Form S-1 USA EQUITIES CORP.

Exhibit 5.1

Mandelbaum Salsburg P. C.

570 Lexington Avenue

New

York, New York 10022

September 3, 2021

USA Equites Corp

901 Northpoint Parkway

Suite 302

West Palm Beach, FL 33407

| Re: | USA Equities Corp | |

| Registration Statement on Form S-1 |

Board of Directors:

We have acted as counsel for USA Equities Corp., a Delaware corporation (the “Company”), in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”) of 2,854,334 shares of common stock (the “Shares”) offered for resale by the selling stockholders (the “Selling Stockholders”) named in the Registration Statement on Form S-1 (the “Registration Statement”) filed with the Securities and Exchange Commission on September 3, 2021.

In connection with this opinion, we have examined and relied upon the Registration Statement, the Company’s Certificate of Incorporation, as amended, and the Company’s Bylaws, each as currently in effect, the Securities Purchase Agreement between the Company and Mercer Street Global Opportunity Fund, LLC, and the Note and Warrants issued pursuant thereto; the Placement Agent Agreement between the Company and Carter, Terry & Company, the Warrants pursuant to which an aggregate of 28,089 of the Shares are to be issued to certain of the Selling Stockholders and the originals, or copies certified to our satisfaction, of such records, documents, certificates, opinions, memoranda and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed below. In rendering this opinion, we have assumed the genuineness and authenticity of all signatures on original documents; the authenticity of all documents submitted to us as originals; the conformity to originals of all documents submitted to us as copies; the accuracy, completeness and authenticity of certificates of public officials; and the due authorization, execution and delivery of all documents where authorization, execution and delivery are prerequisites to the effectiveness of such documents (except we have not assumed due execution and delivery by the Company of any such documents).

On the basis of the foregoing and in reliance thereon, we are of the opinion that the Shares have been validly issued, fully paid and are non-assessable.

We are attorneys licensed to practice in the State of New York and are familiar with the General Corporation Law of the State of Delaware (“the “DGCL”). Our opinion is limited to the laws of the State of New York, the DGCL, including the applicable provisions of the Delaware Constitution and reported judicial decisions interpreting the foregoing, New York law and the federal laws of the United States of America to the extent referred to specifically herein. We express no opinion herein as to any other laws, statutes, regulations or ordinances. We have made such inquiries and review of matters of fact and law as we determined necessary to render the opinions contained herein. We assume no obligation to revise or supplement this opinion letter in the event of future changes in such laws or the interpretations thereof or such facts. We express no opinion as to whether the laws of any particular jurisdiction apply and no opinion to the extent that the laws of any jurisdiction other than those identified above are applicable to the subject matter hereof. We are not rendering any opinion as to compliance with any federal or state antifraud law, rule or regulation relating to securities, or to the sale or issuance thereof.

Our opinion expressed herein is as of the date hereof, and we undertake no obligation to advise you of any changes in applicable law or any other matters that may come to our attention after the date hereof that may affect our opinions expressed herein.

We hereby consent to the reference to our firm under the caption “Legal Matters” in the Registration Statement and to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are experts with the meaning of the Securities Act or the rules and regulations of the Commission thereunder.

| Yours truly, | |

| /s/ Mandelbaum Salsburg P. C. |

Exhibit 10.9

CERTAIN IDENTIFIED INFORMATION HAS BEEN OMITTED FROM THIS DOCUMENT BECAUSE IT IS BOTH NOT MATERIAL AND WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED, AND HAS BEEN MARKED WITH “[***]” TO INDICATE WHERE OMISSIONS HAVE BEEN MADE.

Carter, Terry & Company.

3060 Peachtree Rd, Suite 1200,

Atlanta GA 30305

Phone: 404-364-3070-Member FINRA SIPC

June 28, 2021

Troy Grogan

USA Equities Corp

901 Northpoint Parkway

Suite 302

West Palm Beach, FL 33407

Subject: Private Placement Offering for USA Equities Corp (USAQ.OTCQB)

It is our understanding that USA Equities Corp, the “Company”, desires to raise capital, to fund the Company’s continuing general operations. Based on our discussions, our preliminary review of the financial information submitted to Carter, Terry & Company (referred heretofore as the “Agent”) and representations you and your associates have made to us with regard to the present and proposed business activities of the Company, its operations and financial condition, we would like to confirm our interest in acting as the Company’s non-exclusive Financial Advisor and Placement Agent, on a “best efforts” basis. In such role we would assist the Company in one or more capital raises which might result in a private placement, merger, acquisition, sale of assets, sale of common stock, sale of ownership interest or any other financial transaction hereinafter referred to as a “Transaction” upon the basic terms and conditions set forth herein (the “Agreement”), as well as a full array of additional investment banking services.

Section I: Services to be rendered

Agent services will include (but not be limited to) the following:

| (i) | Arranging for one or more institutional investments of capital, as defined in iii (an “Investment,” which could include any variation thereof, including common stock, preferred stock, mezzanine debt, senior secured debt, any other financial instrument or a combination of several financial instruments), on a best efforts basis to raise capital for use by the Company; |

| (ii) | Any Investment will be placed in compliance with valid exemptions from registration or qualification under federal securities laws, state securities (“blue sky”) laws or foreign securities laws of each jurisdiction in which any offers of an Investment may be made; |

| (iii) | Utilizing appropriate investment information materials or modifying existing Company business plans and documents (collectively, the “Information Memorandum”) to be provided to potential sources of financing. Agent may provide advice with respect to negotiating with all potential financing, merger or acquisition candidates introduced (as defined in Section II below) to the Company by Agent (as defined below; any such identified and introduced candidates, along with their affiliates, associates, subsidiaries, divisions and related entities being hereinafter referred to as “Investor Candidates”) who might be interested or involved in making an Investment in the Company. As used herein, “Investor Candidates” shall mean and include individual, strategic and institutional investors of all types, introduced (as defined in Section II below) to the Company by Agent including individuals, trusts, estates, partnerships and associations, banks, thrifts, insurance companies and other financial institutions, investment companies and other pooled investment vehicles, all tax-exempt organizations such as those subject to ERISA and other public and private pension funds, endowments and foundations as well as corporations in similar lines of business to the Company’s, which might be candidates for acquisition by or merger with, together with their affiliates, divisions, subsidiaries and investment management consultants. All Investor Candidates, if not merger or acquisition candidates, shall be “accredited investors,” as that term is generally understood in the private equity business; |

| 1 |

In performing services hereunder, Agent shall be regarded as an independent contractor and marketing representative. Agent shall not have any right or authority to create any obligations of any kind on behalf of the Company, shall make no representation to any third party to the contrary, and shall not make any representations about the Company, its operations or finances other than what the Company provides for inclusion in the Information Memorandum. Nothing contained in this Agreement shall be deemed or construed to create a partnership or joint venture between Company and Agent or between Company and any Investor Candidate.

