Form SC14D9C F-star Therapeutics, Filed by: F-star Therapeutics, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(D)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

F-Star Therapeutics, Inc.

(Name of Subject Company)

F-Star Therapeutics, Inc.

(Names of Person Filing Statement)

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

30315R107

(CUSIP Number)

Eliot Forster

Chief Executive Officer

Eddeva B920

Babraham Research Campus

Cambridge, CB22 3AT, United Kingdom

+44-1223-497400

(Name, Address and Telephone Number of Person Authorized to Receive Notice and Communications

on Behalf of the Person Filing Statement)

Copies To:

William C. Hicks, Esq.

Matthew Gardella, Esq.

Mintz, Levin, Cohn, Ferris,

Glovsky and Popeo P.C.

One Financial Center

Boston, MA 02111

617-542-6000

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9 filing relates solely to preliminary communications made before the commencement of a planned cash tender offer (the “Offer”) by invoX Pharma Limited, a private limited company organized under the laws of England and Wales (“Parent”) and Fennec Acquisition Incorporated, a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), to acquire all of the issued and outstanding shares of the common stock, par value $0.0001 per share, of F-star Therapeutics, Inc., a Delaware corporation (the “Company”), to be commenced pursuant to the Agreement and Plan of Merger, dated as of June 22, 2022, by and among Parent, Purchaser, the Company and Sino Biopharmaceutical Limited, a company organized under the laws of the Cayman Islands (the “Merger Agreement”). Upon the consummation of the Offer, Purchaser will merge with and into the Company (the “Merger”) pursuant to Section 251(h) of the Delaware General Corporation Law with the Company as the surviving corporation.

| • | Exhibit 99.1: Email from Eliot Forster, Chief Executive Officer of the Company to commercial partners on June 23, 2022 |

| • | Exhibit 99.2: Email from Eliot Forster, Chief Executive Officer of the Company to staff on June 23, 2022 |

| • | Exhibit 99.3: Announcements by the Company and the Company’s management via LinkedIn on June 23, 2022 |

| • | Exhibit 99.4: Announcements by the Company and the Company’s management via Twitter on June 23, 2022 |

| • | Exhibit 99.5: Presentation by the Company at Employee Meeting on June 23, 2022 |

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. These forward-looking statements include, without limitation, statements related to the anticipated consummation of the acquisition of the Company and the timing and benefits thereof, and other statements that are not historical facts. These forward-looking statements are based on Parent’s and the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the parties’ ability to complete the transaction on the proposed terms and schedule; whether the tender offer conditions will be satisfied; whether sufficient stockholders of the Company tender their shares in the transaction; the outcome of legal proceedings that may be instituted against the Company and/or others relating to the transaction; the failure (or delay) to receive the required regulatory approvals relating to the transaction; the possibility that competing offers will be made; and other risks related to the Company’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s filings and reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and subsequent quarterly and current reports filed with the SEC. The risks and uncertainties may be amplified by the Russian invasion of Ukraine and the ongoing COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which these factors impact the Company’s business, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration of the conflict in Ukraine, the duration and spread of the COVID-19 outbreak, the spread of any new variants of COVID-19, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The Company undertakes no duty or obligation to update any forward-looking statements contained in this communication as a result of new information, future events or changes in their expectations, except as required by law.

Additional Information and Where to Find It

The Offer has not yet commenced, and this communication is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Company or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Parent and Purchaser, and a Solicitation / Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Company. The offer to purchase shares of Company common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION / RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR COMMON STOCK, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement. Investors may also obtain, at no charge, the documents filed or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.f-star.com.

Exhibit 99.1

Email from Eliot Forster, Chief Executive Officer of the Company to commercial partners on June 23, 2022

Dear X,

I’m writing to share the exciting news that invoX Pharma will acquire F-star’s pioneering next generation bispecific discovery platform. The transaction is expected to close in the second half of 2022.

