Form N-CSRS Legg Mason ETF Investmen For: May 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: November 30

Date of reporting period: May 31, 2021

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

| Semi-Annual Report | May 31, 2021 |

CLEARBRIDGE

LARGE CAP GROWTH ESG ETF

LRGE

The Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Legg Mason Funds held in your account with your financial intermediary.

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks long-term capital appreciation through investing in large-capitalization companies with the potential for high future earnings growth.

Dear Shareholder,

We are pleased to provide the semi-annual report of ClearBridge Large Cap Growth ESG ETF for the six-month reporting period ended May 31, 2021. Please read on for Fund performance information during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

June 30, 2021

| II |

ClearBridge Large Cap Growth ESG ETF |

For the six months ended May 31, 2021, ClearBridge Large Cap Growth ESG ETF generated a 9.91% return on a net asset value (“NAV”)i basis and 9.86% based on its market priceii per share.

The performance table shows the Fund’s total return for the six months ended May 31, 2021 based on its NAV and market price as of May 31, 2021. The Fund’s broad-based market index, the Russell 1000 Growth Indexiii, returned 11.21% over the same time frame. The Lipper Large-Cap Growth Funds Category Averageiv returned 11.19% for the period. Please note that Lipper performance returns are based on each fund’s NAV.

| Performance Snapshot as of May 31, 2021 (unaudited) |

||||

| 6 months | ||||

| ClearBridge Large Cap Growth ESG ETF: | ||||

| $53.48 (NAV) |

9.91 | %*† | ||

| $53.51 (Market Price) |

9.86 | %*‡ | ||

| Russell 1000 Growth Index | 11.21 | % | ||

| Lipper Large-Cap Growth Funds Category Average | 11.19 | % | ||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns shown are typically based upon the official closing price of the Fund’s shares. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated March 31, 2021, the gross total annual fund operating expense ratio for the Fund was 0.60%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital, if any, at market price, which typically is based upon the official closing price of the Fund’s shares.

| ClearBridge Large Cap Growth ESG ETF | III |

Performance review (cont’d)

Looking for additional information?

The Fund’s daily NAV is available online at www.leggmason.com/etf. The Fund is traded under the symbol “LRGE” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

June 30, 2021

RISKS: Equity securities are subject to market and price fluctuations. Large capitalization companies may fall out of favor with investors based on market and economic conditions. The Fund’s environmental, social and governance (“ESG”) investment strategy may limit the types and number of investment opportunities available to the Fund and, as a result, the Fund may underperform funds that are not subject to such criteria. The Fund’s ESG investment strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole, or forgoing opportunities to invest in securities that might otherwise be advantageous to buy. The Fund may also underperform other funds screened for different ESG standards. In addition, the subadviser may be unsuccessful in creating a portfolio composed of companies that exhibit positive ESG characteristics.

The Fund’s growth-oriented investment style may increase the risks of investing in the Fund. Growth securities typically are very sensitive to market movements because their market prices tend to reflect future expectations. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on value stocks. Securities or other assets in the Fund’s portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| IV |

ClearBridge Large Cap Growth ESG ETF |

| i | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| ii | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The market price may differ from the Fund’s NAV. |

| iii | The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities). The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 90% of the U.S. market. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| iv | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the six-month period ended May 31, 2021, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 671 funds in the Fund’s Lipper category. |

| ClearBridge Large Cap Growth ESG ETF | V |

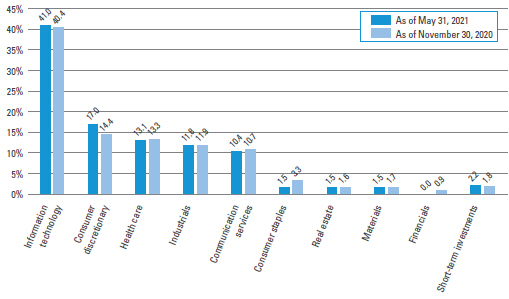

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of May 31, 2021 and November 30, 2020. The composition of the Fund’s investments is subject to change at any time. |

