Form N-CSRS Amplify ETF Trust For: Apr 30

As filed with the U.S. Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23108

Amplify ETF Trust

(Exact name of registrant as specified in charter)

310 South Hale Street

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

Christian Magoon

Amplify ETF Trust

310 South Hale Street

Wheaton, IL 60187

(Name and address of agent for service)

With copies to:

Morrison C. Warren, Esq.

Chapman and Cutler LLP

111 West Monroe Street

Chicago, IL 60603

(855)-267-3837

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2019

Item 1. Reports to Stockholders.

AMPLIFY ETF TRUST

Amplify Online Retail ETF IBUY

Amplify CWP Enhanced Dividend Income ETF DIVO

Amplify Transformational Data Sharing ETF BLOK

Amplify Advanced Battery Metals and Materials ETF BATT

Amplify EASI Tactical Growth ETF EASI

Amplify BlackSwan Growth & Treasury Core ETF SWAN

Amplify International Online Retail ETF XBUY

SEMI-ANNUAL REPORT

April 30, 2019

Beginning on June 29, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Fund’s reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Amplify ETF Trust

Table of Contents

| SCHEDULES OF INVESTMENTS | 2 |

| STATEMENTS OF ASSETS AND LIABILITIES | 13 |

| STATEMENTS OF OPERATIONS | 15 |

| STATEMENTS OF CHANGES IN NET ASSETS | 17 |

| FINANCIAL HIGHLIGHTS | 24 |

| NOTES TO THE FINANCIAL STATEMENTS | 31 |

| BOARD CONSIDERATIONS REGARDING APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT AND SUB-ADVISORY AGREEMENT | 46 |

| DISCLOSURE OF FUND EXPENSES | 50 |

| ADDITIONAL INFORMATION | 52 |

| SUPPLEMENTAL INFORMATION | 53 |

| PRIVACY POLICY | 54 |

Amplify ETF Trust (the “Trust”) files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Form N-Qs are available on the Commission’s website at www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Amplify Investments, LLC (the “Adviser”) uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-855-267-3837 and (ii) on the Commission’s website at www.sec.gov.

| 1 |

Amplify ETF Trust

Amplify Online Retail ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Shares | Value | ||||||

| COMMON STOCKS — 99.8% | ||||||||

| Marketplace — 28.4% | ||||||||

| Alibaba Group Holding Ltd. - ADR(a) | 24,932 | $ | 4,626,631 | |||||

| Copart, Inc.(a) | 175,722 | 11,829,605 | ||||||

| Delivery Hero SE(a)(b) | 90,715 | 4,180,757 | ||||||

| Etsy, Inc.(a) | 178,497 | 12,055,687 | ||||||

| GrubHub, Inc.(a) | 94,844 | 6,334,631 | ||||||

| IAC/InterActiveCorp(a) | 48,197 | 10,836,613 | ||||||

| Just Eat PLC(a) | 460,466 | 4,197,136 | ||||||

| MercadoLibre, Inc.(a) | 10,876 | 5,265,507 | ||||||

| PayPal Holdings, Inc.(a) | 101,175 | 11,409,505 | ||||||

| Rakuten, Inc. | 489,100 | 5,422,492 | ||||||

| Shopify, Inc.(a) | 25,657 | 6,248,249 | ||||||

| 82,406,813 | ||||||||

| Traditional Retail — 58.7% | ||||||||

| 1-800-Flowers.com, Inc.(a) | 658,306 | 14,015,335 | ||||||

| Amazon.com, Inc.(a) | 5,085 | 9,796,354 | ||||||

| ASOS PLC(a) | 51,263 | 2,621,073 | ||||||

| Carvana Co.(a)(c) | 193,343 | 13,835,625 | ||||||

| Chegg, Inc.(a) | 320,871 | 11,439,051 | ||||||

| Cimpress NV(a) | 32,267 | 2,916,937 | ||||||

| Ebay, Inc. | 300,071 | 11,627,751 | ||||||

| Farfetch Ltd.(a) | 171,497 | 4,249,696 | ||||||

| JD.com, Inc. - ADR(a) | 157,962 | 4,781,510 | ||||||

| Lands’ End, Inc.(a) | 481,480 | 8,430,715 | ||||||

| Netflix, Inc.(a) | 27,256 | 10,099,438 | ||||||

| Ocado Group PLC(a) | 337,170 | 5,990,508 | ||||||

| Overstock.com, Inc.(a)(c) | 433,753 | 5,716,864 | ||||||

| PetMed Express, Inc.(c) | 303,518 | 6,631,868 | ||||||

| Pinduoduo, Inc. - ADR(a) | 183,498 | 4,079,161 | ||||||

| Qurate Retail, Inc.(a) | 370,865 | 6,323,248 | ||||||

| Shutterfly, Inc.(a) | 153,829 | 6,742,325 | ||||||

| Stamps.com, Inc.(a) | 50,862 | 4,363,960 | ||||||

| Stitch Fix, Inc.(a) | 316,885 | 8,444,985 | ||||||

| Description | Shares | Value | ||||||

| Vipshop Holdings Ltd. - ADR(a) | 636,874 | $ | 5,483,485 | |||||

| Wayfair, Inc.(a) | 91,153 | 14,780,459 | ||||||

| Zalando SE(a)(b) | 106,513 | 5,010,381 | ||||||

| ZOZO, Inc. | 158,700 | 2,799,457 | ||||||

| 170,180,186 | ||||||||

| Travel — 12.7% | ||||||||

| Booking Holdings, Inc.(a) | 4,467 | 8,286,240 | ||||||

| Ctrip.com International Ltd. - ADR(a) | 110,399 | 4,863,076 | ||||||

| Expedia Group, Inc. | 69,710 | 9,051,147 | ||||||

| MakeMyTrip Ltd.(a) | 149,984 | 3,781,097 | ||||||

| TripAdvisor, Inc.(a) | 153,723 | 8,182,675 | ||||||

| Trivago NV - ADR(a)(c) | 528,077 | 2,529,489 | ||||||

| 36,693,724 | ||||||||

| Total Common

Stocks (Cost $286,345,412) | 289,280,723 | |||||||

| MONEY MARKET FUNDS — 0.2% | ||||||||

| STIT-Government & Agency Portfolio - Institutional Class - 2.34%(d) | 445,155 | 445,155 | ||||||

| Total Money

Market Funds (Cost $445,155) | 445,155 | |||||||

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 9.3% | ||||||||

| First American Government Obligations Fund, Class Y - 2.08%(d) | 26,847,326 | 26,847,326 | ||||||

| Total Investments

Purchased with Proceeds from Securities Lending (Cost $26,847,326) | 26,847,326 | |||||||

| Total Investments — 109.3% (Cost $313,637,893) | $ | 316,573,204 | ||||||

Percentages are based on Net Assets of $289,691,053.

ADR - American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144(a) and Regulation S of 1933. Such securities are treated as liquid securities, according to the Fund’s liquidity guidelines. At April 30, 2019 the value of these securities amounted to $9,191,138 or 3.2% of net assets. |

| (c) | All or a portion of this security is out on loan as of April 30, 2019. Total value of securities out on loan is $26,176,665 or 9.0% of net assets. |

| (d) | Seven-day yield as of April 30, 2019. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

| 2 |

Amplify ETF Trust

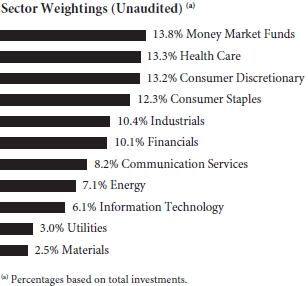

Amplify CWP Enhanced Dividend Income ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Shares | Value | ||||||

| COMMON STOCKS — 95.2% | ||||||||

| Communication Services — 9.1% | ||||||||

| Verizon Communications, Inc. | 14,005 | $ | 800,946 | |||||

| Walt Disney Co.(a) | 7,910 | 1,083,433 | ||||||

| 1,884,379 | ||||||||

| Consumer Discretionary — 14.6% | ||||||||

| Home Depot, Inc.(a) | 5,223 | 1,063,925 | ||||||

| McDonald’s Corp.(a) | 6,429 | 1,270,178 | ||||||

| Starbucks Corp.(a) | 8,924 | 693,216 | ||||||

| 3,027,319 | ||||||||

| Consumer Staples — 13.5% | ||||||||

| Mondelez International, Inc. | 16,622 | 845,229 | ||||||

| Procter & Gamble Co. | 6,532 | 695,527 | ||||||

| Walmart, Inc. | 12,412 | 1,276,450 | ||||||

| 2,817,206 | ||||||||

| Energy — 7.8% | ||||||||

| Chevron Corp.(a) | 8,152 | 978,729 | ||||||

| Valero Energy Corp.(a) | 7,174 | 650,395 | ||||||

| 1,629,124 | ||||||||

| Financials — 11.2% | ||||||||

| American Express Co. | 5,605 | 657,074 | ||||||

| CME Group, Inc. | 3,785 | 677,137 | ||||||

| JPMorgan Chase & Co. | 8,540 | 991,067 | ||||||

| 2,325,278 | ||||||||

| Health Care — 14.6% | ||||||||

| Abbott Laboratories(a) | 9,450 | 751,842 | ||||||

| Johnson & Johnson | 4,654 | 657,145 | ||||||

| Merck & Co., Inc. | 12,506 | 984,347 | ||||||

| UnitedHealth Group, Inc. | 2,800 | 652,596 | ||||||

| 3,045,930 | ||||||||

| Description | Shares | Value | ||||||

| Industrials — 11.5% | ||||||||

| 3M Co. | 2,880 | $ | 545,789 | |||||

| Boeing Co. | 2,660 | 1,004,656 | ||||||

| Caterpillar, Inc. | 6,108 | 851,577 | ||||||

| 2,402,022 | ||||||||

| Information Technology — 6.7% | ||||||||

| Cisco Systems, Inc.(a) | 6,300 | 352,485 | ||||||

| Visa, Inc. - Class A(a) | 6,320 | 1,039,198 | ||||||

| 1,391,683 | ||||||||

| Materials — 2.8% | ||||||||

| Nucor Corp. | 10,264 | 585,766 | ||||||

| Utilities — 3.4% | ||||||||

| Duke Energy Corp. | 7,687 | 700,439 | ||||||

| Total Common

Stocks (Cost $18,376,523) | 19,809,146 | |||||||

| MONEY MARKET FUNDS — 15.3% | ||||||||

| STIT-Government & Agency Portfolio - Institutional Class - 2.34%(b) | 3,179,595 | 3,179,595 | ||||||

| Total Money

Market Funds (Cost $3,179,595) | 3,179,595 | |||||||

| Total Investments — 110.5% (Cost $21,556,118) | $ | 22,988,741 | ||||||

Percentages are based on Net Assets of $20,803,815.

