Form SC 13E3/A LINE Corp Filed by: LINE Corp

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3/A

(Rule 13e-100)

(Amendment No. 11)

TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 13e-3 THEREUNDER

Rule 13e-3 Transaction Statement under Section 13(e)

of the Securities Exchange Act of 1934

LINE CORPORATION

(Name of the Issuer)

| LINE CORPORATION | NAVER CORPORATION NAVER J. HUB CORPORATION |

SOFTBANK CORP. |

(Name of Persons Filing Statement)

Shares of common stock, no par value (“Common Shares”)

American Depositary Shares, each representing one Common Share (“ADSs”)

(Title of Classes of Securities)

ISIN JP3966750006 (Common Shares)

CUSIP 53567X101 (ADSs)

(CUSIP Number of Class of Securities)

| LINE Corporation JR Shinjuku Miraina Tower, 23rd Floor 4-1-6 Shinjuku Shinjuku-ku, Tokyo, 160-0022, Japan Phone Number: +81-3-4316-2050 Attention: Mr. Satoshi Yano |

c/o NAVER Corporation 6, Buljeong-ro, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea Phone Number: +82-1588-3830 Attention: Mr. Jemin Ryoo |

SoftBank Corp. 1-9-1 Higashi-shimbashi Tokyo Shiodome Bldg. Minato-ku, Tokyo, Japan Phone Number: +81-3-6889-2000 Attention: Mr. Hideyuki Sato |

(Name, Address and Telephone Numbers of Person Authorized To Receive Notices and Communications on Behalf of the Persons Filing Statement)

With copies to:

| Toshiro Mochizuki, Esq. Shearman & Sterling LLP Fukoku Seimei Building, 9th Floor 2-2-2 Uchisaiwaicho Chiyoda-ku, Tokyo 100-0011, Japan Phone Number: +81-3-5251-1601 |

Paul J. Shim, Esq. Cleary Gottlieb Steen & One Liberty Plaza New York, NY 10006 Phone

Number: |

Sang Jin Han, Esq. Cleary Gottlieb Steen & 19F Ferrum Tower 19, Eulji-ro 5-gil, Jung-gu, Seoul, Korea Phone Number: |

Ian C. Ho, Esq. Simpson Thacher & 35th Floor, ICBC Tower 3 Garden Road, Central, Hong Kong Phone Number: |

This statement is filed in connection with (check the appropriate box):

| a. | ☐ | The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. | ||

| b. | ☐ | The filing of a registration statement under the Securities Act of 1933. | ||

| c. | ☒ | A tender offer. | ||

| d. | ☐ | None of the above. | ||

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

Calculation of Filing Fee

| Transaction Valuation* | Amount of Filing Fee** | |

|

U.S. $701,797,884.75

|

U.S. $91,093.37

|

| * | Estimated for purposes of calculating the filing fee only. The transaction valuation was calculated by adding (i) the product of (x) 11,583,418, the number of Common Shares estimated to be held by U.S. holders (as that term is defined under instruction 2 to paragraphs (c) and (d) of Rule 14d-1 under the U.S. Securities Exchange Act of 1934, as amended) as of June 30, 2020, which represents the maximum number of Common Shares that can be purchased pursuant to the U.S. Offer to Purchase, multiplied by (y) the offer price of JPY 5,380 per Common Share as converted into U.S. dollars based on an exchange rate of U.S. $1.00 = JPY 105.810, the spot U.S. dollar/Japanese yen exchange rate at 10:00 a.m., Japan Standard Time, on July 27, 2020, as reported by Bloomberg L.P., and (ii) the product of (x) 2,217,917, the number of ADSs outstanding as of the close of business on July 24, 2020, which represents the maximum number of ADSs that can be purchased pursuant to the U.S. Offer to Purchase, multiplied by (y) the offer price of JPY 5,380 per ADS as converted into U.S. dollars based on an exchange rate of U.S. $1.00 = JPY 105.810, the spot U.S. dollar/Japanese yen exchange rate at 10:00 a.m., Japan Standard Time, on July 27, 2020, as reported by Bloomberg L.P. |

| ** | The filing fee was calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory No. 1 for Fiscal Year 2020, issued August 23, 2019, by multiplying the transaction valuation by 0.0001298. |

| ☒ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing. |

| Amount Previously Paid: |

U.S. $91,093.37 | |

| Form or Registration No: |

Schedule TO | |

| Filing Party: |

NAVER Corporation | |

| Date Filed: |

May 27, 2020, August 3, 2020 |

Neither the Securities and Exchange Commission nor any state securities commission has: approved or disapproved of the transaction contemplated herein; passed upon the merits or fairness of such transaction; or passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

This Amendment No. 11 to Schedule 13E-3 (the “Amendment”) amends and supplements the transaction statement filed as Amendment No. 3 to Schedule 13E-3 on August 3, 2020, as amended and supplemented prior to the date hereof (the “Existing Schedule 13E-3”, and as further amended and supplemented by this Amendment, the “Schedule 13E-3”). This Schedule 13E-3 is being filed with the U.S. Securities and Exchange Commission pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), by (i) LINE Corporation, a Japanese corporation (kabushiki kaisha) (“LINE”) listed on the New York Stock Exchange and the First Section of the Tokyo Stock Exchange (the “TSE”) and a consolidated subsidiary of NAVER Corporation, a Korean corporation (jusik hoesa) (“NAVER”) listed on the Korea Exchange, (ii) NAVER, (iii) NAVER J. Hub Corporation, a Japanese corporation (kabushiki kaisha) and a direct wholly owned subsidiary of NAVER (“NAVER Purchaser”), and (iv) SoftBank Corp., a Japanese corporation (kabushiki kaisha) (“SoftBank”, and together with NAVER Purchaser, the “Purchasers”) listed on the First Section of the TSE (LINE, NAVER and the Purchasers collectively, the “Filing Persons”, and each, a “Filing Person”). This Schedule 13E-3 relates to the joint offer by NAVER Purchaser and SoftBank to purchase (the “U.S. Offer”):

| (i) | up to 100% of the outstanding shares of common stock, no par value (collectively, the “Common Shares”, and each, a “Common Share”), of LINE that are held by U.S. holders (as that term is defined under instruction 2 to paragraphs (c) and (d) of Rule 14d-1 under the Exchange Act) (such holders collectively, “U.S. Holders”), and |

| (ii) | up to 100% of the outstanding American Depositary Shares representing Common Shares (collectively, the “ADSs”, and each, an “ADS”), each ADS representing one Common Share, from all holders, wherever located, |

at a purchase price of JPY 5,380 per Common Share and per ADS (which is equivalent to U.S. $51.06 per ADS based on an exchange rate of U.S. $1.00 = JPY 105.365, the spot U.S. dollar/Japanese yen exchange rate at 10:00 a.m., Japan Standard Time, on September 16, 2020, as reported by Bloomberg L.P., rounded to the nearest whole cent), in each case, in cash, without interest, upon the terms and subject to the conditions set forth in the U.S. Offer to Purchase, dated August 3, 2020 (the “U.S. Offer to Purchase”), and in the accompanying Common Share Acceptance Letter or the ADS Letter of Transmittal, as applicable.

Simultaneously with the U.S. Offer, the Purchasers made an offer in Japan in accordance with the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended from time to time) to purchase up to 100% of the outstanding Common Shares, options for the purchase of Common Shares (the “Options”) and zero-coupon convertible bonds due 2023 (the “2023 Bonds”) and zero-coupon convertible bonds due 2025 (the “2025 Bonds”, and together with the 2023 Bonds, the “Convertible Bonds”) issued by LINE, from all holders of Common Shares, Options or Convertible Bonds who are not U.S. Holders, subject to certain restrictions (the “Japan Offer”, and together with the U.S. Offer, the “Offers”). The offer for Common Shares in the Japan Offer was for the same price and on substantially the same terms as offered to purchase Common Shares and ADSs in the U.S. Offer.

