Form N-CSRS ADVISORS SERIES TRUST For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, Wisconsin 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Douglas G. Hess, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 5th Floor

Milwaukee, Wisconsin 53202

(Name and address of agent for service)

(Name and address of agent for service)

(Registrant's telephone number, including area code): (414) 765-6872

Date of fiscal year end: October 31, 2018

Date of reporting period: April 30, 2018

Item 1. Reports to Stockholders.

HUBER CAPITAL EQUITY INCOME FUND

HUBER CAPITAL SMALL CAP VALUE FUND

HUBER CAPITAL DIVERSIFIED

LARGE CAP VALUE FUND

HUBER CAPITAL MID CAP VALUE FUND

Investor Class

Institutional Class

SEMI-ANNUAL REPORT

April 30, 2018

Huber Funds

TABLE OF CONTENTS

|

Letter to Shareholders

|

1

|

|

Expense Example

|

7

|

|

Sector Allocation of Portfolio Assets

|

10

|

|

Schedule of Investments

|

12

|

|

Statements of Assets And Liabilities

|

26

|

|

Statements of Operations

|

30

|

|

Statements of Changes in Net Assets

|

32

|

|

Financial Highlights

|

40

|

|

Notes to Financial Statements

|

48

|

|

Notice to Shareholders

|

62

|

|

Approval of Investment Advisory Agreement

|

63

|

|

Householding

|

71

|

|

Privacy Notice

|

72

|

May 31, 2018

Dear Shareholder:

The fiscal six-month period ended April 30, 2018, was dominated by large cap growth companies, as seen in outperformance of the Russell 1000® Growth Index. This is similar to 2017, however the last six months saw a rebound in commodity prices, making energy the strongest performing sector in both the Russell 1000® Value and Russell 2000® Value Indices, while technology led the Russell 1000® Growth Index. Despite growth outperforming, we continue to believe value will return to favor should commodity prices and equity valuations continue normalizing.

During the six-months ended April 30, 2018, the Huber Capital Equity Income Fund (“Equity Income Fund”) and Huber Capital Diversified Large Cap Value Fund (“Diversified Large Cap Value Fund”) both underperformed the Russell 1000® Value Index, their primary benchmark. The Huber Capital Small Cap Value Fund (“Small Cap Value Fund”) outperformed the Russell 2000® Value Index, the Fund’s primary benchmark. The Huber Capital Mid Cap Value Fund (“Mid Cap Value Fund”) outperformed the Russell Midcap® Value Index, its primary benchmark.

Equity Income Fund Review

For the fiscal six-month period ended April 30, 2018, the Equity Income Fund Investor Class and Institutional Class returned -0.19% and -0.05%, respectively, underperforming the 1.94% total return of the Russell 1000® Value Index and the 3.82% total return of the S&P 500® Index. The sectors that contributed most positively to the Fund’s performance relative to the benchmark Russell 1000® Value Index were technology, utilities and health care, while energy, producer durables and consumer discretionary were the largest detractors. On an individual stock basis, our best relative performers were Microsoft Corp. (“Microsoft”), Regal Entertainment Group – Class A (“Regal Entertainment”) and Voya Financial, Inc. (“Voya”), while our worst performers were KBR, Inc. (“KBR”), Philip Morris International, Inc. (“Philip Morris”) and Tupperware Brands Corporation (“Tupperware Brands”).

The Equity Income Fund was most positively impacted by its ownership of Microsoft, a company engaged in developing, licensing and supporting software products and services. Microsoft’s cloud service business executed well. In general, the company continued to transition from lower growth legacy desktop and Windows products into the high growth Intelligent Cloud segment, specifically their Azure product offering, which continued to grow rapidly and capture market share. The share price of Regal Entertainment, a position we initiated in the Fund during the latter half of 2017, benefitted from the company’s merger with Cineworld. We have since exited the position following its strong performance. Voya, a financial planning and insurance company,

1

demonstrated strong cash flow generation, which was deployed towards a new share repurchase program, a move viewed favorably by investors.

The Equity Income Fund was most negatively impacted by its ownership in KBR, a construction and engineering company. The share price declined despite strong earnings, as the company was required to contribute cash to a joint venture in order to fund completion of a power plant project. Its stock price also reacted negatively when the company announced they may issue equity to finance an acquisition. Philip Morris, a holding company engaged in tobacco and cigarette manufacturing, reported disappointing 1Q18 results that showed slowing growth of its key IQOS product in Japan. This caused investors to downgrade their assessment of the company’s future growth rate and therefore its valuation. We view the investor reaction as overly severe and view the shares attractively. Tupperware Brands, a global producer and marketer of kitchen storage containers, experienced share price weakness due to lower than expected organic growth rates.

Small Cap Value Fund Review

For the fiscal six-month period ended April 30, 2018, the Small Cap Value Fund Investor Class and Institutional Class returned 6.71% and 6.90%, respectively. The Fund outperformed the 0.94% total return of the Russell 2000® Value Index benchmark and the 3.27% total return of the Russell 2000® Index. Sectors that contributed most positively to the Fund’s performance relative to the benchmark Russell 2000® Value Index were technology, financial services and materials & processing, while the most notable detractors were consumer discretionary and producer durables. The most notable contributors to relative performance were Comtech Telecommunications Corp. (“Comtech”), Enova International Inc. (“Enova”) and Golar LNG Ltd. (“GLNG”). The Fund’s most notable detractors from relative performance were KBR, Tupperware Brands and Government Properties Income Trust.

The Fund was most positively impacted by its ownership of Comtech Telecommunications, a communications solutions provider for military and civilian applications. Comtech Telecommunications reported strong operating results and increased guidance after securing large contracts with the U.S. Army and a large domestic wireless carrier (Wireless E911). We believe the company’s outlook for future revenue and earnings growth remains positive on the heels of these new contract wins. The share price of Enova, a leading provider of online financial services to consumers and small businesses, increased after the company announced better than expected cost containment and loan originations. In addition to stronger business fundamentals, the regulatory environment appears to be improving, as certain aspects of Dodd-Frank appear likely to be overturned by Senate Bill 2155, creating a potential tailwind for Enova. Golar LNG Ltd., a master limited partnership that owns and operates Floating Storage Regasification Units (FSRU’s), LNG Carriers

2

(LNGC’s), and Floating Liquefaction Units (FLNG’s), had favorable performance due to their multiyear contracted backlog and soon to be completed dropdown of the Hilli Episeyo, an FLNG vessel.

The Fund was negatively impacted the most by its ownership in KBR and Tupperware Brands, both discussed earlier in this letter. Government Income Properties Trust, a real estate investment trust (“REIT”) which invests primarily in properties on long-term lease to government tenants, was impacted by rising rates which cause some REITs to underperform. The company generated an attractive dividend yield above 10%.

