Form 8-K TPI COMPOSITES, INC For: Nov 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): November 9, 2016

TPI Composites, Inc.

(Exact Name of Registrant as Specified in Charter)

| DELAWARE | 001-37839 | 20-1590775 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| 8501 N. Scottsdale Rd. Suite 100, Scottsdale, Arizona 85253 |

| (Address of Principal Executive Offices) (Zip Code) |

480-305-8910

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | ||

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2016, TPI Composites, Inc. (the Company) issued a press release announcing its unaudited financial results for the three and nine months ended September 30, 2016. A copy of the Company’s press release is furnished herewith as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein. The Company also posted a presentation to its website at www.tpicomposites.com under the tab “Investor Relations” providing information regarding its results of operations and financial condition for the three and nine months ended September 30, 2016. The information contained in the presentation is incorporated by reference herein. The presentation is being furnished herewith as Exhibit 99.2 to this current report on Form 8-K. The Company’s website and the information contained therein is not part of this disclosure. The information in Items 2.02 and 7.01 of this current report on Form 8-K (including Exhibits 99.1 and 99.3) are being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 2.02 and 7.01 of this current report on Form 8-K (including Exhibits 99.1 and 99.3) shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01. Regulation FD Disclosure.

The information set forth under Item 2.02 of this current report on Form 8-K is incorporated by reference as if fully set forth herein. On November 9, 2016, the Company issued a press release announcing it had signed an additional supply agreement with Nordex SE to produce wind blades at the Company’s newly-constructed factory in Izmir, Turkey. A copy of the Company’s press release is furnished herewith as Exhibit 99.3 to this current report on Form 8-K and is incorporated by reference herein. The information in Exhibit 99.3 of this current report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 7.01 of this current report on Form 8-K (including Exhibit 99.3) shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits 99.1 – Press Release dated November 9, 2016 99.2 – Presentation dated November 9, 2016 99.3 – Press Release dated November 9, 2016

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TPI Composites, Inc. | ||

| Date: November 9, 2016 | By: | William E. Siwek |

| William E. Siwek | ||

| Chief Financial Officer | ||

EXHIBIT 99.1

TPI Composites, Inc. Announces Third Quarter 2016 Earnings Results

SCOTTSDALE, Ariz., Nov. 09, 2016 (GLOBE NEWSWIRE) -- TPI Composites, Inc. (Nasdaq: TPIC), the largest U.S.-based independent manufacturer of composite wind blades, today reported financial results for the quarter ended September 30, 2016.

Highlights

For the quarter ended September 30, 2016:

- Net sales increased 23.1% to $198.9 million

- Total billings increased 28.0% to $196.1 million

- Net income attributable to common shareholders increased to $2.2 million or $0.08 per diluted share and net income on a pro forma basis was $2.8 million or $0.08 per diluted share

- EBITDA increased to $11.3 million from $6.3 million in the comparable period in 2015, with an EBITDA margin of 5.7% in the 2016 period compared to 3.9% in 2015

- Adjusted EBITDA increased to $19.6 million from $7.6 million in the comparable period in 2015, with an adjusted EBITDA margin of 9.9% in the 2016 period compared to 4.7% in 2015

| KPIs | Q3'16 | Q3'15 | |

| Setsˆ | 581 | 433 | |

| Estimated megawatts² | 1,321 | 987 | |

| Dedicated manufacturing lines³ | 38 | 29 | |

| Manufacturing lines installed⁴ | 32 | 29 | |

| Manufacturing lines in startup⁵ | 2 | 7 | |

| Manufacturing lines in transition⁶ | - | 10 |

- Number of wind blade sets (which consist of three wind blades) invoiced worldwide in the period.

- Estimated megawatts of energy capacity to be generated by wind blade sets invoiced in the period.

- Number of manufacturing lines dedicated to our customers under long-term supply agreements.

- Number of manufacturing lines installed and either in operation, startup or transition.

- Number of manufacturing lines in a startup phase during the pre-production and production ramp-up period.

- Number of manufacturing lines that were being transitioned to a new wind blade model during the period.

“Our strong operational and financial performance in the third quarter of 2016 underscores our commitment to grow, expand margins and continue to drive down the levelized cost of energy. Our results were driven by increased production across three of our geographic segments as we reported year-over-year increases in net sales, total billings, EBITDA and adjusted EBITDA,” said Steven Lockard, TPI Composites’ President and Chief Executive Officer. “We delivered margin expansion due to improved efficiency and plant utilization with 30 manufacturing lines operating at or near 100% capacity, no manufacturing lines in transition and two lines entering the startup phase late during the quarter. In October, we extended two supply agreements with General Electric International (“GE”) in Newton, Iowa and Juarez, Mexico through 2020. We also entered into a new long-term agreement with GE for the supply of wind blades for our third manufacturing facility under construction in Juarez, Mexico through 2020, expecting to begin production in the first quarter of 2017. Furthermore, today we announced that we have signed a long-term supply agreement with Nordex SE for two additional molds in our new Turkey facility. With the extensions and new long-term agreements, as of today we now have over $4.2 billion in contract value across 44 molds through 2023, this is up from $3.1 billion across 38 molds through 2021 at the end of the second quarter. We expect to continue to capitalize on the strong wind industry growth and outsourcing trends from most of the industries OEMs and we will continue to execute on our strategy for global growth, customer diversification, and profitability under new and existing long-term supply agreements with the industry leading OEMs in the wind energy market. Our global pipeline of demand is strong enough to deliver 25% top line annual growth for the next few years.”

