Form SC 13E3 Inovalon Holdings, Inc. Filed by: Inovalon Holdings, Inc.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(e) OF THE SECURITIES EXCHANGE ACT OF 1934

Inovalon Holdings, Inc.

(Name of the Issuer)

Inovalon Holdings, Inc.

Ocala Bidco, Inc.

Ocala Merger Sub, Inc.

Nordic Capital Epsilon SCA, SICAV-RAIF, on behalf of its compartment,

Nordic Capital Epsilon SCA, SICAV-RAIF - Compartment 1

Keith R. Dunleavy, M.D.

Meritas Group, Inc.

Cape Capital SCSp, SICAR – Inovalon Sub-Fund

(Names of Persons Filing Statement)

Class A Common Stock, par value $0.000005 per share

Class B Common Stock, par value $0.000005 per share

(Title of Class of Securities)

Class A 45781D101

(CUSIP Number of Class of Securities)

| Jonathan Boldt Bowie, MD 20716 (301)-809-4000 |

Els Alwyn Nordic Capital Epsilon SCA, SICAV-RAIF, Nordic Capital Epsilon SCA, SICAV-RAIF - Compartment 1 8 Rue Lou Hemmer L-1748 Senningerberg Grand Duchy of Luxembourg 352 661 124 125 |

Keith R. Dunleavy, M.D. Bowie, MD 20716 (301)-809-4000 |

Aleksandar Vukajlovic c/o Cape Capital Management S.à.r.l. 5 Rue Jean Monnet L-2180 Luxembourg Grand Duchy of Luxembourg 41438886064 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

With copies to

| David Allinson Peter Harwich Latham & Watkins LLP 1271 Avenue of the Americas New York, NY 10020 (212) 906-1200 |

David Feirstein, P.C. Armand A. Della Monica, P.C. Kirkland & Ellis LLP New York, NY 10022 (212) 446-4800 |

This statement is filed in connection with (check the appropriate box):

| a. |

☒ | The filing of solicitation materials or an information statement subject to Regulation 14A (§§240.14a-1 through 240.14b-2), Regulation 14C (§§240.14c-1 through 240.14c-101) or Rule 13e-3(c) (§240.13e-3(c)) under the Securities Exchange Act of 1934 (“the Act”). | ||

| b. |

☐ | The filing of a registration statement under the Securities Act of 1933. | ||

| c. |

☐ | A tender offer. | ||

| d. |

☐ | None of the above. | ||

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☒

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

Calculation of Filing Fee

|

| ||

| Transaction Valuation* | Amount of Filing Fee** | |

| $6,400,000,000 |

$698,240 | |

|

| ||

|

| ||

| * | Calculated solely for purposes of determining the filing fee. The transaction value was calculated as the sum of (A) 73,154,564 shares of Class A Common Stock multiplied by the Merger Consideration of $41.00 per share; (B) 78,081,076 shares of Class B Common Stock multiplied by the Merger Consideration of $41.00 per share; (C) 97,932 options to purchase Shares which would convert into 79, 202 issued Shares (such amount determined using a weighted average exercise price per share of $7.84 and the Merger Consideration of $41.00 per Share) multiplied by the Merger Consideration of $41.00 per share; (D) 14,549 shares of Class A Common Stock issuable upon settlement of Company RSUs multiplied by the Merger Consideration of $41.00 per share; and (E) 5,012,005 shares of Class A Common Stock issuable upon settlement of Company RS Awards multiplied by the Merger Consideration of $41.00 per share (assuming the maximum achievement of the performance goals applicable to performance-vesting Company RS Awards, and assuming the satisfaction of all other conditions to such delivery); which results in a proposed maximum aggregate value of $6,400,000,000 and a total filing fee due of $698,240. |

| ** | In accordance with Exchange Act Rule 0-11(c), the filing fee was determined by multiplying 0.0001091 by the aggregate transaction valuation. |

| ☒ | Check the box if any part of the fee is offset as provided by §240.0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: $698,240 |

| (2) | Form, Schedule or Registration Statement No.: Schedule 14A |

| (3) | Filing Party: Inovalon Holdings, Inc. |

| (4) | Date Filed: September 17, 2021 |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this Transaction Statement on Schedule 13E-3. Any representation to the contrary is a criminal offense.

INTRODUCTION

This Rule 13E-3 Transaction Statement on Schedule 13E-3, together with the exhibits hereto (this “Schedule 13E-3” or “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”), jointly by the following persons (each, a “Filing Person,” and collectively, the “Filing Persons”): (i) Inovalon Holdings, Inc. (“Inovalon” or the “Company”), a Delaware corporation and the issuer of the Class A common stock, par value $0.000005 per share (the “Class A Common Stock”) and the Class B common stock, par value $0.000005 per share (the “Class B Common Stock”, and together with the Class A Common Stock, the “Shares”), that is subject to the Rule 13e-3 transaction, (ii) Ocala Bidco, Inc., a Delaware corporation (“Parent”), (iii) Ocala Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), (iv) Nordic Capital Epsilon SCA, SICAV-RAIF, a société en commandite par actions – société d’investissement à capital variable – fonds d’investissement alternatif réservé, on behalf of its compartment, Nordic Capital Epsilon SCA, SICAV-RAIF - Compartment 1, a private equity investment vehicle and an affiliate of Parent and Merger Sub (“Nordic Capital X” and, collectively with Parent and Merger Sub, the “Parent Entities”), (v) Keith R. Dunleavy, M.D., Inovalon’s Chairman and Chief Executive Officer, (vi) Meritas Group, Inc., a Delaware corporation affiliated with Dr. Dunleavy, and (vii) Cape Capital SCSp, SICAR – Inovalon Sub-Fund, a Luxembourg special limited partnership organized as an investment company in risk capital under the law of June 14, 2004 (“Cape Capital”). The Parent Entities are Filing Persons of this Transaction Statement because they may be deemed to be affiliates of the Company under a possible interpretation of the SEC rules governing “going-private” transactions.

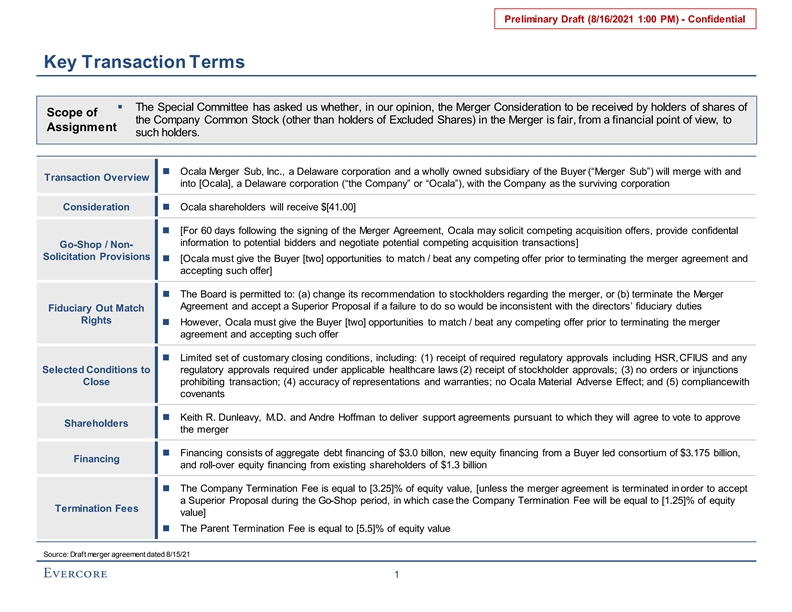

On August 19, 2021, the Company, Parent and Merger Sub entered into an Agreement and Plan of Merger (as amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”), which provides for, among other things, the merger of Merger Sub with and into the Company (the “Merger”), with the Company surviving the Merger as a direct wholly owned subsidiary of Parent. Concurrently with the filing of this Schedule 13E-3, the Company is filing with the SEC a preliminary proxy statement (the “Proxy Statement”) under Regulation 14A of the Exchange Act, relating to a special meeting of the stockholders of the Company (the “Special Meeting”) at which the stockholders of the Company will consider and vote upon a proposal to approve and adopt the Merger Agreement and cast a non-binding, advisory vote to approve certain items of compensation that are based on or otherwise related to the Merger and may become payable to certain named executive officers of the Company under existing agreements with the Company. The adoption of the Merger Agreement will require the affirmative vote of: (i) the holders of a majority of the voting power of the Company’s outstanding common stock, with holders of the outstanding Class A Common Stock and holders of the outstanding Class B Common Stock entitled to vote in accordance with the DGCL voting together as a single class; (ii) the holders of a majority of the outstanding shares of Class A Common Stock entitled to vote in accordance with the DGCL; (iii) the affirmative vote of holders of a majority of the outstanding shares of Class B Common Stock entitled to vote in accordance with the DGCL; and (iv) the holders of a majority of the voting power of the Company’s outstanding common stock held by the Company’s stockholders other than the Rollover Stockholders (as defined below), their respective affiliates or any executive officer or director of the Company (the “Public Stockholders”), with holders of Class A Common Stock and Class B Common Stock voting as a single class, in each case based on such shares outstanding as of the close of business on the record date for the Special Meeting. A copy of the Proxy Statement is attached hereto as Exhibit (a)(2)(i). A copy of the Merger Agreement is attached as Annex A to the Proxy Statement and incorporated herein by reference.

Under the terms of the Merger Agreement, if the Merger is completed, each Share, other than as provided below, will be converted into the right to receive $41.00 in cash (the “Merger Consideration”), without interest and less applicable withholding taxes. The following Shares will not be converted into the right to receive the per Share Merger Consideration in connection with the Merger: (i) certain shares held by Dr. Dunleavy and Cape Capital (the “Rollover Stockholders”) who will, pursuant to the terms of certain rollover agreements, dated as of August 19, 2021, exchange such shares of Company common stock for equity interests of Ocala Topco, Inc., a Delaware corporation, which in turn will be exchanged for equity interests of Ocala Topco, LP, a Delaware limited partnership, in each case subject to the terms and conditions of the applicable rollover agreement; (ii) shares held by Parent or Merger Sub (or any of their respective subsidiaries) or in the treasury of Inovalon; and (iii) shares held by a stockholder who properly exercises and perfects appraisal of his, her or its shares under

Section 262 of the General Corporation Law of the State of Delaware, a copy of which is attached as Annex F to the Proxy Statement and incorporated herein by reference.

