Redemption of OP Units | 33 | |

| 19.2 | Affirmative Covenants of OP Unit Holder | 33 | |

| 19.3 | Equitable Remedies | 34 | |

| 19.4 | Indemnification | 34 | |

| 19.5 | Evidence and Issuance of OP Units | 34 | |

| 19.6 | Compliance with Anti-Money Laundering Regulations, etc | 34 | |

| 19.7 | Transfers - Unacceptable Investors | 36 | |

| 19.8 | FATCA and Other Tax Provisions | 37 | |

| 19.9 | Survival | 39 | |

| iii |

CONTRIBUTION AND SALE AGREEMENT

This CONTRIBUTION AND SALE AGREEMENT (this “Agreement”) is entered into effective as of the 6th day of March, 2018 (the “Effective Date”), by and between Minnite Family, LLC, a West Virginia limited liability company, Belpre I, LLC, a West Virginia limited liability company, Belpre II, LLC, a West Virginia limited liability company, Belpre III, LLC, a West Virginia limited liability company, and Belpre IV, LLC, a West Virginia limited liability company, (hereinafter collectively “Seller”), GMR Belpre, LLC, a Delaware limited liability company (“Buyer”) and Minnite Family, LLC, a West Virginia limited liability company, as OP Unit Holder (as defined below). First American Title Insurance Company (“Escrow Agent”) joins in this Agreement for the limited purposes set forth herein.

BACKGROUND

A. This Agreement is made with reference to the following property (collectively, the “Property”):

(1) Seller’s fee interest in that certain real property located at:

| • | 807 Farson St., Belpre, Ohio 45714 (“Belpre I”); |

| • | 805 Farson St., Belpre, Ohio 45714 (“Belpre II”); |

| • | 803 Farson St., Belpre, Ohio 45714 (“Belpre III”); |

| • | 799 Farson St., Belpre, Ohio 45714 (“Belpre IV”); and |

• certain areas adjacent to Belpre I, Belpre II, Belpre III and Belpre IV (“Minnite Family Property”),

which land is more particularly described on Exhibit “A” attached hereto and incorporated herein by this reference, together with all easements, rights and privileges appurtenant thereto, if any (each of Belpre I, Belpre II, Belpre III, Belpre IV and Minnite Family Property is a “Parcel” and all of the Parcels are collectively, the “Land”);

(2) All of Seller’s right, title and interest in and to the four (4) medical office buildings located upon the Land (the “Buildings”), together with all improvements, structures, fixtures and parking areas located on the Land, if any, and appurtenant thereto (the Buildings and such improvements, structures, fixtures and parking areas being hereinafter collectively referred to as the “Improvements,” and the Land and the Improvements being hereinafter collectively referred to as the “Real Property”);

(3) All of Seller’s right, title and interest in and to the tenant leases and subleases relating to the Improvements and other occupancy agreements with tenants and subtenants occupying or using all or any portion of the Real Property (collectively with all amendments thereto, the “Leases”), any and all security deposits, letters of credit, advance rental, letters of credit or like payments, if any, held by Seller (collectively, the “Security Deposits”), and all guaranties of the Leases, if any, held by Seller;

| 1 |

(4) All of Seller’s right, title and interest in and to all fixtures, equipment, appliances, and other personal property of every nature and description attached or pertaining to, or otherwise used in connection with, the Real Property, owned by Seller and located within the Real Property but expressly excluding any of the foregoing owned or leased by any tenant and any personal property owned or leased by a third party (the “Personal Property”); and

(5) All of Seller’s right, title and interest in and to all intangible rights and property used or useful in connection with the foregoing, if any, including, without limitation, all development rights, contract rights, guaranties, licenses, plans, drawings, permits and warranties and all of Seller’s rights, title and interest, if any, in and to any service marks, logos or any trade names as well as all of Seller’s rights and remedies under all construction, design and related agreements relating to the Buildings (collectively, the “Intangible Property”); provided, however, that this provision does not include and shall not restrict in any manner Seller’s right, title and interest in and to any intangible rights and property similar in nature to the Intangible Property, but which is not related to the Real Property, Buildings, Land, or Improvements other than those which become a Removed Parcel or Removed Parcels hereunder, including, but not limited to, the use of Seller entity names, the development of real estate other than the Real Property, Buildings, Land, or Improvements owned or hereafter owned by Seller or any of Seller entities, regardless of location, and the ownership, operation, development, leasing or sale or conveyance of any Removed Parcel or Removed Parcels.

The terms “Real Property” and “Property” shall be amended to reflect the exclusion of a “Removed Parcel” (as defined in Section 6.3.1 below) from the transactions contemplated by this Agreement.

B. Seller is prepared to sell, transfer and convey the Property to Buyer, and Buyer is prepared to purchase and accept the same from Seller, all for the Purchase Price and on the other terms and conditions hereinafter set forth.

TERMS AND CONDITIONS

In consideration of the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereto agree:

1. Sale and Purchase. Seller hereby agrees to sell, transfer and convey the Property to Buyer, and Buyer hereby agrees to purchase and accept the Property from Seller, in each case for the Purchase Price and subject to the other terms and conditions set forth in this Agreement.

