Form PRE 14A Provention Bio, Inc. For: Mar 19

United

States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Materials Pursuant to Rule 14a-12 |

PROVENTION

BIO, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

55

Broad Street, 2nd Floor

Red Bank, NJ 07701

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 12, 2021

To the Stockholders of

Provention Bio, Inc.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Provention Bio, Inc. (the “Company” or “Provention”) will be held virtually at www.virtualshareholdermeeting.com/PRVB2021 on May 12, 2021, beginning at 9:00 a.m. Eastern Time. In light of the continuing public health impact of the ongoing COVID-19 pandemic and to support the health and safety of the Company’s stockholders and attendees, the Annual Meeting will be held in a virtual meeting format on the above date and time via live audio webcast. There will be no in-person meeting.

At the Annual Meeting, stockholders will act on the following matters:

| 1. | to elect seven directors to serve until the next Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified; | |

| 2. | to approve, on a non-binding advisory basis, the compensation of our named executive officers; | |

| 3. | to approve, on a non-binding advisory basis, the frequency of future non-binding advisory votes on the compensation of our named executive officers; | |

| 4. | to approve an amendment to the Company’s Second Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 100,000,000 to 150,000,000 shares; | |

| 5. | to ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2021; and | |

| 6. | to consider any other matters that may properly come before the Annual Meeting. |

Only stockholders of record at the close of business on March 15, 2021 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting or any postponement or adjournment thereof. A list of these stockholders will be available for inspection during ordinary business hours at the address above beginning on, or before, May 2, 2021, and continuing through the Annual Meeting by contacting our Secretary at (908) 336-0360. A list of these stockholders will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/PRVB2021.

If you were a stockholder of record at the close of business on the Record Date, or you hold a valid proxy for the Annual Meeting, you can attend and vote at the Annual Meeting at www.virtualshareholdermeeting.com/PRVB2021. The procedures for attendance via the Internet are described in the Proxy Statement.

On or about , 2021, we are mailing to stockholders of record entitled to vote at the Annual Meeting a Notice of Internet Availability of Proxy Materials (“Notice of Availability”). Our proxy materials, including our Proxy Statement, our Annual Report for the fiscal year ended December 31, 2020 and our proxy card are available on the Internet at www.proxyvote.com. Instructions on how to access the proxy materials over the Internet or to request a printed copy from us may be found on the Notice of Availability.

Your vote is important. To ensure your shares are voted, you may vote your shares in advance of the Annual Meeting over the Internet, by telephone or by requesting a proxy card to complete, sign and return by mail. Internet and telephone voting procedures are described in the Proxy Statement and on the Notice of Availability. For shares held through a bank, broker or nominee, you may vote by submitting voting instructions to your bank, broker or nominee. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the Annual Meeting.

| By Order of the Board of Directors | |

| [Signature] | |

Ashleigh Palmer President and Chief Executive Officer |

, 2021

Red Bank, NJ

This Notice of Annual Meeting and the Proxy Statement are first being distributed or made available, as the case may be, on or about , 2021

TABLE OF CONTENTS

| i |

| ii |

55

Broad Street, 2nd Floor

Red Bank, NJ 07701

PROXY STATEMENT

This Proxy Statement contains information related to the Annual Meeting of Stockholders to be held virtually at www.virtualshareholdermeeting.com/PRVB2021 on May 12, 2021, beginning at 9:00 a.m. Eastern Time, or at such other time to which the Annual Meeting may be adjourned or postponed. The enclosed proxy is solicited by the Board of Directors of Provention Bio, Inc. (the “Board”). A Notice of Internet Availability of Proxy Materials is first being mailed to stockholders entitled to vote at the meeting on or about , 2021.

Why am I being provided with these materials?

We have made our proxy materials available to you on the Internet or, upon your request, delivered printed versions of these proxy materials to you by mail in connection with the solicitation by the Board of proxies to be voted at our Annual Meeting of Stockholders to be held on May 12, 2021 (“Annual Meeting”), and at any postponements or adjournments of the Annual Meeting.

Why did I receive a Notice Regarding the Availability of Proxy Materials in the mail regarding the Internet availability of proxy materials instead of a paper copy of the proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide stockholders access to our proxy materials over the Internet. We believe that electronic delivery will expedite our stockholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact of our Annual Meeting. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (“Notice of Availability”) on or about , 2021 to stockholders of record entitled to vote at the Annual Meeting. All stockholders will have the ability to access the proxy materials at www.proxyvote.com and to download printable versions of the proxy materials or to request and receive a printed set of the proxy materials from us. Instructions on how to access the proxy materials over the Internet or to request a printed copy from us may be found on the Notice of Availability.

Why are we calling this Annual Meeting?

We are calling the Annual Meeting to seek the approval of our stockholders:

| 1. | to elect seven directors to serve until the next Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified; | |

| 2. | to approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| 1 |

| 3. | to approve, on a non-binding advisory basis, the frequency of future non-binding advisory votes to approve the compensation of our named executive officers; | |

| 4. | to approve an amendment to our Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of common stock from 100,000,000 to 150,000,000; | |

| 5. | to ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2021; and | |

| 6. | to consider any other matters that may properly come before the Annual Meeting. |

What are the Board’s recommendations?

Our Board believes that the election of the director nominees identified herein, the approval of the compensation of our named executive officers described herein, the approval of the amendment to the Certificate of Incorporation and the ratification of the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2021 are advisable and in the best interests of the Company and its stockholders and recommends that you vote FOR these proposals. In addition, our Board believes that a frequency of one year for non-binding advisory votes to approve compensation of our named executive officers is advisable and in the best interests of the Company and its stockholders and recommends that you vote for ONE YEAR for such proposal.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date, March 15, 2021, are entitled to receive notice of the Annual Meeting and to vote the shares of our common stock that they held at the close of business on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. A list of stockholders will be available for inspection by our stockholders during ordinary business hours at our principal executive offices at 55 Broad Street, 2nd Floor, Red Bank, NJ 07701 beginning on, or before, May 2, 2021, and continuing through the Annual Meeting by contacting our Secretary at (908) 336-0360. A list of these stockholders will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/PRVB2021.

As of the Record Date, we had 63,374,738 outstanding shares of our common stock. Each share of our common stock entitles the holder to one vote with respect to all matters submitted to stockholders at the Annual Meeting. Beneficial owners of shares of our common stock may direct the record holder of the shares on how to vote the shares held on their behalf.

Can I attend the Annual Meeting?

In light of the public health concerns related to the ongoing COVID-19 pandemic and after careful consideration, our Board has determined to hold a virtual meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost.

To participate in the Annual Meeting, stockholders as of the Record Date, or their duly appointed proxies, will need the 16-digit control number provided on the proxy card, voting instructions form or Notice of Availability. We encourage you to access the meeting 10 minutes before the start time of 9:00 a.m., Eastern Time, on May 12, 2021. Please allow ample time for online check-in, which will begin at 8:50 a.m., Eastern Time, on May 12, 2021. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual stockholder meeting log in page.

| 2 |

We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/PRVB2021. We will try to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. However, we reserve the right to edit inappropriate language or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

Instructions on how to attend and participate via the Internet, including how to demonstrate proof of ownership, will be posted at www.virtualshareholdermeeting.com/PRVB2021.