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

1 |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on December 1, 2020 and held for the six months ended May 31, 2021.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 | |||||||||||||||||||||||||||||||||||||||||

| 9.91% | $ | 1,000.00 | $ | 1,099.10 | 0.59 | % | $ | 3.09 | 5.00 | % | $1,000.00 | $ | 1,021.99 | 0.59 | % | $ | 2.97 | |||||||||||||||||||||||||||||||||

| 1 | For the six months ended May 31, 2021. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 365. |

| 2 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

Schedule of investments (unaudited)

May 31, 2021

ClearBridge Large Cap Growth ESG ETF

| Security | Shares | Value | ||||||||||

| Common Stocks — 97.7% | ||||||||||||

| Communication Services — 10.4% | ||||||||||||

| Entertainment — 3.7% |

||||||||||||

| Sea Ltd., ADR |

6,690 | $ 1,694,176 | * | |||||||||

| Walt Disney Co. |

21,248 | 3,795,955 | * | |||||||||

| Total Entertainment |

5,490,131 | |||||||||||

| Interactive Media & Services — 6.7% |

||||||||||||

| Facebook Inc., Class A Shares |

30,471 | 10,016,732 | * | |||||||||

| Total Communication Services |

15,506,863 | |||||||||||

| Consumer Discretionary — 17.0% | ||||||||||||

| Auto Components — 1.5% |

||||||||||||

| Aptiv PLC |

15,196 | 2,285,782 | * | |||||||||

| Internet & Direct Marketing Retail — 8.4% |

||||||||||||

| Amazon.com Inc. |

3,906 | 12,589,312 | * | |||||||||

| Specialty Retail — 7.1% |

||||||||||||

| Advance Auto Parts Inc. |

12,193 | 2,313,378 | ||||||||||

| Home Depot Inc. |

11,185 | 3,567,008 | ||||||||||

| Tractor Supply Co. |

10,113 | 1,837,532 | ||||||||||

| Ulta Beauty Inc. |

8,328 | 2,876,158 | * | |||||||||

| Total Specialty Retail |

10,594,076 | |||||||||||

| Total Consumer Discretionary |

25,469,170 | |||||||||||

| Consumer Staples — 1.5% | ||||||||||||

| Beverages — 1.5% |

||||||||||||

| Monster Beverage Corp. |

24,524 | 2,311,877 | * | |||||||||

| Health Care — 13.1% | ||||||||||||

| Biotechnology — 2.8% |

||||||||||||

| Amgen Inc. |

12,616 | 3,001,851 | ||||||||||

| BioMarin Pharmaceutical Inc. |

14,322 | 1,107,091 | * | |||||||||

| Total Biotechnology |

4,108,942 | |||||||||||

| Health Care Equipment & Supplies — 2.0% |

||||||||||||

| Alcon Inc. |

26,804 | 1,867,702 | ||||||||||

| Dexcom Inc. |

3,220 | 1,189,436 | * | |||||||||

| Total Health Care Equipment & Supplies |

3,057,138 | |||||||||||

| Health Care Providers & Services — 5.6% |

||||||||||||

| CVS Health Corp. |

31,082 | 2,686,728 | ||||||||||

| UnitedHealth Group Inc. |

13,656 | 5,625,180 | ||||||||||

| Total Health Care Providers & Services |

8,311,908 | |||||||||||

| Life Sciences Tools & Services — 2.7% |

||||||||||||

| Thermo Fisher Scientific Inc. |

8,666 | 4,068,687 | ||||||||||

| Total Health Care |

19,546,675 | |||||||||||

See Notes to Financial Statements.