The Offers were made pursuant to the business integration agreement, dated as of December 23, 2019 (the “Business Integration Agreement”), by and among NAVER, LINE, SoftBank and Z Holdings Corporation (collectively, the “Business Integration Parties”), a Japanese corporation (kabushiki kaisha) listed on the First Section of the TSE and a consolidated subsidiary of SoftBank, and the transaction agreement, dated as of December 23, 2019, by and between NAVER and SoftBank. The Offers expired on September 15, 2020 and the Purchasers completed the settlement of the Offers on September 24, 2020.

Except as otherwise set forth in this Amendment, the information set forth in the Existing Schedule 13E-3 remains unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment. This Amendment should be read together with the Existing Schedule 13E-3. All information contained in, or incorporated by reference into, this Schedule 13E-3 concerning each Filing Person has been supplied by such Filing Person and no Filing Person has produced any disclosure with respect to any other Filing Persons.

1

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS

ITEM 7. PURPOSES, ALTERNATIVES, REASONS AND EFFECTS

Items 6 and 7 are hereby amended and supplemented to include the following:

On November 24, 2020, LINE announced that it will redeem on December 14, 2020 all of the outstanding Convertible Bonds, which as of November 20, 2020 had an aggregate principal amount of JPY 146.32 billion, pursuant to the terms and conditions of the Convertible Bonds. The 2023 Bonds will be redeemed at a price of JPY 10,138,280 per face value of JPY 10,000,000, and the 2025 Bonds will be redeemed at a price of JPY 10,170,188 per face value of JPY 10,000,000. As of the date hereof, the conversion price for the 2023 Bonds and the 2025 Bonds was JPY 5,830.1 per Common Share and JPY 5,602.5 per Common Share, respectively. On November 20, 2020, the aggregate principal amount of the 2023 Bonds outstanding was JPY 73.16 billion, of which NAVER held JPY 36.58 billion, the aggregate principal amount of the 2025 Bonds outstanding was JPY 73.16 billion, of which NAVER held JPY 36.58 billion, and the closing price of the Common Shares, as derived from Bloomberg, was JPY 5,380.

On November 25, 2020, LINE distributed to its shareholders a convocation notice, attached as Exhibit (a)(5)(xxiii) hereto, regarding an extraordinary general meeting of shareholders scheduled to be convened on December 15, 2020. As previously announced by LINE on November 9, 2020, at the extraordinary general meeting of shareholders, shareholders will vote on proposals to (i) conduct a Share Consolidation (as defined below) and (ii) delete provisions regarding the number of Common Shares constituting one unit and partially amend LINE’s articles of incorporation.

Under the Business Integration Agreement, the Business Integration Parties agreed that, following the consummation of the Offers, any remaining holders of Common Shares or ADSs will be eliminated by a share consolidation of the Common Shares pursuant to the Business Integration Agreement and the Companies Act of Japan (the “Japan Companies Act”) or other available squeeze-out procedures, with the intended result that, following such procedures and any other adjustment procedures, NAVER and the Purchasers will be the only shareholders of LINE. Subject to the approval of LINE’s shareholders at the extraordinary general meeting of shareholders, the share consolidation (the “Share Consolidation”) will be implemented based on a share consolidation ratio of 29,165,333:1, pursuant to which the number of Common Shares held by shareholders other than NAVER (including Common Shares underlying ADSs) would become a fraction of less than one share. After the Share Consolidation, the Purchasers will receive the number of Common Shares equivalent to the total sum of the fractions of Common Shares held by all shareholders in exchange for an amount equal to such total multiplied by the share consolidation ratio of the Share Consolidation multiplied by the offer price for Common Shares in the Offers of JPY 5,380 per Common Share, subject to the permission of a Japanese court in accordance with the procedures stipulated in Article 235 of the Japan Companies Act and other relevant laws and regulations. The holders of Common Shares and ADSs other than NAVER and the Purchasers will receive such amount in proportion to their respective fractional shares (which amount shall, in the case of ADSs, be subject to conversion into U.S. dollars based on the spot U.S. dollar/Japanese yen exchange rate specified by JPMorgan Chase Bank, N.A., in its capacity as the depositary for the ADSs, and be less the amount of any fees (including any currency conversion fees), expenses and withholding taxes that may be applicable, including a fee of up to U.S. $5.00 for each 100 ADSs (or portion thereof)).

2

ITEM 16. EXHIBITS

Item 16 is hereby amended and supplemented by adding the following exhibits:

| Exhibit No. |

Description | |

| (a)(5)(xxii) | Press Release issued by LINE, dated November 24, 2020 (incorporated by reference to the Form 6-K furnished by LINE on November 24, 2020). | |

| (a)(5)(xxiii) | LINE Notice of the Extraordinary General Meeting of Shareholders, dated November 25, 2020. | |

3

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 25, 2020

| LINE CORPORATION | ||

| By: | /s/ In Joon Hwang | |

| Name: | In Joon Hwang | |

| Title: | Director, Chief Financial Officer | |

| NAVER CORPORATION | ||

| By: | /s/ Seongsook Han | |

| Name: | Seongsook Han | |

| Title: | Chief Executive Officer | |

| NAVER J. HUB CORPORATION | ||

| By: | /s/ Sang-Jin Park | |

| Name: | Sang-Jin Park | |

| Title: | Representative Director | |

| SOFTBANK CORP. | ||

| By: | /s/ Yutaka Uemura | |

| Name: | Yutaka Uemura | |

| Title: | Vice President, Corporate Planning | |

Exhibit (a)(5)(xxiii)

| Note: This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. LINE Corporation assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. |

LINE

Notice of the Extraordinary General Meeting of Shareholders

Date:

10:00 a.m., Tuesday, December 15, 2020

Location:

“LUMINE 0,” 5th floor, NEWoMan Shinjuku

5-24-55 Sendagaya, Shibuya-ku, Tokyo

(Please note that the location is changed from the 20th Ordinary General Meeting of Shareholders.)

No souvenirs will be provided to shareholders attending the Extraordinary General Meeting of Shareholders, for which we would appreciate your understanding.

LINE Corporation Securities code: 3938

1

Securities code: 3938

November 25, 2020

To our shareholders

Takeshi Idezawa,

Representative Director and President

LINE Corporation

4-1-6 Shinjuku, Shinjuku-ku, Tokyo

Notice of the Extraordinary General Meeting of Shareholders

You are cordially invited to attend the Extraordinary General Meeting of Shareholders of LINE Corporation (the Company), which will be held as described below:

Instead of attending the meeting in person, you can exercise your voting rights either of the following methods. Please review the “Reference Documents for the General Meeting of Shareholders” described later and exercise your voting rights.

Exercising voting rights by mail

Please indicate your vote of approval or disapproval using the enclosed voting card, and return the card to us so that it arrives by 6:30 p.m. on Monday, December 14, 2020.

Exercising voting rights via the internet

Please access the voting website designated by the Company (https://soukai.mizuho-tb.co.jp/) with the “voting code” and “password” provided on the enclosed voting card, follow the instructions on the screen and enter your approval or disapproval for each proposal by 6:30 p.m. on Monday, December 14, 2020.

When voting via the internet, please read “Guide to voting via the internet” on page 4.

| 1. Date: |

10:00 a.m., Tuesday, December 15, 2020 |

| 2. Location: |

“LUMINE 0,” 5th floor, NEWoMan Shinjuku |

5-24-55 Sendagaya, Shibuya-ku, Tokyo

(Please note that the location is changed from the 20th Ordinary General Meeting of Shareholders.)

