Form 8-K Expedia, Inc. For: Feb 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) February 8, 2018

EXPEDIA, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-37429 | 20-2705720 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

333 108th Avenue NE

Bellevue, Washington 98004

(Address of principal executive offices) (Zip code)

(425) 679-7200

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐ |

Item 2.02. Results of Operations and Financial Condition.

On February 8, 2018, Expedia, Inc. issued a press release and will hold a conference call regarding its financial results for the quarter and year ended December 31, 2017. A copy of the earnings release is furnished as Exhibit 99.1 hereto.

Expedia is making reference to non-GAAP financial measures in both the earnings release and the conference call. A reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures is contained in the attached Exhibit 99.1 press release.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

Expedia management intends to make presentations to various investors, analysts and others using the slides containing company information attached to this report as Exhibit 99.2 hereto.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On February 8, 2018, Expedia announced that its Executive Committee, acting on behalf of its Board of Directors, has declared a quarterly cash dividend of $0.30 per share of outstanding common stock payable on March 28, 2018 to stockholders of record as of the close of business on March 8, 2018.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number | Description | |

99.1 | ||

99.2 | ||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EXPEDIA, INC. | ||

By: | /s/ ALAN PICKERILL | |

Alan Pickerill | ||

Chief Financial Officer | ||

Dated: February 8, 2018

EXHIBIT INDEX

Exhibit Number | Description | |

99.1 | ||

99.2 | ||

Exhibit 99.1

Expedia, Inc. Reports Fourth Quarter and Full Year 2017 Results

BELLEVUE, WA – February 8, 2018 – Expedia, Inc. (NASDAQ: EXPE) announced financial results today for the fourth quarter and full year ended December 31, 2017.

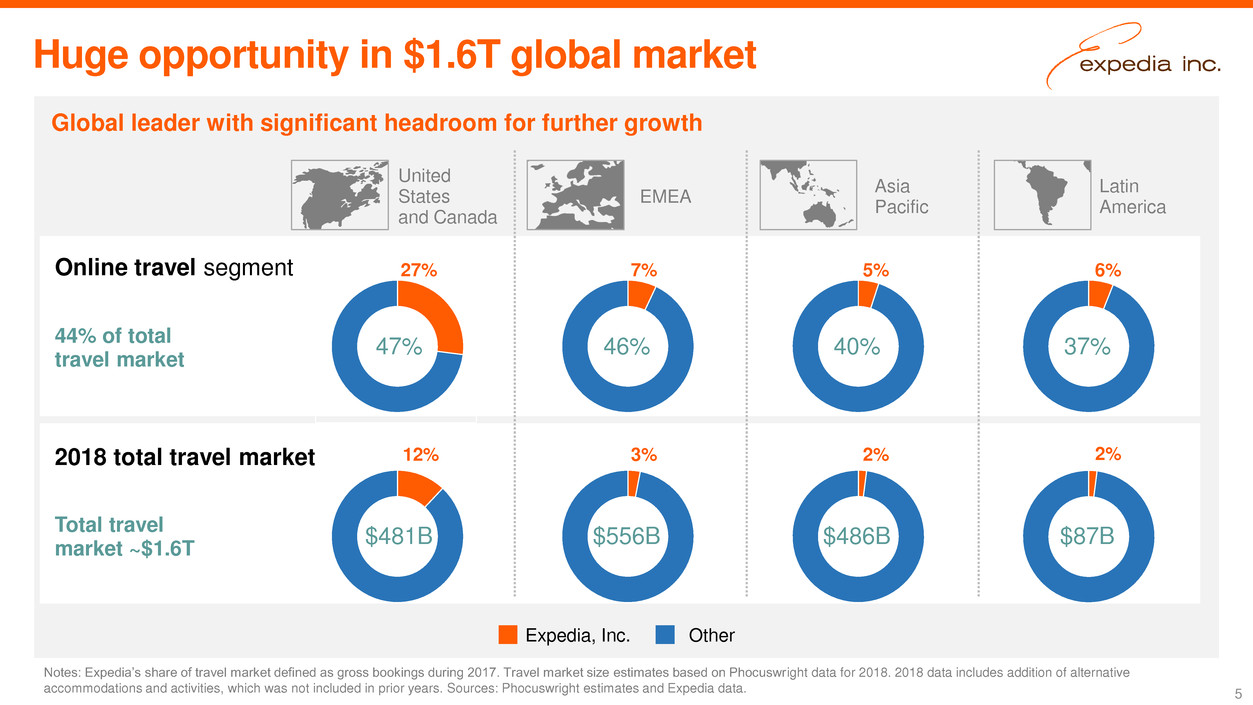

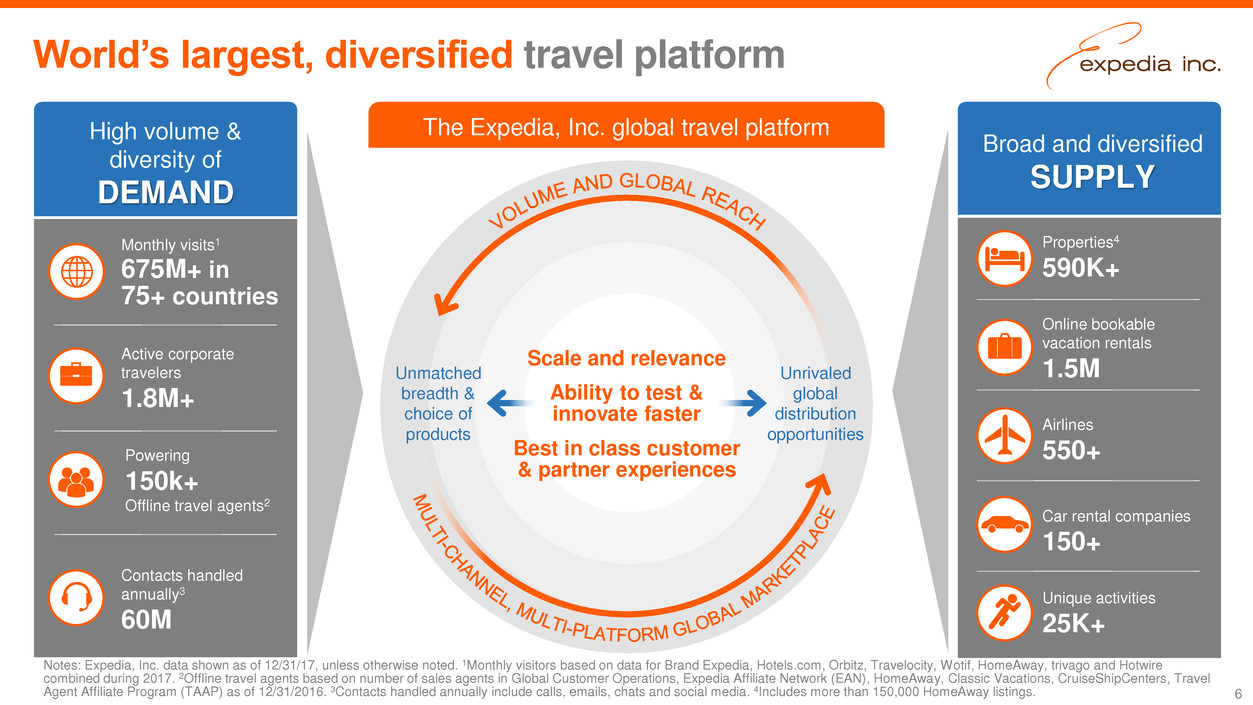

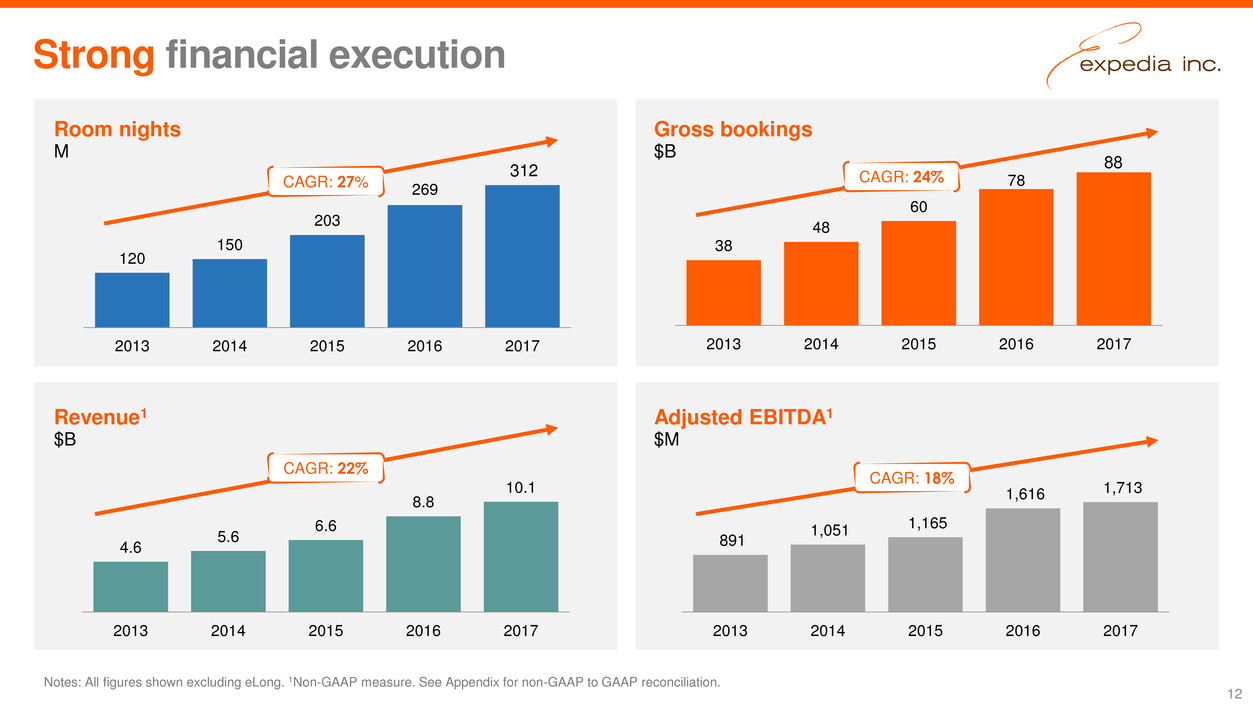

"I am excited to report that Expedia began 2018 firmly on a path toward faster growth and greater share gains in the $1.6 trillion travel industry. Over the past several months, we have made key organizational changes, aligned our company around common objectives and began executing on a new direction aimed at accelerating the geographic expansion of our global travel platform," said CEO Mark Okerstrom. "We are now operating with a clear focus on our highest priority markets, making concentrated investments across the platform including a step function change in our pace of adding new properties to our marketplace. These efforts combined with the impact of our ongoing cloud migration result in expectations for full year 2018 Adjusted EBITDA growth of 6% to 11%*."