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

3 |

Schedule of investments (unaudited) (cont’d)

May 31, 2021

ClearBridge Large Cap Growth ESG ETF

| Security | Shares | Value | ||||||||||

| Industrials — 11.8% | ||||||||||||

| Air Freight & Logistics — 3.0% |

||||||||||||

| United Parcel Service Inc., Class B Shares |

20,960 | $ 4,498,016 | ||||||||||

| Industrial Conglomerates — 2.2% |

||||||||||||

| Honeywell International Inc. |

14,317 | 3,305,939 | ||||||||||

| Professional Services — 2.6% |

||||||||||||

| IHS Markit Ltd. |

37,533 | 3,952,600 | ||||||||||

| Road & Rail — 2.1% |

||||||||||||

| Uber Technologies Inc. |

61,063 | 3,103,832 | * | |||||||||

| Trading Companies & Distributors — 1.9% |

||||||||||||

| W.W. Grainger Inc. |

6,073 | 2,806,698 | ||||||||||

| Total Industrials |

17,667,085 | |||||||||||

| Information Technology — 40.9% | ||||||||||||

| IT Services — 8.0% |

||||||||||||

| Akamai Technologies Inc. |

18,320 | 2,092,327 | * | |||||||||

| Fidelity National Information Services Inc. |

21,310 | 3,174,764 | ||||||||||

| Visa Inc., Class A Shares |

29,660 | 6,741,718 | ||||||||||

| Total IT Services |

12,008,809 | |||||||||||

| Semiconductors & Semiconductor Equipment — 8.5% |

||||||||||||

| ASML Holding NV, Registered Shares |

3,070 | 2,073,693 | ||||||||||

| NVIDIA Corp. |

6,912 | 4,491,279 | ||||||||||

| NXP Semiconductors NV |

11,242 | 2,376,784 | ||||||||||

| QUALCOMM Inc. |

28,360 | 3,815,554 | ||||||||||

| Total Semiconductors & Semiconductor Equipment |

12,757,310 | |||||||||||

| Software — 19.8% |

||||||||||||

| Adobe Inc. |

8,368 | 4,222,325 | * | |||||||||

| Atlassian Corp. PLC, Class A Shares |

9,136 | 2,131,246 | * | |||||||||

| Microsoft Corp. |

30,511 | 7,617,986 | ||||||||||

| Nutanix Inc., Class A Shares |

28,308 | 891,985 | * | |||||||||

| Palo Alto Networks Inc. |

8,790 | 3,192,968 | * | |||||||||

| salesforce.com Inc. |

21,182 | 5,043,434 | * | |||||||||

| Splunk Inc. |

15,999 | 1,939,079 | * | |||||||||

| UiPath Inc., Class A Shares |

10,740 | 857,267 | * | |||||||||

| VMware Inc., Class A Shares |

12,004 | 1,895,312 | * | |||||||||

| Workday Inc., Class A Shares |

7,861 | 1,797,968 | * | |||||||||

| Total Software |

29,589,570 | |||||||||||

| Technology Hardware, Storage & Peripherals — 4.6% |

||||||||||||

| Apple Inc. |

55,906 | 6,966,447 | ||||||||||

| Total Information Technology |

61,322,136 | |||||||||||

See Notes to Financial Statements.

| 4 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

ClearBridge Large Cap Growth ESG ETF

| Security | Shares | Value | ||||||||||||

| Materials — 1.5% | ||||||||||||||

| Chemicals — 1.5% |

||||||||||||||

| Ecolab Inc. |

10,328 | $ | 2,221,346 | |||||||||||

| Real Estate — 1.5% | ||||||||||||||

| Equity Real Estate Investment Trusts (REITs) — 1.5% |

||||||||||||||

| Equinix Inc. |

3,104 | 2,286,779 | ||||||||||||

| Total Investments before Short-Term Investments (Cost — $106,298,007) |

|

146,331,931 | ||||||||||||

| Rate | ||||||||||||||

| Short-Term Investments — 2.2% | ||||||||||||||

| JPMorgan 100% U.S. Treasury Securities Money Market Fund, Institutional Class (Cost — $3,250,821) |

0.006 | % | 3,250,821 | 3,250,821 | ||||||||||

| Total Investments — 99.9% (Cost — $109,548,828) |

149,582,752 | |||||||||||||

| Other Assets in Excess of Liabilities — 0.1% |

156,485 | |||||||||||||

| Total Net Assets — 100.0% |

$ | 149,739,237 | ||||||||||||

| * | Non-income producing security. |

| Abbreviation(s) used in this schedule: |

| ADR — American Depositary Receipts |

See Notes to Financial Statements.

