Form S-4/A resTORbio, Inc.

Exhibit 5.1

August 12, 2020

resTORbio Inc.

500 Boylston Street, 13th Floor

Boston, MA 02116

Re: Securities Registered under Registration Statement on Form S-4

Ladies and Gentlemen:

We have acted as counsel to you in connection with your filing of a Registration Statement on Form S-4 (File No. 333-239372) (as amended or supplemented, the “Registration Statement”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration and proposed issuance by resTORbio, Inc., a Delaware corporation (the “Company”) of up to 28,141,955 shares (the “Shares”) of the Company’s Common Stock, $0.0001 par value per share. The Shares are being issued to the stockholders of Adicet Bio, Inc. (“Adicet”), in connection with, and contingent upon, the merger contemplated by the Agreement and Plan of Merger, dated as of April 28, 2020, by and among the Company, Adicet Bio, Inc., a Delaware corporation, and Project Oasis Merger Sub, Inc., a Delaware corporation (the “Merger Agreement”).

We have reviewed such documents and made such examination of law as we have deemed appropriate to give the opinions set forth below. We have relied, without independent verification, on certificates of public officials and, as to matters of fact material to the opinions set forth below, on certificates of officers of the Company.

The opinion set forth below is limited to the Delaware General Corporation Law.

Based on the foregoing, we are of the opinion that the Shares have been duly authorized and, upon issuance and delivery in exchange for the outstanding shares of capital stock of Adicet, in accordance with the terms of the Merger Agreement, will be validly issued, fully paid and non-assessable.

We hereby consent to the inclusion of this opinion as Exhibit 5.1 to the Registration Statement and to the references to our firm under the caption “Legal Matters” in the Registration Statement. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

| Very truly yours, | ||

| /s/ Goodwin Procter LLP | ||

| GOODWIN PROCTER LLP | ||

Exhibit 8.1

[Morrison & Foerster LLP Letterhead]

August 12, 2020

Adicet Bio, Inc.

200 Construction Drive

Menlo Park, California 94025

Ladies and Gentlemen:

We have acted as special counsel to Adicet Bio, Inc., a Delaware corporation (“Adicet”), in connection with the preparation and filing with the Securities and Exchange Commission of a Registration Statement on Form S-4 (Registration No. 333-239372), as amended or supplemented through the date hereof (the “Registration Statement”), initially filed with the Securities and Exchange Commission on June 23, 2020, which includes the Proxy Statement/Prospectus/Information Statement describing the Agreement and Plan of Merger (the “Merger Agreement”), dated as of April 28, 2020, by and among Adicet, resTORbio, Inc., a Delaware corporation (“resTORbio”), and Project Oasis Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of resTORbio (“Merger Sub”). The Merger Agreement and the ancillary documents thereto provide, among other things, for the merger of Merger Sub with and into Adicet (the “Merger”), with Adicet as the surviving corporation, all on the terms and conditions set forth in the Merger Agreement. Unless otherwise indicated, capitalized terms used herein have the meanings ascribed to them in the Registration Statement.

In connection with this opinion, we have examined the Merger Agreement, the Registration Statement and such other documents, records and papers as we have deemed necessary or appropriate in order to render the opinion set forth herein. In addition, we have assumed that: (i) the Merger and related transactions will be consummated pursuant to and in accordance with the provisions of the Merger Agreement and as described in the Registration Statement (and no transaction, covenant or condition described therein and affecting this opinion will be waived or modified), (ii) the statements concerning the Merger and the parties thereto set forth in the Merger Agreement and the Registration Statement are true, complete and correct and the Registration Statement is true, complete and correct and will remain true, complete and correct at all times up to and including the effective time of the Merger, (iii) all such statements qualified by knowledge, intention, belief or materiality or any comparable qualification are and will be true, complete and correct as if made without such qualification, (iv) the parties to the Merger Agreement have complied with, and if applicable, will continue to comply with, their respective covenants and agreements contained in the Merger Agreement, (v) Adicet, resTORbio, and their respective subsidiaries will treat the Merger for U.S. federal income tax purposes in a manner consistent with the opinion set forth below, (vi) all documents submitted to us as originals are authentic, all documents submitted to us as copies conform to the originals, all relevant documents have been or will be duly executed in the form presented to us and all natural persons who have executed such documents had the requisite legal capacity to execute such documents, and (vii) all applicable reporting requirements have been or will be satisfied. If any of the above described assumptions is untrue or invalid for any reason, or if the Merger is consummated in a manner that differs from the manner described in the Merger Agreement and the Registration Statement, our opinion as expressed below may be adversely affected.

Based upon and subject to the foregoing and the assumptions and qualifications set forth herein, it is our opinion that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”).

We express no opinion on any issue or matter relating to the tax consequences of the transactions contemplated by the Merger Agreement or the Registration Statement other than the opinion set forth above. Our opinion is based on current provisions of the Code, Treasury Regulations promulgated thereunder, published pronouncements of the Internal Revenue Service and case law, any of which may be changed at any time, including with retroactive effect. Any change in applicable laws or the facts and circumstances surrounding the Merger and related transactions, or any inaccuracy in the statements, facts, or assumptions upon which we have relied, may affect the continuing validity of our opinion as set forth herein. We assume no responsibility to inform Adicet of any such change or inaccuracy that may occur or come to our attention.

We are furnishing this opinion solely in connection with the filing of the Registration Statement and this opinion is not to be relied upon for any other purpose without our prior written consent. We hereby consent to the filing of this opinion with the Securities and Exchange Commission as an exhibit to the Registration Statement, and to the references made therein to us insofar as they relate to statements of law or legal conclusions under the federal income tax laws of the United States or pertain to matters of U.S. federal income tax law. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, and the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

Very truly yours,

/s/ Morrison & Foerster LLP

Morrison & Foerster LLP

Exhibit 10.49

FIRST AMENDMENT

TO

LOAN AND SECURITY AGREEMENT

This First Amendment to Loan and Security Agreement (this “Amendment”) is made and entered into as of July 8, 2020, by and between PACIFIC WESTERN BANK, a California state chartered bank (“Bank”), and ADICET BIO, INC. (“Borrower”).

RECITALS

Borrower and Bank are parties to that certain Loan and Security Agreement dated as of April 28, 2020 (as amended from time to time, the “Agreement”). The parties desire to amend the Agreement in accordance with the terms of this Amendment.

NOW, THEREFORE, the parties agree as follows:

| 1) | A new Section 2.1(c) is hereby added to the Agreement, as follows: |

(c) Usage of Credit Card Services Under the Credit Card Line.

(i) Usage Period. Subject to and upon the terms and conditions of this Agreement, at any time from the First Amendment Effective Date through the Credit Card Maturity Date, Borrower may use the Credit Card Services (as defined below) in amounts and upon terms as provided in Section 2.1(c)(ii) below.

(ii) Credit Card Services. Subject to and upon the terms and conditions of this Agreement, Borrower may request corporate credit cards and standard and e-commerce merchant account services from Bank (collectively, the “Credit Card Services”). The aggregate limit of the corporate credit cards and merchant credit card processing reserves shall not exceed the Credit Card Line. The terms and conditions (including repayment and fees) of such Credit Card Services shall be subject to the terms and conditions of Bank’s standard forms of application and agreement for the Credit Card Services, which Borrower hereby agrees to execute.

(iii) Collateralization of Obligations Extending Beyond Maturity. Borrower shall take such actions as Bank may request to cause its obligations with respect to any Credit Card Services to be secured to Bank’s satisfaction as of the Credit Card Maturity Date. If Borrower has not cash secured its obligations with respect to any Credit Card Services by the Credit Card Maturity Date, then, effective as of such date, the balance in any of Borrower’s deposit accounts held by Bank and the certificates of deposit or time deposit accounts issued by Bank in Borrower’s name (and any interest paid thereon or proceeds thereof, including any amounts payable upon the maturity or liquidation of such certificates or accounts), shall automatically secure such obligations to the extent of the then continuing or outstanding Credit Card Services. Borrower authorizes Bank to hold such balances in pledge and to decline to honor any drafts thereon or any requests by Borrower or any other Person to pay or otherwise transfer any part of such balances for so long as the applicable Credit Card Services are outstanding or continue.

| 1 | ||||

|

Adicet Bio, Inc. – 1st Amendment to LSA |

| 2) | The following defined terms are hereby added in Exhibit A to the Agreement, as follows: |

“Credit Card Line” means a Credit Extension of up to $150,000, to be used exclusively for the provision of Credit Card Services.

“Credit Card Maturity Date” means July 7, 2021.

“First Amendment Effective Date” means July 8, 2020.

| 3) | The following defined term in Exhibit A to the Agreement is hereby amended and restated, as follows: |

“Credit Extension” means each Term Loan, the Credit Card Services provided under the Credit Card Line, or any other extension of credit by Bank to or for the benefit of Borrower hereunder.

| 4) | Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Agreement. The Agreement, as amended hereby, shall be and remain in full force and effect in accordance with its respective terms and hereby is ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not operate as a waiver of, or as an amendment of, any right, power, or remedy of Bank under the Agreement, as in effect prior to the date hereof. Borrower ratifies and reaffirms the continuing effectiveness of all agreements entered into in connection with the Agreement. |

| 5) | Borrower represents and warrants that the representations and warranties contained in the Agreement are true and correct as of the date of this Amendment. |

| 6) | This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one instrument. |

| 7) | As a condition to the effectiveness of this Amendment, Bank shall have received, in form and substance satisfactory to Bank, the following: |

| a) | this Amendment, duly executed by Borrower; |

| b) | payment for all Bank Expenses incurred through the date of this Amendment, including Bank’s expenses for the documentation of this Amendment and any UCC, good standing or intellectual property search or filing fees, which may be debited from any of Borrower’s accounts; and |

| c) | such other documents and completion of such other matters, as Bank may reasonably deem necessary or appropriate. |

| 2 | ||||

|

Adicet Bio, Inc. – 1st Amendment to LSA |

IN WITNESS WHEREOF, the undersigned have executed this Amendment as of the first date above written.

| ADICET BIO, INC. | PACIFIC WESTERN BANK | |||||||

| By: | /s/ Anil Singhal |

By: | /s/ Steve Kent | |||||

| Name: | Anil Singhal | Name: | Steve Kent | |||||

| Title: | President and CEO | Title: | Vice President | |||||

| 3 | ||||

|

Adicet Bio, Inc. – 1st Amendment to LSA |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

The Board of Directors

resTORbio, Inc.:

We consent to the use of our report dated March 12, 2020, with respect to the consolidated balance sheets of resTORbio, Inc. as of December 31, 2019 and 2018, the related consolidated statements of operations and comprehensive loss, redeemable convertible preferred stock and stockholders’ equity (deficit), and cash flows for each of the years in the three-year period ended December 31, 2019, and the related notes, included herein and to the reference to our firm under the heading “Experts” in the prospectus.

/s/ KPMG LLP

Boston, Massachusetts

August 11, 2020

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the use in this Registration Statement on Form S-4 of resTORbio, Inc. of our report dated June 23, 2020 relating to the financial statements of Adicet Bio, Inc., which appears in this Registration Statement. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/ PricewaterhouseCoopers LLP

San Jose, California

August 12, 2020

Exhibit 99.1

RESTORBIO, INC.

500 BOYLSTON STREET, 13TH FLOOR

BOSTON, MA 02116

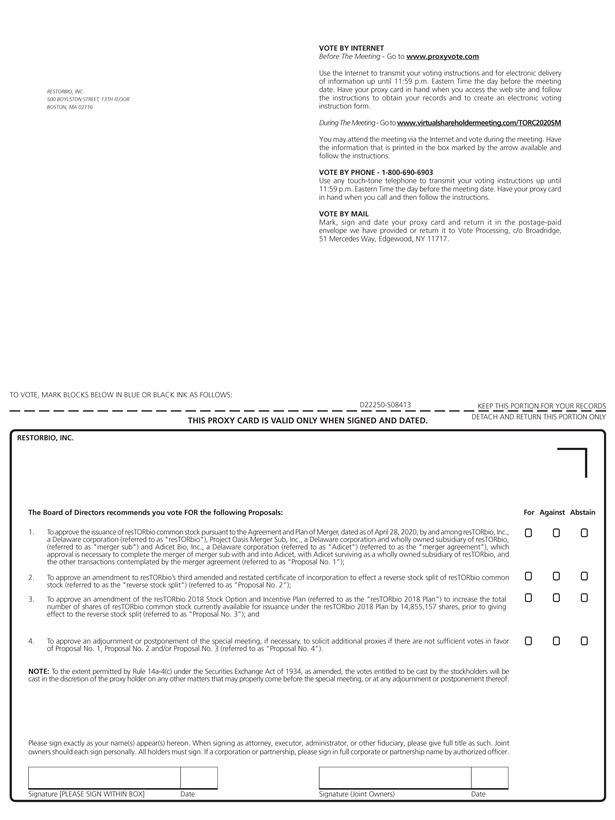

VOTE BY INTERNET

Before The Meeting - Go to

www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before

the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

During The Meeting-Go to www.virtualshareholdermeeting.com/TORC2020SM

You may attend the

meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the meeting date. Have your proxy card in hand when you call and

then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy

card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge,

51 Mercedes Way, Edgewood, NY 11717.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

D22250-S08413

KEEP THIS PORTION FOR YOUR RECORDS

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

RESTORBIO, INC.

The Board of Directors recommends you vote FOR the following Proposals:

For Against Abstain

1. To approve the issuance of resTORbio common stock pursuant to the Agreement and Plan of Merger, dated as of April 28, 2020, by and among resTORbio, Inc., a

Delaware corporation (referred to as “resTORbio”), Project Oasis Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of resTORbio, (referred to as “merger sub”) and Adicet Bio, Inc., a Delaware corporation

(referred to as “Adicet”) (referred to as the “merger agreement”), which approval is necessary to complete the merger of merger sub with and into Adicet, with Adicet surviving as a wholly owned subsidiary of resTORbio, and the

other transactions contemplated by the merger agreement (referred to as “Proposal No. 1”);

2. To approve an amendment to resTORbio’s third

amended and restated certificate of incorporation to effect a reverse stock split of resTORbio common stock (referred to as the “reverse stock split”) (referred to as “Proposal No. 2”);

3. To approve an amendment of the resTORbio 2018 Stock Option and Incentive Plan (referred to as the “resTORbio 2018 Plan”) to increase the total number of shares of

resTORbio common stock currently available for issuance under the resTORbio 2018 Plan by 14,855,157 shares, prior to giving effect to the reverse stock split (referred to as “Proposal No. 3”); and

4. To approve an adjournment or postponement of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1,

Proposal No. 2 and/or Proposal No. 3 (referred to as “Proposal No. 4”).

NOTE: To the extent permitted by Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended, the votes entitled to be cast by the stockholders will be cast in the discretion of the proxy holder on any other matters that may properly come before

the special meeting, or at any adjournment or postponement thereof.

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor,

administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

Signature [PLEASE SIGN WITHIN BOX] Date

Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

D22251-S08413

The Notice and Proxy Statement is available at www.proxyvote.com.

RESTORBIO, INC. Special Meeting of Stockholders September 15, 2020 at 8:00 AM Eastern Time This proxy is solicited by the Board of Directors

The stockholder(s) hereby appoint(s) Chen Schor and Lloyd Klickstein, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to

represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common stock of resTORbio, Inc. that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholders to be held on September 15,

2020 at 8:00 AM Eastern Time at www.virtualshareholdermeeting.com/TORC2020SM, and any adjournment or postponement thereof.

This proxy, when properly executed, will

be voted in the manner directed herein. If no such direction is made, this proxy will be voted “FOR” Proposals 1, 2 and 3 and, if necessary, “FOR” Proposal 4, as more specifically described in the Proxy Statement. To the extent

permitted by Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended, the votes entitled to be cast by the stockholders will be cast in the discretion of the proxy holder on any other matters that

may properly come before the Special Meeting of Stockholders, or at any adjournment or postponement thereof.

Continued and to be signed on reverse side

Exhibit 99.3

August 12, 2020

The Board of Directors

resTORbio, Inc.

500 Boylston Street, 13th Floor

Boston, MA 02116

| Re: | Registration Statement on Form S-4 of |

resTORbio, Inc., as amended July 29, 2020 (the “Registration Statement”)

Ladies and Gentlemen:

Reference is made to our opinion letter, dated April 28, 2020 (“Opinion Letter”), with respect to the fairness from a financial point of view of the exchange ratio to the Company.

The Opinion Letter is provided for the information and assistance of the Board of Directors of the Company in connection with its consideration of the transaction contemplated therein. We understand that the Company has determined to include our opinion in the Registration Statement. In that regard, we hereby consent to the reference to our Opinion Letter under the captions “Boxed Summary – Opinion of resTORbio’s Financial Advisor”, “The Merger – resTORbio’s Reasons for the Merger” and “Financial Advisor Disclosure Section – Opinion of resTORbio’s Financial Advisor” and to the inclusion of the foregoing opinion in the Proxy Statement/Prospectus included in the Registration Statement. Notwithstanding the foregoing, it is understood that our consent is being delivered solely in connection with the filing of the Registration Statement and that our Opinion Letter is not to be used, circulated, quoted or otherwise referred to for any other purpose, nor is it to be filed with, included in or referred to, in whole or in part in any registration statement (including any subsequent amendments to the Registration Statement), proxy statement or any other document, except in accordance with our prior written consent. In giving such consent, we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act of 1933 or the rules and regulations of the Securities and Exchange Commission thereunder.

| Very truly yours, |

| /s/ JMP Securities LLC |

| JMP SECURITIES LLC |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Drilling Tools International Corp. Announces 2024 First Quarter Earnings Release and Conference Call Schedule

- Terex Reports Strong First Quarter 2024 Results; Raises Full-Year Outlook

- First Financial Bancorp Announces First Quarter 2024 Financial Results and Quarterly Dividend

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share