Form 8-K Voya Financial, Inc. For: Nov 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 2, 2016

VOYA FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-35897 | No. 52-1222820 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) | ||

| 230 Park Avenue New York, New York |

10169 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (212) 309-8200

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On November 2, 2016, Voya Financial, Inc. (“Voya Financial”) reported its financial results for the three months and nine months ended September 30, 2016. A copy of the press release containing this information is furnished as Exhibit 99.1 hereto and is incorporated by reference in this item 2.02.

As previously announced, Voya Financial will host a conference call on Wednesday, November 2, 2016 at 10:00 am EDT to discuss its third-quarter 2016 results. The call can be accessed via Voya Financial’s investor relations website at http://investors.voya.com. The call will be accompanied by a slide presentation, which will be accessible via Voya Financial’s investor relations website at http://investors.voya.com beginning at 9:30 am EDT on Wednesday, November 2, 2016. In addition, more detailed financial information can be found in Voya Financial’s Quarterly Investor Supplement for the quarter ended September 30, 2016, available on Voya Financial’s investor relations website at http://investors.voya.com. The Quarterly Investor Supplement for the quarter ended September 30, 2016 is furnished herewith as Exhibit 99.2 and is incorporated by reference in this Item 2.02.

As provided in General Instruction B.2 of Form 8-K, the information and exhibits provided pursuant to this Item 2.02 shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

| (d) | Exhibits |

| 99.1 | Press release of Voya Financial, Inc., dated November 2, 2016 (furnished and not filed) | |

| 99.2 | Quarterly Investor Supplement for the quarter ended September 30, 2016 (furnished and not filed) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Voya Financial, Inc. (Registrant) | ||

| By: | /s/ Trevor Ogle | |

| Name: | Trevor Ogle | |

| Title: | Senior Vice President and Deputy General Counsel | |

Dated: November 2, 2016

Exhibit 99.1

| NEWS RELEASE |

|

Voya Financial Announces Third-Quarter 2016 Results

Board of Directors Authorizes an Additional $600 Million of Share Repurchases

Voya Announces Plans to Achieve Additional Cost Savings in 2018

NEW YORK, Nov. 2, 2016 – Voya Financial, Inc. (NYSE: VOYA) today announced financial results for the third quarter of 2016.

| • | 3Q 2016 net loss available to common shareholders of $1.24 per diluted share, which reflects: |

| • | Closed Block Variable Annuity (CBVA) segment loss of $1.06 per diluted share, after-tax, which includes a $0.31 per diluted share, after-tax, loss related to the annual review of actuarial assumptions and models for the segment; the CBVA segment, which is in run-off, is supported by a hedge program that is primarily designed to mitigate the impacts of market movements on regulatory and rating agency capital resources, creating an accounting asymmetry with U.S. GAAP financial results; and |

| • | A loss of $0.75 per diluted share, after-tax, (operating and non-operating) from the annual review of actuarial assumptions and models in the Ongoing Business, which reflects the lower level of interest rates. |

| • | 3Q 2016 operating earnings1,2 of $0.37 per diluted share, after-tax, which includes: |

| • | $(0.47) per diluted share, after-tax, of deferred acquisition costs and value of business acquired (“DAC/VOBA”) and other intangibles unlocking primarily related to the company’s annual review of actuarial assumptions and models; and |

| • | $0.05 per diluted share, after-tax and DAC/VOBA, of prepayment fee and alternative investment income above, in aggregate, the company’s long-term expectations. |

| • | 3Q 2016 segment results include: |

| • | Retirement net inflows of $1.4 billion due to net inflows in all markets; |

| • | Investment Management net inflows of $297 million (excluding sub-advisor replacements and variable annuity outflows); |

| • | Positive inflows for Annuities investment-only products; |

| • | Unfavorable mortality in Individual Life, although improved compared with 3Q 2015; |

| • | Higher Stop Loss and Group Life loss ratios compared with 3Q 2015, but within the annual expected range; and |

| • | CBVA hedge program continued to protect regulatory and rating agency capital. |

| 1 | Voya Financial assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after-tax.” A 35% tax rate is applied to all non-operating items. The 32% tax rate for operating earnings and components reflects the estimated benefit of the dividend received deduction related to the company’s five Ongoing Business segments, which include Retirement, Investment Management, Annuities, Individual Life, and Employee Benefits. |

| 2 | Consolidated operating earnings, operating earnings for the Ongoing Business, Ongoing Business adjusted operating earnings, and adjusted operating earnings for each segment are each non-GAAP financial measures; information regarding the non-GAAP financial measures included in this press release, and reconciliations to the most comparable U.S. GAAP measures, are provided under the “Use of Non-GAAP Financial Measures” section of this release, and in the “Reconciliations” section of the Quarterly Investor Supplement. |

1

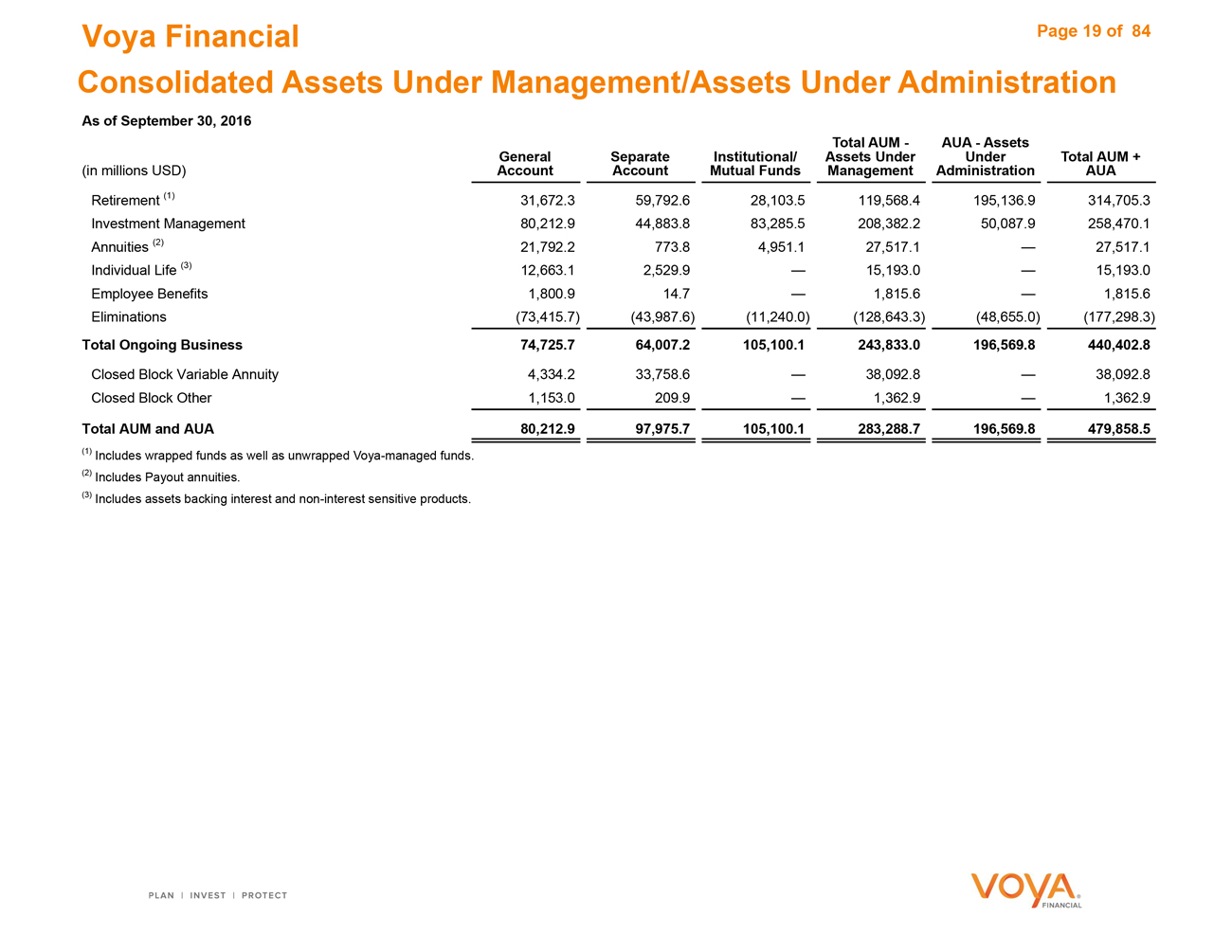

| • | Total assets under management (AUM) of $283 billion; total AUM and administration of $480 billion as of Sept. 30, 2016. |

| • | $150 million of share repurchases in 3Q 2016 through a previously announced share repurchase agreement; $200 million share repurchase agreement planned for 4Q 2016. |

| • | Planning at least $100 million in annual run rate cost savings to be realized in 2018 and subsequent years; represents an increase from the company’s previously announced plans to achieve $30 to $40 million in annual run rate cost savings. |

| • | Estimated combined risk-based capital (RBC) ratio of 468%3, which is above the company’s target of 425%. |

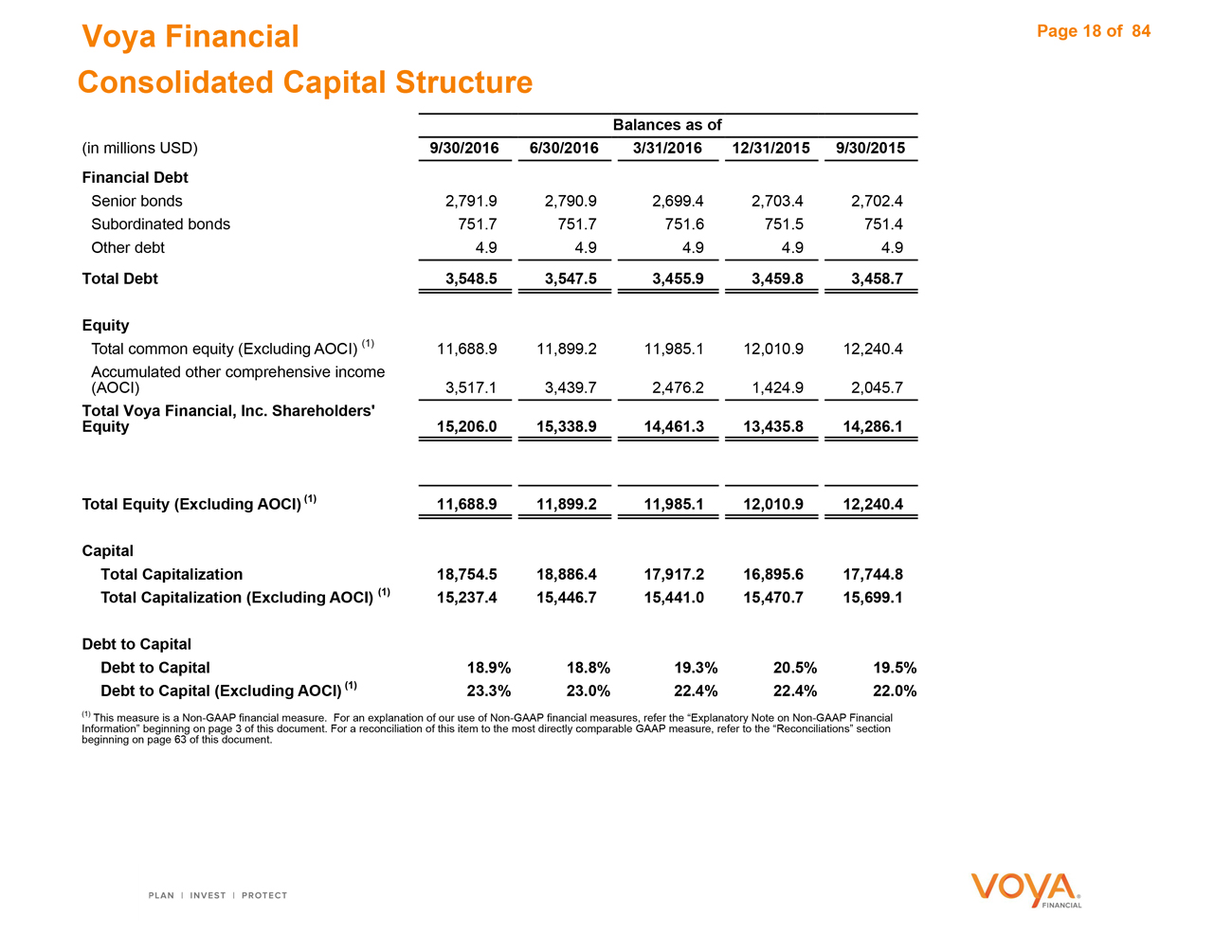

| • | Debt-to-capital ratio, excluding accumulated other comprehensive income (AOCI), of 23.3%4. |

| • | Book value per share (excluding AOCI) of $60.075. |

Third-Quarter Summary

3Q 2016 net income (loss) available to common shareholders was $(248) million, or $(1.24) per diluted share, compared with net income (loss) available to common shareholders of $40 million, or $0.18 per diluted share in 3Q 20156. The following items primarily accounted for this change:

| • | A $322 million loss related to the company’s annual review of actuarial assumptions and models during 3Q 2016, compared with a loss of $214 million in 3Q 2015; and |

| • | A loss of $123 million in 3Q 2016 due to changes in the fair value of guaranteed benefit derivatives related to nonperformance risk in CBVA, which the company considers a non-economic factor, compared with a gain of $241 million in 3Q 20157. |

Net income available to common shareholders includes the effect of the company’s CBVA hedge program – which focuses on protecting regulatory and rating agency capital from market movements, rather than minimizing GAAP earnings volatility – as well as net investment gains and losses, among other items.

| 3 | Estimated combined RBC ratio primarily for Voya Financial’s four principal U.S. insurance subsidiaries. |

| 4 | Debt-to-capital ratio, excluding AOCI, is a non-GAAP financial measure. Information regarding this non-GAAP financial measure, and a reconciliation to the most comparable U.S. GAAP measure, is provided under the “Use of Non-GAAP Financial Measures” section of this release, and in the “Reconciliations” section of the Quarterly Investor Supplement. |

| 5 | Book value per share (excluding AOCI) is a non-GAAP financial measure. Information regarding this non-GAAP financial measure, and a reconciliation to the most comparable U.S. GAAP measure, is provided under the “Use of Non-GAAP Financial Measures” section of this release, and in the “Reconciliations” section of the Quarterly Investor Supplement. |

| 6 | For the three months ended Sept. 30, 2016 and 2015, weighted-average fully diluted common shares outstanding were 201.5 million and 223.6 million, respectively. |

| 7 | Includes actuarial assumptions and model updates of $(36) million in 3Q 2016 and $21 million in 3Q 2015. |

2

3Q 2016 after-tax operating earnings were $74 million, or $0.37 per diluted share, compared with $93 million, or $0.42 per diluted share, in 3Q 20158. The following items primarily accounted for this change:

| • | $32 million, after tax, of incremental unfavorable DAC/VOBA and other intangibles unlocking; |

| • | $18 million, after tax, of higher adjusted operating earnings from the Ongoing Business; and |

| • | $6 million, after tax, of lower operating earnings from other Closed Blocks primarily due to the accelerated recognition of the deferred financing cost related to terminating three funding agreements. |

“During the third quarter, we demonstrated strong sales momentum across our Ongoing Business,” said Rodney O. Martin, Jr., chairman and chief executive officer, Voya Financial. “We achieved positive net flows in Retirement, Investment Management third party assets and in investment-only products in Annuities while also achieving strong sales in Employee Benefits and Individual Life. We continue to execute on our plans to grow our Ongoing Business at higher returns on capital and – while our industry remains challenged by the low interest rate environment – we are taking actions to help maintain and improve profitability. For example, during the third quarter, we announced plans to combine our Annuities and Individual Life businesses to share resources among the businesses and provide us with greater agility and flexibility.

“At the same time, our CBVA hedge program continued to protect regulatory and rating agency capital during the third quarter, and our capital position at Voya remains strong. At Sept. 30, 2016, we had excess capital of $978 million, even after repurchasing $150 million of common stock during the quarter. With the additional $600 million repurchase authorization we’ve received from the board of directors, we plan to continue repurchasing shares opportunistically to help drive greater shareholder value,” added Martin.

New Cost Savings Target

Voya Financial also announced today a higher cost savings target as part of the company’s broader plans to achieve its 2018 return on equity target.

Through a series of initiatives focused on Voya becoming a simpler, more-agile company able to deliver an enhanced customer experience, the company now expects to achieve annual run rate cost savings of at least $100 million in 2018 and subsequent years. These cost savings represent an increase of at least $60 to $70 million annually from the company’s previously announced plans to achieve $30 to $40 million in annual run rate cost savings in 2018. The additional cost savings will be achieved, in part, by simplifying how the company operates, including a further emphasis on less capital-intensive products; greater migration to an information technology cloud environment; and the achievement of operational synergies from the combination of its Annuities and Individual Life businesses.

To achieve its new, targeted annual run rate cost savings of at least $100 million in 2018 and beyond, Voya will incur certain restructuring expenses through 2018. These expenses, which

| 8 | For the three months ended Sept. 30, 2016 and 2015, weighted-average fully diluted common shares outstanding were 201.5 million and 223.6 million, respectively. |

3

will be classified as non-operating items, are not reflected in the company’s run-rate cost savings estimates for 2018. Those estimates also exclude development expenses that will be incurred in 2018 as part of the company’s $350 million strategic investment program.

In the fourth quarter of 2016, Voya will incur restructuring expenses of at least $30 million in connection with these cost-saving initiatives. Additional restructuring costs, which cannot currently be estimated, but which could be material, will be recognized in one or more periods through the end of 2018.

“Since our initial public offering in 2013, we have consistently demonstrated our ability to take proactive steps to achieve our goals and help our customers get ready to retire better,” said Martin. “By increasing our efforts to simplify our company and allocate capital to areas of higher return, we are actively addressing the low interest rate environment while increasing our ability to meet our customers’ needs.”

4

| Three months ended Sept. 30, | ||||||||||||

| ($ in millions, except per share amounts) | 2016 | 2015 | % Change | |||||||||

| Operating earnings before income taxes by segment |

||||||||||||

| Retirement |

$ | 63 | $ | 80 | (21 | )% | ||||||

| Investment Management |

52 | 46 | 13 | |||||||||

| Annuities |

113 | 51 | 116 | |||||||||

| Individual Life |

(76 | ) | (11 | ) | NM | |||||||

| Employee Benefits |

41 | 44 | (7 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Ongoing Business |

$ | 193 | $ | 210 | (8 | )% | ||||||

| Corporate |

(78 | ) | (76 | ) | NM | |||||||

| Closed Block Other |

(7 | ) | 3 | NM | ||||||||

|

|

|

|

|

|

|

|||||||

| Total operating earnings before income taxes |

$ | 108 | $ | 137 | (21 | )% | ||||||

|

|

|

|

|

|

|

|||||||

| Closed Block Variable Annuity |

(328 | ) | (7 | ) | NM | |||||||

| Net investment gains (losses) |

(66 | ) | (65 | ) | NM | |||||||

| Other adjustments* |

(70 | ) | 15 | NM | ||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

$ | (356 | ) | 80 | NM | |||||||

| Less: Income tax expenses (benefit) |

(119 | ) | (36 | ) | NM | |||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss), after-tax |

$ | (237 | ) | $ | 116 | NM | ||||||

| Net income (loss) attributable to non-controlling interest |

11 | 76 | NM | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) available to common shareholders, after-tax |

$ | (248 | ) | $ | 40 | NM | ||||||

|

|

|

|

|

|

|

|||||||

| ($ in per diluted share) |

||||||||||||

| Operating earnings, after-tax** |

$ | 0.37 | $ | 0.42 | (12 | )% | ||||||

| Closed Block Variable Annuity, after-tax*** |

(1.06 | ) | (0.02 | ) | NM | |||||||

| Net investment gains (losses), after-tax*** |

(0.21 | ) | (0.19 | ) | NM | |||||||

| Other adjustments, after-tax*** |

(0.26 | ) | (0.18 | ) | NM | |||||||

| Effect of assumed tax rate vs. actual tax rate**** |

(0.07 | ) | 0.15 | NM | ||||||||

| Adjustment due to antidilutive effect of net loss in the current period |

(0.01 | ) | — | NM | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) available to common shareholders |

$ | (1.24 | ) | $ | 0.18 | NM | ||||||

|

|

|

|

|

|

|

|||||||

| Fully diluted weighted average shares outstanding (in millions) |

201.5 | 223.6 | ||||||||||

| * | “Other adjustments” consists of net guaranteed benefit hedging gains (losses) and related charges and adjustments; income (loss) from business exited; income (loss) attributable to non-controlling interests; immediate recognition of net actuarial gains (losses) related to pension and other post-retirement benefit obligations and gains (losses) from plan amendments and curtailments; expenses associated with the rebranding of Voya Financial from ING U.S.; and restructuring expenses (severance, lease write-offs, etc.). |

| ** | Voya Financial assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after-tax.” The 32% tax rate for operating earnings reflects the estimated dividends received deduction benefit related to the Ongoing Business. |

| *** | A 35% tax rate is applied to all non-operating items. |

| **** | Represents the difference between actual tax expense and the tax expense reflected in other line items using the assumed 32% (operating) tax rate or 35% (non-operating) tax rate. |

NM = Not Meaningful

5

Ongoing Business Results

Voya Financial’s Ongoing Business includes the Retirement, Investment Management, Annuities, Individual Life, and Employee Benefits segments. The Corporate and closed block segments, including CBVA, are not reflected in Ongoing Business results.

| Three months ended Sept. 30, | ||||||||

| ($ in millions, before income taxes) |

2016 | 2015 | ||||||

| Ongoing Business operating earnings |

$ | 193 | $ | 210 | ||||

| Less: Gain due to Lehman bankruptcy settlement |

3 | — | ||||||

| Less: DAC/VOBA and other intangibles unlocking |

(140 | ) | (93 | ) | ||||

|

|

|

|

|

|||||

| Ongoing Business adjusted operating earnings |

$ | 330 | $ | 303 | ||||

|

|

|

|

|

|||||

Ongoing Business operating earnings in 3Q 2016 benefitted from a gain resulting from a Lehman Brothers bankruptcy settlement, which is not reflected in Ongoing Business adjusted operating earnings.

DAC/VOBA and other intangibles, which affects Ongoing Business operating earnings but not adjusted operating earnings, was $47 million unfavorable compared with 3Q 2015 and reflects updated market return assumptions and unfavorable liability and expense assumptions.

Ongoing Business adjusted operating earnings before income taxes were $330 million, compared with $303 million in 3Q 2015. The following items primarily accounted for the change in operating earnings (in addition to DAC/VOBA and other intangibles unlocking) and adjusted operating earnings:

| • | Lower DAC/VOBA and other intangible amortization ($32 million positive variance) and lower underwriting gain and other revenue ($23 million negative variance) primarily driven by a positive change in net mortality in Individual Life as a result of reduced severity when compared with 3Q 2015, partially offset by a negative change in Annuities as a result of model refinements in 3Q 2016 compared with 3Q 2015; |

| • | Higher investment spread and other income ($24 million positive variance) across the segments primarily due to higher prepayment fee income, higher alternative investment income and higher volume resulting from customer transfers from variable to fixed investment accounts, partially offset by declining fixed income portfolio yields; |

| • | Higher commissions ($7 million negative variance) and lower administrative expenses ($2 million positive variance); and |

| • | Higher fee-based margin ($1 million positive variance) primarily due to higher performance fees and higher average AUM due to Investment Management sourced net cash flows and market improvements, partially offset by lower recordkeeping fees as well as lower full-service variable fees from customer transfers from variable to fixed accounts. |

6

Segment Discussions

The following segment discussions compare 3Q 2016 with 3Q 2015, unless otherwise noted. All figures are presented before income taxes.

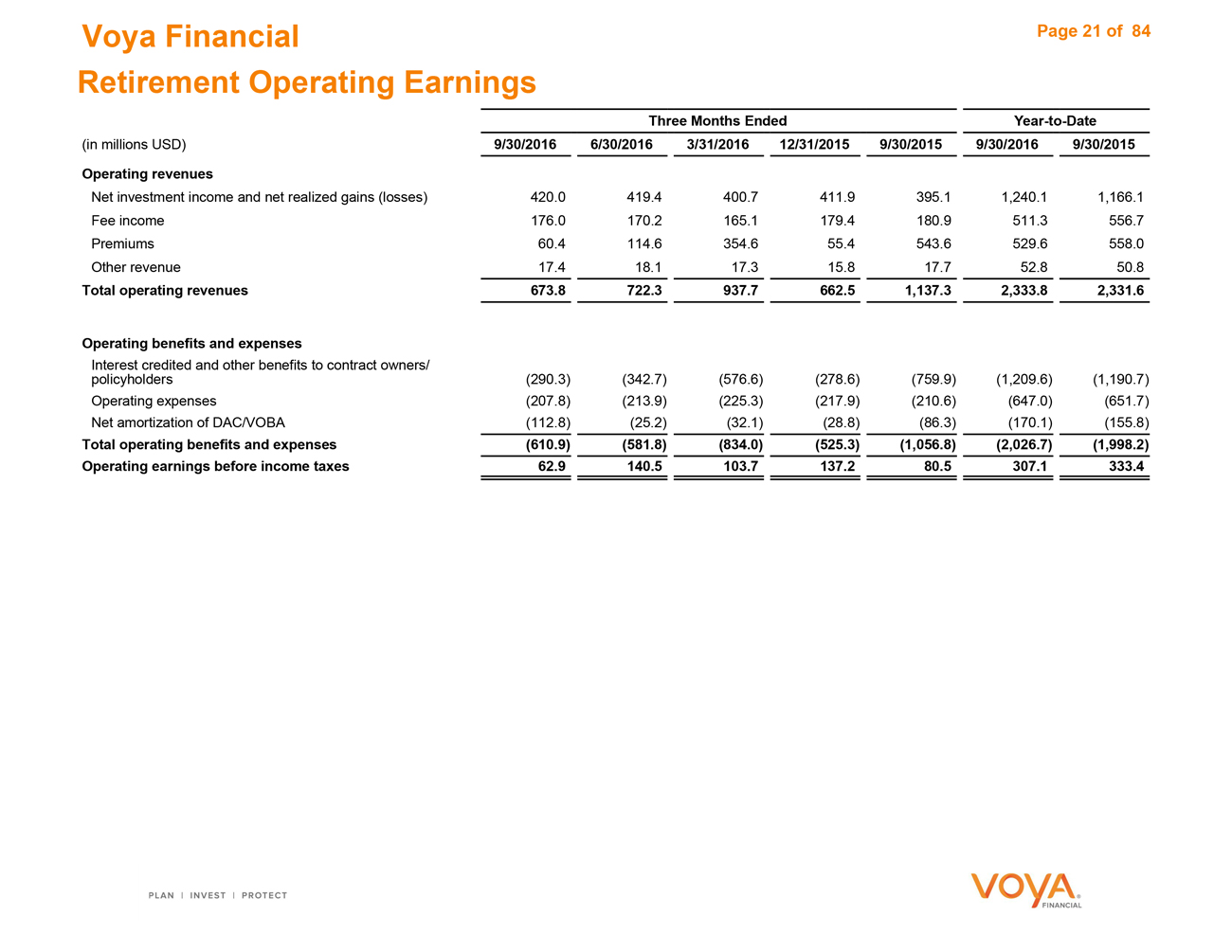

Retirement

Positive Net Flows; Higher Investment Spread and Lower Administrative Expenses

| Three months ended Sept. 30, | ||||||||

| ($ in millions, before income taxes) |

2016 | 2015 | ||||||

| Operating earnings |

$ | 63 | $ | 80 | ||||

| Less: DAC/VOBA and other intangibles unlocking |

(74 | ) | (48 | ) | ||||

|

|

|

|

|

|||||

| Adjusted operating earnings |

$ | 137 | $ | 129 | ||||

|

|

|

|

|

|||||

DAC/VOBA and other intangibles unlocking, which affects Retirement operating earnings but not adjusted operating earnings, was $26 million unfavorable compared with 3Q 2015.

The following items primarily accounted for the change in Retirement operating earnings (in addition to DAC/VOBA and other intangibles unlocking) and adjusted operating earnings:

| • | Higher investment spread and other income ($9 million positive variance) driven by materially higher investment volumes arising, in part, from a shift in participant assets from variable to fixed investment accounts, offset by declining fixed income portfolio earned yields and higher credited interest; |

| • | Lower fee-based margin ($3 million negative variance) due to lower recordkeeping fees reflecting Voya’s exit from the defined benefit business as well as lower full-service, variable fees due in part to customer transfers from variable to fixed investment accounts; |

| • | Lower administrative expenses ($6 million positive variance) due to lower recordkeeping, IT and operations expenses, partially offset by higher trail commissions ($3 million negative variance) resulting from growth in the business; and |

| • | Higher underwriting income ($1 million positive variance). |

Prepayment fee and alternative investment income was $6 million above long-term expectations, in aggregate, before the effect of income taxes and after DAC.

Retirement net inflows were $1.4 billion, compared with net outflows of $1.1 billion in 3Q 2015 and net inflows of $693 million in 2Q 2016. Net flows vary in size and timing, sometimes substantially, from one quarter to the next. Retirement AUM totaled $120 billion, up from $115 billion as of June 30, 2016, and $107 billion as of Sept. 30, 2015.

7

Investment Management

Positive Investment Management Sourced and Affiliate Sourced Net Flows; Higher Revenues from Investment Capital, Partially Offset by Higher Administrative Expenses

| Three months ended Sept. 30, | ||||||||

| ($ in millions, before income taxes) |

2016 | 2015 | ||||||

| Operating earnings |

$ | 52 | $ | 46 | ||||

| Less: Gain due to Lehman bankruptcy settlement |

3 | — | ||||||

|

|

|

|

|

|||||

| Adjusted operating earnings |

$ | 49 | $ | 46 | ||||

|

|

|

|

|

|||||

Investment Management operating earnings in 3Q 2016 benefitted from a gain resulting from a Lehman Brothers bankruptcy settlement, which is not reflected in Investment Management adjusted operating earnings.

The following items primarily accounted for the change in Investment Management operating earnings (in addition to the gain resulting from a Lehman Brothers bankruptcy settlement) and adjusted operating earnings:

| • | Higher investment capital and other investment income ($4 million positive variance) due to income earned on alternative investments; |

| • | Higher fee-based margin ($4 million positive variance) primarily due to higher performance fees and higher average AUM due to Investment Management sourced net cash flows and market improvements; and |

| • | Higher administrative expenses ($5 million negative variance) primarily due to higher compensation-related expenses associated with sales and due, in part, to timing of expenses. |

Alternative investment income was in line with long-term expectations before the impact of income taxes.

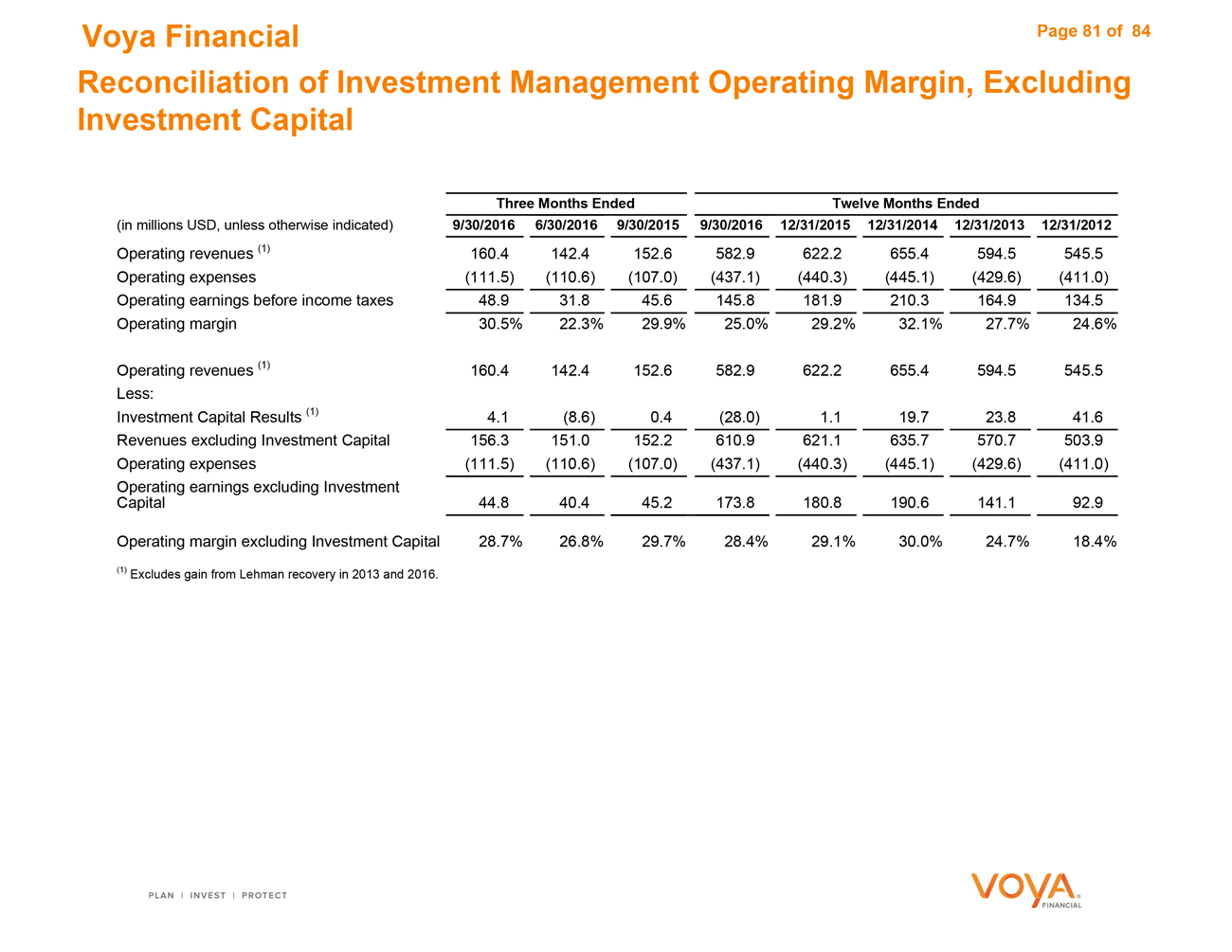

Investment Management Operating Margin

| 3Q 2016 | 2Q 2016 | 3Q 2015 | ||||||||||

| Operating Margin |

30.5 | %9 | 22.3 | % | 29.9 | % | ||||||

| Operating Margin, excluding investment capital results10 |

28.7 | % | 26.8 | % | 29.7 | % | ||||||

The increase in the 3Q 2016 operating margin, excluding investment capital and other investment income, compared with 2Q 2016 was primarily due to higher fee-based revenue resulting from higher performance fees and higher average AUM. Compared with 3Q 2015, the 3Q 2016 operating margin excluding investment capital and other investment income declined primarily due to higher compensation-related expenses associated with sales and due, in part, to timing of expenses.

| 9 | Excludes gain resulting from a Lehman Brothers bankruptcy settlement. |

| 10 | Operating margin, excluding investment capital results, is a non-GAAP financial measure. Information regarding this non-GAAP financial measure, and a reconciliation to the most comparable U.S. GAAP measure, is provided under the “Use of Non-GAAP Financial Measures” section of this release, and in the “Reconciliations” section of the Quarterly Investor Supplement. |

8

Investment Management Net Flows

| ($ in billions) |

3Q 2016 | 2Q 2016 | 3Q 2015 | |||||||||

| Investment Management Sourced Net Flows |

$ | 0.2 | $ | 0.5 | $ | (1.1 | ) | |||||

| Affiliate Sourced Net Flows |

0.1 | 0.0 | (1.4 | ) | ||||||||

| Sub-Advisor Replacements |

0.2 | 0.0 | 1.4 | |||||||||

| VA Net Flows |

(0.8 | ) | (0.7 | ) | (0.8 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | (0.3 | ) | $ | (0.2 | ) | $ | (1.9 | ) | |||

|

|

|

|

|

|

|

|||||||

During 3Q 2016, Investment Management Sourced net inflows were driven by institutional net flows, including flows from global distribution and alternative asset classes.

Third-party11 sales were $4.7 billion, compared with $6.2 billion in 3Q 2015 and $4.3 billion in 2Q 2016. Third-party AUM totaled $128 billion as of Sept. 30, 2016, up from $125 billion as of June 30, 2016, and $122 billion as of Sept. 30, 2015.

