Form PRE 14A Envista Holdings Corp For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☑ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ☐ | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |||||||

ENVISTA HOLDINGS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||||||||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| 1 | Title of each class of securities to which transaction applies: | |||||||||||||

| 2 | Aggregate number of securities to which transaction applies: | |||||||||||||

| 3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| 4 | Proposed maximum aggregate value of transaction: | |||||||||||||

| 5 | Total fee paid: | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| 1 | Amount previously paid: | |||||||||||||

| 2 | Form, Schedule or Registration Statement No.: | |||||||||||||

| 3 | Filing party: | |||||||||||||

| 4 | Date Filed: | |||||||||||||

2021

Notice of Annual Meeting

of Stockholders

and Proxy Statement

ENVISTA HOLDINGS CORPORATION

200 S. Kraemer Boulevard, Building E

Brea, CA 92821

Notice of 2021 Annual Meeting of Stockholders

| ¶ | 3 | ? | : | |||||||||||||||||

When: May 25, 2021 at 7:00 a.m., PT. Where: Virtually, at www.virtualshareholdermeeting.com/NVST2021 | Items of Business: 4 measures to review as listed below | Who Can Vote: Stockholders of Envista’s common stock at the close of business on March 31, 2021. | Attending the Meeting: Stockholders will be able to attend, vote and submit questions during the Annual Meeting from any location via the Internet.* Date of Mailing: The date of mailing of this Proxy Statement or Notice of Internet Availability is on or about April 12, 2021. | |||||||||||||||||

*Due to concerns regarding the ongoing novel coronavirus (“COVID-19”) pandemic and to protect the health and safety of our employees and stockholders, the 2021 Annual Meeting will be a virtual meeting conducted solely online and can be attended by visiting www.virtualshareholdermeeting.com/NVST2021.

Items of Business:

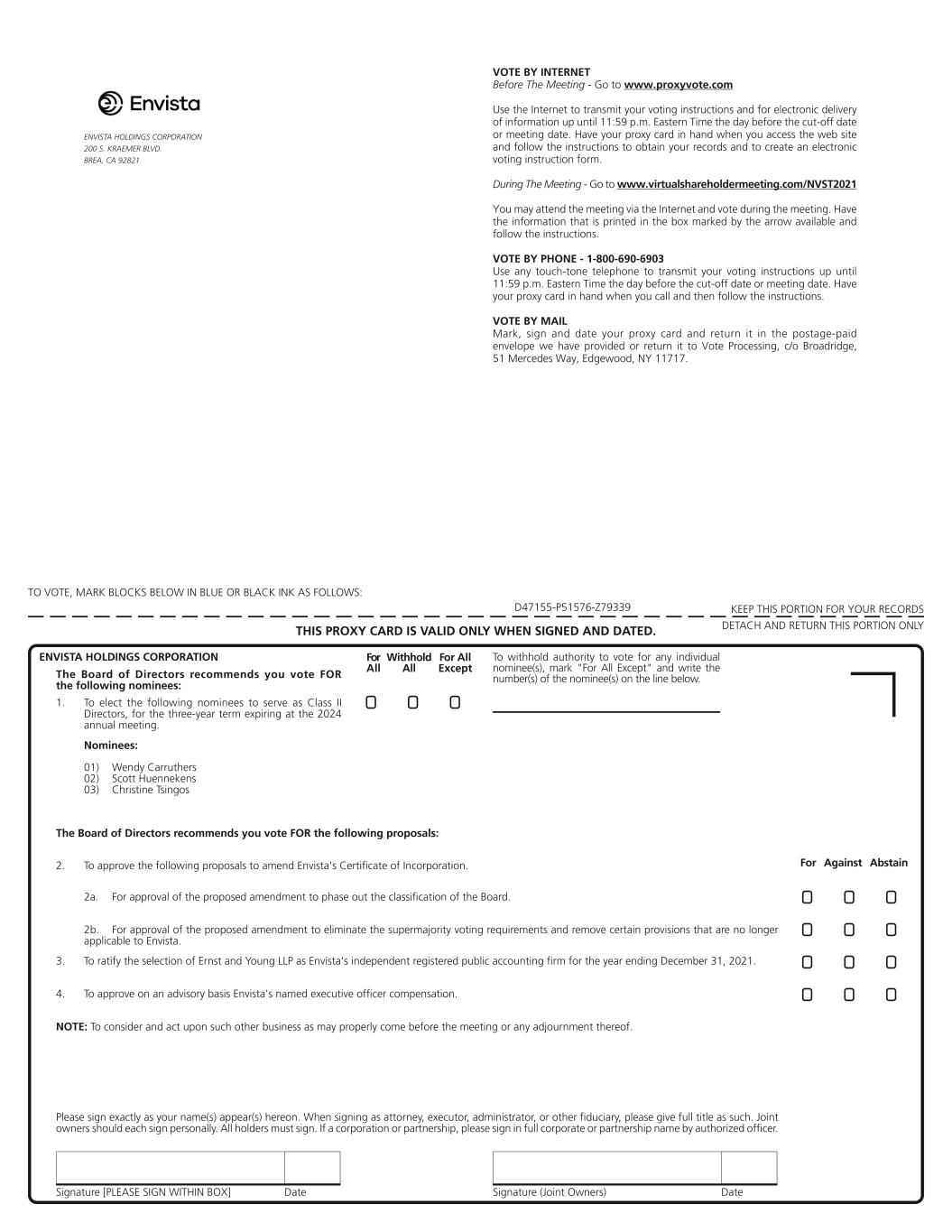

1. To elect each of Ms. Wendy Carruthers, Mr. Scott Huennekens, and Ms. Christine Tsingos to serve as a Class II Director, for a three-year term expiring at the 2024 annual meeting of stockholders and until his or her successor is elected and qualified.

2. To approve amendments to Envista’s amended and restated certificate of incorporation (“Certificate of Incorporation”) to (a) phase out the classification of the Board of Directors and (b) eliminate the supermajority voting requirements and remove certain provisions that are no longer applicable to Envista.

3. To ratify the selection of Ernst & Young LLP as Envista’s independent registered public accounting firm for the year ending December 31, 2021.

4. To approve on an advisory basis Envista’s named executive officer compensation.

5. To consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card or voting instruction form. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 25, 2021:

The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com.

| By Order of the Board of Directors, | |||||

| Mark Nance | |||||

| Secretary | |||||

April 12, 2021

2021 Annual Meeting of Stockholders

Notice of Annual Meeting and Proxy Statement

Table of Contents

| Proxy Statement Summary | |||||

| Proxy Statement | |||||

| Purpose of the Annual Meeting | |||||

| Annual Meeting Admission | |||||

| Outstanding Stock and Voting Rights | |||||

| Solicitation of Proxies | |||||

| Proxy Instructions | |||||

| Notice of Internet Availability of Proxy Materials | |||||

| Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement | |||||

| Voting Methods | |||||

| Changing Your Vote | |||||

| Householding | |||||

| Beneficial Ownership of Common Stock by Directors, Officers and Principal Stockholders | |||||

| Directors and Executive Officers | |||||

| Principal Stockholders | |||||

| Proposal 1 – Election of Directors | |||||

| Class II Director Nominees | |||||

| Current Class I Directors | |||||

| Current Class III Directors | |||||

| Board Composition and Diversity | |||||

| Corporate Governance | |||||

| Corporate Governance Overview | |||||

| Corporate Governance Guidelines, Committee Charters and Code of Conduct | |||||

