Form PRER14A Cogent Biosciences, Inc.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Amendment No. 4

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ | |||

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

COGENT BIOSCIENCES, INC.

(Formerly known as Unum Therapeutics Inc.)

(Exact name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

Table of Contents

PRELIMINARY PROXY STATEMENT DATED OCTOBER 6, 2020—SUBJECT TO COMPLETION

COGENT BIOSCIENCES, INC.

200 Cambridge Park Drive, Suite 2500

Cambridge, Massachusetts 02140

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held [●], 2020

Notice is hereby given that a special meeting of stockholders, or Special Meeting, of Cogent Biosciences, Inc. (formerly known as Unum Therapeutics Inc.), or “we,” “Cogent” or the “Company”, will be held online on [●], 2020 at [●] Eastern Time. You, or your proxy may attend the meeting virtually via the Internet at https://www.virtualshareholdermeeting.com/COGT2020, where you, or your proxy, will be able to vote electronically and examine the Company’s stocklist during the Special Meeting. You will need the 16-digit control number included with these materials to attend the Special Meeting and to vote and otherwise participate in the Special Meeting. The purpose of the Special Meeting is the following:

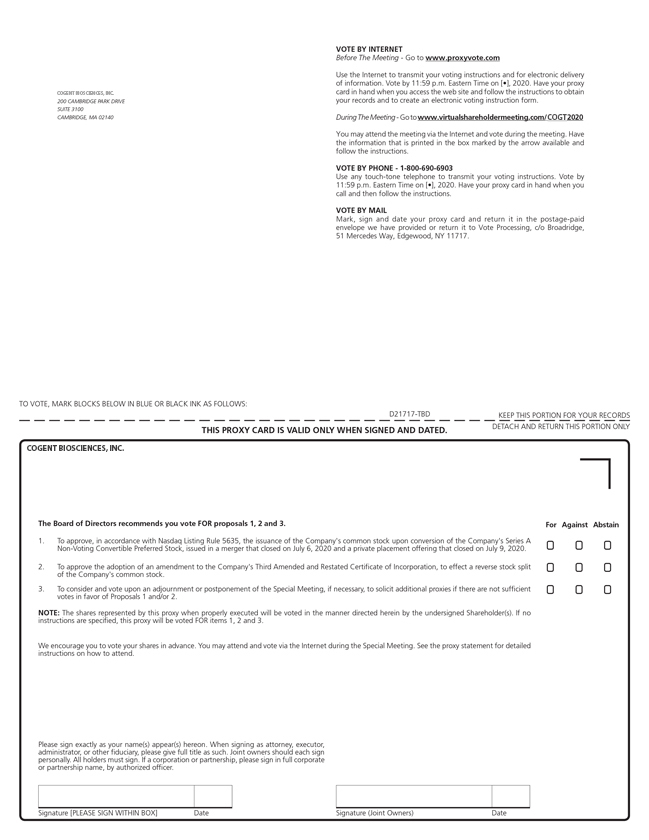

| 1. | To approve, in accordance with Nasdaq Listing Rule 5635, the issuance of the Company’s common stock, par value $0.001 per share, referred to as “Common Stock” or “our common stock”, upon conversion of the Company’s Series A Non-Voting Convertible Preferred Stock, par value $0.001 per share, or Series A Preferred Stock, issued in a merger that closed on July 6, 2020 and a private placement offering that closed on July 9, 2020 (the “Conversion Proposal” or “Proposal No. 1”); |

| 2. | To approve an amendment to our Third Amended and Restated Certificate of Incorporation, or Certificate of Incorporation, to effect a reverse stock split of the Company’s Common Stock at a ratio of between and including 1:[●] and 1:[●] (the “Reverse Stock Split Proposal” or “Proposal No. 2”); and |

| 3. | To approve the adjournment or postponement of the Special Meeting, if necessary, to continue to solicit votes for the Conversion Proposal and/or the Reverse Stock Split Proposal (the “Adjournment Proposal” or “Proposal No. 3”). |

Only Cogent Biosciences, Inc. stockholders of record at the close of business on [●], 2020, will be entitled to vote at the Special Meeting and any adjournment or postponement thereof.

Your vote is important. Whether or not you are able to attend the virtual meeting, it is important that your shares be represented. To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the virtual meeting, by submitting your proxy via the Internet at the address listed on the proxy card or by signing, dating and returning the proxy card.

| By order of the Board of Directors, | ||

| Charles Wilson, Ph.D. | ||

| President and Chief Executive Officer | ||

Cambridge, Massachusetts

[●], 2020

Table of Contents

| i | ||||

| i | ||||

| iii | ||||

| iii | ||||

| iii | ||||

| iv | ||||

| iv | ||||

| v | ||||

| vi | ||||

| vii | ||||

| vii | ||||

| 1 | ||||

| 5 | ||||

| 6 | ||||

| 10 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 23 | ||||

| 25 | ||||

| 26 | ||||

| Certain Cogent Management Unaudited Prospective Financial Information |

26 | |||

| 28 | ||||

| Interests of Cogent’s Directors and Executive Officers in the Merger |

37 | |||

| 43 | ||||

| 43 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 57 | ||||

| 102 |

Table of Contents

Table of Contents

This summary highlights selected information from this proxy statement and may not contain all of the information that is important to you. To better understand the proposals being considered at the Special Meeting, you should read this entire proxy statement carefully, including the materials attached as annexes, as well as other documents referred to or incorporated by reference herein. Each item in this summary includes a page reference directing you to a more complete description of that item contained in later parts of this proxy statement. You may obtain the information incorporated by reference into this proxy statement without charge by following the instructions under the section of this proxy statement entitled “Where You Can Find Additional Information”.

Merger Agreement (pages [●])

On July 6, 2020, we completed our acquisition of Kiq Bio LLC (formerly Kiq LLC), a Delaware limited liability company (“Kiq”), in accordance with the terms of the Agreement and Plan of Merger (the “Merger Agreement”), dated July 6, 2020, between the Company, Utah Merger Sub 1 LLC, a Delaware limited liability company and a wholly owned subsidiary of Cogent (“First Merger Sub”), Utah Merger Sub 2 LLC, a Delaware limited liability company and wholly owned subsidiary of Cogent (“Second Merger Sub”), and Kiq. Pursuant to the Merger Agreement, First Merger Sub merged with and into Kiq, pursuant to which Kiq was the surviving entity and became a wholly owned subsidiary of Cogent (the “First Merger”). Immediately following the First Merger, Kiq merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the surviving entity (together with the First Merger, the “Merger”). The Merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes. The Board of Directors of Cogent, or “Board of Directors” or the “Cogent Board”, unanimously approved the Merger Agreement and the related transactions, and the consummation of the Merger was not subject to approval of the Cogent stockholders.

Support Agreements (pages [●])

In connection with the execution of the Merger Agreement, Cogent and Kiq entered into stockholder support agreements (the “Support Agreements”) with Cogent’s directors and certain officers and one of Cogent’s largest stockholders, which collectively own an aggregate of approximately 23.0% of the outstanding shares of the Common Stock, or 27.9% of the shares of Common Stock entitled to vote on Proposal No. 1. The Support Agreements provide that, among other things, each of the stockholders has agreed to vote or cause to be voted all of the shares of Common Stock owned by such stockholder in favor of the Conversion Proposal at the Special Meeting. Each of the stockholders that have entered into the Support Agreements are entitled to vote on the Conversion Proposal.

Lock-up Agreements (pages [●])

Concurrently and in connection with the execution of the Merger Agreement, former Kiq securityholders as of immediately prior to the Merger, and the directors and officers of Cogent as of immediately following the Merger, which collectively own an aggregate of approximately 30.7% of Cogent outstanding capital stock, entered into lock-up agreements with Cogent and Kiq, pursuant to which each stockholder is subject to a 90 day lockup on the sale or transfer of shares of Common Stock held by each such stockholder at the closing of the Merger, including those shares received by Kiq securityholders in the Merger (the “Lock-up Agreements”).

Contingent Value Rights Agreement (pages [●])

Pursuant to the Merger Agreement, within 30 days following the closing of the Merger, Cogent and the Rights Agent (as defined therein) executed and delivered a contingent value rights agreement (the “CVR Agreement”),

i

Table of Contents

pursuant to which each holder of Common Stock as of immediately prior to the effective time of the Merger (the “Effective Time”) is entitled to one contractual contingent value right issued by Cogent, subject to and in accordance with the terms and conditions of the CVR Agreement, for each share of Common Stock held by such holder. Each contingent value right entitles the holder thereof to receive certain Common Stock and/or cash payments from the net proceeds, if any, related to the disposition of Cogent’s legacy cell therapy assets within three years following the closing of the Merger. The contingent value rights are not transferable, except in certain limited circumstances as will be provided in the CVR Agreement, will not be certificated or evidenced by any instrument and will not be registered with the SEC or listed for trading on any exchange.

Private Placement and Securities Purchase Agreement (pages [●])

On July 6, 2020, Cogent entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the purchasers named therein (the “Investors”). Pursuant to the Purchase Agreement, Cogent agreed to sell an aggregate of approximately 118,638 shares of Series A Preferred Stock for an aggregate purchase price of $104,401,000 (collectively, the “Financing”). Each share of Series A Preferred Stock is convertible into 1,000 shares of Common Stock, as described below in “Description of the Series A Preferred Stock”. The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A Preferred Stock are set forth in the Certificate of Designations. The closing of the Financing occurred on July 9, 2020 (the “Financing Closing Date”).

Registration Rights Agreement (pages [●])

On the Financing Closing Date, in connection with the Purchase Agreement, Cogent entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors. Pursuant to the Registration Rights Agreement, Cogent has prepared and filed a resale registration statement with the SEC within 90 calendar days following the Financing Closing Date (the “Filing Deadline”). Cogent will use its reasonable best efforts to cause this registration statement to be declared effective by the SEC within 30 calendar days of the Filing Deadline (or within 60 calendar days if the SEC reviews the registration statement). Cogent also agreed, among other things, to indemnify the Investors, their officers, directors, members, employees and agents, successors and assigns under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incident to Cogent’s obligations under the Registration Rights Agreement.

Reasons for Stockholder Approval (pages [●])

Cogent’s Common Stock is listed on the Nasdaq Global Select Market, and, as such, Cogent is subject to the applicable rules of the Nasdaq Stock Market LLC, or NASDAQ Listing Rules, including NASDAQ Listing Rule 5635. In order to comply with the NASDAQ Listing Rules and to satisfy conditions under the Purchase Agreement, we are seeking stockholder approval of this Proposal No. 1. We are seeking stockholder approval of the Conversion Proposal in order to satisfy the requirements of NASDAQ Listing Rule 5635 with respect to the terms of the Series A Preferred Stock and the issuance of shares of Common Stock upon conversion of the Series A Preferred Stock in excess of the 20% of the voting power outstanding before the issuance.

Vote Required (pages [●])

Stockholder approval of this Proposal No. 1 requires a “FOR” vote from the holders of a majority of votes properly cast at the Special Meeting (subject to the separate tabulation of votes described in “Questions and Answers About the Special Meeting—How many votes can be cast by all stockholders?”).

ii

Table of Contents

The Board of Directors has approved and declared advisable an amendment to our certificate of incorporation, which would effect a reverse stock split, or Reverse Stock Split, of all issued and outstanding shares of our Common Stock, at a ratio ranging from 1-for-[●] to 1-for-[●], inclusive. The Board of Directors has recommended that this proposed amendment be presented to our stockholders for approval. Our stockholders are being asked to approve the proposed amendment pursuant to Proposal No. 2 to effect a Reverse Stock Split of the issued and outstanding shares of Common Stock. Accordingly, effecting a Reverse Stock Split would reduce the number of outstanding shares of Common Stock.

Should we receive the required stockholder approval for Proposal No. 2, the Board of Directors will have the sole authority to elect, at any time on or prior to one-year anniversary of the Special Meeting, or [●], 2021, and without the need for any further action on the part of our stockholders, whether to effect the Reverse Stock Split and the number of whole shares of Common Stock, between and including [●] and [●], that will be combined into one share of Common Stock.

Vote Required (pages [●])

Stockholder approval of this Proposal No. 2 requires a “FOR” vote from the holders of a majority of the outstanding shares of our Common Stock as of the record date

If the Company fails to receive a sufficient number of votes to approve Proposals Nos. 1 and/or 2, the Company may propose to adjourn or postpone the Special Meeting. The Company currently does not intend to propose adjournment or postponement at the Special Meeting if there are sufficient votes to approve Proposal No. 1 and 2.

Vote Required (pages [●])

The affirmative vote of the holders of a majority of the votes properly cast at the Special Meeting is required for approval of Proposal No. 3 (for the purpose of soliciting additional proxies to approve Proposals No. 1 and/or 2), if a quorum is present at the Special Meeting. If a quorum is not present at the Special Meeting, the affirmative vote of the stockholders holding a majority of the voting power present in person or by proxy at the Special Meeting is required for approval of Proposal No. 3.

Summary of the Merger (page [●])

Upon the terms and subject to the conditions of the Merger Agreement and in accordance with the General Corporation Law of the Stage of Delaware (“DGCL”) and the Delaware Limited Liability Company Act (“DLLCA”), at the effective time of the Merger (the “Effective Time”), First Merger Sub merged with and into Kiq, pursuant to which Kiq was the surviving entity and became a wholly owned subsidiary of Cogent (the “First Merger”). Immediately following the First Merger, Kiq merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the surviving entity (together with the First Merger, the “Merger’). As a result of the Second Merger, Second Merger Sub will continue as the surviving company of the Merger (the “Surviving Company”).

iii

Table of Contents

Cogent’s Reasons for the Merger (page [●])

The Board of Directors considered various reasons for the Merger, including, among others, the following factors:

| • | the Cogent Board and its financial advisor undertook a comprehensive and thorough process of reviewing and analyzing potential strategic transactions, including the sale of existing assets and reverse mergers to identify the opportunity that would, in the Cogent Board’s opinion, create the most value for Cogent’s stockholders. |

| • | the Cogent Board believes that, as a result of arm’s length negotiations with Kiq, Cogent and its representatives negotiated the most favorable equity split for Cogent shareholders that Kiq was willing to agree to, and that the terms of the Merger Agreement include the most favorable terms to Cogent in the aggregate to which Kiq was willing to agree. |

| • | the Cogent Board believes, after a thorough review of strategic alternatives and discussions with Cogent senior management, financial advisors and legal counsel, that the Merger is more favorable to Cogent’s stockholders than the potential value that might have resulted from other strategic options available to Cogent, including to a liquidation of Cogent and the distribution of any available cash. |

| • | the Cogent Board believes, based in part on a scientific diligence and analysis process conducted over several weeks by Cogent’s management and reviewed with the Cogent Board, that Kiq’s worldwide rights to develop and commercialize PLX9486, a selective KIT D816V inhibitor, in multiple indications, represents a sizeable potential market opportunity, and may thereby create value for the stockholders of the combined organization and an opportunity for Cogent stockholders to participate in the potential growth of the combined company. |

| • | the Cogent Board also reviewed with the management of Cogent the current plans of Kiq for developing the worldwide rights to develop and commercialize PLX9486, a selective KIT D816V inhibitor, in multiple indications to confirm the likelihood that the combined company would possess sufficient financial resources to allow the management team to focus on such continued development and anticipated commercialization. The Cogent Board also considered the possibility that the combined company would be able to take advantage of the potential benefits resulting from the combination of Cogent’s public company structure with Kiq’s business to raise additional funds in the future, if necessary. |

For more information on the Board of Director’s reasons for the transaction, see the section entitled “The Merger—Cogent’s Reasons for the Merger” beginning on page [●] of this proxy statement.

Opinion of Cogent’s Financial Advisor (page [●])

Cogent retained Ladenburg on March 17, 2020 to act as the financial advisor in connection with the Merger and to render the Opinion to the Cogent Board as to the fairness of the amount of Merger Shares to be issued to the holders of Membership Interests to the stockholders of Cogent. Ladenburg rendered the oral opinion, subsequently confirmed by delivery of the written opinion dated July 5, 2020, to the Cogent Board, that the amount of Merger Shares (as defined below) to be issued to the holders of Company Membership Interests, was fair from a financial point of view, to the Cogent stockholders as of the date of such Opinion and based upon the various assumptions, qualifications and limitations set forth therein.

The full text of the written Opinion is attached as Annex B to this proxy statement and is incorporated by reference. Cogent encourages its stockholders to read the Opinion in its entirety for the assumptions made, procedures followed, other matters considered and limits of the review by Ladenburg. The summary of the written Opinion set forth herein is qualified by reference to the full text of the Opinion.

iv

Table of Contents

Ladenburg provided its Opinion for the sole benefit and use by the Board of Directors in its consideration of the Merger. The Opinion is not a recommendation to the Board of Directors or to any stockholder as to how to vote with respect to the proposed Merger or to take any other action in connection with the Merger or otherwise.

Overview of the Merger Agreement (page [●])

Merger Consideration

At the effective time of the Merger:

| • | the limited liability company interests of Kiq (the “Kiq Membership Interests”) outstanding immediately prior to the First Effective Time were converted solely into the right to receive a number of shares of Common Stock equal to the amount of Merger Shares (as defined below) multiplied by the applicable member’s percentage interest in Kiq as set forth on the allocation certificate Kiq provided to Cogent. |

| • | No fractional shares of Common Stock were issuable to Kiq’s members pursuant to the Merger. |

The aggregate number of shares of Common Stock pursuant to the Merger to any member of Kiq could not result in the acquisition of beneficial ownership of Cogent in excess of 19.99% of the total number of shares of Common Stock outstanding immediately prior to the First Effective Time (the “Stock Consideration Cap”). As the aggregate number of shares of Common Stock issued pursuant to the Merger would have resulted in the issuance of shares of Common Stock in an amount in excess of the Stock Consideration Cap, the Company issued to Kiq’s members shares of Common Stock up to the Stock Consideration Cap and issued the remaining balance of such member’s Merger Shares in shares of Series A Preferred Stock, in each case, in accordance with the applicable member’s percentage interest in Kiq as set forth on the allocation certificate Kiq provided to Cogent.

Immediately following the closing of the Merger, (i) the former members of Kiq as of immediately prior to the Merger owned approximately 60.8% of Cogent on a fully-diluted basis and (ii) Cogent stockholders as of immediately prior to the Merger owned approximately 39.2% of Cogent on a fully-diluted basis. On a pro forma basis and based upon the number of shares of Common Stock and Series A Preferred Stock issued in the Merger and the Financing, Cogent equity holders immediately prior to the acquisition will own approximately 16.2% of Cogent on a fully-diluted basis.

Equity Awards

Prior to the closing of the Merger, the Cogent Board adopted appropriate resolutions and take all other actions necessary and appropriate to provide that the vesting and exercisability of each unexpired, unexercised and unvested option to purchase Common Stock (“Cogent Option”) was accelerated in full effective as of immediately prior to the First Effective Time. The Cogent Stock Plans remain in effect and each unexpired, unexercised Cogent Option continues to remain outstanding after the Effective Time.

Prior to the closing of the Merger, the Cogent Board adopted appropriate resolutions and take all other actions necessary and appropriate to provide that (i) the vesting of each outstanding and unvested awards of restricted stock units of Cogent (“Cogent RSUs”) be accelerated in full effective as of immediately prior to the First Effective Time and (ii) each outstanding and unsettled Cogent RSU (including any Cogent RSUs that are accelerated as stated above or upon termination of employment) were settled and each holder received, immediately prior to the First Effective Time a number of shares of Common Stock equal to the number of vested and unsettled Cogent RSUs underlying such Cogent RSUs.

v

Table of Contents

Conditions to the Completion of the Merger

Each party’s obligation to complete the Merger was subject to the satisfaction or waiver by each of the parties, at or prior to the Merger, of various conditions, which include the following:

| • | there must not have been issued, and remain in effect, any temporary restraining order, preliminary or permanent injunction or other order preventing the consummation of the Merger or any of the other transactions contemplated by the Merger Agreement by any court of competent jurisdiction or other governmental entity of competent jurisdiction, and no law, statute, rule, regulation, ruling or decree shall be in effect which has the effect of making the consummation of the Merger or any of the other transactions contemplated by the Merger Agreement illegal; |

| • | the members of a majority of the limited liability interests of Kiq must have adopted and approved the Merger Agreement, which adoption and approval was obtained on July 6, 2020; |

| • | the approval of the listing of additional shares of Common Stock on Nasdaq must have been obtained and the shares of Common Stock to be issued in the First Merger must have been approved for listing (subject to official notice of issuance) on Nasdaq; and |

| • | The Purchase Agreement must have been in full force and effect and cash proceeds of not less than the Concurrent Investment Amount (as defined in the Merger Agreement) must have been received by Cogent, or would be received by Cogent substantially simultaneously with the closing of the Merger, in connection with the consummation of the transactions contemplated by the Purchase Agreement. |

In addition, the obligation of Cogent, First Merger Sub and Second Merger Sub to complete the Merger was further subject to the following documents, each of which must have been in full force and effect: (A) the Kiq member written consent; (B) the Company Lock-Up Agreements (as defined in the Merger Agreement); (C) the Kiq Valuation Schedule (as defined below); and (D) the Allocation Certificate (as defined in the Merger Agreement).

The obligation Kiq to complete the Merger was further subject to the following documents, each of which must have been in full force and effect: (A) a copy of the Certificate of Designation, certified by the Secretary of State of the State of Delaware; (B) the Utah Net Cash Schedule (as defined in the Merger Agreement); (C) written resignations in forms satisfactory to Kiq, dated as of the closing date and effective as of the closing executed by the officers and directors of Cogent who were not to continue as officers or directors of Cogent.

Summary of the Financing (page [●])

On July 6, 2020, the Company entered into the Purchase Agreement with the purchasers named therein (the “Investors”), pursuant to which the Company agreed to sell an aggregate of approximately 118,638 shares of Series A Preferred Stock for an aggregate purchase price of $104,401,000 (collectively, the “Financing”). The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A Preferred Stock are set forth in the Certificate of Designations, which is filed as Exhibit 3.1 to the Current Report on Form 8-K filed with the SEC on July 6, 2020, and is incorporated herein by reference. The closing of the Financing occurred on July 9, 2020 (the “Financing Closing Date”).

The consummation of the Financing was subject to the satisfaction or waiver of, among other customary closing conditions, the accuracy of the representations and warranties in the Purchase Agreement, the compliance by the parties with the covenants in the Purchase Agreement, the absence of any legal order barring the Financing, no suspension in the trading of the Common Stock and the closing of the Merger. The parties were also provided with customary termination rights, including the right of either party to terminate the Purchase Agreement if the consummation of the Financing had not occurred within 30 days after the signing unless the failure of the Financing to be consummated was caused by such party.

vi

Table of Contents

The Financing is exempt from registration pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder, as a transaction by an issuer not involving a public offering. The Investors have acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends have been affixed to the securities issued in this transaction.

The Financing has already been completed, and the approval of our stockholders is not required for the Financing. As discussed above, the Company is not seeking stockholder approval of, and you are not being asked to vote on, the Financing.

The Company is subject to various risks associated with its business and its industry.

Neither Cogent nor Kiq was required to make any filings or to obtain approvals or clearances from any antitrust regulatory authorities in the United States or other countries to consummate the Merger. In the United States, Cogent must comply with applicable federal and state securities laws and the NASDAQ rules in connection with the issuance of shares of Common Stock and Series A Preferred Stock in the Merger and the Financing, including the filing with the SEC of this proxy statement.

vii

Table of Contents

PRELIMINARY PROXY STATEMENT DATED OCTOBER 6, 2020—SUBJECT TO COMPLETION

COGENT BIOSCIENCES, INC.

200 Cambridge Park Drive, Suite 2500

Cambridge, Massachusetts 02140

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD [●], 2020

This proxy statement contains information about the Special Meeting of Stockholders, or the Special Meeting, of Cogent Biosciences, Inc., which will be held online on [●], 2020 at [●] Eastern Time. You may attend the meeting virtually via the Internet at https://www.virtualshareholdermeeting.com/COGT2020, where you will be able to vote electronically. The board of directors of Cogent Biosciences, Inc., or Board of Directors, is using this proxy statement to solicit proxies for use at the Special Meeting. In this proxy statement, the terms “Cogent,” “we,” “us,” and “our” refer to Cogent Biosciences, Inc. The mailing address of our principal executive offices is Cogent Biosciences, Inc., 200 Cambridge Park Drive, Suite 2500, Cambridge, Massachusetts 02140.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our Board of Directors with respect to each of the matters set forth in the accompanying Notice of Meeting. You may revoke your proxy at any time before it is exercised at the meeting by giving our corporate secretary written notice to that effect.

At the Special Meeting:

| • | Cogent will ask its stockholders to approve, in accordance with Nasdaq Listing Rule 5635, the issuance of the Company’s Common Stock, upon conversion of the Company’s Series A Preferred Stock, issued in a merger that closed on July 6, 2020 and a private placement offering that closed on July 9, 2020. Pursuant to the rules of The Nasdaq Stock Market LLC (referred to as the “Nasdaq rules”), the issuance of Common Stock requires the approval of Cogent’s stockholders because it exceeds 20% of the number of shares of Common Stock outstanding prior to the issuance; and |

| • | Cogent will ask its stockholders to approve an amendment to the Certificate of Incorporation to effect a reverse stock split of Common Stock at a ratio of between and including 1:[●] and 1:[●] (referred to as the “Reverse Stock Split”), which approval is also necessary to issue the shares of Common Stock upon conversion of the Company’s Series A Preferred Stock, issued in a merger that closed on July 6, 2020 and a private placement offering that closed on July 9, 2020. Upon the effectiveness of the amendment to the Certificate of Incorporation effecting the Reverse Stock Split, the outstanding shares of Common Stock will be combined into a lesser number of shares to be determined by the Board of Directors prior to the effective time of such amendment and public announcement by Cogent. |

After careful consideration, the Board of Directors has approved the proposals referred to above, and has determined that they are advisable, fair and in the best interests of Cogent’s stockholders. Accordingly, the Board of Directors recommends that stockholders vote “FOR” the issuance of Common Stock upon conversion of the Company’s Series A Preferred Stock, issued in a merger that closed on July 6, 2020 and a private placement offering that closed on July 9, 2020, “FOR” the amendment to the Certificate of Incorporation to effect the reverse stock split at a ratio of between and including 1:[●] and 1:[●], and “FOR” the adjournment or postponement of the Special Meeting if necessary to solicit additional proxies if there are not sufficient votes to approve Proposal No. 1 and/or Proposal No. 2.

Your vote is important. Whether or not you expect to attend the virtual Special Meeting, please complete, date, sign and promptly return the accompanying proxy card in the enclosed postage paid envelope to ensure that your shares will be represented and voted at the Special Meeting. You can also vote your shares via the internet or by telephone as provided in the instructions set forth in the enclosed proxy card. If you hold your shares in “street name” through a broker, you should follow the procedures provided by your broker.

Table of Contents

We thank you for your consideration and continued support.

| Yours sincerely, | ||

| Charles Wilson, Ph.D. | ||

| President and Chief Executive Officer | ||

This proxy statement is dated [●], 2020 and is first being mailed to stockholders on or about [●], 2020.

Table of Contents

COGENT BIOSCIENCES, INC.

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Except as specifically indicated, the following information and all other information contained in this proxy statement does not give effect to the reverse stock split described in Proposal No. 2.

The following section provides answers to frequently asked questions about the Special Meeting. This section, however, only provides summary information. These questions and answers may not address all issues that may be important to you as a stockholder. You should carefully read this entire proxy statement, including each of the annexes.

When are this proxy statement and the accompanying materials scheduled to be sent to stockholders?

On or about [●], 2020, we will begin mailing our proxy materials, including the Notice of the Special Meeting, this proxy statement and the accompanying proxy card or, for shares held in street name (i.e. held for your account by a broker or other nominee), a voting instruction form.

Who is soliciting my vote?

Our Board of Directors is soliciting your vote for the Special Meeting.

When is the record date for the Special Meeting?

The record date for determination of stockholders entitled to vote at the Special Meeting is the close of business on [●], 2020.

How many votes can be cast by all stockholders?

There were [●] shares of our Common Stock, par value $0.001 per share, outstanding on [●], 2020, all of which are entitled to vote with respect to all matters to be acted upon at the Special Meeting. Each outstanding share of our Common Stock is entitled to one vote on each matter considered at the Special Meeting. None of our shares of undesignated preferred stock were outstanding as of [●], 2020.

Of the shares of our Common Stock issued and outstanding and entitled to vote, 6,235,903 shares of Common Stock were issued in the Merger (as described in “Proposal No. 1—General—Merger Agreement” below) and are not entitled to vote on Proposal No. 1 for purposes of the Nasdaq rules. The Company anticipates that these 6,235,903 shares of Common Stock will be voted in favor of Proposal No. 1 for purposes of adopting the proposal under Delaware law. However, to comply with Nasdaq rules, the Company will instruct the inspector of elections to conduct a separate tabulation that subtracts 6,235,903 shares from the total number of shares voted in favor of Proposal No. 1 for purposes of determining whether that proposal has been adopted.

How do I vote?

By Internet at the Special Meeting.

Instructions on how to attend and vote at the Special Meeting are described at http://www.virtualshareholdermeeting.com/COGT2020, although Cogent encourages you to vote by proxy at your earliest convenience to ensure your shares are represented, in case you later decide not to attend the Special Meeting virtually. Stockholders will need their unique 16-digit control number that accompanied the proxy materials. A technical support telephone number will be posted on the log-in page of http://www.virtualshareholdermeeting.com/COGT2020 that you can call if you encounter any difficulties accessing the virtual meeting during the check-in or during the Special Meeting.

1

Table of Contents

By Proxy

If you will not be attending the virtual Special Meeting, you may vote by proxy. You can vote by proxy via the Internet by visiting the address listed on the proxy card, via telephone by calling the toll-free phone number listed on the proxy card or you can vote by mailing your proxy as described in the proxy materials. To ensure your shares are voted by proxy, proxies submitted by Internet or by telephone should be received by the cutoff time of [●] p.m. Eastern Time on [●], 2020. Proxies submitted by mail must be received before the start of the Special Meeting.

If you complete and submit your proxy before the Special Meeting, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy without giving voting instructions, your shares will be voted in the manner recommended by the Board of Directors on all matters presented in this proxy statement. You may also authorize another person or persons to act for you as proxy by complying with the Amended and Restated By-laws of the Company and Section 212 of the DGCL.

How do I revoke my proxy?

You may revoke your proxy by (1) following the instructions on the proxy card and entering a new vote by mail that we receive before the start of the Special Meeting or over the Internet or by telephone by the cutoff time of [●] p.m. Eastern Time on [●], 2020, (2) attending and voting at the virtual Special Meeting (although attendance at the Special Meeting will not in and of itself revoke a proxy), or (3) by filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with our Corporate Secretary. Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Special Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or sent to our principal executive offices at Cogent Biosciences, Inc., 200 Cambridge Park Drive, Suite 2500, Cambridge, Massachusetts 02140, Attention: Corporate Secretary.

If a broker, bank, or other nominee holds your shares, you must contact such broker, bank, or nominee in order to find out how to change your vote.

How is a quorum reached?

Our Amended and Restated Bylaws, or bylaws, provide that a majority of the shares entitled to vote, present at the virtual meeting or represented by proxy, will constitute a quorum for the transaction of business at the Special Meeting.

Under the General Corporation Law of the State of Delaware, shares that are voted “abstain” or “withheld” and “broker non-votes” (if any) are counted as present for purposes of determining whether a quorum is present at the Special Meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

What proposals will be voted on at the Special Meeting?

There are three proposals scheduled to be voted on at the meeting:

| • | Proposal No. 1—Approval of the issuance of shares of Common Stock upon conversion of the Series A Preferred Stock. |

| • | Proposal No. 2—Approval of the reverse stock split of the Common Stock as further described below. |

| • | Proposal No. 3—Approval of, if necessary, the adjournment or postponement of the Special Meeting, to continue to solicit votes for Proposal No. 1 and/or Proposal No. 2. |

What vote is required to approve each item at the Special Meeting?

You may vote “for,” “against” or “abstain” on each of the proposals being placed before our stockholders. Under our bylaws, any proposal other than an election of directors is decided by a majority of the votes properly cast for

2

Table of Contents

and against such proposal, except where a larger vote is required by law or by our Certificate of Incorporation or bylaws. To approve Proposal No. 1, stockholders holding a majority of votes properly cast at the Special Meeting must vote “FOR” the proposal (subject to the separate tabulation of votes described in “Questions and Answers About the Special Meeting—How many votes can be cast by all stockholders?”). To approve Proposal No. 2, stockholders holding a majority of the outstanding shares of our Common Stock as of the record date must vote “FOR” the proposal. If a quorum is present at the Special Meeting, the affirmative vote of the stockholders holding a majority of the votes properly cast at the Special Meeting is required for approval of Proposal No. 3 (for the purpose of soliciting additional proxies to approve Proposals No. 1 and/or 2). If a quorum is not present at the Special Meeting, the affirmative vote of the stockholders holding a majority of the voting power present in person or by proxy at the Special Meeting is required for approval of Proposal No. 3.

How is the vote counted?

If your shares are registered directly in your name, you are a “stockholder of record” who may vote at the meeting, and we are sending these proxy materials directly to you. As the stockholder of record, you have the right to direct the voting of your shares by voting over the Internet, by telephone, by returning your proxy or by voting online during the Special Meeting at https://www.virtualshareholdermeeting.com/COGT2020.

If your shares are held in an account at a bank or at a brokerage firm or other nominee holder, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your bank, broker or other nominee who is considered the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares and to participate in the Special Meeting. You should receive a proxy card and voting instructions with these proxy materials from that organization rather than from us. You will receive instructions from your bank, broker or other nominee explaining how you can vote your shares and whether they permit Internet or telephone voting. Follow the instructions from your bank, broker or other nominee included with these proxy materials, or contact your bank, broker or other nominee to request a proxy form. We encourage you to provide voting instructions to your bank, broker or other nominee by giving your proxy to them. This ensures that your shares will be voted at the Special Meeting according to your instructions.

If you hold shares through a bank, broker or other intermediary firm, the intermediary firm is subject to certain New York Stock Exchange, or NYSE, rules regarding voting. Under NYSE rules, Proposal No. 2 and Proposal No. 3 are each considered a discretionary item. This means that an intermediary firm may vote in its discretion on behalf of clients who have not furnished voting instructions on those proposals at least 10 days before the date of the Special Meeting. In contrast, Proposal No. 1 is a non-discretionary item. Intermediary firms that have not received voting instructions from their clients on this item may not vote on Proposal No. 1. A “broker non-vote” on a proposal results when shares are deemed present at the Special Meeting but the shares are not voted because the proposal is a non-discretionary item and the intermediary firm has not received instructions from its client. A broker non-vote will have no effect on the outcome of Proposal No. 1.

Abstentions, if any, would have no effect on the vote for Proposal No. 1 and, if a quorum is present at the Special Meeting, will have no effect on the vote for Proposal No. 3. Abstentions, if any, will have the same effect as a vote “AGAINST” Proposal No. 2, and, if a quorum is not present at the Special Meeting, will have the same effect as a vote “AGAINST” Proposal No. 3.

What is the Reverse Stock Split and why is it necessary?

If Proposal No. 2 is approved, the outstanding shares of Common Stock will be combined into a lesser number of shares to be determined by the Board of Directors and publicly announced by Cogent. The Board of Directors believes that a reverse stock split may be desirable for a number of reasons. Cogent’s Common Stock is currently listed on the Nasdaq Global Select Market, or Nasdaq. According to the applicable Nasdaq rules, in order for Cogent’s Common Stock to continue to be listed on Nasdaq, Cogent must satisfy certain requirements

3

Table of Contents

established by Nasdaq. The Board of Directors expects that a reverse stock split of Common Stock will increase the market price of Common Stock so that Cogent will be able to maintain compliance with the relevant Nasdaq listing requirements for the foreseeable future, although Cogent cannot assure that it will be able to do so. The Board of Directors intends to effect a reverse stock split, or Reverse Stock Split, of the shares of Common Stock at a ratio of between and including 1:[●] and 1:[●].

What happens if the Conversion Proposal is approved but the Reverse Stock Split Proposal is not approved?

If the Conversion Proposal is approved but the Reverse Stock Split Proposal is not approved, there will not be a sufficient number of authorized but unissued shares of our Common Stock available for all of the shares of Series A Preferred Stock to convert into shares of our Common Stock.

Who pays the cost for soliciting proxies?

We will bear the cost of soliciting proxies, including the printing, mailing and filing of this proxy statement, the proxy card and any additional information furnished to stockholders. You will need to obtain your own internet access if you choose to access the proxy materials and/or vote over the internet. Cogent may use the services of its directors, officers and other employees to solicit proxies from Cogent’s stockholders without additional compensation. In addition, Cogent has engaged The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and provide related advice and informational support, for a services fee, plus the reimbursement of customary disbursements, which are not expected to exceed $30,000 in total. Arrangements will also be made with banks, brokers, nominees, custodians and fiduciaries who are record holders of Common Stock for the forwarding of solicitation materials to the beneficial owners of Common Stock. Cogent will reimburse these banks, brokers, nominees, custodians and fiduciaries for the reasonable out-of-pocket expenses they incur in connection with the forwarding of solicitation materials.

How can I know the voting results?

We plan to announce the final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Special Meeting.

Who can provide me with additional information and help answer my questions?

If you would like additional copies, without charge, of this proxy statement or if you have questions about the proposals being considered at the Special Meeting, including the procedures for voting your shares, you should contact The Proxy Advisory Group, LLC, Cogent’s proxy solicitor, by telephone at (212) 616-2181.

4

Table of Contents

CAUTIONARY INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement, and the documents incorporated by reference into this proxy statement, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding: uses of proceeds; projected cash runways; future product development plans; stockholder approval of the conversion rights of the Series A Preferred Stock; and any future payouts under the CVR Agreement. The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, our clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. We may not actually achieve the forecasts disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to those set forth under the caption “Risk Factors” in Cogent’s most recent Annual Report on Form 10-K filed with the SEC, as well as discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither we, nor our affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date hereof.

5

Table of Contents

PROPOSAL NO. 1: THE APPROVAL OF, UNDER APPLICABLE NASDAQ LISTING RULES, THE ISSUANCE OF SHARES OF OUR COMMON STOCK UPON CONVERSION OF THE COMPANY’S SERIES A NON-VOTING CONVERTIBLE PREFERRED STOCK

General

Merger Agreement. As previously announced, on July 6, 2020, we completed our acquisition of Kiq Bio LLC (formerly Kiq LLC), a Delaware limited liability company (“Kiq”), in accordance with the terms of the Agreement and Plan of Merger (the “Merger Agreement”), dated July 6, 2020, between the Company, Utah Merger Sub 1 LLC, a Delaware limited liability company and a wholly owned subsidiary of Cogent (“First Merger Sub”), Utah Merger Sub 2 LLC, a Delaware limited liability company and wholly owned subsidiary of Cogent (“Second Merger Sub”), and Kiq. Pursuant to the Merger Agreement, First Merger Sub merged with and into Kiq, pursuant to which Kiq was the surviving entity and became a wholly owned subsidiary of Cogent (the “First Merger”). Immediately following the First Merger, Kiq merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the surviving entity (together with the First Merger, the “Merger”). The Merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes. The Board of Directors unanimously approved the Merger Agreement and the related transactions, and the consummation of the Merger was not subject to approval of the Cogent stockholders.

Under the terms of the Merger Agreement, at the closing of the Merger on July 6, 2020, Cogent issued the securityholders of Kiq 6,235,903 shares of Common Stock and 44,687 shares of Cogent Series A Non-Voting Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), which was newly created upon the filing of a Certificate of Designations of Preferences, Rights and Limitations of the Series A Non-Voting Convertible Preferred Stock with the Secretary of State of the State of Delaware (the “Certificate of Designations”) on July 6, 2020.

Pursuant to the Merger Agreement, Cogent agreed to hold the Special Meeting to submit the following matters to its stockholders for their consideration: (i) the Conversion Proposal, (ii) the Reverse Stock Split Proposal, if deemed necessary by Cogent, and (iii) the approval of an amendment to the certificate of incorporation of Cogent to authorize sufficient shares of Common Stock for the conversion of the Series A Preferred Stock issued pursuant to the Merger Agreement and the Securities Purchase Agreement (as described below) (the “Charter Amendment Proposal”). Cogent and Kiq no longer believe it is necessary to submit the Charter Amendment Proposal to Cogent’s stockholders for their consideration.

Support Agreements.

In connection with the execution of the Merger Agreement, Cogent and Kiq entered into stockholder support agreements (the “Support Agreements”) with Cogent’s directors and certain officers and one of Cogent’s largest stockholders, which collectively own an aggregate of approximately 23.0% of the outstanding shares of the Common Stock, or 27.9% of the shares of Common Stock entitled to vote on Proposal No. 1. The Support Agreements provide that, among other things, each of the stockholders has agreed to vote or cause to be voted all of the shares of Common Stock owned by such stockholder in favor of the Conversion Proposal at the Special Meeting. Each of the stockholders that have entered into the Support Agreements are entitled to vote on the Conversion Proposal. The form of Support Agreement is attached as Exhibit B to the Merger Agreement, which is filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on July 6, 2020, and is incorporated into this proxy statement by reference.

Lock-up Agreements.

Concurrently and in connection with the execution of the Merger Agreement, former Kiq securityholders as of immediately prior to the Merger, and the directors and officers of Cogent as of immediately following the Merger, which collectively own an aggregate of approximately 30.7% of Cogent outstanding capital stock,

6

Table of Contents

entered into lock-up agreements with Cogent and Kiq, pursuant to which each stockholder is subject to a 90 day lockup on the sale or transfer of shares of Common Stock held by each such stockholder at the closing of the Merger, including those shares received by Kiq securityholders in the Merger (the “Lock-up Agreements”). The form of Lock-up Agreement is attached as Exhibit C to the Merger Agreement, which is filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on July 6, 2020, and is incorporated into this proxy statement by reference.

Contingent Value Rights Agreement.

Pursuant to the Merger Agreement, within 30 days following the closing of the Merger, Cogent and the Rights Agent (as defined therein) executed and delivered the Contingent Value Rights Agreement (the “CVR Agreement”), dated as of August 6, 2020, by and among Cogent, Computershare Inc. and Computershare Trust Company, N.A., pursuant to which each holder of Common Stock as of immediately prior to the effective time of the Merger (the “Effective Time”) is entitled to one contractual contingent value right (“CVR”) issued by Cogent, subject to and in accordance with the terms and conditions of the CVR Agreement, for each share of Common Stock held by such holder. Each CVR entitles the holder thereof to receive certain Common Stock and/or cash payments from the net proceeds, if any, related to the disposition of Cogent’s legacy cell therapy assets within three years following the closing of the Merger. The contingent value rights are not transferable, except in certain limited circumstances as will be provided in the CVR Agreement, will not be certificated or evidenced by any instrument and will not be registered with the SEC or listed for trading on any exchange. The CVR Agreement is filed as Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC on August 10, 2020, and is incorporated herein by reference.

Private Placement and Securities Purchase Agreement. On July 6, 2020, Cogent entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the purchasers named therein (the “Investors”). Pursuant to the Purchase Agreement, Cogent agreed to sell an aggregate of approximately 118,638 shares of Series A Preferred Stock for an aggregate purchase price of $104,401,000 (collectively, the “Financing”). Each share of Series A Preferred Stock is convertible into 1,000 shares of Common Stock, as described below in “Description of the Series A Preferred Stock”. The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A Preferred Stock are set forth in the Certificate of Designations. The closing of the Financing occurred on July 9, 2020 (the “Financing Closing Date”).

Registration Rights Agreement.

On the Financing Closing Date, in connection with the Purchase Agreement, Cogent entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors. Pursuant to the Registration Rights Agreement, Cogent has prepared and filed a resale registration statement with the SEC within 90 calendar days following the Financing Closing Date (the “Filing Deadline”). Cogent will use its reasonable best efforts to cause this registration statement to be declared effective by the SEC within 30 calendar days of the Filing Deadline (or within 60 calendar days if the SEC reviews the registration statement). Cogent also agreed, among other things, to indemnify the Investors, their officers, directors, members, employees and agents, successors and assigns under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incident to Cogent’s obligations under the Registration Rights Agreement.

The Financing is exempt from registration pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder, as a transaction by an issuer not involving a public offering. The Investors have acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends have been affixed to the securities issued in this transaction.

The Investors; Certain Interests.

The Investors include Venrock Healthcare Capital Partners, BVF Partners L.P., Atlas Venture, Acorn Bioventures, Perceptive Advisors LLC, RTW Investments, OrbiMed, Samsara BioCapital, Logos Capital, Ally

7

Table of Contents

Bridge Group and Commodore Capital, as well as additional undisclosed institutional investors. Due to his direct or indirect beneficial ownership of Series A Preferred Stock as a member of AVA IX LLC, an affiliate of Atlas Venture, Bruce Booth, DPhil., who served as a director of the Company from October 2014 until his resignation in connection with the Merger on July 6, 2020, has an interest in the Conversion Proposal. Also, due to their direct or indirect beneficial ownership of Series A Preferred Stock as Managing Member and Director of Research, respectively, of Fairmount Funds Management LLC, Peter Harwin and Chris Cain, who were appointed directors of the Company in connection with the Merger on July 6, 2020, have an interest in the Conversion Proposal.

Use of Proceeds. Gross proceeds from the Financing were approximately $104.4 million, with net proceeds of approximately $99.0 million, after deducting commissions and estimated offering costs. We used the net proceeds from the Financing for general corporate working capital purposes.

Description of the Series A Preferred Stock. Holders of Series A Preferred Stock are entitled to receive dividends on shares of Series A Preferred Stock equal, on an as-if-converted-to-Common-Stock basis, and in the same form as dividends actually paid on shares of the Common Stock. Except as otherwise required by law, the Series A Preferred Stock does not have voting rights. However, as long as any shares of Series A Preferred Stock are outstanding, Cogent will not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series A Preferred Stock, (a) alter or change adversely the powers, preferences or rights given to the Series A Preferred Stock, (b) alter or amend the Certificate of Designations, (c) amend its certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Preferred Stock, (d) increase the number of authorized shares of Series A Preferred Stock, (e) prior to the stockholder approval of the Conversion Proposal or at any time while at least 40% of the originally issued Series A Preferred Stock remains issued and outstanding, consummate a Fundamental Transaction (as defined in the Certificate of Designations) or (f) enter into any agreement with respect to any of the foregoing. The Series A Preferred Stock does not have any preemptive rights or a preference upon any liquidation, dissolution or winding-up of Cogent.

Following stockholder approval of the Conversion Proposal, each share of Series A Preferred Stock is convertible into 1,000 shares of Common Stock at any time at the option of the holder thereof, subject to certain limitations, including that a holder of Series A Preferred Stock is prohibited from converting shares of Series A Preferred Stock into shares of Common Stock if, as a result of such conversion, such holder, together with its affiliates, would beneficially own more than a specified percentage (to be established by the holder between 4.9% and 19.9%) of the total number of shares of Common Stock issued and outstanding immediately after giving effect to such conversion.

Reasons for Stockholder Approval. Cogent’s Common Stock is listed on the Nasdaq Global Select Market, and, as such, Cogent is subject to the applicable rules of the Nasdaq Stock Market LLC, or NASDAQ Listing Rules, including NASDAQ Listing Rule 5635. In order to comply with the NASDAQ Listing Rules and to satisfy conditions under the Purchase Agreement, we are seeking stockholder approval of this Proposal No. 1. Certain sections of NASDAQ Listing Rule 5635 are generally described below:

| • | NASDAQ Listing Rule 5635(a) requires stockholder approval in connection with the acquisition of the stock or assets of another company if, due to the present or potential issuance of common stock, the common stock of the issuer has or will have upon issuance voting power equal to or in excess of 20% of the voting power outstanding before the issuance of stock or securities convertible into or exercisable for common stock of the issuer. |

| • | NASDAQ Listing Rule 5635(b) requires stockholder approval for issuances of securities that will result in a “change of control” of the issuer. NASDAQ may deem a change of control to occur when, as a result of an issuance, an investor or a group would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power of an issuer would be the largest ownership position of the issuer. |

8

Table of Contents

We are seeking stockholder approval of the Conversion Proposal in order to satisfy the requirements of NASDAQ Listing Rule 5635 with respect to the terms of the Series A Preferred Stock and the issuance of shares of Common Stock upon conversion of the Series A Preferred Stock in excess of the 20% of the voting power outstanding before the issuance.

Assuming the full conversion of the Series A Preferred Stock (with a conversion ratio of 1000:1), such securities, in the hands of the Investors and the former securityholders of Kiq, would represent approximately 80.8% of the outstanding shares of our Common Stock (based on [●] shares of our Common Stock outstanding as of [●], 2020 plus the approximately 163.3 million additional shares of our Common Stock (before giving effect to the Reverse Stock Split) that would be outstanding as a result of such conversion).

Peter Harwin and Chris Cain, who serve as Managing Member and Director of Research, respectively, of Fairmount Funds Management LLC, serve as directors of the Company. Bruce Booth, who is a member of

AVA IX LLC, an affiliate of an Investor, served as a director of the Company at the time the Investor purchased shares of Series A Preferred Stock.

The Merger Agreement requires us to submit this proposal to our stockholders at the Special Meeting. Approval of this Proposal No. 1 will constitute approval pursuant to the NASDAQ Listing Rules.

Dilution. If this Proposal No. 1 and the Reverse Stock Split Proposal are approved, existing Cogent stockholders will suffer significant dilution in ownership interests and voting rights as a result of the issuance of shares of our Common Stock upon the conversion of the shares of Series A Preferred Stock. Upon conversion in full of the shares of Series A Preferred (with a conversion ratio of 1000:1), 163,323,000 additional shares of our Common Stock will be outstanding, and the ownership interest of our existing stockholders would be correspondingly reduced. The number of shares of our Common Stock described above does not give effect to any other future issuances of our Common Stock or the Reverse Stock Split. The sale into the public market of these shares also could materially and adversely affect the market price of our Common Stock.

Vote Required; Recommendation of Board of Directors

Stockholder approval of this Proposal No. 1 requires a “FOR” vote from the holders of a majority of votes properly cast at the Special Meeting (subject to the separate tabulation of votes described in “Questions and Answers About the Special Meeting—How many votes can be cast by all stockholders?” set forth above).

THE BOARD OF DIRECTORS RECOMMENDS THAT COGENT’S STOCKHOLDERS VOTE “FOR” THE APPROVAL OF, UNDER APPLICABLE NASDAQ LISTING RULES, THE ISSUANCE OF SHARES OF COMMON STOCK UPON CONVERSION OF THE SERIES A NON-VOTING CONVERTIBLE PREFERRED STOCK.

9

Table of Contents

PROPOSAL NO. 2: THE APPROVAL OF THE AMENDMENT TO THE THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO IMPLEMENT A REVERSE STOCK SPLIT OF THE COMPANY’S OUTSTANDING COMMON STOCK

General

Our Board of Directors has approved and declared advisable an amendment to our certificate of incorporation, which would effect a reverse stock split, or Reverse Stock Split, of all issued and outstanding shares of our Common Stock, at a ratio ranging from 1-for-[●] to 1-for-[●], inclusive. Our Board of Directors has recommended that this proposed amendment be presented to our stockholders for approval. Our stockholders are being asked to approve the proposed amendment pursuant to Proposal No. 2 to effect a Reverse Stock Split of the issued and outstanding shares of Common Stock. Accordingly, effecting a Reverse Stock Split would reduce the number of outstanding shares of Common Stock.

Should we receive the required stockholder approval for Proposal No. 2, our Board of Directors will have the sole authority to elect, at any time on or prior to one-year anniversary of the Special Meeting, or [●], 2021, and without the need for any further action on the part of our stockholders, whether to effect the Reverse Stock Split and the number of whole shares of Common Stock, between and including [●] and [●], that will be combined into one share of Common Stock.

Notwithstanding approval of Proposal No. 2 by our stockholders, our Board of Directors may, at its sole option, abandon the proposed amendment and determine prior to the effectiveness of any filing with the Secretary of State of the State of Delaware not to effect any reverse stock split, as permitted under Section 242(c) of the General Corporation Law of the State of Delaware. If our Board of Directors does not implement the Reverse Stock Split on or prior to the one-year anniversary of the Special Meeting, or [●], 2021, stockholder approval would again be required prior to implementing any reverse stock split.

By approving Proposal No. 2, our stockholders will: (a) approve an amendment to our Third Amended and Restated Certificate of Incorporation pursuant to which any whole number of outstanding shares of Common Stock between and including [●] and [●] could be combined into one share of Common Stock; and (b) authorize our Board of Directors to file such amendment.

APPROVAL OF REVERSE STOCK SPLIT OF OUR COMMON STOCK (PROPOSAL NO. 2)

Our Board of Directors has adopted and is recommending that our stockholders approve an amendment to our certificate of incorporation to effect a Reverse Stock Split. The text of the proposed form of Certificate of Amendment to our Third Amended and Restated Certificate of Incorporation, which we refer to as the Certificate of Amendment, is attached hereto as Annex A.

We are proposing that our Board of Directors have the discretion to select the Reverse Stock Split ratio from within a range between and including 1-for-[●] and 1-for-[●], rather than proposing that stockholders approve a specific ratio at this time, in order to give our Board of Directors the flexibility to implement a Reverse Stock Split at a ratio that reflects the Board’s then-current assessment of the factors described below under “Criteria to be Used for Determining the Reverse Stock Split Ratio to Implement.” If Proposal No. 2 is approved, we will file the Certificate of Amendment with the Secretary of State of the State of Delaware and the Reverse Stock Split will be effective at [5:01 p.m.], Eastern time, on the date of filing of the Certificate of Amendment with the office of the Secretary of State of the State of Delaware, or such later date as is chosen by the Board of Directors and set forth in the Certificate of Amendment. Except for adjustments that may result from the treatment of fractional shares as described below, each of our stockholders will hold the same percentage of our outstanding Common Stock immediately following the Reverse Stock Split as such stockholder holds immediately prior to the Reverse Stock Split.

10

Table of Contents

To maintain our listing on The Nasdaq Global Select Market. By potentially increasing our stock price, the Reverse Stock Split would reduce the risk that our Common Stock could be delisted from The Nasdaq Capital

Market. To continue our listing on The Nasdaq Global Select Market, we must comply with Nasdaq Marketplace Rules, which requirements include a minimum bid price of $1.00 per share. On December 31, 2019, we were notified by the Nasdaq Listing Qualifications Department that we do not comply with the $1.00 minimum bid price requirement as our Common Stock had traded below the $1.00 minimum bid price for 30 consecutive business days. Prior to the expiration of the compliance period, Cogent regained compliance with the minimum bid price requirement and was notified by NASDAQ of such compliance on July 20, 2020 and the matter was closed, however, there is no guarantee that Cogent will remain in compliance with the minimum bid price requirement.

The Board of Directors has considered the potential harm to us and our stockholders should Nasdaq delist our Common Stock from The Nasdaq Capital Market following a transfer from The Nasdaq Global Select Market under Nasdaq Listing Rule 5810(c)(3)(A)(ii). Delisting could adversely affect the liquidity of our Common Stock since alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our Common Stock on an over-the-counter market. Many investors likely would not buy or sell our Common Stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or for other reasons. In addition, the delisting of our Common Stock from the Nasdaq Capital Market would restrict our ability to sell shares of our Common Stock under our purchase agreement with Lincoln Park Capital Fund, LLC dated March 19, 2020.

The Board of Directors believes that the proposed Reverse Stock Split is a potentially effective means for us to maintain compliance with the $1.00 minimum bid requirement and to avoid, or at least mitigate, the likely adverse consequences of our Common Stock being delisted from The Nasdaq Capital Market by producing the immediate effect of increasing the bid price of our Common Stock.

To potentially improve the marketability and liquidity of our Common Stock. Our Board of Directors believes that the increased market price of our Common Stock expected as a result of implementing a Reverse Stock Split could improve the marketability and liquidity of our Common Stock and encourage interest and trading in our Common Stock.

| • | Stock Price Requirements: We understand that many brokerage houses, institutional investors and funds have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers or by restricting or limiting the ability to purchase such stocks on margin. Additionally, a Reverse Stock Split could help increase analyst and broker interest in our Common Stock as their internal policies might discourage them from following or recommending companies with low stock prices. |

| • | Stock Price Volatility: Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may make the processing of trades in low-priced stocks economically unattractive to brokers. |

| • | Transaction Costs: Investors may be dissuaded from purchasing stocks below certain prices because brokers’ commissions, as a percentage of the total transaction value, can be higher for low-priced stocks. |

Criteria to be Used for Determining the Reverse Stock Split Ratio to Implement

In determining which Reverse Stock Split ratio to implement, if any, following receipt of stockholder approval of Proposal No. 2, our Board of Directors may consider, among other things, various factors, such as:

| • | The historical trading price and trading volume of our Common Stock; |

11

Table of Contents

| • | The then-prevailing trading price and trading volume of our Common Stock tock and the expected impact of the Reverse Stock Split on the trading market for our Common Stock in the short- and long-term; |

| • | Our ability to maintain our listing on The Nasdaq Global Select Market or The Nasdaq Capital Market; |

| • | Which Reverse Stock Split ratio would result in the least administrative cost to us; |

| • | Prevailing general market and economic conditions; and |

| • | Whether and when our Board of Directors desires to have the additional authorized but unissued shares of Common Stock that will result from the implementation of a Reverse Stock Split available to provide the flexibility to use our Common Stock for business and/or financial purposes, as well as to accommodate the shares of our Common Stock to be authorized and reserved for future equity awards. |

Effects of Reverse Stock Split

After the effective date of the Reverse Stock Split, each stockholder will own a reduced number of shares of Common Stock. However, the Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of our stockholders owning a fractional share as described below. Voting rights and other rights and preferences of the holders of our Common Stock will not be affected by a Reverse Stock Split (other than as a result of the payment of cash in lieu of fractional shares). For example, a holder of 2% of the voting power of the outstanding shares of our Common Stock immediately prior to a Reverse Stock Split would continue to hold 2% (assuming there is no impact as a result of the payment of cash in lieu of issuing fractional shares) of the voting power of the outstanding shares of our Common Stock immediately after such Reverse Stock Split. The number of stockholders of record will not be affected by a Reverse Stock Split (except to the extent that any stockholder holds only a fractional share interest and receives cash for such interest after such Reverse Stock Split). The foregoing description of the effects of the Reverse Stock Split does not include the dilution in ownership interests and voting rights to existing stockholders that will occur if the Conversion Proposal is approved (see “Proposal No. 1—Dilution” above).

The principal effects of a Reverse Stock Split will be that:

| • | Depending on the Reverse Stock Split ratio selected by the Board of Directors, each [●] to [●] shares of our Common Stock owned by a stockholder will be combined into one new share of our Common Stock; |