The presence at the Annual Meeting, online or by proxy, of the holders of a majority of our common stock outstanding on the Record Date and entitled to vote will constitute a quorum for the Annual Meeting. Abstentions, withheld votes and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting to determine whether a quorum has been established.

If you are a record holder, meaning your shares are registered in your name, you may vote or submit a proxy:

1. By Telephone — You can vote your shares by telephone by following the instructions provided on the Notice of Availability or proxy card. The telephone voting procedures are designed to authenticate a stockholder’s identity to allow a stockholder to vote its shares and confirm that its instructions have been properly recorded. Voting by telephone authorizes the named proxies to vote your shares in the same manner as if you had submitted a validly executed proxy card.

2. Over the Internet — You can simplify your voting by voting your shares via the Internet as instructed on the Notice of Availability or proxy card. The Internet procedures are designed to authenticate a stockholder’s identity to allow a stockholder to vote its shares and confirm that its instructions have been properly recorded. Voting via the Internet authorizes the named proxies to vote your shares in the same manner as if you had submitted a validly executed proxy card.

3. By Mail — You may vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the card where indicated and by mailing or otherwise returning the card in the envelope provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity.

4. Submit Your Vote Online During the Virtual Annual Meeting — You may submit your vote online during the Annual Meeting by following the instructions available at www.virtualshareholdermeeting.com/PRVB2021. You will need the 16-digit control number provided on your proxy card, voting instructions form or Notice of Availability.

| 3 |

Even if you plan to attend the Annual Meeting, we recommend that you vote by proxy as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you hold your shares through bank, broker or other nominee (i.e., in “street name”), you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your bank, broker or other nominee on how to submit voting instructions.

What if I vote and then change my mind?

You may revoke your proxy at any time before it is exercised by:

| 1. | filing with the Secretary of the Company a notice of revocation; | |

| 2. | voting again by Internet or telephone at a later time; | |

| 3. | sending in another duly executed proxy bearing a later date; or | |

| 4. | virtually attending the meeting and casting your vote online during the meeting. | |

| Your latest vote will be the vote that is counted. | ||

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuers Solutions, Inc., you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly to us or to cast your vote during the Annual Meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and your broker, bank or nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are also invited to attend the Annual Meeting. However, since beneficial owners are not the stockholder of record, you may not vote these shares at the Annual Meeting unless you obtain a proxy from the record holder giving you the right to vote the shares. If you do not vote your shares or otherwise provide the stockholder of record with voting instructions, your shares may constitute “broker non-votes.” The effect of broker non-votes is more specifically described in “What vote is required to approve each proposal?” below.

| 4 |

What vote is required to approve each proposal?

The vote required to elect directors and approve each of the matters scheduled for a vote at the Annual Meeting is set forth below:

| Proposal | Vote Required | Board Recommendation | ||

| 1. Election of directors | Plurality of votes cast | FOR | ||

| 2. Executive compensation | Majority of voting power present and entitled to vote | FOR | ||

| 3. Frequency of executive compensation votes | Plurality of votes cast | ONE YEAR | ||

| 4. Amendment to Certificate of Incorporation | Majority of voting power entitled to vote | FOR | ||

| 5. Ratification of appointment of EisnerAmper LLP for the year ending December 31, 2021 | Majority of voting power present and entitled to vote | FOR |

Proposal 1: With respect to the first proposal (election of directors), directors are elected by a plurality of the votes cast by the shares present in person (including virtually) or represented by proxy and entitled to vote thereon, and the director nominees who receive the greatest number of votes at the Annual Meeting (up to the total number of directors to be elected) will be elected. With respect to each nominee, stockholders have the option to vote “For” or “Withhold.” Withheld votes and “broker non-votes” (see below), if any, will not affect the outcome of the vote on this proposal.

Proposal 2: With respect to the second proposal (executive compensation), the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy and entitled to vote thereon is required to approve the proposal. Since the proposal is an advisory vote, the result will not be binding on our Board. However, our Board values our stockholders’ opinions, and our Board and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. Stockholders have the option to vote “For,” “Against,” or “Abstain.” Abstentions, if any, will have the effect of a vote against this proposal, and “broker non-votes” (see below), if any, will not affect the outcome of the vote on this proposal.

Proposal 3: With respect to the third proposal (frequency of executive compensation votes), the option of one, two or three years that receives the greatest number of votes at the Annual Meeting will be approved. Since this proposal is an advisory vote, the result will not be binding on our Board. However, our Board values our stockholders’ opinions, and our Board and the Compensation Committee will take into account the outcome of the advisory vote when determining how often we should submit to stockholders future votes on executive compensation. Stockholders have the option to vote “One Year,” “Two Years,” “Three Years,” or “Abstain.” Abstentions and “broker non-votes” (see below), if any, will not affect the outcome of the vote on this proposal.

Proposal 4: With respect to the fourth proposal (amendment to the Certificate of Incorporation), the affirmative vote of a majority of the voting power of the shares entitled to vote at the Annual Meeting is required to approve the proposal. As a result, abstentions and “broker non-votes” (see below) will have the same effect as a vote against this proposal. Banks, brokers and other nominees generally have discretionary authority to vote on this proposal; thus, we do not expect any broker non-votes on this proposal.

Proposal 5: With respect to the fifth proposal (ratification of the auditors), the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy and entitled to vote thereon is required to approve this proposal. As a result, abstentions and “broker non-votes” (see below) will have the same effect as a vote against this proposal. Banks, brokers and other nominees generally have discretionary authority to vote on this proposal; thus, we do not expect any broker non-votes on this proposal.

| 5 |

With respect to the approval of any other matter that may properly come before the Annual Meeting, the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy and entitled to vote thereon is required to approve these proposals. Abstentions and “broker non-votes” (see below), if any, will not affect the outcome of the vote on these proposals.

Holders of our common stock will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the Annual Meeting.

Broker non-votes occur when nominees, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial holders of such shares. If that happens, the nominees may vote those shares only on matters deemed “routine,” such as the ratification of auditors. Nominees cannot vote on non-routine matters unless they receive voting instructions from beneficial holders, resulting in so-called “broker non-votes.”

Each of the election of directors (Proposal No. 1), executive compensation (Proposal No. 2) and frequency of executive compensation (Proposal No. 3) votes is not considered to be a “routine” matter, and nominees are not permitted to vote on this matter if the nominee has not received instructions from the beneficial owner. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares. The amendment to our Certificate of Incorporation (Proposal No. 4) and ratification of our independent registered public accounting firm (Proposal No. 5) are considered to be “routine” matters, and hence your brokerage firm will be able to vote on Proposals No. 4 and 5 even if it does not receive instructions from you, so long as it holds your shares in its name.

How are we soliciting this proxy?

We are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or other electronic means.

We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our common stock and to obtain proxies.

| 6 |

PROPOSAL NO. 1: TO ELECT Seven DIRECTORS TO SERVE UNTIL THE NEXT ANNUAL MEETING AND UNTIL THEIR SUCCESSORS HAVE BEEN DULY ELECTED AND QUALIFIED

Our Board is currently composed of seven directors. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall hold office until the next election for which such director shall have been chosen and until his or her successor shall have been duly elected and qualified or until his or her earlier resignation, death or removal.

Each of the nominees listed below is currently one of our directors. In August 2020, the Board increased its size from six directors to seven directors and appointed Dr. John Jenkins to fill the newly created directorship, in each case upon the recommendation of the Nominating and Corporate Governance Committee. Dr. Jenkins was introduced to the Company by an advisor to the Company and recommended by our Nominating and Corporate Governance Committee to the Board for appointment to the Board after conducting its review of his qualifications to serve on the Board. The other nominees listed below were elected by the Company’s stockholders at the Company’s 2020 Annual Meeting of Stockholders. Each of the nominees listed below has been nominated by the Board for reelection upon the recommendation of the Nominating and Corporate Governance Committee.

It is the intention of the persons named in the proxies for the holders of common stock to vote the proxies for the election of the nominees named below, unless otherwise specified in any particular proxy. Our management does not contemplate that the nominees will become unavailable for any reason, but if that should occur before the meeting, proxies will be voted for another nominee, or other nominees, to be selected by our Board. In accordance with our bylaws and Delaware law, a stockholder entitled to vote for the election of directors may withhold authority to vote for certain nominees for directors or may withhold authority to vote for all nominees for directors. The director nominees receiving a plurality of the votes cast by the holders of shares of common stock present in person or by proxy at the meeting and entitled to vote on the election of directors will be elected directors. Withheld votes and broker non-votes will not be treated as a vote for or against any particular director nominee and will not affect the outcome of the election. Stockholders may not vote, or submit a proxy, for a greater number of nominees than the seven nominees named below.

The persons listed below have been nominated for election (the “Director Nominees”) to fill the seven director positions to be elected by the holders of our common stock. Ages are presented as of March 1, 2021.

| Directors | Age | Year First Became Director | ||

| Ashleigh Palmer (Co-Founder, President and Chief Executive Officer) | 58 | 2016 | ||

| Jeffrey Bluestone | 67 | 2019 | ||

| Avery Catlin | 72 | 2018 | ||

| Sean Doherty | 52 | 2019 | ||

| Wayne Pisano (Chairman) | 66 | 2018 | ||

| Nancy Wysenski | 63 | 2020 | ||

| John Jenkins | 63 | 2020 |

| 7 |

The following biographical descriptions set forth certain information with respect to the Director Nominees, based on information furnished to us by each Director Nominee.

Ashleigh Palmer, B.Sc., MBA – Co-Founder, President and Chief Executive Officer, Director

Mr. Palmer is a co-founder of Provention and has served as our President and Chief Executive Officer (“CEO”) and on the board of directors since inception in 2016. Mr. Palmer currently serves as a non-executive director on the board of Third Pole, a clinical-stage biopharmaceutical company developing electric generated inhaled nitric oxide for certain life-threatening and debilitating critical care and chronic cardiopulmonary conditions, a role he has held from 2014 to 2020. Mr. Palmer is also President of Creative BioVentures™ Corp. (CBV), a strategic advisory firm serving the biopharma industry. Since founding CBV in 2002, Mr. Palmer has advised numerous clients regarding corporate positioning and strategy, fund raising, merger and acquisition transactions, clinical development and commercialization, and has undertaken a number of CEO and board level transformational leadership and turnaround assignments for both public and private biopharma companies. From 2015 through 2017, Mr. Palmer served as Executive Chairman of Celimmune, LLC, a clinical development-stage immunotherapy company dedicated to developing therapies for celiac disease and refractory celiac disease. Celimmune was acquired by Amgen Inc. in November 2017. Mr. Palmer served as Chief Executive Officer of Unigene Laboratories, Inc., a biopharmaceutical company, from 2010 to July 2013 in conjunction with a substantial restructuring of Unigene’s debt. Following the debtholder’s acquisition of substantially all of Unigene’s assets, Unigene filed for bankruptcy in July 2013. Prior to founding Celimmune and CBV, Mr. Palmer was Vice President, Business Development for British Oxygen’s Ohmeda Pharmaceutical Products, Inc., where he was instrumental in its sale to a consortium led by Baxter International Inc. by spinning out the company’s inhaled nitric oxide assets as INO Therapeutics, Inc. (now Ikaria/Mallinckrodt). Under his leadership, as founding President and CEO, INO Therapeutics developed and commercialized the world’s first selective pulmonary vasodilator, INOmax®, establishing a time-based pricing, orphan drug franchise, subsequently acquired by Mallinckrodt in 2015 for $2.3 billion. Earlier in his career, Mr. Palmer held positions of increasing responsibility in sales and marketing leadership at Reckitt Benckiser. Mr. Palmer received his MBA from the University of Bradford and his B.Sc. honors in Biochemistry and Applied Molecular Biology from the University of Manchester. Mr. Palmer’s 30-plus years of extensive experience in the areas of corporate strategy formulation and preclinical and clinical drug evaluation, business and product development and commercialization make him a valuable member of our board of directors.

Jeffrey Bluestone – Director

Dr. Bluestone joined our board of directors in March 2019. Dr. Bluestone currently serves as the president and CEO of Sonoma Biotherapeutics, a role he has held since 2019. He has served as a member of the board of Gilead Sciences since 2019 and served on the board of Rheos Medicines in 2017. Dr. Bluestone has been the A.W. and Mary Margaret Clausen Distinguished Professor at University of California San Francisco (UCSF) in the Diabetes Center since 2000. From 2010 to 2015 Dr. Bluestone served as Executive Vice Chancellor and Provost at UCSF and from 2015 to 2019 as President and CEO of the Parker Institute for Cancer Immunotherapy. Dr. Bluestone was the founding director of the Immune Tolerance Network, the largest NIH-funded multicenter Exhibit A clinical immunology research program, testing novel immunotherapies in transplantation, autoimmunity and asthma/allergy. He was appointed by former Vice President, Joe Biden as a member of the Blue Ribbon Panel of scientific experts to guide the National Cancer Moonshot Initiative and also served as a senior investigator at the National Cancer Institute of the National Institutes of Health. Dr. Bluestone is a highly accomplished scientific researcher whose work over nearly three decades has focused on understanding the basic processes that control T-cell activation and immune tolerance in autoimmunity, organ transplantation and cancer. His research has led to the development and commercialization of multiple immunotherapies, including the first FDA-approved drug targeting T-cell co-stimulation to treat autoimmune disease and organ transplantation and the first CTLA-4 antagonist drugs approved by the FDA for the treatment of metastatic melanoma. Dr. Bluestone was part of the team of early developers of a novel anti-CD3 monoclonal antibody, now called teplizumab, a pro-tolerogenic drug that has shown clinical activity in type 1 diabetes (T1D), psoriatic arthritis, and the reversal of kidney transplant rejection. He received his B.S. and M.S. from Rutgers University and his Ph.D. in immunology from the Weill Cornell Graduate School of Medical Science. Dr. Bluestone’s extensive scientific experience in autoimmunity and clinical development of FDA-approved therapies make him a valuable member of our board of directors.

| 8 |

Avery Catlin – Director

Mr. Catlin joined our board of directors in September 2018. He currently serves on the Board of Corbus Pharmaceutical Holdings, Inc., a role he has held since August 2014. Mr. Catlin previously served as Senior Vice President and Chief Financial Officer of Celldex Therapeutics, Inc. from 2000 to 2017, where he raised more than $500 million from equity, convertible debt and private placement transactions, as well as devised and led financial strategies to successfully complete several asset acquisitions. Prior to Celldex, Mr. Catlin held senior financial and operational positions with public biopharma companies Endogen, Inc. and Repligen Corporation. Mr. Catlin earned a B.A. in Psychology from the University of Virginia and an MBA from Babson College. He is also a certified public accountant. Mr. Catlin’s more than 22 years of experience as a senior financial officer of public biopharmaceutical companies make him a valuable member of our board of directors.

