Form DEF 14A Destination Maternity For: Oct 19

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

DESTINATION MATERNITY CORPORATION

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | |||

Table of Contents

232 Strawbridge Drive

Moorestown, New Jersey 08057

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

October 19, 2017

To the Stockholders of Destination Maternity Corporation:

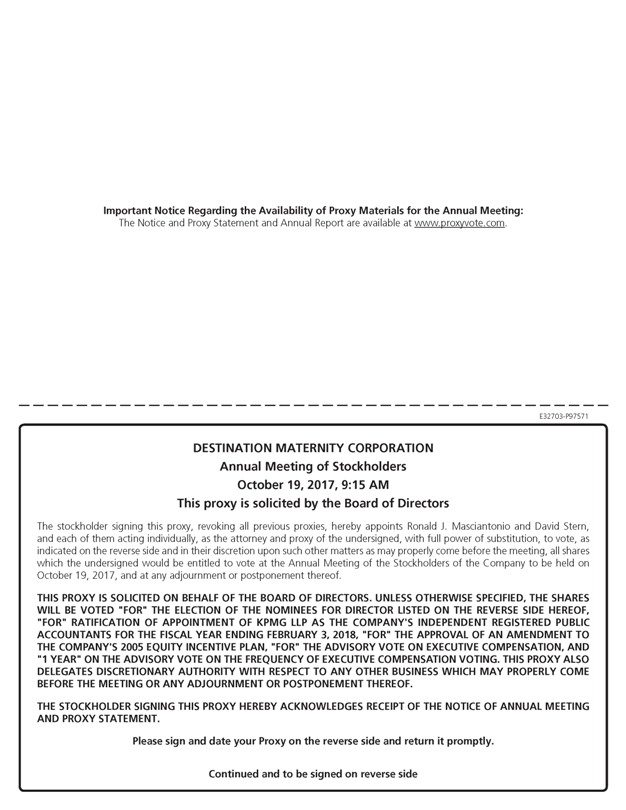

The Annual Meeting of Stockholders of Destination Maternity Corporation, a Delaware corporation (the “Company”), will be held at 9:15 a.m. Eastern Standard Time, on Thursday, October 19, 2017, at the corporate headquarters of the Company at 232 Strawbridge Drive, Moorestown, NJ 08057, for the following purposes:

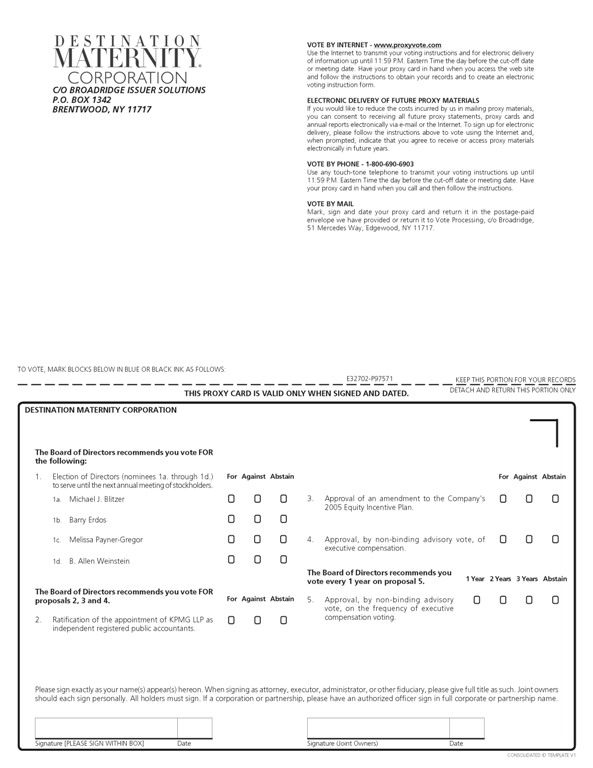

| 1. | To elect four directors of the Company; |

| 2. | To ratify the action of the Audit Committee of the Board of Directors in appointing KPMG LLP (“KPMG”) as independent registered public accountants to audit the consolidated financial statements of the Company and its subsidiaries for the fiscal year ending February 3, 2018 and the Company’s internal control over financial reporting as of February 3, 2018; |

| 3. | To approve an amendment to the Company’s 2005 Equity Incentive Plan (as amended and restated, the “2005 Plan”) which would authorize the Company to grant an additional 1,000,000 shares of common stock in respect of awards under the 2005 Plan, with 625,000 of such additional shares of common stock issuable in respect of awards of restricted stock or restricted stock units; |

| 4. | To hold an advisory vote on executive compensation; |

| 5. | To hold an advisory vote on the frequency of executive compensation voting; and |

| 6. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Only holders of the Company’s common stock at the close of business on September 18, 2017 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Such stockholders may vote in person or by proxy. The stock transfer books of the Company will not be closed. The accompanying form of proxy is solicited by the Board of Directors of the Company.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, OCTOBER 19, 2017:

The Notice of Annual Meeting, Proxy Statement and Annual Report are available at

http://investor.destinationmaternity.com.

By Order of the Board of Directors

B. Allen Weinstein

Chief Executive Officer

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON, YOU ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE SELF-ADDRESSED ENVELOPE, ENCLOSED FOR YOUR CONVENIENCE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE YOUR SHARES BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE PROXY CARD. IF YOU DECIDE TO ATTEND THE MEETING AND WISH TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY BY WRITTEN NOTICE AT THAT TIME.

September 21, 2017

Table of Contents

PROXY STATEMENT

| Topic |

Page | |||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

10 | |||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| Consideration of Most Recent Stockholder Advisory Vote on Executive Compensation |

13 | |||

| 13 | ||||

| Total Compensation and Allocation Between Compensation Elements |

13 | |||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 20 | ||||

| 20 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 34 | ||||

| 34 | ||||

| Proposal 2—Ratification of Appointment of Independent Registered Public Accountants |

36 | |||

| Proposal 3—Approval of an amendment to the Company’s 2005 Equity Incentive Plan |

38 | |||

| 45 | ||||

| Proposal 5—Advisory Vote on the Frequency of Executive Compensation Voting |

46 | |||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| Appendix A—Destination Maternity Corporation Amended and Restated 2005 Equity Incentive Plan |

A-1 | |||

Table of Contents

232 Strawbridge Drive

Moorestown, New Jersey 08057

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

OCTOBER 19, 2017

This proxy statement, which is first being mailed to stockholders on approximately September 21, 2017, is furnished in connection with the solicitation by the Board of Directors of Destination Maternity Corporation (the “Company”) of proxies to be used at the 2017 Annual Meeting of Stockholders of the Company (the “Annual Meeting”), to be held at 9:15 a.m., Eastern Standard Time, on Thursday, October 19, 2017, at 232 Strawbridge Drive, Moorestown, NJ 08057, and at any adjournments or postponements thereof. If proxies in the accompanying form are properly executed and returned prior to voting at the meeting, the shares of the Company’s common stock (“Common Stock”) represented thereby will be voted as instructed on the proxy. If no instructions are given on a properly executed and returned proxy, the shares of the Common Stock represented thereby will be voted for the election of the nominees for director named below, for the ratification of the appointment of KPMG LLP as independent registered public accountants, for the amendment of the Company’s 2005 Equity Incentive Plan, for approval, on an advisory basis, of the compensation of the Company’s named executive officers, for approval, on an advisory basis, of the holding of advisory stockholder votes on executive compensation once every calendar year, and in support of management on such other business as may properly come before the Annual Meeting or any adjournments thereof. Any proxy may be revoked by a stockholder prior to its exercise upon written notice to the Secretary of the Company, by delivering a duly executed proxy bearing a later date, or by the vote of a stockholder cast in person at the Annual Meeting.

