Form DFAN14A MICROSEMI CORP Filed by: MICROCHIP TECHNOLOGY INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to § 240.14a-12 | |

MICROSEMI CORPORATION

(Name of Registrant as Specified in its Charter)

MICROCHIP TECHNOLOGY INCORPORATED

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

On March 1, 2018, Microchip Technology Incorporated will hold an Analyst and Investor Day Conference at which Microchip’s pending acquisition of Microsemi Corporation and other matters will be discussed. A copy of the presentation slides from the conference that relate to the pending acquisition of Microsemi is below. Microchip may use some of all of such slides at other presentations to employees, stockholders or other parties. Such materials may also be made available to such persons in electronic or paper form.

Steve Sanghi Chief Executive Officer ©March 2018 Microsemi Acquisition March 1, 2018

Forward Looking Statement Safe Harbor: During the course of this presentation, we will make projections or other forward-looking statements regarding the future financial performance of the company or future events, including our strategy, growth drivers, industry outlook, industry trends, market size and our financial model. We will also make projections or other forward-looking statements regarding our pending acquisition of Microsemi including deal timing, deal benefits, synergies, integration plans, plans to finance the transaction, deal accretion and pro-forma financial information for the transaction. We wish to caution you that such statements are just predictions and that actual events or results may differ materially. These statements are subject to a number of risks and uncertainties, including the actual timing of the closing of the Microsemi acquisition, the satisfaction of the conditions to closing in the Microsemi acquisition agreement, any termination of the Microsemi acquisition agreement, the effect of the acquisition on Microchip’s and Microsemi’s existing relationships with customers and vendors and their operating results and businesses; the costs and outcome of any litigation involving Microchip, Microsemi or the acquisition transaction, our ability to successfully integrate the operations and employees, retain key employees and customers and otherwise realize the expected synergies and benefits of our Microsemi acquisition; the impact of any future significant acquisitions that we may make; any economic uncertainty due to monetary policy, political or other issues in the U.S. or internationally, any unexpected fluctuations or weakness in the U.S. and global economies (including China), changes in demand or market acceptance of our products and the products of our customers; changes in U.S. corporate tax laws as a result of the Tax Cuts and Jobs Act of 2017 or other future legislation, foreign currency effects on our business; the mix of inventory we hold and our ability to satisfy short-term orders from our inventory; changes in utilization of our manufacturing capacity and our ability to effectively manage and expand our production levels; competitive developments including pricing pressures; the level of orders that are received and can be shipped in a quarter; the level of sell-through of our products through distribution; changes or fluctuations in customer order patterns and seasonality; our ability to obtain a sufficient supply of wafers from third party wafer foundries and the cost of such wafers, the costs and outcome of any current or future tax audit or any litigation or other matters involving intellectual property, customers, or other issues; disruptions in our business or the businesses of our customers or suppliers due to natural disasters (including any floods in Thailand), terrorist activity, armed conflict, war, worldwide oil prices and supply, public health concerns or disruptions in the transportation system; and general economic, industry or political conditions in the United States or internationally. Actual results may differ materially from the expected results. For a detailed discussion of these and other risk factors, please refer to Microchip's and Microsemi’s filings on Forms 10-K, 10-Q and 8-K. You can obtain copies of Forms 10-K, 10-Q, 8-K and other relevant documents for free at Microchip's website (www.microchip.com), Microsemi’s website (www.microsemi.com) or the SEC's website (www.sec.gov) or from commercial document retrieval services. These documents contain and identify other important factors that could cause our actual results to differ materially from those contained in our projections or forward-looking statements. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date such statements are made. We do not undertake any obligation to publicly update any forward-looking statements to reflect events, circumstances or new information after this presentation or to reflect the occurrence of unanticipated events. Additional Information and Where to Find It In connection with the proposed acquisition, Microsemi will file a proxy statement and other related documents with the SEC. INVESTORS AND STOCKHOLDERS ARE ADVISED TO READ THESE DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a free copy of these documents (when available) and other documents filed by Microsemi at the SEC's web site at www.sec.gov and at the Investor section of their website at https://investor.microsemi.com/. Microchip, Microsemi and their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Microsemi in connection with the Merger. Information regarding the special interests of these directors and executive officers in the transaction will be included in the proxy statement described above. Additional information regarding the directors and executive officers of Microchip is also included in Microchip's proxy statement for its 2017 Annual Meeting of Stockholders, which was filed with the SEC on July 13, 2017. Additional information regarding the directors and executive officers of Microsemi is also included in Microsemi’s proxy statement for its 2018 Annual Meeting of Stockholders, which was filed with the SEC on December 20, 2017. These documents are available free of charge at the SEC's web site at www.sec.gov and as described above.