Key Highlights

• | Gross bookings increased $2.4 billion or 14% year-over-year to $19.8 billion in the fourth quarter of 2017. Revenue increased 11% year-over-year to $2.3 billion in the fourth quarter. |

• | Room nights stayed for Brand Expedia, Hotels.com, Expedia Affiliate Network and Egencia combined increased 17% year-over-year in the fourth quarter of 2017, with HomeAway room nights stayed up 30% year-over-year for the same period. |

• | In 2017, gross bookings on the HomeAway platform increased 46% year-over-year to $8.7 billion. Total revenue of $906 million included transactional revenue of $617 million, which grew 115% year-over-year. |

• | Expedia, Inc.'s global Core OTA lodging portfolio increased to more than 590,000 properties available as of December 31, 2017, up 69% year-over-year, including 150,000 instantly bookable HomeAway listings. |

• | In the fourth quarter of 2017, Expedia repurchased 1.3 million shares for $156 million and paid $46 million in dividends. During 2017, Expedia generated nearly $1.1 billion in free cash flow. |

*A reconciliation of Adjusted EBITDA guidance to the closest corresponding GAAP measure is not provided because we are unable to predict the ultimate outcome of certain significant items without unreasonable efforts. These items include, but are not limited to, foreign exchange, returns on investment spending, and acquisition-related or restructuring expenses. As such, the items that are excluded from our non-GAAP guidance are uncertain, depend on various factors, and could have a material impact on GAAP results for the guidance period.

Financial Summary & Operating Metrics ($ millions except per share amounts) - Fourth Quarter 2017

Metric | Q4 2017 | Q4 2016 | Δ Y/Y |

Room night growth(1) | 15% | 23% | (757) bps |

Gross bookings(1) | $19,765.9 | $17,402.5 | 14% |

Revenue | 2,319.2 | 2,092.8 | 11% |

Operating income | 113.5 | 147.2 | (23)% |

Net income attributable to Expedia, Inc. | 55.2 | 79.5 | (31)% |

Diluted EPS | $0.35 | $0.51 | (31)% |

Adjusted EBITDA(2) | 402.5 | 441.5 | (9)% |

Adjusted net income(2) | 131.6 | 182.9 | (28)% |

Adjusted EPS(2) | $0.84 | $1.17 | (28)% |

Free cash flow(2) | (307.6) | (161.6) | (90)% |

(1) Expedia acquired HomeAway on December 15, 2015. Beginning in the first quarter of 2017, HomeAway results are included in lodging room nights and gross bookings operating metrics, with quarterly results for 2016 adjusted to reflect this change.

Page 1 of 22

(2) “Adjusted EBITDA” (Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization), “Adjusted net income,” “Adjusted EPS” and “Free cash flow” are non-GAAP measures as defined by the Securities and Exchange Commission (the “SEC”). See “Definitions of Non-GAAP Measures” and “Tabular Reconciliations for Non-GAAP Measures” on pages 16-20 herein for an explanation and reconciliations of non-GAAP measures used throughout this release.

Financial Summary & Operating Metrics ($ millions except per share amounts) - Full Year 2017

Metric | 2017 | 2016 | Δ Y/Y |

Room night growth(1) | 16% | 32%(2) | (1,594) bps |

Gross bookings(1) | $88,410.5 | $78,410.7 | 13% |

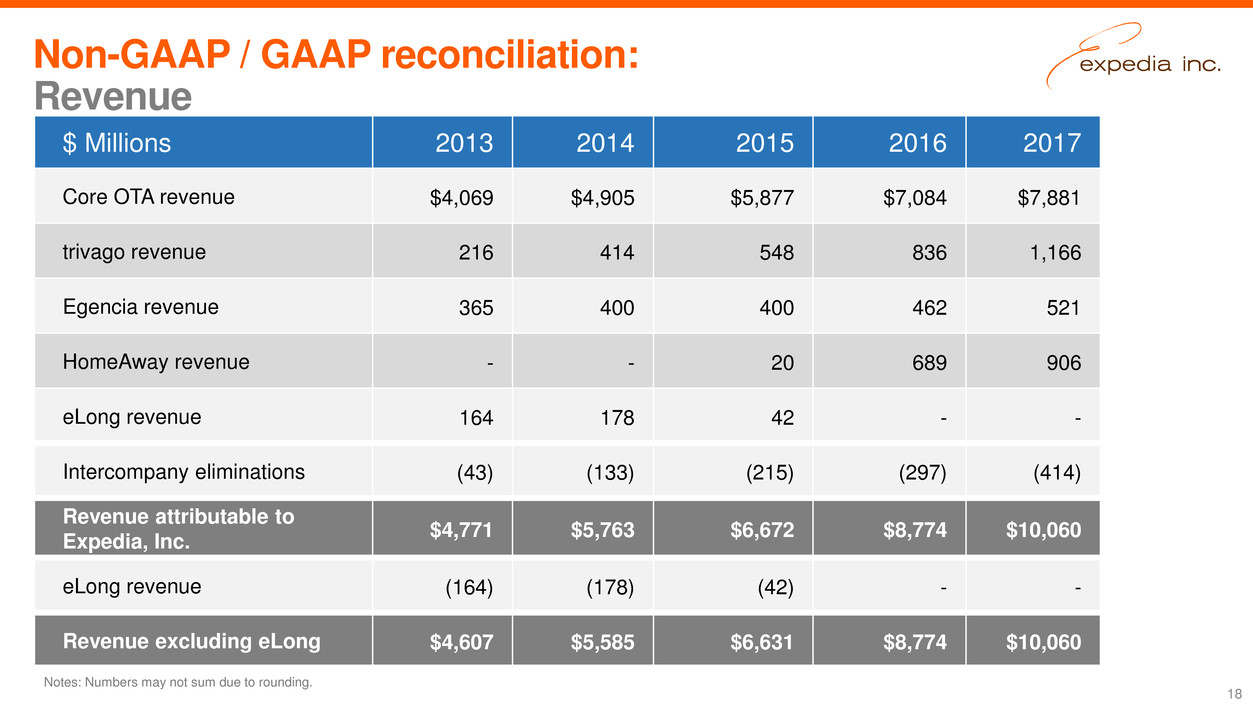

Revenue | 10,059.8 | 8,773.6 | 15% |

Operating income | 625.1 | 461.7 | 35% |

Net income attributable to Expedia, Inc. | 378.0 | 281.8 | 34% |

Diluted EPS | $2.42 | $1.82 | 33% |

Adjusted EBITDA(3) | 1,712.5 | 1,615.7 | 6% |

Adjusted net income(3) | 678.5 | 698.8 | (3)% |

Adjusted EPS(3) | $4.30 | $4.49 | (4)% |

Free cash flow(3) | 1,088.8 | 815.0 | 34% |

(1) Expedia acquired HomeAway on December 15, 2015. Beginning in the first quarter of 2017, HomeAway results are included in lodging room nights and gross bookings operating metrics, with quarterly results for 2016 adjusted to reflect this change.

(2) Expedia sold its ownership interest in eLong, Inc. on May 22, 2015 and eLong is excluded from our results from that point forward. Expedia, Inc. 2016 room night growth also excludes eLong, Inc. results prior to May 22, 2015.

(3) “Adjusted EBITDA” (Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization), “Adjusted net income,” “Adjusted EPS” and “Free cash flow” are non-GAAP measures as defined by the Securities and Exchange Commission (the “SEC”). See “Definitions of Non-GAAP Measures” and “Tabular Reconciliations for Non-GAAP Measures” on pages 16-20 herein for an explanation and reconciliations of non-GAAP measures used throughout this release.

Please refer to the "Glossary of Business Terms," located in the Quarterly Results section on Expedia’s investor relations website, for business and financial statement definitions used throughout this release.

Discussion of Results

The results for Expedia, Inc. ("Expedia" or "the Company") include Expedia.com® ("Brand Expedia"), Hotels.com®, Expedia® Affiliate Network ("EAN"), trivago®, HomeAway®, Egencia®, Orbitz®, Travelocity®, Hotwire.com®, Wotif Group, CheapTickets®, ebookers®, CarRentals.comTM, Classic Vacations®, Expedia Local Expert®, Expedia® CruiseShipCenters®, SilverRail Technologies, Inc. ("SilverRail"), ALICE and AirAsia ExpediaTM, including the related international points of sale for all brands. All amounts shown are in U.S. dollars.

The results include the impacts of SilverRail and ALICE following Expedia's acquisition of majority ownership stakes in June 2017 and August 2017, respectively. All comparisons, unless otherwise noted, are to the corresponding 2016 periods.

Gross Bookings & Revenue

Gross Bookings by Segment ($ millions)

Fourth Quarter | Full Year | ||||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ% | ||||||||||||||||

Core OTA | $ | 16,182 | $ | 14,650 | 10% | $ | 72,701 | $ | 66,064 | 10 | % | ||||||||||

HomeAway | 1,913 | 1,299 | 47% | 8,746 | 5,979 | 46 | % | ||||||||||||||

Egencia | 1,670 | 1,454 | 15% | 6,963 | 6,368 | 9 | % | ||||||||||||||

Total | $ | 19,766 | $ | 17,403 | 14% | $ | 88,410 | $ | 78,411 | 13 | % | ||||||||||

Note: Some numbers may not add due to rounding.

Fourth Quarter 2017: Total gross bookings increased 14% (including 2 percentage points of positive foreign exchange impact), driven primarily by growth in Brand Expedia, HomeAway, Hotels.com, EAN and Egencia.

Page 2 of 22

Domestic gross bookings increased 7% and international gross bookings increased 26% (including 6 percentage points of positive foreign exchange impact). International gross bookings totaled $8.0 billion and accounted for 40% of worldwide bookings, compared with 36% in the fourth quarter of 2016.

Full Year 2017: Total gross bookings increased 13%, driven primarily by growth in Brand Expedia, HomeAway, Hotels.com and EAN. Foreign exchange impact on total gross bookings growth was negligible. Domestic gross bookings increased 8% and international gross bookings increased 21% (including 1 percentage point of positive foreign exchange impact). International gross bookings totaled $33.2 billion and accounted for 38% of worldwide bookings, compared with 35% in the prior year.