Holders of record of Common Stock on September 18, 2017 will be entitled to vote at the Annual Meeting or any adjournments or postponements thereof. As of that date, there were 13,960,777 shares of Common Stock outstanding and entitled to vote. The presence, in person or by proxy, of holders of Common Stock entitled to cast at least a majority of the votes which all holders of the Common Stock are entitled to cast will constitute a quorum for purposes of the transaction of business. Each share of Common Stock entitles the holder thereof to one vote on the election of each of the nominees for director and on any other matter that may properly come before the Annual Meeting. Stockholders are not entitled to cumulative voting in the election of directors.

The Company’s By-laws provide for majority voting in uncontested director elections. Because the number of nominees properly nominated for the Annual Meeting is the same as the number of directors to be elected at the Annual Meeting, the election of directors is an uncontested election. As a result, in order to be elected, a nominee must receive a majority of the votes cast with respect to his or her election (or re-election, in the case of any nominee who is an incumbent director), which means the number of votes “for” a nominee must exceed the number of votes “against” that nominee. Abstentions are not counted as votes cast. Incumbent nominees have

1

Table of Contents

tendered a contingent resignation which would become effective if (i) the nominee does not receive a majority of the votes cast with respect to his or her election at the Annual Meeting and (ii) the Board of Directors accepts such resignation. Adoption of Proposals 2, 3, 4 and 5 require the affirmative vote of the majority of shares of Common Stock present in person or represented by proxy and entitled to vote at the meeting.

Abstentions and broker non-votes (described below) are counted in determining whether a quorum is present. Abstentions with respect to any proposal other than the election of directors (Proposal 1) will have the same effect as votes against the proposal, because, in the case of all other proposals approval requires a vote in favor of the proposal by a majority of the shares entitled to vote present at the Annual Meeting in person or represented by proxy. A “broker non-vote” occurs when a broker submits a proxy that does not indicate a vote for some of the proposals because the beneficial owners have not instructed the broker on how to vote on such proposals and the broker does not have discretionary authority to vote in the absence of instructions. Brokers are entitled to vote uninstructed shares with respect to the ratification of the selection of independent registered public accountants, but brokers are not entitled to vote uninstructed shares with respect to other matters. Broker non-votes are not considered to be shares “entitled to vote” (other than for quorum purposes), and will therefore have no effect on the outcome of any of the matters to be voted upon at the Annual Meeting.

The cost of solicitation of proxies by the Board of Directors will be borne by the Company. Proxies may be solicited by mail, personal interview, telephone or facsimile and, in addition, directors, officers and regular employees of the Company may solicit proxies by such methods without additional remuneration. Banks, brokerage houses and other institutions, nominees or fiduciaries will be requested to forward the proxy materials to beneficial owners in order to solicit authorizations for the execution of proxies. The Company will, upon request, reimburse such banks, brokerage houses and other institutions, nominees and fiduciaries for their expenses in forwarding such proxy materials to the beneficial owners of the Common Stock.

2

Table of Contents

Board of Directors Leadership Structure

The Board of Directors’ policy is that the roles of the Non-Executive Chair of the Board of Directors and the Chief Executive Officer should be separate and should not be held simultaneously by the same individual, thus enabling the Board of Directors to benefit from independent leadership. Mr. Arnaud Ajdler, an independent director, had served as the Non-Executive Chair of the Board of Directors since the Annual Meeting held in February 2011. Mr. Barry Erdos, an independent member of the Board of Directors since 2010, was elected by the Board of Directors to succeed Mr. Ajdler as Non-Executive Chair effective September 7, 2017. Mr. Ajdler has not been nominated for re-election to the Board of Directors and his term on the Board of Directors will expire at the Annual Meeting.

Inasmuch as the Non-Executive Chair of the Board of Directors has been independent, the Board of Directors does not believe that a lead independent director will be currently necessary. However, the Board of Directors in executive session will establish a lead independent director in the event of the need for emergency succession actions with respect to either or both the Non-Executive Chair and the Chief Executive Officer or for other purposes as the Board of Directors may determine. The independent directors who chair the Company’s Audit, Compensation, and Nominating and Corporate Governance Committees also provide leadership to the Board of Directors in their assigned areas of responsibility. The Board of Directors believes its current structure and operation as described here properly safeguard the independence of the Board of Directors.

Corporate Governance Principles

We maintain Corporate Governance Principles that provide a structure within which directors and management can effectively pursue the Company’s objectives for the benefit of its stockholders. Our Corporate Governance Principles are available on the Company’s investor website at http://investor.destinationmaternity.com or are available to our stockholders by writing to our Secretary at the following address: Destination Maternity Corporation, Attention: Secretary, 232 Strawbridge Drive, Moorestown, New Jersey 08057.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is designed to promote the highest standards of business conduct in our relationships with each other and with our customers, suppliers and others. The Code of Business Conduct and Ethics contains basic principles to guide directors, officers and employees of our Company. Our Code of Business Conduct and Ethics is available on the Company’s investor website at http://investor.destinationmaternity.com or is available to our stockholders by writing to our Secretary at the following address: Destination Maternity Corporation, Attention: Secretary, 232 Strawbridge Drive, Moorestown, New Jersey 08057.

Board of Directors Independence

The Company’s Corporate Governance Principles require that a majority of the Company’s directors be independent. The Nasdaq Stock Market listing standards require that a majority of the Company’s directors be independent and that the Audit, Compensation, and Nominating and Corporate Governance Committees be comprised entirely of independent directors. The Board of Directors has adopted standards to assist it in making the annual determination of each director’s independence status. These director independence standards, which are set forth in our Corporate Governance Principles, are consistent with the Nasdaq listing standards. A director will be considered “independent” if he or she meets the requirements of our director independence standards and the independence criteria in the Nasdaq listing standards.

3

Table of Contents

The Board of Directors has affirmatively determined that all of the Company’s current and nominee directors other than Mr. Weinstein, our interim Chief Executive Officer, have no direct or indirect material relationship with the Company and satisfy the requirements to be considered independent.

The Board of Directors has determined that each of the Company’s current Audit, Compensation, and Nominating and Corporate Governance Committees is composed solely of independent directors. Independence for Audit Committee purposes requires compliance with applicable independence rules of the Securities and Exchange Commission (the “SEC”) in addition to the Nasdaq listing standards. In making the independence determinations for the Board of Directors and its committees, the Board of Directors reviewed all of the directors’ relationships with the Company. This review is based primarily on a review of the responses of the directors to questions regarding employment, business, family, compensation and other relationships with the Company and its management.

Compensation Committee Interlocks and

Insider Participation

None of the members of the Compensation Committee is currently or has been an officer or employee of the Company. No interlocking relationship exists between any member of the Company’s Board of Directors and the compensation committee of any other company.

Committee Meetings

During the year ended January 28, 2017 (“fiscal year 2016”), the Board of Directors held 11 meetings that were called and held in person and six meetings that were called and held telephonically. Each incumbent director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and committees of the Board of Directors on which he or she served.

We expect all of our directors to attend the annual meetings of stockholders. All of our then-current directors attended last year’s annual meeting of stockholders.

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee. During fiscal year 2016, the Audit Committee, which consisted throughout the fiscal year and currently consists of Mr. Erdos, Chair, Mr. Michael J. Blitzer, and Ms. Payner-Gregor, held four meetings that were called and held in person and one meeting that was called and held telephonically. Mr. Erdos is designated as the “audit committee financial expert.” Mr. Erdos has no direct or indirect material relationship with the Company and satisfies the independence criteria in the Nasdaq listing standards. The function of the Audit Committee is to assist the Board of Directors in preserving the integrity of the financial information published by the Company through the review of financial and accounting controls and policies, financial reporting requirements, alternative accounting principles that could be applied and the quality and effectiveness of the independent registered public accountants. The Audit Committee’s charter is posted on the Company’s investor website at http://investor.destinationmaternity.com.