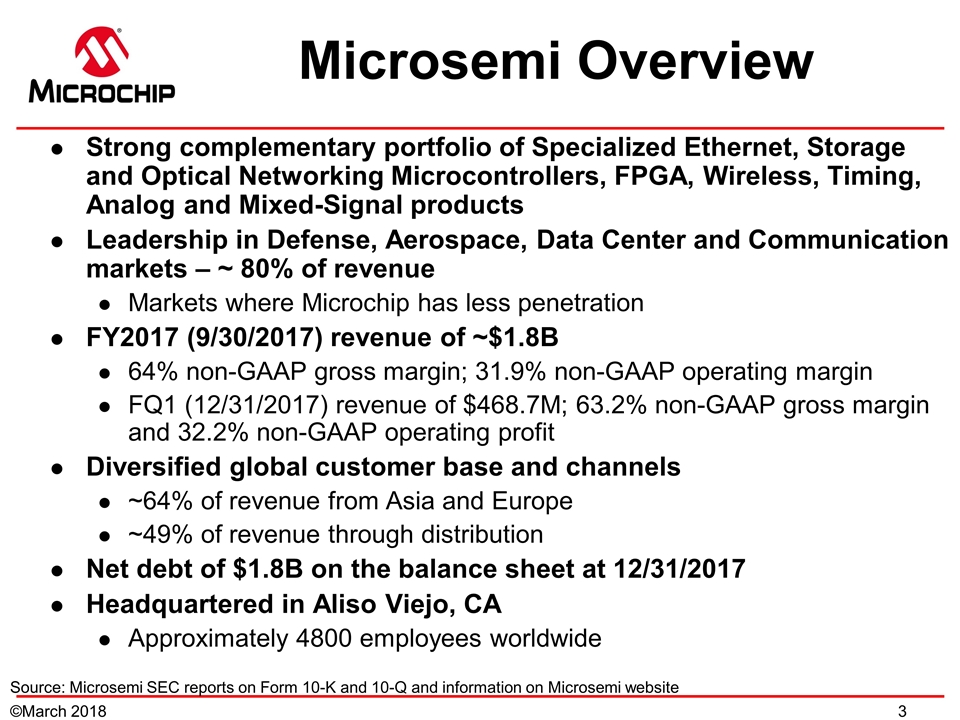

Microsemi Overview Strong complementary portfolio of Specialized Ethernet, Storage and Optical Networking Microcontrollers, FPGA, Wireless, Timing, Analog and Mixed-Signal products Leadership in Defense, Aerospace, Data Center and Communication markets – ~ 80% of revenue Markets where Microchip has less penetration FY2017 (9/30/2017) revenue of ~$1.8B 64% non-GAAP gross margin; 31.9% non-GAAP operating margin FQ1 (12/31/2017) revenue of $468.7M; 63.2% non-GAAP gross margin and 32.2% non-GAAP operating profit Diversified global customer base and channels ~64% of revenue from Asia and Europe ~49% of revenue through distribution Net debt of $1.8B on the balance sheet at 12/31/2017 Headquartered in Aliso Viejo, CA Approximately 4800 employees worldwide Source: Microsemi SEC reports on Form 10-K and 10-Q and information on Microsemi website

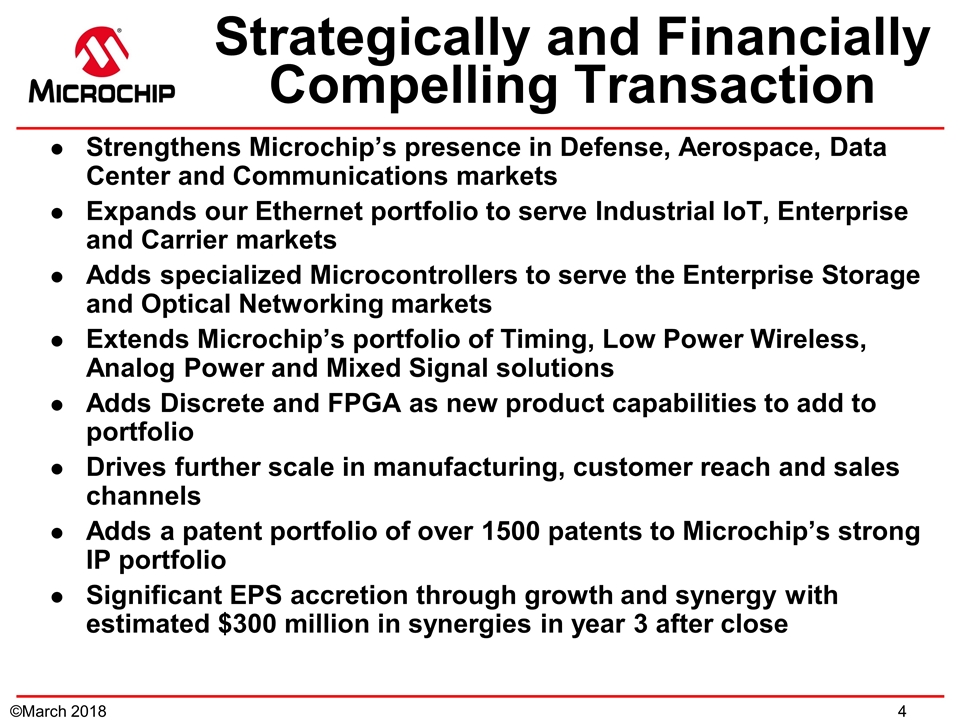

Strategically and Financially Compelling Transaction Strengthens Microchip’s presence in Defense, Aerospace, Data Center and Communications markets Expands our Ethernet portfolio to serve Industrial IoT, Enterprise and Carrier markets Adds specialized Microcontrollers to serve the Enterprise Storage and Optical Networking markets Extends Microchip’s portfolio of Timing, Low Power Wireless, Analog Power and Mixed Signal solutions Adds Discrete and FPGA as new product capabilities to add to portfolio Drives further scale in manufacturing, customer reach and sales channels Adds a patent portfolio of over 1500 patents to Microchip’s strong IP portfolio Significant EPS accretion through growth and synergy with estimated $300 million in synergies in year 3 after close