| (a) | All or a part of this security is held as collateral for the options written. At April 30, 2019, the value of these securities amounted to $7,883,401 or 37.9% of net assets. |

| (b) | Seven-day yield as of April 30, 2019. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of the financial statements.

| 3 |

Amplify ETF Trust

Amplify CWP Enhanced Dividend Income ETF

Schedule of Options Written

April 30, 2019 (Unaudited)

| Description | Contracts | Notional Amount | Value | |||||||||

| Call Options Written(a) — (0.39)% | ||||||||||||

| Abbott Laboratories, Expires 5/17/2019, Strike Price $80.00 | 70 | (556,920 | ) | $ | (6,720 | ) | ||||||

| Chevron Corp., Expires 5/17/2019, Strike Price $126.00 | 60 | (720,360 | ) | (1,020 | ) | |||||||

| Cisco Systems, Inc., Expires 5/03/2019, Strike Price $55.00 | 63 | (352,485 | ) | (6,584 | ) | |||||||

| Home Depot, Inc., Expires 5/10/2019, Strike Price $212.50 | 52 | (1,059,240 | ) | (650 | ) | |||||||

| McDonald’s Corp., Expires 5/03/2019, Strike Price $205.00 | 64 | (1,264,448 | ) | (160 | ) | |||||||

| Starbucks Corp., Expires 5/03/2019, Strike Price $73.00 | 82 | (636,976 | ) | (38,540 | ) | |||||||

| Valero Energy Corp., Expires 5/03/2019, Strike Price $88.50 | 66 | (598,356 | ) | (15,675 | ) | |||||||

| Expires 5/03/2019, Strike Price $90.00 | 5 | (45,330 | ) | (655 | ) | |||||||

| Visa, Inc., Expires 5/17/2019, Strike Price $167.50 | 40 | (657,720 | ) | (2,700 | ) | |||||||

| Walt Disney Co., Expires 5/10/2019, Strike Price $140.00 | 50 | (684,850 | ) | (7,975 | ) | |||||||

| Total

Call Options Written (Premiums Received $67,719) | $ | (80,679 | ) | |||||||||

| (a) | Exchange Traded |

The accompanying notes are an integral part of the financial statements.

| 4 |

Amplify ETF Trust

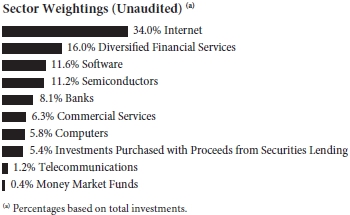

Amplify Transformational Data Sharing ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Shares | Value | ||||||

| COMMON STOCKS — 99.3% | ||||||||

| Banks — 8.5% | ||||||||

| Banco Bilbao Vizcaya Argentaria SA - ADR | 166,544 | $ | 1,014,253 | |||||

| Banco Santander SA - ADR | 149,076 | 743,889 | ||||||

| BOC Hong Kong Holdings Ltd. | 241,328 | 1,079,774 | ||||||

| Citigroup, Inc. | 16,976 | 1,200,203 | ||||||

| JPMorgan Chase & Co. | 12,745 | 1,479,057 | ||||||

| Signature Bank/New York NY | 8,133 | 1,074,125 | ||||||

| The Goldman Sachs Group, Inc. | 13,820 | 2,845,815 | ||||||

| 9,437,116 | ||||||||

| Commercial Services — 6.6% | ||||||||

| Hive Blockchain Technologies Ltd.(a) | 6,068,601 | 2,174,314 | ||||||

| QIWI PLC - ADR(a) | 67,157 | 940,870 | ||||||

| Square, Inc.(a) | 57,486 | 4,186,130 | ||||||

| 7,301,314 | ||||||||

| Computers — 6.1% | ||||||||

| Accenture PLC | 17,570 | 3,209,512 | ||||||

| International Business Machines Corp. | 25,386 | 3,560,894 | ||||||

| 6,770,406 | ||||||||

| Diversified Financial Services — 16.9% | ||||||||

| American Express Co. | 6,529 | 765,395 | ||||||

| CME Group, Inc. | 11,314 | 2,024,075 | ||||||

| GAIN Capital Holdings, Inc. | 84,747 | 446,617 | ||||||

| Galaxy Digital Holdings Ltd.(a) | 2,261,067 | 3,375,483 | ||||||

| IG Group Holdings PLC | 199,175 | 1,324,076 | ||||||

| Intercontinental Exchange, Inc. | 21,100 | 1,716,485 | ||||||

| Mastercard, Inc. | 2,181 | 554,497 | ||||||

| Monex Group, Inc. | 529,248 | 1,605,869 | ||||||

| Nasdaq, Inc. | 11,496 | 1,059,931 | ||||||

| Plus500 Ltd. | 139,404 | 959,815 | ||||||

| Description | Shares | Value | ||||||

| SBI Holdings, Inc. | 185,976 | $ | 3,961,767 | |||||

| Visa, Inc. | 5,064 | 832,673 | ||||||

| 18,626,683 | ||||||||

| Internet — 35.9% | ||||||||

| Alibaba Group Holding Ltd. - ADR(a) | 6,765 | 1,255,381 | ||||||

| Alphabet, Inc.(a) | 2,348 | 2,815,158 | ||||||

| Baidu, Inc. - ADR(a) | 11,073 | 1,840,665 | ||||||

| Digital Garage, Inc. | 154,049 | 4,466,792 | ||||||

| Facebook, Inc.(a) | 3,610 | 698,174 | ||||||

| GMO Internet, Inc. | 323,689 | 4,995,030 | ||||||

| JD.com, Inc. - ADR(a) | 78,029 | 2,361,938 | ||||||

| Kakao Corp. | 36,531 | 3,752,703 | ||||||

| LINE Corp. - ADR(a)(b) | 50,750 | 1,698,095 | ||||||

| Opera Ltd. - ADR(a)(b) | 348,326 | 3,357,863 | ||||||

| Overstock.com, Inc.(a)(b) | 236,494 | 3,116,991 | ||||||

| Rakuten, Inc. | 354,775 | 3,933,274 | ||||||

| Tencent Holdings Ltd. | 21,351 | 1,056,010 | ||||||

| Xunlei Ltd. - ADR(a)(b) | 416,032 | 1,456,112 | ||||||

| Yahoo Japan Corp. | 1,065,340 | 2,830,833 | ||||||

| 39,635,019 | ||||||||

| Semiconductors — 11.8% | ||||||||

| Advanced Micro Devices, Inc.(a) | 63,346 | 1,750,250 | ||||||

| Global Unchip Corp. | 406,283 | 2,984,571 | ||||||

| Intel Corp. | 30,032 | 1,532,833 | ||||||

| NVIDIA Corp. | 8,426 | 1,525,106 | ||||||

| Samsung Electronics Co. Ltd. | 45,781 | 1,796,909 | ||||||

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | 77,962 | 3,416,295 | ||||||

| 13,005,964 | ||||||||

| Software — 12.2% | ||||||||

| Akamai Technologies, Inc.(a) | 14,659 | 1,173,600 | ||||||

| DocuSign, Inc.(a) | 16,141 | 914,711 | ||||||

| Microsoft Corp. | 23,817 | 3,110,500 | ||||||

| Nexon GT Co. Ltd.(a) | 267,542 | 2,771,269 | ||||||

| Oracle Corp. | 43,571 | 2,410,783 | ||||||

| SAP SE - ADR | 24,127 | 3,109,005 | ||||||

| 13,489,868 | ||||||||

| Telecommunications — 1.3% | ||||||||

| Cisco Systems, Inc. | 25,701 | 1,437,971 | ||||||

| Total Common

Stocks (Cost $122,626,859) | 109,704,341 | |||||||

| MONEY MARKET FUNDS — 0.4% | ||||||||

| STIT-Government & Agency Portfolio - Institutional Class - 2.34%(c) | 451,567 | 451,567 | ||||||

| Total Money

Market Funds (Cost $451,567) | 451,567 | |||||||

The accompanying notes are an integral part of the financial statements.

| 5 |

Amplify ETF Trust

Amplify Transformational Data Sharing ETF

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

| Description | Shares | Value | ||||||

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 5.7% | ||||||||

| First American Government Obligations Fund, Class Y - 2.08%(c) | 6,263,114 | $ | 6,263,114 | |||||

| Total

Investments Purchased with Proceeds from Securities Lending (Cost $6,263,114) | 6,263,114 | |||||||

| Total Investments — 105.4% (Cost $129,341,540) | $ | 116,419,022 | ||||||

Percentages are based on Net Assets of $110,505,796.