Sean Doherty – Director

Mr. Doherty joined our board of directors in September 2019. He serves as the Chairman of the JDRF T1D Fund, a venture philanthropy fund accelerating life-changing solutions to cure type 1 diabetes through catalytic commercial investments, since its inception in 2016. Since 2019, Mr. Doherty has served on the board of directors of IM Therapeutics, Inc. From 2005 to 2018, Mr. Doherty was a Managing Director and the General Counsel of Bain Capital, L.P., a private global investment firm. Previously, he was an attorney at Ropes & Gray LLP and an officer in the United States Navy. Mr. Doherty received his B.A. degree in Government from Harvard College and J.D. from Harvard Law School. Mr. Doherty’s experience in the concept creation and continuing strategy management of the JDRF T1D Fund as well as his extensive philanthropic work in the T1D market environment make him a valuable member of our board of directors.

Wayne Pisano – Director

Mr. Pisano joined our board of directors in April 2018. He also serves on the board of biotechnology companies Oncolytics Biotech and Altimmune Inc., where he has been a director since May 2013 and September 2018, respectively. In addition, Mr. Pisano served on the board of directors of IMV, Inc., a biopharmaceutical company, from October 2011 to March 2021. Mr. Pisano served as President and CEO of VaxInnate, a biotechnology company, from January 2012 until November 2016. Prior to VaxInnate, Mr. Pisano was at Sanofi Pasteur from 1997 to 2011 and was President and CEO there from 2007 until his retirement in 2011. He has a bachelor’s degree in biology from St. John Fisher College, New York and an MBA from the University of Dayton, Ohio. Mr. Pisano’s depth of experience across the spectrum of commercial operations, public immunization policies and pipeline development make him a valuable member of our board of directors.

| 9 |

Nancy Wysenski - Director

Ms. Wysenski joined our board of directors in May 2020. She served as the Executive Vice President and Chief Commercial Officer of Vertex Pharmaceuticals from December 2009 through her retirement in June 2012. During her tenure at Vertex, Ms. Wysenski was responsible for the launches of Incivek and Kalydeco. Prior to joining Vertex, Ms. Wysenski held the position of Chief Operating Officer of Endo Pharmaceuticals, a specialty pharmaceutical company, where she led sales, marketing, commercial operations, supply chain management, human resources and various business development initiatives. Prior to her role at Endo, Ms. Wysenski participated in the establishment of EMD Pharmaceuticals, Inc., where she held various leadership positions, including the role of President and Chief Executive Officer from 2001 to 2006 and Vice President of Commercial from 1999 to 2001. From 1984 to 1998, Ms. Wysenski held several sales focused roles at major pharmaceutical companies, including Vice President of Field Sales for Astra Merck, Inc. Ms. Wysenski has served as a member of the board of directors of Alkermes plc and Cytokinetics Inc. since 2013 and 2020, respectively. Ms. Wysenski formerly served as a director on the board of Tetraphase Pharmaceuticals Inc. from 2014 to 2020, Dova Pharmaceuticals, Inc. from 2018 to 2019 and Inovio Pharmaceuticals, Inc. from 2015 to 2017. She is a founder of the Research Triangle Park chapter of the Healthcare Businesswomen’s Association and served on the Nominating Committee and National Advisory Board of the Healthcare Businesswomen’s Association. Ms. Wysenski’s expertise in the commercial launch of multiple products and her previous commercial leadership experience make her a valuable member of our board of directors.

John Jenkins – Director

Dr. Jenkins joined our board of directors in August 2020. Dr. Jenkins served as the Director of the Office of New Drugs (OND) at the United States Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) from 2002 to 2017, where he was responsible for more than 1,000 agency employees and 19 product-review divisions. During that time, he oversaw the review of thousands of new drug applications and biological licensing applications, as well as the approval of more than 400 new molecular entities. Dr. Jenkins served as a member of the CDER Senior Leadership Team and was involved in broad policy initiatives, including negotiation and implementation of the Prescription Drug User Fee and biosimilar programs. Dr. Jenkins began his FDA career in 1992 as a medical officer in the Division of Oncology and Pulmonary Drug Products. He subsequently served as Pulmonary Medical Group Leader and Acting Division Director before being appointed as Director of the Division of Pulmonary Drug Products in 1995. He then became the Director of the Office of Drug Evaluation II in 1999 and remained in that position until he was appointed Director of OND in 2002. Following his retirement from the FDA after over 25 years of federal service in January 2017, Dr. Jenkins joined Greenleaf Health, an FDA-focused, strategic consulting firm where he served as Principal, Drug and Biological Products. Dr. Jenkins is also a member of the board of Corbus Pharmaceuticals, where he has served since June 2018. Dr. Jenkins is board certified in internal medicine and pulmonary diseases by the American Board of Internal Medicine. He received his medical degree from the University of Tennessee, Memphis and completed his postgraduate medical training in internal medicine, pulmonary diseases, and critical care medicine at VA Commonwealth University/Medical College of VA. Prior to joining the FDA, Dr. Jenkins served as Assistant Professor of Pulmonary and Critical Care Medicine at VCU/MCV and as a Staff Physician at the Hunter Holmes McGuire VA Medical Center in Richmond, VA. Dr. Jenkins’s significant expertise in the FDA review process and product candidate development make him a valuable member of our board of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE DIRECTOR NOMINEES.

| 10 |

The Board of Directors and Its Committees

Our Board is currently composed of seven directors. Our directors hold office until their successors have been elected and qualified or until the earlier of their resignation or removal.

The Board believes that diversity among the Company’s directors contributes a range of perspectives that encourages balanced and thoughtful decision making, which promotes effective strategic oversight and stewardship. The Nominating and Corporate Governance Committee is committed to ensuring that the individuals on the Board represent a diverse mix of backgrounds and experiences that will maximize the Board’s ability to serve the Company’s needs and the long-term interests of its shareholders. Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established records of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape.

Our Board met 10 times in 2020. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which such director served on the Board) and (ii) the total number of meetings of all committees of our Board on which such director served (during the periods for which such director served on such committee or committees). All directors serving at the time of the 2020 Annual Meeting of Stockholders attended the 2020 Annual Meeting of Stockholders. We do not have a formal policy requiring members of our Board to attend our annual meetings.

Our common stock is listed on The Nasdaq Global Select Market tier of The Nasdaq Stock Market (“Nasdaq”). Under Nasdaq rules, a director will only qualify as an “independent director” if, among other qualifications, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Under Nasdaq rules, “independent directors” must comprise a majority of our Board. In addition, Nasdaq rules require that (i) subject to certain exceptions, all of the members of the Audit Committee must be independent as defined by Nasdaq and, in addition, satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), (ii) all of the members of the Compensation Committee must be independent as defined by Nasdaq in accordance with Rule 10C-1 under the Exchange Act and (iii) either the members of the Nominating and Corporate Governance Committee must be independent as defined by Nasdaq (subject to certain limited exceptions) or director nominees must be selected or recommended for the Board’s selection by the separate vote of a majority of the Board’s independent directors.

Our Board undertook a review of its composition, the composition of its committees and the independence of each director. Based on information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that Avery Catlin, Sean Doherty, Wayne Pisano, Nancy Wysenski, John Jenkins and Jeffrey Bluestone do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under Nasdaq rules.

| 11 |

In making this determination, our Board considered the relationships that each non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence.

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Our Board may establish other committees to facilitate the management of our business.

The Board has established an Audit Committee currently consisting of Mr. Catlin (Chair), Mr. Doherty and Mr. Pisano. The Audit Committee’s primary functions are to oversee and review the integrity of the Company’s financial statements and other financial information furnished by us, our compliance with legal and regulatory requirements, our systems of internal accounting and financial controls, our independent auditor’s engagement, qualifications, performance, compensation and independence, related party transactions, and compliance with our Code of Business Conduct and Ethics.

The Audit Committee also appoints (and recommends that the Board submit for shareholder ratification), compensates, retains and oversees the independent auditor retained for the purpose of preparing or issuing an audit report or other related service. The Audit Committee pre-approves audit, review and non-audit services provided by our independent auditor pursuant to the pre-approval policy described in additional detail herein. In addition, the Audit Committee discusses guidelines and policies related to risk assessment and risk management with us, prepares an Audit Committee report in accordance with SEC regulations, sets policies regarding the hiring of employees or former employees of our independent auditor, reviews and investigates any matters pertaining to integrity of management, including conflicts of interest, reviews related party transactions, reviews financial reporting and accounting standards, meets with officers as necessary, reviews the independence of the independent public accountants and reviews the adequacy of our internal accounting controls.

Each member of the Audit Committee is “independent” as that term is defined under the applicable rules of the SEC and Nasdaq. The Board has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee. The Board determined that Mr. Catlin is an “audit committee financial expert,” as defined under the applicable rules of the SEC. The Audit Committee met five times during 2020. Our Board has adopted an Audit Committee Charter, which is available for viewing at www.proventionbio.com.

The Board has established a Compensation Committee currently consisting of Ms. Wysenski (Chair), Mr. Catlin and Mr. Pisano. The primary functions of the Compensation Committee are to facilitate the Board’s discharge of its responsibilities relating to the evaluation and compensation of our executives, oversee the administration of our compensation plan, review and determine director compensation, and prepare any reports on executive compensation required by the SEC and Nasdaq.

The Compensation Committee also establishes, in consultation with our senior management, and periodically reviews, a general compensation strategy for us and our subsidiaries, reviews the Chief Executive Officer’s compensation and evaluates his or her performance (at least annually), reviews and discusses compensation disclosure as may be required by the SEC, reviews and makes recommendations with respect to incentive compensation plans and equity-based plans, and conducts or authorizes investigations or studies of any matters within the scope of the Compensation Committee’s responsibilities.

| 12 |

To determine executive compensation, the Compensation Committee, with input from the Chief Executive Officer (who does not participate in the deliberations regarding his own compensation), at least annually reviews and makes recommendations to the Board of appropriate compensation levels or other terms of employment for each of our executive officers. The Compensation Committee considers all factors it deems relevant. Our Compensation Committee has engaged the services of Radford Rewards Consulting (part of Aon plc), a compensation consulting firm, to provide the Compensation Committee with guidance regarding the amount and types of compensation that we provide to our executives and directors and how our compensation practices compare to the compensation practices of other companies. Radford Rewards Consulting does not provide any services to us other than the services provided to assist the Compensation Committee in developing executive and director pay programs, setting a compensation peer group and assisting with certain proxy disclosures, including the Compensation, Discussion and Analysis included below. The Compensation Committee believes that Radford Rewards Consulting does not have any conflicts of interest in advising the Compensation Committee under applicable SEC or Nasdaq rules.

The Compensation Committee met five times during 2020. Our Board has determined that each member of the Compensation Committee currently serving is independent under the listing standards, is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an “outside director” as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended. Our Board has adopted a Compensation Committee Charter, which is available for viewing at www.proventionbio.com.

Nominating and Corporate Governance Committee

The Board has established a Nominating and Corporate Governance Committee consisting of Mr. Pisano (Chair), Mr. Doherty, Ms. Wysenski and Dr. Jenkins. The primary functions of the Nominating and Corporate Governance Committee are to identify, review the qualifications of, and recommend to the Board, proposed nominees for election to the Board (consistent with criteria approved by the Board), select, or recommend that the Board select, the director nominees for the next annual meeting of stockholders, and oversee the annual evaluation of the Board and management.

The Nominating and Corporate Governance Committee also makes recommendations to the full Board regarding the size and composition of the Board and the criteria for Board and committee membership, establishes procedures to be followed by stockholders in submitting recommendations for director candidates, establishes a process for identifying and evaluating nominees for the Board, retains advisory firms to help identify director candidates, and reviews stockholder proposals and proposed responses.

The Nominating and Corporate Governance Committee met seven times during 2020. All members of the Nominating and Governance Committee are independent directors as defined under Nasdaq rules. Our Board has adopted a Nominating and Corporate Governance Charter, which is available for viewing at www.proventionbio.com.

Stockholder Nominations for Directorships

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the information set forth in Section 2.4 (Advance Notice Procedures) of our bylaws to the Secretary of the Company at the address set forth below under “Stockholder Communications.” All such recommendations will be forwarded to the Nominating and Corporate Governance Committee, which will review and only consider such recommendations if such information is provided on a timely basis. All stockholder recommendations for director candidates must be received by the Company in the timeframe(s) set forth under the heading “Stockholder Proposals” below.

| 13 |

Assuming that appropriate information is provided for candidates recommended by stockholders, the Nominating and Corporate Governance Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by members of the Board or other persons, as described above and as set forth in its written charter.

We believe in the value of an independent Board and have structured our leadership to promote the role of independent directors. Six of our seven current directors are independent, and all of our Board committees consist solely of independent directors. Through our committees, we entrust to independent directors various critical matters, including pertaining to our financial statements, executive compensation and governance.

We also currently separate the positions of chairman of the Board and Chief Executive Officer. Wayne Pisano, an independent director, is the chairman of the Board. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, particularly given the time and effort he is required to devote to our development and commercialization efforts and our numerous product candidates, while leveraging the independent perspective and experience of our chairman. We also believe that having an independent chairman gives independent directors a greater role in the oversight of our Company, including in overseeing material risks we face, as described below, and in supervising and evaluating our Chief Executive Officer and other members of our management. In addition, we believe that having an independent chairman promotes more active participation by independent directors in setting the agendas of and establishing priorities and procedures for our Board. Finally, we believe that having an independent chairman enables more effective decision-making by facilitating input from both internal and external vantage points.

Our Board has primary responsibility for the oversight of material risks facing the Company. We face a number of risks, including those described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and other reports filed with the SEC. We are committed to promoting a culture of decision-making that is risk-adjusted, taking into account material risks without hindering innovation. We believe that successful risk management requires understanding the risks we face, monitoring them, and adopting appropriate mitigation measures. To that end, our Board receives regular reports directly from officers responsible for oversight of particular risks within our Company, as well as full reports from each committee chair regarding the committee’s considerations and actions with regard to risks facing the Company (as described below). Through these reports and other discussions with management and Board committees, our Board monitors management’s performance of its responsibilities to identify relevant risks and assess, monitor, and take appropriate steps to mitigate risks.

We are committed to corporate social responsibility, including environmental sustainability, diversity and inclusion. Our Board takes its role in overseeing corporate social responsibility seriously and believes that good corporate governance and high ethical standards are key to our Company’s future success.

| 14 |

At the committee level, our Audit Committee discusses guidelines and policies developed by our management and the Board with respect to risk assessment and risk management and the steps that our management has taken to monitor and control financial risk exposure, including anti-fraud programs and controls. In addition, our Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding various matters, including the confidential submission by employees of concerns relating to questionable accounting or auditing matters or violations of our Code of Business Conducts and Ethics. The Compensation Committee considers, and reviews and discusses narrative disclosure of, the relation of the Company’s compensation policies and practices to compensation risk and risk management. Our Nominating and Corporate Governance Committee considers and makes recommendations pertaining to the Board’s leadership structure. As described above, our leadership structure currently reflects our belief in the value of promoting the role of independent directors in risk management.

The Board will give appropriate attention to written communications that are submitted by stockholders and will respond if and as appropriate. Absent unusual circumstances or as contemplated by committee charters, and subject to advice from legal counsel, our Secretary is primarily responsible for monitoring communications from stockholders and for providing copies or summaries of such communications to the Board as they consider appropriate.

Communications from stockholders will be forwarded to all directors if they relate to important substantive matters or if they include suggestions or comments that the Secretary considers to be important for the Board to know. Communication relating to corporate governance and corporate strategy are more likely to be forwarded to the Board than communications regarding personal grievances, ordinary business matters, and matters as to which we tend to receive repetitive or duplicative communications.

Stockholders who wish to send communications to the Board should address such communications to: The Board of Directors, Provention Bio, Inc., 55 Broad Street, 2nd Floor, Red Bank, NJ 07701, Attention: Secretary.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our directors, officers and employees. The purpose of the Code of Business Conduct and Ethics is to deter wrongdoing and to provide guidance to directors, officers and employees to help them recognize and deal with ethical issues, to provide mechanisms to report unethical or illegal conduct and to contribute positively to our culture of accurate disclosure, ethical performance and accountability. We have established a means for individuals to report a violation or suspected violation of the Code of Business Conduct and Ethics anonymously, including those violations relating to accounting, internal controls or auditing matters, and federal securities laws. Our Code of Business Conduct and Ethics is publicly available on our website at www.proventionbio.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver, including any implicit waiver from a provision of the Code of Business Conduct and Ethics to our directors or executive officers, we will disclose the nature of such amendments or waiver on our website or in a current report on Form 8-K.

Under the terms of our insider trading policy, we prohibit each officer, director and employee of the Company, and each of their family members and controlled entities, from engaging in certain forms of hedging or monetization transactions. Such transactions include those, such as zero-cost collars and forward sale contracts, that would allow them to lock in much of the value of their stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock, and to continue to own the covered securities but without the full risks and rewards of ownership.

| 15 |

Limitation of Directors’ Liability and Indemnification

Our certificate of incorporation contains a provision that eliminates, to the maximum extent permitted by the Delaware General Corporation Law (the “DGCL”), the personal liability of directors for monetary damages for breach of their fiduciary duties as a director or otherwise. Our bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by the DGCL.

Section 145 of the DGCL provides that a corporation may indemnify any person made a party to an action, suit or proceeding by reason of the fact that he or she was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful, except that, in the case of an action by or in right of the corporation, no indemnification may generally be made in respect of any claim as to which such person is adjudged to be liable to the corporation.

We have entered into and intend to continue to enter into indemnification agreements with our directors and officers, in addition to the indemnification provided for in our bylaws.

We maintain insurance on behalf of any person who is or was a director or officer of the Company against any loss arising from any claim asserted against him or her and incurred by him or her in any such capacity, subject to certain exclusions.

As a result of Mr. Doherty’s position as the Chairman of the JDRF T1D Fund, our board of directors approved, under Section 122(17) of the DGCL, the renouncement of any interest or expectancy in, or in being offered an opportunity to participate in, any matter, transaction or interest that is presented to, or acquired, created or developed by, or which otherwise comes into possession of Mr. Doherty in his role as the Chairman of the JDRF T1D Fund unless such matter, transaction or interest is presented to, or acquired by, or which otherwise comes into possession of Mr. Doherty expressly and solely in his capacity as director of the Company.

The following table sets forth certain information regarding our executive officers. Ages are presented as of March 1, 2021.

| Name of Individual | Age | Position and Office | ||

| Ashleigh Palmer | 58 | Co-Founder, President, Chief Executive Officer, Director | ||

| Andrew Drechsler | 49 | Chief Financial Officer | ||

| Francisco Leon | 49 | Co-Founder, Chief Scientific Officer | ||

| Eleanor Ramos | 64 | Chief Medical Officer | ||

| Jason Hoitt | 43 | Chief Commercial Officer | ||

| Heidy King-Jones | 38 | Chief Legal Officer |

| 16 |

Our executive officers are appointed by, and serve at the discretion of, our Board. The business experience for the past five years, and in some instances, for prior years, of each of our executive officers is as follows:

Ashleigh Palmer

For Mr. Palmer’s biography, please see the section above entitled “Directors.”

Andrew Drechsler

Mr. Drechsler joined Provention as Chief Financial Officer (“CFO”) in September 2017. Mr. Drechsler has over 20 years of financial and operational leadership experience in life sciences companies. Prior to Provention, Mr. Drechsler was most recently CFO of Insmed Incorporated from 2012 to 2017. Mr. Drechsler’s prior roles also include: CFO of VaxInnate Corporation, a privately held clinical-stage biotechnology company that developed vaccines for infectious diseases; CFO of publicly-traded Valera Pharmaceuticals where he completed an initial public offering; controller for Abbott Laboratories’ Point of Care Division, which was publicly-traded as i-STAT Corporation prior to being acquired by Abbott; controller of Biomatrix, Inc., which was publicly-traded prior to being acquired by Genzyme. Mr. Drechsler currently serves on the board of directors of Baudax Bio, a position he has held since August 2020. Mr. Drechsler graduated magna cum laude from Villanova University with a BS in Accounting and received his certified public accountant license in New Jersey.

Francisco Leon

Dr. Leon, co-founder of Provention and its Chief Scientific Officer (“CSO”), joined Provention in October 2017. Dr. Leon brings to the Company a breadth of experience and expertise from his academic and industry careers in the fields of immunology and immune-mediated disease clinical research. Dr. Leon was most recently the Chief Executive Officer and Chief Medical Officer of Celimmune, LLC, a clinical development-stage immunotherapy company dedicated to developing transformational therapies for celiac disease and refractory celiac disease (intestinal lymphoma) from 2015 to 2017. Celimmune was acquired by Amgen Inc. in November 2017. Additionally, Dr. Leon is a co-founder and shareholder of Glutenostics, Inc. since April 2016. Prior to founding Celimmune in 2015, Dr. Leon served as Vice President and Head of Translational Medicine at Johnson & Johnson’s Janssen Pharmaceuticals, where he led early-stage clinical development in immunology. Before joining Janssen in 2010, Dr. Leon served as Chief Medical Officer at Alba Therapeutics; Director of Clinical Development, Inflammation & Respiratory at Medimmune (AstraZeneca); and Director of Clinical Discovery, Immunology & Oncology at Bristol-Myers Squibb. Prior to joining the biopharma industry, Dr. Leon served as a Postdoctoral Fellow at the National Institutes for Allergy and Infectious Diseases (NIAID) of the National Institutes of Health (NIH). In 2011, he became an Associate Professor of Medicine at Jefferson Medical College in Philadelphia, where he continues to contribute to the clinical research efforts of the Department of Gastroenterology. Dr. Leon is a clinical and translational immunologist who received his M.D. and Ph.D. from Autónoma University in Madrid, Spain. In his 25 years of experience in translational immunology, Dr. Leon has authored or co-authored more than 85 peer-reviewed articles and book chapters, as well as a dozen issued patents and patent applications.

| 17 |

Eleanor Ramos

Dr. Ramos joined Provention in July 2017 as its Chief Medical Officer (“CMO”). Dr. Ramos’ background includes significant clinical expertise in autoimmunity, inflammation, organ transplant rejection and the treatment of acute and chronic viral infections. Prior to joining Provention, Dr. Ramos served as a Chief Medical Officer of Global Blood Therapeutics Inc., a biopharmaceutical company dedicated to developing novel therapeutics to treat blood-based and hypoxemic pulmonary disorders from 2014 to 2016. Her past experience includes roles as Chief Medical Officer of Theraclone Sciences, a therapeutic antibody discovery and development company, where she oversaw the development of clinical programs in viral diseases including severe influenza from 2011 to 2014, and as Chief Medical Officer at ZymoGenetics, Inc., overseeing its clinical portfolio across infectious diseases/hepatitis C, immunology/lupus nephritis, oncology and hemostasis from 2009 to 2011. Dr. Ramos is currently a member of the Scientific Advisory Board of EpiVax Oncology, a private biotechnology company focused on developing personalized cancer vaccines. Her experience also encompasses leading the Clinical Trials Group at the Immune Tolerance Network, a collaborative network for clinical research funded by the National Institute of Allergy and Infectious Diseases. She holds a medical degree and undergraduate degree from Tufts University, along with advanced training in the subspecialty of nephrology with a focus on transplantation immunology at Brigham and Women’s Hospital, Harvard Medical School.

Jason Hoitt

Mr. Hoitt joined Provention as its Chief Commercial Officer (“CCO”) in January 2020. Prior to joining Provention, Mr. Hoitt served as Chief Commercial Officer at Dova Pharmaceuticals (acquired by Swedish Orphan Biovitrum AB, or Sobi) and led all commercial efforts including the pre-launch and launch strategy and execution for DOPTELET ® (avatrombopag) targeting chronic immune thrombocytopenia. Prior to Dova Pharmacetucials, Mr. Hoitt was a member of the commercial leadership team at Insmed Incorporated, serving as a Vice President and Head of Sales for the launch of Arikayce. Mr. Hoitt was also a member of the commercial leadership team at Sarepta Therapeutics, where he launched Exondys 51. Prior to Sarepta he held roles of increasing responsibility at Vertex Pharmaceuticals, where he launched Incivek, and Gilead Sciences, working on Hepsera and the launch of Viread HBV. Mr. Hoitt holds a B.A. from the College of the Holy Cross.

Heidy King-Jones

Ms. King-Jones joined Provention as its Chief Legal Officer (“CLO”) in August 2020. She brings nearly 13 years of corporate counsel and law firm experience in the biotechnology and pharmaceutical sectors. As Chief Legal Officer, Ms. King-Jones supports Provention Bio’s commitment to upholding the best practices of compliance, corporate governance, and legal and enterprise risk management. Prior to joining Provention, Ms. King-Jones served as Senior Vice President and General Counsel of Axcella Health, Inc. where she worked from January 2018 to August 2020. Prior to Axcella, she held legal roles of increasing responsibility at Sarepta Therapeutics from July 2013 to January 2018, including head of Corporate Law Department and lead attorney for commercialization of Exondys 51. Ms. King-Jones started her career as a part of Ropes & Gray LLP’s Securities & Public Company Practice Group. She holds a B.A. from Dartmouth College and a J.D. and LL.M. from Cornell Law School.

There are no family relationships among any of our directors and executive officers.

| 18 |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) provides an overview of our executive compensation philosophy, the objectives of our executive compensation program and each compensation component that we provide. In addition, we explain how and why the Compensation Committee arrived at specific compensation policies and decisions involving our named executive officers for the fiscal year ended December 31, 2020. This CD&A is intended to be read in conjunction with the tables which immediately follow, which include historical context of pay.

The following executive officers constituted our named executive officers (“NEOs”) for the last completed fiscal year:

| Ashleigh Palmer | Chief Executive Officer | |

| Andrew Drechsler | Chief Financial Officer | |

| Francisco Leon | Chief Scientific Officer | |

| Eleanor Ramos | Chief Medical Officer | |

| Jason Hoitt | Chief Commercial Officer |

The Company’s accomplishments in 2020 are directly tied to the performance of the Company’s NEOs, and thus were an important factor in determining NEO compensation in 2020. Although the Company experienced certain challenges resulting from the ongoing COVID-19 pandemic, such as difficultly in recruiting participants for trials, the Company’s 2020 accomplishments, including advancing its pipeline of product candidates aimed at intercepting and preventing autoimmune disease included the below:

| ● | PRV-031 (Teplizumab): In December 2020, the FDA accepted and filed for review our Biologics License Application (“BLA”) for teplizumab for the delay or prevention of T1D in at-risk individuals. The FDA also granted our request for Priority Review and assigned a user fee goal date of July 2, 2021 under the PDUFA. In its acceptance letter, the FDA has stated that it is currently planning to hold an advisory committee meeting, which is tentatively scheduled for May 27, 2021, to discuss the BLA. | |

| ● | PRV-101: In December 2020, we initiated the PROVENT (PROtocol for coxsackievirus VaccinE in healthy voluNTeers) study, a first-in-human study of our polyvalent inactivated CVB vaccine candidate, PRV-101. We are developing PRV-101 for the prevention of acute CVB infection and the potential delay or prevention of T1D and celiac disease. | |

| ● | PRV-015: In August 2020, we, with our development partner Amgen, initiated the Phase 2b PROACTIVE (PROvention Amgen Celiac ProtecTIVE) study of PRV-015, an anti-interleukin-15 monoclonal antibody, in adult celiac patients not responding to a gluten-free diet, a condition known as non-responsive celiac disease (NRCD). |

| 19 |

| ● | PRV-3279: In March 2020, we announced top-line results from the Phase 1b portion of the PREVAIL (PRV-3279 EVAluation In Lupus) study, which evaluated PRV-3279 in 16 healthy volunteers, supporting the planned commencement of the Phase 2a portion of this study the second half of 2021. | |

| ● | Organization Growth and Financings: Since January 2020, we successfully raised approximately $215.5 million from our at-the-market program and a public offering, including approximately $113.2 million in 2020, to fund the company’s advancement of its pipeline of product candidates and other operations, including our activities to prepare for a potential commercialization of teplizumab. The Company successfully scaled up from an organization of 18 employees in January 2020 to an organization of 52 employees by December 2020 to develop additional capacity and expertise to support its business plans, including hiring a Chief Commercial Officer and Chief Legal Officer. We also added two new non-employee directors, Ms. Wysenski and Dr. Jenkins, who bring deep regulatory and commercial expertise to our Board. | |

| ● | Strong Stock Price Performance: Our stock price has continued to exhibit strong growth in 2020. Our total shareholder return (“TSR”) was 13.7% for the past year, with our TSR since our initial public offering exceeding 252% and outpacing relevant indices, as shown in the chart below. We believe this growth is reflective of the market’s support for our product pipeline development and other operational achievements, and further supports our compensation program’s focus on creating long-term shareholder value.

|

| 20 |

We believe that the efforts of our named executive officers were critical to our operational successes in 2020.

The Company’s executive compensation program is designed to closely tie pay to performance, rewarding executives for the achievement of corporate short-term and long-term strategic goals that create shareholder value. We strongly believe that a well-structured executive compensation program should be heavily reliant on variable, “at-risk” pay, a philosophy we reflect in our compensation program. As our company grows, so has our compensation program, and it will continue to do so. We believe the following three examples demonstrate our approach to compensation:

| 1) | Performance-based stock options — Approximately 60% of our annual equity grant to executives is comprised of performance-based stock options. As a clinical stage biopharmaceutical company, options are a common equity vehicle choice amongst our peers. However, attaching performance conditions to those awards is not. Our Board felt this was appropriate to incentivize our executives to focus on corporate strategic goals that are vital to our success, and therefore to the creation of shareholder value. | |

| 2) | Teamwork (with slight differentiation) — Under our annual incentive plan structure, all executives have the same corporate performance goals, but with different weightings. Our Compensation Committee feels this is important, as different executives have varying influence and oversight over each goal. | |

| 3) | Equal equity grants – The Compensation Committee, in consultation with our CEO determined that in 2020 as in 2019, all executives including the CEO would receive the same number of equity awards, including both time-vesting and performance-vesting awards, in order to support and incentivize teamwork culture. |

We believe that the design and structure of our pay program supports our business strategy and organizational objectives while successfully aligning executive and shareholder interests. Our compensation framework has been tailored to reward and incentivize executives for focusing on and achieving specific financial and strategic objectives, both quantitative and qualitative, that our Board believes are central to delivering long-term stockholder value.

The primary elements of our executive compensation program in 2020 were base salary, short-term cash incentives, and long-term equity incentives. The elements of our executive compensation program take into consideration market data, described below, and each executive’s individual experience, skills and performance.

| Base Salary | Base salaries provide annual fixed pay and are intended to be competitive within our industry and are important in attracting and retaining talented executives. | |

Annual Cash Incentives |

Our annual cash incentives are intended to motivate and reward our executives for the achievement of certain short-term strategic goals of the Company. In 2020, our annual incentives were based on key corporate milestones, focusing on clinical trials, manufacturing, and regulatory goals, as well as pre-commercial and funding goals. |

| 21 |

Long-Term Equity Incentives |

Long-term equity awards incentivize executives to deliver long-term shareholder value by offering the opportunity to benefit from appreciation in our stock price, while also providing a retention vehicle for our top employee talent. In 2020, each executive received a grant of an option to purchase shares of our common stock and Mr. Hoitt received an additional new hire option grant. Forty percent of the shares underlying each grant vest based on continued employment with us and the remaining 60% vest based on achievement of pre-established performance goals. |

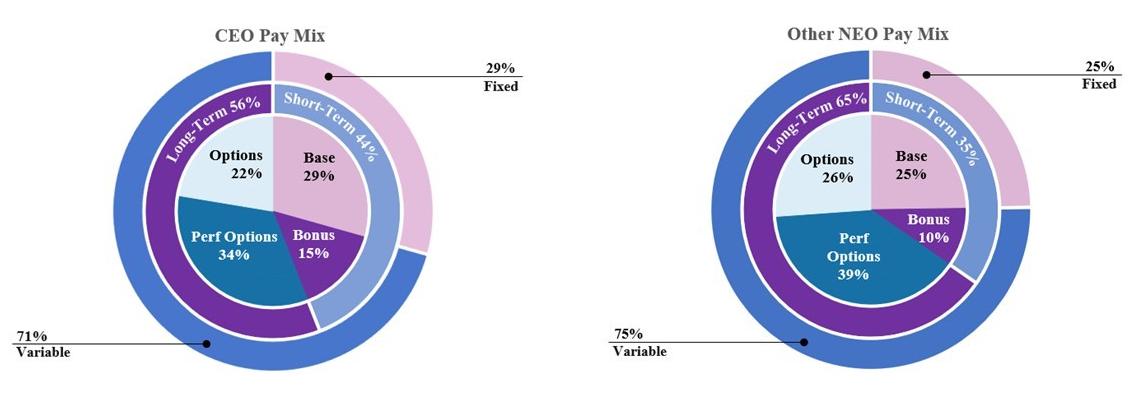

The Compensation Committee utilizes the above-mentioned elements to align our executive pay opportunities with our short- and long-term performance. To do so, and to align management interests most closely with the interests of our stockholders, the majority of the compensation we pay to our named executive officers is provided as at-risk, variable incentives, as shown in the graphics below. The Compensation Committee does not have any formal policies for allocating total compensation among the various components. Instead, the Compensation Committee relies on its judgment as well as the advice from its independent compensation consultant.

Compensation Governance Practices

To complement our pay structure, we adhere to several notable best practices to encourage actions that are in the long-term interests of our stockholders and the Company alike. These include:

| What We Do | ● | Align pay with performance | |

| ● | Provide an appropriate mix of short and long-term incentives to our executives | ||

| ● | Responsible use of shares under our long-term incentive program | ||

| ● | Engage an independent compensation consultant | ||

| ● | Identify and use a comparator peer group based on market data and industry profile. | ||

| ● | “Double-trigger” change-in-control provisions | ||

| ● | Maintain a robust insider trading policy |

What We Don’t Do |

● | No excise tax gross-ups | |