Form N-CSRS MFS SPECIAL VALUE TRUST For: Apr 30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05912

MFS SPECIAL VALUE TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2018

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

Semiannual Report

April 30, 2018

MFS® Special Value Trust

MFV-SEM

Table of Contents

MANAGED DISTRIBUTION POLICY DISCLOSURE

The MFS Special Value Trust’s (the fund) Board of Trustees adopted a managed distribution policy. The fund seeks to pay monthly distributions based on an annual rate of 10.00% of the fund’s average monthly net asset value. The primary purpose of the managed distribution policy is to provide shareholders with a constant, but not guaranteed, fixed minimum rate of distribution each month. You should not draw any conclusions about the fund’s investment performance from the amount of the current distribution or from the terms of the fund’s managed distribution policy. The Board may amend or terminate the managed distribution policy at any time without prior notice to fund shareholders. The amendment or termination of the managed distribution policy could have an adverse effect on the market price of the fund’s shares.

With each distribution, the fund will issue a notice to shareholders and an accompanying press release which will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. Please refer to “Tax Matters and Distributions” under Note 2 of the Notes to Financial Statements for information regarding the tax character of the fund’s distributions.

Under a managed distribution policy the fund may at times distribute more than its net investment income and net realized capital gains; therefore, a portion of your distribution may result in a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the fund is paid back to you. Any such returns of capital will decrease the fund’s total assets and, therefore, could have the effect of increasing the fund’s expense ratio. In addition, in order to make the level of distributions called for under its managed distribution policy, the fund may have to sell portfolio securities at a less than opportune time. A return of capital does not necessarily reflect the fund’s investment performance and should not be confused with ‘yield’ or ‘income’. The fund’s total return in relation to changes in net asset value is presented in the Financial Highlights.

Table of Contents

MFS® Special Value Trust

New York Stock Exchange Symbol: MFV

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Table of Contents

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Rising bond yields have led to a measurable uptick in market volatility — a departure from the low-volatility environment that prevailed for much of 2017. In recent months,

against this backdrop, global markets have given back some of the strong gains recorded during 2017 and early 2018. Global economic growth remains robust, notwithstanding signs of a modest slowdown over the past few months, particularly in Europe.

Although the U.S. Federal Reserve continues to gradually raise interest rates and shrink its balance sheet, monetary policy remains accommodative around the world, with many central banks taking only tentative steps toward tighter policies. Newly enacted U.S. tax reforms have been welcomed by equity markets, while emerging market economies have benefited from a weaker U.S. dollar.

Around the world, inflation remains largely subdued, but tight labor markets and solid global demand have investors on the lookout for its potential resurgence. Increased U.S. protectionism is also a growing concern, as investors fear that trade friction could disrupt the synchronized rise in global growth.

As a global investment manager, MFS® strives to create long-term value and protect capital for clients through an active approach and an investment platform built on nearly a century of expertise. To make that long-term value meaningful for clients, we work to align with you on our beliefs, your needs and the time it takes to deliver on your desired outcomes.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

June 18, 2018

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

2

Table of Contents

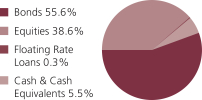

Portfolio Composition – continued

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income futures contracts, which have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and commodities. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (o) | Less than 0.1%. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of April 30, 2018.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

| Portfolio Manager | Primary Role | Since | Title and Five Year History | |||

| William Adams | Below Investment Grade Debt Instruments Portfolio Manager |

2011 | Investment Officer of MFS; employed in the investment management area of MFS since 2009. | |||

| Ward Brown | Emerging Markets Debt Instruments Portfolio Manager |

2012 | Investment Officer of MFS; employed in the investment management area of MFS since 2005. | |||

| Nevin Chitkara | Equity Securities Portfolio Manager |

2012 | Investment Officer of MFS; employed in the investment management area of MFS since 1997. | |||

| David Cole | Below Investment Grade Debt Instruments Portfolio Manager |

2006 | Investment Officer of MFS; employed in the investment management area of MFS since 2004. | |||

| Matt Ryan | Emerging Markets Debt Instruments Portfolio Manager |

2012 | Investment Officer of MFS; employed in the investment management area of MFS since 1997. | |||

| Michael Skatrud | Below Investment Grade Debt Instruments Portfolio Manager |

2018 |

Investment Officer of MFS; employed in the investment management area of MFS since 2013. | |||

Note to Shareholders: Effective March 1, 2018, Michael Skatrud became a Portfolio Manager of the Fund. Effective September 1, 2018, William Adams will no longer be a Portfolio Manager of the Fund.

4

Table of Contents

The fund’s shares may trade at a discount or premium to net asset value. When fund shares trade at a premium, buyers pay more than the net asset value underlying fund shares, and shares purchased at a premium would receive less than the amount paid for them in the event of the fund’s concurrent liquidation.

The fund’s monthly distributions may include a return of capital to shareholders to the extent that the fund’s net investment income and net capital gains, determined in accordance with federal income tax regulations, are insufficient to meet the fund’s target annual distribution rate. Distributions that are treated for federal income tax purposes as a return of capital will reduce each shareholder’s basis in his or her shares and, to the extent the return of capital exceeds such basis, will be treated as gain to the shareholder from a sale of shares. It may also result in a recharacterization of what economically represents a return of capital to ordinary income in those situations where a fund has long term capital gains and a capital loss carryforward. Returns of shareholder capital may have the effect of reducing the fund’s assets and increasing the fund’s expense ratio.

The fund’s target annual distribution rate is calculated based on an annual rate of 10.00% of the fund’s average monthly net asset value, not a fixed share price, and the fund’s dividend amount will fluctuate with changes in the fund’s average monthly net assets.

In accordance with Section 23(c) of the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees shall determine.

5

Table of Contents

4/30/18 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Bonds - 54.8% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Aerospace - 1.1% | ||||||||

| Dae Funding LLC, 5%, 8/01/2024 (n) | $ | 135,000 | $ | 130,113 | ||||

| KLX, Inc., 5.875%, 12/01/2022 (n) | 120,000 | 125,250 | ||||||

| TransDigm, Inc., 6.5%, 7/15/2024 | 125,000 | 127,109 | ||||||

| TransDigm, Inc., 6.375%, 6/15/2026 | 65,000 | 65,325 | ||||||

|

|

|

|||||||

| $ | 447,797 | |||||||

| Asset-Backed & Securitized - 0.0% | ||||||||

| Morgan Stanley Capital I, Inc., 1.493%, 4/28/2039 (i)(z) | $ | 40,778 | $ | 61 | ||||

| Broadcasting - 2.1% | ||||||||

| Liberty Media Corp. - Liberty Formula One, 8.5%, 7/15/2029 | $ | 110,000 | $ | 118,525 | ||||

| Liberty Media Corp. - Liberty Formula One, 8.25%, 2/01/2030 | 50,000 | 53,750 | ||||||

| Match Group, Inc., 6.375%, 6/01/2024 | 105,000 | 110,775 | ||||||

| Meredith Corp., 6.875%, 2/01/2026 (n) | 95,000 | 96,064 | ||||||

| Netflix, Inc., 5.875%, 2/15/2025 | 60,000 | 61,632 | ||||||

| Netflix, Inc., 4.375%, 11/15/2026 | 40,000 | 37,388 | ||||||

| Netflix, Inc., 4.875%, 4/15/2028 (n) | 25,000 | 23,594 | ||||||

| Netflix, Inc., 5.875%, 11/15/2028 (n) | 100,000 | 99,750 | ||||||

| Sinclair Broadcast Group, Inc., 5.125%, 2/15/2027 (n) | 125,000 | 115,937 | ||||||