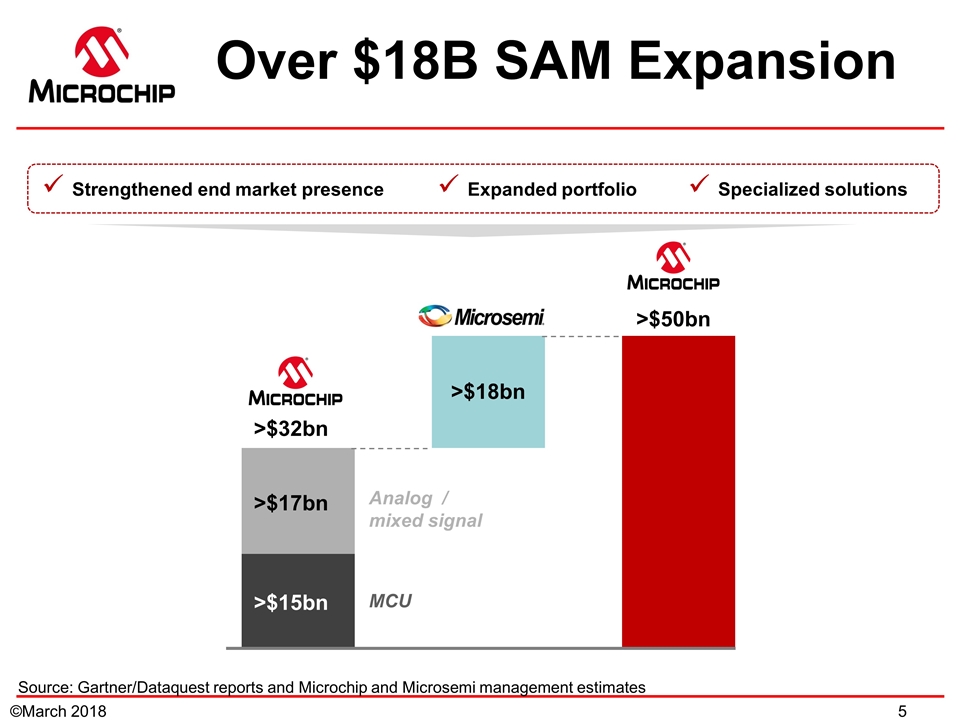

Over $18B SAM Expansion MCU Analog / mixed signal >$15bn >$17bn >$18bn >$50bn Strengthened end market presence Expanded portfolio Specialized solutions >$32bn Source: Gartner/Dataquest reports and Microchip and Microsemi management estimates

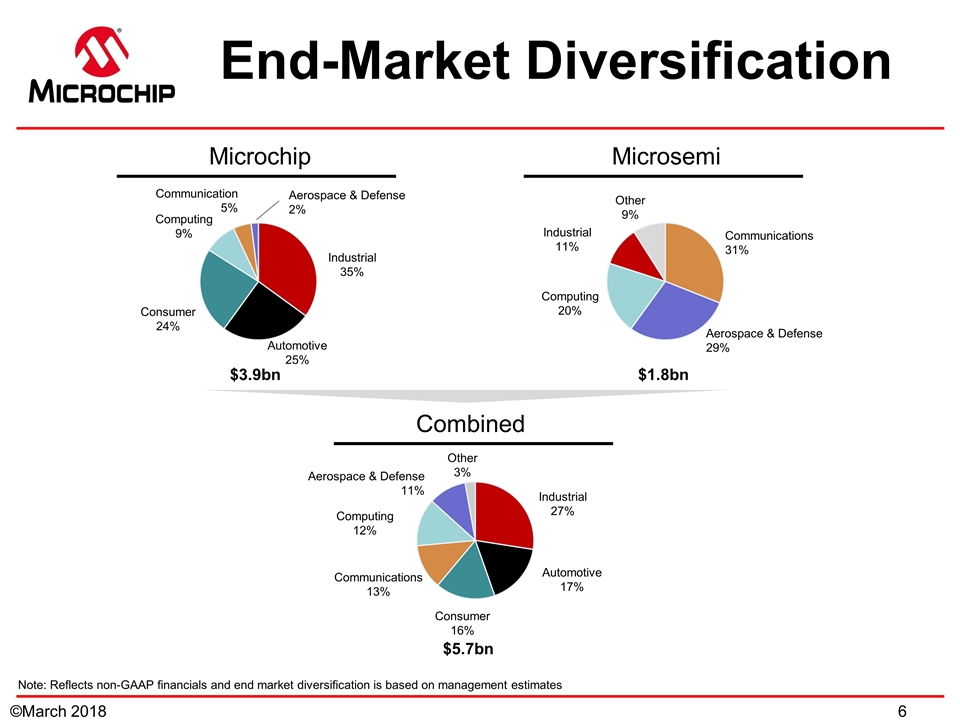

End-Market Diversification Industrial 35% Automotive 25% Consumer 24% Computing 9% Communication 5% Aerospace & Defense 2% Industrial 11% Computing 20% Communications 31% Other 9% Aerospace & Defense 29% Microchip Microsemi Industrial 27% Computing 12% Communications 13% Other 3% Aerospace & Defense 11% Combined Automotive 17% Consumer 16% $3.9bn $1.8bn $5.7bn Note: Reflects non-GAAP financials and end market diversification is based on management estimates