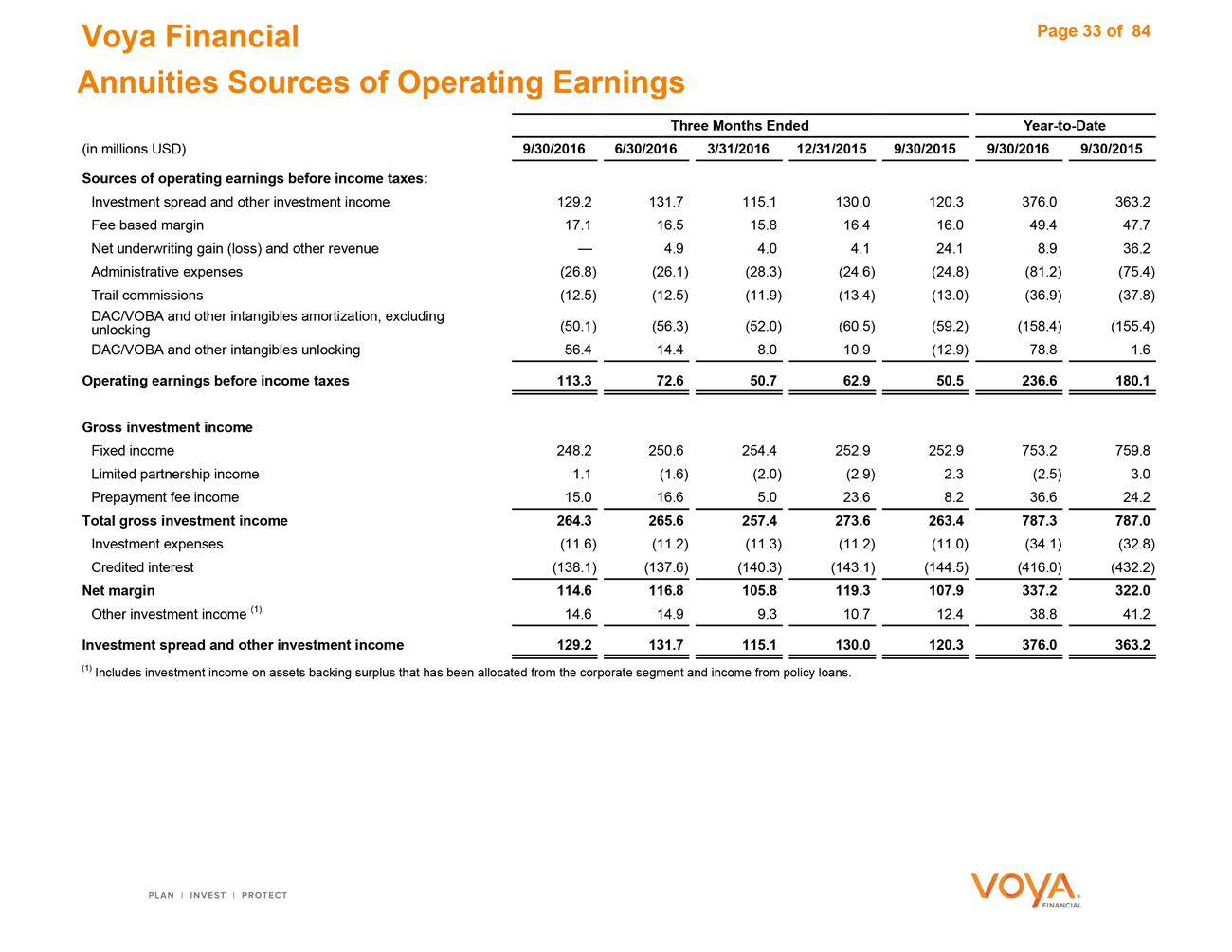

Annuities

Positive Net Flows for Investment-Only Products; Lower Underwriting Results Partially Offset by Higher Prepayment Fee Income

| Three months ended Sept. 30, | ||||||||

| ($ in millions, before income taxes) |

2016 | 2015 | ||||||

| Operating earnings |

$ | 113 | $ | 51 | ||||

| Less: DAC/VOBA and other intangibles unlocking |

56 | (13 | ) | |||||

|

|

|

|

|

|||||

| Adjusted operating earnings |

$ | 57 | $ | 63 | ||||

|

|

|

|

|

|||||

DAC/VOBA and other intangibles unlocking, which affects Annuities operating earnings but not adjusted operating earnings, was $69 million favorable compared with 3Q 2015.

The following items primarily accounted for the change in Annuities operating earnings (in addition to DAC/VOBA and other intangibles unlocking) and adjusted operating earnings:

| • | Lower net underwriting income ($24 million negative variance) primarily due to a $6 million negative reserve adjustment in 3Q 2016 related to valuation model refinements, compared with a $22 million positive reserve adjustment in 3Q 2015 – this was partially offset by favorable mortality; |

| • | Higher investment spread and other income ($9 million positive variance) primarily due to higher prepayment fee income; and |

| • | Lower DAC/VOBA and other intangibles amortization ($9 million positive variance) primarily due to the previously mentioned valuation model refinements. |

| 11 | Excludes general account assets of Voya Financial’s insurance company subsidiaries. |

9

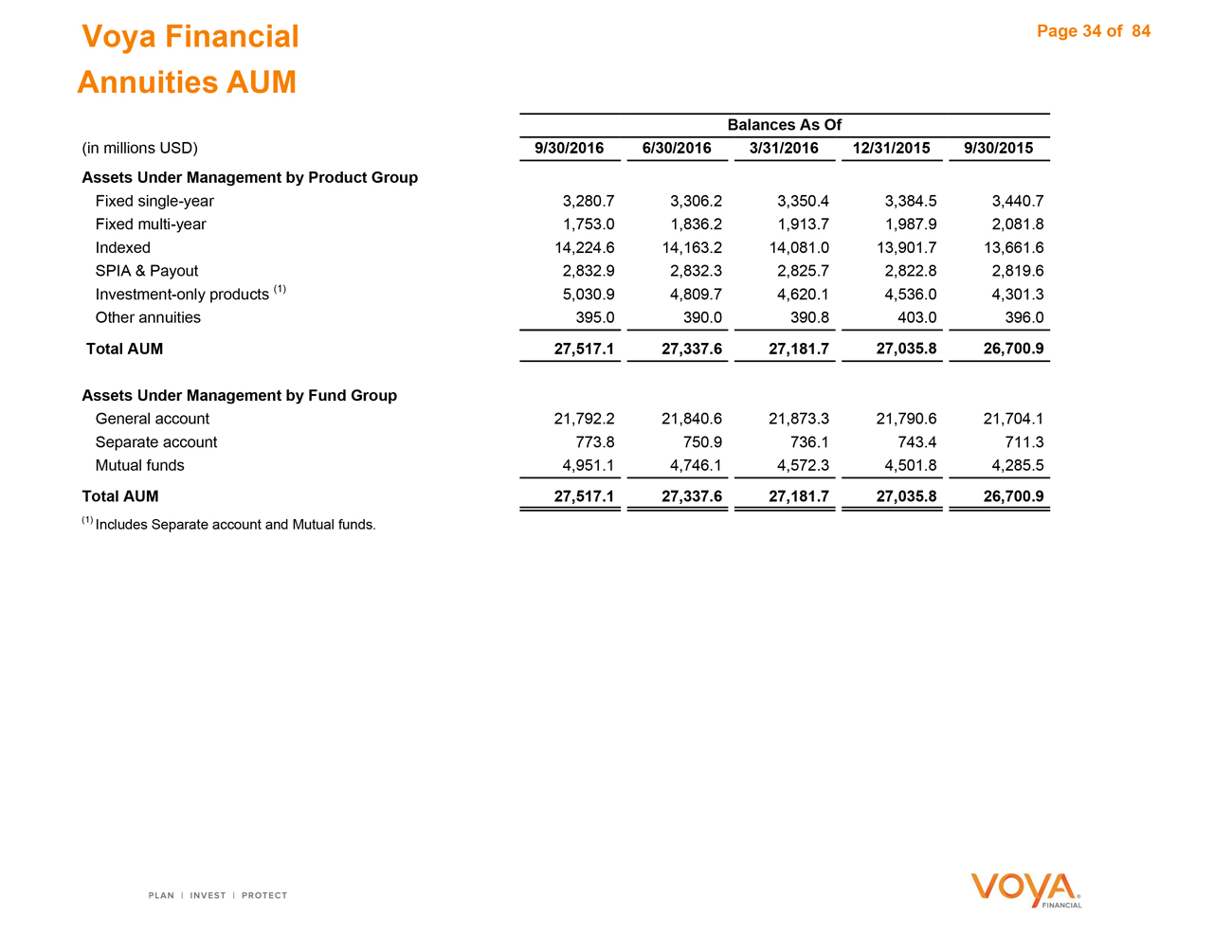

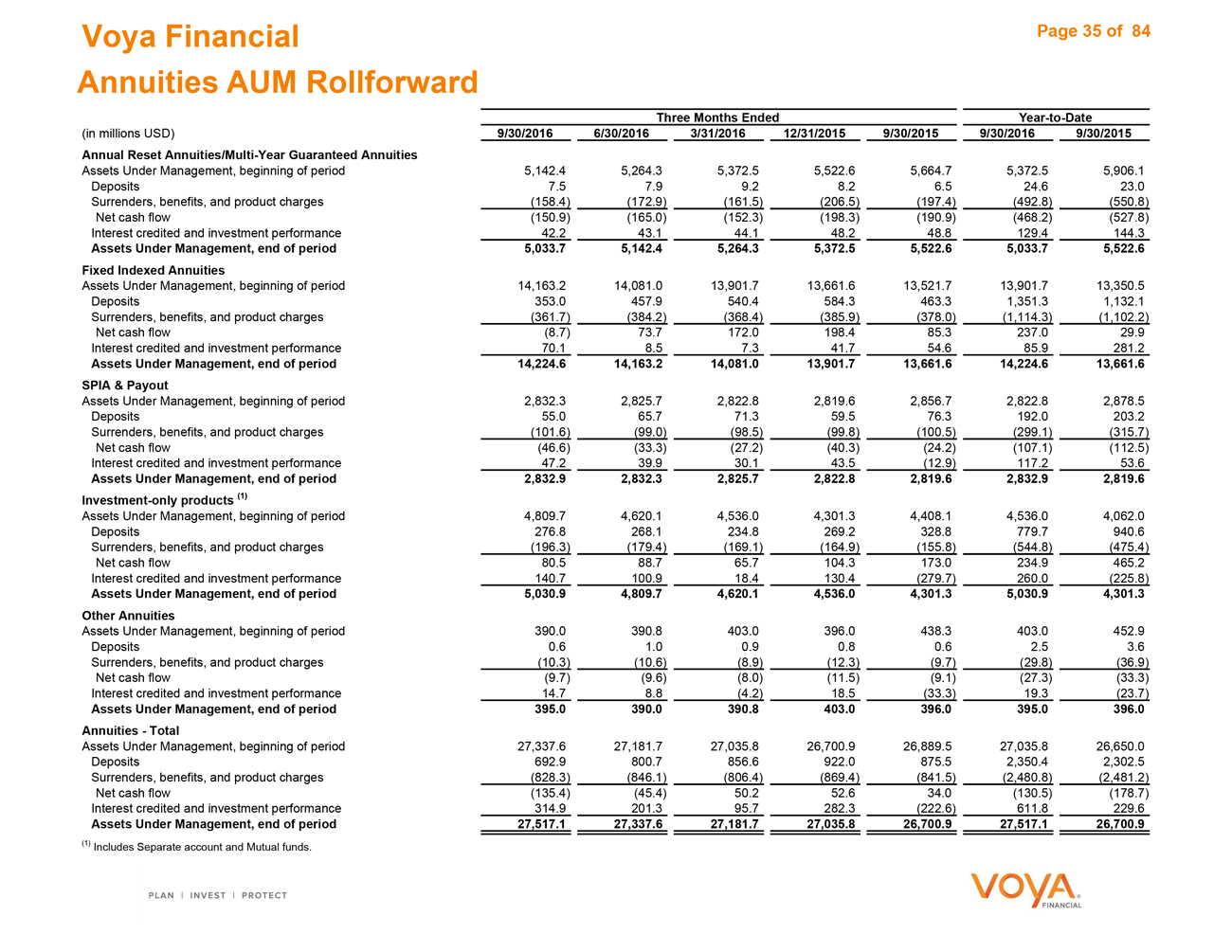

Prepayment fee and alternative investment income was $5 million above long-term expectations, before the effect of income taxes and after DAC. Total Annuities net outflows were $135 million as net inflows of $81 million in investment-only products were more than offset by net outflows of $9 million in fixed indexed annuities, $151 million in fixed rate annuities, and $56 million in income and other annuities.

Annuities AUM totaled $28 billion as of Sept. 30, 2016, up from $27 billion as of June 30, 2016, and $27 billion as of Sept. 30, 2015.

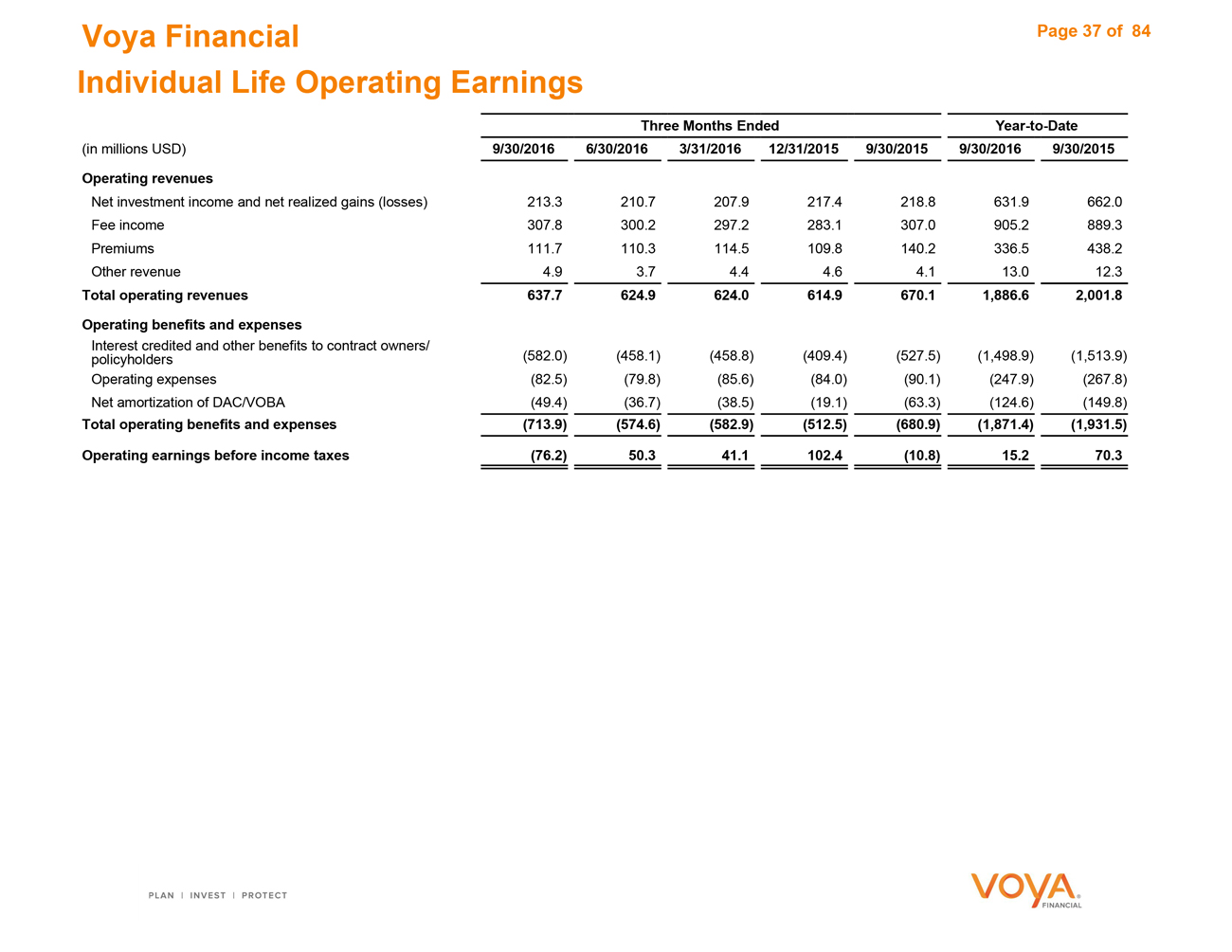

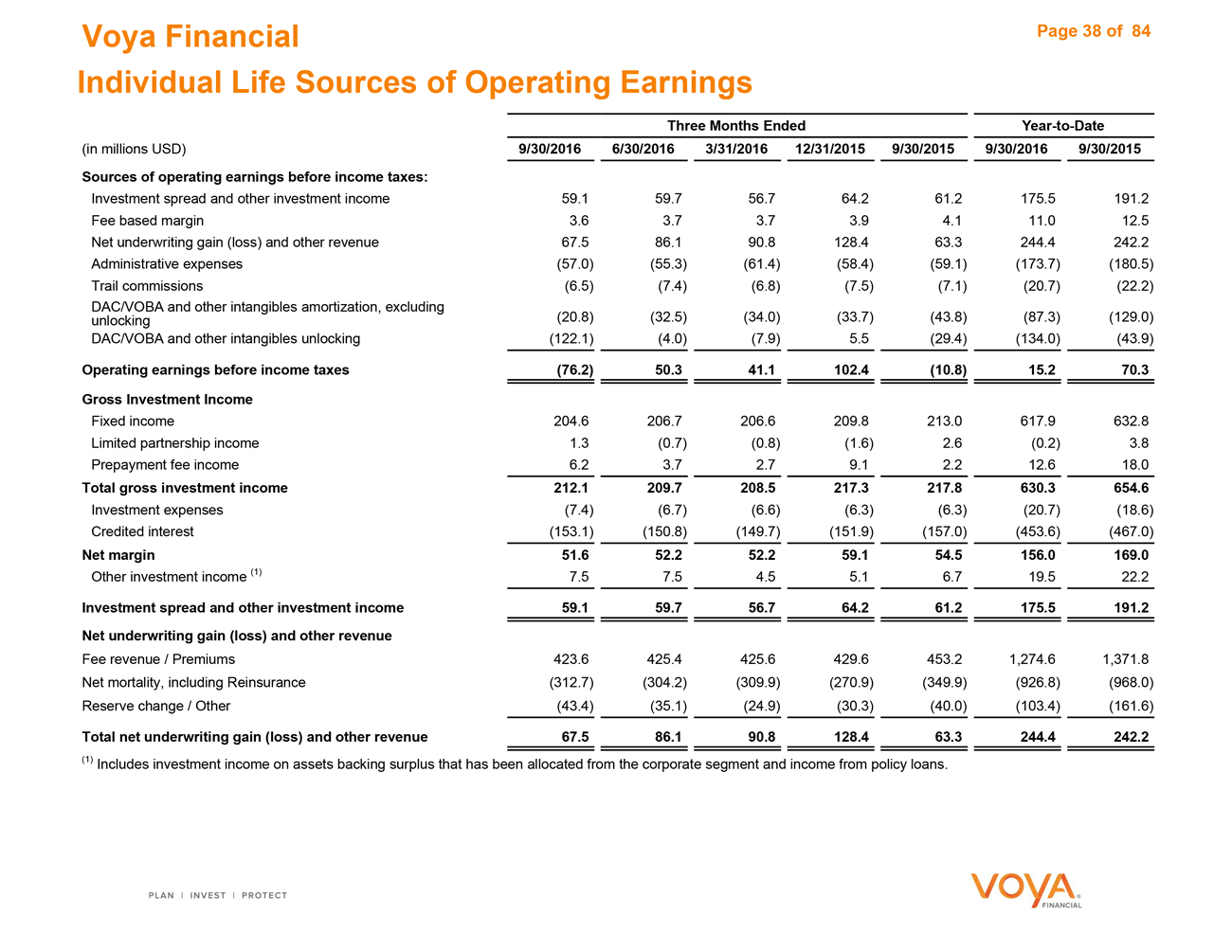

Individual Life

Higher Underwriting Income and Favorable Amortization Offset by Lower Investment Spread

| Three months ended Sept. 30, | ||||||||

| ($ in millions, before income taxes) |

2016 | 2015 | ||||||

| Operating earnings |

$ | (76 | ) | $ | (11 | ) | ||

| Less: DAC/VOBA and other intangibles unlocking |

(122 | ) | (29 | ) | ||||

|

|

|

|

|

|||||

| Adjusted operating earnings |

$ | 46 | $ | 19 | ||||

|

|

|

|

|

|||||

DAC/VOBA and other intangibles unlocking, which affects Individual Life operating earnings but not adjusted operating earnings, was $93 million unfavorable compared with 3Q 2015.

The following items primarily accounted for the change in Individual Life operating earnings (in addition to DAC/VOBA and other intangibles unlocking) and adjusted operating earnings:

| • | Higher net underwriting income and lower DAC/VOBA and other intangibles amortization ($27 million positive variance) primarily driven by net mortality as a result of reduced severity when compared to 3Q 2015; |

| • | Lower administrative expenses ($2 million positive variance); and |

| • | Lower investment spread ($2 million negative variance) primarily due to lower yields on fixed income portfolios partially offset by favorable prepayment fee income. |

Prepayment fee and alternative investment income was $2 million above long-term expectations, before the impact of income taxes and after DAC.

Total sales were $24 million, $20 million (or 82%) of which were indexed life sales. This compares with 3Q 2015 total sales of $25 million, $18 million (or 74%) of which were indexed life sales.

10

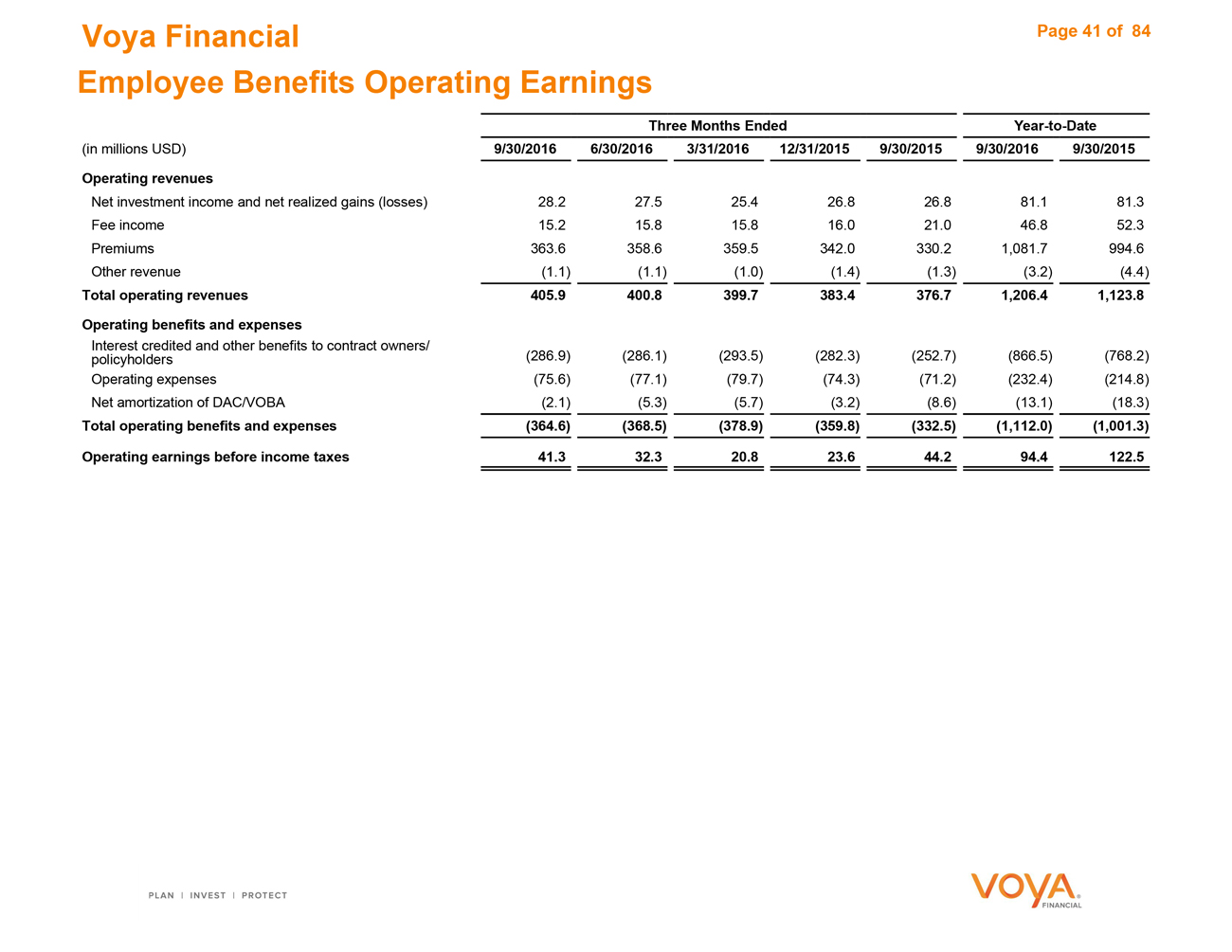

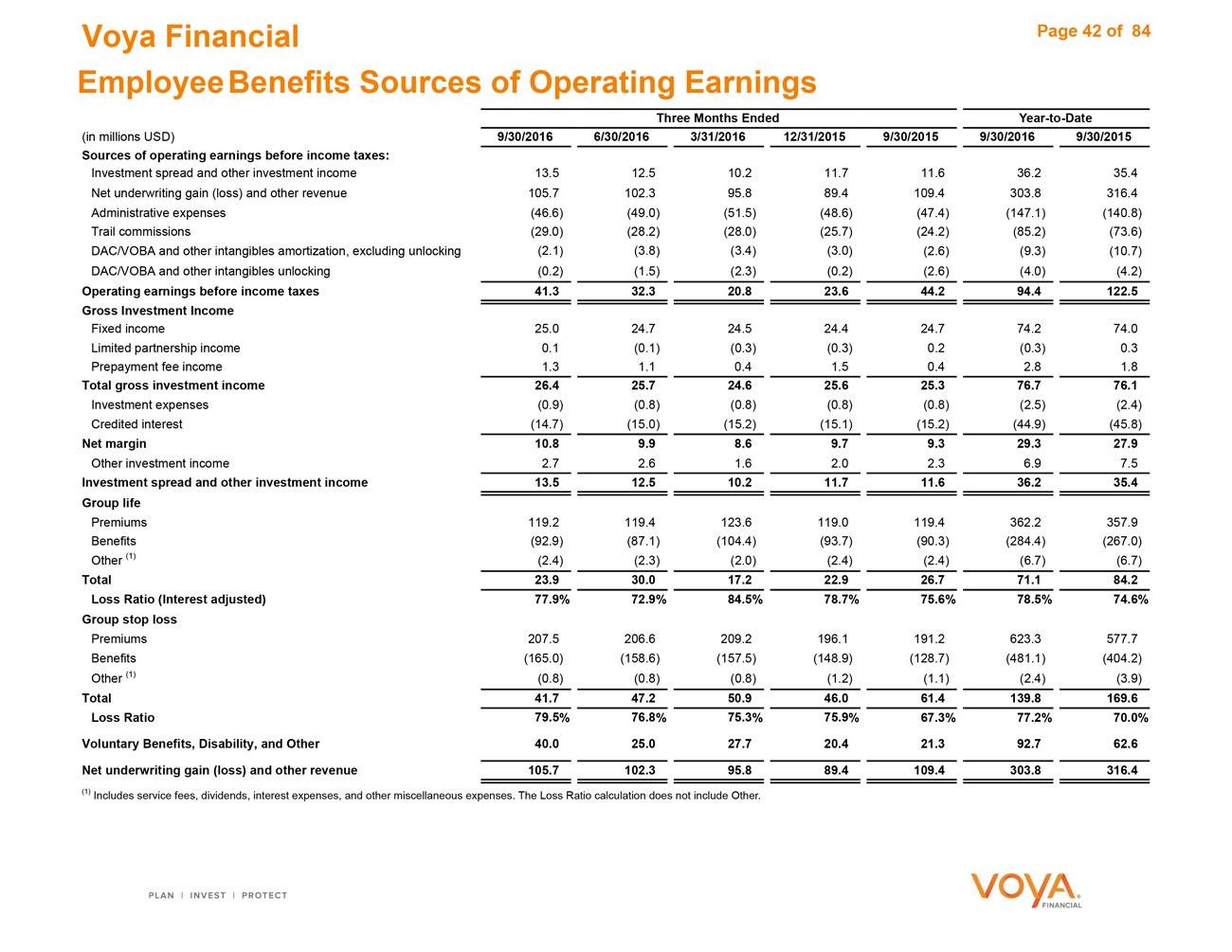

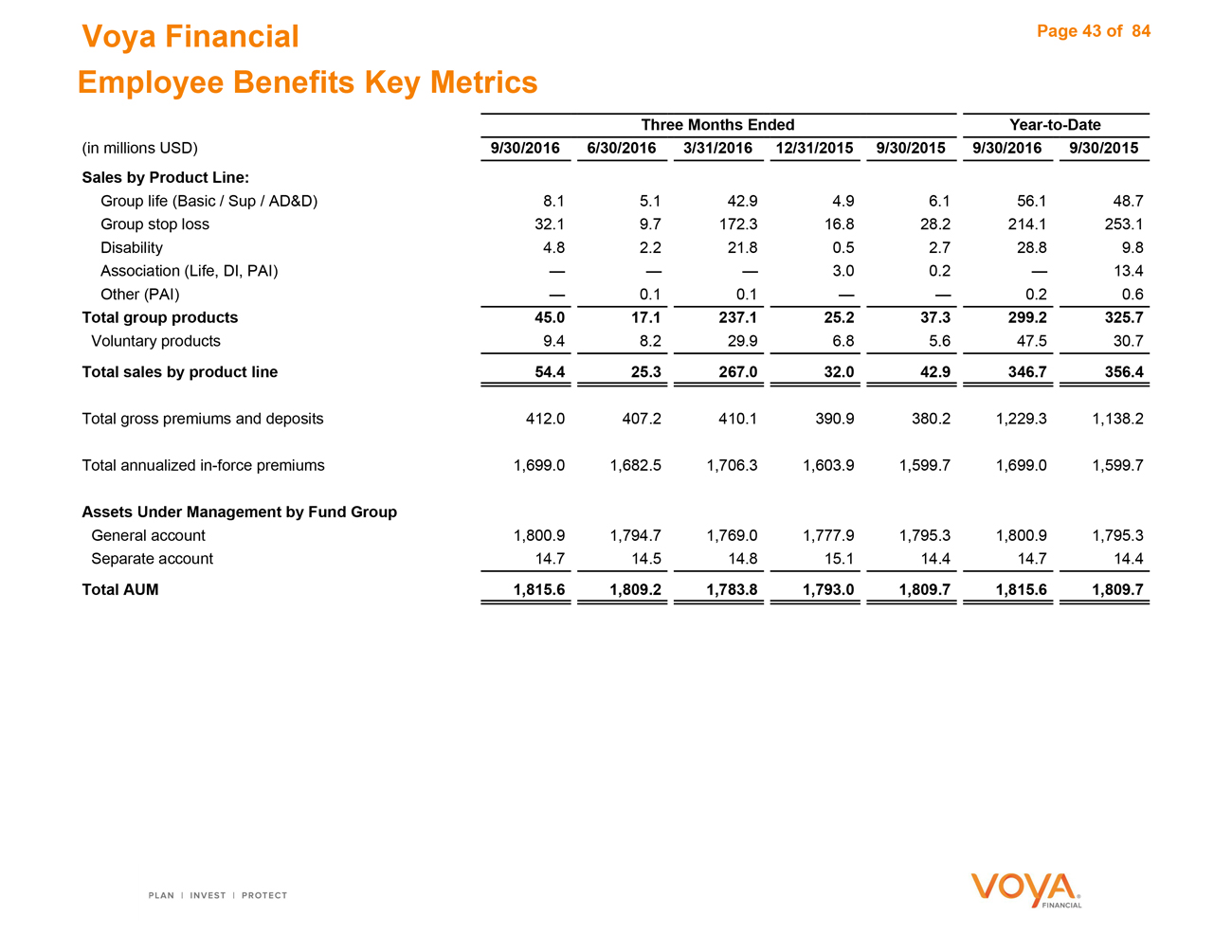

Employee Benefits

Continued Revenue Growth Across the Business Offset by Higher, but Within Expected Range, Loss Ratios

| Three months ended Sept. 30, | ||||||||

| ($ in millions, before income taxes) |

2016 | 2015 | ||||||

| Operating earnings |

$ | 41 | $ | 44 | ||||

| Less: DAC/VOBA and other intangibles unlocking |

(0 | ) | (3 | ) | ||||

|

|

|

|

|

|||||

| Adjusted operating earnings |

$ | 42 | $ | 47 | ||||

|

|

|

|

|

|||||

DAC/VOBA and other intangibles unlocking, which affects Employee Benefits operating earnings but not adjusted operating earnings, was approximately $3 million favorable compared with 3Q 2015.

The following items primarily accounted for the change in Employee Benefits operating earnings (in addition to DAC/VOBA and other intangibles unlocking) and adjusted operating earnings:

| • | Lower net underwriting income ($4 million negative variance) as both Stop Loss and Group Life loss ratios were within expected ranges, but higher than the very favorable results in 3Q 2015 – this was partially offset by in-force premium growth across the business and a $17 million, post-DAC, favorable reserve refinement on the company’s Compass product line; |

| • | Higher trail commissions ($5 million negative variance) due to growth in the business; and |

| • | Higher investment spread and other income ($2 million positive variance). |

Prepayment fee and alternative investment income was $1 million above long-term expectations, before the impact of income taxes.

The loss ratio for Group Life was 77.9%, compared with 75.6%. The loss ratio for Stop Loss was 79.5%, compared with 67.3%. The expected annual loss ratio range for Group Life and Stop Loss is 77-80%.

Sales were $54 million, compared with $43 million in 3Q 2015.

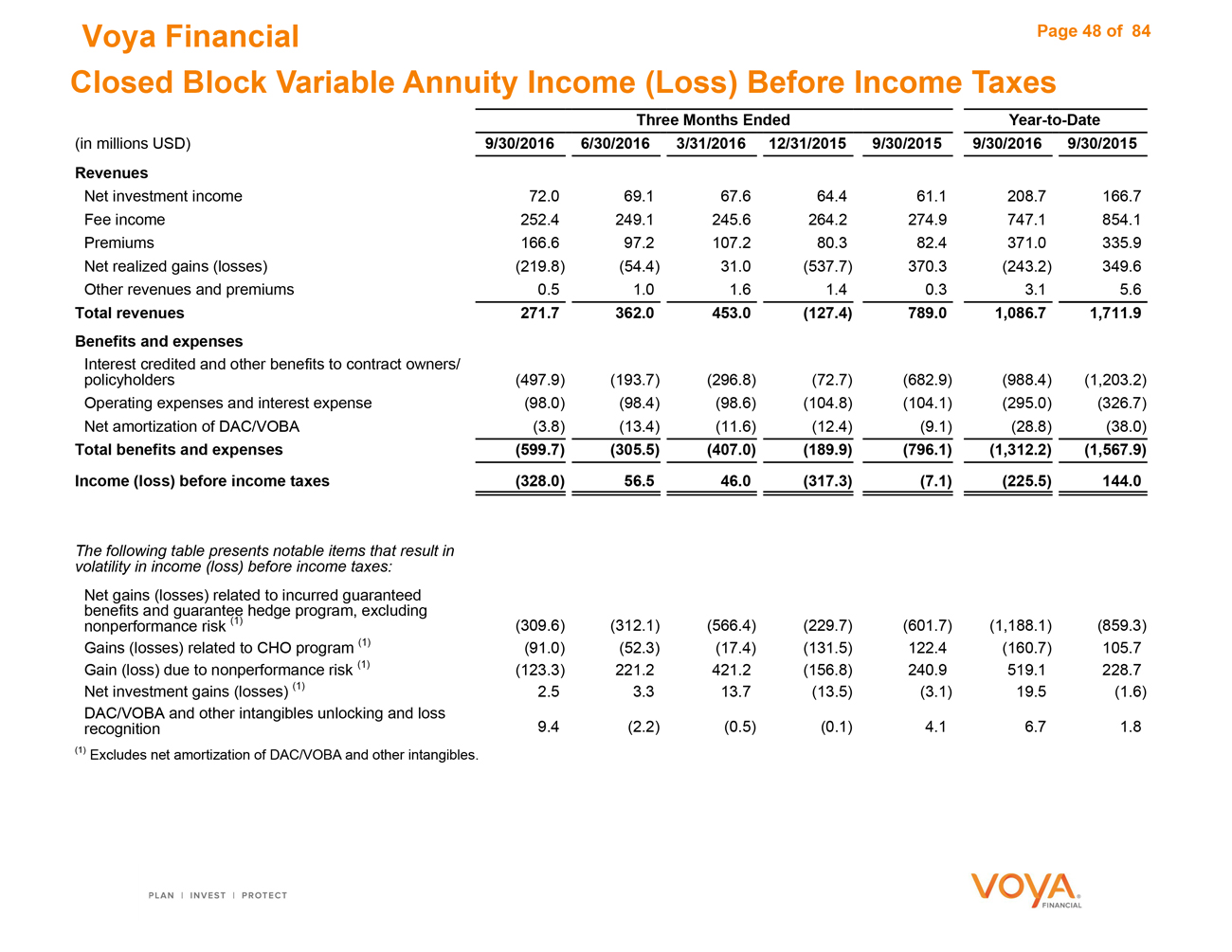

CBVA

CBVA had a net loss before income taxes of $328 million, compared with a net loss before income taxes of $7 million in 3Q 2015. Changes in the fair value of guaranteed benefit derivatives related to nonperformance risk, which the company considers a non-economic factor, generated a loss of $123 million in 3Q 2016, compared to a gain of $241 million in 3Q 2015.

CBVA’s $328 million net loss in 3Q 2016 included a $96 million loss due to annual assumption changes. The $96 million loss reflects the negative impact of lower interest rate assumptions and other model updates, which were partially offset by the positive impact of policyholder behavior assumption changes.

