Form PRE 14A First Northwest Bancorp For: May 25

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

FIRST NORTHWEST BANCORP

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed

| |||

Table of Contents

Table of Contents

LETTER FROM OUR PRESIDENT AND CEO

April 15, 2021

DEAR SHAREHOLDER:

On behalf of the Board of Directors and management of First Northwest Bancorp, we are pleased to invite you to the 2021 Annual Meeting of Shareholders. This year’s meeting will be held virtually at 4:00 p.m. (Pacific Time) on Tuesday, May 25, 2021. While hoped to hold an in-person meeting this year, the ongoing pandemic forced us to limit this year’s meeting to virtual-only. We hope to return to an in-person, or hybrid, meeting format for the 2022 Annual Meeting of Shareholders.

The attached Proxy Statement discusses each matter expected to be voted on at the Annual Meeting of Shareholders in depth. The Board of Directors and management team encourage you to attend the meeting virtually. In addition to voting on the proposed items, you will have the opportunity to hear a brief report on current operations and have your questions and comments addressed afterward. Whether or not you participate in the Annual Meeting, it is important that your shares be represented and voted. We urge you to promptly vote and submit your proxy (1) via the Internet, (2) by phone, or (3) if you received your proxy materials by mail, by signing, dating, and returning the enclosed proxy card or voting instruction form in the envelope provided for your convenience.

As we are all keenly aware, the past year has presented unprecedented social and business challenges around the world. We are humbled and appreciative of the opportunities First Northwest Bancorp has had during these complex times to support our communities and help overcome the difficulties they face. During these challenging times, the Board and executive leadership worked to ensure that First Northwest Bancorp upheld its commitments to our employees, customers, the communities we serve, and of course our shareholders. With a focus on supporting these stakeholders, First Northwest Bancorp leveraged strong positions to produce another record year for financial performance and delivered strong results for our shareholders. In seeking to also support shareholder perspectives, our Board Chair and members of management engaged with a cross-section of shareholders, and the feedback from those conversations helped inform the Board’s decision to ask for shareholder approval to declassify the Board of Directors and provide for the annual election of all directors beginning in 2022.

As our communities begin to advance and recover this year, your Board of Directors and management team look forward to demonstrating our commitment to the long-term interests of our broad array of stakeholders, and the continued success of First Northwest Bancorp. We appreciate your confidence and support and look forward to the meeting.

Sincerely,

|

Matthew P. Deines President and Chief Executive Officer |

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Board of Directors of First Northwest Bancorp (the “Board”) is using this Proxy Statement to solicit proxies from our shareholders for use at our 2021 Annual Meeting of Shareholders. We first provided electronic access to this Proxy Statement, a form of proxy card, and our Annual Report to our shareholders on or about April 15, 2021.

| Meeting date: May 25, 2021 |

Record date: | March 26, 2021 | ||

|

Meeting time: 4:00 p.m. (Pacific Time) |

Meeting Place: | www.proxydocs.com/FNWB | ||

Due to concerns about containing the spread of the novel coronavirus, this year’s Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares, and submit your questions electronically prior to and during the meeting by visiting www.proxydocs.com/FNWB on the meeting date at the time described in the accompanying proxy statement.

Annual Meeting Business

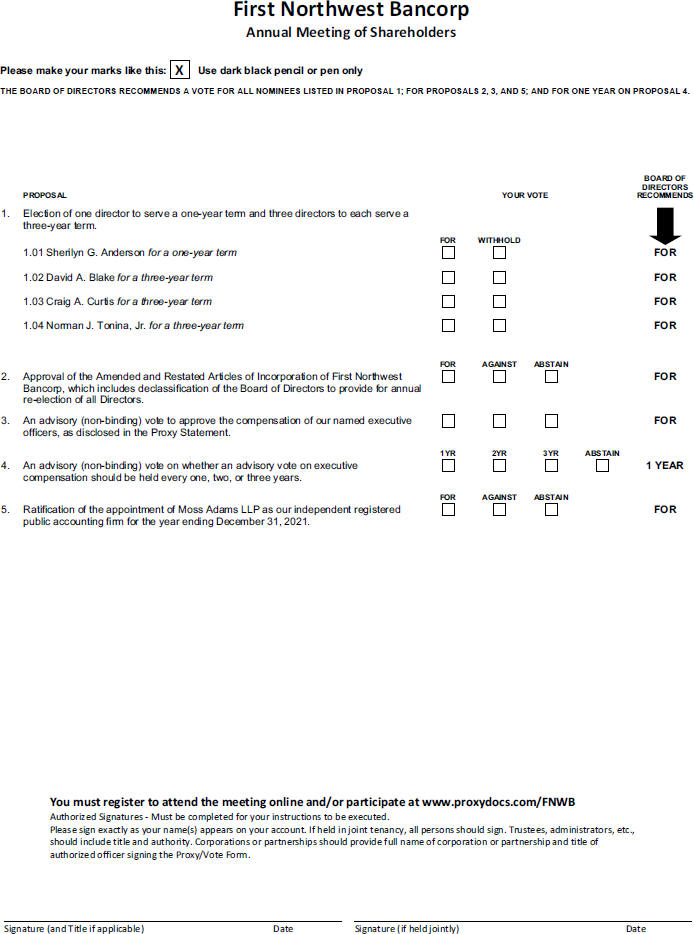

PROPOSAL 1 - Election of one director to serve a one-year term and three directors to each serve a three-year term;

PROPOSAL 2 - Approval of the Amended and Restated Articles of Incorporation of First Northwest Bancorp, which includes declassification of the Board of Directors to provide for annual re-election of all directors;

PROPOSAL 3 - An advisory (non-binding) vote to approve the compensation of our named executive officers, as disclosed in this Proxy Statement;

PROPOSAL 4 - An advisory (non-binding) vote on whether an advisory vote on executive compensation should be held every one, two, or three years; and

PROPOSAL 5 - Ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the year ending December 31, 2021.

YOUR VOTE IS IMPORTANT. We urge you to read this Proxy Statement carefully. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote promptly through the Internet, by telephone, or by mail. This will ensure the presence of a quorum at the meeting. For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail. You can request to receive proxy materials by mail or e-mail as well. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning the proxy card or voting instruction form, will save us the expense and extra work of additional solicitation. If you are a shareholder of record and vote at the Annual Meeting, your proxy will not be used.

By Order of the Board of Directors

Allison R. Mahaney

Corporate Secretary and Assistant General Counsel

Port Angeles, Washington

April 15, 2021

The information provided in this Proxy Statement relates to First Northwest Bancorp and its wholly owned subsidiary, First Federal Savings and Loan Association of Port Angeles. First Northwest Bancorp may also be referred to as “First Northwest” and First Federal Savings and Loan Association of Port Angeles may also be referred to as “First Federal” or the “Bank.” References to “we,” “us,” and “our” refer to First Northwest and, as the context requires, First Federal.

2021 PROXY STATEMENT

Table of Contents

Table of Contents

This summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information you should consider before casting your vote. Please read this entire Proxy Statement carefully before voting.

Information About the Annual Meeting

| TIME

4:00 p.m. (Pacific Time) |

DATE

Tuesday May 25, 2021 |

LOCATION

Annual Meeting to be held live

| ||

| BY INTERNET

www.proxydocs.com/FNWB |

BY PHONE

1-866-256-0967 |

BY MAIL

Mark, sign and date your proxy card | ||

Matters to be Considered at the Annual Meeting

At the meeting, you will be asked to consider and vote upon the following proposals:

| MATTER | BOARD VOTE RECOMMENDATION |

PAGE REFERENCE (FOR MORE DETAIL) | ||||||||||

| Proposal 1 | Election of one director to serve a one-year term and three directors to each serve a three-year term; | FOR each nominee |

7 | |||||||||

| Proposal 2 | Approval of the Amended and Restated Articles of Incorporation of First Northwest Bancorp, which includes declassification of the Board of Directors to provide for annual re-election of all directors; | FOR | 14 | |||||||||

| Proposal 3 | An advisory (non-binding) vote to approve the compensation of our named executive officers, as disclosed in this Proxy Statement; | FOR | 28 | |||||||||

| Proposal 4 | An advisory (non-binding) vote on whether an advisory vote on executive compensation should be held every one, two, or three years; and | ONE YEAR | 29 | |||||||||

| Proposal 5 | Ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the year ending December 31, 2021. | FOR | 31 | |||||||||

2021 PROXY STATEMENT 1

Table of Contents

2020 Business Highlights

First Northwest Bancorp reported record annual profits in 2020 which contributed to increased earnings per share. We continue to focus on growing our services and footprint to better serve our customers and communities across Western Washington.