Third Quarter 2016 Financial Results

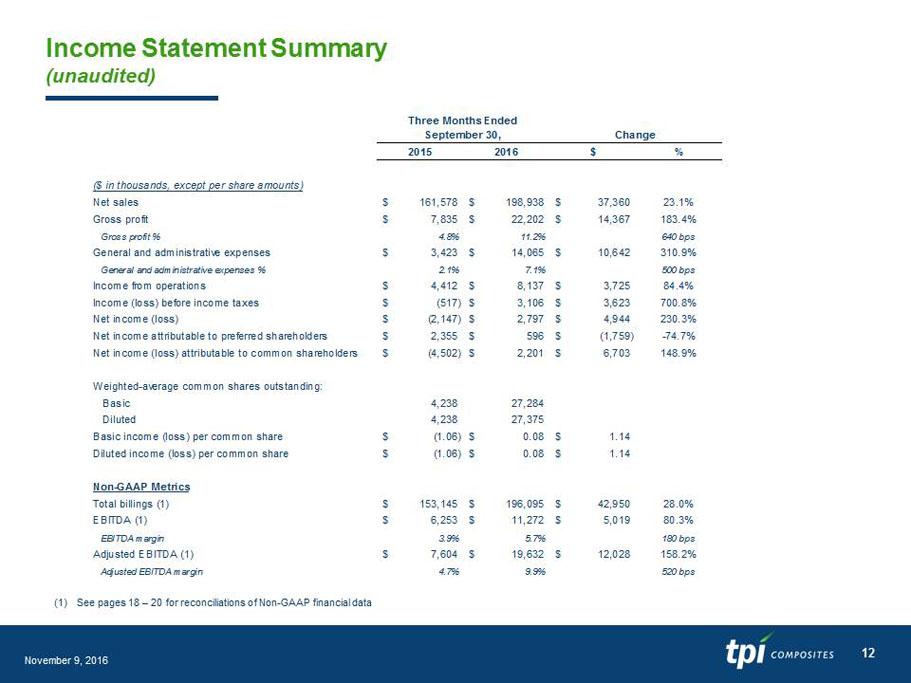

Net sales for the three months ended September 30, 2016 increased by $37.3 million or 23.1% to $198.9 million compared to $161.6 million in the same period in 2015. This was primarily driven by a 30.2% increase in the number of wind blades delivered in the three months ended September 30, 2016 compared to the same period in 2015. These increases were primarily the result of additional wind blade volume in our plants in the U.S., China and Mexico, partially offset by reductions to sales prices as a result of savings in raw material costs, a portion of which we share with our customers and foreign currency fluctuations in Turkey and China of 0.4%. Total billings for the three months ended September 30, 2016 increased by $43.0 million or 28.0% to $196.1 million compared to $153.1 million in the same period in 2015.

Total cost of goods sold for the three months ended September 30, 2016 was $176.7 million and included aggregate costs of $5.1 million related to startup costs in our new plants in Mexico and Turkey. This compares to total cost of goods sold for the three months ended September 30, 2015 of $153.7 million, including aggregate costs of $3.0 million related to the transition of wind blades in our U.S., Mexico and Taicang, China plants and startup costs in Dafeng, China. Cost of goods sold as a percentage of net sales of wind blades decreased by 11% in the three months ended September 30, 2016 as compared to the same period in 2015, driven by improved operating efficiencies globally, the impact of savings in raw material costs and the favorable impact of fluctuations of the U.S. dollar relative to the Chinese Renminbi, Turkish Lira, Mexican Peso and Euro of 1.9%. This was somewhat offset by share-based compensation of approximately $1.2 million recorded in the 2016 period.

General and administrative expenses for the three months ended September 30, 2016 totaled $14.1 million as compared to $3.4 million for the same period in 2015. As a percentage of net sales, general and administrative expenses were 7.1% for the three months ended September 30, 2016, up from 2.1% in the same period in 2015. The increase was primarily driven by share-based compensation of $6.9 million recorded in the 2016 period (none was recorded in 2015) as well as additional costs incurred to enhance our corporate support functions to support our growth and public company governance.

Net income for the three months ended September 30, 2016 was $2.8 million, as compared to a net loss of $2.1 million in the same period in 2015.

Net income attributable to common shareholders was $2.2 million during the three months ended September 30, 2016, compared to a net loss attributable to common shareholders of $4.5 million in the same period in 2015. This was primarily due to the increase in net income discussed above. Diluted earnings per share was $0.08 for the three months ended September 30, 2016, compared to a loss of $1.06 for the three months ended September 30, 2015.

EBITDA for three months ended September 30, 2016 increased to $11.3 million, compared to $6.3 million during the same period in 2015. The EBITDA margin improved to 5.7% compared to 3.9% in the 2015 period.

Adjusted EBITDA for three months ended September 30, 2016 increased to $19.6 million compared to $7.6 million during the same period a year ago. The Adjusted EBITDA margin improved to 9.9%, compared to 4.7% during the same period a year ago.

Capital expenditures decreased slightly to $4.7 million for three months ended September 30, 2016 from $4.9 million during the same period a year ago. Capex is primarily related to new facilities or facility expansions and related machinery and equipment.

Net debt for the three months ended September 30, 2016 decreased to $7.1 million from $90.7 million as of December 31, 2015. The reduction was primarily a result of the completion of our IPO during the quarter and the repayment of certain debt with cash flows from operations offset by an increase in financing related to our new facilities in Mexico and Turkey.

2016 Outlook

For 2016, the Company expects:

· Total billings between $750 to $760 million (1)

· Sets delivered of between 2,147 to 2,162

· Estimated megawatts of sets delivered to be between 4,915 to 4,955

· Dedicated manufacturing lines under long-term contracts at year end of between 44 and 46, up from our previous guidance of 38 to 46.

· Manufacturing lines installed of between 33 and 36

· No manufacturing lines in transition

· Manufacturing lines in startup to be between 3 and 6

· Capital expenditures to be between $50.0 million and $55.0 million

· Effective tax rate to be between 25% and 30%

· Depreciation and amortization of between $14.0 million and $15.0 million

· Interest expense of between $15.0 million and $16.0 million

· Income tax expense of between $5.5 million and $6.5 million

· Share-based compensation of between $9.5 million and $10.5 million

(1) We have not reconciled our expected total billings to expected net sales as calculated under GAAP because we have not yet finalized calculations necessary to provide the reconciliation, including the expected change in deferred revenue, and as such the reconciliation is not possible without unreasonable efforts.