3. Agenda:

Items To Be Resolved:

| Proposal No. 1 |

Share Consolidation |

| Proposal No. 2 |

Partial Amendments to the Articles of Incorporation |

Notes:

| • | You are kindly requested to present the enclosed voting card to the receptionist when you attend the meeting. To conserve natural resources, please bring this Notice with you. |

| • | Please note that persons other than shareholders who can exercise voting rights, such as proxy agents who are not shareholders or those accompanying shareholders, will not be permitted to enter the meeting venue. |

2

| • | In the event of situations requiring amendments to items in the Reference Documents for the General Meeting of Shareholders, amended items will be posted on the Company’s website. |

| • | The results of the resolutions will be posted on the Company’s website after the close of the Extraordinary General Meeting of Shareholders. A written notice of resolutions will not be sent to you, for which we would appreciate your understanding. |

| • | No souvenirs will be provided to shareholders attending the Extraordinary General Meeting of Shareholders. |

The Company’s website (URL: https://linecorp.com/en/ir/stock/)

3

Notice Regarding the Prevention of the Spread of Infection of the Novel Coronavirus (COVID-19)

In order to avoid infection and prevent the spread of COVID-19, we have set the following policy for holding this Extraordinary General Meeting of Shareholders, placing the safety of shareholders first. Thank you for your understanding and cooperation.

| • | Requests to Shareholders |

| • | The Company strongly requests that shareholders exercise their voting rights in writing (by mail) or via the internet as described on the next page to the extent possible. We ask shareholders who intend to attend this Extraordinary General Meeting of Shareholders in person to check the situation and their health condition on the day of the meeting. If there is any concern or anxiety, shareholders are kindly advised not to force themselves to attend, and instead to consider refraining from attending, the meeting in person. |

| • | Note that shareholders will be seated at a distance from each other to avoid infection and prevent the spread of COVID-19, and it may therefore be impossible to provide sufficient seating for all attendees. Please be aware that, if all seats are filled, even shareholders who come to the venue will not be allowed to enter. We appreciate your understanding. |

| • | We ask that shareholders attending the meeting wear masks. |

| • | The detailed explanations of the proposals will be omitted at this Extraordinary General Meeting of Shareholders, from the perspective of shortening the meeting’s duration in order to avoid infection and prevent the spread of COVID-19. We ask shareholders to look over the notice of convocation prior to the meeting. |

| • | Measures by the Company |

| • | Alcohol disinfectant will be placed near the reception of the meeting venue. |

| • | Officers and staff members at the General Meeting of Shareholders will be wearing masks. Further preventive measures against the spread of infection will be taken as appropriate. |

| • | Depending on the severity of the impact of COVID-19, the venue or date of the meeting may have to be changed. In that case, changed items will be posted on the Company’s website (https://linecorp.com/en/ir/stock/). |

4

Instructions for Exercising Voting Rights

The right to vote at the General Meeting of Shareholders is an important right held by shareholders. We ask that you make sure to exercise your voting rights. There are three ways to exercise your voting rights as described below:

When attending the General Meeting of Shareholders

You are kindly requested to present the enclosed voting card to the receptionist when you attend the meeting. Please note that persons, such as proxies and accompanying persons, other than the shareholders who are eligible to vote will not be allowed entry to the meeting even if they bring the voting card with them. Furthermore, if you attend the General Meeting of Shareholders, you are kindly requested to bring this Notice to conserve resources.

| Date: | 10:00 a.m., Tuesday, December 15, 2020 | |

| Location: | “LUMINE 0,” 5th floor, NEWoMan Shinjuku 5-24-55 Sendagaya, Shibuya-ku, Tokyo |

When mailing your voting card

Please indicate your approval or disapproval of each resolution on the enclosed voting card and return it by postal mail.

Please refer to the instructions below regarding how to fill out your voting card.

Deadline: To be received by 6:30 p.m., Monday, December 14, 2020

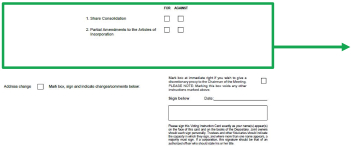

How to fill out your voting card

|

|

| |||

|

Please indicate your approval or disapproval of each resolution here

|

||||

| Proposals No. 1, No. 2

• If you approve, put a circle in the APPROVAL box.

• If you disapprove, put a circle in the DISAPPROVAL box. |

||||

|

Handling of votes

If you do not indicate your approval or disapproval of a proposal in your voting card, we will assume that you have voted in favor of the proposal. |

||||

Exercise of voting rights via the internet

Please access the voting website designated by the Company (https://soukai.mizuho-tb.co.jp/) with the “voting code” and “password” provided on the enclosed voting card, follow the instructions on the screen and enter your approval or disapproval for each proposal.

Deadline: 6:30 p.m., Monday, December 14, 2020

5

Guide to voting via the internet

| When exercising voting rights via the internet

Please have the “voting code” and “password” provided on the voting card ready as they will be required.

In regard to exercising voting rights

In the case where the voting card is submitted by mail and voting rights are exercised via the internet, votes exercised via the internet will be considered effective. In addition, if you have exercised your voting rights more than once via the internet, only the final voting shall be deemed as effective.

Voting website: https://soukai.mizuho-tb.co.jp/ |

| Inquiries regarding operation of the website for exercising voting rights |

Stock Transfer Agency Department, Mizuho Trust & Banking Co., Ltd. Toll free: 0120-768-524 (Hours: 9:00 a.m. – 9:00 p.m. on weekdays) |

Electronic Voting Platform

Trust banks and other nominee shareholders (including standing proxies) who have applied in advance to use the electronic voting platform operated by ICJ, Inc. may use this platform in exercising voting rights.

6

Reference Documents for the General Meeting of Shareholders

Proposals and Reference Information

| Proposal | No. 1 Share Consolidation |

| 1. | Reasons for the Share Consolidation |

As announced in the “Announcement of Opinion Regarding the Joint Tender Offer for the Shares of LINE Corporation by SoftBank Corp. and NAVER J. Hub Corporation, a Wholly-Owned Subsidiary of NAVER Corporation, the Controlling Shareholder of LINE Corporation” dated August 3, 2020 (the “August 3, 2020 Opinion Announcement Press Release”), tender offers were jointly carried out from August 4, 2020 until September 15, 2020 by SoftBank Corp. (President & CEO: Ken Miyauchi) (“SoftBank”) and NAVER J. Hub Corporation (“NAVER J. Hub” and SoftBank and NAVER J. Hub being referred to individually as a “Purchaser” and collectively as the “Purchasers”), a wholly-owned subsidiary of NAVER Corporation (President & CEO: Han Seong-sook) (“NAVER,” and together with NAVER J. Hub, the “NAVER Parties”), the controlling shareholder of the Company, consisting of (i) a tender offer implemented in Japan pursuant to the Financial Instruments and Exchange Act (Act No. 25 of 1948, as amended from time to time) for the purpose of acquiring all of the common shares of the Company (the “Common Shares”), the Share Options (see Note 1 below) and the Convertible Bonds (see Note 2 below), as well as American depositary receipts that are registered and issued by JPMorgan Chase Bank, N.A. (the “Depositary Bank”) in the United States (meaning the United States of America, and the same applies hereinafter) and listed on the New York Stock Exchange, representing the title to one Common Share deposited with Mizuho Bank, Ltd., which is the custodian bank of the underlying shares (the “ADSs”) (excluding the NAVER-owned Company Target Securities (collectively referring to the Common Shares, the Share Options, the Convertible Bonds and the ADSs; the same applies hereinafter) and the treasury shares owned by the Company) (the “Japan Offer” (see Note 3 below)), and (ii) a tender offer in the United States pursuant to the U.S. Securities Exchange Act of 1934 to acquire the Common Shares owned by residents of the United States and the ADSs (the “U.S. Offer”; and together with the Japan Offer, the “Offers”). As a result, as of the commencement of settlement of the Offers on September 24, 2020, SoftBank and NAVER J. Hub came to own a total of 15,617,335 shares of the Common Shares (including Common Shares represented by ADSs) (ownership ratio of voting rights (see Note 4 below): 6.41%) and 15,617,335 shares of the Common Shares and the ADSs (ownership ratio of voting rights: 6.41%), respectively, and together with a total of 174,992,000 shares of the Common Shares owned by NAVER (ownership ratio of voting rights: 71.81%), SoftBank and the NAVER Parties came to own a total of 206,226,670 shares of the Common Shares and the ADSs (ownership ratio of voting rights: 84.62%).