Compensation Committee. During fiscal year 2016, the Compensation Committee, which consisted of Mr. B. Allen Weinstein, Chair, Mr. Ajdler, and Mr. Erdos throughout the fiscal year, held one meeting that was called and held in person and eight meetings that were called and held telephonically. The Compensation Committee considers recommendations of the Company’s management regarding compensation, bonuses and fringe benefits of the executive officers of the Company, and determines whether the recommendations of management are consistent with general policies, practices, and compensation scales established by the Board of

4

Table of Contents

Directors. In addition, the Compensation Committee administers the Company’s equity-based compensation plans. The Compensation Committee also reviews, and discusses with management, the Compensation Discussion and Analysis (“CD&A”) to be included in the Company’s annual proxy statement or annual report, as applicable, and determines whether to recommend to the Board of Directors that the CD&A be included in the proxy statement or annual report. Effective September 7, 2017, Mr. Weinstein resigned from the Compensation Committee in connection with his election as interim Chief Executive Officer. The Compensation Committee’s charter is posted on the Company’s investor website at http://investor.destinationmaternity.com.

Nominating and Corporate Governance Committee. During fiscal year 2016, the Nominating and Corporate Governance Committee, which consisted throughout the fiscal year and currently consists of Ms. Melissa Payner-Gregor, Chair, and Mr. Ajdler, did not hold any meetings. The Nominating and Corporate Governance Committee functions include establishing the criteria for selecting candidates for nomination to the Board of Directors, actively seeking candidates who meet those criteria, and making recommendations to the Board of Directors of nominees to fill vacancies on, or as additions to, the Board of Directors.

The Nominating and Corporate Governance Committee will consider director candidates who have relevant business experience, are accomplished in their respective fields, and who possess the skills and expertise to make a significant contribution to the Board of Directors, the Company and its stockholders. It is the Nominating and Corporate Governance Committee’s policy to consider Director nominees in a manner that seeks to produce the best candidates with a diversity of qualities, backgrounds and complementary skills. Director nominees should have high-leadership business experience, knowledge about issues affecting the Company and the ability and willingness to apply sound and independent business judgment. The Nominating and Corporate Governance Committee applies the same criteria to nominees recommended by stockholders. Such recommendations should be submitted in writing to the attention of the Nominating and Corporate Governance Committee, c/o Destination Maternity Corporation, 232 Strawbridge Drive, Moorestown, New Jersey 08057, and should not include self-nominations. The Nominating and Corporate Governance Committee’s charter is posted on the Company’s investor website at http://investor.destinationmaternity.com.

Board of Directors Role in Risk Oversight

The Board of Directors takes an active role in risk oversight. The Board of Directors oversees the Company’s strategic planning and the risks inherent in the operation of its business. The Board of Directors administers its risk oversight function through the full Board of Directors and each of its committees. Management of the Company, which is responsible for day-to-day risk management, identifies and assesses the Company’s risks on a regular basis, and develops steps to mitigate and manage risks. The Board of Directors exercises its risk oversight function by making inquiries of management with respect to areas of particular interest. Each of the committees of the Board of Directors is responsible for oversight of risk management practices for categories of top risks relevant to their functions, as summarized below.

The Audit Committee assists the Board of Directors with its risk oversight in a variety of areas, including financial reporting, internal controls, and legal and regulatory compliance. The Audit Committee has oversight of the Company’s internal audit function and the Company’s Code of Business Conduct and Ethics. The Audit Committee also appoints the independent registered public accounting firm and approves the services it provides to the Company. The Compensation Committee oversees risk in connection with compensation programs, including incentive compensation plans and equity-based plans. The Nominating and Corporate Governance Committee oversees risk in connection with corporate governance practices. All of these committees make regular reports of their activities to the full Board of Directors.

5

Table of Contents

Pursuant to our Non-Employee Director Compensation Policy, during fiscal 2016 each of our non-employee directors was entitled to receive a retainer of $12,500 per quarter. In addition, during fiscal 2016, each non-employee director who is a member of a committee was paid an additional quarterly retainer as follows:

| Additional Quarterly Retainer ($) |

||||

| Audit Committee Chair |

3,750 | |||

| Audit Committee Member |

1,875 | |||

| Compensation Committee Chair |

3,750 | |||

| Compensation Committee Member |

1,250 | |||

| Nominating and Corporate Governance Committee Chair |

2,500 | |||

| Nominating and Corporate Governance Committee Member |

1,250 | |||

During fiscal 2016, our Non-Executive Chair received an additional retainer of $6,250 per quarter. Except as described below under “M&A Committee Compensation,” during fiscal 2016 non-employee directors did not receive any additional compensation for participation in either board or committee meetings. However, members of our Board of Directors are reimbursed for their reasonable travel expenses incurred to attend meetings of our Board of Directors or committees of the Board of Directors on which they serve.

Upon conclusion of our 2016 Annual Meeting of Stockholders, the Company granted each non-employee director 4,000 shares of restricted stock that vest on the earlier of: (1) one year from the date of grant, or (2) one day before the Company’s next Annual Meeting of Stockholders, subject to acceleration in the event of the non-employee director’s death or disability or upon a change in control of the Company. Further, our Non-Executive Chair received an additional 2,000 shares of restricted stock, which additional shares are subject to vesting on the same basis as described above with respect to the 4,000 share award received by all non-employee directors.

In April 2016, the Compensation Committee approved an amendment to the Company’s Non-Employee Director Compensation Policy to allow directors to elect to receive their quarterly cash retainer for Board service (but not for Committee service) and their annual equity compensation for the following calendar year in the form of deferred stock units in lieu of restricted stock. These deferred stock units will vest on the same terms as the restricted stock, but they will not result in the delivery of shares of common stock to the director until the director eventually leaves the Board (whether by virtue of expiration of such director’s term, removal, resignation or other reason), subject to acceleration in the event of the non-employee director’s death or disability or upon a change in control of the Company. The full text of the revised Non-Employee Director Compensation Policy is posted on our investor website at http://investor.destinationmaternity.com.

The Company’s equity ownership guidelines applicable to named executive officers and non-employee directors require each non-employee director to own shares of the Company’s common stock having an aggregate fair market value equal to or greater than four times the annual cash retainer then payable to such non-employee director, measured as of the date of each Annual Meeting of Stockholders. Any non-employee director elected for the first time following the adoption of these guidelines will have three years from the date of such initial election to satisfy the guidelines. Under the terms of the April 2016 amendment to the Company’s Non-Employee Director Compensation Policy, any non-employee director who is not in compliance with the Company’s equity ownership guidelines will be required to receive his or her quarterly retainer for Board service (but not for committee service) and any future annual equity compensation award in the form of deferred stock units.

Due to the current low market price of the Company’s common stock, currently none of our non-employee directors for whom the equity ownership guidelines are effective hold Company equity in excess of the

6

Table of Contents

guidelines’ requirement. The Compensation Committee further notes that none of these directors have sold equity during their time as directors.

Pursuant to the Company’s Non-Employee Director Compensation Policy, each of our non-employee directors received 3,658 deferred stock units in calendar 2016 in payment for the two quarterly retainers that would otherwise have been payable to them in cash during the period between the April 2016 amendment of our Non-Employee Director Compensation Policy and December 19, 2016, the date of the signing of the Agreement and Plan of Merger (the “Merger Agreement”) between the Company and Orchestra-Prémaman S.A. (“Orchestra”) and its wholly owned subsidiary, US OP Corporation (“Merger Sub”). Under the terms of the Merger Agreement, the Company was restricted from issuing equity awards during the pre-closing period. As such, commencing on the date of the Merger Agreement, the Compensation Committee waived compliance with the requirement that non-employee directors who were not in compliance with the Company’s equity ownership guidelines receive their quarterly retainers for Board service in the form of deferred stock units in lieu of cash. Accordingly, all non-employee directors received payment of their quarterly retainer for the fourth quarter of fiscal 2016 and the first quarter of fiscal 2017 in cash.