The Merger remains subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, including the approval and adoption of the Merger Agreement by the Company’s stockholders.

The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3. Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Proxy Statement, including all appendices thereto, is incorporated in its entirety herein by reference, and the responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained in the Proxy Statement and the appendices thereto.

As of the date hereof, the Proxy Statement is in preliminary form and is subject to completion and/or amendment. This Schedule 13E-3 will be amended to reflect such completion or amendment of the Proxy Statement. Capitalized terms used but not expressly defined in this Schedule 13E-3 shall have the respective meanings given to them in the Proxy Statement.

The information concerning the Company contained in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied by the Company. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied by such Filing Person. No Filing Person, including the Company, is responsible for the accuracy of any information supplied by any other Filing Person.

While each of the Filing Persons acknowledges that the Merger is a “going private” transaction for purposes of Rule 13E-3 under the Exchange Act, the filing of this Transaction Statement shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing Person, that the Company is “controlled” by any Filing Person.

| Item 1. | Summary Term Sheet |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

| Item 2. | Subject Company Information |

(a) Name and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“PARTIES TO THE MERGER—The Company”

(b) Securities. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“INFORMATION ABOUT THE SPECIAL MEETING – Record Date and Quorum”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Market Price of Shares and Dividends”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Security Ownership of Certain Beneficial Owners and Management”

(c) Trading Market and Price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Market Price of Shares and Dividends”

(d) Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Market Price of Shares and Dividends”

(e) Prior Public Offerings. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Prior Public Offerings”

(f) Prior Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Certain Transactions in the Shares”

| Item 3. | Identity and Background of Filing Person |

(a) – (c) Name and Address; Business and Background of Entities; Business and Background of Natural Persons. Inovalon Holdings, Inc. is the subject company. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“PARTIES TO THE MERGER”

“OTHER INTERESTED PARTIES IN THE MERGER”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY”

| Item 4. | Terms of the Transaction |

(a)(1) Tender Offers. Not Applicable.

(a)(2) Mergers or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Material U.S. Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS – Financing of the Merger”

“SPECIAL FACTORS – Accounting Treatment”

“INFORMATION ABOUT THE SPECIAL MEETING – Vote Required”

“THE MERGER AGREEMENT”

Annex A – Merger Agreement

(c) Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Support Agreements”

“SPECIAL FACTORS – Rollover Agreements”

“THE MERGER AGREEMENT – Treatment of Equity Compensation Awards”

“THE MERGER AGREEMENT – Employee Matters”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

Annex A – Merger Agreement

Annex B – Support Agreements

Annex C – Rollover Agreements

(d) Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Appraisal Rights”

“THE MERGER AGREEMENT – Dissenters’ Rights”

“INFORMATION ABOUT THE SPECIAL MEETING – Appraisal Rights”

“THE MERGER (THE MERGER PROPOSAL – PROPOSAL 1) – Appraisal Rights”

Annex A – Merger Agreement

Annex F – Section 262 of the General Corporation Law of the State of Delaware

(e) Provisions for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Provisions for Public Stockholders”

(f) Eligibility for Listing or Trading. Not Applicable.

| Item 5. | Past Contracts, Transactions, Negotiations and Agreements |

(a) Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“THE MERGER AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Certain Transactions in the Shares”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Past Contracts, Transactions, Negotiations and Agreements”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex A – Merger Agreement

(b) Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Financing of the Merger”

“SPECIAL FACTORS – Limited Guarantee”

“SPECIAL FACTORS – Support Agreements”

“SPECIAL FACTORS – Rollover Agreements”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

Annex A – Merger Agreement

Annex B – Support Agreements

Annex C – Rollover Agreements

(c) Negotiations or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

(e) Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Intent of the Directors and Executive Officers to Vote in Favor of the Merger”

“SPECIAL FACTORS – Intent of the Rollover Stockholders to Vote in Favor of the Merger”

“SPECIAL FACTORS – Financing of the Merger”

“SPECIAL FACTORS – Limited Guarantee”

“SPECIAL FACTORS – Support Agreements”

“SPECIAL FACTORS – Rollover Agreements”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Certain Transactions in the Shares”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex A – Merger Agreement

Annex B – Support Agreements

Annex C – Rollover Agreements

| Item 6. | Purposes of the Transaction and Plans or Proposals |

(b) Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Payment of Merger Consideration”

“THE MERGER AGREEMENT”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A – Merger Agreement

(c)(1) – (8) Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Intent of the Directors and Executive Officers to Vote in Favor of the Merger”

“SPECIAL FACTORS – Intent of the Rollover Stockholders to Vote in Favor of the Merger”

“SPECIAL FACTORS – Financing of the Merger”

“SPECIAL FACTORS – Limited Guarantee”

“SPECIAL FACTORS – Support Agreements”

“SPECIAL FACTORS – Rollover Agreements”

“THE MERGER AGREEMENT”

“INFORMATION ABOUT THE SPECIAL MEETING”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A – Merger Agreement

Annex B – Support Agreements

Annex C – Rollover Agreements

| Item 7. | Purposes, Alternatives, Reasons and Effects |

(a) Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

(b) Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“SPECIAL FACTORS – Certain Effects on the Company if the Merger is Not Completed”

(c) Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Opinion of the Company’s Financial Advisor”

“SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

Annex D – Opinion of the Company’s Financial Advisor

Annex E – Opinion of the Special Committee’s Financial Advisor

(d) Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“SPECIAL FACTORS – Plans for the Company After the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“SPECIAL FACTORS – Certain Effects on the Company if the Merger is not Completed”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Material U.S. Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS – Fees and Expenses”

“SPECIAL FACTORS – Accounting Treatment”

“SPECIAL FACTORS – Payment of the Merger Consideration”

“THE MERGER AGREEMENT – The Merger”

“THE MERGER AGREEMENT – The Merger Consideration”

“THE MERGER AGREEMENT – Impact of Stock Splits, Etc.”

“THE MERGER AGREEMENT – Treatment of Equity Compensation Awards”

“THE MERGER AGREEMENT – Exchange Procedures and Payment Procedures”

“THE MERGER AGREEMENT – Withholding”

“THE MERGER AGREEMENT – Dissenters’ Rights”

“THE MERGER AGREEMENT – Organizational Documents, Directors and Officers of the Surviving Corporation”

“THE MERGER AGREEMENT – Delisting”

“THE MERGER AGREEMENT – Employee Matters”

“THE MERGER AGREEMENT – Indemnification; Directors’ and Officers’ Insurance”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A – Merger Agreement

| Item 8. | Fairness of the Transaction |

(a), (b) Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Opinion of the Company’s Financial Advisor”

“SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“THE MERGER AGREEMENT – Indemnification; Directors’ and Officers’ Insurance”

Annex D – Opinion of the Company’s Financial Advisor

Annex E – Opinion of the Special Committee’s Financial Advisor

(c) Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“THE MERGER AGREEMENT – Company Stockholder Approval”

“THE MERGER AGREEMENT – Conditions to the Completion of the Merger”

“INFORMATION ABOUT THE SPECIAL MEETING – Record Date and Quorum”

“INFORMATION ABOUT THE SPECIAL MEETING – Vote Required”

“INFORMATION ABOUT THE SPECIAL MEETING – Voting”

“INFORMATION ABOUT THE SPECIAL MEETING – How to Vote”

“INFORMATION ABOUT THE SPECIAL MEETING – Proxies and Revocation”

“THE MERGER (THE MERGER PROPOSAL – PROPOSAL 1)”

Annex A – Merger Agreement

(d) Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Opinion of the Company’s Financial Advisor”

“SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor”

“SPECIAL FACTORS – Provisions for Public Stockholders”

(e) Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Intent of the Directors and Executive Officers to Vote in Favor of the Merger”

“INFORMATION ABOUT THE SPECIAL MEETING – Recommendation of the Company Board”

“INFORMATION ABOUT THE SPECIAL MEETING – Voting Intentions of the Company’s Directors and Executive Officers”

“THE MERGER (THE MERGER PROPOSAL – PROPOSAL 1) – Vote Recommendation”

(f) Other Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“THE MERGER AGREEMENT – No Solicitation by the Company”

Annex A – Merger Agreement

| Item 9. | Reports, Opinions, Appraisals and Negotiations |

(a) – (c) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference.

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Opinion of the Company’s Financial Advisor”

“SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex D – Opinion of the Company’s Financial Advisor