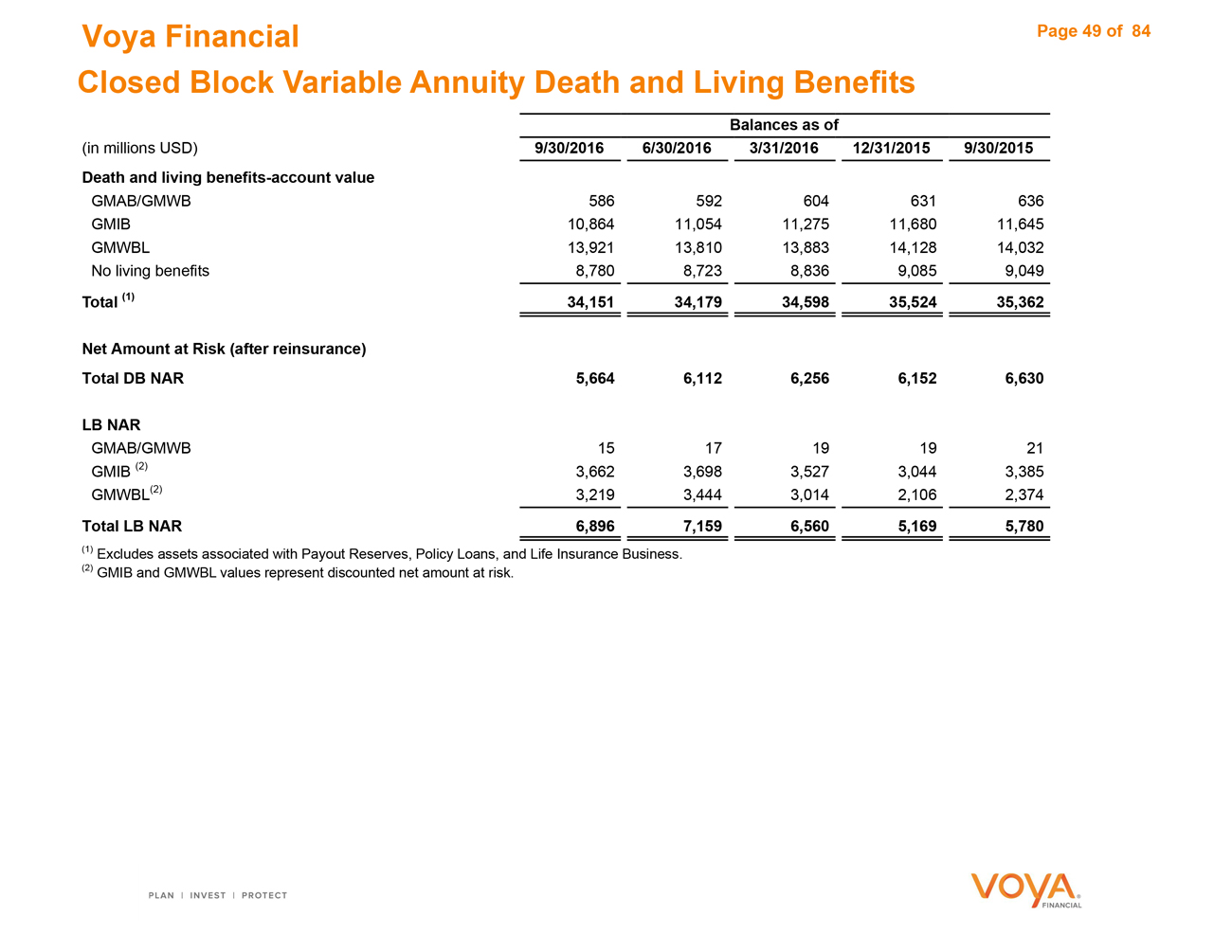

The CBVA segment contains variable annuity products with substantial guarantee features, which are in run-off. CBVA is supported by a hedge program that is primarily designed to mitigate the impacts of market movements on capital resources. As U.S. GAAP accounting differs from the methods used to determine regulatory and rating agency capital measures, the CBVA hedge program can create earnings volatility for U.S. GAAP financial statements.

11

During 3Q 2016, the hedge program resulted in a net gain to regulatory surplus as a result of the difference between the decrease in reserves and hedge resources related to equity market movements.

As of Sept. 30, 2016, Voya had estimated available resources of $6.3 billion for CBVA, $1.0 billion higher than statutory reserve requirements, and no letters of credit required or issued.

Corporate

Corporate operating losses were $78 million, compared with losses of $76 million in 3Q 2015.

Share Repurchases

During 3Q 2016, Voya completed the repurchase agreement announced in 2Q 2016 by repurchasing 5.7 million shares of its common stock at an average price per share of approximately $26.36 for an aggregate purchase price of approximately $150 million. In 4Q 2016, Voya plans to enter into an agreement to repurchase $200 million of its common stock.

Additional Share Repurchase Authorization

Voya Financial announced today that its board of directors has increased the amount of the company’s common stock authorized for repurchase under the company’s share repurchase program by an additional $600 million. Including this additional $600 million authorization and giving effect to the planned repurchase of $200 million of shares under an agreement to be entered into in 4Q 2016, the aggregate amount currently available under the company’s share repurchase authorization would be approximately $633 million. Under its share repurchase program, the company may, from time to time, purchase shares of its common stock through various means, including open market transactions, privately negotiated transactions, forward, derivative, accelerated repurchase, or automatic repurchase transactions, or tender offers. The additional $600 million share repurchase authorization expires on Dec. 31, 2017 (unless extended), and does not obligate the company to purchase any shares. The authorization for the share repurchase program may be terminated, increased or decreased by the board of directors at any time.

Supplementary Financial Information

More detailed financial information can be found in the company’s Quarterly Investor Supplement, which is available on Voya’s investor relations website, investors.voya.com.

Earnings Conference Call and Slide Presentation

Voya will host a conference call on Wednesday, Nov. 2, 2016, at 10 a.m. ET, to discuss the company’s third-quarter 2016 results. The call and slide presentation can be accessed via the company’s investor relations website at investors.voya.com. A replay of the call will be available on the company’s investor relations website at investors.voya.com starting at 1 p.m. ET on Nov. 2, 2016.

12

| Media Contact: | Investor Contact: | |

| Christopher Breslin 212-309-8941 |

Darin Arita 212-309-8999 |

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA), helps Americans plan, invest and protect their savings — to get ready to retire better. Serving the financial needs of approximately 13 million individual and institutional customers in the United States, Voya is a Fortune 500 company that had $11 billion in revenue in 2015. The company had $480 billion in total assets under management and administration as of Sept. 30, 2016. With a clear mission to make a secure financial future possible – one person, one family, one institution at a time – Voya’s vision is to be America’s Retirement Company™. The company is equally committed to conducting business in a way that is socially, environmentally, economically and ethically responsible – Voya has been recognized as one of the 2016 World’s Most Ethical Companies® by the Ethisphere Institute, and as one of the Top Green Companies in the U.S., by Newsweek magazine. For more information, visit voya.com. Follow Voya Financial on Facebook and Twitter @Voya.

Use of Non-GAAP Financial Measures

Operating earnings before income taxes is a financial measure we use to evaluate segment performance. We believe that operating earnings before income taxes provides a meaningful measure of our business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of our underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors. We use the same accounting policies and procedures to measure segment operating earnings before income taxes as we do for consolidated net income (loss). We also report operating earnings on an aggregate basis (both before and after income taxes) for both our Ongoing Business and for our company as a whole. Operating earnings does not replace net income (loss) as the measure of our results of operations. Therefore, we believe that it is useful to evaluate both net income (loss) and Operating earnings before income taxes when reviewing our financial and operating performance. Each segment’s operating earnings before income taxes is calculated by adjusting income (loss) before income taxes for the following items:

| • | Net investment gains (losses), net of related amortization of DAC, VOBA, sales inducements and unearned revenue, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the fair value option unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest; |

| • | Net guaranteed benefit hedging gains (losses), which are significantly influenced by economic and market conditions, include changes in the fair value of derivatives related to guaranteed benefits, net of related reserve increases (decreases) and net of related amortization of DAC, VOBA and sales inducements, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating results, including the impacts related to changes in our nonperformance spread; |

| • | Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions); |

| • | Income (loss) attributable to non-controlling interest; |

| • | Income (loss) related to early extinguishment of debt; |

| • | Impairment of goodwill, value of management contract rights and value of customer relationships acquired; |

| • | Immediate recognition of net actuarial gains (losses) related to our pension and other postretirement benefit obligations and gains (losses) from plan amendments and curtailments; and |

| • | Other items, including restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of Voya Financial by ING Group and expenses associated with the rebranding of Voya Financial from ING U.S., Inc. |

13

Operating earnings before income taxes, when presented on a consolidated basis, also does not reflect the results of operations of our CBVA segment because this segment is managed to focus on protecting regulatory and rating agency capital rather than achieving operating metrics or generating net income. As a result of this focus on regulatory and rating agency capital, the financial results of the CBVA segment presented in accordance with GAAP tend to exhibit a high degree of volatility based on factors, such as the asymmetry between the accounting for certain liabilities and the corresponding hedging assets, and gains and losses due to changes in nonperformance risk, that are not necessarily reflective of the economic costs and benefits of our CBVA business. When we present the adjustments to income (loss) before income taxes on a consolidated basis, each adjustment excludes the portions attributable to our CBVA segment.

We also use adjusted operating earnings before income taxes as a measure of our financial performance. This measure excludes from operating earnings the following items: (1) DAC/VOBA and other intangibles unlocking, (2) net gains from a distribution of cash in conjunction with a Lehman Brothers bankruptcy settlement for assets held in a partnership owned by the company, (3) losses on certain receivables associated with the previously disposed low-income housing tax credit partnerships, and (4) interest expense related to debt in our Corporate segment. Because DAC/VOBA and other intangibles unlocking can be volatile, excluding the effect of this item can improve period to period comparability. The net gain from the Lehman Brothers bankruptcy settlement and the loss from the disposition of low-income housing tax credit partnerships affected run-rate results and we believe that this effect is not reflective of our ongoing performance.

We report Ongoing Business operating earnings before income taxes (both adjusted and unadjusted as described above) because we believe this measure is a useful indicator of the business performance for our Ongoing Business segments, excluding the effect of our Closed Blocks and Corporate segments.

Operating earnings (both before and after income taxes), adjusted operating earnings before income taxes, Ongoing Business operating earnings before income taxes and Ongoing Business adjusted operating earnings before income taxes, are each non-GAAP measures. For a reconciliation of each of these non-GAAP measures to the most directly comparable U.S. GAAP measures, see the tables that accompany this release, as well as our Quarterly Investor Supplement.

We report Ongoing Business adjusted operating ROE and adjusted operating ROC because we believe these measures are useful indicators of how effectively we use capital resources allocated to our Ongoing Business. The most directly comparable U.S. GAAP measure to Ongoing Business adjusted operating ROE and adjusted operating ROC is return on equity. For a reconciliation of these non-GAAP measures to return on equity, see the tables that accompany this release as well as our Quarterly Investor Supplement.

In our Investment Management business, we report the operating margin excluding Investment Capital results. Because results from Investment Capital can be volatile, excluding the effect of this item can improve period-to-period comparability.

In addition to net income (loss) per share, we report operating earnings per share because we believe that operating earnings before income taxes provides a meaningful measure of its business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of the underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors.

In addition to book value per share including AOCI, we report book value per share excluding AOCI. Included in AOCI are investment portfolio unrealized gains or losses. In the ordinary course of business we do not plan to sell most investments for the sole purpose of realizing gains or losses, and book value per share excluding AOCI provides a measure consistent with that view.

We also analyze our Ongoing Business performance based on the sources of earnings. We believe this supplemental information is useful in order to gain a better understanding of our financial performance, because it provides insight into the main drivers of operating earnings (loss) before income taxes of our Ongoing Business. The sources of earnings are defined as follows:

| • | Investment spread and other investment income consists of net investment income and net realized investment gains (losses) associated with swap settlements and accrued interest, less interest credited to policyholder reserves. |

| • | Fee-based margin consists primarily of fees earned on AUM, AUA, and transaction-based recordkeeping fees. |

| • | Net underwriting gain (loss) and other revenue contains the difference between fees charged for insurance risks and incurred benefits, including mortality, morbidity, and surrender results, contractual charges for universal life and annuity contracts, the change in the unearned revenue reserve for universal life contracts, and that portion of |

14

| traditional life insurance premiums intended to cover expenses and profits. Certain contract charges for universal life insurance are not recognized in income immediately, but are deferred as unearned revenues and are amortized into income in a manner similar to the amortization of DAC. |

| • | Administrative expenses are general expenses, net of amounts capitalized as acquisition expenses and exclude commission expenses and fees on letters of credit. |

| • | Trail commissions are commissions paid that are not deferred and thus recorded directly to expense. |

| • | For a detailed explanation of DAC/VOBA and other intangibles amortization/unlocking see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Unlocking of DAC/VOBA and other Contract Owner/Policyholder Intangibles” in our 2015 Annual Report on Form 10-K, filed with the Securities and Exchange Commission on Feb. 25, 2016, and our Quarterly Report on Form 10-Q for the three months ended Sept. 30, 2016, which the company expects to file with the Securities and Exchange Commission on or before Nov. 9, 2016. |

More details on these sources of earnings can be found in Voya Financial’s Quarterly Investor Supplement, which is available on Voya Financial’s investor relations website, investors.voya.com.

Forward-Looking and Other Cautionary Statements

This press release contains forward-looking statements. Forward-looking statements include statements relating to future developments in our business or expectations for our future financial performance and any statement not involving a historical fact. Forward-looking statements use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. Actual results, performance or events may differ materially from those projected in any forward-looking statement due to, among other things, (i) general economic conditions, particularly economic conditions in our core markets, (ii) performance of financial markets, including emerging markets, (iii) the frequency and severity of insured loss events, (iv) mortality and morbidity levels, (v) persistency and lapse levels, (vi) interest rates, (vii) currency exchange rates, (viii) general competitive factors, (ix) changes in laws and regulations, including those relating to the use of and possible application of NAIC accreditation standards to captive reinsurance entities and those made pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act or the U.S. Department of Labor’s final rules and exemptions pertaining to the fiduciary status of providers of investment advice, and (x) changes in the policies of governments and/or regulatory authorities. Factors that may cause actual results to differ from those in any forward-looking statement also include those described under “Risk Factors” and “Management’s Discussion and Analysis of Results of Operations and Financial Condition – Trends and Uncertainties” in our Annual Report on Form 10-K for the year ended Dec. 31, 2015, filed with the Securities and Exchange Commission on Feb. 25, 2016, and our Quarterly Report on Form 10-Q for the three-month period ended Sept. 30, 2016, which the company expects to file with the Securities and Exchange Commission on or before Nov. 9, 2016.

15

Reconciliation of Ongoing Business Adjusted Operating Earnings to Net Income (Loss) - Quarter-to-Date

| ($ in millions) | Three Months ended September 30, 2016 |

Three Months ended September 30, 2015 |

||||||

| Net income (loss) |

(236.5 | ) | 116.2 | |||||

| Less: Net income (loss) attributable to noncontrolling interest |

11.6 | 75.9 | ||||||

|

|

|

|

|

|||||

| Net income (loss) available to Voya Financial, Inc.’s common shareholders |

(248.1 | ) | 40.3 | |||||

| Less: Adjustments to operating earnings |

||||||||

| Closed Block Variable Annuity |

(328.0 | ) | (7.1 | ) | ||||

| Net investment gains (losses) and related charges and adjustments |

(65.6 | ) | (64.6 | ) | ||||

| Other adjustments |

(82.3 | ) | (60.9 | ) | ||||

|

|

|

|

|

|||||

| Total adjustments to operating earnings before tax effect |

(475.9 | ) | (132.6 | ) | ||||

| Income taxes on adjustments to operating earnings (1) |

166.6 | 46.4 | ||||||

|

|

|

|

|

|||||

| Total Adjustments to operating earnings, after tax (1) |

(309.3 | ) | (86.2 | ) | ||||

| Less: Difference between actual tax (expense) benefit and assumed tax rate |

(12.5 | ) | 33.3 | |||||

|

|

|

|

|

|||||

| Operating earnings, after-tax (1) |

73.7 | 93.2 | ||||||

| Less: Income taxes (1) |

(34.7 | ) | (43.8 | ) | ||||

|

|

|

|

|

|||||

| Total operating earnings before income taxes |

108.4 | 137.0 | ||||||

| Less: Corporate |

(77.5 | ) | (75.6 | ) | ||||

| Less: Closed Block Other |

(6.9 | ) | 2.6 | |||||

|

|

|

|

|

|||||

| Operating earnings before income taxes for Ongoing Business |

192.8 | 210.0 | ||||||

| Less: DAC/VOBA and other intangibles unlocking |

(140.0 | ) | (93.1 | ) | ||||

| Less: Lehman bankruptcy (2) |

2.6 | — | ||||||

|

|

|

|

|

|||||

| Ongoing Business adjusted operating earnings before income taxes |

$ | 330.2 | $ | 303.1 | ||||

|

|

|

|

|

|||||

| (1) | Voya Financial assumes a 32% tax rate on operating earnings and all components of operating earnings described as “after tax.” A 35% tax rate is applied to all non-operating items. The 32% tax rate for operating earnings and components reflects the estimated benefit of the dividend received deduction related to the Company’s five Ongoing Business segments, which include Retirement, Annuities, Investment Management, Individual Life, and Employee Benefits. |

| (2) | Includes the net gain included in operating earnings from a distribution of cash and securities in conjunction with a Lehman Brothers bankruptcy settlement. |

Voya Financial

Reconciliation of Book Value Per Share

| As of September 30, 2016 |

||||

| Book value per share, including AOCI |

$ | 78.14 | ||

| Per share impact of AOCI |

$ | (18.07 | ) | |

|

|

|

|||

| Book value per share, excluding AOCI |

$ | 60.07 | ||

|

|

|

|||

16

Voya Financial

Reconciliation of Investment Management Operating Margin

| ($ in millions, unless otherwise indicated) | Three Months Ended September 30, 2016 |

Three Months Ended June 30, 2016 |

Three Months Ended September 30, 2015 |

|||||||||

| Operating revenues * |

$ | 160.4 | $ | 142.4 | $ | 152.6 | ||||||

| Operating expenses |

(111.5 | ) | (110.6 | ) | (107.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Operating earnings before income taxes * |

$ | 48.9 | $ | 31.8 | $ | 45.6 | ||||||

| Operating margin |

30.5 | % | 22.3 | % | 29.9 | % | ||||||

| Operating revenues * |

$ | 160.4 | $ | 142.4 | $ | 152.6 | ||||||

| Less: |

||||||||||||

| Investment Capital Results * |

4.1 | (8.6 | ) | 0.4 | ||||||||

|

|

|

|

|

|

|

|||||||

| Revenues excluding Investment Capital |

156.3 | 151.0 | 152.2 | |||||||||

| Operating expenses |

(111.5 | ) | (110.6 | ) | (107.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Operating earnings excluding Investment Capital * |

$ | 44.8 | $ | 40.4 | $ | 45.2 | ||||||

|

|

|

|

|

|

|

|||||||

| Operating margin excluding Investment Capital |

28.7 | % | 26.8 | % | 29.7 | % | ||||||

| * | Excludes gain from Lehman recovery in 3Q 2016. |

17

Exhibit 99.2

Exhibit 99.1

Quarterly Investor Supplement

September 30, 2016

This report should be read in conjunction with Voya Financial, Inc.’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2016. Voya Financial’s Annual Reports on Form 10-K, and Quarterly Reports on Form 10-Q, can be accessed upon filing at the Securities and Exchange Commission’s website at www.sec.gov, and at our website at investors.voya.com. All information is unaudited.