The Merger Agreement was terminated by mutual agreement of the parties on July 27, 2017. Accordingly, the Company is no longer restricted from issuing equity awards to directors and others. Nevertheless, because of the current low market price of the Company’s common stock, the Board of Directors determined to waive the requirement that non-employee directors that are not in compliance with the equity ownership guidelines of our Non-Employee Director Compensation Policy receive their quarterly retainers for Board service through calendar 2018 in the form of deferred stock units in lieu of cash, due to the concern that issuance of deferred stock units to non-employee directors in payment of their quarterly retainer for Board service would be excessively dilutive to stockholders.

M&A Committee Compensation

In December 2015, our Board of Directors formed an M&A Committee consisting of Messrs. Erdos, Ajdler and J. Daniel Plants to evaluate potential strategic transactions. Mr. Erdos served as Chair of the M&A Committee. Our Board of Directors approved compensation for members of the M&A Committee in addition to the compensation paid to non-employee directors generally.

Specifically, in March 2016, Messrs. Erdos, Ajdler and Plants were granted 5,547, 4,160 and 4,160 shares of restricted stock, respectively, for their service on the M&A Committee. These shares were subject to vesting based on the continued service of the grantee through the earliest of (i) the day prior to our 2017 annual meeting of stockholders, (ii) a cessation of the grantee’s service other than due to his resignation, or (iii) a change in control of the Company.

In addition, each member of the M&A Committee received (i) $1,500 per M&A Committee meeting attended after December 2, 2016, and (ii) $750 per meeting of the Board of Directors attended after December 2, 2016, if that meeting was called at the request of the M&A Committee. The members of the M&A Committee were also reimbursed for reasonable travel and other out-of-pocket expenses incurred in connection with their service on the M&A Committee.

Our other non-employee directors (i.e., those who did not serve on the M&A Committee) received $750 for each meeting of our Board of Directors that he or she attended after March 11, 2016, if that meeting was called at the request of the M&A Committee.

Following the execution of the Merger Agreement, the Board of Directors concluded that the M&A Committee had concluded its work and disbanded the M&A Committee on January 15, 2017.

***

7

Table of Contents

In fiscal year 2016, our non-employee directors received the following compensation:

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) (1)(2) |

Total ($) | |||||||||

| Arnaud Ajdler |

95,500 | 66,774 | 162,274 | |||||||||

| Michael J. Blitzer |

39,250 | 49,524 | 88,774 | |||||||||

| Barry Erdos |

88,000 | 64,514 | 152,514 | |||||||||

| J. Daniel Plants (3) |

66,303 | 54,514 | 120,817 | |||||||||

| Melissa Payner-Gregor |

62,245 | 49,524 | 111,769 | |||||||||

| William A. Schwartz, Jr. (4) |

14,375 | — | 14,375 | |||||||||

| B. Allen Weinstein |

51,750 | 49,524 | 101,274 | |||||||||

| (1) | Upon conclusion of the Annual Meeting of Stockholders on May 19, 2016, in accordance with the Company’s Non-Employee Director Compensation Policy, the Company granted each non-employee director who was then serving on the Board of Directors at that time 4,000 shares of restricted stock with a grant date fair value of $24,520, and granted an additional 2,000 shares of restricted stock to Mr. Ajdler for his service as Non-Executive Chairman with a grant date fair value of $12,260. On March 30, 2016, the Company granted 5,547, 4,160 and 4,160 shares of restricted stock to Messrs. Erdos, Ajdler and Plants, respectively, for their service on the M&A Committee. The grant date fair values of these additional restricted stock awards to Messrs. Erdos, Ajdler and Plants were $39,994, $29,994 and $29,994, respectively. On August 17, 2016, the Company granted 2,101 deferred stock units to each of Mr. Blitzer, Ms. Payner-Gregor and Mr. Weinstein with a grant date fair value of $12,501 per award. On November 17, 2016, the Company granted 1,557 deferred stock units to each of Mr. Blitzer, Ms. Payner-Gregor and Mr. Weinstein with a grant date fair value of $12,503 per award. These grant date fair values were computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“FASB ASC Topic 718”). |

| (2) | As of the end of fiscal 2016, our non-employee directors held the following unvested stock awards: |

| Name |

Restricted Stock (#) |

|||

| Arnaud Ajdler |

10,160 | |||

| Michael J. Blitzer |

4,000 | |||

| Barry Erdos |

9,547 | |||

| Melissa Payner-Gregor |

4,000 | |||

| B. Allen Weinstein |

4,000 | |||

| (3) | Mr. Plants resigned from the Board of Directors, effective December 20, 2016 and his unvested equity awards were cancelled effective at the time of such resignation. |

| (4) | Mr. Schwartz’s term of service as a member of the Board of Directors ended on May 19, 2016. |

Pursuant to the policy of the Board of Directors, all communications directed to the Board of Directors will be delivered to the Board of Directors. Stockholders may contact the Board of Directors by writing to them c/o Destination Maternity Corporation, 232 Strawbridge Drive, Moorestown, New Jersey 08057.

Certain Relationships and Related Party Transactions

Our Board of Directors recognizes that related party transactions present a heightened risk of conflicts of interest and/or improper valuation (or the perception thereof). Pursuant to the Company’s Code of Business Conduct and Ethics, information about transactions involving related parties is reviewed by the Audit

8

Table of Contents

Committee. It is the Company’s policy that all business decisions will reflect independent judgment and discretion, uninfluenced by considerations other than those honestly believed to be in the best interests of the Company and its stockholders. Any direct or indirect conflict of interest between the Company and any director, officer or employee is prohibited unless otherwise consented to by the General Counsel or the Audit Committee in accordance with the Code of Business Conduct and Ethics. Related parties include Company directors, nominees for director, and executive officers, as well as their immediate family members. Related party transactions include transactions, arrangements or relationships pursuant to which the judgment and discretion of a director, officer or employee is or may be influenced by considerations of personal gain or benefit, or gain or benefit to a third party, whether or not affiliated with the director, officer or employee.

When reviewing a related party transaction, the Audit Committee will use any process and review any information that it determines is appropriate. The Audit Committee takes into consideration all of the relevant facts and circumstances available to it, including (if applicable), but not limited to: (i) the material terms and conditions of the transaction or transactions; (ii) the related party’s relationship to the Company; (iii) the related party’s interest in the transaction, including their position or relationship with, or ownership of, any entity that is a party to or has an interest in the transaction; (iv) the approximate dollar value of the transaction; (v) the availability from other sources of comparable products or services; and (vi) an assessment of whether the transaction is on terms that are comparable to the terms available to us from an unrelated third party. All related party transactions will be disclosed in accordance with SEC rules.

In the event the Company becomes aware of a related party transaction that was not previously approved or ratified by the Audit Committee or management, the Company shall evaluate all options available, including ratification, revision or termination of the transaction.

On December 19, 2016, Destination Maternity Corporation entered into the Merger Agreement with Orchestra and Merger Sub, providing for the merger of Merger Sub with and into the Company, with the Company surviving as a wholly-owned subsidiary of Orchestra. A more complete summary of the terms of the Merger Agreement is set forth under the heading “Recent Developments—Agreement and Plan of Merger” of the Company’s Annual Report on Form 10-K for the fiscal year ended January 28, 2017 (the “Form 10-K”), filed with the SEC on April 13, 2017, and such summary is incorporated herein by reference. The Merger Agreement was terminated by mutual agreement of the parties on July 27, 2017, as more fully described in the Company’s Current Report on Form 8-K filed with the SEC on July 27, 2017, which is incorporated herein by reference.

As a consequence of the termination of the Merger Agreement and the related mutual release among the parties, the other business agreements between the Company and its affiliates, on the one hand, and Orchestra and its affiliates, on the other hand, were terminated, including a retail consulting agreement, a consulting agreement for construction project management and architectural services and a product purchase agreement, as well as an executive employment agreement among Orchestra, Merger Sub and Ronald J. Masciantonio. More complete summaries of the terms of these agreements is set forth in Item 13—Certain Relationships and Related Transactions, and Director Independence, in Amendment No. 1 to the Form 10-K, filed with the SEC on May 26, 2017, and such summaries are incorporated herein by reference.

