Form DFAN14A XL GROUP LTD Filed by: AXA

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☒

|

Soliciting Material under §240.14a-12

|

XL GROUP LTD

(Name of Registrant as Specified In Its Charter)

AXA

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

AXA to acquire XL GroupCreating the new AXA March 5, 2018

IMPORTANT LEGAL INFORMATION AND CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING STATEMENTS AND THE TIMING OF THE PLANNED IPO AND INTENDED SUBSEQUENT SELL-DOWNSCertain statements contained herein may be forward-looking statements including, but not limited to, the timing of the transaction, AXA's conduct of XL Group's business following the completion of the transaction, the expected benefits of the transaction, as well as statements regarding the future conduct, direction and success of XL Group's business, as well as other statements that are predictions of or indicate future events, trends, plans, expectations or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties and can be affected by other factors that could cause AXA’s actual results to differ materially from those expressed or implied in the forward looking statements. These risks and uncertainties include, but are not limited to: uncertainties relating to the timing of the transaction; the possibility that the closing conditions are not satisfied; the effects of a disturbance AXA's business caused by the announcement of the transaction; the risk of a shareholder dispute or otherwise failure to obtain shareholder approval in connection with the transaction, the risk that a government entity may prohibit, delay or refuse to grant approval for the consummation of the transaction, the occurrence of any event, change or other circumstances that could give rise to termination of the merger agreement, risks related to the disruption of management's attention from AXA's ongoing business operations due to the proposed transaction and other risks and uncertainties described in Part 4 - “Risk factors and risk management” of AXA’s Registration Document for the year ended December 31, 2016, which describes certain important factors, risks and uncertainties that may affect AXA’s business and/or results of operations. AXA undertakes no obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information, future events or circumstances or otherwise, except as part of applicable regulatory or legal obligations.In addition, this presentation refers to certain non-GAAP financial measures, or alternative performance measures, used by management in analyzing AXA’s operating trends, financial performance and financial position and providing investors with additional information that management believes is useful and relevant regarding AXA’s results. These alternative performance measures generally have no standardized meaning and therefore may not be comparable to similarly labelled measures used by other companies. As a result, none of these non-GAAP financial measures should be considered in isolation from, or as a substitute for, the Group’s consolidated financial statements and related notes prepared in accordance with IFRS. The non-GAAP measures underlying earnings and adjusted earnings are reconciled to net income on pages A27 and A28 of AXA’s 2017 Earnings presentation. Adjusted return on equity (“Adjusted ROE”) is reconciled to the financial statements in the table set forth on page 28 of AXA’s 2017 Activity Report. The abovementioned and other non-GAAP financial measures used in this presentation are defined in the Glossary set forth in AXA’s 2017 Activity Report pages 69 to 76.ADDITIONAL INFORMATION AND WHERE TO FIND ITThis presentation may be deemed to be solicitation material in respect of the proposed transaction between XL Group and AXA. In connection with the proposed transaction, XL Group intends to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”) and may file or furnish other documents with the SEC regarding the proposed transaction. This presentation is not a substitute for the definitive proxy statement or any other documents that AXA or XL Group may file with the SEC or send to shareholders in connection with the proposed transaction. SHAREHOLDERS OF XL Group ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.Investors and security holders will be able to obtain copies of the proxy statement (when available) and other documents filed with the SEC (when available) free of charge at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by XL Group will be made available free of charge on XL Group’s website at http://xlgroup.com/. Copies of documents filed with the SEC by AXA will be made available free of charge on AXA’s website at www.axa.com.PARTICIPANTS IN SOLICITATIONXL Group and its directors and executive officers, and AXA and its directors and executive officers may be deemed to be participants in the solicitation of proxies from XL Group’s shareholders in connection with the proposed transaction. Information regarding XL Group’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in XL Group’s annual proxy statement filed with the SEC on April 5, 2017, XL Group’s Current Report on Form 8-K filed with the SEC on October 26, 2017 and XL Group’s Current Report on Form 8-K filed with the SEC on February 20, 2018. Information about the directors and executive officers of AXA is set forth on its website at www.axa.com. A more complete description will be available in the proxy statement on Schedule 14A. You may obtain free copies of these documents as described in the preceding paragraph filed, with or furnished to the SEC. All such documents, when filed or furnished, are available free of charge at the SEC’s website (www.sec.gov) or by directing a request to XL Group or AXA at the Investor Relations contacts above. 2 AXA to acquire XL Group | March 5, 2018