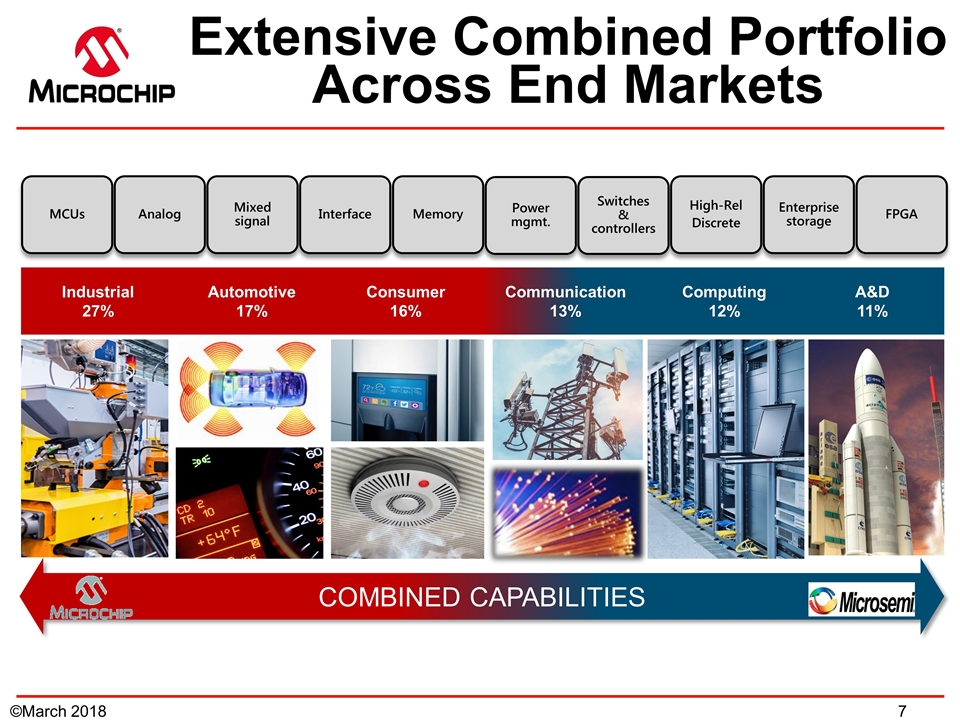

Extensive Combined Portfolio Across End Markets MCUs Mixed signal Memory Analog Interface Switches & controllers High-Rel Discrete Power mgmt. COMBINED CAPABILITIES Industrial 27% Automotive 17% Consumer 16% Communication 13% Computing 12% A&D 11% Enterprise storage FPGA

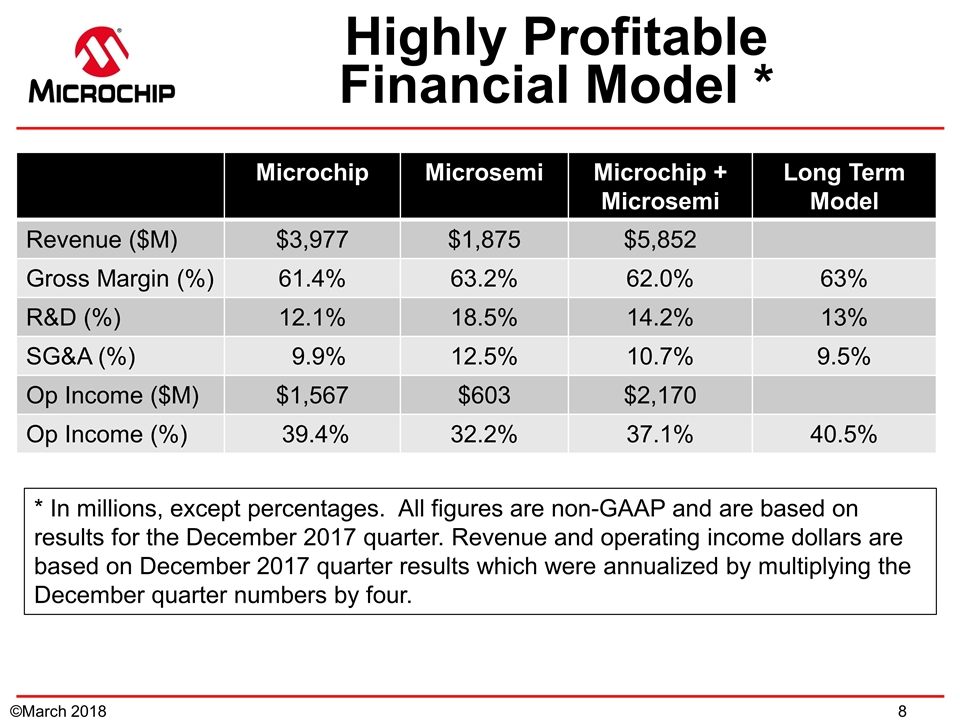

Highly Profitable Financial Model * * In millions, except percentages. All figures are non-GAAP and are based on results for the December 2017 quarter. Revenue and operating income dollars are based on December 2017 quarter results which were annualized by multiplying the December quarter numbers by four. Microchip Microsemi Microchip + Microsemi Long Term Model Revenue ($M) $3,977 $1,875 $5,852 Gross Margin (%) 61.4% 63.2% 62.0% 63% R&D (%) 12.1% 18.5% 14.2% 13% SG&A (%) 9.9% 12.5% 10.7% 9.5% Op Income ($M) $1,567 $603 $2,170 Op Income (%) 39.4% 32.2% 37.1% 40.5%