Revenue by Segment ($ millions)

Fourth Quarter | Full Year | |||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ% | |||||||||||||||

Core OTA | $ | 1,857 | $ | 1,695 | 10% | $ | 7,881 | $ | 7,084 | 11% | ||||||||||

trivago | 215 | 183 | 18% | 1,166 | 836 | 40% | ||||||||||||||

HomeAway | 193 | 166 | 16% | 906 | 689 | 32% | ||||||||||||||

Egencia | 137 | 116 | 18% | 521 | 462 | 13% | ||||||||||||||

Intercompany eliminations | (83 | ) | (67 | ) | (24)% | (414 | ) | (297 | ) | (39)% | ||||||||||

Total | $ | 2,319 | $ | 2,093 | 11% | $ | 10,060 | $ | 8,774 | 15% | ||||||||||

Note: Some numbers may not add due to rounding.

Fourth Quarter 2017: Total revenue increased 11% (including 3 percentage points of positive foreign exchange impact), driven primarily by growth in Brand Expedia, EAN and Hotels.com. Domestic revenue increased 4% and international revenue increased 19% (including 9 percentage points of positive foreign exchange impact). International revenue equaled $1.1 billion, representing 46% of worldwide revenue, compared to 43% in the fourth quarter of 2016.

Full Year 2017: Total revenue increased 15%, driven primarily by growth in Brand Expedia, trivago, HomeAway and EAN. Foreign exchange impact on total revenue growth was negligible. Domestic revenue increased 10% and international revenue increased 21% (including 3 percentage points of positive foreign exchange impact). International revenue equaled $4.5 billion, representing 45% of worldwide revenue, compared to 43% in the prior year.

Product & Services Detail - Fourth Quarter 2017

As a percentage of total worldwide revenue in the fourth quarter of 2017, lodging accounted for 69%, advertising and media accounted for 9%, air accounted for 8% and all other revenues accounted for the remaining 14%.

Lodging revenue, which includes hotel and HomeAway revenue, increased 11% in the fourth quarter of 2017 on a 15% increase in room nights stayed driven by growth in Brand Expedia, EAN, Hotels.com and HomeAway, partially offset by a 4% decrease in revenue per room night.

Air revenue was essentially flat in the fourth quarter of 2017 on a 3% increase in air tickets sold, offset by a 3% decrease in revenue per ticket year-over-year.

Advertising and media revenue increased 13% (including 6 percentage points of positive foreign exchange impact) in the fourth quarter of 2017 due to continued growth in Expedia® Media Solutions and trivago. All other revenue increased 14% in the fourth quarter of 2017 reflecting growth in travel insurance and car rental products.

Product & Services Detail - Full Year 2017

As a percentage of total worldwide annual revenue, lodging accounted for 68%, advertising and media accounted for 11%, air accounted for 8% and all other revenues accounted for the remaining 13%.

Page 3 of 22

Lodging revenue increased 14% in 2017 on a 16% increase in room nights stayed driven by growth in Brand Expedia, HomeAway and EAN, partially offset by a 2% decrease in revenue per room night.

Air revenue increased 1% in 2017 on a 4% increase in air tickets sold, partially offset by a 3% decrease in revenue per ticket.

Advertising and media revenue increased 33% in 2017 due to continued growth in trivago and Expedia® Media Solutions. All other revenue increased 16% in 2017 reflecting growth in travel insurance and car rental products.

Generally Accepted Accounting Principles (GAAP) Expenses

Costs and Expenses | As a % of Revenue | |||||||||||||||||||

Fourth Quarter | Fourth Quarter | |||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ in bps | |||||||||||||||

($ millions) | ||||||||||||||||||||

GAAP cost of revenue | $ | 437 | $ | 371 | 18 | % | 18.9 | % | 17.7 | % | 114 | |||||||||

GAAP selling and marketing | 1,124 | 969 | 16 | % | 48.5 | % | 46.3 | % | 217 | |||||||||||

GAAP technology and content | 372 | 324 | 15 | % | 16.0 | % | 15.5 | % | 56 | |||||||||||

GAAP general and administrative | 198 | 174 | 14 | % | 8.5 | % | 8.3 | % | 21 | |||||||||||

Total GAAP costs and expenses | $ | 2,131 | $ | 1,838 | 16 | % | 91.9 | % | 87.8 | % | 408 | |||||||||

Costs and Expenses | As a % of Revenue | |||||||||||||||||||

Full Year | Full Year | |||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ in bps | |||||||||||||||

($ millions) | ||||||||||||||||||||

GAAP cost of revenue | $ | 1,757 | $ | 1,597 | 10 | % | 17.5 | % | 18.2 | % | (74 | ) | ||||||||

GAAP selling and marketing | 5,298 | 4,367 | 21 | % | 52.7 | % | 49.8 | % | 288 | |||||||||||

GAAP technology and content | 1,387 | 1,235 | 12 | % | 13.8 | % | 14.1 | % | (29 | ) | ||||||||||

GAAP general and administrative | 676 | 678 | — | % | 6.7 | % | 7.7 | % | (101 | ) | ||||||||||

Total GAAP costs and expenses | $ | 9,118 | $ | 7,877 | 16 | % | 90.6 | % | 89.8 | % | 84 | |||||||||

GAAP Cost of Revenue

• | Fourth Quarter 2017: Total GAAP cost of revenue increased 18%, compared to the fourth quarter of 2016, due to $39 million more in data center, cloud and other costs, as well as $19 million more in customer operations expenses, the largest driver being growth of operations to support our partner solutions business. Cloud expense in GAAP cost of revenue was $18 million during the fourth quarter of 2017, compared to $2 million in the fourth quarter of 2016. |

• | Full Year 2017: Total GAAP cost of revenue increased 10%, compared to the prior year, driven by $122 million more in data center, cloud and other costs, including a $37 million increase in depreciation expense that is primarily data center related, as well as $40 million more in customer operations expenses. Cloud expense in GAAP cost of revenue was $57 million during 2017, compared to $4 million in 2016. |

GAAP Selling and Marketing

• | Fourth Quarter 2017: Total GAAP selling and marketing expense increased 16%, compared to the fourth quarter of 2016, due to a $121 million increase in direct costs, including online and offline marketing expenses. trivago, Brand Expedia, EAN and HomeAway accounted for a majority of the increase in direct selling and marketing expenses in the fourth quarter of 2017. |

• | For the fourth quarter of 2017, indirect costs increased $34 million, primarily driven by growth in personnel due to an accelerated pace of hiring in the lodging supply organization as well as increased headcount at Egencia. |

Page 4 of 22

• | Full Year 2017: Total GAAP selling and marketing expense increased 21%, compared to the prior year, due to an $830 million increase in direct costs, including online and offline marketing expenses. trivago, Brand Expedia, EAN and Hotels.com accounted for the majority of the increase in direct selling and marketing expenses in 2017. |

• | For the full year 2017, indirect costs increased $101 million, compared to the prior year. The increase was primarily driven by growth in personnel at Egencia as well as in the lodging supply organization. |

GAAP Technology and Content

• | Fourth Quarter 2017: Total GAAP technology and content expense increased 15%, compared to the fourth quarter of 2016, due to $26 million more in personnel and overhead costs from increased headcount. Depreciation and amortization of technology assets also increased $19 million, compared to the fourth quarter of 2016. Cloud expense in GAAP technology and content expense was $11 million during the fourth quarter of 2017, compared to $12 million in the fourth quarter of 2016. |

• | Full Year 2017: Total GAAP technology and content expense increased 12%, compared to the prior year, due to an increase of $83 million in depreciation and amortization and $67 million more in personnel and overhead costs from increased headcount. Cloud expense in GAAP technology and content expense was $38 million in 2017, compared to $35 million in 2016. |

GAAP General and Administrative

• | Fourth Quarter 2017: Total GAAP general and administrative expense increased 14%, compared to the fourth quarter of 2016, primarily due to a $19 million increase in personnel and overhead expenses from increased headcount. |

• | Full Year 2017: Total GAAP general and administrative expense was relatively flat compared to the prior year, primarily due to a decrease in stock-based compensation of $63 million, from the current year reversal of approximately $41 million of previously recognized stock-based compensation expense related to the departure of the former CEO as well as the absence of prior year increases related to trivago. This is offset by an increase of $42 million in personnel and overhead expenses from increased headcount and, to a lesser extent, an increase in professional fees. |

Adjusted Expenses

Costs and Expenses | As a % of Revenue | |||||||||||||||||||

Fourth Quarter | Fourth Quarter | |||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ in bps | |||||||||||||||

($ millions) | ||||||||||||||||||||

Adjusted cost of revenue * | $ | 409 | $ | 352 | 16 | % | 17.6 | % | 16.8 | % | 83 | |||||||||

Adjusted selling and marketing * | 1,104 | 951 | 16 | % | 47.6 | % | 45.5 | % | 214 | |||||||||||

Adjusted technology and content * | 239 | 210 | 14 | % | 10.3 | % | 10.0 | % | 26 | |||||||||||

Adjusted general and administrative * | 168 | 147 | 14 | % | 7.2 | % | 7.0 | % | 20 | |||||||||||

Total adjusted costs and expenses | $ | 1,920 | $ | 1,660 | 16 | % | 82.8 | % | 79.3 | % | 343 | |||||||||

Total depreciation | 165 | 132 | 25 | % | 7.1 | % | 6.3 | % | 81 | |||||||||||

Total stock-based compensation | 46 | 45 | 2 | % | 2.0 | % | 2.1 | % | (17 | ) | ||||||||||

Total costs and expenses | $ | 2,131 | $ | 1,837 | 16 | % | 91.9 | % | 87.8 | % | 408 | |||||||||

Page 5 of 22

Costs and Expenses | As a % of Revenue | |||||||||||||||||||

Full Year | Full Year | |||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ in bps | |||||||||||||||

($ millions) | ||||||||||||||||||||

Adjusted cost of revenue * | $ | 1,647 | $ | 1,523 | 8 | % | 16.4 | % | 17.4 | % | (99 | ) | ||||||||

Adjusted selling and marketing * | 5,220 | 4,292 | 22 | % | 51.9 | % | 48.9 | % | 297 | |||||||||||

Adjusted technology and content * | 887 | 810 | 10 | % | 8.8 | % | 9.2 | % | (41 | ) | ||||||||||

Adjusted general and administrative * | 599 | 546 | 10 | % | 6.0 | % | 6.2 | % | (26 | ) | ||||||||||

Total adjusted costs and expenses | $ | 8,354 | $ | 7,171 | 16 | % | 83.0 | % | 81.7 | % | 131 | |||||||||

Total depreciation | 614 | 477 | 29 | % | 6.1 | % | 5.4 | % | 67 | |||||||||||

Total stock-based compensation | 149 | 242 | (38 | )% | 1.5 | % | 2.8 | % | (128 | ) | ||||||||||

Total costs and expenses | $ | 9,117 | $ | 7,890 | 16 | % | 90.6 | % | 89.9 | % | 70 | |||||||||

*Adjusted expenses are non-GAAP measures. See pages 16-20 herein for a description and reconciliation to the corresponding GAAP measures.