Table of contents Introduction Transaction highlights XL Group overview Strategic rationale Financial aspects – Ambition 2020 Conclusion 3 AXA to acquire XL Group | March 5, 2018

1 Introduction

Key takeaways A major leap forward in AXA’s strategic journey Creating the leading global P&C Commercial Lines player across all lines Strong complementarities to fuel future earnings growth and value creation Effective use of proceeds from the planned US IPO and intended subsequent sell-downs1, at an attractive return Material risk diversification and capital benefits under Solvency II Ambition 2020 targets reaffirmed 5 AXA to acquire XL Group | March 5, 2018 All notes are on pages 32 and 33 Back to agenda

Moving from a predominantly L&S company to predominantly P&C 50%P&C 10%Health AXA1 39%P&C New AXA1,2 Highly diversified AXA with reinforced cash remittance and growth potential 6 AXA to acquire XL Group | March 5, 2018 All notes are on pages 32 and 33 Back to agenda 20% Protection Adding XL Group Excluding AXA US 23% Savings 4 21% Protection 14% Savings4 4% Asset management 5 10% Asset management 39% Health 2016 pre-tax underlying earnings

Becoming the #1 global P&C Commercial Lines insurer 13.4 7 AXA to acquire XL Group | March 5, 2018 All notes are on pages 32 and 33 Back to agenda 25.8 Peer 4 AXA + XL Group2 30.2 Peer 5 21.2 Peer 2 16.9 Peer 1 23.3 Peer 3 #1 global P&C Commercial Lines company Enhanced global footprint with access to US and London markets Strengthened exposure to large and upper mid-market segments Stronger presence in profitable, growing and least prone to disruption specialty lines 2016 GWP in Euro billion 1

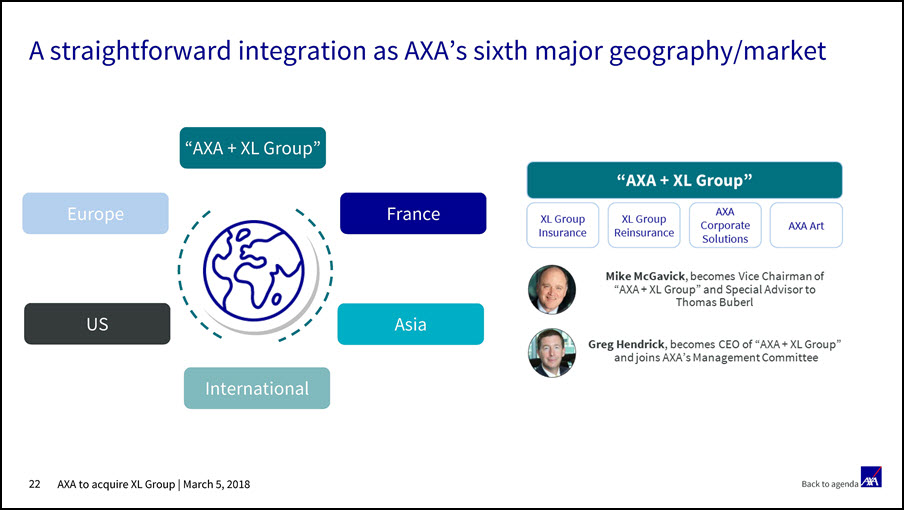

Building the champion in large, mid-market and specialty risks “AXA + XL Group” Very limited integration challenge, reflecting strong complementarity “Create the most innovative insurer known for solving complex risks enabled by the best talent in the industry with leading data and analytics, digital operations and lower cost of capital.” Greg Hendrick, becomes CEO of “AXA + XL Group” and joins AXA’s Management Committee Mike McGavick, becomes Vice Chairman of “AXA + XL Group” and Special Advisor to Thomas Buberl XL Group Reinsurance XL Group Insurance AXA Art AXA Corporate Solutions 8 AXA to acquire XL Group | March 5, 2018 Back to agenda