Conference Call and Webcast Information TPI Composites will host an investor conference call today at 5:00pm ET. Interested parties are invited to listen to the conference call which can be accessed live over the phone by dialing 1-877-407-3982, or for international callers, 1-201-493-6780. A replay will be available two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the live call and the replay is 13648582. The replay will be available until November 16, 2016. Interested investors and other parties may also listen to a simultaneous webcast of the conference call by logging onto the Investor Relations section of the Company’s website at www.tpicomposites.com. The online replay will be available for a limited time beginning immediately following the call.

About TPI Composites, Inc.

TPI Composites, Inc. is the largest U.S.-based independent manufacturer of composite wind blades for the wind energy market. TPI delivers high-quality, cost-effective composite solutions through long term relationships with leading wind turbine manufacturers. TPI is headquartered in Scottsdale, Arizona and operates factories throughout the U.S., Mexico, China and Turkey.

Forward-Looking Statements

This release contains forward-looking statements which are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements, among other things, concerning: effects on our financial statements and our financial outlook; our business strategy, including anticipated trends and developments in and management plans for our business and the wind industry and other markets in which we operate; competition; future financial results, operating results, revenues, gross margin, operating expenses, products, projected costs, warranties, our ability to improve our operating margins, and capital expenditures. These forward-looking statements are often characterized by the use of words such as "estimate," "expect," "anticipate," "project," "plan," "intend," "seek," "believe," "forecast," "foresee," "likely," "may," "should," "goal," "target," "might," "will," "could," "predict," "continue" and the negative or plural of these words and other comparable terminology. Forward-looking statements are only predictions based on our current expectations and our projections about future events. You should not place undue reliance on these forward-looking statements. We undertake no obligation to update any of these forward-looking statements for any reason. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from those expressed or implied by these statements. These factors include, but are not limited to, the matters discussed in "Risk Factors," in our Registration Statement on Form S-1 and other reports that we will file with the SEC.

Non-GAAP Definitions

This press release includes unaudited non-GAAP financial measures, including total billings, EBITDA, adjusted EBITDA, net debt and free cash flow. We define total billings as total amounts billed from products and services that we are entitled to payment and have billed under the terms of our long-term supply agreements or other contractual arrangements. We define EBITDA as net income plus interest expense (including losses on extinguishment of debt and net of interest income), income taxes and depreciation and amortization. We define adjusted EBITDA as EBITDA plus any share-based compensation expense plus or minus any gains or losses from foreign currency transactions. We define net debt as the total principal amount of debt outstanding less unrestricted cash and equivalents. We define free cash flow as net cash flow generated from operating activities less capital expenditures. We present non-GAAP measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See below for a reconciliation of certain non-GAAP financial measures to the comparable GAAP measures.

| TPI COMPOSITES, INC. AND SUBSIDIARIES | ||||||||||||||

| TABLE ONE - CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||

| (UNAUDITED) | ||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| ($ in thousands, except per share amounts) | 2016 | 2015 | 2016 | 2015 | ||||||||||

| Net sales | $ | 198,938 | $ | 161,578 | $ | 569,303 | $ | 406,906 | ||||||

| Cost of sales | 171,648 | 150,732 | 499,896 | 370,824 | ||||||||||

| Startup and transition costs | 5,088 | 3,011 | 11,449 | 15,546 | ||||||||||

| Total cost of goods sold | 176,736 | 153,743 | 511,345 | 386,370 | ||||||||||

| Gross profit | 22,202 | 7,835 | 57,958 | 20,536 | ||||||||||

| General and administrative expenses | 14,065 | 3,423 | 24,154 | 9,530 | ||||||||||

| Income from operations | 8,137 | 4,412 | 33,804 | 11,006 | ||||||||||

| Other income (expense): | ||||||||||||||

| Interest income | 27 | 11 | 76 | 149 | ||||||||||

| Interest expense | (4,663 | ) | (3,620 | ) | (12,709 | ) | (10,894 | ) | ||||||

| Realized loss on foreign currency remeasurement | (243 | ) | (1,351 | ) | (700 | ) | (1,621 | ) | ||||||

| Miscellaneous income (expense) | (152 | ) | 31 | 192 | 300 | |||||||||

| Total other expense | (5,031 | ) | (4,929 | ) | (13,141 | ) | (12,066 | ) | ||||||

| Income (loss) before income taxes | 3,106 | (517 | ) | 20,663 | (1,060 | ) | ||||||||

| Income tax provision | (309 | ) | (1,630 | ) | (4,565 | ) | (2,734 | ) | ||||||

| Net income (loss) | 2,797 | (2,147 | ) | 16,098 | (3,794 | ) | ||||||||

| Net income attributable to preferred shareholders | 596 | 2,355 | 5,471 | 7,067 | ||||||||||

| Net income (loss) attributable to common shareholders | $ | 2,201 | $ | (4,502 | ) | $ | 10,627 | $ | (10,861 | ) | ||||

| Weighted-average common shares outstanding: | ||||||||||||||

| Basic | 27,284 | 4,238 | 12,042 | 4,238 | ||||||||||

| Diluted | 27,375 | 4,238 | 12,133 | 4,238 | ||||||||||

| Basic income (loss) per common share | $ | 0.08 | $ | (1.06 | ) | $ | 0.88 | $ | (2.56 | ) | ||||

| Diluted income (loss) per common share | $ | 0.08 | $ | (1.06 | ) | $ | 0.88 | $ | (2.56 | ) | ||||

| Non-GAAP Measures: | ||||||||||||||

| Total billings | $ | 196,095 | $ | 153,145 | $ | 566,779 | $ | 409,837 | ||||||