This is great news for patients, for our team, and our shareholders, with invoX putting F-star at the heart of their international centre of excellence in antibody research and clinical development. It will enable greater and longer-term opportunities to develop the F-star platform as we work together towards a future free from cancer and other serious diseases.

We’re still early on in the process and will keep you updated as the transaction progresses. Your support and collaboration have been an important part of us achieving this milestone and I would like to share my thanks.

Details of our announcement today are [here]. If you have any queries, please do let me know.

With best wishes,

EF

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. These forward-looking statements include, without limitation, statements related to the anticipated consummation of the acquisition of the Company and the timing and benefits thereof, and other statements that are not historical facts. These forward-looking statements are based on Parent’s and the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the parties’ ability to complete the transaction on the proposed terms and schedule; whether the tender offer conditions will be satisfied; whether sufficient stockholders of the Company tender their shares in the transaction; the outcome of legal proceedings that may be instituted against the Company and/or others relating to the transaction; the failure (or delay) to receive the required regulatory approvals relating to the transaction; the possibility that competing offers will be made; and other risks related to the Company’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s filings and reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and subsequent quarterly and current reports filed with the SEC. The risks and uncertainties may be amplified by the Russian invasion of Ukraine and the ongoing COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which these factors impact the Company’s business, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration of the conflict in Ukraine, the duration and spread of the COVID-19 outbreak, the spread of any new variants of COVID-19, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The Company undertakes no duty or obligation to update any forward-looking statements contained in this communication as a result of new information, future events or changes in their expectations, except as required by law.

Additional Information and Where to Find It

The Offer has not yet commenced, and this communication is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Company or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Parent and Purchaser, and a Solicitation / Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Company. The offer to purchase

shares of Company common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION / RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR COMMON STOCK, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement. Investors may also obtain, at no charge, the documents filed or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.f-star.com.

Exhibit 99.2

Email from Eliot Forster, Chief Executive Officer of the Company to staff on June 23, 2022

Dear all,

Many thanks to those of you who joined us a little earlier to hear the exciting news that invoX will acquire F-star Therapeutics Inc, and along with it the talent and capabilities driving and supporting our pioneering next generation bispecific discovery platform.

For those unable to join us, the news release is here. Neil and other members of the leadership team will be available at 1pm UK time tomorrow for a drop in session. Joining details below.

This is great news for patients as we work together towards a future free from cancer and other serious diseases. It enables greater and longer-term opportunities to develop the F-star platform, accelerating our pace and unlocking even more potential.

We’re still early on in the process and will keep you updated as the transaction progresses. The most important thing is for us all to carry on delivering and supporting great science and clinical research.

While we might not have all the answers to your questions right now, please do be in touch with any immediate queries. Email [email protected].

With best wishes,

EF

**********************************************************

Q&A FOR STAFF

| • | What has been announced? |

We announced today that a deal has been agreed for invoX Pharma, a subsidiary of Sino Biopharm, to acquire F-star’s pioneering next generation bispecific discovery platform at $7.12 per share, with a valuation of approximately $161m.

| • | Who are Sino Biopharm and invoX? |

Sino Biopharm are a top 40 global biopharmaceutical company, headquartered in Hong Kong and listed on the Hong Kong Stock Exchange. invoX are their wholly owned UK subsidiary responsible for their growth strategy outside of China.

| • | Will there be staff changes? |

Your talent and expertise are a big reason for invoX’s interest in this acquisition, and your skills complement their existing expertise in biologics and bring in new areas of specialism they don’t currently have across the wider business.

| • | Will there be changes in the Leadership team? |

Leadership level changes are very common in these sorts of transactions. Once the deal is complete, we’re excited to say that Neil Brewis will lead F-star, while Eliot Forster and Darlene Deptula-Hicks will leave the company after a short time. There will be an important focus on ensuring a stable transition during this time.

| • | Why are invoX interested in acquiring us? |

They see the value of our pipeline, platform and people to build out their own international growth strategy.