| Board Leadership Structure and Risk Oversight | |||||

| Director Independence | |||||

| Board of Directors and Committees of the Board | |||||

| Director Nomination Process | |||||

| Executive Officers of the Company | |||||

| Certain Relationships and Related Transactions | |||||

| Policy | |||||

| Relationships and Transactions | |||||

| Proposals 2A and 2B – Approval of Amendments to our Amended and Restated Certificate of Incorporation | |||||

| Proposal 2A - Declassification of the Board of Directors | |||||

| Proposal 2B - Elimination of the Supermajority Voting Requirements Applicable to Shares of Common Stock | |||||

| Compensation Discussion and Analysis | |||||

| Executive Summary | |||||

| 2020 Executive Compensation Decision-Making and Oversight | |||||

| Analysis of 2020 Executive Compensation | |||||

| 2021 Executive Compensation Developments | |||||

| Compensation Peer Group Analysis | |||||

| 2020 Say on Pay Vote Results | |||||

| Stock Ownership Policies | |||||

| Recoupment Policy | |||||

| Tax Deductibility of Executive Compensation | |||||

| Risk Considerations and Review of Executive Compensation Practices | |||||

| CEO Pay Ratio | |||||

| Compensation Committee Report | |||||

| Executive Compensation Tables | |||||

| Summary Compensation Table | |||||

| Grants of Plan-Based Awards for Fiscal 2020 | |||||

| Outstanding Equity Awards at 2020 Fiscal Year-End | |||||

| Option Exercises and Stock Vested During Fiscal 2020 | |||||

| 2020 Nonqualified Deferred Compensation | |||||

| Potential Payments Upon Termination or Change-of-Control as of 2020 Fiscal Year-End | |||||

| Employment Agreements | |||||

| Employee Benefit Plans | |||||

| Equity Compensation Plan Information | |||||

| Director Compensation | |||||

| Director Compensation Philosophy | |||||

| Process for Setting Director Compensation | |||||

| Director Compensation Structure | |||||

| Temporary Changes to Direct Compensation Due to COVID-19 | |||||

| Director Stock Ownership Requirements | |||||

| Director Summary Compensation Table | |||||

| Proposal 3 – Ratification of Independent Registered Public Accounting Firm | |||||

| Fees Paid to Independent Registered Public Accounting Firm | |||||

| Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors | |||||

| Audit Committee Report | |||||

| Proposal 4 – Advisory Vote on Executive Compensation | |||||

| Other Matters | |||||

| Website Disclosure | |||||

| Stockholder Proposals for Next Year’s Annual Meeting | |||||

| Appendix A - Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited) | |||||

| Appendix B - Second Amended and Restated Certificate of Incorporation of Envista Holdings Corporation | |||||

Proxy Statement Summary

To assist you in reviewing the proposals to be acted upon at our 2021 Annual Meeting, below is summary information regarding the meeting. For more information about these topics, please review the complete Proxy Statement. This Proxy Statement and proxy card are first being sent to our stockholders on or about April 12, 2021.

2021 Annual Meeting of Stockholders

| Date and time: | May 25, 2021, 7:00 a.m. PT | |||||||

| Place: | Virtually, at www.virtualshareholdermeeting.com/NVST2021 | |||||||

| Record date: | March 31, 2021 | |||||||

| Voting: | Stockholders of Envista’s common stock at the close of business on March 31, 2021 are entitled to one vote per share of common stock on each matter to be voted upon at the 2021 Annual Meeting of Stockholders (“Annual Meeting”). | |||||||

| Admission: | To virtually attend the Annual Meeting, you will need the control number located on the Notice of Internet Availability of Proxy Materials, your proxy card or the instructions that accompanied your proxy materials. | |||||||

Items of Business

| PROPOSAL | VOTE REQUIRED | BOARD RECOMMENDATION | ||||||||||||

Proposal 1: Election of Class II Directors (page 15) | Plurality of votes cast for each of the director nominees. | FOR each of the nominees | ||||||||||||

Proposals 2A & 2B: Approval of amendments to our Certificate of Incorporation to (a) phase out the classification of our Board of Directors and (b) eliminate the supermajority voting requirements and remove certain provisions no longer applicable to the Company (page 28) | The affirmative vote of the holders of two-thirds of the outstanding shares entitled to vote at the Annual Meeting (for both Proposal 2A and 2B). | FOR each of Proposal 2A and 2B | ||||||||||||

Proposal 3: Ratification of the appointment of the independent registered public accounting firm (page 68) | The affirmative vote of a majority of the shares represented in person (virtually) or by proxy. | FOR | ||||||||||||

Proposal 4: Approval on an advisory basis of our named executive officer compensation (page 70) | The affirmative vote of a majority of the shares represented in person (virtually) or by proxy. | FOR | ||||||||||||

1

Company Overview

We are one of the largest global dental products companies with significant market positions in some of the most attractive segments of the dental products industry; including implants, orthodontics, and digital imaging technologies. We develop, manufacture, and market one of the most comprehensive portfolios of dental consumables, equipment, and services to dental professionals. We cover an estimated 90% of dentists’ clinical needs for diagnosing, treating, and preventing dental conditions as well as improving the aesthetics of the human smile. Our operating companies, Nobel Biocare, Ormco, and KaVo Kerr, serve more than 1 million dentists in over 150 countries through one of the largest commercial organizations in the dental products industry and through our dealer partners. In 2020, we generated total sales of $2.3 billion, of which approximately 74% were derived from sales of consumables, services, and spare parts.

On September 20, 2019, we completed our initial public offering and separated from Danaher Corporation (the “Separation”). The disposition of our shares owned by Danaher (the “Split-Off”) was completed on December 18, 2019 and resulted in the full separation of us and disposal of Danaher’s entire ownership and voting interest in us.

2

Our COVID-19 Response

Our COVID-19 Response | |||||

| Employee Safety and Wellbeing | Financial Resiliency | ||||

•Prioritized employee health and safety, following Centers for Disease Control and Prevention and other relevant guidelines. •Instituted work-from-home arrangements for many of our employees. •Implemented safety protocols to protect employees required to work on-site: daily health and temperature screenings, mandatory face masks, social distancing guidelines, staggered shifts and frequent disinfection processes. •Implemented a program to reimburse employees working from home for certain expenses. •Awarded a one-time appreciation bonus totaling over $3M to our front-line workers. •Increased communication with our employees through frequent online CEO Forums, COVID-19 update emails, and CEO video messages. •Implemented online training and education for our employees. | •Initiated cost mitigation and productivity initiatives at the outset of the pandemic to ensure the ongoing strength of our business. •Accelerated permanent cost reduction program to eliminate more than $100M of spending. •Exited our treatment unit business in North and Latin America. •Temporarily reduced salaries for our executive officers and other highly compensated employees, as well as 15% reduction in Board retainers. | ||||

| Customer Support and Community Outreach | Business Continuity | ||||

•Expanded availability of our training and education for our customers, reaching over 400,000 dental professionals in 2020 through more than 4,000 events. •Donated infection prevention products and eye protection to healthcare professionals. | •Ensured active and ongoing oversight by and engagement with our Board during the pandemic (see page 20 for additional details). •Established executive management COVID-19 response team to mitigate risks and evaluate the impact of the pandemic on strategy, operations, liquidity and financial matters •Invested in growth priorities including orthodontics, infection prevention, implants, and China. | ||||

3

Financial Highlights

| $ in millions | Second Half 2020 (“2H”) | 2020 | ||||||

| Total Revenue | $1,372.8 | $2,282.0 | ||||||

| Total Sales Growth | (0.5) | % | (17.1) | % | ||||

| Core Sales Growth* | 1.2 | % | (14.8) | % | ||||

| Net Income | $144.0 | $33.3 | ||||||

| Adjusted EBITDA* | $282.7 | $303.1 | ||||||

| Cash Provided by Operating Activities | $341.5 | $283.9 | ||||||

| Free Cash Flow* | $320.5 | $241.5 | ||||||

| Diluted Earnings Per Share | $0.86 | $0.20 | ||||||

| Adjusted Diluted EPS* | $1.04 | $0.98 | ||||||

* See Appendix A for a reconciliation of GAAP to non-GAAP measures

Our Values

During 2020, we established a set of core values meant to define our company culture and guide how we operate. These core values are built around Customer centricity, leading Innovation, Respect for all, an embrace of Continuous improvement, and Leadership that is accountable for their actions and results. We use the acronym “CIRCLe” to ensure we have these values top of mind.

4

Human Capital Resources

Our success depends on our ability to attract, develop, and retain a talented employee base. We aspire to help our employees

thrive both personally and professionally. As part of these efforts, we strive to embody our core values, offer a competitive

compensation and benefits program, foster a community where everyone feels included and respected, and provide ample

professional development opportunities.

Compensation and Benefits Program

Our compensation programs and practices are designed to attract employees, motivate and reward performance, drive growth,

and support retention. We offer competitive compensation packages based on market data, which include base salary and may also include annual cash performance incentives, commissions, overtime opportunities, allowances and, in some countries where these are customary, additional monthly payments. In addition, employees in select senior management roles may receive long-term compensation in the form of equity awards. We regularly review our compensation structure to ensure that we remain competitive, reward top performance, as well as to ensure internal equity. We offer robust benefits in each of our locations. In the U.S., our benefits package includes health (medical, dental & vision) insurance, paid time off, paid parental leave, a retirement plan, and life and disability coverage.

Diversity and Inclusion

Diversity, inclusion, and equality are at the core of what make our culture and our teams so successful and are embodied by our value of Respect. We know that when our employees show up every day as their authentic selves, there is greater teamwork, more thoughtful debate, and more reasons to celebrate. We are committed to a culture where diversity, respect, belonging, and authenticity are valued. We drive diversity and inclusion by way of diverse candidate slates for executive level, professional level, and sales roles and we ensure succession plan talent is diverse in representation and receives promotional advocacy. We have a Diversity and Inclusion Council, consisting of leaders within the Company to drive accountability and results for our diversity and inclusion strategic efforts and initiatives. We have four standing Diversity and Inclusion Committees in the areas of talent acquisition and engagement, education and learning, events and celebrations, and global communication. We have two Employee Resource Groups: Women + Friends and Multicultural + Friends, as well as learning events during each historical heritage month throughout the year to celebrate our workforce. Additionally, we have strategically partnered with the Consortium for early career diverse talent and with historically Black colleges and universities (HBCUs) and Hispanic Serving Institutions (HSIs) to further advance our workforce diversity efforts.

5

Learning and Development Opportunities

We empower our employees to thrive in their current roles as well as support employees’ aspiration to move into different

roles. We have a promote-from-within culture with opportunities across our operating companies. We support our employees through a multitude of training and development programs, including training on our Envista Business System (“EBS”) tools through our Envista Business System University, individual development plans (which encourages our employees to take charge of their learning and growth opportunities and provides access to hundreds of online courses), and various management trainings. We also have several programs focused on early career development, including internship programs and our six-year General Management Development Program. This commitment to our employees’ professional development reflects both our

Continuous Improvement and Leadership core values.

Sustainability

From the start, establishing Envista as a company that sets a high standard of performance on environmental, social, and governance measures has been a priority. We have spent considerable time and effort over the past year examining what is most important to our stakeholders and our business. We will be launching our Inaugural Sustainability Report in May and we are excited to share our environmental, social, and governance commitments with our stakeholders at that time.

Corporate Governance Highlights

Our Board of Directors recognizes that enhancing and protecting long-term value for our stockholders requires a robust framework of corporate governance that serves the best interests of all our stockholders.

Recent Governance Actions:

•Subject to approval by the stockholders of Proposal 2A, declassification of the Board of Directors to provide for the annual election of directors after a sunset period. The classified board structure was approved by Danaher, our former parent, prior to the Separation. Our Board of Directors approved, at the recommendation of our Nominating and Governance Committee, the declassification of the Board subject to the legally required approval of the stockholders.

•Subject to approval by the stockholders of Proposal 2B, approved the elimination of the supermajority voting requirements applicable to shares of common stock.

•Implemented an ESG and sustainability program, with oversight by the Nominating and Governance Committee. Our Inaugural Sustainability Report will be released in May of this year.

•Conducted our annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees.

Additional Highlights of Our Corporate Governance Framework:

•Our Chairman and CEO positions are separate, with an independent Chairman.

•All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the New York Stock Exchange (“NYSE”) listing standards and applicable Securities and Exchange Commission (“SEC”) rules.

•Approximately 88% of our directors are non-employee directors and 75% of our Board is comprised of independent directors.

•Independent directors meet regularly without management.

•We hold a say-on-pay advisory vote every year.

•We have robust stock ownership requirements for our directors and executive officers.

•Director orientation and continuing education programs for directors.

•We have no stockholder rights plan.

•Our corporate governance guidelines limit the number of boards of other public companies on which our directors may serve to four.

•We maintain a related person transaction policy with oversight by the Nominating and Governance Committee.

•All members of the Audit Committee are audit committee financial experts.

6

Executive Compensation Highlights

Overview of Executive Compensation Program

The components of our executive compensation program are intended to support our human capital strategy and to further stockholder interests as follows:

| ELEMENT | FORM OF COMPENSATION | PRIMARY OBJECTIVES | ||||||

| Base Salary | Cash | •Help attract and retain executive talent. •Balance pay-at-risk components by providing a stable source of income. •Recognize day-to-day role and scope of responsibility. | ||||||

| Annual Incentive Compensation | Cash | •Align executives with key strategic and operational initiatives. •Reward performance on key annual financial measures, including core sales growth, profitability and cashflow generation. •Motivate and reward teamwork and individual performance. | ||||||

| Long-Term Incentive Compensation | Stock Options RSUs | •Drive sustainable performance that delivers value to stockholders over the long-term. •Provide direct alignment to stock price appreciation. •Align the interest of the executive with those of the stockholders. | ||||||

| Other Compensation | Employee Benefits Perquisites Severance | •Provide a competitive compensation package. •Reinforce alignment with stockholder interests through deferrals in Company stock and, also, retention through vesting restrictions (e.g., ECP & EDIP). •Support corporate objectives (e.g., relocation and tax equalization benefits). | ||||||

7

Compensation Governance Highlights

Our approach to executive compensation reflects a range of practices that promote alignment between the interests of executives and those of stockholders, as illustrated below.

8

Proxy Statement

Envista Holdings Corporation

200 S. Kraemer Boulevard, Building E

Brea, CA 92821

2021 Annual Meeting of Stockholders

May 25, 2021

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Envista Holdings Corporation, a Delaware corporation (“Envista”), of proxies for use at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 7:00 a.m., PT, and at any and all postponements or adjournments thereof. Please note that, due to concerns regarding the ongoing novel coronavirus (“COVID-19”) pandemic and to protect the health and safety of our employees and stockholders, the Annual Meeting will be a virtual meeting conducted solely online and can be attended by visiting www.virtualshareholdermeeting.com/NVST2021. Envista’s principal address is 200 S. Kraemer Boulevard, Building E, Brea, CA 92821. The date of mailing of this Proxy Statement is on or about April 12, 2021.

Purpose of the Annual Meeting

The purpose of the Annual Meeting is to:

1.Elect each of Ms. Wendy Carruthers, Mr. Scott Huennekens, and Ms. Christine Tsingos to serve as a Class II Director, for a three-year term expiring at the 2024 annual meeting of stockholders and until his or her successor is elected and qualified;

2.Approve amendments to our Certificate of Incorporation to (a) phase out the classification of the Board and (b) eliminate the supermajority voting requirements and remove certain provisions that are no longer applicable to Envista;

3.Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021;

4.Approve on an advisory basis our named executive officer compensation; and

5.Consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

Annual Meeting Admission

If a stockholder would like to virtually attend the Annual Meeting in person, he or she must access www.virtualshareholdermeeting.com/NVST2021 using the control number located on the Notice of Internet Availability of Proxy Materials, or on each proxy card or by following the instructions that accompanied his or her proxy materials.

Outstanding Stock and Voting Rights

In accordance with Envista’s Amended and Restated Bylaws, the Board has fixed the close of business on March 31, 2021, as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to vote. The only outstanding securities of Envista entitled to vote at the Annual Meeting are shares of Common Stock, $.01 par value (“Common Stock”). Each outstanding share of Common Stock entitles the holder to one vote on each directorship and other matter brought before the Annual Meeting. As of the close of business on March 31, 2021, 160,645,564 shares of Common Stock were outstanding, excluding shares held by or for the account of Envista.

9

Solicitation of Proxies

The proxies being solicited hereby are being solicited by the Board. The total expense of the solicitation will be borne by us, including reimbursement paid to banks, brokerage firms and nominees for their reasonable expenses in forwarding material regarding the Annual Meeting to beneficial owners. Solicitation of proxies may be made personally or by mail, telephone, internet, e-mail or facsimile by officers and other of our management employees, who will receive no additional compensation for their services. We have hired D.F. King & Co., Inc. to help us send out the proxy materials and to solicit proxies for the Annual Meeting at an estimated cost of $12,500 plus reimbursement of certain additional out of pocket expenses.

Proxy Instructions

Proxies will be voted as specified in the stockholder’s proxy.

If you sign and submit your proxy card with no further instructions, your shares will be voted:

•FOR the election of Ms. Wendy Carruthers, Mr. Scott Huennekens, and Ms. Christine Tsingos to serve as a Class II director;

•FOR the approval of the amendments to our Certificate of Incorporation to (a) phase out the classification of the Board and (b) eliminate the supermajority voting requirements and remove certain provisions that are no longer applicable to Envista (comprising two proposals);

•FOR ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021;

•FOR approval of our named executive officer compensation; and

•In the discretion of the proxy holders on any other matter that properly comes before the meeting or any adjournment thereof. The Board has selected Amir Aghdaei and Mark Nance to act as proxies with full power of substitution.

Notice of Internet Availability of Proxy Materials

As permitted by SEC rules, we are making the proxy materials available to our stockholders primarily via the Internet. By doing so, we can reduce the printing and delivery costs and the environmental impact of the Annual Meeting. On April 12, 2021, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. The Notice contains instructions on how to access our proxy materials and how to vote online or by telephone. If you would like to receive a paper copy of the proxy materials, please follow the instructions in the Notice.

Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement

Quorum. The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting as of the record date. Virtual attendance at our Annual Meeting constitutes presence in person for purposes of quorum at the Annual Meeting. Abstentions and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied.

Broker Non-Votes. Under NYSE rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote those shares on Proposal 3, which is considered a “routine” matter. However, on “non-routine” matters such as Proposals 1, 2 and 4, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. Therefore, if you are a beneficial owner and do not provide your broker with voting instructions, your shares may constitute broker non-votes with respect to Proposals 1, 2 and 4. Broker non-votes will not affect the required vote with respect to Proposals 1 and 4.

10

Approval Requirements. If a quorum is present, the vote required under the Company’s Amended and Restated Bylaws and the Amended and Restated Certificate of Incorporation to approve each of the proposals is as follows:

•With respect to Proposal 1, the election of directors, you may vote “for” or “withhold” authority to vote for any or all of the Class II director nominees. In elections of directors, a nominee is elected by a plurality of the votes cast by the shares entitled to vote, provided that a quorum is present. A “plurality of the votes cast” means that the individuals with the highest number of votes are elected as directors up to the maximum number of directors to be elected.

•With respect to Proposals 2A and 2B, the affirmative vote of two-thirds of the outstanding shares of our common stock entitled to vote on the proposal is required for approval. Abstentions and broker non-votes will have the same effect as votes against the proposal.

•With respect to Proposals 3 and 4, the affirmative vote of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal.

Tabulation of Votes. Broadridge Financial Solutions, Inc. will tabulate votes cast by proxy or in person (virtually) at the meeting and American Election Services, LLC will act as the Independent Inspector of Election. We will report the results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

Voting Methods

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the registered holder of those shares. As the registered stockholder, you can ensure your shares are voted at the Annual Meeting by submitting your instructions over the Internet, or if you received printed proxy materials, via the Internet, telephone or by completing, signing, dating and returning the enclosed proxy card in the envelope provided, or by attending the virtual Annual Meeting and voting your shares at the meeting. Telephone and internet voting for registered stockholders will be available 24 hours a day, up until 11:59 p.m., Eastern time on May 24, 2021.

Detailed instructions for Internet voting are set forth on the Notice, proxy card or voting instruction form.

| 8 | Vote your shares at www.proxyvote.com. | |||||||

| ( | Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number needed to vote. | |||||||

Call toll-free number 1-800-690-6903 | ||||||||

| + | Mark, sign, date, and return the enclosed proxy card or voting instruction form in the envelope we have provided or return it to: Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | |||||||

If you hold your shares through a broker, bank or nominee, rather than registered directly in your name, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or nominee, together with a voting instruction form. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction forms.

If you participate in the Envista Stock Fund through the Envista Holdings Corporation Savings Plan ( the “Savings Plan” and a “401(k) Plan”), your proxy will also serve as a voting instruction for Fidelity Management Trust Company (“Fidelity”), the trustee of the Savings Plan, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by May 20, 2021, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

11

Changing Your Vote

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Envista a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by virtually attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Virtual attendance at the meeting will not, by itself, revoke a proxy.