Annex E – Opinion of the Special Committee’s Financial Advisor

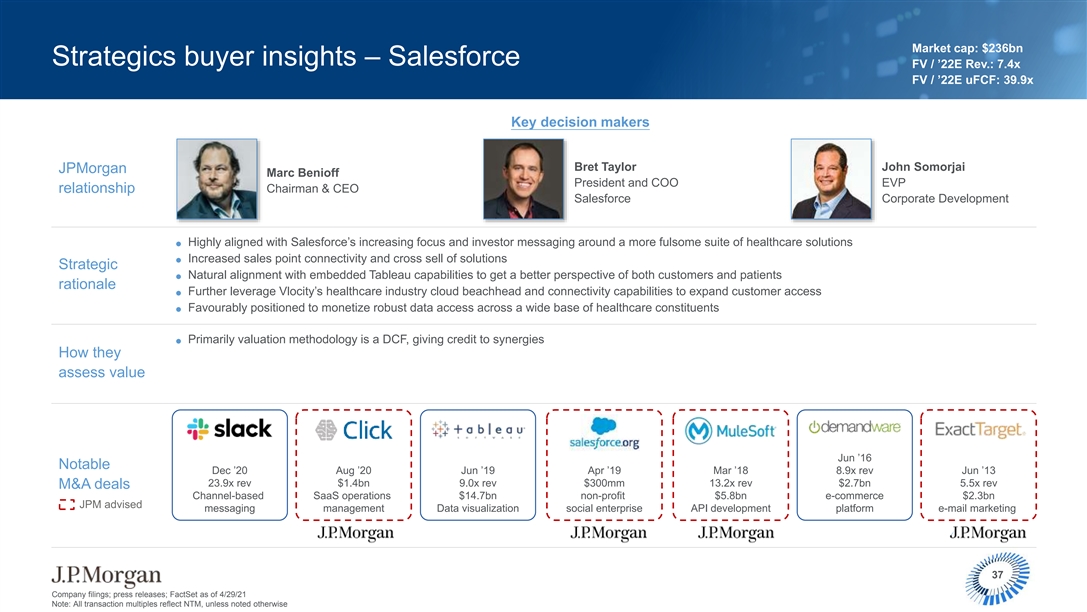

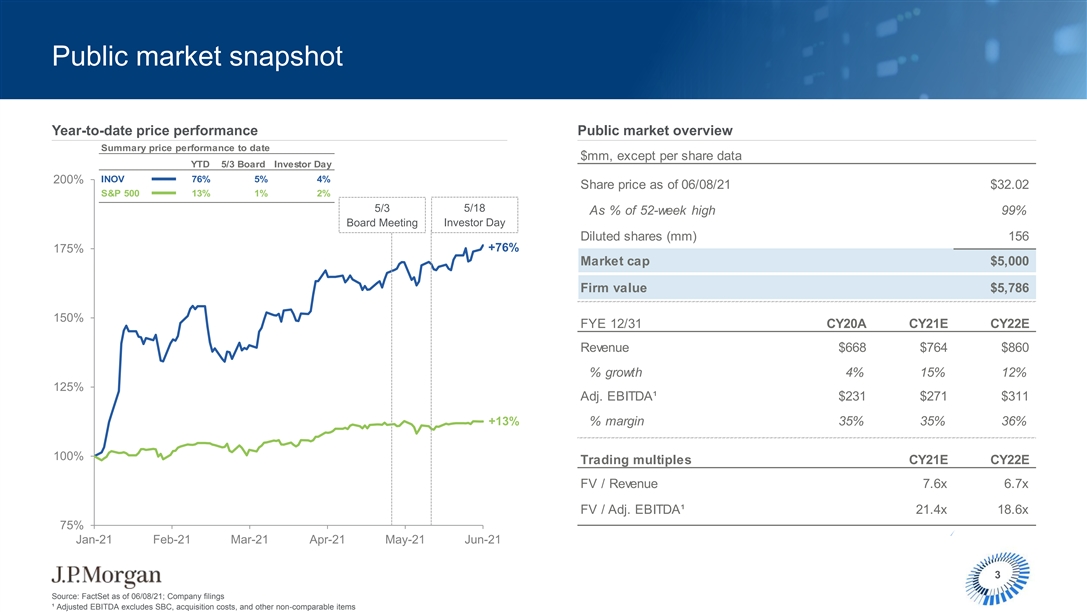

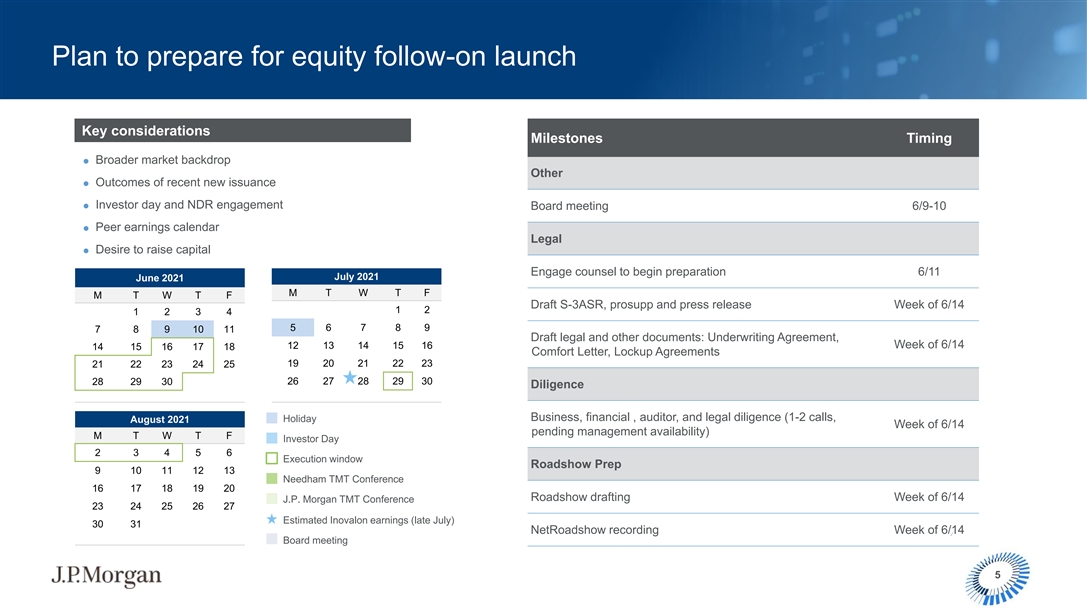

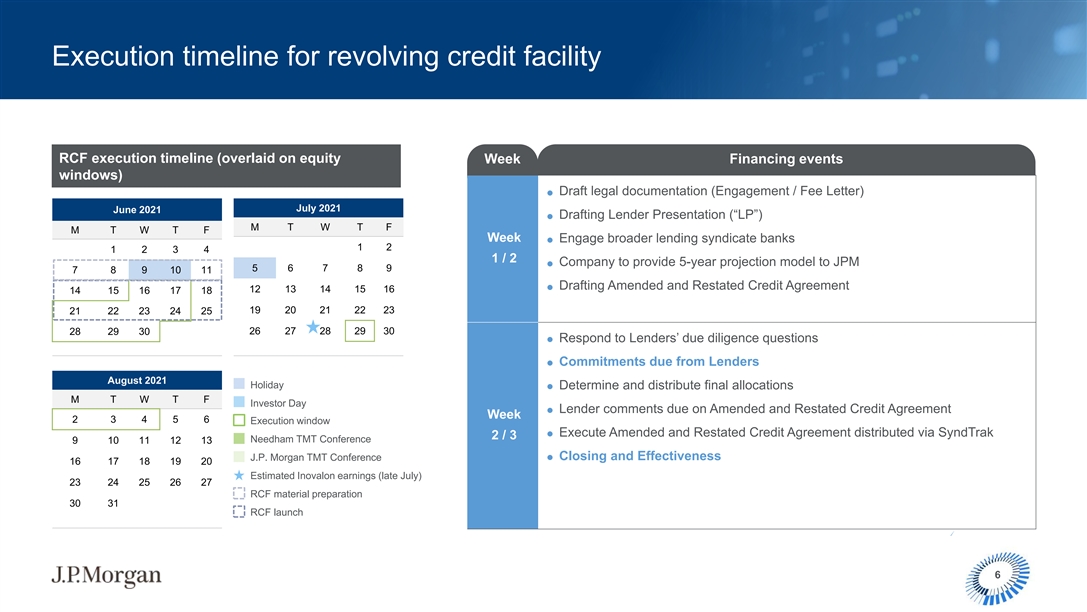

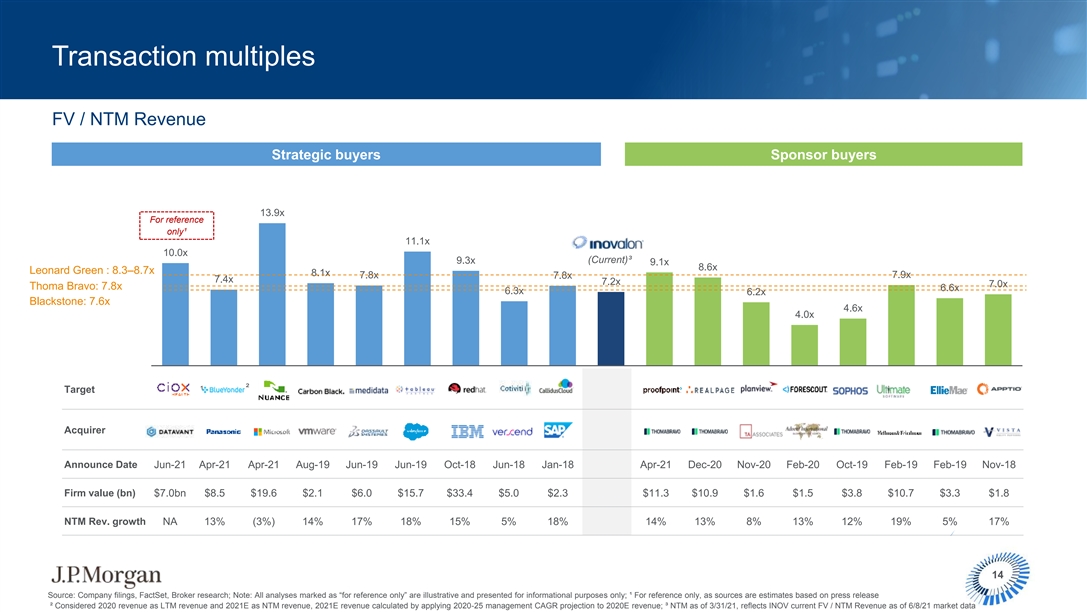

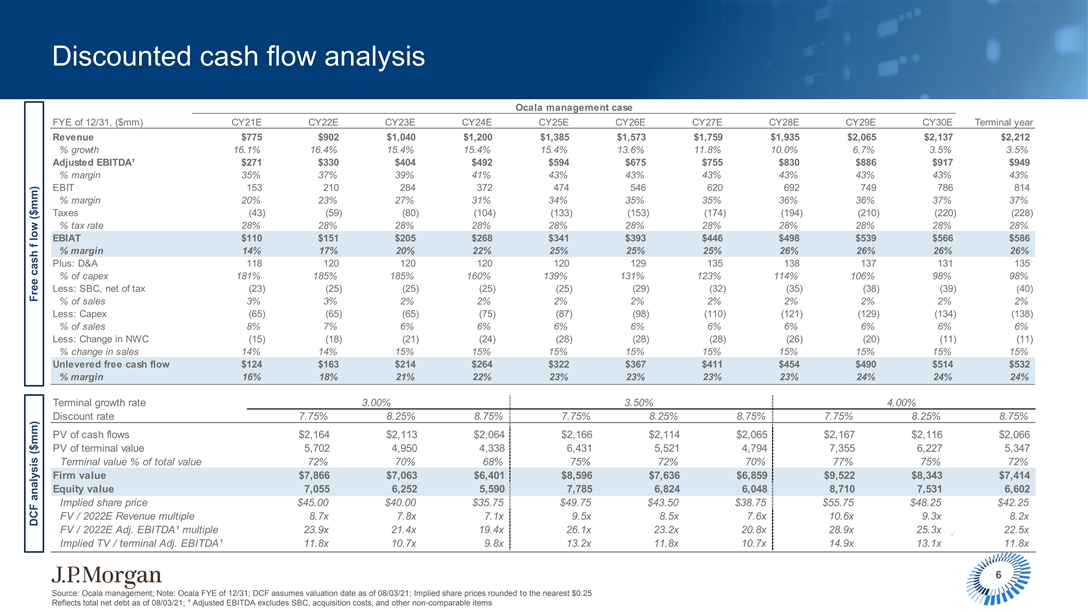

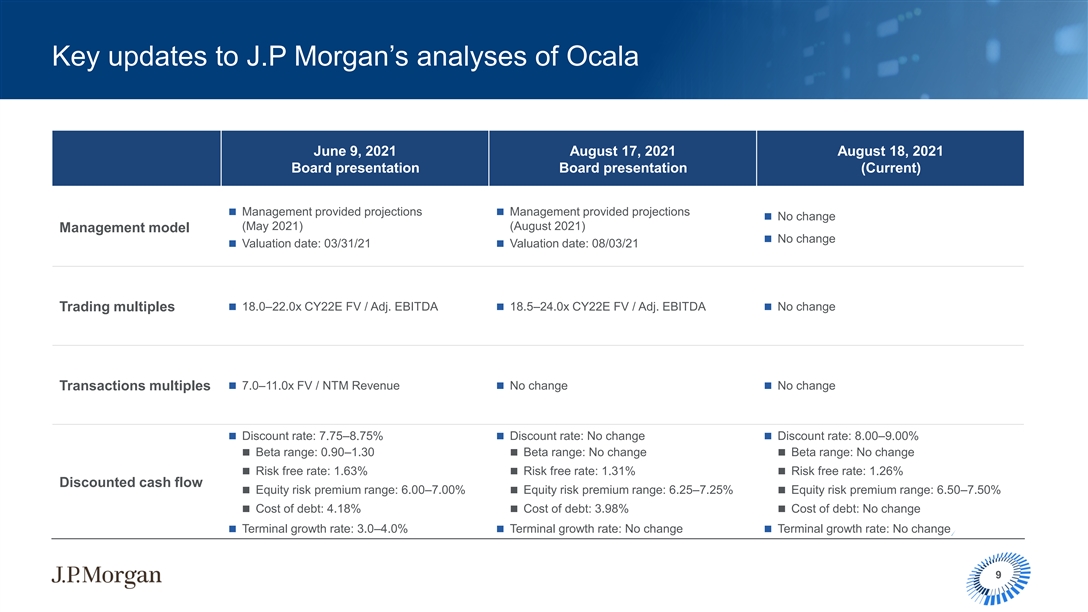

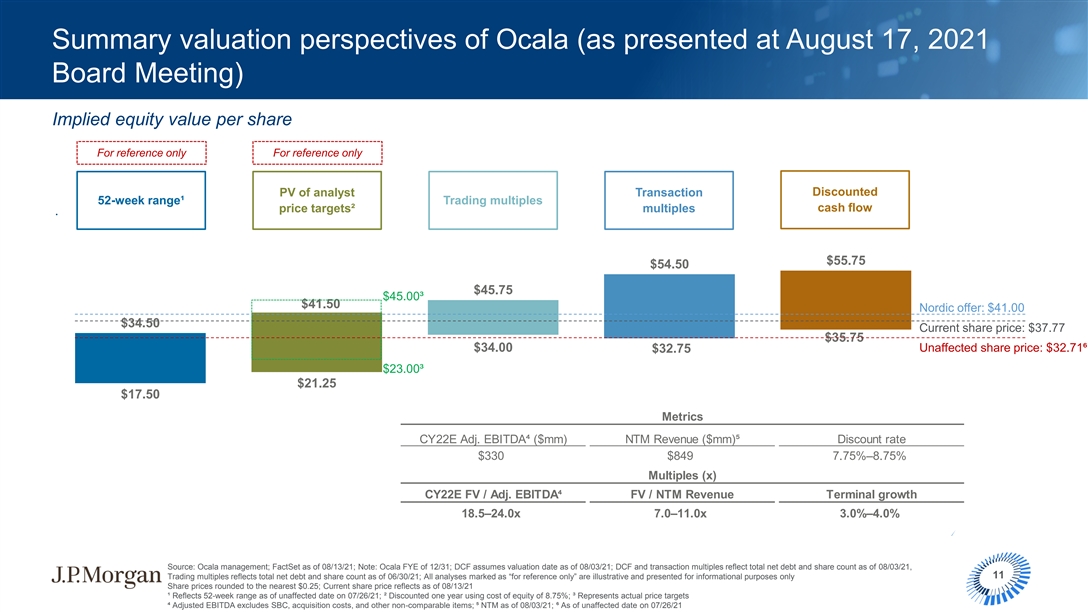

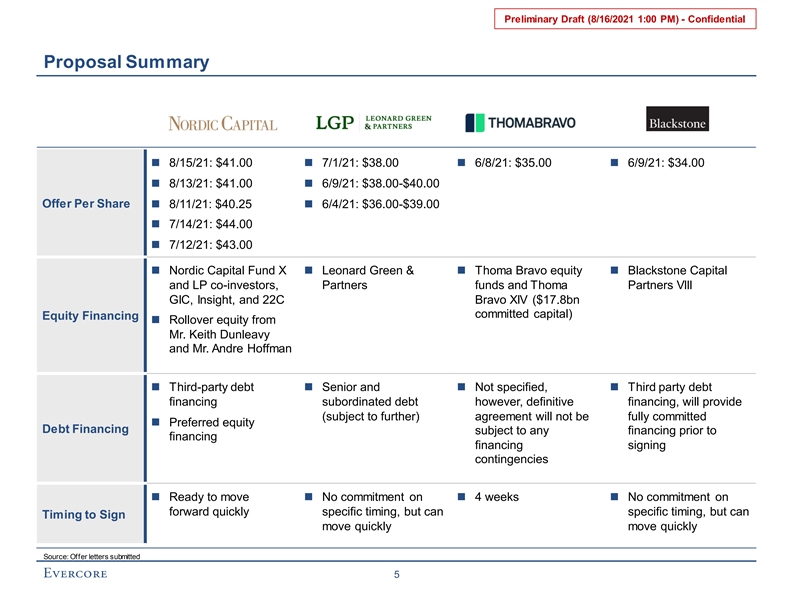

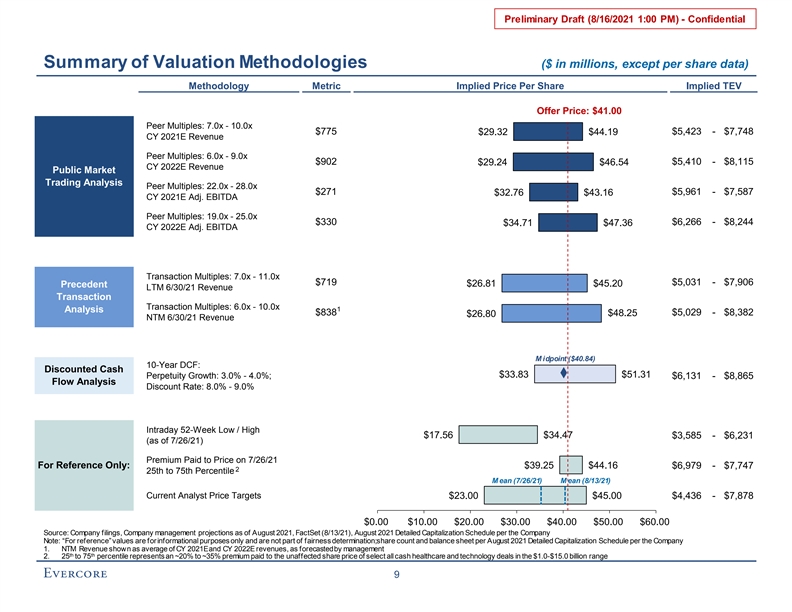

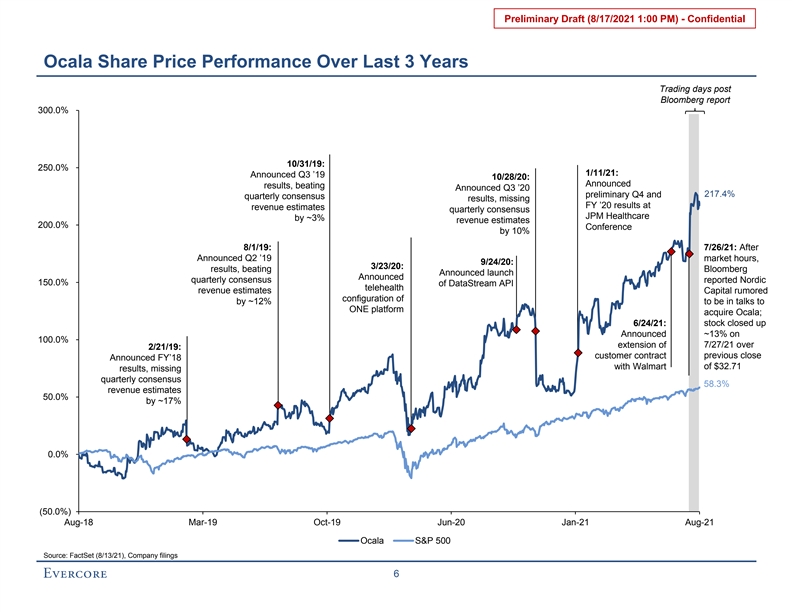

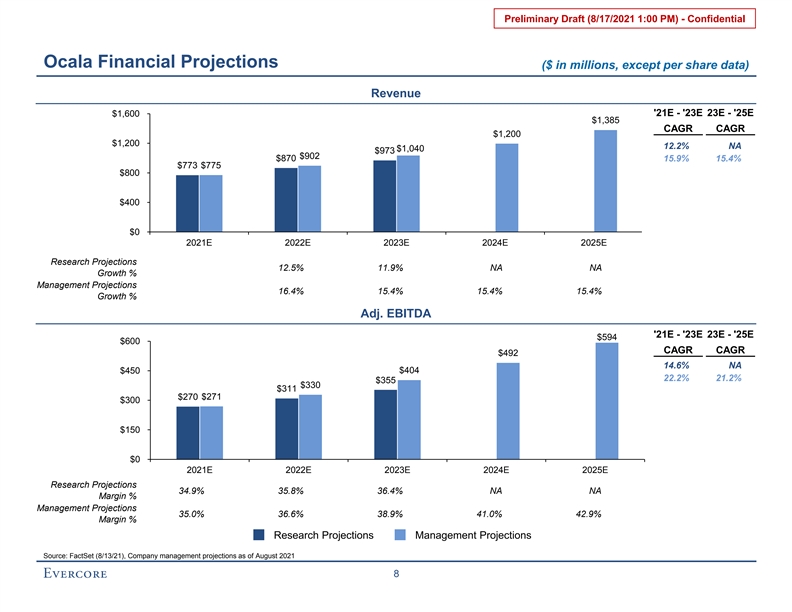

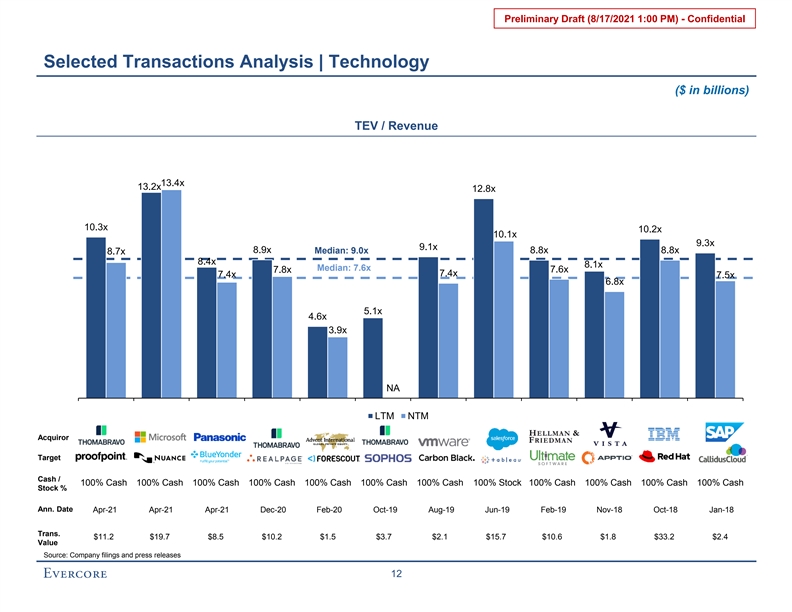

The Preliminary Discussion Materials dated May 3, 2021, which was for illustrative purposes only, and June 9, 2021, and the Fairness Opinion Presentation Materials dated August 17 and August 18, 2021, each prepared by J.P. Morgan Securities LLC and reviewed by the Company Board (as defined in the Proxy Statement), are attached hereto as Exhibits (c)(iii), (c)(iv), (c)(v) and (c)(vi), and are incorporated by reference herein.

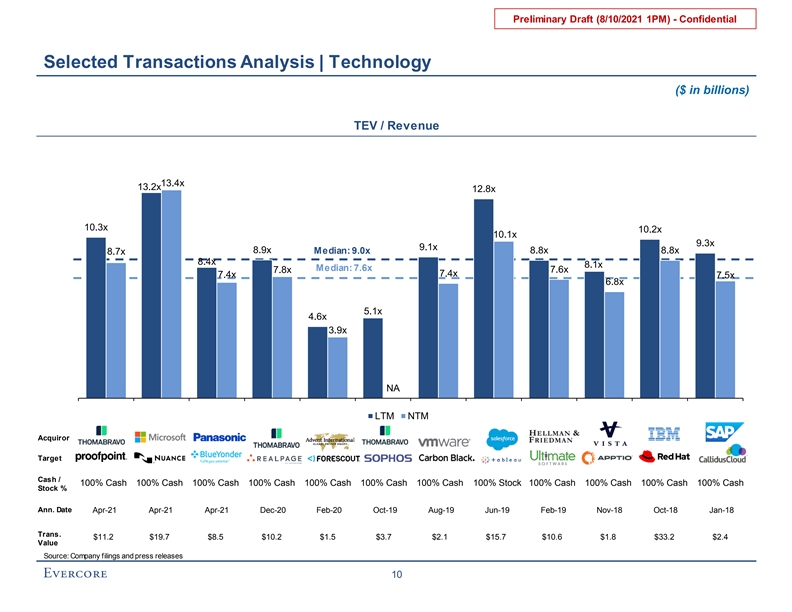

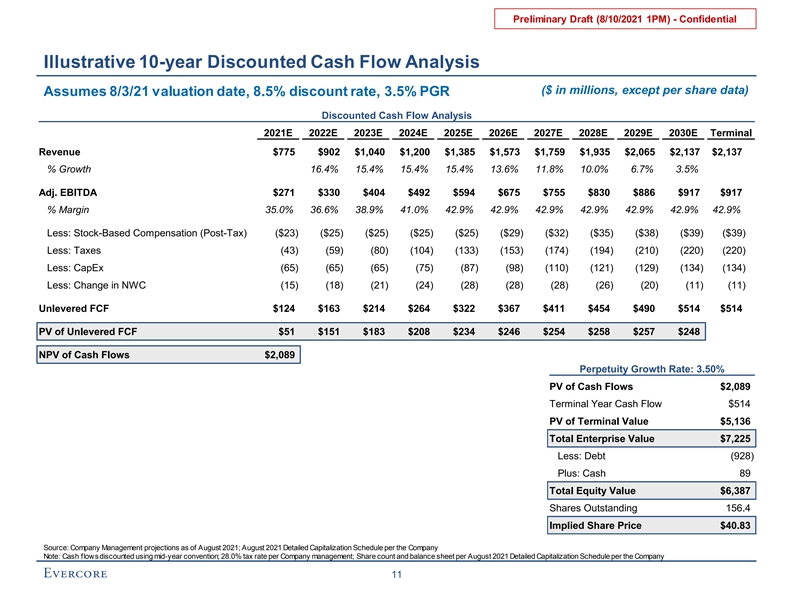

The Preliminary Discussion Materials dated August 10, 2021 and the Fairness Opinion Presentation Materials dated August 16, 2021 and August 17, 2021, each prepared by Evercore Group L.L.C. and reviewed by the Special Committee (as defined in the Proxy Statement), are attached hereto as Exhibits (c)(vii), (c)(viii) and (c)(ix), and are incorporated by reference herein.

| Item 10. | Source and Amount of Funds or Other Consideration |

