Form 8-K TerraForm Power, Inc. For: Feb 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2018 (February 6, 2018)

____________________________________________________________

TerraForm Power, Inc.

(Exact name of registrant as specified in its charter)

______________________________________________________________

Delaware | 001-36542 | 46-4780940 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I. R. S. Employer Identification No.) |

7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814

(Address of principal executive offices, including zip code)

(240) 762-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

EXPLANATORY NOTE

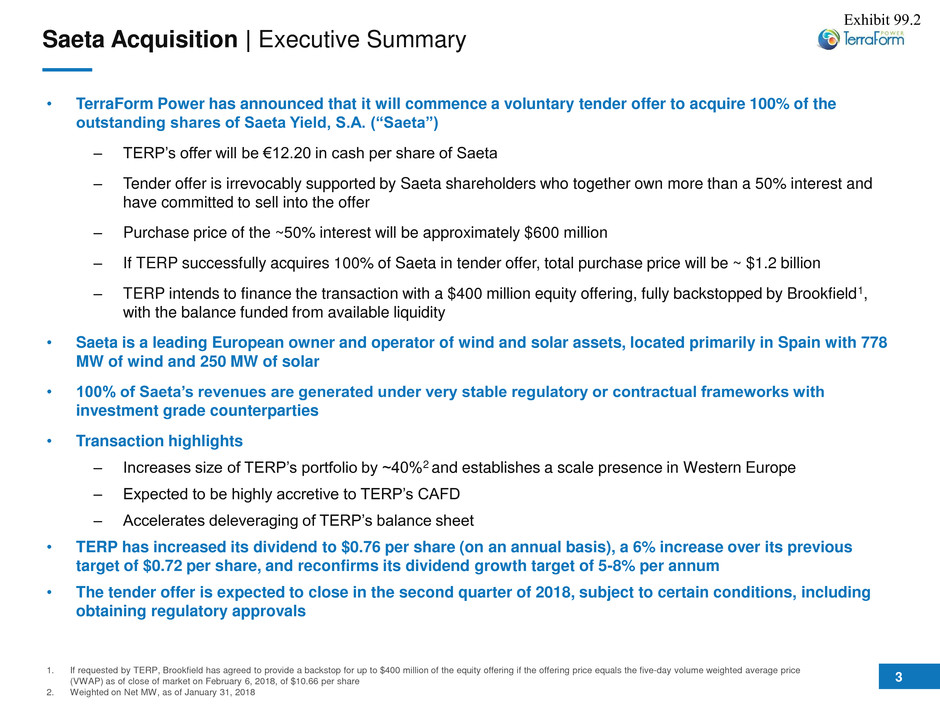

On February 7, 2018, TerraForm Power, Inc. (Nasdaq: TERP) (the “Company”) announced that it intends to launch a voluntary tender offer (the “Tender Offer”) to acquire 100% of the outstanding shares of Saeta Yield, S.A., a Spanish corporation (“Saeta”) and a leading, publicly-listed European owner and operator of wind and solar assets, located primarily in Spain. The Tender Offer will be for €12.20 in cash per share of Saeta. The Tender Offer is expected to be completed in the second quarter of 2018, subject to certain closing conditions.

Item 1.01 Entry into a Material Definitive Agreement.

Irrevocable Agreement to Launch Tender Offer

On February 6, 2018, TERP Spanish HoldCo, S.L., a subsidiary of the Company entered into an Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A. (the “Irrevocable Agreement”), with Cobra Concesiones, S.L., a company incorporated under the laws of Spain (“Cobra”) and GIP II Helios, S.à r.l., a société à responsabilité limitée organized under the laws of the Grand Duchy of Luxembourg (“GIP”), an Irrevocable Undertaking Agreement with Mutuactivos, S.A.U., S.G.I.I.C, a company incorporated under the laws of Spain (“Mutuactivos”) and an Irrevocable Undertaking Agreement with Sinergia Advisors 2006, A.V., S.A., a company incorporated under the laws of Spain (“Sinergia” and, together with Cobra , GIP and Mutuactivos, the “Selling Stockholders”) pursuant to which the Company has agreed to launch the Tender Offer. Under the terms of these Irrevocable Undertaking Agreements, the Selling Stockholders have irrevocably and unconditionally agreed to tender their combined 50.338% interest in Saeta in the Tender Offer.

The Company’s acceptance of the shares of Saeta tendered in the Tender Offer is conditioned upon the Company obtaining compulsory authorization required from the European Commission and Cobra and GIP irrevocably accepting the Tender Offer in respect of their shares of Saeta representing no less than 48.222% of Saeta’s voting share capital.

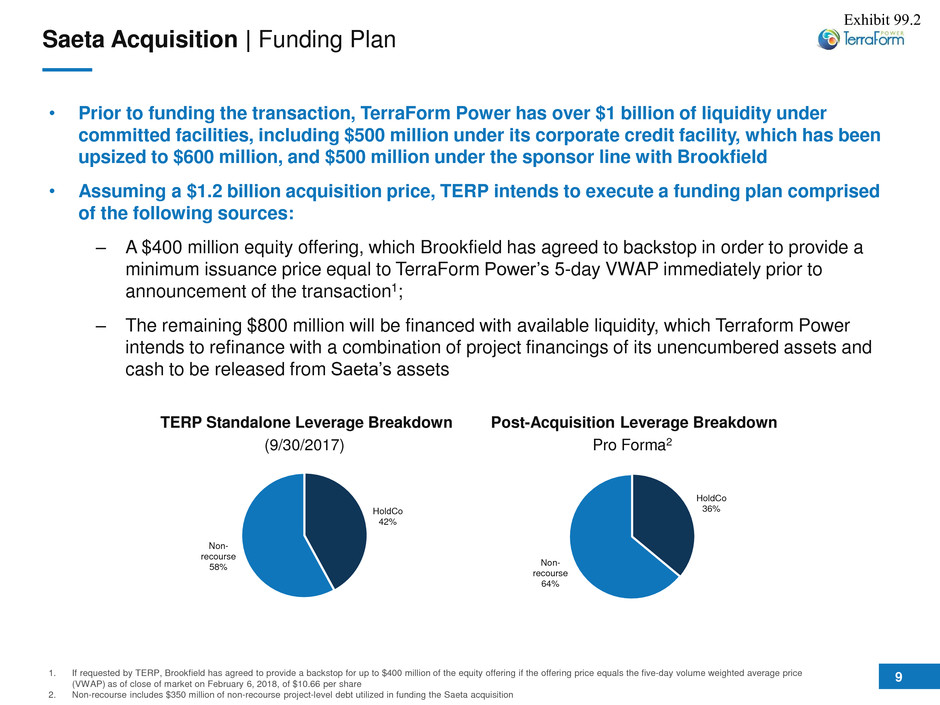

The aggregate value of the shares of Saeta held by the Selling Stockholders is approximately $600 million. If the Company successfully acquires all of the remaining Saeta shares in the Tender Offer, the aggregate purchase price (including the value of the Selling Stockholders shares) will be approximately $1.2 billion. Assuming a $1.2 billion acquisition price, the Company intends to finance the acquisition with a $400 million equity issuance of the Company’s Class A common stock and the remaining $800 million will be financed from available liquidity, which the Company expects to refinance with a combination of non-recourse financings of the Company’s currently unencumbered wind and solar assets and certain cash released from Saeta’s assets.

In connection with the launch of the Tender Offer, the Company is required to post a bank guarantee (the “Bank Guarantee”) with the Comisión Nacional del Mercado de Valores (the “CNMV”) in Spain for the maximum amount payable in the Tender Offer, which amount will be approximately $1.2 billion. In connection with posting this bank guarantee, the Company expects to enter into a Letter of Credit Facility with a syndicate of banks that will govern the Company’s obligations to reimburse such banks upon any drawing under the Bank Guarantee. It is expected that this Letter of Credit Facility will be entered into prior to the launch of the Tender Offer and is expected to have customary fees and expenses, representations and warranties, covenants and event of default provisions.

The foregoing description of the Irrevocable Undertaking Agreements and the Tender Offer does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Irrevocable

Undertaking Agreements attached hereto as Exhibits 10.1, 10.2 and 10.3 and incorporated herein by reference.

Backstop Agreement with Brookfield

In connection with the Tender Offer, the Company intends to finance the acquisition of Saeta shares with a $400 million equity issuance of the Company’s Class A common stock (the “Equity Offering”).

On February 6, 2018, the Company entered into a Support Agreement (the “Support Agreement”) with Brookfield Asset Management Inc. (“Brookfield”). Pursuant to the Support Agreement, Brookfield agreed that, if requested by the Company, Brookfield would provide a back-stop to the Company for up to 100% of the Equity Offering (such agreement, the “Back-Stop”) if the offering price per Class A Share of the Company in the Equity Offering equals the five-day volume weighted average price (VWAP) of the Class A Shares ending the trading day prior to the Company’s announcement of the Tender Offer.

Brookfield’s obligations in relation to the provision of the Back-Stop under the Support Agreement are subject to successful commencement of the Tender Offer and to prior effectiveness of a registration statement, if required, that the Company would file in connection with the Equity Offering and such obligation would not apply to any Equity Offering commenced prior to May 1, 2018 or after September 30, 2018.