A P&C dominated company to create substantial value for stakeholders Increases the Group’s risk diversification Reduces sensitivities to financial markets Higher proportion of technical margin earnings Increases cash remittance potential Reinforces Group’s growth potential 9 AXA to acquire XL Group | March 5, 2018 Back to agenda

2 Transaction highlights

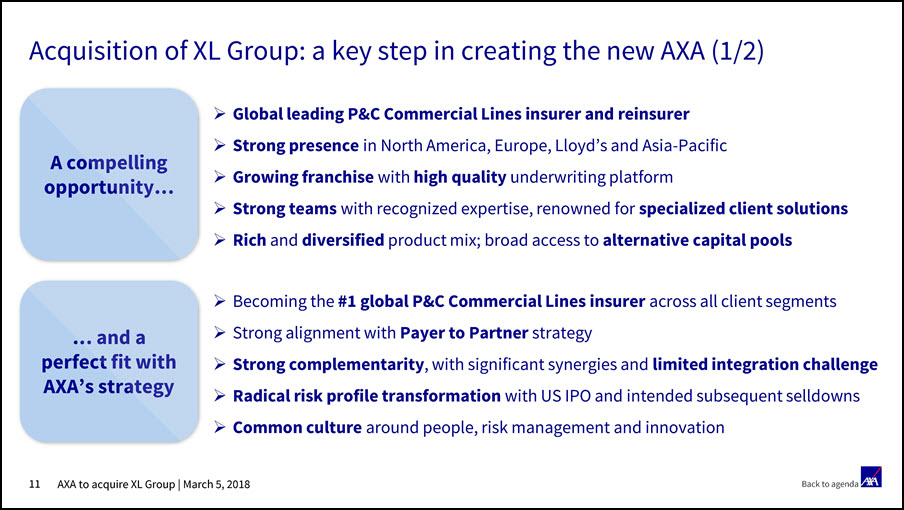

Acquisition of XL Group: a key step in creating the new AXA (1/2) Global leading P&C Commercial Lines insurer and reinsurer Strong presence in North America, Europe, Lloyd’s and Asia-Pacific Growing franchise with high quality underwriting platform Strong teams with recognized expertise, renowned for specialized client solutions Rich and diversified product mix; broad access to alternative capital pools Becoming the #1 global P&C Commercial Lines insurer across all client segments Strong alignment with Payer to Partner strategy Strong complementarity, with significant synergies and limited integration challenge Radical risk profile transformation with US IPO and intended subsequent sell downs Common culture around people, risk management and innovation and a perfect fit with AXA’s strategy A compelling opportunity Back to agenda 11 AXA to acquire XL Group | March 5, 2018

Acquisition 1 of XL Group 100% paid in cash, for a price of USD 15.3 billion (Euro 12.4 billion) or USD 57.6 per share, i.e. a 33% premium to its closing share price on March 2nd Transaction valued at 11x P/E post synergies Financed with a combination of cash at hand, sub debt and US IPO related proceeds Expected closing end of 3Q or 4Q 2018 Acquisition of XL Group: a key step in creating the new AXA (2/2) Offsetting US IPO earnings dilution as soon as 2018 Material risk diversification and capital benefits under Solvency II (ca. 30%)Ambition 2020 targets reaffirmed (UEPS, FCF, ROE, SII)Strong return on investment – ROI at 10% Significant value creation Consideration and timing Back to agenda 12 AXA to acquire XL Group | March 5, 2018 All notes are on pages 32 and 33

3 Overview of XL Group

XL Group overview: a compelling opportunity Founded in 1986, leader in P&C commercial and specialty lines Active global network, with ca. 7,400 colleagues worldwide USD 15 billion GWP in 2017, of which ca. 5 billion in reinsurance Strong access to large and mid-market segments Highly agile and innovative company Back to agenda 14 AXA to acquire XL Group | March 5, 2018

