Form SC14D9C Talend S.A. Filed by: Talend S.A.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement under Section 14(d)(4)

of the Securities Exchange Act of 1934

TALEND S.A.

(Name of Subject Company)

TALEND S.A.

(Name of Person(s) Filing Statement)

American Depository Shares, each representing one ordinary share, nominal value €0.08 per share; Ordinary Shares, nominal value €0.08 per share

(Title of Class of Securities)

874224207

(CUSIP Number of Class of Securities)

Christal Bemont

Chief Executive Officer

Talend S.A.

5-7, rue Salomon de Rothschild

Suresnes, France 92150

+33 (0) 1 46 25 06 00

(Name, address and telephone number of person authorized to receive notices and communications

on behalf of the person(s) filing statement)

With copies to:

Robert Ishii

Patrick Sandor

Wilson Sonsini Goodrich & Rosati, Professional Corporation

One Market Plaza

Spear Tower, Suite 3300

San Francisco, California 94105

(415) 947-2000

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

On March 10, 2021, Talend S.A., a société anonyme organized under the laws of France (the “Company” or “Talend”), issued a press release announcing the execution of a Memorandum of Understanding (the “MoU”) with Tahoe Bidco (Cayman), LLC, an exempted company incorporated under the laws of the Cayman Islands (“Parent”) and an affiliate of Thoma Bravo, L.P. (“Thoma Bravo”). It is contemplated that pursuant to the MoU, Parent and the Company shall pursue a series of transactions pursuant to which, among other transactions, Parent is seeking to acquire (through one or more of its affiliates) at least 80% of the issued and outstanding ordinary shares, nominal value of €0.08 per share, of the Company (the “Company Shares”), including American Depositary Shares representing Company Shares (the “ADSs”), and Company Shares issuable upon the exercise of any outstanding options, warrant, convertible securities or rights to purchase, subscribe for, or be allocated Company Shares, pursuant to a cash tender offer (the “Offer”).

This Schedule 14D-9 filing consists of the following documents related to the proposed Offer:

| (i) | Summary slides, first used June 8, 2021 (Exhibit 99.1) |

The information set forth under Items 1.01, 8.01 and 9.01 of Talend’s Current Report on Form 8-K filed by the Company on March 10, 2021 (including all exhibits attached thereto) is incorporated herein by reference.

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Talend S.A. (“Talend”) by Tahoe Bidco (Cayman), LLC, an exempted company incorporated under the laws of the Cayman Islands (“Parent”), Parent will commence, or will cause to be filed, a tender offer for all of the outstanding shares, American Depositary Shares, and other outstanding equity interests of Talend. The tender offer has not commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities of Talend. It is also not a substitute for the tender offer materials that Parent will file with the Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time that the tender offer is commenced, Parent will file tender offer materials on Schedule TO with the SEC, and Talend will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY TALEND’S SECURITY HOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer materials and the solicitation/recommendation statement will be made available to Talend’s investors and security holders free of charge. A free copy of the tender offer materials and the solicitation/recommendation statement will also be made available to all of Talend’s investors and security holders by contacting Talend at [email protected], or by visiting Talend’s website (www.talend.com). In addition, the tender offer materials and the solicitation/recommendation statement (and all other documents filed by Talend with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. TALEND’S investors and security holders ARE ADVISED TO READ THE TENDER OFFER MATERIALS AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED BY PARENT OR TALEND WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER. THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER, PARENT AND TALEND.

Forward-Looking Statements

This document contains certain statements that constitute forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the proposed transaction, the timing and benefits thereof, as well as other statements that are not historical fact. These forward-looking statements are based on currently available information, as well as Talend’s views and assumptions regarding future events as of the time such statements are being made. Such forward looking statements are subject to inherent risks and uncertainties. Accordingly, actual results may differ materially and adversely from those expressed or implied in such forward-looking statements. Such risks and uncertainties include, but are not limited to, the potential failure to satisfy conditions to the completion of the proposed transaction due to the failure to receive a sufficient number of tendered shares in the tender offer; the failure to obtain necessary regulatory or other approvals; the outcome of legal proceedings that may be instituted against Talend and/or others relating to the transaction; the possibility that competing offers will be made, risks associated with acquisitions, such as the risk that transaction may be more difficult, time-consuming or costly than expected or that the expected benefits of the transaction will not occur; as well as those described in cautionary statements contained elsewhere herein and in Talend’s periodic reports filed with the SEC including the statements set forth under “Risk Factors” set forth in Talend’s most recent annual report on Form 10-K, and any subsequent reports on Form 10-Q or form 8-K filed with the SEC, the Tender Offer Statement on Schedule TO (including the offer to purchase, the letter of transmittal and other documents relating to the tender offer) to be filed by Parent, and the Solicitation/Recommendation Statement on Schedule 14D-9 to be filed by Talend. As a result of these and other risks, the proposed transaction may not be completed on the timeframe expected or at all. These forward-looking statements reflect Talend’s expectations as of the date of this report. The forward-looking statements included in this communication are made only as of the date hereof. Talend assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Exhibit Index