(a), (b) Source of Funds; Conditions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS – Financing of the Merger”

“SPECIAL FACTORS – Limited Guarantee”

“THE MERGER AGREEMENT – Closing of the Merger”

“THE MERGER AGREEMENT – Effective Time of the Merger”

“THE MERGER AGREEMENT – Covenants Related to the Company’s Conduct of Business”

“THE MERGER AGREEMENT – Parent Financing and Company Cooperation”

“THE MERGER AGREEMENT – Conditions to the Completion of the Merger”

Annex A – Merger Agreement

(c) Expenses. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Fees and Expenses”

“THE MERGER AGREEMENT – Termination”

“THE MERGER AGREEMENT – Termination Fees”

“THE MERGER AGREEMENT – Expenses”

“INFORMATION ABOUT THE SPECIAL MEETING – Solicitation of Proxies; Payment of Solicitation Expenses”

Annex A – Merger Agreement

(d) Borrowed Funds.

“SPECIAL FACTORS – Financing of the Merger”

“THE MERGER AGREEMENT – Parent Financing and Company Cooperation”

| Item 11. | Interest in Securities of the Subject Company |

(a) Securities Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Support Agreements”

“INFORMATION ABOUT THE SPECIAL MEETING – Record Date and Quorum”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Security Ownership of Certain Beneficial Owners and Management”

Annex B – Support Agreements

(b) Securities Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Support Agreements”

“SPECIAL FACTORS – Rollover Agreements”

“THE MERGER AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Certain Transactions in the Shares”

Annex A – Merger Agreement

Annex B – Support Agreements

Annex C – Rollover Agreements

Item 12. The Solicitation or Recommendation

(d) Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Intent of the Directors and Executive Officers to Vote in Favor of the Merger”

“SPECIAL FACTORS – Intent of the Rollover Stockholders to Vote in Favor of the Merger”

“SPECIAL FACTORS – Support Agreements”

“INFORMATION ABOUT THE SPECIAL MEETING – Recommendation of the Company Board”

“INFORMATION ABOUT THE SPECIAL MEETING – Voting Intentions of the Company’s Directors and Executive Officers”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Security Ownership of Certain Beneficial Owners and Management”

Annex B – Support Agreements

(e) Recommendation of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Position of Parent Entities as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Parent Entities for the Merger”

“SPECIAL FACTORS – Position of the Rollover Stockholders as to the Fairness of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Rollover Stockholders for the Merger”

“INFORMATION ABOUT THE SPECIAL MEETING – Recommendation of the Company Board”

| Item 13. | Financial Statements |

(a) Financial Information. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Selected Historical Consolidated Financial Data”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY – Book Value per Share”

“WHERE YOU CAN FIND MORE INFORMATION”

(b) Pro Forma Information. Not Applicable.