A high quality asset 11.0 8.1 15.0 2014 2015 2016 2017 13.9 78% 62% 58% 2014 2015 2016 2017 57% Strong growth and excellent underwriting expertise Gross written premiums In USD billion Net loss ratio 1 Nat Cat ca. 63% 15 All notes are on pages 32 and 33 Back to agenda Historical long term average 2

Speciality & Others Casualty &Professional Property Cat Property Non-Cat …supported by a strong market presence and diversified reach Professional 19% 20% Property Specialty & Other Casualty 23%24%33% 68% 20 Insurance G 17 32% P Reinsurance 22%28%31% 16 All notes are on pages 32 and 33 Back to agenda #1 for industry product innovation 1 Reinsurance company of the year 2 Comprehensive business model – originating, packaging and selling risks Glossary on page 34 of this document

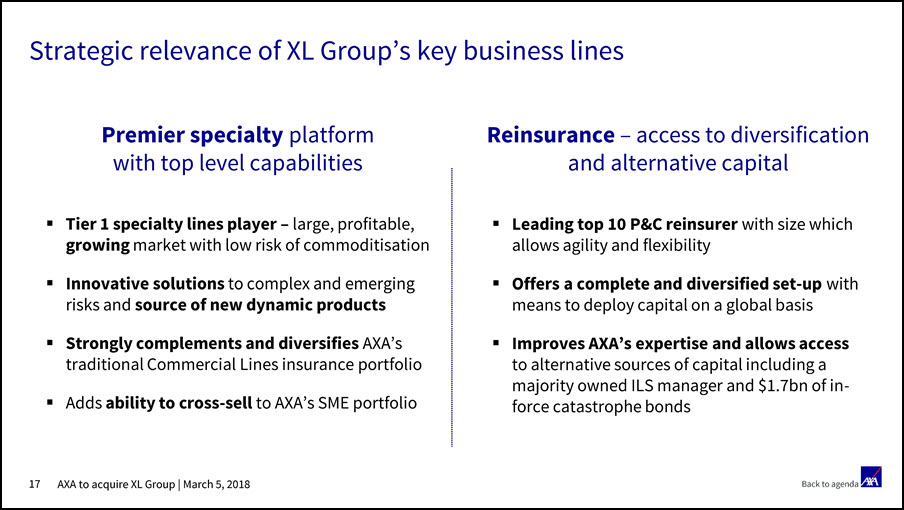

Strategic relevance of XL Group’s key business lines Premier specialty platform with top level capabilities Tier 1 specialty lines player – large, profitable, growing market with low risk of commoditization Innovative solutions to complex and emerging risks and source of new dynamic products Strongly complements and diversifies AXA’ straditional Commercial Lines insurance portfolio Adds ability to cross-sell to AXA’s SME portfolio Reinsurance – access to diversification and alternative capital Leading top 10 P&C reinsurer with size which allows agility and flexibility Offers a complete and diversified set-up with means to deploy capital on a global basis Improves AXA’s expertise and allows access to alternative sources of capital including a majority owned ILS manager and $1.7bn of in- force catastrophe bonds Back to agenda 17 AXA to acquire XL Group | March 5, 2018

4 Strategic rationale

Continuity in AXA’s ongoing transformation Health Protection P&C Commercial High frequency customer contacts Attractive segments for additional services Geared towards technical margin Ripe for innovation and new business models AXA’s November 2017 Investor Day Back to agenda 19 AXA to acquire XL Group | March 5, 2018

A strong complementarity Leading global insurer with ca. €100bn revenues #1 insurance brand for the 9th consecutive year Leading pan-European SME player Leader in P&C Commercial Lines and specialty Industry-wide recognition 1 for high performance and customer satisfaction across its businesses Strong large and mid-market player Innovation and sustainability leader in insurance Agile and innovative company Excellent capital base and cash generation Superior franchise and underwriting All notes are on pages 32 and 33 Back to agenda 20 AXA to acquire XL Group | March 5, 2018