| (Note 1) | “Share Options” collectively refers to the share options issued based on the resolution of the board of directors meeting of the Company held on December 11, 2013 (the 4th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on December 11, 2013 (the 5th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on February 5, 2014 (the 7th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on February 5, 2014 (the 8th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on August 1, 2014 (the 10th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on August 1, 2014 (the 11th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on September 30, 2014 (the 13th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on September 30, 2014 (the 14th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on January 30, 2015 (the 16th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on January 30, 2015 (the 17th Series Share Options), share options issued based on the resolution of the board of |

7

| directors meeting of the Company held on January 30, 2015 (the 18th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on January 30, 2015 (the 19th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on June 26, 2017 (the 20th Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on July 9, 2019 (the 22nd Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on July 9, 2019 (the 23rd Series Share Options), share options issued based on the resolution of the board of directors meeting of the Company held on July 9, 2019 (the 24th Series Share Options), share options issued based on the resolutions of the board of directors meetings of the Company held on July 9, 2019 and March 30, 2020 (the 25th Series Share Options). Note that the Share Options do not include the share options to be allocated to the directors (except for outside directors and part-time directors) of the Company on November 5, 2020 (the 26th Series Share Options), share options to be allocated to the outside directors of the Company on November 5, 2020 (the 27th Series Share Options), and share options to be allocated to the employees of the Company and its subsidiaries on April 28, 2021 (the 28th Series Share Options), which the Company resolved to issue at its board of directors meeting held on July 29, 2020. |

| (Note 2) | “Convertible Bonds” collectively refers to Euroyen convertible bonds due 2023 issued based on the resolution of the board of directors of the Company on September 4, 2018 (the “Convertible Bonds due 2023”) and Euroyen convertible bonds due 2025 issued based on the resolution of the board of directors of the Company on September 4, 2018 (the “Convertible Bonds due 2025”). |

| (Note 3) | As announced in the August 3, 2020 Opinion Announcement Press Release, we understand that tenders of ADSs were not accepted in the Japan Offer. |

| (Note 4) | “Ownership ratio of voting rights” is calculated by setting as the denominator the number of voting rights (2,437,033 voting rights) pertaining to the number of shares (243,703,320 shares), which is calculated by subtracting the number of shares held in treasury by the Company as of September 30, 2020 (12,222 shares) from the total number of issued shares of the Company (243,715,542 shares) as of September 30, 2020, as described in the “Summary of Consolidated Financial Results for the Nine Months Ended September 30, 2020 (IFRS) announced by the Company on October 28, 2020 (rounded to two decimal places; the same applies hereinafter in calculations for the ownership ratio of voting rights). |

As announced in “(i) Background, Purpose and Decision-making Process of the Decision to Implement the Offers, and the Management Policy after the Offers” in “② Purpose and Background of the Offers” in “(2) Grounds and Reasons for the Opinion” in “3. Details, Grounds, and Reasons for the Opinion Regarding the Offers” in the August 3, 2020 Opinion Announcement Press Release, the Company, by using the mobile messenger platform “LINE” as a basis, provides content-based services, such as games and music distribution services, as well as general services including advertising, mobile remittances, and payment services. The Company Group (a corporate group consisting of the Company, its 64 subsidiaries and 78 affiliates (the number of companies as of the end of June 2020), and the same applies hereinafter), with “CLOSING THE DISTANCE” as its corporate mission, aims to realize a world in which people and people, people and information and services and content are connected seamlessly, and in which life is complete just by connecting to “LINE,” and expresses this standard of value of realizing this mission in the word “WOW.” “WOW” refers to the “first experience that impresses users” and refers to the “surprise that people cannot help but share with their friends,” and the Company Group has positioned the pursuit of “WOW” as a strategy in order to continue to grow over the medium-to-long term and create social value.

SoftBank, NAVER and the Company believe that the social and industrial situations surrounding us are facing major global changes on a daily basis. In particular, overseas companies, mainly in the United States and China, dominate the Internet market, and by comparing the size of these companies, the reality is that they have widened the gap between companies in Asia (excluding China) and Japan.

8

Furthermore, in Japan, there is a need to improve productivity in response to the shrinking labor force and to respond swiftly to natural disasters, and SoftBank, NAVER and the Company believe that the use of AI (see Note 5 below) and technology in these fields has great potential.

| (Note 5) | AI is an abbreviation for Artificial Intelligence. |

The Company was told that, under these circumstances, SoftBank, under the “Beyond Carrier” strategy which aims to achieve sustainable growth through further expansion of the telecommunications business, growth of Yahoo Japan Corporation (ZHD) and expansion into new fields, aims to go beyond its role as a telecommunications carrier and develop new businesses that leverage cutting-edge technology such as AI and IoT (see Note 6 below) through collaboration with each group company and prominent companies in which it has invested. In addition, NAVER aims to transform and innovate its state-of-the-art technological platforms in order to provide services that transcend the boundaries of South Korea’s largest search engine portal. As of December 23, 2019, the intention of the four companies was that, in the business integration of the Company and its subsidiaries, on one side, and Z Holdings Corporation (President and Representative Director: Kentaro Kawabe) (“ZHD”), a consolidated subsidiary of SoftBank, and its subsidiaries, on the other (the “Business Integration”), ZHD Group (a corporate group consisting of ZHD, its 94 subsidiaries and 24 affiliates (the number of companies as of the end of March 2020), and the same applies hereinafter) which provides various services in Japan, with a firm user base (annual log-in user IDs: approximately 80 million; total MAUs (see Note 7 below) of all applications: 140 million) and abundant assets (total consolidated assets: JPY 2,795,895 million), and the Company Group, which has a customer base of 84 million MAUs in Japan and 101 million MAUs overseas, and abundant service lineups, are to consolidate management resources, strengthen each business domain, and invest in the growth of new business domains, in order to provide convenient experiences to Japanese users and update Japan’s society and industries, and thereby become the leading companies to lead the world from Japan and Asia by expanding this innovative model to Asia and to the world beyond. Regarding the Business Integration, SoftBank, NAVER, ZHD and the Company are expecting to collaborate in a variety of fields. SoftBank, by further growth of ZHD which plays a key role in its “Beyond Carrier” strategy and by creating new business opportunities in the 5G era, and NAVER, by accelerating the growth of Fintech services (see Note 8 below) which utilizes cutting-edge technologies, and by establishing its position as the leading IT company based on AI technologies, believe the Business Integration to be a significant transaction that will contribute to increasing the corporate value of both SoftBank and NAVER.

| (Note 6) | IoT is an abbreviation for the Internet of Things, in which items communicate via the Internet. |

| (Note 7) | MAUs is an abbreviation for Monthly Active Users, which means the number of monthly active users. Specifically, according to ZHD, it refers to the number of active IDs which log in within a year. According to the Company, the same term refers to the number of user accounts which activate “LINE” or “LINE GAME” from mobile terminals one or more times in a certain month, or the number of user accounts which activate “LINE” or other related applications based on “LINE” and send messages from PCs or mobile terminals. |

| (Note 8) | Fintech is a term created by combining “Finance” and “Technology.” It refers to activities aimed at resolving inefficiencies in existing financial services and providing innovations in financial services by utilizing smart devices such as smartphones and tablets, as well as big data utilization technologies. |

SoftBank, ZHD, NAVER and the Company began discussions on various possibilities, including potential business alliances, in mid-June 2019. After that, and since around early August of the same year, the four companies have discussed and examined a wide range of options for the feasibility and methods of the Business Integration, bearing in mind issues such as limitations under applicable domestic and foreign laws and regulations.