2. Purchase Price. The purchase price for the Property (the “Purchase Price”) shall be Sixty-Four Million Two Hundred Thousand and 00/100 Dollars ($64,200,000). Seller and Buyer hereby acknowledge and agree that the Purchase Price shall be allocated among the Parcels in the manner set forth on the attached Schedule 1 (the “Allocated Purchase Price”). Seller and Buyer agree that the Allocated Purchase Price has been arrived at by a process of arm’s length negotiations, including, without limitation, the parties’ best judgment as to the fair market value of each respective asset, and Seller and Buyer will consistently reflect those allocations on their respective federal, state and local tax returns, including any state, county and other local transfer or sales tax declarations or forms to be filed in connection with this transaction, which obligations shall survive the Closing. In the event either Seller or Buyer desires to adjust the Allocated Purchase Price between the Effective Date and the Closing, Seller and Buyer shall reasonably cooperate to effect such adjustment and Schedule 1 shall be amended to reflect such adjustment.

| 2 |

The Purchase Price, subject to the terms and conditions hereinafter set forth, shall be paid to Seller by Buyer as follows:

2.1 Deposit. Within three (3) Business Days (as defined below) following the mutual execution and delivery of this Agreement by Buyer and Seller, Buyer shall deliver to Escrow Agent a deposit in the amount of One Million and 00/100 Dollars ($1,000,000) (together with any interest thereon, the “Initial Deposit”). If Buyer approves all matters pursuant to Section 3.2 hereof on or before the expiration of the Inspection Period and if the Closing has not already occurred, Buyer shall deliver to Escrow Agent an additional deposit in the amount of One Million and 00/100 Dollars ($1,000,000) (together with any interest thereon, the “Additional Deposit”) within three (3) Business Days following the expiration of the Inspection Period. The Initial Deposit and the Additional Deposit shall be referred to herein collectively as the “Deposit.” The Deposit shall be delivered to Escrow Agent in immediately available funds, to be held in escrow and delivered in accordance with this Agreement at the following address: First American Title Insurance Company, 777 S. Figueroa St., 4th Floor, Los Angeles, CA 90017, attention: Brian Serikaku, Senior Escrow Officer, telephone: (213) 271-1774, facsimile: (877) 398-1603, e-mail: [email protected]. Each Seller and Buyer hereby acknowledge and agree that the Deposit shall be allocated among each Parcel in the same percentage allocation as the Purchase Price is allocated to each Building on the Property (with respect to each Property, the “Allocated Deposit”).

2.2 Payment at Closing.

(a) OP Units. The parties acknowledge and agree that all or a portion of the Purchase Price may be payable to Minnite Family, LLC, a West Virginia limited liability company (the “OP Unit Holder”) in partnership units (the “OP Units”) in Global Medical REIT, L.P., a Delaware limited partnership (the “Operating Partnership”), Buyer’s sole member. The amount of the Purchase Price to be paid through the issuance of OP Units (the “OP Unit Issuance Amount”) and the Parcel(s) or portions thereof to be contributed in exchange for OP Units shall be determined by Seller, at its sole discretion, upon the delivery of written notice to Buyer and to Escrow Agent no later than 5:00 pm (Eastern Time) on the date that is two (2) Business Days after Buyer has delivered to Seller a copy of GMR REIT’s Annual Report on Form 10-K for the year ended December 31, 2017; provided, however that the OP Unit Issuance Amount shall not exceed Five Million Five Hundred Thousand and 00/100 Dollars ($5,500,000.00). The number of OP Units to be received by OP Unit Holder will be equal to the quotient of the portion of the Purchase Price to be received by such individual or entity divided by the greater of either (i) the Market Value (as defined below) or (ii) Nine and 00/100 Dollars ($9.00). The transfer of the OP Units to each such individual or entity shall be evidenced by an amendment (the “Operating Partnership Amendment”) to the OP Partnership Agreement (as defined in Section 4.30(d)). As used herein, the term “Market Value” shall be equal to the Volume Weighted Average Price of the common stock of Global Medical REIT Inc. as reported on the New York Stock Exchange during the twenty (20) trading days ending on the trading day immediately preceding the Closing Date. No fractional OP Units will be issued and all fractional interests, if any, shall be rounded to the nearest whole number.

| 3 |

(b) At the consummation of the transaction contemplated hereby (the “Closing”), Buyer shall deliver to Escrow Agent cash or immediately available funds in an amount equal to the Purchase Price, less the Deposit and less the OP Unit Issuance Amount. To the extent paid in cash or immediately available funds, the Purchase Price, subject to adjustments and apportionments as set forth herein, shall be paid at Closing by wire transfer of immediately available federal funds, transferred to the order or account of Seller or such other person as Seller may designate in writing.

(c) The delivery and recording of documents and the disbursement of funds shall be effectuated through the Escrow Agent at the Closing and pursuant to the closing instructions from the parties hereto, which closing instructions shall not modify or diminish the parties’ respective obligations hereunder.

2.3 Independent Consideration. Seller and Buyer acknowledge and agree that One Hundred Dollars ($100.00) of the Deposit shall be paid to Seller if this Agreement is terminated for any reason (the “Independent Contract Consideration”), in addition to any other rights Seller may have hereunder. Moreover, Seller and Buyer acknowledge and agree that the Independent Contract Consideration has been bargained for and agreed to as additional consideration for Seller’s execution and delivery of this Agreement and is non-refundable to Buyer.

2.4 Allocation. Seller and Buyer acknowledge that no portion of the Purchase Price is allocated to the Personal Property, if any, transferred pursuant to this Agreement.