leading to substantial synergies and diversification benefits Cost synergies ca. USD 0.2 billion pre-tax p.a. Rationalization of existing operations globally Rationalization of central functions Internalization of Asset Management mandates Capital synergies ca. 30% SCR reduction for XL Group or 5-10 pts benefit in AXA Group’s SII ratio Following capital diversification Expected by 2020 following the approval/integration of XL Group internal model Revenue synergiesca. USD 0.1 billion pre-tax earnings impact p.a.XL Group specialty products delivered through AXA’s distribution channels Combined firepower to address high growth markets and multinational clients Reinsurance synergies ca. USD 0.1 billion pre-tax to be saved p.a. Lower reinsurance costs due to procurement synergies and diversification Savings are net of additional reinsurance bought to align with AXA Group risk appetite USD 0.4 billion pre-tax earningsrun-rate per annum 21 Back to agenda

A straightforward integration as AXA’s sixth major geography/market France Asia Europe US “AXA + XL Group” International 22 Back to agenda

5 Financial aspectsAmbition 2020

Financial implications of the transaction Substantial synergies15x P/E11x P/E synergized Strong strategic and financial benefits for shareholders High return 10% ROI Cash accretion 80%+remittance ratio from XL Group Back to agenda 24 AXA to acquire XL Group | March 5, 2018

Financing plan of the transaction Sub debt 25 All notes are on pages 32 and 33 Back to agenda ca. 3.0 Cash at hand US IPO and related pre-IPO transactions 1 ca. 3.5 Transaction value 12.4 ca. 6.0 Transaction fully financed in cash Limited additional debt issuance Temporary increase of our debt gearing Comfortable estimated end-2018 Solvency II position Euro 9 billion backup bridge financing in place In Euro billion

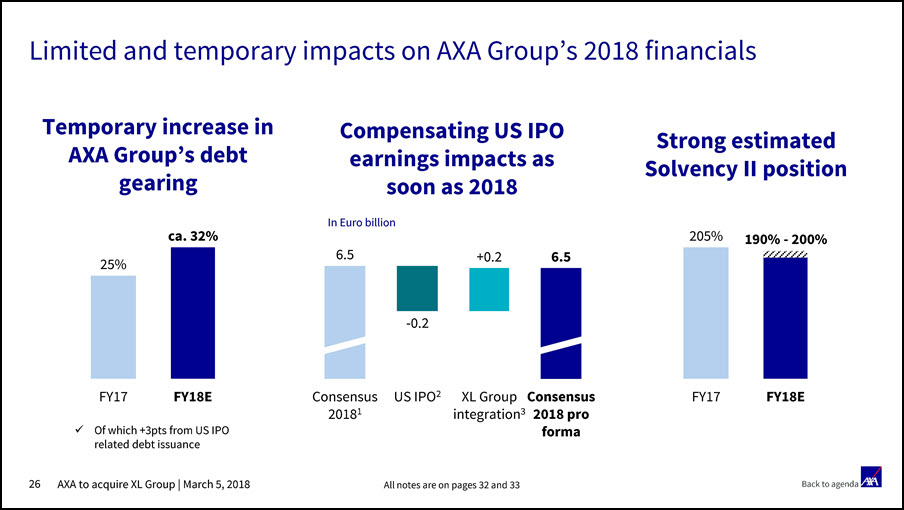

Limited and temporary impacts on AXA Group’s 2018 financials Temporary increase in AXA Group’s debt gearing Strong estimated Solvency II position ca. 32% 25% FY18E 190% - 200% FY17 205% +0.2 6.5 26 All notes are on pages 32 and 33 Back to agenda US IPO2 XL Group Consensus integration 3 2018 pro forma -0.2 Consensus 20181 6.5 Compensating US IPO earnings impacts as soon as 2018 In Euro billion FY17 FY 18E Of which +3 pts from US IPO related debt issuance