| WMG Acquisition Corp., 5%, 8/01/2023 (n) | 30,000 | 29,812 | ||||||

| WMG Acquisition Corp., 4.875%, 11/01/2024 (n) | 95,000 | 93,100 | ||||||

| WMG Acquisition Corp., 5.5%, 4/15/2026 (n) | 15,000 | 15,075 | ||||||

|

|

|

|||||||

| $ | 855,402 | |||||||

| Building - 2.1% | ||||||||

| ABC Supply Co., Inc., 5.75%, 12/15/2023 (n) | $ | 105,000 | $ | 108,250 | ||||

| Beacon Escrow Corp., 4.875%, 11/01/2025 (n) | 60,000 | 56,700 | ||||||

| Beacon Roofing Supply, Inc., 6.375%, 10/01/2023 | 95,000 | 99,512 | ||||||

| Gibraltar Industries, Inc., 6.25%, 2/01/2021 | 95,000 | 96,510 | ||||||

| New Enterprise Stone & Lime Co, Inc., 10.125%, 4/01/2022 (n) | 90,000 | 95,850 | ||||||

| New Enterprise Stone & Lime Co., Inc., 6.25%, 3/15/2026 (n) | 50,000 | 50,625 | ||||||

| PriSo Acquisition Corp., 9%, 5/15/2023 (n) | 80,000 | 83,600 | ||||||

| Standard Industries, Inc., 5.375%, 11/15/2024 (n) | 95,000 | 96,247 | ||||||

| Standard Industries, Inc., 6%, 10/15/2025 (n) | 65,000 | 67,438 | ||||||

| Summit Materials LLC/Summit Materials Finance Co., 6.125%, 7/15/2023 | 105,000 | 107,331 | ||||||

|

|

|

|||||||

| $ | 862,063 | |||||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Business Services - 2.2% | ||||||||

| Alliance Data Systems Corp., 5.875%, 11/01/2021 (n) | $ | 100,000 | $ | 101,750 | ||||

| Alliance Data Systems Corp., 5.375%, 8/01/2022 (n) | 55,000 | 55,275 | ||||||

| Ascend Learning LLC, 6.875%, 8/01/2025 (n) | 70,000 | 71,225 | ||||||

| CDK Global, Inc., 4.875%, 6/01/2027 | 155,000 | 149,962 | ||||||

| Equinix, Inc., 5.375%, 1/01/2022 | 25,000 | 25,781 | ||||||

| Equinix, Inc., 5.375%, 4/01/2023 | 35,000 | 35,963 | ||||||

| Equinix, Inc., 5.875%, 1/15/2026 | 60,000 | 62,100 | ||||||

| First Data Corp., 5%, 1/15/2024 (n) | 190,000 | 191,425 | ||||||

| MSCI, Inc., 4.75%, 8/01/2026 (n) | 90,000 | 89,177 | ||||||

| Travelport Worldwide Ltd., 6%, 3/15/2026 (n) | 90,000 | 92,025 | ||||||

|

|

|

|||||||

| $ | 874,683 | |||||||

| Cable TV - 3.5% | ||||||||

| Altice Financing S.A., 6.625%, 2/15/2023 (n) | $ | 200,000 | $ | 200,000 | ||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.125%, 5/01/2023 (n) | 155,000 | 155,728 | ||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.75%, 1/15/2024 | 160,000 | 161,504 | ||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.375%, 5/01/2025 (n) | 25,000 | 24,578 | ||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.75%, 2/15/2026 (n) | 80,000 | 79,400 | ||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.875%, 5/01/2027 (n) | 45,000 | 43,988 | ||||||

| DISH DBS Corp., 5%, 3/15/2023 | 60,000 | 51,975 | ||||||

| DISH DBS Corp., 5.875%, 11/15/2024 | 45,000 | 38,306 | ||||||

| Intelsat Jackson Holdings S.A., 5.5%, 8/01/2023 | 70,000 | 58,800 | ||||||

| Intelsat Jackson Holdings S.A., 8%, 2/15/2024 (n) | 20,000 | 21,125 | ||||||

| Sirius XM Radio, Inc., 4.625%, 5/15/2023 (n) | 85,000 | 83,937 | ||||||

| Sirius XM Radio, Inc., 6%, 7/15/2024 (n) | 60,000 | 61,662 | ||||||

| Sirius XM Radio, Inc., 5.375%, 4/15/2025 (n) | 45,000 | 44,775 | ||||||

| Unitymedia KabelBW GmbH, 6.125%, 1/15/2025 (n) | 200,000 | 210,000 | ||||||

| Videotron Ltd., 5.375%, 6/15/2024 (n) | 25,000 | 25,688 | ||||||

| Videotron Ltd., 5.125%, 4/15/2027 (n) | 155,000 | 151,900 | ||||||

|

|

|

|||||||

| $ | 1,413,366 | |||||||

| Chemicals - 0.7% | ||||||||

| OCI N.V., 6.625%, 4/15/2023 (n) | $ | 200,000 | $ | 202,800 | ||||

| PolyOne Corp., 5.25%, 3/15/2023 | 90,000 | 92,137 | ||||||

|

|

|

|||||||

| $ | 294,937 | |||||||

| Computer Software - 0.7% | ||||||||

| Diamond 1 Finance Corp./Diamond 2 Finance Corp., 5.875%, 6/15/2021 (n) | $ | 85,000 | $ | 87,451 | ||||

| Diamond 1 Finance Corp./Diamond 2 Finance Corp., 6.02%, 6/15/2026 (n) | 45,000 | 47,725 | ||||||

| VeriSign, Inc., 4.625%, 5/01/2023 | 30,000 | 30,075 | ||||||

| VeriSign, Inc., 5.25%, 4/01/2025 | 85,000 | 87,231 | ||||||

7

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Computer Software - continued | ||||||||

| VeriSign, Inc., 4.75%, 7/15/2027 | $ | 27,000 | $ | 25,886 | ||||

|

|

|

|||||||

| $ | 278,368 | |||||||

| Computer Software - Systems - 0.6% | ||||||||

| CDW LLC/CDW Finance Corp., 5%, 9/01/2025 | $ | 25,000 | $ | 24,905 | ||||

| JDA Software Group, Inc., 7.375%, 10/15/2024 (n) | 85,000 | 88,188 | ||||||

| Sabre GLBL, Inc., 5.375%, 4/15/2023 (n) | 115,000 | 116,115 | ||||||

|

|

|

|||||||

| $ | 229,208 | |||||||

| Conglomerates - 2.3% | ||||||||

| Amsted Industries Co., 5%, 3/15/2022 (n) | $ | 135,000 | $ | 134,748 | ||||

| Apergy Corp, 6.375%, 5/01/2026 (n) | 40,000 | 40,600 | ||||||

| Apex Tool Group LLC, 9%, 2/15/2023 (n) | 95,000 | 92,625 | ||||||

| EnerSys, 5%, 4/30/2023 (n) | 155,000 | 155,775 | ||||||

| Enpro Industries, Inc., 5.875%, 9/15/2022 | 130,000 | 133,900 | ||||||

| Entegris, Inc., 4.625%, 2/10/2026 (n) | 100,000 | 96,500 | ||||||

| Gates Global LLC, 6%, 7/15/2022 (n) | 48,000 | 48,600 | ||||||

| SPX FLOW, Inc., 5.625%, 8/15/2024 (n) | 105,000 | 106,312 | ||||||

| TriMas Corp., 4.875%, 10/15/2025 (n) | 110,000 | 105,875 | ||||||

|

|

|

|||||||

| $ | 914,935 | |||||||

| Construction - 0.5% | ||||||||

| Empresas ICA S.A.B. de C.V., 8.9%, 2/04/2021 (a)(d) | $ | 125,000 | $ | 19,438 | ||||