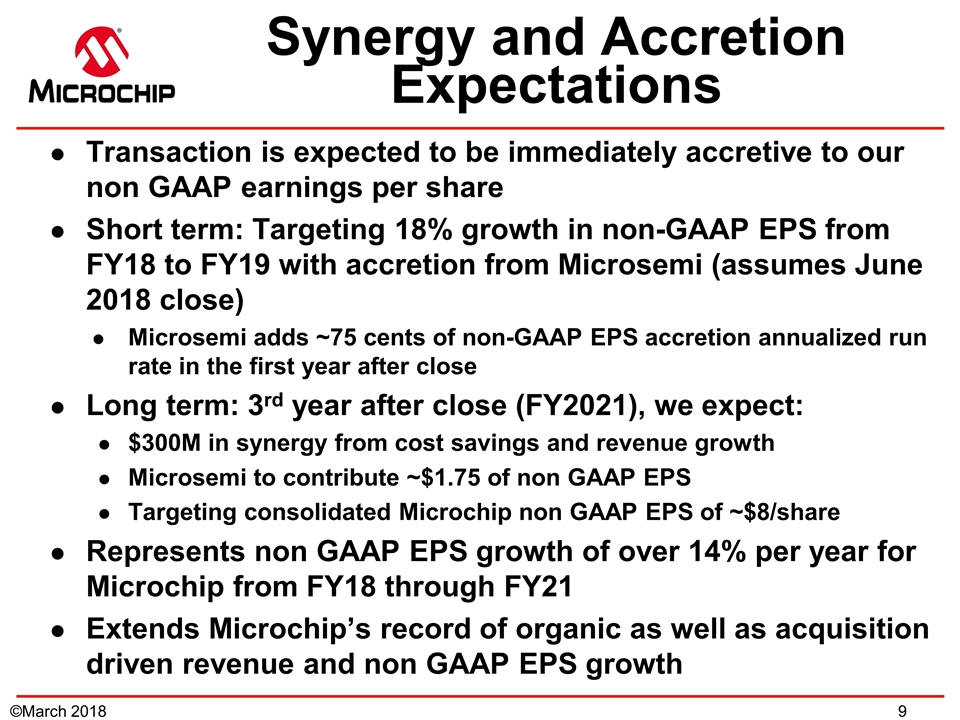

Synergy and Accretion Expectations Transaction is expected to be immediately accretive to our non GAAP earnings per share Short term: Targeting 18% growth in non-GAAP EPS from FY18 to FY19 with accretion from Microsemi (assumes June 2018 close) Microsemi adds ~75 cents of non-GAAP EPS accretion annualized run rate in the first year after close Long term: 3rd year after close (FY2021), we expect: $300M in synergy from cost savings and revenue growth Microsemi to contribute ~$1.75 of non GAAP EPS Targeting consolidated Microchip non GAAP EPS of ~$8/share Represents non GAAP EPS growth of over 14% per year for Microchip from FY18 through FY21 Extends Microchip’s record of organic as well as acquisition driven revenue and non GAAP EPS growth

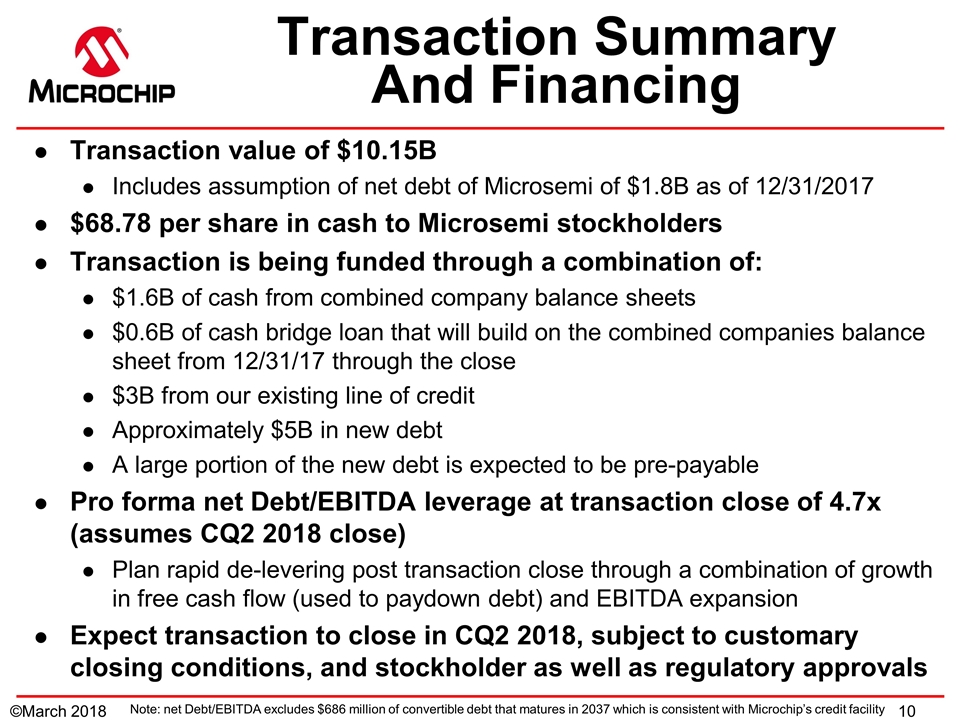

Transaction Summary And Financing Transaction value of $10.15B Includes assumption of net debt of Microsemi of $1.8B as of 12/31/2017 $68.78 per share in cash to Microsemi stockholders Transaction is being funded through a combination of: $1.6B of cash from combined company balance sheets $0.6B of cash bridge loan that will build on the combined companies balance sheet from 12/31/17 through the close $3B from our existing line of credit Approximately $5B in new debt A large portion of the new debt is expected to be pre-payable Pro forma net Debt/EBITDA leverage at transaction close of 4.7x (assumes CQ2 2018 close) Plan rapid de-levering post transaction close through a combination of growth in free cash flow (used to paydown debt) and EBITDA expansion Expect transaction to close in CQ2 2018, subject to customary closing conditions, and stockholder as well as regulatory approvals Note: net Debt/EBITDA excludes $686 million of convertible debt that matures in 2037 which is consistent with Microchip’s credit facility

Summary Microsemi adds strong complementary product lines which support the Microchip 2.0 strategy Microsemi’s strength in Defense, Aerospace, Data Center and Communication markets complements Microchip’s strength in Industrial, Automotive and Consumer markets Microsemi adds further operational and customer scale in a consolidating industry The transaction creates significant stockholder value from strong non GAAP EPS accretion Microsemi acquisition is the next step in Microchip’s track record of successful M&A Another Compelling Transaction!

Thank You!