Item 14. Persons/Assets, Retained, Employed, Compensated or Used

(a) Solicitations or Recommendations. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS – Fees and Expenses”

“INFORMATION ABOUT THE SPECIAL MEETING – Solicitation of Proxies; Payment of Solicitation Expenses”

(b) Employees and Corporate Assets. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS – Background of the Merger”

“SPECIAL FACTORS – Purpose and Reasons of the Company for the Merger; Recommendation of the Company Board and the Special Committee; Fairness of the Merger”

“INFORMATION ABOUT THE SPECIAL MEETING”

“INFORMATION ABOUT THE SPECIAL MEETING – Solicitation of Proxies; Payment of Solicitation Expenses”

Item 15. Additional Information

(b) The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTOR – Interests of Executive Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS – Certain Effects of the Merger”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS (THE GOLDEN PARACHUTE PROPOSAL – PROPOSAL 2)”

Annex A – Merger Agreement

(c) Other Material Information. The entirety of the Proxy Statement, including all appendices thereto, is incorporated herein by reference.

| Item 16. | Exhibits |

The following exhibits are filed herewith:

| Exhibit No. |

Description | |

| (a)(2)(i) | Preliminary Proxy Statement of Inovalon Holdings, Inc. (included in the Schedule 14A filed on September 17, 2021 and incorporated herein by reference) (the “Preliminary Proxy Statement”). | |

| (a)(2)(ii) | Form of Proxy Card (included in the Preliminary Proxy Statement and incorporated herein by reference). | |

| (a)(2)(iii) | Letter to Stockholders (included in the Preliminary Proxy Statement and incorporated herein by reference). | |

| (a)(2)(iv) | Notice of Special Meeting of Stockholders (included in the Preliminary Proxy Statement and incorporated herein by reference). | |

| (a)(5)(i) | Press Release, dated August 19, 2021 (incorporated by reference to Exhibit 99.1 to Inovalon Holding, Inc.’s Form 8-K filed August 19, 2021). | |

| (a)(5)(ii) | Associate FAQs, dated August 19, 2021 (included in the Schedule 14A filed on August 19, 2021 and incorporated herein by reference) | |

| (a)(5)(iii) | Letter to Associates from the Chief Executive Officer of Inovalon, dated August 19, 2021 (included in the Schedule 14A filed on August 19, 2021 and incorporated herein by reference) | |

| (a)(5)(iv) | Letter to Customers, dated August 19, 2021 (included in the Schedule 14A filed on August 19, 2021 and incorporated herein by reference) | |

| (a)(5)(v) | Letter to Vendor Partners, dated August 19, 2021 (included in the Schedule 14A filed on August 19, 2021 and incorporated herein by reference) | |

| (a)(5)(vi) | Social Media Posts dated August 19, 2021 (included in the Schedule 14A filed on August 19, 2021 and incorporated herein by reference) | |

| (b)(i) | Commitment Letter, dated August 19, 2021, executed by Blackstone Alternative Credit Advisors LP (together with funds and accounts managed or advised by it or its affiliates), Owl Rock Capital Advisors LLC (together with its affiliates and its and their managed funds and accounts) and Apollo Global Funding LLC and Apollo Capital Management, L.P., on behalf of one or more investment funds, separate accounts, and other entities owned (in whole or in part), controlled, managed, and/or advised by it or its affiliates and accepted by Ocala Bidco, Inc. | |

| (c)(i) | Opinion of J.P. Morgan Securities LLC, dated August 19, 2021 (included as Annex D to the Preliminary Proxy Statement, and incorporated herein by reference). | |

| (c)(ii) | Opinion of Evercore Group L.L.C., dated August 18, 2021 (included as Annex E to the Preliminary Proxy Statement, and incorporated herein by reference). | |

| (c)(iii) | Preliminary Discussion Materials, dated May 3, 2021, which was for illustrative purposes only, of J.P. Morgan Securities LLC prepared for the Company Board (as defined in the Proxy Statement). | |

| (c)(iv) | Preliminary Discussion Materials, dated June 9, 2021, of J.P. Morgan Securities LLC prepared for the Company Board (as defined in the Proxy Statement). | |

| (c)(v) | Fairness Opinion Presentation Materials, dated August 17, 2021, of J.P. Morgan Securities LLC prepared for the Company Board (as defined in the Proxy Statement). | |

| (c)(vi) | Fairness Opinion Presentation Materials, dated August 18, 2021, of J.P. Morgan Securities LLC prepared for the Company Board (as defined in the Proxy Statement). | |

| (c)(vii) | Preliminary Discussion Materials, dated August 10, 2021, of Evercore Group L.L.C. prepared for the Special Committee (as defined in the Proxy Statement). | |

| Exhibit No. |

Description | |

| (c)(viii) | Fairness Opinion Presentation Materials, dated August 16, 2021, of Evercore Group L.L.C. prepared for the Special Committee (as defined in the Proxy Statement). | |

| (c)(ix) | Fairness Opinion Presentation Materials, dated August 17, 2021, of Evercore Group L.L.C. prepared for the Special Committee (as defined in the Proxy Statement). | |

| (d)(i) | Agreement and Plan of Merger, dated August 19, 2021, by and among Inovalon Holdings, Inc., Ocala Bidco, Inc. and Ocala Merger Sub, Inc. (included as Annex A to the Preliminary Proxy Statement, and incorporated herein by reference). | |

| (d)(ii) | Voting and Support Agreement, dated August 19, 2021, by and among Ocala Bidco, Inc., Keith R. Dunleavy Management Trust u/a dated December 22, 2008, as amended, Meritas Holdings, LLC and Meritas Group, Inc. (included as Annex B to the Preliminary Proxy Statement, and incorporated herein by reference). | |

| (d)(iii) | Voting and Support Agreement, dated August 19, 2021, by and among Ocala Bidco, Inc., André Hoffmann and Cape Capital SCSp, SICAR – Inovalon Sub-Fund (included as Annex B to the Preliminary Proxy Statement, and incorporated herein by reference). | |

| (d)(iv) | Rollover Agreement, dated August 19, 2021, by and among Ocala Topco, LP, Ocala Topco, Inc. and Meritas Group, Inc. (included as Annex C to the Preliminary Proxy Statement and incorporated herein by reference). | |

| (d)(v) | Rollover Agreement, dated August 19, 2021, by and among Ocala Topco, LP, Ocala Topco, Inc. and Cape Capital SCSp, SICAR – Inovalon Sub-Fund (included as Annex C to the Preliminary Proxy Statement and incorporated herein by reference). | |

| (d)(vi) | Limited Guarantee, dated August 19, 2021, by Nordic Capital Epsilon SCA, SICAV-RAIF, on behalf of its compartment, Nordic Capital Epsilon SCA, SICAV-RAIF – Compartment 1, and each other guarantor party thereto, in favor of Inovalon Holdings, Inc. | |

| (d)(vii) | Equity Commitment Letter, dated August 19, 2021, by and among Nordic Capital Epsilon SCA, SICAV-RAIF, on behalf of its compartment, Nordic Capital Epsilon SCA, SICAV-RAIF - Compartment 1, Ocala Bidco, Inc. and each other equity investor party thereto. | |

| (f) | Section 262 of the General Corporation Law of the State of Delaware (included as Annex F to the Proxy Statement, and incorporated herein by reference). | |

| (g) | Not Applicable. | |

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| INOVALON HOLDINGS, INC. | ||

| By: | /s/ Jonathan Boldt | |

| Name: | Jonathan Boldt | |

| Title: | Chief Financial Officer | |

Date: September 17, 2021

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| OCALA BIDCO, INC. | ||

| By: | /s/ Aditya Desaraju | |

| Name: | Aditya Desaraju | |

| Title: | President | |

Date: September 17, 2021

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| OCALA MERGER SUB, INC. | ||

| By: | /s/ Aditya Desaraju | |

| Name: | Aditya Desaraju | |

| Title: | President | |

Date: September 17, 2021

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

NORDIC CAPITAL EPSILON SCA, SICAV-RAIF

(acting through its general partner NORDIC CAPITAL EPSILON GP SARL)

for and on behalf of its compartment NORDIC CAPITAL EPSILON SCA, SICAV-RAIF-COMPARTMENT 1

| By: | /s/ Ian Charoub | |

| Name: | Ian Charoub | |

| Title: | Class A Manager |

Date: September 17, 2021

| By: | /s/ Monica Morsch | |

| Name: | Monica Morsch | |

| Title: | Class B Manager |

Date: September 17, 2021

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| KEITH R. DUNLEAVY, M.D. | ||

| By: | /s/ Keith R. Dunleavy, M.D. | |

| Name: | Keith R. Dunleavy, M.D. | |

Date: September 17, 2021

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| MERITAS GROUP, INC. | ||

| By: | /s/ Keith R. Dunleavy, M.D. | |

| Name: | Keith R. Dunleavy, M.D. | |

| Title: | President | |

Date: September 17, 2021

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

CAPE CAPITAL SCSP, SICAR – INOVALON SUB-FUND

(by the General Partner CAPE CAPITAL MANAGEMENT S.À.R.L)

| By: | /s/ Rolf Johan Holgersson | |

| Name: | Rolf Johan Holgersson | |

| Title: | Member of the Board of Managers |

Date: September 17, 2021

| By: | /s/ Véronique Trausch | |

| Name: | Véronique Trausch | |

| Title: | Member of the Board of Managers | |

Date: September 17, 2021

Exhibit (b)(i)

EXECUTION VERSION

CONFIDENTIAL

August 19, 2021

| BLACKSTONE ALTERNATIVE 345 Park Avenue New York, New York 10154 |

OWL ROCK CAPITAL 399 Park Avenue, 38th New

York, New York |

APOLLO CAPITAL APOLLO GLOBAL 9 West 57th Street New York, NY 10019 |

Ocala Bidco, Inc.

c/o Nordic Capital X Limited

26 Esplanade,

St. Helier, Jersey JE2 3QA

Channel Islands

Project Ocala

Commitment Letter

Ladies and Gentlemen:

You have advised Blackstone Alternative Credit Advisors LP (together with funds and accounts managed or advised by it or its affiliates, “Blackstone”), Owl Rock Capital Advisors LLC (together with its affiliates and its and their managed funds and accounts, “Owl Rock”), and APOLLO GLOBAL FUNDING, LLC (“AGF”) and APOLLO CAPITAL MANAGEMENT, L.P., on behalf of one or more investment funds, separate accounts, and other entities owned (in whole or in part), controlled, managed, and/or advised by it or its affiliates (in such capacity, “ACM” and together with AGF, “Apollo”, and together with Blackstone and Owl Rock, the “Commitment Parties”, “us” or “we”) that you intend to acquire, directly or indirectly, the Target (as defined on Exhibit A hereto) and consummate the other transactions described on Exhibit A hereto. Capitalized terms used but not otherwise defined herein are used with the meanings assigned to such terms in the Exhibits hereto.

| 1. | Commitments. |

In connection with the Transactions contemplated hereby, (i) (a) each of Blackstone, Owl Rock and ACM (the “Initial Term Lenders”) hereby commits, on a several but not joint basis, to provide $1,287.0 million, $526.5 million and $526.5 million, respectively, of the entire principal amount of the Initial Term Facility, (b) each of Blackstone, Owl Rock and ACM hereby commits, on a several but not joint basis, to provide $137.5 million, $56.25 million and $56.25 million, respectively, of the entire principal amount of the Revolving Facility, (c) each of Blackstone, Owl Rock and ACM hereby commits, on a several but not joint basis, to provide $137.5 million, $56.25 million and $56.25 million, respectively, of the entire principal amount of the Delayed Draw Term Loan Facility and (d) each of Blackstone, Owl Rock and ACM (the “Second Lien PIK Lenders” and together with the Initial Term Lenders, each, an “Initial Lender” and, collectively, the “Initial Lenders”), on a several but not joint basis, hereby commit to provide $260.70 million, $250.80 million and $148.50 million of the entire principal amount of the Second Lien PIK Term Facility upon the terms set forth or referred to in this letter, the Transaction Summary attached as Exhibit A hereto and the Summary of Terms and Conditions attached as Exhibit B hereto and (ii) the initial funding of which is subject only to the conditions (the “Financing Conditions”) set forth on Exhibit C hereto (such Exhibits A through C, including the annexes thereto, the “Term Sheets” and together with this letter, collectively, this “Commitment Letter”).