Section II: Fees, Expenses and Term

AGENT will be a non-exclusive financial advisor for the next twelve consecutive (12) months commencing on the date of this Agreement, with an option to extend this Agreement an additional 6 months, provided however, that either party may withdraw from this Agreement at any time upon written notice to the other party. Otherwise, this engagement and the terms hereunder will continue, subject to the same right of either party to terminate on written notice to the other party, until a Transaction is successfully completed or until the Agreement is terminated or expires. Within three business days after the effective date of any termination by the Company (the “Termination Date”), Agent shall deliver to Company a list of all introduced Investor Candidates, merger or acquisition candidates and Strategic Investors (the “Covered Parties”) with which Agent can confirm that (a) the Company, at Agent’s instigation or by Agent’s introduction, has had discussions concerning a Transaction during the term of this Agreement and prior to receipt of the notice of termination or (b) such Covered Parties have, prior to such notice of termination, expressed an interest in considering or pursuing a Transaction with Company. On and after the Termination Date, Agent shall also either destroy or return to Company any and all Information, Information Memoranda and any other confidential information of the Company (including extracts thereof), which are in Agent’s possession or control; provided however that Agent shall be permitted to retain such copies as it is required to comply with applicable law, regulation (including but not limited to FINRA regulation), or internal document retention policies and procedures. The provisions concerning confidentiality, indemnification, compensation and the Company’s obligations to pay fees and reimburse expenses contained herein and the Company’s obligations contained in the Indemnification Provisions (as hereinafter defined) will survive any such termination. Agent agrees not to use any confidential information about the Company for any purposes other than in connection with a Transaction and directly related matters.

The Company will attach any investor candidate that is considered already engaged with them on APPENDIX A, following the signature page. The Company agrees any investor candidate introduced by Agent not on the list is considered the Agent’s introduction.

| 2 |

Agent agrees to introduce the Company to certain potential Investor Candidates; provided that Agent shall not approach any Strategic Investor or party engaged in a business similar to that of the Company without the prior consent of the Company. Upon written request from the Company, Agent may designate independent counsel to prepare the appropriate documents (including subscription and escrow agreement) with regard to the terms of any financial transactions and the closing thereof. The Company is responsible for any and all reasonable expenses associated with the Offering and the closing documents, escrow and escrow agent. However incurrence of any such expenses over $1,500.00 shall require the prior written consent for those expenses from the Company.

| (i) | Cash Compensation Fees for Capital Raises: If, within the greater of (A) a two year period commencing on the date hereof or (B) within twelve months after the Termination Date, the Investor Candidate, singly or with others, purchases debt or equity securities of, or loans money to the Company, the Company will pay Agent within three business days upon after any such transaction a success fee for debt and/or equity capital raised by Agent on behalf of Company shall be subject to the following fee structure: |

| a. | 10% of the amount for any equity or hybrid equity capital raised up to $1,000,000 |

| b. | 8% of the amount for any equity or hybrid equity capital raised up to $5,000,000 |

| c. | 6% of the amount for any equity or hybrid equity capital raised over $5,000,000 |

| (ii) | Cash Compensation Fees for Subsequent Capital Raises: If, within the greater of (A) a two year period commencing on the date hereof or (B) within twelve months after the Termination Date, the Investor Candidate, singly or with others, purchases debt or equity securities of, or loans money to the Company, the Company will pay Agent within three business days upon after any such transaction a success fee which shall be one-half of the amount provided in Section II (i) above of the Aggregate Consideration (except as further defined in (iii) below) received by Company from any Transaction closed, including multiple successive Transactions which increases the amount of cash received by the Company, with an Investor Candidate or a Strategic Candidate (or upon closing a Transaction with a Covered Party, including multiple successive Transactions, within twelve months after the Termination Date), which amount will be paid when the Company receives the proceeds from the Transaction. |

| (iii) | Restricted Stock Fees for Capital Raises: In connection with the compensation set forth above, the Company agrees to issue to Agent upon the Closing of the transaction an amount of restricted shares equal to 4% of capital raised divided by the last reported closing price of the stock on the date of close. These shares shall have piggy back registration rights. In the event the shares are not registered within 6 months of the anniversary of this executed engagement, the Company agrees to approve and pay for the opinion of sale under Rule 144. |

For purposes of this Agreement, “introduced” means that Agent shall have brought the Company to the attention of the prospective Investor Candidate, Strategic Investor other than through an e-mail or other means of communication directed at multiple parties or Transaction and Agent shall have been a procuring cause in its consummation of the matter. “Procuring cause” shall mean that Agent shall have identified the Company to Investor Candidate, the merger or acquisition candidate or the Strategic Investor and conducted initial qualifying discussions regarding an Investment in or other Transaction with Company, or caused the parties to have attended meetings for the purpose of considering a Transaction.

| 3 |

For purposes of this Agreement, “Aggregate Consideration” shall mean the total value of all cash, securities, other property and any other consideration, including, without limitation (as, if, and when received), any contingent, earned or other assets or consideration, paid or payable, directly or indirectly, in connection with the Transaction, net of any indebtedness owed upon the same, it being the intention of this provision that the Aggregate Consideration shall mean the net equity value of any cash, tangible assets or measurable intangible assets acquired by, invested in, loaned to or transferred to the Company, provided that in the case of contingent consideration, payment will only be made upon receipt thereof by the Company. If any non-cash consideration is a class of newly-issued, publicly-traded securities, then the fair market value thereof shall be the average of the closing prices for the twenty trading days subsequent to the fifth trading day after the consummation of the Transaction. If no public market exists for any securities issued in the Transaction or a class of securities is not intended to be publicly traded or convertible into publicly-traded securities, then the fair market value thereof shall be determined by the valuation placed upon these securities by the parties to the Transaction.