ADR - American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is out on loan as of April 30, 2019. Total value of securities out on loan is $6,065,106 or 5.5% of net assets. |

| (c) | Seven-day yield as of April 30, 2019. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

| 6 |

Amplify ETF Trust

Amplify Advanced Battery Metals and Materials ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Shares | Value | ||||||

| COMMON STOCKS — 99.1% | ||||||||

| Industrials — 3.0% | ||||||||

| AMG Advanced Metallurgical Group NV | 2,729 | $ | 82,704 | |||||

| Clean TeQ Holdings Ltd.(a) | 351,234 | 76,757 | ||||||

| 159,461 | ||||||||

| Materials — 96.1% | ||||||||

| African Rainbow Minerals Ltd. | 12,068 | 143,466 | ||||||

| Albemarle Corp. | 1,663 | 124,825 | ||||||

| Altura Mining Ltd.(a) | 1,264,718 | 93,614 | ||||||

| Aneka Tambang Tbk | 3,170,593 | 192,461 | ||||||

| Assore Ltd. | 6,786 | 176,185 | ||||||

| Bushveld Minerals Ltd.(a) | 201,311 | 65,102 | ||||||

| China Molybdenum Co. Ltd. | 345,240 | 129,826 | ||||||

| Cobalt 27 Capital Corp.(a) | 30,376 | 99,991 | ||||||

| Eramet | 1,924 | 134,484 | ||||||

| First Quantum Minerals Ltd. | 15,597 | 164,737 | ||||||

| Freeport-McMoRan, Inc. | 6,021 | 74,119 | ||||||

| Galaxy Resources Ltd.(a) | 92,723 | 95,433 | ||||||

| Ganfeng Lithium Co Ltd. | 32,130 | 117,516 | ||||||

| Glencore PLC | 33,173 | 131,655 | ||||||

| Independence Group NL | 54,194 | 170,390 | ||||||

| Jinchuan Group International Resources Co. Ltd.(a) | 1,612,746 | 150,075 | ||||||

| Johnson Matthey PLC | 3,175 | 138,159 | ||||||

| Jupiter Mines Ltd. | 525,877 | 131,605 | ||||||

| Katanga Mining Ltd.(a)(b) | 355,327 | 120,679 | ||||||

| Kidman Resources Ltd.(a) | 149,209 | 136,214 | ||||||

| Description | Shares | Value | ||||||

| Largo Resources Ltd.(a) | 41,400 | $ | 52,225 | |||||

| Lithium Americas Corp.(a)(b) | 42,165 | 155,479 | ||||||

| Livent Corp.(a) | 12,624 | 136,087 | ||||||

| Lundin Mining Corp. | 33,991 | 182,425 | ||||||

| Metals X Ltd.(a) | 516,315 | 101,913 | ||||||

| MMC Norilsk Nickel PJSC | 13,887 | 308,291 | ||||||

| Nanjing Hanrui Cobalt Co. Ltd. | 7,650 | 79,920 | ||||||

| Nemaska Lithium, Inc.(a) | 223,132 | 55,795 | ||||||

| Orocobre Ltd.(a) | 48,746 | 114,430 | ||||||

| Panoramic Resources Ltd.(a) | 242,412 | 71,773 | ||||||

| Pilbara Minerals Ltd.(a) | 252,535 | 108,595 | ||||||

| Sherritt International Corp.(a) | 290,198 | 42,240 | ||||||

| Sociedad Quimica y Minera de Chile SA - ADR(b) | 4,235 | 150,935 | ||||||

| South32 Ltd. | 51,093 | 120,300 | ||||||

| Sumitomo Metal Mining Co. Ltd. | 5,049 | 157,686 | ||||||

| Syrah Resources Ltd.(a) | 92,484 | 72,368 | ||||||

| Tawana Resources NL(a)(c) | 44,689 | – | ||||||

| Tianqi Lithium Corp. | 31,290 | 137,621 | ||||||

| Umicore SA | 2,696 | 104,323 | ||||||

| Vale Indonesia Tbk PT(a) | 844,192 | 180,687 | ||||||

| Western Areas Ltd. | 74,662 | 118,951 | ||||||

| Zhejiang Huayou Cobalt Co. Ltd. | 19,260 | 83,138 | ||||||

| 5,125,718 | ||||||||

| Total Common

Stocks (Cost $7,776,149) | 5,285,179 | |||||||

| MONEY MARKET FUNDS — 0.7% | ||||||||

| STIT - Government & Agency Portfolio - Institutional Class - 2.34%(d) | 37,093 | 37,093 | ||||||

| Total Money

Market Funds (Cost $37,093) | 37,093 | |||||||

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 9.5% | ||||||||

| First American Government Obligations Fund, Class Y - 2.08%(d) | 505,920 | 505,920 | ||||||

| Total

Investments Purchased with Proceeds from Securities Lending (Cost $505,920) | 505,920 | |||||||

| Total Investments — 109.3% (Cost $8,319,162) | $ | 5,828,192 | ||||||

Percentages are based on Net Assets of $5,331,896.

ADR — American Depositary Receipt

| (a) | Non-income producing security. |

The accompanying notes are an integral part of the financial statements.

| 7 |

Amplify ETF Trust

Amplify Advanced Battery Metals and Materials ETF

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

| (b) | All or a portion of this security is out on loan as of April 30, 2019. Total value of securities out on loan is $355,930 or 6.7% of net assets. |

| (c) | Illiquid security. At April 30, 2019, the value of this security amounted to $0.00 or 0.00% of net assets. The Fund has fair valued this security. Value determined using significant unobservable inputs. |

| (d) | Seven-day yield as of April 30, 2019. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

| 8 |

Amplify ETF Trust

Amplify EASI Tactical Growth ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Shares | Value | ||||||

| COMMON STOCKS — 99.9% | ||||||||

| Communication Services — 2.4% | ||||||||

| Autohome, Inc. - ADR(a) | 5,439 | $ | 628,150 | |||||

| Consumer Discretionary — 11.1% | ||||||||

| Alibaba Group Holding Ltd. - ADR(a) | 3,108 | 576,752 | ||||||

| Amazon.com, Inc.(a) | 315 | 606,854 | ||||||

| Boot Barn Holdings, Inc.(a) | 19,257 | 554,409 | ||||||

| Lululemon Athletica, Inc.(a) | 3,444 | 607,349 | ||||||

| Norwegian Cruise Line Holdings Ltd.(a) | 9,996 | 563,674 | ||||||

| 2,909,038 | ||||||||

| Energy — 4.2% | ||||||||

| Cabot Oil & Gas Corp. | 21,441 | 555,108 | ||||||

| ProPetro Holding Corp.(a) | 25,179 | 557,211 | ||||||

| 1,112,319 | ||||||||

| Financials — 6.9% | ||||||||

| NMI Holdings, Inc.(a) | 21,714 | 609,729 | ||||||

| Voya Financial, Inc. | 10,752 | 590,177 | ||||||

| Willis Towers Watson PLC | 3,234 | 596,156 | ||||||

| 1,796,062 | ||||||||

| Health Care — 6.7% | ||||||||

| Charles River Labratories International, Inc.(a) | 4,053 | 569,325 | ||||||

| Horizon Pharma PLC(a) | 22,491 | 574,195 | ||||||

| Veeva Systems, Inc.(a) | 4,347 | 608,015 | ||||||

| 1,751,535 | ||||||||

| Description | Shares | Value | ||||||

| Industrials — 18.4% | ||||||||

| AMETEK, Inc. | 6,825 | $ | 601,760 | |||||

| Armstrong World Industries, Inc. | 6,972 | 604,263 | ||||||

| Clean Harbors, Inc.(a) | 8,064 | 612,864 | ||||||

| Great Lakes Dredge & Dock Corp.(a) | 60,753 | 621,503 | ||||||

| HEICO Corp. | 5,817 | 613,868 | ||||||

| Jacobs Engineering Group, Inc. | 7,602 | 592,500 | ||||||

| Quanta Services, Inc. | 14,490 | 588,294 | ||||||

| The Timken Co. | 12,264 | 588,059 | ||||||

| 4,823,111 | ||||||||

| Information Technology — 36.8% | ||||||||

| Adobe, Inc.(a) | 2,163 | 625,648 | ||||||

| ANSYS, Inc.(a) | 3,087 | 604,435 | ||||||

| Booz Allen Hamilton Holding Corp. | 9,996 | 592,663 | ||||||

| Cadence Design Systems, Inc.(a) | 9,009 | 625,044 | ||||||

| CyberArk Software Ltd.(a) | 4,809 | 620,024 | ||||||

| Entegris, Inc. | 14,553 | 594,636 | ||||||

| EPAM Systems, Inc.(a) | 3,381 | 606,416 | ||||||

| Intuit, Inc. | 2,268 | 569,404 | ||||||

| Paycom Software, Inc.(a) | 3,108 | 629,463 | ||||||

| ServiceNow, Inc.(a) | 2,415 | 655,697 | ||||||

| The Trade Desk, Inc.(a) | 2,919 | 646,500 | ||||||

| Visa, Inc. | 3,675 | 604,280 | ||||||

| VMware, Inc. | 3,045 | 621,576 | ||||||

| WEX, Inc.(a) | 2,898 | 609,449 | ||||||

| Xilinx, Inc. | 4,347 | 522,249 | ||||||

| Zebra Technologies Corp.(a) | 2,520 | 532,073 | ||||||

| 9,659,557 | ||||||||

| Materials — 2.2% | ||||||||

| Berry Global Group, Inc.(a) | 9,996 | 587,765 | ||||||

| Real Estate — 11.2% | ||||||||

| American Tower Corp.(b) | 2,961 | 578,284 | ||||||

| Crown Castle International Corp.(b) | 4,536 | 570,538 | ||||||

| Hannon Armstrong Sustainable Infrastructure Capital, Inc.(b) | 22,659 | 602,503 | ||||||

| Innovative Industrial Properties, Inc.(b)(c) | 6,909 | 588,232 | ||||||

| STORE Capital Corp.(b) | 17,493 | 582,867 | ||||||

| 2,922,424 | ||||||||

| Total Common

Stocks (Cost $25,570,795) | 26,189,961 | |||||||

| MONEY MARKET FUNDS — 0.2% | ||||||||

| STIT - Government & Agency Portfolio - Institutional Class - 2.34%(d) | 57,062 | 57,062 | ||||||

| Total

Money Market Funds (Cost $57,062) | 57,062 | |||||||

The accompanying notes are an integral part of the financial statements.

