Form SUPPL MAG SILVER CORP

Table of Contents

Filed pursuant to General Instruction II.L. of Form F-10;

File number 333-237807

PROSPECTUS SUPPLEMENT

To a Short Form Base Shelf Prospectus dated April 23, 2020

| New Issue |

November 23, 2021 |

MAG SILVER CORP.

US$40,131,000

Common Shares

This prospectus supplement, together with the short form base shelf prospectus to which it relates dated April 23, 2020, including any amendments thereto, qualifies the distribution of 2,340,000 common shares (the “Offered Shares”) of MAG Silver Corp. (the “Company”, “MAG” or “we”), at a price (the “Offering Price”) of US$17.15 per Offered Share (the “Offering”) pursuant to an underwriting agreement dated November 23, 2021 (the “Underwriting Agreement”) between the Company, BMO Nesbitt Burns Inc. and Raymond James Ltd. (the “Lead Underwriters”) and Scotia Capital Inc., Canaccord Genuity Corp., H.C. Wainwright & Co., LLC, National Bank Financial Inc., Roth Canada, ULC and TD Securities Inc. (together with the Lead Underwriters, the “Underwriters”). H.C. Wainwright & Co., LLC is not registered as an investment dealer in any Canadian jurisdiction for the purposes of the Offering and, accordingly, will not offer and sell the Offered Shares in Canada. The Offering Price of the Offered Shares was determined between the Company and the Underwriters. The Offered Shares will be offered in the United States and in each of the provinces and territories of Canada, other than Québec, through the Underwriters either directly or through their respective U.S. or Canadian broker-dealer affiliates or agents.

The outstanding common shares of the Company (the “Common Shares”) are listed for trading on the Toronto Stock Exchange (the “TSX”) under the trading symbol “MAG” and the NYSE American, LLC (the “NYSE American”) under the trading symbol “MAG”. On November 22, 2021, being the last full trading day prior to the date of this prospectus supplement, the closing price of the Common Shares on the TSX and NYSE American was C$22.93 and US$18.07, respectively. The Company has applied, or will apply, to list the Offered Shares distributed under the final prospectus supplement on the TSX and NYSE American. Listing will be subject to the Company fulfilling all listing requirements of the TSX and NYSE American, as applicable.

Price: US$17.15 per Offered Share

| Public Offering Price |

Underwriters’ Fee (1)(2) |

Net Proceeds to the Company (3) |

||||||||||

| Per Offered Share |

US$ | 17.15 | US$ | 0.8575 | US$ | 16.2925 | ||||||

| Total (4) |

US$ | 40,131,000 | US$ | 2,006,550 | US$ | 38,124,450 | ||||||

Notes:

| (1) | The Company has agreed to pay the Underwriters a cash commission (the “Underwriters’ Fee”) equal to 5.0% of the gross proceeds of the Offering (US$0.8575 per Offered Share), other than gross proceeds on any sales made to the President’s List (as defined below) purchasers, on which a reduced fee of 2.5% of such gross proceeds will be paid to the Underwriters (or US$0.42875 per Offered Share sold to President’s List purchasers). “President’s List” means a list of purchasers of Offered Shares provided by the Company to the Underwriters. See “Plan of Distribution”. |

| (2) | Assumes no sales to President’s List purchasers under the Offering. |

| (3) | After deducting the Underwriters’ Fee but before deducting the expenses of the Offering, which are estimated at US$650,000 and will be paid by the Company from the proceeds of the Offering. The net proceeds payable to the Company will be derived from the sale of the Offered Shares. |

| (4) | The Company has granted the Underwriters an over-allotment option (the “Over-Allotment Option”), exercisable in whole or in part within 30 days from the date of closing of the Offering, to purchase up to 351,000 additional Common Shares (the “Additional Shares”) at the same price as set forth above, to cover over-allotments, if any, and for market stabilization purposes. See “Plan of Distribution”. If the Over-Allotment Option is exercised in full, the total public Offering Price, Underwriters’ Fee (assuming no sales to President’s List purchasers under the Offering) and net proceeds to the Company, before deducting the expenses of the Offering, will be US$46,150,650, US$2,307,532.50 and US$43,843,117.50, respectively. This prospectus supplement and the accompanying short form base shelf prospectus also qualify under applicable Canadian securities laws the distribution of the Over-Allotment Option and any Additional Shares that may be delivered upon the exercise of the Over-Allotment Option. |

Table of Contents

When used herein, unless otherwise indicated or the context otherwise requires, all references to Offered Shares include any Additional Shares issued in connection with any exercise of the Over-Allotment Option.

The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if as and when issued, and, accepted by the Underwriters, in accordance with the conditions contained in the Underwriting Agreement described under “Plan of Distribution” and subject to the approval of certain legal matters on behalf of MAG by Blake, Cassels & Graydon LLP, with respect to Canadian legal matters, and by Paul, Weiss, Rifkind, Wharton & Garrison LLP, with respect to U.S. legal matters, and on behalf of the Underwriters by Stikeman Elliott LLP, with respect to Canadian legal matters, and by Skadden, Arps, Slate, Meagher & Flom LLP with respect to U.S. legal matters. Subscriptions will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is expected that the closing of the Offering will occur on or about November 29, 2021 (the “Closing”), or such other date as may be agreed between the Company and the Underwriters, but in any event no later than 42 days following the date of the receipt for this Prospectus Supplement. A purchaser who acquires Offered Shares forming part of the Underwriters’ over-allocation position acquires those Offered Shares under this prospectus supplement, regardless of whether the over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. An electronic Deposit ID evidencing the Offered Shares is expected to be registered to CDS Clearing and Depository Services Inc. (“CDS”) and will be deposited with CDS at Closing. See “Plan of Distribution”.

The total gross proceeds from the Offering will be US$40,131,000. The Company estimates that the net proceeds from the Offering will be approximately US$37,474,450, after deducting the Underwriters’ Fee of US$2,006,550 and the expenses of the Offering, which are estimated to be US$650,000. If the Underwriters’ Over-Allotment Option is exercised in full, the net proceeds to the Company will be approximately US$43,193,117.50.

In connection with the Offering, subject to applicable laws, the Underwriters may over-allot or effect transactions that stabilize or maintain the market price of the Common Shares at levels other than those which otherwise might prevail on the open market. Such transactions, if commenced, may be discontinued at any time. See “Plan of Distribution”.

The Underwriters propose to offer the Offered Shares initially at the Offering Price. After the Underwriters have made reasonable efforts to sell all of the Offered Shares, the initial Offering Price may be decreased, and further changed from time to time, to an amount not greater than the initial Offering Price. Notwithstanding any reduction by the Underwriters on the Offering Price, the Company will still receive net proceeds of US$17.15 per Offered Share purchased by the Underwriters pursuant to this Offering. See “Plan of Distribution”.