9

Table of Contents

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of September 8, 2017, except as otherwise noted, with respect to the beneficial ownership of shares of Common Stock by each person who is known to us to be the beneficial owner of more than five percent of the outstanding shares of Common Stock, by each director or nominee for director, by each of the Company’s named executive officers, and by all directors and executive officers as a group. Unless otherwise indicated, each person has sole voting power and sole investment power.

| Common Stock | ||||||||

| Name and Address of Beneficial Owner (a) |

Amount and Nature of Beneficial Ownership (#) |

Percent of Class (%) (b) |

||||||

| B. Allen Weinstein |

33,600 | (c) | * | |||||

| Ronald J. Masciantonio |

118,376 | (d) | * | |||||

| David Stern |

33,882 | (e) | * | |||||

| Arnaud Ajdler |

57,036 | (f) | * | |||||

| Michael J. Blitzer |

24,522 | (c) | * | |||||

| Barry Erdos |

60,147 | (g) | * | |||||

| Melissa Payner-Gregor |

35,376 | (c) | * | |||||

| Anthony M. Romano |

277,625 | (h) | * | |||||

| Judd Tirnauer |

0 | (i) | * | |||||

| Towle & Co. |

2,097,818 | (j) | 15.0 | % | ||||

| 1610 Des Peres Road, Suite 250 |

||||||||

| St. Louis, MO 63131 |

||||||||

| Yeled |

1,922,820 | (k) | 13.8 | % | ||||

| 318 rue de Neudorf |

||||||||

| L-2222 Luxembourg |

||||||||

| Renaissance Technologies LLC |

781,400 | (l) | 5.6 | % | ||||

| 800 Third Avenue |

||||||||

| New York, NY 10022 |

||||||||

| Royce and Associates, LP |

769,967 | (m) | 5.5 | % | ||||

| 745 Fifth Avenue |

||||||||

| New York, NY 10151 |

||||||||

| All current directors and officers as a group (8 persons) |

378,429 | (n) | 2.7 | % | ||||

| * | Less than 1% of the outstanding Common Stock or less than 1% of the voting power. |

| (a) | Except as otherwise indicated, the address of each person named in the table is: c/o Destination Maternity Corporation, 232 Strawbridge Drive, Moorestown, New Jersey 08057. |

| (b) | Based upon 13,960,777 shares of common stock issued and outstanding as of September 8, 2017. |

| (c) | Includes 4,000 shares of unvested restricted stock expected to be granted upon completion of the Annual Meeting under the Company’s Non-Executive Director Compensation Policy, subject to this non-employee’s re-election as a director. |

| (d) | Includes 820 shares of unvested restricted stock from the December 4, 2013 grant of 3,279 shares, which shares vest on December 4, 2017, 4,069 shares of unvested restricted stock from the December 5, 2014 grant of 8,138 shares, of which 2,034 shares vest on December 5, 2017 and 2,035 shares vest on December 5, 2018, and 8,763 shares of unvested restricted stock from the March 30, 2016 grant of 11,683 shares, of which 2,921 shares vest on each of March 30, 2018, March 30, 2019, and March 30, 2020. Also includes 91,161 shares purchasable upon exercise of stock options owned (or which may be deemed to be owned) as of September 8, 2017 or 60 days thereafter. |

| (e) | Includes 11,677 shares of unvested restricted stock from the August 1, 2016 grant of 15,569 shares, of which 3,892 shares vested on August 1, 2017, 3,892 shares will vest on each of August 1, 2018 and August 1, 2019, and 3,983 shares vest on August 1, 2020. Also includes 18,313 shares purchasable upon exercise of stock options owned (or which may be deemed to be owned) as of September 8, 2017 or 60 days thereafter. |

10

Table of Contents

| (f) | Includes 4,160 shares of unvested restricted stock granted to Mr. Ajdler on March 30, 2016, which shares vest on the earlier of: (a) the end of the day immediately prior to the Annual Meeting; (b) the end of Mr. Ajdler’s service on the board of directors of Destination Maternity other than via resignation; and (c) a change in control of the Company (as defined in the Company’s Amended and Restated 2005 Equity Incentive Plan). |

| (g) | Includes 6,000 shares of unvested restricted stock expected to be granted upon completion of the Annual Meeting under the Company’s Non-Employee Director Compensation Policy, subject to Mr. Erdos’ re-election as a director and appointment as Non-Executive Chairman of the Board of Directors, and 5,547 shares of unvested restricted stock granted to Mr. Erdos on March 30, 2016, which shares vest on the earlier of: (a) the end of the day immediately prior to the Annual Meeting; (b) the end of Mr. Erdos’ service on the board of directors of Destination Maternity other than via resignation; and (c) a change in control of the Company (as defined in the Company’s Amended and Restated 2005 Equity Incentive Plan). |

| (h) | Includes 234,027 shares purchasable upon exercise of stock options owned (or which may be deemed to be owned) as of September 8, 2017 or 60 days thereafter. Mr. Romano’s employment terminated effective at the close of business on September 7, 2017. |

| (i) | Mr. Tirnauer’s employment terminated effective at the close of business on April 22, 2016. |

| (j) | Information is based on the Schedule 13G filed with the SEC on December 30, 2016. According to that filing, Towle & Co. beneficially owns all of the shares specified on the above table. |

| (k) | On May 2, 2016, Orchestra-Prémaman, delivered to Yeled substantially all of such Destination Maternity Shares for €16.4 million, for which payment of €16.2 million had already been made at the year-end close of February 29, 2016, the remainder of €0.2 million being due 10 days after the signing of the agreement. Orchestra-Prémaman has an option to buy back the stock within 26 months of the sale at the price for which it sold such Destination Maternity Shares to Yeled. |

| (l) | Information is based on the Schedule 13G/A filed with the SEC on February 14, 2017. According to that filing, Renaissance Technologies LLC (“RTC”), and Renaissance Technologies Holdings Corporation (“RTHC”), because of RTHC’s majority ownership of RTC, beneficially own all of the shares specified on the above table. Also according to that filing, certain funds and accounts managed by RTC have the right to receive dividends and proceeds from the sale of the shares. |

| (m) | Information is based on the Schedule 13G/A filed with the SEC on January 6, 2017. According to that filing, Royce & Associates, LLC beneficially owns all of the shares specified on the above table. |

| (n) | Includes the following number of shares purchasable upon exercise of stock options owned (or which may be deemed to be owned) by the following persons as of September 8, 2017 or 60 days thereafter: Anthony M. Romano—234,027, Ronald J. Masciantonio—91,161 and David Stern—18,313. Also includes the following number of shares of unvested restricted stock owned (or which may be deemed to be owned) by the following persons: Ronald J. Masciantonio—13,652, David Stern—11,677, Arnaud Ajdler—4,160, and Barry Erdos—5,547. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities (collectively, “Reporting Persons”) to file with the SEC initial reports of ownership (on Form 3) and reports of changes in ownership of the Common Stock and other equity securities of the Company (on Forms 4 and 5). Reporting Persons are additionally required to furnish us with copies of all Section 16(a) reports they file.

To our knowledge, based solely upon a review of the copies of such reports furnished to us, all Section 16(a) reports for the fiscal year ended January 28, 2017 were timely filed, with the exception of Orchestra, which did not timely file a Form 4 in connection with its sale of shares of Company common stock to its controlling stockholder.

11

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee of our Board of Directors (the “Committee”) has developed and implemented compensation policies, plans and programs that seek to enhance our profitability, and thus stockholder value, by aligning the financial interests of our senior management with those of our stockholders. Our compensation arrangements are designed to attract and retain corporate officers and other key employees and to motivate them to perform to the full extent of their abilities, in the best long-term interests of our stockholders.