|

Exhibit Number |

Description | |

| 99.1 | Summary slides, first used June 8, 2021 (Exhibit 99.1) | |

Exhibit 99.1

Supplemental Information Regarding Talend’s Proposed Acquisition by Thoma Bravo June 8, 2021

2 2 Talend + Thoma Bravo: Delivering Compelling, Certain Value for Talend Shareholders PROVIDES AN IMMEDIATE, COMPELLING CASH PREMIUM TO TALEND SHAREHOLDERS • 100% cash transaction • ~29% premium to Talend’s pre - announcement closing price • ~81% premium to VWAP over last twelve months prior to announcement CONSTITUTES AN ATTRACTIVE MULTIPLE RELATIVE TO TALEND’S HISTORICAL TRADING RANGE AND PRECEDENT TRANSACTIONS • Deal implies a 7.4x EV/NTM revenue multiple • 54% premium to Talend’s average multiple since 2019 until announcement • Highest multiple paid adjusted for growth and profitability , relative to precedent transactions (1) RESULT OF EXTENSIVE, MULTI - YEAR PROCESS LED BY HIGHLY - EXPERIENCED AND INDEPENDENT BOARD • Board periodically evaluated potential strategic alternatives relative to Talend’s standalone prospects • Engaged with 6 potentially interested parties in 2019 - 2020 on both a proactive and reactive basis • Given significant inbound interest in late 2020, conducted a targeted process (pre - announcement) involving 7 financial and strategic parties in 2021 , resulting in the Thoma Bravo transaction • Competitive process led to the submissions of indications by 3 parties and a ~27% increase from initial to final bid from Thoma Bravo GO - SHOP AND LOW TERMINATION FEE ENSURED ABILITY OF BOARD TO SOLICIT POTENTIALLY SUPERIOR BIDS TO THE THOMA BRAVO OFFER • Board negotiated a 30 - day Go - Shop period to provide assurances that Thoma Bravo’s offer was value maximizing • Conducted outreach to 66 strategic and financial parties resulting in discussions with 6 potential buyers ; however, no party submitted a proposal • Board negotiated a 2% termination fee during both the Go - Shop and post - Go - Shop period to minimize the obstacles to another party pursuing a superior offer RESPONSIVE TO FEEDBACK OF MAJOR PUBLIC SHAREHOLDERS • Over the course of the past 2+ years, several significant shareholders have encouraged the management team and Board to pursue a sale process Talend proposed to be acquired by Thoma Bravo , a leading private equity investment firm focused on the software and technology - enabled services sectors OVERVIEW OF THE TRANSACTION Talend proposed to become a private company; would maintain strong presence in both California and France ; corporate entity would be reincorporated in the Netherlands Transaction value of ~$2.4B (~€2.1B) including net debt POST - TRANSACTION 2 $66.00 per Talend ordinary share and ADS (each representing one ordinary share) in cash (1) Precedent transactions include selected public company transactions with equity values between $1 billion and $20 billion inv olv ing subscription software companies with NTM revenue growth rates less than 30% between July 2011 and March 2021.

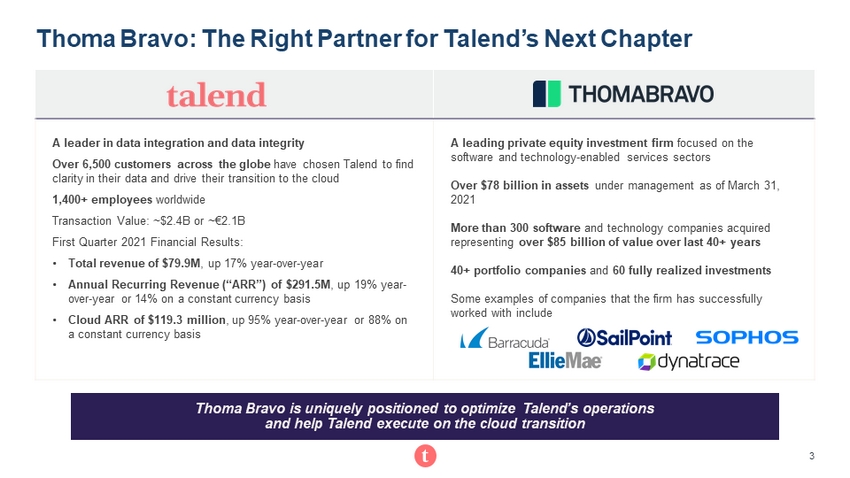

3 3 Thoma Bravo: The Right Partner for Talend’s Next Chapter A leader in data integration and data integrity Over 6,500 customers across the globe have chosen Talend to find clarity in their data and drive their transition to the cloud 1,400+ employees worldwide Transaction Value: ~$2.4B or ~€2.1B First Quarter 2021 Financial Results: • Total revenue of $79.9M , up 17% year - over - year • Annual Recurring Revenue (“ARR”) of $291.5M , up 19% year - over - year or 14% on a constant currency basis • Cloud ARR of $119.3 million , up 95% year - over - year or 88% on a constant currency basis A leading private equity investment firm focused on the software and technology - enabled services sectors Over $78 billion in assets under management as of March 31, 2021 More than 300 software and technology companies acquired representing over $85 billion of value over last 40+ years 40+ portfolio companies and 60 fully realized investments Some examples of companies that the firm has successfully worked with include 3 Thoma Bravo is uniquely positioned to optimize Talend’s operations and help Talend execute on the cloud transition

4 4 • Cash tender offer by Tahoe Bidco , B.V. (an affiliate of Thoma Bravo) to acquire all outstanding Ordinary Shares / ADSs of the Company • Subject to 80% tender condition (but may be reduced to as low as 67% in Thoma Bravo’s sole discretion) • Conditioned upon approval of 66.66% of shares voted at the GM, Talend SA transfers all assets and liabilities to Talend SAS in exchange for new ordinary shares in SAS • Talend will file a tax ruling in accordance with Article 209 II of the French Tax Code • Subject to consummation of Demerger and conditioned upon approval of 66.66% of shares voted at the GM, Talend SA will be merged into Tahoe AcquireCo BV, a Dutch private company wholly owned by Thoma Bravo • Non - tendering holders of Talend SA Ordinary Shares will own an equivalent proportional equity interest in AcquireCo • Tahoe AcquireCo BV will liquidate and any equity holders that are not affiliates of Thoma Bravo will receive consideration equal to that received in the Tender Offer • However, consideration will be made without interest and subject to applicable Tax Withholding Transaction Structure Overview 4 Tender Offer Demerger Into Talend SAS (France) Cross - Border Merger with Tahoe AcquireCo BV (Netherlands) Post - Merger Reorganization Subject of GM Proposals