As a result, a basic common understanding was reached among the four companies that the method stated in “① Overview of the Offers” in “(2) Grounds and Reasons for the Opinion” in “3. Details, Grounds, and

9

Reasons for the Opinion Regarding the Offers” in the August 3, 2020 Opinion Announcement Press Release, including the delisting of the Company by SoftBank and NAVER or one of its wholly-owned subsidiaries, was to be considered as a primary matter. Accordingly, as of November 18, 2019, a non-binding memorandum of understanding regarding a series of transactions relating to the Business Integration was executed. On the same day, the Company received from SoftBank and NAVER a letter of intent regarding the proposal of the Offers for conducting the transaction to realize the Business Integration. In the letter of intent, SoftBank and NAVER proposed to the Company that the purchase price for the Common Shares in the Offers (the “Tender Offer Price”) would be JPY 5,200 per Common Share.

In the course of such discussions and examinations, the Company determined that there was the possibility of structural conflicts of interest between NAVER, the controlling shareholder of the Company, and the Company’s minority shareholders in carrying out the Business Integration, and similarly there were issues with information asymmetry. Therefore the Company began to develop a system to examine and negotiate the Business Integration independently from NAVER, from the standpoint of increasing the Company’s corporate value and securing the interests of the Company’s general shareholders, to secure the appropriateness of the transaction terms and the fairness of the procedures of the Business Integration.

Specifically, as stated in “IV. Establishment of the Special Committee in the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below, the Company established a special committee on October 15, 2019, which consists of three persons, Rehito Hatoyama (Chairperson), Tadashi Kunihiro and Koji Kotaka who did not have an interest in the potential transaction that was different from, or in addition to, the interests of the minority shareholders of the Company, who are outside directors of the Company, about whose status as independent officers the Tokyo Stock Exchange, Inc. (the “TSE”) has been notified, and who are deemed to have the experience and eligibility necessary to consider the Business Integration (the “Special Committee”). In considering the Business Integration, the Company consulted with the Special Committee regarding (i) whether the Business Integration contributes to an increase in corporate value and its purpose is reasonable, (ii) whether the fairness of procedures for the Business Integration has been secured, (iii) whether the appropriateness of the terms and conditions of the Business Integration is secured, and (iv) whether it is considered based on (i) to (iii) above that the Business Integration can be considered not to be adverse to the interests of minority shareholders.

After receiving the proposal of the Offers from SoftBank and NAVER, considering that if the series of procedures to take the Company private including the Offers (the “Delisting Procedures”) are implemented, the Delisting Procedures will constitute transactions between the Company and its controlling shareholder as set forth in the Securities Listing Regulations of the TSE, the Company, while continuously consulting with the Special Committee, resolved at its board of directors meeting held on November 18, 2019, to change the terms of reference for the Special Committee to: (i) whether the Business Integration, including the Offers, could be seen as contributing to an increase in corporate value and for a reasonable purpose, (ii) whether the fairness of procedures for the Business Integration, including the Offers, has been secured, (iii) whether the appropriateness of the terms and conditions of the Delisting Procedures including the Offers (including the Tender Offer Price of the Offers) has been secured, (iv) whether, taking the above (i) to (iii) together, the Business Integration could be deemed adverse to the interests of the minority shareholders of the Company, and (v) whether it is considered to be reasonable that the Company’s board of directors will express support for the Offers and recommend the Company’s shareholders to tender their shares in the Offers ((i) through (v) are collectively referred to as the “Terms of Reference”). The Company also resolved to make decisions on the Business Integration including the Offers, by accurately understanding and comprehending, and fully respecting, the findings of the Special Committee, and not to agree to the Business Integration including the Offers if the Special Committee determined that the terms and conditions of the Offers and the Delisting Procedures are not appropriate.

Furthermore, as discussed in “V. Acquisition of a fairness opinion for the Special Committee from its own financial advisor” and “VI. Acquisition of advice from independent law firms for the Special Committee” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in

10

“3. Matters Concerning the Appropriateness of the Consolidation Ratio” below, the Special Committee appointed Merrill Lynch Japan Securities Co., Ltd. (“BofA Securities”) as its financial advisor and Nakamura, Tsunoda & Matsumoto and White & Case Registered Foreign Lawyers’ Office (Gaikokuho-Jimu-Bengoshi-Jimusho)/White & Case (Gaikokuho-Kyodo-Jigyo) as its legal advisors, each independent from SoftBank, NAVER, ZHD, and the Company.

As explained in “II. Acquisition of a share valuation report and a fairness opinion from an independent third-party valuation advisor by the Company” and “III. Acquisition of advice from independent law firms by the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below, the Company appointed JPMorgan Securities Japan Co., Ltd. (“J.P. Morgan”) as its financial advisor and third-party valuation advisor and Anderson Mori & Tomotsune and Shearman & Sterling Registered Foreign Lawyers’ Office (Gaikokuho-Jimu-Bengoshi-Jimusho) as its legal advisors, each independent from SoftBank, NAVER, ZHD, and the Company.

The Company received an initial proposal from SoftBank and NAVER on November 18, 2019, involving a Tender Offer Price of JPY 5,200, and subsequently continued to discuss and negotiate the transaction terms of the Delisting Procedures including the Tender Offer Price with SoftBank and NAVER. Specifically, the Company received a proposal of a Tender Offer Price of JPY 5,200 on December 10, 2019, and a proposal of a Tender Offer Price of JPY 5,320 on December 18, 2019 from SoftBank and NAVER. However, the Company determined that the proposed Tender Offer Price of JPY 5,320 was not sufficient as an appropriate price and requested SoftBank and NAVER to reconsider the proposal. Through these negotiations, the Company received a proposal of a Tender Offer Price of JPY 5,380 from SoftBank and NAVER on December 20, 2019.

In the above-referenced examination and negotiation process, the Company made timely reports to the Special Committee with respect to the important aspects of the negotiations and decided negotiation policies consistent with the directions and requests from the Special Committee, and the Special Committee attended negotiations between the Company and SoftBank, and NAVER as necessary. Specifically, the Company first gave prior explanation to the Special Committee with respect to the negotiation policy regarding the Delisting Procedures, and as the Special Committee requested the Company increase the Tender Offer Price based on the stand-alone share value of the Company and the premiums in transactions of similar nature, the Company decided its negotiation policy consistent with such request. When the Company held negotiations on the Delisting Procedures with SoftBank and NAVER, the Special Committee attended the negotiations with SoftBank and NAVER on three occasions in order to communicate its request clearly to the related parties, and the Special Committee expressed its views on these occasions.

Subsequently, on December 23, 2019, the Company received findings from the Special Committee stating: based on certain assumptions, (i) it is found that the Business Integration, including the Offers, can be seen as contributing to an increase in the corporate value, and its purpose can be seen as reasonable; (ii) it is found that the procedures for the Business Integration, including the Offers, can be seen as having secured fairness; (iii) it is found that the terms and conditions of the Delisting Procedures including the Offers (excluding the prices of the Share Options and the Convertible Bonds in the Offers) can be seen as having secured appropriateness; (iv) based on (i) to (iii) above, the resolutions of the Company’s board of directors in relation to expressing support for the Offers, and the Business Integration including the Delisting Procedures through a share consolidation or other methods after the Offers, can be considered as not adverse to the interests of the Company’s minority shareholders; and (v) it can be considered reasonable for the Company’s board of directors to express support for the Offers and to recommend that the Company’s shareholders and holders of the ADSs tender their Common Shares in the Offers (the “December 2019 Findings”) (for the outline of the December 2019 Findings, please see “IV. Establishment of the Special Committee in the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below). In addition, together with the December 2019 Findings, the Company received from the Special Committee financial analyses regarding the results of calculations of the value of Common Shares submitted to the

11

Special Committee by BofA Securities on December 23, 2019 (the “BofA Securities Analyses”) and a written opinion (fairness opinion) to the effect that the purchase price of the Common Shares and ADSs (as defined in “V. Acquisition of a fairness opinion for the Special Committee from its own financial advisor” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below, and the same applies hereinafter) in the Offers is fair to the holders of the Common Shares and ADSs (except for SoftBank and NAVER, and their affiliated companies) from a financial perspective under certain conditions (the “BofA Securities Fairness Opinion”) (for the outline of the BofA Securities Analyses and the BofA Securities Fairness Opinion, please see “V. Acquisition of a fairness opinion for the Special Committee from its own financial advisor” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below).

As such, based on the legal advice from Anderson, Mori & Tomotsune and Shearman & Sterling Registered Foreign Lawyers’ Office (Gaikokuho-Jimu-Bengoshi-Jimusho), advice from J.P. Morgan from a financial perspective, the content of the share valuation report regarding the results of calculations of the value of the Common Shares from J.P. Morgan as of December 23, 2019 (the “JPM Valuation Report”), a fairness opinion from J.P. Morgan to the effect that, under certain conditions precedent, the Tender Offer Price was fair from a financial perspective for the common shareholders of the Company, excluding SoftBank and NAVER, and their related parties (the “JPM Fairness Opinion”), and the BofA Securities Analyses and the BofA Securities Fairness Opinion submitted through the Special Committee, and by fully respecting the findings of the Special Committee as stated in the December 2019 Findings, the Company carefully discussed and examined at its board of directors meeting held on December 23, 2019, whether the Delisting Procedures including the Offers contribute to an increase in the corporate value of the Company, and whether the transaction terms of the Delisting Procedures, including the Tender Offer Price, were appropriate.

Consequently, the Company concluded that the Business Integration including the Offers, in which the ZHD Group and the Company Group will consolidate their management resources, strengthen their respective business areas and invest in new business areas for growth, will enable further enhancement of the Company’s corporate value.

Furthermore, the Company determined from the points below (among other things) that the Tender Offer Price of JPY 5,380 per share is an appropriate price that ensures the benefit that the Company’s general shareholders should receive, and that the Offers will provide the Company’s general shareholders with a reasonable opportunity to sell the Common Shares at a price with an appropriate premium.

| (i) | The price was agreed upon as a result of thorough, repeated negotiations with SoftBank and NAVER with the substantial involvement of the Special Committee, subject to sufficient measures to secure the fairness of the transaction terms of the Delisting Procedures, including the Tender Offer Price, as stated in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below. |

| (ii) | The price is greater than the upper limit of the valuation range of the valuation results based on the market share price analysis and within the valuation range of the valuation results based on the discounted cash flow method (the “DCF Method”) of J.P. Morgan’s valuation results for the Common Shares based on the JPM Valuation Report, as stated in “II. Acquisition of a share valuation report and a fairness opinion from an independent third-party valuation advisor by the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below. In addition, a fairness opinion has been issued to the effect that the Tender Offer Price is fair to the holders of Common Shares, other than SoftBank, NAVER and their related parties, from a financial perspective under certain conditions, as stated in “II. Acquisition of a share valuation report and a fairness opinion from an independent third-party valuation advisor by the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below. |

12

| (iii) | The price is greater than the upper limit of the valuation range based on the market share price analysis and within the valuation range based on the discounted cash flow analysis (the “DCF Analysis”) of BofA Securities’ valuation results for the Company’s Shares based on the BofA Securities Analyses, as stated in “V. Acquisition of a fairness opinion for the Special Committee from its own financial advisor” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below. |

| (iv) | The price includes a premium of 17.34% (rounded to two decimal places; the same applies hereinafter in calculating the premium rate) added to the closing price of JPY 4,585 of the Common Shares on the First Section of the TSE on November 13, 2019, which is regarded as the price not influenced by speculative reports about the Business Integration by some of the media, considering the fact that such speculative reports were made on the night of November 13, 2019; a premium of 31.69% added to the simple average closing price of JPY 4,085 (rounded to the nearest whole number; the same applies hereinafter in calculating the simple average closing price) for the month prior to November 13, 2019; a premium of 36.75% added to the simple average closing price of JPY 3,934 for the three months prior to the same day; and a premium of 50.68% added to the simple average closing price of JPY 3,570 for the six months prior to the same day, all of which are regarded as reasonable premiums compared with the premium level in case studies of other tender offers for the purpose of delisting a subsidiary by a parent company. |

| (v) | The December 2019 Findings of the Special Committee found that the price can be seen as having secured appropriateness, as stated in “IV. Establishment of the Special Committee in the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below. |

Therefore, the Company concluded that the Delisting Procedures would contribute to an increase in the corporate value of the Company and that the transaction terms of the Delisting Procedures, including the Tender Offer Price, were appropriate. Accordingly, the Company resolved at its board of directors meeting held on December 23, 2019, to express support for the Offers and to recommend that the Company’s shareholders and holders of the ADSs tender their Common Shares or ADSs in the Offers.

Additionally, as the Company had not examined the appropriateness of the purchase price of the Share Options and the Convertible Bonds, and as the Share Options were issued to the directors and employees of the Company and its subsidiaries and as the purchase price of the Share Options is JPY 1 per unit, the Company’s board of directors resolved to leave it to the discretion of each holder of the Share Options (the “Share Option Holders”) and the Convertible Bonds (the “Convertible Bond Holders”) as to whether to tender their Share Options and Convertible Bonds in the Offers.

As stated in the Announcement of Opinion Regarding the Planned Commencement of the Joint Tender Offer for the Shares of LINE Corporation by SoftBank Corp. and NAVER Corporation, the Controlling Shareholder of LINE Corporation issued by the Company on December 23, 2019 (the “December 23, 2019 Opinion Announcement Press Release”), while the Offers were planned to be promptly implemented once the Conditions Precedent (refers to conditions stated in “① Overview of the Offers” in “(2) Grounds and Reasons for the Opinion” in “3. Details, Grounds, and Reasons for the Opinion Regarding the Offers” in the August 3, 2020 Opinion Announcement Press Release), including the completion of procedures with domestic and foreign competition authorities, were satisfied, it was considered to be difficult to accurately estimate the time required for such procedures with domestic and foreign competition authorities. Given this situation, the aforementioned Company’s board of directors meeting also resolved to request, at the time of the commencement of the Offers, that the Special Committee review whether the Special Committee’s findings stated in the December 2019 Findings required revision, and if the statements did not need revision, report to the Company’s board of directors to that effect, and if the statements needed revision, provide revised findings to the Company’s board of directors, and resolved that taking such findings into account, the Company’s board of directors would express its opinion again on the Offers at the time of the commencement of the Offers.