Table of Contents

Page

Consolidated

Explanatory Note on Non-GAAP Financial Information 3—5

Organizational Chart 6

Consolidated Balance Sheets 7

Consolidated Statements of Operations 8

Key Metrics 9

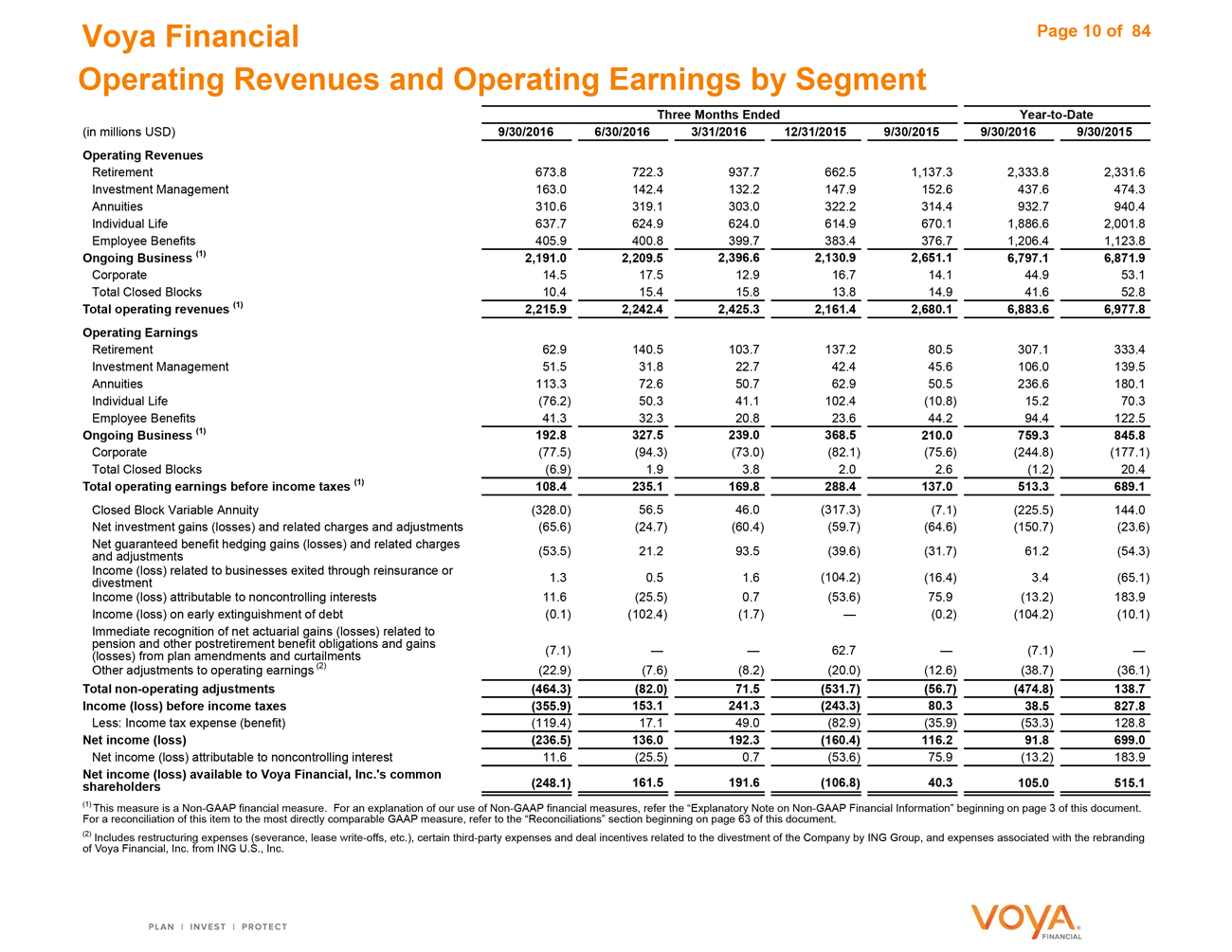

Operating Revenues and Operating Earnings by Segment 10

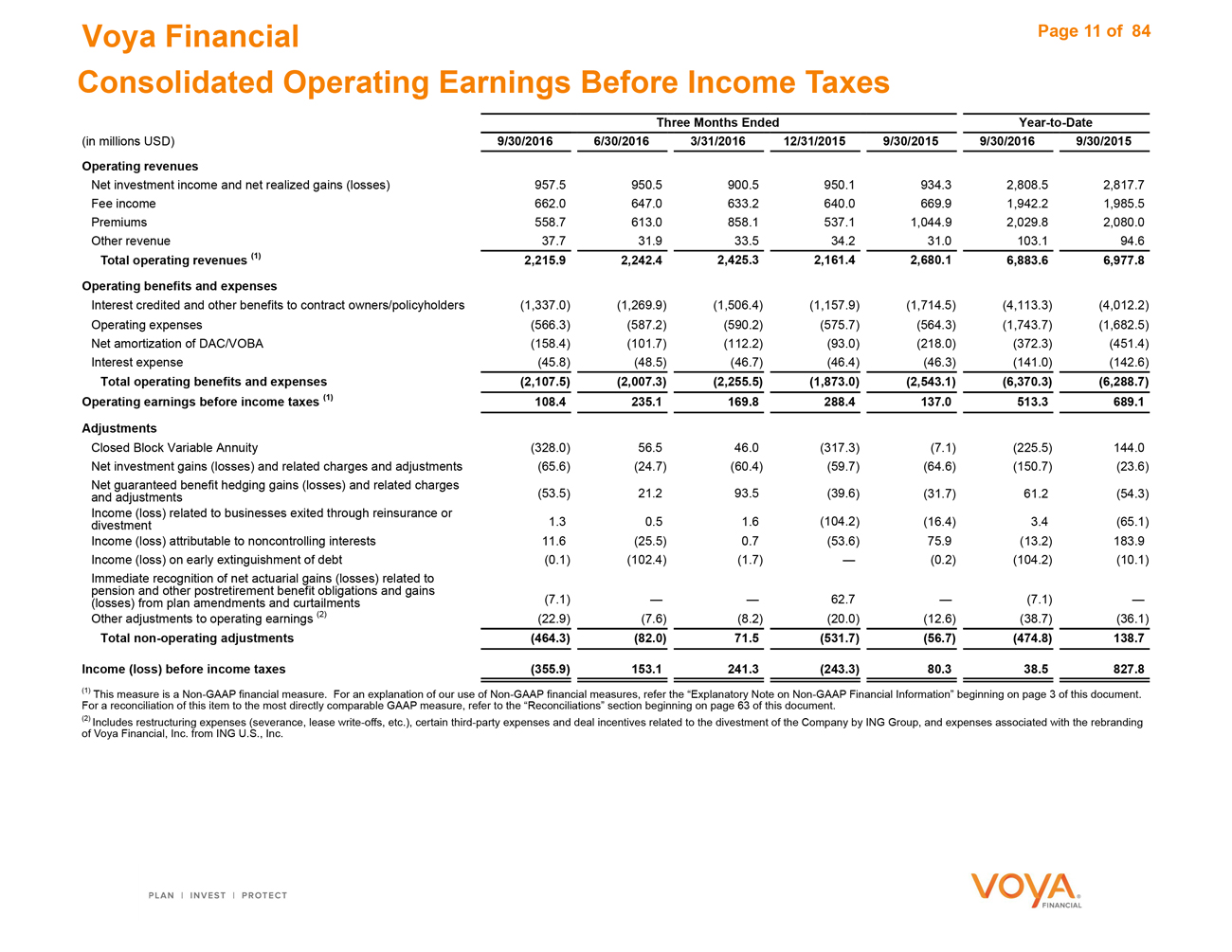

Consolidated Earnings Before Income Taxes 11

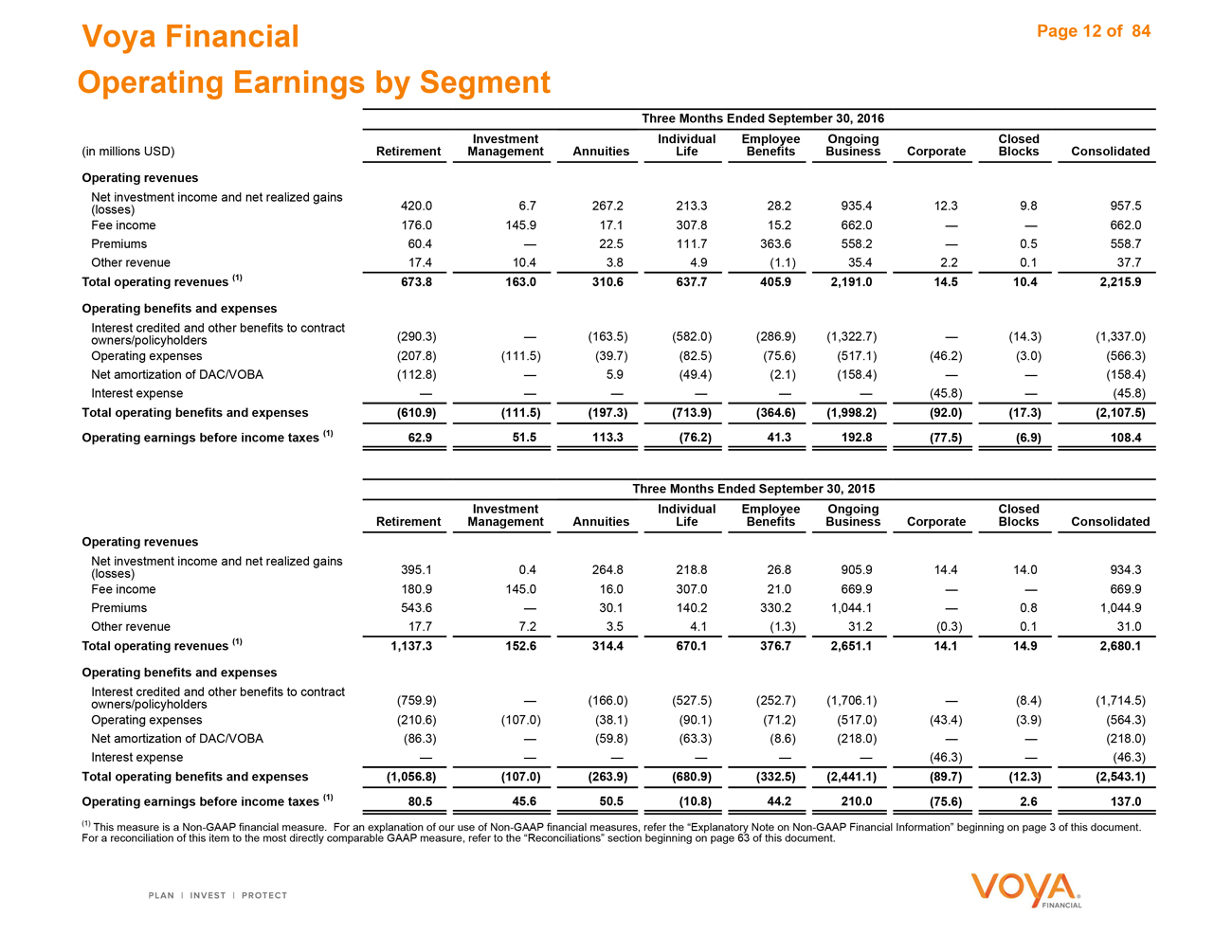

Operating Earnings by Segment (QTD) 12

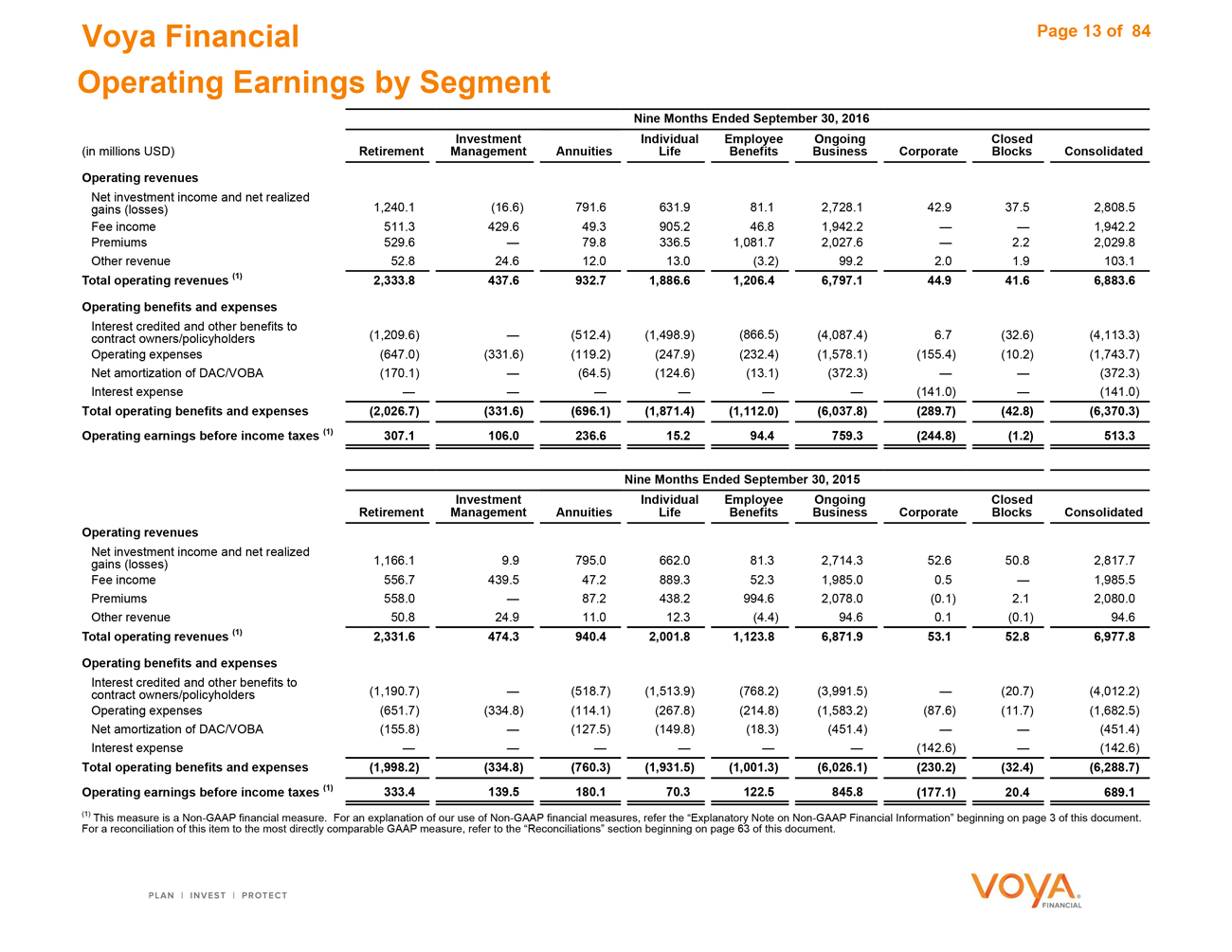

Operating Earnings by Segment (YTD) 13

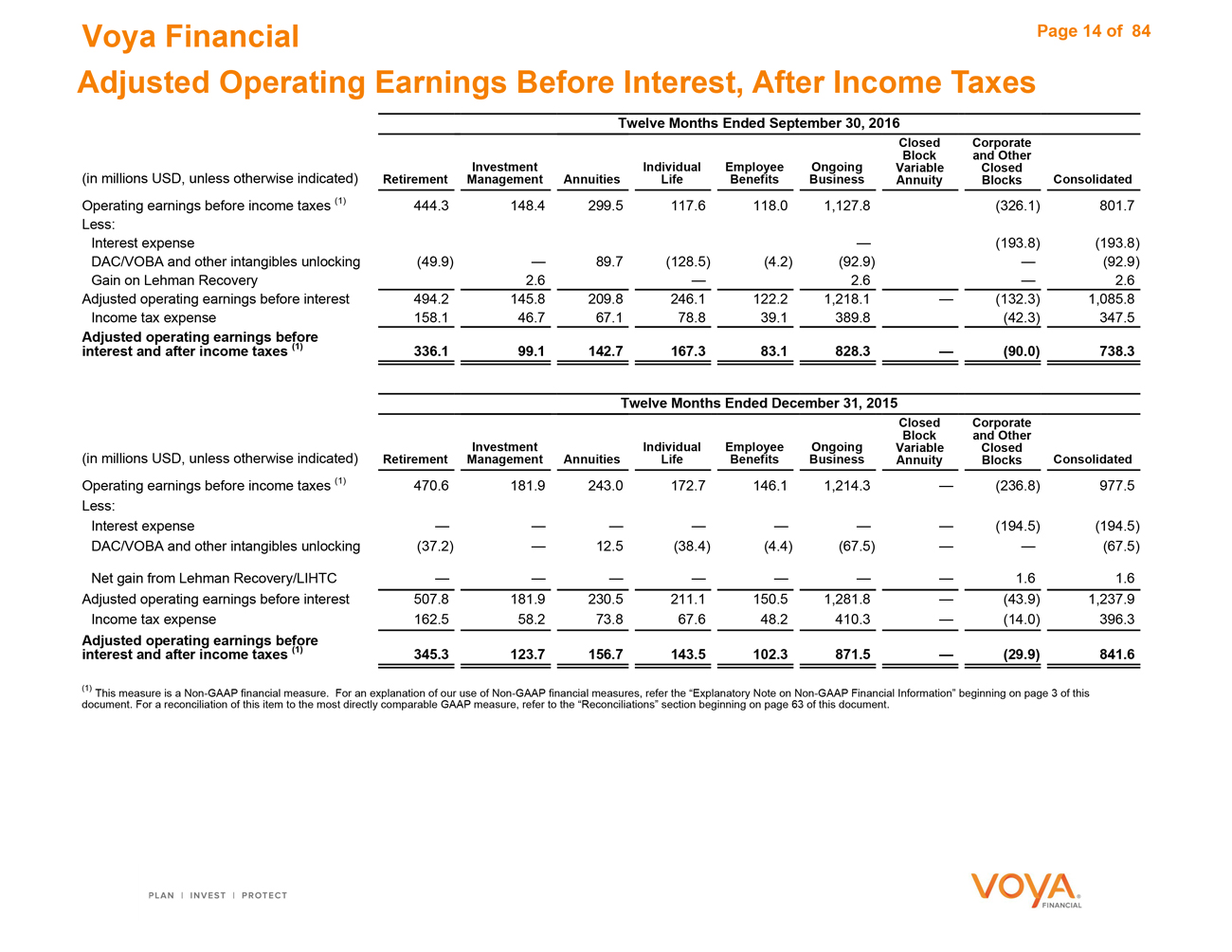

Adjusted Operating Earnings Before Interest, After Income Taxes 14

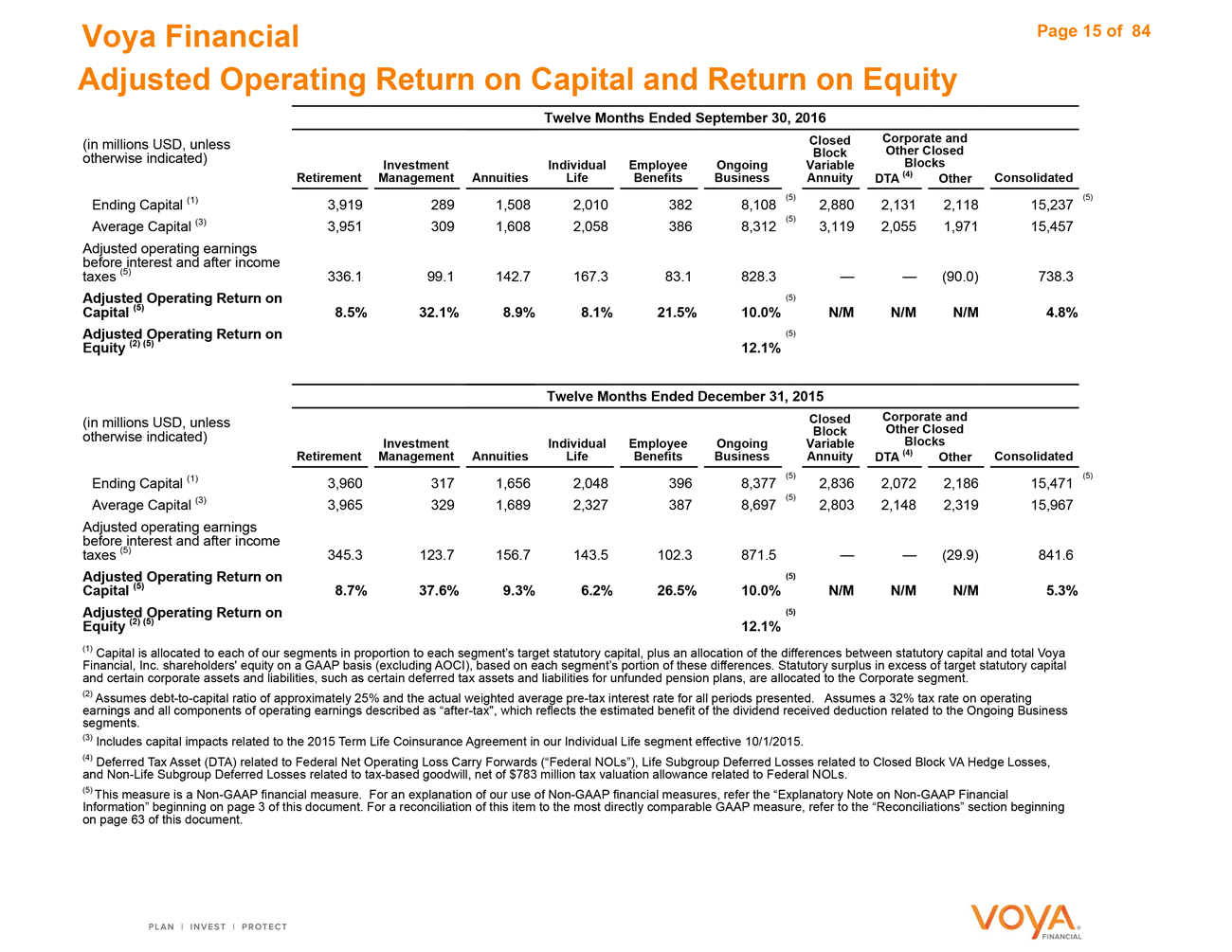

Adjusted Operating Return on Capital and Return on Equity 15

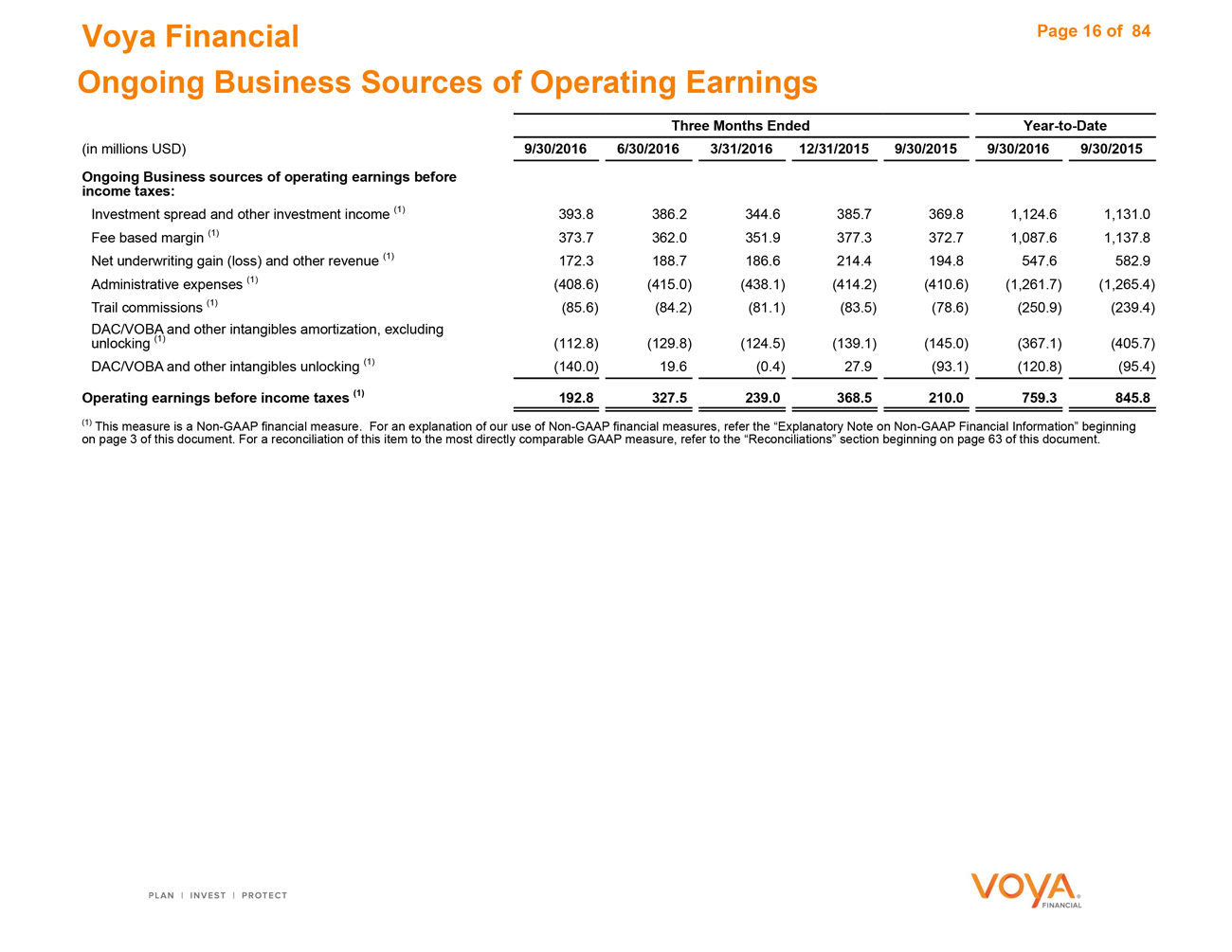

Ongoing Business Sources of Operating Earnings 16

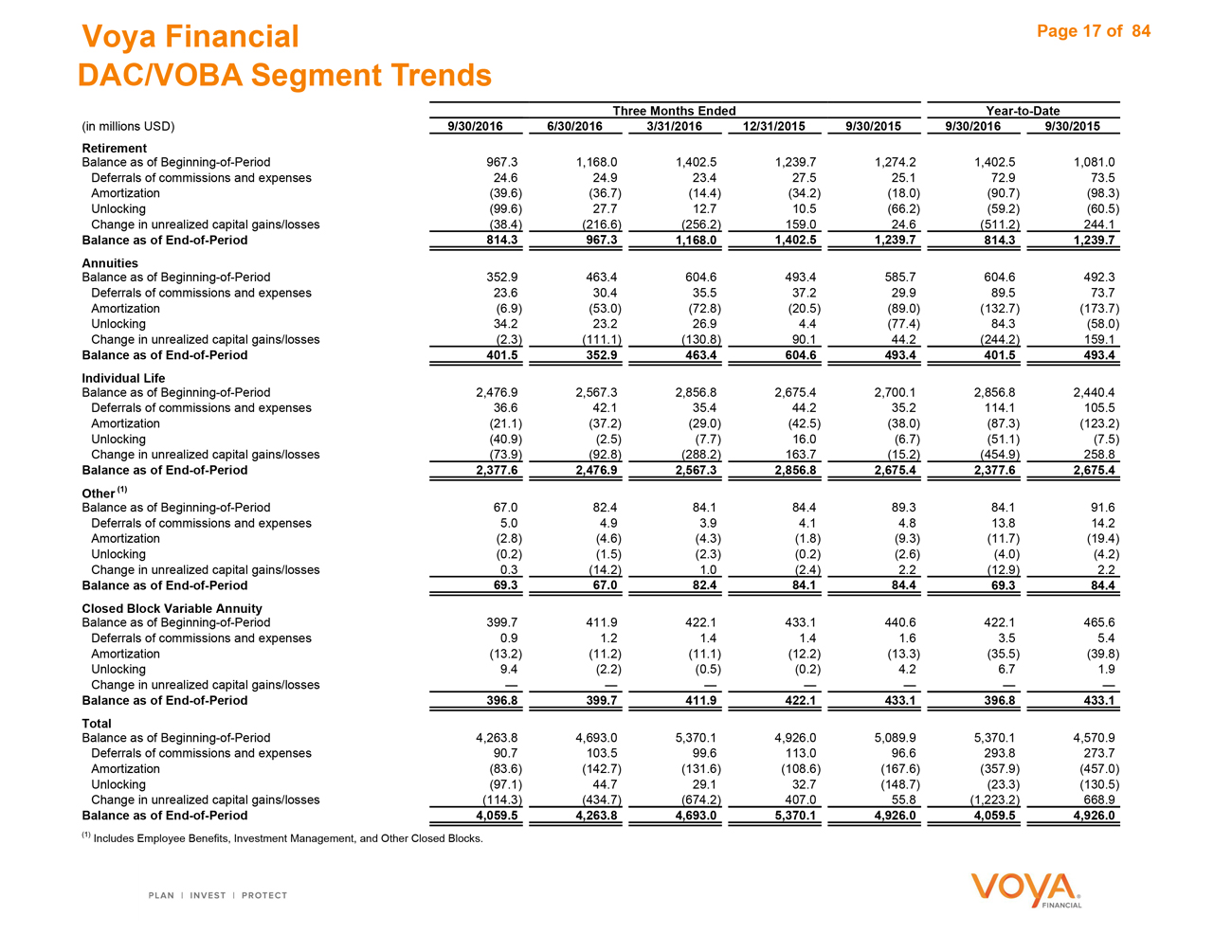

DAC/VOBA Segment Trends 17

Consolidated Capital Structure 18

Consolidated Assets Under Management/Assets Under Administration 19

Retirement

Operating Earnings 21

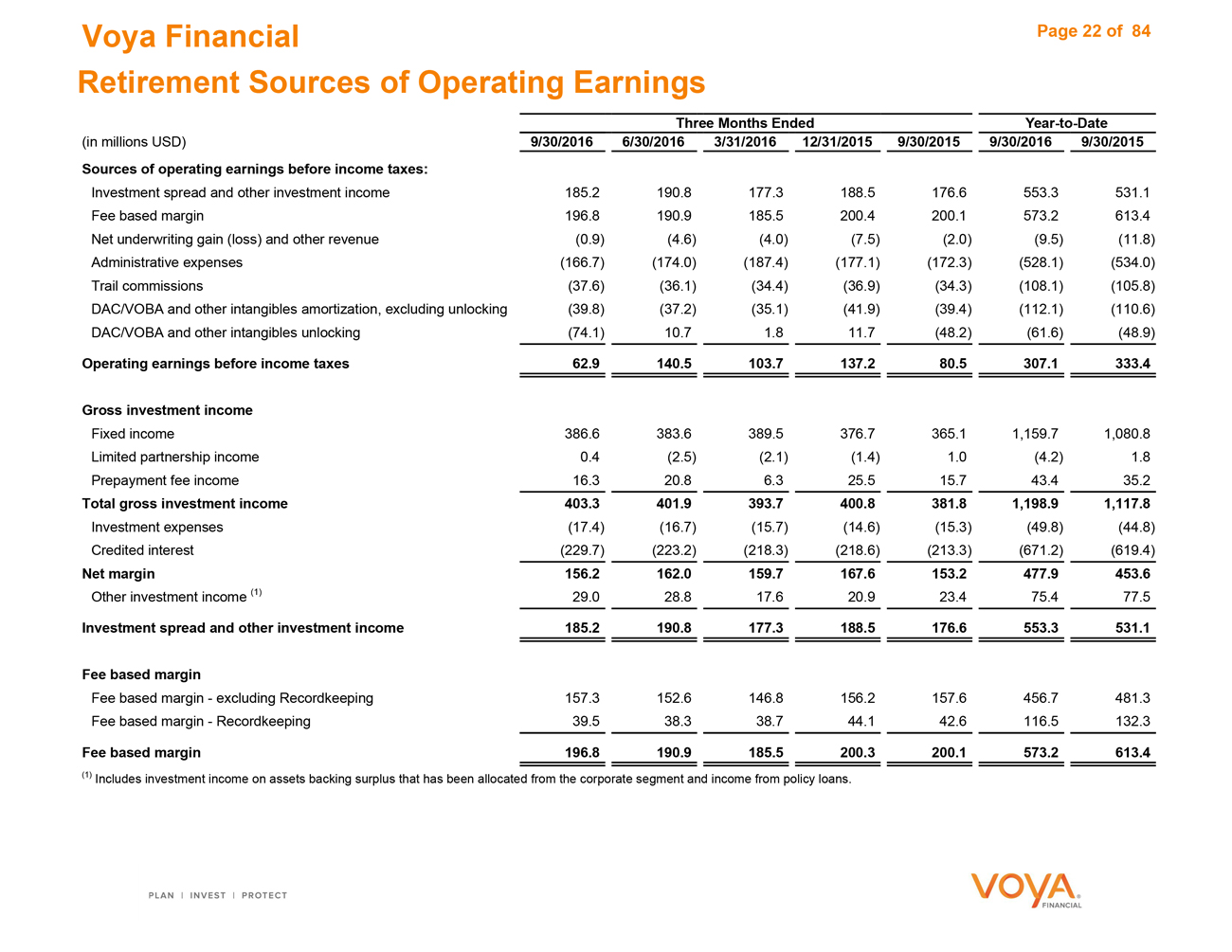

Sources of Operating Earnings 22

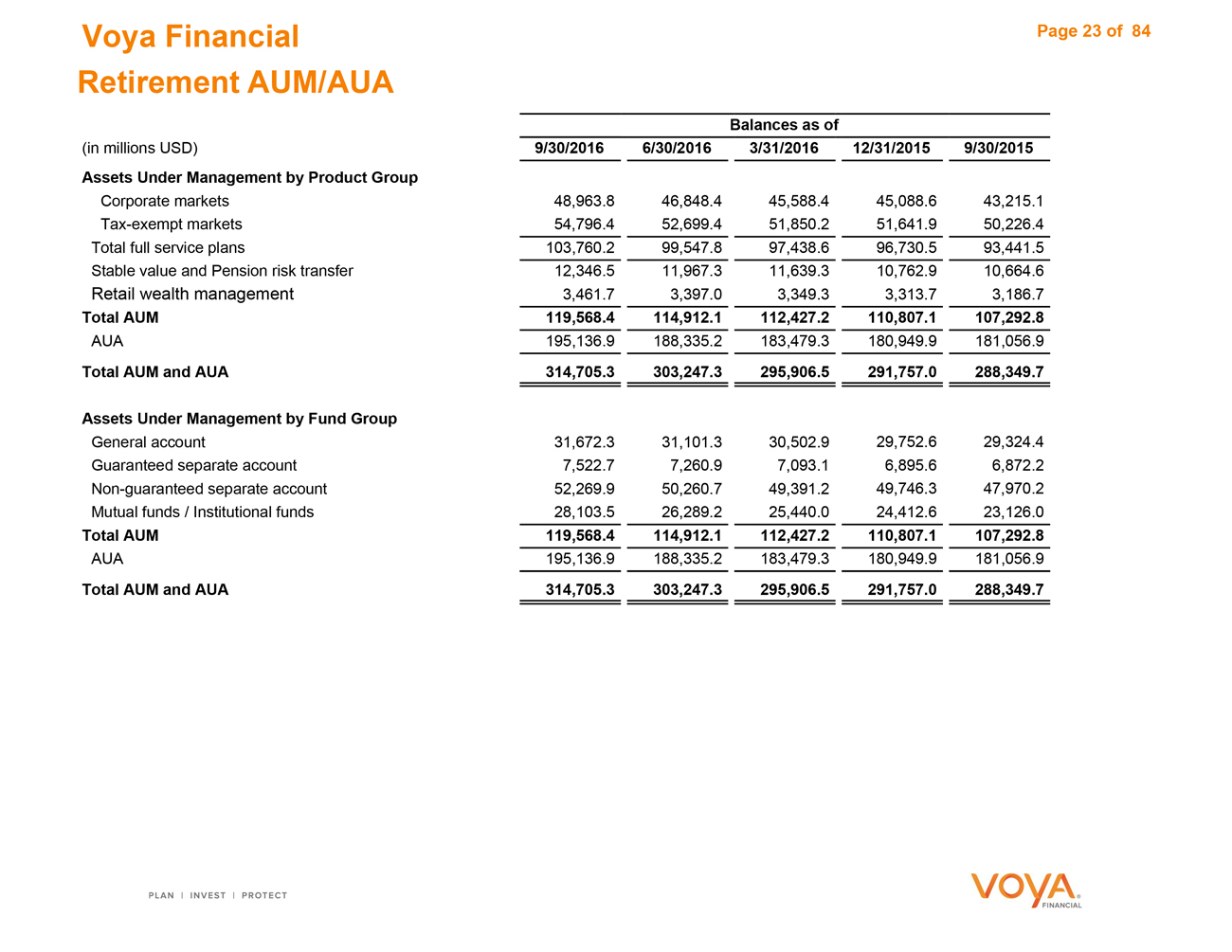

Assets Under Management/Assets Under Administration 23

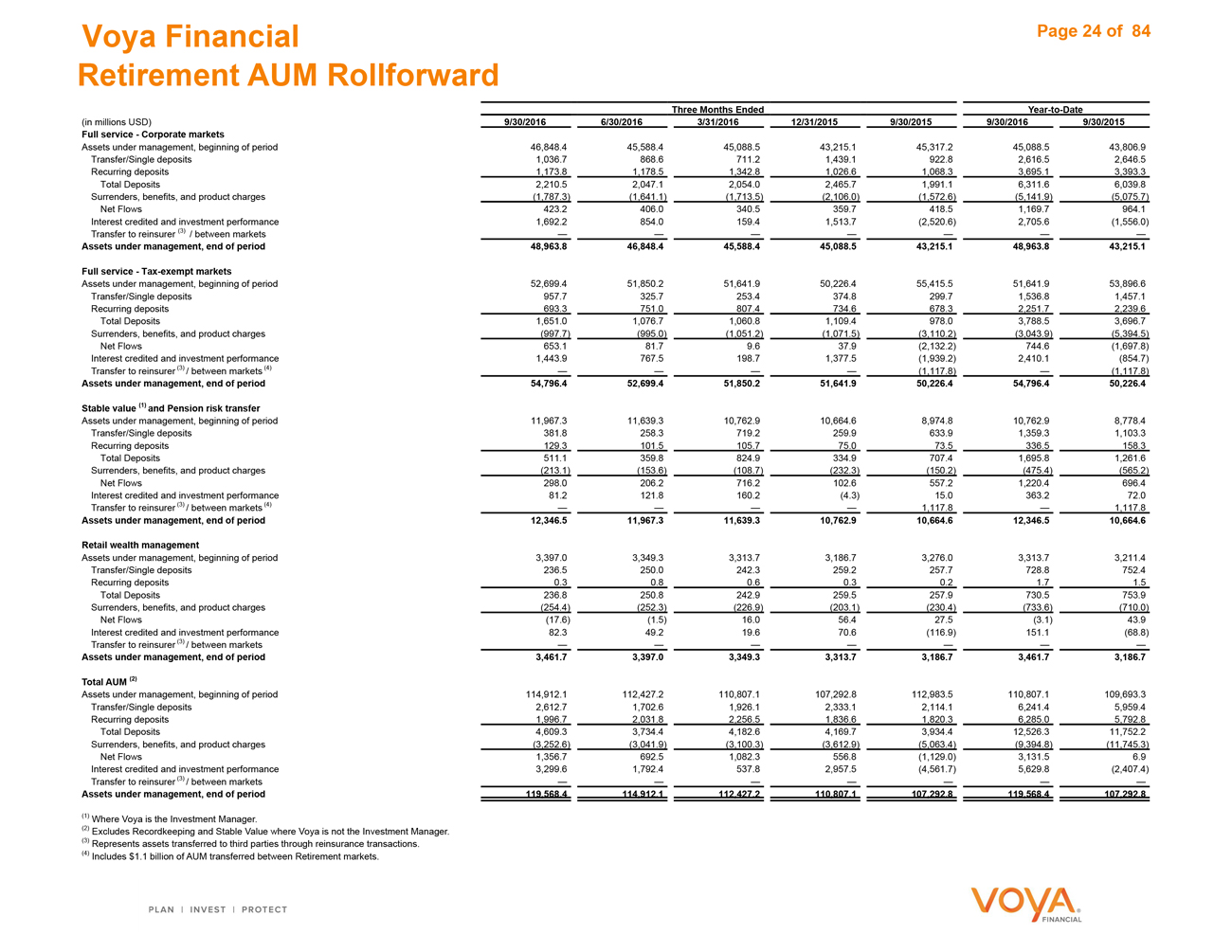

Assets Under Management Rollforward 24

Investment Management

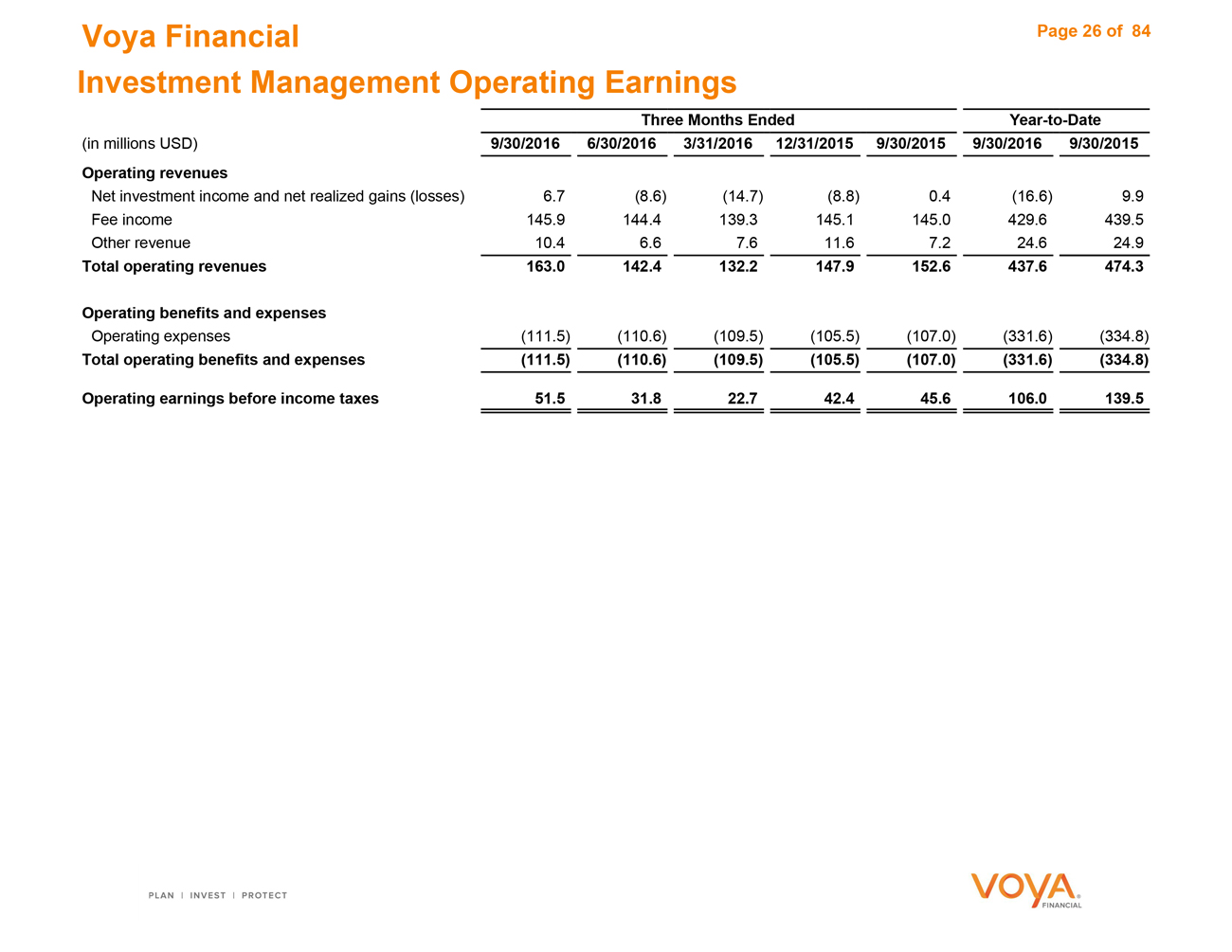

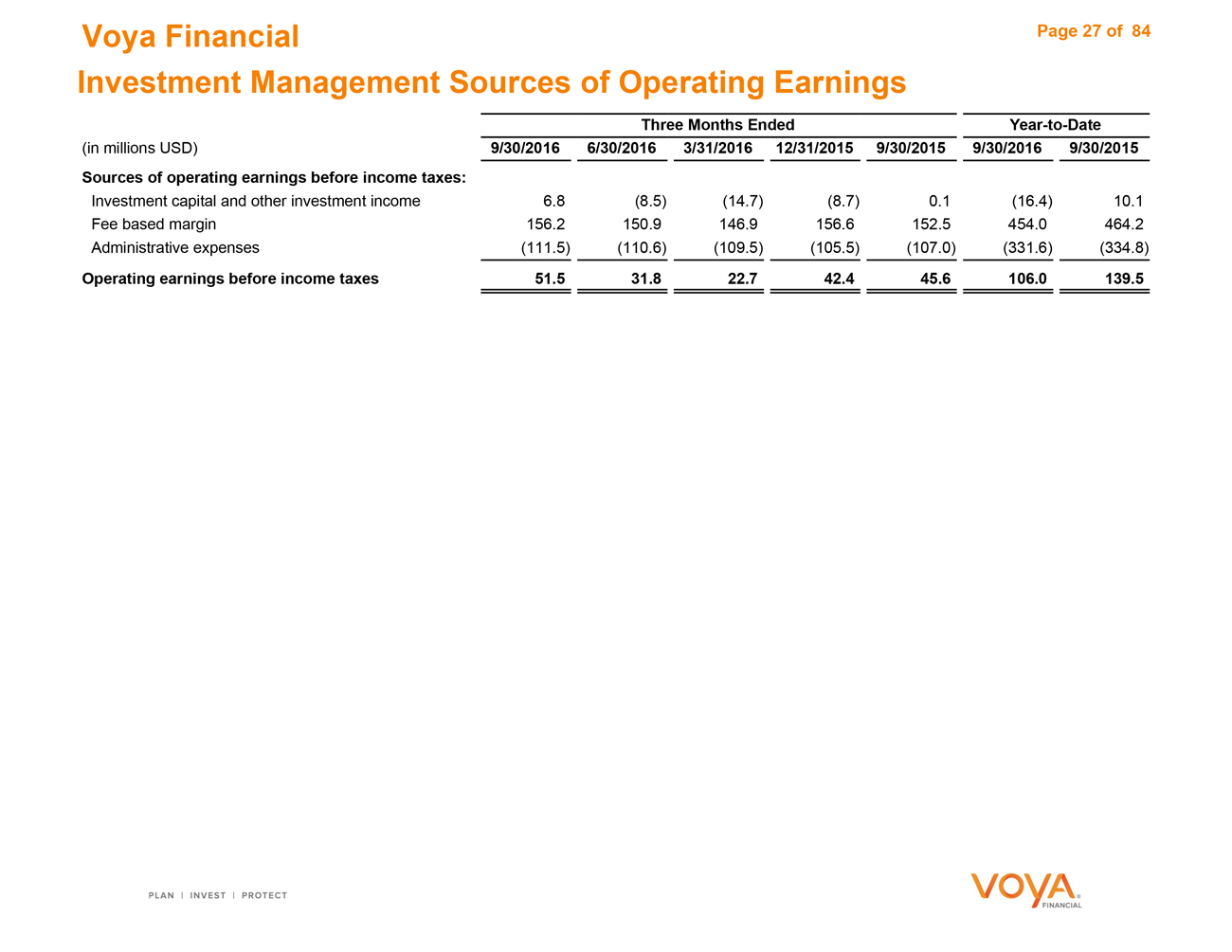

Operating Earnings 26

Sources of Operating Earnings 27

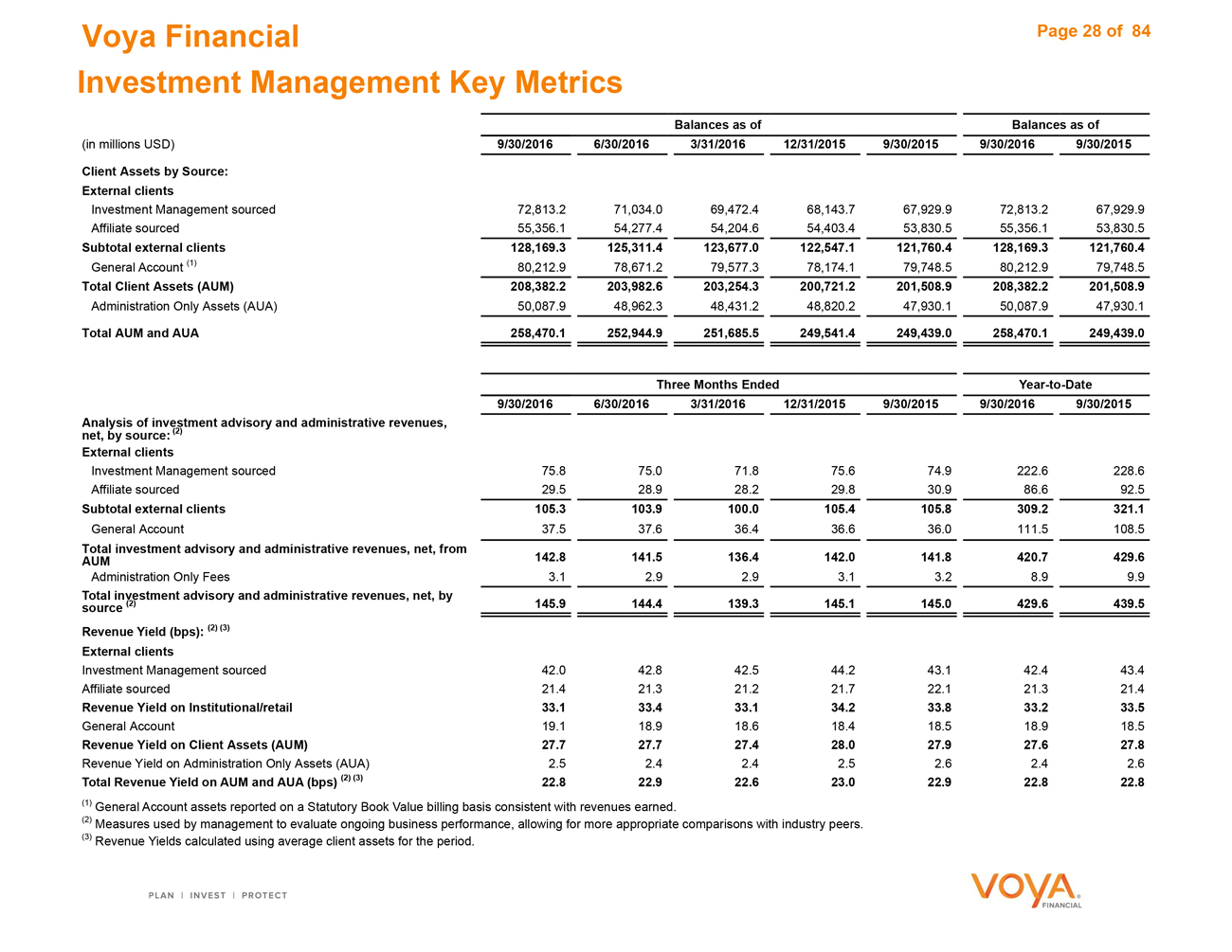

Key Metrics 28

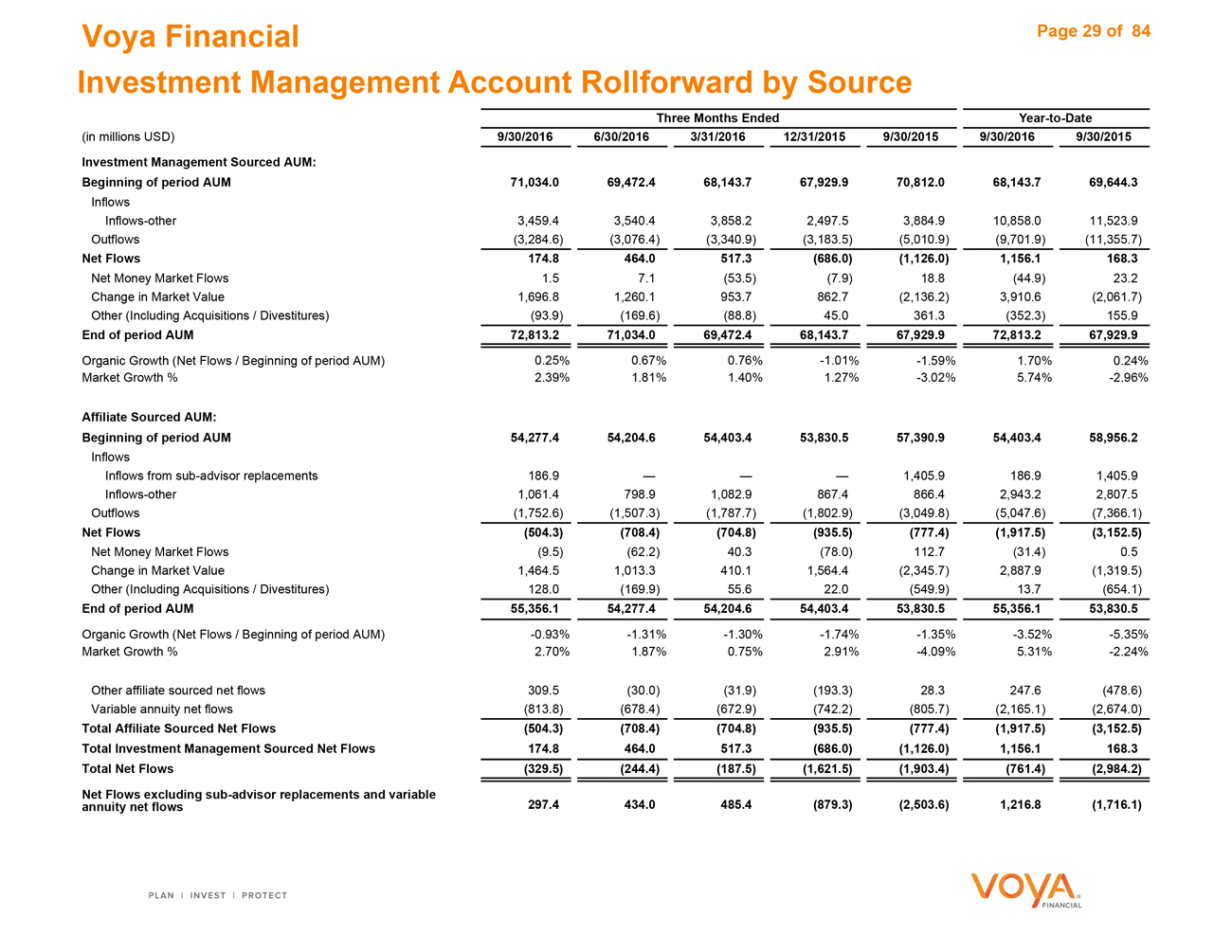

Account Value Rollforward by Source 29

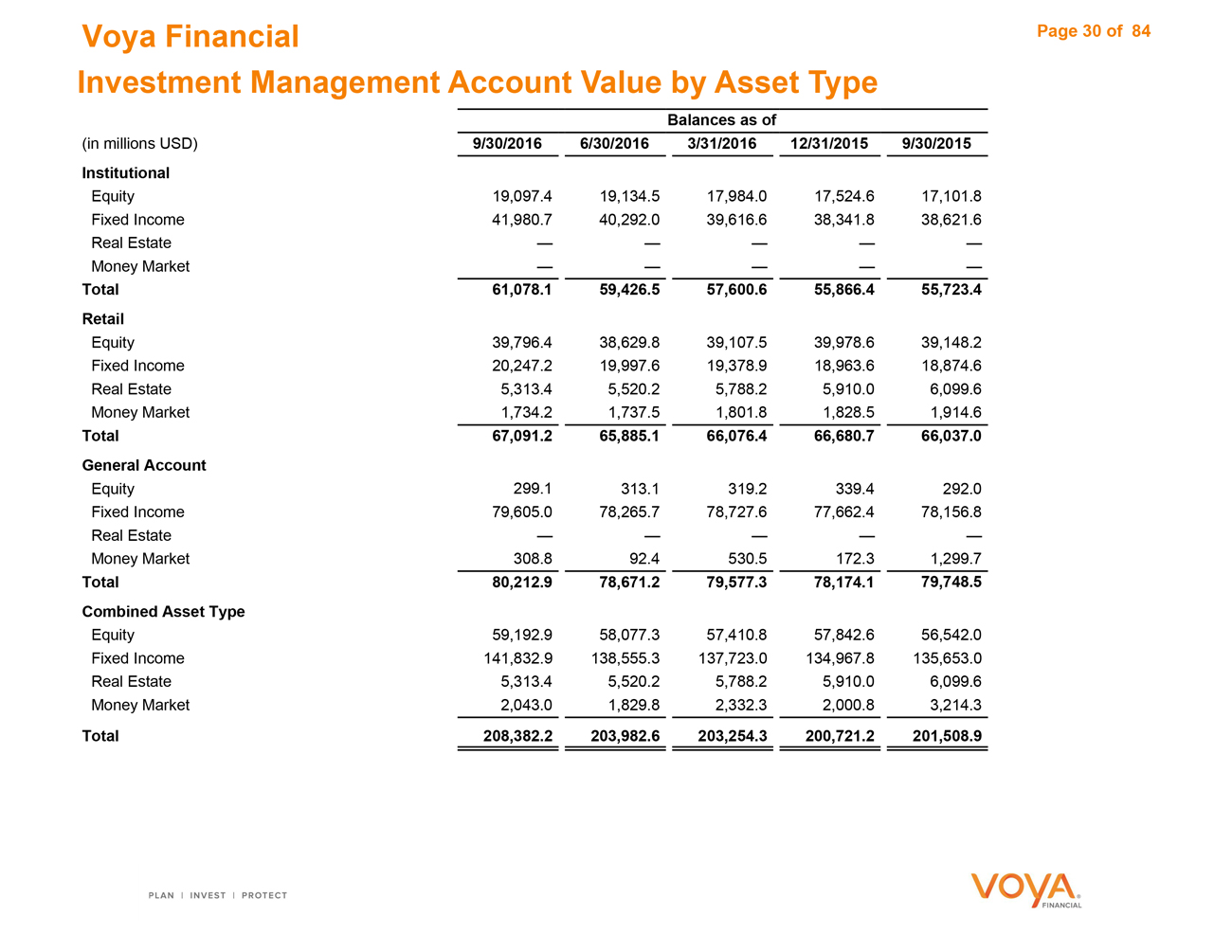

Account Value by Asset Type 30

Annuities

Operating Earnings 32

Sources of Operating Earnings 33

Assets Under Management 34

Assets Under Management Rollforward 35

Individual Life

Operating Earnings 37

Sources of Operating Earnings 38

Key Metrics 39

Employee Benefits

Operating Earnings 41

Sources of Operating Earnings 42

Key Metrics 43

Page

Corporate

Operating Earnings 45

Closed Blocks

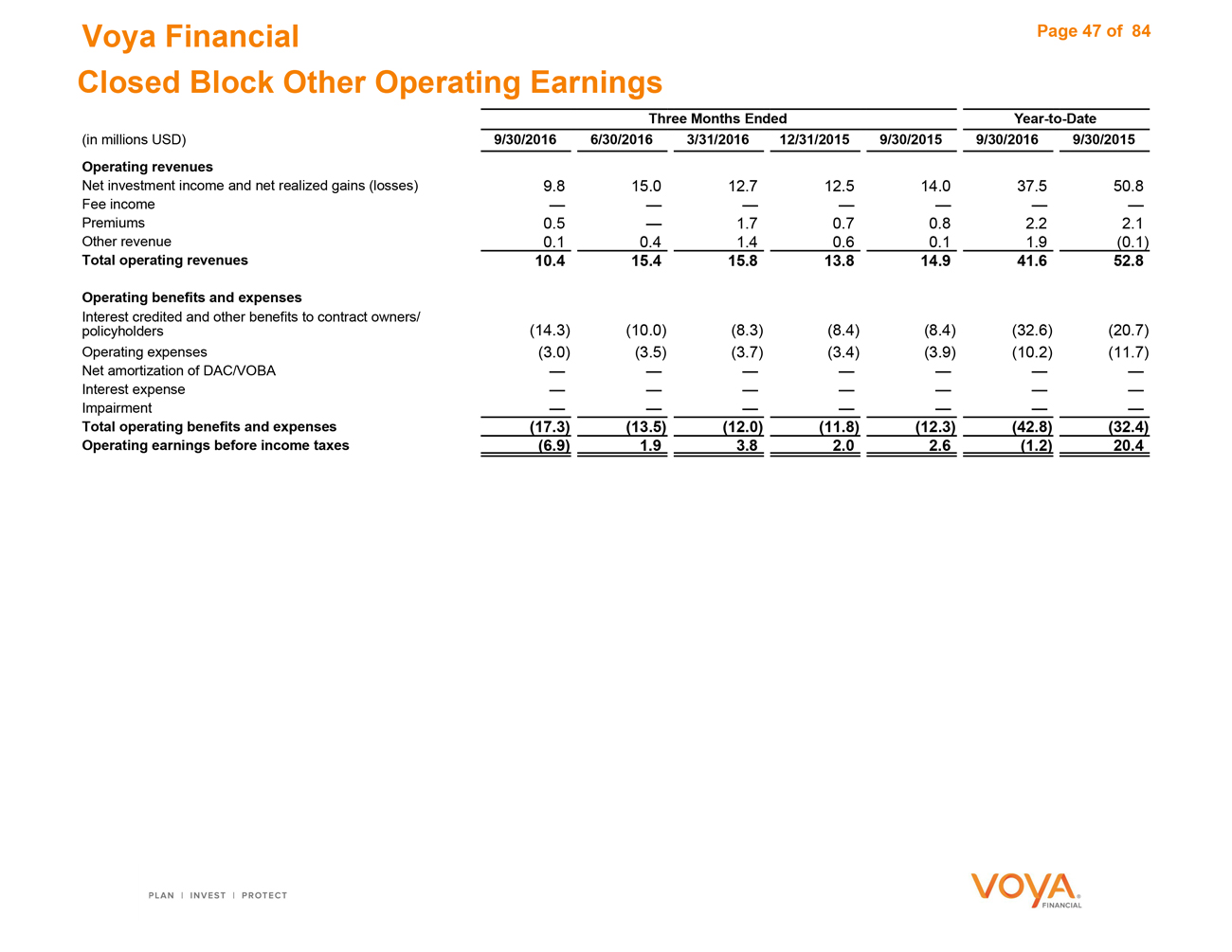

Closed Block Other Operating Earnings 47

Closed Block Variable Annuity Income (Loss) Before Income Taxes 48

Closed Block Variable Annuity Death and Living Benefits 49

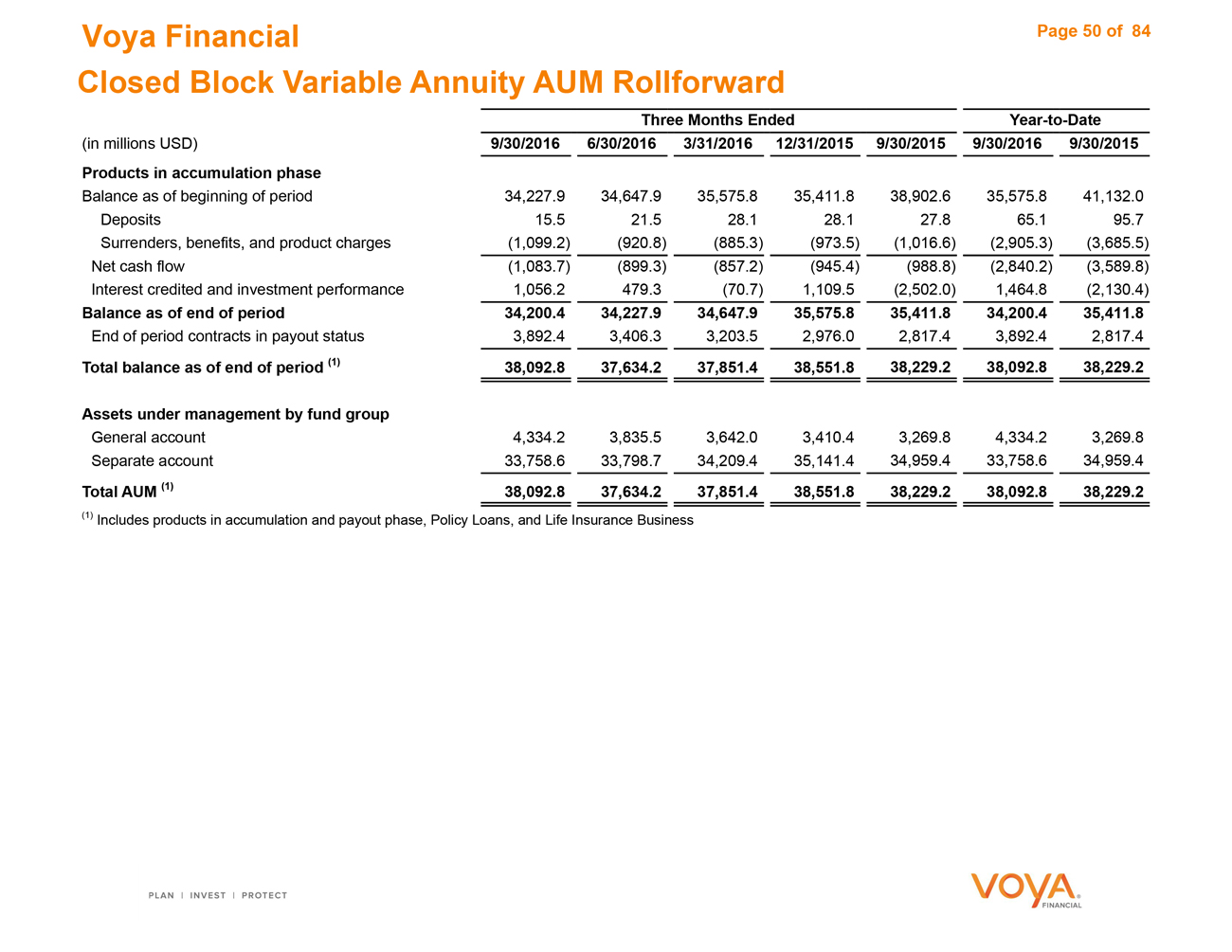

Closed Block Variable Annuity Assets Under Management Rollforward 50

Investment Information

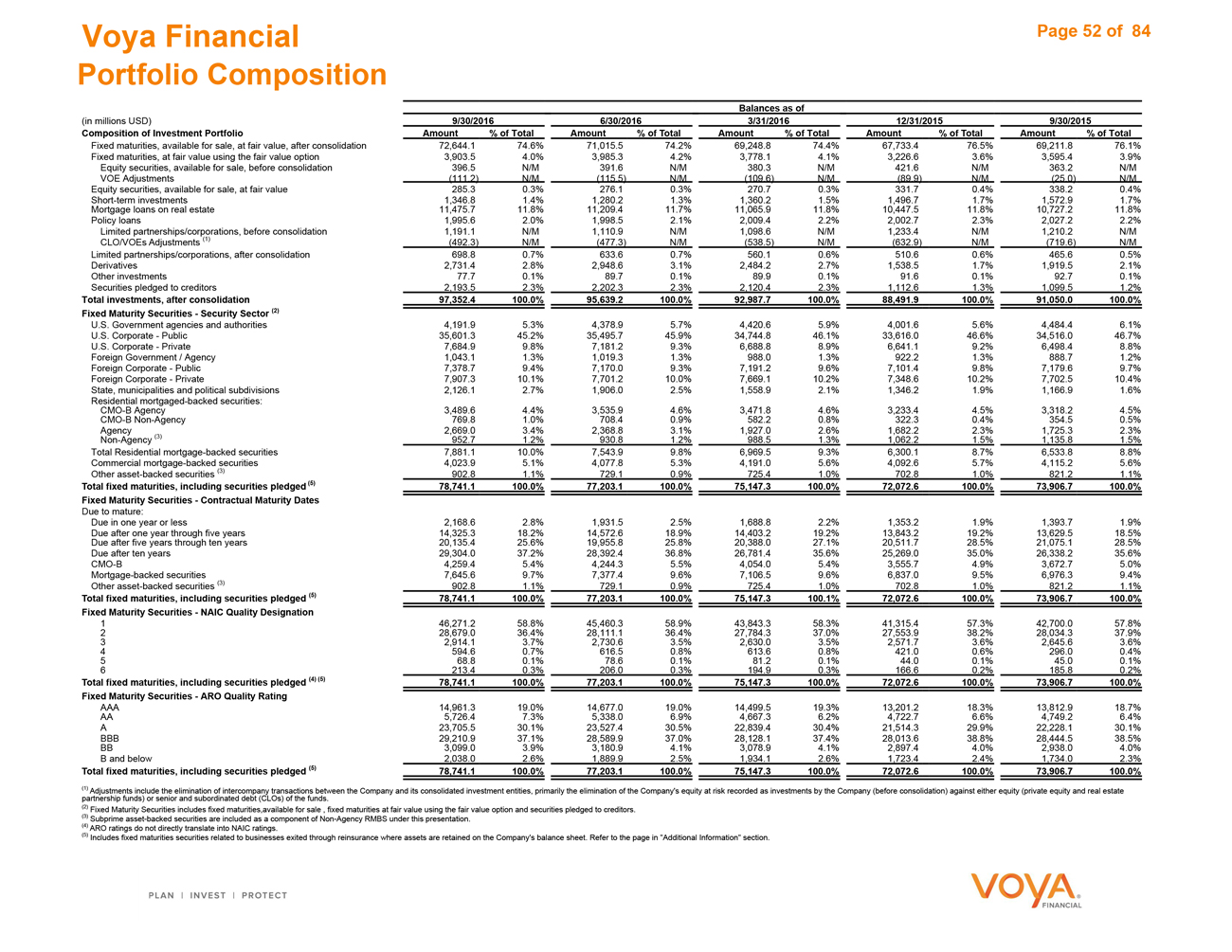

Portfolio Composition 52

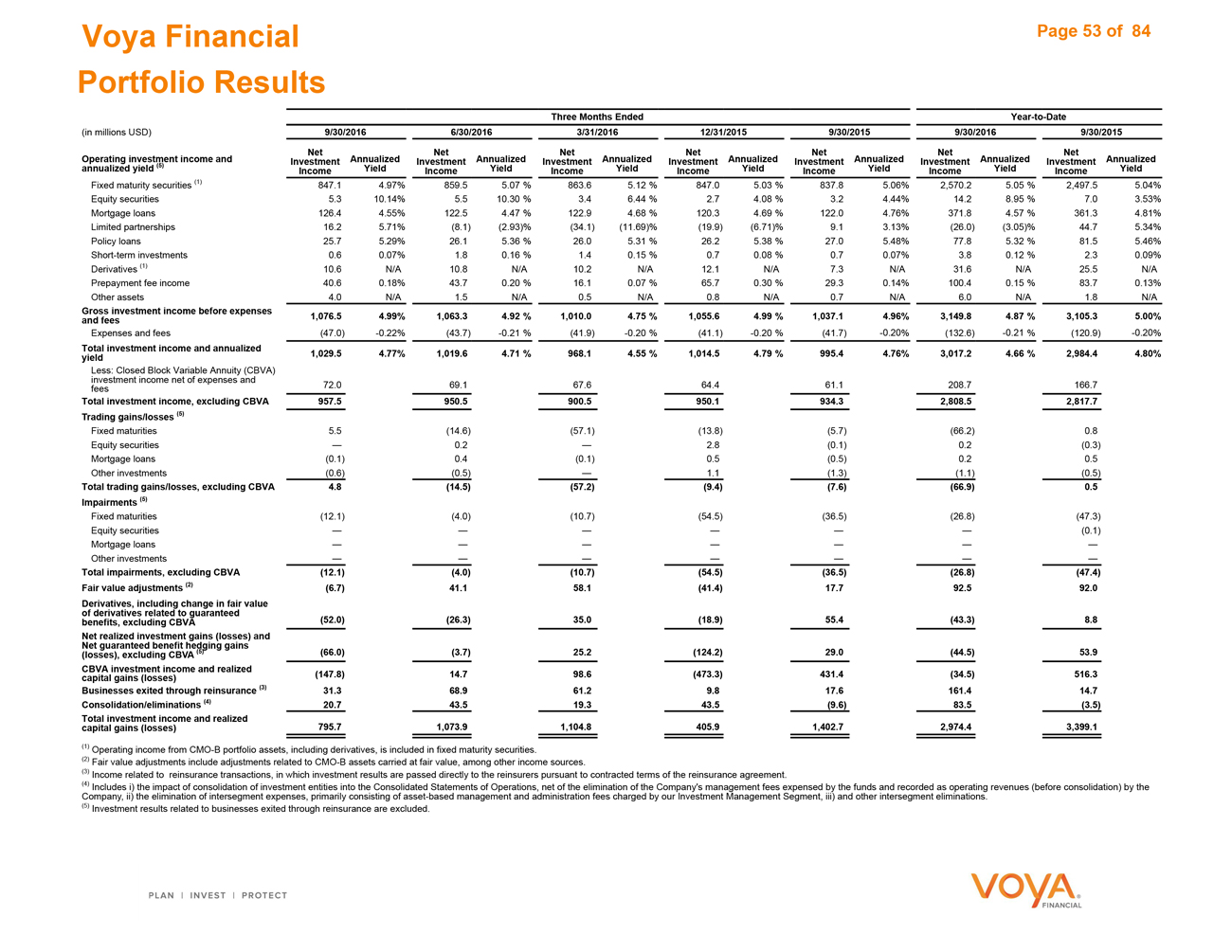

Portfolio Results 53

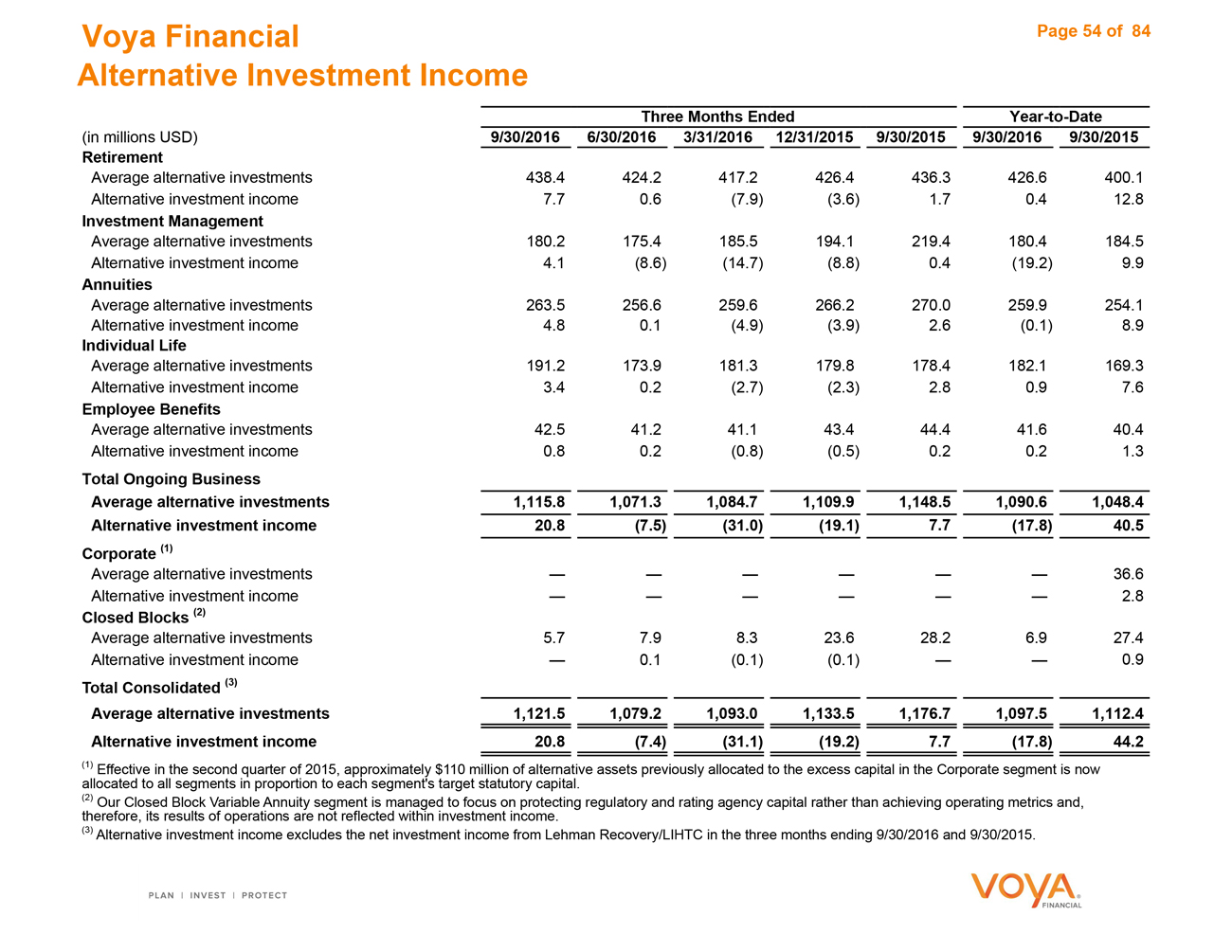

Alternative Investment Income 54

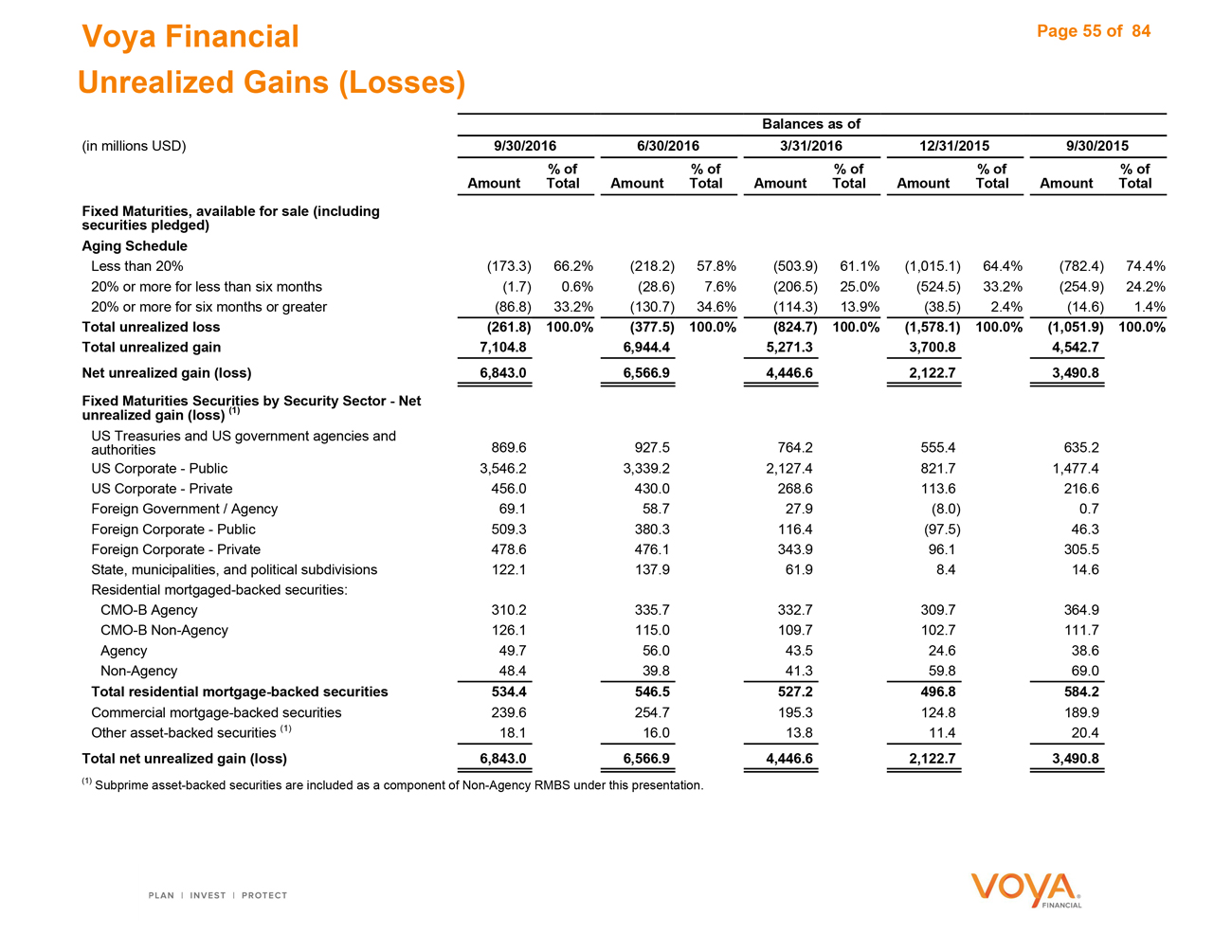

Unrealized Gains (Losses) 55

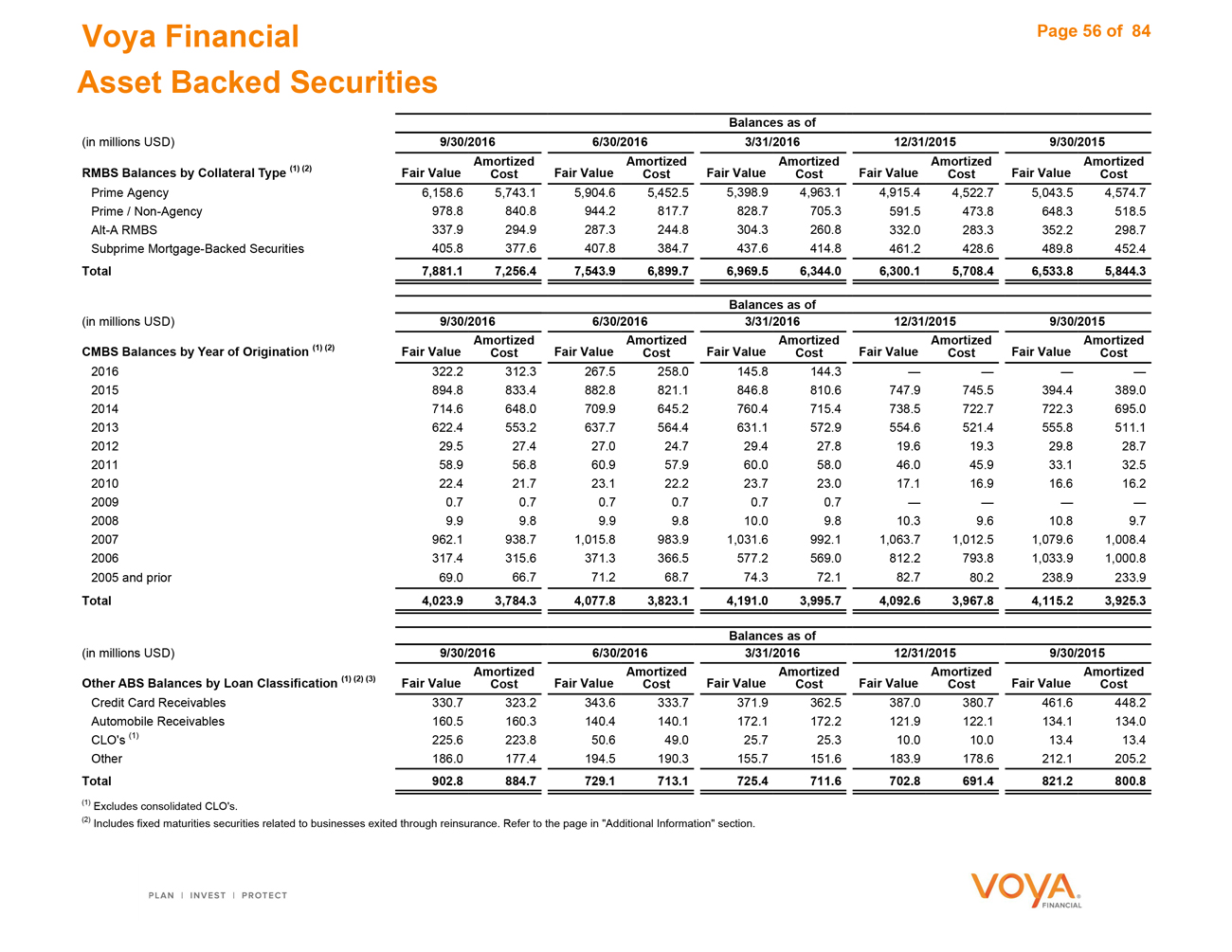

Asset Backed Securities 56

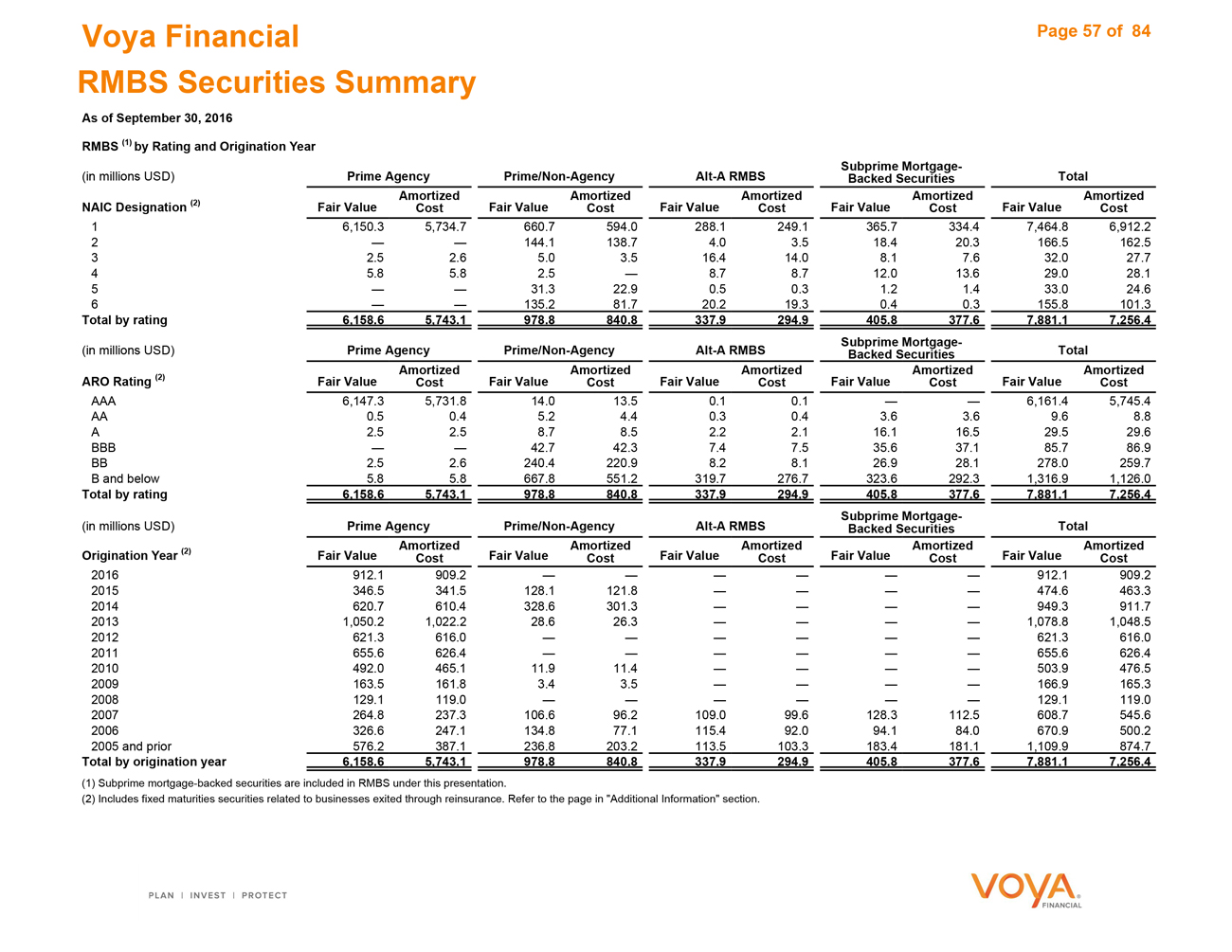

RMBS Securities Summary 57

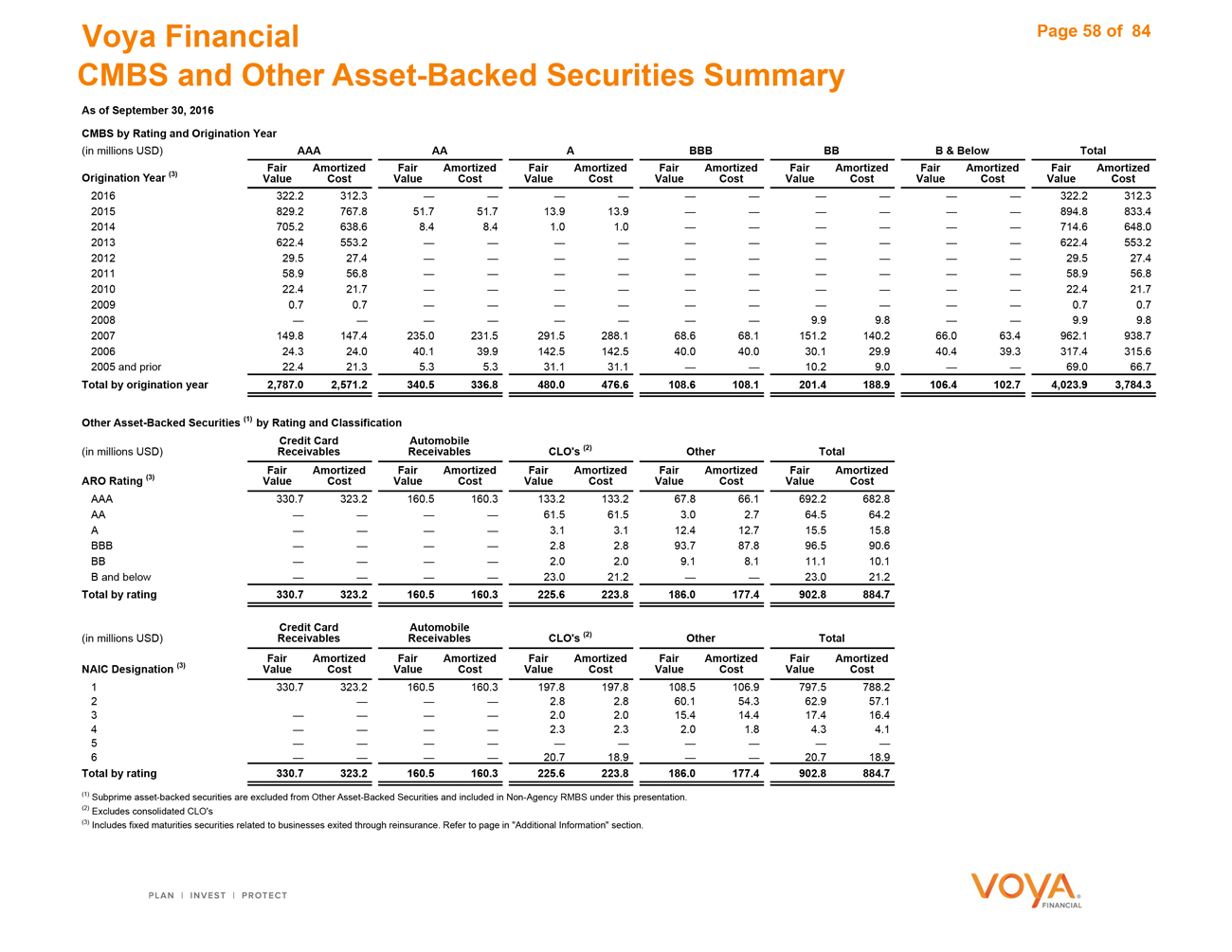

CMBS and Other Asset-Backed Securities Summary 58

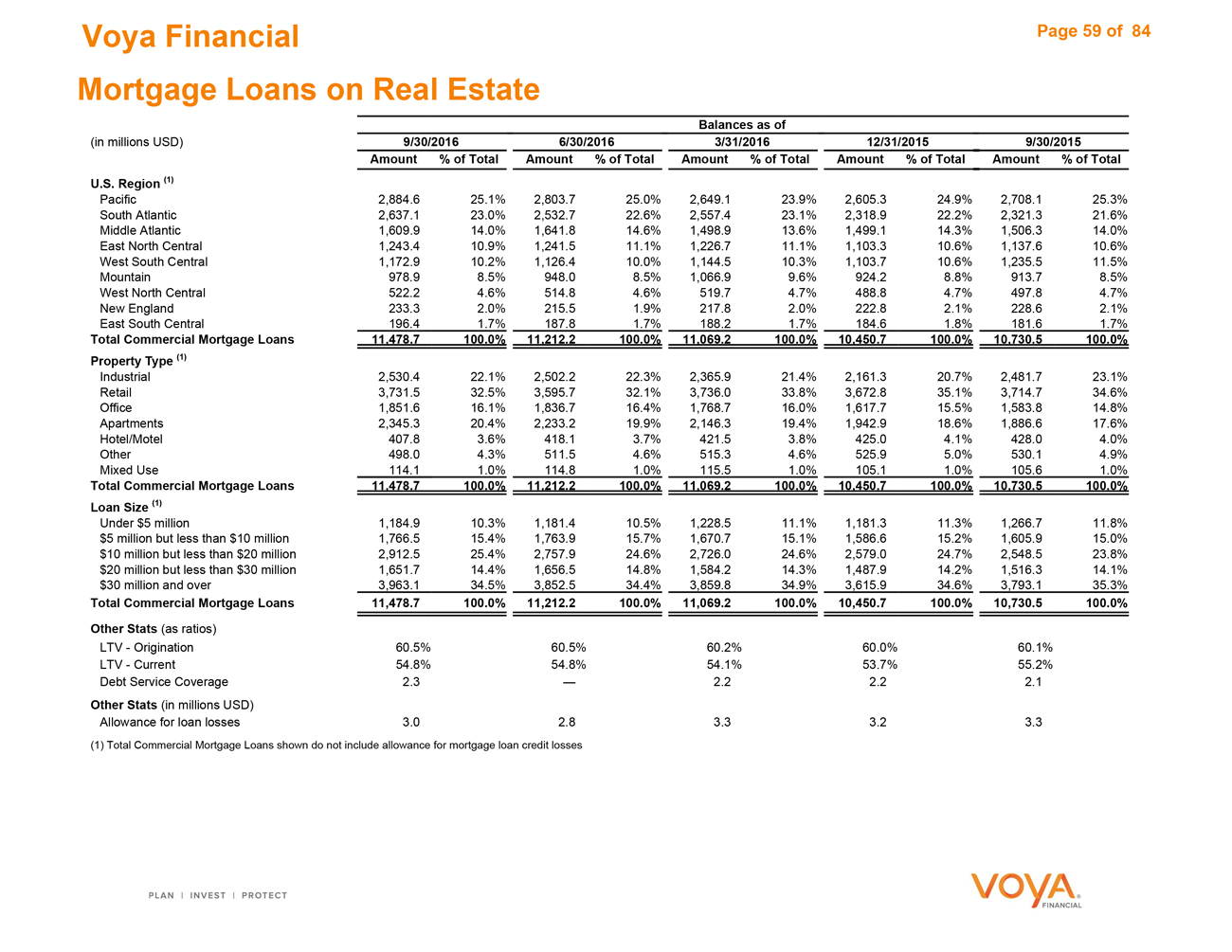

Mortgage Loans on Real Estate 59

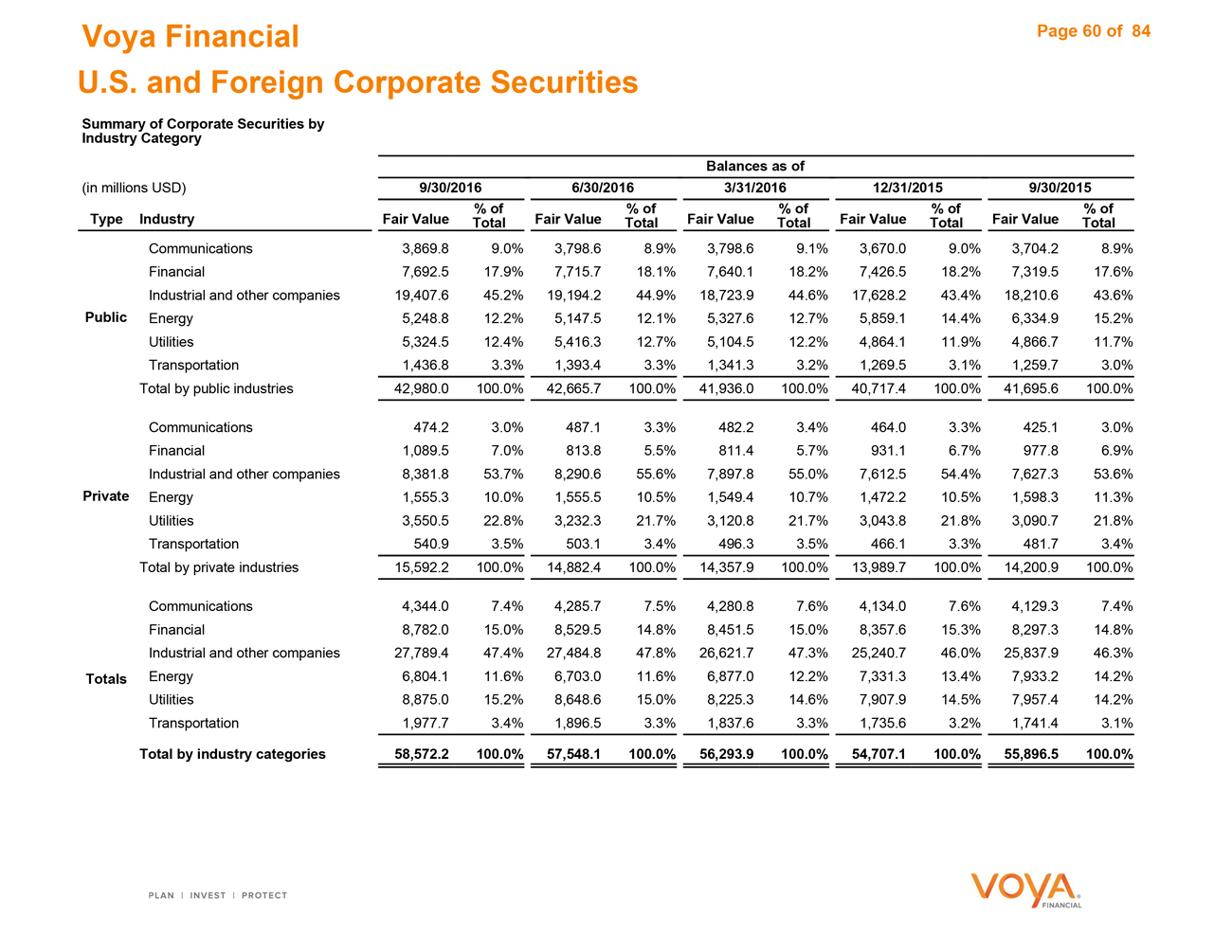

US and Foreign Corporate Securities 60

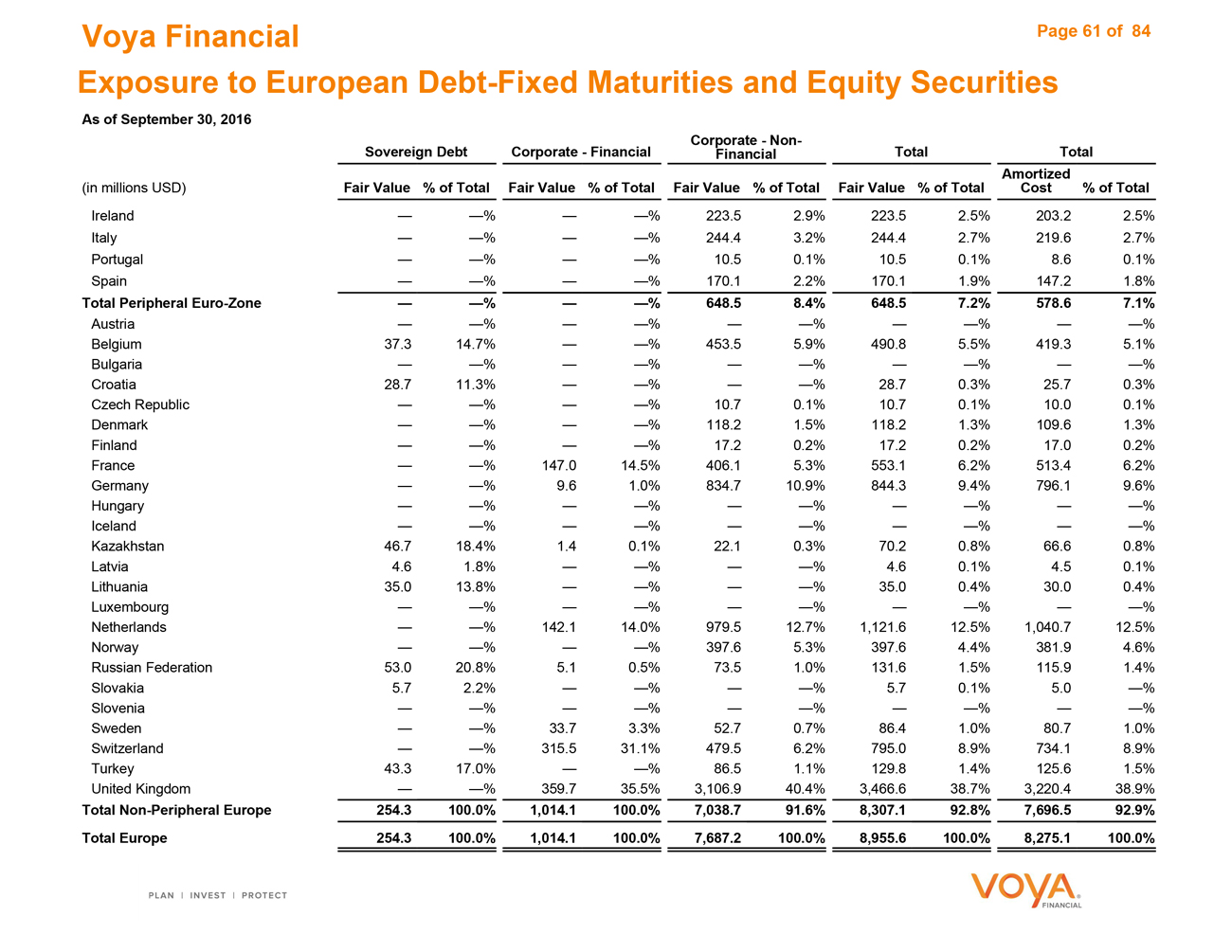

Exposure to European Debt—Fixed Maturities and Equity Securities 61

Reconciliations

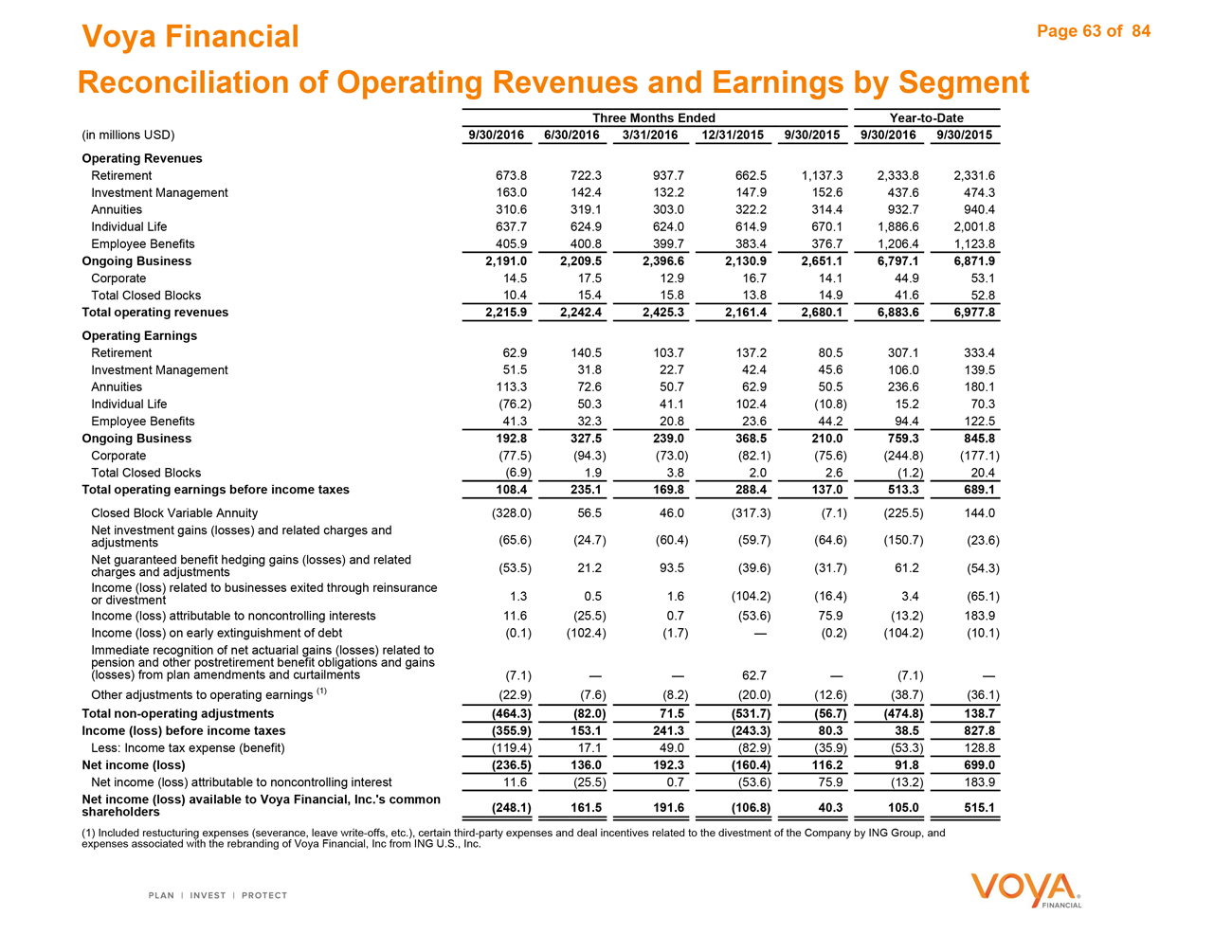

Reconciliation of Operating Revenues and Earnings by Segment 63

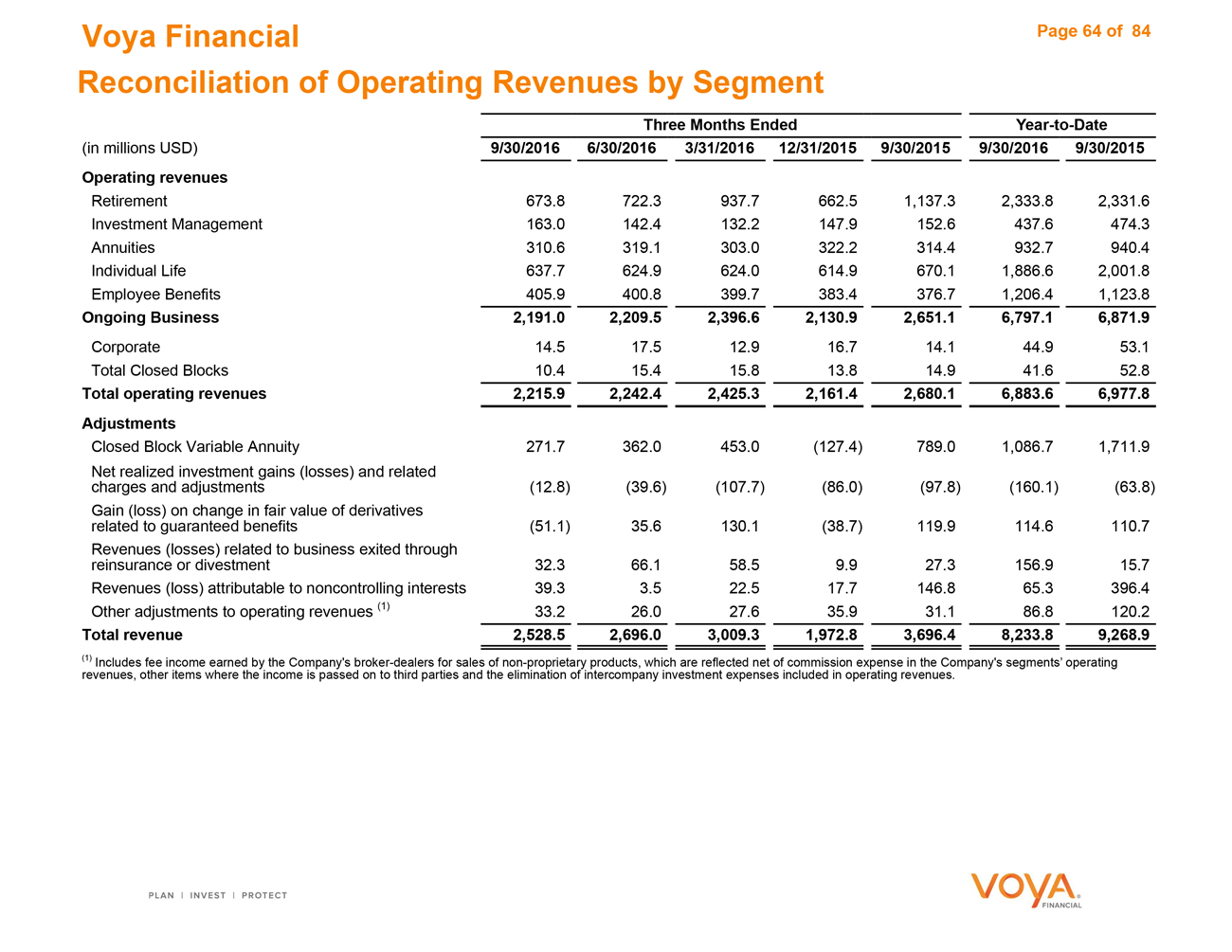

Reconciliation of Operating Revenues by Segment 64

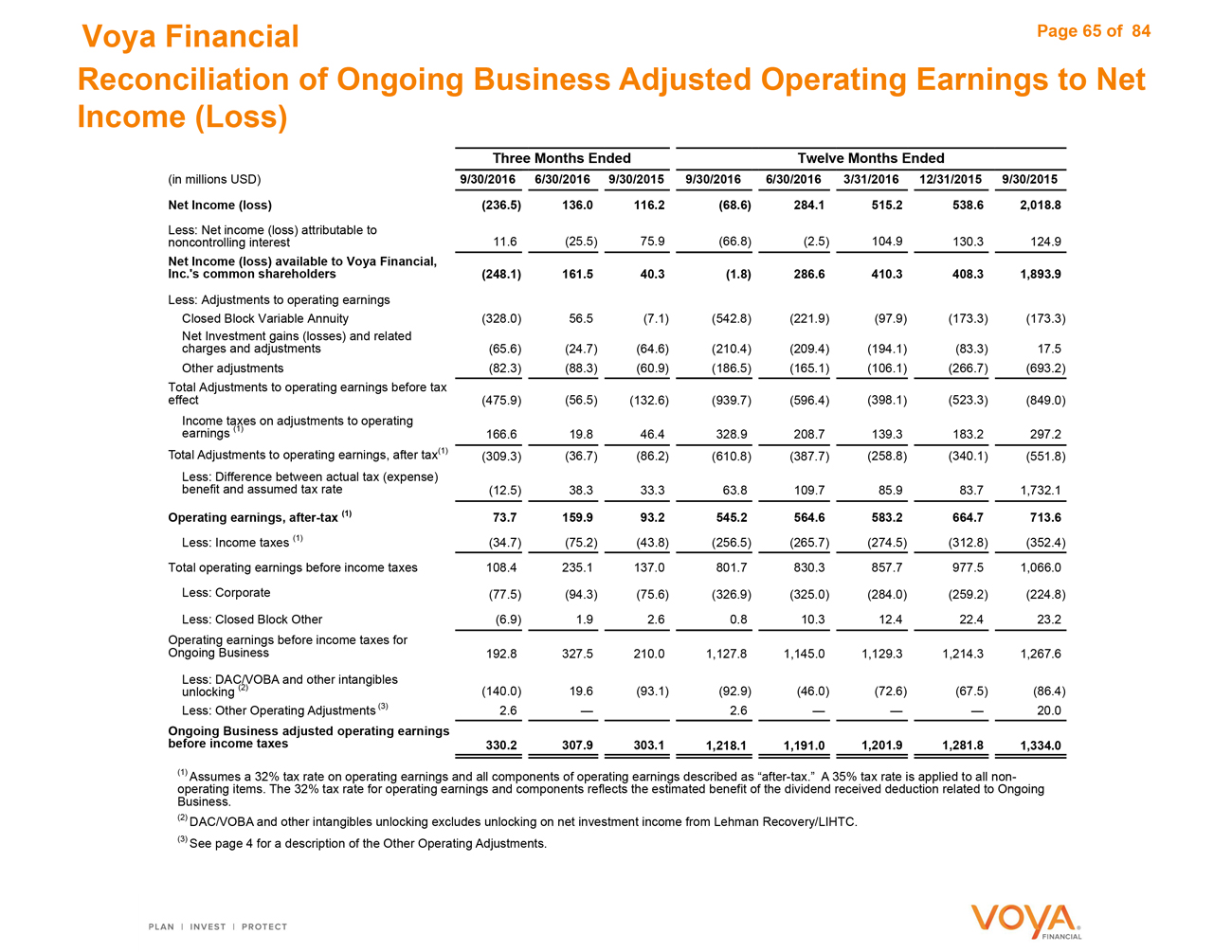

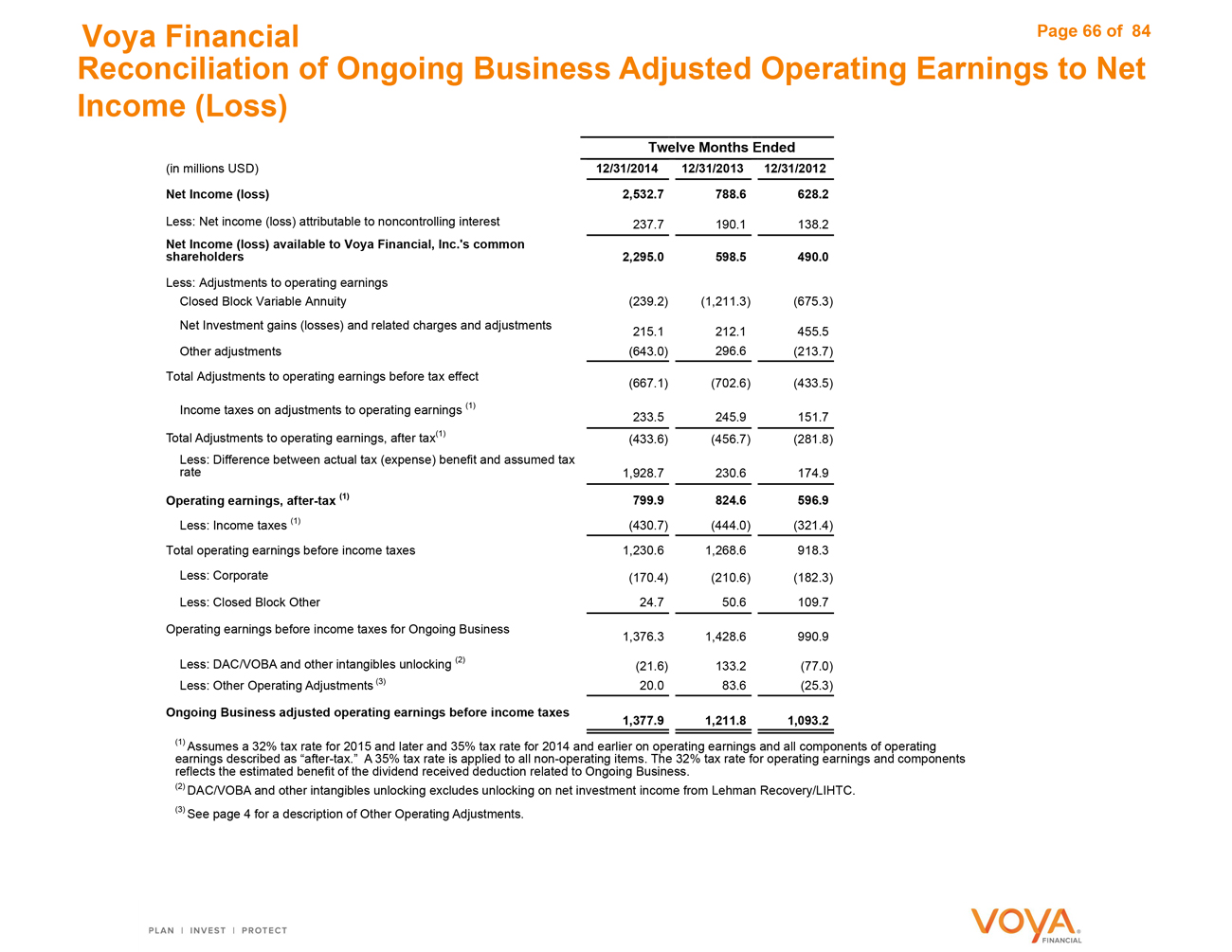

Reconciliation of Ongoing Business Adjusted Operating Earnings to Net

Income (Loss) 65—66

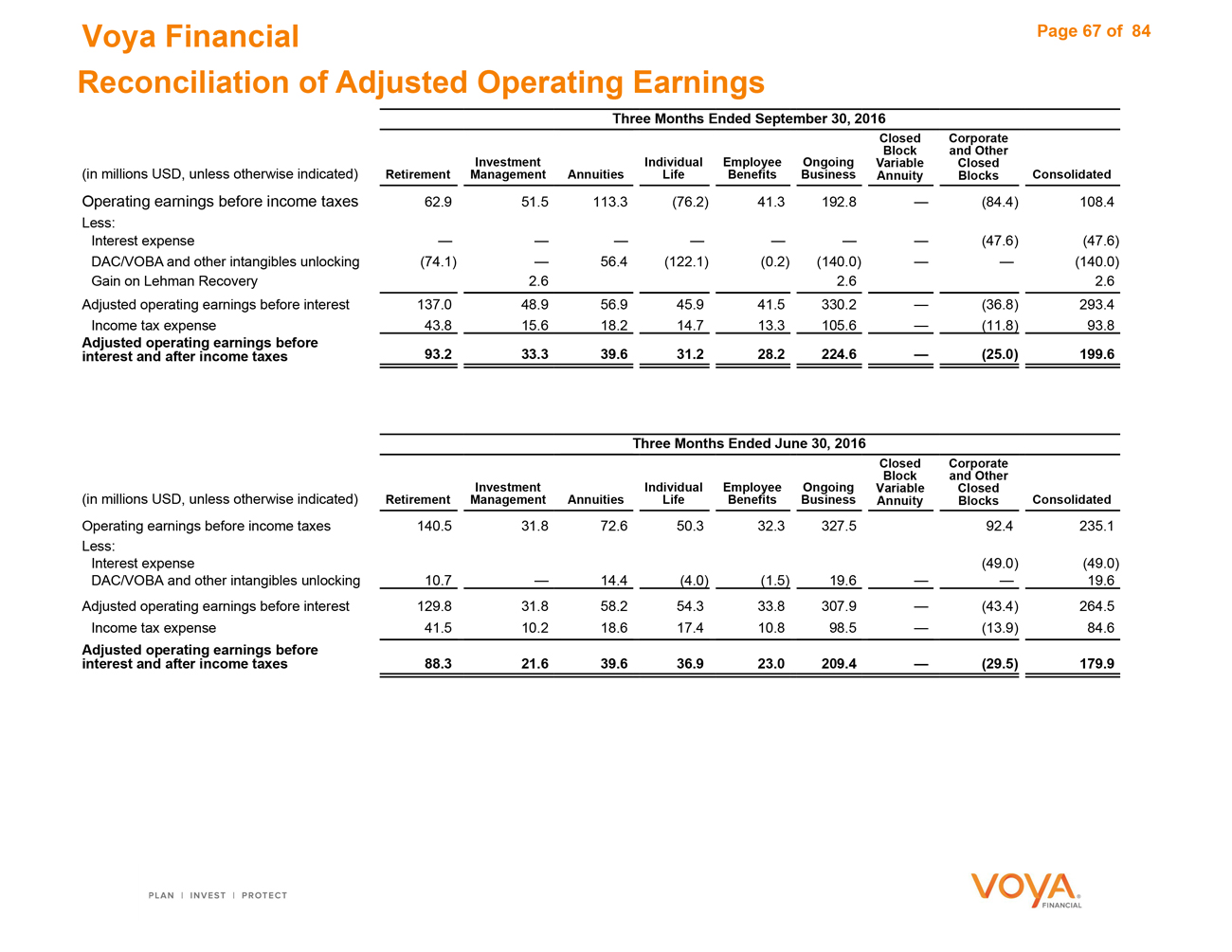

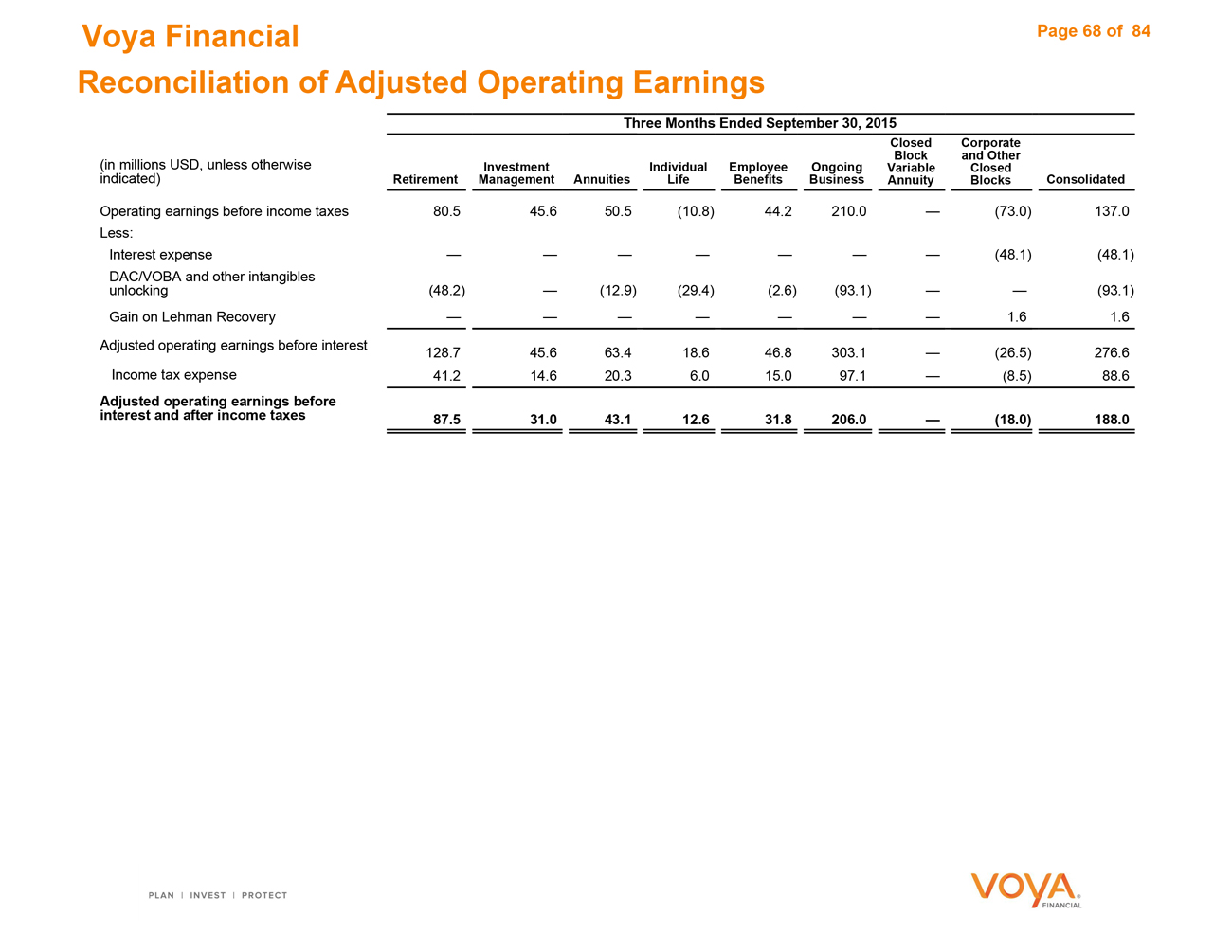

Reconciliation of Adjusted Operating Earnings 67—68

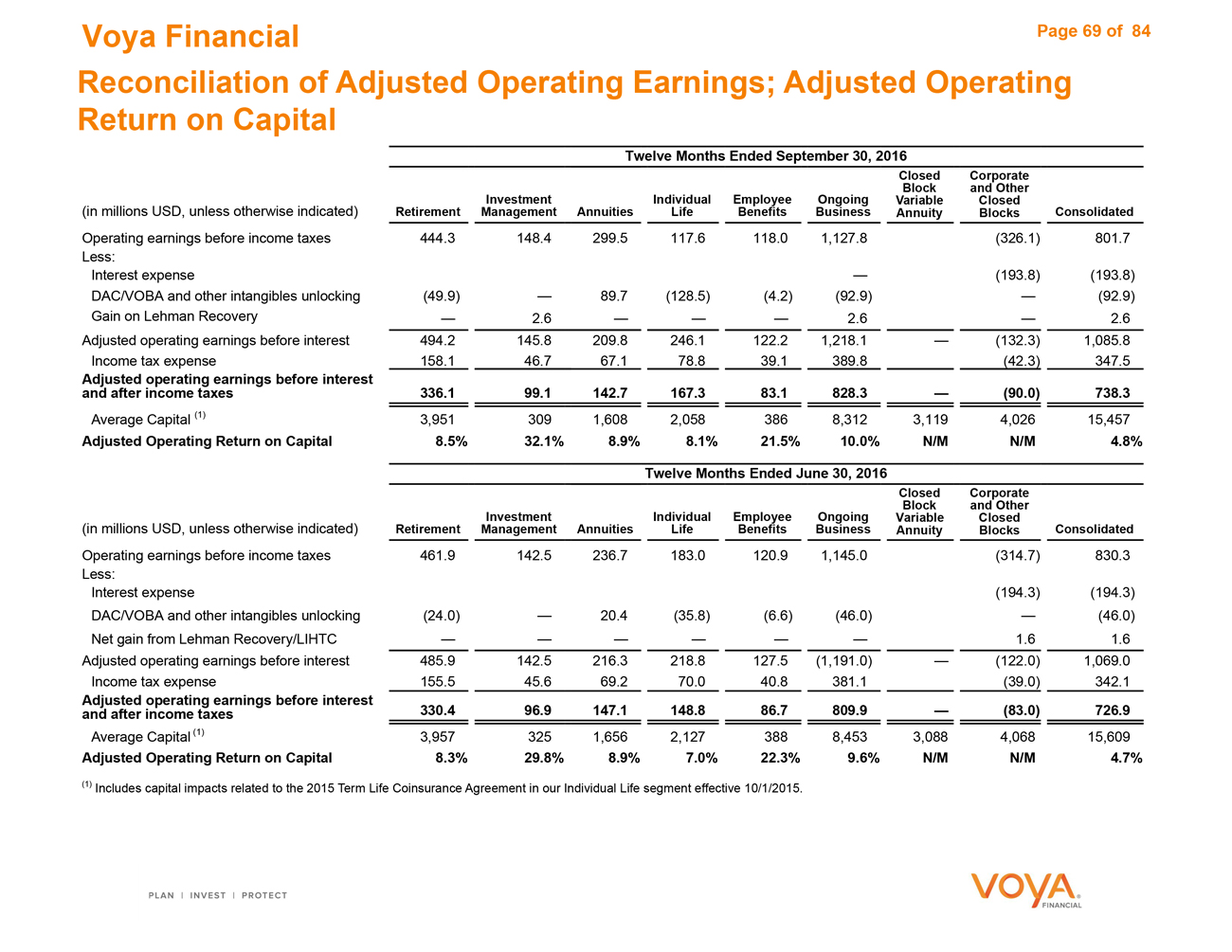

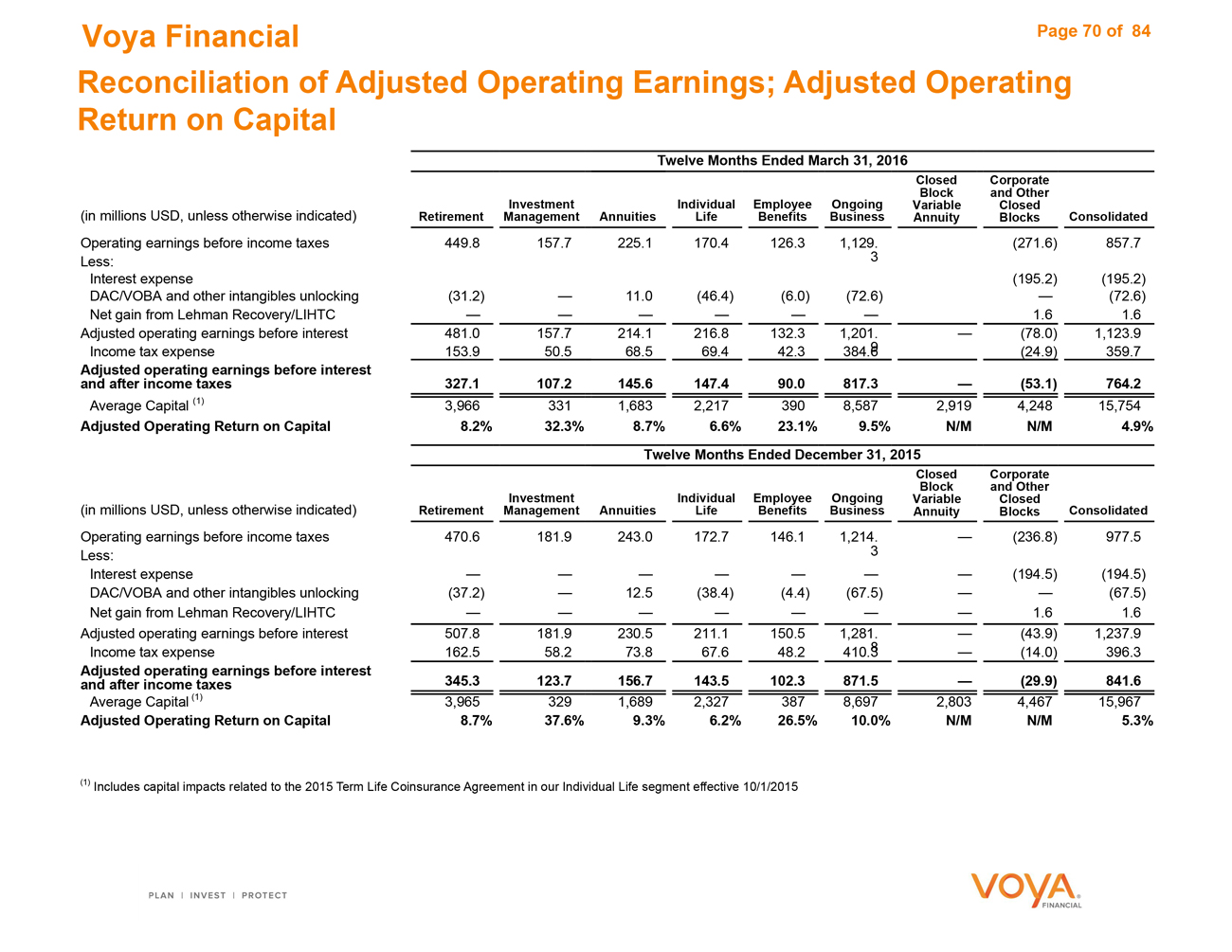

Reconciliation of Adjusted Operating Earnings and Calculation of

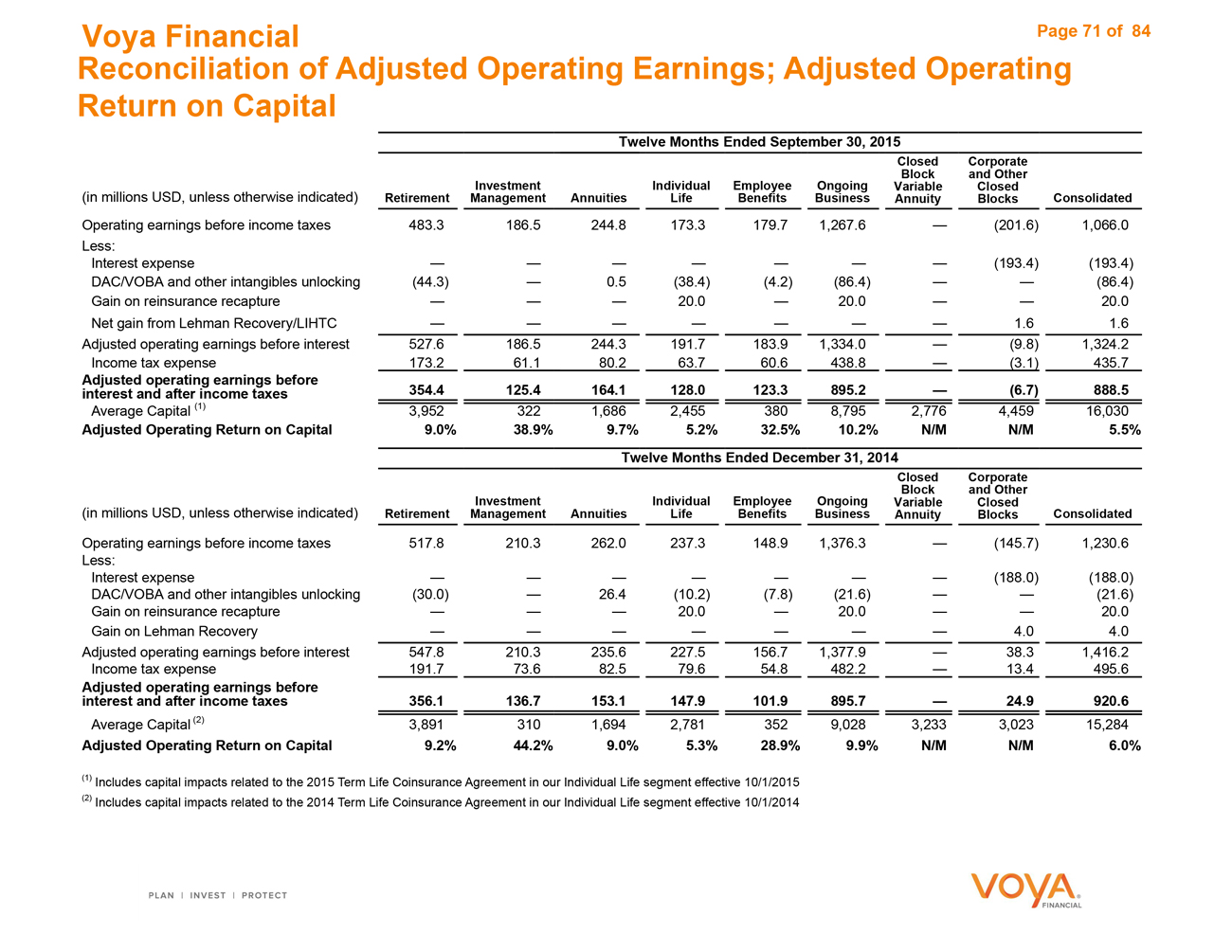

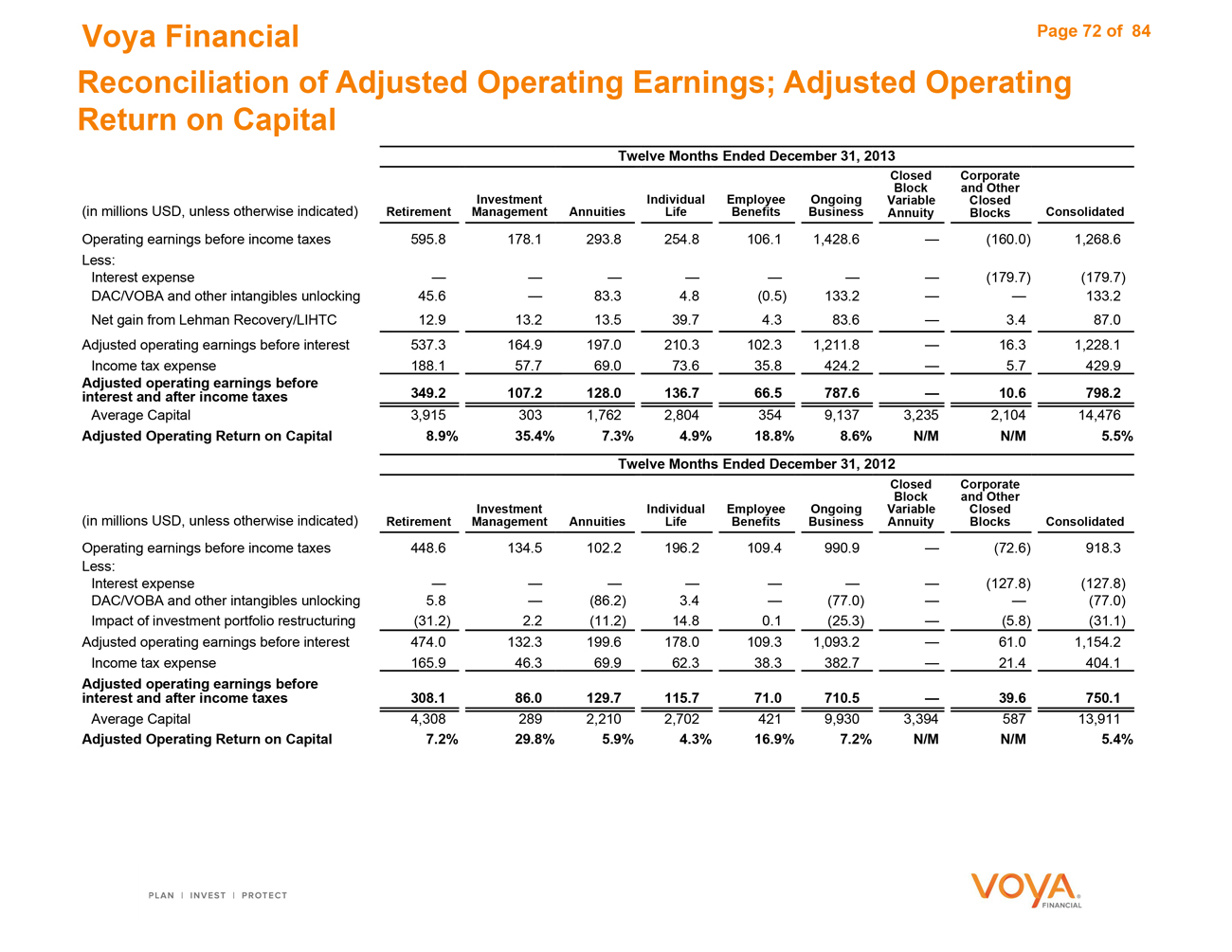

Adjusted Operating Return on Capital 69—72

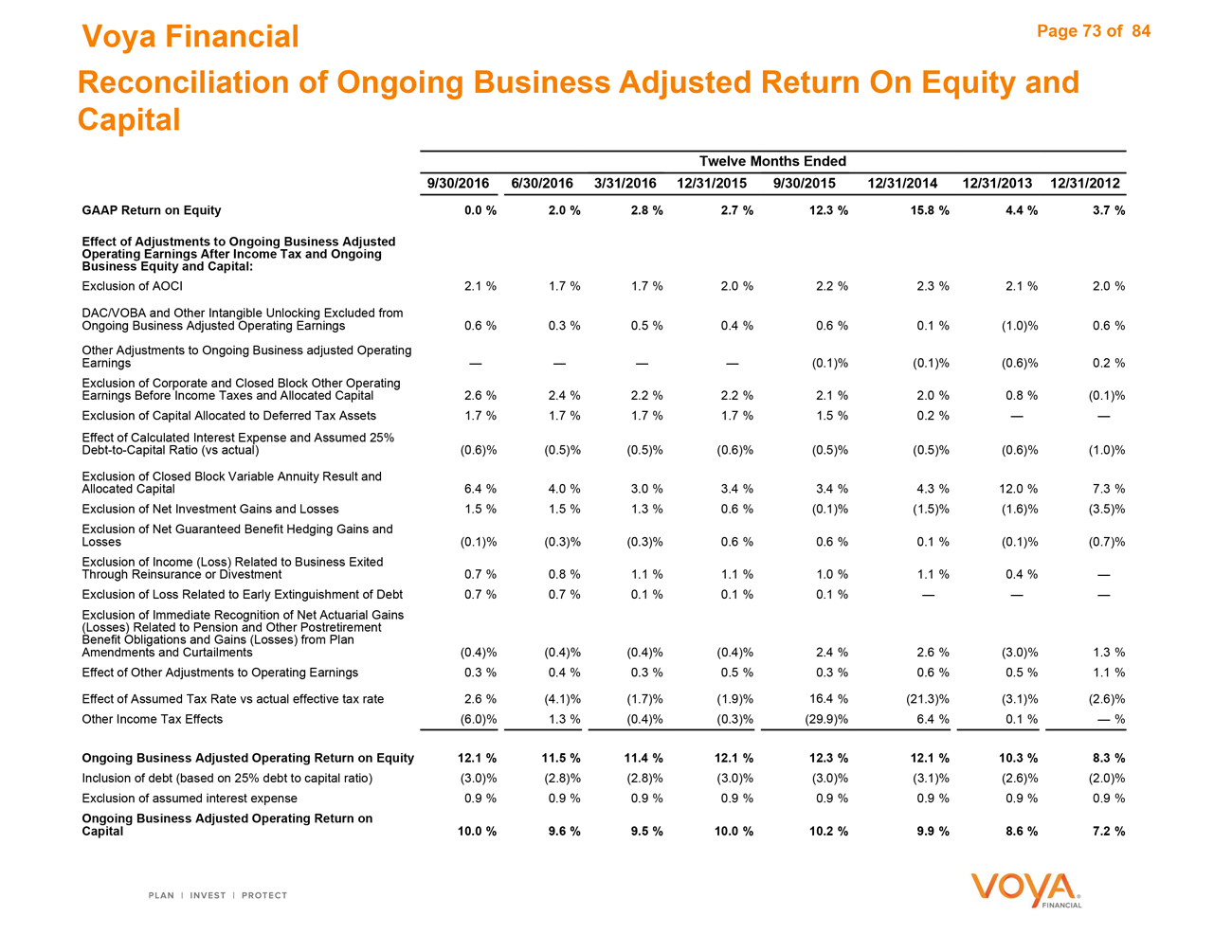

Reconciliation of Ongoing Business Adjusted ROE and Capital 73

Impacts of Prepayments and Alternative Income Above (Below) Long-

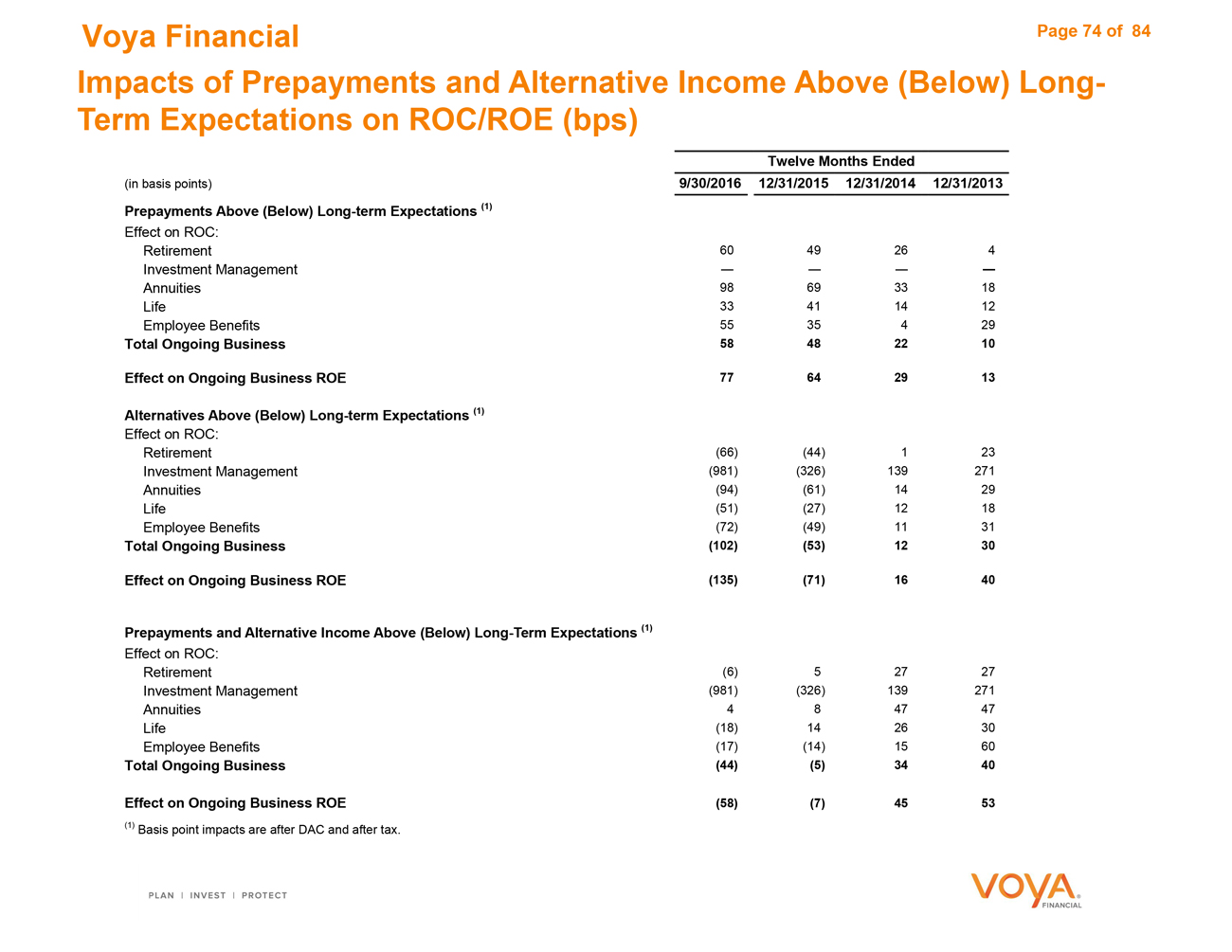

Term Expectations 74

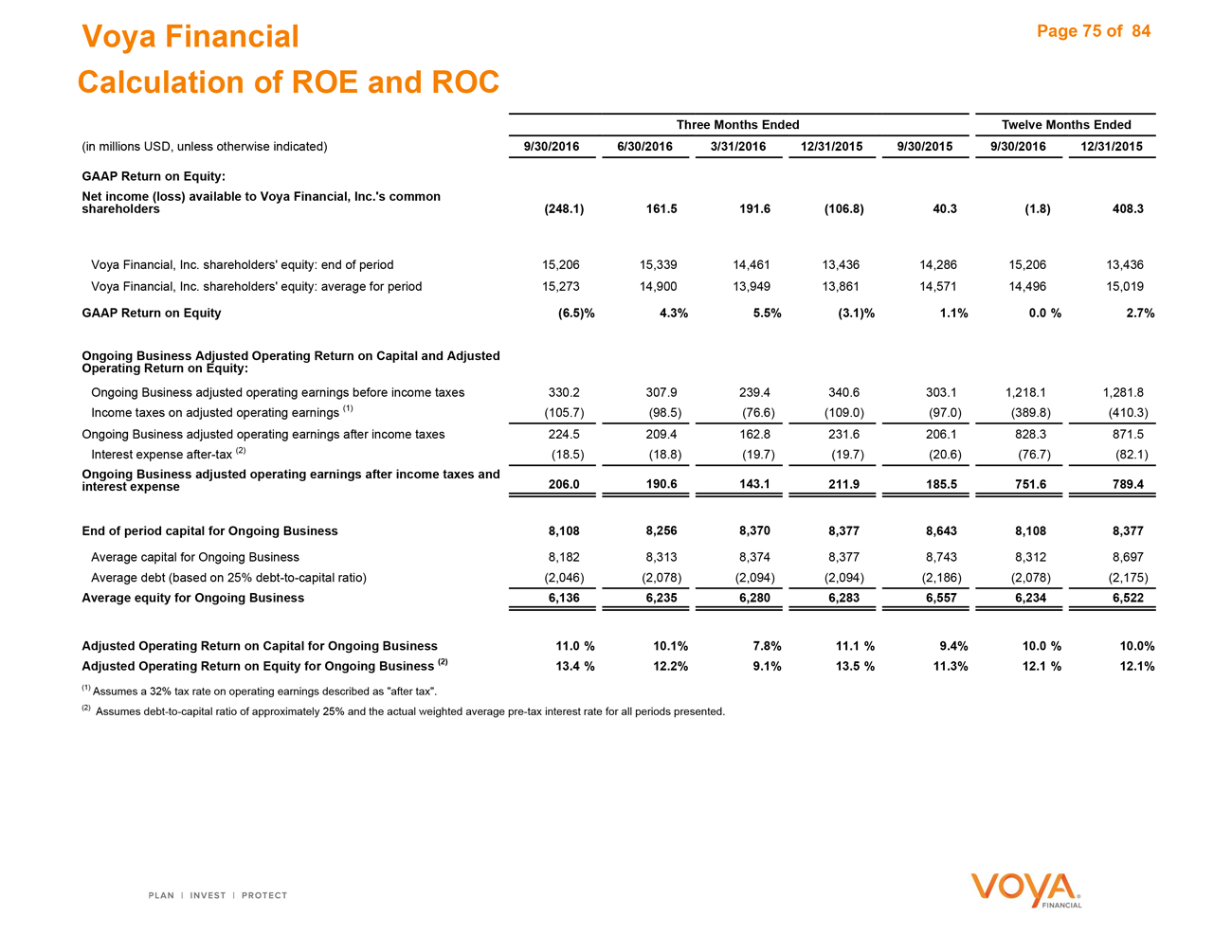

Calculation of ROE and ROC 75

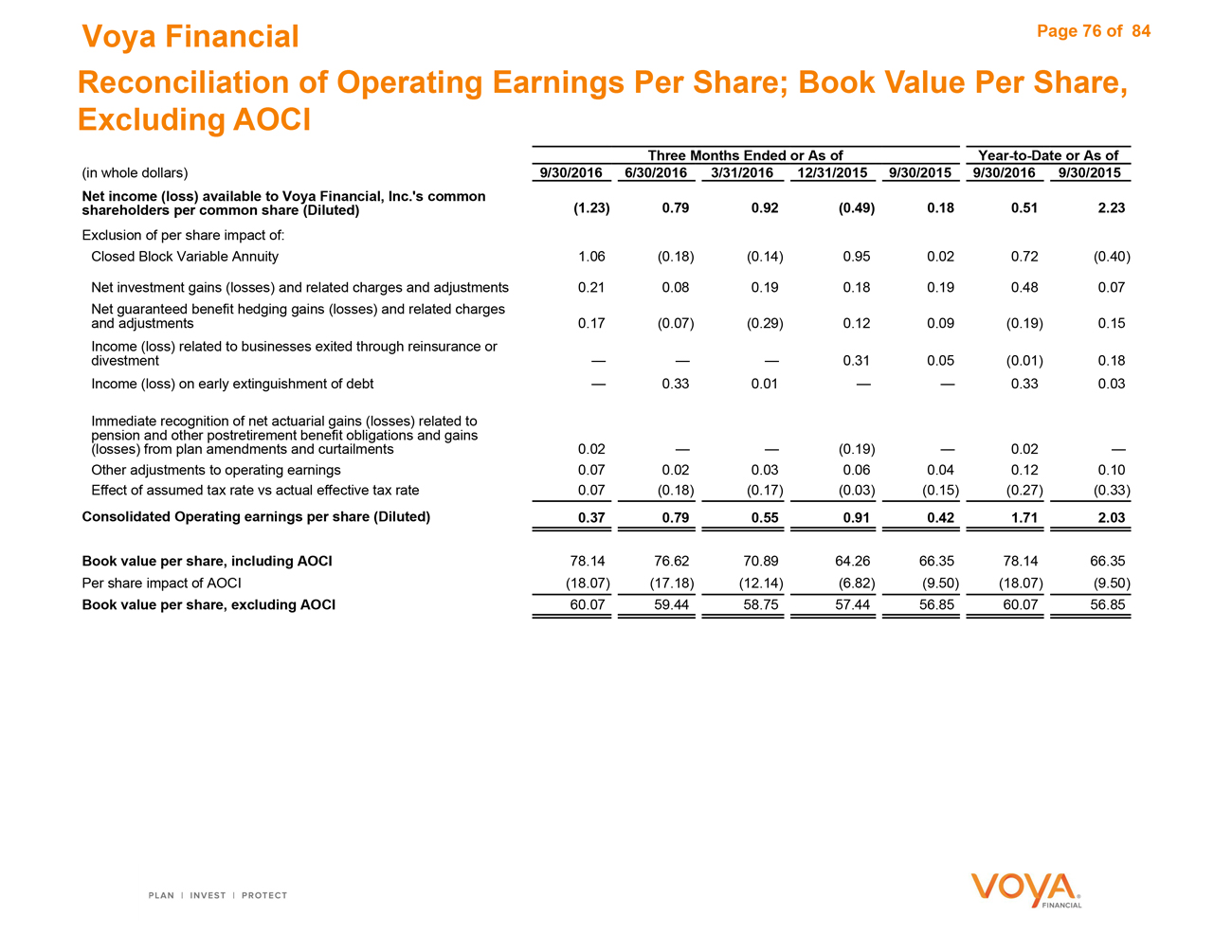

Reconciliation of Operating Earnings Per Share: Book Value Per Share

Excluding AOCI 76

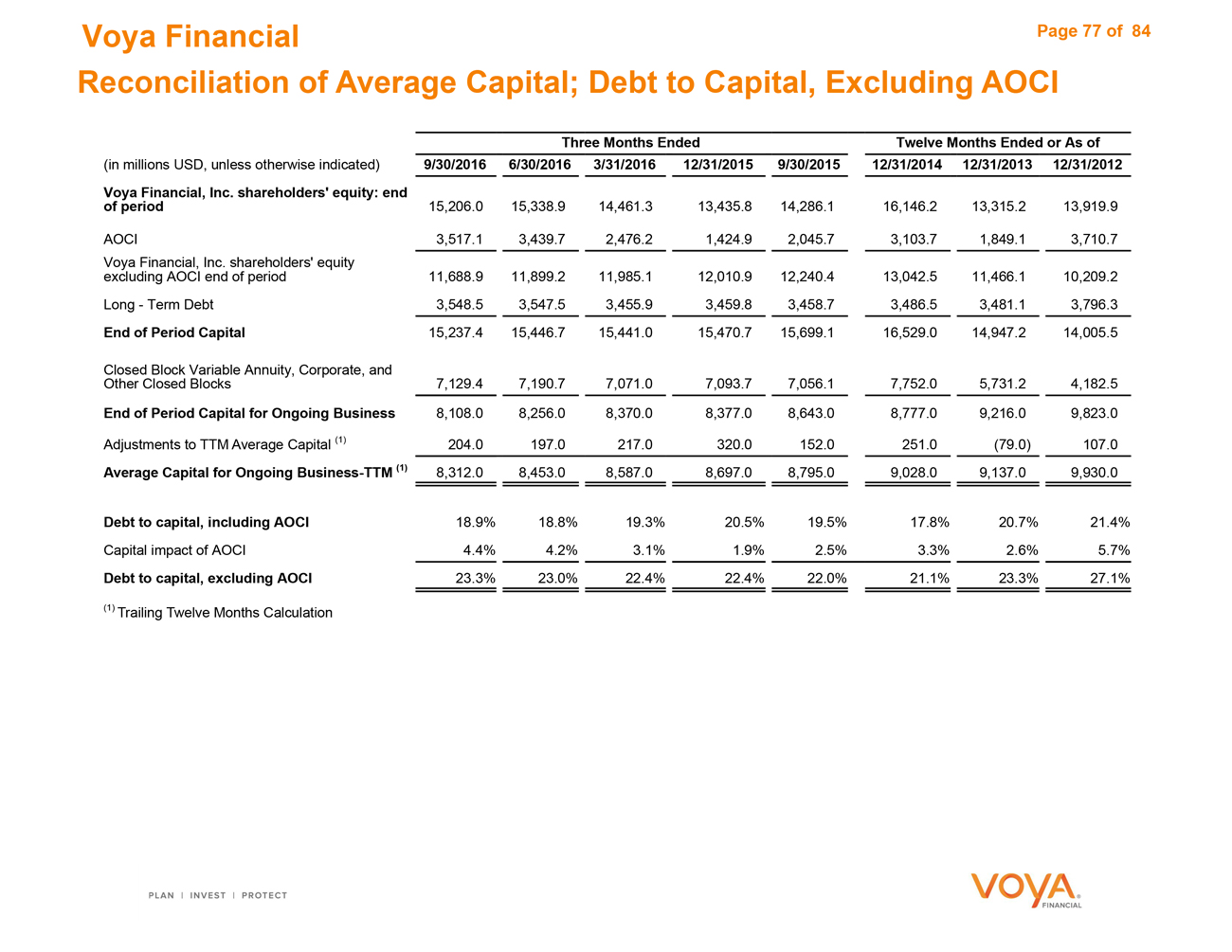

Reconciliation of Average Capital: Debt to Capital, Excluding AOCI 77

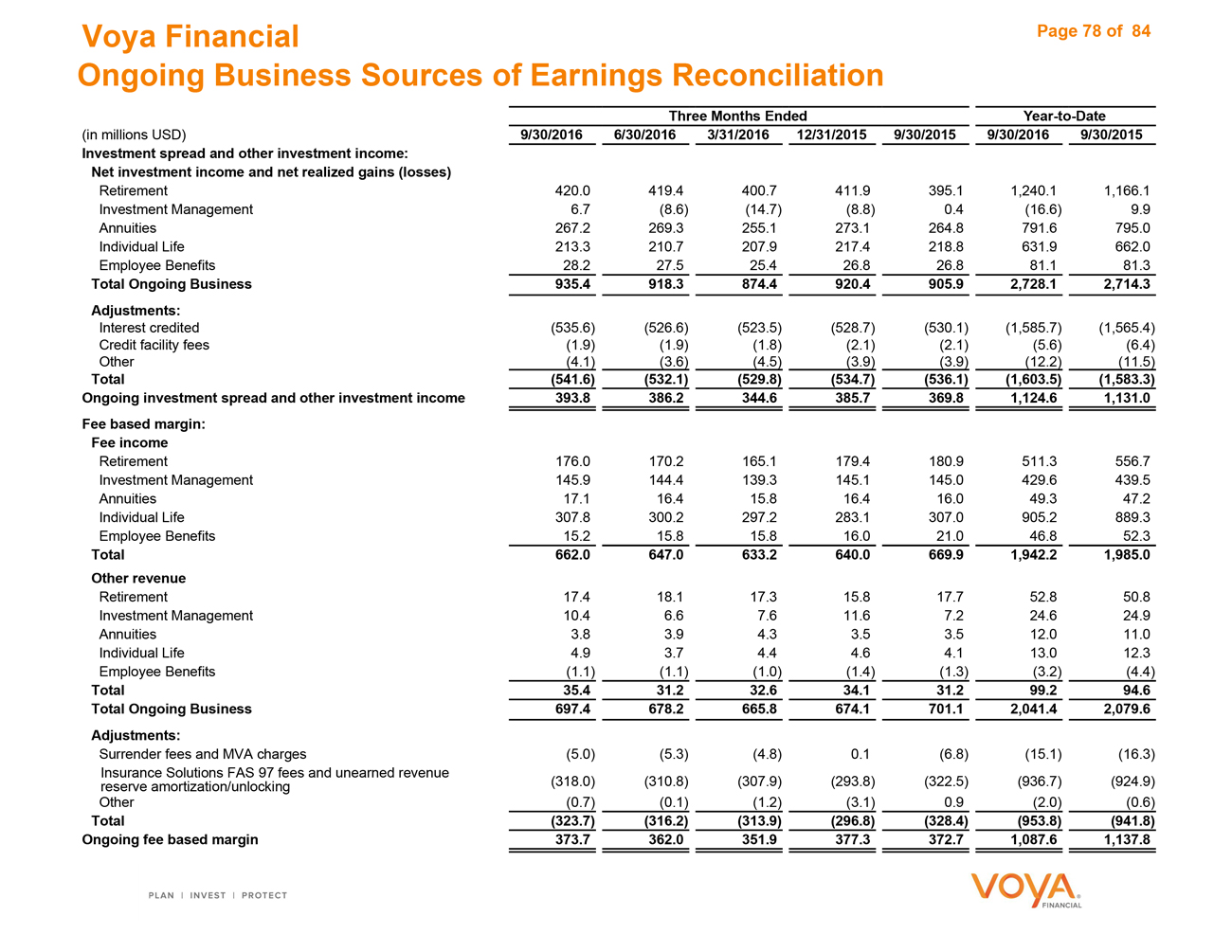

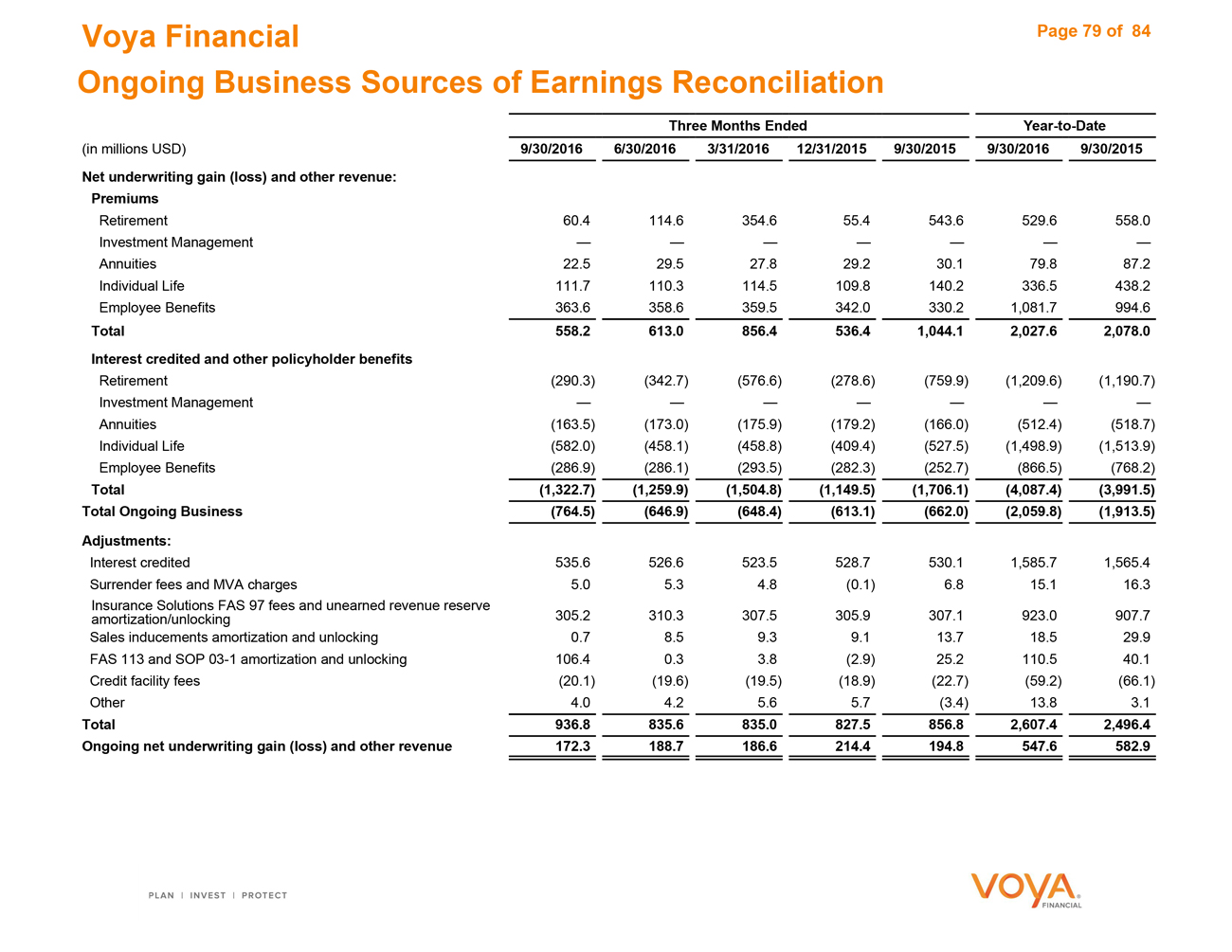

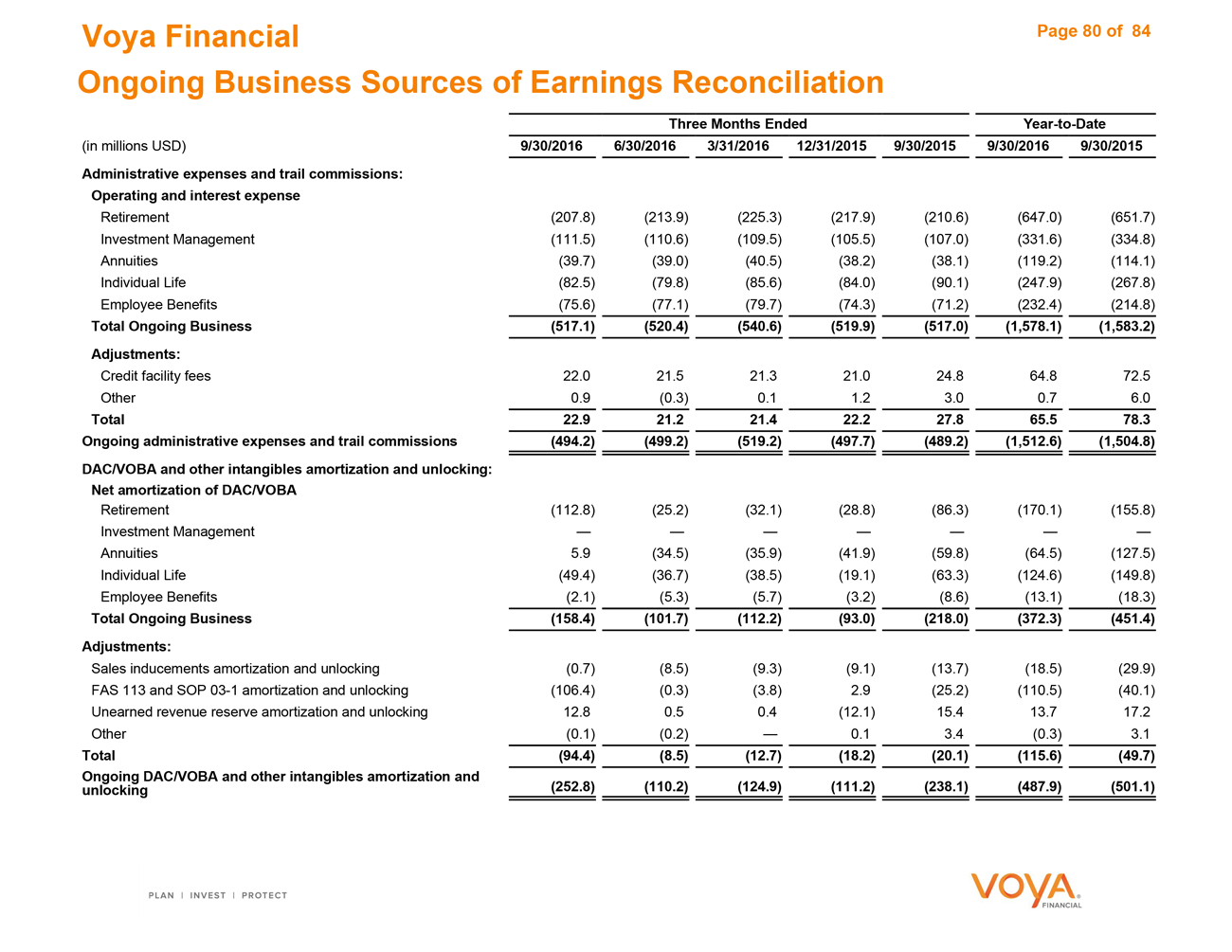

Reconciliation of Ongoing Business Sources of Earnings 78—80

Reconciliation of Investment Management Operating Margin, Excluding

Investment Capital 81

Additional Information

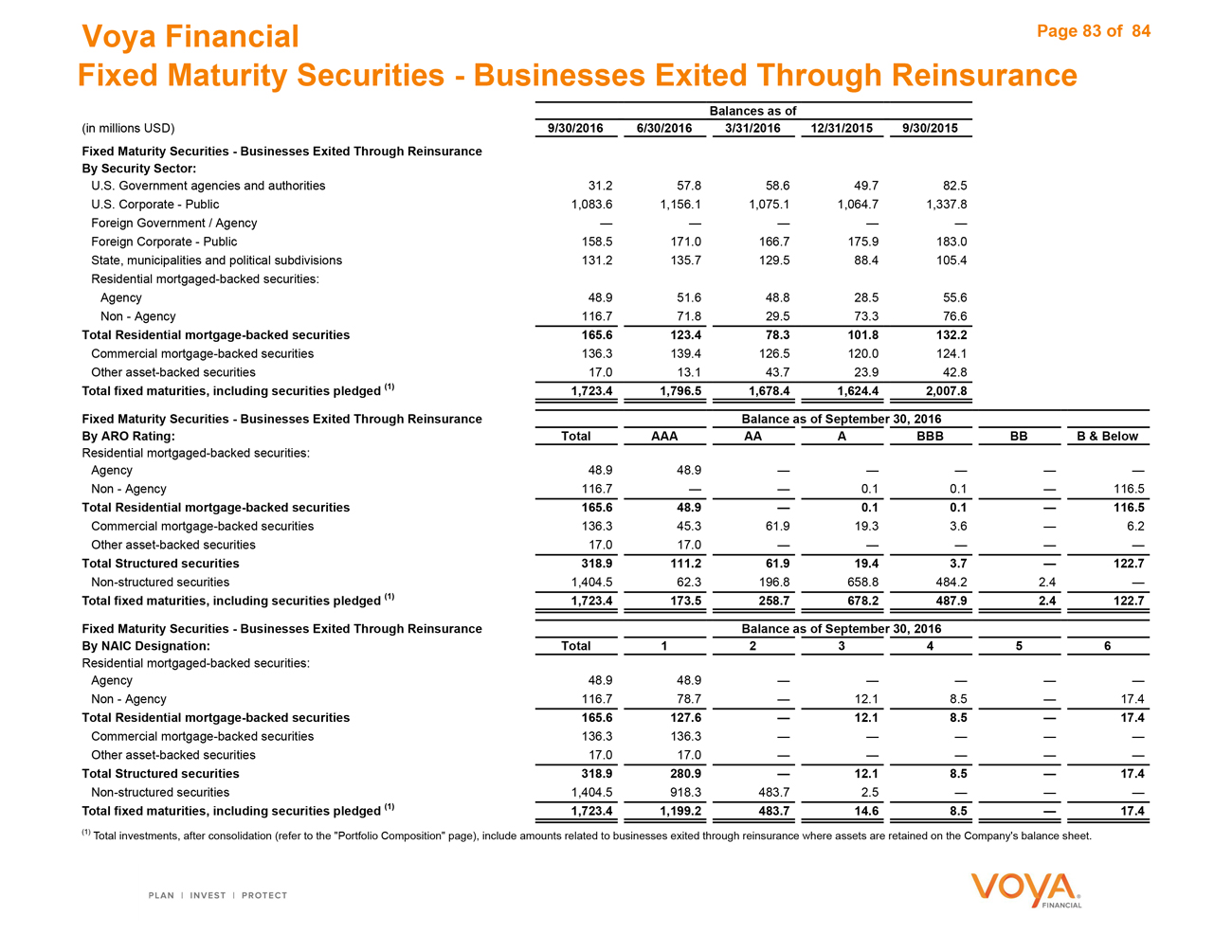

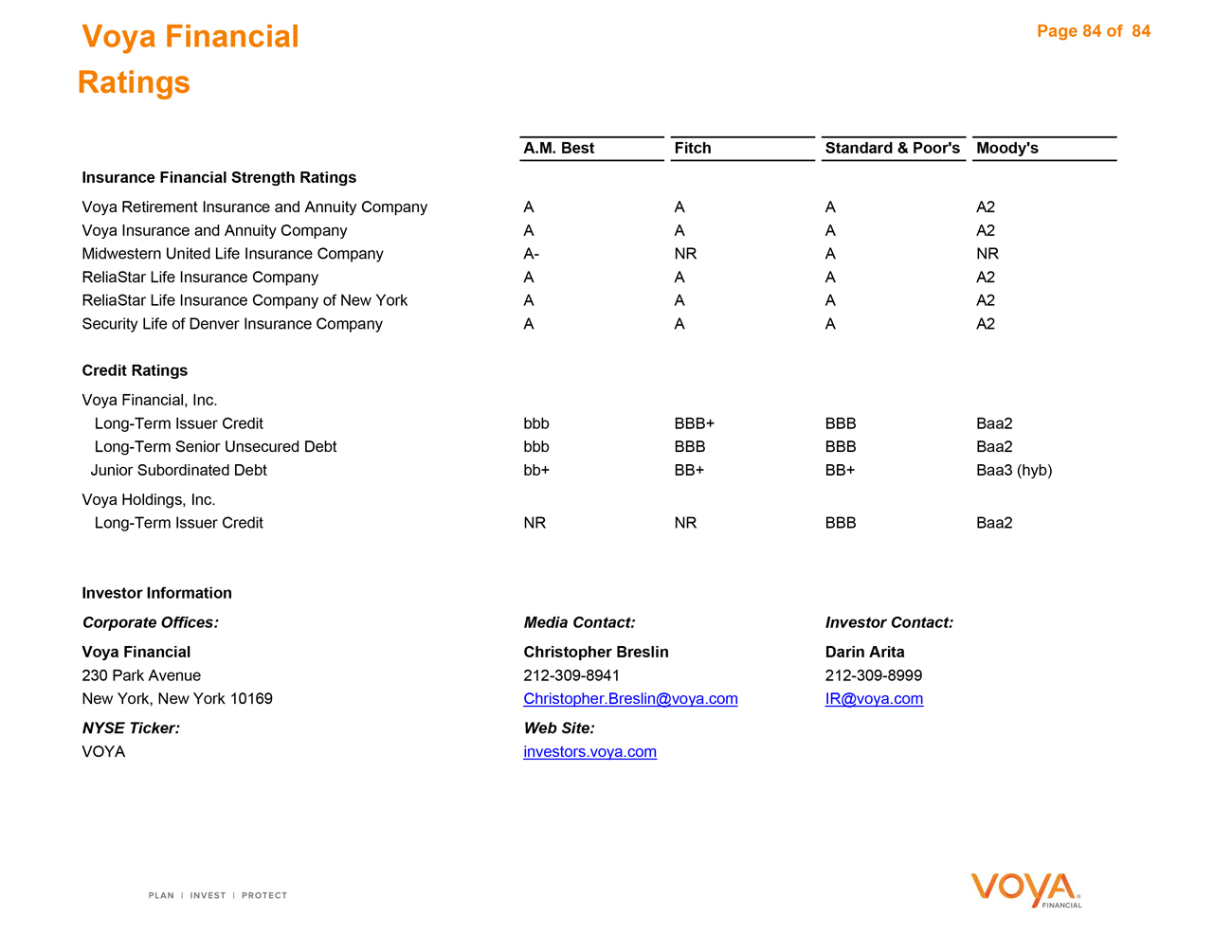

Fixed Maturity Securities—Businesses Exited Through Reinsurance 83

Ratings 84

Voya Financial

Explanatory Note on Non-GAAP Financial Information

Operating Earning Before Income Taxes

Operating earnings before income taxes is a financial measure we use to evaluate segment performance. We believe that operating earnings before income taxes provides a meaningful measure of our business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of our underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors. We use the same accounting policies and procedures to measure segment operating earnings before income taxes as we do for consolidated Net income (loss). We also report operating earnings on an aggregate basis (both before and after income taxes) for both our Ongoing Business and for our Company as a whole.

Operating earnings before income taxes does not replace Net income (loss) as the U.S. GAAP measure of our consolidated results of operations. Therefore, we believe that it is useful to evaluate both Net income (loss) and Operating earnings before income taxes when reviewing our financial and operating performance. Each segment’s operating earnings before income taxes is calculated by adjusting Income (loss) before income taxes for the following items:

Net investment gains (losses), net of related amortization of deferred policy acquisition costs (“DAC”), value of business acquired (“VOBA”), sales inducements and unearned revenue, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the fair value option (“FVO”) unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest;

Net guaranteed benefit hedging gains (losses), which are significantly influenced by economic and market conditions, include changes in the fair value of derivatives related to guaranteed benefits, net of related reserve increases (decreases) and net of related amortization of DAC, VOBA and sales inducements, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating results, including the impacts related to changes in our nonperformance spread;

Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions);

Income (loss) attributable to noncontrolling interest;

Income (loss) related to early extinguishment of debt;

Impairment of goodwill, value of management contract rights and value of customer relationships acquired;

Immediate recognition of net actuarial gains (losses) related to our pension and other postretirement benefit obligations and gains (losses) from plan amendments and curtailments; and

Other items, including restructuring expenses (severance, lease write-offs, etc.), certain third-party expenses and deal incentives related to the divestment of the Company by ING Group, and expenses associated with the rebranding of Voya Financial, Inc. from ING U.S., Inc.

Operating earnings before income taxes, when presented on a consolidated basis, also does not reflect the results of operations of our CBVA segment because this segment is managed to focus on protecting regulatory and rating agency capital rather than achieving operating metrics or generating net income. As a result of this focus on regulatory and rating agency capital, the financial results of the CBVA segment presented in accordance with GAAP tend to exhibit a high degree of volatility based on factors, such as the asymmetry between the accounting for certain liabilities and the corresponding hedging assets, and gains and losses due to changes in nonperformance risk, that are not necessarily reflective of the economic costs and benefits of our CBVA business. When we present the adjustments to Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to our CBVA segment.

Income (loss) related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold and expenses directly related to these transactions) is excluded from the results of operations from Operating earnings before income taxes. When we present the adjustments to Net Income (loss) before income taxes on a consolidated basis, each adjustment excludes the relative portions attributable to businesses exited through reinsurance or divestment.

Effective April 1, 2015, we disposed of, via reinsurance, retained group reinsurance policies. Consistent with our practice to exclude business (including blocks of business) exited via reinsurance or divestment from Operating earnings before income taxes and from Operating revenues, beginning in the second quarter of 2015, the revenues and expenses of this reinsured block of business are excluded from these metrics.

Effective October 1, 2015, we disposed of, via reinsurance, a block of in-force term life contracts. Consistent with our practice to exclude business (including blocks of business) exited via reinsurance or divestment from operating earnings before income taxes and from operating revenues, beginning in the fourth quarter of 2015, the revenues and expenses of these reinsured blocks of business are excluded from these metrics.

The most directly comparable U.S. GAAP measure to Operating earnings before income taxes is Net income (loss) before income taxes. For a reconciliation of Operating earnings before Net income taxes to Net income (loss) before income taxes, and from Total Operating earnings before income taxes to Total adjusted operating earnings before income taxes, refer to the “Reconciliations” section in this document.

Page 3 of 84

Voya Financial

Explanatory Note on Non-GAAP Financial Information

Adjusted Operating Earnings and Ongoing Business Adjusted Operating Earnings

Adjusted operating earnings is also a non-GAAP financial measure. This measure excludes from Operating earnings before income taxes the following items:

DAC/VOBA and other intangibles unlocking;

The net gains included in operating earnings from a distribution of cash and securities in conjunction with a Lehman Brothers bankruptcy settlement (“Lehman Recovery”), and losses as a result of the decision to dispose of certain Low Income Housing Tax Credit partnerships (“LIHTC”) as a mean of exiting this asset class;

A gain related to the amendment or recapture of certain reinsurance agreements during 2014;

The net loss included in operating earnings from the sale of certain alternative investments and investment income associated with assets disposed of during the portfolio restructuring effected during 2012; and

Interest expense related to debt in our Corporate segment.

Because DAC/VOBA and other intangibles unlocking can be volatile, excluding the effect of this item can improve period to period comparability. The net gain from the Lehman Brothers bankruptcy settlement, loss from the disposition of low-income housing tax credit partnerships, gain on reinsurance recapture, and impact of investment portfolio restructuring affected run-rate results and we believe that this effect is not reflective of our ongoing performance.

We report Ongoing Business operating earnings before income taxes (both adjusted and unadjusted as described above) because we believe this measure is a useful indicator of the business performance for our Ongoing Business segments, excluding the effect of our Closed Blocks and Corporate segments.

Adjusted operating earnings before income taxes and Ongoing Business adjusted operating earnings before income taxes are each non-GAAP measures. For a reconciliation of each of these non-GAAP measures to the most directly comparable U.S. GAAP measure, refer to the “Reconciliations” section in this document.

Ongoing Business Adjusted Operating ROE/ROC

We report Ongoing Business adjusted operating ROE and adjusted operating ROC because we believe these measures are useful indicators of how effectively we use capital resources allocated to our Ongoing Businesses. The most directly comparable U.S. GAAP measure to Ongoing Business adjusted operating ROE and adjusted operating ROC is return on equity. For a reconciliation of these non-GAAP measures to return on equity, refer to the “Reconciliations” section in this document.

Operating Earnings per Share; Shareholders’ Equity/Book Value per Share, Excluding AOCI

In addition to Net income (loss) per share, we report Operating Earnings per Share because we believe that operating earnings before income taxes provides a meaningful measure of its business and segment performances and enhances the understanding of our financial results by focusing on the operating performance and trends of the underlying business segments and excluding items that tend to be highly variable from period to period based on capital market conditions and/or other factors.