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

5 |

Statement of assets and liabilities (unaudited)

May 31, 2021

| Assets: | ||||

| Investments, at value (Cost — $109,548,828) |

$ | 149,582,752 | ||

| Receivable for securities sold |

122,553 | |||

| Dividends and interest receivable |

107,701 | |||

| Total Assets |

149,813,006 | |||

| Liabilities: | ||||

| Investment management fee payable |

73,769 | |||

| Total Liabilities |

73,769 | |||

| Total Net Assets | $ | 149,739,237 | ||

| Net Assets: | ||||

| Par value (Note 5) |

$ | 28 | ||

| Paid-in capital in excess of par value |

106,917,995 | |||

| Total distributable earnings (loss) |

42,821,214 | |||

| Total Net Assets | $ | 149,739,237 | ||

| Shares Outstanding | 2,800,000 | |||

| Net Asset Value | $53.48 | |||

See Notes to Financial Statements.

| 6 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended May 31, 2021

| Investment Income: | ||||

| Dividends |

$ | 539,566 | ||

| Interest |

98 | |||

| Less: Foreign taxes withheld |

(2,696) | |||

| Total Investment Income |

536,968 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

407,425 | |||

| Total Expenses |

407,425 | |||

| Net Investment Income | 129,543 | |||

| Realized and Unrealized Gain on Investments (Notes 1 and 3): | ||||

| Net Realized Gain From Investment Transactions |

4,028,328 | |||

| Change in Net Unrealized Appreciation (Depreciation) From Investments |

9,294,122 | |||

| Net Gain on Investments | 13,322,450 | |||

| Increase in Net Assets From Operations | $ | 13,451,993 | ||

See Notes to Financial Statements.

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

7 |

Statements of changes in net assets

| For the Six Months Ended May 31, 2021 (unaudited) and the Year Ended November 30, 2020 |

2021 | 2020 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 129,543 | $ | 510,727 | ||||

| Net realized gain |

4,028,328 | 24,816,779 | ||||||

| Change in net unrealized appreciation (depreciation) |

9,294,122 | 7,864,336 | ||||||

| Increase in Net Assets From Operations |

13,451,993 | 33,191,842 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Total distributable earnings |

(490,001) | (735,000) | ||||||

| Decrease in Net Assets From Distributions to Shareholders |

(490,001) | (735,000) | ||||||

| Fund Share Transactions (Note 5): | ||||||||

| Net proceeds from sale of shares (350,000 and 1,150,000 shares issued, respectively) |

17,390,898 | 41,397,857 | ||||||

| Cost of shares repurchased (100,000 and 3,750,000 shares repurchased, respectively) |

(5,158,502) | (141,506,206) | ||||||

| Increase (Decrease) in Net Assets From Fund Share Transactions |

12,232,396 | (100,108,349) | ||||||

| Increase (Decrease) in Net Assets |

25,194,388 | (67,651,507) | ||||||

| Net Assets: | ||||||||

| Beginning of period |

124,544,849 | 192,196,356 | ||||||

| End of period |

$ | 149,739,237 | $ | 124,544,849 | ||||

See Notes to Financial Statements.

| 8 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

| For a share of beneficial interest outstanding throughout each year ended

November 30, unless otherwise noted: |

||||||||||||||||||||

| 20211,2 | 20202 | 20192 | 20182 | 20172,3 | ||||||||||||||||

| Net asset value, beginning of period | $ | 48.84 | $ | 37.32 | $ | 32.09 | $ | 28.80 | $ | 25.18 | ||||||||||

| Income from operations: | ||||||||||||||||||||

| Net investment income |

0.05 | 0.13 | 0.18 | 0.16 | 0.08 | |||||||||||||||

| Net realized and unrealized gain |

4.77 | 11.53 | 5.66 | 3.24 | 3.54 | |||||||||||||||

| Total income from operations |

4.82 | 11.66 | 5.84 | 3.40 | 3.62 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.18) | (0.14) | (0.16) | (0.11) | — | |||||||||||||||

