Form N-CSRS WILLIAMSBURG INVESTMENT For: Sep 30

| OMB APPROVAL | |

|

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

John Chilton, Esq.

| Sullivan & Worcester LLP 1666 K Street, NW Washington, D.C. 20006 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 |

| Date of fiscal year end: | March 31 | |

| Date of reporting period: | September 30, 2020 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

September 30, 2020

(Unaudited)

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-800-281-3217 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-800-281-3217. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

THE DAVENPORT FUNDS |

October 23, 2020 |

Dear Shareholders,

Equity markets continued their strong positive performance off the March lows in the third quarter. Despite a modest selloff in September, the S&P 500® Index gained 8.93% for the third quarter ended September 30, 2020. Combined with Q2’s 20.54% gain, it was the best two-quarter stretch for large-cap stocks since 2009, when markets were recovering from the financial crisis. Small caps’ gains were less robust, with a 4.93% rise in the Russell 2000® Index during Q3. Year-to-date, the S&P 500 is up 5.57% through the end of the third quarter, and the Russell 2000 is down 8.69%.

Most of the strong index returns have been driven by mega-cap tech stocks. Apple, Inc. (APPL), for example, gained 27% in Q3, becoming the first company in global history to surpass a $2 trillion market cap. Apple’s market cap has surpassed that of the entire Russell 2000 and roughly equals the S&P 500 Energy, Utilities and Materials sectors combined. The Information Technology sector has grown to 28% of the S&P 500, and if you add in the tech-heavy Communication Services sector’s 11% weighting and Amazon’s 5% weighting, the true Tech weighting is now pushing 44%, a record high.

This phenomenon has sucked attention and capital from other areas of the market. While the Nasdaq is up 25% year-to-date, the small-cap oriented Russell 2000 is down 8.69% year-to-date and the Lipper Large Cap Value® Index is down around 11%, highlighting the massive disparity between “growth” and “value” investing. A low-growth economic environment and ultra-low interest rates have combined to increase the allure of long-tailed growth stories. Recently, Fed Chairman Jerome Powell added fuel to the fire by announcing new monetary policy that takes a more relaxed approach to inflation and virtually promising easy money/low interest rates for the foreseeable future. This policy has greased the skids for further speculation, and we clearly see signs of excess in certain areas of the market: with the red-hot initial public offering (IPO) market, junk bonds offering low yields, and the return of day traders – this time on the Robinhood app.

We are making sure that we maintain balance in our portfolios between durable growth stories and more economically sensitive companies. We also recognize that many of our holdings have benefitted from the stay at home phenomena and may have seen a demand pull forward. We have been scaling back our exposure to some of these holdings, while adding to companies that stand to benefit when the world normalizes from the pandemic. In the near term, investors will likely continue to grapple with fears of a second coronavirus wave this fall/winter and potentially positive phase 3 vaccine trial data readouts. Given the cross currents, we think maintaining balance in the portfolios is the most prudent course of action. At the margin, tilting the portfolios towards re-opening beneficiaries could pay off handsomely in the next couple of years, especially given their attractive valuations relative to hotter parts of the market.

All eyes are on the federal government. It remains unclear whether Congress will agree on a fourth stimulus package. Even more importantly, the November elections are in particular focus this year, and the prospect for a delayed/contested outcome seems to be the biggest risk to markets. Market volatility returned in September and we expect volatility to remain

1

elevated through this uncertain period. While political party leadership has typically had very little correlation with equity markets, we expect markets to be volatile throughout the election process. We don’t have a crystal ball on timing, but we think the election will eventually conclude, and the economy should continue to gradually heal from the depths of the pandemic earlier this year. Importantly, Fed policy remains highly supportive for equities, and our rebalancing actions taken in the quarter should further improve risk/reward for our portfolios going forward.

Please see our fund letters for discussion of specific ideas and investment themes. Thank you for your trust.

Davenport Core Fund (DAVPX)

The following chart represents Davenport Core Fund (DAVPX) performance and the performance of the S&P 500 Index, the Core Fund’s primary benchmark, for the periods ended September 30, 2020.

|

Q3 2020 |

1 Year |

3 Years* |

5 Years* |

10 Years* |

Since |

Core Fund (DAVPX) |

8.40% |

9.43% |

10.28% |

11.77% |

12.30% |

7.23% |

S&P 500 Index** |

8.93% |

15.15% |

12.28% |

14.15% |

13.74% |

7.74% |

30-Day SEC Yield: -0.06%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

|

* |

Returns greater than one year are annualized. |

|

** |

The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Core Fund (DAVPX) posted strong performance in the third quarter, building on the second quarter’s sharp recovery from the first quarter selloff. The Core Fund gained 8.40% in the third quarter, roughly in-line with the S&P 500® Index’s 8.93% advance. Calendar year-to-date the Fund is up 2.63%, behind the S&P 500’s 5.57% return.

This year, the S&P 500’s returns have been overwhelmingly driven by a handful of mega-cap Tech stocks. As a market cap-weighted index, the largest companies by market value have a disproportionate effect on the Index’s performance. Given the strong performance of the top five names (Apple, Inc. (AAPL), Amazon.com, Inc. (AMZN), Microsoft Corp. (MSFT), Facebook, Inc. (FB) and Alphabet, Inc. (GOOGL)) over the last several years, these top five now comprise ~22% of the S&P 500, a concentration level not seen since the late 1990s.

We own four of these five companies in the Core Fund (FB being the sole exception), and hold these platform companies in high regard, given their dominance in highly attractive end markets. That being said, a crucial part of our job is to manage the risk of the Fund. Our risk management process has caused us to own these names in smaller size than the S&P 500 Index does. These

2

underweights have made it tough to outperform the Index in recent years, including this one. Nevertheless, we think the owners of the Fund and readers of this letter will be better served with us keeping a watchful eye on risk mitigation over time, rather than continuing to buy at ever higher prices. We note that the S&P 500 Equal-Weighted Index is actually down 5.8% year-to-date, which is one of the wider divergences we have seen. So while we never enjoy underperforming, we think that framing performance in light of the recent market dynamics provides a more complete picture; and we are pleased to have captured most of the broader market’s advance this year.

Transaction activity remained relatively high in Q3, as it has all year given the elevated volatility and unique nature of 2020. We took some profits in standout performers Adobe, Inc. (ADBE) and Amazon.com, Inc. (AMZN). We added to our position in Walt Disney Co. (DIS), which is currently executing well in streaming and would stand to benefit nicely with its parks and sports exposure in a vaccine-led COVID recovery. We swapped out one ESG-friendly company for another, selling our position in sanitation provider Ecolab, Inc. (ECL) to purchase Ball Corp. (BLL), achieving a more attractive valuation for another high-quality company. Ball is the dominant provider of aluminum cans, with more than double the market share of its closest competitor. Aluminum cans are on trend given favorable sustainability attributes (aluminum cans are infinitely recyclable), resulting in a growth tailwind for this franchise that has consistently created shareholder value over time.

We also sold some companies whose outlooks are more challenged. We completely exited the Energy sector, with sales of Chevron Corp. (CVX) and Marathon Petroleum Corp. (MPC), as the environment becomes increasingly difficult for fossil fuel companies when looking out over the long term. We also sold CVS Health Corp. (CVS) and Capital One Financial Corp. (COF), which have been struggling to consistently grow. We added to merger-driven stories we remain excited about: T-Mobile US, Inc. (TMUS) and AON plc (AON).

We continue to invest in what we consider high potential opportunities, buying positions in MercadoLibre, Inc. (MELI) and Illumina, Inc. (ILMN). MercadoLibre is the #1 e-commerce player in South America, where e-commerce penetration remains low and the growth runway very long. We are perhaps even more excited about the FinTech side of the business, which is the front-runner to profitably serve South America’s underbanked population in a low-cost, digital manner. Management has been exceptional at both innovation and execution. Illumina is the dominant provider of genome-sequencing equipment and consumables. Genomic medicine is perhaps the most promising area of healthcare over the next decade, with the potential to detect (and possibly cure) cancer earlier, cure genetic diseases and generally improve our understanding of human biology. Virtually all of these exciting breakthroughs are enabled through the use of ILMN’s platform sequencing technology.

In closing, we have been active during a very turbulent year for the markets, working to uncover new opportunities and optimize the Fund, remaining mindful of risk. Thank you for your trust and interest.

Recent Purchases:

Aon plc (AON) – Given our belief that the rising insurance pricing cycle still has further to run, we elected to add to AON during the quarter, which should stand to benefit without the risks of payouts that underwriters face.

