Form DEFA14A J. Alexander's Holdings,

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

J. Alexander’s Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

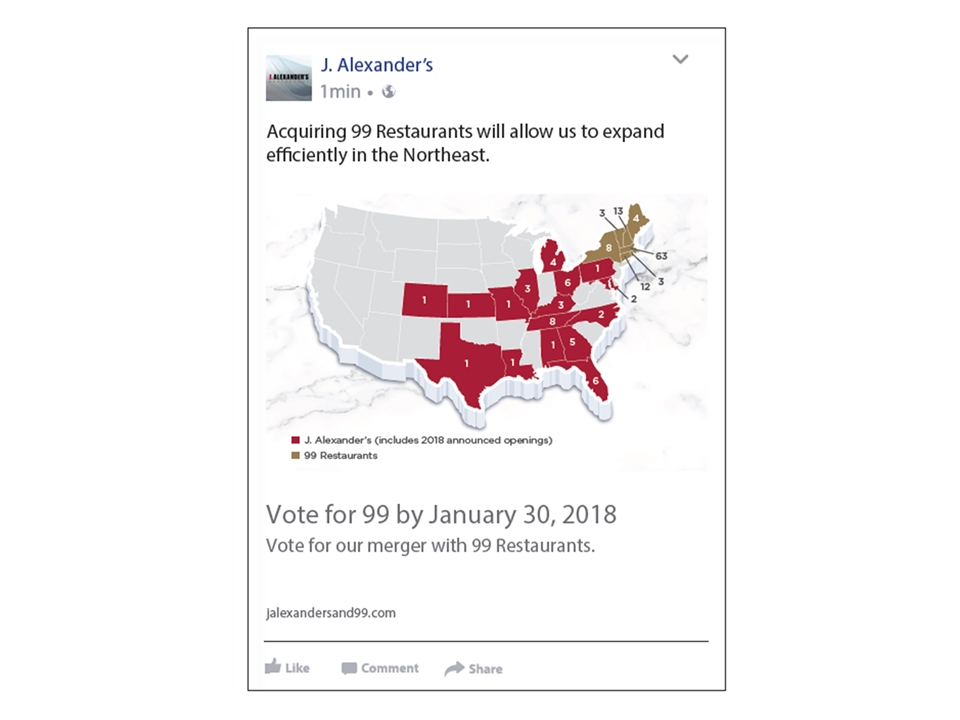

On January 11, 2018, J. Alexander’s Holdings, Inc. (the “Company”) posted the following advertisements online and via Facebook, and may in the future send or use the same or substantially similar communications from time to time:

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

In connection with the safe harbor established under the Private Securities Litigation Reform Act of 1995, the “Company,” “J. Alexander’s” or “JAX”) cautions that certain information contained or incorporated by reference in this document and its filings with the Securities and Exchange Commission (the “SEC”), in its press releases and in statements made by or with the approval of authorized personnel is forward-looking information that involves risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements contained herein. Forward-looking statements discuss the Company’s current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “would,” “can,” “should,” “likely,” “anticipate,” “potential,” “estimate,” “pro forma,” “continue,” “expect,” “project,” “intend,” “seek,” “plan,” “believe,” “target,” “outlook,” “forecast,” the negatives thereof and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements include all statements that do not relate solely to historical or current facts, including statements regarding the Company’s expectations, intentions or strategies and regarding the future. The Company disclaims any intent or obligation to update these forward-looking statements.

Important factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, among other things: the fact that certain directors and executive officers of the Company and 99 Restaurants, LLC (“99 Restaurants”) may have interests in the transactions that are different from, or in addition to, the interests of the Company’s shareholders generally; uncertainties as to whether the requisite approvals of the Company’s shareholders will be obtained; the risk of shareholder litigation in connection with the transactions and any related significant costs of defense, indemnification and liability; the possibility that competing offers will be made; the possibility that various closing conditions for the transactions may not be satisfied or waived; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, including circumstances that may give rise to the payment of a termination fee by the Company; the effects of disruptions to respective business operations of the Company or 99 Restaurants resulting from the transactions, including the ability of the combined company to retain and hire key personnel and maintain relationships with suppliers and other business partners; the risks associated with the future performance of the business of 99 Restaurants; the risks of integration of the business of 99 Restaurants and the possibility that costs or difficulties related to such integration of the business of 99 Restaurants will be greater than expected; the risk that the Company may not be able to obtain borrowing pursuant to an amendment of its existing credit facility on favorable terms, or at all, in order to repay the debt assumed in connection with the consummation of the transactions; the possibility that the anticipated benefits and synergies from the proposed transactions cannot be fully realized or may take longer to realize than expected; the fact that the Company has incurred and will continue to incur substantial transaction-related costs; and the fact that the transactions will dilute the Company’s economic interest in certain operating subsidiaries of the Company, and any increase in total revenue, income and cash flows of such operating subsidiaries as a result of the transactions may not outweigh such dilution. Further, the business of 99 Restaurants and the business of the Company remain subject to a number of general risks and other factors that may cause actual results to differ materially. There can be no assurance that the proposed transactions will in fact be consummated.

Additional information about these and other material factors or assumptions underlying such forward looking statements are set forth in the reports that the Company files from time to time with the SEC, including those items listed under the “Risk Factors” heading in Item 1.A of the Company’s Annual Report on Form 10-K for the year ended January 1, 2017, and in its subsequent Quarterly Reports on Form 10-Q, including for the quarters ended October 1, 2017, July 2, 2017, and April 2, 2017. The

foregoing list of risk factors is not exhaustive. These risks, as well as other risks associated with the contemplated transactions, are more fully discussed in the definitive proxy statement filed with the SEC on December 21, 2017. These forward-looking statements reflect the Company’s expectations as of the date of this communication. The Company disclaims any intent or obligation to update these forward-looking statements for any reason, even if new information becomes available or other events occur in the future, except as may be required by law.

The Company cautions shareholders and other interested parties that certain statements and assumptions included in this presentation include, make reference to, or otherwise rely on historical results of financial operations, restaurant capital expenditures, same store sales, guest check average, guest traffic, and other historical and projected financial information of 99 Restaurants as reported to us by 99 Restaurant’s management team without our independent verification.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger, the Company has filed with the SEC a definitive proxy statement on Schedule 14A on December 21, 2017, which has been mailed to the Company’s shareholders on or about December 22, 2017. SHAREHOLDERS OF THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD REGARDING THE PROPOSED MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the proxy statement and other filings containing information about the Company at the SEC’s website at www.sec.gov. The definitive proxy statement and the other filings may also be obtained free of charge at the Company’s “Investor Relations” website at investor.jalexandersholdings.com under the tab “More” and then under the tab “SEC Filings.”

PARTICIPANTS IN THE SOLICITATION

The Company and certain of its respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of the Company’s shareholders in connection with the proposed merger. Information about the directors and executive officers of the Company and their ownership of Company common stock is set forth in the proxy statement for the Company’s 2017 annual meeting of shareholders, as filed with the SEC on Schedule 14A on April 11, 2017, and the definitive proxy statement for the Company’s meeting of shareholders to vote on the proposed merger, as filed with the SEC on December 21, 2017. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transactions are included in the above-referenced definitive proxy statement regarding the proposed merger. Free copies of these documents may be obtained as described in the preceding paragraph.