Note: Some numbers may not add due to rounding.

Adjusted Cost of Revenue

• | Fourth Quarter 2017: Total adjusted cost of revenue increased 16%, compared to the fourth quarter of 2016, due to $32 million more in data center, cloud and other costs and $17 million more in customer operations expenses, the largest driver being growth of operations to support our partner solutions business. Cloud expense in adjusted cost of revenue was $18 million during the fourth quarter of 2017, compared to $2 million in the fourth quarter of 2016. |

• | Full Year 2017: Total adjusted cost of revenue increased 8%, compared to the prior year, due to $93 million more in data center, cloud and other costs and $33 million more in customer operations expenses. Cloud expense in adjusted cost of revenue was $57 million during 2017, compared to $4 million in 2016. |

Adjusted Selling and Marketing

• | Fourth Quarter 2017: Total adjusted selling and marketing expense increased 16%, compared to the fourth quarter of 2016, due to $121 million more in direct costs, including online and offline marketing expenses. trivago, Brand Expedia, EAN and HomeAway accounted for a majority of the increase in direct selling and marketing expenses in the fourth quarter of 2017. |

• | For the fourth quarter of 2017, indirect costs increased $31 million, primarily driven by growth in personnel due to an accelerated pace of hiring in the lodging supply organization as well as increased headcount at Egencia. As a percentage of total adjusted selling and marketing, indirect costs represented 21% in the fourth quarter of 2017, consistent with 21% in the fourth quarter of 2016. |

• | Full Year 2017: Total adjusted selling and marketing expense increased 22%, compared to the prior year, due to an $830 million increase in direct costs, including online and offline marketing expenses. trivago, Brand Expedia, EAN and Hotels.com accounted for a majority of the increase in direct selling and marketing expenses in 2017. |

• | For the full year 2017, indirect costs increased $98 million, compared to the prior year. The increase was primarily driven by growth in personnel at Egencia as well as in the lodging supply organization. As a percentage of total adjusted selling and marketing, indirect costs represented 16% in 2017, down from 18% in 2016. |

Adjusted Technology and Content

• | Fourth Quarter 2017: Total adjusted technology and content expense increased 14%, compared to the fourth quarter of 2016, due to $26 million more in total personnel and overhead costs from increased headcount. Cloud expense in adjusted technology and content expense was $11 million during the fourth quarter of 2017, compared to $12 million in the fourth quarter of 2016. |

• | Full Year 2017: Total adjusted technology and content expense increased 10%, compared to the prior year, due to $67 million more in total personnel and overhead costs from increased headcount. Cloud expense in adjusted technology and content expense was $38 million during 2017, compared to $35 million in 2016. |

Page 6 of 22

Adjusted General and Administrative

• | Fourth Quarter 2017: Total adjusted general and administrative expense increased 14%, compared to the fourth quarter of 2016, primarily due to a $17 million increase in personnel and overhead from increased headcount. |

• | Full Year 2017: Total adjusted general and administrative expense increased 10%, compared to the prior year, primarily due to a $34 million increase in personnel and overhead from increased headcount and, to a lesser extent, an increase in professional fees. |

Depreciation Expense

Depreciation expense increased $33 million to $165 million in the fourth quarter of 2017 and $137 million to $614 million in 2017, primarily due to previously capitalized software development costs for completed technology projects which have been placed into service, as well as investments in corporate technology infrastructure.

Stock-Based Compensation Expense

Stock-based compensation expense increased $1 million to $46 million in the fourth quarter of 2017. Stock-based compensation expense decreased $93 million to $149 million in 2017, due to the exercise of Expedia's call right on certain trivago shares held by employees in 2016, as described below, as well as the reversal of approximately $41 million in the third quarter of 2017 of previously recognized stock-based compensation expense related to Expedia's former CEO.

During the second quarter of 2016, Expedia exercised its call right on certain shares held by trivago employees, which were originally awarded in the form of stock options pursuant to the trivago employee stock option plan and subsequently exercised by such employees, and elected to do so at a premium to fair value, which resulted in an incremental stock-based compensation charge of approximately $49 million in the second quarter of 2016 pursuant to liability award treatment. The acquisition of these employee minority interests increased Expedia's ordinary ownership of trivago by a nominal amount.

Net Income Attributable to Expedia and Adjusted EBITDA*

Adjusted EBITDA by Segment ($ millions)

Fourth Quarter | Full Year | |||||||||||||||||||

2017 | 2016 | Δ% | 2017 | 2016 | Δ% | |||||||||||||||

Core OTA | $ | 537 | $ | 532 | 1% | $ | 2,069 | $ | 1,966 | 5% | ||||||||||

trivago(1) | (9 | ) | 14 | NM | 5 | 35 | (84)% | |||||||||||||

HomeAway | 31 | 42 | (28)% | 202 | 175 | 15% | ||||||||||||||

Egencia | 19 | 21 | (7)% | 94 | 81 | 17% | ||||||||||||||

Unallocated overhead costs | (176 | ) | (168 | ) | (5)% | (657 | ) | (641 | ) | (3)% | ||||||||||

Total | $ | 402 | $ | 442 | (9)% | $ | 1,713 | $ | 1,616 | 6% | ||||||||||

Net income attributable to Expedia, Inc.(2) | 55 | $ | 79 | (31)% | $ | 378 | $ | 282 | 34% | |||||||||||

(1) Upon completion of its initial public offering on December 16, 2016, trivago became a separately listed company on the Nasdaq Global Select Market and, therefore, is subject to its own reporting and filing requirements which could result in possible differences that are not expected to be material to Expedia, Inc.(2) Expedia does not calculate or report net income by segment.

* Adjusted EBITDA is a non-GAAP measure. See pages 16-20 herein for a description and reconciliation to the corresponding GAAP measure.

Note: Some numbers may not add due to rounding.

GAAP net income attributable to Expedia was $55 million in the fourth quarter of 2017, compared to GAAP net income of $79 million in the fourth quarter of 2016. GAAP net income attributable to Expedia was $378 million in 2017, an increase of 34% compared to GAAP net income of $282 million in 2016.

Page 7 of 22

Adjusted EBITDA was $402 million in the fourth quarter of 2017, a decrease of 9% compared to Adjusted EBITDA of $442 million in the fourth quarter of 2016. Adjusted EBITDA was $1.7 billion in 2017, an increase of 6% compared to Adjusted EBITDA of $1.6 billion in 2016.

Amortization of Intangible Assets

Consolidated amortization of intangible assets increased $3 million to $71 million in the fourth quarter of 2017, primarily due to new business acquisitions in the current year. Consolidated amortization of intangible assets decreased $42 million to $275 million in 2017, due to the completion of amortization related to certain intangible assets, partially offset by $11 million of amortization related to new business acquisitions in the current year. In addition, in 2016 we recorded a $35 million impairment loss related to indefinite-lived trade names.

Restructuring and Related Reorganization Charges

In connection with activities to centralize and optimize certain operations as well as migrate technology platforms in the prior year, primarily related to the previously disclosed acquisitions, we recognized $17 million and $56 million in restructuring and related reorganization charges during 2017 and 2016. Based on current plans, which are subject to change, and excluding any possible future acquisition integrations, we do not expect to incur material restructuring charges in 2018.

Interest and Other

Consolidated interest income increased $4 million in the fourth quarter of 2017 and increased $14 million in 2017, compared to the prior year periods, primarily due to higher invested balances in both periods, and to a lesser extent higher rates of return during 2017. Consolidated interest expense increased $9 million in the fourth quarter of 2017 and $9 million in 2017, compared to the prior year periods, primarily due to the issuance of the $1 billion of senior unsecured notes in September 2017.

Consolidated other, net was a gain of $5 million in the fourth quarter of 2017, consistent with a gain of $5 million in the fourth quarter of 2016. Consolidated other, net was a loss of $61 million in 2017, compared to a loss of $32 million in 2016. The losses in 2017 and 2016 were primarily related to foreign exchange. Expedia’s revenue hedging program is designed primarily to offset the book-to-stay impact on merchant hotel revenue. Expedia includes that portion of any realized gains or losses from the revenue hedging program that are included in other, net that relate to revenue recognized in the period in the calculation of Adjusted EBITDA.

Income Taxes

The effective tax rate on GAAP pretax income was 30% and 11% for the fourth quarter and full year 2017, respectively, compared to 26% and 6% in the prior year periods. The increase in the quarterly effective tax rate for 2017 compared to 2016 is due to a number of factors, including an increase in losses in foreign jurisdictions, offset by the estimated effect of the Tax Cuts and Jobs Act (the "Tax Act"). The increase in the annual effective tax rate for 2017 compared to 2016 was primarily due to the same factors, as well as one-time benefits in the prior year period. In addition, the effective tax rate for 2017 and 2016 was lower than the 35% U.S. federal statutory rate due to earnings in foreign jurisdictions, predominantly Switzerland, where the statutory income tax rate is lower, as well as excess tax benefits related to share-based payments.

The effective tax rate on pretax adjusted net income ("ANI") was 31% and 25% for the fourth quarter and full year 2017, respectively, compared to 28% and 26% in the prior year periods. The year-over-year change in the ANI effective tax rate for the fourth quarter of 2017 was primarily driven by the timing of recognition for certain discrete items recorded during the fourth quarter of 2017 tied to the filing of various tax returns. The year-over-year change in the ANI effective tax rate for the full year 2017 was relatively consistent with the prior year.

United States Tax Reform Impacts

As of December 31, 2017, we have not completed our accounting for the tax effects of enactment of the Tax Act. We have recognized a net tax benefit of $14 million for the provisional tax impacts of the Tax Act related to the transition tax and revaluation of our net deferred tax liability and included these estimates in our consolidated financial statements for the year ended December 31, 2017. The ultimate impact may materially differ from these provisional amounts, due to, among other things, additional analysis, changes in interpretations and assumptions we

Page 8 of 22

have made, additional regulatory guidance that may be issued and actions we may take as a result of the Tax Act. These provisional tax effects were excluded from our computation of ANI.