| EBITDA | $ | 11,272 | $ | 6,253 | $ | 42,999 | $ | 18,156 | ||||||

| Adjusted EBITDA | $ | 19,632 | $ | 7,604 | $ | 51,816 | $ | 19,777 | ||||||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | ||||||

| TABLE TWO - CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||

| ($ in thousands) | September 30, 2016 | December 31, 2015 | ||||

| (Unaudited) | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | 106,802 | $ | 45,917 | ||

| Restricted cash | 2,409 | 1,760 | ||||

| Accounts receivable | 100,150 | 72,913 | ||||

| Inventories | 58,824 | 50,841 | ||||

| Inventories held for customer orders | 48,203 | 49,594 | ||||

| Prepaid expenses and other current assets | 26,415 | 31,337 | ||||

| Total current assets | 342,803 | 252,362 | ||||

| Noncurrent assets: | ||||||

| Property, plant, and equipment, net | 78,635 | 67,732 | ||||

| Other noncurrent assets | 17,655 | 9,826 | ||||

| Total assets | $ | 439,093 | $ | 329,920 | ||

| Current liabilities: | ||||||

| Accounts payable and accrued expenses | $ | 107,319 | $ | 101,108 | ||

| Accrued warranty | 31,057 | 13,596 | ||||

| Deferred revenue | 61,949 | 65,520 | ||||

| Customer deposits and customer advances | 13,775 | 8,905 | ||||

| Current maturities of long-term debt | 27,171 | 52,065 | ||||

| Total current liabilities | 241,271 | 241,194 | ||||

| Noncurrent liabilities: | ||||||

| Long-term debt, net of debt issuance costs, discount | ||||||

| and current maturities | 83,751 | 77,281 | ||||

| Other noncurrent liabilities | 4,287 | 3,812 | ||||

| Total liabilities | 329,309 | 322,287 | ||||

| Preferred shares and warrants | - | 198,830 | ||||

| Shareholders' equity (deficit) | 109,784 | (191,197 | ) | |||

| Total liabilities and shareholders' equity (deficit) | $ | 439,093 | $ | 329,920 | ||

| Non-GAAP Measure: | ||||||

| Net debt | $ | 7,067 | $ | 90,667 | ||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||||||||||

| TABLE THREE - CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||

| (UNAUDITED) | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| ($ in thousands) | 2016 | 2015 | 2016 | 2015 | |||||||||||

| Net cash provided by operating activities | $ | 17,801 | $ | 3,442 | $ | 27,976 | $ | 3,510 | |||||||

| Net cash used in investing activities | (4,673 | ) | (4,851 | ) | (18,917 | ) | (25,161 | ) | |||||||

| Net cash provided by (used in) financing activities | 63,012 | (3,769 | ) | 52,371 | (14,721 | ) | |||||||||

| Impact of foreign exchange rates on cash and cash | |||||||||||||||

| equivalents | (395 | ) | (190 | ) | (545 | ) | (263 | ) | |||||||

| Cash and cash equivalents, beginning of period | 31,057 | 12,325 | 45,917 | 43,592 | |||||||||||

| Cash and cash equivalents, end of period | $ | 106,802 | $ | 6,957 | $ | 106,802 | $ | 6,957 | |||||||

| TPI COMPOSITES, INC. AND SUBSIDIARIES | |||||||||||||

| TABLE FOUR - RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||

| (UNAUDITED) | |||||||||||||

| Total billings is reconciled as follows: | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

| ($ in thousands) | 2016 | 2015 | 2016 | 2015 | |||||||||

| Net sales | $ | 198,938 | $ | 161,578 | $ | 569,303 | $ | 406,906 | |||||

| Change in deferred revenue: | |||||||||||||

| Blade-related deferred revenue at beginning of period (1) | (65,656 | ) | (68,226 | ) | (65,520 | ) | (59,476 | ) | |||||

| Blade-related deferred revenue at end of period (1) | 61,949 | 56,089 | 61,949 | 56,089 | |||||||||

| Foreign exchange impact (2) | 864 | 3,704 | 1,047 | 6,318 | |||||||||

| Change in deferred revenue | (2,843 | ) | (8,433 | ) | (2,524 | ) | 2,931 | ||||||

| Total billings | $ | 196,095 | $ | 153,145 | $ | 566,779 | $ | 409,837 | |||||

| EBITDA and adjusted EBITDA are reconciled as follows: | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

| ($ in thousands) | 2016 | 2015 | 2016 | 2015 | |||||||||

| Net income (loss) | $ | 2,797 | $ | (2,147 | ) | $ | 16,098 | $ | (3,794 | ) | |||

| Adjustments: | |||||||||||||

| Depreciation and amortization | 3,530 | 3,161 | 9,703 | 8,471 | |||||||||

| Interest expense (net of interest income) | 4,636 | 3,609 | 12,633 | 10,745 | |||||||||

| Income tax provision | 309 | 1,630 | 4,565 | 2,734 | |||||||||

| EBITDA | 11,272 | 6,253 | 42,999 | 18,156 | |||||||||

| Share-based compensation expense | 8,117 | - | 8,117 | - | |||||||||

| Realized loss on foreign currency remeasurement | 243 | 1,351 | 700 | 1,621 | |||||||||

| Adjusted EBITDA | $ | 19,632 | $ | 7,604 | $ | 51,816 | $ | 19,777 | |||||

| Free cash flow is reconciled as follows: | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

| ($ in thousands) | 2016 | 2015 | 2016 | 2015 | |||||||||

| Net cash provided by operating activities | $ | 17,801 | $ | 3,442 | $ | 27,976 | $ | 3,510 | |||||

| Capital expenditures | (4,673 | ) | (4,851 | ) | (18,917 | ) | (25,161 | ) | |||||

| Free cash flow | $ | 13,128 | $ | (1,409 | ) | $ | 9,059 | $ | (21,651 | ) | |||