Diversified Large Cap Value Fund Review

For the fiscal six-month period ended April 30, 2018, the Diversified Large Cap Value Fund Investor Class and Institutional Class returned 0.40% and 0.55%, respectively, underperforming the 1.94% total return of the Russell 1000® Value Index, and underperforming the 3.82% total return of the broader S&P 500® Index. Sectors that contributed most positively to the Fund’s performance relative to the benchmark Russell 1000® Value Index were utilities, health care and technology, while energy, producer durables and consumer discretionary were the most notable detractors. Stocks that were most accretive to relative performance were Microsoft, JPMorgan Chase & Co. (“JPMorgan Chase”) and Bank of America Corp. (“Bank of America”). The most notable detractors were KBR, Phillip Morris and Arconic, Inc. (“Arconic”).

The Fund’s strongest positive contributor, Microsoft, was discussed earlier in this letter. JPMorgan Chase and Bank of America, multinational financial services companies, posted strong performance due to an improving regulatory environment and rising interest rates.

The Fund’s largest detractors, KBR and Phillip Morris, were discussed earlier in this letter. Arconic, a spin-off from Alcoa that is engaged in lightweight metals engineering and manufacturing, declined as operational issues at several facilities impacted profitability despite generally strong end-market demand. Although recent quarterly results were better than expected, the company lowered full-year guidance for earnings and free cash flow.

Mid Cap Value Fund Review

For the fiscal six-month period ended April 30, 2018, the Mid Cap Value Fund Investor Class and Institutional Class returned 7.66% and 7.82%, respectively, versus the 2.55% total return of the Russell Midcap® Value Index. The sectors that contributed most positively to the Fund’s performance relative to the benchmark Russell Midcap® Value Index were technology, materials & processing and financial services, while the sectors that detracted the most from relative performance were producer durables and consumer discretionary. Stocks that were most additive to relative performance were Comtech Telecommunications,

3

Enova International and HighPoint Resources Corp. (“HighPoint Resources”). Stocks that detracted the most from relative performance were KBR, Tupperware Brands and Government Properties Income Trust.

The Fund’s largest positive contributors, Comtech Telecommunications and Enova, were discussed earlier in this letter. HighPoint Resources, an exploration and production company focused on developing oil and natural gas assets in the U.S., benefited from completing the acquisition of Fifth Creek Energy during the period, which led to increased guidance for the year.

The Fund was negatively impacted the most by its ownership in KBR, Tupperware Brands and Government Properties Income Trust, all discussed earlier in this letter.

Outlook

Following a strong 2017, equities continued advancing in 2018, despite some downside volatility in February and March. In terms of style, growth outpaced value, yet we remain steadfast in the long-term outlook of our deep value philosophy. Though equity valuations appear stretched due to improving macroeconomic trends and earnings growth, we believe tailwinds for equities will continue in the near-term. Huber Capital Management is of the opinion that the end of the complacency cycle is near. It remains to be seen what the rest of the year will bring, as the anticipated rate hikes and trade-war discussions continue.

Huber Capital Management is optimistic with respect to its Funds. Despite a generally upward market over the past three years, which created a headwind for active managers, the team remains committed to Huber Capital’s philosophy and process, populating its Funds with companies we believe embody meaningful upside potential and tangible valuation support. It continues to be our view that a company’s valuation ultimately reverts to reflect its normalized cash generation capabilities and that investing in companies trading at a discount to normalized earnings should produce superior risk-adjusted returns over time.

Consistent with our value philosophy, we strive to generate outperformance through fundamental bottom-up investing, rather than betting on macroeconomic factors. In our view, benchmarks have become price momentum strategies, a trend exacerbated by the shift to passive investing, and index sector weights often fail to reflect factor weights in the broader economy. Furthermore, frequently used classification schema (i.e., GICS) may assign companies to sectors which, we believe, do not accurately reflect the company’s primary exposure. For this reason, although we maintain macroeconomic factor neutrality, we may at certain times appear over- or under-weight relative to the sector weights of the Funds’ corresponding benchmarks.

Currently, relative to the Russell 1000® Value Index, the Equity Income Fund is overweight producer durables and technology and underweight utilities, health

4

care, material & processing, financial services, energy, consumer discretionary and consumer staples. Relative to the Russell 2000® Value Index, the Small Cap Value Fund is overweight materials & processing, technology and energy and underweight consumer discretionary, health care, financial services, utilities and producer durables. Relative to the Russell 1000® Value Index, the Diversified Large Cap Value Fund is overweight producer durables, technology and consumer staples and underweight health care, financial services, utilities, materials & processing, energy and consumer discretionary. Relative to the Russell Midcap® Value Index, the Mid Cap Value Fund is overweight technology, energy, materials & processing, producer durables and financial services and underweight consumer discretionary, utilities, health care and consumer staples.

Thank you for your support and for entrusting us with your investment dollars. We continue to work hard to earn your trust and aim to meet your investment needs in the years to come.

Sincerely,

The Huber Capital Management Team

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Funds may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks are greater for investments in emerging markets. Additionally, the Funds are subject to sector emphasis risk meaning that companies in the same or related businesses may comprise a significant portion of a Fund’s portfolio and adversely affect the value of the portfolio to a greater extent than if such business comprised a lesser portion of a portfolio. Investments in initial public offerings (“IPOs”) carry additional risk such as market and liquidity risk and can fluctuate considerably. When a Fund’s asset base is small, the impact of IPOs on the Fund’s performance could be magnified. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Small- and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Value stocks have a lower expected growth rate in earnings and sales, versus growth stocks.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the schedule of investments in this report for complete Fund holdings.

Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Huber Capital Management, LLC and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

The Russell 1000® Growth Index is an unmanaged market capitalization-weighted index of growth-oriented stocks of the largest U.S. domiciled companies that are included in the Russell 1000 Index. Growth-oriented stocks tend to have higher price-to-book ratios and higher forecasted growth values.

5

The S&P 500® Index, an unmanaged index, consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

The Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index, an unmanaged index, is comprised of the 2,000 smallest companies in the Russell 3000® Index.

The Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

The Russell Midcap® Value Index, an unmanaged index, measures the performance of the mid-cap value segment of the U.S. equity universe. It is a market capitalization weighted index representing the smallest 800 companies of the Russell 1000® Index. It includes those Russell Midcap companies with lower price-to-book ratios and lower expected growth values.

The indexes do not reflect the payment of transaction costs, fees and expenses associated with an investment in the Funds. The Funds’ value disciplines may prevent or restrict investment in major stocks in the benchmark indices. It is not possible to invest directly in an index. The Funds’ returns may not correlate with the returns of their benchmark indexes.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g., depreciation) and interest expense to pretax income.