| Net realized gains |

— | — | (0.45) | — | — | |||||||||||||||

| Total distributions |

(0.18) | (0.14) | (0.61) | (0.11) | — | |||||||||||||||

| Net asset value, end of period | $ | 53.48 | $ | 48.84 | $ | 37.32 | $ | 32.09 | $ | 28.80 | ||||||||||

| Total return, based on NAV4 |

9.91 | % | 31.35 | % | 18.80 | % | 11.84 | % | 14.38 | % | ||||||||||

| Net assets, end of period (000s) | $ | 149,739 | $ | 124,545 | $ | 192,196 | $ | 6,419 | $ | 2,880 | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Gross expenses |

0.59 | %5 | 0.59 | % | 0.59 | % | 0.59 | % | 0.59 | %5 | ||||||||||

| Net expenses |

0.59 | 5 | 0.59 | 0.59 | 0.59 | 0.59 | 5 | |||||||||||||

| Net investment income |

0.19 | 5 | 0.34 | 0.53 | 0.52 | 0.54 | 5 | |||||||||||||

| Portfolio turnover rate6 | 9 | % | 21 | % | 21 | % | 20 | % | 7 | % | ||||||||||

| 1 | For the six months ended May 31, 2021 (unaudited). |

| 2 | Per share amounts have been calculated using the average shares method. |

| 3 | For the period May 22, 2017 (inception date) to November 30, 2017. |

| 4 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 5 | Annualized. |

| 6 | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

9 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

ClearBridge Large Cap Growth ESG ETF (the “Fund”) is a separate diversified investment series of Legg Mason ETF Investment Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The Fund is an actively managed exchange-traded fund (“ETF”). ETFs are funds that trade like other publicly-traded securities. Unlike shares of a mutual fund, which can be bought from and redeemed by the issuing fund by all shareholders at a price based on net asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain large institutional investors who have entered into agreements with the Fund’s distributor (“Authorized Participants”). Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.

Shares of the Fund are listed and trade at market prices on NASDAQ. The market price for the Fund’s shares may be different from the Fund’s NAV. The Fund issues and redeems shares at NAV only in blocks of a specified number of shares or multiples thereof (“Creation Units”). Only Authorized Participants may purchase or redeem Creation Units directly with the Fund at NAV. Creation Units are created and redeemed principally in-kind (although under some circumstances its shares are created and redeemed partially for cash). Except when aggregated in Creation Units, shares of the Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares directly from the Fund at NAV.

The Fund seeks long-term capital appreciation through investing in large-capitalization companies with the potential for high future earnings growth.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services typically use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will use the currency exchange rates, generally determined as of 4:00 p.m. (London Time). If independent third party pricing services are

| 10 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Global Fund Valuation Committee (formerly known as Legg Mason North Atlantic Fund Valuation Committee prior to March 1, 2021) (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Trustees. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

11 |

Notes to financial statements (unaudited) (cont’d)

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — quoted prices in active markets for identical investments |

| • | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Common Stocks† | $ | 146,331,931 | — | — | $ | 146,331,931 | ||||||||||

| Short-Term Investments† | 3,250,821 | — | — | 3,250,821 | ||||||||||||

| Total Investments | $ | 149,582,752 | — | — | $ | 149,582,752 | ||||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(c) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(d) REIT distributions. The character of distributions received from Real Estate Investment Trusts (‘‘REITs’’) held by the Fund is generally comprised of net investment income, capital gains, and return of capital. It is the policy of the Fund to estimate the character of distributions received from underlying REITs based on historical data provided by the REITs. After each calendar year end, REITs report the actual tax character of these distributions.

| 12 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

Differences between the estimated and actual amounts reported by the REITs are reflected in the Fund’s records in the year in which they are reported by the REITs by adjusting related investment cost basis, capital gains and income, as necessary.

(e) Distributions to shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of November 30, 2020, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(g) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and ClearBridge Investments, LLC (“ClearBridge”) is the Fund’s subadviser. Western Asset Management Company, LLC (“Western Asset”) manages the portion of the Fund’s cash and short-term instruments allocated to it. LMPFA, ClearBridge and Western Asset are indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Resources”).