2.5 Tax Consequences to Seller. Notwithstanding anything to the contrary contained in this Agreement, including without limitation the use of words and phrases such as “sell,” “sale,” “purchase,” and “pay,” the parties hereto acknowledge, agree and consent that it is their intention that the transactions contemplated hereby be treated for federal income tax purposes (i) in accordance with Section 721 of the Internal Revenue Code of 1986, as amended (the “Code”) with respect to any portion of the Purchase Price that is payable in OP Units; and (ii) as a sale of the Property to the Operating Partnership to the extent of the Seller’s receipt of cash consideration pursuant to Section 2 of this Agreement.

3. Property Information; Confidentiality. No later than three (3) Business Days after the Effective Date, Seller shall, to the extent the items are in Seller’s possession or are readily available to Seller, deliver to Buyer accurate and complete copies of all of the information set forth on Exhibit “K” (collectively, the “Property Information”). All Property Information shall be delivered to Attention: Alfonzo Leon, Chief Investment Officer, Global Medical REIT, address: 2 Bethesda Metro Center, Suite 440, Bethesda, Maryland 20814, telephone: (202) 524-6853, facsimile: (202) 380-0891, e-mail: [email protected].

| 4 |

The Property Information, or much of the Property Information, is proprietary and confidential in nature, and the disclosure or use thereof in violation of these provisions will result in serious damage to Seller. Accordingly, unless otherwise required by law, including without limitation, court order, legal process or securities laws, Buyer will hold all Property Information in strict confidence, will not use or disclose to any third party or permit the use or disclosure to any third party of any Property Information except to such directors, officers, managers, members, partners, employees, agents, or representatives who need such Property Information for the proper performance of their assigned duties relating to the evaluation of the transaction contemplated hereby, and shall take appropriate action to cause their directors, officers, managers, members, partners, employees, agents, or representatives to be bound by the provisions hereof, and shall remain liable for any disclosure or misuse of such information by any such director, officer, manager, member, partner, employee, agent or representative. Buyer may disclose such Property Information to third party professional advisors for evaluation, provided that such advisors agree not to use any such Property Information except as provided in this Agreement, and provided further that Buyer shall remain liable under this Agreement for any disclosure or misuse of such Property Information by any such advisor.

In the event that either party terminates this Agreement, Buyer shall, upon request of Seller, immediately deliver or cause to be delivered to Seller, without retaining any copies thereof, or destroy, at the option of Seller, any and all documents, statements or other information obtained from the Seller containing Property Information as well as any summary, record or notation thereof, except to the extent any such summary, record or notation is subject to any attorney-client, work-product, confidentiality, or other privilege and/or except to the extent Buyer is required to retain such documents, statements, other information, summary, record or notation by law or by Buyer’s internal document retention policies.

Buyer agrees that breach of these provisions will cause Seller irreparable injury for which an adequate remedy does not exist at law alone, and that Seller may, in addition to seeking damages at law as hereinafter provided, obtain an injunction to stop any breach. Northing contained in this paragraph, however, shall limit the resort by Seller to any right or remedy available at law, including, but not limited to, available remedies pursuant to state of federal statutes protecting trade secrets or other statutory protections or remedies, or at common law, for damages or otherwise.

Notwithstanding the foregoing, these provisions shall not apply to any Property Information which (i) is or becomes generally available to the public other than as a result of improper disclosure hereunder; or (ii) was available or becomes available to Buyer on a non-confidential basis.

3.1 Entry. During the Inspection Period (as defined below), Buyer and its agents and representatives shall be entitled to enter upon the Real Property from time to time (as coordinated through Seller’s property manager), including all leased areas, upon reasonable prior notice to Seller, to perform inspections and tests of the Property, including surveys, environmental studies, examinations and tests of all structural and mechanical systems within the Improvements, to interview Seller’s key personnel and to examine the books and records of Seller and Seller’s property manager relating to the Property.

| 5 |

Notwithstanding the foregoing, Buyer shall not be permitted to interfere unreasonably with Seller’s operations at the Property or disturb or interfere with any tenant’s rights, occupancy and operations at the Property, and the scheduling of any inspections shall take into account the timing and availability of access to tenants’ premises and tenant’s aforesaid rights, occupancy and operation. If Buyer wishes to engage in any testing which is invasive, which will disturb any portion of the Property, which will involve sampling, or which will involve testing of subsurface soils, surface water, or groundwater, Buyer shall obtain Seller’s prior written consent thereto which consent shall not be unreasonably withheld, conditioned or delayed; provided, however, that no such inspections, testing or sampling shall disturb or damage any improvements on or to the Property. Buyer shall indemnify and hold harmless Seller from any claims, damages, liabilities, or losses arising from any damage to persons or property directly caused by Buyer’s investigations conducted pursuant to this Section; provided, however, that Buyer shall have no obligation to indemnify, defend and hold Seller harmless from and against any such claims, damages, liabilities, or losses to the extent resulting from Seller’s acts or omissions or Buyer’s mere discovery of adverse physical conditions affecting the Property, including, without limitation, any Hazardous Materials (as defined below).

3.2 Inspection Period. The term “Inspection Period,” as used herein, shall mean the period commencing on the Effective Date and ending at 5:00 p.m. Pacific time on the date which is thirty (30) days following the Effective Date, provided, that if such date is not a Business Day (as defined below), then the Inspection Period shall continue through 5:00 p.m. Pacific time on the next Business Day following such date. Buyer may terminate this Agreement in its entirety, and only in its entirety, in its sole discretion for any reason or no reason by giving written notice of such election to Seller at any time prior to the expiration of the Inspection Period, in which event the Deposit shall automatically be refunded and returned forthwith to Buyer and, except as expressly set forth herein, neither party shall have any further liability or obligation to the other hereunder. In the absence of such written notice of termination, the contingency provided for in this Section 3.2 no longer shall be applicable, and this Agreement shall continue in full force and effect.