Free cash flow is the cash that a company generates after paying its expenses and maintaining its current asset base, the remainder of which is then available to pursue further opportunities that enhance shareholder value. Free cash flow is calculated by adding non-cash charges (e.g. depreciation) to net income and subtracting maintenance capital expenditures.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

6

Huber Funds

EXPENSE EXAMPLE – April 30, 2018 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees, and (2) ongoing costs, including management fees, distribution and/or service fees, and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Huber Capital Equity Income Fund (“Equity Income Fund”), Huber Capital Small Cap Value Fund (“Small Cap Value Fund”), Huber Capital Diversified Large Cap Value Fund (“Diversified Large Cap Value Fund”), and Huber Capital Mid Cap Value Fund (“Mid Cap Value Fund”) Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (11/1/17 – 4/30/18).

Actual Expenses

For each class of the Equity Income Fund, the Small Cap Value Fund, the Diversified Large Cap Value Fund and the Mid Cap Value Fund two lines are presented in the tables below – the first line for each class provides information about actual account values and actual expenses. Actual net expenses are limited to 1.39% for Investor Class shares and 0.99% for Institutional Class shares of the Equity Income Fund, 1.75% for Investor Class shares and 1.35% for Institutional Class shares of the Small Cap Value Fund, 1.15% for Investor Class shares and 0.75% for Institutional Class shares of the Diversified Large Cap Value Fund, and 1.40% for Investor Class shares and 1.10% for Institutional Class shares of the Mid Cap Value Fund per the operating expenses limitation agreement. In addition, you may be assessed a fee for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. The Examples below include, but are not limited to, management fees, fund accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” for your Fund and class to estimate the expenses you paid on your account during this period.

7

Huber Funds

EXPENSE EXAMPLE – April 30, 2018 (Unaudited), Continued

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line for each class provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Equity Income Fund

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period

|

Expense

|

|

|

11/1/17

|

4/30/18

|

11/1/17 – 4/30/18

|

Ratio*

|

|

|

Investor Class

|

||||

|

Actual

|

$1,000.00

|

$ 998.10

|

$6.74

|

1.36%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,018.05

|

$6.81

|

1.36%

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$ 999.50

|

$4.91

|

0.99%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,019.89

|

$4.96

|

0.99%

|

Small Cap Value Fund

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period

|

Expense

|

|

|

11/1/17

|

4/30/18

|

11/1/17 – 4/30/18

|

Ratio*

|

|

|

Investor Class

|

||||

|

Actual

|

$1,000.00

|

$1,067.10

|

$8.71

|

1.70%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,016.36

|

$8.50

|

1.70%

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,069.00

|

$6.93

|

1.35%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,018.10

|

$6.76

|

1.35%

|

8

Huber Funds

EXPENSE EXAMPLE – April 30, 2018 (Unaudited), Continued

Diversified Large Cap Value Fund

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period

|

Expense

|

|

|

11/1/17

|

4/30/18

|

11/1/17 – 4/30/18

|

Ratio*

|

|

|

Investor Class

|

||||

|

Actual

|

$1,000.00

|

$1,004.00

|

$4.97

|

1.00%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,019.84

|

$5.01

|

1.00%

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,005.50

|

$3.73

|

0.75%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,021.08

|

$3.76

|

0.75%

|

Mid Cap Value Fund

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period

|

Expense

|

|

|

11/1/17

|

4/30/18

|

11/1/17 – 4/30/18

|

Ratio*

|

|

|

Investor Class

|

||||

|

Actual

|

$1,000.00

|

$1,076.60

|

$6.69

|

1.30%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,018.35

|

$6.51

|

1.30%

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,078.20

|

$5.10

|

0.99%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,019.89

|

$4.96

|

0.99%

|

|

*

|

Expenses are equal to the annualized expense ratio of each class, multiplied by the average account value over the period, multiplied by 181 (days in most recent fiscal half-year) / 365 days to reflect the one-half year expense.

|

9

Huber Funds

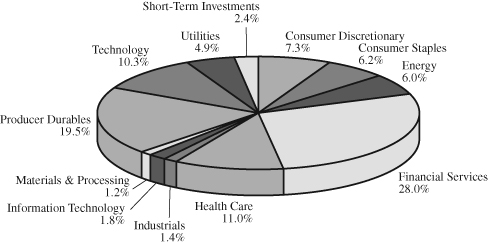

SECTOR ALLOCATION OF PORTFOLIO ASSETS – April 30, 2018 (Unaudited)

HUBER CAPITAL EQUITY INCOME FUND

HUBER CAPITAL SMALL CAP VALUE FUND

Percentages represent market value as a percentage of total investments.

10

Huber Funds

SECTOR ALLOCATION OF PORTFOLIO ASSETS – April 30, 2018 (Unaudited)

HUBER CAPITAL DIVERSIFIED LARGE CAP VALUE FUND

HUBER CAPITAL MID CAP VALUE FUND

Percentages represent market value as a percentage of total investments.

11

Huber Capital Equity Income Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited)

|

Shares

|

COMMON STOCKS - 97.97%

|

Value

|

|||||

|

Aerospace & Defense - 7.86%

|

|||||||

|

60,335

|

Arconic, Inc.

|

$

|

1,074,566

|

||||

|

15,800

|

Northrop Grumman Corp.

|

5,088,232

|

|||||

|

6,162,798

|

|||||||

|

Air Transport - 2.68%

|

|||||||

|

8,500

|

FedEx Corp.

|

2,101,200

|

|||||

|

Banks: Diversified - 4.47%

|

|||||||

|

39,600

|

SunTrust Banks, Inc.

|

2,645,280

|

|||||

|

16,500

|

Wells Fargo & Co.

|

857,340

|

|||||

|

3,502,620

|

|||||||

|

Chemicals: Diversified - 0.85%

|

|||||||

|

25,600

|

BASF SE - ADR

|

666,880

|

|||||

|

Computer Services, Software

|

|||||||

|

& Systems - 8.77%

|

|||||||

|

48,300

|

CA, Inc.

|

1,680,840

|

|||||

|

50,700

|

Microsoft Corp.

|

4,741,464

|

|||||

|

10,000

|

Oracle Corp.

|

456,700

|

|||||

|

6,879,004

|

|||||||

|

Computer Technology - 1.48%

|

|||||||

|

37,500

|

Hewlett Packard Enterprise Co.

|

639,375

|

|||||

|

24,300

|

HP, Inc.

|

522,207

|

|||||

|

1,161,582

|

|||||||

|

Diversified Financial Services - 14.68%

|

|||||||

|

113,600

|

Bank of America Corp.

|

3,398,912

|

|||||

|

56,000

|

Citigroup, Inc.

|

3,823,120

|

|||||

|

39,400

|

JPMorgan Chase & Co.

|

4,285,932

|

|||||

|

11,507,964

|

|||||||

|

Diversified Retail - 2.09%

|

|||||||

|

18,500

|

Wal-Mart Stores, Inc.

|

1,636,510

|

|||||

|

Electronic Components - 0.71%

|

|||||||

|

6,095

|

TE Connectivity Ltd.

|

559,216

|

|||||

|

Engineering & Contracting Services - 5.81%

|

|||||||

|

273,241

|

KBR, Inc.

|

4,560,392

|

|||||

|

Financial Data & Systems - 1.27%

|

|||||||

|

5,600

|

Mastercard, Inc. - Class A

|

998,312

|

|||||

The accompanying notes are an integral part of these financial statements.