Section III: Indemnification

The Company agrees to indemnify and hold Agent which terms for the purposes of this Agreement include the partners, controlling persons, officers, employees and agents of Agent, harmless from and against any and all losses, claims, damages, costs, liabilities or expenses (including reasonable attorney’s fees and expenses), joint or several, to which Agent may become subject in connection with its performance of the services described herein resulting from Company’s gross negligence, willful misconduct or misfeasance, provided, however, that Company shall not be liable in any such case to the extent that any such loss, claim, damage, liability, cost or expense is found in a final judgment by a court of law to have directly resulted from the gross negligence or willful misconduct of Agent.

Likewise Agent agrees to indemnify and hold Company, which terms for the purposes of this paragraph include the subsidiaries, partners, controlling persons, officers, stockholders and employees of Company, harmless from and against any and all losses, claims, damages, costs, liabilities or expenses (including reasonable attorney’s fees and expenses), joint or several, to which Company may become subject resulting from Agent’s gross negligence, willful misconduct or misfeasance, provided however, that Agent shall not be liable in any such case to the extent that any such loss, claim, damage, liability, cost or expense is found in a final judgment by a court of law to have directly resulted from the gross negligence or willful misconduct of Company.

To provide for just and equitable contribution in circumstances in which the indemnification provided pursuant to Section III is for any reason held to be unavailable from Company, on the one hand, and Agent, on the other, shall contribute to the aggregate losses, liabilities, claims, damages and expenses (including any amount paid in settlement of any action, suit, or proceeding or any claims asserted) in such amounts as a court of competent jurisdiction may determine (or in the case of settlement, in such amounts as may be agreed upon by the parties) in such proportion to reflect the relative fault of Company, on the one hand, and Agent, on the other hand, in connection with the events described in Section III, as the case may be, which resulted in such losses, liabilities, claims, damages or expenses, as well as any other equitable considerations. The relative fault of the parties shall be determined by reference to, among other things, whether any untrue or alleged untrue statement of a material fact or the omission or alleged omission to state a material fact relates to information supplied by Company, on the one hand, or Agent, on the other, and the parties’ relative intent, knowledge, access to information and opportunity to correct or prevent such omission or statement.

Section IV: Other

Each party to this Agreement agrees to keep in strict confidence the proprietary and non-public information of the other party during the term of this Agreement and thereafter, provided however that the foregoing shall not prohibit disclosures (i) pursuant to the exercise of the parties’ responsibilities under this Agreement; (ii) required by law or legal process (provided notice is given prior to such disclosure); or (iii) of matters which become public other than by the actions of the disclosing party hereunder.

| 4 |

If Agent completes the Private Placement or any other Transaction pursuant to the Agreement, Agent may, at its own expense, place an announcement, subject to Company’s prior consent and approval, in any newspapers and periodicals it may select stating that Agent has acted as financial advisor, investment banker or placement agent for Company in the Transaction.

Carter, Terry & Company is a registered broker dealer, whose address is herein below for to this contemplated transaction.

Carter, Terry & Company.

3060 Peachtree Rd

Suite 1200

Atlanta, GA 30305

Attention: Mr. Timothy J. Terry

Telephone: (404) 364-2057

This agreement shall be construed in accordance with the laws of the State of Georgia and the parties agree to submit themselves to the jurisdiction of the courts located in that state, which shall be the sole tribunals in which either party may institute and maintain a legal proceeding against the other party arising from any dispute hereunder.

If any agreement, covenant, warranty or other provision of this Agreement is invalid, illegal or incapable of being enforced by reason of any rule of law or public policy, all other agreements, covenants, warranties and other provisions of this Agreement shall, nevertheless, remain in full force and effect. No waiver by either party of a breach or non-performance of any provision or obligation of this Agreement shall be deemed to be a waiver of any preceding or succeeding breach of the same or any other provision of this Agreement. This Agreement is the entire agreement of the parties with respect to the subject matter hereof, supersedes all prior agreements and understandings, oral or written, relating to the subject matter hereof, and may not be amended, supplemented, or modified except by written instrument executed by all parties hereto. Neither party may assign any of its rights or obligations under this Agreement without the prior written consent of the other party.

All notices or other communications under this Agreement must be in writing and sent by prepaid, recognized overnight courier, delivered by hand or transmitted by facsimile or email to the email address or facsimile number of the recipient set out below, confirmed, in the case of facsimile or e-mail, a confirming copy delivered by overnight courier, or such other address, email address or facsimile number as may be furnished in writing by the recipient to the other party. The addresses, email addresses and facsimile numbers of the parties for purposes of this Agreement are:

| USA Equities Corp. | Carter, Terry & Company. |

| 901 Northpoint Parkway | 3060 Peachtree Rd |

| Suite 302 | Suite 1200 |

| West Palm Beach, FL 33407 | Atlanta, GA 30305 |

| Phone: (929) 379-6503 | Phone: 404-364-3070 |

If the foregoing is acceptable to you, please indicate your approval by signing in the space provided and returning an executed copy of this Agreement to us.

We are very enthusiastic about working with your team toward the successful completion of this assignment.

| 5 |

Understood and agreed, this 28th day of June, 2021.

| USA Equities Corp | Carter, Terry & Company | |

| /s/ Troy Grogan | /s/ Timothy Terry | |

| Troy Grogan, CEO | Timothy J. Terry, CEO |

APPENDIX A

***

***

***

***

***

***

***

***

| 6 |

Exhibit 10.10

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE REASONABLY ACCEPTABLE TO THE ISSUER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 UNDER SAID ACT.