3.3 Title and Survey Matters. Title to the Real Property shall be examined by Buyer at its cost. If said title examination and a preliminary title report and/or any title insurance commitment Buyer may obtain from Escrow Agent (acting in its capacity as title company (the “Title Company”)), (the “Title Report”), or any survey obtained by Buyer at its cost, discloses material defects in title to the Real Property to which Buyer objects (collectively “Title Objections”), Buyer shall notify Seller in writing within twenty (20) days of Buyer’s receipt of the Title Report and/or survey. If Buyer timely notifies Seller in writing of the Title Objections, Seller shall have five (5) Business Days after receipt of such notice (the “Title Cure Period) to elect (but shall have no obligation whatsoever) to cure any Title Objection, and if so elected, shall either (a) satisfy the Title Objections at Seller’s sole cost and expense, or (b) provide Buyer and the Title Company with satisfactory evidence that Seller can and will cure such Title Objections prior to or at Closing; provided, however, Seller shall be obligated to remove, pay and/or satisfy prior to or at Closing any monetary liens against the Property (each, a “Monetary Lien”). Failure by Seller to timely respond in writing to any Title Objections shall be deemed Seller’s decision to cure any Title Objections. If Seller elects not to satisfy any of the Title Objections or otherwise fails to satisfy the Title Objections within the Title Cure Period, Buyer shall have the option, exercisable within five (5) Business Days after the expiration of the Title Cure Period, to (i) waive the unsatisfied Title Objections, in which event the unsatisfied Title Objections will become Permitted Exceptions (hereinafter defined), or (ii) terminate this Agreement in which event the Deposit shall automatically be refunded and returned forthwith to Buyer and, except as expressly set forth herein, neither party shall have any further liability or obligation to the other hereunder. If Buyer fails to notify Seller in writing within five (5) Business Days after the expiration of the Title Cure Period that Buyer has elected to terminate this Agreement pursuant to this Section 3.3, then Buyer shall be deemed to have waived all unsatisfied Title Objections. If, after the expiration of the Inspection Period, Title Company amends or adds any exception to the Title Report other than at the request of Buyer (including any liens against the Property for a liquidated amount that Seller is not obligated hereunder to satisfy at Closing), the Title Company will notify Buyer and Seller immediately. Within two (2) Business Days after Buyer receives notice from Title Company (and the Closing Date shall be extended if needed so that the Closing shall not occur prior to the end of such two (2) Business Day period), together with a copy of such intervening lien or matter, Buyer shall notify Seller in writing of any objections thereto (a “Supplemental Title Objection”). If Buyer fails to notify Seller of such Supplemental Title Objection within such two (2) Business Day period, Buyer shall be deemed to have waived any objection and approved all such exceptions. If the Supplemental Title Objection is material and adverse to the Property, is not caused by Buyer and Seller does not agree to remove such matter (other than any Monetary Lien), then Buyer may within two (2) Business Days after the Supplemental Title Objection, terminate this Agreement in which event the Deposit shall automatically be refunded and returned forthwith to Buyer and, except as expressly set forth herein, neither party shall have any further liability or obligation to the other hereunder. If Seller has not received written notice from Buyer that Buyer has elected to terminate this Agreement within such two (2) Business Day period of time, then Buyer shall be deemed to have waived any unsatisfied Supplemental Title Objection. “Permitted Exceptions” shall mean any title or survey item, other than Monetary Liens: (i) not raised as Title Objections by Buyer, or (ii) raised as Title Objections by Buyer but thereafter waived or deemed waived.

| 6 |

Buyer shall have the right, but is not obligated, to obtain a current survey of the Property which shall be at Buyer’s sole expense.

3.4 Memoranda of Leases. No later than three (3) Business Days prior to the end of the Inspection Period, Seller shall cause to be recorded a memorandum of lease with respect to each Lease. Such memorandum shall be in a form acceptable to Buyer in its sole discretion. In the event Seller is unable to cause to be recorded a memorandum of lease with respect to a Lease despite using commercially reasonable efforts to do so, such failure shall not constitute a default by Seller under this Agreement.

4. Representations and Warranties of Seller. Seller represents and warrants to Buyer as follows:

4.1 Authority. Seller has all requisite power and authority to enter into this Agreement and perform its obligations hereunder. The execution, delivery and performance of this Agreement and all documents contemplated hereby by Seller has been duly and validly authorized by all necessary action on the part of Seller, and all required consents and approvals have been duly obtained and will not result in a breach of any of the terms or provisions of, or constitute a default under any indenture, agreement or instrument to which any Seller is a party, other than those related to Monetary Liens to be resolved, paid and/or satisfied prior to or at Closing. This Agreement is a legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject to the effect of applicable bankruptcy, insolvency, reorganization, arrangement, moratorium or other similar laws affecting the rights of creditors generally.

| 7 |

4.2 No Conflict. Neither the execution, delivery or performance of this Agreement nor compliance herewith (i) conflicts or will conflict with or results or will result in a breach of or constitutes or will constitute a default under (a) any agreement or instrument to which Seller is a party or by which all or any part of the Property is bound other than those related to Monetary Liens to be resolved, paid and/or satisfied prior to or at Closing or (b) any law or any order, writ, injunction or decree of any court or governmental authority, (ii) results in the creation or imposition of any lien, charge or encumbrance upon its property pursuant to any such agreement or instrument, or (iii) violates any restriction, requirement, covenant or condition to which all or any part of the Property is bound.