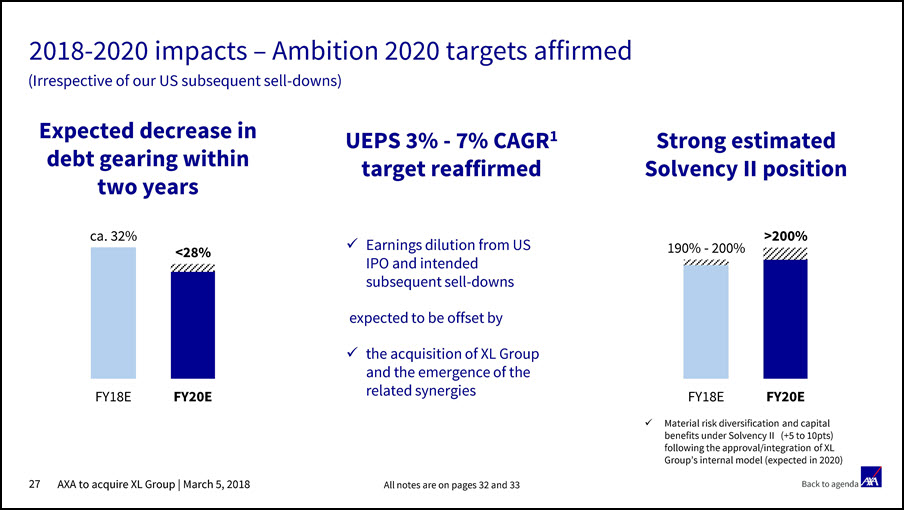

Expected decrease in debt gearing within two years UEPS 3% - 7% CAGR1 target reaffirmed Strong estimated Solvency II position FY20E <28% FY18E ca. 32% 190% - 200% 27 All notes are on pages 32 and 33 Back to agenda >200% FY18E FY20E Material risk diversification and capital benefits under Solvency II (+5 to 10 pts) following the approval/integration of XL Group’s internal model (expected in 2020) Earnings dilution from US IPO and intended subsequent sell-downs expected to be offset by the acquisition of XL Group and the emergence of the related synergies 2018-2020 impacts – Ambition 2020 targets affirmed(Irrespective of our US subsequent sell-downs)

XL Group acquisition is positive in medium and long term 3% - 7% UEPS CAGR12015-2020 28 – 32 Euro billion 2016 -2020 cumulative FCF 2 12% - 14%Adjusted ROE2 Ambition 2020 targets reaffirmed Medium to long term outlook Reduces sensitivities to financial markets Lower beta and cost of equity Increases cash remittance potential Reinforces group's growth potential 28 All notes are on pages 32 and 33 Back to agenda 170% - 230% Solvency II ratio 3 range Supporting our 45% - 55% payout ratio guidance

6 Conclusion

Key takeaways A major leap forward in AXA’s strategic journey Creating the leading global P&C Commercial Lines player across all lines Strong complementarities to fuel future earnings growth and value creation Effective use of proceeds from the planned US IPO and intended subsequent sell-downs 1, at an attractive return Material risk diversification and capital benefits under Solvency II Ambition 2020 targets reaffirmed Back to agenda 30 AXA to acquire XL Group | March 5, 2018 All notes are on pages 32 and 33

Thank you

Notes (1/2) 32 Page 51. Subject to market conditions Page 62016 pre-tax underlying earnings excluding AXA SA New AXA based on 2016 pre-tax underlying earnings excluding AXA SA and AXA US (Life & Savings and AB), and including 100% of XL Group. For XL Group, earnings are based on 2016 operating net income before taxes converted with a 2016 average foreign exchange rate of 1.11 USD per Euro Asset Management and other: includes AB, AXA IM and other insurance and non-insurance entities of AXA Savings includes G/A Savings, Unit-Linked and Mutual funds & Other Asset Management and other: includes AXA IM and other insurance and non-insurance entities of AXAPage 7 Using a 2016 average foreign exchange rate of 1.11 USD per Euro Includes P&C Commercial Lines and Commercial Health for comparability purposes Page 121. Completion of the transaction is subject to approval by XL Group shareholders and customary closing conditions, including the receipt of regulatory approvals Page 15Based on net earned premiums Combined average since 2008 for both XL Group and Catlin Page 16 Advisen’s Pacesetter Index, 2016 and 2017 European and UK Captive Awards, 2017