Notwithstanding anything set forth herein to the contrary, (a) no Commitment Party shall be relieved, released or novated from its obligations hereunder (including its obligation to fund its applicable percentage of the Credit Facilities on the Closing Date) in connection with any assignment or other transfer until after the initial funding of the Credit Facilities on the Closing Date, (b) no such assignment or other transfer shall become effective with respect to any portion of the Commitment Parties’ commitments in respect of the Credit Facilities until the initial funding of the Credit Facilities on the Closing Date, and (c) unless the Borrower agrees in writing, each Commitment Party shall retain exclusive control over all rights and obligations with respect to its commitments in respect of the Credit Facilities, including all rights with respect to consents, waivers, modifications, supplements and amendments, until the Closing Date has occurred.

| 2. | Titles and Roles. |

It is agreed that:

| (a) | Owl Rock Capital Advisors LLC and AGF will act as joint lead arrangers and joint bookrunners for the Unitranche Facilities (acting in such capacities, the “Lead Arrangers”); |

| (b) | a third-party with customary agency capabilities appointed by you and reasonably acceptable to the Commitment Parties will act as sole administrative agent and as sole collateral agent for the Unitranche Facilities (the “Unitranche Agent”); and |

| (c) | Owl Rock Capital Corporation will act as sole administrative agent and as sole collateral agent for the Second Lien PIK Term Facility (the “Second Lien Agent”). |

You agree that no other agents, co-agents, arrangers, managers or arrangers will be appointed, no other titles will be awarded and no compensation (other than that expressly contemplated in this Commitment Letter, the fee letter dated the date hereof and delivered in connection herewith (the “Fee Letter”) and the arranger fee letter dated the date hereof and delivered in connection herewith (the “Arranger Fee Letter” and, together with the Fee Letter, the “Fee Letters”) will be paid in order to obtain any commitments with respect to the Credit Facilities unless you and we shall so reasonably agree.

| 3. | Information. |

You hereby represent and warrant that (to your knowledge with respect to the Target and its subsidiaries) (a) all written information and written data concerning Holdings, you and your subsidiaries and the Target and its subsidiaries, other than any projections, other forward-looking information and information of a general economic or industry-specific nature, that has been or will be made available to any of us by Holdings, you, the Sponsor or any of your and their respective representatives on your or their behalf in connection with the transactions contemplated hereby (the “Information”), when taken as a whole, is correct in all material respects and does not or will not, when furnished, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein not materially misleading in light of the circumstances under which such statements are made (after giving effect to all supplements and updates thereto from time to time) and (b) the Projections that have been or will be made available to any of us by Holdings, you, the Sponsor or any of your and their respective representatives on your or their behalf have been or will

2

be prepared in good faith based upon assumptions believed by you to be reasonable at the time made and at the time such Projections are furnished to us (it being recognized by the Commitment Parties that such Projections are not to be viewed as facts and are subject to significant uncertainties and contingencies many of which are beyond your control, that no assurance can be given that any particular financial projections will be realized, that actual results may differ from projected results and that such differences may be material). You agree that if, at any time prior to the Closing Date, you become aware that any of the representations and warranties in the preceding sentence would be incorrect in any material respect if the Information or the Projections were being furnished and such representations and warranties were being made at such time, you will (or with respect to Information and Projections concerning the Target and its subsidiaries, you will, subject to any applicable limitations on your rights as set forth in the Acquisition Agreement, use commercially reasonable efforts to) promptly supplement the Information and the Projections so that (to your knowledge with respect to the Target and its subsidiaries) the representations and warranties in the preceding sentence remain true in all material respects. Notwithstanding anything to the contrary contained in this Commitment Letter or the Fee Letters, none of the making of any representation under this Section 3, the making of any supplementation thereof, or the accuracy of any such representation shall constitute a condition precedent to the availability and initial funding of the Credit Facilities on the Closing Date.

| 4. | Fee Letters. |

As consideration for the commitments and agreements of the Commitment Parties hereunder, you agree to pay or cause to be paid the fees and closing payments described in the Fee Letters on the terms and subject to the conditions (including as to timing and amount) set forth therein.

| 5. | Certain Funds Provision. |

Notwithstanding anything in this Commitment Letter, the Fee Letters, the Credit Documentation or any other letter agreement or other undertaking concerning the financing of the transactions contemplated hereby to the contrary, (a) the only representations and warranties the accuracy of which shall be a condition to the availability and initial funding of the Credit Facilities on the Closing Date, shall be (i) such of the representations made by or on behalf of the Target (as defined in Exhibit A), its subsidiaries or their respective businesses in the Acquisition Agreement as are material to the interests of the Commitment Parties (the “Specified Acquisition Agreement Representations”), it being agreed that the failure of a Specified Acquisition Agreement Representation shall not result in the failure of a condition to the availability and initial funding of the Credit Facilities unless you or your affiliates have the right to terminate your or their obligations under the Acquisition Agreement or such failure results in a failure of a condition precedent to your or your affiliates obligation to consummate the Acquisition pursuant to the terms of the Acquisition Agreement and (ii) the Specified Representations (as defined below), (b) the terms of the Credit Documentation shall be in a form such that they do not impair the availability or the initial funding of the Credit Facilities on the Closing Date if the conditions set forth on Exhibit C hereto are satisfied or waived, it being understood that, to the extent any Collateral (including the creation or perfection of any security interest) is not or cannot be provided on the Closing Date (other than, to the extent required under the Term Sheet, (i) a lien on Collateral that may be perfected by the filing of a financing statement under the UCC and (ii) a pledge of the equity interests of the Borrower and the Subsidiary Guarantors organized under the laws of the United States with respect to which a lien may be perfected by the delivery of a physical stock or equivalent certificate (together with a stock power or similar instrument of transfer endorsed in blank) to the extent, in the case of Subsidiary Guarantors that are subsidiaries of the Target, received from the Target on or prior to the Closing Date after your use of commercially reasonable efforts to do so without undue burden or expense) after your use of commercially reasonable efforts to do so without undue burden or expense, then the provision and/or perfection of such Collateral shall not constitute a condition precedent to the availability and initial funding of the Credit Facilities on the Closing Date but may instead be delivered and/or perfected within 90 days (or such longer period as the

3

Unitranche Required Lenders (as defined in Exhibit B) may reasonably agree in their discretion) after the Closing Date pursuant to arrangements to be mutually agreed by the parties hereto acting reasonably, and (c) the only conditions (express or implied) to the availability of the Credit Facilities on the Closing Date are those expressly set forth on Exhibit C hereto, such conditions shall be subject in all respects to the provisions of this paragraph and upon satisfaction (or waiver) of the such conditions, each of the Commitment Parties will execute the Credit Documentation to which it is a party and the initial funding of term loans and provision of revolving commitments under Credit Facilities will occur. For purposes hereof, “Specified Representations” means the representations and warranties set forth in the Credit Documentation relating to: corporate power or other organizational existence of the Loan Parties; organizational power and authority (as it relates to due authorization, execution, delivery and performance of the Credit Documentation) of the Loan Parties; due authorization, execution and delivery of the relevant Credit Documentation by the Loan Parties, and enforceability, in each case as it relates to the entering into and performance of the relevant Credit Documentation by the Loan Parties; solvency as of the Closing Date (after giving effect to the Transactions) of the Borrower and its subsidiaries taken as a whole (in form and scope consistent with the solvency certificate to be delivered pursuant to paragraph 1(b) of Exhibit C hereto); no conflicts of the Credit Documentation with the charter documents of the Loan Parties; Federal Reserve margin regulations; the Investment Company Act; the PATRIOT Act; use of proceeds not violating OFAC, FCPA and other applicable anti-corruption and anti-terrorism laws and laws relating to sanctioned persons; and the creation, validity, perfection and priority of security interests in the Collateral (subject in all respects to security interests and liens permitted under the Credit Documentation and to the foregoing provisions of this paragraph). This paragraph, and the provisions contained herein, shall be referred to as the “Certain Funds Provision”.