Householding

We are permitted to send a single set of our proxy statement and annual report to stockholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our annual report and proxy statement to you if you contact us at Envista Holdings Corporation, Attn: Investor Relations, 200 S. Kraemer Boulevard, Building E, Brea, CA 92821; telephone us at 714-817-7000; or email us at IR@envistaco.com. In addition, if you want to receive separate copies of the proxy statement or annual report in the future; if you and another stockholder sharing an address would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

12

Beneficial Ownership of Common Stock by Directors, Officers and Principal Stockholders

Directors and Executive Officers

The following table sets forth as of March 31, 2021 (unless otherwise indicated) the number of shares and percentage of Common Stock beneficially owned by each of our directors, nominees for director and each of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”), and all current executive officers and directors as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of March 31, 2021. Except as indicated, the address of each director and executive officer shown in the table below is c/o Envista Holdings Corporation, 200 S. Kraemer Boulevard, Building E, Brea, CA 92821.

| Shares of common stock beneficially owned | ||||||||||||||

Name of Beneficial Owner | Number of Shares(1) | Percent of Shares(1) | ||||||||||||

| Amir Aghdaei | 651,862 | (2) | * | |||||||||||

| Wendy Carruthers | 16,195 | (3) | * | |||||||||||

| Patrik Eriksson | 169,763 | (4) | * | |||||||||||

| Kieran T. Gallahue | 10,265 | (3) | * | |||||||||||

| Scott Huennekens | 21,970 | (3) | * | |||||||||||

| Vivek Jain | 9,200 | (3) | * | |||||||||||

| Jean-Claude Kyrillos | 10,962 | (5) | * | |||||||||||

| Mark Nance | 17,071 | (6) | * | |||||||||||

| Daniel A. Raskas | 10,265 | (3) | * | |||||||||||

| Gayle Sheppard | 6,460 | (3) | * | |||||||||||

| Christine Tsingos | 16,185 | (3) | * | |||||||||||

| Howard H. Yu | 77,584 | (7) | * | |||||||||||

| All directors and executive officers as a Group (15 persons) | 1,314,356 | (8) | * | |||||||||||

_________________

* Denotes less than 1% of the outstanding Common Stock on March 31, 2021

(1)Balances credited to each executive officer’s account under the Envista Executive Deferred Incentive Plan (the “EDIP”), the Envista Excess Contribution Program (the “ECP”) and/or the Envista Deferred Contribution Plan (the “DCP”) which are vested or are scheduled to vest within 60 days of March 31, 2021, are included in the table. See “Employee Benefit Plans—Supplemental Retirement Program” for a description of our EDIP, ECP and DCP. The incremental number of notional phantom shares of Common Stock credited to a person’s EDIP, ECP, or DCP account is based on the incremental amount of contribution to the person’s EDIP, ECP, or DCP balance divided by the closing price of Common Stock as reported on the NYSE on the date of the contribution. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of March 31, 2021 or upon vesting of Restricted Stock Units (“RSUs”) that vest within 60 days of March 31, 2021.

(2)Includes 58,639 shares of Common Stock held by Mr. Aghdaei, 10,000 shares acquired through our directed share program in connection with the IPO, options to acquire 436,622 shares, 43,614 RSUs that vested on February 24, 2020 but are not available to Mr. Aghdaei until February 24, 2022, 37,250 RSUs that vested on February 24, 2021 but are not available to Mr. Aghdaei until February 24, 2023, and 65,737 shares attributable to Mr. Aghdaei’s EDIP account.

(3)Consists of RSUs that are vested but not released and RSUs granted to non-employee directors which vest within 60 days of March 31, 2021. The underlying shares of vested RSUs will be delivered at the earlier of the director’s death or the first day of the seventh month following the director’s resignation from the Board. Ms. Carruthers’ total also includes 10 shares of Common Stock.

(4)Includes 21,076 shares of Common Stock held by Mr. Eriksson, 5,000 shares acquired through our directed share program in connection with the IPO, options to acquire 118,975 shares, and 24,712 shares attributable to Mr. Eriksson’s EDIP account.

(5)Includes 1,558 shares of Common Stock held by Mr. Kyrillos, and options to acquire 9,404 shares.

(6)Includes 2,808 shares of Common Stock held by Mr. Nance, and options to acquire 14,263 shares.

(7)Includes 2,000 shares acquired through our directed share program in connection with the IPO, options to acquire 75,191 shares, and 393 shares attributable to Mr. Yu’s ECP account.

(8)Includes 113,303 shares of Common Stock, 28,000 shares acquired through our directed share program in connection with the IPO, options to acquire 885,674 shares, 112,614 RSUs that have vested but are not released until a later date, 59,094 RSUs that will vest within 60 days of March 31, 2021, 1,126 options that will vest within 60 days of March 31, 2021, 112,922 shares attributable to EDIP accounts, and 1,623 shares attributable to DCP and ECP accounts.

13

Principal Stockholders

The following table sets forth the number of shares and percentage of Common Stock beneficially owned by each person who owns of record or is known to us to beneficially own more than five percent of Common Stock.

| NAME AND ADDRESS | NUMBER OF SHARES BENEFICIALLY OWNED | PERCENT OF CLASS | ||||||||||||||||||

T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202 | 24,877,283 | (1) | 15.5% | |||||||||||||||||

| FMR LLC 245 Summer Street, Boston, MA 02210 | 20,476,344 | (2) | 12.8% | |||||||||||||||||

| Eaton Vance Management 2 International Place, Boston, MA 02110 | 15,624,554 | (3) | 9.8% | |||||||||||||||||

| The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | 13,943,258 | (4) | 8.7% | |||||||||||||||||

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 11,737,716 | (5) | 7.4% | |||||||||||||||||

| Harris Associates L.P. 111 South Wacker Drive, Suite 4600, Chicago, IL 60606 | 8,255,383 | (6) | 5.2% | |||||||||||||||||

(1)The amount shown and the following information is derived from a Schedule 13G/A filed February 16, 2021 by T. Rowe Price Associates, Inc. (“Price Associates”) and T. Rowe Price Capital Appreciation Fund, Inc. (the “Fund”), which sets forth Price Associates’ and the Fund’s beneficial ownership as of December 31, 2020. According to the Schedule 13G/A, Price Associates has sole voting power over 6,100,201 shares and sole dispositive power over 24,877,283 shares. The Fund has sole voting power over 11,974,423 shares. According to the Schedule 13G/A, Price Associates does not serve as custodian of the assets of any of its clients; accordingly, in each instance only the client or the client’s custodian or trustee bank has the right to receive dividends paid with respect to, and proceeds from the sale of, such securities. The ultimate power to direct the receipt of dividends paid with respect to, and the proceeds from the sale of, such securities, is vested in the individual and institutional clients which Price Associates serves as investment adviser. Any and all discretionary authority which has been delegated to Price Associates may be revoked in whole or in part at any time. With respect to securities owned by the Fund, only the custodian of the Fund has the right to receive dividends paid with respect to, and proceeds from the sale of, such securities. No other person is known to have such right, except that the shareholders of the Fund participate proportionately in any dividends and distributions so paid.

(2)The amount shown and the following information is derived from a Schedule 13G/A filed March 10, 2021 by FMR LLC and Abigail P. Johnson, which sets forth their respective beneficial ownership as of March 9, 2021. According to the Schedule 13G/A, FMR LLC and Abigail P. Johnson have sole voting power over 2,482,421 shares and sole dispositive power over 20,476,344 shares.

(3)The amount shown and the following information is derived from a Schedule 13G filed February 12, 2021 by Eaton Vance Management, which sets forth its beneficial ownership as of December 31, 2020. According to the Schedule 13G, Eaton Vance Management has sole voting and sole dispositive power over 15,624,554 shares.

(4)The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 2021 by The Vanguard Group, which sets forth its beneficial ownership as of December 31, 2020. According to the Schedule 13G/A, The Vanguard Group has shared voting power over 106,446 shares, sole dispositive power over 13,708,105 shares and shared dispositive power over 235,153 shares.

(5)The amount shown and the following information is derived from a Schedule 13G/A filed February 5, 2021 by BlackRock, Inc., which sets forth its beneficial ownership as of December 31, 2020. According to the Schedule 13G/A, BlackRock Inc. has sole voting power over 11,199,917 shares and sole dispositive power over 11,737,716 shares.

(6)The amount shown and the following information is derived from a Schedule 13G filed February 16, 2021 by Harris Associates L.P. and Harris Associates Inc., which sets forth their respective beneficial ownership as of December 31, 2020. According to the Schedule 13G, Harris Associates L.P. and Harris Associates Inc. have sole voting power over 6,659,883 shares and sole dispositive power over 8,255,383 shares.

14

Proposal 1. Election of Directors

Pursuant to the Company’s Amended and Restated Certificate of Incorporation adopted prior to the Separation, the Board is constituted into three classes as follows:

•Class I: Kieran T. Gallahue and Gayle Sheppard, whose terms expire at the 2023 Annual Meeting of Stockholders;

•Class II: Wendy Carruthers, Scott Huennekens, and Christine Tsingos, whose terms expire at the Annual Meeting; and

•Class III: Amir Aghdaei, Daniel A. Raskas, and Vivek Jain, whose terms expire at the 2022 Annual Meeting of Stockholders.

At the Annual Meeting, stockholders will be asked to elect each of the current Class II director nominees identified below (who have been recommended by the Nominating and Governance Committee, nominated by the Board and currently serve as Class II Directors of Envista) to serve until the 2024 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified.

We have set forth below information as of March 31, 2021 relating to each nominee for election as director and each director continuing in office, including: his or her principal occupation and any board memberships at other public companies during the past five years; the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Envista; the year in which he or she became a director; and age. Please see “Corporate Governance – Director Nomination Process” for a further discussion of the Board’s process for nominating Board candidates. Each of the nominees has consented to serve if elected. In the event a nominee declines or is unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

Class II Director Nominees – Three Year Term That Will Expire in 2024

| Wendy Carruthers | Director since: 2019 | Other Current Public Company Directorships: None | ||||||||||||

Age: 52 | Independent | Board Committees: Compensation (Chair) & Nominating and Governance | ||||||||||||

Wendy Carruthers has served as Senior Vice President of Human Resources at Boston Scientific Corporation, a medical device manufacturer, since December 2012 after serving in a series of progressively more responsible human resources roles since joining Boston Scientific in 2004, including as Vice President of Human Resources for Europe, Middle East and Africa from January 2006 to December 2010. A native of the United Kingdom, Ms. Carruthers’ international background and broad experience in the areas of executive compensation and talent management are particularly valuable to our Board as international expansion and talent acquisition, development, compensation and retention are critical strategic objectives for Envista.

Qualifications: Ms. Carruthers’ qualifications to sit on the Board include, among other factors, an international business background and broad experience in the areas of executive compensation and talent management.

15

| Scott Huennekens | Director since: 2019 | Other Current Public Company Directorships: NuVasive, Inc., ViewRay, Inc. and Acutus Medical, Inc. | ||||||||||||

Age: 56 | Independent | Board Committees: Audit & Nominating and Governance | ||||||||||||

Scott Huennekens served as President, Chief Executive Officer and Chairman of the Board of Directors of Verb Surgical, Inc., a medical equipment manufacturer, from August 2015 to January 2019. Prior to this role, Mr. Huennekens served as President and Chief Executive Officer of Volcano Corporation, a medical device company, from 2002 to February 2015, and as President and Chief Executive Officer of Digirad Corporation, a diagnostic imaging centers company, from 1999 to 2002. Mr. Huennekens is currently a member of the Board of Directors of NuVasive, Inc., ViewRay, Inc. and Acutus Medical, Inc., and previously served as a director of Reva Medical Inc., EndoChoice Holdings, Volcano Corporation and Bellerophon Therapeutics Inc. Mr. Huennekens brings to Envista an extensive background in the medical device field and significant tenure leading public companies as both Chairman and CEO, which positions him to provide to us strategic market insights as well as deep leadership experience.

Qualifications: Mr. Huennekens’ qualifications to sit on the Board include, among other factors, prior public company Chairman and CEO experience and an extensive background in the medical device field.

| Christine Tsingos | Director since: 2019 | Other Current Public Company Directorships: Onto Innovation Inc. and Varex Imaging Corporation. | ||||||||||||

Age: 62 | Independent | Board Committees: Audit (Chair) & Compensation | ||||||||||||

Christine Tsingos served as Executive Vice President and Chief Financial Officer at Bio-Rad Laboratories, Inc., a manufacturer of life science research and clinical diagnostics products, from 2002 to May 2019. Ms. Tsingos is also currently a member of the Board of Directors of each of Onto Innovation Inc. (formerly Nanometrics Incorporated) and Varex Imaging Corporation. Ms. Tsingos brings to Envista deep finance and accounting leadership as well as substantial audit committee experience, which are areas of critical importance for us as a large, global and complex public company.

Qualifications: Ms. Tsingos’ qualifications to sit on the Board include, among other factors, deep finance and accounting leadership as well as substantial audit committee experience.

The Board of Directors recommends that stockholders vote “FOR” the election to the Board of each of the foregoing Class II Director Nominees. | ||

16

Current Class I Directors – Directors with Terms That Will Expire in 2023

| Kieran T. Gallahue | Director since: 2019 | Other Current Public Company Directorships: Edwards Lifesciences, Intersect ENT, Arena Pharmaceuticals | ||||||||||||

Age: 57 | Independent | Board Committees: Nominating and Governance (Chair) | ||||||||||||

Kieran T. Gallahue is the former Chairman and Chief Executive Officer of CareFusion Corporation, a global medical technology company, from 2011 until its acquisition by Becton, Dickinson and Company in March 2015. From January 2008 through January 2011, Mr. Gallahue served as President, Chief Executive Officer and a Director of ResMed, Inc., a medical device firm serving the sleep-disordered breathing and respiratory markets. Mr. Gallahue is also currently a member of the Board of Directors of each of Edwards Lifesciences Corp., Intersect ENT, Inc. and Arena Pharmaceuticals, Inc. Mr. Gallahue brings to Envista extensive executive leadership and public company board experience, as well as a deep background in the medical device industry and other related fields, all of which are particularly valuable attributes to our Board.

| Gayle Sheppard | Director since: 2020 | Other Current Public Company Directorships: None | ||||||||||||

Age: 67 | Independent | Board Committees: Compensation | ||||||||||||

Gayle Sheppard has served as Corporate Vice President, Azure Data, Microsoft Corporation since April 2019, where she leads the vision & strategy for Microsoft’s data and analytics products and services. Prior to joining Microsoft, Ms. Sheppard served as Vice President and General Manager of the AI/ML Division, Intel Corporation, from October 2015 through October 2018. Prior to joining Intel, Ms. Sheppard held various leadership positions at Saffron Technology, Inc., Peoplesoft, Inc., Ketera Technologies, Inc. and J.D. Edwards, Inc. Ms. Sheppard has founded, created, or contributed to start-up and Fortune 100 companies focused on Artificial Intelligence platforms, solutions in business and consumer markets, and digitization of business in a wide variety of industries. Ms. Sheppard brings to Envista extensive global business experience and deep technology expertise, which are areas of critical importance for us as a large, international company.

17

Current Class III Directors – Directors with Terms That Will Expire in 2022

| Amir Aghdaei | Director since: 2019 | Other Current Public Company Directorships: None | ||||||||||||

Age: 63 | Board Committees: None | |||||||||||||

Amir Aghdaei has served as our President and Chief Executive Officer and as a director on our Board since May 2019. Prior to that, Mr. Aghdaei served in multiple leadership roles since joining Danaher Corporation in 2008, including as Vice President - Group Executive since 2011 and with responsibility for Danaher’s Dental business since July 2015. Before joining Danaher, Mr. Aghdaei served in a variety of international leadership roles with Hewlett-Packard Company, Agilent Technologies Inc. and Credence Systems Corporation. Mr. Aghdaei brings to Envista an in-depth knowledge of our Dental business and extensive international experience, which is particularly important given our global footprint.

| Daniel A. Raskas | Director since: 2019 | Other Current Public Company Directorships: None | ||||||||||||

Age: 54 | Board Committees: None | |||||||||||||

Daniel A. Raskas has served as Senior Vice President - Corporate Development of Danaher Corporation since 2010 after serving as Vice President - Corporate Development from 2004, when he joined Danaher. Prior to joining Danaher, Mr. Raskas was a Managing Director for Thayer Capital Partners, a private equity investment firm. Mr. Raskas’ corporate development and private equity experience give him particular insight into acquisition strategy, which represents a key strategic opportunity for us.

| Vivek Jain | Director since: 2020 | Other Current Public Company Directorships: ICU Medical, Inc. | ||||||||||||

Age: 49 | Independent | Board Committees: Audit | ||||||||||||

Vivek Jain has served as CEO and Chairman of the Board of ICU Medical, Inc., a global medical technology company specializing in infusion therapy, since February 2014. Prior to this role, Mr. Jain served at CareFusion Corporation, a global medical technology company, as President of Procedural Solutions from 2011 to February 2014 and as President, Medical Technologies and Services from September 2009 until 2011. Before joining CareFusion Corporation, Mr. Jain served as the Executive Vice President-Strategy and Corporate Development of Cardinal Health, Inc., a health care services company, from June 2007 until August 2009. Mr. Jain served as Senior Vice President, Business Development and M&A for the Philips Medical Systems business of Koninklijke Philips Electronics N.V., an electronics company, from 2006 to August 2007. Mr. Jain served as an investment banker at J.P. Morgan Securities, Inc., an investment banking firm, from 1994 to 2006. Mr. Jain’s last position with J.P. Morgan was as Co-Head of Global Healthcare Investment Banking from 2002 to 2006. Mr. Jain brings to Envista significant CEO and Chairman experience at a public company and a deep background in the medical technology and healthcare fields, which are areas of particular value to our Board.

18

Board Composition and Diversity

The below charts reflect information for all nominees and continuing directors (8 directors). The Skills and Experience graph reflects the number of directors with substantial experience in each of the listed categories.

Skills and Experience

Independence and Diversity

19

Corporate Governance

Corporate Governance Overview

Our Board of Directors recognizes that enhancing and protecting long-term value for our stockholders requires a robust framework of corporate governance that serves the best interests of all our stockholders.

Recent Governance Actions:

•Subject to approval by the stockholders of Proposal 2A, declassification of the Board of Directors to provide for the annual election of directors after a sunset period. The classified board structure was approved by Danaher, our former parent, prior to the Separation. Our Board of Directors approved, at the recommendation of our Nominating and Governance Committee, the declassification of the Board subject to the legally required approval of the stockholders.

•Subject to approval by the stockholders of Proposal 2B, approved the elimination of the supermajority voting requirements applicable to shares of common stock.

•Implemented an ESG and sustainability program, with oversight by the Nominating and Governance Committee. Our Inaugural Sustainability Report will be released in May of this year.

•Conducted our annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees.

Additional Highlights of Our Corporate Governance Framework:

•Our Chairman and CEO positions are separate, with an independent Chairman.

•All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the NYSE listing standards and applicable SEC rules.

•Approximately 88% of our directors are non-employee directors and 75% of our Board is comprised of independent directors.

•Independent directors meet regularly without management.

•We hold a say-on-pay advisory vote every year.

•We have robust stock ownership requirements for our directors and executive officers.

•Director orientation and continuing education programs for directors.

•We have no stockholder rights plan.

•Our corporate governance guidelines limit the number of boards of other public companies on which our directors may serve to four.

•We maintain a related person transaction policy with oversight by the Nominating and Governance Committee.

•All members of the Audit Committee are audit committee financial experts.

Corporate Governance Guidelines, Committee Charters and Code of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and adopted written charters for each of the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee of the Board. The Board of Directors has also adopted for the Company our Code of Conduct that includes, among others, a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Nominating and Governance Committee Charter, and Code of Conduct referenced above are each available in the “Investors – Governance” section of our website at http://www.envistaco.com.

Board Leadership Structure and Risk Oversight

Board Leadership Structure. The Board has separated the positions of Chairman and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our stockholders.

The entire Board selects its Chairman, and our Board has selected Scott Huennekens, an independent director, as its Chairman, in light of Mr. Huennekens’ independence and his deep experience and knowledge with corporate governance, board management, stockholder engagement, risk management and extensive background in the medical device field.

20

As the independent Chairman of the Board, Mr. Huennekens leads the activities of the Board, including:

•Calling and presiding at all meetings of the Board;

•Together with the CEO and the Corporate Secretary, setting the agenda for the Board;

•Calling and presiding at the executive sessions of non-management directors and of the independent directors;

•Advising the CEO on strategic aspects of the Company’s business, including developments and decisions that are to be discussed with, or would be of interest to, the Board;

•Acting as a liaison as necessary between the non-management directors and the management of the Company; and

•Acting as a liaison as necessary between the Board and the Committees of the Board.

In the event that the Chairman of the Board is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select by majority vote an independent director to serve as the Lead Independent Director with the authority to:

•Preside at all meetings of the Board at which the Chairman is not present, including the executive sessions;

•Call meetings of the independent directors;

•Act as a liaison as necessary between the independent directors and the CEO; and

•Advise with respect to the Board’s agenda.

The Board’s non-management directors meet in executive session following the Board’s regularly-scheduled meetings, with the executive sessions chaired by the independent Chairman. In addition, the independent directors meet as a group in executive session at least once a year.

Risk Oversight. Our management has day-to-day responsibility for assessing and managing our risk exposure and the Board and its committees oversee those efforts, with particular emphasis on the most significant risks facing us. Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities.

| BOARD/COMMITTEE | PRIMARY AREAS OF RISK OVERSIGHT | ||||

| Full Board | Risks associated with our strategic plan, acquisition and capital allocation program, capital structure, liquidity, organizational structure and other significant risks, and overall risk assessment and risk management policies. | ||||

| Audit Committee | Major financial risk exposures, significant legal, compliance, reputational and cyber security risks and overall risk assessment and risk management policies. | ||||

| Compensation Committee | Risks associated with compensation policies and practices, including incentive compensation. | ||||

| Nominating and Governance Committee | Risks related to corporate governance, effectiveness of Board and committee oversight and review of director candidates, conflicts of interest and director independence. | ||||

Since risk issues often overlap, committees from time to time request that the full Board discuss particular risks. On an annual basis, the Company’s Enterprise Risk Management Committee (consisting of members of senior management) inventory, assess and prioritize the most significant risks facing the Company as well as related mitigation efforts, and provide a report to the Board.

In determining to separate the position of the CEO and the Chairman, and in determining the appointment of the Chairman of the Board and the Chairs of the Committees, the Board and the Nominating and Governance Committee considered the implementation of a governance structure and appointment of chairpersons with appropriate and relevant risk management experience that would enable the Company to efficiently and effectively assess and oversee its risks.

Oversight of COVID-19. The Board and its Committees have been actively overseeing the Company’s response to and risk management of the ongoing COVID-19 pandemic, including regular updates from and discussions with management. Topics around this ongoing crisis span a broad range of matters, including protecting the health, safety and well-being of our employees; evaluating the impact of the pandemic on strategy, operations, liquidity and financial matters; assessing our compensation programs; minimizing supply chain disruption; monitoring continued compliance with applicable laws; and supporting the communities in which we operate. See page 3 for more information on our efforts in response to the COVID-19 pandemic.

Oversight of Human Capital. The Board is actively engaged in overseeing the Company’s people and culture strategy. The Board receives regular reports from management on a broad range of human capital management topics, including talent management; leadership development; retention; culture; employee engagement; employee education and training; and diversity and inclusion. See page 5 for more information on our human capital and culture.

21

Oversight of Sustainability. The Board, with specific oversight from the Nominating and Governance Committee, oversaw our stakeholder engagement, key topic identification process, and the development of our Inaugural Sustainability Report. Going forward, the Board will continue to oversee our sustainability strategy and management of related risks and opportunities. See page 6 for more information on our sustainability efforts and the launch of our Inaugural Sustainability Report.

Director Independence

The Board has determined that Mses. Carruthers, Sheppard and Tsingos and Messrs. Gallahue, Huennekens, and Jain are independent directors under the applicable rules of the NYSE. Mr. Huennekens serves as independent Chairman of the Board.

The Board assesses on a regular basis, and at least annually, the independence of directors and, based on the recommendation of the Nominating and Governance Committee, makes a determination as to which members are independent.

Board of Directors and Committees of the Board

Director Attendance. The Board met 16 times during 2020. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served (during the period they so served) during 2020. The Board expects, as a general matter, that its members will attend the Annual Meeting and all of the then seven directors attended the 2020 Annual Meeting.

Committee Membership. The membership of each of the Audit, Compensation, and Nominating and Governance committees as of March 31, 2021 is set forth below.

| NAME OF DIRECTOR | AUDIT | COMPENSATION | NOMINATING AND GOVERNANCE | ||||||||

Kieran T. Gallahue | Chair | ||||||||||

Wendy Carruthers | Chair | Member | |||||||||

Scott Huennekens | Member | Member | |||||||||

Christine Tsingos | Chair | Member | |||||||||

Amir Aghdaei | |||||||||||

| Daniel A. Raskas | |||||||||||

| Gayle Sheppard | Member | ||||||||||

| Vivek Jain | Member | ||||||||||

Audit Committee. The Audit Committee met nine times during 2020. The Audit Committee meets at least quarterly and assists the Board in overseeing:

◦the quality and integrity of our financial statements;

◦the effectiveness of our internal control over financial reporting;

◦the qualifications, independence and performance of our independent auditors;

◦the performance of our internal audit function and head of internal audit;

◦our compliance with legal and regulatory requirements; and

◦the risks described above under “Board Leadership Structure and Risk Oversight.”

The Audit Committee is governed by a charter that complies with the rules of the NYSE. A copy of the Audit Committee Charter is available on the “Investors – Governance” section of our website.

The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and the independent auditor in carrying out its oversight responsibilities. Management is responsible for the preparation, presentation, and integrity of our financial statements, accounting and financial reporting principles, internal control over financial reporting, and disclosure controls and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of our system of internal control over financial reporting. Our independent auditor, Ernst & Young LLP, is responsible for performing an independent audit of our financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

22

The Audit Committee also prepares a report of the Audit Committee as required by the SEC to be included in this Proxy Statement. The Audit Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.

The Board has determined that Ms. Tsingos and Messrs. Huennekens and Jain are each an “audit committee financial expert” for purposes of the rules of the SEC and all members of the Audit Committee are “financially literate” within the meaning of the NYSE listing standards. In addition, the Board has determined that each of the members of the Audit Committee is independent, as defined by the rules of the NYSE and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Furthermore, as of the date of this Proxy Statement, no Audit Committee member serves on the audit committee of more than three public companies.

Compensation Committee. The Compensation Committee met six times during 2020. The Compensation Committee discharges the Board’s responsibilities relating to the compensation of our executive officers, including setting goals and objectives for, evaluating the performance of, and approving the compensation paid to, our executive officers. The Compensation Committee also:

◦reviews and discusses with management the Compensation Discussion and Analysis (“CD&A”) and recommends to the Board the inclusion of the CD&A in the annual meeting proxy statement;

◦reviews and makes recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercises all authority of the Board (and all responsibilities assigned by such plans to the Committee) with respect to the oversight and administration of such plans;

◦reviews and considers the results of stockholder advisory votes on our executive compensation, and makes recommendations to the Board regarding the frequency of such advisory votes;

◦reviews and makes recommendations to the Board regarding non-management director compensation;

◦monitors compliance by directors and executive officers with our stock ownership requirements;

◦assists the Board in overseeing the risks described above under “Board Leadership Structure and Risk Oversight”;

◦prepares the report of the Compensation Committee required by the SEC to be included in the annual meeting proxy statement; and

◦considers factors relating to independence and conflicts of interests in connection with the compensation consultants that provide advice to the Compensation Committee.

The Compensation Committee is governed by a charter that complies with the rules of the NYSE. A copy of the Compensation Committee Charter is available on the “Investors – Governance” section of our website. Each member of the Compensation Committee is an “outside director” for purposes of Section 162(m) of the Internal Revenue Code (“Section 162(m)”), a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and, based on the determination of the Board, independent under the NYSE listing standards and under Rule 10C-1 under the Exchange Act. The Committee typically meets in executive session, without the presence of management, at its regularly scheduled meetings. Under the terms of its charter, the Compensation Committee has the authority to form, and delegate authority to, such standing and ad-hoc subcommittees as it determines necessary or desirable. The Compensation Committee Charter also provides that, to the extent permitted by applicable law and the provisions of a given equity-based plan, and consistent with the requirements of applicable law and such equity-based plan, the Compensation Committee may delegate to one or more executive officers of the Company, or a sub-committee of the Compensation Committee formed for such purpose, the power to make grants and awards (other than grants and awards to any Company director or any officer subject to Section 16 of the Exchange Act) pursuant to such equity-based plan to employees of the Company or any subsidiary of the Company.

Management Role in Supporting the Compensation Committee. Our Chief Human Resources Officer, Vice President-Total Rewards, and Assistant General Counsel generally attend, and from time-to-time our CEO attends, the Compensation Committee meetings. In particular, our CEO:

•provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy;

•participates in the Committee’s discussions regarding the performance and compensation of the other executive officers and provides recommendations to the Committee regarding all significant elements of compensation paid to such officers, their annual, personal performance objectives and his evaluation of their performance (the Committee gives considerable weight to our CEO’s evaluation of and recommendations with respect to the other executive officers because of his direct knowledge of each such officer’s performance and contributions); and

•provides feedback regarding the companies that he believes we compete with in the marketplace and for executive talent.

Our human resources and legal departments also assist the Committee Chair in scheduling and setting the agendas for the Committee’s meetings, prepare meeting materials and provide the Committee with data relating to executive compensation as requested by the Committee.

23