Form 8-K/A HOVNANIAN ENTERPRISES For: Dec 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 28, 2017

HOVNANIAN ENTERPRISES, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

1-8551 |

22-1851059 |

|

(State or Other |

(Commission File Number) |

(I.R.S. Employer |

110 West Front Street

P.O. Box 500

Red Bank, New Jersey 07701

(Address of Principal Executive Offices) (Zip Code)

(732) 747-7800

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

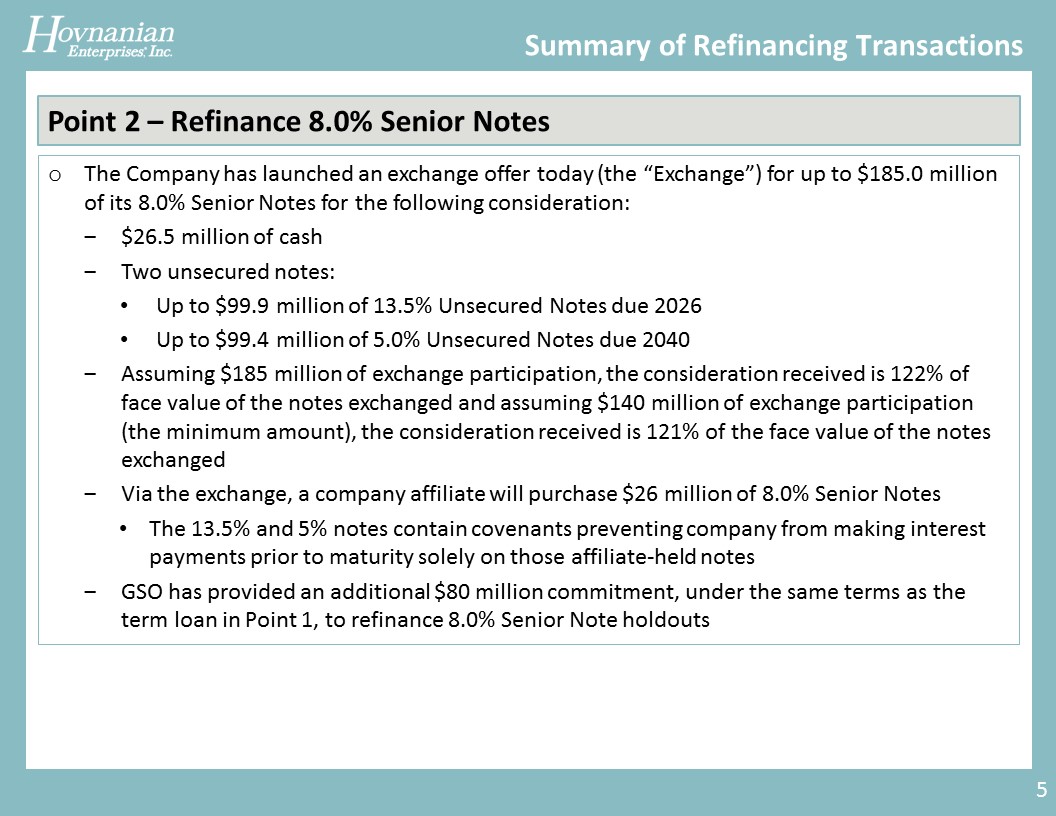

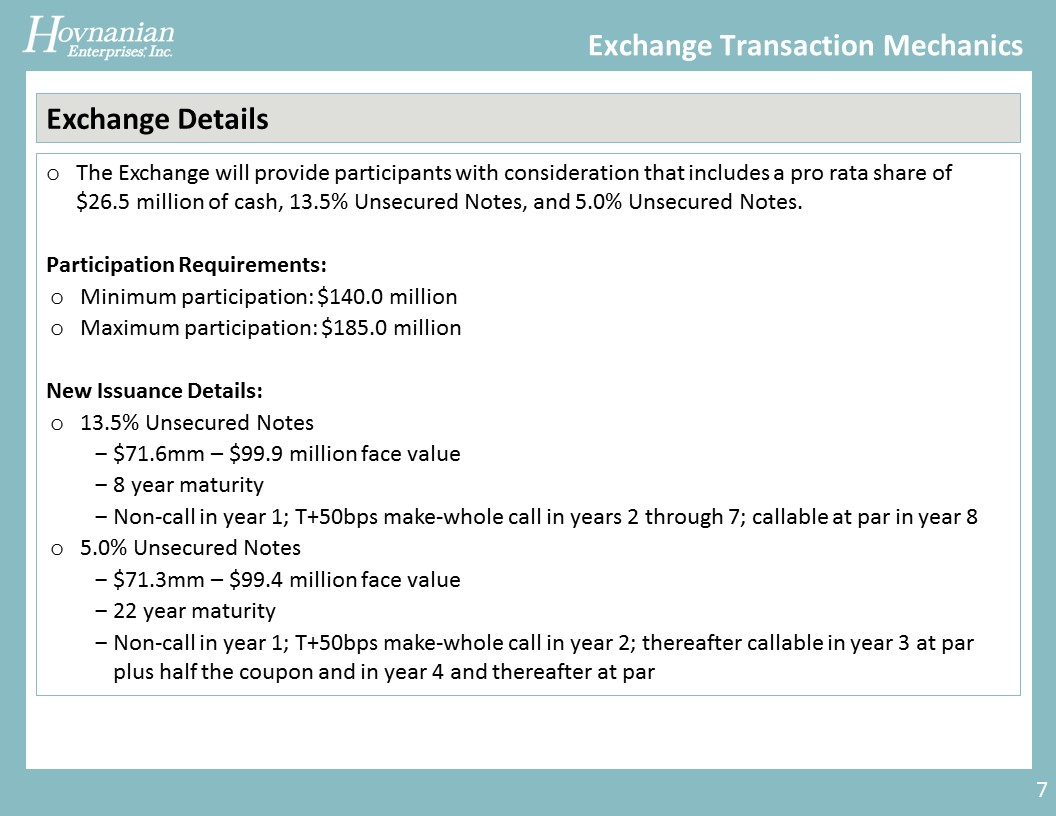

This Current Report on Form 8-K/A of Hovnanian Enterprises, Inc. (“Hovnanian”) amends Hovnanian’s Current Report on Form 8-K filed on December 28, 2017 (the “Initial 8-K”). This amendment is being furnished solely to correct certain typographical errors in slide 7 of Hovnanian’s slide presentation entitled “Refinancing Transaction” (the “Presentation”) and filed as Exhibit 99.5 to the Initial 8-K filing.

Due to typographical error, in the final bullet under “5.0% Unsecured Notes” on slide 7, the Presentation erroneously stated “thereafter callable in year 3 at half the coupon . . . .” This statement should read “thereafter callable in year 3 at par plus half the coupon. . . .” There are no changes to the Presentation other than these corrective changes to slide 7 and all other content and information contained in the Initial 8-K filing remains the same as that which was contained in the Initial 8-K filing. This Amendment supersedes in its entirety the Initial 8-K filing with respect to the Presentation only. A copy of the corrected Presentation is attached as Exhibit 99.5.

The information furnished pursuant to Item 7.01 in this report on Form 8-K/A shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, unless Hovnanian specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

* * * *

All statements in this Current Report on Form 8-K/A that are not historical facts should be considered as “Forward-Looking Statements” within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Although the Company believes that our plans, intentions and expectations reflected in, or suggested by, such forward-looking statements are reasonable, we can give no assurance that such plans, intentions or expectations will be achieved. By their nature, forward-looking statements: (i) speak only as of the date they are made, (ii) are not guarantees of future performance or results and (iii) are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Therefore, actual results could differ materially and adversely from those forward-looking statements as a result of a variety of factors. Such risks, uncertainties and other factors include, but are not limited to, (1) changes