3

Ball Corporation (BLL) – BLL is the dominant player in the metal packaging industry, which we believe should be supported by several tailwinds over the coming years, so we chose to initiate a position.

Illumina, Inc. (ILMN) – We initiated a position in ILMN as it is the world’s dominant provider of tools (machines & consumables) for genetic and genomic analysis, with an 80-90% market share. In 2019, the company did $3.5bn in revenue with a 70% gross margin and a 28% operating margin. We chose to add to our position during the quarter as long term prospects outweigh near-term pandemic pressures on the stock.

iShares Nasdaq Biotechnology ETF (IBB) – We added to IBB during the quarter to gain diversified exposure to the broad-based innovation happening in the healthcare sector, while looking to minimize stock-specific risks attached to any one therapy.

MercadoLibre, Inc. (MELI) – MELI is an online marketplace e-commerce and payments company operating across Latin America. MELI’s original e-commerce business launched in 1999, and has become the #1 e-commerce website in Latin America. In light of the business model, growth rate, and large market opportunity, we elected to initiate a position at what we believe to be a reasonable valuation.

Sony Corporation (SNE) – SNE has grown from an audio-video equipment manufacturer to a global digital entertainment conglomerate. With the company focused on cultivating its portfolio to be an enabler of entertainment, we chose to initiate a position in the name.

T-Mobile US, Inc. (TMUS) – We added to our position in TMUS. We continue to see a significant runway for double-digit earnings growth as TMUS continues to take share, improves its network with the Sprint spectrum, reduces duplicative marketing costs, and eliminates a competitor.

Walt Disney Company (The) (DIS) – Despite results from the COVID-19 pandemic, Disney’s best-in-class brand, global distribution, production assets, content library, and balance sheet strength should allow the company to build scaled DTC video platforms in the large and growing streaming market that is significantly bigger than Disney’s parks and movie theater businesses currently. As such we added to our position.

Recent Sales:

Adobe, Inc. (ADBE) – Despite two previous chips, the strong performance had caused the stock to become the biggest position in the portfolio and the only position above 5.0%.As such, we elected to reduce the position back by 120 basis points (1.2%.)

Amazon.com, Inc. (AMZN) – We elected to reduce our position size somewhat after a 63% year-to-date move relative to a flat S&P 500®, as we think there is some risk that future gains have been pulled forward so far this year.

Capital One Financial Corporation (COF) – COF has been a frustrating stock over the last couple of years given a persistently low valuation that seems to overly discount the prospects for negative revisions while giving little credit to positive developments. As such, we elected to sell our position.

Chevron Corporation (CVX) – With governments and entrepreneurs around the world increasingly working to decrease their use in favor of greener alternatives, we are not enthused by the longer-term growth outlook for fossil fuel producers, and therefore elected to sell our position in CVX.

4

CVS Health Corporation (CVS) – We elected to sell our position during the quarter, as shares have failed to gain steam during our ownership period. While we ultimately think that the merger with Aetna could turn out to become a major positive for CVS, it is hard to have much visibility in the near term.

Ecolab, Inc. (ECL) – While ECL has been a good stock for us since our initial purchase, we chose to sell the shares as recent earnings growth has been disappointing and valuations appear full.

Marathon Petroleum Corporation (MPC) – MPC has been a volatile name for us over our holding period. While we initially purchased it well, we overstayed our welcome with the refining cycle peaking in 2018. With the effects of the COVID-19 pandemic, the clouded visibility combined with a more reasonable valuation prompted us to move out of the name.

Davenport Value & Income Fund (DVIPX)

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the Russell 1000® Value Index, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended September 30, 2020.

|

Q3 2020 |

1 Year |

3 Years* |

5 Years* |

Since |

Value & Income Fund (DVIPX) |

8.10% |

(3.71%) |

2.32% |

7.28% |

9.51% |

Russell 1000® Value Index** |

5.59% |

(5.02%) |

2.63% |

7.66% |

9.09% |

S&P 500 Index** |

8.93% |

15.15% |

12.28% |

14.15% |

12.93% |

30-Day SEC Yield: 1.50%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

|

* |

Returns greater than one year are annualized. |

|

** |

The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Value & Income Fund (DVIPX) continued to recover during the third quarter ended September 30, 2020, increasing 8.10%, but remains down 10.11% year-to-date. This compares to the Fund’s primary benchmark, the Russell 1000 Value® Index, which increased 5.59% in the third quarter and is down 11.58% year-to-date. The S&P 500® Index increased 8.93% in the third quarter and is up 5.57% year-to-date. Many of the same themes from the second quarter continued into the third, with strong performance from growth stocks as well as those tied to an economic recovery. We continue to try to maintain a balance between companies that have benefitted from “stay at home” and those that should do well in a COVID-19 recovery scenario. At the same time, we have reduced exposure to areas where the crisis has accelerated or intensified secular headwinds.

5

Third-quarter performance was led by Industrials stocks as the economy snapped back sharply from second quarter lows. United Parcel Service, Inc. (UPS) and Watsco, Inc. (WSO) were our top two performers as both companies reported stellar results. UPS continues to benefit from increased e-commerce volumes and we think the new management team’s focus on operational efficiency, margins, and returns should lead to continued gains ahead. QUALCOMM, Inc. (QCOM) was another standout performer as the company removed a significant overhang by settling two long-standing legal battles, allowing investors to focus solely on the upcoming 5G cycle. Our key detractors in the quarter were Cisco Systems, Inc. (CSCO), Chevron Corp. (CVX), and CVS Health Corp. (CVS). Cisco was hurt by poor earnings and a subdued outlook given a slowdown in IT spending. Chevron continues to be hurt by low oil prices and a tough investing environment for fossil fuel businesses. We sold our position in CVS during the quarter as the company’s integration of Aetna is taking longer than anticipated, and we suspect some of the front of store pressure may persist post-COVID.

During the quarter, as part of our balanced strategy, we increased our positions in several names that pay good dividends and are also likely to benefit from economic improvement. These include Lamar Advertising Co. (LAMR), Brookfield Asset Management, Inc. (BAM), Gaming & Leisure Properties, Inc. (GLPI), and 3M Co. (MMM). As noted, we reduced exposure to names with secular headwinds, including the sale of Bank of America Corp. (BAC), Marathon Petroleum Corp. (MPC), International Business Machines (IBM), and the aforementioned CVS. We reinvested the proceeds into new positions in Sony Corp. (SNE), Deere & Co. (DE), L3Harris Technologies, Inc. (LHX), and Alphabet, Inc. (GOOGL). We view all four of these stocks as significantly undervalued relative to their growth prospects and business quality.

Deere is a perfect example of what we are focused on in the current environment. The company is the largest manufacturer of agricultural equipment in the world and a major producer of construction machinery. As expected, the company’s earnings (and stock) were hurt by the worldwide coronavirus outbreak, which gave us an opportunity to purchase this best-in-class industrial at an attractive price. As the recovery continues, the company’s strong efficiency during down cycles should lead to earnings that are double or triple this year’s cyclical low. With an investment-grade balance sheet, shareholder-friendly management team, and consistently growing dividend, we think the stock fits well in the Fund.

In sum, we are pleased that the Fund continues to recover and is outpacing its benchmark so far this year. A reversal of the outperformance of “growth” vs. “value” stocks would certainly bode well for the Fund. However, in the meantime we believe our balanced approach should position us well as the recovery continues, while also improving our risk profile should things take a turn for the worse.

Recent Purchases:

Alphabet, Inc. - Class A (GOOGL) – GOOGL may not be thought of as a traditional “value” stock, but we believe the stock is undervalued relative to its growth prospects and business quality, so we initiated a position in the name.

Brookfield Asset Management, Inc. (BAM) – We added to BAM as near zero interest rates in virtually all developed economies enhanced the value of the contractual cash flows associated with the company’s asset base.

6

Deere & Company (DE) – We view Deere as a best-in-class industrial cyclical with dominant market share and a focus on technology that should allow the company to continue to outperform peers. Therefore we decided to initiate a position.

Gaming and Leisure Properties, Inc, (GLPI) – Due to an improved outlook for the company, dividend visibility, and valuation below that of peers, we elected to add to the position.

Fidelity National Financial, Inc. (FNF) – At 10x 2021 consensus expectations, we feel the stock sports an attractive risk reward profile, especially when considering a near 3.9% dividend yield and ongoing share repurchases. As such, we have added to our position.

Lamar Advertising Company (LAMR) – We think the current level (down 12% from their June highs) is attractive for a company that is still generating solid cash flow and we believe can get through the current period of duress and emerge stronger on the other side, so we have added to our position.