COMMON STOCK PURCHASE WARRANT

USA EQUITIES CORP.

| Warrant Shares: 15,900_______ | Initial Exercise Date: March 16, 2021__ |

THIS COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies that, for value received, Juan Escobar or assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after the date hereof (the “Initial Exercise Date”) and on or prior to the close of business on March 15, 2023 (the “Termination Date”) but not thereafter, to subscribe for and purchase from USA Equities Corp., a Delaware corporation (the “Company”), up to 15,900 shares (the “Warrant Shares”) of common stock, par value $.0001 per share, of the Company (the “Common Stock”). The purchase price of one share of Common Stock under this Warrant shall be equal to the Exercise Price, as defined in Section 1(b).

Section 1. Exercise

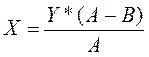

a) Exercise. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time or times on or after the Initial Exercise Date and on or before the Termination Date by delivery of a duly executed facsimile copy of the Notice of Exercise Form annexed hereto to the Company (or such other office or agency of the Company as it may designate by notice in writing to the registered Holder at the address of such Holder appearing on the books of the Company); and, if the Exercise Price is to be paid in cash, within three Trading Days of the date said Notice of Exercise is delivered to the Company, the Company shall have received payment of the aggregate Exercise Price of the shares thereby purchased by wire transfer or cashier’s check drawn on a United States bank. If at the time the Holder desires to exercise this Warrant, the Warrant Shares have not been registered for issuance in a registration statement filed under the Securities Act of 1933, as amended (the “Securities Act”) and an exemption from the registration requirements of the Securities Act is not available for the sale and issuance of the Warrant Shares, the Holder may pay the Exercise Price, in whole or in part, by surrender or delivery to the Company of securities of the Company, including all or a portion of this Warrant in a “cashless exercise,” having a fair market value, as determined below, on the date of the exercise equal to the portion of the purchase price being so paid. If the Holder elects to exercise this Option, or a portion hereof, and to pay for the Common Stock by way of cashless exercise (a “Cashless Exercise”), the Holder shall deliver the Exercise Notice duly executed by such Holder or by such Holder’s duly authorized attorney, at the principal office of the Company, or at such other office or agency as the Company may designate in writing prior to the date of such exercise, in which event the Company shall issue to the Holder the number of shares computed according to the following equation:

| 1 |

where

X = the number of shares of Common Stock to be issued to the Holder.

Y = the number of shares of Common Stock then purchasable under this Warrant or, if only a portion of the Warrant is being exercised, the number of shares of Common Stock as to which the Warrant is being exercised.

A = the Fair Market Value (defined below) of one share of Common Stock on the Exercise Date.

B = the Exercise Price (as adjusted pursuant to the provisions of this Warrant).

For purposes of this Section 1, in the case of a Cashless Exercise, the “Exercise Date” shall mean the day on which the Holder delivers the Exercise Notice to the Company by hand or e-mail, or the day the Holder deposits the Exercise Notice in a facility of the US mails or with a recognized overnight courier, and “Fair Market Value” of one share of Common Stock on the Exercise Date shall have one of the following meanings:

(1) if the Common Stock is traded on the NYSE MKT or other national securities exchange registered with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Fair Market Value shall be deemed to be the average of the Closing Prices over a five Trading Day period ending on the Exercise Date. For the purposes of this Agreement, “Closing Price” means the closing sale price of one share of Common Stock, as reported by NYSE MKT or such other such national securities exchange, or if NYSE MKT or such other national securities exchange does not publish such information, Bloomberg L.P; or

(2) if the Common Stock is not traded on a national securities exchange, the Fair Market Value shall be deemed to be the average of the closing bid and asked prices over the ten (10) trading day period ending on the Exercise Date; or

(3) if neither (1) nor (2) is applicable, the Fair Market Value shall be at the commercially reasonable price per share which the Company could obtain on the Exercise Date from a willing buyer (not a current employee or director) for shares of Common Stock sold by the Company, from authorized but unissued shares, as determined in good faith by the Company’s Board of Directors.

| 2 |

As used in this Warrant, “Trading Days” mean days on which the Common Stock is traded on the principal market on which it is then traded.

b) Surrender. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and the Warrant has been exercised in full, in which case, the Holder shall surrender this Warrant to the Company for cancellation within three Trading Days of the date the final Notice of Exercise is delivered to the Company. Partial exercises of this Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable hereunder in an amount equal to the applicable number of Warrant Shares purchased. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Company shall deliver any objection to any Notice of Exercise Form within three Business Days of receipt of such notice. In the event of any dispute or discrepancy, the records of the Company shall be controlling and determinative in the absence of manifest error. The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof. As used in this Warrant, “Business Day” means any day except Saturday, Sunday, any day which shall be a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

c) Exercise Price. The exercise price per share of the Common Stock under this Warrant shall be $0.75 (one hundred fifty (150%) of the Conversion Price in the transaction resulting in the issuance of this Warrant), subject to adjustment hereunder (the “Exercise Price”).

d) Mechanics of Exercise.

i. Authorization of Warrant Shares. The Company covenants that all Warrant Shares which may be issued upon the exercise of the purchase rights represented by this Warrant will, upon exercise of the purchase rights represented by this Warrant, be duly authorized, validly issued, fully paid and non-assessable and free from all taxes, liens and charges created by the Company in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

ii. Delivery of Certificates Upon Exercise. Certificates for shares purchased hereunder shall be transmitted by the transfer agent of the Company to the Holder by crediting the account of the Holder’s prime broker with the Depository Trust Company through its Deposit Withdrawal Agent Commission (“DWAC”) system if the Company is a participant in such system, and otherwise by physical delivery to the address specified by the Holder in the Notice of Exercise within five (5) Trading Days from the delivery to the Company of the Notice of Exercise Form, surrender of this Warrant (if required) and payment of the aggregate Exercise Price as set forth above (“Warrant Share Delivery Date”). This Warrant shall be deemed to have been exercised on the date the Exercise Price is received by the Company. The Warrant Shares shall be deemed to have been issued, and Holder or any other person so designated to be named therein shall be deemed to have become a holder of record of such shares for all purposes, as of the date the Warrant has been exercised by payment to the Company of the Exercise Price and all taxes required to be paid by the Holder, if any, pursuant to Section 1(c)(v) prior to the issuance of such shares, have been paid.