| 9 |

Amplify ETF Trust

Amplify EASI Tactical Growth ETF

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

| Description | Shares | Value | ||||||

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 0.0%(e) | ||||||||

| First American Government Obligations Fund, Class Y - 2.08%(d) | 5,591 | $ | 5,591 | |||||

| Total

Investments Purchased with Proceeds from Securities Lending (Cost $5,591) | 5,591 | |||||||

| Total Investments — 100.1% (Cost $25,633,448) | $ | 26,252,614 | ||||||

Percentages are based on Net Assets of $26,234,766.

ADR — American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Real Estate Investment Trust. |

| (c) | All or a portion of this security is out on loan as of April 30, 2019. Total value of securities out on loan is $5,364 or 0.2% of net assets. |

| (d) | Seven-day yield as of April 30, 2019. |

| (e) | Less than 0.005%. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of the financial statements.

| 10 |

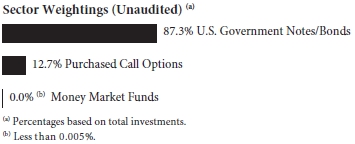

Amplify ETF Trust

Amplify BlackSwan Growth & Treasury Core ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Par Value | Value | ||||||

| U.S. GOVERNMENT NOTES/BONDS — 87.0% | ||||||||

| 2.750%, 09/30/2020 | $ | 3,372,000 | $ | 3,391,428 | ||||

| 2.875%, 10/15/2021 | 11,460,000 | 11,629,886 | ||||||

| 2.875%, 09/30/2023 | 11,419,000 | 11,705,144 | ||||||

| 3.000%, 09/30/2025 | 11,346,000 | 11,766,600 | ||||||

| 2.875%, 08/15/2028 | 11,450,000 | 11,810,049 | ||||||

| 3.000%, 08/15/2048 | 14,821,000 | 14,990,052 | ||||||

| Total U.S. Government Notes/Bonds (Cost $63,987,479) | 65,293,159 | |||||||

| Contracts | Notional Amount | |||||||||||

| PURCHASED CALL OPTIONS(a) — 12.7% | ||||||||||||

| SPDR S&P 500 ETF Trust, Expires 06/21/2019, Strike Price $250.00 | 961 | $ | 28,255,322 | 4,386,965 | ||||||||

| SPDR S&P 500 ETF Trust, Expires 12/20/2019, Strike Price $255.00 | 1,150 | 33,812,300 | 5,127,850 | |||||||||

| Total Purchased Call Options (Cost $5,900,112) | 9,514,815 | |||||||||||

| Shares | ||||||||||||

| MONEY MARKET FUNDS — 0.0%(b) | ||||||||||||

| STIT-Government & Agency Portfolio - Institutional Class - 2.34%(c) | 18,898 | 18,898 | ||||||||||

| Total Money Market Funds (Cost $18,898) | 18,898 | |||||||||||

| Total Investments — 99.7% (Cost $69,906,489) | $ | 74,826,872 | ||||||||||

Percentages are based on Net Assets of $75,036,970.

| (a) | Exchange Traded |

| (b) | Less than 0.005%. |

| (c) | Seven-day yield as of April 30, 2019. |

The accompanying notes are an integral part of the financial statements.

| 11 |

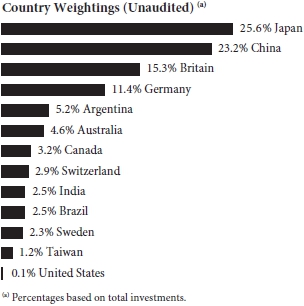

Amplify ETF Trust

Amplify International Online Retail ETF

Schedule of Investments

April 30, 2019 (Unaudited)

| Description | Shares | Value | ||||||

| COMMON STOCKS — 99.9% | ||||||||

| Marketplace — 31.7% | ||||||||

| 58.com, Inc. - ADR(a) | 870 | $ | 62,457 | |||||

| Alibaba Group Holding Ltd. - ADR(a) | 342 | 63,465 | ||||||

| B2W Cia Digital(a) | 7,200 | 70,026 | ||||||

| Delivery Hero SE(a)(b) | 1,926 | 88,692 | ||||||

| Just Eat PLC(a) | 7,358 | 67,050 | ||||||

| Kogan.com Ltd. | 11,594 | 45,698 | ||||||

| MercadoLibre, Inc.(a) | 152 | 73,589 | ||||||

| Mercari, Inc.(a) | 2,400 | 74,020 | ||||||

| Rakuten, Inc. | 7,800 | 86,492 | ||||||

| Shopify, Inc.(a) | 372 | 90,593 | ||||||

| Syuppin Co. Ltd. | 4,000 | 26,541 | ||||||

| Tencent Holdings Ltd. | 1,200 | 59,347 | ||||||

| Yixin Group Ltd.(a)(b) | 96,000 | 23,494 | ||||||

| Yume No Machi Souzou Iinkai Co. Ltd. | 4,600 | 68,809 | ||||||

| 900,273 | ||||||||

| Traditional Retail — 54.9% | ||||||||

| ASKUL Corp. | 2,600 | 69,800 | ||||||

| ASOS PLC(a) | 1,770 | 90,475 | ||||||

| boohoo Group PLC(a) | 29,886 | 95,726 | ||||||

| Boozt AB(a)(b) | 4,288 | 36,039 | ||||||

| China Literature Ltd.(a)(b) | 12,800 | 58,082 | ||||||

| Dustin Group AB(b) | 3,174 | 28,412 | ||||||

| Farfetch Ltd.(a) | 2,870 | 71,119 | ||||||

| HelloFresh SE(a) | 3,520 | 35,504 | ||||||

| iQIYI, Inc. - ADR(a) | 2,552 | 56,425 | ||||||

| Istyle, Inc. | 9,200 | 65,422 | ||||||

| JD.com, Inc. - ADR(a) | 2,020 | 61,145 | ||||||

| Description | Shares | Value | ||||||

| Jumei International Holding Ltd. - ADR(a) | 12,030 | $ | 29,233 | |||||

| Kitanotatsujin Corp. | 15,400 | 73,284 | ||||||

| MOGU, Inc. - ADR(a) | 4,406 | 36,570 | ||||||

| MonotaRO Co. Ltd. | 3,000 | 69,010 | ||||||

| Ocado Group PLC(a) | 4,242 | 75,347 | ||||||

| Oisix ra daichi, Inc.(a) | 4,600 | 68,066 | ||||||

| Orflame Holding AG | 4,018 | 83,050 | ||||||

| PChome Online, Inc.(a) | 8,000 | 34,044 | ||||||

| Pinduoduo, Inc. - ADR(a) | 2,602 | 57,842 | ||||||

| Secoo Holding Ltd. - ADR(a) | 2,758 | 26,449 | ||||||

| Vipshop Holdings Ltd. - ADR(a) | 7,416 | 63,852 | ||||||

| Webjet Ltd. | 7,068 | 83,875 | ||||||

| Zalando SE(a)(b) | 1,838 | 86,390 | ||||||

| zooplus AG(a) | 282 | 30,561 | ||||||

| ZOZO, Inc. | 4,000 | 70,572 | ||||||

| 1,556,294 | ||||||||

| Travel — 13.3% | ||||||||

| Ctrip.com International Ltd. - ADR(a) | 1,348 | 59,379 | ||||||

| Despegar.com Corp.(a) | 5,130 | 74,847 | ||||||

| Evolable Asia Corp. | 1,400 | 26,284 | ||||||

| MakeMyTrip Ltd.(a) | 2,786 | 70,235 | ||||||

| On the Beach Group PLC(b) | 5,768 | 34,439 | ||||||

| Open Door, Inc.(a) | 1,000 | 28,687 | ||||||

| Trivago NV - ADR(a) | 17,416 | 83,423 | ||||||

| 377,294 | ||||||||

| Total Common

Stocks (Cost $2,549,373) | 2,833,861 | |||||||

| MONEY MARKET FUNDS — 0.1% | ||||||||

| STIT - Government & Agency Portfolio - Institutional Class - 2.34%(c) | 2,694 | 2,694 | ||||||

| Total Money

Market Funds (Cost $2,694) | 2,694 | |||||||

| Total Investments — 100.0% (Cost $2,552,067) | $ | 2,836,555 | ||||||

Percentages are based on Net Assets of $2,836,334.