| • | Will invoX support our strategy or will it change? |

Our strategy continues but it can have a wider horizon with our overall aim of delivering our pipeline, and future programs, to commercial launch.

| • | What happens to our programs and partners? Should we continue with our planned work and business interactions? |

Yes, our programs and partnerships continue as planned. We’re in a critical phase of delivery and it’s important that we maintain momentum to deliver against our plans and goals. We need you to carry on delivering and supporting the delivery of excellent science and clinical research, as you’ve always done.

| • | What happens to the F-star name/brand? |

The F-star name and brand continues unchanged.

| • | Will we remain a public Company with a US presence? |

Once the transaction closes, F-star will no longer be a public company listed on NASDAQ in the US, and we’ll become a wholly owned subsidiary of invoX, with an ongoing US presence.

| • | What are the timings/process? What happens next? |

The Board agreed to proceed with the sale of the Company yesterday, subject to approvals and other customary closing conditions. There is a strict process to follow and we anticipate the deal will close in the second half of this year. Until the transaction is closed the two companies will continue to operate as separate independent entities.

| • | What will happen to my stock in F-star? |

Upon closing of this transaction, all stock option vesting will be ‘fully accelerated’, such that you will be 100% vested in your stock options. You will then receive cash in the amount of the difference between $7.12 USD and your option grant price, less applicable taxes. ‘Black out’ rules remain in force.

| • | What will happen to our benefits? |

F-star’s staff benefits (or substantially comparable benefits) will remain in place.

| • | What should I do if I’m contacted by an external party such as the media or an investor? |

Please refer any incoming enquiries from media or investors to Darlene, our CFO.

| • | Who can I contact if I have questions related to this transaction? |

Please email [email protected] with any queries you have and we’ll do our best to answer them.

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. These forward-looking statements include, without limitation, statements related to the anticipated consummation of the acquisition of the Company and the timing and benefits thereof, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the parties’ ability to complete the transaction on the proposed terms and schedule; whether the tender offer conditions will be satisfied; whether sufficient stockholders of the Company tender their shares in the transaction; the outcome of legal proceedings that may be instituted against the Company and/or others relating to the transaction; the failure (or delay) to receive the required regulatory approvals relating to the transaction; the possibility that competing offers will be made; and other risks related to Company’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in Company’s SEC filings and reports, including their respective Annual Reports on Form 10-K for the year ended December 31, 2021 and subsequent quarterly and current reports filed with the SEC. The risks and uncertainties may be amplified by the Russian invasion of Ukraine and the ongoing COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which these factors impact Company’s business, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration of the conflict in Ukraine, the duration and spread of the COVID-19 outbreak, the spread of any new variants of COVID-19, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Company undertakes no duty or obligation to update any forward-looking statements contained in this report as a result of new information, future events or changes in their expectations, except as required by law.

Additional Information and Where to Find It

The Offer has not yet commenced, and this communication is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Company or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Parent and Purchaser, and a Solicitation / Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Company. The offer to purchase shares of Company common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION / RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR COMMON STOCK, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement. Investors may also obtain, at no charge, the documents filed or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.f-star.com.

Exhibit 99.3

Announcements by the Company and the Company’s management via LinkedIn on June 23, 2022

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. These forward-looking statements include, without limitation, statements related to the anticipated consummation of the acquisition of the Company and the timing and benefits thereof, and other statements that are not historical facts. These forward-looking statements are based on Parent’s and the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the parties’ ability to complete the transaction on the proposed terms and schedule; whether the tender offer conditions will be satisfied; whether sufficient stockholders of the Company tender their shares in the transaction; the outcome of legal proceedings that may be instituted against the Company and/or others relating to the transaction; the failure (or delay) to receive the required regulatory approvals relating to the transaction; the possibility that competing offers will be made; and other risks related to the Company’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s filings and reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and subsequent quarterly and current reports filed with the SEC. The risks and uncertainties may be amplified by the Russian invasion of Ukraine and the ongoing COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which these factors impact the Company’s business, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration of the conflict in Ukraine, the duration and spread of the COVID-19 outbreak, the spread of any new variants of COVID-19, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The Company undertakes no duty or obligation to update any forward-looking statements contained in this communication as a result of new information, future events or changes in their expectations, except as required by law.