| 3 |

iii. Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Company shall, at the request of a Holder and upon surrender of this Warrant certificate, at the time of delivery of the certificate or certificates representing Warrant Shares, deliver to Holder a new Warrant evidencing the rights of Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

iv. No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant. As to any fraction of a share which Holder would otherwise be entitled to purchase upon such exercise, the Company shall at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share.

v. Charges, Taxes and Expenses. Issuance of certificates for Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such certificate, all of which taxes and expenses shall be paid by the Company, and such certificates shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however, that in the event certificates for Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by the Assignment Form attached hereto duly executed by the Holder; and the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any transfer tax incidental thereto.

vi. Closing of Books. The Company will not close its stockholder books or records in any manner which prevents the timely exercise of this Warrant, pursuant to the terms hereof.

Section 2. Certain Adjustments.

a) Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding: (A) pays a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon exercise of this Warrant), (B) subdivides outstanding shares of Common Stock into a larger number of shares, or (C) combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event and the number of shares issuable upon exercise of this Warrant shall be proportionately adjusted. Any adjustment made pursuant to this Section 2(a) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

| 4 |

b) Fundamental Transaction. If, at any time while this Warrant is outstanding, (A) the Company effects any merger or consolidation of the Company with or into another Person (as defined below), (B) the Company effects any sale of all or substantially all of its assets in one or a series of related transactions, (C) any tender offer or exchange offer (whether by the Company or another Person) is completed pursuant to which holders of Common Stock are permitted to tender or exchange their shares for other securities, cash or property, or (D) the Company effects any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (each “Fundamental Transaction”), then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, the number of shares of Common Stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such merger, consolidation or disposition of assets by a Holder of the number of shares of Common Stock for which this Warrant is exercisable immediately prior to such event. For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Company or surviving entity in such Fundamental Transaction shall issue to the Holder a new warrant consistent with the foregoing provisions and evidencing the Holder’s right to exercise such warrant into Alternate Consideration. The terms of any agreement pursuant to which a Fundamental Transaction is effected shall include terms requiring any such successor or surviving entity to comply with the provisions of this Section 2(b) and insuring that this Warrant (or any such replacement security) will be similarly adjusted upon any subsequent transaction analogous to a Fundamental Transaction.

| 5 |

Notwithstanding anything to the contrary, in the event of a Fundamental Transaction that is an all cash transaction, whereby the holders of Common Stock immediately prior to such event are to receive cash in substitution for their shares, and, upon the exercise of this Option the Holder is entitled to receive an amount in cash which, on a per share basis is less than the Exercise Price then in effect, this Agreement shall be deemed to have terminated as of the date of such change.

As used in this Warrant, “Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

c) Calculations. All calculations under this Section 2 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 2, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding.

d) Voluntary Adjustment By Company. The Company may at any time during the term of this Warrant reduce the then current Exercise Price to any amount and for any period of time deemed appropriate by the Board of Directors of the Company.

e) Notice to Holder.

i. Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 2, the Company shall promptly mail to the Holder a notice setting forth the Exercise Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment.

ii. Notice to Allow Exercise by Holder. If (A) the Company shall declare a dividend (or any other distribution in whatever form) on the Common Stock; (B) the Company shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock; (C) the Company shall authorize the granting to all holders of the Common Stock rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights; (D) the approval of any stockholders of the Company shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Company is a party, any sale or transfer of all or substantially all of the assets of the Company, of any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property; (E) the Company shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company; then, in each case, the Company shall cause to be mailed to the Holder at its last address as it shall appear upon the Warrant Register of the Company, at least 20 calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange; provided that the failure to mail such notice or any defect therein or in the mailing thereof shall not affect the validity of the corporate action required to be specified in such notice. The Holder is entitled to exercise this Warrant during the 20-day period commencing on the date of such notice to the effective date of the event triggering such notice.

| 6 |

Section 3. Transfer of Warrant.

a) Transferability. Subject to compliance with any applicable securities laws and the conditions set forth in Section 3(d) hereof, this Warrant and all rights hereunder are transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto duly executed by the Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Upon such surrender and, if required, such payment, the Company shall execute and deliver a new Warrant or Warrants in the name of the assignee or assignees and in the denomination or denominations specified in such instrument of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this Warrant shall promptly be cancelled. A Warrant, if properly assigned, may be exercised by a new holder for the purchase of Warrant Shares without having a new Warrant issued.

b) New Warrants. This Warrant may be divided or combined with other Warrants upon presentation hereof at the aforesaid office of the Company, together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the Holder or its agent or attorney. Subject to compliance with Section 3(a) as to any transfer which may be involved in such division or combination, the Company shall execute and deliver a new Warrant or Warrants in exchange for the Warrant or Warrants to be divided or combined in accordance with such notice.

c) Warrant Register. The Company shall register this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”), in the name of the record Holder hereof from time to time. The Company may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary.

d) Transfer Restrictions. If, at the time of the surrender of this Warrant in connection with any transfer of this Warrant, the transfer of this Warrant shall not be registered pursuant to an effective registration statement under the Securities Act and under applicable state securities or blue sky laws, the Company may require, as a condition of allowing such transfer, that (i) the Holder or transferee of this Warrant, as the case may be, furnish to the Company a written opinion of counsel acceptable to the Company (which opinion shall be in form, substance and scope customary for opinions of counsel in comparable transactions) to the effect that such transfer may be made without registration under the Securities Act and under applicable state securities or blue sky laws, and (ii) the Holder or transferee execute and deliver to the Company an investment letter in form and substance acceptable to the Company, and (iii) the transferee is not a U.S. Person (as defined in Rule 902(k) of Regulation S under the Securities Act or is an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), or (a)(8) promulgated under the Securities Act.

| 7 |

In addition to the foregoing, transfer of this Warrant may be prohibited by the Company if, in its sole judgement, the proposed transfer is likely to increase the probability that the Company must register under the Securities Act the sale of the shares issuable upon exercise of this Warrant in order to avoid being deemed to be conducting an unregistered public offering of the securities issuable upon exercise hereof.