ADR — American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144(a) and Regulation S of 1933. Such securities are treated as liquid securities, according to the Fund’s liquidity guidelines. At April 30, 2019 the value of these securities amounted to $355,548 or 12.5% of net assets. |

| (c) | Seven-day yield as of April 30, 2019. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund Management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

| 12 |

Amplify ETF Trust

Statements of Assets and Liabilities

April 30, 2019 (Unaudited)

| Amplify Online Retail ETF | Amplify CWP Enhanced Dividend Income ETF | Amplify Transformational Data Sharing ETF | Amplify Advanced Battery Metals and Materials ETF | Amplify EASI Tactical Growth ETF | ||||||||||||||||

| Assets: | ||||||||||||||||||||

| Investments, at Cost | $ | 313,637,893 | $ | 21,556,118 | $ | 129,341,540 | $ | 8,319,162 | $ | 25,633,448 | ||||||||||

| Foreign Currency, at Cost | 1,388 | — | — | — | — | |||||||||||||||

| Investments, at Fair Value | $ | 316,573,204 | $ | 22,988,741 | $ | 116,419,022 | $ | 5,828,192 | $ | 26,252,614 | ||||||||||

| Foreign Currency, at Fair Value | 1,378 | — | — | — | — | |||||||||||||||

| Receivable for Investments Sold | — | 6,480 | — | — | — | |||||||||||||||

| Dividends and Interest Receivable | 18,637 | 26,562 | 367,149 | 7,156 | 1,117 | |||||||||||||||

| Securities Lending Income Receivable | 95,564 | — | 47,035 | 5,877 | 568 | |||||||||||||||

| Total Assets | 316,688,783 | 23,021,783 | 116,833,206 | 5,841,225 | 26,254,299 | |||||||||||||||

| Liabilities: | ||||||||||||||||||||

| Options Written, at Value (Premiums Received $0, $67,719, $0, $0, $0) | — | 80,679 | — | — | — | |||||||||||||||

| Payable for Investments Purchased | — | 2,034,081 | — | — | — | |||||||||||||||

| Payable for Distributions to Shareholders | — | 95,223 | — | — | — | |||||||||||||||

| Collateral Received for Securities Loaned (See Note 4) | 26,847,326 | — | 6,263,114 | 505,920 | 5,591 | |||||||||||||||

| Advisory Fees Payable, net of waiver, if any | 150,404 | 7,985 | 64,296 | 3,409 | 13,942 | |||||||||||||||

| Total Liabilities | 26,997,730 | 2,217,968 | 6,327,410 | 509,329 | 19,533 | |||||||||||||||

| Net Assets | $ | 289,691,053 | $ | 20,803,815 | $ | 110,505,796 | $ | 5,331,896 | $ | 26,234,766 | ||||||||||

| Net Assets Consist of: | ||||||||||||||||||||

| Paid-in Capital ($0.01 par value) | $ | 56,500 | $ | 7,000 | $ | 61,500 | $ | 4,500 | $ | 10,500 | ||||||||||

| Additional Paid-in Capital | 289,434,754 | 18,955,305 | 137,978,879 | 8,629,027 | 26,363,263 | |||||||||||||||

| Total distributable earnings (accumulated deficit) | 199,799 | 1,841,510 | (27,534,583 | ) | (3,301,631 | ) | (138,997 | ) | ||||||||||||

| Net Assets | $ | 289,691,053 | $ | 20,803,815 | $ | 110,505,796 | $ | 5,331,896 | $ | 26,234,766 | ||||||||||

| Outstanding Shares of Beneficial Interest (unlimited authorized - $0.01 par value) | 5,650,000 | 700,000 | 6,150,000 | 450,000 | 1,050,000 | |||||||||||||||

| Net Asset Value, Offering and Redemption Price per Share | $ | 51.27 | $ | 29.72 | $ | 17.97 | $ | 11.85 | $ | 24.99 | ||||||||||

| Includes loaned Securities with a value of | $ | 26,176,665 | — | $ | 6,065,106 | $ | 355,930 | $ | 5,364 | |||||||||||

The accompanying notes are an integral part of the financial statements.

| 13 |

Amplify ETF Trust

Statements of Assets and Liabilities

April 30, 2019 (Unaudited)

| Amplify BlackSwan Growth & Treasury Core ETF | Amplify International Online Retail ETF | |||||||

| Assets: | ||||||||

| Investments, at Cost | $ | 69,906,489 | $ | 2,552,067 | ||||

| Investments, at Fair Value | $ | 74,826,872 | $ | 2,836,555 | ||||

| Dividends and Interest Receivable | 239,278 | 1,348 | ||||||

| Total Assets | 75,066,150 | 2,837,903 | ||||||

| Liabilities: | ||||||||

| Advisory Fees Payable, net of waiver, if any | 29,180 | 1,569 | ||||||

| Total Liabilities | 29,180 | 1,569 | ||||||

| Net Assets | $ | 75,036,970 | $ | 2,836,334 | ||||

| Net Assets Consist of: | ||||||||

| Paid-in Capital ($0.01 par value) | $ | 28,000 | $ | 1,000 | ||||

| Additional Paid-in Capital | 70,097,395 | 2,499,297 | ||||||

| Total distributable earnings | 4,911,575 | 336,037 | ||||||

| Net Assets | $ | 75,036,970 | $ | 2,836,334 | ||||

| Outstanding Shares of Beneficial Interest (unlimited authorized - $0.01 par value) | 2,800,000 | 100,000 | ||||||

| Net Asset Value, Offering and Redemption Price per Share | $ | 26.80 | $ | 28.36 | ||||

The accompanying notes are an integral part of the financial statements.

| 14 |

Amplify ETF Trust

Statements of Operations

For the Period Ended April 30, 2019 (Unaudited)

| Amplify Online Retail ETF | Amplify CWP Enhanced Dividend Income ETF | Amplify | Amplify | Amplify | ||||||||||||||||

| Investment Income: | ||||||||||||||||||||

| Dividend Income (Net of Foreign Withholding Tax of $3,772, $0, $50,364, $2,449 and $0, respectively) | $ | 393,793 | $ | 210,361 | $ | 772,949 | $ | 21,477 | $ | 209,688 | ||||||||||

| Interest Income | 4,617 | 10,469 | 3,143 | 297 | 410 | |||||||||||||||

| Securities Lending Income | 490,558 | 32 | 168,033 | 27,046 | 2,690 | |||||||||||||||

| Total Investment Income | 888,968 | 220,862 | 944,125 | 48,820 | 212,788 | |||||||||||||||

| Expenses: | ||||||||||||||||||||

| Advisory Fees | 972,917 | 81,324 | 500,594 | 26,672 | 63,370 | |||||||||||||||

| Total Expenses | 972,917 | 81,324 | 500,594 | 26,672 | 63,370 | |||||||||||||||

| Advisory Fees Waived (See Note 3) | — | (39,378 | ) | (111,243 | ) | (5,798 | ) | — | ||||||||||||

| Net Expenses | 972,917 | 41,946 | 389,351 | 20,874 | 63,370 | |||||||||||||||

| Net Investment Income (Loss) | (83,949 | ) | 178,916 | 554,774 | 27,946 | 149,418 | ||||||||||||||

| Realized and Unrealized Gain (Loss): | ||||||||||||||||||||

| Net Realized Gain (Loss) on: | ||||||||||||||||||||

| Investments | 3,570,484 | 653,774 | (14,770,325 | ) | (613,067 | ) | 291,422 | |||||||||||||

| Foreign Currency | (42,582 | ) | — | (18,742 | ) | (3,681 | ) | — | ||||||||||||

| Options Written | — | 92,661 | — | — | — | |||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on: | ||||||||||||||||||||

| Investments | 32,823,696 | 287,699 | 16,719,427 | 192,551 | 599,569 | |||||||||||||||

| Foreign Currency | (81 | ) | — | (1,666 | ) | 19 | — | |||||||||||||

| Options Written | — | (13,882 | ) | — | — | — | ||||||||||||||

| Net Realized and Unrealized Gain (Loss) | 36,351,517 | 1,020,252 | 1,928,694 | (424,178 | ) | 890,991 | ||||||||||||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 36,267,568 | $ | 1,199,168 | $ | 2,483,468 | $ | (396,232 | ) | $ | 1,040,409 | |||||||||

| (a) | Fund commenced operations on January 16, 2018. |

| (b) | Fund commenced operations on June 4, 2018. |

| (c) | Fund commenced operations on June 13, 2018. |

The accompanying notes are an integral part of the financial statements.

| 15 |

Amplify ETF Trust

Statements of Operations

For the Period Ended April 30, 2019 (Unaudited)

Amplify | Amplify | |||||||

| Investment Income: | ||||||||

| Dividend Income (Net of Foreign Withholding Tax of $0, $93, respectively) | $ | — | $ | 1,542 | ||||

| Interest Income | 742,318 | 48 | ||||||

| Total Investment Income | 742,318 | 1,590 | ||||||

| Expenses: | ||||||||

| Advisory Fees | 140,859 | 4,565 | ||||||

| Total Expenses | 140,859 | 4,565 | ||||||

| Net Investment Income (Loss) | 601,459 | (2,975 | ) | |||||

| Realized and Unrealized Gain (Loss): | ||||||||

| Net Realized Gain (Loss) on: | ||||||||

| Investments | (124,186 | ) | 54,022 | |||||

| Foreign Currency | — | 517 | ||||||

| Net Change in Unrealized Appreciation on: | ||||||||

| Investments | 4,920,383 | 284,473 | ||||||

| Net Realized and Unrealized Gain | 4,796,197 | 339,012 | ||||||

| Net Increase in Net Assets Resulting from Operations | $ | 5,397,656 | $ | 336,037 | ||||

| (a) | Fund commenced operations on November 5, 2018. |

| (b) | Fund commenced operations on January 29, 2019. |

The accompanying notes are an integral part of the financial statements.