Notes (2/2) 33 Page 201. Highest in Customer Satisfaction within Large Insurers (J.P. Power 2016 & 2017 Large Commercial Insurance Study), #1 for Industry Product Innovation (Advisen’s Pacesetter Index 2016 & 2017), Top Performer in London Market Across Nearly All Metrics (Gracehurch survey), Re/insurance Company of the Year (European and UK Captive Awards 2017), Captive Fronting Partner & Customer Care Award (UK Captive Services Awards 2017), US Captive Services Award for Re/insurance Award (US Captive Awards 2017), Bermuda Insurer of the Year (Reactions magazine 2017), Ranked joint No.1 for Overall Satisfaction (Gracecurch London Claims Report 2016), “Most Just” insurance company (The Just 100: America’s Best Corporate Citizens 2016) and Commercial Lines Insurer of the Year (British Insurance Awards 2017)Page 251. As described in AXA Group’s November 2017 Investor Day Page 26 Bloomberg consensus as at March 2, 20182018 estimate based on bloomberg consensus for AXA Group underlying earnings as at March 2, 2018 and AXA US contribution to AXA Group’s 2017 underlying earnings, assuming the planned IPO would take place in the end of 1H18 and assuming it would be for a 35% stake 2018 bloomberg consensus for XL Group’s operating net income assuming an expected closing end of 3Q18 Page 271. Compounded annual growth rate Page 28 Compounded annual growth rate Adjusted RoE and free cash flows are non-GAAP financial measures. For further information, please refer to the reconciliation of adjusted ROE to the financial statements and its definition in the Glossary, which are provided in AXA’s 2017 Activity Report (respectively, on page 22-26 and pages 69 to 76).The Solvency II ratio is estimated based on AXA’s internal model calibrated based on adverse 1/200 years shock and assuming US equivalence. For further information on AXA’s internal model and Solvency II disclosures, please refer to AXA Group’s SFCR for FY2016, available on AXA’s website (www.axa.com)Page 301. Subject to market conditions

Glossary 34 Insurance XL Group’s insurance operations provide customized insurance policies for complex corporate risks, focusing on lines of business believed to provide the best return on capital over time: Professional liability products include a broad range of coverages to professional services firms and public and private companies. Products offered are directors’ and officers’ liability, errors and omissions liability, employment practices liability, and cyber liability and technology coverages, Property business includes exposures to man-made and natural disasters. Products include commercial combined packages, general property, business interruption and boiler and machinery. Casualty products generally provide large capacity on a primary or excess of loss basis. Global insurance programs are targeted to large multinational companies in major industry groups including automotive, consumer products, pharmaceutical, pulp and paper, high technology, telecommunications, transportation and basic metals. Specialty & Other includes the following lines of business: aviation & satellite, marine (including North America inland marine), fine art & specie, equine, livestock & aquaculture, crisis management (product recall, political violence, kidnap & ransom, contingency, sport & leisure, title), political risk, trade credit and life, accident & health. The London wholesale market makes up a significant portion of the Specialty premium income, and we take full advantage of the Lloyd's trading market for subscription business. Reinsurance This segment provides casualty, property risk, property catastrophe, specialty, and other reinsurance lines on a global basis with business being written on both a proportional and non-proportional treaty basis, and also on a facultative basis. Our lines of business within the Reinsurance segment continue to focus on those that provide the best risk adjusted return on capital: Casualty & Professional includes general liability, professional liability, automobile liability and workers' compensation and directors' and officers', errors and omissions, employment practices, medical malpractice and environmental liability.Property Cat provides coverage on an excess of loss basis when aggregate losses and loss adjustment expenses from a single occurrence of a covered event, or multiple occurrences in the case of aggregate covers, exceed the attachment point specified in the policy. Property Non-Cat covers a loss to the reinsured on a single risk of the type reinsured rather than to aggregate losses for all covered risks on a specific event, as is the case with catastrophe reinsurance. Our property proportional account business includes reinsurance of direct property insurance. Specialty & Others: specialty products include energy, marine, aviation and space. Other reinsurance products include fidelity, surety, trade credit, accident and health, mortgage and political risk. In addition, we write several whole account capital gearing quota share contracts on select syndicates at Lloyd's.