4.3 OFAC Compliance. To the best of Seller’s knowledge, Seller is in compliance with the requirements of Executive Order No. 13224, 66 Fed. Reg. 49079 (Sept. 25, 2001) (the “Order”) and other similar requirements contained in the rules and regulations of the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) and in any enabling legislation or other Executive Orders or regulations in respect thereof (the Order and such other rules, regulations, legislation or executive orders are collectively referred to herein as the “Orders”). To the best of Seller’s knowledge, neither Seller nor any beneficial owner of Seller:

4.3.1 is listed on the Specifically Designated Nationals and Blocked Persons List maintained by OFAC pursuant to the Orders or on any other list of terrorists or terrorist organizations maintained pursuant to any of the rules and regulations of OFAC or pursuant to any other applicable Orders (collectively, the “Lists”);

4.3.2 is a person who has been determined by competent authority to be subject to the prohibitions contained in the Orders;

4.3.3 is owned or controlled by, or acts for or on behalf of, any person or entity listed on the Lists or any other person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders; or

4.3.4 shall transfer or permit the transfer of any interest in Seller or any beneficial owner in Seller to any person or entity who is, or any of whose beneficial owners are, listed on the Lists.

4.4 No Governmental Authority Required. To the best of Seller’s knowledge, no authorization, consent or approval of any governmental authority (including, without limitation, courts) is required for the execution and delivery by Seller of this Agreement or the performance of its obligations hereunder.

| 8 |

4.5 Credit of the Property. Seller has not (i) made a general assignment for the benefit of creditors, (ii) filed any voluntary petition in bankruptcy or suffered the filing of an involuntary petition by Seller’s creditors, (iii) suffered the appointment of a receiver to take possession of all or substantially all of Seller’s assets, (iv) suffered the attachment or other judicial seizure of all, or substantially all, of Seller’s assets, (v) admitted in writing its inability to pay its debts as they come due or (vi) made an offer of settlement, extension or composition to its creditors generally.

4.6 Governmental Commitments. Seller has not entered into any material commitments or agreements with any governmental authorities or agencies affecting the Property, except as set forth on Exhibit “C”.

4.7 Leases. Seller has delivered or made available to Buyer true and complete copies of the Leases. The list of Leases set forth on Exhibit “B” attached hereto is true, correct and complete. Each of the Leases is in full force and effect. Seller is “landlord” or “lessor” under the Leases and is entitled to assign to Buyer without the consent of any party, the Leases. Seller has no ownership interest in, or any other affiliation with, any tenant. The rent roll provided to Buyer is true, correct, and complete. There are no rights to renew, extend or terminate the Leases or expand any tenant lease premises, except as shown in the rent roll or the Leases. There is no Lease which provides that a tenant pays rent in the form of percentage rent. No rent or other payments have been collected in advance for more than one (1) month and no rents or other deposits are held by Seller, except the security deposits described on the rent roll and rent for the current month. Neither Seller nor any tenant is in default under its respective Lease, and there exists no condition or circumstance or written notice of any condition or circumstance which, with the passage of time, would constitute a default under any of the Leases by any party. No tenant has asserted any claim of offset or other defense in respect of its or Seller’s obligations under its respective Lease. No tenant has (i) filed for bankruptcy or taken any similar debtor-protection measure, (ii) defaulted under its Lease, (iii) discontinued operations at the Property or (iv) given notice of its intention to do any of the foregoing.

4.8 No Condemnation. Seller has not received any written notice of any pending or contemplated condemnation, eminent domain or similar proceeding with respect to all or any portion of the Real Property and, to Seller’s knowledge, no such proceedings are threatened.

4.9 Contracts. There are no construction, management, commission, brokerage, leasing, service, equipment, supply, maintenance or concession agreements entered into by or on behalf of Seller in effect with respect to the Real Property or the Personal Property which cannot be terminated upon thirty (30) days’ prior written notice without penalty, except as set forth in Exhibit “C”. All other construction, management, commission, brokerage, leasing, service, equipment, supply, maintenance or concession agreements entered into by or on behalf of Seller in effect with respect to the Real Property or the Personal Property are listed on Exhibit “C-1”. The agreements listed on Exhibit “C” and Exhibit “C-1” are, collectively, the “Contracts”). Seller has delivered or made available to Buyer true and complete copies of the Contracts. Seller has not, within the last year, received any written notice of any default under any contract that has not been cured or waived. To Seller’s knowledge, neither Seller nor any counterparty is in material default under any Contracts, and no event exists which, with the passage of time or the giving of notice or both, will become a material default thereunder on the part of Seller or any counterparty.

| 9 |

4.10 Tenant Improvement Allowances. There are no tenant improvement allowances, tenant improvement obligations of Landlord, leasing commissions and/or rent concessions with respect to any of the Leases.

4.11 Correction of Conditions. Seller has not received any written notice from, and there are no grounds for, any association, declarant or easement holder requiring the correction of any condition with respect to the Property, or any part thereof, by reason of a violation of any other restrictions or covenants recorded against the Property. Seller is not in default under any such document, nor, to Seller’s knowledge, is any other party subject to any such document.