13

In late June, 2020, the Company was informed by the Purchasers that they planned to commence the Offers as soon as the procedures and measures necessary under the competition laws of relevant countries were completed or such procedures and measures were expected to be completed by the day prior to the expiry of the purchase period of the Japan Offer (the “Tender Offer Period”). Therefore, as stated in “IV. Establishment of the Special Committee in the Company” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below, the Company requested that the Special Committee review whether the Special Committee’s findings stated in the December 2019 Findings require revision, and if the statements do not need revision, report to the Company’s board of directors to that effect, and if the statements need revision, to provide revised findings to the Company’s board of directors. In response to the request, the Special Committee reviewed the subject of the Terms of Reference above and accordingly confirmed that there was no material change in the Company’s business conditions and environment surrounding the Business Integration, even taking the fact that various events (including the spread of COVID-19) occurred after the announcement of the Business Integration (meaning the announcement made on December 23, 2019; the same applies hereinafter) into consideration, and submitted its findings, dated August 3, 2020, to the Company’s board of directors to the effect that there were no changes to the Special Committee’s views in the December 2019 Findings ( the “August 2020 Findings”). Note that the Special Committee determined that the Tender Offer Price’s appropriateness was maintained as of the date of the August 2020 Findings, considering among other factors that the Tender Offer Price was appropriate and reflected the Company’s fundamental value even after taking into consideration the fact that the various events after the announcement of the Business Integration did not have a material effect on the Company’s fundamental value and that the Company’s stock price exceeded the Tender Offer Price at certain times between the announcement of the Business Integration and the date of the August 2020 Findings. In addition, the Special Committee determined that it was not necessary to change the Tender Offer Price considering such factors and determinations, and considering the Company’s determination that the Business Integration is in the best interests of the minority shareholders of the Company.

Based on such findings of the Special Committee and the business conditions and environment surrounding the Delisting Procedures, the Company carefully examined again the terms and conditions of the Offers. As a result, the Company concluded that, even as of August 3, 2020, there were no factors that changed its determination on the Offers. Therefore, the Company decided, by resolution of the board of directors meeting held on August 3, 2020, to express support for the Offers, to recommend that the Company’s shareholders and holders of the ADSs tender their Common Shares and ADSs in the Offers, and to leave it to the discretion of each holder of the Share Options and the Convertible Bonds as to whether to tender their Share Options and the Convertible Bonds in the Offers. Note that, as of August 3, 2020, each country, including Japan, where the Company operates its businesses was affected by the spread of COVID-19, but the Company decided that it was not necessary to change the conclusion that the Delisting Procedures contribute to an increase in the corporate value of the Company and that the transaction terms of the Delisting Procedures including the Tender Offer Price are appropriate, even taking into account the impact of the worldwide spread of COVID-19. Moreover, although the Company’s share price had exceeded the Tender Offer Price at certain times between the announcement of the Business Integration and August 3, 2020, given that there were neither material changes in the business conditions of the Company or the environment surrounding the Business Integration nor material circumstances that would require the Company to change its business plan based on which third-party valuation advisors evaluated the share value of the Company, and also in light of the content of the August 2020 Findings submitted by the Special Committee, the Company determined that there was no impact on the above conclusion.

For the details of the decision-making process of the board of directors, please see “VII. Approval of all the directors of the Company without interests and the opinion of all the statutory auditors of the Company without interests that they have no objection” in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below.

14

The Offers were carried out in this way, but the Purchasers could not acquire all of the Company Target Securities (excluding the Company Target Securities owned by NAVER and the shares held in treasury by the Company) through the Offers, and SoftBank and the NAVER Parties requested that the Company hold the Extraordinary General Meeting, where the following proposals will be addressed: conducting a share consolidation of the Common Shares to make NAVER the only shareholder of the Company; partially amending the Company’s articles of incorporation such that provisions regarding share units are deleted, subject to such share consolidation taking effect. As such, the Company resolved at the Board Meeting to place on the agenda for the Extraordinary General Meeting a share consolidation where 29,165,333 Common Shares will be consolidated to one Common Share (the “Share Consolidation”) in order to make NAVER the only shareholder of the Company, subject to the approval of the Company shareholders. As it is possible that, at the time of the effectiveness of the Share Consolidation, shareholders other than NAVER own a number of Common Shares equal to or greater than those owned by the Purchasers, in order to prevent such shareholders from remaining as shareholders of the Company after the Share Consolidation, it has been decided that the ratio of consolidation should be such that the number of Common Shares owned by the Purchasers will also be a fraction less than one full share. It is therefore expected that the Share Consolidation will cause the number of Common Shares owned by the Company’s shareholders other than NAVER to be a fraction less than one full share.

| 2. | The Share Consolidation |

| (1) | Consolidation ratio |

29,165,333 shares of the Common Shares will be consolidated into one share.

| (2) | Effective date of Share Consolidation |

January 4, 2021 (Planned)

| (3) | Total number of authorized shares as of the effective date: 32 shares |

| 3. | Matters Concerning the Appropriateness of the Consolidation Ratio |

For the consolidation ratio of the Share Consolidation, 29,165,333 shares will be consolidated into one share. As stated in “1. Reasons for the Share Consolidation” above, the Company has determined that the share consolidation ratio is appropriate given that the purpose of the Share Consolidation is to make NAVER the sole shareholder of the Company and in view of the following matters:

| (1) | Matters considered to ensure that interests of shareholders other than the parent company (if any) will not be undermined |

Given that the Share Consolidation procedures will be carried out as the second step in the so-called two-step acquisition following the Offers, SoftBank, the NAVER Parties and the Company have implemented the measures in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” below from the perspective of securing the fairness of the Delisting Procedures, including the Offers, taking into account the fact that the Company was a consolidated subsidiary of NAVER on August 3, 2020 and that structural conflicts of interest might have arisen during consideration of the Delisting Procedures of the Company.

| (2) | Matters concerning the treatment of fractional shares less than one share in cases where such treatment will likely be necessary, and matters concerning the amount of cash to be delivered to shareholders as part of the treatment of fractional shares and the appropriateness of such amount |

As stated in “1. Reasons for the Share Consolidation” above, the number of Common Shares to be owned by the shareholders of the Company other than NAVER as a result of the Share Consolidation is expected to become a fraction less than one full share. The number of shares equivalent to the total of the fractional shares less than one full share resulting from the Share Consolidation (pursuant to the

15

provisions of Article 235, Paragraph 1 of the Companies Act (Law No. 86 of 2005, as amended; and the same applies hereinafter), if such total has any fractional shares less than one full share, such fraction shall be omitted) will be sold in accordance with Article 235 of the Companies Act and other relevant laws and regulations, and the proceeds obtained from such sale will be delivered to the shareholders according to the number of their fractional shares. With respect to such sale, the Company plans to sell to the Purchasers the Common Shares equivalent to the total number of such fractions after obtaining permission from a court in accordance with the provision of Article 234, Paragraph 2 of the Companies Act, applied mutatis mutandis in Article 235, Paragraph 2 of the same act. If the court permission mentioned above can be obtained as planned, the sales price will be set as a price such that each shareholder will receive the amount of money equivalent to the amount obtained by multiplying the number of the Common Shares owned by such shareholder by JPY 5,380, the Tender Offer Price.