| 16 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify Online Retail ETF | ||||||||

| Six-Months Ended April 30, 2019 (Unaudited) | Year Ended October 31, 2018 | |||||||

| Operations: | ||||||||

| Net Investment Loss | $ | (83,949 | ) | $ | (1,168,710 | ) | ||

| Net Realized Gain (Loss) on Investments and Foreign Currency | 3,527,902 | 41,465,768 | ||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency | 32,823,615 | (40,918,130 | ) | |||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | 36,267,568 | (621,072 | ) | |||||

| Capital Share Transactions: | ||||||||

| Subscriptions | 25,305,035 | 419,059,730 | ||||||

| Redemptions | (142,513,445 | ) | (156,288,880 | ) | ||||

| Increase in Net Assets from Capital Share Transactions | (117,208,410 | ) | 262,770,850 | |||||

| Total Increase (Decrease) in Net Assets | (80,940,842 | ) | 262,149,778 | |||||

| Net Assets: | ||||||||

| Beginning of Period | 370,631,895 | 108,482,117 | ||||||

| End of Period | $ | 289,691,053 | $ | 370,631,895 | ||||

| Share Transactions: | ||||||||

| Subscriptions | 600,000 | 9,050,000 | ||||||

| Redemptions | (3,400,000 | ) | (3,500,000 | ) | ||||

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | (2,800,000 | ) | 5,550,000 | |||||

The accompanying notes are an integral part of the financial statements.

| 17 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify CWP Enhanced Dividend Income ETF | ||||||||

| Six-Months Ended April 30, 2019 (Unaudited) | Year Ended October 31, 2018 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 178,916 | $ | 216,721 | ||||

| Net Realized Gain on Investments and Options Written | 746,435 | 427,576 | ||||||

| Net Change in Unrealized Appreciation on Investments and Options Written | 273,817 | 373,331 | ||||||

| Net Increase in Net Assets Resulting from Operations | 1,199,168 | 1,017,628 | ||||||

| Distributions to Shareholders: | ||||||||

| Dividends and Distributions | (479,442 | ) | (646,297 | ) | ||||

| Return of Capital | — | (107,770 | ) | |||||

| Total Distributions | (479,442 | ) | (754,067 | ) | ||||

| Capital Share Transactions: | ||||||||

| Subscriptions | 4,403,705 | 4,400,665 | ||||||

| Increase in Net Assets from Capital Share Transactions | 4,403,705 | 4,400,665 | ||||||

| Total Increase in Net Assets | 5,123,431 | 4,664,226 | ||||||

| Net Assets: | ||||||||

| Beginning of Period | 15,680,384 | 11,016,158 | ||||||

| End of Period | $ | 20,803,815 | $ | 15,680,384 | ||||

| Share Transactions: | ||||||||

| Subscriptions | 150,000 | 150,000 | ||||||

| Net Increase in Shares Outstanding from Share Transactions | 150,000 | 150,000 | ||||||

The accompanying notes are an integral part of the financial statements.

| 18 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify Transformational Data Sharing ETF | ||||||||

| Six-Months Ended April 30, 2019 (Unaudited) | Period Ended | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 554,774 | $ | 1,149,723 | ||||

| Net Realized Gain (Loss) on Investments | (14,789,067 | ) | 1,602,143 | |||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments | 16,717,761 | (29,643,294 | ) | |||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,483,468 | (26,891,428 | ) | |||||

| Distributions to Shareholders: | ||||||||

| Dividends and Distributions | (1,276,455 | ) | — | |||||

| Total Distributions | (1,276,455 | ) | — | |||||

| Capital Share Transactions: | ||||||||

| Subscriptions | 847,845 | 213,529,655 | ||||||

| Redemptions | (23,346,270 | ) | (54,896,875 | ) | ||||

| Transaction Fees (See Note 1) | 35,061 | 20,795 | ||||||

| Increase (Decrease) in Net Assets from Capital Share Transactions | (22,463,364 | ) | 158,653,575 | |||||

| Total Increase (Decrease) in Net Assets | (21,256,351 | ) | 131,762,147 | |||||

| Net Assets: | ||||||||

| Beginning of Period | 131,762,147 | — | ||||||

| End of Period | $ | 110,505,796 | $ | 131,762,147 | ||||

| Share Transactions: | ||||||||

| Subscriptions | 50,000 | 10,350,000 | ||||||

| Redemptions | (1,450,000 | ) | (2,800,000 | ) | ||||

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | (1,400,000 | ) | 7,550,000 | |||||

| (a) | The Fund commenced operations on January 16, 2018. |

The accompanying notes are an integral part of the financial statements.

| 19 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify Advanced Battery Metals and Materials ETF | ||||||||

| Six-Months Ended April 30, 2019 (Unaudited) | Period Ended | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 27,946 | $ | 55,558 | ||||

| Net Realized Loss on Investments | (616,748 | ) | (230,819 | ) | ||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments | 192,570 | (2,683,545 | ) | |||||

| Net Decrease in Net Assets Resulting from Operations | (396,232 | ) | (2,858,806 | ) | ||||

| Distributions to Shareholders: | ||||||||

| Dividends and Distributions | (46,593 | ) | — | |||||

| Total Distributions | (46,593 | ) | — | |||||

| Capital Share Transactions: | ||||||||

| Subscriptions | — | 9,290,765 | ||||||

| Redemptions | (662,965 | ) | — | |||||

| Transaction Fees (See Note 1) | 2,334 | 3,393 | ||||||

| Increase (Decrease) in Net Assets from Capital Share Transactions | (660,631 | ) | 9,294,158 | |||||

| Total Increase (Decrease) in Net Assets | (1,103,456 | ) | 6,435,352 | |||||

| Net Assets: | ||||||||

| Beginning of Period | 6,435,352 | — | ||||||

| End of Period | $ | 5,331,896 | $ | 6,435,352 | ||||

| Share Transactions: | ||||||||

| Subscriptions | — | 500,000 | ||||||

| Redemptions | (50,000 | ) | — | |||||

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | (50,000 | ) | 500,000 | |||||

| (a) | The Fund commenced operations on June 4, 2018. |

The accompanying notes are an integral part of the financial statements.

| 20 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify EASI Tactical Growth ETF | ||||||||

| Six-Months Ended April 30, 2019 (Unaudited) | Period Ended | |||||||

| Operations: | ||||||||

| Net Investment Income (Loss) | $ | 149,418 | $ | (3,267 | ) | |||

| Net Realized Gain (Loss) on Investments | 291,422 | (900,980 | ) | |||||

| Net Change in Unrealized Appreciation on Investments | 599,569 | 19,597 | ||||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,040,409 | (884,650 | ) | |||||

| Distributions to Shareholders: | ||||||||

| Dividends and Distributions | (64,813 | ) | — | |||||

| Total Distributions | (64,813 | ) | — | |||||

| Capital Share Transactions: | ||||||||

| Subscriptions | 20,689,495 | 16,436,350 | ||||||

| Redemptions | (8,510,740 | ) | (2,471,285 | ) | ||||

| Increase in Net Assets from Capital Share Transactions | 12,178,755 | 13,965,065 | ||||||

| Total Increase in Net Assets | 13,154,351 | 13,080,415 | ||||||

| Net Assets: | ||||||||

| Beginning of Period | 13,080,415 | — | ||||||

| End of Period | $ | 26,234,766 | $ | 13,080,415 | ||||

| Share Transactions: | ||||||||

| Subscriptions | 850,000 | 650,000 | ||||||

| Redemptions | (350,000 | ) | (100,000 | ) | ||||

| Net Increase in Shares Outstanding from Share Transactions | 500,000 | 550,000 | ||||||

| (a) | The Fund commenced operations on June 13, 2018. |

The accompanying notes are an integral part of the financial statements.

| 21 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify BlackSwan Growth & Treasury Core ETF | ||||

Period Ended | ||||

| Operations: | ||||

| Net Investment Income | $ | 601,459 | ||

| Net Realized Loss on Investments | (124,186 | ) | ||

| Net Change in Unrealized Appreciation on Investments | 4,920,383 | |||

| Net Increase in Net Assets Resulting from Operations | 5,397,656 | |||

| Distributions to Shareholders: | ||||

| Dividends and Distributions | (486,081 | ) | ||

| Total Distributions | (486,081 | ) | ||

| Capital Share Transactions: | ||||

| Subscriptions | 70,125,395 | |||

| Increase in Net Assets from Capital Share Transactions | 70,125,395 | |||

| Total Increase in Net Assets | 75,036,970 | |||

| Net Assets: | ||||

| Beginning of Period | — | |||

| End of Period | $ | 75,036,970 | ||

| Share Transactions: | ||||

| Subscriptions | 2,800,000 | |||

| Net Increase in Shares Outstanding from Share Transactions | 2,800,000 | |||

| (a) | The Fund commenced operations on November 5, 2018. |

The accompanying notes are an integral part of the financial statements.