Section 4. Miscellaneous.

a) No Rights as Shareholder Until Exercise. This Warrant does not entitle the Holder to any voting rights or other rights as a shareholder of the Company prior to the exercise hereof.

b) Loss, Theft, Destruction or Mutilation of Warrant. The Company covenants that upon receipt by the Company of evidence reasonably satisfactory to it of the loss, theft, destruction or mutilation of this Warrant or any stock certificate relating to the Warrant Shares, and in case of loss, theft or destruction, of indemnity or security reasonably satisfactory to it (which, in the case of the Warrant, shall not include the posting of any bond), and upon surrender and cancellation of such Warrant or stock certificate, if mutilated, the Company will make and deliver a new Warrant or stock certificate of like tenor and dated as of such cancellation, in lieu of such Warrant or stock certificate.

c) Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a Business Day, then such action may be taken or such right may be exercised on the next succeeding Business Day.

d) Authorized Shares. The Company covenants that during the period the Warrant is outstanding, it will reserve from its authorized and unissued Common Stock a sufficient number of shares to provide for the issuance of the Warrant Shares upon the exercise of any purchase rights under this Warrant. The Company further covenants that its issuance of this Warrant shall constitute full authority to its officers who are charged with the duty of executing stock certificates to execute and issue the necessary certificates for the Warrant Shares upon the exercise of the purchase rights under this Warrant. The Company will take all such reasonable action as may be necessary to assure that such Warrant Shares may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of any trading market upon which the Common Stock may be listed.

| 8 |

Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment. Without limiting the generality of the foregoing, the Company will (a) not increase the par value of any Warrant Shares above the amount payable therefor upon such exercise immediately prior to such increase in par value, (b) take all such action as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable Warrant Shares upon the exercise of this Warrant, and (c) use commercially reasonable efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction thereof as may be necessary to enable the Company to perform its obligations under this Warrant.

Before taking any action which would result in an adjustment in the number of Warrant Shares for which this Warrant is exercisable or in the Exercise Price, the Company shall obtain all such authorizations or exemptions thereof, or consents thereto, as may be necessary from any public regulatory body or bodies having jurisdiction thereof.

e) Jurisdiction. This Warrant shall be governed by and construed in accordance with the laws of the State of Delaware without regard to conflict of laws principles.

f) Restrictions. The Holder acknowledges that the Warrant Shares acquired upon the exercise of this Warrant, if not registered, will have restrictions upon resale imposed by state and federal securities laws.

g) Nonwaiver and Expenses. No course of dealing or any delay or failure to exercise any right hereunder on the part of Holder shall operate as a waiver of such right or otherwise prejudice Holder’s rights, powers or remedies, notwithstanding the fact that all rights hereunder terminate on the Termination Date. If the Company willfully and knowingly fails to comply with any provision of this Warrant, which results in any material damages to the Holder, the Company shall pay to Holder such amounts as shall be sufficient to cover any costs and expenses including, but not limited to, reasonable attorneys’ fees, including those of appellate proceedings, incurred by Holder in collecting any amounts due pursuant hereto or in otherwise enforcing any of its rights, powers or remedies hereunder.

h) Notices. Any notice, demand or other communication which any party hereto may be required, or may elect, to give to anyone interested hereunder shall be sufficiently given if (a) deposited, prepaid, with a recognized international courier service or (b) delivered personally, in each case to the Company at its address as provided to the Holder or to the Holder as contained in the records of the Company. Any notice delivered personally shall be effective upon receipt and a notice delivered by recognized courier shall be effective on the second business day following its delivery to the courier. Notice of a change of address shall be effective only upon receipt. Notwithstanding the foregoing, notice of the exercise of this Warrant shall only be delivered to the Company or its designee, by e-mail with a confirming telephone call.

| 9 |

i) Limitation of Liability. No provision hereof, in the absence of any affirmative action by Holder to exercise this Warrant to purchase Warrant Shares, and no enumeration herein of the rights or privileges of Holder, shall give rise to any liability of Holder for the purchase price of any Common Stock or as a stockholder of the Company, whether such liability is asserted by the Company or by creditors of the Company.

j) Remedies. Holder, in addition to being entitled to exercise all rights granted by law, including recovery of damages, will be entitled to specific performance of its rights under this Warrant. The Company agrees that monetary damages would not be adequate compensation for any loss incurred by reason of a breach by it of the provisions of this Warrant and hereby agrees to waive and not to assert the defense in any action for specific performance that a remedy at law would be adequate.

k) Successors and Assigns. Subject to applicable securities laws, this Warrant and the rights and obligations evidenced hereby shall inure to the benefit of and be binding upon the successors of the Company and the successors and permitted assigns of Holder. The provisions of this Warrant are intended to be for the benefit of all Holders from time to time of this Warrant and shall be enforceable by any such Holder or holder of Warrant Shares.

l) Amendment. This Warrant may be modified or amended or the provisions hereof waived with the written consent of the Company and the Holder.

m) Severability. Wherever possible, each provision of this Warrant shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Warrant shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provisions or the remaining provisions of this Warrant.

n) Headings. The headings used in this Warrant are for the convenience of reference only and shall not, for any purpose, be deemed a part of this Warrant.

********************

IN WITNESS WHEREOF, the Company has caused this Warrant to be executed by its officer thereunto duly authorized as of the date first above indicated.

| USA EQUITIES CORP. | ||

| By: | /s/: Troy Grogan | |

| Troy Grogan | ||

| President | ||

| 10 |

NOTICE OF EXERCISE

(paid in cash)

To: USA EQUITIES CORP..