| Mattamy Group Corp., 6.5%, 10/01/2025 (n) | 85,000 | 84,787 | ||||||

| Toll Brothers Finance Corp., 4.875%, 11/15/2025 | 30,000 | 29,775 | ||||||

| Toll Brothers Finance Corp., 4.35%, 2/15/2028 | 95,000 | 87,875 | ||||||

|

|

|

|||||||

| $ | 221,875 | |||||||

| Consumer Products - 0.8% | ||||||||

| Coty, Inc., 6.5%, 4/15/2026 (n) | $ | 115,000 | $ | 111,838 | ||||

| Prestige Brands, Inc., 6.375%, 3/01/2024 (n) | 110,000 | 110,550 | ||||||

| Spectrum Brands, Inc., 6.125%, 12/15/2024 | 10,000 | 10,150 | ||||||

| Spectrum Brands, Inc., 5.75%, 7/15/2025 | 105,000 | 104,900 | ||||||

|

|

|

|||||||

| $ | 337,438 | |||||||

| Consumer Services - 1.2% | ||||||||

| Interval Acquisition Corp., 5.625%, 4/15/2023 | $ | 130,000 | $ | 135,525 | ||||

| Matthews International Corp., 5.25%, 12/01/2025 (n) | 80,000 | 78,400 | ||||||

| Service Corp. International, 4.625%, 12/15/2027 | 75,000 | 73,335 | ||||||

| ServiceMaster Co. LLC, 5.125%, 11/15/2024 (n) | 105,000 | 102,270 | ||||||

| West Corp., 8.5%, 10/15/2025 (n) | 110,000 | 106,150 | ||||||

|

|

|

|||||||

| $ | 495,680 | |||||||

| Containers - 2.5% | ||||||||

| Berry Global Group, Inc., 5.5%, 5/15/2022 | $ | 125,000 | $ | 128,204 | ||||

| Berry Global Group, Inc., 6%, 10/15/2022 | 30,000 | 31,238 | ||||||

8

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Containers - continued | ||||||||

| Berry Global Group, Inc., 5.125%, 7/15/2023 | $ | 50,000 | $ | 50,312 | ||||

| Crown Americas LLC/Crown Americas Capital Corp., 4.75%, 2/01/2026 (n) | 25,000 | 24,125 | ||||||

| Crown Americas LLC/Crown Americas Capital Corp. V, 4.25%, 9/30/2026 | 55,000 | 50,944 | ||||||

| Flex Acquisition Co., Inc., 6.875%, 1/15/2025 (n) | 70,000 | 70,350 | ||||||

| Multi-Color Corp., 6.125%, 12/01/2022 (n) | 123,000 | 126,690 | ||||||

| Reynolds Group, 5.75%, 10/15/2020 | 48,456 | 48,819 | ||||||

| Reynolds Group, 5.125%, 7/15/2023 (n) | 70,000 | 70,437 | ||||||

| Reynolds Group, 7%, 7/15/2024 (n) | 70,000 | 72,887 | ||||||

| Sealed Air Corp., 4.875%, 12/01/2022 (n) | 115,000 | 116,725 | ||||||

| Sealed Air Corp., 5.125%, 12/01/2024 (n) | 25,000 | 25,375 | ||||||

| Sealed Air Corp., 5.5%, 9/15/2025 (n) | 25,000 | 25,844 | ||||||

| Silgan Holdings, Inc., 5.5%, 2/01/2022 | 10,000 | 10,150 | ||||||

| Silgan Holdings, Inc., 4.75%, 3/15/2025 | 85,000 | 82,246 | ||||||

| W/S Packaging Group, Inc., 9%, 4/15/2023 (n) | 70,000 | 71,575 | ||||||

|

|

|

|||||||

| $ | 1,005,921 | |||||||

| Electrical Equipment - 0.4% | ||||||||

| CommScope Tech LLC, 5%, 3/15/2027 (n) | $ | 175,000 | $ | 167,562 | ||||

| Electronics - 0.4% | ||||||||

| Sensata Technologies B.V., 5.625%, 11/01/2024 (n) | $ | 40,000 | $ | 41,500 | ||||

| Sensata Technologies B.V., 5%, 10/01/2025 (n) | 130,000 | 129,675 | ||||||

|

|

|

|||||||

| $ | 171,175 | |||||||

| Emerging Market Sovereign - 0.7% | ||||||||

| Republic of Ecuador, 10.5%, 3/24/2020 (n) | $ | 200,000 | $ | 206,000 | ||||

| Republic of Venezuela, 7%, 3/31/2038 (d) | 203,000 | 59,885 | ||||||

|

|

|

|||||||

| $ | 265,885 | |||||||

| Energy - Independent - 4.1% | ||||||||

| Afren PLC, 11.5%, 2/01/2016 (a)(d)(z) | $ | 195,167 | $ | 488 | ||||

| Alta Mesa Holdings LP/Alta Mesa Finance Services Corp., 7.875%, 12/15/2024 | 145,000 | 150,075 | ||||||

| CrownRock LP/CrownRock Finance, Inc., 5.625%, 10/15/2025 (n) | 110,000 | 108,625 | ||||||

| Diamondback Energy, Inc., 5.375%, 5/31/2025 | 145,000 | 146,812 | ||||||

| Diamondback Energy, Inc., 5.375%, 5/31/2025 (n) | 40,000 | 40,550 | ||||||

| Gulfport Energy Corp., 6%, 10/15/2024 | 125,000 | 118,750 | ||||||

| Gulfport Energy Corp., 6.375%, 5/15/2025 | 35,000 | 33,589 | ||||||

| Indigo Natural Resources LLC, 6.875%, 2/15/2026 (n) | 110,000 | 105,600 | ||||||

| Parsley Energy LLC/Parsley Finance Corp., 5.625%, 10/15/2027 (n) | 145,000 | 146,812 | ||||||

| PDC Energy, Inc., 6.125%, 9/15/2024 | 130,000 | 133,250 | ||||||

9

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Energy - Independent - continued | ||||||||

| QEP Resources, Inc., 5.25%, 5/01/2023 | $ | 120,000 | $ | 117,000 | ||||

| QEP Resources, Inc., 5.625%, 3/01/2026 | 85,000 | 81,388 | ||||||

| Sanchez Energy Corp., 6.125%, 1/15/2023 | 45,000 | 32,499 | ||||||

| Seven Generations Energy, 6.75%, 5/01/2023 (n) | 105,000 | 108,938 | ||||||

| Seven Generations Energy, 5.375%, 9/30/2025 (n) | 55,000 | 53,488 | ||||||

| SM Energy Co., 6.75%, 9/15/2026 | 120,000 | 122,100 | ||||||

| SRC Energy, Inc., 6.25%, 12/01/2025 (n) | 90,000 | 90,900 | ||||||

| WPX Energy, Inc., 6%, 1/15/2022 | 66,000 | 68,805 | ||||||

|

|

|

|||||||

| $ | 1,659,669 | |||||||

| Entertainment - 1.0% | ||||||||

| Cedar Fair LP, 5.375%, 6/01/2024 | $ | 35,000 | $ | 35,438 | ||||

| Cedar Fair LP, 5.375%, 4/15/2027 (n) | 70,000 | 69,650 | ||||||

| Cinemark USA, Inc., 5.125%, 12/15/2022 | 50,000 | 50,812 | ||||||

| Cinemark USA, Inc., 4.875%, 6/01/2023 | 35,000 | 34,563 | ||||||

| Live Nation Entertainment, Inc., 5.625%, 3/15/2026 (n) | 70,000 | 69,825 | ||||||

| Six Flags Entertainment Corp., 4.875%, 7/31/2024 (n) | 165,000 | 161,238 | ||||||