| 22 |

Amplify ETF Trust

Statements of Changes in Net Assets

| Amplify International Online Retail ETF | ||||

Period Ended | ||||

| Operations: | ||||

| Net Investment Loss | $ | (2,975 | ) | |

| Net Realized Gain on Investments and Foreign Currency | 54,539 | |||

| Net Change in Unrealized Appreciation on Investments and Foreign Currency | 284,473 | |||

| Net Decrease in Net Assets Resulting from Operations | 336,037 | |||

| Capital Share Transactions: | ||||

| Subscriptions | 2,500,000 | |||

| Transaction Fees | 297 | |||

| Increase in Net Assets from Capital Share Transactions | 2,500,297 | |||

| Total Increase in Net Assets | 2,836,334 | |||

| Net Assets: | ||||

| Beginning of Period | — | |||

| End of Period | $ | 2,836,334 | ||

| Share Transactions: | ||||

| Subscriptions | 100,000 | |||

| Net Increase in Shares Outstanding from Share Transactions | 100,000 | |||

| (a) | The Fund commenced operations on January 29, 2019. |

The accompanying notes are an integral part of the financial statements.

| 23 |

Amplify ETF Trust

Amplify Online Retail ETF

Financial Highlights

| Six-Months Ended April 30, 2019 (Unaudited) | Year Ended October 31, 2018 | Year Ended October 31, 2017 | Period Ended | |||||||||||||

| Net Asset Value, Beginning of Year/Period | $ | 43.86 | $ | 37.41 | $ | 27.18 | $ | 25.00 | ||||||||

| Income (Loss) from Investment Operations: | ||||||||||||||||

| Net Investment Loss(b) | (0.01 | ) | (0.17 | ) | (0.13 | ) | (0.05 | ) | ||||||||

| Net Realized and Unrealized Gain | 7.42 | 6.62 | (c) | 10.36 | (d) | 2.23 | ||||||||||

| Total from Investment Operations | 7.41 | 6.45 | 10.23 | 2.18 | ||||||||||||

| Net Asset Value, End of Year/Period | $ | 51.27 | $ | 43.86 | $ | 37.41 | $ | 27.18 | ||||||||

| Total Return on Net Asset Value(e) | 16.90 | % | 17.25 | % | 37.64 | %(f) | 8.71 | %(i) | ||||||||

| Supplemental Data: | ||||||||||||||||

| Net Assets, End of Year/Period (000’s) | $ | 289,691 | $ | 370,632 | $ | 108,482 | $ | 4,077 | ||||||||

| Ratio of Expenses to Average Net Assets | 0.65 | %(g) | 0.65 | % | 0.65 | % | 0.65 | %(g) | ||||||||

| Ratio of Net Investment Loss to Average Net Assets | -0.06 | %(g) | -0.35 | % | -0.38 | % | -0.34 | %(g) | ||||||||

| Portfolio Turnover(h) | 21 | %(i) | 17 | % | 11 | % | 8 | %(i) | ||||||||

| (a) | The Fund commenced operations on April 19, 2016. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period and may not reconcile with the aggregate gains and losses in the statement of operations due to share transactions for the year. |

| (d) | Includes a $0.01 gain derived from a payment from affiliate. See Note 5. |

| (e) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (f) | Before payment from affiliate for the loss resulting from a trade error, the total return for the period would have been 37.63%. See Note 5. |

| (g) | Annualized. |

| (h) | Excludes the impact of in-kind transactions. |

| (i) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 24 |

Amplify ETF Trust

Amplify CWP Enhanced Dividend Income ETF

Financial Highlights

| Six-Months Ended April 30, 2019 (Unaudited) | Year Ended October 31, 2018 | Period Ended | ||||||||||

| Net Asset Value, Beginning of Period | $ | 28.51 | $ | 27.54 | $ | 25.00 | ||||||

| Income from Investment Operations: | ||||||||||||

| Net Investment Income(b) | 0.30 | 0.45 | 0.39 | |||||||||

| Net Realized and Unrealized Gain | 1.69 | 2.02 | 2.92 | |||||||||

| Total from Investment Operations | 1.99 | 2.47 | 3.31 | |||||||||

| Distributions to Shareholders | ||||||||||||

| Net Investment Income | (0.78 | ) | (1.29 | ) | (0.57 | ) | ||||||

| Return of Capital | — | (0.21 | ) | (0.20 | ) | |||||||

| Total from Distributions | (0.78 | ) | (1.50 | ) | (0.77 | ) | ||||||

| Net Asset Value, End of Year/Period | $ | 29.72 | $ | 28.51 | $ | 27.54 | ||||||

| Total Return on Net Asset Value(c) | 7.09 | % | 9.12 | % | 13.40 | %(f) | ||||||

| Supplemental Data: | ||||||||||||

| Net Assets, End of Year/Period (000’s) | $ | 20,804 | $ | 15,680 | $ | 11,016 | ||||||

| Ratio of Expenses to Average Net Assets (Before Advisory Fees Waived) | 0.95 | %(d) | 0.95 | % | N/A | |||||||

| Ratio of Expenses to Average Net Assets (After Advisory Fees Waived) | 0.49 | %(d) | 0.94 | % | 0.95 | %(d) | ||||||

| Ratio of Net Investment Income to Average Net Assets (Before Advisory Fees Waived) | 1.63 | %(d) | 1.53 | % | N/A | |||||||

| Ratio of Net Investment Income to Average Net Assets (After Advisory Fees Waived) | 2.09 | %(d) | 1.54 | % | 1.67 | %(d) | ||||||

| Portfolio Turnover(e) | 67 | %(f) | 151 | % | 187 | %(f) | ||||||

| (a) | The Fund commenced operations on December 13, 2016. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (d) | Annualized. |

| (e) | Excludes the impact of in-kind transactions. |

| (f) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 25 |

Amplify ETF Trust

Amplify Transformational Data Sharing ETF

Financial Highlights

| Six-Months Ended April 30, 2019 (Unaudited) | Period Ended | |||||||

| Net Asset Value, Beginning of Period | $ | 17.45 | $ | 20.00 | ||||

| Income (Loss) from Investment Operations: | ||||||||

| Net Investment Income(b) | 0.08 | 0.14 | ||||||

| Net Realized and Unrealized Gain (Loss) | 0.62 | (2.69 | )(c) | |||||

| Total from Investment Operations | 0.70 | (2.55 | ) | |||||

| Distributions to Shareholders | ||||||||

| Net Investment Income | (0.19 | ) | — | |||||

| Total from Distributions | (0.19 | ) | — | |||||

| Capital Share Transactions | ||||||||

| Transaction Fees | 0.01 | — | (d) | |||||

| Net Asset Value, End of Period | $ | 17.97 | $ | 17.45 | ||||

| Total Return on Net Asset Value(e) | 4.29 | % | -12.74 | %(f)(i) | ||||

| Supplemental Data: | ||||||||

| Net Assets, End of Period (000’s) | $ | 110,506 | $ | 131,762 | ||||

| Ratio of Expenses to Average Net Assets (Before Advisory Fees Waived) | 0.90 | %(g) | 0.90 | %(g) | ||||

| Ratio of Expenses to Average Net Assets (After Advisory Fees Waived) | 0.70 | %(g) | 0.70 | %(g) | ||||

| Ratio of Net Investment Income to Average Net Assets (Before Advisory Fees Waived) | 0.80 | %(g) | 0.68 | %(g) | ||||

| Ratio of Net Investment Income to Average Net Assets (After Advisory Fees Waived) | 1.00 | %(g) | 0.88 | %(g) | ||||

| Portfolio Turnover(h) | 18 | %(i) | 44 | %(i) | ||||

| (a) | The Fund commenced operations on January 16, 2018. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Includes a less than $0.01 gain per share derived from payment from an affiliate. See Note 5. |

| (d) | Less than 0.005. |

| (e) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (f) | Before payment from affiliate for the loss resulting from trade error, the total return for the period would have been -12.74%. See Note 5. |

| (g) | Annualized. |

| (h) | Excludes the impact of in-kind transactions. |

| (i) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 26 |

Amplify ETF Trust

Amplify Advanced Battery Metals and Materials ETF

Financial Highlights

| Six-Months Ended April 30, 2019 (Unaudited) | Period Ended | |||||||

| Net Asset Value, Beginning of Period | $ | 12.87 | $ | 20.00 | ||||

| Income (Loss) from Investment Operations: | ||||||||

| Net Investment Income(b) | 0.06 | 0.13 | ||||||

| Net Realized and Unrealized Loss | (0.99 | ) | (7.27 | )(c) | ||||

| Total from Investment Operations | (0.93 | ) | (7.14 | ) | ||||

| Distributions to Shareholders | ||||||||

| Net Investment Income | (0.10 | ) | — | |||||

| Total from Distributions | (0.10 | ) | — | |||||

| Capital Share Transactions | ||||||||

| Transaction Fees | 0.01 | 0.01 | ||||||

| Net Asset Value, End of Period | $ | 11.85 | $ | 12.87 | ||||

| Total Return on Net Asset Value(d) | -7.12 | % | -35.65 | %(e)(h) | ||||

| Supplemental Data: | ||||||||

| Net Assets, End of Period (000’s) | $ | 5,332 | $ | 6,435 | ||||

| Ratio of Expenses to Average Net Assets (Before Advisory Fees Waived) | 0.92 | %(f) | 0.92 | %(f) | ||||

| Ratio of Expenses to Average Net Assets (After Advisory Fees Waived) | 0.72 | %(f) | 0.72 | %(f) | ||||

| Ratio of Net Investment Income to Average Net Assets (Before Advisory Fees Waived) | 0.76 | %(f) | 1.82 | %(f) | ||||