The foregoing description of the Support Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Support Agreement attached hereto as Exhibit 10.4 and incorporated herein by reference.

Upsizing of Revolving Credit Facility

On February 6, 2018, TerraForm Power Operating, LLC (“TERP Operating”), an indirect subsidiary of the Company, elected to increase the aggregate principal amount of its revolving credit facility (the “Revolving Credit Facility”) pursuant to the Credit and Guaranty Agreement dated as of October 17, 2017, by and among TERP Operating, TerraForm Power, LLC, certain subsidiary guarantors of TERP Operating, and the lenders and issuing banks party thereto from time to time and HSBC Bank USA, National Association, as administrative agent and collateral agent from $450 million to $600 million (the “Revolving Loan Commitment Increase”). The Revolving Loan Commitment Increase became effective on February 6, 2018.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 7.01 Regulation FD Disclosure.

Tender Offer Announcement

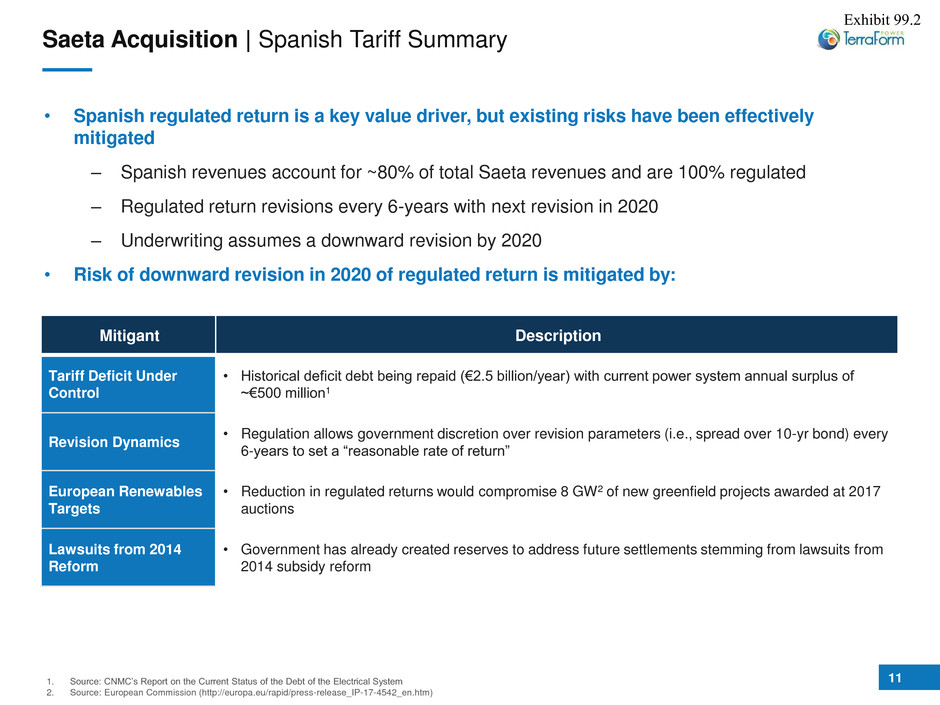

On February 7, 2018, the Company issued a press release announcing the Tender Offer. A copy of the press release is furnished herewith as Exhibit 99.1. Also on February 7, 2018, the Company posted presentation materials to the Investors section of its website. A copy of the presentation is furnished herewith as Exhibit 99.2.

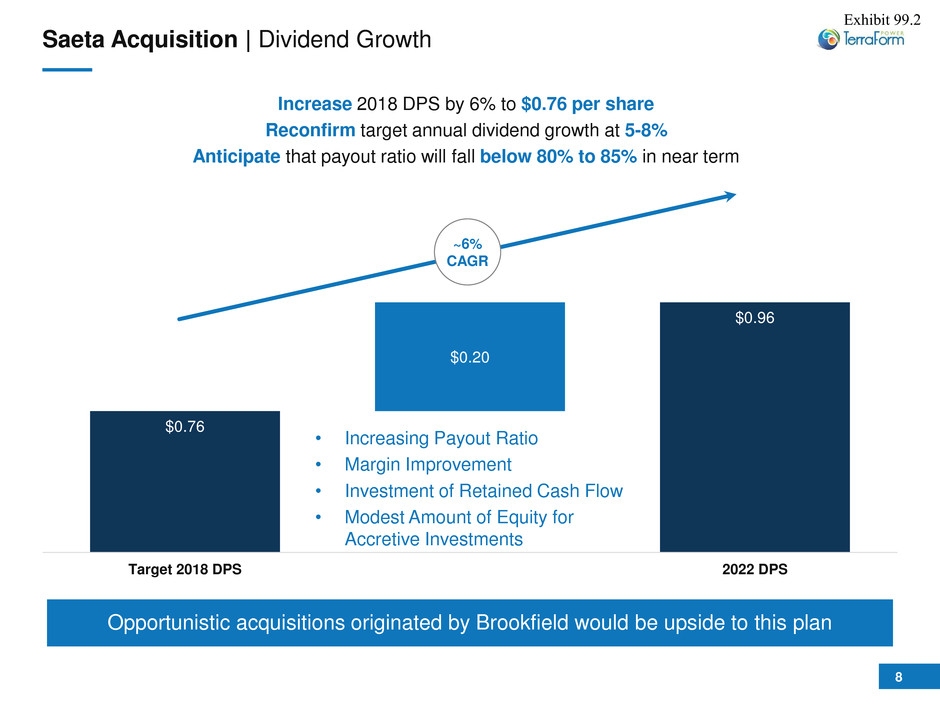

Announcement of Quarterly Dividend

As also described in the press release dated February 7, 2018 and furnished as Exhibit 99.1, TerraForm Power announced that, on February 6, 2018, its Board declared a quarterly dividend with respect to TerraForm Power’s Class A common stock of $0.19 per share. The dividend is payable on March 30, 2018 to shareholders of record as of February 28, 2018.

The information in Exhibits 99.1 and 99.2 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information Exhibits 99.1 and 99.2 shall not be incorporated by reference into any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document.

Cautionary Note Regarding Forward-Looking Statements. Except for historical information contained in this Form 8-K and the press release and the presentation materials attached as an exhibit hereto, this Form 8-K and the press release and the presentation materials contain forward-looking statements which involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release and the presentation materials regarding these forward-looking statements.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

Exhibit No. | Description |

10.1 | Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A., dated as of February 6, 2018 between TERP Spanish HoldcCo, S.L., Cobra Concesiones, S.L. and GIP II Helios, S.à r.l. |

10.2 | Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A., dated as of February 6, 2018 between TERP Spanish HoldCo, S.L. and Mutuactivos, S.A.U., S.G.I.I.C. |

10.3 | Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A., dated as of February 6, 2018 between TERP Spanish HoldCo, S.L. and Sinergia Advisors 2006, A.V., S.A. |

10.4 | Support Agreement, dated as of February 6, 2018, between TerraForm Power, Inc. and Brookfield Asset Management Inc. |

99.1 | Press release, dated February 7, 2018, titled “TerraForm Power Announces Offer to Acquire 100% of Leading European Renewable Power Business, Saeta Yield.” |

99.2 | TerraForm Power, Inc. presentation materials titled “Saeta Yield Acquisition”, dated as of February 7, 2018. |

EXHIBIT INDEX

Exhibit No. | Description |

Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A., dated as of February 6, 2018 between TerraForm Power, Inc., Cobra Concesiones, S.L. and GIP II Helios, S.à r.l. | |

Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A., dated as of February 6, 2018 between TERP Spanish HoldCo, S.L. and Mutuactivos, S.A.U., S.G.I.I.C. | |

Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A., dated as of February 6, 2018 between TERP Spanish HoldCo, S.L. and Sinergia Advisors 2006, A.V., S.A. | |

Support Agreement, dated as of February 6, 2018, between TerraForm Power, Inc. and Brookfield Asset Management Inc. | |

Press release, dated February 7, 2018, titled “TerraForm Power Announces Offer to Acquire 100% of Leading European Renewable Power Business, Saeta Yield.” | |

TerraForm Power, Inc. presentation materials titled “Saeta Yield Acquisition”, dated as of February 7, 2018. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TERRAFORM POWER, INC. | ||