Microsemi Expands Our Served Available Market FPGA High Reliability Analog Mixed-ignal Optical Networking Storage Adapters Ethernet Solutions Discretes & Power Modules Power Management Security Technology Sensor Interfaces Software & IPs Power over Ethernet (PoE) RFIC/MMIC Audio Processing Timing & Sync. Storage Controllers & Switches Precision Clocks Voice Line Circuits Leading Provider of Semiconductor Solutions Differentiated by Power, Security, Reliability and Performance Actuation & Power Management Systems Avionics, Engine Systems & Control Drone / UAV Electrical Power & Payload Systems Telemetry Tracking & Control Secure Communications Radar / Electronic Warfare Guidance & Control Computers AEROSPACE & DEFENSE NVMe Storage Solutions Server Storage and Co-Processors Ethernet Networking Storage Systems Data Protection & Security Motherboard Components Rack Connectivity DATA CENTER Broadband Home / CPE Access Network Cellular Infrastructure Metro Network Optical Networking Wireless Backhaul Enterprise Infrastructure Data Center Interconnect COMMUNICATIONS Industrial Ethernet Networking Automotive Motor Control HMI (Human Machine Interface) Smart Energy Medical IP Security Camera Programmable Logic Control INDUSTRIAL

Microsemi Innovation

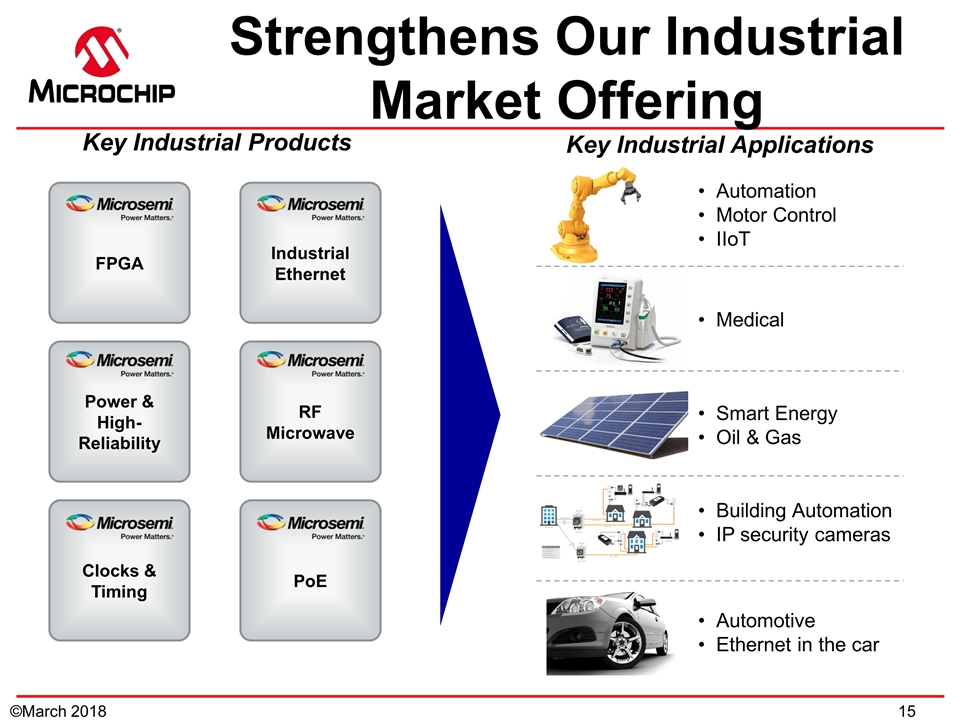

Smart Energy Oil & Gas Key Industrial Products FPGA Industrial Ethernet Power & High-Reliability RF Microwave Clocks & Timing Automation Motor Control IIoT Automotive Ethernet in the car Medical Key Industrial Applications PoE Building Automation IP security cameras Strengthens Our Industrial Market Offering

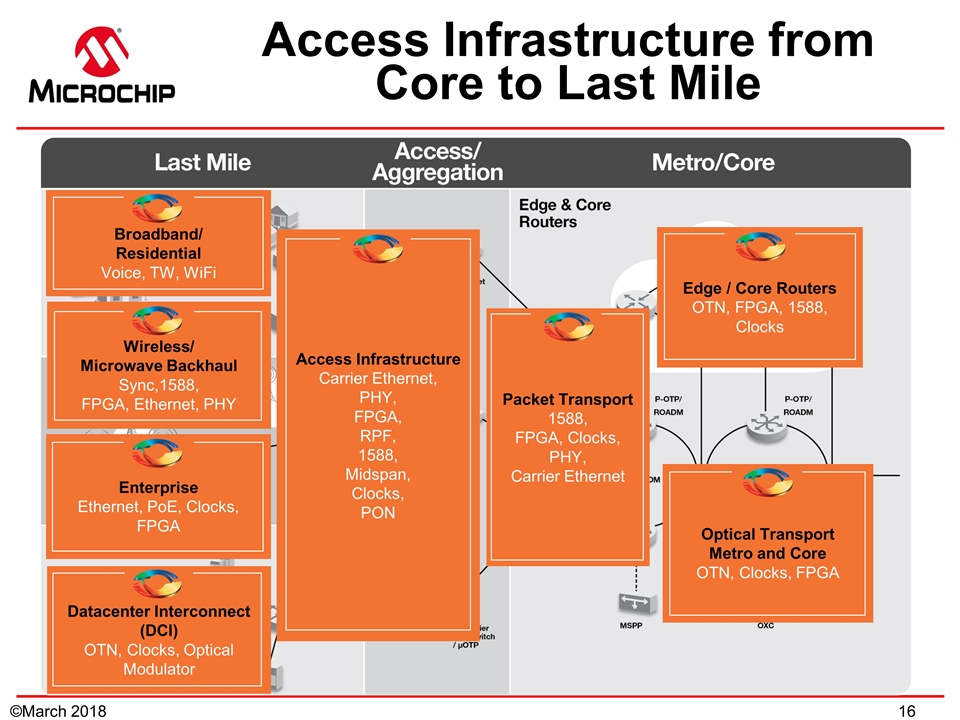

Edge / Core Routers OTN, FPGA, 1588, Clocks Optical Transport Metro and Core OTN, Clocks, FPGA Packet Transport 1588, FPGA, Clocks, PHY, Carrier Ethernet Access Infrastructure Carrier Ethernet, PHY, FPGA, RPF, 1588, Midspan, Clocks, PON Broadband/ Residential Voice, TW, WiFi Wireless/ Microwave Backhaul Sync,1588, FPGA, Ethernet, PHY Enterprise Ethernet, PoE, Clocks, FPGA Datacenter Interconnect (DCI) OTN, Clocks, Optical Modulator Access Infrastructure from Core to Last Mile