Balance Sheet, Cash Flows and Capitalization

Cash, cash equivalents, restricted cash and short-term investments totaled $3.4 billion at December 31, 2017. For the year ended December 31, 2017, consolidated net cash provided by operating activities was $1.8 billion and consolidated free cash flow totaled $1.1 billion. Both measures include $593 million from net changes in operating assets and liabilities, primarily driven by an increase in deferred merchant bookings. For the three months ended December 31, 2017, consolidated free cash flow was $(308) million, a decrease of $146 million, compared to the prior year period, primarily due to the decrease in net cash provided by operating activities. For the year ended December 31, 2017, consolidated free cash flow was $1.1 billion, an increase of $274 million, compared to the prior year period, primarily due to the increase in net cash provided by operating activities related to changes in working capital and higher Adjusted EBITDA.

Long-term investments and other assets includes an investment in Despegar.com, Corp. ("Despegar"), which is recorded at a fair value of $264 million as of December 31, 2017, and $338 million of a $350 million investment made in Traveloka Holding Limited in July 2017, accounted for as a cost method investment (with a small portion allocated to intangible assets). Despegar completed its initial public offering in September 2017.

Current maturities of long-term debt includes $500 million in 7.456% senior notes due in August 2018. Long-term debt, net of applicable discounts, debt issuance costs and current maturities, totaled $3.7 billion at December 31, 2017 consisting of $990 million in 3.8% senior notes due 2028; $741 million in 5.0% senior notes due 2026; $495 million in 4.5% senior notes due 2024; $775 million (€650 million) in 2.5% senior notes due 2022; and $748 million in 5.95% senior notes due 2020. The 3.8% senior notes due 2028 were issued during the third quarter of 2017. In addition, as of December 31, 2017, Expedia had a $1.5 billion unsecured revolving credit facility, which was essentially untapped.

At December 31, 2017, Expedia, Inc. had stock-based awards outstanding representing approximately 18 million shares of Expedia common stock, consisting of options to purchase approximately 16 million common shares with a $95.23 weighted average exercise price and weighted average remaining life of 4.4 years, and approximately 2 million restricted stock units (“RSUs”).

During 2017, Expedia, Inc. repurchased 2.3 million shares of Expedia, Inc. common stock for an aggregate purchase price of $294 million excluding transaction costs (an average of $127.04 per share). As of December 31, 2017, there were approximately 4.9 million shares remaining under a February 2015 repurchase authorization.

On December 7, 2017, Expedia, Inc. paid a quarterly dividend of $46 million ($0.30 per common share). In addition, on February 7, 2018, the Executive Committee of Expedia’s Board of Directors declared a quarterly cash dividend of $0.30 per share of outstanding common stock to be paid to stockholders of record as of the close of business on March 8, 2018, with a payment date of March 28, 2018. Based on current shares outstanding, the total payment for this quarterly dividend is estimated to be approximately $46 million. Future declaration of dividends and the establishment of future record and payment dates are subject to the final determination of Expedia’s Board of Directors.

Page 9 of 22

Recent Highlights

Expedia, Inc.

• | As of December 31, 2017, Expedia's global lodging portfolio consisted of more than 590,000 properties available, including more than 150,000 HomeAway listings. |

• | Expedia renewed its supply marketing agreements with Air Serbia and Air Tahiti Nui. |

• | G6 Hospitality became the latest hotel chain to implement Expedia’s Partner Loyalty Enrollment program which enables them to enlist and sign up users from Brand Expedia and Hotels.com sites for their brand loyalty programs. |

• | Bahia Principe and Omni Hotels & Resorts each entered into agreements for Expedia to power package bookings on their US sites. Additionally, Minor Hotels became the first hotel chain in APAC to integrate Expedia’s white-label MICE (meetings, incentives, conferences, exhibitions) solution into its website. |

Core OTA

• | Brand Expedia launched Deutsche Bahn rail tickets as well as tickets for international rail routes to travelers in Germany, with plans to extend to an international audience in early 2018. |

• | Brand Expedia launched flights and packages on its Korean site, which are now available in addition to hotels. |

• | Hotels.com collaborated with Capital One, giving Capital One Venture cardholders ten times the miles on bookings while still earning Hotels.com Rewards points when they book at hotels.com/venture. Additionally, Hotels.com gift cards are now available through Vector Gift Cards & Marketing Agency, with National Gift Card as new agency of record for business-to-business sales. |

• | EAN and Amadeus announced that travel sellers worldwide will be able to book EAN’s rates and inventory at more than 400,000 hotels worldwide through Amadeus, including full-service hotel brands, boutique hotels, and serviced apartments. |

• | In November, Hotwire launched its Million Dollar Sale featuring $50 5-star hotels in Las Vegas. This fixed price sale, which was the brand’s first, garnered outsized media and social buzz, more than doubled Hotwire's demand for Las Vegas during the sale period and netted four times more new customers versus typical expectations. |

• | Expedia CruiseShipCenters achieved over $675 million in gross bookings in 2017, exhibiting 20% year-over-year growth. |

trivago

• | trivago’s emerging markets showed a strong performance, increasing the share of the Rest of World (ROW) region in the fourth quarter to 23%, up from 15% in the same period in 2016. |

• | In November, trivago launched the integration of HomeAway vacation rental inventory on its platform to amplify its catalog and diversify its advertiser base, with over 70,000 properties listed as of December 31, 2017. |

HomeAway

• | HomeAway launched its Premier Partner program, highlighting property owners and managers who meet marketplace requirements designed to provide great traveler experiences. HomeAway continued to launch new tools for property owners and managers, such as the Marketplace Feed that alerts owners to booking opportunities, as well as win/loss notifications that highlight bookings won or lost by the property owner and allowing them to compare their property with others in the market. |

• | HomeAway launched a new daytime television series in the United States called “Vacation Rental Potential” on the A&E Network that highlights the purchasing and managing of vacation rental properties. |

Egencia

• | Egencia surpassed one million cumulative app downloads as of the end of 2017, with downloads during the year increasing 65% over 2016. Travelers are increasingly using the app during their trips; in-trip views grew 29% year-over-year in 2017. |

• | Corporate Travel Awards named Egencia the #1 TMC in the UK, Travel News named Egencia the #1 TMC in Sweden, while Tour Hedbo named Egencia the #2 TMC in France. |

• | Egencia entered into agreement renewals with Netflix, the world’s leading internet entertainment service, and BlackBerry, a global software solutions provider delivering ‘smart in everyThing.’ |

Page 10 of 22

EXPEDIA, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for per share data)

(Unaudited)

Three months ended December 31, | Year ended December 31, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Revenue | $ | 2,319,208 | $ | 2,092,829 | $ | 10,059,844 | $ | 8,773,564 | |||||||

Costs and expenses: | |||||||||||||||

Cost of revenue (1) (2) | 437,278 | 370,841 | 1,756,531 | 1,596,698 | |||||||||||

Selling and marketing (1) (2) | 1,123,658 | 968,555 | 5,297,832 | 4,367,417 | |||||||||||

Technology and content (1) (2) | 372,156 | 324,098 | 1,386,787 | 1,235,019 | |||||||||||

General and administrative (1) (2) | 197,558 | 173,897 | 675,961 | 678,292 | |||||||||||

Amortization of intangible assets | 71,479 | 68,022 | 275,445 | 317,141 | |||||||||||

Impairment of intangible assets | — | 32,749 | — | 34,890 | |||||||||||

Legal reserves, occupancy tax and other | 2,456 | (2,152 | ) | 25,412 | 26,498 | ||||||||||

Restructuring and related reorganization charges (1) | 1,148 | 9,633 | 16,738 | 55,907 | |||||||||||

Operating income | 113,475 | 147,186 | 625,138 | 461,702 | |||||||||||

Other income (expense): | |||||||||||||||

Interest income | 9,287 | 5,377 | 34,137 | 19,726 | |||||||||||

Interest expense | (52,073 | ) | (42,875 | ) | (181,712 | ) | (173,148 | ) | |||||||

Other, net | 5,217 | 5,438 | (60,799 | ) | (31,680 | ) | |||||||||

Total other expense, net | (37,569 | ) | (32,060 | ) | (208,374 | ) | (185,102 | ) | |||||||

Income before income taxes | 75,906 | 115,126 | 416,764 | 276,600 | |||||||||||

Provision for income taxes | (23,031 | ) | (30,244 | ) | (45,405 | ) | (15,315 | ) | |||||||

Net income | 52,875 | 84,882 | 371,359 | 261,285 | |||||||||||

Net (income) loss attributable to non-controlling interests | 2,284 | (5,425 | ) | 6,605 | 20,563 | ||||||||||

Net income attributable to Expedia, Inc. | $ | 55,159 | $ | 79,457 | $ | 377,964 | $ | 281,848 | |||||||

Earnings per share attributable to Expedia, Inc. available to common stockholders: | |||||||||||||||

Basic | $ | 0.36 | $ | 0.53 | $ | 2.49 | $ | 1.87 | |||||||

Diluted | 0.35 | 0.51 | 2.42 | 1.82 | |||||||||||

Shares used in computing earnings per share: | |||||||||||||||

Basic | 152,252 | 150,624 | 151,619 | 150,367 | |||||||||||

Diluted | 155,974 | 155,071 | 156,385 | 154,517 | |||||||||||

Dividends declared per common share | $ | 0.30 | $ | 0.26 | $ | 1.16 | $ | 1.00 | |||||||

_________ | |||||||||||||||

(1) Includes stock-based compensation as follows: | |||||||||||||||

Cost of revenue | $ | 2,318 | $ | 2,620 | $ | 10,173 | $ | 11,388 | |||||||

Selling and marketing | 9,218 | 9,282 | 39,855 | 46,654 | |||||||||||

Technology and content | 13,052 | 12,539 | 54,633 | 63,536 | |||||||||||

General and administrative | 21,170 | 20,374 | 44,689 | 108,149 | |||||||||||

Restructuring and related reorganization charges | — | — | — | 12,690 | |||||||||||

(2) Includes depreciation as follows: | |||||||||||||||

Cost of revenue | $ | 26,077 | $ | 16,567 | $ | 99,489 | $ | 62,420 | |||||||

Selling and marketing | 10,680 | 8,055 | 37,552 | 28,747 | |||||||||||

Technology and content | 120,003 | 101,266 | 445,083 | 361,434 | |||||||||||

General and administrative | 8,595 | 6,340 | 31,975 | 24,460 | |||||||||||

Page 11 of 22

EXPEDIA, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

December 31, | |||||||

2017 | 2016 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 2,846,729 | $ | 1,796,811 | |||