In addition, the Common Shares subject to the Share Consolidation include the Common Shares owned by the Depositary Bank that are the underlying assets of the ADSs. Therefore, if the Share Consolidation is carried out, the number of the Common Shares to be owned by the Depositary Bank after the Share Consolidation will also become a fraction less than one full share. In this case, the holders of the ADSs will be entitled to receive through the Depositary Bank cash delivered to the Depositary Bank from the cash that is obtained by selling the Common Shares equivalent to the total of the fractional shares less than one full share resulting from the Share Consolidation pursuant to the above procedures. Specifically, the holders of the ADSs will receive through the Depositary Bank cash in the amount equal to the value obtained by multiplying (i) the value derived by converting the Tender Offer Price to U.S. dollars based on the U.S. dollar exchange rate against the Japanese yen determined at the time when the Depositary Bank delivers the cash to the holders of the ADSs (rounded off to the nearest whole number) less the amount of any applicable fees and expenses payable to the Depositary Bank, as well as any taxes or other costs by (ii) the number of the Common Shares represented by the ADSs owned by each holder of the ADSs.

As stated above, the Company plans to provide its shareholders with the monetary sum equivalent to the price obtained by multiplying JPY 5,380, which is equal to the Tender Office Price, by the number of the Common Shares owned by such shareholders through the aforementioned treatment of fractional shares.

Furthermore, the Company determined from the points below that the Tender Offer Price of JPY 5,380 per share is an appropriate price that ensures the benefit that the Company’s general shareholders should receive, and that the Offers will provide the Company’s general shareholders with a reasonable opportunity to sell the Common Shares at a price with an appropriate premium.

| (i) | The price was agreed upon as a result of thorough, repeated negotiations with SoftBank and NAVER with the substantial involvement of the Special Committee, subject to sufficient measures to secure the fairness of the transaction terms of the Delisting Procedures, including the Tender Offer Price, as described in “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” below. |

| (ii) | The price is greater than the upper limit of the valuation range of the valuation results based on the market share price analysis and within the valuation range of the valuation results based on the DCF Method of J.P. Morgan’s valuation results for the Common Shares based on the JPM Valuation Report, as described in “II. Acquisition of a share valuation report and a fairness opinion from an independent third-party valuation advisor by the Company” under “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” below. In addition, a fairness opinion has been issued to the effect that the Tender Offer Price is fair to the Company’s common shareholders, other than SoftBank, NAVER and their related parties, from a financial perspective under certain conditions, as described in “II Acquisition of a share valuation report and a fairness opinion from an independent third-party valuation advisor by the Company” under “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” below. |

16

| (iii) | The price is greater than the upper limit of the valuation range based on the market share price analysis and within the valuation range based on the DCF Analysis of BofA’s valuation results for the Common Shares based on the BofA Securities Analyses, as described in “V. Acquisition of a fairness opinion for the Special Committee from its own financial advisor” under “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” below. |

| (iv) | The price includes a premium of 17.34% added to the closing price of JPY 4,585 of the Common Shares on the First Section of TSE on November 13, 2019, which is regarded as the price not influenced by speculative reports about the Business Integration by some of the media, considering the fact that such speculative reports were made on the night of November 13, 2019; a premium of 31.69% added to the simple average closing price of JPY 4,085 for one month prior to November 13, 2019; a premium of 36.75% added to the simple average closing price of JPY 3,934 for three months prior to the same day; and a premium of 50.68% added to the simple average closing price of JPY 3,570 for six months prior to the same day, all of which are regarded as reasonable premiums compared with the premium level in case studies of other tender offers for the purpose of delisting a subsidiary by a parent company. |

| (v) | The December 2019 Findings obtained from the Special Committee determined that the price is appropriate, as described in “IV. Establishment of the Special Committee in the Company” under “(3) Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest” below. |

Further, the Company confirmed that, after it expressed its opinion supporting the Offers, and to recommend that the Company’s shareholders and holders of the ADSs tender their Common Shares and ADSs in the Offers, and to leave it to the discretion of each of the Share Option Holders and the Convertible Bond Holders as to whether to tender their Share Options and Convertible Bonds in the Offers, no material change has occurred in the conditions that served as a basis for the calculation of that price up until the board of directors held its meeting on November 9, 2020.

Based on the above, the Company has determined that the amount expected to be delivered to the shareholders as a result of the handling of fractional shares is appropriate.

| (3) | Measures to secure the fairness of the Delisting Procedures and to avoid conflicts of interest |

While the Share Consolidation will be carried out as the second step of the so-called two-step acquisition following the Offers, as described in “(6) Measures to Secure the Fairness of the Offers, such as Measures to Secure the Fairness of the Tender Offer Price and to Avoid Conflicts of Interest” in “3. Details, Grounds, and Reasons for the Opinion Regarding the Offers” in the August 3, 2020 Opinion Announcement Press Release, taking into account that the Company is the consolidated subsidiary of NAVER as of August 3, 2020, and the possibility of structural conflicts of interest may arise in considering the Delisting Procedures of the Company, SoftBank, the NAVER Parties and the Company have respectively implemented the measures below from the perspective of ensuring the fairness of the Offers.

The following descriptions that relate to the measures taken by SoftBank and the NAVER Parties are based on the explanations the Company received from SoftBank and the NAVER Parties.

| I. | Acquisition of a share valuation report from an independent third-party valuation advisor by SoftBank and NAVER |

| (i) | Common shares |

Acquisition of a share valuation report from an independent third-party valuation advisor by NAVER

In determining the Tender Offer Price, in order to ensure the fairness of the Tender Offer Price, NAVER requested Deutsche Securities Korea Co. (“Deutsche Bank”), its financial

17

advisor, as a third-party valuation advisor independent from SoftBank, NAVER, ZHD and the Company, to evaluate the share value of the Common Shares. Deutsche Bank is not a related party to SoftBank, NAVER, ZHD or the Company, nor does it have any material interests in relation to the Offers (except for the receipt of fees in connection with its engagement in a series of transactions relating to the Business Integration).

Deutsche Bank has evaluated the value of the Common Shares by using the Average Market Price Method since the Common Shares are listed on the TSE as well as the DCF Method in order to reflect financial forecasts and other information related to the Company provided by the management of NAVER in the evaluation. NAVER received a report on the valuation of the Common Shares from Deutsche Bank (the “DB Valuation Report”) on December 22, 2019.

NAVER has not requested or received any opinion concerning the fairness of the Tender Offer Price (a fairness opinion) from Deutsche Bank. The analyses prepared by Deutsche Bank and furnished to NAVER are not an opinion to NAVER or holders of the Common Shares with respect to the fairness of the Business Integration or the Tender Offer Price, do not constitute a recommendation to SoftBank, NAVER, ZHD, the Company, or shareholders of the Company with respect to the Business Integration or a recommendation to shareholders of the Company as to whether they should tender the Common Shares in the Offers or as to how they should vote with respect to any other matter, and should not be relied on as the basis for any investment decision.

The results of the valuation made by Deutsche Bank with respect to the value of each Common Share are as follows:

| Average Market Price Method | JPY 3,570 to JPY 4,585 | |

| DCF Method | JPY 3,819 to JPY 5,497 |

Under the Average Market Price Method, Deutsche Bank reviewed the historical trading prices of the Common Shares on the TSE and chose November 13, 2019 as the valuation reference date (referred to as the “Reference Date” in “3. Matters Concerning the Appropriateness of the Consolidation Ratio” below), in order to avoid any impact on the share value due to speculative press reports regarding the Business Integration that was reported after such date. Based on the closing price of the Common Shares of JPY 4,585 on the TSE as of the reference date as well as the simple average closing price over the month-long period ending on November 13, 2019 of JPY 4,085 (rounded to the nearest JPY 1; hereinafter the same applies to calculations of the simple average closing price in this section), the simple average closing price over the 3-month-long period ending on November 13, 2019 of JPY 3,934, and the simple average closing price over the 6-month-long period ending on November 13, 2019 of JPY 3,570, Deutsche Bank derived a range of implied value per Common Share of JPY 3,570 to JPY 4,585.