|

|

|

|||||||

| $ | 421,526 | |||||||

| Financial Institutions - 1.1% | ||||||||

| Aircastle Ltd., 5.125%, 3/15/2021 | $ | 40,000 | $ | 41,050 | ||||

| Aircastle Ltd., 5.5%, 2/15/2022 | 40,000 | 41,800 | ||||||

| Navient Corp., 7.25%, 1/25/2022 | 100,000 | 105,750 | ||||||

| Navient Corp., 7.25%, 9/25/2023 | 75,000 | 78,375 | ||||||

| Park Aerospace Holdings Ltd., 5.5%, 2/15/2024 (n) | 175,000 | 169,969 | ||||||

|

|

|

|||||||

| $ | 436,944 | |||||||

| Food & Beverages - 2.0% | ||||||||

| Aramark Services, Inc., 4.75%, 6/01/2026 | $ | 80,000 | $ | 77,600 | ||||

| Aramark Services, Inc., 5%, 2/01/2028 (n) | 60,000 | 58,425 | ||||||

| Cott Holdings, Inc., 5.5%, 4/01/2025 (n) | 110,000 | 109,175 | ||||||

| JBS USA LLC/JBS USA Finance, Inc., 6.75%, 2/15/2028 (n) | 30,000 | 28,800 | ||||||

| JBS USA Lux S.A./JBS USA Finance, Inc., 5.875%, 7/15/2024 (n) | 95,000 | 92,150 | ||||||

| Lamb Weston Holdings, Inc., 4.625%, 11/01/2024 (n) | 65,000 | 64,431 | ||||||

| Lamb Weston Holdings, Inc., 4.875%, 11/01/2026 (n) | 40,000 | 39,650 | ||||||

| Pilgrim’s Pride Corp., 5.875%, 9/30/2027 (n) | 120,000 | 114,600 | ||||||

| Pinnacle Foods Finance LLC/Pinnacle Foods Finance Corp., 5.875%, 1/15/2024 | 105,000 | 108,150 | ||||||

| U.S. Foods Holding Corp., 5.875%, 6/15/2024 (n) | 110,000 | 111,925 | ||||||

|

|

|

|||||||

| $ | 804,906 | |||||||

| Forest & Paper Products - 0.0% | ||||||||

| Appvion, Inc., 9%, 6/01/2020 (d)(n) | $ | 41,000 | $ | 4 | ||||

10

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Gaming & Lodging - 2.3% | ||||||||

| CCM Merger, Inc., 6%, 3/15/2022 (n) | $ | 85,000 | $ | 86,488 | ||||

| GLP Capital LP/GLP Financing II, Inc., 5.375%, 11/01/2023 | 95,000 | 98,206 | ||||||

| GLP Capital LP/GLP Financing II, Inc., 5.375%, 4/15/2026 | 10,000 | 10,075 | ||||||

| Hilton Domestic Operating Co., Inc., 5.125%, 5/01/2026 (n) | 90,000 | 90,000 | ||||||

| Hilton Worldwide Finance LLC, 4.625%, 4/01/2025 | 105,000 | 101,829 | ||||||

| MGM Resorts International, 6.625%, 12/15/2021 | 90,000 | 96,300 | ||||||

| Ryman Hospitality Properties, Inc., REIT, 5%, 4/15/2021 | 105,000 | 105,656 | ||||||

| Ryman Hospitality Properties, Inc., REIT, 5%, 4/15/2023 | 50,000 | 50,125 | ||||||

| Wyndham Hotels Group, LLC, 5.375%, 4/15/2026 (n) | 80,000 | 80,600 | ||||||

| Wynn Macau Ltd., 5.5%, 10/01/2027 (n) | 200,000 | 194,002 | ||||||

|

|

|

|||||||

| $ | 913,281 | |||||||

| Industrial - 0.6% | ||||||||

| Cleaver Brooks, Inc., 7.875%, 3/01/2023 (n) | $ | 120,000 | $ | 123,900 | ||||

| KAR Auction Services, Inc., 5.125%, 6/01/2025 (n) | 120,000 | 116,400 | ||||||

|

|

|

|||||||

| $ | 240,300 | |||||||

| Insurance - 0.2% | ||||||||

| AssuredPartners Inc., 7%, 8/15/2025 (n) | $ | 75,000 | $ | 74,063 | ||||

| Insurance - Health - 0.2% | ||||||||

| Centene Corp., 5.625%, 2/15/2021 | $ | 35,000 | $ | 35,919 | ||||

| Centene Corp., 6.125%, 2/15/2024 | 60,000 | 62,850 | ||||||

|

|

|

|||||||

| $ | 98,769 | |||||||

| Insurance - Property & Casualty - 0.3% | ||||||||

| Hub International Holdings, Inc., 7.875%, 10/01/2021 (n) | $ | 60,000 | $ | 62,532 | ||||

| Hub International Ltd., 7%, 5/01/2026 (n) | 40,000 | 40,050 | ||||||

|

|

|

|||||||

| $ | 102,582 | |||||||

| Major Banks - 0.2% | ||||||||

| Bank of America Corp., 5.875% to 3/15/2028, FLR to 12/31/2059 | $ | 90,000 | $ | 89,820 | ||||

| Medical & Health Technology & Services - 3.2% | ||||||||

| DaVita, Inc., 5.125%, 7/15/2024 | $ | 30,000 | $ | 29,063 | ||||

| DaVita, Inc., 5%, 5/01/2025 | 80,000 | 75,816 | ||||||

| HCA, Inc., 7.5%, 2/15/2022 | 135,000 | 148,500 | ||||||

| HCA, Inc., 5%, 3/15/2024 | 90,000 | 91,012 | ||||||

| HCA, Inc., 5.375%, 2/01/2025 | 60,000 | 59,700 | ||||||

| HealthSouth Corp., 5.125%, 3/15/2023 | 105,000 | 106,575 | ||||||

| Heartland Dental, LLC, 8.5%, 5/01/2026 (n) | 75,000 | 75,169 | ||||||

| NVA Holdings, Inc., 6.875%, 4/01/2026 (n) | 35,000 | 35,263 | ||||||

| Polaris, 8.5%, 12/01/2022 (n) | 85,000 | 86,275 | ||||||

| Quorum Health Corp., 11.625%, 4/15/2023 | 65,000 | 69,062 | ||||||

11

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Medical & Health Technology & Services - continued | ||||||||

| Tenet Healthcare Corp., 8.125%, 4/01/2022 | $ | 140,000 | $ | 145,775 | ||||

| Tenet Healthcare Corp., 6.75%, 6/15/2023 | 60,000 | 58,988 | ||||||

| THC Escrow Corp. III, 5.125%, 5/01/2025 (n) | 85,000 | 82,662 | ||||||

| Universal Health Services, Inc., 7.625%, 8/15/2020 | 155,000 | 156,162 | ||||||

| West Street Merger Sub, Inc., 6.375%, 9/01/2025 (n) | 70,000 | 68,775 | ||||||

|

|

|

|||||||

| $ | 1,288,797 | |||||||

| Medical Equipment - 0.4% | ||||||||

| Teleflex, Inc., 5.25%, 6/15/2024 | $ | 80,000 | $ | 81,200 | ||||

| Teleflex, Inc., 4.875%, 6/01/2026 | 30,000 | 29,580 | ||||||

| Teleflex, Inc. , 4.625%, 11/15/2027 | 45,000 | 42,975 | ||||||

|

|

|

|||||||

| $ | 153,755 | |||||||

| Metals & Mining - 3.7% | ||||||||

| First Quantum Minerals Ltd., 7%, 2/15/2021 (n) | $ | 50,000 | $ | 50,112 | ||||

| First Quantum Minerals Ltd., 7.25%, 4/01/2023 (n) | 200,000 | 199,460 | ||||||

| Freeport-McMoRan Copper & Gold, Inc., 3.875%, 3/15/2023 | 45,000 | 43,144 | ||||||

| Freeport-McMoRan Copper & Gold, Inc., 5.4%, 11/14/2034 | 40,000 | 36,900 | ||||||

| Freeport-McMoRan, Inc., 6.875%, 2/15/2023 | 198,000 | 212,355 | ||||||

| Kaiser Aluminum Corp., 5.875%, 5/15/2024 | 155,000 | 159,650 | ||||||

| Kinross Gold Corp., 5.95%, 3/15/2024 | 26,000 | 27,105 | ||||||

| Kinross Gold Corp., 4.5%, 7/15/2027 (n) | 13,000 | 12,220 | ||||||

| Lundin Mining Corp., 7.875%, 11/01/2022 (n) | 85,000 | 89,223 | ||||||

| Northwest Acquisitions ULC/Dominion Finco, Inc., 7.125%, 11/01/2022 (n) | 115,000 | 117,104 | ||||||

| Novelis Corp., 5.875%, 9/30/2026 (n) | 140,000 | 138,950 | ||||||

| Petra Diamonds U.S. Treasury PLC, 7.25%, 5/01/2022 (n) | 200,000 | 199,900 | ||||||

| Steel Dynamics, Inc., 5.125%, 10/01/2021 | 45,000 | 45,801 | ||||||

| Steel Dynamics, Inc., 5.5%, 10/01/2024 | 80,000 | 82,200 | ||||||

| TMS International Corp., 7.25%, 8/15/2025 (n) | 75,000 | 77,625 | ||||||

|

|

|

|||||||

| $ | 1,491,749 | |||||||

| Midstream - 2.4% | ||||||||

| Blue Racer Midstream LLC/Blue Racer Finance Corp., 6.125%, 11/15/2022 (n) | $ | 140,000 | $ | 143,500 | ||||

| DCP Midstream LLC, 3.875%, 3/15/2023 | 85,000 | 82,025 | ||||||

| DCP Midstream LP, 4.95%, 4/01/2022 | 43,000 | 43,645 | ||||||

| DCP Midstream LP, 5.6%, 4/01/2044 | 45,000 | 44,100 | ||||||

| Energy Transfer Equity LP, 5.875%, 1/15/2024 | 115,000 | 117,444 | ||||||

| Energy Transfer Equity LP, 5.5%, 6/01/2027 | 30,000 | 30,000 | ||||||

| Tallgrass Energy GP, LP, 5.5%, 1/15/2028 (n) | 195,000 | 194,512 | ||||||

| Targa Resources Partners LP/Targa Resources Finance Corp, 5.375%, 2/01/2027 | 200,000 | 191,500 | ||||||

| Targa Resources Partners LP/Targa Resources Finance Corp., 5.25%, 5/01/2023 | 75,000 | 74,813 | ||||||

12

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Midstream - continued | ||||||||

| Targa Resources Partners LP/Targa Resources Finance Corp., 5.125%, 2/01/2025 (n) | $ | 40,000 | $ | 38,800 | ||||

|

|

|

|||||||

| $ | 960,339 | |||||||

| Network & Telecom - 0.4% | ||||||||

| Zayo Group LLC/Zayo Capital, Inc., 6.375%, 5/15/2025 | $ | 60,000 | $ | 62,112 | ||||

| Zayo Group LLC/Zayo Capital, Inc., 5.75%, 1/15/2027 (n) | 110,000 | 109,217 | ||||||

|

|

|

|||||||

| $ | 171,329 | |||||||

| Oil Services - 1.2% | ||||||||

| Bristow Group, Inc., 6.25%, 10/15/2022 | $ | 165,000 | $ | 136,125 | ||||

| Diamond Offshore Drill Co., 7.875%, 8/15/2025 | 45,000 | 46,181 | ||||||

| Diamond Offshore Drill Co., 5.7%, 10/15/2039 | 140,000 | 109,200 | ||||||

| Ensco PLC, 7.75%, 2/01/2026 | 90,000 | 84,825 | ||||||

| Trinidad Drilling Ltd., 6.625%, 2/15/2025 (n) | 120,000 | 115,050 | ||||||

|

|

|

|||||||

| $ | 491,381 | |||||||

| Oils - 0.3% | ||||||||

| Parkland Fuel Corp., 6%, 4/01/2026 (n) | $ | 115,000 | $ | 115,000 | ||||

| Pharmaceuticals - 0.7% | ||||||||

| Mallinckrodt International Finance S.A., 5.75%, 8/01/2022 (n) | $ | 85,000 | $ | 70,762 | ||||

| Mallinckrodt International Finance S.A., 5.625%, 10/15/2023 (n) | 30,000 | 23,475 | ||||||

| Valeant Pharmaceuticals International, Inc., 5.5%, 3/01/2023 (n) | 90,000 | 81,225 | ||||||

| Valeant Pharmaceuticals International, Inc., 6.125%, 4/15/2025 (n) | 105,000 | 94,707 | ||||||

|

|

|

|||||||

| $ | 270,169 | |||||||

| Precious Metals & Minerals - 0.2% | ||||||||

| Teck Resources Ltd., 6%, 8/15/2040 | $ | 15,000 | $ | 15,637 | ||||

| Teck Resources Ltd., 6.25%, 7/15/2041 | 80,000 | 84,800 | ||||||

|

|

|

|||||||

| $ | 100,437 | |||||||

| Printing & Publishing - 0.2% | ||||||||

| Nielsen Finance LLC, 5%, 4/15/2022 (n) | $ | 71,000 | $ | 71,540 | ||||

| Real Estate - Healthcare - 0.5% | ||||||||

| MPT Operating Partnership LP/MPT Financial Co., REIT, 5.25%, 8/01/2026 | $ | 100,000 | $ | 97,000 | ||||

| MPT Operating Partnership LP/MPT Financial Co., REIT, 5%, 10/15/2027 | 120,000 | 113,700 | ||||||

|

|

|

|||||||

| $ | 210,700 | |||||||

13

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Real Estate - Other - 0.5% | ||||||||

| CyrusOne LP/CyrusOne Finance Corp., REIT, 5%, 3/15/2024 | $ | 120,000 | $ | 120,300 | ||||

| CyrusOne LP/CyrusOne Finance Corp., REIT, 5.375%, 3/15/2027 | 60,000 | 60,000 | ||||||

| Starwood Property Trust, Inc., 5%, 12/15/2021 | 10,000 | 10,120 | ||||||

| Starwood Property Trust, Inc., 4.75%, 3/15/2025 (n) | 10,000 | 9,625 | ||||||

|

|

|

|||||||

| $ | 200,045 | |||||||

| Restaurants - 0.7% | ||||||||

| Golden Nugget, Inc., 6.75%, 10/15/2024 (n) | $ | 85,000 | $ | 86,275 | ||||

| IRB Holding Corp. , 6.75%, 2/15/2026 (n) | 75,000 | 72,375 | ||||||

| KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC, 5.25%, 6/01/2026 (n) | 115,000 | 115,575 | ||||||

|

|

|

|||||||

| $ | 274,225 | |||||||

| Retailers - 0.3% | ||||||||

| Hanesbrands, Inc., 4.625%, 5/15/2024 (n) | $ | 25,000 | $ | 24,125 | ||||

| Hanesbrands, Inc., 4.875%, 5/15/2026 (n) | 105,000 | 100,800 | ||||||

|

|

|

|||||||

| $ | 124,925 | |||||||

| Specialty Chemicals - 0.7% | ||||||||

| A Schulman, Inc., 6.875%, 6/01/2023 | $ | 95,000 | $ | 99,750 | ||||

| Univar USA, Inc., 6.75%, 7/15/2023 (n) | 180,000 | 185,400 | ||||||

|

|

|

|||||||

| $ | 285,150 | |||||||

| Specialty Stores - 0.2% | ||||||||

| Group 1 Automotive, Inc., 5%, 6/01/2022 | $ | 85,000 | $ | 85,238 | ||||

| Supermarkets - 0.2% | ||||||||

| Albertsons Cos. LLC/Safeway Co., 6.625%, 6/15/2024 | $ | 90,000 | $ | 83,813 | ||||