Restricted cash and cash equivalents | 69,055 | 18,733 | |||||

Short-term investments | 468,508 | 72,313 | |||||

Accounts receivable, net of allowance of $30,696 and $25,278 | 1,865,995 | 1,343,247 | |||||

Income taxes receivable | 20,633 | 19,402 | |||||

Prepaid expenses and other current assets | 268,669 | 199,745 | |||||

Total current assets | 5,539,589 | 3,450,251 | |||||

Property and equipment, net | 1,575,258 | 1,394,904 | |||||

Long-term investments and other assets | 845,450 | 520,058 | |||||

Deferred income taxes | 17,930 | 23,658 | |||||

Intangible assets, net | 2,308,536 | 2,446,652 | |||||

Goodwill | 8,228,865 | 7,942,023 | |||||

TOTAL ASSETS | $ | 18,515,628 | $ | 15,777,546 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable, merchant | $ | 1,837,936 | $ | 1,509,313 | |||

Accounts payable, other | 697,560 | 577,012 | |||||

Deferred merchant bookings | 3,219,279 | 2,617,791 | |||||

Deferred revenue | 325,722 | 282,517 | |||||

Income taxes payable | 33,374 | 49,739 | |||||

Accrued expenses and other current liabilities | 1,264,819 | 1,090,826 | |||||

Current maturities of long-term debt | 500,000 | — | |||||

Total current liabilities | 7,878,690 | 6,127,198 | |||||

Long-term debt, excluding current maturities | 3,749,054 | 3,159,336 | |||||

Deferred income taxes | 328,602 | 484,970 | |||||

Other long-term liabilities | 408,380 | 312,939 | |||||

Commitments and contingencies | |||||||

Redeemable non-controlling interests | 22,334 | — | |||||

Stockholders’ equity: | |||||||

Common stock $.0001 par value | 23 | 22 | |||||

Authorized shares: 1,600,000 | |||||||

Shares issued: 228,467 and 224,310 | |||||||

Shares outstanding: 138,939 and 137,232 | |||||||

Class B common stock $.0001 par value | 1 | 1 | |||||

Authorized shares: 400,000 | |||||||

Shares issued and outstanding: 12,800 and 12,800 | |||||||

Additional paid-in capital | 9,162,909 | 8,794,298 | |||||

Treasury stock — Common stock, at cost | (4,822,743 | ) | (4,510,655 | ) | |||

Shares: 89,528 and 87,077 | |||||||

Retained earnings | 331,078 | 129,034 | |||||

Accumulated other comprehensive income (loss) | (148,933 | ) | (280,399 | ) | |||

Total Expedia, Inc. stockholders’ equity | 4,522,335 | 4,132,301 | |||||

Non-redeemable non-controlling interests | 1,606,233 | 1,560,802 | |||||

Total stockholders’ equity | 6,128,568 | 5,693,103 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 18,515,628 | $ | 15,777,546 | |||

Page 12 of 22

EXPEDIA, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Year ended December 31, | |||||||

2017 | 2016 | ||||||

Operating activities: | |||||||

Net income | $ | 371,359 | $ | 261,285 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation of property and equipment, including internal-use software and website development | 614,099 | 477,061 | |||||

Amortization of stock-based compensation | 149,350 | 242,417 | |||||

Amortization of intangible assets | 275,445 | 317,141 | |||||

Impairment of intangible assets | — | 34,890 | |||||

Deferred income taxes | (103,308 | ) | (14,088 | ) | |||

Foreign exchange (gain) loss on cash, cash equivalents and short-term investments, net | (78,819 | ) | 16,253 | ||||

Realized (gain) loss on foreign currency forwards | (6,335 | ) | 53,089 | ||||

Non-controlling interest basis adjustment | (1,678 | ) | — | ||||

Other | (13,660 | ) | 7,555 | ||||

Changes in operating assets and liabilities, net of effects from acquisitions and disposals: | |||||||

Accounts receivable | (455,668 | ) | (276,154 | ) | |||

Prepaid expenses and other assets | (116,768 | ) | (30,198 | ) | |||

Accounts payable, merchant | 315,989 | 184,398 | |||||

Accounts payable, other, accrued expenses and other current liabilities | 256,728 | 79,202 | |||||

Tax payable/receivable, net | (30,577 | ) | (100,525 | ) | |||

Deferred merchant bookings | 592,912 | 261,402 | |||||

Deferred revenue | 30,085 | 50,606 | |||||

Net cash provided by operating activities | 1,799,154 | 1,564,334 | |||||

Investing activities: | |||||||

Capital expenditures, including internal-use software and website development | (710,330 | ) | (749,348 | ) | |||

Purchases of investments | (1,811,355 | ) | (45,352 | ) | |||

Sales and maturities of investments | 1,096,404 | 60,935 | |||||

Acquisitions, net of cash acquired | (170,639 | ) | (777 | ) | |||

Proceeds from sale of business, net of cash divested and disposal costs | — | 67,088 | |||||

Net settlement on foreign currency forwards | 6,335 | (53,089 | ) | ||||

Other, net | 7,195 | 2,222 | |||||

Net cash used in investing activities | (1,582,390 | ) | (718,321 | ) | |||

Financing activities: | |||||||

Proceeds from issuance of long-term debt, net of issuance costs | 989,600 | (2,093 | ) | ||||

Payment of HomeAway Convertible Notes | — | (401,424 | ) | ||||

Purchases of treasury stock | (312,089 | ) | (455,746 | ) | |||

Payment of dividends to stockholders | (175,775 | ) | (150,159 | ) | |||

Proceeds from exercise of equity awards and employee stock purchase plan | 229,081 | 141,043 | |||||

Changes in controlled subsidiaries, net | (18,137 | ) | 208,016 | ||||

Withholding taxes for stock option exercises | (9,063 | ) | (1,282 | ) | |||

Other, net | (16,103 | ) | (28,974 | ) | |||

Net cash provided by (used in) financing activities | 687,514 | (690,619 | ) | ||||

Effect of exchange rate changes on cash and cash equivalents | 145,640 | (34,882 | ) | ||||

Net increase in cash and cash equivalents | 1,049,918 | 120,512 | |||||

Cash and cash equivalents at beginning of year | 1,796,811 | 1,676,299 | |||||

Cash and cash equivalents at end of year | $ | 2,846,729 | $ | 1,796,811 | |||

Supplemental cash flow information | |||||||

Cash paid for interest | $ | 162,932 | $ | 153,755 | |||

Income tax payments, net | 174,180 | 124,291 | |||||

Page 13 of 22

Expedia, Inc.

Trended Metrics

(All figures in millions)

The supplemental metrics below are intended to supplement the financial statements in this release and in our filings with the SEC, and do not include adjustments for one-time items, acquisitions, foreign exchange or other adjustments. The definition, methodology and appropriateness of any of our supplemental metrics are subject to removal and/or change, and such changes could be material. In the event of any discrepancy between any supplemental metric and our historical financial statements, you should rely on the information filed with the SEC and the financial statements in our most recent earnings release.

2016 | 2017 | Full Year | Y/Y Growth | ||||||||||||||||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | 2016 | 2017 | Q417 | 2017 | ||||||||||||||||||||||||||||||||||

Gross bookings by segment | |||||||||||||||||||||||||||||||||||||||||||||

Core OTA | $ | 17,226 | $ | 17,182 | $ | 17,007 | $ | 14,650 | $ | 19,110 | $ | 18,954 | $ | 18,456 | $ | 16,182 | $ | 66,064 | $ | 72,701 | 10% | 10% | |||||||||||||||||||||||

HomeAway | 1,818 | 1,460 | 1,403 | 1,299 | 2,697 | 2,123 | 2,013 | 1,913 | 5,979 | 8,746 | 47% | 46% | |||||||||||||||||||||||||||||||||

Egencia | 1,656 | 1,679 | 1,579 | 1,454 | 1,804 | 1,761 | 1,728 | 1,670 | 6,368 | 6,963 | 15% | 9% | |||||||||||||||||||||||||||||||||

Total | $ | 20,699 | $ | 20,321 | $ | 19,988 | $ | 17,403 | $ | 23,610 | $ | 22,838 | $ | 22,197 | $ | 19,766 | $ | 78,411 | $ | 88,410 | 14% | 13% | |||||||||||||||||||||||

Gross bookings by geography | |||||||||||||||||||||||||||||||||||||||||||||

Domestic | $ | 13,744 | $ | 13,320 | $ | 12,915 | $ | 11,074 | $ | 15,128 | $ | 14,730 | $ | 13,540 | $ | 11,800 | $ | 51,053 | $ | 55,197 | 7% | 8% | |||||||||||||||||||||||

International | 6,955 | 7,001 | 7,073 | 6,329 | 8,483 | 8,108 | 8,657 | 7,966 | 27,358 | 33,213 | 26% | 21% | |||||||||||||||||||||||||||||||||

Total | $ | 20,699 | $ | 20,321 | $ | 19,988 | $ | 17,403 | $ | 23,610 | $ | 22,838 | $ | 22,197 | $ | 19,766 | $ | 78,411 | $ | 88,410 | 14% | 13% | |||||||||||||||||||||||

Gross bookings by business model | |||||||||||||||||||||||||||||||||||||||||||||

Agency | $ | 10,640 | $ | 10,611 | $ | 10,023 | $ | 8,869 | $ | 11,342 | $ | 11,168 | $ | 10,392 | $ | 9,493 | $ | 40,143 | $ | 42,395 | 7% | 6% | |||||||||||||||||||||||

Merchant | 8,242 | 8,250 | 8,563 | 7,235 | 9,572 | 9,546 | 9,792 | 8,360 | 32,289 | 37,269 | 16% | 15% | |||||||||||||||||||||||||||||||||

HomeAway | 1,818 | 1,460 | 1,403 | 1,299 | 2,697 | 2,123 | 2,013 | 1,913 | 5,979 | 8,746 | 47% | 46% | |||||||||||||||||||||||||||||||||

Total | $ | 20,699 | $ | 20,321 | $ | 19,988 | $ | 17,403 | $ | 23,610 | $ | 22,838 | $ | 22,197 | $ | 19,766 | $ | 78,411 | $ | 88,410 | 14% | 13% | |||||||||||||||||||||||

Revenue by segment | |||||||||||||||||||||||||||||||||||||||||||||

Core OTA | $ | 1,540 | $ | 1,765 | $ | 2,083 | $ | 1,695 | $ | 1,700 | $ | 2,009 | $ | 2,314 | $ | 1,857 | $ | 7,084 | $ | 7,881 | 10% | 11% | |||||||||||||||||||||||

trivago | 176 | 201 | 276 | 183 | 286 | 328 | 338 | 215 | 836 | 1,166 | 18% | 40% | |||||||||||||||||||||||||||||||||

HomeAway | 142 | 172 | 210 | 166 | 185 | 224 | 305 | 193 | 689 | 906 | 16% | 32% | |||||||||||||||||||||||||||||||||

Egencia | 110 | 125 | 112 | 116 | 123 | 135 | 126 | 137 | 462 | 521 | 18% | 13% | |||||||||||||||||||||||||||||||||

Intercompany eliminations | (64 | ) | (66 | ) | (101 | ) | (67 | ) | (104 | ) | (110 | ) | (117 | ) | (83 | ) | (297 | ) | (414 | ) | (24)% | (39)% | |||||||||||||||||||||||

Total | $ | 1,904 | $ | 2,196 | $ | 2,581 | $ | 2,093 | $ | 2,189 | $ | 2,586 | $ | 2,966 | $ | 2,319 | $ | 8,774 | $ | 10,060 | 11% | 15% | |||||||||||||||||||||||

Revenue by geography | |||||||||||||||||||||||||||||||||||||||||||||

Domestic | $ | 1,115 | $ | 1,271 | $ | 1,451 | $ | 1,199 | $ | 1,249 | $ | 1,457 | $ | 1,576 | $ | 1,252 | $ | 5,037 | $ | 5,535 | 4% | 10% | |||||||||||||||||||||||

International | 789 | 924 | 1,130 | 893 | 940 | 1,129 | 1,390 | 1,067 | 3,737 | 4,525 | 19% | 21% | |||||||||||||||||||||||||||||||||

Total | $ | 1,904 | $ | 2,196 | $ | 2,581 | $ | 2,093 | $ | 2,189 | $ | 2,586 | $ | 2,966 | $ | 2,319 | $ | 8,774 | $ | 10,060 | 11% | 15% | |||||||||||||||||||||||

Revenue by business model | |||||||||||||||||||||||||||||||||||||||||||||

Agency | $ | 523 | $ | 612 | $ | 723 | $ | 567 | $ | 571 | $ | 684 | $ | 803 | $ | 629 | $ | 2,425 | $ | 2,687 | 11% | 11% | |||||||||||||||||||||||

Merchant | 1,065 | 1,210 | 1,407 | 1,170 | 1,176 | 1,376 | 1,559 | 1,283 | 4,852 | 5,394 | 10% | 11% | |||||||||||||||||||||||||||||||||

Advertising & media | 174 | 202 | 241 | 190 | 257 | 302 | 299 | 214 | 807 | 1,073 | 13% | 33% | |||||||||||||||||||||||||||||||||

HomeAway | 142 | 172 | 210 | 166 | 185 | 224 | 305 | 193 | 689 | 906 | 16% | 32% | |||||||||||||||||||||||||||||||||

Total | $ | 1,904 | $ | 2,196 | $ | 2,581 | $ | 2,093 | $ | 2,189 | $ | 2,586 | $ | 2,966 | $ | 2,319 | $ | 8,774 | $ | 10,060 | 11% | 15% | |||||||||||||||||||||||

Adjusted EBITDA by segment | |||||||||||||||||||||||||||||||||||||||||||||

Core OTA | $ | 292 | $ | 428 | $ | 714 | $ | 532 | $ | 306 | $ | 488 | $ | 737 | $ | 537 | $ | 1,966 | $ | 2,069 | 1% | 5% | |||||||||||||||||||||||

trivago | 8 | 7 | 6 | 14 | 21 | 2 | (8 | ) | (9 | ) | 35 | 5 | NM | (86)% | |||||||||||||||||||||||||||||||

HomeAway | 17 | 38 | 77 | 42 | 6 | 39 | 126 | 31 | 175 | 202 | (28)% | 15% | |||||||||||||||||||||||||||||||||

Egencia | 15 | 26 | 18 | 21 | 27 | 28 | 20 | 19 | 81 | 94 | (7)% | 17% | |||||||||||||||||||||||||||||||||

Unallocated overhead costs | (156 | ) | (169 | ) | (148 | ) | (168 | ) | (151 | ) | (164 | ) | (166 | ) | (176 | ) | (641 | ) | (657 | ) | (5)% | (3)% | |||||||||||||||||||||||

Total | $ | 177 | $ | 331 | $ | 667 | $ | 442 | $ | 208 | $ | 393 | $ | 709 | $ | 402 | $ | 1,616 | $ | 1,713 | (9)% | 6% | |||||||||||||||||||||||

Net income (loss) attributable to Expedia, Inc. | $ | (109 | ) | $ | 32 | $ | 279 | $ | 79 | $ | (86 | ) | $ | 57 | $ | 352 | $ | 55 | $ | 282 | $ | 378 | (31)% | 34% | |||||||||||||||||||||

Page 14 of 22

Expedia, Inc. (excluding eLong)

Trended Metrics

(All figures in millions)

2016 | 2017 | Full Year | ||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | 2016 | 2017 | |||||||||||||||||||||

Worldwide lodging (merchant, agency & HomeAway) | ||||||||||||||||||||||||||||||

Room nights | 57.4 | 66.0 | 80.2 | 64.9 | 64.0 | 79.9 | 93.5 | 74.8 | 268.5 | 312.1 | ||||||||||||||||||||

Room night growth | 50 | % | 31 | % | 31 | % | 23 | % | 12 | % | 21 | % | 16 | % | 15 | % | 32 | % | 16 | % | ||||||||||

Domestic room night growth | 50 | % | 36 | % | 36 | % | 22 | % | 7 | % | 17 | % | 12 | % | 10 | % | 35 | % | 12 | % | ||||||||||

International room night growth | 50 | % | 24 | % | 25 | % | 24 | % | 17 | % | 26 | % | 22 | % | 21 | % | 29 | % | 22 | % | ||||||||||

ADR growth | 1 | % | 5 | % | 8 | % | 5 | % | 2 | % | 2 | % | 4 | % | 4 | % | 5 | % | 3 | % | ||||||||||

Revenue per night growth | (6 | )% | (1 | )% | — | % | 4 | % | 1 | % | (4 | )% | (1 | )% | (4 | )% | (1 | )% | (2 | )% | ||||||||||

Revenue growth | 41 | % | 29 | % | 30 | % | 27 | % | 12 | % | 16 | % | 15 | % | 11 | % | 31 | % | 14 | % | ||||||||||

Worldwide air (merchant & agency) | ||||||||||||||||||||||||||||||

Tickets sold growth | 52 | % | 45 | % | 32 | % | 6 | % | 8 | % | 2 | % | 4 | % | 3 | % | 32 | % | 4 | % | ||||||||||

Airfare growth | (8 | )% | (8 | )% | (6 | )% | (4 | )% | (3 | )% | 1 | % | (2 | )% | 1 | % | (6 | )% | (1 | )% | ||||||||||

Revenue per ticket growth | 1 | % | 3 | % | 15 | % | —% | (4 | )% | 4 | % | (10 | )% | (3 | )% | 5 | % | (3 | )% | |||||||||||

Revenue growth | 54 | % | 50 | % | 52 | % | 6 | % | 4 | % | 6 | % | (7 | )% | —% | 39 | % | 1 | % | |||||||||||

Notes:

• | The year-over-year growth figures through Q2 2016 exclude eLong, Inc., as Expedia sold its ownership interest on May 22, 2015. |

• | The metrics above include Orbitz Worldwide following the acquisition on September 17, 2015 and HomeAway following the acquisition on December 15, 2015. |

• | HomeAway gross bookings and room nights operating metrics include on-platform and reported transactions from all HomeAway brands, with the exception of BedandBreakfast.com and TopRural (which, if included, would collectively add less than an estimated 2% to each of gross bookings and room nights). On-platform gross bookings and room nights for Stayz, Bookabach and Travelmob (which collectively represent less than 10% of total on-platform transactions) represent our best estimates. |

• | Advertising & Media Revenue includes 3rd party revenue from trivago. All trivago revenue is classified as international. |

• | Some numbers may not add due to rounding. |

Page 15 of 22

Notes & Definitions:

Gross Bookings: Gross bookings generally represent the total retail value of transactions booked, recorded at the time of booking reflecting the total price due for travel by travelers, including taxes, fees and other charges, adjusted for cancellations and refunds.

Core OTA: Core Online Travel Agencies ("Core OTA") segment provides a full range of travel and advertising services to our worldwide customers through a variety of brands including: Brand Expedia, Hotels.com, Expedia Affiliate Network, Hotwire, Orbitz, Travelocity, Wotif Group, CheapTickets, ebookers, AirAsia Expedia, CarRentals.com, Classic Vacations, SilverRail and ALICE.

trivago: trivago segment generates advertising revenue primarily from sending referrals to online travel companies and travel service providers from its localized hotel metasearch websites.

HomeAway: HomeAway segment provides a range of travel services for the vacation rental industry through a global portfolio of brands including: HomeAway, VRBO, VacationRentals.com and BedandBreakfast.com, among others.

Egencia: Egencia segment provides managed travel services to corporate customers worldwide.

Corporate: Includes unallocated corporate expenses.

Lodging metrics: Reported on a stayed basis and includes both merchant and agency model hotel stays, as well as alternative accommodations primarily made available through HomeAway.

Room Nights: Room nights represent stayed hotel room nights for our Core OTA and Egencia reportable segments and property nights for our HomeAway reportable segment. Hotel room nights are reported on a stayed basis and include both merchant and agency hotel stays. Property nights are reported upon the first day of stay and check-in to a property and represent the total number of nights for which a property is rented.

Worldwide Air metrics: Reported on a booked basis and includes both merchant and agency air bookings.

Definitions of Non-GAAP Measures

Expedia, Inc. reports Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted EPS, Free Cash Flow and Adjusted Expenses (non-GAAP cost of revenue, non-GAAP selling and marketing, non-GAAP technology and content and non-GAAP general and administrative), all of which are supplemental measures to GAAP and are defined by the SEC as non-GAAP financial measures. These measures are among the primary metrics by which management evaluates the performance of the business and on which internal budgets are based. Management believes that investors should have access to the same set of tools that management uses to analyze our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP. Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted EPS have certain limitations in that they do not take into account the impact of certain expenses to our consolidated statements of operations. We endeavor to compensate for the limitation of the non-GAAP measures presented by also providing the most directly comparable GAAP measures and descriptions of the reconciling items and adjustments to derive the non-GAAP measures. Adjusted EBITDA, Adjusted Net Income (Loss) and Adjusted EPS also exclude certain items related to transactional tax matters, which may ultimately be settled in cash, and we urge investors to review the detailed disclosure regarding these matters in the Management Discussion and Analysis, Legal Proceedings sections, as well as the notes to the financial statements, included in the Company’s annual and quarterly reports filed with the Securities and Exchange Commission. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The definition of Adjusted Net Income (Loss) was revised in the fourth quarters of 2010, 2011, 2012 and 2017 and the definition for Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization was revised in the fourth quarter of 2012 and in the first quarter of 2016. The definition of Adjusted Expenses was revised in the first quarter of 2014 and in the second quarter 2015.