L3Harris Technologies, Inc. (LHX) – We initiated a position in LHX as we like the combination of above-average growth, industry-leading margins, and significant cash flow generation, all at a below-market valuation.

3M Company (MMM) – While MMM has benefited from COVID-related sales (they are the largest producer of N95 masks), we think economies re-opening will provide an added lift given the broad diversification of the company’s end markets. We believe the valuation discount can close and felt now was a good time to boost our position.

QUALCOMM, Inc. (QCOM) – We added to our position as we continue to be attracted to the Qualcomm story with a multi-year earnings growth outlook driven by the implementation of 5G wireless networks globally.

Sony Corporation (SNE) – The company’s portfolio of key content IP assets across gaming, music, and movies/TV will enable the company to execute the shift of value creation from consumer hardware to software (content and services). Therefore, we elected to initiate a position.

Starbucks Corporation (SBUX) – SBUX has been a first mover in the digital area, with a widely used app that customers can order and pay through. These digital investments should position SBUX well for a rebound on the other side of the pandemic so we added to our position.

Recent Sales:

Bank of America Corporation (BAC) – While we think BAC has improved its business greatly under the current leadership, we think the stock is likely to continue to struggle in the face of zero interest rates, unknown loan losses, lack of loan demand, and limited capital returns to shareholders. As such, we elected to sell the position.

CVS Health Corporation (CVS) – We have elected to sell our position in CVS as we struggle to find any near-term catalysts and think earnings estimates are likely to trend down as front of store pressure may persist post-COVID.

International Business Machines Corporation (IBM) – Shares of IBM have failed to gain much traction year-to-date as IBM’s non-cloud business continues to deteriorate. We have become more cautious on the company’s long-term strategy and growth potential, and elected to sell the position.

7

Las Vegas Sands Corporation (LVS) – Considering March lows, LVS’ business remains significantly impaired and there is limited visibility on the exact timeline of a return to normal. Thus we decided to sell our position.

Lowe’s Companies, Inc. (LOW) – With the stock trading at an all-time high and the potential for moderating growth in the second half of the year, we felt it prudent to take some profits. We continue to like the story long-term but decided to chip our position.

Marathon Petroleum Corporation (MPC) – Given the large losses the company is currently running and an unclear timeline on a path back to profitability, we elected to move on from the name.

Watsco, Inc. (WSO) – We have been waiting for Watsco’s technology investments to pay off, and it seems that margins are finally inflecting higher, and e-commerce adoption is accelerating. WSO was (and continues to be) one of our largest positions, but we decided to take some profits after the recent move.

Davenport Equity Opportunities Fund (DEOPX)

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap® Index, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended September 30, 2020.

|

Q3 2020 |

1 Year |

3 Years* |

5 Years* |

Since |

Equity Opportunities Fund (DEOPX) |

9.24% |

8.57% |

11.49% |

11.84% |

12.39% |

Russell Midcap® Index** |

7.46% |

4.55% |

7.13% |

10.13% |

10.67% |

S&P 500 Index** |

8.93% |

15.15% |

12.28% |

14.15% |

12.93% |

30-Day SEC Yield: -0.27%; Expense Ratio in current prospectus: 0.91%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

|

* |

Returns greater than one year are annualized. |

|

** |

The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000, which represents approximately 25% of the total market capitalization of the Russell 1000®. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Equity Opportunities Fund (DEOPX) enjoyed continued momentum in the third quarter ended September 30, 2020. The Fund’s 9.24% quarterly advance outpaced the 7.46% increase for the Russell Midcap® Index and puts it nicely into positive territory with a 4.39% year-to-date gain. Again, this compares favorably to the Russell Midcap, which is down 2.35% year-to-date.

8

Recent purchase DraftKings, Inc. (DKNG) was the Fund’s top performer for the period, advancing north of 75% alongside strong results, compelling partnership announcements (i.e., ESPN and several NFL teams), and additional sports gambling approvals in new jurisdictions. We are pleased this relatively new position has gotten off to such a strong start and realize recent momentum and media attention may lend itself to a higher degree of volatility for the stock going forward. That said, we believe upside remains as the company capitalizes on its first-mover advantage in a new and exciting market opportunity with significant growth runway. Watsco, Inc. (WSO) was another top contributor as the leading HVAC distributor reported strong results, highlighting the resilience of the company’s business model. We added to the position in the midst of panic-selling in April and were pleased to see the shares rally nearly 50% subsequently. Though we elected to trim the position during the quarter, we are still very constructive on the outlook for the company and the stock. After performing well in the second quarter, Dish Network Corp. (DISH) was the Fund’s top detractor in the period. Though this special situation has tried our patience over the years, we maintain confidence that the company will realize significant value through the construction of a next-generation 5G wireless network, utilizing its unique spectrum holdings and newly acquired Boost Mobile assets.

As has been the case throughout the history of the Fund, much of the activity during the period centered on taking opportunities to redistribute funds is a way that optimizes the overall risk/reward profile. This involves maintaining a balance between durable growth stories (some of which have benefitted from the “stay at home” phenomenon) and companies that could benefit substantially from a COVID recovery scenario. As such, we maintain meaningful exposure to companies such as American Tower Corp. (AMT), Etsy, Inc. (ETSY), Take Two Interactive Software, Inc. (TTWO), and others, which are largely net beneficiaries of COVID-19 related restrictions. On the flip side, we have also taken incremental steps to emphasize great businesses with solid long-term prospects that might have more leverage to a “normalization” of economic conditions. Two names that fit this mold are Lamar Advertising Co. (LAMR) and Colfax Corp. (CFX).

Lamar Advertising is a leader in the outdoor advertising space (a.k.a. billboards) and is a name we have great familiarity with, having owned it in the past. Big picture, we are attracted to this category of advertising as it continues to take share from other forms and note the company is still in the early stages of converting traditional billboards to a digital format, which offers attractive returns. In the meantime, LAMR is generating solid cash flow that can get it through the current period of duress and emerge stronger on the other side. While LAMR did cut its dividend (current yield of 3.0%), we expect the dividend to recover quickly as ad spending should get a boost from new categories (i.e., sports betting) and the current political season. As states resume re-opening, we expect consumers to spend more time on the road, thus benefiting outdoor advertising.

As worldwide economies continue to re-open, our confidence in the recovery at Colfax Corp. (CFX) has increased as a rebound in global industrial production should help the welding business and numbers around elective surgeries (many of which can be postponed but not put off indefinitely) should drive a recovery in MedTech. We continue to believe the company’s portfolio is now in a good position to implement its continuous improvement program and compound value creation for shareholders. While near-term results are likely to remain choppy, we think CFX can return to pre-COVID levels of EBITDA in the next year and note that the shares continue to trade at a meaningful discount to peers on a blended basis.

9

In sum, we are pleased with the Fund’s performance to date and continue to take steps to optimize the risk/reward profile of the strategy. In the face of continued uncertainty, we think it makes sense to maintain an element of balance in the Fund while always staying true to our commitment to quality.

Recent Purchases:

Align Technologies, Inc. (ALGN) – While overall case volumes remain down in this pandemic-affected period, ALGN is well-positioned to ride out this bumpy period with no debt, $400mn of cash on the balance sheet and strong free cash flow generation. Since our initial purchase, the stock has continued to act well, so we added to our position.

Brookfield Asset Management, Inc. (BAM) – We elected to add to BAM as near-zero interest rates in virtually all developed economies enhances the value of the contractual cash flows associated with the company’s asset base.

Black Knight, Inc. (BKI) – BKI has been a stout performer for the strategy, nearly tripling in value since its split from Fidelity National Financial (FNF) in 2015. We are grateful to have had the knowledge base and opportunity to make BKI a meaningful holding early on, and have added to the position again.

Cannae Holdings, Inc. (CNNE) – Put simply, our conviction level is very high with this name and the significant margin of safety coupled with the long list of catalysts/value drivers, we feel like the risk/reward is quite favorable here. Thus, we added to our position multiple times this quarter.

Colfax Corporation (CFX) – While near-term results are likely to remain choppy, we think CFX can return to pre-COVID levels of EBITDA in the next year, and the shares continue to trade at a meaningful discount to peers on a blended basis, so we elected to add to our position.

Draftkings, Inc. (DKNG) – DKNG is the leading U.S. provider of online sports betting. We believe sports betting and mobile gaming can grow at a 25-30% rate for the next decade. DKNG seems well positioned with a leading brand, strong balance sheet (net debt-free), and attractive unit economics at scale so we elected to add to our position.

Fidelity National Financial, Inc. (FNF) – We added to our position as we feel the stock sports an attractive risk reward profile, especially when considering a near 4.5% dividend yield and ongoing share repurchases.

Lamar Advertising Company (LAMR) – We think the current level is attractive for a company that is still generating solid cash flow and we believe can get through the current period of duress and emerge stronger on the other side so initiated a position. We then added to the position as we have greater conviction and visibility with respect to earnings power.

Take-Two Interactive Software, Inc. (TTWO) – Shares of TTWO outperformed throughout the COVID-19 crisis as stay at home orders have encouraged more engagement with the video game publisher’s content, leading to a surge in recurrent consumer spending (RCS) and game sales. Thus, we added to our position.

10

Recent Sales:

Cboe Global Markets, Inc. (CBOE) – Visibility on the growth outlook has become more clouded since our purchase in 2018. Performance has been somewhat underwhelming as CBOE’s multiple has contracted further. We elected to move on from the name and reposition proceeds into names with a more visible growth outlook

Liberty Broadband Corporation (LBRDK) – As a reminder, LBRDK is a holding company that owns shares of cable company Charter Communications (CHTR). The stock is now trading near all-time highs due to strong performance from CHTR and we felt it prudent to take some profits and redeploy the funds elsewhere. In addition, we chipped the position a second time during the quarter bringing the name to a more normal position size.

LiveNation Entertainment, Inc. (LYV) – After adding to the position in the throes of COVID-19 shutdown panic, we have since been trimming the position as the dramatic recovery in the stock has given way to a more balanced risk-reward profile. For the time being, we elect to sell our position, but hope to return to this company someday.

Watsco, Inc. (WSO) – We have been waiting for WSO’s technology investments to pay off and it seems that margins are finally inflecting higher and e-commerce adoption is accelerating. We continue to believe the company will increase share, grow through acquisition, expand margins and return cash to shareholders. Though we decided to take some profits multiple times this quarter, we are still very constructive on the long-term outlook for this company.

Davenport Small Cap Focus Fund (DSCPX)

This chart represents Davenport Small Cap Focus Fund (DSCPX) performance and the performance of the Russell 2000® Index, the Small Cap Focus Fund’s primary benchmark, for the periods ended September 30, 2020.

|

Q3 2020 |

1 Year |

3 Year |

5 Year |

Since |

Small Cap Focus Fund (DSCPX) |

8.70% |

16.66% |

9.97% |

13.82% |

10.08% |

Russell 2000® Index** |

4.93% |

0.39% |

1.77% |

8.00% |

5.44% |

30-Day SEC Yield: 0.04%; Expense Ratio in current prospectus: 0.98%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

|

* |

Returns greater than one year are annualized. |

|

** |

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® index, representing approximately 8% of the total market capitalization of the Russell 3000. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Small Cap Focus Fund (DSCPX) advanced 8.70% during the third quarter ended September 30, 2020, outpacing the 4.93% gain for the Russell 2000® Index. Calendar year-to-date, the Fund is now up 4.53%, which compares favorably to the 8.69% decline for the Russell 2000.

11

As we highlighted at the end of last quarter, housing has been an important theme for the strategy and a meaningful contributor to performance. This quarter was no different, as building products distributor Builders FirstSource, Inc. (BLDR) and title insurer Stewart Information Services Corp. (STC) produced gains of roughly 58% and 35% during the period, respectively. On top of strong industry fundamentals, BLDR responded favorably to a transformational merger announcement with a major competitor, BMC Stock Holdings, Inc. (BMCH). We elaborate on STC in detail below, as it was a name we pressed meaningfully early in the quarter. Elsewhere, the Fund benefitted from a more than 50% surge in the shares of leading pet insurer, Trupanion, Inc. (TRUP), which saw gains following strong quarterly results and kicked into overdrive due to a short squeeze. While we remain attracted to the long-term growth runway for both the industry and the company, we elected to exit the position entirely as the stock’s valuation became difficult to justify. Our worst performer was a relatively new position called GAN Ltd. (GAN), which is an enabler of online sports betting and virtual casino gambling over the internet. While we are disappointed the position got off to a rocky start, we remain attracted to the company’s net debt-free balance sheet, profitable software-driven business model, and positioning as an enabler of an exciting growth theme.

As mentioned above, we meaningfully increased exposure to Stewart Information Services Corp. (STC) during the quarter. In addition to liking the backdrop for housing transaction activity due to favorable interest rates, demographics, and supply/demand characteristics, we saw a compelling company-specific opportunity for self-improvement on both the operational and capital allocation fronts. We have long followed Stewart Title, having observed several unsuccessful attempts to bring the company’s margin and return profile up to industry standards. Following industry leader Fidelity National Financial, Inc.’s (FNF) unsuccessful takeover bid for the company in late 2019, STC finally got what it needed. In stepped new CEO Fred Eppinger, who has quickly refocused the company operationally and revamped the capital allocation strategy. Already, Eppinger and team executed on a dramatic cost reduction program, stemmed market share losses and announced several M&A transactions that make financial and strategic sense. Though we have been rewarded with the stock’s 35%+ ascent during the quarter, we continue to believe the shares offer further upside as management continues to execute against a favorable industry backdrop.

As is core to our process, we took several steps aimed at optimizing the risk/reward profile of the Fund. As the country (and world) emerges from what we hope is the worst of COVID-19 related shutdowns, we have been busy identifying good businesses, with ample access to liquidity that can survive the current turmoil and have more leverage to a recovery scenario. As such, we have begun to reintroduce names like OneSpaWorld Holdings Ltd. (OSW), which operates spas on cruise ships. This business is extremely predictable and cash generative (when the industry is not shut down), and the company has the liquidity to survive until the end of 2021 with no revenues. We have also introduced a new position in J&J Snack Foods Corp. (JJSF), a distributor of popular snacks (funnel cakes, hot pretzels, and churros) and beverages (owner of the ICEE franchise) to entertainment venues. While the current environment is clearly challenging for the company, this is a quality business with no debt that has compounded value for shareholders consistently over the years. In each of these cases, the stocks trade at meaningful discounts when considering normalized earnings power and should benefit from pent up demand when/if the world ever returns to a state of normalcy. Importantly, we note that these actions have been measured and incremental, reflecting our intent to achieve balance between durable growth companies with defensive characteristics and good businesses with a bit more economic sensitivity.

12

In sum, we are pleased with our results to date, yet remain hard at work positioning the Fund for the future. On top of the balanced and concentrated collection of high-quality businesses, we continue to have ample flexibility via an above-average cash balance. As always, we thank you for your trust and support.

Davenport Balanced Income Fund (DBALX)

The following chart represents Davenport Balanced Income Fund (DBALX) performance and performance of the Fund’s primary benchmark, the Russell 1000® Value Index for the period ended September 30, 2020.

|

Q3 2020 |

1 Year |

3 Year |

Since |

Balanced Income Fund (DBALX) |

5.60% |

(0.83%) |

2.62% |

5.02% |

Russell 1000® Value Index** |

5.59% |

(5.02%) |

2.63% |

6.83% |

30-Day SEC Yield: 0.91%; Expense Ratio in current prospectus: 0.96%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

|

* |

Returns greater than one year are annualized. |

|

** |

The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values |

The Davenport Balanced Income Fund (DBALX) increased 5.60% during the third quarter ended September 30, 2020, outperforming the 3.61% increase for the blended 60% Russell 1000 Value® Index and 40% Bloomberg Barclays Intermediate Government/Credit Index. Calendar year-to-date, the Fund decreased 5.07% compared to the 4.25% decrease for the blended benchmark.

The equity performance within the Fund was led by industrial stocks as the economy emerged from lows seen in the previous quarter. United Parcel Service, Inc. (UPS) was our top contributor to performance as the company continues to benefit from increased e-commerce volumes and focus on overall operational efficiency, improving margins, and returns. Outside of Industrials, Brookfield Renewable Partners LP (BEP) was a big contributor to performance during the quarter as there continues to be a growing focus on renewable energy and de-carbonization of the electricity sector. BEP is well-positioned to benefit from this trend, given their diversified global portfolio of renewable generation assets. Our biggest detractors during the quarter were Cisco Systems, Inc. (CSCO), Chevron Corp. (CVX), and CVS Health Corp. (CVS). We elected to sell our position in CVS during the quarter as we believe the company’s integration of Aetna is taking longer than originally anticipated and believe the retail side of the business may continue to see pressure beyond COVID-19.

During the quarter, we introduced and increased positions that we believe are likely to benefit from economic improvement such as Lamar Advertising Co. (LAMR) and Gaming & Leisure Properties, Inc. (GLPI)—while also reducing exposure to names facing secular headwinds such as Bank of America Corp. (BAC) and the aforementioned CVS. We initiated a new position in

13

Sony Corp. (SNE), a global digital entertainment conglomerate with market-leading positions in video games, music, movies, CMOS image sensors, consumer electronics, and financial services. Despite the company’s business shift from traditional electronic hardware to higher growth digital entertainment verticals, the stock has maintained a below-market multiple over recent years, and we believe the stock trades at a significant discount to intrinsic value, especially when looking out beyond the current fiscal year which has been affected by the global pandemic. Additionally, the company is led by a high-quality management team with a capital allocation strategy that prioritizes investments for the future and returning cash to shareholders through share repurchases and dividends. While the current yield may appear low, the company intends to grow the dividend more meaningfully in the future.

The bond allocation of the Balanced Income Fund consists of 26 high-quality bonds across seven sectors with the top allocations to U.S. Treasuries at 23.06%, Consumer Discretionary at 21.55%, and Energy at 19.62%. The credit quality of the Fund is A+/A1 with an effective maturity of 4.05 years and a duration of 3.62 years. Our floating-rate exposure at the end of the quarter was 17.40%; as you may remember this exposure was closer to 40% at the beginning of 2019 when 3-month LIBOR (London Inter-Bank Offered Rate) was around 3.00%. As the Federal Reserve has taken drastic measures to calm the downdraft in the economy and the market, LIBOR finished Q3 2020 at 0.23%. The income levels for the floating-rate notes change quarterly based on the level of 3-month LIBOR. We still feel that the spread margin of the vintage floating-rate notes that we bought prior to the downturn offer a compelling yield compared to the recent issue fixed issuance. Therefore, we are not outright sellers nor inclined to increase our exposure at this point, as the new floating-rate notes spread on this product doesn’t compensate the Fed Funds rate risk. So, going forward, we will let the floating-rate notes mature, which will decrease our exposure to this coupon type. With the accommodation of the Fed, we will be looking to add exposure to corporate credit if we are compensated for taking either rate or credit risk.

In closing, we are pleased to see the Fund outperform the blended benchmark during the quarter. As the economic recovery continues and we enter a potentially volatile election season, we continue to see value in a balanced portfolio. Our allocation to dividend-paying, value-oriented equities with what we consider strong balance sheets that can weather economic uncertainty and defensive positioning in fixed income should continue to provide a volatility buffer in the near-term as well current income and long-term capital appreciation.

Sincerely,

John P. Ackerly IV, CFA

President, The Davenport Funds

14

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

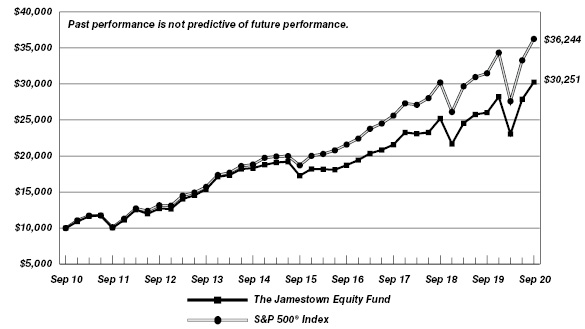

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the S&P 500® Index

Average Annual Total Returns |

||||

1 Year |

5 Years |

10 Years |

||

Davenport Core Fund(a) |

9.43% |

11.77% |

12.30% |

|

S&P 500® Index |

15.15% |

14.15% |

13.74% |

|

(a) |

The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

15

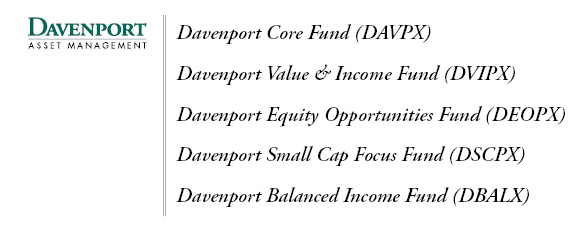

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Russell 1000® Value Index

and the Lipper Equity Income Index

Average Annual Total Returns |

||||

1 Year |

5 Years |

Since |

||

Davenport Value & Income Fund(a) |

(3.71%) |

7.28% |

9.51% |

|

Russell 1000® Value Index |

(5.02%) |

7.66% |

9.09% |

|

Lipper Equity Income Index |

(1.35%) |

8.91% |

9.15% |

|

(a) |

The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) |

Commencement of operations was December 31, 2010. |

16

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

Average Annual Total Returns |

||||

1 Year |

5 Years |

Since |

||

Davenport Equity Opportunities Fund(a) |

8.57% |

11.84% |

12.39% |

|

Russell Midcap® Index |

4.55% |

10.13% |

10.67% |

|

(a) |

The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) |

Commencement of operations was December 31, 2010. |

17

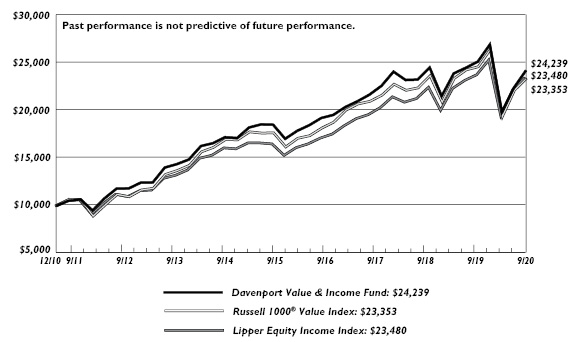

DAVENPORT SMALL CAP FOCUS FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russell 2000® Index

Average Annual Total Returns |

||||

1 Year |

5 Years |

Since |

||

Davenport Small Cap Focus Fund(a) |

16.66% |

13.82% |

10.08% |

|

Russell 2000® Index |

0.39% |

8.00% |

5.44% |

|

(a) |

The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) |

Commencement of operations was December 31, 2014. |

18

DAVENPORT BALANCED INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Davenport Balanced

Income Fund, the Russell 1000® Value Index, a Blended 60% Russell 1000® Value

Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index

and the Morningstar US OE Allocation — 50% to 70% Equity

Average Annual Total Returns |

||||

1 Year |

3 Years |

Since |

||

Davenport Balanced Income Fund(a) |

(0.83%) |

2.62% |

5.02% |

|

Russell 1000® Value Index |

(5.02%) |

2.63% |

6.83% |

|

Blended 60% Russell 1000® Value Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index |

0.12% |

3.79% |

5.92% |

|

Morningstar US OE Allocation - 50% to 70% Equity |

6.28% |

5.38% |

6.95% |

|

(a) |

The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) |

Commencement of operations was December 31, 2015. |

19

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

September 30, 2020 (Unaudited)

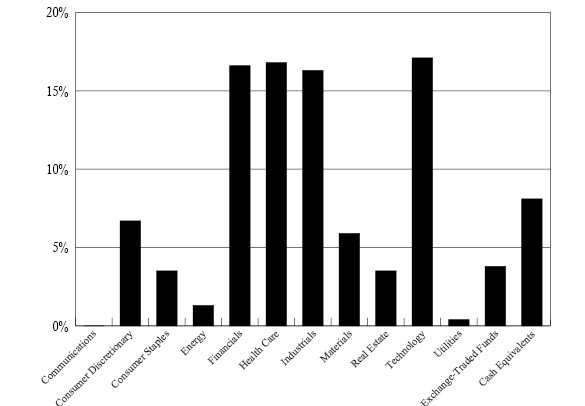

Sector Allocation vs. the S&P 500® Index

Top Ten Equity Holdings

Security Description |

% of Net Assets |

Danaher Corporation |

4.3% |

Adobe, Inc. |

3.8% |

American Tower Corporation |

3.7% |

Microsoft Corporation |

3.6% |

Accenture plc - Class A |

3.3% |

T-Mobile US, Inc. |

3.2% |

Apple, Inc. |

3.2% |

Amazon.com, Inc. |

3.2% |

Mastercard, Inc. - Class A |

3.1% |

Visa, Inc. - Class A |

2.9% |

20

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

September 30, 2020 (Unaudited)

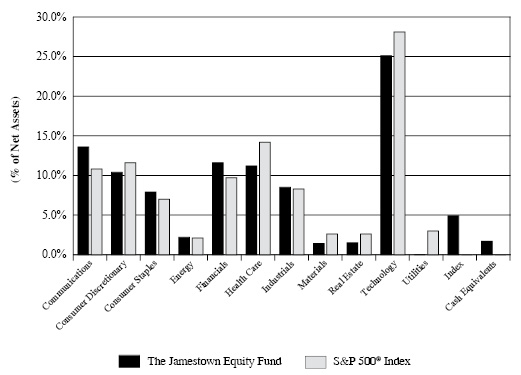

Sector Allocation vs. the Russell 1000® Value Index

Top Ten Equity Holdings

Security Description |

% of Net Assets |

Comcast Corporation - Class A |

3.6% |

Johnson & Johnson |

3.6% |

Brookfield Asset Management, Inc. - Class A |

3.6% |

Watsco, Inc. |

3.4% |

United Parcel Service, Inc. - Class B |

3.3% |

Fidelity National Financial, Inc. |

3.2% |

QUALCOMM, Inc. |

3.2% |

Lamar Advertising Conpany - Class A |

2.8% |

Diageo plc - ADR |

2,8% |

Berkshire Hathaway, Inc. - Class B |

2.7% |

21

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

September 30, 2020 (Unaudited)

Sector Allocation vs. the Russell Midcap® Index

Top Ten Equity Holdings

Security Description |

% of Net Assets |

American Tower Corporation |

5.7% |

Sherwin-Williams Company (The) |

5.6% |

Brookfield Asset Management, Inc. - Class A |

5.0% |

Etsy, Inc. |

4.8% |

Take-Two Interactive Software, Inc. |

4.7% |

Markel Corporation |

4.7% |

DISH Network Corporation - Class A |

4.6% |

O’Reilly Automotive, Inc. |

4.2% |

Fidelity National Financial, Inc. |

4.2% |

Liberty Broadband Corporation - Series C |

4.1% |

22

DAVENPORT SMALL CAP FOCUS FUND

PORTFOLIO INFORMATION

September 30, 2020 (Unaudited)

Sector Allocation vs. the Russell 2000® Index

Top Ten Equity Holdings

Security Description |

% of Net Assets |

Cannae Holdings, Inc. |

6.4% |

Monarch Casino & Resort, Inc. |

5.9% |

Evoqua Water Technologies Corporation |

5.3% |

Stewart Information Services Corporation |

4.8% |

Builders FirstSource, Inc. |

4.3% |

Colfax Corporation |

3.9% |

Lamar Advertising Company - Class A |

3.9% |

Switch, Inc. - Class A |

3.7% |

Diamond Hill Investment Group, Inc. |

3.4% |

Watsco, Inc. |

3.4% |

23

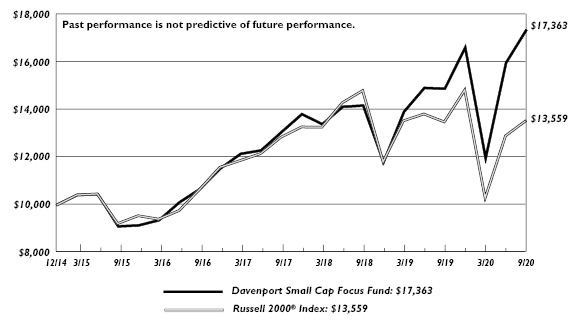

DAVENPORT BALANCED INCOME FUND

PORTFOLIO INFORMATION

September 30, 2020 (Unaudited)

Asset Allocation (% of Net Assets) |

Ten Largest Equity Holdings |

% of Net Assets |

|

|

Comcast Corporation - Class A |

2.0% |

|

Brookfield Asset Management, Inc. - Class A |

1.9% |

||

Johnson & Johnson |

1.9% |

||

Watsco, Inc. |

1.8% |

||

Fidelity National Financial, Inc. |

1.8% |

||

United Parcel Service, Inc. - Class B |

1.8% |

||

QUALCOMM, Inc. |

1.8% |

||

Brookfield Renewable Partners, L.P. |

1.6% |

||

Lamar Advertising Company - Class A |

1.6% |

||

Diageo plc - ADR |

1.6% |

Equity Sector Concentration vs. the Russell 1000 Value Index (62.0% of Net Assets) |

Bond Portfolio (42.6% of Net Assets) |

Credit Quality |

Composite Quality |

||

Number of Fixed-Income Securities |

23 |

AAA |

||

Average Quality |

AA |

|||

Effective Maturity |

yrs. |

A |

||

Average Effective Duration |

yrs. |

BBB |

||

Ba |

||||

Sector Breakdown |

% of Corporate |

Consumer Staples |

9.3% |

Energy |

19.6% |

Financials |

13.6% |

Health Care |

8.3% |

Industrials |

9.4% |

Materials |

5.9% |

Technology |

10.8% |

U.S. Treasury |

23.1% |

24

DAVENPORT CORE FUND |

||||||||

COMMON STOCKS — 95.7% |

Shares |

Value |

||||||

Communications — 10.8% |

||||||||

Alphabet, Inc. - Class A (a) |

8,290 | $ | 12,149,824 | |||||

Alphabet, Inc. - Class C (a) |

6,941 | 10,200,494 | ||||||

Liberty Broadband Corporation - Series C (a) |

103,475 | 14,783,473 | ||||||

T-Mobile US, Inc. (a) |

181,618 | 20,769,834 | ||||||

Walt Disney Company (The) |

93,875 | 11,648,010 | ||||||

| 69,551,635 | ||||||||

Consumer Discretionary — 11.3% |

||||||||

Amazon.com, Inc. (a) |

6,552 | 20,630,479 | ||||||

CarMax, Inc. (a) |

139,983 | 12,865,838 | ||||||

Home Depot, Inc. (The) |

35,678 | 9,908,137 | ||||||

MercadoLibre, Inc. (a) |

5,315 | 5,753,381 | ||||||

NIKE, Inc. - Class B |

96,606 | 12,127,917 | ||||||

TJX Companies, Inc. (The) |

207,349 | 11,538,972 | ||||||

| 72,824,724 | ||||||||

Consumer Staples — 5.2% |

||||||||

Mondelez International, Inc. - Class A |

154,758 | 8,890,847 | ||||||

Nestlé S.A. - ADR |

126,482 | 15,083,611 | ||||||

PepsiCo, Inc. |

65,734 | 9,110,733 | ||||||

| 33,085,191 | ||||||||

Financials — 14.4% |

||||||||

Aon plc - Class A |

60,100 | 12,398,630 | ||||||

Berkshire Hathaway, Inc. - Class B (a) |

82,053 | 17,472,366 | ||||||

Brookfield Asset Management, Inc. - Class A |

493,357 | 16,310,382 | ||||||

Charles Schwab Corporation (The) |

282,887 | 10,248,996 | ||||||

CME Group, Inc. |

56,766 | 9,497,519 | ||||||

JPMorgan Chase & Company |

116,788 | 11,243,181 | ||||||

Markel Corporation (a) |

15,757 | 15,342,591 | ||||||

| 92,513,665 | ||||||||

Health Care — 12.9% |

||||||||

Abbott Laboratories |

103,075 | 11,217,652 | ||||||

Becton, Dickinson and Company |

44,474 | 10,348,210 | ||||||

Danaher Corporation |

126,980 | 27,342,604 | ||||||

Illumina, Inc. (a) |

30,448 | 9,410,868 | ||||||

Johnson & Johnson |

99,285 | 14,781,551 | ||||||

Medtronic plc |

92,610 | 9,624,031 | ||||||

| 82,724,916 | ||||||||

Industrials — 5.0% |

||||||||

Honeywell International, Inc. |

65,415 | 10,767,963 | ||||||

Lockheed Martin Corporation |

21,531 | 8,252,402 | ||||||

Union Pacific Corporation |

65,908 | 12,975,308 | ||||||

| 31,995,673 | ||||||||

Materials — 7.7% |

||||||||

Air Products & Chemicals, Inc. |

39,294 | 11,704,111 | ||||||

25

DAVENPORT CORE FUND |

||||||||

COMMON STOCKS — 95.7% (Continued) |

Shares |

Value |

||||||

Materials — 7.7% (Continued) |

||||||||

Ball Corporation |

115,660 | $ | 9,613,659 | |||||

Martin Marietta Materials, Inc. |

43,247 | 10,178,614 | ||||||

Sherwin-Williams Company (The) |

25,703 | 17,908,308 | ||||||

| 49,404,692 | ||||||||

Real Estate — 3.7% |

||||||||

American Tower Corporation |

98,746 | 23,869,871 | ||||||

Technology — 24.7% |

||||||||

Accenture plc - Class A |

93,234 | 21,069,952 | ||||||

Adobe, Inc. (a) |

50,230 | 24,634,299 | ||||||

Apple, Inc. |

179,128 | 20,744,814 | ||||||

Broadcom, Inc. |

29,532 | 10,759,098 | ||||||

Mastercard, Inc. - Class A |

59,045 | 19,967,248 | ||||||

Microsoft Corporation |

108,857 | 22,895,893 | ||||||

Moody’s Corporation |

36,170 | 10,483,874 | ||||||

Sony Corporation - ADR |

119,530 | 9,173,927 | ||||||

Visa, Inc. - Class A |

92,686 | 18,534,419 | ||||||

| 158,263,524 | ||||||||

Total Common Stocks (Cost $343,075,474) |

$ | 614,233,891 | ||||||

|

||||||||

EXCHANGE-TRADED FUNDS — 1.4% |

Shares |

Value |

||||||

iShares Nasdaq Biotechnology ETF (Cost $9,000,550) |

64,546 | $ | 8,740,174 | |||||

|

||||||||

MONEY MARKET FUNDS — 1.5% |

Shares |

Value |

||||||

First American Treasury Obligations Fund - Class Z, 0.04% (b) (Cost $9,387,059) |

9,387,059 | $ | 9,387,059 | |||||

Total Investments at Value — 98.6% (Cost $361,463,083) |

$ | 632,361,124 | ||||||

Other Assets in Excess of Liabilities — 1.4% |

9,091,537 | |||||||

Net Assets — 100.0% |

$ | 641,452,661 | ||||||

ADR - American Depositary Receipt.

|

(a) |

Non-income producing security. |

|

(b) |

The rate shown is the 7-day effective yield as of September 30, 2020. |

See accompanying notes to financial statements.

26

DAVENPORT VALUE & INCOME FUND |

||||||||

COMMON STOCKS — 98.3% |

Shares |

Value |

||||||

Communications — 6.8% |

||||||||

Alphabet, Inc. - Class A (a) |

6,649 | $ | 9,744,775 | |||||

Comcast Corporation - Class A |

508,509 | 23,523,626 | ||||||

Verizon Communications, Inc. |

184,737 | 10,990,004 | ||||||

| 44,258,405 | ||||||||

Consumer Discretionary — 6.2% |

||||||||

Lowe’s Companies, Inc. |

63,437 | 10,521,661 | ||||||

McDonald’s Corporation |

74,202 | 16,286,597 | ||||||

Starbucks Corporation |

154,691 | 13,291,050 | ||||||

| 40,099,308 | ||||||||

Consumer Staples — 13.4% |

||||||||

Anheuser-Busch InBev S.A./N.V. - ADR |

248,693 | 13,399,579 | ||||||

Bunge Ltd. |

284,727 | 13,012,024 | ||||||

Diageo plc - ADR |

132,306 | 18,213,244 | ||||||

PepsiCo, Inc. |

120,461 | 16,695,895 | ||||||

Philip Morris International, Inc. |

196,772 | 14,755,932 | ||||||

Tyson Foods, Inc. - Class A |

180,501 | 10,736,199 | ||||||

| 86,812,873 | ||||||||

Energy — 2.7% |

||||||||

Chevron Corporation |

122,264 | 8,803,008 | ||||||

Enbridge, Inc. |

303,018 | 8,848,126 | ||||||

| 17,651,134 | ||||||||

Financials — 18.7% |

||||||||

Berkshire Hathaway, Inc. - Class B (a) |

83,352 | 17,748,975 | ||||||

Brookfield Asset Management, Inc. - Class A |

694,467 | 22,959,079 | ||||||

Capital One Financial Corporation |

179,721 | 12,914,751 | ||||||

Fairfax Financial Holdings Ltd. |

41,675 | 12,222,444 | ||||||

Fidelity National Financial, Inc. |

660,175 | 20,670,080 | ||||||

JPMorgan Chase & Company |

183,956 | 17,709,444 | ||||||

Markel Corporation (a) |

17,206 | 16,753,482 | ||||||

| 120,978,255 | ||||||||

Health Care — 10.3% |

||||||||

Bristol-Myers Squibb Company |

232,049 | 13,990,234 | ||||||

Johnson & Johnson |

155,492 | 23,149,649 | ||||||

Medtronic plc |

161,829 | 16,817,270 | ||||||

Merck & Company, Inc. |

154,002 | 12,774,466 | ||||||

| 66,731,619 | ||||||||

Industrials — 17.2% |

||||||||

3M Company |

108,467 | 17,374,244 | ||||||

Deere & Company |

53,955 | 11,958,046 | ||||||

L3Harris Technologies, Inc. |

55,517 | 9,429,007 | ||||||

Norfolk Southern Corporation |

71,232 | 15,242,936 | ||||||

TE Connectivity Ltd. |

143,304 | 14,006,533 | ||||||

27

DAVENPORT VALUE & INCOME FUND |

||||||||

COMMON STOCKS — 98.3% (Continued) |

Shares |

Value |

||||||

Industrials — 17.2% (Continued) |

||||||||

United Parcel Service, Inc. - Class B |

128,609 | $ | 21,430,118 | |||||

Watsco, Inc. |

93,164 | 21,696,964 | ||||||

| 111,137,848 | ||||||||

Real Estate — 8.8% |

||||||||

Crown Castle International Corporation |

93,603 | 15,584,900 | ||||||

Gaming and Leisure Properties, Inc. |

377,879 | 13,955,062 | ||||||

Lamar Advertising Company - Class A |

277,643 | 18,371,637 | ||||||

W.P. Carey, Inc. |

135,517 | 8,830,288 | ||||||

| 56,741,887 | ||||||||

Technology — 9.8% |

||||||||

Cisco Systems, Inc. |

307,385 | 12,107,895 | ||||||

Microsoft Corporation |

82,296 | 17,309,318 | ||||||

QUALCOMM, Inc. |

174,494 | 20,534,454 | ||||||

Sony Corporation - ADR |

170,308 | 13,071,139 | ||||||

| 63,022,806 | ||||||||

Utilities — 4.4% |

||||||||

Dominion Energy, Inc. |

223,273 | 17,622,938 | ||||||

NextEra Energy, Inc. |

37,769 | 10,483,163 | ||||||

| 28,106,101 | ||||||||

Total Common Stocks (Cost $541,703,734) |

$ | 635,540,236 | ||||||

|

||||||||

MONEY MARKET FUNDS — 0.2% |

Shares |

Value |

||||||

First American Treasury Obligations Fund - Class Z, 0.04% (b) (Cost $1,497,827) |

1,497,827 | $ | 1,497,827 | |||||

Total Investments at Value — 98.5% (Cost $543,201,561) |

$ | 637,038,063 | ||||||

Other Assets in Excess of Liabilities — 1.5% |

9,584,761 | |||||||

Net Assets — 100.0% |

$ | 646,622,824 | ||||||

ADR - American Depositary Receipt.

|

(a) |

Non-income producing security. |

|

(b) |

The rate shown is the 7-day effective yield as of September 30, 2020. |

See accompanying notes to financial statements.

28

DAVENPORT EQUITY OPPORTUNITIES FUND |

||||||||

COMMON STOCKS — 98.5% |

Shares |

Value |

||||||

Communications — 16.2% |

||||||||

Altice USA, Inc. - Class A (a) |

555,409 | $ | 14,440,634 | |||||

DISH Network Corporation - Class A (a) |

828,365 | 24,047,436 | ||||||

Liberty Broadband Corporation - Series C (a) |

149,709 | 21,388,925 | ||||||

Take-Two Interactive Software, Inc. (a) |

146,444 | 24,195,478 | ||||||

| 84,072,473 | ||||||||

Consumer Discretionary — 22.3% |

||||||||

Cannae Holdings, Inc. (a) |

529,947 | 19,745,825 | ||||||

CarMax, Inc. (a) |

203,830 | 18,734,015 | ||||||

DraftKings, Inc. - Class A (a) |

282,846 | 16,642,659 | ||||||

Etsy, Inc. (a) |

203,598 | 24,763,625 | ||||||

MercadoLibre, Inc. (a) |

13,071 | 14,149,096 | ||||||

O’Reilly Automotive, Inc. (a) |

47,551 | 21,924,815 | ||||||

| 115,960,035 | ||||||||

Financials — 17.7% |

||||||||

Brookfield Asset Management, Inc. - Class A |

791,144 | 26,155,221 | ||||||

Fairfax Financial Holdings Ltd. |

67,386 | 19,762,966 | ||||||

Fidelity National Financial, Inc. |

690,050 | 21,605,465 | ||||||

Markel Corporation (a) |

24,847 | 24,193,524 | ||||||

| 91,717,176 | ||||||||

Health Care — 5.1% |

||||||||

Align Technology, Inc. (a) |

36,156 | 11,836,028 | ||||||

Zoetis, Inc. |

87,976 | 14,548,591 | ||||||

| 26,384,619 | ||||||||

Industrials — 10.4% |

||||||||

Colfax Corporation (a) |

471,677 | 14,791,791 | ||||||

Watsco, Inc. |

87,416 | 20,358,312 | ||||||

Xylem, Inc. |

224,492 | 18,884,267 | ||||||

| 54,034,370 | ||||||||

Materials — 8.8% |

||||||||

Martin Marietta Materials, Inc. |

71,088 | 16,731,272 | ||||||

Sherwin-Williams Company (The) |

41,395 | 28,841,552 | ||||||

| 45,572,824 | ||||||||

Real Estate — 8.2% |

||||||||

American Tower Corporation |

123,333 | 29,813,286 | ||||||

Lamar Advertising Company - Class A |

190,442 | 12,601,547 | ||||||

| 42,414,833 | ||||||||

Technology — 9.8% |

||||||||

Autodesk, Inc. (a) |

67,113 | 15,503,774 | ||||||

Black Knight, Inc. (a) |

239,209 | 20,823,144 | ||||||

Intuit, Inc. |

45,549 | 14,858,539 | ||||||

| 51,185,457 | ||||||||

Total Common Stocks (Cost $368,339,179) |

$ | 511,341,787 | ||||||

29

DAVENPORT EQUITY OPPORTUNITIES FUND |

||||||||

MONEY MARKET FUNDS — 1.8% |

Shares |

Value |

||||||

First American Treasury Obligations Fund - Class Z, 0.04% (b) (Cost $9,506,489) |

9,506,489 | $ | 9,506,489 | |||||

Total Investments at Value — 100.3% (Cost $377,845,668) |

$ | 520,848,276 | ||||||

Liabilities in Excess of Other Assets — (0.3%) |

(1,726,117 | ) | ||||||

Net Assets — 100.0% |

$ | 519,122,159 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

The rate shown is the 7-day effective yield as of September 30, 2020. |

See accompanying notes to financial statements.

30

DAVENPORT SMALL CAP FOCUS FUND |

||||||||

COMMON STOCKS — 92.3% |

Shares |

Value |

||||||

Communications — 9.9% |

||||||||

Cable One, Inc. |

3,357 | $ | 6,329,388 | |||||

Liberty Latin America Ltd. - Class C (a) |

639,576 | 5,206,149 | ||||||

Shenandoah Telecommunications Company |

150,368 | 6,681,602 | ||||||

Switch, Inc. - Class A |

703,796 | 10,986,256 | ||||||

| 29,203,395 | ||||||||

Consumer Discretionary — 27.4% |

||||||||

American Woodmark Corporation (a) |

100,212 | 7,870,651 | ||||||

Builders FirstSource, Inc. (a) |

391,598 | 12,773,927 | ||||||

Cannae Holdings, Inc. (a) |

503,866 | 18,774,047 | ||||||

Etsy, Inc. (a) |

29,629 | 3,603,775 | ||||||

GAN Ltd. (a) |

369,308 | 6,241,305 | ||||||

Hanesbrands, Inc. |

626,701 | 9,870,541 | ||||||

Monarch Casino & Resort, Inc. (a) |

387,244 | 17,271,082 | ||||||

OneSpaWorld Holdings Ltd. |

655,099 | 4,258,144 | ||||||

| 80,663,472 | ||||||||

Consumer Staples — 7.1% |

||||||||

Bunge Ltd. |

110,000 | 5,027,000 | ||||||

J & J Snack Foods Corporation |

51,000 | 6,649,890 | ||||||

Seaboard Corporation |

3,254 | 9,230,589 | ||||||

| 20,907,479 | ||||||||

Financials — 16.0% |

||||||||

Diamond Hill Investment Group, Inc. |

79,614 | 10,056,840 | ||||||

Foley Trasimene Acquisition Corporation (a) |

800,000 | 9,032,000 | ||||||

Kinsale Capital Group, Inc. |

16,917 | 3,217,275 | ||||||

Stewart Information Services Corporation |

323,757 | 14,157,894 | ||||||

TowneBank |

323,732 | 5,309,205 | ||||||

Trebia Acquisition Corporation (a) |

500,000 | 5,400,000 | ||||||

| 47,173,214 | ||||||||

Industrials — 15.3% |

||||||||

Casella Waste Systems, Inc. - Class A (a) |

139,012 | 7,763,820 | ||||||

Colfax Corporation (a) |

366,992 | 11,508,869 | ||||||

Evoqua Water Technologies Corporation (a) |

739,579 | 15,693,866 | ||||||

Watsco, Inc. |

42,896 | 9,990,050 | ||||||

| 44,956,605 | ||||||||

Materials — 7.7% |

||||||||

Fortuna Silver Mines, Inc. (a) |

1,078,251 | 6,857,676 | ||||||

MAG Silver Corporation (a) |

407,434 | 6,624,877 | ||||||

NewMarket Corporation |

27,246 | 9,326,851 | ||||||

| 22,809,404 | ||||||||

Real Estate — 5.5% |

||||||||

FRP Holdings, Inc. (a) |

118,860 | 4,952,896 | ||||||

Lamar Advertising Company - Class A |

171,595 | 11,354,441 | ||||||

| 16,307,337 | ||||||||

31

DAVENPORT SMALL CAP FOCUS FUND |

||||||||

COMMON STOCKS — 92.3% (Continued) |

Shares |

Value |

||||||

Technology — 3.4% |

||||||||

Sonos, Inc. (a) |

301,970 | $ | 4,583,904 | |||||

Verra Mobility Corporation (a) |

549,260 | 5,305,852 | ||||||

| 9,889,756 | ||||||||

Total Common Stocks (Cost $225,446,792) |

$ | 271,910,662 | ||||||

|

||||||||

MONEY MARKET FUNDS — 7.9% |

Shares |

Value |

||||||

First American Treasury Obligations Fund - Class Z, 0.04% (b) (Cost $23,298,839) |

23,298,839 | $ | 23,298,839 | |||||

Total Investments at Value — 100.2% (Cost $248,745,631) |

$ | 295,209,501 | ||||||

Liabilities in Excess of Other Assets — (0.2%) |

(687,151 | ) | ||||||

Net Assets — 100.0% |

$ | 294,522,350 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

The rate shown is the 7-day effective yield as of September 30, 2020. |

See accompanying notes to financial statements.

32

DAVENPORT BALANCED INCOME FUND |

||||||||

COMMON STOCKS — 61.5% |

Shares |

Value |

||||||

Communications — 3.7% |

||||||||

Alphabet, Inc. - Class A (a) |

925 | $ | 1,355,680 | |||||

Comcast Corporation - Class A |

72,401 | 3,349,270 | ||||||

Verizon Communications, Inc. |

25,334 | 1,507,120 | ||||||

| 6,212,070 | ||||||||

Consumer Discretionary — 4.2% |

||||||||

Cannae Holdings, Inc. (a) |

35,849 | 1,335,734 | ||||||

Lowe’s Companies, Inc. |

8,846 | 1,467,198 | ||||||

McDonald’s Corporation |

10,246 | 2,248,894 | ||||||

Starbucks Corporation |

21,567 | 1,853,037 | ||||||

| 6,904,863 | ||||||||

Consumer Staples — 8.7% |

||||||||

Anheuser-Busch InBev S.A./N.V. - ADR |

34,055 | 1,834,883 | ||||||

Bunge Ltd. |

39,012 | 1,782,849 | ||||||

Diageo plc - ADR |

18,672 | 2,570,388 | ||||||

Ingredion, Inc. |

13,155 | 995,570 | ||||||

PepsiCo, Inc. |

16,526 | 2,290,504 | ||||||

Philip Morris International, Inc. |

27,471 | 2,060,050 | ||||||

Tyson Foods, Inc. - Class A |

24,894 | 1,480,695 | ||||||

Universal Corporation |

31,964 | 1,338,652 | ||||||

| 14,353,591 | ||||||||

Energy — 1.9% |

||||||||

Chevron Corporation |

16,932 | 1,219,104 | ||||||

Enbridge, Inc. |

41,717 | 1,218,137 | ||||||

Enterprise Products Partners, L.P. |

45,067 | 711,608 | ||||||

| 3,148,849 | ||||||||

Financials — 12.4% |

||||||||

Berkshire Hathaway, Inc. - Class B (a) |

11,473 | 2,443,061 | ||||||

Brookfield Asset Management, Inc. - Class A |

97,228 | 3,214,358 | ||||||

Capital One Financial Corporation |

24,967 | 1,794,129 | ||||||

Diamond Hill Investment Group, Inc. |

11,715 | 1,479,839 | ||||||

Fairfax Financial Holdings Ltd. |

5,756 | 1,688,120 | ||||||

Fidelity National Financial, Inc. |

94,131 | 2,947,241 | ||||||