The Company has historically operated on a fiscal year ending September 30 of each year. On December 4, 2014, the Company announced a change in its fiscal year to a 52/53 week retail calendar ending on the Saturday nearest January 31 of each year. The change was effective with the Company’s fiscal year 2015, which began February 1, 2015 and ended January 30, 2016. In each succeeding year, the fiscal year will end on the Saturday closest to January 31st. The foregoing change resulted in a four-month transition period from October 1, 2014 through January 31, 2015 (the “Transition Period” or “TP”). All references herein to the Company’s fiscal year 2015 and subsequent years refer to the fiscal years ending on the Saturday nearest January 31st of the following year. All references herein to the Company’s fiscal year 2014 and preceding years refer to the fiscal year ending on September 30 of each such year.

In the 2016 fiscal year, the Committee consisted of Mr. Weinstein, Chair, Mr. Ajdler, and Mr. Erdos. Through the end of the 2016 fiscal year, none of these individuals has ever been an officer or employee of the Company. Each member of the Committee is considered to be an “independent director” under Nasdaq rules and the rules of the SEC. The Report of the Compensation Committee is set forth below after this “Compensation Discussion and Analysis” section.

The Committee meets at least annually regarding compensation decisions. In fiscal year 2016, the Committee met nine times. Effective September 7, 2017, Mr. Weinstein resigned from the Committee in connection with his election as interim Chief Executive Officer.

Significant Corporate and Personnel Developments

In fiscal year 2016, our Chief Executive Officer and the rest of the senior management team, with the support of the Board, continued its efforts to strengthen the foundational operations of the Company with a view toward enabling scalable and repeatable success necessary to maximize long-term stockholder value. The focus of the management team’s efforts included: (1) continued refinement of the merchandising design and buying process through adoption of, and adherence to, a more disciplined product life cycle calendar; (2) implementation of significant internally developed tools to increase visibility into product performance; (3) implementation of a new industry standard product allocation tool; (4) continued efforts to significantly rationalize the Company’s product vendor base to better concentrate product orders and improve margin; (5) continued efforts to re-launch the Company’s ecommerce websites with a best in class SAAS (software as a service) provider improving customer experience and back end management; (6) implementation of a full real estate portfolio review with a view toward rationalizing distribution points; and (7) a continual effort to rationalize the expense base of the Company through rigorous expense management and profit maximizing initiatives.

It is the practice of the Committee to periodically review existing arrangements with our named executive officers to determine if such arrangements remain appropriate in the current commercial landscape. Whenever practicable, the Committee seeks to update existing arrangements to remove outdated terms and to otherwise ensure the arrangements remain effective and consistent with the best interests of our stockholders. In fiscal year 2016, the Committee took several actions in this regard as highlighted under the “Significant Actions Taken” section below.

12

Table of Contents

Consideration of Most Recent Stockholder Advisory Vote on Executive Compensation

During fiscal year 2016, we again conducted a “Say-On-Pay” stockholder advisory vote, as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The Committee appreciates that once again over 87% of the shares voting approved of our executive compensation and believes, therefore, that our stockholders are highly supportive of our executive compensation practices. Nevertheless, the Committee continues to refine our executive compensation practices in its ongoing effort to ensure that those practices support our corporate goals and values.

Significant compensation related actions taken during fiscal year 2016 and thereafter include the following:

| (1) | Establishing the compensation arrangements in connection with the appointment of David Stern as the Company’s Executive Vice President & Chief Financial Officer; |

| (2) | Establishment of certain retention and transaction bonus arrangements with both the Company’s Chief Executive Officer and Chief Administrative Officer, and modifications thereto, in connection with the Company’s process which resulted in the execution of the Merger Agreement; |

| (3) | The negotiation of an Amended and Restated Employment Agreement with the Company’s Executive Vice President and Chief Administrative Officer in connection with the Company’s process which resulted in the execution of the Merger Agreement; |

| (4) | Establishment of 2016 annual incentive goals, payout of the earned 2016 annual incentive to named executive officers other than the Chief Executive Officer; |

| (5) | The addition of a requirement that the payment of the Chief Executive Officer’s otherwise earned 2016 annual incentive be subject to the same conditions as the payment of his transaction bonus; |

| (6) | Approval of 2016 annual equity awards; |

| (7) | Establishment of 2017 annual incentive goals; |

| (8) | As discussed in more detail in the section entitled “Events Occurring after Fiscal Year-End” below, on September 7, 2017, the employment of Mr. Romano, the Company’s former Chief Executive Officer, terminated and Mr. Weinstein was appointed as the Company’s interim Chief Executive Officer; and |

| (9) | An increase to Mr. Masciantonio’s base salary effective September 7, 2017 in connection with the management changes described in (8) above. |

In addition to a discussion of our compensation philosophy in general, the following discussion highlights these specific decisions.

Total Compensation and Allocation Between Compensation Elements

Both the total amount of compensation paid to our named executive officers and the portion of total compensation represented by each element of compensation have been determined by the Committee with reference to each executive’s experience, capabilities, contributions and strategic importance, the pay levels for peer employees within the Company, the pay levels for similar positions at companies in our peer group and our performance as a whole. As further discussed below, in evaluating these considerations, the Committee sometimes solicits input from its compensation consultant, Korn Ferry Hay Group, an outside executive compensation consulting firm (“Korn Ferry”). The Committee worked with Korn Ferry to assist it in evaluating the Company’s executive compensation practices for senior management personnel and in developing and refining the Company’s peer group.

The input of Korn Ferry is given substantial weight and, in general, the Committee does not increase an executive’s total compensation, or any element of an executive’s compensation, unless it concludes that such

13

Table of Contents

increase was necessary to conform to the relevant peer group median or, based on the independent judgment and experience of the Committee members, was necessary for a strategic reason (e.g., the retention of a key executive).

The payments to Korn Ferry in fiscal year 2016 totaled $2,000.

The Committee has concluded that Korn Ferry’s work for us does not raise any conflict of interest. The Committee has also considered the independence of Korn Ferry. Because of policies and procedures Korn Ferry and the Committee have in place, the Committee is confident that the advice it receives from executive compensation consultants at Korn Ferry is objective and not influenced by Korn Ferry’s or its affiliates’ relationships with the Company or its officers. These policies and procedures include the following:

| • | the consultants receive no incentive or other compensation based on the fees charged to the Company for other services provided by Korn Ferry or any of its affiliates; |

| • | the consultants are not responsible for selling other Korn Ferry or affiliate services to the Company; |

| • | Korn Ferry’s professional standards prohibit the individual consultant from considering any other relationships Korn Ferry or its affiliates may have with the Company in rendering his or her advice and recommendations; |

| • | the consultants have direct access to the Committee without management intervention; |

| • | the Committee has the sole authority to retain and terminate Korn Ferry; and |

| • | the Committee evaluates the quality and objectivity of the services provided by Korn Ferry each year and determines whether to continue to retain Korn Ferry. |

In October 2015, Korn Ferry identified the following companies as our “peers”, both for purposes of benchmarking total compensation and individual pay elements:

| Bebe Stores, Inc. Build a Bear Workshop, Inc. Cato Corp. Christopher & Banks Corporation Citi Trends, Inc. Destination XL Group Francesca’s |

New York & Company, Inc. Pacific Sunwear Shoe Carnival, Inc. Stein Mart Tilly’s, Inc. Vera Bradley, Inc. Zumiez Inc. |

This list reflects a comprehensive revision of our peer group by Korn Ferry in consultation with the Committee. While some members of the earlier peer group were retained, others were removed because they had ceased to be publicly traded and/or replaced because their revenues and/or market capitalization had ceased to be reasonably comparable to ours. The resulting group contains companies within the retail apparel industry which Korn Ferry considers comparable to our Company. Consistent with its typical process, Korn Ferry considered the following guidelines when reviewing the peer group companies to be used in assessing the Company’s compensation programs:

| (a) | Size: revenues and / or market cap (Korn Ferry typically includes companies in the range of approximately 0.4x to 2.5x the client revenues, subject to the availability of viable peer candidates); |

| (b) | Sector: industry / business competitors; |

| (c) | Talent market: companies from which the Company’s executives may be recruited to or from; |

| (d) | Complexity: related to the number of “moving parts”, operating model or business strategy; |

14

Table of Contents

| (e) | Location: a national or global presence is often appropriate at the executive level; and |

| (f) | Customer base / market share: magnitude and demographics of customers. |

No changes have been made to our peer group since that time.