| Net debt is reconciled as follows: | |||||||||||||

| September 30, | December 31, | ||||||||||||

| ($ in thousands) | 2016 | 2015 | |||||||||||

| Total debt, net of debt issuance costs and discount | $ | 110,922 | $ | 129,346 | |||||||||

| Add debt issuance costs | 2,947 | 4,220 | |||||||||||

| Add discount on debt | - | 3,018 | |||||||||||

| Less cash and cash equivalents | (106,802 | ) | (45,917 | ) | |||||||||

| Net debt | $ | 7,067 | $ | 90,667 | |||||||||

| (1) Total billings is reconciled using the blade-related deferred revenue amounts at the beginning and the end of the period as follows: | |||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||

| ($ in thousands) | 2016 | 2015 | 2016 | 2015 | |||||||||

| Blade-related deferred revenue at beginning of period | $ | 65,656 | $ | 68,226 | $ | 65,520 | $ | 59,476 | |||||

| Non-blade related deferred revenue at beginning of period | - | - | - | - | |||||||||

| Total current and noncurrent deferred revenue at beginning of period | $ | 65,656 | $ | 68,226 | $ | 65,520 | $ | 59,476 | |||||

| Blade-related deferred revenue at end of period | $ | 61,949 | $ | 56,089 | $ | 61,949 | $ | 56,089 | |||||

| Non-blade related deferred revenue at end of period | - | - | - | - | |||||||||

| Total current and noncurrent deferred revenue at end of period | $ | 61,949 | $ | 56,089 | $ | 61,949 | $ | 56,089 | |||||

| (2) Represents the effect of the difference in the exchange rate used by our various foreign subsidiaries on the invoice date versus the exchange rate | |||||||||||||

| used at the period-end balance sheet date. | |||||||||||||

Investor Relations

480-315-8742

[email protected]

EXHIBIT 99.2

Q3 2016 Earnings Call November 9, 2016

2 November 9, 2016 Legal Disclaimer This presentation contains forward - looking statements within the meaning of the federal securities laws . All statements other than statements of historical facts contained in this presentation , including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward - looking statements . In many cases, you can identify forward - looking statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words . Forward - looking statements contained in this presentation include, but are not limited to, statements about (i) growth of the wind energy market and our addressable market ; (ii) the potential impact of GE’s pending acquisition of LM Wind Power upon our business ; (iii) our future financial performance, including our net sales, cost of goods sold, gross profit or gross margin, operating expenses, ability to generate positive cash flow, and ability to achieve or maintain profitability ; ( iv) the sufficiency of our cash and cash equivalents to meet our liquidity needs ; (v ) our ability to attract and retain customers for our products, and to optimize product pricing ; ( vi) competition from other wind blade manufacturers ; ( vii) the discovery of defects in our products ; ( viii) our ability to successfully expand in our existing markets and into new international markets ; (ix) worldwide economic conditions and their impact on customer demand ; (x ) our ability to effectively manage our growth strategy and future expenses ; ( xi) our ability to maintain, protect and enhance our intellectual property ; ( xii) our ability to comply with existing, modified or new laws and regulations applying to our business ; and ( xiii ) the attraction and retention of qualified employees and key personnel . These forward - looking statements are only predictions . These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to materially differ from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements . Because forward - looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward - looking statements as guarantees of future events . Further information on the factors, risks and uncertainties that could affect our financial results and the forward - looking statements in this presentation are included in our filings with the Securities and Exchange Commission and will be included in subsequent periodic and current reports we make with the Securities and Exchange Commission from time to time, including in our Quarterly Report on Form 10 - Q for the quarter ended September 30 , 2016 . The forward - looking statements in this presentation represent our views as of the date of this presentation . We anticipate that subsequent events and developments will cause our views to change . However, while we may elect to update these forward - looking statements at some point in the future, we undertake no obligation to update any forward - looking statement to reflect events or developments after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent required by applicable law . You should, therefore, not rely on these forward - looking statements as representing our views as of any date after the date of this presentation . Our forward - looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make . This presentation includes unaudited non - GAAP financial measures including Total Billings, EBITDA, Adjusted EBITDA, Net Debt and Free Cash Flow . We define Total Billings as the total amounts we have invoiced our customers for products and services for which we are entitled to payment under the terms of our long term supply agreements or other contractual agreements . We define EBITDA as net income (loss) attributable to the Company plus interest expense (including losses on extinguishment of debt and net of interest income), income taxes, and depreciation and amortization . We define Adjusted EBITDA as EBITDA plus any share - based compensation expense plus or minus any gains or losses from foreign currency remeasurement . We define Net Debt as the total principal amount of debt outstanding less unrestricted cash and equivalents . We define F ree C ash F low as net cash flow generated from operating activities less capital expenditures . We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors . Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies . The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP . See the appendix for the reconciliations of certain non - GAAP financial measures to the comparable GAAP measures . This presentation also contains estimates and other information concerning our industry that are based on industry publications, surveys and forecasts . This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the information .

3 November 9, 2016 Agenda • Q3 2016 Highlights • Industry Update • Competitive Landscape • Q3 2016 Financial Highlights • 2016 Guidance • Q&A • Appendix - Non - GAAP Information

4 November 9, 2016 Q3 2016 Highlights

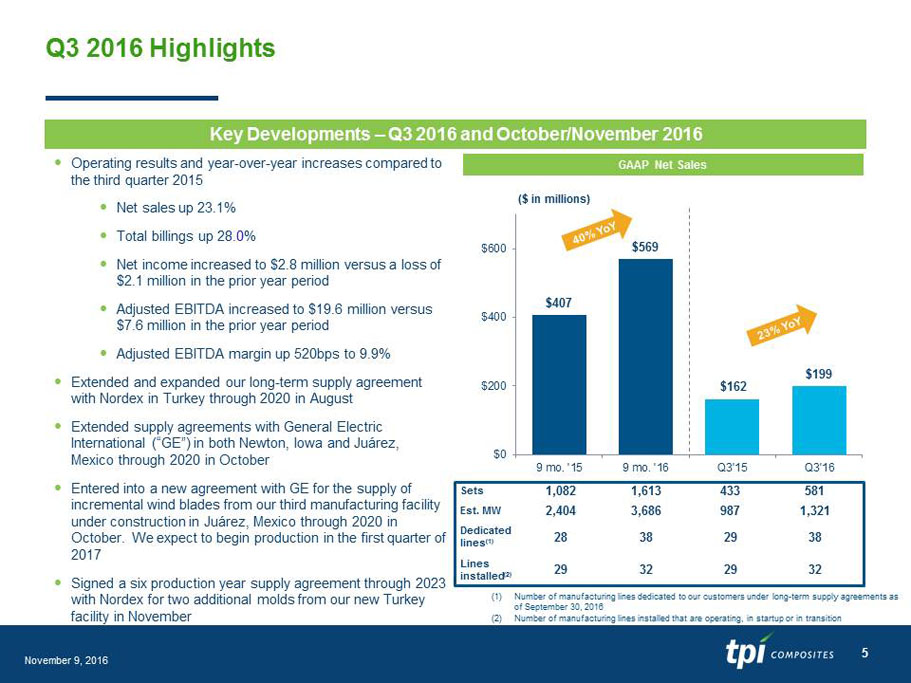

5 November 9, 2016 Q3 2016 Highlights Operating results and year - over - year increases compared to the third quarter 2015 Net sales up 23.1% Total billings up 28. 0 % Net income increased to $2.8 million versus a loss of $2.1 million in the prior year period Adjusted EBITDA increased to $19.6 million versus $7.6 million in the prior year period Adjusted EBITDA margin up 520bps to 9.9% Extended and expanded our long - term supply agreement with Nordex in Turkey through 2020 in August Extended supply agreements with General Electric International (“GE”) in both Newton, Iowa and Juárez, Mexico through 2020 in October Entered into a new agreement with GE for the supply of incremental wind blades from our third manufacturing facility under construction in Juárez, Mexico through 2020 in October. We expect to begin production in the first quarter of 2017 Signed a six production year supply agreement through 2023 with Nordex for two additional molds from our new Turkey facility in November Key Developments – Q3 2016 and October/November 2016 $407 $569 $162 $199 $0 $200 $400 $600 9 mo. '15 9 mo. '16 Q3'15 Q3'16 GAAP Net Sales ($ in millions) Sets 1,082 1,613 433 581 Est. MW 2,404 3,686 987 1,321 Dedicated lines (1) 28 38 29 38 Lines installed (2) 29 32 29 32 (1) Number of manufacturing lines dedicated to our customers under long - term supply agreements as of September 30, 2016 (2) Number of manufacturing lines installed that are operating, in startup or in transition

6 November 9, 2016 Existing Contracts Provide for up to $4.2 Billion in Revenue through 2023 2016 2017 2018 2019 2020 2021 2022 2023 Iowa Turkey Mexico China Note: Our contracts with some of our customers are subject to termination or reduction on short notice, generally with substantial pen alties, and contain liquidated damages provisions, which may require us to make unanticipated payments to our customers or our customers to make payments to us . The chart depicts the term of the longest contract in each location. (1) As of November 9, 2016 – includes extensions of supply agreements with GE in Iowa and Mexico, a new supply agreement with GE in our new Mexico facility and a new supply agreement with Nordex in our new Turkey facility Long - term supply agreements provide for estimated minimum aggregate volume commitments from our customers of $2.7 billion and encourage our customers to purchase additional volume up to, in the aggregate, an estimated total contract value of over $4.2 billion through the end of 2023 (1) Long - term Supply Agreements

7 November 9, 2016 Industry Update Global onshore grid - connected demand estimated to be over 55GW per year from 2016 through 2025 (1) At the end of the third quarter, there were over 20GW of wind either under construction or in advanced stages of development in the United States (2) Strong demand estimated with onshore annual grid - connected demand through 2025 of 7.2GW in the US market (1) Strong growth and utilization in the United States, in particular Iowa Iowa’s fleet of wind farms accounted for 35.8% of in - state power generation on a 12 - month rolling average through August of 2016 (2) Commercial and Industrial segment driving significant demand in the United States Repowering expected to increase over the next several years and provide capacity growth in key mature markets Global Policy Stability Continues to Pave Way for Renewables Growth (1) Source: MAKE Consulting (2) Source: AWEA TPI Composites remains well positioned to capitalize on wind industry trends

8 November 9, 2016 Competitive Landscape In October, GE announced their intention to acquire LM Wind Power (LM) GE has committed to honoring current TPI contracts TPI extended two contracts and entered in a new contract with GE all through 2020 Currently in discussions with GE to extend the China and Turkey agreements GE’s proposed acquisition of LM highlights confidence in wind industry growth Continued focus on customer diversification New opportunities for TPI to expand among the OEMs given the fact that LM would become a division of one of their key competitors TPI’s Growth Strategy Proactively Addresses Changes in Competitive Landscape

9 November 9, 2016 Q3 2016 Financial Highlights

10 November 9, 2016 Q3 2016 Financial Highlights (unaudited) Select Financial Data Net Sales $198.9 $161.6 23.1% Total Billings (1) $196.1 $153.1 28.0% Net Income (Loss) $2.8 ($2.1) $4.9 Adjusted EBITDA (1) $19.6 $7.6 158.2% Adjusted EBITDA Margin 9.9% 4.7% 520bps Net Debt (1) $7.1 $90.7 (2) ($83.6) Free Cash Flow (1) $13.1 ($1.4) $14.5 Capital Expenditures $4.7 $4.9 ($0.2) Key Performance Indicators Sets 581 433 34.2% Estimated Megawatts 1,321 987 33.8% Dedicated Manufacturing Lines 38 29 9 lines Lines Installed 32 29 3 lines Lines in Startup 2 7 5 lines Lines in Transition - 10 10 lines Q3 2016 Q3 20 15 ∆ Note : Dollars in millions . (1) See pages 18 – 20 for reconciliations of non - GAAP financial data (2) September 30, 2015 is before IPO and conversion transactions Q3 20 16 Performance Compared to Q3 20 15

11 November 9, 2016 $8 $13 $39 $8 $20 2013A 2014A 2015A Q3'15 Q3'16 $221 $363 $600 $153 $196 2013A 2014A 2015A Q3'15 Q3'16 648 966 1,609 433 581 2013A 2014A 2015A Q3'15 Q3'16 Strong Financial Performance Trend Continues (unaudited) . Note: Dollars in millions Net Sales Total Billings Estimated MW 1,173 2,029 3,595 $215 $321 $586 $162 $199 2013A 2014A 2015A Q3'15 Q3'16 Adjusted EBITDA Volume (# Sets) 987 1,321

12 November 9, 2016 Income Statement Summary (unaudited) (1) See pages 18 – 20 for reconciliations of Non - GAAP financial data 2015 2016 $ % ($ in thousands, except per share amounts) Net sales 161,578$ 198,938$ 37,360$ 23.1% Gross profit 7,835$ 22,202$ 14,367$ 183.4% Gross profit % 4.8% 11.2% 640 bps General and administrative expenses 3,423$ 14,065$ 10,642$ 310.9% General and administrative expenses % 2.1% 7.1% 500 bps Income from operations 4,412$ 8,137$ 3,725$ 84.4% Income (loss) before income taxes (517)$ 3,106$ 3,623$ 700.8% Net income (loss) (2,147)$ 2,797$ 4,944$ 230.3% Net income attributable to preferred shareholders 2,355$ 596$ (1,759)$ -74.7% Net income (loss) attributable to common shareholders (4,502)$ 2,201$ 6,703$ 148.9% Weighted-average common shares outstanding: Basic 4,238 27,284 Diluted 4,238 27,375 Basic income (loss) per common share (1.06)$ 0.08$ 1.14$ Diluted income (loss) per common share (1.06)$ 0.08$ 1.14$ Non-GAAP Metrics Total billings (1) 153,145$ 196,095$ 42,950$ 28.0% EBITDA (1) 6,253$ 11,272$ 5,019$ 80.3% EBITDA margin 3.9% 5.7% 180 bps Adjusted EBITDA (1) 7,604$ 19,632$ 12,028$ 158.2% Adjusted EBITDA margin 4.7% 9.9% 520 bps Three Months Ended September 30, Change

13 November 9, 2016 Key Balance Sheet and Cash Flow Data (unaudited) (1) See page 20 for a reconciliation of net debt and free cash flow ($ in thousands) December 31, 2015 September 30, 2016 Assets and Liabilities: Cash and cash equivalents 45,917$ 106,802$ Restricted cash 1,760$ 2,409$ Accounts receivable 72,913$ 100,150$ Inventories 50,841$ 58,824$ Inventories held for customer orders 49,594$ 48,203$ Deferred revenue 65,520$ 61,949$ Total debt-current and noncurrent, net 129,346$ 110,922$ Net debt (1) 90,667$ 7,067$ ($ in thousands) 2015 2016 Cash Flow: Net cash provided by operating activities 3,442$ 17,801$ Capital expenditures 4,851$ 4,673$ Free cash flow (1) (1,409)$ 13,128$ Three Months Ended September 30,

14 November 9, 2016 2016 Guidance

15 November 9, 2016 Guidance for the Full Year 2016 (1) We have not reconciled our expected Total billings to expected net sales as calculated under GAAP because we have not yet finalized calculations necessary to provide the reconciliation, including expected change in deferred revenue, and as such the reconciliation is not possible wit hout unreasonable efforts. (2) Previous guidance of 0 Lines in Transition was for the second half of 2016. This guidance does not include the 3 Lines in Tra nsi tion in the first half of 2016. Total Billings (1) $750M to $760M $750M to $760M Sets 2,147 to 2,162 2,147 to 2,162 Estimated Megawatts 4,915 to 4,955 4,915 to 4,955 Dedicated Manufacturing Lines at Year - end 44 to 46 38 to 46 Total Lines Installed 33 to 36 33 to 36 Lines in Transition (2) 0 0 Lines in Startup 3 to 6 3 to 6 Capital Expenditures $50M to $55M $52M to $57M Effective Tax Rate 25% to 30% 25% to 30% Depreciation and Amortization $14.0M to $15.0M $12.7M to $13.2M Interest Expense $15.0M to $16.0M $14.5M to $15.5M Income Tax Expense $5.5M to $6.5M $6.5M to $7.0M Share - based Compensation $9.5M to $10.5M $9.5M to $10.5M Current Previous

16 November 9, 2016 Q&A

17 November 9, 2016 Appendix - Non - GAAP Information This presentation includes unaudited non - GAAP financial measures including total billings , EBITDA, adjusted EBITDA, net debt and free cash flow . We define total b illings as the total amounts we have invoiced our customers for products and services for which we are entitled to payment under the terms of our long - term supply agreements or other contractual agreements . We define EBITDA as net income (loss) attributable to the Company plus interest expense (including losses on extinguishment of debt and net of interest income), income taxes, and depreciation and amortization . We define Adjusted EBITDA as EBITDA plus any share - based compensation expense plus or minus any gains or losses from foreign currency remeasurement . We define net debt as the total principal amount of debt outstanding less unrestricted cash and equivalents . We define free cash flow as net cash flow generated from operating activities less capital expenditures . We present non - GAAP measures when we believe that the additional information is useful and meaningful to investors . Non - GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies . The presentation of non - GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP . See below for a reconciliation of certain non - GAAP financial measures to the comparable GAAP measures .