(1) The undersigned hereby elects to purchase ________ shares of common stock of the Company pursuant to the terms of the attached Warrant (only if exercised in full), and tenders herewith payment of the exercise price in full, together with all applicable transfer taxes, if any.

(2) Payment shall take the form of in lawful money of the United States.

(3) Please issue a certificate or certificates representing said shares of common stock in the name of the undersigned or in such other name as is specified below:

_______________________________

The shares shall be delivered to the following DWAC Account Number or by physical delivery of a certificate to:

_______________________________

_______________________________

_______________________________

(4) Status of Holder Exercising Warrant: The undersigned is (check the applicable box(es) below):

[ ] an “accredited investor” as defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended; or

[ ] not a “U.S. Person” as defined in of Rule 902(k) of Regulation S under the Securities Act.

| Name: | ||

| Signature: | ||

| Date: |

| 11 |

NOTICE OF EXERCISE

(cashless exercise)

To: USA EQUITIES CORP.

(1) The undersigned hereby elects to convert his right to purchase _______ shares of Common Stock of USA Equities Corp.. (the “Company”), as provided in the Warrant dated ______ __, ______, into ____ shares of the common stock of the Company (based on a fair market value per share of $_______ ). Please issue the shares in accordance with the instructions given below.

(2) Please issue a certificate or certificates representing said shares of common stock in the name of the undersigned or in such other name as is specified below:

_______________________________

The shares shall be delivered to the following DWAC Account Number or by physical delivery of a certificate to:

_______________________________

_______________________________

_______________________________

(3) Status of Holder Exercising Warrant: The undersigned is (check the applicable boxe(s) below):

[ ] an “accredited investor” as defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended; or

[ ] not a “U.S. Person” as defined in of Rule 902(k) of Regulation S under the Securities Act.

| Name: | ||

| Signature: | ||

| Date: |

| 12 |

ASSIGNMENT FORM

(To assign the foregoing warrant, execute this form and supply required information.

Do not use this form to exercise the warrant.)

FOR VALUE RECEIVED, [____] all of or [_______] shares of the foregoing Warrant and all rights evidenced thereby are hereby assigned to _______________________________________________ whose address is

_______________________________________________________________.

_______________________________________________________________

Dated: ______________, _______

Holder’s Signature: _____________________________

Holder’s Address: _____________________________

_____________________________

Signature Guaranteed: ___________________________________________

NOTE: The signature to this Assignment Form must correspond with the name as it appears on the face of the Warrant, without alteration or enlargement or any change whatsoever, and must be guaranteed by a bank or trust company. Officers of corporations and those acting in a fiduciary or other representative capacity should file proper evidence of authority to assign the foregoing Warrant.

| 13 |

Exhibit 10.11

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE REASONABLY ACCEPTABLE TO THE ISSUER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 UNDER SAID ACT.

COMMON STOCK PURCHASE WARRANT

USA EQUITIES CORP.

| Warrant Shares: 53,704_______ | Initial Exercise Date: May 7, 2021__ |

THIS COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies that, for value received, Juan Escobar or assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after the date hereof (the “Initial Exercise Date”) and on or prior to the close of business on May 6, 2023 (the “Termination Date”) but not thereafter, to subscribe for and purchase from USA Equities Corp., a Delaware corporation (the “Company”), up to 53,704 shares (the “Warrant Shares”) of common stock, par value $.0001 per share, of the Company (the “Common Stock”). The purchase price of one share of Common Stock under this Warrant shall be equal to the Exercise Price, as defined in Section 1(b).

Section 1. Exercise

a) Exercise. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time or times on or after the Initial Exercise Date and on or before the Termination Date by delivery of a duly executed facsimile copy of the Notice of Exercise Form annexed hereto to the Company (or such other office or agency of the Company as it may designate by notice in writing to the registered Holder at the address of such Holder appearing on the books of the Company); and, if the Exercise Price is to be paid in cash, within three Trading Days of the date said Notice of Exercise is delivered to the Company, the Company shall have received payment of the aggregate Exercise Price of the shares thereby purchased by wire transfer or cashier’s check drawn on a United States bank. If at the time the Holder desires to exercise this Warrant, the Warrant Shares have not been registered for issuance in a registration statement filed under the Securities Act of 1933, as amended (the “Securities Act”) and an exemption from the registration requirements of the Securities Act is not available for the sale and issuance of the Warrant Shares, the Holder may pay the Exercise Price, in whole or in part, by surrender or delivery to the Company of securities of the Company, including all or a portion of this Warrant in a “cashless exercise,” having a fair market value, as determined below, on the date of the exercise equal to the portion of the purchase price being so paid. If the Holder elects to exercise this Option, or a portion hereof, and to pay for the Common Stock by way of cashless exercise (a “Cashless Exercise”), the Holder shall deliver the Exercise Notice duly executed by such Holder or by such Holder’s duly authorized attorney, at the principal office of the Company, or at such other office or agency as the Company may designate in writing prior to the date of such exercise, in which event the Company shall issue to the Holder the number of shares computed according to the following equation:

| 1 |

where

X = the number of shares of Common Stock to be issued to the Holder.

Y = the number of shares of Common Stock then purchasable under this Warrant or, if only a portion of the Warrant is being exercised, the number of shares of Common Stock as to which the Warrant is being exercised.

A = the Fair Market Value (defined below) of one share of Common Stock on the Exercise Date.

B = the Exercise Price (as adjusted pursuant to the provisions of this Warrant).