Date: February 7, 2018 | By: | /s/ Andrea Rocheleau |

Name: | Andrea Rocheleau | |

Title: | General Counsel and Secretary | |

Exhibit 10.1

Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A. |

BETWEEN |

TERP Spanish HoldCo, S.L. |

As the Bidder |

AND |

Cobra Concesiones, S.L. |

GIP II Helios, S.à r.l. |

As the Selling Shareholders |

In Madrid, on 6 February 2018 |

1/18

TABLE OF CONTENTS

1.LAUNCHING OF THE OFFER 5

1.1Commitment to launch the Offer 5

1.2The terms of the Offer 5

1.3Announcement and filing for authorisation 7

1.4Withdrawal of the Offer 8

1.5Amendments to the Offer Terms and Conditions 8

1.6Information 8

2.THE SELLING SHAREHOLDERS’ COMMITMENTS 8

2.1Acceptance of the Offer 8

2.2Voting 9

2.3Directors’ report on the Offer 9

2.4Selling Shareholders’ proprietary directors’ resignation 9

2.5Standstill 9

2.6Related-party transactions 9

2.7Termination of the ROFO Agreement 9

3.POST OFFER SETTLEMENT STANDSTILL 10

4.REPRESENTATIONS AND WARRANTIES 10

4.1Representations and warranties from the Bidder 10

4.2Representations and warranties from the Selling Shareholders 11

5.SEVERAL LIABILITY OF THE SELLING SHAREHOLDERS 11

6.BREACH 11

7.DURATION 12

8.EARLY TERMINATION OF THE AGREEMENT 12

9.ANNOUNCEMENTS 12

10.MISCELLANEOUS 13

10.1No assignment 13

10.2Amendments 13

10.3Severability 13

10.4Entire Agreement 13

2/18

10.5Counterparts 13

10.6Waiver 14

10.7Costs 14

10.8Notices 14

10.9Governing law 15

10.10Jurisdiction 15

3/18

BETWEEN

On the one hand,

“TERP Spanish HoldCo, S.L.”, a company incorporated and validly existing under the laws of Spain, with registered office at 21 calle Serrano, Madrid, 28001, registered at the Commercial Registry of Madrid at book 35,995, volume 9, section 8, sheet M-646,732, entry 1 and provided with tax identification number B87827648 (the “Bidder”), duly represented by Mr Alfredo Zamarriego Fernández and Mr Ricardo Arias Sainz, in their capacity as Joint and Several Directors of the Bidder, pursuant to the notarial deed executed on 30 January 2018 before the notary public of Madrid Mr Francisco Miras Ortiz, with number 301 of his protocol;

And, on the other hand,

“Cobra Concesiones, S.L.”, a company incorporated and validly existing under the laws of Spain, with registered office at Calle Cardenal Marcelo Spinola, 10, Madrid, Spain, registered at the Commercial Registry of Madrid and provided with tax identification number B84878883 (“Cobra”), duly represented by Mr José María Castillo Lacabex, in his capacity as sole director of Cobra, pursuant to the notarial deed granted on 10 October 2017 before the notary public of Madrid Mr Segismundo Álvarez Royo-Villanova, with number 3,209 of his protocol;

and

“GIP II Helios, S.à r.l.”, a company incorporated and validly existing under the laws of Luxembourg, with registered office at 6, rue Eugène Ruppert, L-2453, Luxembourg and registered at the Luxembourg Trade and Companies Registry with number B 194.517 (“GIP” and, together with Cobra, the “Selling Shareholders” and, individually, a “Selling Shareholder”), duly represented by Mr Alejandro Ortiz, in his capacity as GIP’s attorney, pursuant to a decision of the Board of Directors of GIP dated 1 February 2018.

The Bidder, on the one hand, and the Selling Shareholders, on the other hand, shall be hereinafter collectively referred to as the “Parties” and individually as a “Party”.

WHEREAS

I. | “Saeta Yield, S.A.” is a Spanish corporation (sociedad anónima) with registered office at Avenida de Burgos, 16D, Madrid, 28036, holding Tax Identification Number (NIF) A-85699221, and registered with the Commercial Registry of Madrid at Volume (Tomo) 26,842, Page (Folio) 14 and Sheet (Hoja) M-483,710 (the “Target” or the “Company”), whose issued share capital amounts to EUR 81,576,928.00 and is represented by 81,576,928 ordinary shares, of EUR 1.00 par value each, fully subscribed and paid-up, all of which are |

4/18

of the same class and pertain to the same series and are represented by book entries (the “Shares”). All the Shares are listed on the Madrid, Barcelona, Bilbao and Valencia Stock Exchanges and traded through the Automated Quotation System of such Stock Exchanges (Sistema de Interconexión Bursátil).

II. | As of the date hereof, the Selling Shareholders jointly own 39,337,270 Shares in the Company, which represent 48.222% of the Company’s total share capital (the “Selling Shareholders’ Shares”). Each Selling Shareholder owns the Shares described as follows: |

Shareholder | Number of Shares (owned directly or indirectly) | % |

Cobra Concesiones, S.L. | 19,750,212 | 24.211% |

GIP II Helios, S.à r.l. | 19,587,058 | 24.011% |

Notwithstanding the above, should the Selling Shareholders acquire, receive by any means or be entitled to any other Shares during the course of the Offer, as defined in the following paragraph, the Selling Shareholders’ Shares will also encompass such other Shares.

III. | The Bidder has agreed to launch a voluntary takeover bid in relation with the total share capital of the Company (the “Offer”), through which the Bidder wishes to acquire the Selling Shareholders’ Shares from the Selling Shareholders, and the Selling Shareholders have agreed to irrevocably accept the Offer and tender the Selling Shareholders’ Shares under the Offer, all the preceding pursuant to the terms and conditions set out herein. |

IV. | In view of the foregoing, the Parties have agreed to enter into this irrevocable undertaking agreement for the launch and acceptance of the Offer (the “Agreement”) in accordance with the following |

CLAUSES

1. | LAUNCHING OF THE OFFER |

1.1 | Commitment to launch the Offer |

The Bidder has taken the decision to launch the Offer, conditional only on the execution of this Agreement, and undertakes to do so by filing the necessary documentation with the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores) (the “CNMV”) for the purposes of obtaining its approval of the relevant offer document (folleto explicativo) (the “Offer Document”) and the Offer, in accordance with the terms and conditions of this Agreement.

1.2 | The terms of the Offer |

The Offer will be on the following terms and conditions (the “Offer Terms and Conditions”):

(i) | the Offer shall be launched at a price of EUR 12.20 per Share of the Company, to be paid fully in cash (the “Offer Price”); |

(ii) | the shareholders of the Company shall be granted a term of 15 calendar days to accept the Offer (the “Acceptance Period”); and |

5/18

(iii) | the Offer shall only be conditional upon: |

(a) | the Bidder obtaining merger control clearance from the European Commission (in so far as legally required); and |

(b) | the Selling Shareholders irrevocably accepting the Offer in respect of Shares representing no less than 48.222% of the Company’s voting share capital. |

The conditions described under Clauses 1.2(iii)(a) and 1.2(iii)(b) will be collectively referred throughout this Agreement as the “Offer Conditions”.

If the European Commission and/or any other applicable antitrust authority requests, requires or imposes any condition, obligation, undertaking and/or remedy (each, a “Commitment”) to the Bidder in order to approve the acquisition by the Bidder of a controlling stake in the Company, the Bidder shall offer, accept and agree to any such Commitment (which shall not include, without the prior written consent of the Selling Shareholders, any amendment to the Offer Terms and Conditions) as may be necessary to obtain such approval, provided that the Bidder shall be under no obligation to offer, accept or agree to any Commitment that requires any action to be taken by any person other than TerraForm Power Inc. and/or its subsidiaries (including, for the avoidance of doubt, the Target and its subsidiaries). The Bidder undertakes that, between the date hereof and the satisfaction of the Offer Condition in Clause 1.2(iii)(a) above, neither it nor TerraForm Power Inc. nor any subsidiary of TerraForm Power Inc. shall take any action which is reasonably likely to preclude or hinder the satisfaction of the Offer Condition in Clause 1.2(iii)(a) above, including (without limitation) any corporate and/or M&A transaction.

The Offer Price has been determined on the basis of the Target not making any distribution of dividends, reserves, premium or any other equivalent form of equity or related shareholding distribution or equity remuneration of any kind to its shareholders prior to the settlement of the Offer other than quarterly dividends in line with the Company’s dividend policy as currently publicised.

For this purpose, dividends up to the following maximum amounts shall be considered as being in line with the Company’s dividend policy:

(w) | if the settlement of the Offer takes place before 25 May 2018, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount of EUR 0.1967 per share; |

(x) | if the settlement of the Offer takes place on or after 25 May 2018 and before 24 August 2018, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount of EUR 0.3967 per share; |

(y) | if the settlement of the Offer takes place on or after 24 August 2018 and before 23 November 2018, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount a maximum of EUR 0.6017 per share; and |

(z) | if the settlement of the Offer takes place on or after 23 November 2018 and before 22 February 2019, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount of EUR 0.8067 per share, |

provided, in all cases, that the ex-dividend date of the corresponding dividend(s) takes place on or before the settlement of the Offer.

6/18

If the settlement of the Offer were to take place on or after 22 February 2019, the above-mentioned maximum aggregated amount increases on a quarterly basis by EUR 0.205 per share and the reference date for the settlement of the Offer is the Friday falling on the penultimate week of May, August, November or February, as applicable.

Consequently, should the Target carry out before the settlement of the Offer any equity distribution or remuneration to the shareholders other than quarterly dividends in line with the Company’s dividend policy as currently publicised, or any distribution of quarterly dividends in excess of the abovementioned amounts per share (each, an “Excess Distribution”), the Bidder may, in accordance with article 33.1 of Spanish Royal Decree 1066/2007, of July 27 (Real Decreto 1066/2007, de 27 de julio, sobre el régimen de las ofertas públicas de adquisición de valores) (the “Takeover Regulations”), maintain the Offer and adjust the Offer Price by an amount equivalent to the gross amount per share received, or to the gross amount per share received in excess of the abovementioned amounts, as applicable, due to said Excess Distribution, inasmuch as the potential reduction of the consideration does not exceed what is deemed necessary to maintain the financial equivalence with the consideration previously offered, and the Bidder obtains the prior authorization from the CNMV, without prejudice to the withdrawal right provided in said article 33.1 of the Takeover Regulations.

1.3 | Announcement and filing for authorisation |

The Bidder shall publish the relevant public announcement of the Offer referred to in article 16 of the Takeover Regulations in the form of Annex 1 hereto on the date on which this Agreement is signed or, in any event, before the commencement of trading in the Spanish Stock Exchanges the following day.

The Bidder undertakes to file with the CNMV the request for authorisation of the Offer in accordance with the provisions of the Takeover Regulations in terms of content, procedure and timing (the “Request for Authorisation”), which will include the Offer Document. Subject to the Offer Terms and Conditions and Clause 1.5 below, the terms and conditions of the Offer and the final content of the Offer Document will be in such form as the Bidder considers desirable or necessary in order to obtain the authorisation of the Offer by the CNMV.

The Bidder shall file with the CNMV any ancillary documents required pursuant to article 20 of the Takeover Regulations.

The Bidder shall (i) amend the Offer Document as requested by the CNMV from time to time, and (ii) provide to the CNMV revised versions of the Offer Document and any other documentation and information requested, in each case in a timely manner with the aim to obtain the CNMV’s authorisation of the Offer as soon as possible.

For the purposes of this Agreement, a “business day” shall be deemed any day of the week, except for Saturdays, Sundays or any banking holiday in Madrid.

1.4 | Withdrawal of the Offer |

The Bidder may, at its sole discretion, withdraw the Offer only (a) if any of the Offer Conditions is not met, or (b) pursuant to article 33.1 of the Takeover Regulations.

In any such event, this Agreement will terminate in accordance with Clause 8.

7/18

1.5 | Amendments to the Offer Terms and Conditions |

Subject to the Offer Terms and Conditions, the Bidder shall be entitled to extend the acceptance period of the Offer or to modify the Offer and the Offer Document whenever deemed necessary to obtain the authorisation of the Offer and/or to achieve its success.

Should the Bidder decide to increase the Offer Price, the Selling Shareholders will be entitled to benefit from such price increase and will receive, for each of the Selling Shareholders’ Shares, the new Offer Price. For the avoidance of doubt, any increase to the Offer Price shall be made fully in cash.

1.6 | Information |

The Bidder shall:

(i) | provide to the Selling Shareholders and its advisors the initial and subsequent versions of the Offer Document and the Request for Authorisation and, to the extent they contain references to the Selling Shareholders, excerpts of press releases, investor presentations or any other material Offer document, in each case with forty-eight (48) hours for review before they are filed with the CNMV or disclosed to the market (as applicable), and consider (but not be bound by) any reasonable comment they may provide; and |

(ii) | keep the Selling Shareholders timely informed of the Offer authorisation process and any material developments or requests received from the CNMV or any other regulatory authority. |

2. | THE SELLING SHAREHOLDERS’ COMMITMENTS |

2.1 | Acceptance of the Offer |

The Selling Shareholders hereby, irrevocably and on the terms of this Agreement, undertake to accept the Offer with all of the Selling Shareholders’ Shares, under the Offer Terms and Conditions —as amended in accordance herewith, as the case may be— within the first 5 business days of the Acceptance Period and further undertake not to revoke such acceptance, except where, as applicable:

(i) | the Bidder decides to withdraw the Offer in accordance with Clause 1.4; or |

(ii) | the CNMV does not authorize the Offer by 31 July 2018. |

Save for the provisions in Clause 10, which shall remain in force, if any of the scenarios described in (i) and (ii) above takes place, the Selling Shareholders shall be entitled to freely transact with the Selling Shareholders’ Shares in any way without any obligation or liability vis-à-vis the Bidder. Under no circumstances other than those specified in this paragraph may the Selling Shareholders accept any third-party offer in relation to any or all Selling Shareholders’ Shares.

2.2 | Voting |

From the date this Agreement is entered into until the settlement of the Offer —except where this Agreement is terminated pursuant to Clause 7 below—, the Selling Shareholders undertake, to the extent legally possible, to exercise the voting rights attached to the Selling Shareholders’ Shares against resolutions which, if passed, (i) might reasonably result in the Offer Conditions

8/18

not being fulfilled or which might reasonably impede or frustrate the Offer in any way, or (ii) will result in any Excess Distribution.

2.3 | Directors’ report on the Offer |

To the extent permitted by applicable law and subject to the fulfilment of the directors’ legal duties and any other laws and regulations applicable to them, the Selling Shareholders undertake to instruct the proprietary directors nominated by each of them to vote in favour of a favourable Directors’ report on the Offer, pursuant to article 24 of the Takeover Regulations.

2.4 | Selling Shareholders’ proprietary directors’ resignation |

To the extent permitted by applicable law, the Selling Shareholders shall procure the resignation of the proprietary directors nominated by them in the Company’s Board of Directors no later than 3 business days following the settlement of the Offer.

2.5 | Standstill |

For the term of this Agreement, the Selling Shareholders undertake not to, nor to cause any related person in accordance with the Takeover Regulations to, transact with any Shares of the Company.

In particular, for the term of this Agreement the Selling Shareholders, shall not, nor cause any related person to, subscribe for, purchase, sell, transfer, swap or otherwise acquire or dispose of any Shares, financial instruments having the Shares as underlying asset or rights attached to the Shares, or the voting or economic rights attached to them, nor create any charges, pledges, liens, encumbrances or in any way purchase, subscribe for or grant any right over Shares or the voting or economic rights attached to them.

2.6 | Related-party transactions |

For the term of this Agreement, none of the Selling Shareholders, nor any party related to them in accordance with applicable law, may enter into, amend or terminate any agreement with the Company or any company of its group of companies, unless in the ordinary course of business.

2.7 | Termination of the ROFO Agreement |

The Selling Shareholders expressly acknowledge and agree that the Bidder intends that the agreement entered into on 29 January 2015 by the Company with ACS Servicios Comunicaciones y Energía, S.L. and Bow Power, S.L., as amended from time to time (the “ROFO Agreement”) be terminated. For that purpose, the Bidder will either (i) cause the Company to terminate the ROFO Agreement within one month from the squeeze-out settlement date; or, in the absence of squeeze-out, (ii) within one month from the Offer settlement date, convene a general shareholders meeting of the Company and vote in favour of such termination.

If the Company so requests , the Selling Shareholders shall use all reasonable efforts to cause the parties to the ROFO Agreement other than the Company to consent to the termination of the ROFO Agreement without any penalty or consideration being triggered.

3. | POST OFFER SETTLEMENT STANDSTILL |

Within the 6 months from the Offer’s settlement date, the Bidder undertakes that:

9/18

(i) | neither it nor TerraForm Power Inc. nor any subsidiary of TerraForm Power Inc. shall transfer, acquire or agree to transfer or acquire any Share; and |

(ii) | it shall use all reasonable efforts to cause its affiliates (other than those mentioned in the preceding paragraph) not to transfer, acquire or agree to transfer or acquire any Share, |

in each case for a price per Share higher than the price per Share paid by the Bidder to the Selling Shareholders.

4. | REPRESENTATIONS AND WARRANTIES |

4.1 | Representations and warranties from the Bidder |

The Bidder represents and warrants to the Selling Shareholders that:

(i) | The Bidder is validly incorporated, in existence and duly registered under the laws of its jurisdiction and has full corporate power to carry out its object (including the capacity to dispose of and encumber its assets) as conducted as at the date of this Agreement; and to be party to the contracts and perform the obligations deriving from them. |

(ii) | The Bidder has obtained all corporate authorisations and all other governmental, statutory, regulatory or other consents, licenses and authorizations required to enter into and perform its obligations under this Agreement. |

(iii) | This Agreement is not contrary to or entail a breach of any of the corporate documents of the Bidder, nor is it contrary to any laws or regulations in its jurisdiction or of any order, decree or judgment of any court or any governmental or regulatory authority. |

(iv) | The Bidder is neither insolvent or bankrupt under the laws of its jurisdiction of incorporation, nor unable to pay its debts as they fall due or is held liable due to its inability to pay any debt. The Bidder is not party to any proceeding against it in connection with arrangements with creditors, nor is it subject to any winding up, bankruptcy or insolvency proceeding or are there reasons to believe such proceedings may be initiated against the Bidder in the future. |

(v) | The Bidder has available funds and/or has obtained binding funding commitments which provide the necessary cash resources to settle the Offer and obtain the bank guarantee referred to in article 15.2 of the Takeover Regulations, in each case covering the Offer Price for 100% of the Shares. |

(vi) | Each of the above representations and warranties is true and accurate at the date hereof and shall remain true and accurate and not misleading on the settlement date of the Offer as if repeated immediately before the settlement of the Offer. |

4.2 | Representations and warranties from the Selling Shareholders |

Each of the Selling Shareholders, acting severally (mancomunadamente) and not jointly (solidariamente), represents and warrants that:

(i) | It is validly incorporated, in existence and duly registered under the laws of its jurisdiction and has full corporate power to carry out its object (including the capacity to dispose of |

10/18

and encumber its assets) as conducted as at the date of this Agreement; and to be party to the contracts and perform the obligations deriving from them.

(ii) | It has obtained all internal corporate authorisations, and there are no governmental, statutory or regulatory consents or authorizations, in each case required to enter into and perform its obligations under this Agreement. |

(iii) | This Agreement is not contrary to or entails a breach of any of the corporate documents of the Selling Shareholder, nor is it contrary to any laws or regulations in its jurisdiction or of any order, decree or judgment of any court or any governmental or regulatory authority, in each case which are applicable to it. |

(iv) | It is the sole legal and beneficial owner of its relevant Selling Shareholders’ Shares as per Recital II. The Selling Shareholders’ Shares owned by it are free from all liens, encumbrances and third-party rights and include all the voting and other rights attached thereto, as evidenced by the ownership certificate(s) a copy of which is attached hereto (which certificate(s) remain in the Selling Shareholders’ possession). |

(v) | It is entitled to dispose, sell and transfer the Selling Shareholders’ Shares it owns on the terms and conditions herein described. |

(vi) | It is neither insolvent nor bankrupt under the laws of its jurisdiction of incorporation, nor unable to pay its debts as they fall due or were held liable due to their inability to pay any debt. It is not party to any proceeding in connection with arrangements with creditors nor is it subject to any winding up, bankruptcy or insolvency proceeding or has reasons to believe such proceedings may be initiated it in the future. |

(vii) | Each of the above representations and warranties is true and accurate at the date hereof and shall remain true and accurate and not misleading on the settlement date of the Offer as if repeated immediately before the settlement of the Offer. |

5. | SEVERAL LIABILITY OF THE SELLING SHAREHOLDERS |

The liability of the Selling Shareholders under this Agreement is several (responsabilidad mancomunada); thus, each Selling Shareholder shall only be responsible for the fulfilment of the duties herein described in connection with the Selling Shareholders’ Shares owned individually by such Selling Shareholder.

6. | BREACH |

The breach by any Party of this Agreement will entitle the other Party(ies) to claim against the breaching Party(ies) either (i) the specific performance of the breached undertaking(s), or (ii) in the event of a material breach of the Agreement, the termination of the Agreement; in both cases, together with a compensation for damages.

The non-breaching Party(ies) shall notify the breach to the other Party(ies) and the request for specific performance or termination of the Agreement, as described in the preceding paragraph, in accordance with the notification procedure set out in Clause 10.8 below.

For the avoidance of doubt, none of the Parties shall be liable for any indirect, consequential or reputational damages or loss of profits.

11/18

7. | DURATION |

This Agreement will be in force from the date hereof until the settlement of the Offer, unless terminated earlier in accordance with its terms. Notwithstanding anything to the contrary in this Agreement, Clauses 3, 5, 6 and 10 shall remain in full force and effect after the settlement of the Offer.

8. | EARLY TERMINATION OF THE AGREEMENT |

This Agreement may only be terminated in any of the following circumstances:

(i) | by one Party giving notice to the other Parties if the CNMV rejects the Offer and the Bidder decides not to request again its authorization; or |

(ii) | by one Party giving notice to the other Parties if the CNMV does not authorize the Offer by 31 July 2018; or |

(iii) | by the Bidder upon withdrawing the Offer pursuant to Clause 1.4; or |

(iv) | by a non-breaching Party giving notice to the other Parties if this Agreement has been materially breached, pursuant to Clause 6. |

Unless terminated earlier, this Agreement will expire if and when the Bidder has launched the Offer and the Selling Shareholders have accepted the Offer, tendered the Selling Shareholders’ Shares to the Bidder and received the Offer Price, in each case pursuant to the terms herein, and no other obligation of any Party hereunder remains outstanding (save as set out in Clause 7 above).

The expiry or termination of this Agreement will be without prejudice to the provisions in Clauses 3, 5, 6 and 10, which shall remain in force, and to the accrued rights and obligations of the Parties hereunder on and prior thereto, including as to the consequences set out for each of the events triggering the termination throughout this Agreement.

9. | ANNOUNCEMENTS |

The Selling Shareholders agree to the public announcement referred to in Clause 1.3 incorporating references to the Selling Shareholders and to this Agreement in the terms set out in Annex 1 hereto.

Other than the above-referred public announcement, the Request for Authorisation and the press release and investor presentations to be made by the Bidder, none of the Parties (nor any of their respective affiliates) shall make any announcement or disclosure or issue any circular in connection with the possibility, existence, subject matter, content, terms and conditions or Parties to this Agreement or the Offer without the prior written approval of the other Party (such approval not to be unreasonably withheld or delayed).

The restriction in this Clause 9 shall not apply (i) to the extent that the announcement or circular is required or requested by any applicable law or regulation, by any stock exchange or any regulatory or other supervisory body or authority of competent jurisdiction, whether or not the requirement or request has the force of law, in which case, the Party making the announcement or issuing the circular shall, to the extent feasible and legally permitted, use its reasonable efforts to consult with the other Party in advance as to its form, content and timing, or (ii) to any disclosure to any affiliate of, or direct or indirect investor in, the relevant Party, provided that

12/18

the disclosing Party shall procure that the applicable affiliate shall observe the confidentiality obligations set out in this Clause 9.

In any event, the Parties acknowledge and agree that they are obliged not to and shall therefore, under no circumstance, make any announcement or disclosure in connection with this Agreement to any third party (including, for the avoidance of doubt, any stock exchange or any other regulatory or supervisory body or authority) before the Bidder publishes the announcement of the Offer as per Clause 1.3.

10. | MISCELLANEOUS |

10.1 | No assignment |

No Party may without the prior unanimous written consent of the other Parties assign its rights and obligations deriving from this Agreement to any other person, nor may it, without the prior written consent of the other Parties, assign, grant any security interest over, or otherwise transfer the benefit of the whole or any part of this Agreement.

10.2 | Amendments |

No amendment to this Agreement will be valid unless made in writing and signed by all the Parties.

10.3 | Severability |

If any provision of this Agreement is declared void, invalid or unenforceable by a competent court or authority, this Agreement will remain in force except for that part declared void, invalid or unenforceable. The Parties will consult each other and use their best efforts to agree upon a valid and enforceable provision as a reasonable substitute for the void, invalid or unenforceable provision in accordance with the spirit of this Agreement.

10.4 | Entire Agreement |

This Agreement constitutes the entire agreement among the Parties in relation to the launch and acceptance of the Offer and replaces any other prior agreement, whether oral or in writing, regarding the same matter.

10.5 | Counterparts |

This Agreement may be signed in one or more counterparts, each of which will be an original and complete Agreement.

10.6 | Waiver |

Expect for the situations described in Clause 8, any failure or delay to exercise a right, power or privilege provided in this Agreement will not in itself amount to a waiver thereof and the individual or partial exercise of these rights, powers or privileges will not constitute a waiver to exercise the right, power or privilege in the future.

10.7 | Costs |

Each Party shall bear all costs incurred by it in connection with the preparation, negotiation and entry into of this Agreement.

13/18

10.8 | Notices |

Any notice between the Parties in connection to this Agreement shall be made in writing and in English to the following addresses or e-mails:

If sent to the Bidder:

Addressee: | Ms Emmanuelle Rouchel |

Address: | 99 Bishopsgate, London, EC2M 3XD |

E-mail: | |

Addressee: | Mr Ricardo Arias |

Address: | 21 calle Serrano, 2nd floor, 28001, Madrid, Spain |

E-mail: | |

With a copy to:

If sent to the Selling Shareholders:

Cobra:

Addressee: | Mr José María Castillo Lacabex |

Address: | Calle Cardenal Marcelo Spínola 10, 28016 Madrid (Spain) |

E-mail: | |

With a copy to:

Addressee: | Ms Aida Pérez Alonso |

Address: | Calle Cardenal Marcelo Spínola 10, 28016 Madrid (Spain) |

E-mail: | |

Addressee: | Mr Alejandro Ortiz Vaamonde and Mr Esteban Arza Bombin |

Address: | Calle Almagro 40, 28010 Madrid (Spain) |

E-mail: | |

14/18

GIP:

Addressee: | GIP II Helios, S.à r.l. Board of managers |

Address: | 6, rue Eugène Ruppert, L-2453, Luxembourg |

Addressee: | Mr Antoine Kerrenneur |

Address: | The Peak, 5 Wilton Road, London SW1V 1AN, United Kingdom |

E-mail: | |

With a copy to:

Addressee: | Mr Joseph Blum Global Infrastructure Partners, General Counsel |

Address: | The Peak, 5 Wilton Road, London SW1V 1AN, United Kingdom |

E-mail: | |

Addressee: | Mr Alejandro Ortiz Vaamonde and Mr Esteban Arza Bombin |

Address: | Calle Almagro 40, 28010 Madrid (Spain) |

E-mail: | |

Any correspondence sent to the above addresses will be deemed to have been received by the addressee (unless the addressee had previously informed the sender of a change of address by notice in accordance with this Clause), provided that they evidence receipt by the addressee.

10.9 | Governing law |

This Agreement shall be governed by the common Laws of the Kingdom of Spain (legislación común española).

10.10 | Jurisdiction |

The Parties, waiving their right to any other jurisdiction, irrevocably submit to the courts of the city of Madrid (Spain) for the resolution of any dispute, claim or controversy arising from or relating to this Agreement, including any question with respect to its existence, validity, termination, nullification or effectiveness.

As an expression of their consent, the Parties initial each page and sign at the end of the three counterparts in which this Agreement is formalised in the place and on the date indicated in its heading.

[Signature pages follow]

15/18

[Signature page to the Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A.]

TERP Spanish HoldCo, S.L. By: /s/ Alfredo Zamarriego Fernández Mr Alfredo Zamarriego Fernández | By: /s/ Ricardo Arias Sainz Mr Ricardo Arias Sainz | |

16/18

[Signature page to the Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A.]

Cobra Concesiones, S.L. By: /s/ José María Castillo Lacabex Mr José María Castillo Lacabex | ||

17/18

[Signature page to the Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A.]

GIP II Helios, S.à r.l.

By: /s/ Alejandro Ortiz

Mr Alejandro Ortiz

18/18

Exhibit 10.2

Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A. |

BETWEEN |

TERP Spanish HoldCo, S.L. |

As the Bidder |

AND |

MUTUACTIVOS, S.A.U., S.G.I.I.C. |

In Madrid, on 6 February 2018 |

1/13

TABLE OF CONTENTS

1.LAUNCHING OF THE OFFER 5

1.1Commitment to launch the Offer 5

1.2The terms of the Offer 5

1.3Announcement and filing for authorisation 6

1.4Withdrawal of the Offer 7

1.5Amendments to the Offer Terms and Conditions 7

2.THE SELLING SHAREHOLDER’S COMMITMENTS 7

2.1Acceptance of the Offer 7

2.2Voting 7

2.3Standstill 8

2.4Related-party transactions 8

3.REPRESENTATIONS AND WARRANTIES 8

3.1Representations and warranties from the Bidder 8

3.2Representations and warranties from the Selling Shareholder 9

4.BREACH 9

5.DURATION 10

6.EARLY TERMINATION OF THE AGREEMENT 10

7.ANNOUNCEMENTS 10

8.MISCELLANEOUS 11

8.1No assignment 11

8.2Amendments 11

8.3Severability 11

8.4Entire Agreement 11

8.5Counterparts 11

8.6Waiver 11

8.7Costs 11

8.8Notices 11

8.9Governing law 12

8.10Jurisdiction 12

2/13

BETWEEN

On the one hand,

I.“TERP Spanish HoldCo, S.L.”, a company incorporated and validly existing under the laws of Spain, with registered office at 21 calle Serrano, Madrid, 28001, registered at the Commercial Registry of Madrid at book 35,995, volume 9, section 8, sheet M-646,732, entry 1 and provided with tax identification number B87827648 (the “Bidder”), duly represented by Mr Alfredo Zamarriego Fernández and Mr Ricardo Arias Sainz, in their capacity as Joint and Several Directors of the Bidder, pursuant to the notarial deed executed on 30 January 2018 before the notary public of Madrid Mr Francisco Miras Ortiz, with number 301 of his protocol;

And, on the other hand,

II.“MUTUACTIVOS, S.A.U., S.G.I.I.C.”, a company incorporated and validly existing under the laws of Spain, with registered office at Paseo de la Castellana, 33 registered with the Commercial Registry of Madrid at book 3,256 (tomo), and sheet (hoja) M-55,390 and with the Registry of Collective Investment Schemes Managers at the Spanish National Securities Market Commission, and provided with tax identification number A78015203 (the “Selling Shareholder”), duly represented on a joint basis by (i) Mr Ángel Fresnillo Salcedo, in his capacity as representative of the Selling Shareholder pursuant to the notarial deed executed on 3 May 2015 before the notary public of Madrid Mr José Miguel García Lombardia, with number 893 of his protocol, and (ii) and Mr Pedro Pablo García García, in his capacity as representative of the Selling Shareholder pursuant to the notarial deed executed on 2 July 2012 before the notary public of Madrid Mr José Miguel García Lombardia, with number 2,880 of his protocol.

The Bidder and the Selling Shareholder shall be hereinafter collectively referred to as the “Parties” and individually as a “Party”.

WHEREAS

I. | Saeta Yield, S.A. is a Spanish corporation (sociedad anónima) with registered office at Avenida de Burgos, 16D, Madrid, 28036, holding Tax Identification Number (NIF) A-85699221, and registered with the Commercial Registry of Madrid at Volume (Tomo) 26,842, Page (Folio) 14 and Sheet (Hoja) M-483,710 (the “Target” or the “Company”), whose issued share capital amounts to EUR 81,576,928.00 and is represented by 81,576,928 ordinary shares, of EUR 1.00 par value each, fully subscribed and paid-up, all of which are of the same class and pertain to the same series and are represented by book entries (the “Shares”). All the Shares are listed on the Madrid, Barcelona, Bilbao and Valencia Stock Exchanges and traded through the Automated Quotation System of such Stock Exchanges (Sistema de Interconexión Bursátil). |

3/13

II. | As of the date hereof, the Selling Shareholder represents funds, SICAVs and managed portfolios identified in Annex 1 hereto, which collectively own 1,430,726 Shares in the Company representing 1.754% of the Company’s total share capital (the “Selling Shareholder’s Shares”). Notwithstanding, should the Selling Shareholder acquire, receive by any means or be entitled to any other Shares during the course of the Offer, as defined in the following paragraph, the Selling Shareholder’s Shares will also encompass such other Shares. |

III. | The Bidder has agreed to launch a voluntary takeover bid in relation with the total share capital of the Company (the “Offer”), through which the Bidder wishes to acquire the Selling Shareholder’s Shares, and the Selling Shareholder has agreed to irrevocably accept the Offer and tender the Selling Shareholder’s Shares under the Offer pursuant to the terms and conditions set out herein. |

IV. | In view of the foregoing, the Parties have agreed to enter into this irrevocable undertaking agreement for the launch and acceptance of the Offer (the “Agreement”) in accordance with the following |

CLAUSES

1. | LAUNCHING OF THE OFFER |

1.1 | Commitment to launch the Offer |

The Bidder has taken the decision to launch the Offer, subject to certain conditions, and undertakes to do so by filing the necessary documentation with the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores) (the “CNMV”) for the purposes of obtaining its approval of the relevant offer document (folleto explicativo) (the “Offer Document”) and the Offer, in accordance with the terms and conditions of this Agreement.

1.2 | The terms of the Offer |

The Offer will be on the following terms and conditions (the “Offer Terms and Conditions”):

(i) | the Offer shall be launched at a price of EUR 12.20 per Share, to be paid fully in cash (the “Offer Price”); |

(ii) | the shareholders of the Company shall be granted a term of 15 calendar days to accept the Offer (the “Acceptance Period”); and |

(iii) | the Offer shall only be conditional upon: |

(a) | the Bidder obtaining merger control clearance from the European Commission (in so far as legally required); and |

(b) | the Offer being irrevocably accepted by shareholders of the Target representing no less than 48.222% of the Company’s voting share capital. |

The conditions described under Clauses 1.2(iii)(a) and 1.2(iii)(b) will be collectively referred throughout this Agreement as the “Offer Conditions”.

If the European Commission and/or any other applicable antitrust authority requests, requires or imposes any condition, obligation, undertaking and/or remedy (each, a “Commitment”) to the Bidder in order to approve the acquisition by the Bidder of a controlling stake in the Company, the Bidder shall offer, accept and agree to any such Commitment (which shall not include, without

4/13

the prior written consent of the Selling Shareholder, any amendment to the Offer Terms and Conditions) as may be necessary to obtain such approval, provided that the Bidder shall be under no obligation to offer, accept or agree to any Commitment that requires any action to be taken by any person other than TerraForm Power Inc. and/or its subsidiaries (including, for the avoidance of doubt, the Target and its subsidiaries). The Bidder undertakes that, between the date hereof and the satisfaction of the Offer Condition in Clause 1.2(iii)(a) above, neither it nor TerraForm Power Inc. nor any subsidiary of TerraForm Power Inc. shall take any action which is reasonably likely to preclude or hinder the satisfaction of the Offer Condition in Clause 1.2(iii)(a) above, including (without limitation) any corporate and/or M&A transaction.

The Offer Price has been determined on the basis of the Target not making any distribution of dividends, reserves, premium or any other equivalent form of equity or related shareholding distribution or equity remuneration of any kind to its shareholders prior to the settlement of the Offer other than quarterly dividends in line with the Company’s dividend policy as currently publicised.

For this purpose, dividends up to the following maximum amounts shall be considered as being in line with the Company’s dividend policy:

(w) | if the settlement of the Offer takes place before 25 May 2018, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount of EUR 0.1967 per share; |

(x) | if the settlement of the Offer takes place on or after 25 May 2018 and before 24 August 2018, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount of EUR 0.3967 per share; |

(y) | if the settlement of the Offer takes place on or after 24 August 2018 and before 23 November 2018, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount a maximum of EUR 0.6017 per share; and |

(z) | if the settlement of the Offer takes place on or after 23 November 2018 and before 22 February 2019, one or more dividends can be paid, as from the date hereof, up to a maximum aggregated amount of EUR 0.8067 per share, |

provided, in all cases, that the ex-dividend date of the corresponding dividend(s) takes place on or before the settlement of the Offer.

If the settlement of the Offer were to take place on or after 22 February 2019, the above-mentioned maximum aggregated amount increases on a quarterly basis by EUR 0.205 per share and the reference date for the settlement of the Offer is the Friday falling on the penultimate week of May, August, November or February, as applicable.

Consequently, should the Target carry out before the settlement of the Offer any equity distribution or remuneration to the shareholders other than quarterly dividends in line with the Company’s dividend policy as currently publicised, or any distribution of quarterly dividends in excess of the abovementioned amounts per share (each, an “Excess Distribution”), the Bidder may, in accordance with article 33 of Spanish Royal Decree 1066/2007, of July 27 (Real Decreto 1066/2007, de 27 de julio, sobre el régimen de las ofertas públicas de adquisición de valores) (the “Takeover Regulations”), either: (a) withdraw the Offer if, in the Bidder’s opinion, the

5/13

Excess Distribution prevents it from maintaining the Offer and the Bidder obtains prior approval from the CNMV; or (b) maintain the Offer and adjust the Offer Price by an amount equivalent to the gross amount per share received, or to the gross amount per share received in excess of the abovementioned amounts, as applicable, due to said Excess Distribution, inasmuch as the potential reduction of the consideration does not exceed what is deemed necessary to maintain the financial equivalence with the consideration previously offered, and the Bidder obtains the prior authorization from the CNMV.

1.3 | Announcement and filing for authorisation |

The Bidder shall make the relevant public announcement of the Offer referred to in article 16 of the Takeover Regulations no later than 5 business days after the execution of the Agreement.

For the purposes of this Agreement, a “business day” shall be deemed any day of the week, except for Saturdays, Sundays or any banking holiday in Madrid.

The Bidder undertakes to file with the CNMV the request for authorisation of the Offer in accordance with the provisions of the Takeover Regulations in terms of content, procedure and timing (the “Request for Authorisation”), which will include the Offer Document. Subject to the Offer Terms and Conditions and Clause 1.5 below, the terms and conditions of the Offer and the final content of the Offer Document will be in such form as the Bidder considers desirable or necessary in order to obtain the authorisation of the Offer by the CNMV.

The Bidder shall file with the CNMV any ancillary documents required pursuant to article 20 of the Takeover Regulations.

1.4 | Withdrawal of the Offer |

The Bidder may, at its sole discretion, withdraw the Offer only (a) if and when any of the Offer Conditions is not met, or (b) pursuant to article 33.1 of the Takeover Regulations.

In any such event, this Agreement will terminate in accordance with Clause 6.

1.5 | Amendments to the Offer Terms and Conditions |

Subject to the Offer Terms and Conditions, the Bidder shall be entitled to extend the acceptance period of the Offer or to modify the Offer and the Offer Document whenever deemed necessary to obtain the authorisation of the Offer and/or to achieve its success.

Should the Bidder decide to increase the Offer Price, the Selling Shareholder will be entitled to benefit from such price increase and will receive, for each of the Selling Shareholder’s Shares, the new Offer Price.

2. | THE SELLING SHAREHOLDER’S COMMITMENTS |

2.1 | Acceptance of the Offer |

The Selling Shareholder hereby irrevocably and unconditionally undertakes to accept the Offer with all of the Selling Shareholder’s Shares, under the Offer Terms and Conditions -as amended in accordance herewith, as the case may be- within the first 5 business days of the Acceptance Period and further undertakes not to revoke such acceptance, except where:

(i) | the Bidder decides to withdraw the Offer, in accordance with Clause 1.4; or |

(ii) | the CNMV does not authorise the Offer. |

6/13

Save for the provisions in Clause 8, which shall remain in force, if any of the scenarios described in (i) and (ii) above takes place, the Selling Shareholder shall be entitled to freely transact with the Selling Shareholder’s Shares in any way without any obligation or liability vis-à-vis the Bidder. Under no circumstances other than those specified in this paragraph may the Selling Shareholder accept any third-party offer in relation to any or all Selling Shareholder’s Shares.

2.2 | Voting |

From the date this Agreement is entered into until the settlement of the Offer —except where this Agreement is terminated pursuant to Clause 6 below—, the Selling Shareholder undertakes, to the extent legally possible, to exercise the voting rights attached to the Selling Shareholder’s Shares against resolutions which, if passed, (i) might reasonably result in the Offer Conditions not being fulfilled or which might reasonably impede or frustrate the Offer in any way, or (ii) will result in any Excess Distribution.

2.3 | Standstill |

For the term of this Agreement, the Selling Shareholder undertakes not to, nor to cause any related person in accordance with the Takeover Regulations to, transact with any Shares of the Company.

In particular, the Selling Shareholder, shall not, nor cause any related person to, subscribe for, purchase, sell, transfer, swap or otherwise acquire or dispose of any Shares, financial instruments having the Shares as underlying asset or rights attached to the Shares, or the voting or economic rights attached to them, nor create any charges, pledges, liens, encumbrances or in any way purchase, subscribe for or grant any right over Shares or the voting or economic rights attached to them.

2.4 | Related-party transactions |

For the term of this Agreement, neither the Selling Shareholder, nor any party related to it in accordance with applicable law, may enter into, amend or terminate any agreement with the Company or any company of its group of companies.

3. | REPRESENTATIONS AND WARRANTIES |

3.1 | Representations and warranties from the Bidder |

The Bidder represents and warrants to the Selling Shareholder that:

(i) | The Bidder is validly incorporated, in existence and duly registered under the laws of its jurisdiction and has full corporate power to carry out its object (including the capacity to dispose of and encumber its assets) as conducted as at the date of this Agreement; and to be party to the contracts and perform the obligations deriving from them. |

(ii) | The Bidder has obtained all corporate authorisations and all other governmental, statutory, regulatory or other consents, licenses and authorizations required to enter into and perform its obligations under this Agreement. |

(iii) | This Agreement is not contrary to or does not entail a breach of any of the corporate documents of the Bidder, nor is it contrary to any laws or regulations in its jurisdiction or of any order, decree or judgment of any court or any governmental or regulatory authority. |

7/13

(iv) | The Bidder is neither insolvent or bankrupt under the laws of its jurisdiction of incorporation, nor unable to pay its debts as they fall due or is held liable due to its inability to pay any debt. The Bidder is not party to any proceeding against it in connection with arrangements with creditors, nor is it subject to any winding up, bankruptcy or insolvency proceeding or are there reasons to believe such proceedings may be initiated against the Bidder in the future. |

(v) | Each of the above representations and warranties is true and accurate at the date hereof and shall remain true and accurate and not misleading on the settlement date of the Offer as if repeated immediately before the settlement of the Offer |

3.2 | Representations and warranties from the Selling Shareholder |

The Selling Shareholder represents and warrants that:

(i) | It is validly incorporated, in existence and duly registered under the laws of its jurisdiction and has full corporate power to carry out its object (including the capacity to dispose of and encumber its assets) as conducted as at the date of this Agreement; and to be party to the contracts and perform the obligations deriving from them. |

(ii) | It has obtained all internal corporate authorisations, and there are no governmental, statutory or regulatory consents or authorizations, in each case, required to enter into and perform its obligations under this Agreement. |

(iii) | This Agreement is not contrary to or does not entail a breach of any of the corporate documents of the Selling Shareholder, nor is it contrary to any laws or regulations in its jurisdiction or of any order, decree or judgment of any court or any governmental or regulatory authority, in each case which are applicable to it. |

(iv) | It is the legal representative of the sole legal and beneficial owners of each of the Selling Shareholder’s Shares. The Selling Shareholder’s Shares are free from all liens, encumbrances and third party rights and include all the voting and other rights attached thereto, as evidenced by the ownership certificate(s) attached hereto. |

(v) | It is entitled to dispose, sell and transfer the Selling Shareholder’s Shares on the terms and conditions herein described. |

(vi) | It is neither insolvent nor bankrupt under the laws of its jurisdiction of incorporation, nor unable to pay its debts as they fall due or were held liable due to their inability to pay any debt. It is not party to any proceeding in connection with arrangements with creditors nor is it subject to any winding up, bankruptcy or insolvency proceeding or has reasons to believe such proceedings may be initiated it in the future. |

(vii) | Each of the above representations and warranties is true and accurate at the date hereof and shall remain true and accurate and not misleading on the settlement date of the Offer as if repeated immediately before the settlement of the Offer. |

4. | BREACH |

The breach by either Party of this Agreement will entitle the other Party to claim against the breaching Party either (i) the specific performance of the breached undertaking(s), or (ii) in the

8/13

event of a material breach of the Agreement, the termination of the Agreement; in both cases, together with a compensation for damages.

The non-breaching Party shall notify the breach to the other Party and the request for specific performance or termination of the Agreement, as described in the preceding paragraph, in accordance with the notification procedure set out in Clause 8.8 below.

For the avoidance of doubt, none of the Parties shall be liable for any indirect, consequential or reputational damages or loss of profits.

5. | DURATION |

This Agreement will be in force from the date hereof until the settlement of the Offer, unless terminated earlier in accordance with its terms. Notwithstanding anything to the contrary in this Agreement, Clauses 4 and 8 shall remain in full force and effect after the settlement of the Offer.

6. | EARLY TERMINATION OF THE AGREEMENT |

This Agreement may only be terminated as follows:

(i) | by one Party giving notice to the other Party if the CNMV does not authorise the Offer and the Bidder decides not to request again such authorisation; |

(ii) | by the Bidder upon withdrawing the Offer pursuant to Clause 1.4, without prejudice to any of its rights under Clause 4; or |

(iii) | by the non-breaching Party giving notice to the other Party if this Agreement has been materially breached, pursuant to Clause 4 |

Unless terminated earlier, this Agreement will expire if and when the Bidder has launched the Offer and the Selling Shareholder has accepted the Offer and tendered the Selling Shareholder’s Shares to the Bidder, in each case pursuant to the terms herein, and no other obligation of any Party hereunder remains outstanding.

The expiry or termination of this Agreement will be without prejudice to the provisions in Clauses 4 and 8, which shall remain in force, and to the accrued rights and obligations of the Parties hereunder on and prior thereto, including as to the consequences set out for each of the events triggering the termination throughout this Agreement.

7. | ANNOUNCEMENTS |

The Selling Shareholder agrees to the public announcement referred to in Clause 1.3 incorporating references to the Selling Shareholder and to this Agreement in the terms set out in the Takeover Regulations.

Other than the above-referred public announcement, the Request for Authorisation, and the press release and investor presentations to be made by the Bidder, neither Party (nor any of their respective affiliates) shall make any announcement or disclosure or issue any circular in connection with the possibility, existence, subject matter, content, terms and conditions or Parties to this Agreement or the Offer without the prior written approval of the other Party (such approval not to be unreasonably withheld or delayed).

The restriction in this Clause 7 shall not apply to the extent that the announcement or circular is required by any applicable law or regulation, by any stock exchange or any regulatory or other

9/13

supervisory body or authority of competent jurisdiction, whether or not the requirement has the force of law. If this exception applies, the Party making the announcement or issuing the circular shall, to the extent feasible and legally permitted, use its reasonable efforts to consult with the other Party in advance as to its form, content and timing.

In any event, the Parties acknowledge and agree that they are obliged not to and shall therefore, under no circumstance, make any announcement or disclosure in connection with this Agreement to any third party (including, for the avoidance of doubt, any stock exchange or any other regulatory or supervisory body or authority) before the Bidder publishes the announcement of the Offer as per Clause 1.3.

8. | MISCELLANEOUS |

8.1 | No assignment |

Neither Party may without the prior unanimous written consent of the other Party assign its rights and obligations deriving from this Agreement to any other person, nor may it, without the prior written consent of the other Party, assign, grant any security interest over, or otherwise transfer the benefit of the whole or any part of this Agreement.

8.2 | Amendments |

No amendment to this Agreement will be valid unless made in writing and signed by both Parties.

8.3 | Severability |

If any provision of this Agreement is declared void, invalid or unenforceable by a competent court or authority, this Agreement will remain in force except for that part declared void, invalid or unenforceable. The Parties will consult each other and use their best efforts to agree upon a valid and enforceable provision as a reasonable substitute for the void, invalid or unenforceable provision in accordance with the spirit of this Agreement.

8.4 | Entire Agreement |

This Agreement constitutes the entire agreement between the Parties in relation to the launch and acceptance of the Offer and replaces any other prior agreement, whether oral or in writing, regarding the same matter.

8.5 | Counterparts |

This Agreement may be signed in one or more counterparts, each of which will be an original and complete Agreement.

8.6 | Waiver |

Expect for the situations described in Clause 6, any failure or delay to exercise a right, power or privilege provided in this Agreement will not in itself amount to a waiver thereof and the individual or partial exercise of these rights, powers or privileges will not constitute a waiver to exercise the right, power or privilege in the future.

8.7 | Costs |

Each Party shall bear all costs incurred by it in connection with the preparation, negotiation and entry into of this Agreement.

10/13

8.8 | Notices |

The notice between the Parties in connection to this Agreement shall be made in writing and in English to the following addresses or e-mails:

If sent to the Bidder:

Addressee: | Ms Emmanuelle Rouchel |

Address: | 99 Bishopsgate, London, EC2M 3XD |

E-mail: | ###@brookfield.com |

Addressee: | Mr Ricardo Arias |

Address: | 21 calle Serrano, 2nd floor, 28001, Madrid, Spain |

E-mail: | ####@brookfield.com |

With a copy to:

If sent to the Selling Shareholder:

Addressees: | Mr. Angel Fresnillo Salcedo |

Address: | Paseo de la Castellana, 33, Edificio Fortuny, 28010, Madrid, Spain |

E-mail: | |

With a copy to:

Addressee: | Mr. José Ángel Fuentes Berna |

Address: | Paseo de la Castellana, 33, Edificio Fortuny, 28010, Madrid, Spain |

E-mail: | |

Any correspondence sent to the above addresses will be deemed to have been received by the addressee (unless the addressee had previously informed the sender of a change of address by notice in accordance with this Clause), provided that they evidence receipt by the addressee.

8.9 | Governing law |

This Agreement shall be governed by the common Laws of the Kingdom of Spain (legislación común española).

8.10 | Jurisdiction |

11/13

The Parties, waiving their right to any other jurisdiction, irrevocably submit to the courts of the city of Madrid (Spain) for the resolution of any dispute, claim or controversy arising from or relating to this Agreement, including any question with respect to its existence, validity, termination, nullification or effectiveness.

As an expression of their consent, the Parties initial each page and sign at the end of the 2 counterparts in which this Agreement is formalised in the place and on the date indicated in its heading.

TERP Spanish HoldCo S.L. By: /s/ Alfredo Zamarriego Fernández Mr Alfredo Zamarriego Fernández | By: /s/ Ricardo Arias Sainz Mr Ricardo Arias Sainz | |

MUTUACTIVOS, S.A.U., S.G.I.I.C. By: /s/ Angel Fresnillo Salcedo Mr Angel Fresnillo Salcedo | MUTUACTIVOS, S.A.U., S.G.I.I.C. By: /s/ Pedro Pablo García García Mr Pedro Pablo García García | |

12/13

ANNEX 1

LIST OF FUNDS, SICAVS AND MANAGED PORTFOLIOS REPRESENTED BY THE SELLING SHAREHOLDER

Portfolio | ISIN | Spanish tax identification number | Target Company’s Shares |

Mutuafondo Unnefar F.I. | ES0165184005 | V-87426110 | 2,553 |

Mutuafondo Crecimiento F.I. | ES0175808007 | V-86995288 | 62,155 |

Mutuafondo Fortaleza F.I. | ES0165145006 | V-86995503 | 8,257 |

Mutuafondo España F.I. | ES0165144009 | V-58644128 | 375,768 |

Mutuafondo Estrategia Global F.I.L. | ES0165112006 | V-85852523 | 125,838 |

Mutuafondo Dividendo F.I. | ES0175809005 | V-87256251 | 567,084 |

Mutuafondo Valores F.I. | ES0165241037 | V-82112533 | 209,328 |

Arizcun, Sicav, S.A. | ES0110226034 | A-78935509 | 4,335 |

Portfolio | Reg. no. with Pension Fund Regulator (DGSFP) | Spanish tax identification number | Target Company’s Shares |

Fondomutua F.P. | F0984 | V-83477349 | 18,037 |

Fondauto F.P. | F0232 | V-79513032 | 46,518 |

Fondomutua Empleo Moderado F.P. | F1370 | V-84671833 | 7,261 |

Fondomutua Empleo Dinámico F.P. | F1373 | V-84671908 | 3,592 |

13/13

Exhibit 10.3

Irrevocable Undertaking Agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield, S.A. |

BETWEEN |

TERP Spanish HoldCo, S.L. |

As the Bidder |

AND |

Sinergia Advisors 2006, A.V., S.A. |

In Madrid, on 6 February 2018 |

1/12

TABLE OF CONTENTS

1.LAUNCHING OF THE OFFER 5

1.1Commitment to launch the Offer 5

1.2The terms of the Offer 5

1.3Announcement and filing for authorisation 7

1.4Withdrawal of the Offer 7

1.5Amendments to the Offer Terms and Conditions 7

2.THE SELLING SHAREHOLDER’S COMMITMENTS 7

2.1Acceptance of the Offer 7

2.2Voting 8

2.3Standstill 8

2.4Related-party transactions 8

3.REPRESENTATIONS AND WARRANTIES 8

3.1Representations and warranties from the Bidder 8

3.2Representations and warranties from the Selling Shareholder 9

4.BREACH 10

5.DURATION 10

6.EARLY TERMINATION OF THE AGREEMENT 10

7.ANNOUNCEMENTS 10

8.MISCELLANEOUS 11

8.1No assignment 11

8.2Amendments 11

8.3Severability 11

8.4Entire Agreement 11

8.5Counterparts 11

8.6Waiver 11

8.7Costs 12

8.8Notices 12

8.9Governing law 12

8.10Jurisdiction 12

2/12

BETWEEN

On the one hand,

I. | “TERP Spanish HoldCo, S.L.”, a company incorporated and validly existing under the laws of Spain, with registered office at 21 calle Serrano, Madrid, 28001, registered at the Commercial Registry of Madrid at book 35,995, volume 9, section 8, sheet M-646,732, entry 1 and provided with tax identification number B87827648 (the “Bidder”), duly represented by Mr Alfredo Zamarriego Fernández and Mr Ricardo Arias Sainz, in their capacity as Joint and Several Directors of the Bidder, pursuant to the notarial deed executed on 30 January 2018 before the notary public of Madrid Mr Francisco Miras Ortiz, with number 301 of his protocol; |

And, on the other hand,