Form SC 13D/A EMC INSURANCE GROUP INC Filed by: SHEPARD GREGORY M

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20459

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

EMC INSURANCE GROUP INC.

(Name of Issuer)

Common Stock, $1.00 par value

(Title of Class of Securities)

268664109

(CUSIP Number of Class of Securities)

Gregory M. Shepard

7028 Portmarnock Place

Lakewood Ranch, FL 34202

(941) 306-5368

(Name, address and telephone number of persons authorized to receive notices and communications

on behalf of person(s) filing statement)

Copy to:

Eric M. Fogel, Esq.

SmithAmundsen LLC

150 N. Michigan Ave., Suite 3300

Chicago, IL 60601

(312) 894-3325

March 25, 2019

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-l(b)(3) or (4), check the following box ☐.

Page 1 of 4

CUSIP No. 268664109

| 1. |

NAME OF REPORTING PERSON S.S. OR I.R.S. IDENTIFICATION NOS. OF REPORTING PERSON

Gregory M. Shepard | |||||

| 2. | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐

| |||||

| 3. | SEC USE ONLY

| |||||

| 4. | SOURCE OF FUNDS

PF, BK | |||||

| 5. | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☒ | |||||

| 6. | CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America | |||||

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. | SOLE VOTING POWER

1,100,000 | ||||

| 8. | SHARED VOTING POWER

-0- | |||||

| 9. | SOLE DISPOSITIVE POWER

1,100,000 | |||||

| 10. | SHARED DISPOSITIVE POWER

-0- | |||||

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,100,000 | |||||

| 12. | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

| |||||

| 13. | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.09% | |||||

| 14. | TYPE OF REPORTING PERSON

IN | |||||

Page 2 of 4

SCHEDULE 13D

| ITEM 1. | SECURITY AND ISSUER. |

This statement constitutes Amendment No. 2 to the Schedule 13D relating to the common stock, $1.00 par value (the “Shares”), issued by EMC Insurance Group Inc. (the “Issuer”), and hereby amends the Schedule 13D filed with the Securities and Exchange Commission (as previously amended, the “Schedule 13D”) to furnish additional information set forth herein. All capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D.

| ITEM 4. | PURPOSE OF TRANSACTION. |

Item 4 of the Schedule 13D is hereby amended to add the following at the end thereof:

On March 25, 2019, the Filing Person sent a letter to Issuer’s Special Committee of the Board of Directors (the “March 25 Letter”). A copy of the March 25 Letter is attached hereto as Exhibit 7.6 and is incorporated by reference herein.

The Special Committee of the Issuer’s Board of Directors did offer to hear Filing Person’s views on valuations. See the correspondence attached hereto as Exhibit 7.7, which is incorporated by reference herein.

| ITEM 7. | MATERIAL TO BE FILED AS EXHIBITS. |

Exhibit 7.6 Letter dated March 25, 2019, from the Filing Person to the Special Committee of the Board of Directors of the Issuer.

Exhibit 7.7 Sandler O’Neill emails to the Filing Person dated February 1, February 25 and March 5, 2019; letter from SmithAmundsen LLC to Wilkie Farr & Gallagher LLP dated March 5, 2019; letter from Wilkie Farr & Gallagher LLP to SmithAmundsen LLC dated March 6, 2019; and email from Wilkie Farr & Gallagher LLP to SmithAmundsen LLC dated March 22, 2019.

Page 3 of 4

SIGNATURE

After reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

| DATED: March 25, 2019 |

| /s/ Gregory M. Shepard |

| Gregory M. Shepard |

Page 4 of 4

Exhibit 7.6

Gregory M. Shepard

Attorney at Law

7028 Portmarnock Place

Lakewood Ranch, FL 34202

March 25, 2019

Special Committee

Board of Directors

EMC Insurance Group Inc.

P.O. Box 712

Des Moines, Iowa 50306

| Re: | Maximizing Value for EMCI Shareholders |

Members of the Special Committee:

As you know, I am a large and long-term shareholder of EMC Insurance Group Inc. (the “Company” or “EMCI”). I have owned the stock since 2005 and am now the second largest public shareholder of the Company, with an ownership stake of 1.1 million shares.

In November 2018, the Company’s majority owner, Employers Mutual Casualty Company (“EMCC”), made an opportunistic proposal to acquire the shares of the Company that EMCC did not already own (the “Proposal”). The Proposal values the Company at 1.13 times book value and was made during an extremely difficult Fourth Quarter that resulted in temporarily depressed financial results. I do not believe this is an august way for the Company to end more than thirty years of being owned in the public markets.

I believe the Special Committee of the Company’s Board has an obligation to resist any effort by EMCC (and its CEO, Mr. Kelley) to take advantage of the public shareholders of the Company and must consider precedent transactions and all alternatives to the Proposal, including the sale of the Company to other bidders, to maximize value for all public shareholders.

Consistent with those precedents and opportunities, as described more completely below, I believe the Company should be valued in any go-private transaction well in excess of two times book value, which is significantly more than $50 per share.

The current $30 per share Proposal is therefore woefully inadequate.

The Special Committee Is Conflicted

While it is true that each member of the Special Committee is “independent” of the Company under Nasdaq rules, no one can seriously believe the members of the Special Committee are without strong ties to EMCC and its CEO, Bruce Kelley.

Mr. Kelley has controlled the voting (including in all director elections) at EMCI’s annual meetings since each of you was appointed to the Company’s Board. Each of you serves on the EMCI Board solely because of Mr. Kelley’s support and EMCC’s willingness to nominate and vote for you. You are undoubtedly aware that if you reject the Proposal - or bargain so hard that EMCC walks away, your lucrative assignment, as EMCC’s hand picked board member of the Company, will likely vanish.

Special Committee of the Board of Directors

EMC Insurance Group Inc.

March 25, 2019

Page 2

I am also aware that the Director seat you occupy at the Company has been quite lucrative for each of you. Collectively, the four of you have received close to $2.5 million in fees over your tenures; nearly 90% of that was paid to you in cash.1 You are undoubtedly grateful for EMCC’s support.

And while you have received substantial cash fees at the behest of EMCC and Mr. Kelley, you do not own much Company stock. According to the last proxy statement issued by the Company, the four of you own less than one-quarter of one percent of EMCI’s stock. (I alone own twenty times the amount of stock you own collectively.)

I think it is fair for the public shareholders like me to be concerned that your economic loyalties lie with Mr. Kelley and not with the Company’s shareholders, to whom you owe fiduciary duties. I frankly wish you all owned more stock, so that your economic outcome would be more aligned with those of the public shareholders.

Your Refusal to Allow Me to Serve on the Board Lacks Sound Reasoning

Recognizing the potentially conflicting loyalties of the Special Committee members, in late January I requested to be added to the Board and the Special Committee to assist the Company in evaluating the Proposal and reasonable alternatives to the Proposal.

In addition to owning 1.1 million shares of the Company, my family and I have been in the insurance business as operators and investors for decades. With twenty times the ownership of the Special Committee, I could have represented the public shareholders well and brought increased legitimacy to a process otherwise fraught with conflicts of interest and competing loyalties.

Instead, you rejected my offer of assistance.

I frankly do not understand your reasoning. The public shareholders would surely have taken comfort from the presence of a large shareholder on the Special Committee. It is hard to see how my involvement, experience and background would have been anything but additive at this critical time.

Your refusal to allow me to assist you directly is extremely concerning to me and, I suspect, to other shareholders. I fear it reflects your loyalty to EMCC and Mr. Kelley.

EMCC’s Proposal Is Opportunistically Timed

The Company has been publicly traded for more than 35 years. EMCC could have chosen to make a consolidation proposal at any time. I believe EMCC chose to make its Proposal in the Fourth Quarter of 2018 because it knew the Company’s business and financial results would be particularly weak. As such, the timing of the Proposal is opportunistic.

In 2018, for the first time in more than 15 years, the Company lost money for a full year. The Fourth Quarter was particularly bad: the quarterly operating loss was the single worst financial performance in more than twenty years. Some of these losses, it should be noted, were incurred voluntarily, as Mr. Kelley chose to realize investment losses during the quarter.

| 1 | Notably, most of the non-cash compensation was delivered to you in the form of substantial discounts on the purchase of Company stock (a 25% discount to fair market value). Surprisingly, despite this substantial economic incentive to purchase stock in the Company, the four of you own less than $1.5 million of Company stock today. |

Special Committee of the Board of Directors

EMC Insurance Group Inc.

March 25, 2019

Page 3

The quarter’s bad performance undoubtedly affected investor sentiment, which along with book value, was driven lower during the quarter. The outlook was reflected in sellside analyst estimates as well. For 2019 EPS, analysts had been estimating $1.67 as recently as early 2018; by the time of the Proposal, the average 2019 EPS estimate had been lowered to $1.38, according to Factset.

With shareholders facing depressing financial results, EMCC made its Proposal. But I don’t believe that 2018 or the Fourth Quarter is indicative of the Company’s future or its value to EMCC or other strategic parties. Fair transactions – especially between related parties – do not occur when one side takes advantage of short-term weakness.

That said, it has been a while since the Company’s stock has performed for shareholders. Indeed, it is clear investors do not have much confidence in the controlling shareholder and the Company’s management team.

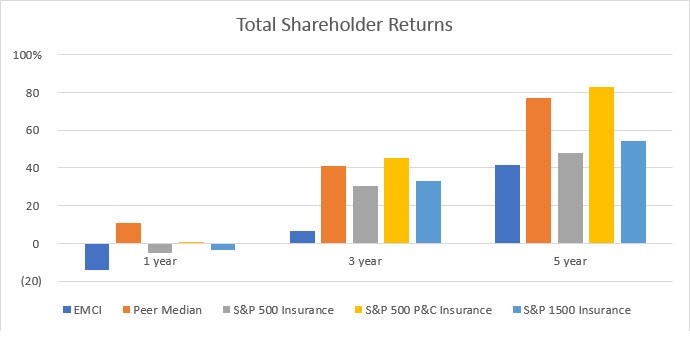

In each of the one-, three- and five-year periods up to the date EMCC made the Proposal, the Company’s total shareholder return has lagged its insurance company peers and relevant indexes substantially.2 For example, over the three years ended November 15, 2018 (the day before the EMCC offer for the Company), the S&P 500 Property and Casualty index was up more than 45% and the peers had a median return of 41%, while the Company’s total return was just 7%.

Source: FactSet. Returns through November 15, 2018.

| 2 | EMCI compared to other companies headquartered in the United States with primary SIC code of 6330 and the S&P 500 Insurance, S&P 500 Property and Casualty Insurance Index and the S&P Composite 1500 Insurance index. |

Special Committee of the Board of Directors

EMC Insurance Group Inc.

March 25, 2019

Page 4

Instead of implementing the necessary operational changes required to fix the Company’s performance and bring it in line with peers, EMCC and Mr. Kelley made the Proposal, I believe, so that they could buy the public’s interest in the Company, at a depressed price, and keep the upside for themselves.

But the Company and its shareholders do not need to sell. And, we do not need to sell now. Just because the timing is good for EMCC, does not mean that the Company should accept less than fair value or feel rushed to complete a transaction with EMCC.

You Must Consider All Alternatives

As a Special Committee, you can only know the true value of the Company by doing independent work and evaluating all alternatives.

Other public downstream insurance companies that were controlled by mutual insurance companies have engaged in various forms of transactions to maximize value for the public shareholders, including a combination or affiliation among mutual insurance companies followed by a cash-out of the public shareholders, or an outright sale to the parent mutual insurance company.

Make no mistake. EMCC does not want the Company to look at its various alternatives as a way to gauge fair value. To highlight this point – and strongly discourage any other suitor from showing up – EMCC issued a “clarification” to its Proposal on January 31. In that statement, EMCC noted that, as the controlling shareholder of the Company, it is “not willing to consider” any proposal or structure other than one involving the Company and EMCC combining. In other words, no alternative suitors need apply!

This heavy-handed attempt to block a legitimate market-check, to narrow the alternatives for the Company, and to limit the price discovery that the Special Committee could otherwise conduct was clearly an effort to coerce the Special Committee and shareholders into accepting EMCC’s opportunistic, low-priced offer. The Special Committee, now without the ability to shop EMCC’s proposal, is left to hypothetical alternative transactions and investment banker math, instead of real, legitimate alternatives.

This is hugely disappointing because we believe a consolidation of EMCC with another mutual insurance company would not only help fulfill EMCC’s stated mission — providing attractive and low-cost insurance products to insureds inside and outside of Iowa (through additional lines, lower cost of capital, a stronger balance sheet and increased diversity among other things) — it would allow the Company to achieve a significantly better outcome for shareholders than the Proposal. I have carefully followed many mutual-to-mutual consolidations and affiliations and they almost always produce excellent outcomes for all constituents, save perhaps the controlling CEO or founder of the mutual insurance company.

I believe Mr. Kelley’s attempt to shut down the strategic alternatives review is a selfish act aimed at keeping tight control of EMCC and the Company. It is not in the policyholders’ interests or in the interests of the Company’s shareholders. And, I believe, the Company should not agree to unilateral negotiations with EMCC. Competitive bidding is the best way to determine the fair clearing price for an asset.

So, while EMCC has attempted, for its own advantage, to prohibit a competitive process, the Special Committee should nevertheless consider the structure under which the Company’s value would be maximized and insist upon a price from EMCC that at least matches what could have been achieved in a properly structured process. The Special Committee should not allow EMCC to push hard on the scale and then pay the discounted price that results from the mis-measurement of the Company’s opportunity and value.

Special Committee of the Board of Directors

EMC Insurance Group Inc.

March 25, 2019

Page 5

The Precedent Transactions Resulted in Values At or Above Two Times Book Value

There are several relevant precedent transactions for a mutual insurance company buying a publicly traded subsidiary, either in conjunction with a mutual-to-mutual combination or as a standalone transaction. There are five precedents in particular upon which the Special Committee should focus because of their similarity to the current circumstance. These transactions exhibit a clear valuation pattern: these transactions tend to occur at approximately two to four times book value.

| Year |

Buyer |

Public Company |

Price to Book3 |

Stock Price Premium4 |

||||||||

| 1996 |

Meridian Insurance Group | Citizen Security Group | 1.90x | 108 | % | |||||||

| 1998 |

Nationwide Mutual | Allied Group | 3.57x | 74 | % | |||||||

| 2000 |

State Auto Mutual | Meridian Insurance Group | 1.82x | 135 | % | |||||||

| 2007 |

Alfa Mutual companies | Alfa Corporation | 2.12x | 45 | % | |||||||

| 2011 |

Nationwide Mutual | Harleysville Group | 2.22x | 137 | % | |||||||

|

|

|

|

|

|||||||||

| Average | 2.33x | 100 | % | |||||||||

The premiums and multiples achieved in these prior transactions reflect the unique circumstances of a downstream public insurance company being consolidated with its mutual insurance company parent either as a stand-alone transaction or as part of a consolidation among mutual insurance companies. The savings associated with public company cost and significant simplification of company operations – and, in the case of a mutual-to-mutual transaction, the mutual’s surplus that gets consolidated — justifies the substantial premiums observed in these deals.

Moreover, there is good reason to believe that the Company would be extremely attractive in an open and fair strategic alternatives review process and would garner book-value multiples closer to Allied Group’s 3.57 times than to the other public companies on this list. Among other things, the Company’s business is now entirely commercial (which is more attractive than personal lines of insurance), the premium base is large and in attractive geographies ($1.8 billion of premiums at EMCC and the Company), the employees and operations are in low cost areas and the opportunity to consolidate and reduce overhead are substantial given the market presence of several other large mutual insurance companies, and the surplus at EMCC is large, especially relative to the value of the shares owned by the public shareholders of the Company. Based upon my decades of experience investing in the insurance industry, I strongly believe that a large mutual insurance company would happily consolidate with EMCC — bringing better, more diverse and less expensive insurance products to EMCC’s clients — and pay a significantly higher price than the Proposal to Company shareholders in order to do so.

| 3 | Includes consideration paid for in-the-money options and, in the case of Alfa, for phantom shares and restricted stock awards. |

| 4 | Premiums calculated based on unaffected stock prices. |

Special Committee of the Board of Directors

EMC Insurance Group Inc.

March 25, 2019

Page 6

The Proposal is not reflective of the value of the Company to either EMCC or to another mutual insurance company that would consolidate with EMCC. In fact, the Proposal represents a mere 1.13 times price-to-book ratio on the Company’s September 30, 2018 book value of $26.63.

This is at least a full turn lower than the precedent transactions for an asset that is substantially more attractive than the public companies in most of those prior transactions.

The $30 per share price in the Proposal is significantly below fair value.

The Offer Premium is Misleading to Shareholders and Inadequate in Any Event

EMCC touts that the Proposal represents a 26% premium to the Company’s closing price on the day before the offer.

First, this too is obviously inadequate compared to the precedent transactions as shown in the table above. There is a good reason that these transactions occur at high premiums. Downstream public insurance companies always trade at a discount to their value in a consolidation because the parent mutual company controls the timing of any such go-private transaction. But, when transactions occur, those public companies rightly insist on full value for their contributions to the consolidated entity. The same should be true here.

Second, after the Company’s stock has underperformed for years at the hands of EMCC, it is surely unfair to use that depressed stock price as a basis for an offer. EMCC should not be permitted to manage the Company inadequately and then to benefit from that poor performance in a takeout. Moreover, the stock price at the time of the Proposal was down significantly because of short-term issues: storms and casualties that were of unknown loss severity for the Company. (It should also be noted that the Company revised downward its earnings guidance on July 26, when the stock was trading above $28 per share.) The Proposal represents a mere 7% premium to these late summer price levels and a discount to the then 52-week high, which was achieved in November 2017.

I am mindful as well that the Company’s stock has traded at a premium to the Proposal’s offer price ever since the Proposal was announced. This trading history reflects a widespread belief on the part of the Company’s owners that EMCC can and should pay substantially more for the Company.

If the Special Committee were to recommend the Proposal at the offer price, it would clearly be doing so in spite of clear precedents that indicate the fair price for the Company to be far in excess of $50 per share.

Conclusion

I am gravely concerned about the independence of the Special Committee and the lack of economic and emotional alignment with shareholder interests. I believe it is incumbent upon the Special Committee to vigorously defend the interests of the Company’s public shareholders and I will settle for no less than that.

Special Committee of the Board of Directors

EMC Insurance Group Inc.

March 25, 2019

Page 7

In 1911, EMCC was formed by Mr. Kelley’s great grandfather as a means of selling insurance at attractive prices to insureds who, as policyholders, would share the benefits of owning the company. The right transaction today is for the Special Committee to insist upon a consolidation of EMCC with another mutual insurance company that has a similar organizational culture, a higher A.M. Best Rating, a better capital structure and a stronger reserve position. This would not only preserve and extend EMCC’s founding principles, it would greatly benefit the Company’s shareholders.

If Mr. Kelley insists that EMCC remain independent, despite the disadvantages to policyholders and shareholders alike, the Special Committee should surely insist that any purchase of the Company occur at a price reflective of what the Company would garner in a proper strategic alternatives process. Mr. Kelley should not both be allowed to insist upon his way and significantly disadvantage the public shareholders, who have put their faith in you (the Special Committee).

Clearly, EMCC does not want the Special Committee to discover how attractive the Company and EMCC may be to other buyers. The Special Committee should take account of EMCC’s refusal to allow the Company to shop itself as it negotiates with EMCC and insist that EMCC pay a fair price for the Company if it wishes to be the exclusive bidder.

Any reasonable analysis of the precedents would yield the conclusion that the current Proposal is objectively and significantly inadequate.

| Yours truly, |

| /s/ Gregory M. Shepard |

| Gregory M. Shepard |

Exhibit 7.7

From: [email protected]

Sent: 2/1/2019 12:41:59 PM Eastern Standard Time

Subject: Introductory Call with Sandler O’Neill

Dear Mr. Shepard,

As you may know, Sandler O’Neill is serving as financial advisor to the Special Committee of EMCI. In that capacity, they have asked me to contact you to determine your interest in having an introductory call with us. Although we would primarily be in “listen mode”, we would be eager to get your views on the EMCC proposal and any thoughts you may have on the valuation the EMCI in the context of this going private transaction.

If you are interested in a discussion, please feel free to propose some times that could work for your schedule. We could be available as early as after 3:30 this afternoon or Monday after 11am.

Regards,

George

George Johns

Principal

Sandler O’Neill + Partners, L.P.

1251 Avenue of the Americas, 6th Floor

New York, NY 10020

email: [email protected]

(212) 466-7998 (W)

(917) 208-7531 (Cell)

From: [email protected]

Sent: 2/25/2019 6:04:33 PM Eastern Standard Time

Subject: RE: Introductory Call with Sandler O’Neill

Dear Mr. Shepard,

I believe that the attorney at Wilkie Farr, John Schwolsky, has been in touch with your attorney, Eric Fogel, regarding a role on the EMCI special committee. At this time, I just wanted to reiterate our sincere interest in getting your views on price and other considerations per my email below. I am available to take your call at any time or schedule a call in advance.

I look forward to speaking with you.

Regards,

George

From: [email protected]

Sent: 3/5/2019 2:58:29 PM Eastern Standard Time

Subject: Follow-up

Dear Mr. Shepard,

As follow-up to your amended 13-D filing, we are reaching out yet again to express our interest in getting your views on the EMCC proposal to acquire the shares of EMCI that they do not already own. We are also interested in learning more about any alternate transaction structures that you may have in mind.

Regards,

George

Eric M. Fogel

Direct Line: (312) 894-3325

Email: [email protected]

March 5, 2019

John M. Schwolsky, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019-6099

Re: Request for Confidentiality Agreement

Dear John:

As you know, this Firm represents Mr. Gregory M. Shepard.

On Friday, March 1, 2019, Mr. Shepard sent a letter to EMC Insurance Group Inc.’s Chief Legal Officer requesting the opportunity to speak to the Special Committee and its independent legal and financial advisors regarding Employers Mutual Casualty Company’s November 15, 2018 proposal.

|

787 Seventh Avenue New York, NY 10019-6099 Tel: 212 728 8000 Fax: 212 728 8111 |

To facilitate and encourage open communication, Mr. Shepard requests that a Confidentiality Agreement between the Special Committee and Mr. Shepard first be put in place. Kindly send me a draft Confidentiality Agreement.

If we do not receive a Confidentiality Agreement by Thursday, March 7, 2019, we will take that as the Special Committee declining to enter into a Confidentiality Agreement with Mr. Shepard.

If you have any questions, or would like to discuss this matter, please call me.

| Very truly yours, |

| /s/ Eric M. Fogel |

| Eric M. Fogel |

| Partner, Co-Chair |

| Corporate Practice Group |

March 6, 2019

Mr. Eric M. Fogel

SmithAmundsen

150 North Michigan Avenue

Suite 3300

Chicago, IL 60601

Dear Eric,

The special committee would welcome the opportunity to meet with Mr. Shepard and, in that regard, has on three previous occasions attempted unsuccessfully to make arrangements to speak with Mr. Shepard through its financial advisors. We propose that a meeting take place in our offices in New York City at a date and time that is convenient to your client and the members of the special committee. In addition to the special committee and counsel to the special committee, the special committee’s financial advisors, Sandler O’Neill & Partners will be present.

The special committee views this meeting as an excellent opportunity for Mr. Shepard to share with the special committee any proposals he has for increasing the value of EMCI. The special committee does not intend to share material non-public information with Mr. Shepard at this meeting and, accordingly, does not believe that a confidentiality agreement is necessary or appropriate at this time. If, after meeting with Mr. Shepard and having a better understanding of Mr. Shepard’s specific proposals, the special committee should determine that providing Mr. Shepard with material non-public information concerning EMCI would be to the EMCI shareholders’ advantage, we can discuss the provision of such information under confidentiality, trading and other customary restrictions at that time.

Please let me know some dates and times that work for your client and we can coordinate with the members of the special committee and its advisors. Also, please copy my partners Laura Delanoy and Tariq Mundiya on all future correspondence.

| Regards, |

| /s/ John Schwolsky |

| John Schwolsky |

| cc: LauraDelanoy |

| Tariq Mundiya |

From: Schwolsky, John [mailto:[email protected]]

Sent: Friday, March 22, 2019 2:53 PM

To: Fogel, Eric

Cc: Delanoy, Laura; Mundiya, Tariq

Subject: RE: Proposed Meeting with Special Committee

Eric,

We have not heard from you with respect to the special committee’s March 6 invitation to meet with Mr. Shephard at our offices in New York. We assume that Mr. Shephard is not interested in such a meeting at this time. If he should change his mind please let us know.

Regards,

John

John M. Schwolsky

Willkie Farr & Gallagher LLP

787 Seventh Avenue | New York, NY 10019-6099

Direct: +1 212 728 8232 | Fax: +1 212 728 9232

[email protected] | vCard | www.willkie.com bio

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

13DSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share