For purposes of this Section 1, in the case of a Cashless Exercise, the “Exercise Date” shall mean the day on which the Holder delivers the Exercise Notice to the Company by hand or e-mail, or the day the Holder deposits the Exercise Notice in a facility of the US mails or with a recognized overnight courier, and “Fair Market Value” of one share of Common Stock on the Exercise Date shall have one of the following meanings:

(1) if the Common Stock is traded on the NYSE MKT or other national securities exchange registered with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Fair Market Value shall be deemed to be the average of the Closing Prices over a five Trading Day period ending on the Exercise Date. For the purposes of this Agreement, “Closing Price” means the closing sale price of one share of Common Stock, as reported by NYSE MKT or such other such national securities exchange, or if NYSE MKT or such other national securities exchange does not publish such information, Bloomberg L.P; or

(2) if the Common Stock is not traded on a national securities exchange, the Fair Market Value shall be deemed to be the average of the closing bid and asked prices over the ten (10) trading day period ending on the Exercise Date; or

(3) if neither (1) nor (2) is applicable, the Fair Market Value shall be at the commercially reasonable price per share which the Company could obtain on the Exercise Date from a willing buyer (not a current employee or director) for shares of Common Stock sold by the Company, from authorized but unissued shares, as determined in good faith by the Company’s Board of Directors.

| 2 |

As used in this Warrant, “Trading Days” mean days on which the Common Stock is traded on the principal market on which it is then traded.

b) Surrender. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and the Warrant has been exercised in full, in which case, the Holder shall surrender this Warrant to the Company for cancellation within three Trading Days of the date the final Notice of Exercise is delivered to the Company. Partial exercises of this Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable hereunder in an amount equal to the applicable number of Warrant Shares purchased. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Company shall deliver any objection to any Notice of Exercise Form within three Business Days of receipt of such notice. In the event of any dispute or discrepancy, the records of the Company shall be controlling and determinative in the absence of manifest error. The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof. As used in this Warrant, “Business Day” means any day except Saturday, Sunday, any day which shall be a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

c) Exercise Price. The exercise price per share of the Common Stock under this Warrant shall be $0.74 (one hundred fifty (150%) of the Conversion Price in the transaction resulting in the issuance of this Warrant), subject to adjustment hereunder (the “Exercise Price”).

d) Mechanics of Exercise.

i. Authorization of Warrant Shares. The Company covenants that all Warrant Shares which may be issued upon the exercise of the purchase rights represented by this Warrant will, upon exercise of the purchase rights represented by this Warrant, be duly authorized, validly issued, fully paid and non-assessable and free from all taxes, liens and charges created by the Company in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

ii. Delivery of Certificates Upon Exercise. Certificates for shares purchased hereunder shall be transmitted by the transfer agent of the Company to the Holder by crediting the account of the Holder’s prime broker with the Depository Trust Company through its Deposit Withdrawal Agent Commission (“DWAC”) system if the Company is a participant in such system, and otherwise by physical delivery to the address specified by the Holder in the Notice of Exercise within five (5) Trading Days from the delivery to the Company of the Notice of Exercise Form, surrender of this Warrant (if required) and payment of the aggregate Exercise Price as set forth above (“Warrant Share Delivery Date”). This Warrant shall be deemed to have been exercised on the date the Exercise Price is received by the Company. The Warrant Shares shall be deemed to have been issued, and Holder or any other person so designated to be named therein shall be deemed to have become a holder of record of such shares for all purposes, as of the date the Warrant has been exercised by payment to the Company of the Exercise Price and all taxes required to be paid by the Holder, if any, pursuant to Section 1(c)(v) prior to the issuance of such shares, have been paid.

| 3 |

iii. Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Company shall, at the request of a Holder and upon surrender of this Warrant certificate, at the time of delivery of the certificate or certificates representing Warrant Shares, deliver to Holder a new Warrant evidencing the rights of Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

iv. No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant. As to any fraction of a share which Holder would otherwise be entitled to purchase upon such exercise, the Company shall at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share.

v. Charges, Taxes and Expenses. Issuance of certificates for Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such certificate, all of which taxes and expenses shall be paid by the Company, and such certificates shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however, that in the event certificates for Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by the Assignment Form attached hereto duly executed by the Holder; and the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any transfer tax incidental thereto.

vi. Closing of Books. The Company will not close its stockholder books or records in any manner which prevents the timely exercise of this Warrant, pursuant to the terms hereof.

Section 2. Certain Adjustments.

a) Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding: (A) pays a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon exercise of this Warrant), (B) subdivides outstanding shares of Common Stock into a larger number of shares, or (C) combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event and the number of shares issuable upon exercise of this Warrant shall be proportionately adjusted. Any adjustment made pursuant to this Section 2(a) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

| 4 |

b) Fundamental Transaction. If, at any time while this Warrant is outstanding, (A) the Company effects any merger or consolidation of the Company with or into another Person (as defined below), (B) the Company effects any sale of all or substantially all of its assets in one or a series of related transactions, (C) any tender offer or exchange offer (whether by the Company or another Person) is completed pursuant to which holders of Common Stock are permitted to tender or exchange their shares for other securities, cash or property, or (D) the Company effects any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (each “Fundamental Transaction”), then, upon any subsequent exercise of this Warrant, the Holder shall have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, the number of shares of Common Stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such merger, consolidation or disposition of assets by a Holder of the number of shares of Common Stock for which this Warrant is exercisable immediately prior to such event. For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Company or surviving entity in such Fundamental Transaction shall issue to the Holder a new warrant consistent with the foregoing provisions and evidencing the Holder’s right to exercise such warrant into Alternate Consideration. The terms of any agreement pursuant to which a Fundamental Transaction is effected shall include terms requiring any such successor or surviving entity to comply with the provisions of this Section 2(b) and insuring that this Warrant (or any such replacement security) will be similarly adjusted upon any subsequent transaction analogous to a Fundamental Transaction.

| 5 |

Notwithstanding anything to the contrary, in the event of a Fundamental Transaction that is an all cash transaction, whereby the holders of Common Stock immediately prior to such event are to receive cash in substitution for their shares, and, upon the exercise of this Option the Holder is entitled to receive an amount in cash which, on a per share basis is less than the Exercise Price then in effect, this Agreement shall be deemed to have terminated as of the date of such change.

As used in this Warrant, “Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

c) Calculations. All calculations under this Section 2 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 2, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding.

d) Voluntary Adjustment By Company. The Company may at any time during the term of this Warrant reduce the then current Exercise Price to any amount and for any period of time deemed appropriate by the Board of Directors of the Company.

e) Notice to Holder.

i. Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 2, the Company shall promptly mail to the Holder a notice setting forth the Exercise Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment.