Form PRE 14A PREFERRED APARTMENT COMM For: Apr 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant | x | Filed by a Party other than the Registrant | o | ||||||||

Check the appropriate box:

| x | Preliminary Proxy Statement | ||||

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| o | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to §240.14a-12 | ||||

PREFERRED APARTMENT COMMUNITIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| 1. | Title of each class of securities to which transaction applies: | |||||||

| 2. | Aggregate number of securities to which transaction applies: | |||||||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| 4. | Proposed maximum aggregate value of transaction: | |||||||

| 5. | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing | |||||||

| 1. | Amount Previously Paid: | |||||||

| 2. | Form, Schedule or Registration Statement No.: | |||||||

| 3. | Filing Party: | |||||||

| 4. | Date Filed: | |||||||

Letter from our President and Chief Executive Officer

Joel T. Murphy President and Chief Executive Officer | April [16], 2021 Dear Fellow Stockholders: On behalf of the Board of Directors and management, I cordially invite you to attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Preferred Apartment Communities, Inc. The Annual Meeting will be held on Thursday, June 3, 2021, at 9:00 a.m. Eastern Time. This year’s Annual Meeting will be a virtual meeting of stockholders. Registered holders, and beneficial stockholders who register for the meeting in advance, will be able to participate in the meeting, vote, and submit questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/APTS2021. If you are a registered holder, a secure control number that will allow you to attend the meeting electronically can be found on your proxy card and on the Notice of Internet Availability of Proxy Materials. If you hold your shares in the name of a bank, broker or other holder of record, you may either: (i) vote in advance of the meeting by contacting your broker and attend the virtual meeting as a guest; or (ii) register to attend the virtual meeting as a stockholder in advance (allowing you to both vote and ask questions during the meeting) by following the instructions in the Proxy Statement. Details of the business to be presented at the Annual Meeting can be found in the accompanying Notice of 2021 Annual Meeting of Stockholders and Proxy Statement (our “Proxy Statement”). We are pleased to take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to stockholders over the Internet. We believe that this e-proxy process expedites stockholders’ receipt of proxy materials, while setting a great precedent for our Company by keeping costs down and reducing the environmental impact of our Annual Meeting. On approximately April 21, 2021, we will begin mailing a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement for 2021 and annual report to stockholders for 2020 (the “2020 Annual Report”) and how to vote over the Internet or how to request and return a proxy card by mail. Stockholders who previously made a request to receive a paper copy of the proxy materials will be mailed the Proxy Statement, 2020 Annual Report and proxy card. Whether or not you plan to attend the Annual Meeting, your vote is important and we encourage you to vote promptly. You may vote your shares via a toll-free telephone number or over the Internet. If you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. Instructions regarding all three methods of voting are contained in the Proxy Statement and on the proxy card. On behalf of the Board of Directors, we thank you for your ongoing support and investment in our Company. Sincerely,  Joel T. Murphy President and Chief Executive Officer | ||||

iii | ||||||||

Notice of 2021 Annual Meeting of Stockholders

Time and Date 9:00 a.m. (Eastern Time) on June 3, 2021 Place Virtual Meeting. Please visit: www.virtualshareholdermeeting.com/APTS2021 to participate. Record Date In order to vote, you must have been a stockholder at the close of business on April 5, 2021. | Voting Matters | Board Recommendation | |||||||||

Proposal 1 To elect seven directors to serve until the annual meeting of stockholders in 2022. See page 14 | For each of the 7 directors | ||||||||||

Proposal 2 To approve the First Amendment to the 2019 Stock Incentive Plan. See page 39 | For | ||||||||||

Proposal 3 To conduct an advisory vote on named executive officer compensation. See page 43 | For | ||||||||||

We cordially invite you to attend the virtual meeting, but regardless of whether you plan to be present, please vote in one of the following ways: VISIT www.proxyvote.com to vote via the Internet. Have your proxy card in hand when you access the website and follow the instructions to vote your shares If you receive a printed copy of the proxy materials by mail, you may vote by telephone by CALLING 1-800-690-6903 (this is a free call in the U.S.). Have your proxy card in hand when you call and then follow the instructions to vote your shares If you receive a printed copy of the proxy materials by mail, you may vote if you MARK, SIGN, DATE AND PROMPTLY RETURN your proxy card in the envelope provided, which requires no additional postage if mailed in the U.S. | |||||||||||

Proposal 4 To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021. See page 74 | For | ||||||||||

To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. | |||||||||||

Only stockholders of the Company and its invited guests may attend the meeting. If you are a registered holder, a secure control number that will allow you to attend the meeting electronically can be found on your proxy card and on the Notice of Internet Availability of Proxy Materials. If you hold your shares in the name of a bank, broker or other holder of record, you may either: (i) vote in advance of the meeting by contacting your broker and attend the virtual meeting as a guest; or (ii) register to attend the virtual meeting as a stockholder in advance (allowing you to both vote and ask questions during the meeting) by following the instructions in the Proxy Statement. Any proxy may be revoked by you at any time prior to its exercise at the meeting. By Order of the Board of Directors,  Jeffrey R. Sprain General Counsel and Secretary [April 16, 2021] | |||||||||||

iv | ||||||||

Table of Contents

v | ||||||||

A-1 | |||||

vi | ||||||||

| |||||||||||

PROXY STATEMENT | |||||||||||

| |||||||||||

Proxy Statement

3284 Northside Parkway NW, Suite 150

Atlanta, Georgia 30327

2021 ANNUAL MEETING OF STOCKHOLDERS

Preferred Apartment Communities, Inc. (“we,” “our,” “us”, the “Company” or "PAC") is furnishing this Proxy Statement in connection with our solicitation of proxies to be voted at our 2021 Annual Meeting of Stockholders (the “Annual Meeting”). This year’s Annual Meeting will be held at 9:00 a.m. Eastern Time on June 3, 2021 and will be a virtual meeting of stockholders. You will be able to participate in the 2021 Annual Meeting, vote, and submit your questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/APTS2021. You must have your 15-digit control number to enter and participate in the virtual meeting. If you are a registered holder, your control number is provided by the Company on your Notice of Internet Availability of Proxy Materials (“Availability Notice”) or on your proxy card. If your shares are held in the name of a bank, broker or other holder of record, you may either (i) vote in advance of the meeting by contacting your broker and attend the virtual meeting as a guest; or (ii) register to attend the virtual meeting as a stockholder in advance (allowing you to both vote and ask questions during the meeting) by following the instructions below under “Attendance at the Annual Meeting.” This Proxy Statement and the proxy card are being made available over the Internet or delivered by mail on or about April 21, 2021, to stockholders of record as of April 5, 2021.

2 | ||||||||

| ||

ABOUT THE PROXY STATEMENT | ||

| ||

About the Proxy Statement

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will be asked to consider and act upon the following matters:

•Election of seven directors nominated by our Board of Directors (the “Board”) and listed in this Proxy Statement to serve until the annual meeting of stockholders in 2022;

•Approval of the First Amendment to the 2019 Stock Incentive Plan;

•An advisory vote on the compensation of our named executive officers as disclosed in this Proxy Statement;

•Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2021; and

•Such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a printed set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), we are permitted to furnish our proxy materials over the Internet to our stockholders by delivering a Notice of Internet Availability of Proxy Materials in the mail. Unless requested, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice of Internet Availability of Proxy Materials instructs you on how to access and review the Proxy Statement and 2020 Annual Report over the Internet at www.proxyvote.com. In addition, you can access the Proxy Statement and 2020 Annual Report here: https://materials.proxyvote.com/74039L. The Notice of Internet Availability of Proxy Materials also instructs you on how you may submit your proxy over the Internet, or how you can request a full set of proxy materials, including a proxy card to return by mail. If you received a Notice of Internet Availability of Proxy Materials in the mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials provided in the Notice of Internet Availability of Proxy Materials.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 5, 2021, the record date for the Annual Meeting, are entitled to receive notice of and vote at the Annual Meeting.

If you hold your shares through a bank, broker or other nominee and intend to vote in person at the Annual Meeting, you will need to provide a legal proxy from your bank, broker or other stockholder of record.

What are the voting rights of stockholders?