4.12 Compliance. Seller has not received any written notice from, and there are no grounds for, any governmental agency requiring the correction of any condition with respect to the Property, or any part thereof, by reason of a violation of any applicable federal, state, county or municipal law, code, rule or regulation (including, but not limited to, those respecting the Americans With Disabilities Act), which has not been cured or waived. Seller and the Property are in compliance with all applicable federal, state, county and municipal laws, codes, rules and/or regulations. Seller has not received written notice from any governmental agency or other body of any existing violations of any federal, state, county or municipal laws, ordinances, orders, codes, regulations or requirements affecting the Property which have not been cured.

4.13 Zoning. To the best of Seller’s knowledge, the Property is properly zoned for its current use. To the best of Seller’s knowledge, there is no pending or, to Seller’s knowledge, threatened request, application or proceeding to alter or restrict the zoning or other use restrictions applicable to the Property. To the best of Seller’s knowledge, there is no plan, study or effort by any governmental authority or agency or any private party or entity that in any way affects or would affect the authorization of the current use and operation of the Property.

4.14 Property Permits. Seller has not received any written notice of an intention to revoke or suspend any certificate of occupancy, license, or permit issued in connection with the Property.

4.15 Structural Defects. To the best of Seller’s knowledge, there are no material defects in the structural elements of the Improvements and all Improvements (including, without limitation, machinery, equipment, electrical, plumbing, heating and air conditioning systems and equipment) located on the Property are in good mechanical working order, condition and repair, and are structurally safe and sound and have no material defect (reasonable wear and tear excepted), and there is no leak or material defect in any roof located upon the Property.

4.16 Utilities. All water, sewer, gas, electric, telephone, and drainage facilities and all other utilities required by applicable law for the present use and operation of the Property are installed across public property or valid easements to the boundary lines of the Land, and are connected pursuant to valid permits (to the extent required) with all installation and connection charges paid in full, and Seller has received no notice that such facilities are inadequate to service the Property or are not in good operating condition, and such facilities are adequate to service the Property and are in good operating condition.

| 10 |

4.17 Hazardous Materials. To the best of Seller’s knowledge, and except as reflected in any report of environmental site assessments or similar report provided by Seller to Buyer, there are no Hazardous Materials (as defined below) stored on, incorporated into, located on, present in or used on the Property in violation of, and requiring remediation under, any laws, ordinances, statutes, codes, rules or regulations. For purposes of this Agreement, the term “Hazardous Materials” shall mean any substance which is or contains: (i) any “hazardous substance” as now or hereafter defined in Section 101(14) of the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (42 U.S.C. § 9601, et seq.) (“CERCLA”) or any regulations promulgated under CERCLA; (ii) any “hazardous waste” as now or hereafter defined in the Recourse Conservation and Recovery Act (42 U.S.C. § 6901, et seq.) (“RCRA”) or regulations promulgated under RCRA; (iii) any substance regulated by the Toxic Substances Control Act (15 U.S.C. § 2601, et seq.); (iv) gasoline, diesel fuel or other petroleum hydrocarbons; (v) asbestos and asbestos containing materials, in any form, whether friable or non-friable; (vi) polychlorinated biphenyls; (vii) radon gas; or (viii) any additional substances or materials which are now or hereafter classified or considered to be hazardous or toxic under any laws, ordinances, statutes, codes, rules, regulations, agreements, judgments, orders and decrees now or hereafter enacted, promulgated, or amended, of the United States, the state, the county, the city or any other political subdivision in which the Property is located and any other political subdivision, agency or instrumentality exercising jurisdiction over the owner of the Property, the Property or the use of the Property relating to pollution, the protection or regulation of human health, natural resources or the environment, or the emission, discharge, release or threatened release of pollutants, contaminants, chemicals or industrial, toxic or hazardous substances or waste into the environment (including, without limitation, ambient air, surface water, ground water or land or soil). Notwithstanding the foregoing, Seller represents and warrants that none of the Buildings and Improvements nor any portion thereof contains any asbestos or asbestos containing materials, in any form, whether friable or non-friable. To the best of Seller’s knowledge, neither the Property nor any portion thereof contains any form of toxic mold. No treatment has been undertaken by Seller with respect to termite or similar infestation, fungi, or dry rot on the Property other than normal periodic service, and there is no damage to any portion of the Property from termite or similar infestation, fungi or dry rot.

4.18 Litigation. There is no action, suit, court or arbitration proceedings, or administrative action or proceeding, which is pending or threatened against or affecting the Property or arising out of the ownership, management or operation of the Property.

4.19 FIRPTA. Seller is not a “foreign person” as defined in Section 1445(f)(3) of the Internal Revenue Code.

4.20 Liens. To the best of Seller’s knowledge, there are no claims pending or unpaid bills which would result in the creation of any lien on the Property for any improvements completed or in progress, including, but not limited to, water, sewage, street paving, electrical or power improvements. To the best of Seller’s knowledge, there are no delinquent bills or claims in connection with any repair of the Property or other work or material purchased in connection with the Property which will not be paid by or at the Closing or placed in escrow pursuant to the provisions of this Agreement.

| 11 |

4.21 Insurance. Seller has received no notices or requests from any insurance company issuing any policy of insurance covering the Property requesting the performance of any work with respect to the Property which has not been fully complied with.

4.22 Operation. Seller has not received any written notice relating to the operation of the Property from any agency, board, commission, bureau or other instrumentality of any government, whether federal, state or local, that, Seller is not in compliance in all material respects with, nor does Seller have any knowledge that Seller is not in compliance with, all applicable statutes, rules, regulations and requirements of all federal, state and local commissions, boards, bureaus and agencies having jurisdiction over Seller and the Property. With respect to the Property, Seller has timely filed all reports, data and other information required to be filed with such commissions, boards, bureaus and agencies where a failure to file timely would have a material adverse effect on the transactions contemplated hereby or the intended operation of the Property.

4.23 Change of Facts. Seller shall immediately notify Buyer, in writing, of any event or condition known to Seller which occurs prior to the Closing, which causes a material adverse change in the facts relating to, or the truth of, any of the representations or warranties.

4.24 On-Site Employees. There are no on-site employees of Seller or its affiliates at the Property, and upon the Closing Date, Buyer shall have no obligation to employ or continue to employ any individuals employed by Seller or its affiliates in connection with the Property.

4.25 Information. All information given by Seller to Buyer in this Agreement or in connection with the transactions contemplated hereunder shall be true and accurate in every material respect as of the date hereof and at the Closing. Seller has not failed to disclose and deliver any material fact, document or information to Buyer necessary to make the statements herein or otherwise provided in connection with the transactions contemplated hereunder not misleading. Seller has not failed to disclose and deliver any material fact, document or information to Buyer relating to the operation, use or marketability of the Property. Seller has no knowledge or information of any facts, circumstances, or conditions that are inconsistent with the representations and warranties contained herein. Seller shall promptly inform Buyer in writing if there occurs any (i) material adverse change in the condition, financial or otherwise, of the Property, or the operation thereof, at any time prior to the Closing Date or (ii) if any information, document, agreement or other material delivered to Buyer is amended, superseded, modified or supplemented.

4.26 Seller’s Knowledge. As used herein, “to Seller’s knowledge”, “knowledge of Seller”, “best of Seller’s knowledge” and similar references to knowledge of Seller shall mean the actual knowledge of Jason R. Minnite, who is knowledgeable about the Property after checking with key employees at the Property and the property manager, if any.

4.27 No Other Options. Other than this Agreement and the Permitted Exceptions, the Property is not subject to any outstanding agreement(s) of sale or options, rights of first refusal or other rights of purchase.

| 12 |

4.28 Survivability of Representations and Warranties. The representations and warranties of Seller and Buyer set forth in this Agreement are remade as of the Closing Date and shall not be deemed to be merged into or waived by the instruments of Closing and shall survive for one (1) year after the Closing Date.

4.29 Limitations Regarding Representations and Warranties. EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, IT IS UNDERSTOOD AND AGREED THAT SELLER IS NOT MAKING AND HAS NOT AT ANY TIME MADE ANY WARRANTIES OR REPRESENTATIONS OF ANY KIND OR CHARACTER, EXPRESS OR IMPLIED, WITH RESPECT TO THE PROPERTY, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OR REPRESENTATIONS AS TO HABITABILITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

BUYER ACKNOWLEDGES AND AGREES THAT UPON CLOSING SELLER SHALL SELL AND CONVEY TO BUYER AND BUYER SHALL ACCEPT THE PROPERTY “AS IS, WHERE IS, WITH ALL FAULTS”, EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, AND/OR IN THE TRANSACTION DOCUMENTS REFERENCED HEREIN.

4.30 Additional Representations and Warranties by OP Unit Holder. OP Unit Holder represents and warrants to Buyer as follows:

(a) Tax Advice. OP Unit Holder represents and warrants that it has obtained from its own counsel advice regarding the tax consequences of (i) the receipt of the OP Units as consideration for a portion of the Purchase Price, (ii) OP Unit Holder’s admission as a limited partner of the Operating Partnership and (iii) any other transaction contemplated by this Agreement. OP Unit Holder further represents and warrants that it has not relied on Buyer, the Operating Partnership, Global Medical REIT Inc., a Maryland corporation (“GMR REIT”) or any of their affiliates, representatives or counsel for such tax advice.

(b) OP Unit Holder represents and warrants that it is an “accredited investor” as defined in Section 501 of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). OP Unit Holder has contemporaneously herewith provided Buyer and the Operating Partnership with a duly executed Accredited Investor Questionnaire, a form of which is attached hereto as Exhibit “P” (the “Investor Questionnaire”). No event or circumstance has occurred since delivery of such Investor Questionnaire to make the statements contained therein false or misleading.

(c) OP Unit Holder is acquiring the OP Units for investment for its own account and not with a view to, or in connection with, a distribution thereof within the meaning of Section 2(11) of the Securities Act or the securities laws of Ohio, West Virginia or any other state.

| 13 |

(d) OP Unit Holder acknowledges that no portion of the OP Units or the shares of GMR REIT issuable upon redemption thereof (the “Common Stock”) pursuant to the Operating Partnership’s Partnership Agreement (the “OP Partnership Agreement”), a copy of which is attached hereto as Exhibit “Q”, have been registered under the securities laws of any U.S. or non-U.S. jurisdiction, including, without limitation, the Securities Act or the securities laws of Ohio or any other state. OP Unit Holder further acknowledges that the OP Units are being offered and sold under this Agreement pursuant to one or more exemptions from registration under the Securities Act and applicable state securities laws based in part upon OP Unit Holder’s representations in this Agreement. OP Unit Holder acknowledges that the OP Units and the Common Stock are subject to substantial restrictions on transfer as set forth in the OP Partnership Agreement, under the Securities Act and applicable state securities laws and as set forth herein.

(e) OP Unit Holder understands that there will be no public market for the OP Units, that it cannot dispose of the OP Units or the Common Stock except pursuant to an effective registration statement under the Securities Act or an exemption from registration thereunder, and that neither GMR REIT nor the Operating Partnership has any obligation or intention to register any of the OP Units or the Common Stock or to take action so as to permit sales pursuant to the Securities Act (including Rule 144 promulgated thereunder which permits limited resales of shares purchased in a private placement subject to the satisfaction of certain conditions). OP Unit Holder understands that the operating performance of GMR REIT and the Operating Partnership is subject to risks associated with the real estate industry, that stock values are subject to fluctuations and cycles in value and demand, and that it must bear the economic risk of the investment in the OP Units for an indefinite period of time. OP Unit Holder has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of an investment in the Operating Partnership and making an informed investment decision with respect thereto. OP Unit Holder is able to bear the substantial economic risks related to an investment in the Operating Partnership for an indefinite period of time, has no need for liquidity in such investment, and, at the present time, can afford a complete loss of such investment.

(f) OP Unit Holder acknowledges having received and reviewed this Agreement and the OP Partnership Agreement and agrees to and accepts all of the terms hereof and thereof, including, without limitation, Article IX of the OP Partnership Agreement. OP Unit Holder also expressly acknowledges and agrees that upon OP Unit Holder’s submission of an executed Joinder page to the OP Partnership Agreement at the Closing (the “Joinder”), and receipt of a fully executed OP Partnership Agreement with a revised Exhibit A showing OP Unit Holder’s limited partnership interest in the Operating Partnership, OP Unit Holder shall be a “Limited Partner” as defined in the OP Partnership Agreement and shall have all the rights and responsibilities of a Limited Partner under the OP Partnership Agreement.

(g) OP Unit Holder acknowledges that GMR REIT is a publicly listed REIT whose public filings are accessible on the SEC’s EDGAR website and that OP Unit Holder has had an opportunity to review, and has reviewed, GMR REIT’s public filings that have been filed as of the date of this Agreement. In addition, OP Unit Holder will have access to, and will review, all public filings made by GMR REIT from the date of this Agreement through the Closing Date, including but not limited to GMR REIT’s Annual Report on Form 10-K for the year ended December 31, 2017. Simultaneously with providing Buyer with notification of the OP Unit Issuance Amount, OP Unit Holder shall deliver to buyer an executed copy of the Document Receipt attached hereto (the “Document Receipt”) indicating that OP Unit Holder has reviewed the public filings listed on the Document Receipt.

| 14 |

(h) OP Unit Holder has received and reviewed all other information and documents about or pertaining to GMR REIT, the Operating Partnership, the business and prospects of GMR REIT and the Operating Partnership and the issuance of the OP Units as OP Unit Holder deems necessary or desirable, and has been given the opportunity to obtain any additional information or documents and to ask questions and receive answers about such information and documents, GMR REIT, the Operating Partnership, the business and prospects of GMR REIT and the Operating Partnership and the OP Units that OP Unit Holder deems necessary or desirable to evaluate the merits and risks related to its investment in the OP Units and to conduct its own independent valuation of the OP Units; and OP Unit Holder understands and has taken cognizance of all risk factors related to the purchase of the OP Units. IN ACQUIRING THE OP UNITS AND ENGAGING IN THIS TRANSACTION, OP UNIT HOLDER IS NOT RELYING UPON ANY REPRESENTATIONS MADE TO IT BY GMR REIT, THE OPERATING PARTNERSHIP, OR ANY OF THE OFFICERS, EMPLOYEES, OR AGENTS OF THE OPERATING PARTNERSHIP NOT CONTAINED IN THIS AGREEMENT OR ANY OTHER AGREEMENT EXECUTED IN CONNECTION WITH THIS TRANSACTION. OP Unit Holder is relying upon its own independent analysis and assessment (including with respect to taxes), and the advice of OP Unit Holder’s advisors (including tax and investment advisors), and not upon that of GMR REIT, the Operating Partnership or any of their respective advisors or affiliates, for purposes of evaluating, entering into, and consummating the transactions contemplated by this Agreement.

(i) OP Unit Holder recognizes that an investment in the Operating Partnership involves investment risks and it has taken full cognizance of and understands all of the risk factors relating to the purchase of the OP Units. OP Unit Holder acknowledges and is aware that no U.S. or non-U.S. federal, state, or local agency has made or will make any finding or determination as to the fairness of an investment in the OP Units, nor any recommendation or endorsement of such an investment. OP Unit Holder recognizes that none of the Operating Partnership, GMR REIT or any other person has promised, represented, or guaranteed: (i) the safety of any capital investment in the Operating Partnership; (ii) that the Operating Partnership will be profitable; or (iii) that any particular investment return will be achieved by the Operating Partnership. Further, OP Unit Holder understands that any such promise, representation, or guarantee, if made, would be strictly unauthorized and should not be relied on by OP Unit Holder.

(j) OP Unit Holder is not investing in OP Units as a result of or subsequent to any advertisement, article, notice, or other communication published in any newspaper, magazine, or similar media, or broadcast over television or radio, or presented at any investment seminar, or meeting open to the public.

(k) Buyer, Seller and OP Unit Holder have determined that the terms and conditions of the transactions contemplated by this Agreement, on an overall basis, are fair and reasonable.

(l) The residence address of OP Unit Holder and percentage interest of OP Unit Holder in the issuance of the OP Units is set forth in Schedule 4.30 attached hereto.

| 15 |

5. Representations of Buyer. Buyer represents and warrants that: