Form SD HELEN OF TROY LTD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

Helen of Troy Limited

(Exact name of the registrant as specified in its charter)

| Bermuda | 001-14669 | ||||||||||

| (State or other jurisdiction of | (Commission | ||||||||||

| incorporation) | File Number) | ||||||||||

Clarendon House

2 Church Street

Hamilton, Bermuda

(Address of principal executive offices)

| Tessa Judge | (915) 225-8000 | |||||||

| (Name and telephone number, including area code, of the person to contact in connection with this report.) | ||||||||

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

ý Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2021.

☐ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended _________.

Section 1 — Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

Helen of Troy Limited (“Helen of Troy” or “Company”) has concluded in good faith that during 2021,

•Helen of Troy contracted to have manufactured products for which “conflict minerals” (as defined in Section 1502(e)(4) of the Dodd-Frank Wall Street Reform and Consumer Protection Act) may be necessary to the functionality or production.

•Based on a “reasonable country of origin inquiry” and subsequent due diligence, Helen of Troy is unable to determine whether or not various components/materials, which contribute to products sold by its business segments, are Democratic Republic of Congo (“DRC”) conflict free.

In accord with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”), Helen of Troy has filed this Specialized Disclosure Form and the associated Conflict Minerals Report, and both reports are posted to a publicly available Internet site at www.helenoftroy.com.

Item 1.02 Exhibit

The Conflict Minerals Report for the calendar year ended December 31, 2021 is filed as Exhibit 1.01.

Section 2 — Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 — Exhibits

Item 3.01 Exhibits

The following exhibit is filed as part of this Form SD:

| Exhibit Number | Description | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| Helen of Troy Limited | ||||||||

| /s/ Matthew J. Osberg | May 10, 2022 | |||||||

| Matthew J. Osberg | ||||||||

| Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer | ||||||||

1 EXHIBIT 1.01 Conflict Minerals Report of Helen of Troy Limited In accord with Rule 13p-1 under the Securities Exchange Act of 1934 This is the Conflict Minerals Report of Helen of Troy Limited (“Helen of Troy”, the “Company”) for calendar year 2021 (excepting conflict minerals that, prior to January 31, 2013, were located outside of the supply chain) in accord with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”). 1. Introduction Helen of Troy is a leading global consumer products company offering creative solutions for our customers through a diversified portfolio of well-recognized and widely trusted brands. The Company has built leading market positions through new product innovation, product quality and competitive pricing. Helen of Troy was incorporated as Helen of Troy Corporation in Texas in 1968 and reorganized as Helen of Troy Limited in Bermuda in 1994. Helen of Troy has three business segments: Home & Outdoor (formerly named Housewares), Health & Wellness (formerly named Health & Home), and Beauty. The Home & Outdoor segment provides a broad range of innovative consumer products for home activities such as food preparation, cooking, cleaning, and organization; as well as products for outdoor and on the go activities such as hydration, food storage, backpacks, and travel gear. This segment sells primarily to retailers as well as through our direct-to-consumer channel. The Health & Wellness segment provides health and wellness products including healthcare devices, thermometers, water and air filtration systems, humidifiers, and fans. Sales for the segment are primarily to retailers, along with some direct-to-consumer product distribution. The Beauty segment distributes haircare products including styling appliances, grooming tools, decorative hair accessories, and prestige market liquid- based products. This segment sells primarily to retailers in the prestige and mass merchandise channels, beauty supply wholesalers, and through our direct- to- consumer channel. Helen of Troy purchases its products from unaffiliated manufacturers, most of which are located in China, Mexico and the United States. Helen of Troy contracts to have products manufactured that may contain gold, tantalum, tin and tungsten (“3TG”). As these materials may be necessary to Helen of Troy’s products, the Company has embarked on a process to trace the origin of these metals to determine whether its sourcing practices support conflict or human rights abuses in the Democratic Republic of Congo (“DRC”) and the surrounding area (the “Covered Countries”). The intent of this Conflict Minerals Report (“CMR”) is to describe this due diligence process.

2 2. Product Description Helen of Troy contracts to have products manufactured that may contain 3TG, such as home, outdoor, health, wellness, and beauty consumer products. Helen of Troy purchases finished product and is therefore several tiers removed from the mining operations. The Company does not purchase any materials directly from smelters or refiners, so Helen of Troy must rely on its suppliers to provide reliable and accurate information about 3TG. Helen of Troy’s suppliers were requested to use the Conflict-Free Sourcing Initiative’s Conflict Minerals Reporting Template (“CMRT”) to identify gold, tantalum, tin and tungsten smelters or refiners (“SORs”) and associated countries of origin. Verified SORs were matched against available lists of processors that have been certified by internationally- recognized industry validation schemes, such as the Responsible Minerals Assurance Process (RMAP), the London Bullion Market Association Good Delivery Program (“LBMA”), and the Responsible Jewelry Council Chain-of-Custody Certification (“RJC”). Conflict free certification information is current as of April 15, 2022. 3. Reasonable Country of Origin Inquiry Description Helen of Troy obtained the aforementioned product information by implementing a Reasonable Country of Origin Inquiry (“RCOI”). Helen of Troy assembled an internal team comprised of representatives from Helen of Troy’s finance, legal and supply chain departments. Helen of Troy engaged Source Intelligence (“SI”), a third-party information management service provider, to gather information from suppliers and establish a system of controls and transparency over its supply chain. This is the eighth consecutive year the Company worked with SI. Helen of Troy’s Tier 1 suppliers were engaged by SI to collect information regarding the presence and sourcing of 3TG used in the products supplied to them. Information was collected and stored using an online platform provided by SI. Supplier Engagement As in previous years, the RCOI began with an introduction email from Helen of Troy to suppliers describing its conflict minerals reporting requirements. Following that introduction email, a subsequent email was sent to suppliers containing a registration and survey request link to the online data collection platform. In an effort to increase awareness of the Company’s Conflict Minerals Compliance Program (CMCP), supporting regulation, and frequently asked questions (FAQs) concerning 3TG mineral tracing, Helen of Troy’s suppliers were given access to an online Supplier Resource Center. The Supplier Resource Center provided educational information to facilitate a deeper understanding of conflict minerals and to inform suppliers as to why information was being requested. There were also opportunities to participate in webinars providing information on the Conflict Minerals Rule.

3 Subsequent engagement followed these steps: • Following the initial introductions to the program and information request, up to three reminder emails were sent to each non-responsive supplier requesting survey completion. • Suppliers who remained non-responsive were contacted by email and offered assistance. This assistance included, but was not limited to, further information about the Conflict Minerals Compliance Program, an explanation of why the information was being collected, a review of how the information would be used, and clarification regarding how the information could be provided. • If, after these efforts, a given supplier still did not register with the system or provide the information requested, an escalation process was initiated. The escalation process consisted of direct outreach by Helen of Troy. Specifically, Helen of Troy contacted these suppliers by email to request their participation in the program. SI followed up with an email in a timely manner. Information Requested Suppliers were asked to provide information regarding the sourcing of their materials with the ultimate goal of identifying the 3TG SORs and associated mine countries of origin. Suppliers who had already performed a RCOI through the use of the CMRT were asked to upload this document into the online data collection platform or to provide this information in the online survey version. Where a supplier was unable to provide a CMRT, SI requested information on its suppliers of products or components which may require 3TG for their production or functionality. These Tier 2 suppliers, and subsequent tiers of suppliers as needed, were then engaged following the contact procedures explained above. When contact information was provided, Tier 2 and beyond suppliers were contacted via email in order to build a chain-of-custody back to the 3TG SOR. Every effort was made to address and meet the concerns of suppliers regarding their need to maintain the confidentiality of their data. In order to address this concern, SI executed non-disclosure agreements with Helen of Troy suppliers when requested. Helen of Troy chose to give their suppliers the ability to share information at a level with which they were most comfortable, i.e. company, product or user-defined, but the declaration scope had to be specified. Suppliers were requested to provide an electronic signature before submitting their data to Helen of Troy to verify that all answers submitted were accurate to the best of the supplier’s knowledge, but the suppliers were not required to provide an electronic signature to submit their data.

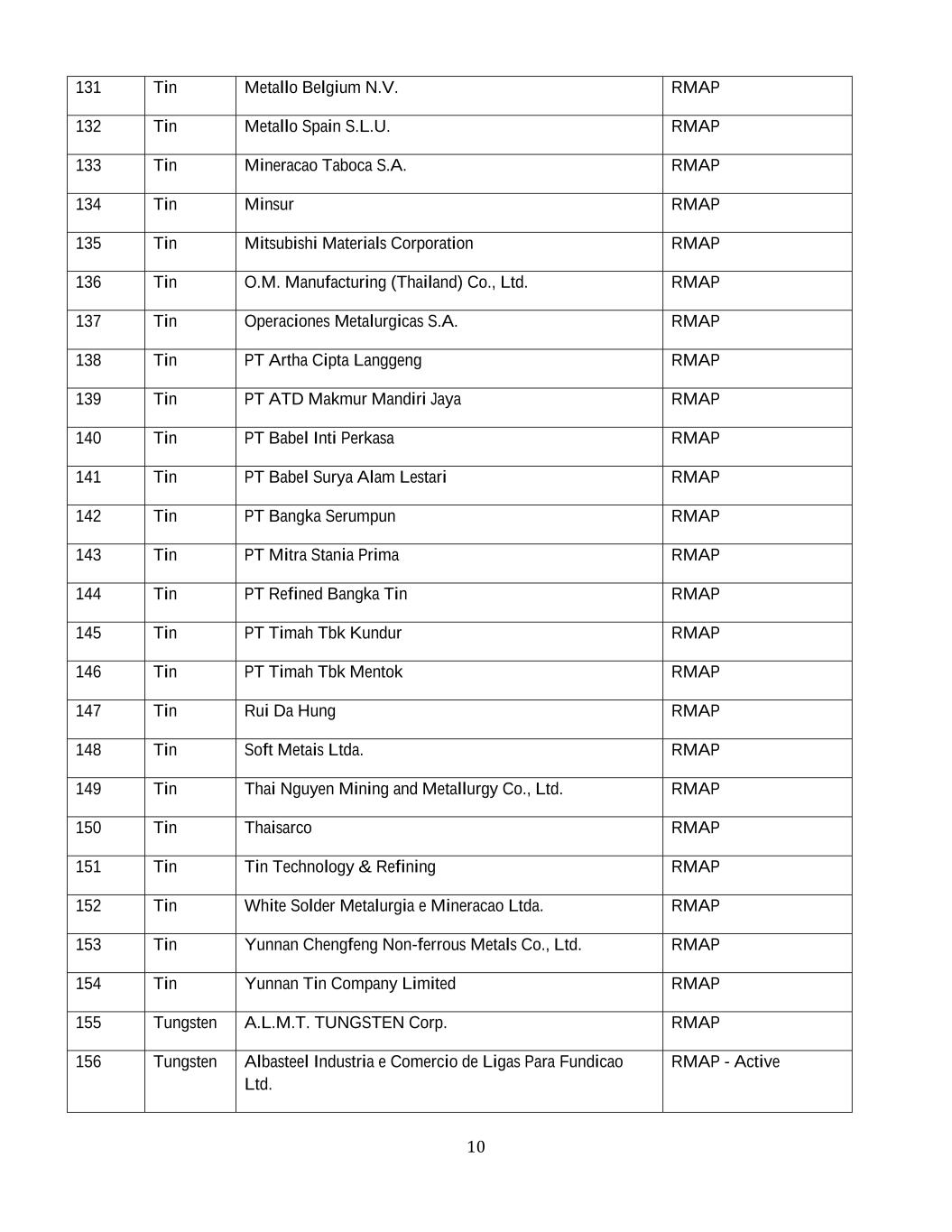

4 Quality Assurance Supplier responses were evaluated for plausibility, consistency, and gaps. If any of the following “quality control” (QC) flags were raised, suppliers were automatically contacted by the SI platform on a bi-weekly basis up to 3 contacts. • One or more smelter or refiners (SORs) were listed for an unused metal; • SOR information was not provided for a used metal, or SOR information provided was not a verified metal processor; • Supplier answered yes to sourcing from the Democratic Republic of the Congo or adjoining countries (“DRC”), but none of the SORs listed are known to source from the region; • Supplier indicated that they have not received conflict minerals data for each metal from all relevant suppliers; • Supplier indicated they have not identified all of the SORs used for the products included in the declaration scope; • Supplier indicated they have not provided all applicable SOR information received; and • Supplier indicated 100% of the 3TG for products covered by the declaration originates from scrap/recycled sources, but one or more SORs listed are not known to be exclusive recyclers. 4. RCOI Results Helen of Troy’s RCOI process revealed the following: • A total of 129 Tier 1 suppliers were identified by Helen of Troy as potentially in-scope for conflict mineral reporting purposes and all were contacted as part of the RCOI process. The survey response rate among these suppliers was 100%. • Out of these responding suppliers, 30.2% indicated conflict minerals were necessary to the functionality or production of the products they supply to Helen of Troy. • The responding suppliers using conflict minerals provided names of 187 verified SORs. • Of the 187 verified SORs, 90.9% are currently certified, of those that are not yet certified, 29.4% are actively moving through the certification process. Around 79.7% of verified SORs had no indication of sourcing from the DRC/Covered Countries. Of those SORs that show indication of sourcing from the DRC/Covered Countries, all are currently certified. The following table lists the verified SORs provided by Helen of Troy’s suppliers, along with the certification status of each SOR as of April 15, 2022.

5 Number Metal Official Smelter Name Conflict-Free Certifications 1 Gold Advanced Chemical Company RMAP 2 Gold Aida Chemical Industries Co., Ltd. RMAP 3 Gold Allgemeine Gold-und Silberscheideanstalt A.G. LBMA, RJC, RMAP 4 Gold Almalyk Mining and Metallurgical Complex (AMMC) LBMA, RMAP 5 Gold AngloGold Ashanti Corrego do Sitio Mineracao LBMA, RMAP 6 Gold Argor-Heraeus S.A. LBMA, RMAP 7 Gold Asahi Pretec Corp. LBMA, RMAP 8 Gold Asahi Refining Canada Ltd. LBMA, RMAP 9 Gold Asahi Refining USA Inc. LBMA, RMAP 10 Gold Asaka Riken Co., Ltd. RMAP 11 Gold Aurubis AG LBMA, RMAP 12 Gold Bangalore Refinery RMAP 13 Gold Bangko Sentral ng Pilipinas (Central Bank of the Philippines) LBMA, RMAP 14 Gold Boliden AB LBMA, RMAP 15 Gold C. Hafner GmbH + Co. KG LBMA, RJC, RMAP 16 Gold CCR Refinery - Glencore Canada Corporation LBMA, RMAP 17 Gold CGR Metalloys Pvt Ltd. NA 18 Gold Chimet S.p.A. LBMA, RMAP 19 Gold Chugai Mining RMAP 20 Gold DODUCO Contacts and Refining GmbH RMAP 21 Gold DSC (Do Sung Corporation) RMAP 22 Gold Eco-System Recycling Co., Ltd. East Plant RMAP 23 Gold Emirates Gold DMCC RMAP 24 Gold Geib Refining Corporation RMAP 25 Gold Gold Refinery of Zijin Mining Group Co., Ltd. LBMA, RMAP

6 26 Gold Guangdong Jinding Gold Limited NA 27 Gold Heimerle + Meule GmbH LBMA, RMAP 28 Gold Heraeus Metals Hong Kong Ltd. LBMA, RJC, RMAP 29 Gold Heraeus Precious Metals GmbH & Co. KG RMAP 30 Gold Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. LBMA, RMAP 31 Gold Ishifuku Metal Industry Co., Ltd. LBMA, RMAP 32 Gold Italpreziosi RJC, RMAP 33 Gold Japan Mint LBMA, RMAP 34 Gold Jiangxi Copper Co., Ltd. LBMA, RMAP 35 Gold JSC Uralelectromed NA 36 Gold JX Nippon Mining & Metals Co., Ltd. LBMA, RMAP 37 Gold Kazakhmys Smelting LLC NA 38 Gold Kazzinc LBMA, RMAP 39 Gold Kennecott Utah Copper LLC LBMA, RMAP 40 Gold Kojima Chemicals Co., Ltd. RMAP 41 Gold L'Orfebre S.A. RMAP 42 Gold LS-NIKKO Copper Inc. LBMA, RMAP 43 Gold LT Metal Ltd. RMAP 44 Gold Marsam Metals RMAP 45 Gold Materion RMAP 46 Gold Matsuda Sangyo Co., Ltd. LBMA, RMAP 47 Gold Metalor Technologies (Hong Kong) Ltd. LBMA, RJC, RMAP 48 Gold Metalor Technologies (Singapore) Pte., Ltd. LBMA, RJC, RMAP 49 Gold Metalor Technologies (Suzhou) Ltd. RJC, RMAP 50 Gold Metalor Technologies S.A. LBMA, RJC, RMAP 51 Gold Metalor USA Refining Corporation LBMA, RJC, RMAP

7 52 Gold Metalurgica Met-Mex Penoles S.A. De C.V. LBMA, RMAP 53 Gold Mitsui Mining and Smelting Co., Ltd. LBMA, RMAP 54 Gold Moscow Special Alloys Processing Plant NA 55 Gold Navoi Mining and Metallurgical Combinat RMAP 56 Gold Nihon Material Co., Ltd. LBMA, RMAP 57 Gold Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH RJC, RMAP 58 Gold OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet) NA 59 Gold OJSC Novosibirsk Refinery NA 60 Gold PAMP S.A. LBMA, RMAP 61 Gold Planta Recuperadora de Metales SpA RMAP 62 Gold PT Aneka Tambang (Persero) Tbk LBMA, RMAP 63 Gold PX Precinox S.A. LBMA, RMAP 64 Gold Rand Refinery (Pty) Ltd. LBMA, RMAP 65 Gold REMONDIS PMR B.V. RMAP 66 Gold Samduck Precious Metals RMAP 67 Gold SAXONIA Edelmetalle GmbH RMAP - Active 68 Gold SEMPSA Joyeria Plateria S.A. LBMA, RMAP 69 Gold Shandong Zhaojin Gold & Silver Refinery Co., Ltd. LBMA, RMAP 70 Gold Sichuan Tianze Precious Metals Co., Ltd. LBMA, RMAP 71 Gold Singway Technology Co., Ltd. RMAP 72 Gold SOE Shyolkovsky Factory of Secondary Precious Metals NA 73 Gold Solar Applied Materials Technology Corp. LBMA, RMAP 74 Gold State Research Institute Center for Physical Sciences and Technology NA 75 Gold Sumitomo Metal Mining Co., Ltd. LBMA, RMAP 76 Gold T.C.A S.p.A LBMA, RMAP

8 77 Gold Tanaka Kikinzoku Kogyo K.K. LBMA, RMAP 78 Gold The Refinery of Shandong Gold Mining Co., Ltd. LBMA, RMAP 79 Gold Tokuriki Honten Co., Ltd. LBMA, RMAP 80 Gold Tongling Nonferrous Metals Group Co., Ltd. NA 81 Gold Tony Goetz NV NA 82 Gold Torecom RMAP 83 Gold Umicore S.A. Business Unit Precious Metals Refining LBMA, RMAP 84 Gold United Precious Metal Refining, Inc. RMAP 85 Gold Valcambi S.A. LBMA, RJC, RMAP 86 Gold Western Australian Mint (T/a The Perth Mint) LBMA, RMAP 87 Gold WIELAND Edelmetalle GmbH RMAP 88 Gold Yamakin Co., Ltd. RMAP 89 Gold Yokohama Metal Co., Ltd. RMAP 90 Gold Zhongyuan Gold Smelter of Zhongjin Gold Corporation LBMA, RMAP 91 Tantalum Changsha South Tantalum Niobium Co., Ltd. RMAP 92 Tantalum D Block Metals, LLC RMAP 93 Tantalum Exotech Inc. RMAP - Active 94 Tantalum F&X Electro-Materials Ltd. RMAP 95 Tantalum FIR Metals & Resource Ltd. RMAP 96 Tantalum Global Advanced Metals Aizu RMAP 97 Tantalum Global Advanced Metals Boyertown RMAP 98 Tantalum Guangdong Zhiyuan New Material Co., Ltd. RMAP 99 Tantalum H.C. Starck Hermsdorf GmbH RMAP 100 Tantalum H.C. Starck Inc. RMAP 101 Tantalum Hengyang King Xing Lifeng New Materials Co., Ltd. RMAP 102 Tantalum Jiangxi Dinghai Tantalum & Niobium Co., Ltd. RMAP 103 Tantalum JiuJiang JinXin Nonferrous Metals Co., Ltd. RMAP

9 104 Tantalum Jiujiang Tanbre Co., Ltd. RMAP 105 Tantalum Mineracao Taboca S.A. RMAP 106 Tantalum Ningxia Orient Tantalum Industry Co., Ltd. RMAP 107 Tantalum NPM Silmet AS RMAP 108 Tantalum Taki Chemical Co., Ltd. RMAP 109 Tantalum TANIOBIS Co., Ltd. RMAP 110 Tantalum TANIOBIS GmbH RMAP 111 Tantalum TANIOBIS Japan Co., Ltd. RMAP 112 Tantalum TANIOBIS Smelting GmbH & Co. KG RMAP 113 Tantalum Ulba Metallurgical Plant JSC RMAP 114 Tin Alpha RMAP 115 Tin Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. RMAP 116 Tin China Tin Group Co., Ltd. RMAP 117 Tin Dowa RMAP 118 Tin EM Vinto RMAP 119 Tin Fenix Metals RMAP 120 Tin Gejiu Kai Meng Industry and Trade LLC NA 121 Tin Gejiu Non-Ferrous Metal Processing Co., Ltd. RMAP 122 Tin Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. RMAP 123 Tin Gejiu Zili Mining And Metallurgy Co., Ltd. RMAP 124 Tin Guangdong Hanhe Non-Ferrous Metal Co., Ltd. RMAP 125 Tin HuiChang Hill Tin Industry Co., Ltd. RMAP 126 Tin Jiangxi New Nanshan Technology Ltd. RMAP 127 Tin Magnu's Minerais Metais e Ligas Ltda. RMAP 128 Tin Malaysia Smelting Corporation (MSC) RMAP 129 Tin Melt Metais e Ligas S.A. RMAP - Active 130 Tin Metallic Resources, Inc. RMAP

10 131 Tin Metallo Belgium N.V. RMAP 132 Tin Metallo Spain S.L.U. RMAP 133 Tin Mineracao Taboca S.A. RMAP 134 Tin Minsur RMAP 135 Tin Mitsubishi Materials Corporation RMAP 136 Tin O.M. Manufacturing (Thailand) Co., Ltd. RMAP 137 Tin Operaciones Metalurgicas S.A. RMAP 138 Tin PT Artha Cipta Langgeng RMAP 139 Tin PT ATD Makmur Mandiri Jaya RMAP 140 Tin PT Babel Inti Perkasa RMAP 141 Tin PT Babel Surya Alam Lestari RMAP 142 Tin PT Bangka Serumpun RMAP 143 Tin PT Mitra Stania Prima RMAP 144 Tin PT Refined Bangka Tin RMAP 145 Tin PT Timah Tbk Kundur RMAP 146 Tin PT Timah Tbk Mentok RMAP 147 Tin Rui Da Hung RMAP 148 Tin Soft Metais Ltda. RMAP 149 Tin Thai Nguyen Mining and Metallurgy Co., Ltd. RMAP 150 Tin Thaisarco RMAP 151 Tin Tin Technology & Refining RMAP 152 Tin White Solder Metalurgia e Mineracao Ltda. RMAP 153 Tin Yunnan Chengfeng Non-ferrous Metals Co., Ltd. RMAP 154 Tin Yunnan Tin Company Limited RMAP 155 Tungsten A.L.M.T. TUNGSTEN Corp. RMAP 156 Tungsten Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. RMAP - Active

11 157 Tungsten Chenzhou Diamond Tungsten Products Co., Ltd. RMAP 158 Tungsten Chongyi Zhangyuan Tungsten Co., Ltd. RMAP 159 Tungsten Cronimet Brasil Ltda RMAP 160 Tungsten Ganzhou Haichuang Tungsten Co., Ltd. RMAP 161 Tungsten Ganzhou Huaxing Tungsten Products Co., Ltd. RMAP 162 Tungsten Ganzhou Jiangwu Ferrotungsten Co., Ltd. RMAP 163 Tungsten Ganzhou Seadragon W & Mo Co., Ltd. RMAP 164 Tungsten Global Tungsten & Powders Corp. RMAP 165 Tungsten Guangdong Xianglu Tungsten Co., Ltd. RMAP 166 Tungsten H.C. Starck Tungsten GmbH RMAP 167 Tungsten Hunan Chenzhou Mining Co., Ltd. RMAP 168 Tungsten Hunan Chunchang Nonferrous Metals Co., Ltd. RMAP 169 Tungsten Hydrometallurg, JSC RMAP 170 Tungsten Japan New Metals Co., Ltd. RMAP 171 Tungsten Jiangwu H.C. Starck Tungsten Products Co., Ltd. RMAP 172 Tungsten Jiangxi Gan Bei Tungsten Co., Ltd. RMAP 173 Tungsten Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. RMAP 174 Tungsten Jiangxi Xinsheng Tungsten Industry Co., Ltd. RMAP 175 Tungsten Jiangxi Yaosheng Tungsten Co., Ltd. RMAP 176 Tungsten Kennametal Fallon RMAP 177 Tungsten Kennametal Huntsville RMAP 178 Tungsten KGETS CO., LTD. RMAP 179 Tungsten Malipo Haiyu Tungsten Co., Ltd. RMAP 180 Tungsten Niagara Refining LLC RMAP 181 Tungsten NPP Tyazhmetprom LLC RMAP - Active 182 Tungsten TANIOBIS Smelting GmbH & Co. KG RMAP

12 183 Tungsten Unecha Refractory Metals Plant RMAP 184 Tungsten Wolfram Bergbau und Hutten AG RMAP 185 Tungsten Xiamen Tungsten (H.C.) Co., Ltd. RMAP 186 Tungsten Xiamen Tungsten Co., Ltd. RMAP 187 Tungsten Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. RMAP Certification Status: 1. Responsible Minerals Assurance Process (RMAP) • RMAP: The smelter has an active certification or is in the process of renewing their certification. • RMAP -Active: The smelter is actively moving through the certification process. 2. Responsible Gold Certificate: London Bullion Market Association (LBMA) • LBMA: The smelter has obtained a Responsible Gold Certification. 3. Chain of Custody Certificate: Responsible Jewelry Council (RJC) • RJC: The smelter has obtained a Chain-of-Custody Certification. *NA refers to no applicable standard identified Countries of origin for these SORs are believed to include:

13 Country of Origin Angola Israel Spain Argentina Italy Suriname Armenia Ivory Coast Sweden Australia Japan Switzerland Austria Jersey Taiwan Belarus Kazakhstan Tajikistan Belgium Kenya Tanzania Bermuda Korea, Republic of Thailand Bolivia Kyrgyzstan Turkey Brazil Laos Uganda Burundi Luxembourg United Arab Emirates Cambodia Madagascar United Kingdom Canada Malaysia United States Central African Republic Mali Uzbekistan Chile Mexico Viet Nam China Mongolia Zambia Colombia Morocco Zimbabwe Congo (Brazzaville) Mozambique Czech Republic Myanmar Djibouti Namibia DRC- Congo (Kinshasa) Netherlands Ecuador Niger Egypt Nigeria Estonia Papua New Guinea Ethiopia Peru Finland Philippines France Poland Germany Portugal Ghana Russian Federation Guinea Rwanda Guyana Saudi Arabia Hong Kong Sierra Leone Hungary Singapore India Slovakia Indonesia South Africa Ireland South Sudan

14 5. Due Diligence Process Helen of Troy’s due diligence process was designed to conform to the Organization for Economic Cooperation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and accompanying Supplements1. It is important to note that the OECD Guidance was written for both upstream2 and downstream3 companies in the supply chain. As Helen of Troy is a downstream company in the supply chain, due diligence practices were tailored accordingly. • Step 1- Establish strong company management systems Helen of Troy’s conflict minerals policy is publicly available at www.helenoftroy.com. The Company utilizes an internal team comprised of representatives from the finance, legal and supply chain departments to communicate and manage compliance initiatives. Team members work with the suppliers on a continual basis to maintain an open dialog and transparency in the procurement process. Findings are reported to senior management, as well as to the internal audit department. The Company’s internal team efforts are supplemented with a third-party service provider’s extensive knowledge and experience, as well as training seminars on conflict minerals. • Step 2- Identify and assess risk in the supply chain The Company continues to refine its list of product categories and suppliers that may fall within the scope of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Expectations with regard to supplier performance, transparency and sourcing are clearly communicated through supplier training. Quality assessments with suppliers are being expanded to encompass compliance initiatives. Suppliers are being encouraged to implement conflict mineral policies with their vendors. • Step 3- Design and implement a strategy to respond to identified risks Helen of Troy continues to make improvements on risk management. As RCOI are conducted and additional information becomes available regarding components and materials being used in the Company’s products, potential risks can be tracked and mitigated. The online platform maintained by SI allows Helen of Troy to 1 OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Supplement on Tin, Tantalum and Tungsten and Supplement on Gold, 2013; http://www.oecd.org/daf/inv/mne/GuidanceEdition2.pdf. 2 Upstream companies refer to those between the mine and SORs. As such, the companies typically include miners, local traders, or exporters from the country of mineral origin, international concentrate traders and SORs. 3 Downstream companies refer to those entities between the SORs and the retailer. As such, the companies typically include metal traders and exchanges, component manufacturers, product manufacturers, original equipment manufacturers and retailers.

15 access and analyze supplier responses as well as SOR information. Any suppliers found to be sourcing from SORs that support conflict in the DRC region will be required to explore alternative sources. • Step 4- Carry out independent third-party audit of supply chain due diligence at identified points in the supply chain As part of Helen of Troy’s due diligence, and in conjunction with SI, the Company relies upon the following internationally accepted audit standards to determine which SORs are considered DRC Conflict Free: RMAP, LBMA and RJC. If the SOR is not certified by these internationally-recognized schemes, attempts are made to contact the SOR to gain more information about their sourcing practices, including countries of origin and transfer, and whether there are any internal due diligence procedures in place or other processes to track the chain-of-custody on the source of the SOR’s mineral ores. Relevant information to review includes: whether the SOR has a documented, effective and communicated conflict free policy, an accounting system to support a mass balance of materials processed, and traceability documentation. Internet research is also performed to determine whether there are any outside sources of information regarding the SOR’s sourcing practices. • Step 5- Report on supply chain due diligence Helen of Troy reports annually on supply chain due diligence through the Form SD and this CMR filed with the Securities and Exchange Commission. The Form SD is publicly available at www.helenoftroy.com. 6. Steps to Improve Due Diligence Helen of Troy will endeavor to continuously improve upon its supply chain due diligence efforts via the following measures: • Continue to assess the presence of 3TG in its supply chain • Clearly communicate expectations with regard to supplier performance, transparency and sourcing • Maintain the response rate for the RCOI process • Continue to compare RCOI results to information collected via independent conflict free smelter validation programs 7. Product Determination Based on its RCOI process, Helen of Troy is unable to determine whether or not various components/materials, which contribute to products sold by its business segments, are DRC conflict free.

16 8. Independent Private Sector Audit Based on Helen of Troy’s declaration, a private sector audit is not required.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Siili Solutions Plc: Business review, 1 January–31 March 2024

- CallTower's Seanna Baumgartner Recognized as an Icon's Edge Top 10 Inspiring Leaders of 2024

- JuneX Capital Partners Launch “Founders Office“ with €100M Evergreen Fund to Back European Entrepreneurs in Human Capital and Investment Management

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share