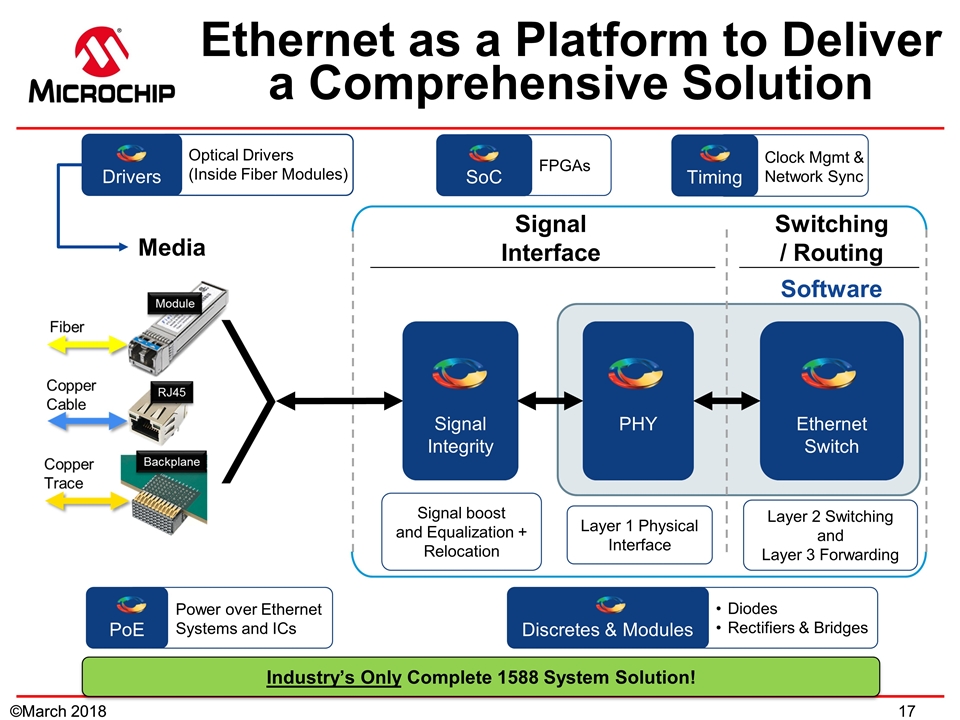

Ethernet as a Platform to Deliver a Comprehensive Solution Signal boost and Equalization + Relocation Power over Ethernet Systems and ICs Diodes Rectifiers & Bridges Optical Drivers (Inside Fiber Modules) Software Media PoE Drivers Signal Interface Signal Integrity PHY Switching / Routing Ethernet Switch SoC FPGAs Clock Mgmt & Network Sync Discretes & Modules Timing Layer 1 Physical Interface Layer 2 Switching and Layer 3 Forwarding Industry’s Only Complete 1588 System Solution!

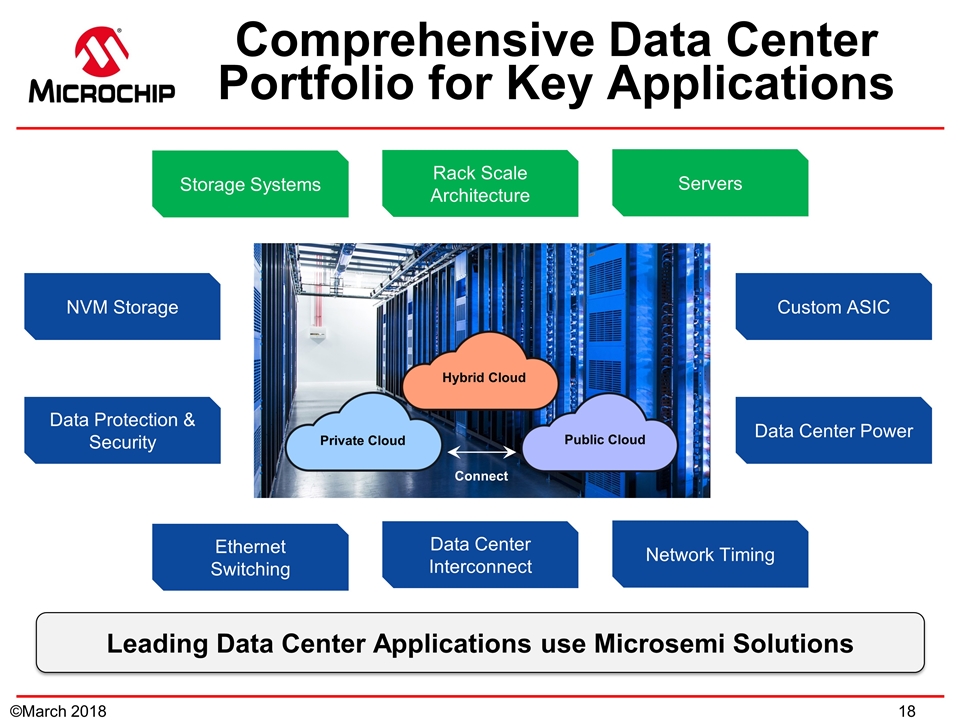

Comprehensive Data Center Portfolio for Key Applications Hybrid Cloud Private Cloud Public Cloud Connect Storage Systems NVM Storage Rack Scale Architecture Ethernet Switching Data Protection & Security Network Timing Data Center Power Data Center Interconnect Servers Custom ASIC Leading Data Center Applications use Microsemi Solutions