| 6. | Indemnification; Expenses. |

You agree (a) to indemnify and hold harmless each of the Commitment Parties, their respective affiliates and controlling persons and their respective directors, officers, managers, members, employees, partners, agents, advisors and other representatives of each of the foregoing and their successors and permitted assigns (each, an “indemnified person”) from and against any and all losses, claims, damages, liabilities and expenses, joint or several, to which any such indemnified person may become subject arising out of, resulting from or in connection with this Commitment Letter, the Fee Letter, the Credit Facilities, the use of the proceeds thereof and the Acquisition and the Transactions, or any claim, dispute, litigation, investigation or proceeding relating to any of the foregoing (a “Proceeding”), regardless of whether any indemnified person is a party thereto or whether such Proceeding is brought by you, any of your affiliates or any third party, and to reimburse each indemnified person within thirty (30) days following written demand therefor (together with reasonable backup documentation supporting such reimbursement request) for any reasonable and documented legal fees or other out-of-pocket expenses incurred in connection with investigating or defending any of the foregoing (but limited, in the case of legal fees and expenses, to one external counsel to such indemnified persons taken as a whole and, solely in the case of an actual or potential conflict of interest, one additional external counsel to all affected indemnified persons, taken as a whole (and, if reasonably necessary, of one local external counsel in any relevant jurisdiction to all such persons, taken as a whole and, solely in the case of an actual or potential conflict of interest, one additional external local counsel to all affected indemnified persons, taken as a whole, in each such relevant jurisdiction)); provided, that the foregoing indemnity will not, as to any indemnified person, apply to losses, claims, damages, liabilities or related expenses to the extent they arise from (i) the willful misconduct, bad faith or gross negligence of, or material breach of a funding obligation of this Commitment Letter, the Fee Letters or the Credit Documentation by, such indemnified person (or any of its Related Parties (as defined below)), in each case as determined by a final non-appealable judgment of a court of competent jurisdiction or (ii) any disputes solely among indemnified persons (other than any claims against any Commitment Party in its capacity or in fulfilling its role as an administrative agent or any similar role under any facility) and not arising out of any act or omission of

4

Holdings, you, the Sponsor any of your or their respective affiliates, and (b) if the Closing Date occurs, to reimburse the Commitment Parties on the Closing Date (to the extent an invoice therefor is received by the Invoice Date) or, if invoiced after the Invoice Date, within thirty (30) days, for all reasonable and documented out-of-pocket fees and expenses (including, but not limited to, due diligence expenses, travel expenses, and legal fees and expenses (but limited to, in the case of legal expenses, the reasonable fees, charges and disbursements of (x) one external counsel to the Commitment Parties and, if reasonably necessary, of one local external counsel in any relevant jurisdiction), (y) one external counsel to the Unitranche Agent pursuant to arrangement to be agreed between the Unitranche Agent and you, and, if reasonably necessary, of one local external counsel for the Unitranche Agent in any relevant jurisdiction and (z) one external counsel to the Second Lien Agent pursuant to arrangement to be agreed between the Second Lien Agent and you, and, if reasonably necessary, of one local external counsel for the Second Lien Agent in any relevant jurisdiction)), incurred in connection with each of the Credit Facilities and any related documentation (including this Commitment Letter, the Fee Letters and the Credit Documentation). No indemnified person or any other party hereto shall be liable for any damages arising from the use by any person of Information or other materials obtained through electronic, telecommunications or other information transmission systems, except to the extent any such damages arise from the gross negligence, bad faith or willful misconduct of such indemnified person (or any of its Related Parties), in each case as determined by a final non-appealable judgment of a court of competent jurisdiction. None of the indemnified persons, Holdings, you, the Investors, the Target, the Sellers or any of your or their respective affiliates or the respective directors, officers, employees, agents, advisors or other representatives of any of the foregoing shall be liable for any special, indirect, consequential or punitive damages in connection with this Commitment Letter, the Fee Letters or the Credit Facilities (including the use or intended use of the proceeds of the Credit Facilities) or the transactions contemplated hereby; provided, that nothing contained in this sentence shall limit your indemnification obligations to the extent set forth herein to the extent such special, indirect, consequential or punitive damages are included in any third party claim in connection with which such indemnified person is entitled to indemnification hereunder. You shall not be liable for any settlement of any Proceeding effected by any indemnified person without your consent (which consent shall not be unreasonably withheld, conditioned or delayed), but if settled with your written consent, or if there is a final non-appealable judgment of a court of competent jurisdiction against an indemnified person in any such Proceeding, you agree to indemnify and hold harmless such indemnified person in the manner set forth above. You shall not, without the prior written consent of the affected indemnified person (which consent shall not be unreasonably withheld, conditioned or delayed), effect any settlement of any pending or threatened Proceeding against such indemnified person in respect of which indemnity could have been sought hereunder by such indemnified person unless such settlement (a) includes an unconditional release of such indemnified person from all liability or claims that are the subject matter of such Proceeding and (b) does not include any statement as to any admission of fault or culpability. Notwithstanding the foregoing, each indemnified person shall be obligated to refund or return any and all amounts paid by you under this paragraph to such indemnified person for any losses, claims, damages, liabilities and expenses to the extent such indemnified person is not entitled to payment of such amounts in accordance with the terms hereof as determined by a court of competent jurisdiction in a final non-appealable judgment. For purposes hereof, “Related Party” and “Related Parties” of an indemnified person mean (a) any controlling person or controlled affiliate of such indemnified person, (b) the respective directors, officers or employees of such indemnified person or any of its controlling persons or controlled affiliates and (c) the respective agents or representatives of such indemnified person or any of its controlling persons or controlled affiliates, in the case of this clause (c), acting on behalf of, or at the express instructions of, such indemnified person, controlling person or such controlled affiliate.

5

| 7. | Sharing of Information, Absence of Fiduciary Relationship. |

Each Commitment Party, together with its respective affiliates, may be, or may be affiliated with, a full service financial firm and as such from time to time may (a) effect transactions for its own account or the account of customers, and hold long or short positions in debt or equity securities or loans of companies that may be the subject of the transactions contemplated hereby or (b) provide debt financing, equity capital or other services (including without limitation, financing activities and financial planning and benefits counseling) to other companies in respect of which you, the Sponsor or the Target and your and their respective Subsidiaries may have conflicting interests. We will not furnish confidential information obtained from you by virtue of the transactions contemplated by this Commitment Letter or our other relationships with you to other companies (except as permitted by Section 8 below). You also acknowledge that the Commitment Parties and their respective affiliates have no obligation to use in connection with the transactions contemplated hereby, or to furnish to you, confidential information obtained from other companies or other persons. You acknowledge and agree that (a)(i) the commitments by the Commitment Parties hereunder are arm’s-length transactions between you and your affiliates, on the one hand, and the Commitment Parties, on the other hand, that do not directly or indirectly give rise to, nor do you rely on, any fiduciary duty on the part of the Commitment Parties and you waive, to the fullest extent permitted by law, any claims you may have against us for breach of fiduciary duty or alleged breach of fiduciary duty in connection with the transactions contemplated hereby and agree that we will have no liability (whether direct or indirect) to you in respect of such a fiduciary duty claim or to any person asserting a fiduciary duty claim on your behalf, including equity holders, employees or creditors, (ii) you have consulted your own legal, accounting, regulatory and tax advisors to the extent you have deemed appropriate and you are not relying on the Commitment Parties for such advice and (iii) you are capable of evaluating, and understand and accept, the terms, risks and conditions of the transactions contemplated hereby; and (b) in connection with the transactions contemplated hereby, (i) each Commitment Party and its affiliates has been, is, and will be acting solely as a principal and, except as otherwise expressly agreed in writing by the relevant parties, has not been, is not, and will not be acting as an advisor, agent or fiduciary for you or any of your affiliates and (ii) no Commitment Party nor any Commitment Party’s affiliates has any obligation to you or your affiliates except those obligations expressly set forth in this Commitment Letter and any other agreement with you or any of your affiliates. You agree that you will not assert that any Commitment Party or any of their respective affiliates, as the case may be, have rendered advisory services of any nature or respect, or owe a fiduciary or similar duty to you or your affiliates, in connection with such transaction or the process leading thereto.

The Commitment Parties and their respective affiliates may have economic interests that conflict with those of Holdings, Target or the Borrower and may provide financing or other services to parties whose interests’ conflict with yours. In the ordinary course of business, each Commitment Party may acquire, hold or sell, for its own accounts and the accounts of customers, equity, debt and other securities and financial instruments (including bank loans and other obligations) of, you, the Borrower, the Sponsor, the Target or your and their respective subsidiaries and other companies with which you, the Borrower, the Sponsor, the Target or your and their respective subsidiaries may have commercial or other relationships. With respect to any securities and/or financial instruments so held by any Commitment Party, its affiliates or any of their respective customers, all rights in respect of such securities and financial instruments, including any voting rights, will be exercised by the holder of the rights, in its sole discretion. Additionally, you acknowledge and agree that we are not advising you as to any legal, tax, investment, accounting or regulatory matters in any jurisdiction (including, without limitation, with respect to any consents needed in connection with the transactions contemplated hereby).

6

| 8. | Confidentiality. |

This Commitment Letter is entered into on the understanding that neither this Commitment Letter (prior to your acceptance thereof) nor the Fee Letters nor any of their terms or substance shall be disclosed by you, directly or indirectly, to any other person except (a) your subsidiaries, the Investors (or any prospective Investors) and to your and their respective directors, officers, employees, affiliates, members, partners, stockholders, attorneys, accountants, independent auditors, agents and other advisors and those of the Target and its subsidiaries and the Target itself, in each case, on a confidential basis (provided, that any disclosure of the Fee Letters or its contents to the Target or its subsidiaries or their respective directors, officers, employees, affiliates, members, partners, stockholders, attorneys, accountants, independent auditors, agents or other advisors (other than the Investors and their respective directors, officers, employees, affiliates, members, partners, stockholders, attorneys, accountants, independent auditors, agents and other advisors) shall be redacted in a customary manner to be reasonably agreed upon), (b) in any legal, judicial or administrative proceeding or as otherwise required by applicable law, rule or regulation or as requested by any governmental, regulatory or self-regulatory authority (in which case you agree, to the extent permitted by law and reasonably practicable to do so, to inform us promptly in advance thereof), (c) to the extent reasonably necessary or advisable in connection with the exercise of any remedy or enforcement of any right under this Commitment Letter and/or the Fee Letters, (d) this Commitment Letter, including the existence and contents of this Commitment Letter (but not the Fee Letters or the contents thereof, other than the existence thereof and the aggregate amount of the fees payable thereunder) therein as part of projections, pro forma information and a generic disclosure of aggregate sources and uses to the extent customary in marketing materials and other disclosures) may be disclosed in any proxy statement or similar public filing related to the Acquisition or in connection with any public filing requirement and (e) any prospective Replacement Revolving Provider and their respective affiliates on a confidential basis. The foregoing restrictions shall cease to apply in respect of the existence and contents of this Commitment Letter (but not in respect of the Fee Letters and its contents) on the second anniversary of the earlier of the Closing Date and the date of termination of this Commitment Letter in accordance with its terms.