12

Huber Capital Equity Income Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Foods - 2.90%

|

|||||||

|

22,100

|

ConAgra Foods, Inc.

|

$

|

819,247

|

||||

|

20,800

|

Tyson Foods, Inc. - Class A

|

1,458,080

|

|||||

|

2,277,327

|

|||||||

|

Homebuilding - 1.66%

|

|||||||

|

30,468

|

Lennar Corp. - Class B

|

1,300,679

|

|||||

|

Insurance Carriers - 1.29%

|

|||||||

|

11,900

|

Brighthouse Financial, Inc. (b)

|

604,282

|

|||||

|

7,400

|

XL Group Ltd. (a)

|

411,366

|

|||||

|

1,015,648

|

|||||||

|

Insurance: Life - 4.57%

|

|||||||

|

167,000

|

CNO Financial Group, Inc.

|

3,580,480

|

|||||

|

Insurance: Multi-Line - 3.13%

|

|||||||

|

14,200

|

American International Group, Inc.

|

795,200

|

|||||

|

31,704

|

Voya Financial, Inc.

|

1,659,705

|

|||||

|

2,454,905

|

|||||||

|

Media - 1.14%

|

|||||||

|

9,400

|

Time Warner, Inc.

|

891,120

|

|||||

|

Oil: Crude Producers - 0.87%

|

|||||||

|

229,300

|

Chesapeake Energy Corp. (b)

|

681,021

|

|||||

|

Oil: Integrated - 3.84%

|

|||||||

|

30,200

|

BP plc - ADR

|

1,346,618

|

|||||

|

23,834

|

Royal Dutch Shell plc - Class A - ADR

|

1,665,997

|

|||||

|

3,012,615

|

|||||||

|

Oil Well Equipment & Services - 1.30%

|

|||||||

|

180,000

|

Ensco plc - Class A

|

1,017,000

|

|||||

|

Pharmaceuticals - 11.05%

|

|||||||

|

2,900

|

Allergan plc (a)

|

445,585

|

|||||

|

39,000

|

Eli Lilly & Co.

|

3,161,730

|

|||||

|

41,700

|

Merck & Co., Inc.

|

2,454,879

|

|||||

|

71,100

|

Pfizer, Inc.

|

2,602,971

|

|||||

|

8,665,165

|

|||||||

|

Shipping - 4.59%

|

|||||||

|

153,980

|

Euronav SA (a)

|

1,254,937

|

|||||

|

116,912

|

Golar LNG Partners LP (a)

|

2,345,255

|

|||||

|

3,600,192

|

|||||||

The accompanying notes are an integral part of these financial statements.

13

Huber Capital Equity Income Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Specialty Retail - 2.45%

|

|||||||

|

10,400

|

Home Depot, Inc.

|

$

|

1,921,920

|

||||

|

Steel - 0.31%

|

|||||||

|

4,615

|

Carpenter Technology Corp.

|

245,795

|

|||||

|

Tobacco - 3.33%

|

|||||||

|

31,800

|

Philip Morris International, Inc.

|

2,607,600

|

|||||

|

Utilities: Electrical - 4.87%

|

|||||||

|

17,000

|

Entergy Corp.

|

1,387,030

|

|||||

|

61,300

|

Exelon Corp.

|

2,432,384

|

|||||

|

3,819,414

|

|||||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $47,436,462)

|

76,827,359

|

||||||

|

SHORT-TERM INVESTMENTS - 2.38%

|

|||||||

|

933,015

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Government Portfolio, 1.61% (c)

|

933,015

|

||||||

|

933,014

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Treasury Portfolio, 1.59% (c)

|

933,014

|

||||||

|

TOTAL SHORT TERM INVESTMENTS

|

|||||||

|

(Cost $1,866,029)

|

1,866,029

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES

|

|||||||

|

(Cost $49,302,491) - 100.35%

|

78,693,388

|

||||||

|

Liabilities in Excess of

|

|||||||

|

Other Assets - (0.35)%

|

(275,825

|

)

|

|||||

|

NET ASSETS - 100.00%

|

$

|

78,417,563

|

|||||

ADR – American Depository Receipt

|

(a)

|

Foreign issued security.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

Rate shown is the 7-day annualized yield as of April 30, 2018.

|

The accompanying notes are an integral part of these financial statements.

14

Huber Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited)

|

Shares

|

COMMON STOCKS - 95.95%

|

Value

|

|||||

|

Aluminum - 2.17%

|

|||||||

|

16,646

|

Kaiser Aluminum Corp.

|

$

|

1,640,297

|

||||

|

Asset Management & Custodian - 9.35%

|

|||||||

|

77,700

|

BrightSphere Investment Group plc (a)

|

1,178,709

|

|||||

|

743,583

|

Uranium Participation Corp. (a) (b)

|

2,247,052

|

|||||

|

31,486

|

Virtus Investment Partners, Inc.

|

3,631,910

|

|||||

|

7,057,671

|

|||||||

|

Banks: Diversified - 12.49%

|

|||||||

|

55,236

|

Atlantic Capital Bancshares, Inc. (b)

|

1,066,055

|

|||||

|

1,527

|

C&F Financial Corp.

|

88,413

|

|||||

|

14,057

|

Capstar Financial Holdings, Inc. (b)

|

268,348

|

|||||

|

10,195

|

Carter Bank & Trust (b)

|

178,617

|

|||||

|

19,691

|

First Bancorp

|

751,212

|

|||||

|

8,477

|

First Citizens BancShares, Inc. - Class A

|

3,664,522

|

|||||

|

186,131

|

First Horizon National Corp.

|

3,406,197

|

|||||

|

9,423,364

|

|||||||

|

Chemicals: Specialty - 5.28%

|

|||||||

|

54,795

|

Innospec, Inc.

|

3,983,596

|

|||||

|

Commercial Vehicles & Parts - 0.94%

|

|||||||

|

28,552

|

Miller Industries, Inc.

|

706,662

|

|||||

|

Communications Equipment - 9.83%

|

|||||||

|

242,387

|

Comtech Telecommunications Corp.

|

7,414,618

|

|||||

|

Computer Services, Software

|

|||||||

|

& Systems - 3.23%

|

|||||||

|

28,400

|

Science Applications International Corp.

|

2,436,436

|

|||||

|

Consumer Lending - 6.66%

|

|||||||

|

90,207

|

Enova International, Inc. (b)

|

2,643,065

|

|||||

|

128,971

|

EZCORP, Inc. - Class A (b)

|

1,766,903

|

|||||

|

11,655

|

Nelnet, Inc. - Class A

|

615,500

|

|||||

|

5,025,468

|

|||||||

|

Containers & Packaging - 0.52%

|

|||||||

|

11,883

|

UFP Technologies, Inc. (b)

|

395,110

|

|||||

|

Diversified Manufacturing Operations - 1.42%

|

|||||||

|

52,358

|

Harsco Corp. (b)

|

1,070,721

|

|||||

|

Engineering & Contracting Services - 5.13%

|

|||||||

|

231,805

|

KBR, Inc.

|

3,868,826

|

|||||

The accompanying notes are an integral part of these financial statements.

15

Huber Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Equity REIT - Timber - 1.11%

|

|||||||

|

64,197

|

CatchMark Timber Trust, Inc. - Class A

|

$

|

837,129

|

||||

|

Health Care Equipment & Surplus - 1.37%

|

|||||||

|

15,951

|

CONMED Corp.

|

1,037,294

|

|||||

|

Health Care Facilities - 1.10%

|

|||||||

|

34,677

|

Tenet Healthcare Corp. (b)

|

830,167

|

|||||

|

Health Care Providers & Services - 0.04%

|

|||||||

|

1,800

|

Hanger, Inc. (b)

|

32,940

|

|||||

|

Homebuilding - 2.51%

|

|||||||

|

70,475

|

William Lyon Homes - Class A (b)

|

1,892,958

|

|||||

|

Insurance: Life - 3.84%

|

|||||||

|

135,287

|

CNO Financial Group, Inc.

|

2,900,554

|

|||||

|

Oil: Crude Producers - 4.17%

|

|||||||

|

126,100

|

Chesapeake Energy Corp. (b)

|

374,517

|

|||||

|

400,700

|

HighPoint Resources Corp. (b)

|

2,768,837

|

|||||

|

3,143,354

|

|||||||

|

Oil, Gas & Consumable Fuels - 2.05%

|

|||||||

|

86,594

|

Hoegh LNG Partners LP (a)

|

1,545,703

|

|||||

|

Oil Well Equipment & Services - 3.27%

|

|||||||

|

134,277

|

Ensco plc - Class A

|

758,665

|

|||||

|

83,700

|

Superior Energy Services, Inc. (b)

|

898,101

|

|||||

|

206,507

|

TETRA Technologies, Inc. (b)

|

811,573

|

|||||

|

2,468,339

|

|||||||

|

Paper - 1.40%

|

|||||||

|

30,662

|

Kapstone Paper and Packaging Corp.

|

1,055,386

|

|||||

|

Real Estate Investment

|

|||||||

|

Trusts (REITs) - 5.42%

|

|||||||

|

125,443

|

Government Properties Income Trust

|

1,566,783

|

|||||

|

63,908

|

Granite Real Estate Investment Trust (a)

|

2,525,005

|

|||||

|

4,091,788

|

|||||||

|

Restaurants - 1.45%

|

|||||||

|

31,642

|

Boston Pizza Royalties Income Fund (a)

|

494,857

|

|||||

|

55,574

|

Pizza Pizza Royalty Corp. (a)

|

598,612

|

|||||

|

1,093,469

|

|||||||

The accompanying notes are an integral part of these financial statements.

16

Huber Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Shipping - 4.73%

|

|||||||

|

68,986

|

Golar LNG Ltd. (a)

|

$

|

2,217,900

|

||||

|

1,173,569

|

Teekay Tankers Ltd. - Class A

|

1,349,604

|

|||||

|

3,567,504

|

|||||||

|

Steel - 1.23%

|

|||||||

|

17,446

|

Carpenter Technology Corp.

|

929,174

|

|||||

|

Telecommunications Equipment - 1.54%

|

|||||||

|

43,014

|

ARRIS International plc (a) (b)

|

1,161,378

|

|||||

|

Transportation Infrastructure - 0.23%

|

|||||||

|

17,501

|

Wesco Aircraft Holdings, Inc. (b)

|

176,760

|

|||||

|

Utilities: Electrical - 3.47%

|

|||||||

|

41,419

|

Great Plains Energy, Inc.

|

1,355,644

|

|||||

|

29,645

|

Portland General Electric Co.

|

1,259,319

|

|||||

|

2,614,963

|

|||||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $52,401,337)

|

72,401,629

|

||||||

|

SHORT-TERM INVESTMENTS - 4.13%

|

|||||||

|

1,558,692

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Government Portfolio, 1.61% (c)

|

1,558,692

|

||||||

|

1,558,692

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Treasury Portfolio, 1.59% (c)

|

1,558,692

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||

|

(Cost $3,117,384)

|

3,117,384

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES

|

|||||||

|

(Cost $55,518,721) - 100.08%

|

75,519,013

|

||||||

|

Liabilities in Excess of

|

|||||||

|

Other Assets - (0.08)%

|

(62,639

|

)

|

|||||

|

NET ASSETS - 100.00%

|

$

|

75,456,374

|

|||||

|

(a)

|

Foreign issued security.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

Rate shown is the 7-day annualized yield as of April 30, 2018.

|

The accompanying notes are an integral part of these financial statements.

17

Huber Capital Diversified Large Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited)

|

Shares

|

COMMON STOCKS - 93.39%

|

Value

|

|||||

|

Aerospace & Defense - 5.96%

|

|||||||

|

4,100

|

Arconic, Inc.

|

$

|

73,021

|

||||

|

700

|

Northrop Grumman Corp.

|

225,428

|

|||||

|

298,449

|

|||||||

|

Air Transport - 1.97%

|

|||||||

|

400

|

FedEx Corp.

|

98,880

|

|||||

|

Banks: Diversified - 4.14%

|

|||||||

|

2,200

|

Regions Financial Corp.

|

41,140

|

|||||

|

1,400

|

SunTrust Banks, Inc.

|

93,520

|

|||||

|

1,400

|

Wells Fargo & Co.

|

72,744

|

|||||

|

207,404

|

|||||||

|

Capital Markets - 0.48%

|

|||||||

|

100

|

Goldman Sachs Group Inc.

|

23,833

|

|||||

|

Chemicals: Diversified - 1.04%

|

|||||||

|

2,000

|

BASF SE - ADR

|

52,100

|

|||||

|

Computer Services, Software

|

|||||||

|

& Systems - 9.83%

|

|||||||

|

3,626

|

CA, Inc.

|

126,185

|

|||||

|

2,600

|

Microsoft Corp.

|

243,152

|

|||||

|

2,700

|

Oracle Corp.

|

123,309

|

|||||

|

492,646

|

|||||||

|

Computer Technology - 1.74%

|

|||||||

|

3,600

|

Hewlett Packard Enterprise Co.

|

61,380

|

|||||

|

1,200

|

HP, Inc.

|

25,788

|

|||||

|

87,168

|

|||||||

|

Consumer Lending - 0.52%

|

|||||||

|

1,000

|

Ally Financial, Inc.

|

26,100

|

|||||

|

Diversified Financial Services - 13.24%

|

|||||||

|

7,100

|

Bank of America Corp.

|

212,432

|

|||||

|

3,100

|

Citigroup, Inc.

|

211,637

|

|||||

|

2,200

|

JPMorgan Chase & Co.

|

239,316

|

|||||

|

663,385

|

|||||||

|

Diversified Retail - 2.65%

|

|||||||

|

1,500

|

Wal-Mart Stores, Inc.

|

132,690

|

|||||

|

Electronic Components - 0.55%

|

|||||||

|

300

|

TE Connectivity Ltd.

|

27,525

|

|||||

The accompanying notes are an integral part of these financial statements.

18

Huber Capital Diversified Large Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Engineering & Contracting Services - 6.28%

|

|||||||

|

600

|

Fluor Corp.

|

$

|

35,370

|

||||

|

16,730

|

KBR, Inc.

|

279,224

|

|||||

|

314,594

|

|||||||

|

Financial Data & Systems - 1.96%

|

|||||||

|

550

|

Mastercard, Inc. - Class A

|

98,049

|

|||||

|

Foods - 3.23%

|

|||||||

|

1,400

|

ConAgra Foods, Inc.

|

51,898

|

|||||

|

500

|

Lamb Weston Holdings, Inc.

|

32,660

|

|||||

|

1,100

|

Tyson Foods, Inc. - Class A

|

77,110

|

|||||

|

161,668

|

|||||||

|

Homebuilding - 0.78%

|

|||||||

|

918

|

Lennar Corp. - Class B

|

39,189

|

|||||

|

Insurance Carriers - 1.87%

|

|||||||

|

600

|

Brighthouse Financial, Inc. (b)

|

30,468

|

|||||

|

1,135

|

XL Group Ltd. (a)

|

63,095

|

|||||

|

93,563

|

|||||||

|

Insurance: Life - 3.11%

|

|||||||

|

7,273

|

CNO Financial Group, Inc.

|

155,933

|

|||||

|

Insurance: Multi-Line - 1.82%

|

|||||||

|

600

|

American International Group, Inc.

|

33,600

|

|||||

|

1,100

|

Voya Financial, Inc.

|

57,585

|

|||||

|

91,185

|

|||||||

|

IT Services - 0.35%

|

|||||||

|

171

|

DXC Technology Co.

|

17,623

|

|||||

|

Media - 1.70%

|

|||||||

|

900

|

Time Warner, Inc.

|

85,320

|

|||||

|

Oil: Crude Producers - 0.59%

|

|||||||

|

10,000

|

Chesapeake Energy Corp. (b)

|

29,700

|

|||||

|

Oil, Gas & Consumable Fuels - 0.52%

|

|||||||

|

400

|

ConocoPhillips

|

26,200

|

|||||

|

Oil: Integrated - 4.06%

|

|||||||

|

1,900

|

BP plc - ADR

|

84,721

|

|||||

|

1,700

|

Royal Dutch Shell plc - Class A - ADR

|

118,830

|

|||||

|

203,551

|

|||||||

The accompanying notes are an integral part of these financial statements.

19

Huber Capital Diversified Large Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Oil Well Equipment & Services - 1.49%

|

|||||||

|

13,185

|

Ensco plc - Class A

|

$

|

74,495

|

||||

|

Pharmaceuticals - 7.98%

|

|||||||

|

100

|

Allergan plc (a)

|

15,365

|

|||||

|

2,000

|

Eli Lilly & Co.

|

162,140

|

|||||

|

1,100

|

Merck & Co., Inc.

|

64,757

|

|||||

|

4,300

|

Pfizer, Inc.

|

157,423

|

|||||

|

399,685

|

|||||||

|

Scientific Instruments:

|

|||||||

|

Control & Filter - 0.53%

|

|||||||

|

600

|

Flowserve Corp.

|

26,646

|

|||||

|

Shipping - 3.09%

|

|||||||

|

6,200

|

Euronav SA (a)

|

50,530

|

|||||

|

5,200

|

Golar LNG Partners LP (a)

|

104,312

|

|||||

|

154,842

|

|||||||

|

Specialty Retail - 2.21%

|

|||||||

|

600

|

Home Depot, Inc.

|

110,880

|

|||||

|

Telecommunications Equipment - 0.43%

|

|||||||

|

800

|

ARRIS International plc (a) (b)

|

21,600

|

|||||

|

Tobacco - 3.11%

|

|||||||

|

1,900

|

Philip Morris International, Inc.

|

155,800

|

|||||

|

Utilities: Electrical - 5.29%

|

|||||||

|

400

|

American Electric Power Co., Inc.

|

27,992

|

|||||

|

900

|

Entergy Corp.

|

73,431

|

|||||

|

3,300

|

Exelon Corp.

|

130,944

|

|||||

|

200

|

NextEra Energy, Inc.

|

32,782

|

|||||

|

265,149

|

|||||||

|

Utilities: Telecommunications - 0.87%

|

|||||||

|

400

|

Verizon Communications, Inc.

|

19,740

|

|||||

|

800

|

Vodafone Group plc - ADR

|

23,528

|

|||||

|

43,268

|

|||||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $3,331,821)

|

4,679,120

|

||||||

The accompanying notes are an integral part of these financial statements.

20

Huber Capital Diversified Large Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

SHORT-TERM INVESTMENTS - 6.66%

|

Value

|

|||||

|

166,926

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Government Portfolio, 1.61% (c)

|

$

|

166,926

|

|||||

|

166,927

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Treasury Portfolio, 1.59% (c)

|

166,927

|

||||||

|

TOTAL SHORT TERM INVESTMENTS

|

|||||||

|

(Cost $333,853)

|

333,853

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES

|

|||||||

|

(Cost $3,665,674) - 100.05%

|

5,012,973

|

||||||

|

Liabilities in Excess of

|

|||||||

|

Other Assets - (0.05)%

|

(2,371

|

)

|

|||||

|

NET ASSETS - 100.00%

|

$

|

5,010,602

|

|||||

ADR – American Depository Receipt

|

(a)

|

Foreign issued security.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

Rate shown is the 7-day annualized yield as of April 30, 2018.

|

The accompanying notes are an integral part of these financial statements.

21

Huber Capital Mid Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited)

|

Shares

|

COMMON STOCKS - 91.40%

|

Value

|

|||||

|

Aerospace & Defense - 1.31%

|

|||||||

|

1,400

|

Arconic, Inc.

|

$

|

24,934

|

||||

|

Aluminum - 1.55%

|

|||||||

|

300

|

Kaiser Aluminum Corp.

|

29,562

|

|||||

|

Asset Management & Custodian - 7.61%

|

|||||||

|

900

|

BrightSphere Investment Group plc (a)

|

13,653

|

|||||

|

16,800

|

Uranium Participation Corp. (a) (b)

|

50,768

|

|||||

|

700

|

Virtus Investment Partners, Inc.

|

80,745

|

|||||

|

145,166

|

|||||||

|

Banks: Diversified - 13.41%

|

|||||||

|

2,700

|

Atlantic Capital Bancshares, Inc. (b)

|

52,110

|

|||||

|

100

|

First Citizens BancShares, Inc. - Class A

|

43,229

|

|||||

|

3,900

|

First Horizon National Corp.

|

71,370

|

|||||

|

1,200

|

Regions Financial Corp.

|

22,440

|

|||||

|

1,000

|

SunTrust Banks, Inc.

|

66,800

|

|||||

|

255,949

|

|||||||

|

Chemicals: Specialty - 5.71%

|

|||||||

|

1,500

|

Innospec, Inc.

|

109,050

|

|||||

|

Communications Equipment - 8.52%

|

|||||||

|

5,316

|

Comtech Telecommunications Corp.

|

162,617

|

|||||

|

Computer Services, Software

|

|||||||

|

& Systems - 3.62%

|

|||||||

|

1,000

|

CA, Inc.

|

34,800

|

|||||

|

400

|

Science Applications International Corp.

|

34,316

|

|||||

|

69,116

|

|||||||

|

Computer Technology - 0.89%

|

|||||||

|

1,000

|

Hewlett Packard Enterprise Co.

|

17,050

|

|||||

|

Consumer Lending - 5.33%

|

|||||||

|

2,300

|

Enova International, Inc. (b)

|

67,390

|

|||||

|

2,500

|

EZCORP, Inc. - Class A (b)

|

34,250

|

|||||

|

101,640

|

|||||||

|

Diversified Manufacturing Operations - 1.29%

|

|||||||

|

1,200

|

Harsco Corp. (b)

|

24,540

|

|||||

|

Engineering & Contracting Services - 5.68%

|

|||||||

|

6,501

|

KBR, Inc.

|

108,502

|

|||||

The accompanying notes are an integral part of these financial statements.

22

Huber Capital Mid Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Foods - 2.72%

|

|||||||

|

200

|

ConAgra Foods, Inc.

|

$

|

7,414

|

||||

|

466

|

Lamb Weston Holdings, Inc.

|

30,439

|

|||||

|

200

|

Tyson Foods, Inc. - Class A

|

14,020

|

|||||

|

51,873

|

|||||||

|

Health Care Equipment & Surplus - 1.02%

|

|||||||

|

300

|

CONMED Corp.

|

19,509

|

|||||

|

Health Care Facilities - 1.50%

|

|||||||

|

1,200

|

Tenet Healthcare Corp. (b)

|

28,728

|

|||||

|

Health Care Providers & Services - 0.04%

|

|||||||

|

38

|

Hanger, Inc. (b)

|

695

|

|||||

|

Homebuilding - 1.84%

|

|||||||

|

377

|

Lennar Corp. - Class B

|

16,094

|

|||||

|

710

|

William Lyon Homes - Class A (b)

|

19,071

|

|||||

|

35,165

|

|||||||

|

Insurance Carriers - 1.91%

|

|||||||

|

398

|

Brighthouse Financial, Inc. (b)

|

20,210

|

|||||

|

293

|

XL Group Ltd. (a)

|

16,288

|

|||||

|

36,498

|

|||||||

|

Insurance: Life - 2.20%

|

|||||||

|

1,960

|

CNO Financial Group, Inc.

|

42,022

|

|||||

|

Oil: Crude Producers - 5.02%

|

|||||||

|

7,100

|

Chesapeake Energy Corp. (b)

|

21,087

|

|||||

|

10,809

|

HighPoint Resources Corp. (b)

|

74,690

|

|||||

|

95,777

|

|||||||

|

Oil Well Equipment & Services - 3.92%

|

|||||||

|

5,200

|

Ensco plc - Class A

|

29,380

|

|||||

|

5,819

|

TETRA Technologies, Inc. (b)

|

22,869

|

|||||

|

2,100

|

Superior Energy Services, Inc. (b)

|

22,533

|

|||||

|

74,782

|

|||||||

|

Paper - 1.08%

|

|||||||

|

600

|

Kapstone Paper and Packaging Corp.

|

20,652

|

|||||

|

Real Estate Investment Trusts (REITs) - 4.65%

|

|||||||

|

3,000

|

Government Properties Income Trust

|

37,470

|

|||||

|

1,300

|

Granite Real Estate Investment Trust (a)

|

51,363

|

|||||

|

88,833

|

|||||||

The accompanying notes are an integral part of these financial statements.

23

Huber Capital Mid Cap Value Fund

SCHEDULE OF INVESTMENTS at April 30, 2018 (Unaudited), Continued

|

Shares

|

Value

|

||||||

|

Shipping - 7.17%

|

|||||||

|

1,000

|

Golar LNG Ltd. (a)

|

$

|

32,150

|

||||

|

3,000

|

Golar LNG Partners LP (a)

|

60,180

|

|||||

|

38,678

|

Teekay Tankers Ltd. - Class A

|

44,480

|

|||||

|

136,810

|

|||||||

|

Utilities: Electrical - 3.41%

|

|||||||

|

400

|

Entergy Corp.

|

32,636

|

|||||

|

600

|

Great Plains Energy, Inc.

|

19,638

|

|||||

|

300

|

Portland General Electric Co.

|

12,744

|

|||||

|

65,018

|

|||||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $1,312,889)

|

1,744,488

|

||||||

|

SHORT-TERM INVESTMENTS - 8.43%

|

|||||||

|

80,430

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Government Portfolio, 1.61% (c)

|

80,430

|

||||||

|

80,430

|

Morgan Stanley Institutional Liquidity

|

||||||

|

Funds - Treasury Portfolio, 1.59% (c)

|

80,430

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||

|

(Cost $160,860)

|

160,860

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES

|

|||||||

|

(Cost $1,473,749) - 99.83%

|

1,905,348

|

||||||

|

Other Assets in Excess

|

|||||||

|

of Liabilities - 0.17%

|

3,253

|

||||||

|

NET ASSETS - 100.00%

|

$

|

1,908,601

|

|||||

|

(a)

|

Foreign issued security.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

Rate shown is the 7-day annualized yield as of April 30, 2018.

|

The accompanying notes are an integral part of these financial statements.

24

(This Page Intentionally Left Blank.)

25

Huber Funds

STATEMENTS OF ASSETS AND LIABILITIES at April 30, 2018 (Unaudited)

|

Huber Capital

|

Huber Capital

|

|||||||

|

Equity

|

Small Cap

|

|||||||

|

Income Fund

|

Value Fund

|

|||||||

|

ASSETS

|

||||||||

|

Investments in securities, at value

|

||||||||

|

(identified cost $49,302,491 and

|

||||||||

|

$55,518,721, respectively)

|

$

|

78,693,388

|

$

|

75,519,013

|

||||

|

Cash

|

—

|

2,410

|

||||||

|

Receivables

|

||||||||

|

Fund shares issued

|

—

|

317

|

||||||

|

Investment securities sold

|

—

|

70,931

|

||||||

|

Dividends and interest

|

15,187

|

117,255

|

||||||

|

Dividend tax reclaim

|

8,384

|

2,583

|

||||||

|

Prepaid expenses

|

22,687

|

24,046

|

||||||

|

Total assets

|

78,739,646

|

75,736,555

|

||||||

|

LIABILITIES

|

||||||||

|

Payables

|

||||||||

|

Investment securities purchased

|

199,624

|

69,248

|

||||||

|

Advisory fees

|

41,247

|

57,584

|

||||||

|

12b-1 distribution fees

|

17,039

|

54,329

|

||||||

|

Administration fees

|

12,389

|

17,335

|

||||||

|

Audit fees

|

10,617

|

10,617

|

||||||

|

Chief Compliance Officer fee

|

1,463

|

1,463

|

||||||

|

Custody fees

|

—

|

4,666

|

||||||

|

Fund accounting fees

|

8,844

|

9,284

|

||||||

|

Shareholder servicing fees

|

12,730

|

33,121

|

||||||

|

Transfer agent fees and expenses

|

11,783

|

14,824

|

||||||

|

Trustee fees and expenses

|

933

|

917

|

||||||

|

Accrued expenses

|

5,414

|

6,793

|

||||||

|

Total liabilities

|

322,083

|

280,181

|

||||||

|

NET ASSETS

|

$

|

78,417,563

|

$

|

75,456,374

|

||||

The accompanying notes are an integral part of these financial statements.

26

Huber Funds

STATEMENTS OF ASSETS AND LIABILITIES at April 30, 2018 (Unaudited), Continued

|

|

Huber Capital

|

Huber Capital

|

||||||

|

|

Equity

|

Small Cap

|

||||||

|

|

Income Fund

|

Value Fund

|

||||||

|

CALCULATION OF NET ASSET VALUE PER SHARE

|

||||||||

|

Investor Class

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

6,341,274

|

$

|

24,583,105

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

405,804

|

1,355,164

|

||||||

|

Net asset value, offering and redemption

|

||||||||

|

price per share (Note 1)

|

$

|

15.63

|

$

|

18.14

|

||||

|

Institutional Class

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

72,076,289

|

$

|

50,873,269

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

4,622,139

|

2,771,015

|

||||||

|

Net asset value, offering and redemption

|

||||||||

|

price per share (Note 1)

|

$

|

15.59

|

$

|

18.36

|

||||

|

COMPONENTS OF NET ASSETS

|

||||||||

|

Paid-in capital

|

$

|

54,199,970

|

$

|

60,524,381

|

||||

|

Undistributed net investment income

|

274,171

|

163,616

|

||||||

|

Accumulated net realized loss on investments

|

||||||||

|

and foreign currency

|

(5,447,475

|

)

|

(5,231,923

|

)

|

||||

|

Net unrealized appreciation on:

|

||||||||

|

Investments

|

29,390,897

|

20,000,292

|

||||||

|

Foreign currency

|

—

|

8

|

||||||

|

Net assets

|

$

|

78,417,563

|

$

|

75,456,374

|

||||

The accompanying notes are an integral part of these financial statements.

27

Huber Funds

STATEMENTS OF ASSETS AND LIABILITIES at April 30, 2018 (Unaudited)

|

Huber Capital

|

||||||||

|

Diversified

|

Huber Capital

|

|||||||

|

Large Cap

|

Mid Cap

|

|||||||

|

Value Fund

|

Value Fund

|

|||||||

|

ASSETS

|

||||||||

|

Investments in securities, at value

|

||||||||

|

(identified cost $3,665,674 and

|

||||||||

|

$1,473,749, respectively)

|

$

|

5,012,973

|

$

|

1,905,348

|

||||

|

Receivables

|

||||||||

|

Investment securities sold

|

—

|

2,394

|

||||||

|

Dividends and interest

|

2,125

|

2,567

|

||||||

|

Dividend tax reclaim

|

2,861

|

23

|

||||||

|

Due from Adviser (Note 4)

|

13,031

|

15,041

|

||||||

|

Prepaid expenses

|

23,194

|

25,323

|

||||||

|

Total assets

|

5,054,184

|

1,950,696

|

||||||

|

LIABILITIES

|

||||||||

|

Payables

|

||||||||

|

Investment securities purchased

|

—

|

3,559

|

||||||

|

12b-1 distribution fees

|

3,334

|

637

|

||||||

|

Administration fees

|

7,786

|

7,885

|

||||||

|

Audit fees

|

10,617

|

10,616

|

||||||

|

Chief Compliance Officer fee

|

1,463

|

1,463

|

||||||

|

Custody fees

|

1,623

|

3,148

|

||||||

|

Fund accounting fees

|

5,679

|

5,863

|

||||||

|

Shareholder servicing fees

|

4,375

|

774

|

||||||

|

Transfer agent fees and expenses

|

5,627

|

5,323

|

||||||

|

Trustee fees and expenses

|

863

|

873

|

||||||

|

Accrued expenses

|

2,215

|

1,954

|

||||||

|

Total liabilities

|

43,582

|

42,095

|

||||||

|

NET ASSETS

|

$

|

5,010,602

|

$

|

1,908,601

|

||||

The accompanying notes are an integral part of these financial statements.

28

Huber Funds

STATEMENTS OF ASSETS AND LIABILITIES at April 30, 2018 (Unaudited), Continued

|

|

Huber Capital

|

|||||||

|

|

Diversified

|

Huber Capital

|

||||||

|

|

Large Cap

|

Mid Cap

|

||||||

|

|

Value Fund

|

Value Fund

|

||||||

|

CALCULATION OF NET ASSET VALUE PER SHARE

|

||||||||

|

Investor Class

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

1,591,390

|

$

|

410,818

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

111,075

|

31,579

|

||||||

|

Net asset value, offering and redemption

|

||||||||

|

price per share (Note 1)

|

$

|

14.33

|

$

|

13.01

|

||||

|

Institutional Class

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

3,419,212

|

$

|

1,497,783

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

237,487

|

114,860

|

||||||

|

Net asset value, offering and redemption

|

||||||||

|

price per share (Note 1)

|

$

|

14.40

|

$

|

13.04

|

||||

|

COMPONENTS OF NET ASSETS

|

||||||||

|

Paid-in capital

|

$

|

3,849,775

|

$

|

1,488,103

|

||||

|

Undistributed net investment income

|

19,274

|

6,179

|

||||||

|

Accumulated net realized loss on investments

|

||||||||

|

and foreign currency

|

(205,746

|

)

|

(17,281

|

)

|

||||

|

Net unrealized appreciation on:

|

||||||||

|

Investments

|

1,347,299

|

431,599

|

||||||

|

Foreign currency

|

—

|

1

|

||||||

|

Net assets

|

$

|

5,010,602

|

$

|

1,908,601

|

||||

The accompanying notes are an integral part of these financial statements.

29

Huber Funds

STATEMENTS OF OPERATIONS For the Six Months Ended April 30, 2018 (Unaudited)

|

Huber Capital

|

Huber Capital

|

|||||||

|

Equity

|

Small Cap

|