18 November 9, 2016 Non - GAAP Reconciliations (unaudited) Note: Footnote references on the following page Net sales is reconciled to total billings as follows: Net income (loss) is reconciled to EBITDA and adjusted EBITDA as follows: ($ in thousands) 2015 2016 Net sales 161,578$ 198,938$ Change in deferred revenue: Blade-related deferred revenue at beginning of period (1) (68,226) (65,656) Blade-related deferred revenue at end of period (1) 56,089 61,949 Foreign exchange impact (2) 3,704 864 Change in deferred revenue (8,433) (2,843) Total billings 153,145$ 196,095$ Three Months Ended September 30, ($ in thousands) 2015 2016 Net income (loss) (2,147)$ 2,797$ Adjustments: Depreciation and amortization 3,161 3,530 Interest expense (net of interest income) 3,609 4,636 Income tax provision 1,630 309 EBITDA 6,253 11,272 Share-based compensation expense - 8,117 Realized loss on foreign currency remeasurement 1,351 243 Adjusted EBITDA 7,604$ 19,632$ Three Months Ended September 30,

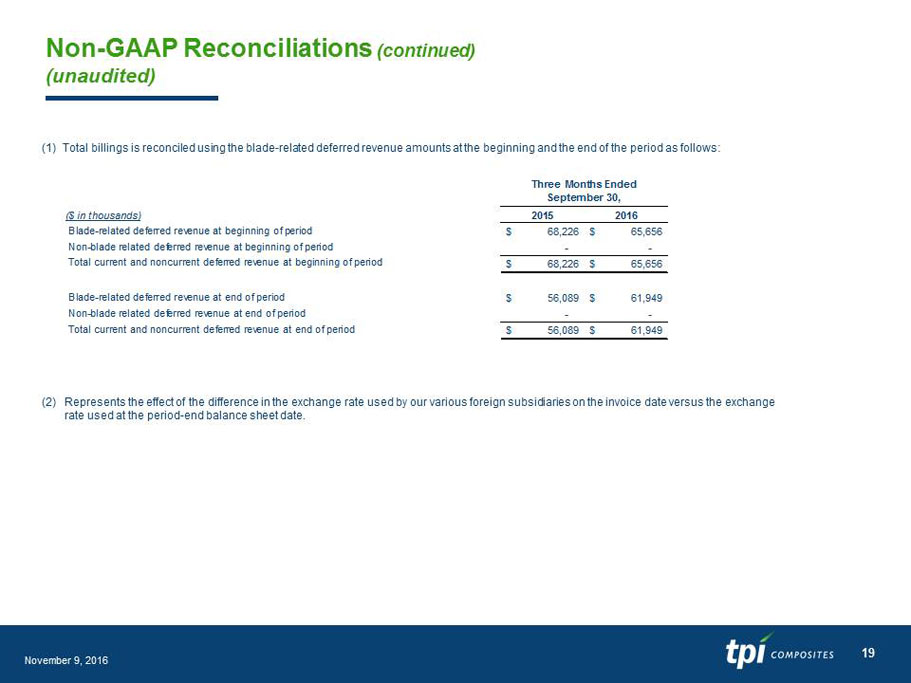

19 November 9, 2016 Non - GAAP Reconciliations (continued) (unaudited) (1) Total billings is reconciled using the blade - related deferred revenue amounts at the beginning and the end of the period as follows : (2) Represents the effect of the difference in the exchange rate used by our various foreign subsidiaries on the invoice date versus the exc han ge rate used at the period - end balance sheet date. ($ in thousands) 2015 2016 Blade-related deferred revenue at beginning of period 68,226$ 65,656$ Non-blade related deferred revenue at beginning of period - - Total current and noncurrent deferred revenue at beginning of period 68,226$ 65,656$ Blade-related deferred revenue at end of period 56,089$ 61,949$ Non-blade related deferred revenue at end of period - - Total current and noncurrent deferred revenue at end of period 56,089$ 61,949$ Three Months Ended September 30,

20 November 9, 2016 Non - GAAP Reconciliations (continued) (unaudited) Net debt is reconciled as follows: Free cash flow is reconciled as follows: ($ in thousands) December 31, 2015 September 30, 2016 September 30, 2015 Total debt, net of debt issuance costs and discount 129,346$ 110,922$ 111,702$ Add debt issuance costs 4,220 2,947 3,462 Add discount on debt 3,018 - 3,771 Less cash and cash equivalents (45,917) (106,802) (6,957) Net debt 90,667$ 7,067$ 111,978$ ($ in thousands) 2015 2016 Net cash provided by operating activities 3,442$ 17,801$ Less capital expenditures (4,851) (4,673) Free cash flow (1,409)$ 13,128$ Three Months Ended September 30,

Exhibit 99.3

TPI Composites Expands its Relationship with Nordex in Turkey

SCOTTSDALE, Ariz., Nov. 09, 2016 (GLOBE NEWSWIRE) -- TPI Composites, Inc., (TPI) (Nasdaq: TPIC), the largest U.S.-based independent manufacturer of composite wind blades, announced today that it has entered into an additional, long-term agreement with Nordex to supply wind blades from two lines at its newly-constructed manufacturing facility in Izmir, Turkey.

“We are pleased that Nordex has chosen to outsource additional blade production with us in Turkey,” said Steve Lockard, TPI’s President and CEO.

TPI has been building wind blades for Nordex in Turkey since 2013 under its original long-term supply agreement with Nordex.

“We are excited to add our second customer to our new Turkey facility and to continue delivering high-quality, cost competitive wind blades to our customers in the EMEA region,” added Senol Bircan, TPI’s Vice President – EMEA Operations.

About TPI Composites, Inc.

TPI Composites, Inc. is the largest U.S.-based independent manufacturer of composite wind blades for the wind energy market. TPI delivers high-quality, cost-effective composite solutions through long term relationships with leading wind turbine manufacturers. TPI is headquartered in Scottsdale, Arizona and operates factories throughout the U.S., Mexico, China and Turkey.

Investor Contact:

[email protected]

480-315-8742