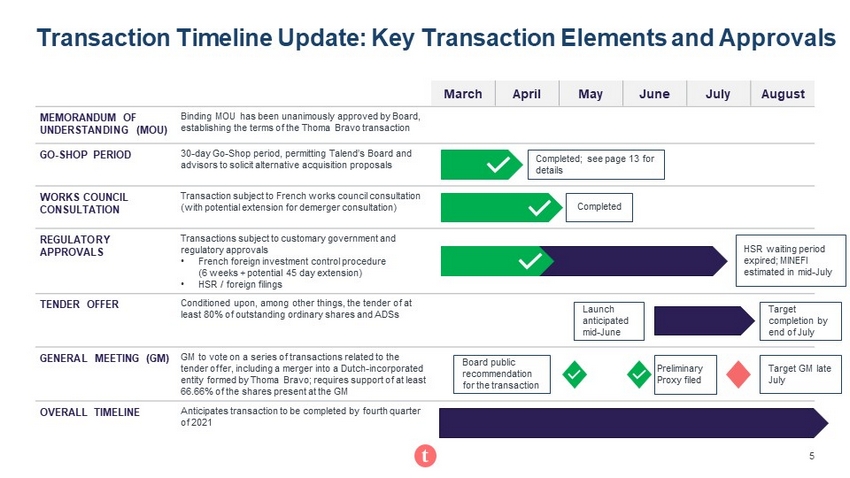

5 5 MEMORANDUM OF UNDERSTANDING (MOU) Binding MOU has been unanimously approved by Board, establishing the terms of the Thoma Bravo transaction GO - SHOP PERIOD 30 - day Go - Shop period, permitting Talend’s Board and advisors to solicit alternative acquisition proposals WORKS COUNCIL CONSULTATION Transaction subject to French works council consultation (with potential extension for demerger consultation) REGULATORY APPROVALS Transactions subject to customary government and regulatory approvals • French foreign investment control procedure (6 weeks + potential 45 day extension) • HSR / foreign filings TENDER OFFER Conditioned upon, among other things, the tender of at least 80% of outstanding ordinary shares and ADSs GENERAL MEETING (GM) GM to vote on a series of transactions related to the tender offer, including a merger into a Dutch - incorporated entity formed by Thoma Bravo; requires support of at least 66.66% of the shares present at the GM OVERALL TIMELINE Anticipates transaction to be completed by fourth quarter of 2021 Transaction Timeline Update: Key Transaction Elements and Approvals March April May June July August * 5 Completed HSR waiting period expired; MINEFI estimated in mid - July Launch in conjunction with preliminary proxy filing Target completion by end of July Board public recommendation for the transaction Target GM late July Completed; see page 13 for details Preliminary Proxy filed

6 6 General Meeting Ballot Items 6 Proposal Board Recommendation Detail 1 – 9. Approve the Appointment of Directors FOR • The directors are being nominated pursuant to Talend’s agreement with the Purchaser • 5 current Board members will resign subject to and effective as of the Offer Acceptance Time • At the Offer Acceptance Time, the Board will be comprised of 10 directors ─ Christal Bemont , Steve Singh and Pat Jones will remain on the Board as continuing directors through the completion of the transaction and, subject to the consummation of the Offer and the occurrence of the Offer Acceptance Time, Amy Coleman Redenbaugh , Kenneth Virning , Mike Hoffman, Elizabeth Yates, David Murphy, Kristen Nimsger and Jim Hagan will be added to the Board 10. Approve the Demerger FOR • Following the consummation of the Offer, Talend intends to transfer all of its assets and liabilities to a société par actions simplifiée organized under the Laws of France and wholly owned by Talend SA • As a result, Talend SAS would own all assets and liabilities of Talend 11. Approve Cross - Border Merger Agreement FOR • Following and subject to the consummation of the Demerger, a merger will be effectuated of Talend SA into Tahoe AcquireCo BV, a direct wholly owned subsidiary of the Purchaser • Upon completion of the merger, Talend will cease to exist as société anonyme organized under the laws of France and the surviving entity shall be the Tahoe AcquireCo BV 12. “Powers Proposal” FOR • Following the approval of the Demerger and Merger Agreements, approval of the “Powers Proposal” would give the Purchaser the power to carry out all filing and publications required by law