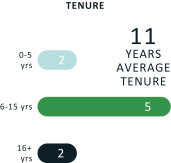

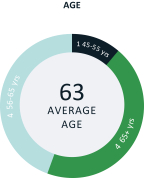

Board Directors and Nominees

| NAME |

GENDER | AGE AS OF DECEMBER 31, |

YEAR FIRST ELECTED OR APPOINTED DIRECTOR |

TERM TO EXPIRE (ASSUMING REELECTION) | |||||||||||||

| Board Nominees |

|||||||||||||||||

| Sherilyn G. Anderson |

Female | 61 | 2020 | 2022 | |||||||||||||

| David A. Blake |

Male | 72 | 2005 | 2024 | |||||||||||||

| Craig A. Curtis |

Male | 60 | 2014 | 2024 | |||||||||||||

| Norman J. Tonina, Jr. |

Male | 56 | 2013 | 2024 | |||||||||||||

| Directors Continuing in Office |

|||||||||||||||||

| Dana D. Behar |

Male | 58 | 2015 | 2022 | |||||||||||||

| Cindy. H. Finnie |

Female | 70 | 2012 | 2022 | |||||||||||||

| Matthew P. Deines |

Male | 47 | 2019 | 2023 | |||||||||||||

| Stephen E. Oliver |

Male | 72 | 2001 | 2023 | |||||||||||||

| Jennifer Zaccardo |

Female | 68 | 2011 | 2023 | |||||||||||||

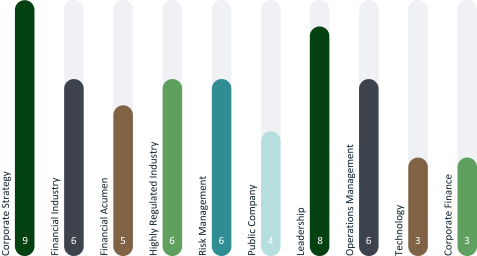

Directors’ Core Competencies,

Out of 9 Directors

2 FIRST NORTHWEST BANCORP

Table of Contents

|

|

OUR ENVIRONMENTAL COMMITMENT

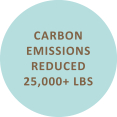

First Northwest Bancorp is committed to Environmental Responsibility and our Nominating and Corporate Governance Committee oversees compliance with all company, local, and federal standards. We integrate responsible environmental practices into our overall business strategy, and we strive for operations that ensure the health and safety of our workforce. We are actively deploying and updating strategies to reduce and reuse waste in our business practices including:

• Companywide recycling programs

• Use of e-records and e-signing technology resulting in:

– Paper waste reduced by approximately 1,800 pounds

– Carbon emissions reduced by over 25,000 pounds

– Water consumption reduced by approximately 32,000 gallons

|

| ||

|

|

OUR SOCIAL COMMITMENT

We are committed to supporting our employees and our communities. We know that good corporate citizenship is key to driving positive change and improving the lives of our people, our customers, our employees, and our communities. Some of our recent workforce investment highlights include:

• Established a companywide minimum wage of $16 per hour

• 35% of our senior team is female

• Prioritized employee safety and support during the pandemic

• Launched an employee-led DEI team to promote a diverse, equitable, and inclusive work environment for all employees

|

| ||

|

|

OUR GOVERNANCE COMMITMENT

We are committed to excellence in corporate governance practices. Our staff works closely with the Board of Directors and committees to continually review and improve our policies. Our emphasis on a culture of accountability is foundational and our team ethically manages our operations for the long-term benefit of our people, our customers, our employees, and our communities. Some of our recent governance highlights include:

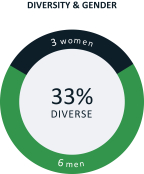

• Appointed our third female director

• Board recommended declassified director tenure

• Formalized policies to increase diversity and social responsibility companywide |

| ||

2021 PROXY STATEMENT 3

Table of Contents

Corporate Citizenship

Our Board takes great pride in First Northwest’s commitment to supporting strong, sustainable communities in our service area. This commitment to good corporate citizenship is evident in many of First Northwest’s community programs. In 2020, our Board pushed corporate citizenship one step further by undertaking to share our ongoing, internal commitment with stakeholders. In doing so, the Board passed the Diversity, Equity, and Inclusion (“DEI”) Policy, providing structure for formalized, internal DEI programming and reporting. Additionally, the Board passed a standalone Environmental, Social, and Governance (“ESG”) Policy in early 2021, mandating Board level oversight and reporting of our ESG practices and planning. Please visit our Investor Relations webpage at https://investor.ourfirstfed.com for policy details as well as additional information and updates on our ESG commitment.

Our COVID-19 Response

The novel coronavirus pandemic of 2020 presented a unique opportunity for First Northwest through First Federal to demonstrate our commitment to our employees and communities. Our initial pandemic response efforts prioritized ensuring the safety of our employees and customers, as well as continuing to provide essential services to our customers. This effort resulted in shifting 88% of our workforce to remote work and limiting or transitioning branch operations to virtual services which provide remote access to live tellers and basic banking services. Additionally, we provided each employee (CEO, Executive Vice Presidents, and Senior Vice Presidents excluded) a pandemic bonus as recognition for their continued efforts to support our customers, our communities, and their coworkers. Bonuses were based on pay status and amounted to a $3.00 per hour increase for hourly employees from March 29, 2020, through April 24, 2020, or a one-time $500 bonus for qualifying salaried employees.

As a bank holding company, we also had an opportunity to support our larger community through thoughtful lending practices at the Bank, including deferred payments and issuing small business loans to provide financial security for customers. We processed over $177 million in commercial and mortgage loan deferrals in 2020. As of December 31, 2020, approximately 98% of these customers were able to resume payment of their loan obligations. Furthermore, we initiated new small business loans under the Paycheck Protection Program and, in doing so, provided over $32.2 million in financial support to 515 local small businesses in 2020.

4 FIRST NORTHWEST BANCORP

Table of Contents

Persons and groups beneficially owning more than five percent of First Northwest’s outstanding shares of common stock (“5% Beneficial Owners”) are required to file reports with the Securities and Exchange Commission (the “SEC”) disclosing their ownership. The following table lists all 5% Beneficial Owners known to management as of the record date for the Annual Meeting, March 26, 2021 (the “Record Date”):

| NAME AND ADDRESS |

NUMBER OF SHARES BENEFICIALLY OWNED |

PERCENT OF SHARES OUTSTANDING (%) | ||||||||

| First Northwest Bancorp Employee Stock Ownership Plan 105 W. Eighth Street Port Angeles, Washington 98362 |

1,022,773 | 1 | * | |||||||

| FMR LLC 245 Summer Street Boston, Massachusetts 02110 |

798,108 | 2 | * | |||||||

| Private Capital Management, LLC 8889 Pelican Bay Boulevard, Suite 500 Naples, Florida 34108 |

676,452 | 3 | * | |||||||

| First Federal Community Foundation4 105 W. Eighth Street Port Angeles, Washington 98362 |

603,423 | * | ||||||||

| 1 | As of the Record Date, the ESOP had sole voting power as to 767,522 shares, shared voting power with respect to 255,251 shares, and sole dispositive power with respect to 1,022,773 shares. The ESOP provides for pass-through voting as to shares allocated to ESOP participants. The trustee for the ESOP will vote all shares as to which participants have not provided voting instructions in the same proportions as the shares as to which the trustee received timely instructions from participants. |

| 2 | Based on information contained in the schedule 13G/A filed on February 8, 2021, reporting shared voting and dispositive power as to all shares by FMR LLC and Abigail P. Johnson, the Chairman and Chief Executive Officer of FMR LLC. |

| 3 | Based on information contained in the schedule 13G/A filed on February 5, 2021, reporting sole voting and dispositive power as to 180,547 shares and shared voting and dispositive power as to 495,905 shares. |

| 4 | We established the First Federal Community Foundation in connection with the mutual to stock conversion of First Federal in 2015 to further our commitment to the local community. Shares of common stock held by the Foundation as of the Record Date will be voted in the same proportions as all shares of common stock voted on all proposals by First Northwest’s other shareholders. |