Additional Information and Where to Find It

The Offer has not yet commenced, and this communication is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Company or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Parent and Purchaser, and a Solicitation / Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Company. The offer to purchase shares of Company common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION / RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR COMMON STOCK, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement. Investors may also obtain, at no charge, the documents filed or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.f-star.com.

Exhibit 99.4

Announcements by the Company and the Company’s management via Twitter on June 23, 2022

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. These forward-looking statements include, without limitation, statements related to the anticipated consummation of the acquisition of the Company and the timing and benefits thereof, and other statements that are not historical facts. These forward-looking statements are based on Parent’s and the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the parties’ ability to complete the transaction on the proposed terms and schedule; whether the tender offer conditions will be satisfied; whether sufficient stockholders of the Company tender their shares in the transaction; the outcome of legal proceedings that may be instituted against the Company and/or others relating to the transaction; the failure (or delay) to receive the required regulatory approvals relating to the transaction; the possibility that competing offers will be made; and other risks related to the Company’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s filings and reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and subsequent quarterly and current reports filed with the SEC. The risks and uncertainties may be amplified by the Russian invasion of Ukraine and the ongoing COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which these factors impact the Company’s business, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration of the conflict in Ukraine, the duration and spread of the COVID-19 outbreak, the spread of any new variants of COVID-19, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The Company undertakes no duty or obligation to update any forward-looking statements contained in this communication as a result of new information, future events or changes in their expectations, except as required by law.

Additional Information and Where to Find It

The Offer has not yet commenced, and this communication is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Company or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Parent and Purchaser, and a Solicitation / Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Company. The offer to purchase shares of Company common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION / RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR COMMON STOCK, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement. Investors may also obtain, at no charge, the documents filed or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.f-star.com.

Exhibit 99.5

Presentation by the Company at Employee Meeting on June 23, 2022

Company Introduction June 2022

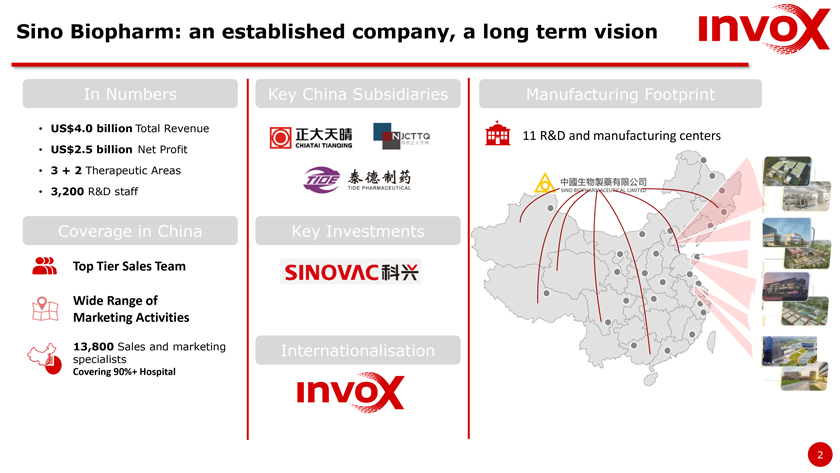

Sino Biopharm: an established company, a long term vision In Numbers Key China Subsidiaries Manufacturing Footprint • US$4.0 billion Total Revenue 11 R&D and manufacturing centers • US$2.5 billion Net Profit • 3 + 2 Therapeutic Areas • 3,200 R&D staff Coverage in China Key Investments er Sales Team Range of ting Activities Sales and marketing Internationalisation Globalization specialists 90%+ Hospital

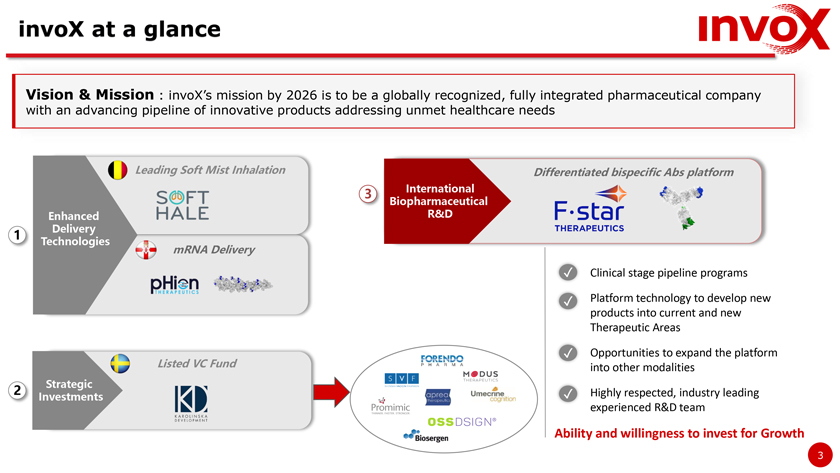

invoX at a glance Vision & Mission invoX’s mission by 2026 is to be a globally recognized, fully integrated pharmaceutical company with an advancing pipeline of innovative products addressing unmet healthcare needs Leading Soft Mist Inhalation Differentiated bispecific Abs platform 3 International Biopharmaceutical Enhanced R&D 1 Delivery Technologies mRNA Delivery Clinical stage pipeline programs Platform technology to develop new products into current and new Therapeutic Areas Listed VC Fund Opportunities to expand the platform into other modalities 2 Strategic Investments Highly respected, industry leading experienced R&D team Ability and willingness to invest for Growth

Forward-Looking Statements

This communication contains forward-looking statements. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. These forward-looking statements include, without limitation, statements related to the anticipated consummation of the acquisition of the Company and the timing and benefits thereof, and other statements that are not historical facts. These forward-looking statements are based on Parent’s and the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the parties’ ability to complete the transaction on the proposed terms and schedule; whether the tender offer conditions will be satisfied; whether sufficient stockholders of the Company tender their shares in the transaction; the outcome of legal proceedings that may be instituted against the Company and/or others relating to the transaction; the failure (or delay) to receive the required regulatory approvals relating to the transaction; the possibility that competing offers will be made; and other risks related to the Company’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in the Company’s filings and reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and subsequent quarterly and current reports filed with the SEC. The risks and uncertainties may be amplified by the Russian invasion of Ukraine and the ongoing COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which these factors impact the Company’s business, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration of the conflict in Ukraine, the duration and spread of the COVID-19 outbreak, the spread of any new variants of COVID-19, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The Company undertakes no duty or obligation to update any forward-looking statements contained in this communication as a result of new information, future events or changes in their expectations, except as required by law.

Additional Information and Where to Find It

The Offer has not yet commenced, and this communication is neither a recommendation, nor an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of the Company or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the SEC by Parent and Purchaser, and a Solicitation / Recommendation Statement on Schedule 14D-9 will be filed with the SEC by the Company. The offer to purchase shares of Company common stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION / RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR COMMON STOCK, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement. Investors may also obtain, at no charge, the documents filed or furnished to the SEC by the Company under the “Investors” section of the Company’s website at www.f-star.com.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Tiger Aesthetics Medical, LLC Acquires Assets of Sientra, Inc.

- Revolutionizing Skincare: Pure Pro Aesthetics Unveils Groundbreaking Exosome LLT Pro Solution from Isov Sorex

- mF International Limited Announces Closing of Initial Public Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share