Appendix A Summary of the Background to the Transaction

8 8 THE TALEND PROCESS WAS LED BY OUR EXPERIENCED AND HIGHLY INDEPENDENT BOARD • All directors are independent other than the CEO (88% independent) • 6 of 7 independent directors have experience as C - level executives of public technology companies BOARD INITIATED A TRANSFORMATION PLAN IN 2018 TO CAPITALIZE ON TALEND’S TRANSITION TO THE CLOUD • Resulted in the appointment of 6 new executives – CEO, CFO, CMO, CRO, CCO, COO and CTO • Grew cloud ARR from $19M as of 12/31/2018 to $108M as of 12/31/2020 • Generated 24% total shareholder returns from CEO appointment in Jan - 2020 to the day prior to transaction announcement THE BOARD PERIODICALLY EVALUATED POTENTIAL VALUE - MAXIMIZING ALTERNATIVES RELATIVE TO TALEND’S STANDALONE PROSPECTS • Engaged with potential buyers both proactively and reactively over the course of the two years preceding the transaction • Focused engagement in 2019 did not yield interest competitive with Talend’s long - term standalone prospects • 2021 targeted process was initiated in response to significant inbound interest and highly competitive environment for enterprise software companies BOARD AND MANAGEMENT MAINTAINED CONSISTENT DIALOGUE WITH OUR SHAREHOLDERS • Several significant shareholders encouraged the Board to pursue strategic alternatives in the two years preceding the transaction Thorough, Multi - Year Process Led by an Experienced and Highly Independent Board 8 2019 EVALUATION OF ALTERNATIVES Phase 1 • The Board conducted outreach to and held management meetings with 3 parties ; all 3 parties declined to proceed 2020 INQUIRIES Phase 2 • Talend received inbound inquiries from 3 parties , indicating interest in business combinations • Interest continued to increase through the end of 2020 POST - ANNOUNCEMENT: GO - SHOP AND BEYOND Phase 4 • The Board negotiated a 30 - day Go - Shop period with Thoma Bravo, whereby it was permitted to actively solicit superior bids from other parties • During the Go - Shop period Talend contacted 66 parties regarding interest in a transaction; no superior offer was submitted • The Board negotiated a 2% termination fee for both the Go - Shop and post - Go - Shop period, minimizing obstacles to a superior offer 2021 TARGETED PROCESS Phase 3 • Board determined degree and breadth of interest warranted consideration • The Board conducted outreach to 7 parties regarding interest in an acquisition • The process resulted in 8 bids from 3 parties, culminating in an offer from Thoma Bravo that the Board believed offered compelling and certain value for shareholders Announced Thoma Bravo transaction (1) Includes multiple bids submitted by individual parties. The Board and management regularly reviewed Talend’s direction and business objectives, including various strategic alternatives that might be available to Talend

9 9 The Board Considered the Complexity and Uncertainty Associated with a Sale in Determining the Scope of Initial Outreach 9 Talend’s unique characteristics created several potential hurdles for potential acquirors, which informed the Board’s choices on the scope of the targeted process Significant size of investment (substantially capitalized with equity) that would be required to successfully complete a transaction Transactional complexity related to Talend’s structure as a French - incorporated société anonyme and any potential reincorporation Broad range of shareholder, stakeholder and regulatory approval requirements related to nexus with French, US and Dutch jurisdictions Selected Transaction Hurdles Maximize value for shareholders Ensure certainty of both reaching agreement and closing Selected Process Objectives Talend’s Board selected a targeted process that: • Incorporated the parties most likely to submit a value - maximizing offer • Provided the parties with sufficient time with management and advisors to gain comfort in their ability to consummate a transaction Maximize speed of process and minimize disruption to our business execution

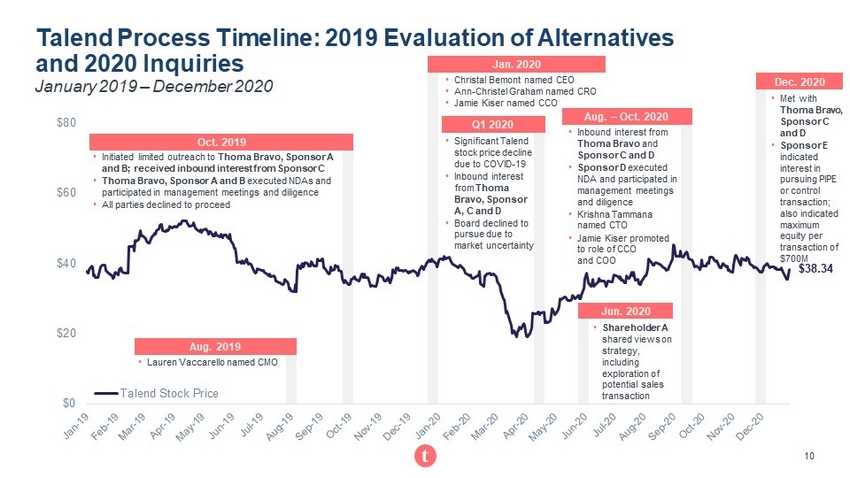

10 10 $0 $20 $40 $60 $80 Talend Stock Price Talend Process Timeline: 2019 Evaluation of Alternatives and 2020 Inquiries 10 $38.34 January 2019 – December 2020 Aug. 2019 Jan. 2020 • Initiated limited outreach to Thoma Bravo, Sponsor A and B; received inbound interest from Sponsor C • Thoma Bravo, Sponsor A and B executed NDAs and participated in management meetings and diligence • All parties declined to proceed • Lauren Vaccarello named CMO Oct. 2019 Dec. 2020 • Shareholder A shared views on strategy, including exploration of potential sales transaction • Christal Bemont named CEO • Ann - Christel Graham named CRO • Jamie Kiser named CCO Jun. 2020 • Inbound interest from Thoma Bravo and Sponsor C and D • Sponsor D executed NDA and participated in management meetings and diligence • Krishna Tammana named CTO • Jamie Kiser promoted to role of CCO and COO Aug. – Oct. 2020 • Met with Thoma Bravo, Sponsor C and D • Sponsor E indicated interest in pursuing PIPE or control transaction; also indicated maximum equity per transaction of $700M • Significant Talend stock price decline due to COVID - 19 • Inbound interest from Thoma Bravo, Sponsor A, C and D • Board declined to pursue due to market uncertainty Q1 2020

11 11 Talend released earnings on Feb. 10, 2021. Stock price increased 16% the following day. $30 $40 $50 $60 $70 Jan-21 Feb-21 Mar-21 Talend Stock Price Talend Process Timeline: Execution of Targeted Process Leading to Announcement of the Thoma Bravo Transaction 11 $51.30 January 2021 – March 2021 Jan. 7, 2021 • Met with Thoma Bravo Jan. 19, 2021 • Thoma Bravo submitted proposal of $52/share Jan. 22, 2021 • Conducted outreach to Strategic A and B and Sponsor C and D Jan. 25, 2021 • Thoma Bravo submitted revised proposal for $58/share Jan. 26, 2021 • Conducted outreach to Sponsor A, B and C • Sponsor D declined to proceed Jan. 28, 2021 • Sponsor C submitted LOI for $53 - $55/share • Sponsor C later declined to proceed Jan. 29, 2021 • Thoma Bravo submitted revised proposal for $59/share Feb. 2, 2021 • Sponsor A submitted IOI for $60.35/share • Thoma Bravo submitted revised proposal for $60/share • Sponsor B declined to proceed • Strategic B declined to proceed Feb. 11, 2021 • Sponsor A declined to proceed Feb. 24, 2021 • Thoma Bravo submitted revised proposal for $65/share Feb. 26, 2021 • Thoma Bravo submitted best and final proposal for $66/share “Go Shop Period” 30 Days Stock price increased 24% from the beginning of January 2021 to Feb. 10, 2021

12 12 Talend’s Process Created Significant Competitive Tension, Maximizing Value for our Shareholders 12 $52.00 $58.00 $53.00 $59.00 $60.00 $60.35 $65.00 $66.00 $55.00 $45 $50 $55 $60 $65 $70 • 3 of 7 parties contacted submitted indications of interest • In total, 8 indications and bids were submitted As a result of this process, the Board secured a 27% increase in per share/ADS consideration from initial Thoma Bravo bid Bidder Thoma Bravo Thoma Bravo Sponsor C Thoma Bravo Thoma Bravo Sponsor A Thoma Bravo Thoma Bravo Date January 19, 2021 January 25, 2021 January 28, 2021 January 29, 2021 February 2, 2021 February 2, 2021 February 24, 2021 February 26, 2021 % Spot Premium 30% 29% 23% - 28% 35% 37% 36% 22% 29% % Premium to LTM VWAP (1) 43% 59% 46% - 51% 62% 65% 66% 79% 81% +27% Increase Initial to Final (1) Preliminary bid premia relative to VWAP for last twelve months prior to announcement date.

13 13 Go - Shop Process Confirmed the Effectiveness of the Targeted Process 13 0 parties submitted a proposal 66 parties contacted, including 36 financial sponsors and 30 strategics 9 parties executed NDAs and received data room access 4 parties participated in management presentations 1 party participated in a follow - up meeting Go - Shop Outreach • The 2021 targeted process included the parties the Board and its advisors believed most likely to submit a value - maximizing offe r with a credible path to closing a transaction • To further ensure that all interested parties had the opportunity to pursue a superior offer, the Board negotiated a 30 - day post - announcement Go - Shop period • In addition, the Board negotiated a 2% termination fee across both the Go - Shop period and post - Go - Shop – minimizing the obstacles to a competitive offer

Appendix B Overview of the Board Recommendation and Reasons for the Offer

15 15 The Board Has Unanimously Recommended That Shareholders Accept Thoma Bravo’s Offer and Tender Their Shares 15 The transaction provides certain, immediate value and cash liquidity to shareholders The value of the transaction constitutes an attractive multiple relative to Talend’s historical trading range, precedent transactions and Talend’s standalone prospects The agreement with Thoma Bravo represents the culmination of outreach to potentially interested parties over an approximately 2 - year period The Go - Shop and 2% termination fee enabled the Board to solicit bids superior to Thoma Bravo’s offer; following extensive outreach a superior bid was not received The transaction is directly responsive to feedback from major Talend shareholders Note: Text on slide is summary only, please refer to the proxy for the full text.

16 16 Transaction Represents a Highly Attractive Premium and Multiple Relative to Talend’s Historical Trading 16 Talend ADS Trading Price (USD) Talend EV / NTM Revenue Multiple (1) - $20.00 $40.00 $60.00 $80.00 Jan-19 Apr-19 Aug-19 Dec-19 Mar-20 Jul-20 Nov-20 Mar-21 Trading Price Offer Price 1.0x 3.0x 5.0x 7.0x 9.0x Jan-19 Apr-19 Aug-19 Dec-19 Mar-20 Jul-20 Nov-20 Mar-21 EV / NTM Revenue Multiple Offer Multiple Offer Multiple: 7.4x Offer Price: $66.00 $51.30 5.6x Source: FactSet and Company filings. (1) NTM revenue based on current street consensus estimates. Premium to: 3/9/2021 29% 30 - day VWAP 29% 90 - day VWAP 50% LTM VWAP 81% Premium to Multiple: 3/9/2021 32% 90 - day Average 51% LTM Average 68% Avg. since 2019 54%

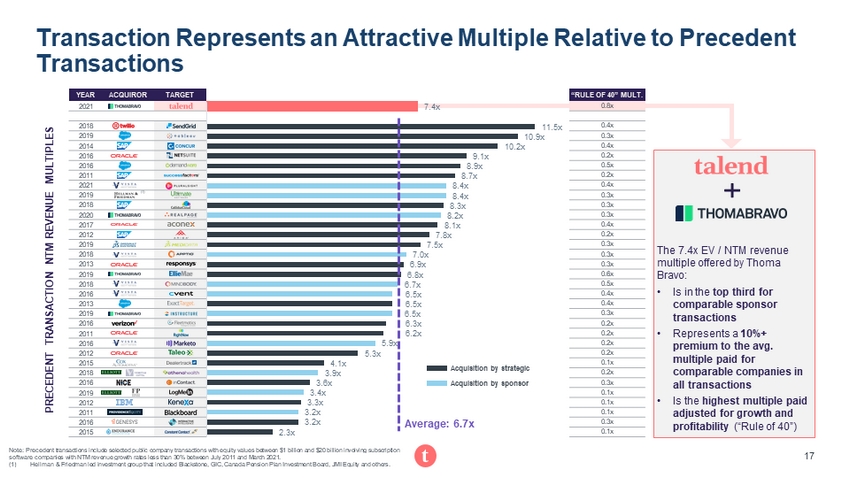

17 17 YEAR ACQUIROR TARGET 2021 2018 2019 2014 2016 2016 2011 2021 2019 2018 2020 2017 2012 2019 2018 2013 2019 2018 2016 2013 2019 2016 2011 2016 2012 2015 2018 2016 2019 2012 2011 2016 2015 Transaction Represents an Attractive Multiple Relative to Precedent Transactions 17 PRECEDENT TRANSACTION NTM REVENUE MULTIPLES 2.3 x 3.2 x 3.2 x 3.3 x 3.4 x 3.6 x 3.9 x 4.1 x 5.3 x 5.9 x 6.2 x 6.3 x 6.5 x 6.5 x 6.5 x 6.7 x 6.8 x 6.9 x 7 .0x 7.5 x 7.8 x 8.1 x 8.2 x 8.3 x 8.4 x 8.4 x 8.7 x 8.9 x 9.1 x 10.2 x 10.9 x 11.5 x 7.4 x The 7.4x EV / NTM revenue multiple offered by Thoma Bravo: • Is in the top third for comparable sponsor transactions • Represents a 10%+ premium to the avg. multiple paid for comparable companies in all transactions • Is the highest multiple paid adjusted for growth and profitability (“Rule of 40”) Note: Precedent transactions include selected public company transactions with equity values between $1 billion and $20 billi on involving subscription software companies with NTM revenue growth rates less than 30% between July 2011 and March 2021. (1) Hellman & Friedman led investment group that included Blackstone, GIC, Canada Pension Plan Investment Board, JMI Equity and o the rs. (1) Average: 6.7x “RULE OF 40” MULT. 0.8x 0.4x 0.3x 0.4x 0.2x 0.5x 0.2x 0.4x 0.3x 0.3x 0.3x 0.4x 0.2x 0.3x 0.3x 0.3x 0.6x 0.5x 0.4x 0.4x 0.3x 0.2x 0.2x 0.2x 0.2x 0.1x 0.2x 0.3x 0.1x 0.1x 0.1x 0.3x 0.1x Acquisition by strategic Acquisition by sponsor

18 18 Important Additional Information and Where to Find It In connection with the proposed acquisition of Talend S.A. (“Talend”) by Tahoe Bidco (Cayman), LLC, an exempted company incor por ated under the laws of the Cayman Islands (“Parent”), Parent will commence, or will cause to be filed, a tender offer for all of the outstanding shares, Am erican Depositary Shares, and other outstanding equity interests of Talend. The tender offer has not commenced. This communication is for informational purposes onl y and is neither an offer to purchase nor a solicitation of an offer to sell securities of Talend. It is also not a substitute for the tender offer materi als that Parent will file with the Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time that the tender offer is commenced, Parent wi ll file tender offer materials on Schedule TO with the SEC, and Talend will file a Solicitation/Recommendation Statement on Schedule 14D - 9 with the SEC with respe ct to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY TALEND’S SECURITY HOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer materials and the solicitation/recommendation statement will be made available to Talend’s investors and securit y h olders free of charge. A free copy of the tender offer materials and the solicitation/recommendation statement will also be made available to all of Talend’s inves tor s and security holders by contacting Talend at [email protected], or by visiting Talend’s website (www.talend.com). In addition, the tender offer materials and the so lic itation/recommendation statement (and all other documents filed by Talend with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon fili ng with the SEC. TALEND’S INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE TENDER OFFER MATERIALS AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED BY PARENT OR TALEND WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER. THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER, PARENT AND TALEND. Forward - Looking Statements This document contains certain statements that constitute forward - looking statements. These forward - looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the pro pos ed transaction, the timing and benefits thereof, as well as other statements that are not historical fact. These forward - looking statements are based on curren tly available information, as well as Talend’s views and assumptions regarding future events as of the time such statements are being made. Such forward looking st ate ments are subject to inherent risks and uncertainties. Accordingly, actual results may differ materially and adversely from those expressed or implied in s uch forward - looking statements. Such risks and uncertainties include, but are not limited to, the potential failure to satisfy conditions to the completion of the propo sed transaction due to the failure to receive a sufficient number of tendered shares in the tender offer; the failure to obtain necessary regulatory or other approvals; the out come of legal proceedings that may be instituted against Talend and/or others relating to the transaction; the possibility that competing offers will be made, risk s a ssociated with acquisitions, such as the risk that transaction may be more difficult, time - consuming or costly than expected or that the expected benefits of the transaction will not occur; as well as those described in cautionary statements contained elsewhere herein and in Talend’s periodic reports filed with the SEC including t he statements set forth under “Risk Factors” set forth in Talend’s most recent annual report on Form 10 - K, and any subsequent reports on Form 10 - Q or form 8 - K filed with the SEC, the Tender Offer Statement on Schedule TO (including the offer to purchase, the letter of transmittal and other documents relating to the tend er offer) to be filed by Parent, and the Solicitation/Recommendation Statement on Schedule 14D - 9 to be filed by Talend. As a result of these and other risks, the propose d transaction may not be completed on the timeframe expected or at all. These forward - looking statements reflect Talend’s expectations as of the date of this report. The forward - looking statements included in this communication are made only as of the date hereof. Talend assumes no obligation and does not inte nd to update these forward - looking statements, except as required by law. 18

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- StateHouse Provides an Update on Application for Management Cease Trade Order

- Notice of 2024 First Quarter Results Conference Call and Webcast for Investors and Analysts and Annual Meeting of Shareholders

- RiverNorth Opportunities Fund, Inc., RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. and RiverNorth Capital and Income Fund, Inc. Announce Preferred Dividends

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share