Beneficial Ownership by Directors and Named Executive Officers

The following table sets forth information, as of the Record Date, regarding share ownership of our directors and director nominees, each current or former executive officer of First Northwest or any of its subsidiaries named in the Summary Compensation Table appearing under “Executive Compensation” below (referred to as “named executive officers”), and all current directors and executive officers of First Northwest and its subsidiaries as a group.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In accordance with Rule 13d-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), a person is deemed to be the beneficial owner of any shares of common stock if he or she has voting or dispositive power with respect to those shares. Therefore, the table below includes shares held by spouses, by other immediate family members in trust, in retirement accounts or funds for the benefit of the named individuals, and in the ESOP and 401(k) Plan.

2021 PROXY STATEMENT 5

Table of Contents

As of the Record Date, there were * shares of First Northwest common stock outstanding.

| NAME |

NUMBER OF SHARES BENEFICIALLY OWNED |

PERCENT OF SHARES OUTSTANDING (%) | ||||||||

| Directors |

| |||||||||

| Sherilyn G. Anderson |

4,930 | 1 | * | |||||||

| Dana D. Behar |

25,023 | 2 | * | |||||||

| David A. Blake |

26,324 | 3 | * | |||||||

| Craig A. Curtis |

24,695 | 4 | * | |||||||

| Cindy H. Finnie |

30,052 | 5 | * | |||||||

| Stephen E. Oliver |

24,006 | 6 | * | |||||||

| Norman J. Tonina, Jr. |

29,746 | 7 | * | |||||||

| Jennifer Zaccardo |

32,752 | 8 | * | |||||||

| Named Executive Officers |

| |||||||||

| Matthew P. Deines** |

76,177 | 9 | * | |||||||

| Kelly A. Liske |

41,214 | 10 | * | |||||||

| Christopher J. Riffle |

35,797 | 11 | * | |||||||

| All current directors and executive officers as a group (15 persons) |

466,579 | 12 | * | |||||||

| * | Less than one percent of shares outstanding. |

| ** | Mr. Deines is also a Director of First Northwest. |

| 1 | Includes 4,930 shares of restricted stock as to which Ms. Anderson has voting power. |

| 2 | Includes 14,520 shares held jointly with spouse and 3,252 shares of restricted stock as to which Mr. Behar has voting power. |

| 3 | Includes 5,052 shares of restricted stock as to which Mr. Blake has voting power. |

| 4 | Includes 6,340 shares held jointly with spouse and 5,052 shares of restricted stock as to which Mr. Curtis has voting power. |

| 5 | Includes 5,052 shares of restricted stock as to which Ms. Finnie has voting power. |

| 6 | Includes 7,830 shares held jointly with spouse and 5,052 shares of restricted stock as to which Mr. Oliver has voting power. |

| 7 | Includes 5,052 shares of restricted stock as to which Mr. Tonina has voting power. |

| 8 | Includes 13,300 shares held jointly with spouse and 5,052 shares of restricted stock as to which Ms. Zaccardo has voting power. |

| 9 | Includes 36,099 shares of restricted stock as to which Mr. Deines has voting power and 2,587 shares held in the 401(k) Plan. |

| 10 | Includes 11,906 shares of restricted stock as to which Ms. Liske has voting power, 100 shares held as custodian for minors of which Ms. Liske disclaims beneficial ownership, 3,449 units held in the 401(k) Plan, and 6,755 shares held in the ESOP. The units consist of shares of First Northwest common stock and a liquidity cash component. |

| 11 | Includes 25,786 shares of restricted stock as to which Mr. Riffle has voting power, and 1,919 shares held in the ESOP. |

| 12 | Includes a total of 85,763 shares of restricted stock as to which four additional executive officers have voting power, as well as 3,167 units held in the 401(k) Plan, and 3,372 shares held in the ESOP for their account. The units consist of shares of First Northwest common stock and a liquidity cash component. |

6 FIRST NORTHWEST BANCORP

Table of Contents

Election of Directors

Our Board of Directors (the “Board”) consists of nine members and, in accordance with our current Articles of Incorporation, is divided into three classes. One-third of the directors are elected annually to serve for a three-year period or until their respective successors are elected and qualified. If Proposal 2 is approved, our Articles of Incorporation will be amended to provide for annual election of all directors and therefore, beginning in 2022, all directors will be elected for one-year terms. The table below sets forth information regarding each director of First Northwest and each nominee for director. All nominees and continuing directors are also directors of First Federal.

In September 2020, David A. Flodstrom retired from our Board and Sherilyn G. Anderson was appointed to serve until the next annual meeting of shareholders. In accordance with the Board’s classified structure provided in our current Articles of Incorporation, Ms. Anderson has been nominated for a one-year term to complete the three-year term of her current position.

The Nominating and Corporate Governance Committee of the Board selects nominees for election as directors and presents its nominees to the Board for consideration. All nominees currently serve as First Northwest directors. Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. It is intended that the proxies solicited on behalf of the Board (other than proxies in which the vote is withheld as to the nominee) will be voted at the Annual Meeting for the election of the nominees identified in the table below. If a nominee is unable to stand for election, the Board may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. At this time, we are not aware of any reason why a nominee might be unable to serve if elected.

Directors are elected by a plurality of the votes cast, individually or by proxy, at the Annual Meeting by holders of First Northwest common stock. Accordingly, the four nominees for election as directors who receive the highest number of votes cast will be elected. Our Articles of Incorporation do not permit shareholders to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because the four nominees receiving the greatest number of votes will be elected.

| NAME |

GENDER | AGE AS OF DECEMBER 31, |

YEAR

FIRST ELECTED OR APPOINTED DIRECTOR1 |

TERM TO

EXPIRE (ASSUMING REELECTION)2 | |||||||||||||

| Board Nominees |

|||||||||||||||||

| Sherilyn G. Anderson |

Female | 61 | 2020 | 2022 | 3 | ||||||||||||

| David A. Blake |

Male | 72 | 2005 | 2024 | |||||||||||||

| Craig A. Curtis |

Male | 60 | 2014 | 2024 | |||||||||||||

| Norman J. Tonina, Jr. |

Male | 56 | 2013 | 2024 | |||||||||||||

| Directors Continuing in Office |

|||||||||||||||||

| Dana D. Behar |

Male | 58 | 2015 | 2022 | |||||||||||||

| Cindy. H. Finnie |

Female | 70 | 2012 | 2022 | |||||||||||||

| Matthew P. Deines |

Male | 47 | 2019 | 2023 | |||||||||||||

| Stephen E. Oliver |

Male | 72 | 2001 | 2023 | |||||||||||||

| Jennifer Zaccardo |

Female | 68 | 2011 | 2023 | |||||||||||||

| 1 | For years prior to 2015, includes service on the Board of Directors of First Federal. |

| 2 | If Proposal 2 is approved, the Amended and Restated Articles of Incorporation and Bylaws of First Northwest will provide for annual election of all directors beginning in 2022. |

| 3 | Ms. Anderson has been nominated for a one-year term to complete the three-year term of her current position. |

2021 PROXY STATEMENT 7

Table of Contents

Director Qualifications and Experience. The following table identifies the experience, qualifications, attributes and skills the Nominating and Corporate Governance Committee considered in making its decision to nominate directors to our Board. The fact that a particular attribute was not considered does not mean that the director lacks such an attribute.

| EXPERIENCE AND ATTRIBUTES |

ANDERSON | BEHAR | BLAKE | CURTIS | DEINES | FINNIE | OLIVER | TONINA | ZACCARDO | ||||||||||||||||||||||||||||||||||||

| Corporate Strategy. Experience developing and executing long-term strategic plans to encourage innovation and growth. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||

| Financial Industry. Financial services or related industry experience and proven knowledge of key customers and/or associated risks. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

| Financial Acumen. Experience or expertise in financial accounting and reporting or the financial management of a major organization. |

✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||

| Highly Regulated Industry. Experience in a highly regulated industry, such as financial services, gaming, healthcare, pharmaceuticals, etc. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

| Risk Management. Experience assessing and mitigating significant competitive, regulatory, legal, or technological risks across an enterprise. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

| Public Company. Past or present board member or executive of another publicly-traded company. |

✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||||

| Leadership. Past or present Chief Executive Officer, Chief Financial Officer, Chief Human Resources Officer, Chief Operating Officer, or similar executive experience. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||

| Operations Management. Experience or expertise in managing the operations of a business or major organization. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||

| Technology. Understanding of information technology systems and development and/or information security, whether through academia or experience. |

✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||

| Corporate Finance. Experience in corporate lending or borrowing, capital markets transactions, significant mergers or acquisitions, private equity, or investment banking. |

✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||

| Gender Diversity. Contributes to the Board’s gender diversity. |

✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||

| Racial and Ethnic Diversity. Contributes to the Board’s racial and ethnic diversity. |

✓ | ||||||||||||||||||||||||||||||||||||||||||||

8 FIRST NORTHWEST BANCORP

Table of Contents

Table of Contents

10 FIRST NORTHWEST BANCORP

Table of Contents

2021 PROXY STATEMENT 11

Table of Contents

12 FIRST NORTHWEST BANCORP

Table of Contents

2021 PROXY STATEMENT 13

Table of Contents

Approval of Amended and Restated Articles of Incorporation

Our Board recommends that shareholders approve the proposed Amended and Restated Articles of Incorporation (the “Articles”) attached to this Proxy Statement as Appendix A. If approved, the proposed amendments would declassify the Board of Directors and provide for annual election of all directors, as well as updating the Articles to include gender-neutral titles and references. The description in this Proxy Statement of the proposed changes to the Articles is qualified in its entirety by reference to, and should be read in conjunction with, the full text of Appendix A.

Under Article VII, Section B, of our current Articles of Incorporation, our directors are divided into three classes, as nearly equal in number as possible and serving staggered three-year terms, such that approximately one-third of our directors are elected at each annual meeting of shareholders. In approving and recommending that shareholders approve the declassification of our Board, the Board reviewed current leading corporate governance practices and the prevailing views of investors regarding board structure. The Board concluded that, as First Northwest matures as a public company, the shareholders will be better served by the adoption of a board structure that promotes accountability by electing all directors annually. While classified boards historically were viewed as promoting continuity and stability, encouraging a long-term perspective, and discouraging coercive takeover tactics, the Board believes that these potential benefits are outweighed by the importance of demonstrating to shareholders that the Board is responsive and accountable to shareholders and committed to strong corporate governance.

Therefore, our Board has unanimously adopted resolutions, subject to shareholder approval, approving the elimination of the classified board provision by amending Article VII, Section B, to read in full as follows:

“B. Election and Term. At each annual meeting of shareholders, the shareholders shall elect the directors to hold office until the next annual meeting of shareholders and until their respective successors are elected and qualified.”

The proposed amendments provide for the annual election of all directors commencing with the 2022 Annual Meeting of Shareholders and, as noted above, would also revise the language used in the Articles to be gender neutral. Approval of Proposal 2 would not affect the Board’s authority to fix the number of directors within a range of five to 15 directors and to fill any vacancies or newly created directorships. If Proposal 2 is approved by the shareholders, First Northwest, the Bank, and the Board of Directors will ensure any additional steps required to provide for the election of individuals to fill all director positions at the 2022 Annual Meeting of Shareholders will be taken including, but not limited to, necessary updates to any organizational documents and resignation of any director terms currently scheduled to extend beyond the date of the 2022 Annual Meeting of Shareholders.

If Proposal 2 is approved, the Amended and Restated Articles of Incorporation as set forth in Appendix A will be effective upon filing with the Washington Secretary of State, subject to any requisite regulatory approvals.

Approval of the Amended and Restated Articles of Incorporation will require the affirmative vote of 80% of the votes entitled to be cast at the Annual Meeting. Abstentions and broker non-votes will have the same effect as a vote against the proposal.

14 FIRST NORTHWEST BANCORP

Table of Contents

Corporate Governance and Board Matters

Board of Directors. The Boards of Directors of First Northwest and First Federal conduct their business through board and committee meetings. In 2020, the Board held 13 meetings and the Board of Directors of the Bank also held 13 meetings. No director of First Northwest or the Bank attended fewer than 90 percent of the total meetings of the boards and committees on which that person served.

Committees and Committee Charters. The Board has standing Audit, Compensation, Nominating and Corporate Governance, and Executive Committees. The Board has adopted written charters for the Audit, Compensation, and Nominating and Corporate Governance Committees, copies of which are available under the “Investor Relations” tab on our website at www.ourfirstfed.com. All members of the Audit, Compensation, and Nominating and Corporate Governance Committees are independent, in accordance with the requirements for companies listed on NASDAQ.

The Audit Committee consists of Directors Zaccardo (Chair), Anderson, Behar, Blake, Finnie, and Oliver. The Board has determined that Ms. Zaccardo and two other members of the Committee meet the definition of “Audit Committee Financial Expert,” as defined by the SEC. This Committee is primarily responsible for overseeing the integrity of First Northwest’s financial reporting processes, financial statement audits, and systems of internal controls regarding finance, accounting, and legal compliance; overseeing the independence and performance of First Northwest’s independent auditors and internal audit function; and providing an avenue of communication among the independent auditor, management, and the Board. The Audit Committee meets quarterly and on an as-needed basis. The Audit Committee met eight times during 2020.

The Compensation Committee consists of Directors Finnie (Chair), Anderson, Oliver, and Tonina. This Committee meets semiannually and as needed, providing general oversight regarding the personnel, compensation, and benefits matters of First Northwest. In furtherance of this purpose, the Compensation Committee is responsible for setting the compensation of our Chief Executive Officer and reviewing his performance, approving the compensation arrangements and performance goals for other senior executives, and recommending board member compensation. The Compensation Committee met five times during 2020.

The Nominating and Corporate Governance Committee consists of Directors Blake (Chair), Curtis, Finnie, Oliver, Tonina, and Zaccardo. This Committee is responsible for assessing board and committee membership composition, succession planning, and implementing policies and processes regarding corporate governance matters — including oversight of First Northwest’s Environmental, Social, and Governance programming. The Committee also ensures that the requisite expertise, diversity of skills, experience, background, gender and ethnicity, and independence of the Board are considered in evaluating board composition and director nominations. The Nominating and Corporate Governance Committee meets semiannually, and on an as-needed basis. This Committee met seven times during 2020.

The Executive Committee consists of Directors Oliver, Finnie, and Zaccardo. This Committee acts for the Board of Directors when formal board action is required between regular meetings. The Executive Committee did not meet during 2020.

Leadership Structure. First Northwest has separated the positions of Chairperson and Chief Executive Officer. The Chairperson, an independent director, leads the Board and presides at all board meetings, while the President and Chief Executive Officer runs the day-to-day business of First Northwest. The Board supports having an independent director in a board leadership position. This enables non-management directors to raise issues and concerns for board consideration without immediately involving management. The Chairperson also serves as a liaison between the Board and senior management.

2021 PROXY STATEMENT 15

Table of Contents

Board Involvement in Risk Management Process. As part of its overall responsibility to oversee the management, business, and strategy of First Northwest and First Federal, one of the primary responsibilities of our Board is to oversee the amount and types of risks taken by management in executing our corporate strategy, and to monitor our risk experience against the policies and procedures set to control those risks. The Board’s risk oversight function is carried out through its approval of various policies and procedures, such as our lending and investment policies, and regular monitoring of risk, such as interest rate risk exposure, liquidity, cyber-security, and problem assets. Some oversight functions are delegated to committees of the Board, with such committees regularly reporting to the full Board the results of their oversight activities. For example, the Audit Committee is responsible for oversight of the independent auditor and meets directly with the auditors at various times during the course of the year, while also receiving quarterly reports on technology and information security, including cybersecurity.