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund. The Fund is responsible for paying interest expenses, taxes, brokerage expenses, future 12b-1 fees (if any), acquired fund fees and expenses, extraordinary expenses and the management fee payable to LMPFA under the investment management agreement.

Under the investment management agreement and subject to the general supervision of the Fund’s Board of Trustees, LMPFA provides or causes to be furnished all investment management, supervisory, administrative and other services reasonably necessary for the operation of the Fund, including certain distribution services (provided pursuant to a separate distribution agreement) and investment advisory services (provided pursuant to separate subadvisory agreements) under a unitary fee structure. The Fund pays an investment management fee, calculated daily and paid monthly, at an annual rate of 0.59% of the Fund’s average daily net assets.

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

13 |

Notes to financial statements (unaudited) (cont’d)

As compensation for its subadvisory services, LMPFA pays a fee monthly, at an annual rate equal to 70% of the management fee paid by the Fund to LMPFA, net of (i) all fees and expenses incurred by LMPFA under the investment management agreement (including without limitation any subadvisory fee paid to another subadviser to the Fund) and (ii) expense waivers, if any, and reimbursements. LMPFA pays Western Asset monthly a fee of 0.02% of the portion of the Fund’s average daily net assets allocated to Western Asset for the management of cash and other short-term instruments, net of expense waivers, if any, and reimbursements.

Legg Mason Investor Services, LLC (“LMIS”) serves as the distributor of Creation Units for the Fund on an agency basis. LMIS is an indirect, wholly-owned broker-dealer subsidiary of Franklin Resources. As of July 7, 2021, LMIS is renamed Franklin Distributors LLC.

The Fund’s Board of Trustees has adopted a Rule 12b-1 shareholder services and distribution plan and under that plan, the Fund is authorized to pay service and/or distribution fees calculated at an annual rate of up to 0.25% of its average daily net assets. No service and/or distribution fees are currently paid by the Fund, and there are no current plans to impose these fees.

All officers and one Trustee of the Trust are employees of Franklin Resources or its affiliates and do not receive compensation from the Trust.

3. Investments

During the six months ended May 31, 2021, the aggregate cost of purchases and proceeds from sales of investments (excluding in-kind transactions and short-term investments) were as follows:

| Purchases | $ | 12,460,025 | ||

| Sales | 13,753,520 |

During the six months ended May 31, 2021, in-kind transactions (Note 5) were as follows:

| Contributions | $ | 17,015,795 | ||

| Redemptions | 5,011,763 | |||

| Realized gain (loss)* | 1,831,208 |

| * | Net realized gains on redemptions in-kind are not taxable to the remaining shareholders of the Fund. |

The in-kind contributions and in-kind redemptions shown in this table may not agree with the Fund Share Transactions on the Statement of Changes in Net Assets. This table represents the accumulation of the Fund’s daily net shareholder transactions while the Statement of Changes in Net Assets reflects gross shareholder transactions including any cash component of the transactions.

| 14 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

At May 31, 2021, the aggregate cost of investments and the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

| Cost | Gross Appreciation |

Gross Unrealized Depreciation |

Net Unrealized Appreciation |

|||||||||||||

| Securities | $ | 109,548,828 | $ | 41,263,234 | $ | (1,229,310) | $ | 40,033,924 | ||||||||

4. Derivative instruments and hedging activities

During the six months ended May 31, 2021, the Fund did not invest in derivative instruments.

5. Fund share transactions

At May 31, 2021, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. Fund shares are issued and redeemed by the Fund only in Creation Units or Creation Unit aggregations, where 50,000 shares of the Fund constitute a Creation Unit. Such transactions are made principally on an in-kind basis and, under some circumstances partially on a cash basis, with a separate cash payment, which is a balancing cash component to equate the transaction to the net asset value per share of the Fund on the transaction date. Transactions in capital shares of the Fund are disclosed in detail in the Statement of Changes in Net Assets. Authorized Participants are subject to standard creation and redemption transaction fees to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. Creations and redemptions for cash (when cash creations and redemptions are available or specified) may be subject to an additional variable fee.