Each share of our common stock is entitled to one vote. There is no cumulative voting.

How many shares are outstanding and entitled to vote at the Annual Meeting?

At the close of business on April 5, 2021, approximately [50,904,599] shares of our common stock were outstanding, including [809,437] shares of unvested restricted common stock, that are entitled to vote at the Annual Meeting. Additionally, [__________] shares of our Series A Redeemable Preferred Stock, [_______] shares of our Series M Redeemable Preferred Stock, [_______] shares of our Series A1 Redeemable Preferred Stock and [_________] shares of our Series M1 Redeemable Preferred Stock were outstanding on such date, none of which are entitled to vote at the Annual Meeting.

4 | ||||||||

ABOUT THE PROXY STATEMENT

What constitutes a quorum?

Stockholders entitled to cast at least a majority of all the votes entitled to be cast must be present at the Annual Meeting in person or by proxy to constitute a quorum for the transaction of business. Withheld votes, “abstentions” and broker non-votes count for purposes of determining whether a quorum is present. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because the proposal is not a “routine” matter and the broker has not received voting instructions from the beneficial owner of the shares. All items on this year’s ballot are “non-routine” matters under New York Stock Exchange (“NYSE”) rules to which we are subject, except ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021 (Proposal 4).

What is the difference between a “stockholder of record” and a “street name” holder?

These terms describe how your shares are held. If your shares are registered directly in your name with Computershare, our transfer agent, you are a “stockholder of record.” If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a “street name” holder.

If you are a “street name” holder, you are considered the beneficial owner of shares held in street name and your broker or nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote your shares. You are also invited to attend the virtual Annual Meeting and vote your shares online; however, in order to vote your shares online, you must provide us with a legal proxy from your bank, broker or other stockholder of record.

Brokerage firms have authority under NYSE rules to vote customers′ shares for which they have not received voting instructions on certain “routine” matters, but may not vote for “non-routine matters” unless they have received voting instructions. As explained above, all items on this year’s ballot are “non-routine” matters under NYSE rules except ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021 (Proposal 4). Therefore, if you do not provide voting instructions, your brokerage firm may not vote your shares on such non-routine matters. We encourage you to provide voting instructions to your brokerage firm. This ensures your shares will be voted at the Annual Meeting.

How do I vote?

If you are a registered stockholder, meaning that your shares are registered in your name, you have four voting options. You may vote:

•over the Internet (if you have access to the Internet, we encourage you to vote in this manner) by going to www.proxyvote.com. Have your proxy card in hand when you access the website and follow the instructions to vote your shares;

•by telephone by calling 1-800-690-6903. Have your proxy card in hand when you call and then follow the instructions to vote your shares;

•by signing and dating your proxy card (if you received a proxy card) and mailing it in the prepaid, preaddressed envelope enclosed therewith; or

•by attending the virtual Annual Meeting and voting as outlined under “What do I need to do to attend the virtual meeting?"

Please carefully follow the directions in the Notice of Internet Availability of Proxy Materials or proxy card you received. Proxies submitted over the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on June 2, 2021. Proxies submitted by mail must be received by the Company prior to the commencement of the virtual Annual Meeting.

If you have any questions about the Annual Meeting, or if you require assistance on voting, please call Broadridge Investor Communications Solutions, Inc. (“Broadridge”), our proxy tabulator, at 1-800-579-1639.

5 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

Can I vote my shares at the virtual meeting?

If you are a “stockholder of record,” you may vote your shares at the virtual meeting. If you hold your shares in “street name,” you must obtain a legal proxy from your broker, bank, trustee or nominee, giving you the right to vote the shares at the virtual meeting.

What do I need to do to attend the virtual meeting?

As permitted by Maryland law and our Bylaws, the Company’s Annual Meeting will be held solely as a virtual meeting live via the Internet. You will be able to attend the Annual Meeting via live webcast by visiting the Company’s virtual meeting website (www.virtualshareholdermeeting.com/APTS2021) at the meeting time. Upon visiting the meeting website, you will be prompted to enter your 15-digit control number provided on your Availability Notice or on your proxy card if you receive proxy materials by mail. Your unique control number allows us to identify you as a stockholder and will enable you to securely log on, vote and submit questions during the Annual Meeting on the meeting website.

Beneficial stockholders who did not received a 15-digit control number from their bank or brokerage firm, who wish to attend the meeting should follow the instructions from their bank or brokerage firm, including any requirement to obtain a legal proxy. Most brokerage firms or banks allow a stockholder to obtain a legal proxy either online or by mail.

Alternatively, if you hold your shares in the name of a bank, broker or other holder of record, you may vote in advance of the virtual meeting by contacting your holder of record (please see “Voting Methods” below) and join the virtual meeting as a guest (without the ability to vote or ask questions) without advance registration.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or proxy card?

It means that you have multiple accounts with our transfer agent and/or with a broker, bank or other nominee. You will need to vote separately with respect to each Notice of Internet Availability of Proxy Materials or proxy card you received. Please vote all the shares you own.

Can I change my vote after I have mailed in my proxy card?

You may revoke your proxy by doing one of the following:

•by sending a written notice of revocation to our Secretary at 3284 Northside Parkway NW, Suite 150, Atlanta, Georgia 30327 so it is received prior to the Annual Meeting, stating that you revoke your proxy;

•by signing a later-dated proxy card and submitting it so it is received prior to the commencement of the Annual Meeting in accordance with the instructions included on the proxy card(s); or

•by attending the virtual Annual Meeting and voting your shares.

How may I vote for each proposal?

Proposal 1 – You may vote for, against or abstain on each individual nominee.

Proposal 2 – You may vote for, against or abstain on the approval of the First Amendment to the 2019 Stock Incentive Plan.

Proposal 3 – You may vote for, against or abstain on the advisory vote on named executive officer compensation.

Proposal 4 – You may vote for, against or abstain from voting to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021.

What are the Board’s recommendations on how I should vote my shares?

Proposal 1 – For all the nominees for election as director.

6 | ||||||||

ABOUT THE PROXY STATEMENT

Proposal 2 – For the approval of the First Amendment to the 2019 Stock Incentive Plan.

Proposal 3 – For the advisory proposal on named executive officer compensation.

Proposal 4 – For the proposal to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021.

What vote is required to approve each item?

| Proposal Number | Subject | Vote Required | Impact of Abstentions and Broker Non-Votes, if any | |||||||||||||||||

| 1 | Election of directors | Since this is an uncontested election, by a majority of the votes cast. | Abstentions and broker non-votes will not count as votes cast on the proposal and will not affect the outcome of the vote. | |||||||||||||||||

| 2 | Approval of the First Amendment to the 2019 Stock Incentive Plan | A majority of the votes cast. | Under NYSE rules, abstentions will be counted as votes cast, and will therefore have the same effect as votes against the proposal. Broker non-votes are not considered in connection the proposal and will not affect the outcome of the vote. | |||||||||||||||||

| 3 | Advisory vote on named executive officer compensation | A majority of the votes cast. | Abstentions and broker non-votes will not count as votes cast on the proposal and will not affect the outcome of the vote. | |||||||||||||||||

| 4 | Ratification of appointment of independent auditors | A majority of the votes cast. | Abstentions and broker non-votes will not count as votes cast on the proposal and will not affect the outcome of the vote. | |||||||||||||||||

What if I return my proxy card but do not provide voting instructions?

If you return a signed proxy card but do not provide voting instructions, your shares will be voted as follows:

Proposal 1 – For all the nominees for election as director.

Proposal 2 – For the approval of the First Amendment to the 2019 Stock Incentive Plan.

Proposal 3 – For the advisory proposal on named executive officer compensation.

Proposal 4 – For the proposal to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021.

What happens if additional matters are presented at the Annual Meeting?

We know of no other matters other than the items of business described in this Proxy Statement that can be considered at the meeting. If other matters requiring a vote do arise, the persons named as proxies will have the discretion to vote on those matters for you.

7 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

Is a list of stockholders available?

The names of stockholders of record entitled to vote at the Annual Meeting will be available to stockholders entitled to vote at this meeting for ten days prior to the Annual Meeting for any purpose relevant to the Annual Meeting. This list can be viewed between the hours of 9:00 a.m. and 5:00 p.m. Eastern Time at our principal executive offices at 3284 Northside Parkway NW, Suite 150, Atlanta, Georgia 30327. Please contact our Secretary at 3284 Northside Parkway NW, Suite 150, Atlanta, Georgia 30327 to make arrangements.

Who will count the votes?

A representative of Broadridge will act as the inspector of elections and will tabulate votes. In connection with the duties as inspector of elections, Broadridge’s representative will also determine whether a quorum is present, evaluate the validity of proxies and ballots and certify the voting results.

Who pays the cost of this proxy solicitation?

Proxies will be solicited on behalf of the Board by mail, in person and by telephone. We will pay the cost of preparing, assembling and mailing the proxy materials and the cost of soliciting proxies. We will also request banks, brokers and other holders of record to send the proxy materials to, and obtain proxies from, beneficial owners and will reimburse them for their reasonable expenses in doing so. We have not hired a proxy solicitor for the Annual Meeting. Our officers, directors and employees may solicit proxies by mail, personal contact, letter, telephone, telegram, facsimile or other electronic means. We have hired Broadridge to assist in the distribution of our proxy materials and the tabulation of proxies. In addition, Broadridge will serve as our inspector of elections. If you have any questions about the Annual Meeting, or if you require assistance on voting, please call Broadridge at 1-800-579-1639.

What is “householding?”

In accordance with a notice sent to certain street name stockholders of our common stock who share a single address, stockholders at a single address will receive only one copy of this Proxy Statement, our 2020 Annual Report or Notice of Availability, as applicable, unless we have previously received contrary instructions. This practice, known as “householding,” is designed to reduce our printing and postage costs. We currently do not “household” for stockholders of record.

If your household received a single set of proxy materials, but you would prefer to receive a separate copy of this Proxy Statement, our 2020 Annual Report or Notice of Availability, as applicable, you may contact us at Preferred Apartment Communities, Inc., 3284 Northside Parkway NW, Suite 150, Atlanta, GA 30327, Attn: Investor Relations, telephone: 1-770-818-4100, and we will deliver the applicable documents to you promptly upon receiving the request. You may also change your householding preferences through the Broadridge Householding Election system toll-free at 1-866-540-7095 or by writing to Broadridge at 51 Mercedes Way, Edgewood, New York 11717, Attn: Householding Department.

You may request or discontinue householding in the future by contacting the broker, bank or similar institution through which you hold your shares.

How do I submit a stockholder proposal for, or nominate an individual for election at, the 2022 annual meeting or related proxy materials, and what is the deadline for submitting a proposal or nominating an individual?

In order for a stockholder proposal to be properly submitted for presentation at our 2022 annual meeting and included in the proxy material for our 2022 annual meeting, we must receive written notice of the proposal at our executive offices by December 22, 2021. In order for a stockholder to nominate an individual for election to our Board, or to present a proposal of other business (other than a proposal to be included in our proxy materials), at our 2022 annual meeting, we must receive written notice of the nomination or proposal during the period beginning on November 22, 2021 and ending at 5:00 p.m., Eastern Time, on December 22, 2021. However, if

8 | ||||||||

ABOUT THE PROXY STATEMENT

our 2022 annual meeting is advanced or delayed by more than 30 days from the first anniversary of the Annual Meeting, then we must receive written notice of the nomination or proposal either (i) during the period beginning on the 150th day prior to, and ending at 5:00 p.m., Eastern Time, on the 120th day prior to, the date of our 2022 annual meeting, or (ii) the tenth day following the day on which we first publicly announce the date of our 2022 annual meeting. All proposals must contain the information specified in, and otherwise comply with, our bylaws and the federal securities laws. Proposals should be sent via registered, certified or express mail to: 3284 Northside Parkway NW, Suite 150, Atlanta, Georgia 30327, Attention: Jeffrey R. Sprain, General Counsel and Secretary.

Other Information

Our 2020 Annual Report, including financial statements audited by PricewaterhouseCoopers LLP, our independent registered public accounting firm, and PricewaterhouseCoopers LLP’s report thereon, is available at https://materials.proxyvote.com/74039L, and if you received a printed copy of this Proxy Statement, accompanies this Proxy Statement. However, the 2020 Annual Report forms no part of the material for the solicitation of proxies.

The 2020 Annual Report may also be accessed through our website at www.pacapts.com by clicking on the “Investors” link, followed by using the “Financials” dropdown and then selecting the “Annual Reports” link. In addition, our Annual Report on Form 10-K for the year ended December 31, 2020 (“2020 Form 10-K Annual Report”) is available on our website and from the SEC’s website at www.sec.gov. At the written request of any stockholder who owns our common stock as of the close of business on the record date, we will provide, without charge, paper copies of our 2020 Form 10-K Annual Report, including the financial statements and financial statement schedules, as filed with the SEC, except exhibits thereto. If requested by stockholders, we will provide copies of the exhibits for a reasonable fee. You can request copies of our 2020 Form 10-K Annual Report by following the instructions on the Notice of Internet Availability of Proxy Materials or by mailing a written request to:

Preferred Apartment Communities, Inc.

3284 Northside Parkway NW, Suite 150

Atlanta, Georgia 30327

Attention: General Counsel and Secretary

9 | ||||||||

| ||

COMMON STOCK OWNERSHIP BY DIRECTORS, EXECUTIVE OFFICERS AND PRINCIPAL STOCKHOLDERS | ||

| ||

Common Stock Ownership by Directors, Executive Officers and Principal Stockholders

Except as otherwise indicated, the following table sets forth the beneficial ownership of shares of our common stock as of March 31, 2021 for:

•our directors and nominees;

•our principal executive officer, principal financial officer and the three other most highly compensated executive officers calculated in accordance with SEC rules and regulations (collectively the “Named Executive Officers”);

•our directors and Named Executive Officers as a group; and

•each person known to us to be the beneficial owner of more than 5% of the outstanding shares of our common stock.

In accordance with SEC rules, each listed person’s beneficial ownership includes all shares of our common stock the person actually owns beneficially or of record, all shares of our common stock over which the person has or shares voting or dispositive control (such as in the capacity as a general partner of an investment fund), and all shares the person has the right to acquire within 60 days (such as shares of common stock that may be issued upon conversion of Class A Units representing Class A limited partnership interests (“Class A Units”) in Preferred Apartment Communities Operating Partnership, L.P. (our “operating partnership”), of which the Company is the general partner). Except as otherwise provided, all shares are owned directly, and the indicated person has sole voting and investment power. Unless otherwise indicated, the business address of the stockholders listed below is the address of our principal executive office, 3284 Northside Parkway NW, Suite 150, Atlanta, Georgia 30327.

| Common Stock Outstanding | ||||||||||||||

| Beneficial Owner | Shares Owned | Percentage | ||||||||||||

| The Vanguard Group | 4,851,581 | (1) | 9.43 | % | ||||||||||

| Blackrock, Inc. | 3,523,489 | (2) | 6.85 | % | ||||||||||

| Joel T. Murphy | 128,477 | (3) | * | |||||||||||

| John A. Iskason | 41,102 | (4)(5) | * | |||||||||||

| Jeffrey D. Sherman | 35,235 | (6)(7) | * | |||||||||||

| Parker Boone DuPree | 33,693 | (8)(9) | * | |||||||||||

| Michael J. Cronin | 106,700 | (10)(11) | * | |||||||||||

| Daniel M. DuPree | 280,431 | (12) | * | |||||||||||

| Steve Bartkowski | 69,305 | (13)(14) | * | |||||||||||

| John M. Cannon | 17,573 | (14) | * | |||||||||||

| Gary B. Coursey | 60,037 | (14) | * | |||||||||||

| Sara J. Finley | 19,797 | (14) | * | |||||||||||

| Howard A. McLure | 91,384 | (14)(15) | * | |||||||||||

| Timothy A. Peterson | 68,963 | (14) | * | |||||||||||

| All directors and executive officers as a group (12 persons) | 952,697 | 1.91 | % | |||||||||||

*Less than 1%

(1)As of December 31, 2020. Based solely upon information provided in a Schedule 13G/A filed with the SEC on February 10, 2021. The Vanguard Group beneficially owned 4,851,581 shares, none of which it has sole voting power with respect thereto, 33,23 shares of which it has shared voting power with respect thereto, 4,803,094 of such shares of which it has sole dispositive power with respect thereto and 48,487 shares of which it has shared dispositive power with respect thereto. The business address for The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355.

(2)As of December 31, 2020. Based solely upon information provided in a Schedule 13G/A filed with the SEC on February 5, 2021. Blackrock, Inc. beneficially owned 3,523,489 shares, 3,473,508 shares of which it has sole voting power with respect thereto and 3,523,489 shares of which it has sole dispositive power with respect thereto. Blackrock, Inc. has shared voting power and shared dispositive power over zero shares. The business address for Blackrock, Inc. is 55 East 52nd Street, New York, NY 10055.

(3)137,741 of these shares are unvested restricted common stock that will vest on June 17, 2024, 148,072 of these shares are unvested restricted common stock that will vest approximately equally on June 17, 2021, June 17, 2022, June 17, 2023 and June 17, 2024 and 109,916 of these shares are unvested restricted common stock that will vest approximately equally on March 15, 2022, March 15 2023,

11 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

March 15, 2024 and March 15, 2025. While Mr. Murphy does not have dispositive power over these shares of restricted stock until vesting, Mr. Murphy has voting control of all of these shares.

(4)20,551 of these shares represent Class A Units of our operating partnership, each of which may be exchanged for one share of our common stock, or cash, as selected by the Company.

(5)48,209 of these shares are unvested restricted common stock that will vest approximately equally on June 17, 2021, June 17, 2022, June 17, 2023 and June 17, 2024 and 37,418 of these shares are unvested restricted common stock that will vest approximately equally on March 15, 2022, March 15 2023, March 15, 2024 and March 15, 2025. While Mr. Isakson does not have dispositive power over these shares of restricted stock until vesting, Mr. Isakson has voting control of all of these shares.

(6)3,405 of these shares represent Class A Units of our operating partnership, each of which may be exchanged for one share of our common stock, or cash, as selected by the Company.

(7)17,218 of these shares are unvested restricted common stock that will vest approximately equally on June 17, 2021, June 17, 2022, June 17, 2023 and June 17, 2024 and 12,862 of these shares are unvested restricted common stock that will vest approximately equally on March 15, 2022, March 15 2023, March 15, 2024 and March 15, 2025. While Mr. Sherman does not have dispositive power over these shares of restricted stock until vesting, Mr. Sherman has voting control of all of these shares.

(8)1,022 of these shares represent Class A Units of our operating partnership, each of which may be exchanged for one share of our common stock, or cash, as selected by the Company.

(9)17,218 of these shares are unvested restricted common stock that will vest approximately equally on June 17, 2021, June 17, 2022, June 17, 2023 and June 17, 2024 and 11,693 of these shares are unvested restricted common stock that will vest approximately equally on March 15, 2022, March 15 2023, March 15, 2024 and March 15, 2025. While Mr. Boone DuPree does not have dispositive power over these shares of restricted stock until vesting, Mr. Boone DuPree has voting control of all of these shares.

(10)28,607 of these shares represent Class A Units of our operating partnership, each of which may be exchanged for one share of our common stock, or cash, as selected by the Company.

(11)9,642 of these shares are unvested restricted common stock that will vest approximately equally on June 17, 2021, June 17, 2022, June 17, 2023 and June 17, 2024 and 7,951 of these shares are unvested restricted common stock that will vest approximately equally on March 15, 2022, March 15 2023, March 15, 2024 and March 15, 2025. While Mr. Cronin does not have dispositive power over these shares of restricted stock until vesting, Mr. Cronin has voting control of all of these shares.

(12)51,078 of these shares represent Class A Units of our operating partnership, each of which may be exchanged for one share of our common stock, or cash, as selected by the Company.

(13)1,223 of these shares represent Class A Units of our operating partnership, each of which may be exchanged for one share of our common stock or cash, as selected by the Company.

(14)11,019 of these shares are unvested shares of restricted common stock that will vest on the earlier of June 17, 2021 or the date of the Annual Meeting.

(15)76,729 of these shares are owned by the Howard Alex McLure Revocable Trust, of which Mr. McLure is the sole trustee and sole beneficiary.

12 | ||||||||

| |||||||||||

PROPOSAL NO. 1 ELECTION OF DIRECTORS | |||||||||||

| |||||||||||

| Proposal No. 1 | Our Board of Directors recommends a vote FOR all of the nominees named below. | ||||

| Election of Directors | |||||

Our charter and by-laws provide that the number of our directors may be established by a majority of the entire Board but may not be fewer than two nor more than ten. We currently have eight directors, including six independent directors. The term of each director expires at the Annual Meeting and when his or her respective successor is duly elected and qualified.

Daniel M. DuPree, our Executive Chairperson of the Board, has decided to retire and not stand for re-election as a member of the Board at the Annual Meeting. Mr. DuPree will continue to serve on our Board as our Executive Chairperson of the Board until his term expires on the date of the Annual Meeting. Mr. DuPree informed the Board that his decision to retire from and not stand for re-election to the Board did not arise from any dispute on any matter relating to the Company’s operations, policies or practices.

Upon the recommendation of our Nominating and Corporate Governance Committee of the Board (which is comprised solely of independent directors) the Board has nominated incumbent directors Steve Bartkowski, John M. Cannon, Gary B. Coursey, Sara J. Finley, Howard A. McLure, Joel T. Murphy and Timothy A. Peterson to stand for re-election at the Annual Meeting and to hold office until the later of our annual meeting of stockholders in 2022 and when a successor is elected and qualified. The Board has not yet nominated someone to fill the vacancy created by Mr. DuPree's retirement, and the Board plans to reevaluate the size of the Board following the Annual Meeting. Please note that proxies cannot be voted for a greater number of persons than the number of nominees named.

We expect that each nominee for election as a director will be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees. Since this is an uncontested election, each director will be elected by a majority of the votes cast, in person or by proxy, at the Annual Meeting, assuming a quorum is present. Abstentions and broker non-votes will not count as votes cast on the proposal and will not affect the outcome of the vote.

Nominees for Election

We have provided below certain information about each nominee for election as a director.

Steve Bartkowski Independent Director  Age 68 Director Since 2011 Committees: Nominating and Corporate Governance | Steve Bartkowski was elected to our Board as a director, effective as of April 31, 2011. Mr. Bartkowski was an All American in both baseball and football at the University of California at Berkeley. In 1975, he was the first pick in the NFL draft, selected by the Atlanta Falcons, serving as their starting quarterback for the following 11 seasons. Mr. Bartkowski was the NFL’s rookie of the year in 1975, the NFL’s highest rated quarterback for three years, and earned All-Pro honors for his efforts in 1980 and 1981. He was the most valuable player in the NFC in 1980. Mr. Bartkowski led the Falcons to their first playoff game in 1978 and again in 1980 and 1982. Mr. Bartkowski played his last season in the NFL for the Los Angeles Rams and retired from professional football in 1987. Following retirement from professional football, Mr. Bartkowski produced and hosted the popular TNN outdoor television series, Backroad Adventures with Steve Bartkowski from 1994 – 1996. He was also the host of a top rated outdoor television series, Suzuki’s Great Outdoors with Steve Bartkowski, on ESPN from 1990 – 1993. From 2000 until his retirement in late 2017, Mr. Bartkowski worked in business development for DPR Construction (“DPR”), a global commercial contractor and construction management company. Since August 2016, Mr. Bartkowski has served as a fly-fishing lodge manager. Since December 2017, Mr. Bartkowski has served as a consultant to DPR. He is a well-known motivational speaker on personal success and excellence, giving speeches throughout the United States. | ||||

Skills and Qualifications We believe that Mr. Bartkowski’s experience in business development for DPR and his previous leadership and management experience, both in professional football and television, make him well qualified to serve as a member of our Board. | |||||

14 | ||||||||

PROPOSAL NO. 1 ELECTION OF DIRECTORS

John M. Cannon Independent Director  Age 58 Director Since 2020 Committees: Audit, Compensation | John M. Cannon was elected to our Board as a director, effective as of May 7, 2020. Since December 2019, Mr. Cannon has served as Executive Vice President of Community Preservation Corporation (“CPC”), a non-profit corporation, where his primary responsibility is serving as President of CPC’s lending subsidiary, CPC Mortgage Company LLC, a full service business line with national licenses across its Freddie Mac, Fannie Mae, and the Federal Housing Authority’s (“FHA”) suite of products. From June 2019 to December 2019, Mr. Cannon served as a consultant to Arbor Realty Trust, where he provided strategic advice to executive management on government-sponsored enterprise (“GSE”) reform, origination activities and mortgage banker recruitment. Mr. Cannon served as Senior Vice President of Freddie Mac in New York from 2012 to 2019 where he built and managed a highly successful team, and was responsible for overall multifamily origination volume, and production strategy. During his tenure at Freddie Mac he oversaw annual production that grew from $28 billion in 2012 to more than $75 billion in 2019. From 1984 to 2011, Mr. Cannon held senior leadership positions at Berkadia Commercial Mortgage LLC (“Berkadia”) and various affiliated and predecessor entities including Capmark and GMAC Commercial Mortgage, primarily coordinating and leading originations of conventional and Housing and Urban Development product lines. Mr. Cannon received his undergraduate degree in International Affairs from Lafayette College in 1984 and a Masters of Science from Drexel University in 1990. | ||||

Skills and Qualifications We believe that Mr. Cannon’s skills, knowledge and over 35 years of extensive experience in commercial banking and agency lending, including his previous experience as Senior Vice President of Freddie Mac, along with his leadership role for a non-profit organization make him well qualified to serve as a member of our Board. | |||||

| Director Since 2019 | |||||

Gary B. Coursey Independent Director  Age 81 Director Since 2010 Committees: Compensation, Nominating and Corporate Governance Other Current Directorships: Boys & Girls Clubs of Metro Atlanta, Inc. and Ronald McDonald House of Atlanta | Gary B. Coursey was elected to our Board as a director on December 3, 2010 as one of the three charter members of our Board. Mr. Coursey has over 50 years of experience in the architectural profession and has managed the completion of thousands of projects representing over $3 billion in construction costs. He founded Gary B. Coursey & Associates Architects, Inc., a LEED certified firm, in 1971 and has built an innovative architectural practice focused on a high level of creativity and design. Mr. Coursey has overseen the design of over 300,000 units of multi-family housing, personal care facilities, athletic facilities, office buildings, industrial buildings, financial institutions, medical facilities, military facilities, restaurants, shopping centers and churches. In January 2015, Mr. Coursey was elected to the College of Fellows of the American Institute of Architects for his notable contributions to the advancement of the profession of architecture. Mr. Coursey has experience throughout the United States, as well as internationally. Mr. Coursey also serves on the Boards of the Ronald McDonald Houses of Atlanta and the Boys & Girls Clubs of Metro Atlanta. He serves on the Advisory Board for The School of Design at Georgia Institute of Technology. Mr. Coursey received his Bachelor of Science in Architecture from the Georgia Institute of Technology and his Associate of Building Construction from Kennesaw State University. | ||||

Skills and Qualifications We believe that Mr. Coursey’s experience as the founder of Gary P. Coursey & Associates Architects, Inc. and his related architectural design experience make him well qualified to serve as a member of our Board. | |||||

15 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

Sara J. Finley Independent Director  Age 61 Director Since 2019 Committees: Compensation, Nominating and Corporate Governance Other Current Directorships: Tivity Health, Inc., Studio Bank, and Oak Paper Products Company, Inc. | Sara J. Finley was elected to our Board as a director, effective as of May 2, 2019. Ms. Finley is the principal of Threshold Corporate Consulting, LLC, a consulting services firm that she founded in 2015. From 2009 to 2011, Ms. Finley served as senior vice president and general counsel of CVS Health Corporation, formerly known as CVS Caremark Corporation (including its predecessor companies, “CVS Caremark”), a publicly traded pharmacy services company (NYSE: CVS). From 2007 to 2009, Ms. Finley served as senior vice president and general counsel of the pharmacy benefits management division of CVS Caremark, and from 2011 until her retirement from the company in 2015, Ms. Finley served as a senior legal advisor for CVS Caremark. From 1998 to 2007, Ms. Finley served as senior vice president, assistant general counsel and corporate secretary of Caremark Rx, Inc., a publicly traded company and a predecessor of CVS Caremark. Previously, she was a partner at the law firm Kutak Rock in Atlanta, Georgia. Ms. Finley graduated from the University of Alabama in 1982 and received her law degree from Vanderbilt University in 1985. She currently serves on the board of directors of Tivity Health, Inc., a publicly traded provider of fitness and health improvement programs based in Franklin, Tennessee (NASDAQ: TVTY), Studio Bank, a state-chartered community bank based in Nashville, Tennessee and Oak Paper Products Company, Inc., a privately-held paper products, packaging and janitorial supply company based in Los Angeles, California. She currently serves on several Nashville non-profit boards, including The Center for Nonprofit Management, The Community Foundation of Middle Tennessee, Leadership Nashville and the Vanderbilt Law School Board of Advisors. | ||||

Skills and Qualifications We believe Ms. Finley’s skills, experience and qualifications with over 15 years of executive management experience for industry-leading health care companies; board leadership roles for corporate and non-profit organizations; and extensive experience as a senior legal advisor for mergers and acquisitions, health care regulatory matters, corporate governance, enterprise risk management, compliance, and other matters make her well qualified to serve as a member of our Board. | |||||

Howard A. McLure Lead Independent Director  Age 64 Director Since 2011 Committees: Audit, Compensation Other Current Directorships: Vituro Health, LLC | Howard A. McLure was elected to our Board as a director, effective as of March 31, 2011. In addition, as of January 1, 2014, Mr. McLure has been designated as our lead director by the independent directors to preside over executive sessions of non-management directors. From September 2012 until its sale to a third party in November 2014, Mr. McLure served as Executive Chairman of the Board of Change Healthcare Corporation, a provider of healthcare cost transparency services to self-insured employers who sponsor high deductible health care benefit plans. From May 2011 until September 2012, Mr. McLure served as Chairman and Chief Executive Officer of Change Healthcare Corporation. From March 2007 until November 2009, he served as Executive Vice President of CVS Caremark Corporation (NYSE: CVS) and President of Caremark Pharmacy Services, a division of CVS Caremark Corporation, where he was responsible for all sales and operations of the division. From June 2005 until March 2007, Mr. McLure served as Senior Executive Vice President and Chief Operating Officer of Caremark Rx, Inc., listed on the New York Stock Exchange prior to the closing of the CVS Corp. — Caremark Rx Inc. merger in March 2007. From May 2000 to June 2005, Mr. McLure served as Executive Vice President and Chief Financial Officer of Caremark Rx, Inc. From June 1998 to May 2000, Mr. McLure served as Senior Vice President and Chief Accounting Officer of Caremark Rx, Inc. From 1995 to 1998, Mr. McLure was Senior Vice President and Controller of Magellan Health Services, Inc. (now known as Magellan Health, Inc.) (NASDAQ: MGLN), a specialty managed healthcare company. Mr. McLure has also served on the Board of Vituro Health, LLC since 2018. Mr. McLure received his Bachelors of Business Administration in Accounting from the University of Georgia in 1979. Mr. McLure formerly was licensed as a Certified Public Accountant and a member of the American Institute of Certified Public Accountants. | ||||

Skills and Qualifications We believe that Mr. McLure’s previous experience as Executive Chairman and Chief Executive Officer of Change Healthcare Corporation, Executive Vice President of CVS Caremark Corporation and Senior Executive Vice President, Chief Operating Officer and Chief Financial Officer of Caremark Rx, Inc. make him well qualified to serve as a member of our Board. | |||||

16 | ||||||||

PROPOSAL NO. 1 ELECTION OF DIRECTORS

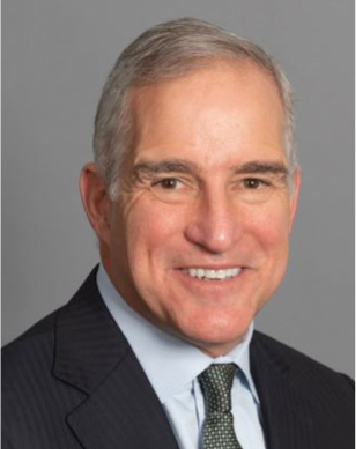

Joel T. Murphy President, Chief Executive Officer and Director  Age 62 Director Since 2019 Other Current Directorships: The Orvis Company | Joel T. Murphy was elected to our Board as a director, effective as of May 2, 2019 and has served as the Company’s Chief Executive Officer since January 1, 2020 and as the Company’s President and Chief Executive Officer since March 4, 2020. Prior to becoming the Company’s Chief Executive Officer and President, Mr. Murphy was Chief Executive Officer of New Market Properties, LLC, a wholly-owned subsidiary of the Company’s operating partnership, since September 1, 2014. In addition, Mr. Murphy served as the chairperson of Preferred Apartment Advisors, LLC’s (the “Manager”) Investment Committee from April 2018 until January 31, 2020. Mr. Murphy also served as a member of our Board from September 1, 2014 to May 7, 2015. Mr. Murphy has over 30 years of experience as an executive officer, principal and advisor in retail and multifamily projects, portfolios and investments. From January 2009 to present, Mr. Murphy served as Chief Executive Officer of Murphy Capital and Advisory Group LLC; from May 2010 to present, as a Managing Member of Paces Andrews Associates; from January 2011 to December 2013, as Principal of Iron Tree Capital LLC; and from August 2012 to July 2014, as Chief Executive Officer of Iron Tree Retail LLC. From 1992 to 1995, Mr. Murphy served as the Director of Development of Cousins Properties Incorporated and from 1995 to 2008, he served as President of the Retail Division of Cousins Properties Incorporated, as well as a member of its investment committee. From 1988 to 1992, he was a partner at New Market Development Company, Ltd., a shopping center management and development company, which owned and managed retail properties primarily in the Mid-Atlantic and Southeast regions and Texas. Mr. Murphy also currently serves on the board of directors of The Orvis Company where he chairs the Governance and Nominating Committee and serves, and has served, on other boards of directors and related committees. Murphy received his Bachelor of Arts degree from the University of North Carolina Chapel Hill, Phi Beta Kappa and his Juris Doctorate from the University of Georgia, where he was a member of the Law Review. | ||||

Skills and Qualifications We believe that Mr. Murphy’s previous experience at Cousins Properties Incorporated and Iron Tree Capital LLC and Iron Tree Retail LLC, along with his experience on the board of directors of The Orvis Company and board leadership roles for non-profit organizations, make him well qualified to serve as a member of our Board. | |||||

Timothy A. Peterson Independent Director  Age 55 Director Since 2011 Committees: Audit, Nominating and Corporate Governance | Timothy A. Peterson was elected to our Board as a director, effective as of March 31, 2011. Since June 2019, Mr. Peterson has served as the Chief Operating Officer and Chief Investment Officer of The Altman Companies, Inc., where his primary responsibilities are overseeing the operations of the development, construction and property management companies. Prior to becoming Chief Operating Officer, he was Chief Financial Officer of the Altman Companies since 2003 and Chief Investment Officer since 2013. Mr. Peterson was Chief Financial Officer for Keystone Property Trust from 1998 to 2002, becoming Executive Vice President from 2002 to 2003. From 1989 to 1998, Mr. Peterson served in a series of positions for Post Properties, including as Executive Vice President. Mr. Peterson was responsible for day-to-day coordination with the accountants, attorneys and investment bankers involved in completing the initial public offering of Post Properties in July 1993. Throughout his career, Mr. Peterson has overseen in excess of $5 billion of real estate financings using public stock sales, secured and unsecured debt, tax-exempt and taxable bond issuances, private placements and joint ventures. Mr. Peterson received his undergraduate degree in Accounting from the University of Florida in 1985 and his MBA in Finance from the University of Florida in 1987. Mr. Peterson was licensed as a Certified Public Accountant. | ||||

Skills and Qualifications We believe that Mr. Peterson’s previous experience as Chief Financial Officer of Keystone Property Trust and Executive Vice President of Post Properties, combined with his financial reporting, accounting and capital markets experience, make him well qualified to serve as a member of our Board. | |||||

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” ALL OF THE NOMINEES NAMED ABOVE. | ||

17 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

Biographical Information Regarding Executive Officers Who Are Not Nominated for Election as a Director

| John A. Isakson Chief Financial Officer | ||||

John A. Isakson, 50, has served as Chief Financial Officer of the Company since July 2018. Prior to that time, he served as Executive Vice President and Chief Capital Officer of the Company from 2014 until August 2018. He has also served as Chief Executive Officer of Main Street Apartment Homes, LLC, an indirect subsidiary of the Company, since its commencement of operations in 2015. Mr. Isakson is now employed by a subsidiary of the Company as of February 1, 2020. Prior to being employed by a subsidiary of the Company, Mr. Isakson was employed by the Manager from April 2011 to January 2020. Prior to his role at the Company, he was Chief Executive Officer of Williams Asset Management, an investment and asset management firm for a private equity fund he co-founded with John Williams, from 2006 to December 2013. Mr. Isakson co-founded Tarpon Development, LLC, serving as CEO from 1999 to 2006. He has a broad depth of knowledge of both the private and institutional side of the real estate industry in acquisitions, dispositions, corporate and property level finance, investor relations and asset management. Mr. Isakson served on the Board of Directors of Legacy Housing Corporation, the fourth largest producer of manufactured homes in the United States. He also serves on the Dean′s Advisory Council at Tulane University. He has served on the Arthritis Foundation′s national board of directors, as well as the board for the Georgia chapter in various positions. Mr. Isakson earned a bachelor’s degree in Economics at Tulane University in 1992, and his master’s degree in Economics at the University of Georgia in 1993. | |||||

| Jeffrey D. Sherman | ||||

Jeffrey D. Sherman, 41, has served as President - Multifamily since March 2020. Prior to that time, Mr. Sherman served as Senior Vice President From 2016 to 2017 and as Executive Vice President from July 2017 to February 2020, both in our multifamily division. Mr. Sherman has overseen the acquisition and development of more than $2.5 billion of multifamily and mixed-use projects across the Southeast and Midwest. Additionally, Mr. Sherman has structured mezzanine debt for over $2 billion in ground-up multifamily development. His experience encompasses a broad array of product types including conventional multifamily, student, LIHTC and condominiums. Mr. Sherman earned a Bachelor's Degree in finance and management information systems from the University of Georgia in 2002 and earned a Master’s degree in real estate from Georgia State University in 2009. | |||||

| Parker Boone DuPree | ||||

Parker Boone DuPree, 33, has served as President - Office since March 2020. Prior to that time, Mr. DuPree was President of Preferred Office Properties, a wholly-owned indirect subsidiary of the Company, from February 2016 to February 2020. Prior to joining the company, Mr. DuPree served on the investments team at Cousins Properties (NYSE: CUZ), a $5B real estate investment trust based in Atlanta, Georgia. While at Cousins, Mr. DuPree executed more than $2 billion of Class A office acquisitions and $600 million of office and mixed-use development starts across the Southeast and Texas. Prior to joining Cousins, Mr. DuPree worked with Boston-based real estate fund and investment advisor Roseview Partners. Mr. DuPree is the son of our current Board chairperson, Daniel M. DuPree. Mr. DuPree earned a Bachelor of Science degree in Finance from Wake Forest University in May 2010. | |||||

18 | ||||||||

PROPOSAL NO. 1 ELECTION OF DIRECTORS

| Michael Aide | ||||

Michael Aide, 47, has served as President - Retail since March 2020. Prior to that, Mr. Aide served as a Senior Vice President and Director of Investments for New Market Properties, LLC, the Company's retail subsidiary from March 2015 to February 2020. As the business unit leader for New Market, Mr. Aide is responsible for developing and implementing strategic initiatives, directing the deployment of capital for new investments, overall company and portfolio performance, and providing leadership to the New Market team. During his time with the Company, Mr. Aide led the company’s retail portfolio expansion from 700,000 square feet and 10 grocery-anchored shopping centers to more than 6.2 million square feet and over 50 centers with a total investment of over $1.2 billion. Mr. Aide earned a Bachelor of Arts in Economics from Hampton Sydney College in 1996. | |||||

| Michael J. Cronin Executive Vice President | ||||

Michael J. Cronin, 66, has served as Executive Vice President of the Company since August 2012. In addition, Mr. Cronin has served as Chief Accounting Officer and Treasurer of the Company since our formation in 2009. Mr. Cronin, who is now employed by a subsidiary of the Company as of February 1, 2020, served in various capacities since first joining Williams Realty Advisors, LLC (“WRA”) in December 2005, most recently as Chief Financial Officer from October 2008 until December 2017. Prior to being employed by a subsidiary of the Company, Mr. Cronin was employed by the Manager from April 2011 to January 2020. Prior to joining WRA, Mr. Cronin served as Vice President of Morgan Stanley Real Estate Advisors from February 2004 to December 2005. Mr. Cronin was the Chief Financial Officer of Hatfield Philips, a commercial real estate company, for three years prior to joining Morgan Stanley Real Estate Advisors. In total, Mr. Cronin has over 27 years of accounting, reporting and finance experience in the real estate field. He is a Certified Public Accountant and earned his Bachelor of Business Administration from the University of Georgia in 1978 and earned a Master′s degree in Accounting from the University of Georgia in 1979. | |||||

| Jeffrey R. Sprain General Counsel and Secretary | ||||

Jeffrey R. Sprain, 49, has served as General Counsel and Secretary of the Company since 2012, and has served as Executive Vice President since 2017. Prior to that time, he served as Legal Counsel and Secretary since the Company′s formation in 2009. Mr. Sprain is now employed by a subsidiary of the Company as of February 1, 2020. Prior to being employed by a subsidiary of the Company, Mr. Sprain was employed by the Manager from April 2011 to January 2020. Mr. Sprain has over 17 years of experience in the real estate industry, including serving as legal counsel of Williams Realty Advisors, LLC from 2006 to December 2017 and for Corporate Holdings, LLC from 2006 to December 2018. From November 2001 to March 2005, Mr. Sprain was an associate at the law firm Faegre & Benson, LLP. From April 2005 until May 2006, Mr. Sprain was an associate at the law firm Kilpatrick Stockton, LLP. From 1994 to 1998 he was an officer on active duty in the United States Air Force where he was a research scientist. Mr. Sprain served as the chair of the Board of Directors of the Andrew P. Stewart Center in 2019 and 2020 and has served on the Board of Directors for the Minnesota Justice Foundation and the Loan Repayment Assistance Program of Minnesota. Mr. Sprain received his Juris Doctorate from the University of Minnesota in 2001 where he graduated magna cum laude and order of the coif, and his BS from University of Wisconsin-Madison in electrical and computer engineering in 1993. | |||||

Director Compensation

Our compensation committee (the “Compensation Committee”) designs our director compensation with the goals of attracting and retaining highly qualified individuals to serve as independent directors and fairly compensating them for their time and efforts. Because of our qualification and operation as a real estate investment trust, or REIT, for

19 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

U.S. federal income tax purposes and the unique attributes of a REIT, service as an independent director on our Board requires broad corporate and business expertise relevant to the fields of real estate and real estate investing.

In 2020, we compensated each of our independent directors with fees as follows:

•Annual fees of $80,000, paid in restricted common stock; and

•Committee service fees of $40,000 paid in cash, in quarterly installments in arrears.

In addition, we compensated the chairs/co-chairs of certain committees with an additional annual fee in cash as follows:

•audit committee (the "Audit Committee") - $20,000;

•nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”) - $12,500; and

•compensation committee (the “Compensation Committee”) - $15,000.

Finally, we compensated our Lead Independent Director with an additional annual fee of $20,000.

All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the Board and committees thereof. If a director is also one of our officers, we will not pay that director any compensation for services rendered as a director. We may issue shares of our common stock pursuant to our 2019 Stock Incentive Plan in lieu of paying an independent director annual fees and/or meeting fees in cash.

All annual fees paid to our independent directors in 2020 were paid in shares of restricted common stock under our 2019 Stock Incentive Plan which vest annually on the earlier of one year from grant or the Company's next annual meeting. We currently expect that the annual fees owed to our independent directors will be paid in restricted shares of our common stock under our 2019 Stock Incentive Plan through our next annual meeting in 2022, that the fees for committee chairs will be paid in cash following the Annual Meeting, and that fees paid for committee service will be paid in cash in equal quarterly installments in arrears. In determining the number of shares granted for the annual fees paid to our independent directors for 2020-2021, our Compensation Committee used the volume weighted average price of our common stock for the 90 calendar days immediately prior to the date of the grant on June 17, 2020 to determine the number of shares to grant. If we elect to pay our independent directors in cash, subject to the consent of the Compensation Committee, each independent director may elect to receive his or her annual fees and/or meeting fees in the form of shares of our common stock or a combination of shares of our common stock and cash. The vesting schedule for fees paid to our independent directors in shares of our common stock will be determined by the Compensation Committee in connection with such award. None of the members of the Board will be entitled to any fees for serving on the Board except as set forth above or unless the Board unanimously determines otherwise.

Compensation of our directors for the year ended December 31, 2020 was as follows:

NAME(1) | FEES EARNED OR PAID IN CASH ($)(2) | STOCK AWARDS ($)(3) | ALL OTHER COMPENSATION ($) | TOTAL ($) | |||||||||||||

| Steve Bartkowski | 42,500 | 88,703 | 10,918 | (4) | 142,121 | ||||||||||||

| John M. Cannon | 20,000 | 88,703 | — | 108,703 | |||||||||||||

| Gary B. Coursey | 30,000 | 88,703 | — | 118,703 | |||||||||||||

| Sara J. Finley | 45,000 | 88,703 | 5,218 | (5) | 138,921 | ||||||||||||

| William J. Gresham, Jr. | 20,000 | — | — | 20,000 | |||||||||||||

| Howard A. McLure | 50,000 | 88,703 | 10,918 | (6) | 149,621 | ||||||||||||

| John M. Wiens | 10,000 | — | — | 10,000 | |||||||||||||

| Timothy A. Peterson | 50,000 | 88,703 | — | 138,703 | |||||||||||||

Daniel M. DuPree(7) | — | — | 284,496 | 284,496 | |||||||||||||

(1)Mr. Murphy, our President and Chief Executive Officer during 2020, is not included in this table as he is a Named Executive Officer of the Company and did not receive compensation for service as a director of the Company in 2020. All compensation paid to Mr. Murphy for the services he provided to the Company is reflected in the Summary Compensation Table.

20 | ||||||||

PROPOSAL NO. 1 ELECTION OF DIRECTORS

(2)Represents cash payments for directors serving as the chair of certain committees, for annual committee service and service as lead independent director.

(3)The amounts included in this column represent the aggregate grant date fair value of each award, computed in accordance with Financial Accounting Standard Board - Accounting Standards Codification Topic 718 (“ASC 718”). On June 17, 2020, we issued 11,019 restricted shares of common stock to each of our independent directors as compensation for annual service on our Board; the grant date fair value of each restricted share of common stock was $8.05 based on the closing price of our common stock on the date prior to the date of grant. Each share of restricted common stock will vest on the earlier of June 17, 2021 or the date of the Annual Meeting. As of December 31, 2020, each independent directors held 11,019 shares of unvested restricted common stock.

(4)This amount includes $10,918 paid by the Company for the employer side of insurance premiums for health insurance provided to Mr. Bartkowski by the Company.

(5)This amount includes $5,218 paid by the Company for the employer portion of insurance premiums for health insurance provided to Ms. Finley by the Company.

(6)The amount includes $10,918 paid by the Company for the employer portion of insurance premiums for health insurance provided to Mr. McLure by the Company.

(7)All amounts disclosed for Mr. DuPree were paid as regular compensation as our employee and not director compensation. It also includes $21,317 in car lease payments and $11,712 for a supplemental health care plan.

21 | ||||||||

| |||||||||||

CORPORATE GOVERNANCE | |||||||||||

| |||||||||||

Corporate Governance

Board of Directors and Committees

The Board is elected by our stockholders and represents stockholder interests in the long-term success of the Company. Except for matters voted upon by stockholders, the Board acts as the ultimate decision maker of the Company. While the Board functions in an oversight capacity, management is responsible for the daily operations of the Company. A majority of our Board members are “independent,” as determined by the requirements of the NYSE and the regulations of the SEC. Our directors keep informed about our business by attending meetings of our Board and its committees and through supplemental reports and communications. Our independent directors will meet regularly in executive session without the presence of our corporate officers or non-independent directors.

| NAME | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||||||

| Steve Bartkowski | l | ||||||||||

| John M. Cannon | ¡ | ¡ | |||||||||

| Gary B. Coursey | ¡ | ¡ | |||||||||

| Daniel M. DuPree | |||||||||||

| Sara J. Finley | l | ¡ | |||||||||

| Howard A. McLure | ¡ | ¡ | |||||||||

| Joel T. Murphy | |||||||||||

| Timothy A. Peterson | l | ¡ | |||||||||

l – Chair ¡ – Member

AUDIT COMMITTEE Timothy A. Peterson (Chairperson) Howard A. McLure John M. Cannon | MEETINGS IN 2020: During 2020, the Audit Committee held 5 meetings. | ||||

RESPONSIBILITIES Our Board has adopted a charter for the Audit Committee that sets forth its specific functions, powers, duties and responsibilities. The Audit Committee, by approval of at least a majority of the members, will: •select the independent registered public accounting firm to audit our annual financial statements; •review with the independent registered public accounting firm the plans and results of the audit engagement; •approve the audit and non-audit services provided by the independent registered public accounting firm; •review the independence of the independent registered public accounting firm and consider the range of audit and non-audit fees; •review the adequacy of our internal accounting controls; and •review and approve any conflict of interest transactions. The Audit Committee will have additional powers, duties and responsibilities as may be delegated to it by the Board. Mr. Peterson serves as chairperson of the Audit Committee and as the “audit committee financial expert,” as defined in applicable SEC rules. The other two members of the Audit Committee also meet the standard of “audit committee financial expert,” as defined in applicable SEC rules. | |||||

23 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

COMPENSATION COMMITTEE Sara J. Finley (Chairperson) Gary B. Coursey Howard A. McLure John M. Cannon | MEETINGS IN 2020: During 2020, the Compensation Committee held 5 meetings. | ||||

RESPONSIBILITIES Our Board has adopted a charter for the Compensation Committee that sets forth its specific functions, powers, duties and responsibilities. Among other things, the Compensation Committee charter calls upon the Compensation Committee to: •review and approve on an annual basis the corporate goals and objectives relevant to chief executive officer compensation, evaluate our chief executive officer’s performance in light of such goals and objectives and, either as a committee or together with our independent directors (as directed by the Board), determine and approve the remuneration of our chief executive officer based on such evaluation; •review and oversee management’s annual process, if any, for evaluating the performance of our officers and review and approve on an annual basis the remuneration of our officers; •oversee our stock incentive plan; and •determine from time to time the remuneration for our independent directors. See “Compensation Discussion and Analysis” for a description of the processes and procedures of the Compensation Committee and for additional information regarding the Compensation Committee’s role and management’s role in determining compensation for executive officers and directors. Actions were also taken during the year by written consent. | |||||

24 | ||||||||

CORPORATE GOVERNANCE

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Steve Bartkowski (Chairperson) Gary B. Coursey Sara J. Finley Timothy A. Peterson | MEETINGS IN 2020: During 2020, the Nominating and Corporate Governance Committee held 6 meetings. | ||||

RESPONSIBILITIES The Nominating and Corporate Governance Committee was formed to establish and implement our corporate governance practices and to nominate individuals for election to the Board. Our Nominating and Corporate Governance Committee operates pursuant to a written charter adopted by our Board. Among other things, the committee charter calls upon the Nominating and Corporate Governance Committee to: •assist the Board by identifying individuals qualified to become Board members, consistent with criteria approved by the Board and Nominating and Corporate Governance Committee; •recommend that the Board select the director nominees for each annual meeting of stockholders and the committee nominees; •annually review and reassess corporate governance principles, codes of conduct and compliance mechanisms applicable to the Company, including the Code of Business Conduct and Ethics; •provide general oversight in the evaluation of the Board and each committee; and •take a leadership role in shaping the Company’s corporate governance policies. | |||||

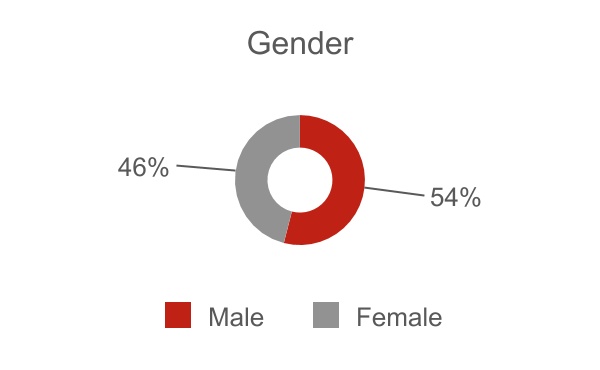

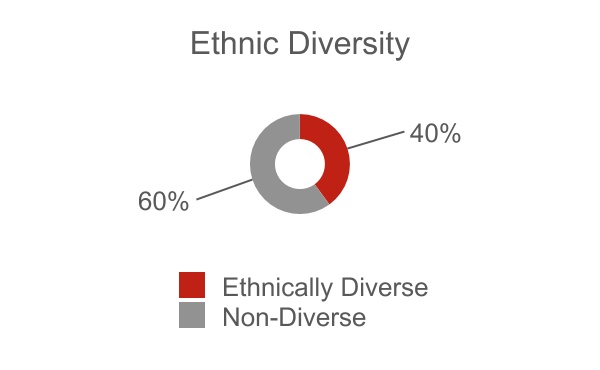

On an annual basis, the Nominating and Corporate Governance Committee evaluates the Board of Directors’ as a whole, and individual directors’ effectiveness, and identifies any areas in which the Board of Directors would be better served by adding new members with different skills, backgrounds or areas of experience. The Board of Directors considers director candidates, including those nominated by stockholders, based on a number of factors including: whether the board member will be “independent,” as such term is defined by the NYSE listing standards; whether the candidate possesses the highest personal and professional ethics, integrity and values; whether the candidate contributes to the overall diversity of the Board of Directors; and whether the candidate has an inquisitive and objective perspective, practical wisdom and mature judgment. Candidates are also evaluated on their understanding of our business, experience and willingness to devote adequate time to carrying out their duties. The Nominating and Corporate Governance Committee also monitors the mix of skills, experience and background in an effort to maintain a Board of Directors that is comprised of individuals who can effectively perform the Board’s functions. We do not have a formal diversity policy, but the Nominating and Corporate Governance Committee does consider certain diversity characteristics when nominating director candidates to the Board of Directors, including differences of viewpoint, professional experience, education, skill, other personal qualities and attributes, race, gender, and national origin. We have not adopted a specific policy regarding the consideration of director nominees recommended to our Nominating and Corporate Governance Committee by stockholders. The Company plans to implement a policy as soon as it receives its first director nominee from stockholders. The Board views it as appropriate to defer developing a formal policy until such time as it receives its first stockholder nominee. Stockholders who wish to recommend nominees for consideration by the committee may submit their nominations in writing to our Secretary at the address provided in this Proxy Statement. The committee may consider these stockholder recommendations when it evaluates and recommends nominees to the Board for submission to the stockholders at each annual meeting. | |||||

25 | ||||||||

PREFERRED APARTMENT COMMUNITIES 2021 PROXY STATEMENT

Independent Directors

Our Board has determined that each of our independent directors is independent within the meaning of the applicable (i) requirements set forth in the Securities and Exchange Act of 1934, as amended, (the “Exchange Act”) and the applicable SEC rules, and (ii) rules of the NYSE. To be considered independent under the NYSE rules, the Board must determine that a director does not have a material relationship with us (either directly, or as a partner, stockholder or officer of an organization that has a relationship with any of those entities). The Board also considered the enhanced independence requirements of the NYSE applicable to members of the Compensation Committee and the enhanced independence requirements of Rule 10A-3 of the Exchange Act applicable to members of the Audit Committee.

Director Stock Ownership Guidelines