| Telecommunications - Wireless - 3.1% | ||||||||

| Altice Luxembourg S.A., 7.625%, 2/15/2025 (n) | $ | 200,000 | $ | 180,250 | ||||

| Digicel Group Ltd., 7.125%, 4/01/2022 (n) | 200,000 | 162,644 | ||||||

| SBA Communications Corp., REIT, 4%, 10/01/2022 (n) | 120,000 | 114,300 | ||||||

| SBA Communications Corp., REIT, 4.875%, 9/01/2024 | 30,000 | 28,838 | ||||||

| Sprint Corp., 7.875%, 9/15/2023 | 140,000 | 150,150 | ||||||

| Sprint Corp., 7.125%, 6/15/2024 | 125,000 | 129,531 | ||||||

| Sprint Corp., 7.625%, 3/01/2026 | 25,000 | 26,344 | ||||||

| Sprint Nextel Corp., 6%, 11/15/2022 | 185,000 | 188,931 | ||||||

| T-Mobile USA, Inc., 6.5%, 1/15/2024 | 75,000 | 78,562 | ||||||

| T-Mobile USA, Inc., 5.125%, 4/15/2025 | 60,000 | 60,450 | ||||||

| T-Mobile USA, Inc., 6.5%, 1/15/2026 | 70,000 | 74,397 | ||||||

| T-Mobile USA, Inc., 5.375%, 4/15/2027 | 50,000 | 50,563 | ||||||

|

|

|

|||||||

| $ | 1,244,960 | |||||||

14

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Telephone Services - 0.4% | ||||||||

| Level 3 Financing, Inc., 5.375%, 1/15/2024 | $ | 50,000 | $ | 49,500 | ||||

| Level 3 Financing, Inc., 5.375%, 5/01/2025 | 100,000 | 98,470 | ||||||

|

|

|

|||||||

| $ | 147,970 | |||||||

| Transportation - Services - 0.2% | ||||||||

| Navios Maritime Holding, Inc., 7.375%, 1/15/2022 (n) | $ | 60,000 | $ | 45,375 | ||||

| Navios South American Logistics, Inc./Navios Logistics Finance (U.S.), Inc., 7.25%, 5/01/2022 | 50,000 | 48,000 | ||||||

|

|

|

|||||||

| $ | 93,375 | |||||||

| Utilities - Electric Power - 1.5% | ||||||||

| Calpine Corp., 5.5%, 2/01/2024 | $ | 120,000 | $ | 110,100 | ||||

| Calpine Corp., 5.75%, 1/15/2025 | 90,000 | 82,584 | ||||||

| Calpine Corp., 5.25%, 6/01/2026 (n) | 55,000 | 52,628 | ||||||

| Covanta Holding Corp., 6.375%, 10/01/2022 | 35,000 | 35,744 | ||||||

| Covanta Holding Corp., 5.875%, 3/01/2024 | 65,000 | 64,025 | ||||||

| Covanta Holding Corp., 5.875%, 7/01/2025 | 50,000 | 48,625 | ||||||

| NextEra Energy Operating Co., 4.25%, 9/15/2024 (n) | 105,000 | 101,325 | ||||||

| Pattern Energy Group, Inc., 5.875%, 2/01/2024 (n) | 115,000 | 117,300 | ||||||

|

|

|

|||||||

| $ | 612,331 | |||||||

| Total Bonds (Identified Cost, $22,830,559) | $ | 22,155,448 | ||||||

| Common Stocks - 38.6% | ||||||||

| Brokerage & Asset Managers - 3.3% | ||||||||

| BlackRock, Inc. | 1,058 | $ | 551,747 | |||||

| NASDAQ, Inc. | 8,870 | 783,399 | ||||||

|

|

|

|||||||

| $ | 1,335,146 | |||||||

| Business Services - 2.5% | ||||||||

| Accenture PLC, “A” | 4,235 | $ | 640,332 | |||||

| Equifax, Inc. | 3,342 | 374,471 | ||||||

|

|

|

|||||||

| $ | 1,014,803 | |||||||

| Cable TV - 1.5% | ||||||||

| Comcast Corp., “A” | 19,221 | $ | 603,347 | |||||

| Chemicals - 1.6% | ||||||||

| PPG Industries, Inc. | 5,980 | $ | 633,162 | |||||

| Construction - 1.7% | ||||||||

| Sherwin-Williams Co. | 1,895 | $ | 696,716 | |||||

15

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Electrical Equipment - 1.2% | ||||||||

| Johnson Controls International PLC | 14,173 | $ | 480,040 | |||||

| Electronics - 1.6% | ||||||||

| Texas Instruments, Inc. | 6,597 | $ | 669,134 | |||||

| Food & Beverages - 1.3% | ||||||||

| Nestle S.A., ADR | 6,895 | $ | 533,397 | |||||

| Insurance - 3.3% | ||||||||

| Aon PLC | 4,808 | $ | 684,996 | |||||

| Travelers Cos., Inc. | 5,017 | 660,237 | ||||||

|

|

|

|||||||

| $ | 1,345,233 | |||||||

| Major Banks - 3.3% | ||||||||

| JPMorgan Chase & Co. | 8,010 | $ | 871,328 | |||||

| Wells Fargo & Co. | 9,146 | 475,226 | ||||||

|

|

|

|||||||

| $ | 1,346,554 | |||||||

| Medical Equipment - 4.5% | ||||||||

| Danaher Corp. | 5,447 | $ | 546,443 | |||||

| Medtronic PLC | 7,068 | 566,359 | ||||||

| Thermo Fisher Scientific, Inc. | 3,274 | 688,686 | ||||||

|

|

|

|||||||

| $ | 1,801,488 | |||||||

| Oil Services - 1.2% | ||||||||

| LTRI Holdings LP (a)(u) | 60 | $ | 53,365 | |||||

| Schlumberger Ltd. | 6,286 | 430,968 | ||||||

|

|

|

|||||||

| $ | 484,333 | |||||||

| Other Banks & Diversified Financials - 4.2% | ||||||||

| Citigroup, Inc. | 14,894 | $ | 1,016,813 | |||||

| U.S. Bancorp | 13,859 | 699,187 | ||||||

|

|

|

|||||||

| $ | 1,716,000 | |||||||

| Pharmaceuticals - 1.6% | ||||||||

| Johnson & Johnson | 5,084 | $ | 643,075 | |||||

| Printing & Publishing - 1.9% | ||||||||

| Moody’s Corp. | 4,692 | $ | 761,042 | |||||

| Tobacco - 1.2% | ||||||||

| Philip Morris International, Inc. | 5,781 | $ | 474,042 | |||||

16

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Utilities - Electric Power - 2.7% | ||||||||

| Duke Energy Corp. | 8,187 | $ | 656,270 | |||||

| Southern Co. | 9,144 | 421,721 | ||||||

|

|

|

|||||||

| $ | 1,077,991 | |||||||

| Total Common Stocks (Identified Cost, $10,543,539) | $ | 15,615,503 | ||||||

| Floating Rate Loans (g)(r) - 0.3% | ||||||||

| Consumer Products - 0.1% | ||||||||

| Spectrum Brands, Inc., Term Loan B, 3.96%, 6/23/2022 | $ | 30,281 | $ | 30,243 | ||||

| Medical & Health Technology & Services - 0.2% | ||||||||

| DaVita HealthCare Partners, Inc., Term Loan B, 4.65%, 6/24/2021 | $ | 74,836 | $ | 75,397 | ||||

| Total Floating Rate Loans (Identified Cost, $104,966) | $ | 105,640 | ||||||

| Investment Companies (h) - 5.8% | ||||||||

| Money Market Funds - 5.8% | ||||||||

| MFS Institutional Money Market Portfolio, 1.78% (v) (Identified Cost, $2,359,302) |

2,359,627 | $ | 2,359,392 | |||||

| Other Assets, Less Liabilities - 0.5% | 194,292 | |||||||

| Net Assets - 100.0% | $ | 40,430,275 | ||||||

| (a) | Non-income producing security. |

| (d) | In default. |

| (g) | The rate shown represents a weighted average coupon rate on settled positions at period end, unless otherwise indicated. |

| (h) | An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $2,359,392 and $37,876,591, respectively. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $12,328,430, representing 30.5% of net assets. |

| (r) | Remaining maturities of floating rate loans may be less than stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. Floating rate loans generally have rates of interest which are determined periodically by reference to a base lending rate plus a premium. |

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. |

17

Table of Contents

Portfolio of Investments (unaudited) – continued

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition Date |

Cost | Value | |||||||

| Afren PLC, 11.5%, 2/01/2016 | 1/27/11 | $191,339 | $488 | |||||||

| Morgan Stanley Capital I, Inc., 1.493%, 4/28/2039 | 7/20/04 | 61 | 61 | |||||||

| Total Restricted Securities | $549 | |||||||||

| % of Net assets | 0.0% | |||||||||

The following abbreviations are used in this report and are defined:

| ADR | American Depositary Receipt |

| FLR | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). The period-end rate reported may not be the current rate. |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

See Notes to Financial Statements

18

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 4/30/18 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

| Investments in unaffiliated issuers, at value (identified cost, $33,479,064) |

$37,876,591 | |||

| Investments in affiliated issuers, at value (identified cost, $2,359,302) |

2,359,392 | |||

| Cash |

80,381 | |||

| Receivables for |

||||

| Investments sold |

201,024 | |||

| Interest and dividends |

341,120 | |||

| Other assets |

16,269 | |||

| Total assets |

$40,874,777 | |||

| Liabilities | ||||

| Payables for |

||||

| Investments purchased |

$365,752 | |||

| Payable to affiliates |

||||

| Investment adviser |

3,813 | |||

| Transfer agent and dividend disbursing costs |

358 | |||

| Payable for independent Trustees’ compensation |

9,716 | |||

| Accrued expenses and other liabilities |

64,863 | |||

| Total liabilities |

$444,502 | |||

| Net assets |

$40,430,275 | |||

| Net assets consist of | ||||

| Paid-in capital |

$37,226,860 | |||

| Unrealized appreciation (depreciation) |

4,397,617 | |||

| Accumulated net realized gain (loss) |

443,952 | |||

| Accumulated distributions in excess of net investment income |

(1,638,154 | ) | ||

| Net assets |

$40,430,275 | |||

| Shares of beneficial interest outstanding |

7,131,782 | |||

| Net asset value per share (net assets of $40,430,275 / 7,131,782 shares of beneficial interest outstanding) |

$5.67 |

See Notes to Financial Statements

19

Table of Contents

Financial Statements

Six months ended 4/30/18 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | ||||

| Income |

||||

| Interest |

$659,266 | |||

| Dividends |

172,813 | |||

| Dividends from affiliated issuers |

18,686 | |||

| Foreign taxes withheld |

(2,615 | ) | ||

| Total investment income |

$848,150 | |||

| Expenses |

||||

| Management fee |

$171,710 | |||

| Transfer agent and dividend disbursing costs |

7,739 | |||

| Administrative services fee |

8,679 | |||

| Independent Trustees’ compensation |

5,622 | |||

| Stock exchange fee |

11,797 | |||

| Custodian fee |

2,947 | |||

| Shareholder communications |

25,642 | |||

| Audit and tax fees |

36,916 | |||

| Legal fees |

1,090 | |||

| Miscellaneous |

14,328 | |||

| Total expenses |

$286,470 | |||

| Net investment income (loss) |

$561,680 | |||

| Realized and unrealized gain (loss) | ||||

| Realized gain (loss) (identified cost basis) |

||||

| Unaffiliated issuers |

$604,680 | |||

| Affiliated issuers |

(144 | ) | ||

| Net realized gain (loss) |

$604,536 | |||

| Change in unrealized appreciation or depreciation |

||||

| Unaffiliated issuers |

$(1,594,659 | ) | ||

| Affiliated issuers |

(100 | ) | ||

| Net unrealized gain (loss) |

$(1,594,759 | ) | ||

| Net realized and unrealized gain (loss) |

$(990,223 | ) | ||

| Change in net assets from operations |

$(428,543 | ) | ||

See Notes to Financial Statements

20

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Change in net assets | Six months ended 4/30/18 (unaudited) |

Year ended |

||||||

| From operations | ||||||||

| Net investment income (loss) |

$561,680 | $1,427,526 | ||||||

| Net realized gain (loss) |

604,536 | 1,095,303 | ||||||

| Net unrealized gain (loss) |

(1,594,759 | ) | 2,578,328 | |||||

| Change in net assets from operations |

$(428,543 | ) | $5,101,157 | |||||

| Distributions declared to shareholders | ||||||||

| From net investment income |

$(1,083,860 | ) | $(1,520,530 | ) | ||||

| From tax return of capital |

— | (2,735,959 | ) | |||||

| From other sources |

(1,038,752 | ) | — | |||||

| Total distributions declared to shareholders |

$(2,122,612 | ) | $(4,256,489 | ) | ||||

| Change in net assets from fund share transactions |

$139,441 | $147,832 | ||||||

| Total change in net assets |

$(2,411,714 | ) | $992,500 | |||||

| Net assets | ||||||||

| At beginning of period |

42,841,989 | 41,849,489 | ||||||

| At end of period (including accumulated distributions in excess of net investment income of $1,638,154 and $77,222, respectively) |

$40,430,275 | $42,841,989 | ||||||

See Notes to Financial Statements

21

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Six months 4/30/18 |

Year ended | |||||||||||||||||||||||

| 10/31/17 | 10/31/16 | 10/31/15 | 10/31/14 | 10/31/13 | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$6.03 | $5.91 | $6.09 | $6.78 | $7.05 | $6.84 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (loss) (d) |

$0.08 | $0.20 | (c) | $0.23 | $0.25 | $0.28 | $0.33 | |||||||||||||||||

| Net realized and unrealized |

(0.14 | ) | 0.52 | 0.18 | (0.29 | ) | 0.15 | 0.58 | ||||||||||||||||

| Total from investment operations |

$(0.06 | ) | $0.72 | $0.41 | $(0.04 | ) | $0.43 | $0.91 | ||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.15 | ) | $(0.21 | ) | $(0.24 | ) | $(0.32 | ) | $(0.42 | ) | $(0.39 | ) | ||||||||||||

| From tax return of capital |

— | (0.39 | ) | (0.35 | ) | (0.33 | ) | (0.28 | ) | (0.31 | ) | |||||||||||||

| From other sources |

(0.15 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.30 | ) | $(0.60 | ) | $(0.59 | ) | $(0.65 | ) | $(0.70 | ) | $(0.70 | ) | ||||||||||||

| Net increase from repurchase of |

$— | $0.00 | (w) | $— | $— | $— | $— | |||||||||||||||||

| Net asset value, end of period (x) |

$5.67 | $6.03 | $5.91 | $6.09 | $6.78 | $7.05 | ||||||||||||||||||

| Market value, end of period |

$6.02 | $6.66 | $5.50 | $5.53 | $7.59 | $7.29 | ||||||||||||||||||

| Total return at market value (%) |

(5.00 | )(n) | 33.86 | 10.75 | (19.11 | ) | 14.73 | 7.94 | ||||||||||||||||

| Total return at net asset |

(1.17 | )(n) | 12.79 | (c) | 8.07 | (0.28 | ) | 5.97 | 13.85 | |||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense reductions (f) |

1.37 | (a) | 1.23 | (c) | 1.42 | 1.41 | 1.35 | 1.39 | ||||||||||||||||

| Expenses after expense reductions (f) |

N/A | N/A | N/A | N/A | 1.35 | 1.39 | ||||||||||||||||||

| Net investment income (loss) |

2.69 | (a) | 3.35 | (c) | 3.88 | 3.80 | 4.05 | 4.73 | ||||||||||||||||

| Portfolio turnover |

17 | (n) | 35 | 26 | 29 | 39 | 40 | |||||||||||||||||

| Net assets at end of period |

$40,430 | $42,842 | $41,849 | $43,126 | $47,904 | $49,402 | ||||||||||||||||||

See Notes to Financial Statements

22

Table of Contents

Financial Highlights – continued

| (a) | Annualized. |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (j) | Total return at net asset value is calculated using the net asset value of the fund, not the publicly traded price and therefore may be different than the total return at market value. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns at net asset value have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

23

Table of Contents

(unaudited)

(1) Business and Organization

MFS Special Value Trust (the fund) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a diversified closed-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in high-yield securities rated below investment grade. Investments in below investment grade quality securities can involve a substantially greater risk of default or can already be in default, and their values can decline significantly. Below investment grade quality securities tend to be more sensitive to adverse news about the issuer, or the market or economy in general, than higher quality debt instruments. The fund invests in foreign securities. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s market, economic, industry, political, regulatory, geopolitical, and other conditions.

In March 2017, the FASB issued Accounting Standards Update 2017-08, Receivables –Nonrefundable Fees and Other Costs (Subtopic 310-20) – Premium Amortization on Purchased Callable Debt Securities (“ASU 2017-08”). For entities that hold callable debt securities at a premium, ASU 2017-08 requires that the premium be amortized to the earliest call date. ASU 2017-08 will be effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Management has evaluated the potential impacts of ASU 2017-08 and believes that adoption of ASU 2017-08 will not have a material effect on the fund’s overall financial position or its overall results of operations.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have

24

Table of Contents

Notes to Financial Statements (unaudited) – continued

been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Debt instruments and floating rate loans, including restricted debt instruments, are generally valued at an evaluated or composite bid as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the

25

Table of Contents

Notes to Financial Statements (unaudited) – continued

value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of April 30, 2018 in valuing the fund’s assets or liabilities:

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Equity Securities: | ||||||||||||||||

| United States |

$15,028,741 | $— | $53,365 | $15,082,106 | ||||||||||||

| Switzerland |

533,397 | — | — | 533,397 | ||||||||||||

| Non-U.S. Sovereign Debt | — | 265,885 | — | 265,885 | ||||||||||||

| U.S. Corporate Bonds | — | 18,430,746 | — | 18,430,746 | ||||||||||||

| Commercial Mortgage-Backed Securities | — | 61 | — | 61 | ||||||||||||

| Foreign Bonds | — | 3,458,756 | — | 3,458,756 | ||||||||||||

| Floating Rate Loans | — | 105,640 | — | 105,640 | ||||||||||||

| Mutual Funds | 2,359,392 | — | — | 2,359,392 | ||||||||||||

| Total | $17,921,530 | $22,261,088 | $53,365 | $40,235,983 | ||||||||||||

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The fund’s policy is to recognize transfers between the levels as of the end of the period. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| Equity Securities | ||||

| Balance as of 10/31/17 | $53,365 | |||

| Change in unrealized appreciation or depreciation |

0 | |||

| Balance as of 4/30/18 | $53,365 | |||

The net change in unrealized appreciation or depreciation from investments held as level 3 at April 30, 2018 is $0. At April 30, 2018, the fund held one level 3 security.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for

26

Table of Contents

Notes to Financial Statements (unaudited) – continued

foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Loans and Other Direct Debt Instruments – The fund invests in loans and loan participations or other receivables. These investments may include standby financing commitments, including revolving credit facilities, which contractually obligate the fund to supply additional cash to the borrower on demand. The fund generally provides this financial support in order to preserve its existing investment or to obtain a more senior secured interest in the assets of the borrower. Loan participations involve a risk of insolvency of the lending bank or other financial intermediary.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. The fund earns certain fees in connection with its floating rate loan purchasing activities. These fees are in addition to interest payments earned and may include amendment fees, commitment fees, facility fees, consent fees, and prepayment fees. Commitment fees are recorded on an accrual basis as income in the accompanying financial statements. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date. Debt obligations may be placed on non-accrual status or set to accrue at a rate of interest less than the contractual coupon when the collection of all or a portion of interest has become doubtful. Interest income for those debt obligations may be further reduced by the write-off of the related interest receivables when deemed uncollectible.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

27

Table of Contents

Notes to Financial Statements (unaudited) – continued

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on the ex-dividend date. The fund seeks to pay monthly distributions based on an annual rate of 10.00% of the fund’s average monthly net asset value. As a result, distributions may exceed actual earnings which may result in a tax return of capital or, to the extent the fund has long-term gains and a capital loss carryforward, distributions of current year long-term gains may be recharacterized as ordinary income. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future.

Book/tax differences primarily relate to defaulted bonds, expiration of capital loss carryforwards, and amortization and accretion of debt securities.

For the six months ended April 30, 2018, the amount of distributions estimated to be a tax return of capital was approximately $1,038,752 which is reported as distributions from other sources in the Statements of Changes in Net Assets.

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| Year ended 10/31/17 |

||||

| Ordinary income (including any short-term capital gains) (a) |

$1,520,530 | |||

| Tax return of capital (b) | 2,735,959 | |||

| Total distributions | $4,256,489 | |||

| (a) | Included in the fund’s distributions from ordinary income for the year ended October 31, 2017 is $50,216 in excess of investment company taxable income which, in accordance with applicable U.S. tax law, is taxable to shareholders as ordinary income distributions. |

| (b) | Distributions in excess of tax basis earnings and profits are reported in the financial statements as a tax return of capital. |

28

Table of Contents

Notes to Financial Statements (unaudited) – continued

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 4/30/18 | ||||

| Cost of investments | $35,903,313 | |||

| Gross appreciation | 5,441,679 | |||

| Gross depreciation | (1,109,009 | ) | ||

| Net unrealized appreciation (depreciation) | $4,332,670 | |||

| As of 10/31/17 | ||||

| Capital loss carryforwards | (89,992 | ) | ||

| Other temporary differences | (35,124 | ) | ||

| Net unrealized appreciation (depreciation) | 5,879,686 | |||

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized for fund fiscal years beginning after October 31, 2011 may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses (“post-enactment losses”). Previously, net capital losses were carried forward for eight years and treated as short-term losses (“pre-enactment losses”). As a transition rule, the Act requires that all post-enactment net capital losses be used before pre-enactment net capital losses.

As of October 31, 2017, the fund had capital loss carryforwards available to offset future realized gains. Such pre-enactment losses expire as follows:

| 10/31/18 | $(89,992 | ) |

(3) Transactions with Affiliates

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.68% of the fund’s average daily net assets and 3.40% of gross income. Gross income is calculated based on tax elections that generally include the accretion of discount and exclude the amortization of premium, which may differ from investment income reported in the Statement of Operations. MFS has agreed to reduce its management fee to the lesser of the contractual management fee as set forth above or 0.90% of the fund’s average daily net assets. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until October 31, 2018. For the six months ended April 30, 2018, the fund’s average daily net assets and gross income fees did not meet the thresholds required to waive the management fee under this agreement. The management fee, from net assets and gross income, incurred for the six months ended April 30, 2018 was equivalent to an annual effective rate of 0.82% of the fund’s average daily net assets.

Transfer Agent – The fund engages Computershare Trust Company, N.A. (“Computershare”) as the sole transfer agent for the fund. MFS Service Center, Inc. (MFSC) monitors and supervises the activities of Computershare for an agreed upon fee approved by the Board of Trustees. For the six months ended April 30, 2018, these fees paid to MFSC amounted to $1,167.

29

Table of Contents

Notes to Financial Statements (unaudited) – continued

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended April 30, 2018 was equivalent to an annual effective rate of 0.0416% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS and MFSC.