Participation of Management in the Compensation Process

Mr. Romano was consulted regularly by the Committee in fiscal year 2016 with respect to compensation decisions regarding, and the individual performance of, named executive officers other than himself. While his input in such matters was afforded substantial weight, the ultimate decision on all named executive officer compensation matters was made only by the Committee or the Board of Directors. The individual performance of Mr. Romano was evaluated by the Committee and the Board of Directors, without input from any employee.

At the request of the Committee, management assembles and distributes to the Committee, in advance of its meeting or meetings, information requested by the Committee to assist the Committee in its compensation decisions. Such information may include corporate financial data, historical compensation data (for us or members of our peer group) and information regarding the accounting, tax or legal consequences of proposed compensation arrangements, as prepared by internal personnel or external advisors.

Effect of Historical Contractual Arrangements

The Committee’s compensation decisions are made in light of our current and foreseeable future circumstances and with an eye toward conformity with perceived “best practices.” However, the Committee’s approach to compensation is also influenced by our existing contractual commitments to named executive officers. When appropriate and practicable, the Committee will negotiate with named executive officers to update such “legacy” commitments to the extent necessary to reflect changed circumstances or evolving commercial practices.

The principal elements of our named executive officers’ compensation are: (1) base salary, (2) annual cash bonuses, (3) special or discretionary cash bonuses, (4) equity-based incentives, and (5) severance and change in control benefits.

Base Salary: The base salary of each named executive officer constitutes compensation for discharging such named executive officer’s job responsibilities and is intended to achieve comparability with the base salaries of senior executives at similar companies holding comparable positions, taking into account such factors as the individual executive’s experience, tenure and alternative employment opportunities.

Individual salary adjustments also take into account individual performance contributions for the year, as well as sustained performance contributions over a number of years and significant changes in responsibilities, if any. The assessment of individual performance is subjective and is not intended to correlate to specific corporate performance measures.

For fiscal year 2016, based on updated benchmarking provided to the Committee by Korn Ferry and the application of its subjective judgment, the Committee determined that no named executive officer would receive a base salary increase.

Annual Bonuses: We pay annual bonuses in cash based on our achievement of corporate performance goals established by the Committee, with input from senior management. The target amount for each executive’s annual bonus is expressed as a percentage of the executive’s base salary for the fiscal year. At the time the

15

Table of Contents

Committee determined 2016 bonus criteria for executive officers in April 2016, the only executive officers expected to continue in employment through fiscal 2016 were Mr. Romano and Mr. Masciantonio. The Committee set Mr. Romano’s threshold annual bonus opportunity at 20% of his base salary, his target annual bonus opportunity at 100% of his base salary and his maximum annual bonus opportunity is 200% of his base salary for fiscal year 2016. The Committee set Mr. Masciantonio’s threshold annual bonus opportunity at 12% of his base salary, his target annual bonus opportunity at 60% of his base salary and his maximum annual bonus opportunity is 120% of his base salary for fiscal year 2016. Mr. Stern joined the Company in August 2016, and his employment agreement set his target annual bonus opportunity at 60% of his base salary. Because Mr. Stern joined the Company mid-fiscal year, his fiscal year 2016 bonus opportunity was pro-rated.

Each executive’s actual annual bonus payment may be lower or higher than the target amount, based on actual corporate performance relative to the specified goals. In determining the amount of the annual bonus payable to an executive when the applicable performance goals have been met, the Committee may exercise negative discretion to reduce the amount of such annual bonus to ensure that the amount ultimately paid is commensurate with the executive’s contribution to the Company’s performance.

The Committee has utilized this same annual bonus approach for several years, and the arrangement is codified as our “Management Incentive Program.”

For fiscal year 2016, the Committee continued to use “Adjusted EBITDA” as the relevant performance metric for annual bonus purposes because it believes that continued profitability will be the key driver to increase stockholder value. For this purpose, “Adjusted EBITDA” represents earnings before interest, taxes, depreciation and amortization, adjusted to exclude: (i) loss on impairment of tangible or intangible assets; (ii) gain or loss on disposal of assets; (iii) gain or loss from the early extinguishment, redemption or repurchase of debt, (iv) stock-based compensation expense and (v) the impact of any changes to accounting principles that become effective during the relevant fiscal year. In addition, Adjusted EBITDA excludes expenses incurred by the Company in connection with certain extraordinary, unusual or infrequently occurring events reported in the Company’s public filings, which includes for fiscal year 2016, expenses incurred in connection with the process which resulted in the execution of the Merger Agreement.

Fiscal Year 2016 Bonuses: With respect to fiscal year 2016 bonuses for named executive officers under the Management Incentive Program, in April 2016 the Committee established that the level of Adjusted EBITDA which would yield 100% of target bonus is $28.5 million and that the level of Adjusted EBITDA which would yield the maximum bonus payment (200% of target bonus) is $34.2 million. The level of Adjusted EBITDA which would yield the threshold level of target bonus of 20% is $22.8 million. In April 2017, the Committee determined that the Company’s Adjusted EBITDA for fiscal year 2016 was $23.3 million. Therefore, 26.6% of target bonus was payable for fiscal year 2016 under the Management Incentive Program.

In April 2017, Mr. Romano agreed that his fiscal year 2016 bonus of $201,885 payable pursuant to the Management Incentive Program would subject to the same conditions as his transaction bonus described below.

Fiscal Year 2017 Bonuses: With respect to bonuses for named executive officers under the Management Incentive Program for the year ending February 3, 2018 (“fiscal year 2017”), in April 2017 the Committee established the levels of Adjusted EBITDA which would yield threshold, target, and maximum bonuses. For fiscal year 2017, the threshold level of bonus was set at 20% of base salary for Mr. Romano and 12% of base salary for Messrs. Stern and Masciantonio, the target level of bonus was set at 100% for Mr. Romano and 60% for Messrs. Stern and Masciantonio, and the maximum level of bonus was set at 200% for Mr. Romano and 120% for Messrs. Stern and Masciantonio (all consistent with their 2016 annual incentive opportunities).

Retention / Transaction Bonuses: In fiscal year 2016, we entered into a Transaction Bonus Agreement with Mr. Romano (the “Romano Agreement”), and a Transaction Bonus and Retention Agreement with Mr. Masciantonio (the “Masciantonio Agreement”, and together with the Romano Agreement, the “Transaction

16

Table of Contents

Bonus Agreements”). The Transaction Bonus Agreements were amended on January 6, 2017 to extend the outside date for the completion of a qualifying transaction from May 31, 2017 to December 31, 2017.

Pursuant to the Romano Agreement, as amended, in connection with the merger, Mr. Romano would have been eligible for a transaction bonus equal to $350,000 in the event (i) we were to complete the merger before January 1, 2018, and (ii) Mr. Romano were to complete 90 days of service following the closing of the merger. The 90-day service requirement would have been waived if, during the 90 days following the closing of the merger, Mr. Romano were to die, become disabled, resign with good reason or be terminated without cause. Because the Merger Agreement has been terminated, Mr. Romano will not be eligible to receive the transaction bonus. The Romano Agreement also amends the severance provisions of Mr. Romano’s employment agreement to provide that, if Mr. Romano resigns with good reason or is terminated without cause within two years following a change in control, Mr. Romano will receive an additional severance amount equal to the greater of (i) his target bonus (presently, 100% of his base salary), or (ii) the average actual performance bonus received for the two years preceding the transaction.