Dr. Peter Megaw, who has provided consent to the incorporation by reference into the short form base shelf prospectus of certain technical information for which he is the responsible qualified person, resides outside of Canada and has appointed an agent for service of process in Canada. See “Agent for Service of Process”.

(ii)

Table of Contents

An investment in the Offered Shares bears certain risks. See “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus supplement, the accompanying short form base shelf prospectus and the risk factors in the Company’s documents which are incorporated by reference herein for a description of risks involved in an investment in Offered Shares.

Our head office is located at 770, 800 West Pender Street, Vancouver, British Columbia, V6C 2V6, Canada, and our registered office is located at 2600 - 595 Burrard Street, Vancouver, British Columbia, V7X 1L3, Canada.

Investors should rely only on current information contained in or incorporated by reference into this prospectus supplement and the accompanying short form base shelf prospectus as such information is accurate only as of the date of the applicable document. We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed to be a part of this prospectus supplement or incorporated by reference and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities. We will not make an offer of these securities in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information contained in this prospectus supplement is accurate as of any date other than the date on the face page of this prospectus supplement or the date of any documents incorporated by reference herein.

This Offering is being made by a Canadian issuer that is permitted, under a multi-jurisdictional disclosure system adopted by Canada and the United States, to prepare this prospectus supplement and the accompanying short form base shelf prospectus in accordance with the disclosure requirements of Canada. Prospective investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as adopted by the International Accounting Standards Board and as amended from time to time, and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the Offered Shares may have tax consequences both in Canada and the United States. Such consequences for investors who are resident in, or citizens of, the United States, may not be described fully in this prospectus supplement or the accompanying short form base shelf prospectus, including the Canadian federal income tax consequences applicable to a foreign controlled Canadian corporation that acquires Offered Shares. Investors should read the tax discussion in this prospectus supplement and consult their own tax advisors with respect to their own particular circumstances. See “Certain Canadian Federal Income Tax Considerations”, Certain United States Federal Tax Considerations” and “Risk Factors”.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that MAG is incorporated under the laws of the Province of British Columbia, Canada, that the majority of the Company’s officers and directors and some or all of the experts named in this prospectus supplement are residents of a country other than the United States, and that a substantial portion of the Company’s assets and the assets of those officers, directors and experts are located outside of the United States.

Neither the United States Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered hereby, passed upon the accuracy or adequacy of this prospectus supplement and the accompanying short form base shelf prospectus or determined if this prospectus supplement and the accompanying short form base shelf prospectus are truthful or complete. Any representation to the contrary is a criminal offence.

(iii)

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

| S-1 | ||||

| S-1 | ||||

| S-2 | ||||

| S-7 | ||||

| S-8 | ||||

| S-9 | ||||

| S-9 | ||||

| S-11 | ||||

| S-15 | ||||

| S-18 | ||||

| S-19 | ||||

| S-20 | ||||

| S-21 | ||||

| S-22 | ||||

| S-24 | ||||

| S-28 | ||||

| S-33 | ||||

| S-33 | ||||

| S-34 | ||||

| S-34 | ||||

| S-34 | ||||

| S-35 |

PROSPECTUS

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 12 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 45 | ||||

| 46 | ||||

| 48 | ||||

| 48 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 52 |

(iv)

Table of Contents

Table of Contents

This document is in two parts. The first part is the prospectus supplement, which describes the terms of the Offering and adds to and updates information contained in the accompanying short form base shelf prospectus and the documents incorporated by reference therein. The second part is the accompanying short form base shelf prospectus, which gives more general information, some of which may not apply to the Offering. This prospectus supplement is deemed to be incorporated by reference into the accompanying short form base shelf prospectus solely for the purpose of this Offering.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying short form base shelf prospectus and on the other information included in the registration statement of which this prospectus supplement and the accompanying short form base shelf prospectus forms a part. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy the securities offered pursuant to this prospectus supplement and the accompanying short form base shelf prospectus in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus supplement and the accompanying short form base shelf prospectus is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this prospectus supplement and the accompanying short form base shelf prospectus or of any sale of our securities pursuant thereto. Our business, financial condition, financial performance and prospects may have changed since those dates.

Market data and certain industry forecasts used in this prospectus supplement and the accompanying short form base shelf prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying short form base shelf prospectus were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

In this prospectus supplement and the accompanying short form base shelf prospectus, unless otherwise indicated, all dollar amounts and references to “US$” are to U.S. dollars and references to “C$” or “$” are to Canadian dollars. This prospectus supplement and the accompanying short form base shelf prospectus and the documents incorporated by reference contain translations of some Canadian dollar amounts into U.S. dollars solely for your convenience. See “Exchange Rate Information”.

The Company is not, and the Underwriters are not, making an offer of the Offered Shares in any jurisdiction where the offer is not permitted by law.

In this prospectus supplement and the accompanying short form base shelf prospectus, unless the context otherwise requires, references to “we”, “us”, “our” or similar terms, as well as references to “MAG” or the “Company”, refer to MAG Silver Corp. together with our subsidiaries.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

We are permitted under a multi-jurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus supplement and the accompanying short form base shelf prospectus, including the documents incorporated by reference, in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws.

Technical disclosure regarding our properties included herein and in the documents incorporated herein by reference has not been prepared in accordance with the requirements of U.S. securities laws. Such technical

S-1

Table of Contents

disclosure has been prepared in accordance with the requirements of National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves (“CIM Definition Standards”).

Canadian standards, including NI 43-101, differ significantly from the historical requirements of the SEC, and mineral resource information contained or incorporated by reference in this prospectus supplement may not be comparable to similar information disclosed by U.S. companies.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, following a two-year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that are included in SEC Industry Guide 7 for fiscal years beginning January 1, 2021 or later.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standards; however, there are still differences in the definitions and standards under the SEC Modernization Rules and the CIM Definition Standards. Therefore, the Company’s mineral resources as determined in accordance with NI 43-101 may be significantly different than if they had been determined in accordance with the SEC Modernization Rules.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying short form base shelf prospectus, and the documents incorporated by reference herein, contain “forward-looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively herein referred to as “forward-looking statements”), including the “safe harbour” provisions of provincial securities legislation and the U.S. Private Securities Litigation Reform Act of 1995, Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the U.S. Securities Act. Such forward-looking statements and information include, but are not limited to:

| • | the timing of the Offering; |

| • | the proposed use of proceeds of the Offering; |

| • | the satisfaction of customary conditions and settlement of definitive documentation required in order for the Company to close the transactions contemplated in the BMO Commitment Letter (as defined herein) and gain access to the Credit Facility (as defined herein) in connection therewith; |

| • | the use of the available funds under the Credit Facility; |

| • | the future price of silver, gold, lead, zinc and copper; |

| • | the estimation of Mineral Resources; |

| • | preliminary economic estimates relating to the Juanicipio Project (as defined herein); |

| • | estimates of the time and amount of future silver, gold, lead, zinc and copper production for specific operations; |

S-2

Table of Contents

| • | estimated future exploration and development expenditures and other expenses for specific operations; |

| • | permitting timelines; |

| • | the Company’s expectations regarding impairments of mineral properties; |

| • | the expected timeline to commercial production at the Juanicipio Project; |

| • | the expected timeline to complete construction at the Juanicipio Project; |

| • | the anticipated electrical hook-up of the Juanicipio processing plant and impact on commissioning; |

| • | the expected timeline for the processing plant at the Juanicipio Project to be commissioned; |

| • | the amount of mineralized development material to be processed through the Fresnillo plc (“Fresnillo”) plant; |

| • | the annual exploration expenditures to be paid by the Company on its share of exploration on the Juanicipio Project; |

| • | the annual exploration expenditures to be paid by the Company on the Deer Trail Project (as defined herein); |

| • | the expected capital requirements to achieve commercial production at the Juanicipio Project; |

| • | proposed amendments to the Federal Labour Law on labour subcontracting in Mexico; |

| • | the Company’s expectations regarding the sufficiency of its capital resources and requirements for additional capital; |

| • | litigation risks; |

| • | currency fluctuations; |

| • | environmental risks and reclamation cost; and |

| • | changes to governmental laws and regulations. |

When used in this prospectus, any statements that express or involve discussions with respect to predictions, beliefs, plans, projections, objectives, assumptions or future events of performance (often but not always using words or phrases such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “strategy”, “goals”, “objectives”, “project”, “potential” or variations thereof or stating that certain actions, events, or results “may”, “could”, “would”, “might” or “will” be taken, occur, or be achieved, or the negative of any of these terms and similar expressions), as they relate to the Company or management, are intended to identify forward-looking statements and information. Such statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions.

Forward-looking statements are necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. Assumptions underlying the Company’s expectations regarding forward-looking statements or information contained in this prospectus supplement include, among others:

| • | our ability to manage our growth effectively; |

| • | the absence of material adverse changes in our industry or the global economy; |

| • | trends in our industry and markets; |

| • | our ability to maintain good business relationships; |

| • | our ability to manage and integrate acquisitions; |

| • | our Mineral Resource estimates, and the assumptions upon which they are based; |

S-3

Table of Contents

| • | our ability to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain required regulatory approvals; |

| • | our expectation that our operations will not be significantly disrupted as a result of political instability, nationalization, terrorism, sabotage, social or political activism, breakdown, natural disasters, governmental or political actions, litigation or arbitration proceedings, equipment or infrastructure failure, labour shortages, transportation disruptions or accidents, or other development or exploration risks; |

| • | our expectations regarding the level of disruption to operations at the Juanicipio Project (as defined herein) and exploration of the Deer Trail Project (as defined herein) as a direct and indirect result of the novel coronavirus and variants thereof (collectively, “COVID-19”); |

| • | our ability to meet the expected timelines to production; |

| • | our ability to retain key personnel; |

| • | our ability to raise sufficient debt or equity financing to support our continued growth; |

| • | the timely receipt of required approvals and permits; |

| • | that the Company will continue to have sufficient working capital to fund its operations; |

| • | the global financial markets and general economic conditions will be stable and prosperous in the future; |

| • | preliminary economic estimates and the assumptions upon which they are based relating to the Juanicipio Project; and |

| • | our resource estimates and the assumptions upon which they are based. |

Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements and information, including, among others:

| • | the use of the net proceeds from the Offering is subject to change; |

| • | risks related to the loss of entire investment; |

| • | funding and property commitments that may result in dilution to the Company’s shareholders; |

| • | the potential for no commercially mineable deposits due to the speculative nature of the Company’s business; |

| • | none of the properties in which the Company has an interest having any Mineral Reserves; |

| • | our material property is in the development stage and many such projects experience cost overruns or delays; |

| • | estimates of Mineral Resources being based on interpretation and assumptions which are inherently imprecise; |

| • | no guarantee of surface rights for the Company’s mineral properties or those it has an interest in; |

| • | no guarantee of the Company’s ability to obtain all necessary licenses and permits that may be required to carry out exploration and development of its mineral properties or those it has an interest in and business activities; |

| • | risks related to the properties in which the Company has an interest being primarily located in foreign jurisdictions, including Mexico, which may be subject to political instability, governmental relations and increased police and military enforcement action against criminal activities; |

| • | the effect of global economic and political instability on the Company’s business; |

S-4

Table of Contents

| • | the effect of virus outbreaks, including the COVID-19 outbreak as a global pandemic, on world markets and the Company’s business; |

| • | risks related to maintaining a positive relationship with the communities in which the Company operates; |

| • | risks related to the Company’s ability to finance substantial expenditures required for commercial operations on its mineral properties or those it has an interest in; |

| • | the Company’s history of losses and no revenues from operations; |

| • | risks related to the Company’s ability to arrange additional financing, and possible dilution in or loss of the Company’s interests in its properties or those it has an interest in due to a lack of adequate funding; |

| • | risks related to access and availability of infrastructure, power and water; |

| • | risks related to ground water levels at the Juanicipio Project; |

| • | risks related to a lack of access to a skilled workforce; |

| • | risks related to the Juanicipio Project mine plan and mine design and the development timeline to production; |

| • | risks related to the Juanicipio Project not achieving the financial results and the development timeline consistent with the Resource Estimate and Preliminary Economic Assessment for the Juanicipio Project titled “MAG Silver Juanicipio NI 43-101 Technical Report (Amended and Restated)” dated October 21, 2017 and amended and restated on January 19, 2018 (the “2017 PEA”); |

| • | risks related to the capital requirements for the Juanicipio Project and the timeline to production; |

| • | risks related to the Company’s decision to participate in the development of the Juanicipio Project; |

| • | risks related to the mine plan and mine design; |

| • | risks related to title, challenge to title, or potential title disputes regarding the Company’s mineral properties or those it has an interest in; |

| • | risks related to the Company being a minority shareholder of Minera Juanicipio (as defined herein); |

| • | risks related to disputes with shareholders of Minera Juanicipio; |

| • | risks related to the influence of the Company’s significant shareholders over the direction of the Company’s business; |

| • | the potential for legal proceedings to be brought against the Company; |

| • | risks related to environmental regulations; |

| • | the highly competitive nature of the mineral exploration industry; |

| • | risks related to equipment shortages, access restrictions and lack of infrastructure on the Company’s mineral properties or those it has an interest in; |

| • | the Company’s dependence upon key personnel; |

| • | the Company’s dependence on certain related party service providers Minera Cascabel S.A. de C.V. (“Cascabel”) and IMDEX Inc. to conduct some of its operations in Mexico; |

| • | the Company’s dependence on Fresnillo to attract, train and retain qualified personnel; |

| • | the Company’s dependence on Fresnillo, as the Juanicipio Project operator, to supervise and operate the Juanicipio Project; |

| • | risks related to directors or officers being, or becoming, associated with other natural resource companies which may give rise to conflicts of interest; |

S-5

Table of Contents

| • | currency fluctuations (particularly the C$/US$ and US$/Mexican Peso exchange rates) and inflationary pressures; |

| • | risks related to mining operations generally; |

| • | risks related to fluctuation of mineral and metal prices and their marketability; |

| • | risks related to the adverse application of new or existing laws, including without limitation anti-corruption laws, human rights laws and Mexican foreign investment, income tax laws and Mexican laws; |

| • | the Company being subject to Canadian disclosure practices concerning its Mineral Resources which allow for more disclosure than is permitted for domestic U.S. reporting companies; |

| • | risks related to maintaining adequate internal control over financial reporting; |

| • | funding and property commitments that may result in dilution to the Company’s shareholders; |

| • | the volatility of the price of the Company’s Common Shares; |

| • | the uncertainty of maintaining a liquid trading market for the Company’s Common Shares; |

| • | the Company potentially being classified as a “passive foreign investment company” in the future which could have adverse U.S. federal income tax consequences for U.S. shareholders; |

| • | the difficulty of U.S. litigants effecting service of process or enforcing any judgments against the Company, as the Company, its principals and assets are located outside of the United States; |

| • | all of the Company’s mineral property assets being located outside of Canada; |

| • | risks related to the decrease of the market price of the Common Shares if the Company’s shareholders sell substantial amounts of Common Shares; |

| • | risks related to future sales or issuances of equity securities diluting voting power and reducing future earnings per share; |

| • | Fresnillo’s ability to maintain community relations programs; |

| • | risks related to dilution to existing shareholders if stock options (“Options”) are exercised; |

| • | risks related to dilution to existing shareholders if deferred share units, restricted share units or performance share units are converted into Common Shares of the Company; |

| • | the history of the Company with respect to not paying dividends and anticipation of not paying dividends in the immediate future; and |

| • | the absence of a market through which the Company’s securities, other than the Common Shares, may be sold. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and information. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements and information due to a variety of risks, uncertainties and other factors, including without limitation, those referred to in this prospectus supplement and the accompanying short form base shelf prospectus under the headings “Risk Factors” and documents incorporated by reference herein. The Company’s forward-looking statements and information are based on the reasonable beliefs, expectations and opinions of management on the date the statements are made and, other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s beliefs, expectations or opinions should change. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements and information.

S-6

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

This prospectus supplement is deemed to be incorporated by reference into the accompanying short form base shelf prospectus solely for the purposes of this Offering. Other documents are also incorporated, or are deemed to be incorporated, by reference into the short form base shelf prospectus and reference should be made to the short form base shelf prospectus for full particulars thereof.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer or Corporate Secretary of the Company at Suite 770, 800 West Pender Street, Vancouver, British Columbia, Canada, V6C 2V6, telephone (604) 630-1399 and are also available electronically under the Company’s profile on the Canadian System for Electronic Document Analysis and Retrieval, or “SEDAR”, at www.sedar.com and on the SEC’s Electronic Data Gathering and Retrieval System, or “EDGAR”, at www.sec.gov.

The following documents, filed with the securities commissions or similar regulatory authorities in certain provinces of Canada and filed with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, the accompanying short form base shelf prospectus and this prospectus supplement:

| 1. |

| 2. |

| 3. |

| 4. |

| 5. |

| 6. |

Any documents of the type required by section 11.1 of National Instrument 44-101 – Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus, including those types of documents referred to above and press releases issued by the Company referencing incorporation by reference in this prospectus supplement, if filed by MAG with the provincial securities commissions of similar authorities in Canada after the date of this prospectus supplement and prior to the completion or termination of the Offering shall be deemed incorporated by reference into the prospectus for the purposes of the Offering. Documents referenced in any of the documents incorporated by reference in this prospectus supplement but not expressly incorporated by reference therein or herein and not otherwise required to be incorporated by reference therein or in this prospectus supplement are not incorporated by reference in this prospectus supplement. These documents are available through the internet on SEDAR which can be accessed at www.sedar.com. In addition, to the extent that any document or information incorporated by reference into this prospectus supplement is filed with, or furnished to, the SEC pursuant to the Exchange Act after the date of this prospectus supplement and prior to the completion or termination of the Offering, such document or information will be deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part (in the case of a report on Form 6-K, if and to the extent expressly provided therein). These documents are available through the internet on EDGAR which can be accessed at www.sec.gov.

S-7

Table of Contents

Any statement contained in the short form base shelf prospectus, in this prospectus supplement or in any document incorporated or deemed to be incorporated by reference in this prospectus supplement or the short form base shelf prospectus for the purpose of this Offering shall be deemed to be modified or superseded, for purposes of this prospectus supplement, to the extent that a statement contained herein or in the short form base shelf prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein or in the short form base shelf prospectus modifies or supersedes such prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document which it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not constitute a part of this prospectus supplement, except as so modified or superseded.

Upon our filing a new annual information form, audited annual financial statements and management’s discussion and analysis with applicable securities regulatory authorities during the currency of this prospectus supplement, the previous annual information form, annual financial statements and management’s discussion and analysis and all quarterly financial statements, supplemental information and material change reports filed prior to the commencement of our financial year in which the new annual financial statements are filed will be deemed no longer to be incorporated into this prospectus supplement for purposes of future offers and sales of our securities under this prospectus supplement. Upon our filing new condensed interim financial statements and the accompanying management’s discussion and analysis with the applicable securities regulatory authorities during the currency of this prospectus supplement, all condensed interim financial statements and the accompanying management’s discussion and analysis filed prior to the new condensed interim financial statements shall be deemed no longer to be incorporated into this prospectus supplement for purposes of future offers and sales of securities under this prospectus supplement.

References to our website in any documents that are incorporated by reference into this prospectus supplement and the accompanying short form base shelf prospectus do not incorporate by reference the information on such website into this prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

In addition to the documents specified in this prospectus supplement under the heading “Documents Incorporated by Reference” and in the accompanying short form base shelf prospectus under “Documents Filed as Part of the Registration Statement”, the following document has been or will be filed with the SEC as part of the registration statement of which this prospectus supplement forms a part: the Underwriting Agreement described under the heading “Plan of Distribution”.

S-8

Table of Contents

The following table sets forth for each period indicated: (i) the exchange rates in effect at the end of the period; (ii) the high and low exchange rates during such period; and (iii) the average exchange rates for such period, for one Canadian dollar, expressed in U.S. dollars, as quoted by the Bank of Canada.

| Year ended December 31 , |

Nine months ended September 30, |

|||||||||||||||||||

| 2020 | 2019 | 2018 | 2021 | 2020 | ||||||||||||||||

| US$ | US$ | US$ | US$ | US$ | ||||||||||||||||

| Closing |

0.7854 | 0.7699 | 0.7330 | 0.7849 | 0.7497 | |||||||||||||||

| High |

0.7863 | 0.7699 | 0.8138 | 0.8406 | 0.7710 | |||||||||||||||

| Low |

0.6898 | 0.7353 | 0.7330 | 0.7778 | 0.6898 | |||||||||||||||

| Average |

0.7854 | 0.7537 | 0.7721 | 0.7994 | 0.7391 | |||||||||||||||

On November 22, 2021, the daily average exchange rate as quoted by the Bank of Canada was C$1.00 = US$0.7886 (US$1.00 = C$1.2680).

The following description of the Company does not contain all of the information about the Company and its properties and business that you should consider before investing in the Offered Shares. You should carefully read the entire prospectus supplement and the accompanying short form base shelf prospectus, including the sections titled “Risk Factors”, as well as the documents incorporated by reference herein and therein before making an investment decision.

Summary Description of Business

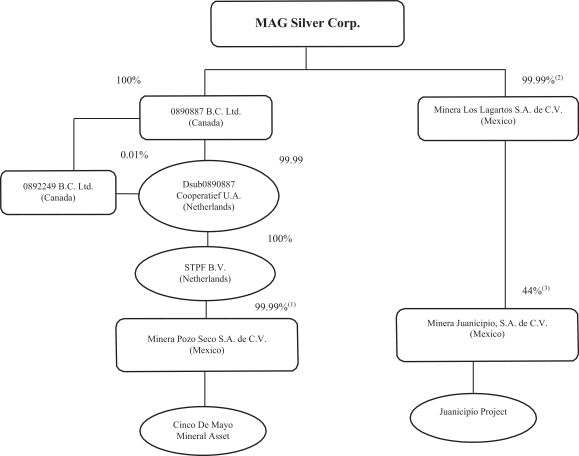

The Company is an advanced stage mineral exploration and development company that is focused on the acquisition, exploration and development of high-grade, high-margin, district-scale projects located in the Americas. The principal property of the Company is the Company’s 44% interest in the Juanicipio property, a primarily silver development and exploration project heading towards production (the “Juanicipio Project”). The Company currently considers the Juanicipio Project to be its only material property for the purposes of NI 43-101.

The Company also has the right to earn a 100% interest in the Deer Trail Carbonate Replacement-Porphyry Project in central Utah (the “Deer Trail Project”) as well as interests in concession rights in other non-material properties, the exploration of which is managed directly by the Company.

Principal Projects

Juanicipio Project

The Juanicipio Project is located in the Fresnillo District, Zacatecas State, Mexico, approximately six kilometres west of the mining town of Fresnillo and covers approximately 7,679 hectares. The Company initially acquired a 100% interest in the Juanicipio Project in 2003. From 2005 to 2007, Industrias Peñoles, S.A. De C.V. (“Peñoles”) earned a 56% interest in the Juanicipio Project by conducting US$5,000,000 of exploration on the property and purchasing US$1,000,000 worth of Common Shares of the Company at market price at the time of purchase. In December 2007, Minera Los Lagartos S.A. DE C.V. (“Lagartos”) and Peñoles established Minera Juanicipio, S.A. De C.V. (“Minera Juanicipio”) to hold and operate all mineral and surface rights related to the Juanicipio Project. In 2008, Peñoles transferred its 56% interest of Minera Juanicipio to Fresnillo pursuant to a statutory merger. Fresnillo is the operator of Minera Juanicipio, which is governed by a shareholders’ agreement

S-9

Table of Contents

dated October 10, 2005 (the “Shareholders Agreement”) and its corporate by-laws. Pursuant to the Shareholders Agreement and Minera Juanicipio’s corporate by-laws, each shareholder is to provide funding pro rata to its interest in Minera Juanicipio, with Fresnillo contributing 56% and the Company, through Lagartos, contributing 44%, and if either party does not fund pro rata, their ownership interest will be diluted in accordance with the Shareholders Agreement.

The Juanicipio Project consists of high-grade silver-gold-lead-zinc epithermal vein deposits. The principal vein, the Valdecañas Vein, has dilatant zones (bulges) at its east and west extremes and several en echelon vein splays and cross-veins. A NI 43-101-compliant technical report commissioned by the Company related to the Juanicipio Project, the 2017 PEA, is incorporated by reference into this prospectus supplement. Fresnillo prepares its own internal resource estimate annually. Fresnillo’s estimates are not prepared in compliance with NI 43-101 and were not used in the 2017 PEA and are not relied upon by the Company.

Deer Trail Project

The Company executed an earn-in agreement effective December 20, 2018 to consolidate and acquire 100% of the Deer Trail Project in the surrounding Alunite Ridge area in Piute County, Utah. The counterparties to the earn-in agreement contributed their respective Deer Trail claims and property rights to a newly formed company (“Deer Trail NewCo”) for a 99% interest in the company, with the Company holding the other 1% interest. The Company is the project operator and has the right to earn a 100% interest in Deer Trail NewCo and the Deer Trail Project, with the other parties retaining a 2% net smelter return (“NSR”) royalty. In order to earn in 100%, MAG must make a total of $30 million in escalating annual expenditures ($8 million expended to September 30, 2021) and $2 million in royalty payments ($0.3 million paid to September 30, 2021), both over the ten (10) year term of the agreement by 2028. The combined optional annual commitments do not exceed $2.5 million per year until after 2025. All minimum obligatory commitments under the earn-in agreement have been satisfied to date.

Deer Trail is a silver-rich Carbonate Replacement Deposit (“CRD”) project potentially related to a molybdenum-copper porphyry system or systems immediately to the west. Consolidating the property package allows the Company to apply its integrated district scale exploration model and apply new technology to the search for an entire suite of mineralization styles expected to occur on the property. The combined property package came with decades of information generated through prior exploration programs focused on the historic Deer Trail mine itself, the inferred porphyry centres and veins scattered throughout the property. These data include: extensive surface and underground geological maps; geochemical sampling results; logs, core and chips from over 20,000 meters of historic drilling; a districtwide airborne magnetic survey; 15 line kilometers of Audio Magneto-Telluric (AMT) geophysics; 2.5 kilometres (“km”) of U.S. Mine Safety and Health Administration (MSHA) certified underground workings; and a mining permit. Infrastructure and access to the Deer Trail mine are excellent. Disturbances identified by the Company are being proactively remediated and reviewed by governmental regulators, leaving no significant environmental legacy issues.

The Company’s exploration focus is to seek the source of the historically mined high-grade silver-lead-zing-cooper-gold Deer Trail manto in the thick section of high-potential limestone host that lies just below the interlayered sedimentary and limestone sequence that hosts the Deer Trail mine. Phase 1 of the drilling program completed in Q2 2021 and saw the completion of three holes (3,927 metres (“m”) drilled from surface spaced along a 1.5 km long corridor. Phase I fulfilled all three of the Company’s planned objectives by: (i) confirming the presence of a thick section of more favorable carbonate host rocks (the “Redwall”) below the Deer Trail Mine; (ii) confirming and projecting two suspected mineralization feeder structures to depth; and (iii) intercepting high-grade mineralization related to those structures in host rocks below what was historically known. Phase 2 of the drilling program commenced on August 20, 2021. The first hole of Phase 2 is an offset of DT21-03 designed to test the wet fault 150 m deeper where it cuts through the Redwall.

S-10

Table of Contents

Recent Developments

On November 15, 2021, the Company announced the signing of the BMO Commitment Letter (as defined herein) for the fully underwritten US$40 million Credit Facility (as defined herein). For additional information with respect to the Credit Facility, see “Consolidated Capitalization” herein.

On October 26, 2021, W.J. (Jim) Mallory was appointed as Chief Sustainability Officer of the Company. Mr. Mallory has more than 44 years of experience in the mining industry, in both operations and management, with his last 23 years in sustainability and executive roles for Canadian resource corporations.

On August 3, 2021, Mr. Dale Peniuk was appointed to the board of directors of the Company (the “Board”). Mr. Peniuk is a Chartered Professional Accountant (CPA, CA) and corporate director. Mr. Peniuk currently serves on the board and as audit committee chair of Lundin Mining Corporation, Capstone Mining Corp. and Argonaut Gold Inc.

In response to the COVID-19 virus outbreak, in April 2020 the Mexican Government ordered a temporary suspension of all “non-essential” operations nationwide in Mexico, including mining operations, until late May 2020 in order to help combat the spread of COVID-19. The Company understands that Fresnillo, the operator of Juanicipio, had been in regular consultation with Mexican Government officials to ensure its compliance with the order. Fresnillo advised the Company that while the order was in effect, underground development continued under government mandated hygiene protocols, surface construction work was reduced and surface-based drilling was temporarily halted. Office-based engineering work and exploration target generation at Juanicipio continued unaffected. Although all work has since resumed and Fresnillo anticipates that it does not expect a change to the overall Juanicipio development timetable, the impact of these changes and possible other COVID-19 consequences on the costs and time for the completion of development at Juanicipio is currently undeterminable. If the Mexican authorities were to reinstate the suspension order caused by the COVID-19 virus outbreak, or if underground and surface development at Juanicipio was suspended for an undefined period of time there could be additional medical and other costs to be incurred, project delays, cost overruns, and operational restart costs. The total amount that the Company is required to finance in order to maintain its proportionate ownership in the project may increase from these and other consequences of the COVID-19 outbreak. See “Risk Factors”, “Virus outbreaks may create instability in work markets and may affect the Company’s Business.”

Investing in our Offered Shares involves a high degree of risk. In addition to the other information contained in this prospectus supplement and the documents incorporated for reference, you should carefully consider the risks described below together with other risks described under the “Risk Factors” section of the accompanying short form base shelf prospectus before purchasing our Offered Shares. If any of the following risks actually occur, our business, financial condition, results of operations and prospects could materially suffer. As a result, the trading price of our securities, including our Common Shares, could decline, and you might lose all or part of your investment. The risks set out below are not the only risks we face; risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, results of operations and prospects. You should also refer to the other information set forth or incorporated by reference in this prospectus supplement and the accompanying short form base shelf prospectus, including our Annual Information Form under the heading “Risk Factors” and our consolidated financial statements and related notes.

S-11

Table of Contents

Risks Related to the Offering and the Company’s Securities

The use of the net proceeds from the Offering is subject to change.

We currently intend to allocate the anticipated net proceeds we will receive from the Offering as described under “Use of Proceeds” of this prospectus supplement. However, our management will have discretion in the actual application of the net proceeds, and we may elect to allocate proceeds differently from that described in “Use of Proceeds” if management believes it would be in the Company’s best interests to do so. The shareholders of the Company may not agree with the manner in which management chooses to allocate and spend the net proceeds. The failure by our management to apply these funds effectively could have a material adverse effect on the Company’s business.

An investment in the Offered Shares may result in the loss of an investor’s entire investment.

An investment in the Offered Shares of the Company is speculative and may result in the loss of an investor’s entire investment. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in the Company.

The Company, its directors, officers and management (with the exception of the Chief Exploration Officer) and its material assets are located outside of the United States, which makes it difficult for U.S. litigants to effect service of process, or enforce, any judgments obtained against the Company or its officers or directors.

Substantially all of the Company’s assets are located outside of the United States and the Company does not currently maintain a permanent place of business within the United States. In addition, most of the directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for U.S. litigants to effect service of process or enforce any judgments obtained against the Company or its officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether the courts of Canada, Mexico and other jurisdictions would recognize or enforce judgments of United States courts obtained against the Company or its directors and officers predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in Canada, Mexico or other jurisdictions against the Company or its directors and officers predicated upon the securities laws of the United States or any state thereof. Further, any payments as a result of judgments obtained in Mexico could be in pesos and service of process in Mexico must be effectuated personally and not by mail.

All of the Company’s mineral assets are located outside of Canada.

All of the Company’s mineral assets are located outside of Canada. As a result, it may be difficult for investors to enforce within Canada any judgments obtained against the Company or its officers or directors, including judgments predicated upon the civil liability provisions of applicable securities laws. In addition, there is uncertainty as to whether the courts of Mexico and other jurisdictions would recognize or enforce judgments of Canadian courts obtained against the Company or its directors and officers predicated upon the civil liability provisions of the securities laws of Canada or be competent to hear original actions brought in Mexico or other jurisdictions against the Company or its directors and officers predicated upon the securities laws of Canada. Further, any payments as a result of judgments obtained in Mexico should be in pesos and service of process in Mexico must be effectuated personally and not by mail.

Funding and property commitments may result in dilution to the Company’s shareholders.

The Company may sell equity securities in public offerings (including through the sale of securities convertible into equity securities) and may issue additional equity securities to finance operations, exploration, development, project construction, acquisitions or other projects. The Company cannot predict the size of future issuances of

S-12

Table of Contents

equity securities or the size and terms of future issuances of debt instruments or other securities convertible into equity securities or the effect, if any, that future issuances and sales of the Company’s securities will have on the market price of the Common Shares. Any transaction involving the issuance of previously authorized but unissued Common Shares, or securities convertible into Common Shares, would result in dilution, possibly substantial, to security holders. Exercises of presently outstanding Options may also result in dilution to security holders.

The Board has the authority to authorize certain offers and sales of additional securities without the vote of, or prior notice to, shareholders. Based on the need for additional capital to fund expected expenditures and growth, the Company may issue additional securities to provide such capital. Such additional issuances may involve the issuance of a significant number of Common Shares at prices less than the current market price for the Common Shares.

Sales of substantial amounts of the Company’s securities, or the availability of such securities for sale, could adversely affect the prevailing market prices for the Company’s securities and dilute investors’ earnings per share. A decline in the market prices of Company’s securities could impair the Company’s ability to raise additional capital through the sale of securities should the Company desire to do so.

Future sales or issuances of securities

The Company may issue additional securities to finance future activities outside of the Offering. The Company cannot predict the size of future issuances of securities or the effect, if any, that future issuances and sales of securities will have on the market price of the Common Shares. Sales or issuances of substantial numbers of Common Shares, or the expectation that such sales could occur, may adversely affect prevailing market prices of the Common Shares. In connection with any issuance of Common Shares, investors will suffer dilution to their voting power and the Company may experience dilution in its earnings per share.

The price of the Company’s Common Shares is volatile.

Publicly quoted securities are subject to a relatively high degree of price volatility. It should be expected that continued fluctuations in price will occur, and no assurances can be made as to whether the price per share will increase or decrease in the future. In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of many companies, particularly those considered exploration or development stage companies, such as the Company, have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. The factors influencing such volatility include pandemics, macroeconomic developments in North America and globally, and market perceptions of the attractiveness of particular industries. The price of the Common Shares is also likely to be significantly affected by short-term changes in precious metal prices or other mineral prices, currency exchange fluctuations and the Company’s financial condition or results of operations as reflected in its earnings reports. Other factors unrelated to the performance of the Company that may have an effect on the price of the Common Shares include the following: the extent of analyst coverage available to investors concerning the business of the Company may be limited if investment banks with research capabilities do not follow the Company’s securities; lessening in trading volume and general market interest in the Company’s securities may affect an investor’s ability to trade significant numbers of securities of the Company; the size of the Company’s public float may limit the ability of some institutions to invest in the Company’s securities; and a substantial decline in the price of the securities of the Company that persists for a significant period of time could cause the Company’s securities to be delisted from an exchange, further reducing market liquidity.

Securities class-action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

S-13

Table of Contents

Virus outbreaks may create instability in world markets and may affect the Company’s business.

Global financial conditions continue to be characterized by extreme volatility as global markets have been adversely impacted by the outbreak of COVID-19. Many industries, including the mining industry, have been impacted by these market conditions. Global financial conditions remain subject to sudden and rapid destabilizations in response to economic shocks and economic crises, including the current outbreak of COVID-19 and the related economic impacts on the global economic environment, and government authorities may have limited resources to respond to such shocks and crises. As a result of the outbreak of COVID-19, among other impacts, financial markets and global economic conditions have deteriorated, consumer spending has decreased, employment rates have reached historic lows and consumer debt levels have continued to increase. These impacts may adversely affect the Company’s growth and profitability. For further discussion with respect to ongoing risks to the Company’s business related to COVID-19, prospective investors are encouraged to refer to the information contained under the heading “Risk Factors” in the Annual Information Form.

There is no assurance of a sufficient liquid trading market for the Company’s Common Shares in the future.

Shareholders of the Company may be unable to sell significant quantities of Common Shares into the public trading markets without a significant reduction in the price of their Common Shares, or at all. There can be no assurance that there will be sufficient liquidity of the Company’s Common Shares on the trading market, and that the Company will continue to meet the listing requirements of the TSX or the NYSE American or achieve listing on any other public listing exchange.

The Company could in the future be classified as a ‘passive foreign investment company’ (“PFIC”), which could have adverse U.S. federal income tax consequences for U.S. Holders of Common Shares.

U.S. investors should be aware that they could be subject to certain adverse U.S. federal income tax consequences in the event that the Company is classified as a PFIC for U.S. federal income tax purposes. The determination of whether the Company is a PFIC for a taxable year depends, in part, on the application of complex U.S. federal income tax rules, which are subject to differing interpretations, and the determination will depend on the composition of the Company’s income, expenses and assets from time to time and the nature of the activities performed by the Company’s officers and employees. The Company believes that MAG was a PFIC for the 2019 and prior financial years. With the start of the underground production at Juanicipio and the Company’s attributable revenue under the PFIC determination rules, the Company no longer believes it is a PFIC as of the 2020 fiscal year. Prospective investors should consult their own tax advisers regarding the likelihood and consequences of the Company being treated as a PFIC for U.S. federal income tax purposes, including the advisability of making certain elections that may mitigate certain possible adverse U.S. federal income tax consequences but may result in an inclusion in gross income without receipt of such income.

The Company has outstanding common share equivalents which, if exercised, could cause dilution to existing shareholders.

The Company has common share equivalents issued consisting of Common Shares issuable upon the exercise of outstanding exercisable Options or issuable upon the conversion of restricted share units (“RSUs”), performance share units (“PSUs”) and deferred share units (“DSUs”) each convertible into one Common Share. Options are likely to be exercised when the market price of the Company’s Common Shares exceeds the exercise price of such Options. RSUs and PSUs may be converted at any time by the holder subject to vesting conditions, and the DSUs may only be converted by a departing director of the Company. The exercise of any of these instruments and the subsequent resale of such Common Shares in the public market could adversely affect the prevailing market price and the Company’s ability to raise equity capital in the future at a time and price which it deems appropriate. The Company may also enter into commitments in the future which would require the issuance of additional Common Shares and the Company may grant additional share purchase warrants, stock options, RSUs, PSUs and DSUs. Any share issuances from the Company’s treasury will result in immediate dilution to existing shareholders’ percentage interest in the Company.

S-14

Table of Contents

The Company has not paid dividends and may not pay dividends in the immediate future.

Payment of dividends on the Company’s Common Shares is within the discretion of the Board and will depend upon the Company’s future earnings, if any, its capital requirements and financial condition, and other relevant factors. The Company anticipates that all available funds will be invested to finance the growth of its business for the immediate future.

The net proceeds to the Company from the Offering, after deducting the Underwriters’ Fee and the estimated expenses of the Offering (estimated to be approximately US$650,000) are expected to be approximately US$37,474,450, or approximately US$43,193,117.50 if the Over-Allotment Option is exercised in full (assuming no sales to President’s List purchasers under the Offering).

The proposed use of the net proceeds is described in detail below. The below noted allocation represents the Company’s intentions with respect to its use of proceeds based on current knowledge, planning and expectations of management of the Company. Actual expenditures may differ from the estimates set forth below. There may be circumstances where, for sound business reasons, a reallocation of the net proceeds may be deemed prudent or necessary. The actual amount that the Company spends in connection with each of the intended uses of proceeds may vary significantly from the amounts specified below and will depend on a number of factors, including those listed under the heading “Risk Factors” in this prospectus supplement and in the AIF.

Although the Company expects the Juanicipio Project to generate positive cash flow once in commercial production, the Company is not expecting to receive, directly or indirectly, its share of cash flow or any portion thereof from such production (whether by way of dividends or otherwise) until early 2023, an underlying assumption in the following Use of Proceeds. The Company intends to use the net proceeds of the Offering as follows:

| Net Proceeds | Net Proceeds (including the Over-allotment Option) |

|||||||

| (US$ Millions) | (US$ Millions) | |||||||

| I) Exploration expenditures related to the Juanicipio Project, the Deer Trail Project and other projects (present to 2023) | 15.0 | 17.5 | ||||||

| II) Development and sustaining capital expenditures not included in the estimated initial project capital related to the Juanicipio Project (2021-2022) | 14.5 | 16.7 | ||||||

| III) Working capital and general corporate purposes (present to 2023) (1) | 8.0 | 9.0 | ||||||

|

|

|

|

|

|||||

| Total: |

37.5 | 43.2 | ||||||

|

|

|

|

|

|||||

Notes:

| (1) | Funds included in general corporate purposes may be allocated to corporate expenses, business development, potential future acquisitions, and to other purposes. |

I) Exploration Expenditures – Juanicipio, Deer Trail and others

The Company intends to use up to US$15.0 million (or up to 40%) of the net proceeds of the Offering to satisfy the Company’s exploration activities through 2022 and into 2023, including its obligation to fund its 44% pro rata interest in the exploration expenditures of the Juanicipio Project and including its exploration activities as principal operator of the Deer Trail Project.

The ongoing exploration at the Juanicipio Project is aimed at finding new veins within the concession boundaries; converting Inferred Mineral Resources included in the Deep Zone (as defined in the 2017 PEA) into Indicated Mineral Resources; and further tracing the Deep Zone laterally and to depth. Most of the Juanicipio

S-15

Table of Contents

property remains unexplored with many untested targets still to be pursued within the property concession. MAG and Fresnillo, as shareholders of Minera Juanicipio, have both acknowledged that there is considerable further exploration potential in the concession license area. The exploration expenditures incurred by Minera Juanicipio on a 100% basis in 2020 were US$4.8 million (MAG’s 44% share was US$2.1 million), while the current year’s Juanicipio exploration budget in progress is $6.0 million (MAG’s 44% share US$2.6 million) and it is anticipated to be at similar levels for subsequent years. Although exploration budgets are approved annually and the 2022 budget has yet to be set, permit applications for drilling other exploration targets on the property have been submitted or are in the process of being generated pending surface access arrangements. Meanwhile, detailed mapping and sampling of these targets is underway. MAG strongly supports further exploration on the Juanicipio property and has encouraged Fresnillo as operator to increase the exploration activity in subsequent years, although there is no assurance as to what levels of exploration budgets will be agreed to for 2022 or subsequent years or that the objectives of such exploration activities will be achieved.

Exploration expenditures incurred by Minera Juanicipio are in addition to and are not included in estimated the $440 million initial capital requirements for the project development currently in progress. The Juanicipio shareholders agreement does not distinguish between funding of exploration expenditures and funding of development and construction expenditures. The Company has an obligation to fund its 44% pro rata interest in the exploration and development of the Juanicipio Project in order to maintain its proportionate ownership in the project and to avoid dilution.

The Deer Trail Project displays and satisfies MAG’s top criteria when exploring for large CRD systems, and as noted above in the Summary Description of the Business the Phase I drill program was successful in achieving all of its planned objectives. A Phase II program is currently in progress and will carry over into 2022, and it is expected further drilling and exploration will also be undertaken later in 2022 and in 2023 on the property.

The Company may also spend a portion of the proceeds designated for exploration on other properties owned by the Company, where the exploration is managed directly by the Company.

II) Juanicipio Project development and sustaining capital expenditures not included in the estimated initial project capital

The Company intends to use up to US$14.5 million (or up to 39%) of the net proceeds of the Offering to satisfy its obligations to fund its 44% pro rata interest in the development of the Juanicipio Project, with respect to sustaining capital and development costs not included in the initial project capital cost estimate.

Fresnillo and MAG, as shareholders of Minera Juanicipio, jointly approved project mine development on April 11, 2019. Development of the Juanicipio Project is being carried out by the project operator, Fresnillo, with MAG participating in all Minera Juanicipio board and technical committee meetings as well as ad-hoc meetings when required. Construction and commissioning of the processing plant is under the guidance of an Engineering, Procurement and Construction Management (“EPCM”) contract entered into with an affiliate of Fresnillo.

Installation of the processing plant and all associated support infrastructure is now nearing completion. The focus is currently transitioning from construction to commissioning activities. Pre-commissioning testing has already begun for key process plant systems as the plant approaches mechanical completion. No-load testing of the facility with progression to water testing is expected during November 2021. According to the operator Fresnillo, the plant is expected to be commissioned by the end of 2021, subject to timely connection to the national electricity transmission grid of Mexico. The connection to the grid is the last step prior to feeding lower grade mineralized material through the grinding mills and mineralized material has been conveyed to the fine ore bin in preparation for processing.

Until the Juanicipio processing plant is commissioned, mineralized development material from Juanicipio is being processed at a targeted rate of 16,000 tonnes per month through the nearby Fresnillo beneficiation plant (100% owned by Fresnillo), with the lead (silver-rich) and zinc concentrates treated at market terms under

S-16

Table of Contents

off-take agreements with a related party to Fresnillo, Met-Mex Peñoles, S.A. de C.V., in Torreón, Mexico. The actual amount of material processed on a monthly basis fluctuates due to the variability of mineralization encountered in the development headings from month to month, but averaged of 19,041 tonnes per month during the quarter ended September 30, 2021.

Labour reform legislation on subcontracting and outsourcing in Mexico was published on April 23, 2021 and came into effect on September 1, 2021. With various restrictions on hiring contractors, Fresnillo, as operator, has indicated a need to internalize a portion of its contractor workforce and perform much of the development work directly rather than outsourcing it to contractors. As a result, an associated investment in equipment is required that was either not previously in the project scope or not envisaged to be required until later in the mine life, but is now required for use in underground operations. As well, certain underground development expenditures related to processing development material (as noted above) and some small items brought forward from project investments planned in the future are considered sustaining capital by Fresnillo. The costs incurred are expected to reduce future sustaining capital costs and totaled approximately $16.6 million on a 100% basis for the quarter ended September 30, 2021. These costs are included in the current Juanicipio development costs but are not considered by the operator as part of the $440 million estimated initial project capital. These additional costs are expected to continue as the plant is commissioned and commercial production is achieved, and MAG will be required to fund its 44% share of such costs. The Company intends to use up to US$14.5 million of the Offering for this purpose.

Although the Company estimates and believes that it will have enough cash and available liquidity to fund its 44% share of Juanicipio capital calls for the remaining Juanicipio mine development, should the scale and scope of the development change further, or should the required capital to complete the development exceed the current estimated initial and sustaining capital requirements, the Company’s cash resources even after giving effect to the Offering and the Credit Facility, may not be sufficient to fund its 44% share of the remaining project development costs. There is also no guarantee that the construction will be completed or, if completed, that production will begin or that financial results will be consistent with the Juanicipio Technical Report (See “Risks Relating to Development of Juanicipio Project” in the accompanying short form base shelf prospectus). Accordingly, the Company may need to raise significant additional capital in the future over and above the current Offering under such circumstances.

III) Working capital and general corporate purposes