6. Deferred capital losses

As of November 30, 2020, the Fund had deferred capital losses of $1,175,489, which have no expiration date, that will be available to offset future taxable capital gains.

7. Recent accounting pronouncement

In March 2020, the Financial Accounting Standards Board issued Accounting Standards Update No. 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting (the “ASU”). The amendments in the ASU provide optional temporary financial reporting relief from the effect of certain types of contract modifications due to the planned discontinuation of the London Interbank Offered Rate and other interbank-offered based reference rates as of the end of 2021. The ASU is effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. Management has reviewed the requirements and believes the adoption of this ASU will not have a material impact on the financial statements.

8. Other matter

The outbreak of the respiratory illness COVID-19 (commonly referred to as “coronavirus”) has continued to rapidly spread around the world, causing considerable uncertainty for the global economy and financial markets. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not

| ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

15 |

Notes to financial statements (unaudited) (cont’d)

known. The COVID-19 pandemic could adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance. In addition, the outbreak of COVID-19, and measures taken to mitigate its effects, could result in disruptions to the services provided to the Fund by its service providers.

| 16 | ClearBridge Large Cap Growth ESG ETF 2021 Semi-Annual Report |

Additional shareholder information (unaudited)

Results of special meeting of shareholders

A special meeting of shareholders was held on June 15, 2021 for shareholders of record as of March 1, 2021 (the “Record Date”) to elect the Board of Trustees of the Trust.

Shareholders of the Fund and each other series of the Trust voted together as a single class to elect the Board.

Shareholders of the Trust voted as indicated below (vote totals are rounded to the nearest whole number). Effective July 1, 2021, the Board is composed of the following Trustees:

| Trustees | For | Withheld | ||||||

| Rohit Bhagat | 941,735,402 | 14,088,498 | ||||||

| Deborah D. McWhinney | 943,565,325 | 12,258,574 | ||||||

| Anantha K. Pradeep | 942,060,249 | 13,763,651 | ||||||

| Jennifer M. Johnson | 943,888,843 | 11,935,057 | ||||||

The above Trustees have also been elected to serve as board members of other funds within the Franklin Templeton fund complex.

| ClearBridge Large Cap Growth ESG ETF |

17 |

ClearBridge

Large Cap Growth ESG ETF

Trustees

Rohit Bhagat

Deborah D. McWhinney

Anantha K. Pradeep

Jennifer M. Johnson*

Chair

* Effective July 1, 2021, Ms. Johnson became Chair.

Investment manager

Legg Mason Partners Fund Advisor, LLC

Subadviser

ClearBridge Investments, LLC

Custodian

The Bank of New York Mellon

Transfer agent

The Bank of New York Mellon

240 Greenwich Street

New York, NY 10286

Independent registered public accounting firm

PricewaterhouseCoopers LLP

Baltimore, MD

ClearBridge Large Cap Growth ESG ETF

The Fund is a separate investment series of Legg Mason ETF Investment Trust, a Maryland statutory trust.

ClearBridge Large Cap Growth ESG ETF

Legg Mason Funds

620 Eighth Avenue, 47th Floor

New York, NY 10018

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Forms N-PORT are available on the SEC’s website at www.sec.gov. To obtain information on Form N-PORT, shareholders can call the Fund at 1-877-721-1926.

Information on how the Fund voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio transactions are available (1) without charge, upon request, by calling the Fund at 1-877-721-1926, (2) at www.leggmason.com/etf and (3) on the SEC’s website at www.sec.gov.

This report is submitted for the general information of the shareholders of ClearBridge Large Cap Growth ESG ETF. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by a current prospectus.

Investors should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before investing.

www.leggmason.com

© 2021 Legg Mason Investor Services, LLC

Member FINRA, SIPC

www.leggmason.com

© 2021 Legg Mason Investor Services, LLC Member FINRA, SIPC

ETFF386463 7/21 SR21-4179

| ITEM 2. | CODE OF ETHICS. |

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

Included herein under Item 1.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable.

| ITEM 11. | CONTROLS AND PROCEDURES. |

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a- 3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) are effective as of a date within 90 days of the filing date of this report that includes the disclosure required by this paragraph, based on their evaluation of the disclosure controls and procedures required by Rule 30a-3(b) under the 1940 Act and 15d-15(b) under the Securities Exchange Act of 1934. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are likely to materially affect the registrant’s internal control over financial reporting. |

| ITEM 12. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 13. | EXHIBITS. |

(a) (1) Not applicable.

Exhibit 99.CODE ETH

(a) (2) Certifications pursuant to section 302 of the Sarbanes-Oxley Act of 2002 attached hereto.

Exhibit 99.CERT

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto.

Exhibit 99.906CERT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this Report to be signed on its behalf by the undersigned, there unto duly authorized.

| Legg Mason ETF Investment Trust | ||

| By: | /s/ Jane Trust | |

| Jane Trust | ||

| Chief Executive Officer | ||

| Date: | July 20, 2021 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Jane Trust | |

| Jane Trust | ||

| Chief Executive Officer | ||

| Date: | July 20, 2021 | |

| By: | /s/ Christopher Berarducci | |

| Christopher Berarducci | ||

| Principal Financial Officer | ||

| Date: | July 20, 2021 | |

CERTIFICATIONS PURSUANT TO SECTION 302

EX-99.CERT

CERTIFICATIONS

I, Jane Trust, certify that:

| 1. | I have reviewed this report on Form N-CSR of Legg Mason ETF Investment Trust – ClearBridge Large Cap Growth ESG ETF; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the registrant and have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and |

| d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officers and I have disclosed to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize, and report financial information; and |

| b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: July 20, 2021 | /s/ Jane Trust | |||||

| Jane Trust | ||||||

| Chief Executive Officer |

CERTIFICATIONS

I, Christopher Berarducci, certify that:

| 1. | I have reviewed this report on Form N-CSR of Legg Mason ETF Investment Trust – ClearBridge Large Cap Growth ESG ETF; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial information included in this report, and the financial statements on which the financial information is based, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the registrant and have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and |

| d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officers and I have disclosed to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize, and report financial information; and |

| b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: July 20, 2021 | /s/ Christopher Berarducci | |||||

| Christopher Berarducci | ||||||

| Principal Financial Officer |

CERTIFICATIONS PURSUANT TO SECTION 906

EX-99.906CERT

CERTIFICATION

Jane Trust, Chief Executive Officer, and Christopher Berarducci, Principal Financial Officer of Legg Mason ETF Investment Trust – ClearBridge Large Cap Growth ESG ETF (the “Registrant”), each certify to the best of their knowledge that:

1. The Registrant’s periodic report on Form N-CSR for the period ended May 31, 2021 (the “Form N-CSR”) fully complies with the requirements of section 15(d) of the Securities Exchange Act of 1934, as amended; and

2. The information contained in the Form N-CSR fairly presents, in all material respects, the financial condition and results of operations of the Registrant.

| Chief Executive Officer | Principal Financial Officer | |||

| Legg Mason ETF Investment Trust | Legg Mason ETF Investment Trust | |||

| ClearBridge Large Cap Growth ESG ETF | ClearBridge Large Cap Growth ESG ETF | |||

| /s/ Jane Trust |

/s/ Christopher Berarducci | |||

| Jane Trust | Christopher Berarducci | |||

| Date: July 20, 2021 | Date: July 20, 2021 | |||

This certification is being furnished to the Securities and Exchange Commission solely pursuant to 18 U.S.C. § 1350 and is not being filed as part of the Form N-CSR with the Commission.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ROSEN, LEADING INVESTOR COUNSEL, Encourages Doximity, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – DOCS

- Net Income of R$ 55.3 mm in 1Q24, a 90.1% Increase YOY and Leases EBITDA Margin of 72.1%

- 1899, LLC, Awarded Concessions Contract for 2024 Summer Season at Easton's Beach

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share