Pursuant to the Masciantonio Agreement, as amended, in connection with the merger, Mr. Masciantonio was eligible to receive a retention bonus equal to 30% of his base salary and a transaction bonus equal to 30% of his base salary. The conditions for payment of the retention bonus payable pursuant to the Masciantonio Agreement were satisfied, and the Company paid the $117,000 retention bonus to Mr. Masciantonio in March 2017. The transaction bonus would have been payable to Mr. Masciantonio if (x) we were to complete the merger before January 1, 2018, and (y) Mr. Masciantonio were to completes 90 days of service following the closing of the merger. The 90-day service requirement described above would have been waived if, during that period, Mr. Masciantonio were to die, become disabled, resign with good reason or be terminated without cause. Because the Merger Agreement has been terminated, Mr. Masciantonio will not be eligible to receive the transaction bonus. The Masciantonio Agreement also provides that Mr. Masciantonio’s outstanding time-vested equity awards will vest in full upon the occurrence of a change in control transaction.

Equity-Based Incentives: The Committee believes that equity awards, when appropriately structured, provide powerful long-term incentives and align the interests of the named executive officers with the interests of our stockholders. Accordingly, we continue to emphasize equity in the total compensation packages provided to our named executive officers.

Fiscal Year 2016 Awards: The equity grants made during fiscal year 2016 to our named executive officers included a mix of performance-vested restricted stock units, time-vested restricted stock and time-vested options. Each performance-based restricted stock unit represents the right to receive one share of our common stock, upon satisfaction of specified performance conditions.

In April 2016, the Committee issued fiscal 2016 equity awards to Mr. Romano and Mr. Masciantonio, our only executive officers at that time expected to continue in service through fiscal 2016. The grant date fair value of awards made to each named executive officer during fiscal year 2016 were approximately $825,000 for Mr. Romano and $350,000 for Mr. Masciantonio. The Committee has generally set the grant date fair value of awards to the named executive officers to approximate the median grant date fair value of annual awards delivered by our peer group companies to their executives serving in comparable positions as determined by Korn Ferry. For each named executive officer, 25% of the value of these awards was in restricted stock, 50% of such value was in options and the remaining 25% of such value was in performance-based restricted stock units. As it has for the past several years, the Committee grants this particular mix of equity to the named executive officers, including performance-based restricted stock units, to incorporate multi-year metrics into our executive compensation, to ensure that performance-based metrics are diversified and to enlarge the at-risk portion of our executive compensation.

Although Mr. Stern was not eligible to receive an annual equity award with respect to fiscal year 2016, he did receive an inducement equity grant which was made upon his commencement of employment with a grant

17

Table of Contents

date fair value of approximately $350,000, which fair value was allocated 50% to a non-qualified stock option, 25% to restricted stock and 25% to a performance-based restricted stock unit. The stock option and the restricted stock vest ratably in annual installments over the four-year period commencing on the grant date and will vest in full upon a termination of Mr. Stern’s employment (a) by the Company without cause, (b) by Mr. Stern for good reason or (c) upon Mr. Stern’s death or disability. The performance-based restricted stock unit vests on the same basis as the performance-based restricted stock units granted in fiscal year 2016 to the other named executive officers. The Committee believed that these equity grants to Mr. Stern were an essential component to induce Mr. Stern to become the Company’s Chief Financial Officer and the Committee also believed that four year vesting on these equity grants would aid in the retention of Mr. Stern.

Performance-Based Restricted Stock Unit Grants in Fiscal Year 2014. For the 2014 awards, the performance condition was based on the Company’s cumulative operating income for the three year period beginning with the start of the fiscal year of issuance (the “Performance Period”). The Committee chose operating income as a measure at that time because it believed that there is a strong relationship between growth in operating income and growth in stockholder value. For the 2014 awards, the following levels of cumulative operating income over the respective Performance Period were used to determine the threshold, target and maximum performance-based restricted stock units earned for each grant:

| Fiscal Year of RSU Grant |

Performance Period (Fiscal Years) |

Threshold Level ($) | Target Level ($) | Maximum Level ($) | ||||||||||||

| 2014 |

2014 through 2016 | 124,110,000 | 136,516,000 | 149,728,000 | ||||||||||||

For the fiscal year 2014 grant, regardless of achievement of a given performance level as set forth above, all performance-based restricted stock units were to be forfeited if operating income for fiscal year 2016 did not equal or exceed $37,494,000 (which was the Company’s Operating Income in fiscal year 2013). The minimum performance metrics applicable to the fiscal year 2014 awards were not achieved and, accordingly no performance-based restricted stock units were earned by the named executive officers pursuant to such awards.

Performance-Based Restricted Stock Unit Grants for Fiscal Years 2015 and 2016. For the fiscal year 2015 and 2016 awards, the performance condition was based on the Company’s cumulative Adjusted EBITDA, as reflected in the Company’s financials for the three-year period commencing with the fiscal year in which the award was issued. Just as with the Company’s Management Incentive Program, the Committee chose Adjusted EBITDA as the relevant performance metric for the performance share grant because it believes that continued profitability will be the key driver to increase stockholder value. The Committee determined that earnings, before interest, taxes, depreciation and amortization will be adjusted to exclude the impact of: (i) loss on impairment of tangible or intangible assets; (ii) gain or loss on disposal of assets; (iii) gain or loss from the early extinguishment, redemption or repurchase of debt, (iv) stock-based compensation expense, (v) the impact of any changes to accounting principles that become effective during the Performance Period, and (vi) any expenses incurred by the Company in connection with certain extraordinary, unusual or infrequently occurring events reported in the Company’s public filings, which includes for fiscal year 2015, any expenses incurred by the Company in connection with the relocation of its corporate headquarters and distribution center facilities, and which includes for fiscal year 2016, expenses incurred in connection with the process which resulted in the execution of the Merger Agreement.

For these awards, the following levels of Adjusted EBITDA will be used to determine the threshold, target and maximum performance-based restricted stock units earned:

| Fiscal Year of RSU Grant |

Performance Period (Fiscal Years) |

Threshold Level ($) | Target Level ($) | Maximum Level ($) | ||||||||||||

| 2015 |

2015 through 2017 | 79,500,000 | 91,600,000 | 103,700,000 | ||||||||||||

| 2016 |

2016 through 2018 | 81,200,000 | 101,500,000 | 114,898,000 | ||||||||||||

18

Table of Contents

The following table sets forth the threshold, target and maximum performance-based restricted stock units that may be earned by each named executive officer upon achievement of threshold, target and maximum levels of performance for each of the 2015 and 2016 awards:

| Named Executive Officer |

Fiscal Year of RSU Grant |

Threshold Level (#) |

Target Level (#) |

Maximum Level (#) |

||||||||||||

| Anthony M. Romano— |

2015 | 9,592 | 19,183 | 28,775 | ||||||||||||

| Former Chief Executive Officer & |

2016 | 6,885 | 27,537 | 41,306 | ||||||||||||

| David Stern— |

||||||||||||||||

| Executive Vice President & Chief Financial Officer effective August 1, 2016 |

2016 | 3,892 | 15,569 | 23,354 | ||||||||||||

| Judd P. Tirnauer— |

2015 | 4,069 | 8,138 | 12,207 | ||||||||||||

| Former Executive Vice President & Chief Financial Officer (2) |

2016 | — | — | — | ||||||||||||

| Ronald J. Masciantonio— |

2015 | 4,069 | 8,138 | 12,207 | ||||||||||||

| Executive Vice President & Chief Administrative Officer |

2016 | 2,921 | 11,683 | 17,525 | ||||||||||||

| (1) | Mr. Romano’s employment with us ceased on September 7, 2017. |

| (2) | Mr. Tirnauer’s employment with us ceased on April 22, 2016. |

The Committee will interpolate to determine the performance-based restricted stock units earned for all levels of cumulative operating income above the threshold level but below the maximum level.

Any dividends declared on the shares of Company stock underlying the performance-based restricted stock units will be credited as additional performance-based restricted stock units based on the fair market value of the Company stock on the dividend record date. Those additional performance-based restricted stock units will be earned, if at all, on the same terms as the original performance-based restricted stock units.