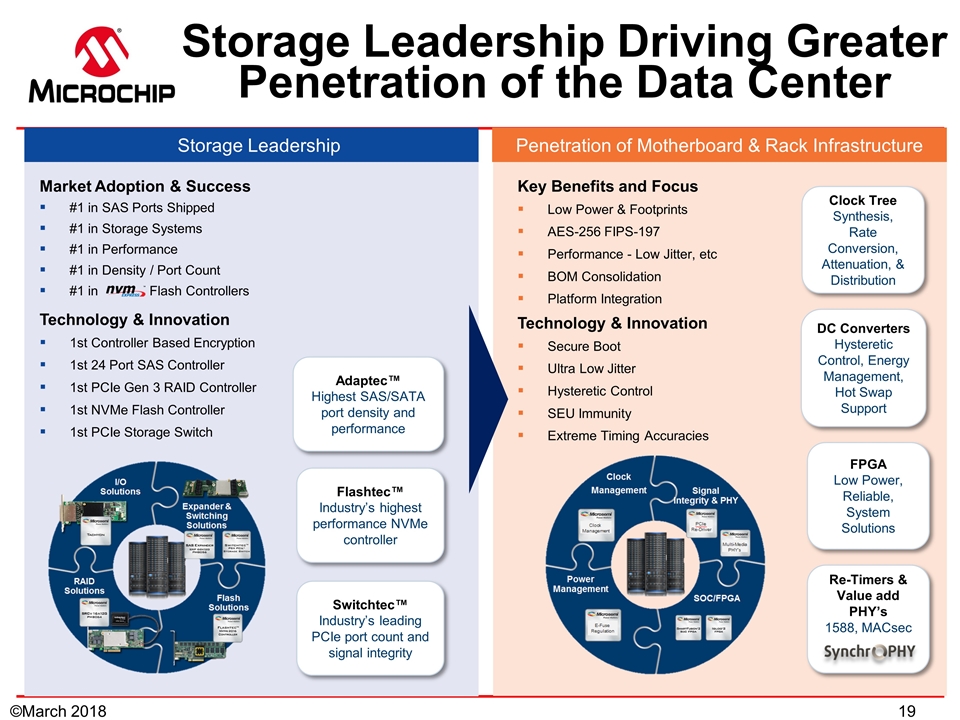

Storage Leadership Driving Greater Penetration of the Data Center #1 in SAS Ports Shipped #1 in Storage Systems #1 in Performance #1 in Density / Port Count #1 in Flash Controllers Market Adoption & Success Technology & Innovation 1st Controller Based Encryption 1st 24 Port SAS Controller 1st PCIe Gen 3 RAID Controller 1st NVMe Flash Controller 1st PCIe Storage Switch Adaptec™ Highest SAS/SATA port density and performance Switchtec™ Industry’s leading PCIe port count and signal integrity Flashtec™ Industry’s highest performance NVMe controller Storage Leadership Penetration of Motherboard & Rack Infrastructure Re-Timers & Value add PHY’s 1588, MACsec FPGA Low Power, Reliable, System Solutions Clock Tree Synthesis, Rate Conversion, Attenuation, & Distribution DC Converters Hysteretic Control, Energy Management, Hot Swap Support Low Power & Footprints AES-256 FIPS-197 Performance - Low Jitter, etc BOM Consolidation Platform Integration Key Benefits and Focus Technology & Innovation Secure Boot Ultra Low Jitter Hysteretic Control SEU Immunity Extreme Timing Accuracies

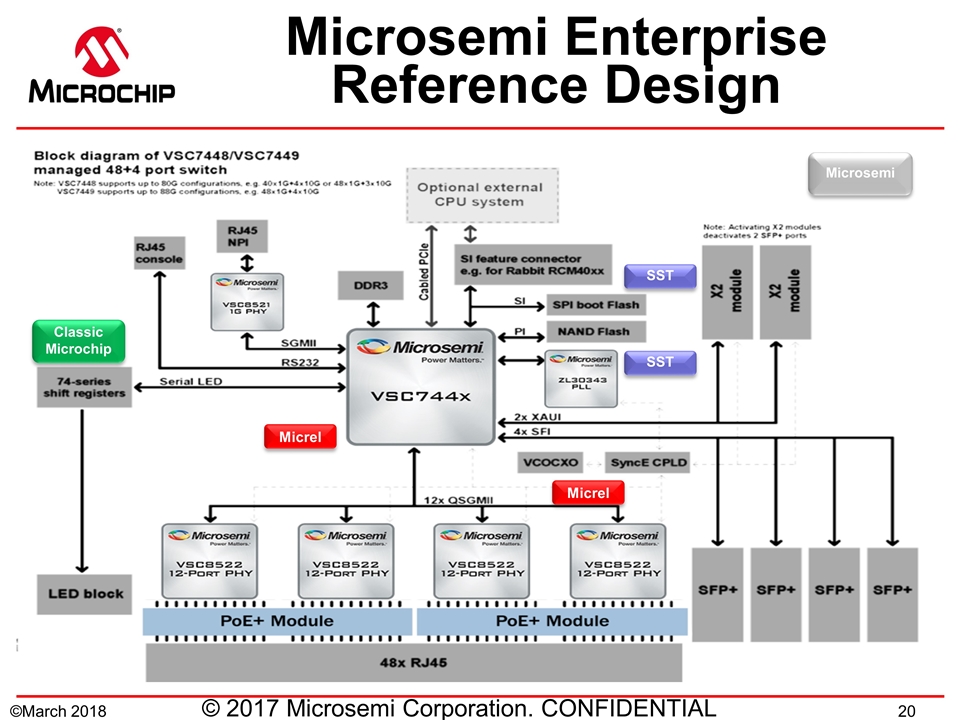

Microsemi Enterprise Reference Design © 2017 Microsemi Corporation. CONFIDENTIAL SST Micrel Classic Microchip Micrel SST Microsemi