| Ratio of Net Investment Income to Average Net Assets (After Advisory Fees Waived) | 0.96 | %(f) | 2.02 | %(f) | ||||

| Portfolio Turnover(g) | 35 | %(h) | 12 | %(h) | ||||

| (a) | The Fund commenced operations on June 4, 2018. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Includes a less than $0.01 gain per share derived from payment from an affiliate. See Note 5. |

| (d) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (e) | Before payment from affiliate for the loss resulting from trade error, the total return for the period would have been -35.65%. See Note 5. |

| (f) | Annualized. |

| (g) | Excludes the impact of in-kind transactions. |

| (h) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 27 |

Amplify ETF Trust

Amplify EASI Tactical Growth ETF

Financial Highlights

| Six-Months Ended April 30, 2019 (Unaudited) | Period Ended | |||||||

| Net Asset Value, Beginning of Period | $ | 23.78 | $ | 25.00 | ||||

| Income (Loss) from Investment Operations: | ||||||||

| Net Investment Income(b) | 0.21 | — | (c) | |||||

| Net Realized and Unrealized Gain (Loss) | 1.10 | (1.22 | ) | |||||

| Total from Investment Operations | 1.31 | (1.22 | ) | |||||

| Distributions to Shareholders | ||||||||

| Net Investment Income | (0.10 | ) | — | |||||

| Total from Distributions | (0.10 | ) | — | |||||

| Net Asset Value, End of Period | $ | 24.99 | $ | 23.78 | ||||

| Total Return on Net Asset Value(d) | 5.50 | % | -4.87 | %(g) | ||||

| Supplemental Data: | ||||||||

| Net Assets, End of Period (000’s) | $ | 26,235 | $ | 13,080 | ||||

| Ratio of Expenses to Average Net Assets | 0.75 | %(e) | 0.75 | %(e) | ||||

| Ratio of Net Investment Income to Average Net Assets | 1.77 | %(e) | 0.03 | %(e) | ||||

| Portfolio Turnover(f) | 126 | %(g) | 289 | %(g) | ||||

| (a) | The Fund commenced operations on June 13, 2018. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Less than $0.005 |

| (d) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (e) | Annualized. |

| (f) | Excludes the impact of in-kind transactions. |

| (g) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 28 |

Amplify ETF Trust

Amplify BlackSwan Growth & Treasury Core ETF

Financial Highlights

Period Ended | ||||

| Net Asset Value, Beginning of Period | $ | 25.00 | ||

| Income from Investment Operations: | ||||

| Net Investment Income(b) | 0.26 | |||

| Net Realized and Unrealized Gain | 1.73 | |||

| Total from Investment Operations | 1.99 | |||

| Distributions to Shareholders | ||||

| Net Investment Income | (0.19 | ) | ||

| Total from Distributions | (0.19 | ) | ||

| Net Asset Value, End of Period | $ | 26.80 | ||

| Total Return on Net Asset Value(c) | 8.01 | % | ||

| Supplemental Data: | ||||

| Net Assets, End of Period (000’s) | $ | 75,037 | ||

| Ratio of Expenses to Average Net Assets | 0.49 | %(d) | ||

| Ratio of Net Investment Income to Average Net Assets | 2.09 | %(d) | ||

| Portfolio Turnover (e) | 82 | %(f) | ||

| (a) | The Fund commenced operations on November 5, 2018. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (d) | Annualized. |

| (e) | Excludes the impact of in-kind transactions. |

| (f) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 29 |

Amplify ETF Trust

Amplify International Online Retail ETF

Financial Highlights

Period

Ended | ||||

| Net Asset Value, Beginning of Period | $ | 25.00 | ||

| Income (Loss) from Investment Operations: | ||||

| Net Investment Income Loss(b) | (0.03 | ) | ||

| Net Realized and Unrealized Gain | 3.39 | |||

| Total from Investment Operations | 3.36 | |||

| Net Asset Value, End of Period | $ | 28.36 | ||

| Total Return on Net Asset Value(c) | 13.45 | % | ||

| Supplemental Data: | ||||

| Net Assets, End of Period (000’s) | $ | 2,836 | ||

| Ratio of Expenses to Average Net Assets | 0.69 | %(d) | ||

| Ratio of Net Investment Loss to Average Net Assets | -0.45 | %(d) | ||

| Portfolio Turnover(e) | 13 | %(f) | ||

| (a) | The Fund commenced operations on January 29, 2019. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| (d) | Annualized. |

| (e) | Excludes the impact of in-kind transactions. |

| (f) | Not Annualized. |

The accompanying notes are an integral part of the financial statements.

| 30 |

Amplify ETF Trust

Notes to the Financial Statement

April 30, 2019 (Unaudited)

| 1. | ORGANIZATION |

Amplify ETF Trust (the “Trust”) was organized as a Massachusetts business trust on January 6, 2015, and is authorized to issue an unlimited number of shares in one or more series of funds. The Trust is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust consists of seven non-diversified funds, Amplify Online Retail ETF (“IBUY”), Amplify CWP Enhanced Dividend Income ETF formerly Amplify YieldShares CWP Dividend & Option Income ETF (“DIVO”), Amplify Transformational Data Sharing ETF (“BLOK”), Amplify Advanced Battery Metals and Materials ETF (“BATT”), Amplify EASI Tactical Growth ETF (“EASI”), Amplify BlackSwan Growth & Treasury Core ETF (“SWAN”) and Amplify International Online Retail ETF (“XBUY”) (each the “Fund” and collectively the “Funds”). Each Fund represents a beneficial interest in a separate portfolio of securities and other assets, with their own investment objectives and policies.

The investment objective of IBUY is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the EQM Online Retail Index. IBUY commenced operations on April 19, 2016. The investment objective of DIVO is to seek to provide current income as its primary objective and capital appreciation as its secondary objective. DIVO commenced operations on December 13, 2016. The investment objective of BLOK is to seek to provide investors with total return. BLOK commenced operations on January 16, 2018. The investment objective of BATT is to seek to provide investors with total return. BATT commenced operations on June 4, 2018. The investment objective of EASI is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the EASI Tactical Growth Index. EASI commenced operations on June 13, 2018. The investment objective of SWAN is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the S-Network BlackSwan Core Total Return Index. SWAN commenced operations on November 5, 2018. The investment objective of XBUY is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the EQM International Ecommerce Index.

IBUY lists and principally trade its shares on The Nasdaq Stock Market® LLC (“Nasdaq”), and DIVO, BLOK, BATT, EASI, SWAN and XBUY list and principally trade their shares on the New York Stock Exchange (“NYSE”) (each an “Exchange” and collectively, the “Exchanges”). Shares of the Funds trade on the Exchanges at market prices that may be below, at, or above the Funds’ net asset value (“NAV”). The Funds will issue and redeem shares on a continuous basis at NAV only in large blocks of shares, typically 50,000 shares, called “Creation Units.” Creation Units will be issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally will trade in the secondary market at market prices that change throughout the day in amounts less than a Creation Unit. Except when aggregated in Creation Units, shares are not redeemable securities of a Fund. Shares of a Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with Quasar Distributors, LLC (“the Distributor”). Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Funds. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

Each Fund currently offers one class of shares, which has no front end sales load, no deferred sales charge, and no redemption fee. A purchase or redemption (i.e. creation or redemption) transaction fee of $500 is imposed for the transfer and other transaction costs associated with the purchase or redemption of Creation Units for IBUY, DIVO, and BLOK. A purchase or redemption transaction fee of $1,000 is imposed for BATT. A purchase or redemption transaction fee of $250 is imposed for EASI and SWAN. A purchase or redemption transaction fee of $750 is imposed for XBUY. The Funds may issue an unlimited number of shares of beneficial interest, with par value of $0.01 per share. All shares of the Funds have equal rights and privileges.

| 31 |

Amplify ETF Trust

Notes to the Financial Statement

April 30, 2019 (Unaudited) (Continued)

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

SECURITY VALUATION

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The following describes the levels of the fair value hierarchy:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date;

Level 2 – Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity)

The valuation techniques used by the Funds to measure fair value for the period ended April 30, 2019 maximized the use of observable inputs and minimized the use of unobservable inputs.

For the period ended April 30, 2019, there have been no significant changes to the Funds’ fair valuation methodologies.

Common stocks, preferred stock, and other equity securities listed on any national or foreign exchange (excluding Nasdaq) and the London Stock Exchange Alternative Investment Market (“AIM”) will be valued at the last price on the exchange on which they are principally traded or, for Nasdaq and AIM securities, the official closing price. Securities traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the exchange representing the principal market for such securities. Foreign securities and other assets denominated in foreign currencies are translated into U.S. dollars at the current exchange rate, which approximates fair value. Redeemable securities issued by open-end investment companies shall be valued at the investment company’s applicable NAV, with the exception of exchange-traded open-end investment companies which are priced as equity securities. Exchange-traded options will be valued at the current mean price where such contracts are principally traded. Futures contracts will be valued at the settlement price. Securities traded in the over-the-counter market are valued at the mean of the bid and the asked price, if available, and otherwise at their closing bid price. Fixed income securities will be valued using the mean price.

If no quotation is available from either a pricing service, or one or more brokers or if the pricing committee has reason to question the reliability or accuracy of a quotation supplied, securities are valued at fair value as determined in good faith by the pricing committee, pursuant to procedures established under the general supervision and responsibility of the Fund’s Board of Trustees (the “Board”).

| 32 |

Amplify ETF Trust

Notes to the Financial Statement

April 30, 2019 (Unaudited) (Continued)