Adjusted EBITDA is defined as net income (loss) attributable to Expedia, Inc. adjusted for:

(1) net income (loss) attributable to non-controlling interests;

(2) provision for income taxes;

(3) total other expenses, net;

(4) stock-based compensation expense, including compensation expense related to certain subsidiary equity plans;

(5) acquisition-related impacts, including

(i) amortization of intangible assets and goodwill and intangible asset impairment,

Page 16 of 22

(ii) gains (losses) recognized on changes in the value of contingent consideration arrangements; and

(iii) upfront consideration paid to settle employee compensation plans of the acquiree;

(6) certain other items, including restructuring;

(7) items included in legal reserves, occupancy tax and other, which includes reserves for potential settlement of issues related to transactional taxes (e.g. hotel and excise taxes), related to court decisions and final settlements, and charges incurred, if any, for monies that may be required to be paid in advance of litigation in certain transactional tax proceedings;

(8) that portion of gains (losses) on revenue hedging activities that are included in other, net that relate to revenue recognized in the period; and

(9) depreciation.

The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, not driven by core operating results and renders comparisons with prior periods and competitors less meaningful. We believe Adjusted EBITDA is a useful measure for analysts and investors to evaluate our future on-going performance as this measure allows a more meaningful comparison of our performance and projected cash earnings with our historical results from prior periods and to the results of our competitors. Moreover, our management uses this measure internally to evaluate the performance of our business as a whole and our individual business segments. In addition, we believe that by excluding certain items, such as stock-based compensation and acquisition-related impacts, Adjusted EBITDA corresponds more closely to the cash operating income generated from our business and allows investors to gain an understanding of the factors and trends affecting the ongoing cash earnings capabilities of our business, from which capital investments are made and debt is serviced. The definition for Adjusted EBITDA was revised in the fourth quarter of 2012.

Adjusted Net Income (Loss) generally captures all items on the statements of operations that occur in normal course operations and have been, or ultimately will be, settled in cash and is defined as net income (loss) attributable to Expedia, Inc. plus the items below, net of tax (which excludes the impact of significant changes resulting from tax legislation such as the Tax Cuts and Jobs Act):

(1) stock-based compensation expense, including compensation expense related to equity plans of certain subsidiaries and equity-method investments;

(2) acquisition-related impacts, including

(i) amortization of intangible assets, including as part of equity-method investments, and goodwill and intangible asset impairment,

(ii) gains (losses) recognized on changes in the value of contingent consideration arrangements,

(iii) upfront consideration paid to settle employee compensation plans of the acquiree, and

(iv) gains (losses) recognized on non-controlling investment basis adjustments when we acquire or lose controlling interests;

(3) currency gains or losses on U.S. dollar denominated cash;

(4) Upon adoption of new accounting guidance in the first quarter of 2018, the changes in fair value of equity investments (other than those accounted for under the equity method and those which are consolidated);

(5) certain other items, including restructuring charges;

(6) items included in Legal reserves, occupancy tax and other, which includes reserves for potential settlement of issues related to transactional taxes (e.g., hotel occupancy and excise taxes), related court decisions and final settlements, and charges incurred, if any, for monies that may be required to be paid in advance of litigation in certain transactional tax proceedings, including as part of equity method investments;

(7) discontinued operations;

(8) the non-controlling interest impact of the aforementioned adjustment items and

(9) unrealized gains (losses) on revenue hedging activities that are included in other, net.

We believe Adjusted Net Income (Loss) is useful to investors because it represents Expedia, Inc.’s combined results, taking into account depreciation, which management believes is an ongoing cost of doing business, but excluding the impact of certain expenses and items not directly tied to the core operations of our businesses. The definition for adjusted net income (loss) was revised in the fourth quarters of 2010, 2011 and 2012.

Page 17 of 22

Adjusted EPS is defined as Adjusted Net Income (Loss) divided by adjusted weighted average shares outstanding, which include dilution from options per the treasury stock method and include all shares relating to RSUs in shares outstanding for Adjusted EPS. This differs from the GAAP method for including RSUs, which treats them on a treasury method basis. Shares outstanding for Adjusted EPS purposes are therefore higher than shares outstanding for GAAP EPS purposes. We believe Adjusted EPS is useful to investors because it represents, on a per share basis, Expedia’s consolidated results, taking into account depreciation, which we believe is an ongoing cost of doing business, as well as other items which are not allocated to the operating businesses such as interest expense, taxes, foreign exchange gains or losses, and minority interest, but excluding the effects of certain expenses not directly tied to the core operations of our businesses. Adjusted Net Income (Loss) and Adjusted EPS have similar limitations as Adjusted EBITDA. In addition, Adjusted Net Income (Loss) does not include all items that affect our net income (loss) and net income (loss) per share for the period. Therefore, we think it is important to evaluate these measures along with our consolidated statements of operations.

Free Cash Flow is defined as net cash flow provided by operating activities less capital expenditures. Management believes Free Cash Flow is useful to investors because it represents the operating cash flow that our operating businesses generate, less capital expenditures but before taking into account other cash movements that are not directly tied to the core operations of our businesses, such as financing activities, foreign exchange or certain investing activities. We added additional detail for the capital expenditures associated with building our new headquarters facility in Seattle, Washington. We believe separating out capital expenditures for this discrete project is important to provide additional transparency to investors related to operating versus project-related capital expenditures. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, it is important to evaluate Free Cash Flow along with the consolidated statements of cash flows.

Adjusted Expenses (cost of revenue, selling and marketing, technology and content and general and administrative expenses) exclude stock-based compensation related to expenses for stock options, restricted stock units and other equity compensation under applicable stock-based compensation accounting standards as well as depreciation expense. Expedia, Inc. excludes stock-based compensation and depreciation expenses from these measures primarily because they are non-cash expenses that we do not believe are necessarily reflective of our ongoing cash operating expenses and cash operating income. Moreover, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use when adopting applicable stock-based compensation accounting standards, management believes that providing non-GAAP financial measures that exclude stock-based compensation allows investors to make meaningful comparisons between our recurring core business operating results and those of other companies, as well as providing management with an important tool for financial operational decision making and for evaluating our own recurring core business operating results over different periods of time. Exclusion of depreciation expense also allows the year-over-year comparison of expenses on a basis that is consistent with the year-over-year comparison of Adjusted EBITDA. There are certain limitations in using financial measures that do not take into account stock-based compensation and depreciation expense, including the fact that stock-based compensation is a recurring expense and a valued part of employees’ compensation and depreciation expense is also a recurring expense and is a direct result of previous capital investment decisions made by management. Therefore it is important to evaluate both our GAAP and non-GAAP measures. See the Notes to the Consolidated Statements of Operations for stock-based compensation and depreciation expense by line item.

Page 18 of 22

Tabular Reconciliations for Non-GAAP Measures

Adjusted EBITDA (Adjusted Earnings Before Interest, Taxes, Depreciation & Amortization)

Three months ended December 31, | Year ended December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

($ thousands) | ||||||||||||||||

Net income attributable to Expedia, Inc. | $ | 55,159 | $ | 79,457 | $ | 377,964 | $ | 281,848 | ||||||||

Net income (loss) attributable to non-controlling interests | (2,284 | ) | 5,425 | (6,605 | ) | (20,563 | ) | |||||||||

Provision for income taxes | 23,031 | 30,244 | 45,405 | 15,315 | ||||||||||||

Total other expense, net | 37,569 | 32,060 | 208,374 | 185,102 | ||||||||||||

Operating income | 113,475 | 147,186 | 625,138 | 461,702 | ||||||||||||

Gain (loss) on revenue hedges related to revenue recognized | 2,799 | 9,054 | 6,323 | 12,746 | ||||||||||||

Restructuring and related reorganization charges, excluding stock-based compensation | 1,148 | 9,633 | 16,738 | 43,217 | ||||||||||||

Legal reserves, occupancy tax and other | 2,456 | (2,152 | ) | 25,412 | 26,498 | |||||||||||

Stock-based compensation | 45,758 | 44,815 | 149,350 | 242,417 | ||||||||||||

Amortization of intangible assets | 71,479 | 68,022 | 275,445 | 317,141 | ||||||||||||

Impairment of intangible assets | — | 32,749 | — | 34,890 | ||||||||||||

Depreciation | 165,355 | 132,228 | 614,099 | 477,061 | ||||||||||||

Adjusted EBITDA | 402,470 | 441,535 | 1,712,505 | 1,615,672 | ||||||||||||

Adjusted Net Income & Adjusted EPS

Three months ended December 31, | Year ended December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

($ thousands, except per share data) | ||||||||||||||||

Net income attributable to Expedia, Inc. | $ | 55,159 | $ | 79,457 | $ | 377,964 | $ | 281,848 | ||||||||

Amortization of intangible assets | 71,479 | 68,022 | 275,445 | 317,141 | ||||||||||||

Impairment of intangible assets | — | 32,749 | — | 34,890 | ||||||||||||

Stock-based compensation | 45,758 | 44,815 | 149,350 | 242,417 | ||||||||||||

Legal reserves, occupancy tax and other | 2,456 | (2,152 | ) | 25,412 | 26,498 | |||||||||||

Restructuring and related reorganization charges, excluding stock-based compensation | 1,148 | 9,633 | 16,738 | 43,217 | ||||||||||||

Unrealized (gain) loss on revenue hedges | (5,013 | ) | (4,793 | ) | 12,229 | (1,865 | ) | |||||||||

Loss on investments, net | — | 1,287 | 14,319 | 12,117 | ||||||||||||

Legal reserves, occupancy tax and other as part of equity method investments | — | 3,682 | — | 5,432 | ||||||||||||

Gain on sale of asset | — | (3,000 | ) | — | (3,000 | ) | ||||||||||

Non-controlling interest basis adjustment | (1,678 | ) | — | (1,678 | ) | — | ||||||||||

Provision for income taxes | (35,333 | ) | (43,799 | ) | (180,170 | ) | (228,654 | ) | ||||||||