Corporate Governance Policy. The Board has adopted a Corporate Governance Policy, a copy of which is available under the “Investor Relations” tab on our website at www.ourfirstfed.com. The Policy covers the following matters:

| • | the role of the Board; |

| • | the composition of the Board; |

| • | responsibilities and operation of the Board; |

| • | the establishment and operation of board committees, including Audit, Nominating and Corporate Governance, and Compensation Committees; |

| • | succession planning annual review for the Board and Chief Executive Officer; |

| • | executive sessions of independent directors; |

| • | the Board’s interaction with management and third parties; |

| • | evaluation of the performance of the Board and the Chief Executive Officer; |

| • | communications with shareholders and annual meeting attendance; and |

| • | director orientation and continuing education. |

Director Independence. Our common stock is listed on the NASDAQ Global Market. In accordance with NASDAQ requirements, at least a majority of our directors must be independent directors. The Board has determined that eight of our nine directors are independent, as defined by NASDAQ rule. Only Matthew Deines, our President and Chief Executive Officer, is not independent.

Code of Ethics. The Code of Ethics applies to each of our directors, officers, and employees, and requires these individuals to maintain the highest standards of professional conduct. The Code is reviewed and updated periodically. The Board reviewed and reapproved the Code in November 2020. A copy of the Code of Ethics is available under the “Investor Relations” tab on our website at www.ourfirstfed.com.

Director Continuing Education. Continuing education programs assist directors in maintaining skills and knowledge necessary or appropriate for the performance of their responsibilities. These programs may include internally developed materials and presentations, programs presented by third parties, and financial and administrative support to attend qualifying academic or other independent programs. Our Board maintains a strong commitment to continuing education activities each year.

16 FIRST NORTHWEST BANCORP

Table of Contents

Board Evaluation. The Nominating and Corporate Governance Committee conducts an annual evaluation of the performance of the Board, the Board Chairperson, and each of its members, including director self-assessment and one-on-one meetings between each director and the Board Chairperson. The results are reported to the Board. The report includes an assessment of the Board’s compliance with its Corporate Governance Policy, and identification of areas in which the Board could improve its performance.

Shareholder Communication with the Board of Directors. The Board welcomes communication from shareholders. Shareholders may send communications to the Board of Directors, First Northwest Bancorp, 105 W. Eighth Street, Port Angeles, Washington 98362. Shareholders should indicate clearly the director or directors for whom the communication is intended so that each communication may be forwarded appropriately.

Annual Meeting Attendance by Directors. We encourage, but do not require, our directors to attend the Annual Meeting of Shareholders. All directors then in office attended the 2020 Annual Meeting of Shareholders held on May 5, 2020.

Transactions with Related Persons. First Federal has followed a policy of granting loans to executive officers and directors which fully complies with all applicable federal regulations. Loans to directors and executive officers are made in the ordinary course of business and on the same terms and conditions, including interest rates and collateral, as those of comparable transactions with persons not related to First Federal prevailing at the time, in accordance with our underwriting guidelines, and do not involve more than the normal risk of collectability or present other unfavorable features. All loans to directors and executive officers and their related persons at December 31, 2020 were performing in accordance with their terms.

Stock Ownership Guidelines. In May 2017, the Board adopted a stock ownership policy because it believes that it is in First Northwest’s best interest to align the financial interests of our non-employee directors and Chief Executive Officer with those of our shareholders. The policy requires non-employee directors to own shares of First Northwest’s common stock equal in value to three times the respective director’s annual cash retainer. Directors must meet these ownership guidelines by May 2020 or within three years of joining the Board, whichever is later. Each of our non-employee directors who was in office at the beginning of 2020 was compliant with this policy requirement throughout 2020. In addition, our stock ownership guidelines require our Chief Executive Officer to hold First Northwest shares valued at three times his annual base salary within three years of his date of hire. Mr. Deines met his stock ownership guideline in 2020, approximately one year after his appointment as Chief Executive Officer of First Northwest, with 76,177 shares held, consisting of 40,078 shares held by direct ownership and 36,099 shares of restricted stock awards, as of the Record Date. See “Executive Compensation” below for a description of our anti-hedging policy applicable to directors, officers, and employees.

Anti-Hedging and Anti-Pledging Policy. Under our Anti-Hedging and Anti-Pledging Policy, we prohibit hedging the economic risk of ownership of our common stock through short sales or the purchase or sale of options, puts, calls, straddles, equity swaps, or other derivative securities that are directly linked to First Northwest stock, by our directors and officers. We also prohibit our directors and officers from holding our stock in a margin account or pledging our stock as collateral for a loan.

2021 PROXY STATEMENT 17

Table of Contents

The following table shows the compensation paid to our directors for the year ended December 31, 2020, except for Mr. Deines, our President and Chief Executive Officer, whose compensation is presented in the Summary Compensation Table in the section entitled “Executive Compensation” below.

| NAME |

FEES PAID IN ($) |

STOCK AWARDS ($)1 |

NONQUALIFIED DEFERRED COMPENSATION EARNINGS ($) |

ALL OTHER COMPENSATION |

TOTAL ($) | |||||

| Sherilyn G. Anderson3 |

12,832 | 0 | 0 | 0 | 12,832 | |||||

| Dana D. Behar |

38,496 | 17,453 | 0 | 718 | 56,667 | |||||

| David A. Blake |

39,000 | 17,453 | 0 | 1,276 | 57,729 | |||||

| Craig A. Curtis |

0 | 17,453 | 36,996 | 1,276 | 55,725 | |||||

| Cindy H. Finnie |

42,252 | 17,453 | 0 | 1,276 | 60,981 | |||||

| David T. Flodstrom4 |

28,125 | 17,453 | 0 | 37,477 | 83,055 | |||||

| Stephen E. Oliver |

50,592 | 17,453 | 0 | 1,276 | 69,321 | |||||

| Norman J. Tonina, Jr. |

39,492 | 17,453 | 0 | 1,276 | 58,221 | |||||

| Jennifer Zaccardo |

5,850 | 17,453 | 33,150 | 1,276 | 57,729 | |||||

| 1 | The dollar amounts shown in the table represent the aggregate fair value of each award based on the closing price of First Northwest’s common stock on the respective date of grant in 2020. Each director other than Ms. Anderson and Mr. Flodstrom received an award of 1,452 shares of restricted stock as of July 7, 2020 that will vest in full on July 7, 2021. Mr. Flodstrom also received an award of 1,452 shares of restricted stock as of July 7, 2020 that vested in full on his retirement. Ms. Anderson received an award of 4,930 shares of restricted stock as of September 22, 2020 that will vest in three equal annual installments beginning on November 7, 2021. Shares of restricted stock granted in July 2016 and unvested as of December 31, 2020 were as follows: Director Behar, 1,800 shares; each of Directors Blake, Curtis, Finnie, Oliver, Tonina, and Zaccardo, 3,600 shares. |

| 2 | Represents amounts paid in cash dividends on unvested shares of restricted stock. The amount shown for Mr. Flodstrom also includes $36,504 paid in cash to repurchase 3,600 shares of restricted stock held by Mr. Flodstrom that were unvested as of the date of his retirement. |

| 3 | Ms. Anderson was appointed as a Director of First Northwest on September 22, 2020. |

| 4 | Mr. Flodstrom retired as a Director of First Northwest, effective September 22, 2020. |

Cash Retainers. The non-employee (outside) directors of First Northwest receive compensation for their service on the Board. In setting their compensation, the Board considers the significant amount of time and level of skill required for director service. In October 2019 the Board approved increases in cash director fees effective January 1, 2020, that set the annual retainer for service as a non-employee director of First Northwest at $32,000. The Board Chairperson is paid an additional annual retainer of $9,600. Under the policy, annual retainers for committee service are as follows:

| COMMITTEE |

CHAIR | MEMBER | ||||||

| Audit |

$ | 4,500 | $ | 4,000 | ||||

| Compensation |

$ | 3,750 | $ | 2,500 | ||||

| Nominating and Corporate Governance |

$ | 3,000 | $ | 2,500 | ||||

| Loan and Asset Quality (First Federal Board) |

$ | 3,000 | $ | 2,500 | ||||

All retainers are paid in equal monthly installments. No additional cash compensation is paid to directors for service on the First Federal Board of Directors.

18 FIRST NORTHWEST BANCORP

Table of Contents

Equity Grants. In mid-2020, the Compensation Committee considered the status of First Northwest’s non-employee director compensation program. The Compensation Committee’s independent compensation consultant, McLagan Aon (“McLagan”) advised that First Northwest’s level of director compensation compared to its peers was low, largely because no equity awards had been granted to non-employee directors under First Northwest’s 2015 Equity Incentive Plan since 2016. McLagan recommended that the Compensation Committee consider granting equity awards to non-employee directors under First Northwest’s new 2020 Equity Incentive Plan. Following consideration, the Compensation Committee approved awards of shares of restricted stock to each non-employee director other than Mr. Flodstrom, who had announced his plan to retire later in 2020, with an economic value of $17,500 and vesting in full one year after the date of grant.

Deferred Compensation Plan. In order to encourage the retention of qualified directors, we offer a deferred compensation plan whereby directors may defer all or a portion of their regular fees until a permitted distribution event occurs under the plan. Each director may direct the investment of the deferred fees among investment options made available by First Federal. We have established a grantor trust to hold the plan investments. Grantor trust assets are considered part of our general assets, and the directors have the status of unsecured creditors of First Northwest with respect to the trust assets. The plan permits the payment of benefits upon a separation from service (on account of termination of service or pre-retirement death or disability), a change in control, an unforeseeable emergency, or upon a date specified by the director, in an amount equal to the value of the director’s account balance (or the amount necessary to satisfy the unforeseeable emergency, in that case). A director may elect, at the time he or she makes a deferral election, to receive the deferred amount and related earnings in a lump sum or in annual installments over a period not exceeding 15 years. A director may subsequently elect to change when or how he or she receives his or her plan benefit, if certain required conditions are met. At December 31, 2020, our estimated deferred compensation liability accrual with respect to non-employee directors under the deferred compensation plan totaled approximately $777,000.

Description of Executive Compensation Program. This section provides a brief overview of our executive compensation program and the process followed by our Compensation Committee in making decisions about executive compensation. Following this discussion are various tables and additional information about the compensation paid or payable to our “named executive officers.”

Compensation Philosophy and Objectives. In general, our executive compensation policies are designed to establish an appropriate relationship between executive pay and our performance. In particular, our executive compensation program is intended to:

| • | attract and retain key executives who are vital to our long-term success; |

| • | provide levels of compensation competitive with our peers and commensurate with our performance; |

| • | compensate executives in ways that inspire and motivate them; and |

| • | properly align risk-taking and compensation. |

Role of the Compensation Committee. The Compensation Committee is responsible for setting the policies and compensation levels for our directors and executive officers. The Committee is responsible for evaluating the performance of the Chief Executive Officer and setting his compensation, and for reviewing the Chief Executive Officer’s report regarding the performance of other senior executives. The Chief Executive Officer is not involved in decisions regarding his own compensation.

2021 PROXY STATEMENT 19

Table of Contents

Role of Compensation Consultants. Our Compensation Committee has the authority to engage its own advisors to assist in carrying out its responsibilities. In 2020, the Compensation Committee engaged McLagan, an independent compensation consultant, to assist with its duties, including providing advice relating to our compensation peer group selection, support, and specific analysis regarding compensation data, and recommendations for executive and non-employee director compensation. McLagan reports directly to our Compensation Committee and not to management, is independent from us, and has provided no services to us other than compensation-related services. The Compensation Committee relies in part on the information and advice from McLagan, as well as other industry information and surveys regarding executive and non-employee director compensation, as a market comparison of compensation levels and practices and to assess the competitiveness of our executive and director compensation program. Our Compensation Committee has assessed the independence of McLagan and concluded that there are no conflicts of interest regarding the work that McLagan performs for the Committee.

Compensation Program Elements. For several years, our executive compensation program has focused primarily on the following components:

| PAY ELEMENT |

WHAT IT REWARDS | PURPOSE | ||

| Base salary |

Core competency in the executive’s role relative to skills, experience and contributions to First Northwest and First Federal | Provide assurance of specified level of compensation to attract and retain qualified individuals | ||

| Cash incentive |

Contributions toward achieving corporate earnings, growth and risk management objectives | Provide opportunities to receive annual performance-based cash incentive compensation | ||

|

Long-term incentive |

Contributions toward increasing long-term shareholder value | Promote long-term growth and profitability through periodic restricted stock awards | ||

Executive officers may also participate in a deferred compensation plan, the 401(k) Plan, and the ESOP as described in more detail under “Retirement Benefits” below. We have also entered into employment agreements with Matthew Deines, Kelly Liske, and Christopher Riffle that provide for, among other things, severance compensation upon involuntary termination in certain situations, as described under “Employment Agreements for Named Executive Officers” below. In addition, First Federal and First Northwest offer medical and dental insurance coverage, vision care coverage, group life insurance coverage, and long-term disability insurance coverage under welfare and benefit plans in which most employees, including executive officers, are eligible to participate.

Compensation Clawback Provision. In the event that First Northwest or First Federal is required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under securities laws, First Federal will recover incentive compensation awarded to current or former executive officers during the preceding three years, to the extent the original awards exceed the amounts that would have been paid under the restated results, or as otherwise required by applicable laws or regulations.

20 FIRST NORTHWEST BANCORP

Table of Contents

The following table presents information regarding the compensation of our President and Chief Executive Officer and our next two most highly compensated executive officers who were serving as executive officers on December 31, 2020.

| NAME AND PRINCIPAL POSITION |

CALENDAR YEAR |

SALARY ($) |

($) |

NON-EQUITY INCENTIVE PLAN COMPENSATION ($)2 |

ALL OTHER COMPENSATION ($)3 |

TOTAL ($) | ||||||||||||||||||||||||

| MATTHEW P. DEINES President and Chief Executive Officer4 |

|

2020 |

|

335,000 |

|

288,348 |

|

103,181 |

|

19,602 |

|

746,131 |

||||||||||||||||||

| 2019 | 167,692 | 200,136 | 39,451 | 7,030 | 414,309 | |||||||||||||||||||||||||

| KELLY A. LISKE Executive Vice President, Chief Banking Officer |

2020 | 230,000 | 57,498 | 80,040 | 32,145 | 399,683 | ||||||||||||||||||||||||

| 2019 | 215,000 | 44,275 | 63,330 | 32,988 | 391,593 | |||||||||||||||||||||||||

| CHRISTOPHER J. RIFFLE Executive Vice President, Chief Operating Officer and General Counsel |

2020 | 230,000 | 57,498 | 66,240 | 25,709 | 379,447 | ||||||||||||||||||||||||

| 2019 | 213,000 | 0 | 66,019 | 17,116 | 296,135 | |||||||||||||||||||||||||

| 1 | Represents the aggregate grant date fair value of awards, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, “Compensation – Stock Compensation” (“FASB ASC Topic 718”). For a discussion of valuation assumptions, see Note 11 of the Notes to Consolidated Financial Statements in First Northwest’s Annual Report on Form 10-K for the year ended December 31, 2020. |

| 2 | Reflects amounts earned under the Cash Incentive Plan. The material terms of the Cash Incentive Plan for 2020 are described below under “Cash Incentive Compensation.” |

| 3 | Amounts reported for 2020 that represent “All Other Compensation” for each of the named executive officers are described in the table below. |

| 4 | Compensation reflects August 2019 hiring date. |

| NAME |

401(K) MATCHING CONTRIBUTION ($) |

ESOP CONTRIBUTIONS ($) |

DIVIDENDS ON ($) |

|||||||||

| MATTHEW P. DEINES |

9,483 | 0 | 868 | |||||||||

| KELLY A. LISKE |

7,453 | 16,841 | 1,600 | |||||||||

| CHRISTOPHER J. RIFFLE |

6,595 | 15,823 | 3,040 | |||||||||

Cash Incentive Compensation. We believe that the opportunity for performance-based pay for officers is a significant factor in aligning the interests of the officers with those of shareholders. The Compensation Committee reviews and approves incentive compensation for the Board and Chief Executive Officer on an annual basis to ensure alignment with First Federal’s business objectives. The Chief Executive Officer is not permitted to be present during any committee deliberations or voting with respect to his compensation. After Compensation Committee approval, incentive compensation is authorized by the Board of Directors.

Each named executive officer has a set of predefined goals which consist of annual corporate performance goals and may also include personal goals outlined in the officer’s individual participation agreement. Each participant is assigned a target award level and range that defines their incentive opportunity. Each executive’s actual incentive compensation will be determined by whether the executive exceeds “threshold,” “target,” or “stretch” performance levels. Actual awards will be allocated based on specific performance goals defined for each participant and will range from 0% to 150% of their target incentive opportunity. Each participant’s payout is calculated on eligible earnings, as defined in the Cash Incentive Plan, and will be made in a cash lump sum.

2021 PROXY STATEMENT 21

Table of Contents

On December 5, 2019, the Compensation Committee selected the participants under the Cash Incentive Plan, including all Executive and Senior Vice Presidents and selected Vice Presidents, and established performance goals for all participants. The annual incentive opportunities for the named executive officers, expressed as a percentage of annualized base salary at December 31, 2020, were as follows:

| EXECUTIVE |

BELOW THRESHOLD |

THRESHOLD (50%) |

TARGET (100%) |

STRETCH (150%) | ||||

| Matthew P. Deines |

0% | 17.5% | 35% | 52.5% | ||||

| Kelly A. Liske |

0% | 15% | 30% | 45% | ||||

| Christopher J. Riffle |

0% | 15% | 30% | 45% | ||||

For 2020, the named executive officers’ goals consisted entirely of corporate goals. The Compensation Committee approved the following corporate performance measures for the named executive officers:

| PERFORMANCE MEASURE (DOLLARS IN THOUSANDS) |

THRESHOLD | TARGET | STRETCH | |||

| Return on Equity1 |

90% 5.4% |

100% 6.0% |

110% 6.6% | |||

| Asset Growth2 |

90% $1,350,000 |

100% $1,500,000 |

110% $1,650,000 | |||

| Non-Interest Income3 |

90% $6,975 |

100% $7,750 |

110% $8,525 | |||

| Coverage Ratio4 |

125% 31.25% |

100% 25.00% |

75% 18.75% | |||

| Efficiency Ratio5 |

105% 73.50% |

100% 70.00% |

95% 66.50% | |||

| 1 | Return on equity for the year ended December 31, 2020. |

| 2 | Total assets at December 31, 2020. |

| 3 | Non-interest income for the year ended December 31, 2020. |

| 4 | Coverage ratio for the year ended December 31, 2020. |

| 5 | Non-interest expense, less amortization of intangible assets, divided by net income on a fully taxable equivalent basis and noninterest income for the year ended December 31, 2020. |

These corporate performance measures are based on the consolidated performance of First Northwest. For the year ended December 31, 2020, the corporate performance weightings applicable to the named executive officers were as follows:

| EXECUTIVE |

RETURN ON EQUITY |

ASSET GROWTH |

NON-INTEREST INCOME |

COVERAGE RATIO |

EFFICIENCY RATIO | |||||

| Matthew P. Deines |

60% | 5% | 10% | 20% | 5% | |||||

| Kelly A. Liske |

30% | 20% | 30% | 10% | 10% | |||||

| Christopher J. Riffle |

50% | 10% | 20% | 10% | 10% | |||||

22 FIRST NORTHWEST BANCORP

Table of Contents

The following table summarizes First Northwest’s performance and resulting payouts associated with the corporate goals for the year ended December 31, 2020 (dollars in thousands):

| PERFORMANCE MEASURE |

PERFORMANCE ACHIEVED |

PAYOUT AS A PERCENTAGE OF TARGET | ||

| Return on Equity |

5.79% | 50% | ||

| Asset Growth |

$1,654,349 | 150% | ||

| Non-Interest Income |

$15,846 | 150% | ||

| Coverage Ratio |

2.65% | 150% | ||

| Efficiency Ratio |

69.33% | 110% | ||

Outstanding Equity Awards. The purpose of both the First Northwest Bancorp 2015 Equity Incentive Plan (the “2015 Plan”) and the First Northwest Bancorp 2020 Equity Incentive Plan (the “2020 Plan”) is to promote the long-term growth and profitability of First Northwest, to provide plan participants with an incentive to achieve corporate objectives, to attract and retain individuals of outstanding competence, and to provide plan participants with incentives that are closely linked to the interests of all shareholders of First Northwest.

The 2015 Plan was approved by shareholders in 2015. In July 2016, each of our then-current named executive officers received a restricted stock award vesting in five equal, annual installments beginning on the anniversary of the grant date. Named executive officers hired since 2016 received a restricted stock award with the same vesting schedule, and any unvested shares held by departing named executive officers prior to the completion of the vesting schedule are forfeited.

The 2020 Plan was approved by shareholders at the Annual Meeting in May 2020 and provides for the grant of a variety of equity-based awards to eligible participants including awards of restricted stock. Unvested shares held by departing named executive officers will be forfeited and returned to the 2020 Plan pool.

Following approval of the 2020 Plan, each of our named executive officers other than Mr. Deines received a restricted share award with a value equal to 25% of base salary, vesting in three equal, annual installments beginning on the first anniversary of the grant date. As shown in the table below, Mr. Deines received an equity award in January and July 2020 totaling 17,600 restricted shares. Beginning in 2021, the Compensation Committee plans to grant equity awards to the named executive officers through a combination of discretionary grants and awards tied to the achievement of specified performance goals.

2021 PROXY STATEMENT 23

Table of Contents

The following information with respect to outstanding stock awards as of December 31, 2020, is presented for the named executive officers.

| STOCK AWARDS | ||||||

| NAME |

GRANT DATE |

NUMBER OF SHARES OR UNITS OF STOCK THAT HAVE NOT VESTED (#) |

MARKET VALUE OF SHARES ($)1 | |||

| Matthew P. Deines |

08/07/20192 01/07/20203 07/04/20204 |

9,920 14,600 3,000 |

$154,752 $227,760 $ 46,800 | |||

| Kelly A. Liske |

07/07/20165 12/07/20196 09/07/20207 |

5,000 2,000 4,906 |

$ 78,000 $ 31,200 $ 76,534 | |||

| Christopher J. Riffle |

09/25/20188 12/07/20189 09/07/20207 |

9,000 6,000 4,906 |

$140,400 $ 93,600 $ 76,534 | |||

| 1 | Market value is based on the per-share closing price of FNWB stock on December 31, 2020 of $15.60. |

| 2 | Vests in four equal annual installments beginning August 7, 2021. |

| 3 | Vests in four equal annual installments beginning January 7, 2021. |

| 4 | Vests in three equal annual installments beginning July 4, 2021. |

| 5 | Vests in full on July 7, 2021. |

| 6 | Vests in four equal annual installments beginning December 7, 2021. |

| 7 | Vests in three equal annual installments beginning September 7, 2021. |

| 8 | Vests in three equal annual installments beginning September 25, 2021. |

| 9 | Vests in three equal annual installments beginning December 7, 2021. |

The 2015 Plan and the 2020 Plan both provide for accelerated vesting of awards in the event of a recipient’s death or disability, or a change in control. Unvested awards will become exercisable or vest upon the date of the recipient’s death or disability. With respect to a change in control, unvested awards will become exercisable or vest only if the participant experiences an involuntary termination within 365 days following the change in control event, or the acquiring company does not either assume the outstanding award or replace the outstanding award with an equivalently-valued award.

Retirement Benefits. In order to encourage the retention of qualified officers, we offer a deferred compensation plan whereby certain officers may defer all or a portion of their annual salary until a permitted distribution event occurs under the plan. Each officer may direct the investment of the deferred salary among investment options made available by First Federal. We have established a grantor trust to hold the plan investments. Grantor trust assets are considered part of our general assets, and the officers have the status of unsecured creditors of First Federal with respect to the trust assets. The plan permits the payment of benefits upon a separation from service (whether on account of termination of employment or pre-retirement death or disability), a change in control, an unforeseeable emergency, or upon a date specified by the officer, in an amount equal to the value of the officer’s account balance (or the amount necessary to satisfy the unforeseeable emergency, in that case). An officer may elect, at the time of the deferral election, to receive the deferred amount and related earnings in a lump sum or in annual installments over a period not exceeding 15 years. An officer may subsequently elect to change when or how he or she receives his or her plan benefit, if certain required conditions are met. Currently, Mr. Deines is the only named executive officer who participates in this plan.

24 FIRST NORTHWEST BANCORP

Table of Contents

We currently offer a qualified, tax-exempt savings plan to eligible employees with a cash or deferred feature qualifying under Section 401(k) of the Internal Revenue Code. Participants are permitted to make pre-tax contributions to the 401(k) Plan of up to a maximum of $19,500 in 2020. In addition, participants who have attained age 50 may defer an additional $6,500 annually as a 401(k) “catch-up” contribution. First Federal matches 50% of the first six percent of participants’ contributions to the 401(k) Plan, including catch-up contributions. All participant 401(k) contributions, rollovers, and earnings are fully and immediately vested. Matching contributions and related earnings vest at a rate of 25% after one year of employment, 50% after two years of employment, 75% after three years of employment, and 100% after four years of employment.

In connection with the conversion of First Federal from the mutual to the stock form of organization, we established an employee stock ownership plan (the “ESOP”). The ESOP provides eligible employees a beneficial interest in First Northwest and an additional retirement benefit in the form of First Northwest common stock. Participants will have a nonforfeitable interest in their individual account based on a vesting schedule of 25% after one year of employment, 50% after two years of employment, 75% after three years of employment, and 100% after four years of employment.

Employment Agreements for Named Executive Officers. On July 28, 2015, we entered into an amended three-year employment agreement with Ms. Liske, which was updated in 2018. Mr. Riffle entered into a three-year employment agreement in 2018, and Mr. Deines entered into a three-year employment agreement in 2019. Prior to the anniversary date of the employment agreements, unless notice is given by First Northwest or First Federal to the executive, or by the executive to First Northwest or First Federal, at least 90 days prior to the anniversary date, the term of the agreements will be extended for an additional year upon review and approval by the Board or the Compensation Committee. In February 2020, the Compensation Committee approved the extension of the term of the agreements for an additional year, to expire in 2023.

Under the employment agreements, the base salary level for each named executive officer is specified, which amounts will be paid by First Northwest and First Federal and may be increased at the discretion of the Compensation Committee. The agreements further provide that the executives may participate, to the same extent as executive officers of First Northwest and First Federal generally, in all plans of First Northwest and First Federal relating to pension, retirement, thrift, profit-sharing, savings, group, or other life insurance, hospitalization, medical and dental coverage, travel and accident insurance, education, cash bonuses, and other retirement or employee benefits or combinations thereof. In addition, the executives are entitled to participate in any other fringe benefit plans or perquisites which are generally available to executive officers of First Northwest or First Federal, including supplemental retirement, deferred compensation programs, supplemental medical or life insurance plans, company cars, club dues, physical examinations, and financial planning and tax preparation services. The executives also will receive annual paid vacation, and voluntary leaves of absence, with or without pay, from time to time at such times and upon such conditions as the Board or the Compensation Committee may determine.

The employment agreements with each of the named executive officers provide for potential payments upon the executive’s involuntary termination in certain situations, or upon death or disability. Any such payments are conditioned on receipt of the executive’s signed release of claims against First Northwest and First Federal. The agreements may be terminated by the Board at any time. If an executive’s employment is terminated other than for cause, without the executive’s consent, or by the executive for “Good Reason,” then for one year after the date of termination First Northwest and First Federal would be required to pay the executive’s salary at the rate in effect immediately prior to the date of termination and the pro rata portion of any incentive award or bonus, the amount of which will be determined by the Compensation Committee in its sole discretion, and continue the executive’s and the

2021 PROXY STATEMENT 25

Table of Contents

executive’s dependents’ coverage under First Northwest’s and First Federal’s health, life, and disability programs. “Good Reason” means, in the absence of the Employee’s written consent, any of the following: (i) a material diminution in the executive’s base compensation; (ii) a material diminution in the executive’s authority, duties, or responsibilities; or (iii) a material change in the geographic location at which the executive must perform services of more than 35 miles.

The employment agreements also provide for severance payments and other benefits if an executive is involuntarily terminated not for cause (or terminates his or her employment for “Good Reason,” as defined above) within 24 months following a Change in Control event. The agreements define “Change in Control” as a change in the ownership or effective control of First Northwest or First Federal or a change in the ownership of a substantial portion of the assets of First Northwest or First Federal, as defined in Treasury Regulation § 1.409A-3(i)(5) or in subsequent regulations or other guidance issued by the Internal Revenue Service. For purposes of illustration, a Change in Control generally occurs on the date that: (i) any one person, or more than one person acting as a group, acquires ownership of First Northwest’s stock or First Federal’s stock that, together with stock already held by the person or group, constitutes more than 50 percent of the total fair market value or total voting power of First Northwest’s stock or First Federal’s stock; (ii) any one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition), ownership of First Northwest stock or First Federal stock that constitutes 35 percent or more of the total voting power of First Northwest’s stock or First Federal’s stock; (iii) a majority of members of the Board of Directors is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the Board of Directors before the appointment or election; or (iv) any one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition), assets from First Northwest or First Federal that have a total gross fair market value equal to or more than 40 percent of the total gross fair market value of all of First Northwest’s assets or First Federal’s assets immediately before the acquisition.

In the event of a termination in connection with a Change in Control, the employment agreements provide that First Northwest and First Federal jointly shall: (1) pay to the executive in a lump sum, as soon as practicable following receipt of the signed release described above, an amount equal to a multiple of the average of the executive’s five prior years’ annual salary (the multiple being 2.75 for Mr. Deines and 2.00 for Ms. Liske and Mr. Riffle); and (2) continue the executive’s and the executive’s dependents’ coverage under First Northwest’s and First Federal’s health, life and disability programs for one year after the executive’s termination of employment. Section 280G of the Internal Revenue Code provides that if payments made in connection with a Change in Control equal or exceed three times the individual’s base amount, then a portion of those payments are deemed to be “excess parachute payments.” An executive’s “base amount” is generally the average of the executive’s taxable compensation for the last five years preceding the year in which a Change in Control occurs. Individuals are subject to a 20% excise tax on the amount of such excess parachute payments, and First Northwest and First Federal would not be entitled to deduct the amount of such excess parachute payments. The employment agreements provide that severance and other payments payable upon a Change in Control, that constitute parachute payments and would be subject to the excise tax, must either be (i) paid in full or (ii) paid to a lesser extent only if no portion would then be subject to the excise tax, whichever amount results in the executive receiving, on an after-tax basis, the greatest amount of benefits without allowing for any additional payment to account for taxes owed by the executive.

Under the employment agreements, each executive also has agreed, while employed by First Federal and for one year following termination of employment, not to compete with First Federal or solicit any employees, customers, or potential customers actively solicited by First Federal during the preceding 12 months.

26 FIRST NORTHWEST BANCORP

Table of Contents

If an executive becomes entitled to benefits under the terms of First Northwest’s or First Federal’s then-current disability plan, if any, or becomes otherwise unable to fulfill the duties required under the employment agreement, the executive shall be entitled to receive such group and other disability benefits as are then provided for executive employees. In the event of an executive’s disability, First Northwest and First Federal may provide the executive with written notice in accordance with the agreement of its intention to terminate the executive’s employment. In such event, the executive’s employment shall terminate effective on the 30th day after receipt of such notice by the executive (the “Disability Effective Date”); provided that, within the 30 days after such receipt, the executive shall not have returned to full-time performance of the executive’s duties.