In addition to book value per share including accumulated other comprehensive income (AOCI), we also report book value per share excluding AOCI and shareholders’ equity excluding AOCI. Included in AOCI are investment portfolio unrealized gains or losses. In the ordinary course of business we do not plan to sell most investments for the sole purpose of realizing gains or losses, and book value per share excluding AOCI and shareholders’ equity excluding AOCI provide a measure consistent with that view.

For a reconciliation of these non-GAAP measures to Net income (loss) per share and book value per share, refer to the “Reconciliations” section in this document.

Page 4 of 84

Voya Financial

Explanatory Note on Non-GAAP Financial Information

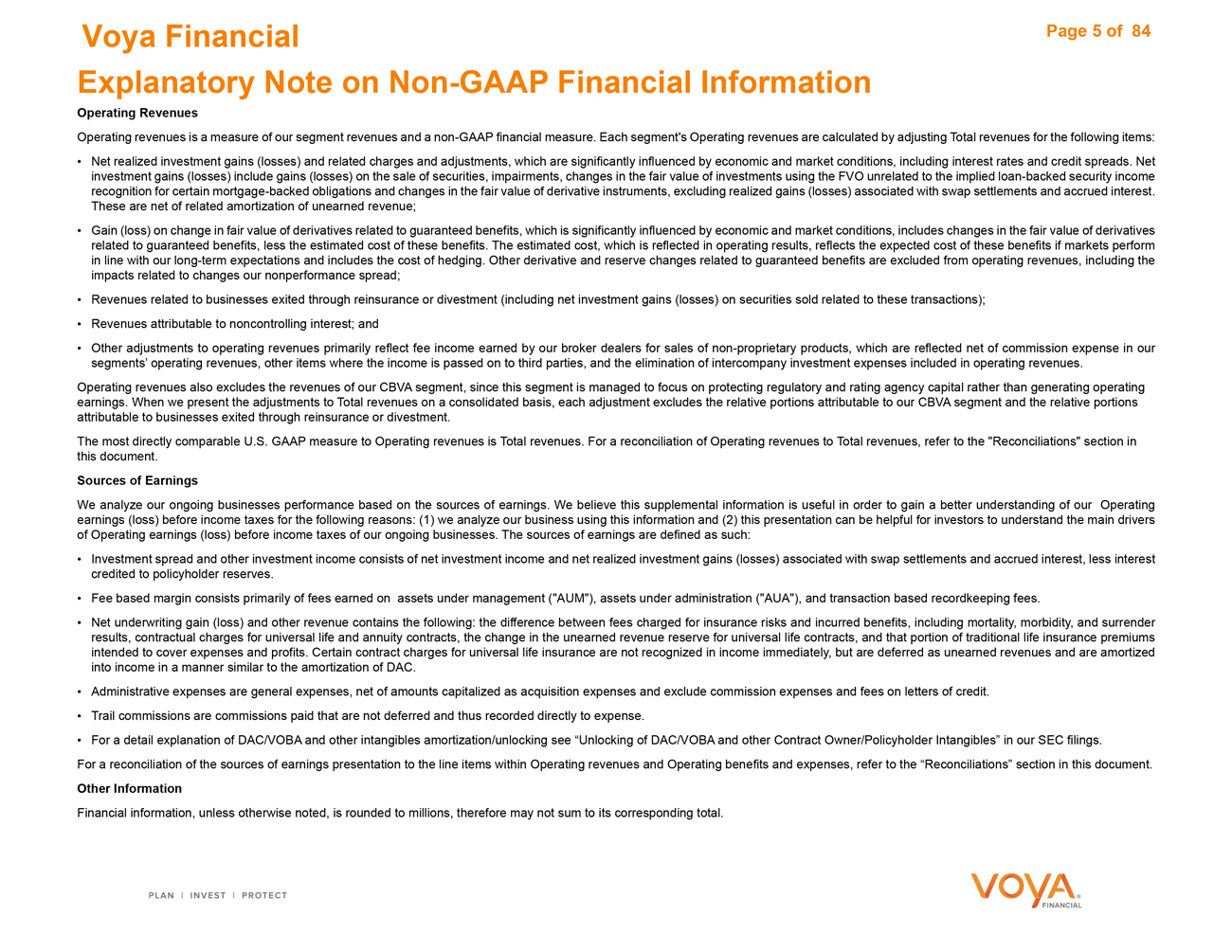

Operating Revenues

Operating revenues is a measure of our segment revenues and a non-GAAP financial measure. Each segment’s Operating revenues are calculated by adjusting Total revenues for the following items:

Net realized investment gains (losses) and related charges and adjustments, which are significantly influenced by economic and market conditions, including interest rates and credit spreads. Net investment gains (losses) include gains (losses) on the sale of securities, impairments, changes in the fair value of investments using the FVO unrelated to the implied loan-backed security income recognition for certain mortgage-backed obligations and changes in the fair value of derivative instruments, excluding realized gains (losses) associated with swap settlements and accrued interest. These are net of related amortization of unearned revenue;

Gain (loss) on change in fair value of derivatives related to guaranteed benefits, which is significantly influenced by economic and market conditions, includes changes in the fair value of derivatives related to guaranteed benefits, less the estimated cost of these benefits. The estimated cost, which is reflected in operating results, reflects the expected cost of these benefits if markets perform in line with our long-term expectations and includes the cost of hedging. Other derivative and reserve changes related to guaranteed benefits are excluded from operating revenues, including the impacts related to changes our nonperformance spread;

Revenues related to businesses exited through reinsurance or divestment (including net investment gains (losses) on securities sold related to these transactions);

Revenues attributable to noncontrolling interest; and

Other adjustments to operating revenues primarily reflect fee income earned by our broker dealers for sales of non-proprietary products, which are reflected net of commission expense in our segments’ operating revenues, other items where the income is passed on to third parties, and the elimination of intercompany investment expenses included in operating revenues.

Operating revenues also excludes the revenues of our CBVA segment, since this segment is managed to focus on protecting regulatory and rating agency capital rather than generating operating earnings. When we present the adjustments to Total revenues on a consolidated basis, each adjustment excludes the relative portions attributable to our CBVA segment and the relative portions attributable to businesses exited through reinsurance or divestment.

The most directly comparable U.S. GAAP measure to Operating revenues is Total revenues. For a reconciliation of Operating revenues to Total revenues, refer to the “Reconciliations” section in this document.

Sources of Earnings

We analyze our ongoing businesses performance based on the sources of earnings. We believe this supplemental information is useful in order to gain a better understanding of our Operating earnings (loss) before income taxes for the following reasons: (1) we analyze our business using this information and (2) this presentation can be helpful for investors to understand the main drivers of Operating earnings (loss) before income taxes of our ongoing businesses. The sources of earnings are defined as such:

Investment spread and other investment income consists of net investment income and net realized investment gains (losses) associated with swap settlements and accrued interest, less interest credited to policyholder reserves.

Fee based margin consists primarily of fees earned on assets under management (“AUM”), assets under administration (“AUA”), and transaction based recordkeeping fees.

Net underwriting gain (loss) and other revenue contains the following: the difference between fees charged for insurance risks and incurred benefits, including mortality, morbidity, and surrender results, contractual charges for universal life and annuity contracts, the change in the unearned revenue reserve for universal life contracts, and that portion of traditional life insurance premiums intended to cover expenses and profits. Certain contract charges for universal life insurance are not recognized in income immediately, but are deferred as unearned revenues and are amortized into income in a manner similar to the amortization of DAC.