in general and local economic, industry and business conditions and impacts of a sustained homebuilding downturn; (2) adverse weather and other environmental conditions and natural disasters; (3) levels of indebtedness and restrictions on the Company’s operations and activities imposed by the agreements governing the Company’s outstanding indebtedness; (4) the Company's sources of liquidity; (5) changes in credit ratings; (6) changes in market conditions and seasonality of the Company’s business; (7) the availability and cost of suitable land and improved lots; (8) shortages in, and price fluctuations of, raw materials and labor; (9) regional and local economic factors, including dependency on certain sectors of the economy, and employment levels affecting home prices and sales activity in the markets where the Company builds homes; (10) fluctuations in interest rates and the availability of mortgage financing; (11) changes in tax laws affecting the after-tax costs of owning a home; (12) operations through joint ventures with third parties; (13) government regulation, including regulations concerning development of land, the home building, sales and customer financing processes, tax laws and the environment; (14) product liability litigation, warranty claims and claims made by mortgage investors; (15) levels of competition; (16) availability and terms of financing to the Company; (17) successful identification and integration of acquisitions; (18) significant influence of the Company’s controlling stockholders; (19) availability of net operating loss carryforwards; (20) utility shortages and outages or rate fluctuations; (21) geopolitical risks, terrorist acts and other acts of war; (22) increases in cancellations of agreements of sale; (23) loss of key management personnel or failure to attract qualified personnel; (24) information technology failures and data security breaches; (25) legal claims brought against the Company and not resolved in the Company’s favor; and (26) certain risks, uncertainties and other factors described in detail in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2017 and subsequent filings with the Securities and Exchange Commission. Except as otherwise required by applicable securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are attached to this Current Report on Form 8-K/A:

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.5 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HOVNANIAN ENTERPRISES, INC. (Registrant) |

|

|

|

|

|

|

|

|

|

By: |

/s/ J. Larry Sorsby |

|

|

|

|

Name: J. Larry Sorsby |

|

|

|

|

Title: Executive Vice President and Chief Financial Officer |

|

Date: December 29, 2017

4

Exhibit 99.5