Administrative expenses are general expenses, net of amounts capitalized as acquisition expenses and exclude commission expenses and fees on letters of credit.

Trail commissions are commissions paid that are not deferred and thus recorded directly to expense.

For a detail explanation of DAC/VOBA and other intangibles amortization/unlocking see “Unlocking of DAC/VOBA and other Contract Owner/Policyholder Intangibles” in our SEC filings.

For a reconciliation of the sources of earnings presentation to the line items within Operating revenues and Operating benefits and expenses, refer to the “Reconciliations” section in this document.

Other Information

Financial information, unless otherwise noted, is rounded to millions, therefore may not sum to its corresponding total.

Page 5 of 84

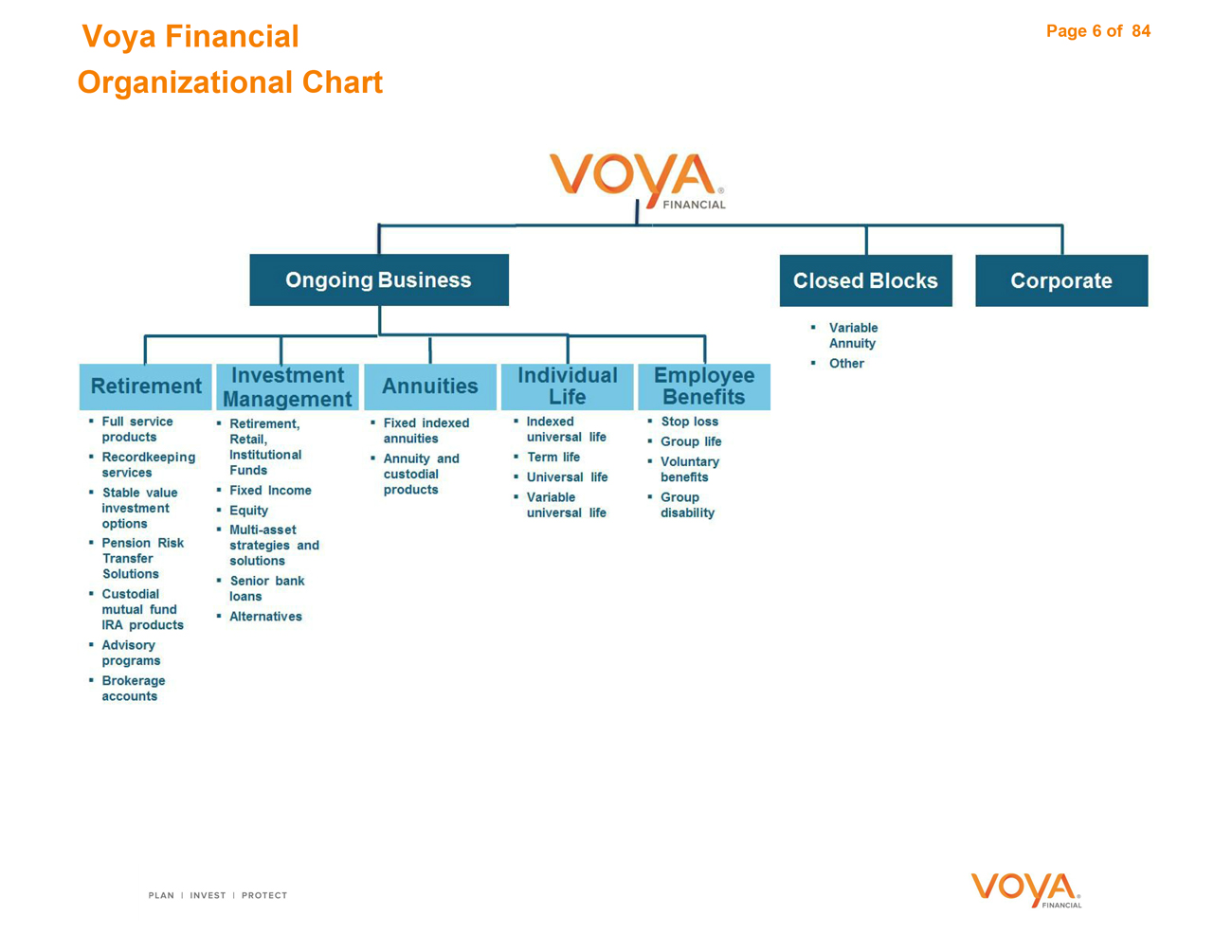

Voya Financial Organizational Chart

Page 6 of 84

Voya Financial

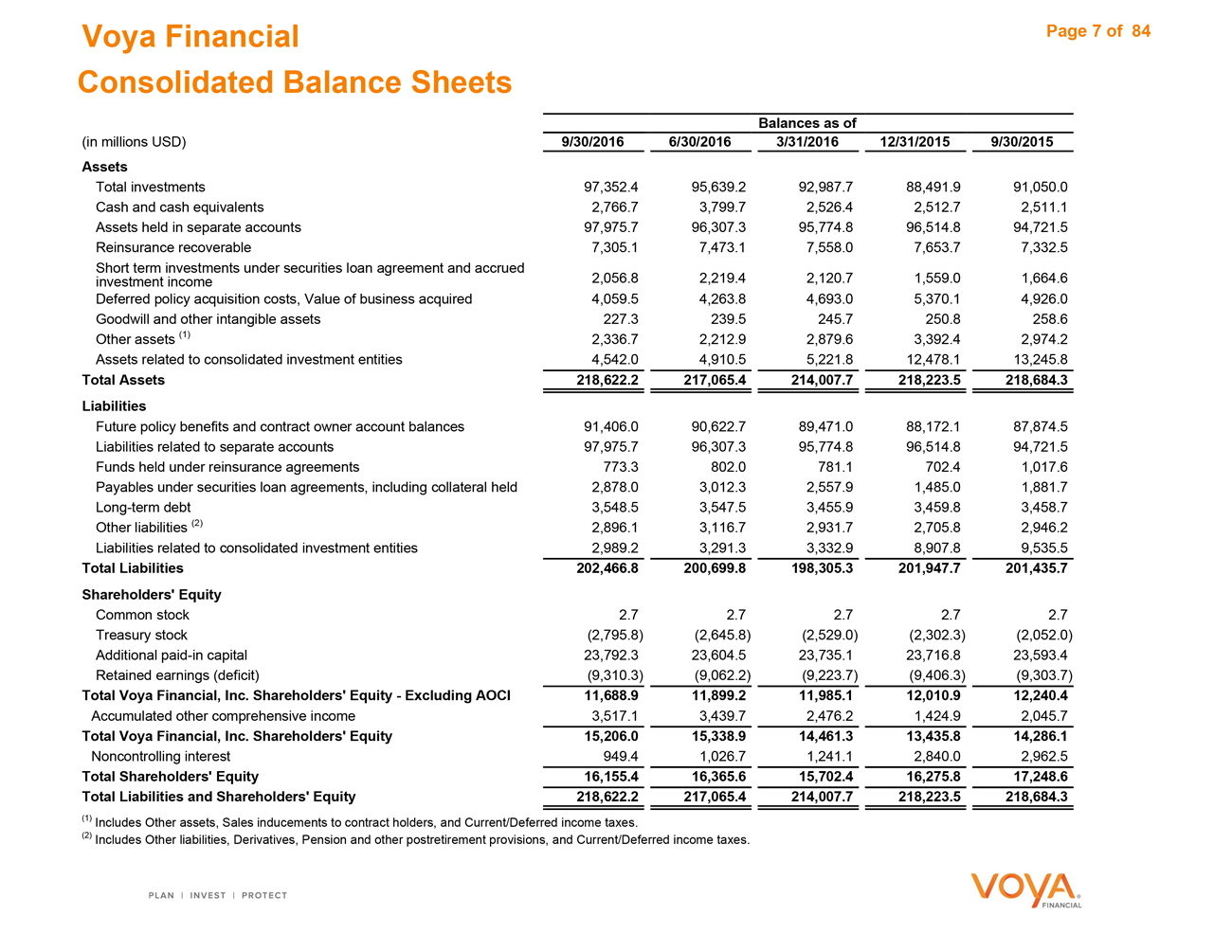

Consolidated Balance Sheets

Balances as of

(in millions USD) 9/30/2016 6/30/2016 3/31/2016 12/31/2015 9/30/2015

Assets

Total investments 97,352.4 95,639.2 92,987.7 88,491.9 91,050.0

Cash and cash equivalents 2,766.7 3,799.7 2,526.4 2,512.7 2,511.1

Assets held in separate accounts 97,975.7 96,307.3 95,774.8 96,514.8 94,721.5

Reinsurance recoverable 7,305.1 7,473.1 7,558.0 7,653.7 7,332.5

Short term investments under securities loan agreement and accrued

investment income 2,056.8 2,219.4 2,120.7 1,559.0 1,664.6

Deferred policy acquisition costs, Value of business acquired 4,059.5 4,263.8 4,693.0 5,370.1 4,926.0

Goodwill and other intangible assets 227.3 239.5 245.7 250.8 258.6

Other assets (1) 2,336.7 2,212.9 2,879.6 3,392.4 2,974.2

Assets related to consolidated investment entities 4,542.0 4,910.5 5,221.8 12,478.1 13,245.8

Total Assets 218,622.2 217,065.4 214,007.7 218,223.5 218,684.3

Liabilities

Future policy benefits and contract owner account balances 91,406.0 90,622.7 89,471.0 88,172.1 87,874.5

Liabilities related to separate accounts 97,975.7 96,307.3 95,774.8 96,514.8 94,721.5

Funds held under reinsurance agreements 773.3 802.0 781.1 702.4 1,017.6

Payables under securities loan agreements, including collateral held 2,878.0 3,012.3 2,557.9 1,485.0 1,881.7

Long-term debt 3,548.5 3,547.5 3,455.9 3,459.8 3,458.7

Other liabilities (2) 2,896.1 3,116.7 2,931.7 2,705.8 2,946.2

Liabilities related to consolidated investment entities 2,989.2 3,291.3 3,332.9 8,907.8 9,535.5

Total Liabilities 202,466.8 200,699.8 198,305.3 201,947.7 201,435.7

Shareholders’ Equity

Common stock 2.7 2.7 2.7 2.7 2.7

Treasury stock (2,795.8) (2,645.8) (2,529.0) (2,302.3) (2,052.0)

Additional paid-in capital 23,792.3 23,604.5 23,735.1 23,716.8 23,593.4

Retained earnings (deficit) (9,310.3) (9,062.2) (9,223.7) (9,406.3) (9,303.7)

Total Voya Financial, Inc. Shareholders’ Equity—Excluding AOCI 11,688.9 11,899.2 11,985.1 12,010.9 12,240.4

Accumulated other comprehensive income 3,517.1 3,439.7 2,476.2 1,424.9 2,045.7

Total Voya Financial, Inc. Shareholders’ Equity 15,206.0 15,338.9 14,461.3 13,435.8 14,286.1

Noncontrolling interest 949.4 1,026.7 1,241.1 2,840.0 2,962.5

Total Shareholders’ Equity 16,155.4 16,365.6 15,702.4 16,275.8 17,248.6

Total Liabilities and Shareholders’ Equity 218,622.2 217,065.4 214,007.7 218,223.5 218,684.3

(1) Includes Other assets, Sales inducements to contract holders, and Current/Deferred income taxes.

(2) Includes Other liabilities, Derivatives, Pension and other postretirement provisions, and Current/Deferred income taxes.

Page 7 of 84

Voya Financial

Consolidated Statements of Operations

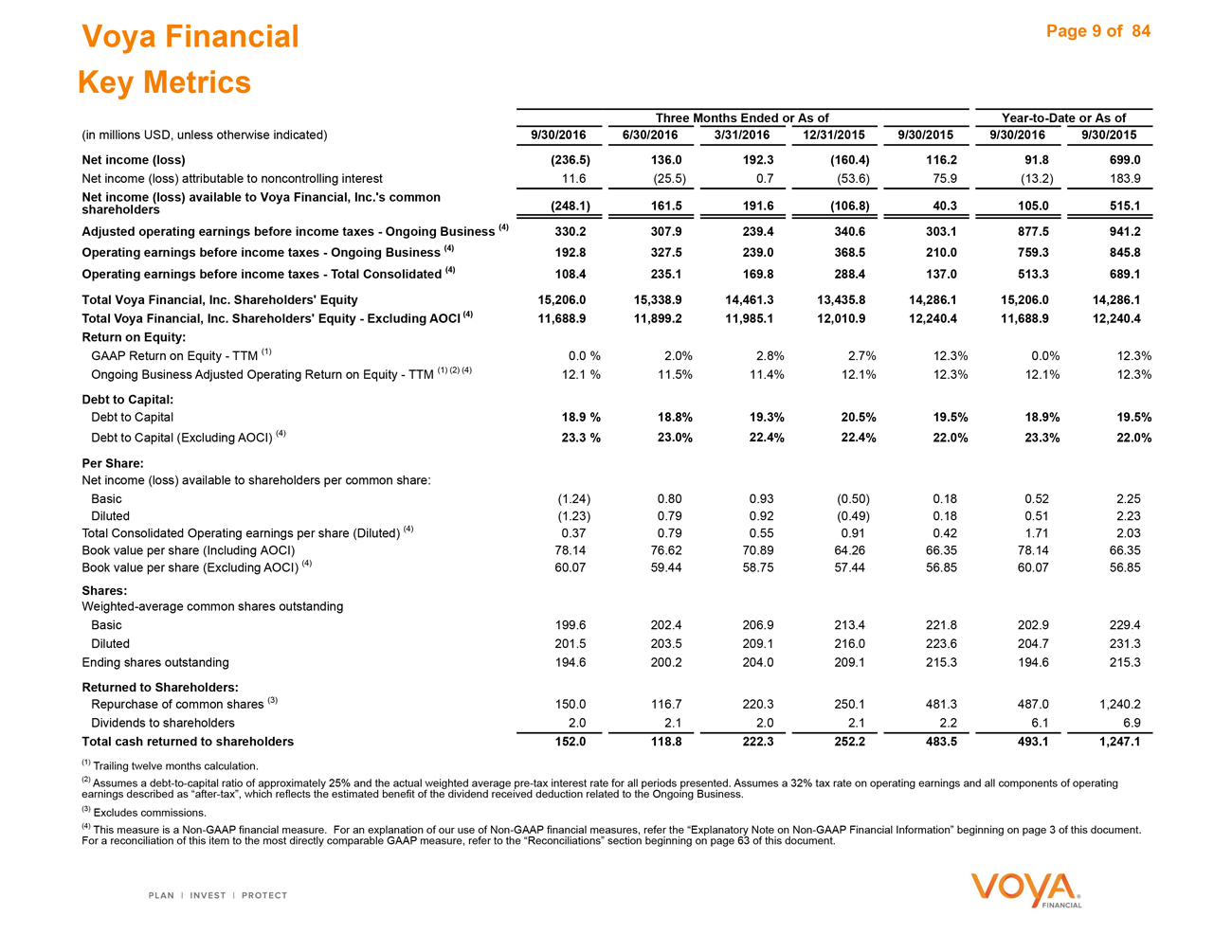

Three Months Ended Year-to-Date

(in millions USD) 9/30/2016 6/30/2016 3/31/2016 12/31/2015 9/30/2015 9/30/2016 9/30/2015

Revenues

Net investment income 1,163.4 1,175.2 1,094.1 1,178.5 1,103.6 3,432.7 3,359.8

Fee income 857.9 826.7 825.8 837.1 871.8 2,510.4 2,644.0

Premiums 726.7 711.6 966.8 619.7 1,128.8 2,405.1 2,404.8

Net realized capital gains (losses) (367.7) (101.3) 10.7 (772.6) 299.1 (458.3) 39.3

Income (loss) related to consolidated investment entities 57.7 (0.8) 29.1 18.5 186.4 86.0 505.7

Other revenues 90.5 84.6 82.8 91.6 106.7 257.9 315.3

Total revenues 2,528.5 2,696.0 3,009.3 1,972.8 3,696.4 8,233.8 9,268.9